Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2011 |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 000-32735

COLOMBIA

ENERGY RESOURCES, INC.

COLOMBIA

ENERGY RESOURCES, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 87-056703 |

| (State or other jurisdiction of incorporation or organization) | (IRS employer identification number) |

| One Embarcadero Center, Suite 500, San Francisco, CA | 94901 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (415) 460-1165

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, Par Value $0.001

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit an post such files).

Yes ¨ No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | ||

| Non-accelerated filer ¨ | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the average bid and asked price of such common equity as of the last business day of the registrant’s most recently competed second fiscal quarter was $7,666,651

.

The number of shares outstanding of the registrant’s common stock on March 22, 2012, was 23,807,776.

DOCUMENTS INCORPORATED BY REFERENCE

| Document Description | 10-K Part | |

| Portions of the Registrant's proxy or information statement related to its 2012 Annual Meeting of Stockholders to be filed pursuant to Regulation 14A or 14C within 120 days after Registrant's fiscal year end of December 31, 2011 are incorporated by reference into Part III of this Report. | III |

Table of Contents

| Page | |

| PART I | 4 |

| ITEM 1. Business | 4 |

| ITEM 1A. Risk Factors | 13 |

| ITEM 1B. Unresolved Staff Comments | 22 |

| ITEM 2. PROPERTIES | 22 |

| ITEM 3. LEGAL PROCEEDINGS | 29 |

| ITEM 4. MINE SAFETY DISCLOSURES | 29 |

| PART II | 29 |

| ITEM 5. MARKET FOR Registrant’s COMMON EQUITY, RELATED STOCKHOLDER MATTERS and Issuer Purchases of Equity Securities | 29 |

| ITEM 6. SELECTED FINANCIAL DATA | 30 |

| ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 31 |

| ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 32 |

| ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 33 |

| ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 33 |

| ITEM 9A. CONTROLS AND PROCEDURES | 33 |

| ITEM 9B. OTHER INFORMATION | 34 |

| PART III | 34 |

| ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 34 |

| ITEM 11. EXECUTIVE COMPENSATION | 34 |

| ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 34 |

| ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 34 |

| ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES | 34 |

| PART IV | 34 |

| ITEM 15. EXHIBITS, FINANCIAL STATEMENTS, SCHEDULES | 34 |

| SIGNATURES | 39 |

| 2 |

Forward Looking Statements

The statements contained in this report that are not historical facts, including, but not limited to, statements found in the Item 1A entitled “Risk Factors,” are forward-looking statements that represent management’s beliefs and assumptions based on currently available information. Forward-looking statements include the information concerning our possible or assumed future results of operations, business strategies, need for financing, competitive position, potential growth opportunities, potential operating performance improvements, ability to retain and recruit personnel, the effects of competition and the effects of future legislation or regulations. Forward-looking statements include all statements that are not historical facts and can be identified by the use of forward-looking terminology such as the words “believes,” “intends,” “may,” “should,” “anticipates,” “expects,” “could,” “plans,” or comparable terminology or by discussions of strategy or trends. Although we believe that the expectations reflected in such forward-looking statements are reasonable, we cannot give any assurances that these expectations will prove to be correct. Such statements by their nature involve risks and uncertainties that could significantly affect expected results, and actual future results could differ materially from those described in such forward-looking statements.

Among the factors that could cause actual future results to differ materially are the risks and uncertainties discussed in this report. While it is not possible to identify all factors, we continue to face many risks and uncertainties including, but not limited to, the cyclicality of the coal industry, global economic and political conditions, global productive capacity, customer inventory levels, changes in commodity pricing, changes in product costing, changes in foreign currency exchange rates, competitive technology positions and operating interruptions (including, but not limited to, labor disputes, leaks, fires, explosions, unscheduled downtime, transportation interruptions, war and criminal or terrorist activities). Mining operations are subject to a variety of existing laws and regulations relating to exploration and development, permitting procedures, safety precautions, property reclamation, employee health and safety, air and water quality standards, pollution and other environmental protection controls, all of which are subject to change and are becoming more stringent and costly to comply with. Should one or more of these risks materialize (or the consequences of such a development worsen), or should the underlying assumptions prove incorrect, actual results could differ materially from those expected. We disclaim any intention or obligation to update publicly or revise such statements whether as a result of new information, future events or otherwise.

The risk factors discussed in Item 1A, “Risk Factors” beginning on page 13 of this report could cause our results to differ materially from those expressed in forward-looking statements. There may also be other risks and uncertainties that we are unable to predict at this time or that we do not now expect to have a material adverse impact on our business.

Throughout this report, unless otherwise designated, the terms “we,” “us,” “our,” “the Company” and “our company” refer to Colombia Energy Resources, Inc., a Delaware corporation, and its consolidated subsidiaries. All amounts in this report are in U.S. Dollars, unless otherwise indicated.

| 3 |

PART I

ITEM 1. Business

General Overview of our Business

We are a U.S. domiciled, coal exploration and development company, with operations in the Republic of Colombia, South America. We own coal mining concessions and are building and operating coal mines focusing on metallurgical coal. During 2010 and 2011 we were focused on acquiring properties and conducting an exploration program on our concessions. While we will continue to analyze additional properties and other acquisitions, during 2012 and beyond our focus will be on opening mines on our existing properties and steadily increasing production pursuant to our business plan.

The key elements of our strategy have been to: (i) selectively acquire high-quality metallurgical coal deposits; (ii) build our leadership team with multinational mining experts combined with local talent; (iii) apply modern exploration techniques; and (iv) import proven, international mining methods and best-practices. We anticipate that our primary operations and revenue sources will include the mining of metallurgical coal for export and domestic sales.

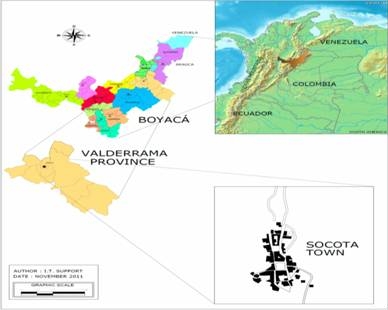

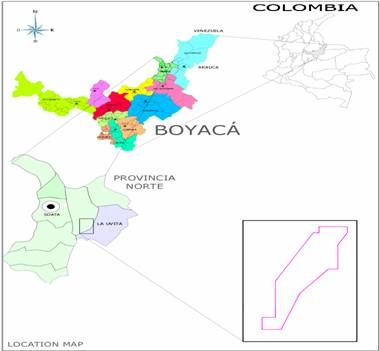

We currently control ten coal mining concession contracts in four locations, which grant us the right to exploit coal deposits in 10,455 hectares (25,834 acres) in the Boyacà and Santander districts of the Republic of Colombia.1 This includes one application with 7.8 hectares (19.2 acres), which will revert to us upon its conversion to a concession contract. The final transfer of the mining titles associated with Rukú is pending final approval of Ingeominas, the Colombian Institute of Mining and Geology. We have also entered into an agreement that grants us the option to purchase an additional coal mining concession (“Boavita”) contract with 1,550 hectares (3,830 acres) in the Boyacà district. This agreement provides us the right to perform exploration on the property and purchase the concession on agreed upon terms upon satisfactory results of such exploration. In addition, we signed an agreement with the seller of Boavita to begin mining on the property. Including the Boavita acquisition, we will control 11 concessions with 12,005 hectares (29,664 acres).

These concessions are concentrated in four coal deposits that comprise our existing and prospective mining projects:

| · | The Rukú Mining Complex (“Rukú). Situated in eastern Boyacà, we purchased 70% of the mining operations, two concession contracts and the right to an application for additional coal mining rights at Rukù. We implemented a mine expansion and worker safety program in December 2011 and are conducting exploration work to measure the coal deposit. Rukú was producing approximately 1,800 tons-per-month of metallurgical coal from two seams before a temporary closure occurred in February 2012 as a result of local vandalism. Coal was produced by basic manual methods using pick and shovel, with a one-ton car equipped with a basic winch used to lift coal to the surface. These methods will be improved upon with increased mechanization including shearers, chain conveyors, and roof props. In February 2012, we acquired 100% of a concession adjacent to Rukú. |

| 1 | Includes one application with 7.8 hectares (19.2 acres), which will revert to us upon its converting to a concession contract. The final transfer of the mining titles associated with Rukú is pending final approval of Ingeominas, the Colombian Institute of Mining and Geology. |

| 4 |

| · | Otanche. Situated in western Boyacà, we purchased 100% of three concession contracts at Otanche. We have an on-going exploration program to measure our coal deposit and plan to develop metallurgical coal mining operations at Otanche. |

| · | Boavita. Situated in eastern Boyacà, we have the option to purchase 100% of the concession contract at Boavita. We have commenced an exploration program at Boavita to characterize the coal deposit and, assuming satisfactory results, we plan to exercise the purchase option and develop coal mining operations at Boavita. In addition, we signed an agreement with the seller to develop and operate coal mines at Boavita prior to our execution of the purchase option. |

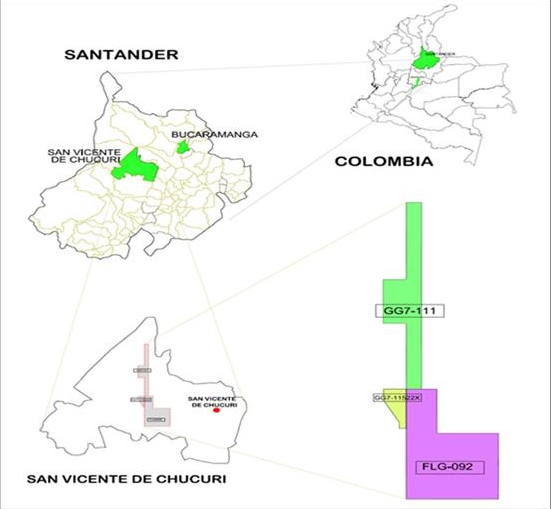

| · | The North Block. Situated in Northwestern Santander, we purchased 100% of three concession contracts in the area we refer to as the North Block. We are exploring the option of jointly developing mining operations on the property with one of the sellers. |

Our current operations include coal production from Rukù and exploration and development activities, such as acquiring coal mining concessions, drilling and testing core samples, performing geological and engineering studies, developing mine plans, performing feasibility and facility design studies and applying for environmental permits and licenses. As defined by SEC Industry Guide 7, Description of Property by Issuers Engaged or to be Engaged in Significant Mining Operations, there are currently no proven or probable reserves on any of our mining concessions or applications, but we have an extensive exploration and drilling program underway to measure and characterize our coal deposits. Preliminary geological review of the areas, including initial borehole drillings, outcrop mapping, outcrop sampling, review of drillings from previous owners and analysis of petroleum borings and seismic data, has confirmed the presence of multiple continuous coal seams on our properties.

We were originally incorporated in the State of Nevada in 1996 and changed our corporate domicile to the State of Delaware in October 2011. We own 99% of Energia Andina Santander Resources Cooperatieve U.A., a company formed under the laws of the Netherlands. The other 1% is owned by Colombia CPF LLC, a Delaware limited liability company that is wholly owned by us. Our Dutch subsidiary owns all of the outstanding shares of Energia Santander Resources Andina S.A.S, a Spanish corporation, which in turn owns 100% of Colombia Clean Power SAS (f/k/a Energia Andina Santander Resources SAS), a Colombian company that owns our assets and conducts our operations in the Republic of Colombia.

In December 2010, we completed a private placement of $8,000,000 in aggregate principal amount of 10% Secured Convertible Notes due June 30, 2012 (the “Notes”) and five-year warrants to purchase in aggregate up to 3,200,000 shares of our common stock at an exercise price of $0.01 per share.

In July 2011, we completed an equity private placement of Units; each $100,000 Unit consisted of 10,000 shares of our Series A Convertible Preferred Stock, which shares are convertible into an aggregate of 50,000 shares of our common stock at any time (the “Series A Preferred Stock”), and a five-year stock purchase warrant entitling each Unit holder thereof to purchase 3,500 shares of Common Stock for $.01 per share, subject to adjustment. We issued an aggregate of 2,930,500 shares of Series A Preferred Stock and warrants to purchase 1,025,675 shares of Common Stock, in consideration of aggregate cash proceeds to us of $22,000,000 and the conversion of Notes in the aggregate principal amount of $7,305,000. The remaining $695,000 of the Notes is convertible at $2.00 per share into 347,500 shares of Common Stock.

We have produced no revenues from our business operations and have achieved losses since inception. As of February 29, 2012, our cash position was $7,645,610.

As a regular part of our business, we review opportunities for, and engage in discussions and negotiations concerning, the acquisition of coal mining assets and interests in coal mining companies, and acquisitions of, or combinations with, coal mining companies. When we believe that these opportunities are consistent with our growth plans and our acquisition criteria, we will make bids or proposals and/or enter into letters of intent and other similar agreements. These bids or proposals, which may be binding or nonbinding, are customarily subject to a variety of conditions and usually permit us to terminate the discussions and any related agreement if, among other things, we are not satisfied with the results of our due diligence investigation.

| 5 |

World Coal Industry

World Coal Markets

Coal is the most abundant and widely-distributed fossil fuel in the world. Coal reserves are available in almost every country, with recoverable reserves in approximately 70 countries. At the end of 2010, global proven coal reserves were estimated to be approximately 861 billion metric tons, which will last 118 years, at current production levels. In contrast, proven oil and gas reserves are expected to last approximately 42 and 60 years, respectively, at current production levels.2

Coal fuels 42% of the world’s electricity and 70% of world steel production relies on coal. In 2010, 6.9 billion metric tons of coal were consumed worldwide, including 891 million tons of coking coal.3 Since 2000, global consumption of coal has grown faster than that of any other fuel. Moreover, coal consumption is expected to rise 53% over the next 20 years. According to the U.S. Energy Information Association, coal’s share of total world energy consumption is expected to remain constant through 2035. Accelerating worldwide energy demand, particularly in rapidly-industrializing countries, such as China, India and Russia, coupled with shifting import/export markets, economic recoveries in the U.S. and Europe and new clean coal technologies, are continuing to drive demand for coal. Moreover, capacity closures during the world financial crisis, stricter environmental legislation, weather problems and infrastructure bottlenecks in Australia have resulted in supply shortages and rising prices.

Growth in metallurgical coal demand is expected to exceed supply over the medium term, despite new supply sources, such as Mongolia. Increased import demand from Asian countries coupled with continued infrastructure bottlenecks and weather problems in Australia are also expected to keep prices high. According to several sources, international hard coking coal prices have remained above $200 per metric ton FOB since 2007 and are projected to be $250 to $280 per metric ton FOB over the next two to three years.4

Properties and Uses of Coal

Coal is a combustible, sedimentary, organic rock composed mainly of carbon, hydrogen and oxygen. Coal seams are formed from vegetation that has been consolidated between rock strata and altered by the effects of pressure and heat over millions of years. Coal quality varies depending on the pressure, heat and length of time in formation. The higher the carbon content in the coal, the more energy the coal contains. Anthracite is the highest value coal; it contains 86%-97% carbon and has heat value of over 15,000 Btu per pound. Bituminous coal is the most abundant coal in the world; it contains 45%-86% carbon and has heat values of 11,000–15,000 Btu per pound. Bituminous coal includes thermal coal used to generate electricity and metallurgical coal used by the steel and iron industries.5

Metallurgical coal, also known as coking coal, is processed into coke and used in the production of steel and iron ore. Coke is a fuel with few impurities and high carbon content. The high temperatures produced by the use of coke give steel its strength and flexibility so it can be used in the construction of bridges, and buildings, and the assembly of automobiles. While metallurgical coal is primarily used by steel companies, it is also used by a variety of other industrial users to heat and power foundries, cement plants, paper mills, chemical plants and other manufacturing and processing facilities.

Coal Imports and Exports

Geographic shifts in demand have resulted in large and growing import and export markets for coal. The following indicates the estimated top export and import markets for coal in 2010 as reported by the World Coal Association.

| 2 | Source: BP Statistical Review of World Energy, June 2011; World Coal Association. | |

| 3 | Source: BP Statistical Review of World Energy, June 2011; World Coal Association. |

| 4 | Sources: J.P. Morgan; AME Group; McCluskey; broker notes. |

| 5 | Source: World Coal Association. |

| 6 |

Top Coal Exporters in 2010

| MT in millions | Steam | Coking | Total | |||||||||

| Australia | 143 | 155 | 298 | |||||||||

| Indonesia | 160 | 2 | 162 | |||||||||

| Russia | 95 | 14 | 109 | |||||||||

| USA | 23 | 51 | 74 | |||||||||

| South Africa | 68 | 2 | 70 | |||||||||

| Colombia | 67 | 1 | 68 | |||||||||

| Canada | 4 | 27 | 31 | |||||||||

Top Coal Importers in 2010

| MT in millions | Steam | Coking | Total | |||||||||

| Japan | 129 | 58 | 187 | |||||||||

| China | 129 | 48 | 177 | |||||||||

| South Korea | 91 | 28 | 119 | |||||||||

| India | 60 | 30 | 90 | |||||||||

| Chinese Taipei | 58 | 5 | 63 | |||||||||

| Germany | 38 | 8 | 46 | |||||||||

| Turkey | 20 | 7 | 27 | |||||||||

Growth in coal imports are being driven primarily by Asian markets. Coal imports into Asian markets were 14.6 quadrillion BTU in 2009 and are expected to increase an additional 67% to 24.4 quadrillion BTU in 2035. Coking coal imports destined for Asia increased to 73 percent in 2009.6

Colombian Coal Industry

Colombia is a major world supplier of coal. It has the largest coal reserves in South America and the ninth largest coal reserves in the world. Colombia is also the world’s tenth largest coal producer, the world’s fourth largest coal exporter and the number 1 exporter of coal to the U.S. 7

Colombia Production and Exports

The Colombian coal sector is robust and rapidly-growing. In 2011, Colombia produced 85.8 million metric tons of coal, of which it exported 79.2 million metric tons. Total coal production was up 15.4% from the 74.4 million metric tons produced in 2010 and almost double production from ten years earlier. Production of metallurgical coal increased from 1.9 million metric tons in 2001 to 4.4 million metric tons in 2011, of which exports have grown from approximately 1.0 million metric tons to 1.5 million metric tons over the same period. In fact, from 2010 to 2011, Colombia moved from the world’s sixth largest exporter of coal to the world’s fourth largest.8

Safety, coupled with an abundant and growing resource base, increased foreign investment into Colombia and a rising focus on metallurgical coal are driving Colombia’s prominence in world coal markets. According to Mauricio Cardenas, Colombia’s Mine and Energy Minister, Colombia’s coal production is expected to increase to 97 million metric tons in 2012 and 144 million metric tons by 2020.

Coal mining is a high priority for Colombia. It is a substantial source of foreign investment and employment and accounts for almost half of the country’s mining activities. Coal is Colombia’s second largest export product after oil and is expected to surpass oil by 2015. Colombia has a long history in the hydrocarbon industry and, as such, offers many advantages to foreign companies setting up operations. Colombia has many local mining companies, a significant pool of trained labor and many highly-trained engineering and support services firms. Several multinational companies are mining in Colombia, such as Xstrata, Vale, BHP, Drummond, Anglo American and MPX.

Coal Regions

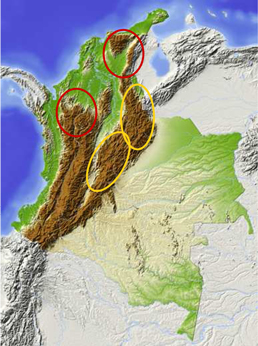

Coal in Colombia formed in intramontane basins during the development of the Andes Mountains in late Cretaceous and Tertiary times. The country’s reserves are concentrated in two regions: the Northern region (red) and the Andean foothills in the interior of the country (yellow).

| 6 | Source: EIA, International Energy Statistics. | |

| 7 | Sources: BP Statistical Review of World Energy, June 2011; World Coal Association; Simco, Colombia Ministry and Information System. |

| 8 | Source: Colombian Ministry of Mines and Energy. |

| 7 |

The Northern region includes the Guajira peninsula along the Atlantic coast and the coal basins in Cesar and Córdoba. These areas contain Colombia’s large thermal coal deposits and primary coal mining operations. Approximately 95% of coal produced and exported in Colombia is mined in these provinces where suitable logistical systems as are available to export the coal. The region contains approximately 6.4 billion metric tons of proven reserves and 11.8 billion metric tons of potential reserves.9 Operations in this region consist of integrated, open-pit steam coal mines with rail transport and coastal export terminals operated by global mining companies. The largest coal producer in the country is the Carbones del Cerrejon consortium comprised of Anglo American, BHP Billiton and Glencore, which operates Cerrejon Zona Norte (“CZN”), the largest coal mine in Latin America and the largest open-cast coal mine in the world. CZN consists of an integrated mine, railroad and coastal export terminal and produces approximately 30 million metric tons of steam coal per year. Drummond is the second largest operator in the region and MPX recently acquired 66,225 hectares with 1.74 billion tons of resources to build a steam coal mine in the region.

By contrast, the Andean foothills, which include the districts of Boyacà, Cundinamarca, Santander, and Norte de Santander, contain substantial reserves of very-high-quality metallurgical coal. Mining operations in this region is dominated by small artisanal miners. Historically, violence, political turmoil and lack of transportation infrastructure rendered the interior region difficult to mine. However, governmental policies and programs supporting mining and infrastructure, coupled with substantially increased safety in the region, have made it possible to exploit this coal. The region contains approximately 700 million metric tons of proven reserves and 5.2 billion metric tons of potential reserves.10 The total annual production in this region amounts to about 6 million to 7 million tons, almost all of which is used in Colombia to produce metallurgical coke for export.

Coal Reserves

Colombia has the largest coal reserves in South American and the ninth largest coal reserves in the world (excluding sub-bituminous and lignite).11 At the current rate of production, Colombia has more than 120 years of coal production.12

| 2010 Reserves (MT in Billions) | ||||

| #1 | U.S. | 108.5 | ||

| #2 | China | 62.2 | ||

| #3 | India | 56.1 | ||

| #4 | Russia | 49.1 | ||

| #5 | Australia | 37.1 | ||

| #6 | South Africa | 30.2 | ||

| #7 | Kazakhstan | 21.5 | ||

| #8 | Ukraine | 15.4 | ||

| #9 | Colombia | 6.4 | ||

| #10 | Poland | 4.4 | ||

In Colombia, the state owns all hydrocarbon reserves and private companies operate coal mines under concession contracts with the state. In 2004, the Ministry of Mines and Energy placed Ingeominas, the national geological institute, in charge of mineral rights and concessions. Ingeominas established eight mining districts for the stewardship of mineral resources and the advancement of the mining sectors. The table below indicates the mining districts, as well as the proven and potential reserves by district, as reported by Ingeominas:

| 9 | Source: Ingeominas. |

| 10 | Source: Ingeominas. |

| 11 | Source: BP Statistical Review of World Energy, June 2011. |

| 12 | Source: Colombian Coal Source of Energy for the World, Ministry of Mines and Energy. |

| 8 |

| Measured | Potential | |||||||||||||

| Type of | Reserves | Reserves | ||||||||||||

| District | Province | Coal | Avg. Btu | (MT) | (MT) | |||||||||

| Barrancas | La Guajira | T | 11,586 | 3,933 | 4,537 | |||||||||

| La Jagua de Ibirico | Cesar | T | 11,655 | 2,035 | 6,556 | |||||||||

| Montelíbano | Córdoba-Norte de Antioquia | T | 9,280 | 381 | 722 | |||||||||

| Northern Region (Atlantic Coast) | 6,350 | 11,815 | ||||||||||||

| Zulia | Norte de Santander | T,M,A | 12,653 | 120 | 795 | |||||||||

| Zulia | Santander | T,M,A | 12,790 | 56 | 464 | |||||||||

| Paz del Río | Boyáca | T,M | 12,781 | 170 | 1,720 | |||||||||

| Zipaquirá | Cundinamarca | T,M | 11,862 | 236 | 1,482 | |||||||||

| Amagá | Antioquia-Antiguo Caldas | T | 10,336 | 90 | 475 | |||||||||

| Jamundí | Valle del Cauca – Cauca | T | 11,016 | 41 | 242 | |||||||||

| Central Region (Interior) | 714 | 5,178 | ||||||||||||

| Total Country | 7,064 | 16,993 | ||||||||||||

| T=thermal(steam); M=me tallurgical; A=anthracite | ||||||||||||||

In 2010, the Colombian government enacted a new law to expedite the development of coal mining concessions, based on three-year exploration period, three-year construction period and total of 30-year license life with an option for one 20-year renewal. To be granted a concession, a company must prove economic capacity, pay a reserve fee, and present a work plan. Each mining concession has three phases: exploration, construction, and exploitation as described below in the section titled “Government Regulation of our Business.”

Coal Quality

Colombian coal is recognized for its high caloric value, low ash and low sulfur contents.

Typical Coal Qualities by Region13

| Region | Moisture % | Ash % | Volatile Matter % | Fixed Carbon % | Total Sulfur % | BTU/Lb | ||||||||||||||||||

| Colombia | 11.9 | 6.9 | 35.9 | 45.2 | 0.4 | 11,600 | ||||||||||||||||||

| CAPP | 10 | 8 | > 30 | 0.6-1 | 12,000-12,500 | |||||||||||||||||||

| Indonesia | < 32 | < 16 | < 45 | 38-43 | < 1 | 8,998-14,000 | ||||||||||||||||||

| Australia | 8.4 | 17.2 | 30.8 | 0.7 | 11,700 | |||||||||||||||||||

| Illinois Basin | 10 | 8 | > 30 | 44.9-78.2 | 1.5-3 | 10,500-11,500 | ||||||||||||||||||

| South Africa | 7.2-8.8 | 19.5-36 | 20.3-26.5 | < 1 | 7,920-10,980 | |||||||||||||||||||

While our internal and third-party testing and analysis of coal qualities on our properties is still in process and not conclusive, preliminary results are indicative of coal quality consistent with the averages for Colombian metallurgical coal.

Coal Production and Delivery Costs

The overall cost of coal mining in Colombia is very competitive in world terms. However, Colombia currently suffers from infrastructure bottlenecks and high transportation costs. The Colombian government in collaboration with private industry has several infrastructure projects in the works to alleviate the bottlenecks and transportation costs.

| 13 | Source: FBR Research, January 2011. |

| 9 |

Coal can typically be mined and delivered ex-mine for $25-$30 per ton for surface mining and $35-$45 per ton for underground mining. However, FOB port costs are double or triple that amount depending on the region in which the coal is mined and the distance in which it must be transported to a port. Steam coal mined in northern Colombia is closer to the ports and typically costs $55-$60 per ton FOB, which includes about $15 per ton for transportation by truck and $15 per ton for port loading and storage. However, most of the metallurgical coal deposits are in the interior of the country and, in the absence of railroad access, can cost $60-$75 per ton to transport bringing the delivered cost to $110-$135 per ton. 14

Transportation in Colombia is regulated by the Ministry of Transport. Road travel is the main means of transport in the country. In 2009, 73.3% of cargo tons were transported by road, as compared with 24.6% by railroad, 2% by internal waterways and less than 1% percent by air.15 The vast majority of the coal exported from Colombia is transported through the Caribbean Basin Ocean ports. Approximately 1% - 2% is trucked to the port of Buenaventura on the Pacific Ocean or to Venezuelan port facilities on Lake Maracaibo. While Colombia’s coal transport and export infrastructure is not as extensive or capable as would be desired presently, it has kept pace with coal industry growth.

Colombian Infrastructure Development

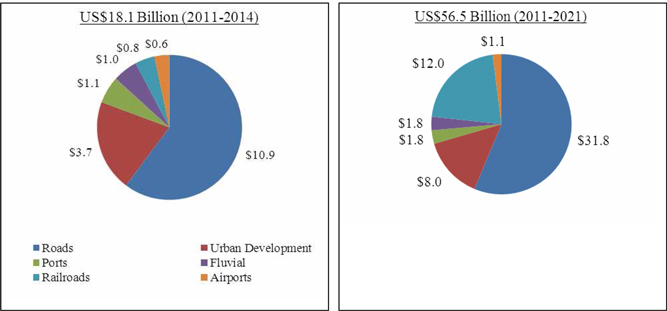

The Colombia Government has launched an ambitious program for the improvement of the quality and capacity of its transportation infrastructure. The government’s infrastructure improvement plan, known as the “Infrastructure Program For Prosperity 2011-2021”, is primarily focused on improving the country’s business competitiveness, bolstering the expansion of its mining and oil sectors and increasing its agricultural production. The plan includes US$56.5 billion of infrastructure development expenditures, US$18.1 billion of which will be spent in the next four years.

Planned Infrastructure Spending

(USD in billions)

Numerous infrastructure development projects are underway, many in participation with the private sector under a concessions scheme. In addition to the private sector, the government expects significant investment from the World Bank and regional development banks.

We are in discussions and negotiations with various existing transportation and logistics providers for the transport of our coal within Colombia to sea ports where customers typically take possession of coal for export. In addition, we are in discussions with multiple parties developing new transportation, infrastructure and logistics projects within Colombia. Our goal is to enter into one or more strategic agreements for coal transport as soon as possible.

| 14 | Source: FBR Research, January 2011 and company experience. |

| 15 | Source: Ministry of Transport |

| 10 |

Government Regulation of Our Business

In Colombia, the sub-soils are owned by the state. The state may authorize private parties to explore and develop mineral deposits under concession contracts. Until 2001, mineral deposits could also be developed under Exploration and Exploitation Contracts executed with specialized agencies of the state. However, as of 2001, Colombia’s new Mining Code modified by Law 1382 of 2010, only permits concession contracts, which are awarded by a single governmental entity, the Colombian Institute of Mining and Geology, and are subject to a standard set of conditions.

A concession contract grants to a concessionaire the exclusive right to carry out geological studies, to execute the works and to build the installations necessary within the given area to establish the existence of minerals and to exploit them according to the principles, rules and criteria of the accepted techniques of geology and mining engineering. It also covers the right to install and build the equipment, services and works necessary to efficiently exercise the rights set forth in the Colombian Mining Code modified by Law 1382 of 2010. Concession contracts are generally granted for a term that the proponent requests, up to a maximum of 30 years. Such term starts from the date the contracts are inscribed at the National Mining Register. Colombian law provides that land owners must grant concessionaires access to the minerals. In practice mining companies tend to purchase sufficient land to support their surface operations.

The concession contract has three phases:

1. Exploration Phase:

| · | During this phase, through subsoil and other tests, the concessionaire needs to determine the existence, size, and location of the contracted mineral, the geometry of the deposit within the area of concession, its quantity and quality and whether it is economically exploitable, the technical feasibility of extracting the mineral as well as any environmental and the social impacts. |

| · | Starts once the contract is inscribed in the Colombian National Mining Register. |

| · | Valid for three years plus a two-year extension. However, the concessionaire may request additional two-year extensions for up to 11 years. To do so, the concessionaire must present technical reasons and economic perspectives, demonstrate the fulfillment of mining and environmental guidelines, describe the works to be executed, specify the duration of the works, describe the investments to be made and make the corresponding payment of the surface fees during exploration. |

| · | Requires the payment of annual surface fee based on the number of hectares in the concession contract. Such fees are paid annually until the concession contract enters the exploitation phase at which time royalties are paid on production. |

| · | Requires an annual Environmental Mining Insurance Policy for 5 % of the value of the planned exploration expenditure for the year. |

| · | At the end of the Exploration Phase, the concessionaire must present a mine plan (PTO) and an Environmental Impact Study (EIA). |

| 2. | Construction Phase: |

| · | This phase consists of the preparation of the mining face and the installation of works, services, equipment, fixed machinery, necessary to start coal production, coal storage and transportation. This phase also includes constructing the infrastructure necessary to produce coal. |

| · | Valid for three years plus a one year extension. |

| · | Requires the payment of annual surface fees as in Exploration Phase based on the number of hectares in the concession. |

| · | Requires an annual Environmental Mining Insurance Policy for 5% of the value of the planned investment as defined in the PTO for the year. |

| 11 |

| · | During this phase, the EIA is reviewed and, upon its approval, an Environmental License is issued, which is required to enter into production. |

| 3. | Exploitation Phase. |

| · | This phase includes all manner of mining operations required to produce coal from the concession area until the mineral reserve is exhausted. This phase also includes mine closing and surface reclamation. |

| · | Valid for 30 years minus the time taken in the Exploration Phase and Construction Phase and is renewable for 20 years. |

| · | Requires an annual Environmental Mining Insurance Policy for 10 % of the result of multiplying the volume of annual production estimated of mineral object of the concession, by the price at the mine head of the mentioned mineral determined annually by the Government. |

| · | Requires royalty payments based on regulations at time of granting of the contract; no annual surface fees are paid. |

The Colombian Mining Law 685 of 2001 modified by Law 1382 of 2010 requires an Environmental Mining Insurance Policy for each concession contract. We have provided the required insurance policy for our three owned mining concessions. In addition, this provision states that an Environmental Impact Study has to be presented at the end of the Exploration Phase if the concession is to proceed to the Construction Phase, and this study must be approved and an Environmental License issued before the Exploitation Phase can begin.

Our mining properties are subject to Colombian and local laws and regulations regarding environmental matters, the extraction of water, and the discharge of mining wastes and materials. Any significant mining operations will have some environmental impact, including land and habitat impact, arising from the use of land for mining and related activities, and certain impact on water resources near the project sites, resulting from water use, rock disposal and drainage run-off. We believe our current concessions and those for which we are currently applying are in material compliance with all environmental rules and regulations. Nevertheless, no assurances can be given that such environmental issues will not have a material adverse effect on our operations in the future.

Also, during the exploration phase we must maintain an environmental inventory and record how we disturb the environment during the exploration and drillings, which in turn forms the basis for compensating the land owner for any disturbance to the environment during this phase. For example, before we drill in an area, we take photographs and inventory the environment, such as trees, streams, etc. We then get written permission from the land owner to drill on his land. At present we have permissions from the land owners where we are currently drilling. After we complete our drilling program and the equipment is removed, we again will take photographs and a second inventory. Any difference, such as removal of a tree, will require us to compensate the land owner. The amount of the compensation is determined by a schedule published by the local environmental authority.

Prior to acquiring additional concessions, we intend to make a thorough assessment to mitigate possible unexpected environmental liabilities. Nevertheless, any mining operations we acquire in the future may currently or historically have used hazardous materials and, to the extent that such materials are not recycled, they could become hazardous waste. We may be subject to claims under federal, regional, or local statutes and/or common law doctrines and their Colombian law equivalents for toxic torts and other damages, as well as for natural resource damages and the investigation and clean-up of soil, surface water, groundwater, and other media. Such claims may arise, for example, out of current or former conditions at sites that we acquire, and at contaminated sites that have always been owned or operated by third parties. Liability may be without regard to fault and may be strict, joint and several, so that we may be held responsible for more than our share of the contamination or other damages, or even for the entire share.

Coal Sales and Marketing

The Company is entertaining various alternatives regarding coal sales including selling into the local market which consists of coke and steel manufacturers as well as aggregating our product with that of others for export. Based on international market conditions, we are confident that a market should exist for substantially all of our production into the near future.

| 12 |

Competition

We compete with other exploration and development companies, many of which possess greater financial resources and technical abilities than we do. Our main areas of competition are acquiring exploration rights and engaging qualified personnel. The coal exploration industry is highly fragmented, and we are a very small participant in this sector. Many of our competitors explore for a variety of coal properties and control many different properties around the world. Many of them have been in business longer than we have and have probably established more strategic partnerships and relationships and have greater financial accessibility than we do.

There is significant competition for properties suitable for coal exploration. As a result, we may be unable to continue to acquire interests in attractive properties on terms that we consider acceptable. We will be subject to competition and unforeseen limited sources of supplies in the industry in the event spot shortages arise for supplies and certain equipment that we will need to conduct exploration. If we are unsuccessful in securing the products, equipment and services we need we may have to suspend our exploration plans until we are able to secure them.

Principal Offices

The address of our principal executive office is One Embarcadero Center, Suite 500, San Francisco, CA 94111. Our telephone number is (415) 460-1165. Our Internet address is www.colombiaenergyresources.com. The address of our headquarters in Bogota, Colombia, is Calle 90 No. 19-41, Oficina 901, Bogota, Colombia.

Employees

We have 133 full-time employees of the Company and its consolidated subsidiaries. We are not represented by labor unions. We believe that our relationship with our employees is satisfactory, but there can be no assurances that we will continue to maintain good relations with our employees.

ITEM 1A. Risk Factors

You should consider carefully the following risks and other information in this Annual Report, including the financial statements. If any of the following risks actually occur, our business, financial condition and operating results could be adversely affected.

Risks Related to Our Company and Its Business

Because of our historic losses from operations since inception, there is substantial doubt about our ability to continue as a going concern.

In their report dated March 30, 2012, our independent registered public accounting firm stated that our financial statements for the year ended December 31, 2011, were prepared assuming that we would continue as a going concern. We have incurred recurring loses since the date of inception that have resulted in an accumulated deficit attributable to common stockholders of approximately $25,700,000 as of December 31, 2011. Although we had approximately $10,800,000 of available cash at December 31, 2011, that amount is not adequate to meet our capital expenditure and operating requirements over the next 12 months. These factors raise substantial doubt about the ability of the Company to continue as a going concern. We are dependent upon obtaining funds from investors to meet our cash flow requirements. If we are unsuccessful in doing so, we would be required to substantially revise our business plan or our business could fail.

Our company has a limited operating history and therefore we cannot ensure the long-term successful operation of our business or the execution of our business plan.

We have been engaged in our current business operations since May 2010. As a result, we have a limited operating history upon which to evaluate our proposed business and prospects. Our proposed business operations will be subject to numerous risks, uncertainties, expenses and difficulties associated with early stage enterprises. Such risks include but are not limited to the following:

| · | the absence of a lengthy operating history; |

| 13 |

| · | insufficient capital to fully realize our operating plan; |

| · | our ability to purchase or lease necessary equipment when required and at reasonable prices; |

| · | our ability to obtain regulatory and environmental approvals of our proposed mines and facilities; |

| · | expected continual losses for the foreseeable future; |

| · | operating in multiple currencies; |

| · | social and political unrest; |

| · | disruptions to transportation routes; |

| · | our ability to anticipate and adapt to a developing market(s); |

| · | acceptance of our coal by consumers; |

| · | limited marketing experience; |

| · | a competitive environment characterized by well-established and well-capitalized competitors; |

| · | the ability to identify, attract and retain qualified personnel; and |

| · | reliance on key personnel. |

Because we are subject to these risks, evaluating our business may be difficult. We may be unable to successfully overcome these risks which could harm our business. Our business strategy may be unsuccessful and we may be unable to address the risks we face in a cost-effective manner, if at all. If we are unable to successfully address these risks our business will be harmed.

We intend to partake in joint ventures and/or strategic alliances to develop and operate our planned businesses. These partnerships or the failure to establish them could have a material adverse effect on our ability to develop and manage our business. In addition, such undertakings may not be successful.

Our strategy includes plans to participate in joint ventures and other strategic alliances to develop and operate our businesses and sell our products. We intend to develop mining operations in part through joint ventures and strategic alliances with other parties as well as with additional outside funding. Joint ventures and strategic alliances may expose us to new operational, regulatory and market risks, as well as risks associated with additional capital requirements. Additionally, we may not be able to identify and secure suitable alliance partners. Even if we identify suitable partners, we may be unable to consummate alliances on terms commercially acceptable to us. If we fail to identify appropriate partners, we may not be able to implement our strategies effectively or efficiently.

In addition to joint venture and strategic alliances, we plan to raise additional debt and/or equity financing to build and operate our proposed mining operations. Such capital raises could result in significant dilution to the percentage ownership held by existing shareholders or the failure to secure such capital could impair our ability to execute our business plan.

We anticipate that the cost to build mining operations on our existing or future mining properties will be significant and we have limited current sources for this funding. We have received indications of interest in future financings but have no firm commitments for any funds. The net proceeds of future offerings are expected to be used to begin and continue initial mining operations, acquire additional properties and fund operations for the next twelve months. Additional offerings using our equity securities or debt instruments convertible into our common stock could require the issuance of a substantial number of additional shares of common or preferred stock. These potential offerings and the issuance of additional shares of common or preferred stock would have the effect of diluting the percentage ownership of existing shareholders. Moreover, there can be no assurance that such financing will be available, or, if available, that such financing will be at a price that will be acceptable or favorable to us. Failure to generate sufficient revenue or raise additional capital would have an adverse impact on our ability to achieve our longer-term business objectives, and would adversely affect our ability to continue operating as a going concern.

| 14 |

Currency fluctuations may negatively affect costs we incur outside of the United States.

Currency fluctuations may affect our costs as the majority of our expenses are incurred in Colombian Pesos. The exchange rate in 2010 ranged from an average monthly low of 1,804 Colombian pesos per U.S. dollar to a high of 1,986 pesos per dollar and in 2011 the exchange rates ranged from an average monthly low of 1,748.41 Colombian pesos per U.S. dollar to a high of 1,972.96 pesos per dollar. These fluctuations have meant that our in-country operational and exploration expenses in U.S. dollar terms have been difficult to predict in any specific reporting period. In addition, any significant decline in the exchange rate could have a material negative impact on our operating funds.

Future acquisitions are expected to be a part of our growth strategy, and could expose us to significant business risks.

One of our strategies is to grow our business through acquisitions of coal mining concessions and other assets. However, we cannot assure you that we will be able to identify and secure suitable acquisition opportunities. Our ability to consummate and integrate effectively any future acquisitions on terms that are favorable to us may be limited by the number of attractive acquisition targets, internal demands on our resources and, to the extent necessary, our ability to obtain financing on satisfactory terms, if at all, for larger acquisitions. Moreover, if an acquisition target is identified, the third parties with whom we seek to cooperate may not select us as a potential partner or we may not be able to enter into arrangements on commercially reasonable terms or at all. The negotiation and completion of potential acquisitions, whether or not ultimately consummated, could also require significant diversion of management’s time and resources and cause potential disruption of our existing business. Furthermore, we cannot assure you that the expected synergies from future acquisitions will actually materialize. In addition, future acquisitions could result in the incurrence of additional indebtedness, costs, and contingent liabilities. Future acquisitions may also expose us to potential risks, including risks associated with:

| · | the integration of new operations, services and personnel; |

| · | unforeseen or hidden liabilities; |

| · | the diversion of financial or other resources from our existing businesses; |

| · | our inability to generate sufficient revenue to recover costs and expenses of the acquisitions; and |

| · | potential loss of, or harm to, relationships with employees or customers. |

Any of the above could significantly disrupt our ability to manage our business and materially and adversely affect our business, financial condition and results of operations.

If we are unable to hire and retain key personnel, we may not be able to implement our plan of operation and our business may fail.

Our success is largely dependent on our ability to continue to hire and retain highly-qualified personnel in both management and operations. These individuals may be in high demand and we may not be able to attract the management staff we need. In addition, we may not be able to afford the high salaries and fees demanded by qualified personnel, including fees associated with U.S. persons employed by us and residing in Colombia, or we may fail to retain such employees after they are hired. Our failure to hire and retain key personnel as needed will have a significant negative effect on our business.

We do not insure against all potential operating risks. We may incur losses and be subject to liability claims as a result of our operations.

We maintain insurance for some, but not all, of the potential risks and liabilities associated with our business. For some risks, we may not obtain insurance if we believe the cost of available insurance is excessive relative to the risks presented. As a result of market conditions, premiums and deductibles for certain insurance policies can increase substantially, and in some instances, certain insurance may become unavailable or available only for reduced amounts of coverage. As a result, we may not be able to renew our existing insurance policies or procure other desirable insurance on commercially reasonable terms, if at all. Although we maintain insurance at levels we believe are appropriate and consistent with industry practice, we are not fully insured against all risks. In addition, pollution and environmental risks generally are not fully insurable. Losses and liabilities from uninsured and underinsured events and delay in the payment of insurance proceeds could have a material adverse effect on our financial condition, results of operations and cash flows.

| 15 |

Risks Associated With Our Current and Proposed Coal Mining Operations

The government of the Republic of Colombia has placed a moratorium on the granting of new mining concessions which may hinder our ability to acquire additional mining properties.

The federal government of the Republic of Colombia has ceased granting new mining concessions while the government makes internal structural changes to create a more efficient administrative process to award mining concessions in compliance with applicable mining laws. The moratorium, which commenced on February 1, 2011, prohibits any new applications made for concessions after that date until the moratorium is lifted, which is anticipated to occur in May 2012. We are unable to determine the specific changes in existing mining law that may occur, but we anticipate that a national mining agency will be created and that more stringent safety rules may be enacted, which could increase the level of review and monitoring of coal mining activities by the government and could result in increased costs of conducting mining operations in the country.

There are no proven or probable reserves on our coal properties. Until we can measure and characterize the coal deposits on properties we own or acquire properties with commercially exploitable quantities, our ability to earn any revenues from operations over time is questionable and if we do not do so our business could fail.

Despite preliminary exploration work on our coal mining properties, we have not as of yet established any proven or probable reserves of coal. A mineral reserve is that part of a mineral deposit that can be economically and legally extracted or produced at the time of the reserve determination, which is normally obtainable only upon completion of a final feasibility study. Even if we do eventually establish proven or probable coal reserves on one or more of our concessions, there can be no assurance that we will be able to develop our properties into producing mines and extract those resources. Both coal exploration and development involve a high degree of risk and few properties which are explored are ultimately developed into producing mines. The commercial viability of an established coal deposit will depend on a number of factors including, by way of example, the size, grade and other attributes of the coal deposit, the proximity of the coal deposit to infrastructure, such as roads and a point for shipping, government regulation and market prices. Most of these factors will be beyond our control, and any of them could increase costs and make extraction of any identified coal unprofitable. Our ability to raise significant funds for current and future operations may also be adversely affected until we are able to generate reports of measurable quantities of coal resources.

Coal mining operations are subject to applicable law and government regulation. Even if we discover coal in a commercially exploitable quantity, these laws and regulations could restrict or prohibit the exploitation of that coal. If we cannot exploit any coal that we might discover on our properties, our business may fail.

Both coal exploration and extraction in the Republic of Colombia require permits from various foreign, federal, state, provincial and local governmental authorities and are governed by laws and regulations, including those with respect to prospecting, mine development, mineral production, transport, export, taxation, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. There can be no assurance that we will be able to obtain or maintain any of the permits required by the Colombian Institute of Mining and Geology for the continued exploration of our coal mining properties or for the construction and operation of a mine on our properties at economically viable costs. If we cannot accomplish these objectives, our business could fail.

We are currently in compliance with all material laws and regulations that currently apply to our proposed business activities, but if we are unable to continue to remain in compliance, our business could fail. Current laws and regulations are being amended and we might not be able to comply with them. Further, there can be no assurance that we will be able to obtain or maintain all permits necessary for our future operations, or that we will be able to obtain them on reasonable terms. To the extent such approvals are required and are not obtained, we may be delayed or prohibited from proceeding with planned exploration or development of our coal mining properties.

| 16 |

Our mining production and delivery operations are subject to conditions and events that are beyond our control, which could result in higher operating costs and decreased production levels.

Our mining operations are planned to be conducted primarily in underground mines and possibly in surface mines. The level of our production is subject to operating conditions or events beyond our control that could disrupt operations, decrease production and affect the cost of mining at particular mines for varying lengths of time. Adverse operating conditions and events that coal producers have experienced in the past include:

| · | unfavorable geologic conditions, such as the thickness of the coal deposits and the amount of rock embedded in or overlying the coal deposit; |

| · | poor mining conditions resulting from geological conditions or the effects of prior mining; |

| · | inability to acquire or maintain, or unexpected delays or difficulties in obtaining, necessary permits or mining or surface rights; |

| · | changes in governmental regulation of the mining industry or the electric utility industry; |

| · | market conditions could change and mean the sale of the type of coal being produced from our concessions is no longer saleable at an economic price; |

| · | coal seam quality decreases so we cannot meet market requirements; |

| · | adverse weather conditions and natural disasters; |

| · | accidental mine water flooding; |

| · | labor-related interruptions; |

| · | interruptions due to transportation delays; |

| · | mining and processing equipment unavailability and failures and unexpected maintenance problems; |

| · | accidents, including fire and explosions from methane and other sources; |

| · | surface subsidence from underground mining, which could result in collapsed roofs at our underground mines, among other difficulties; |

| · | unavailability of mining equipment and supplies and increases in the price of mining equipment and supplies; |

| · | unexpected maintenance problems or key equipment failures; and |

| · | increased or unexpected reclamation costs. |

If any of these or similar conditions or events occur in the future at any of the mines we plan to develop or affect deliveries of our coal to customers, they may increase our costs of mining and delay or halt production at particular mines or sales to our customers, either permanently or for varying lengths of time, which could adversely affect our results of operations, cash flows and financial condition. Our current insurance coverage would cover some but not all of these risks.

Inaccuracies in our estimates of coal deposits could result in lower than expected revenues and higher than expected costs.

We will base our coal deposit information on engineering, economic and geological data assembled and analyzed by our in house and contract workers, which will include various engineers and geologists. The estimates of coal deposits as to both quantity and quality will be continually updated to reflect the production of coal from the deposits and new drilling or other data received. There are numerous uncertainties inherent in estimating quantities and qualities of coal deposits and costs to process these deposits, including many factors beyond our control. Estimates of economically recoverable coal reserves and net cash flows necessarily depend upon a number of variable factors and assumptions, all of which may vary considerably from actual results, such as:

| · | geological and mining conditions and/or effects from prior mining activities that may not be fully identified by available exploration data or that may differ from experience, in current operations; |

| · | the assumed effects of regulation, including the issuance of required permits, and taxes by governmental agencies and assumptions concerning coal prices, operating costs, mining technology improvements, severance and excise tax, development costs and reclamation costs; |

| 17 |

| · | historical production from the area compared with production from other similar producing areas; and |

| · | assumptions concerning future coal prices, operating costs, capital expenditures, severance taxes and development and reclamation costs. |

For these reasons, estimates of the economically recoverable quantities and qualities attributable to any particular group of properties, classifications of coal reserves and non-reserve coal deposits based on risk of recovery and estimates of net cash flows expected from particular reserves prepared by different engineers or by the same engineers at different times may vary substantially and vary materially from estimates. As a result, these estimates may not accurately reflect actual coal reserves or non-reserve coal deposits. Any inaccuracy in our estimates related to our coal deposits could result in lower than expected revenues, higher than expected costs and decreased profitability.

A substantial or extended decline in coal prices could reduce our revenues and the value of our coal resources.

Our results of future operations will be dependent upon the prices we receive for our coal and other products as well as our ability to improve productivity and control costs. Declines in prices could adversely affect our results of operations. The prices charged for coal depend upon factors beyond our control, including:

| · | the supply of, and demand for, domestic and foreign coal and coke; |

| · | the price elasticity of supply; |

| · | the demand for electricity; |

| · | the proximity to and the capacity and cost of transportation facilities; |

| · | governmental regulations and taxes; |

| · | air emission standards for coal-fired power plants; |

| · | regulatory, administrative and judicial decisions, including legislation to allow retail price competition in the electric utility industry; |

| · | the price and availability of alternative fuels, including the effects of technological developments; and |

| · | the effect of worldwide energy conservation measures. |

Decreased demand for coal could result in declines in coal prices and require us to increase productivity and lower costs in order to maintain our margins. If we are not able to maintain our margins, our operating results could be adversely affected. Therefore, price declines may adversely affect our operating results for future periods and our ability to generate cash flows necessary to improve productivity and invest in operations.

A decrease in the availability or increase in costs of labor, key supplies, capital equipment or commodities could decrease our profitability.

We will require access to contract miners at commercially acceptable rates. We currently have no contracts or arrangements for necessary mining personnel. Our proposed mining operations will also require a reliable supply of steel-related products (including roof control for our underground mines), replacement parts, belting products and lubricants, none of which have been secured by definitive agreements or contracts. If the cost of any of these or other supplies increases significantly, or if a source for such mining equipment or supplies are unavailable to meet our replacement demands, our profitability could be adversely affected. In addition, industry-wide demand growth has recently exceeded supply growth for certain underground surface and other capital equipment. As a result, lead times for some items have increased significantly. Significant delays in obtaining required parts and equipment could cause our profitability to be reduced from our current expectations.

| 18 |

We may acquire operating mines that initially may not meet our criteria for safety and may subject us to liability for prior or existing operations until we can upgrade the safety issues.

We are evaluating a number of mining operations which we may target for acquisition in the future, not all of which may meet the safety standards which we have established for our own proposed mining operations. The upgrading of the operations to meet our safety criteria may require a significant period to correct or ameliorate prior less safe operations. During this period of transition we may be subject to the risk of injury to personnel or destruction of equipment or mine infrastructure as a result of prior operations. In addition, we cannot predict the nature of mine safety regulations which are currently under consideration by the government of the Republic of Colombia as result of recent injuries caused by mine cave-ins and explosions. If we are unable to reasonably meet any new standards for existing mining operations acquired by us, or if the cost of such remediation is excessive, we may decide to abandon the mining operation, in which event we would lose our entire investment in the project.

Risks Associated with Doing Business in South America

If we encounter local criminal or political violence in the region in which we operate, our production or other operations may be interrupted or halted and we may be unable to attract and retain foreign or local personnel to work at our mining locations.

Criminal violence, kidnappings, vandalism, and political unrest in many Central and South American countries have caused interruptions in operations and made it more difficult to engage foreign and local professionals to work in these areas. On February 17, 2012 the surface facilities at our Rukú Mining Complex were damaged as a result of vandalism and forced us to cease operations temporarily. There is no assurance that such an incident will not reoccur. Any criminal violence, kidnappings, vandalism, or political unrest in the region in which our mining concessions are located, could have a material negative impact on our ability to complete our planned business operations. These conditions may also affect our ability to secure and retain local professionals. We are currently in the process of developing a policy to protect our foreign and local employees and assets from these potential threats.

Adverse economic and political conditions in the Republic of Colombia affect our financial condition and results of operations.

Most of our operations and property will be located in the Republic of Colombia and accordingly our business is subject to a variety of economic, political, market and credit risks. The quality of our assets, financial condition and results of operations significantly depend on macroeconomic and political conditions prevailing in Colombia and the other jurisdictions in which we operate. The Republic of Colombia is subject to political, economic and other uncertainties, including renegotiation, or nullification of existing contracts, currency exchange restrictions, and international monetary fluctuations. Furthermore, changes in monetary, exchange, and trade policies could affect the overall business environment in Colombia, which would in turn impact our financial condition and results of operations.

Furthermore, decreases in the growth rate in the economies where we operate, particularly in the Republic of Colombia, periods of negative growth, or increases in inflation or interest rates could result in lower demand for our services and products, lower real pricing of our services and products, or in a shift toward lower margin services and products. Because a large percentage of our costs and expenses are fixed, we may not be able to reduce costs and expenses upon the occurrence of any of these events, and our profit margins and results of operations could suffer as a result.

Colombia’s economy remain vulnerable to external shocks that could be caused by significant economic difficulties experienced by its major regional trading partners or by more general “contagion” effects, which could have a material adverse effect on its economic growth and its ability to service their public debt.

Emerging-market investment generally poses a greater degree of risk than investment in more mature market economies because the economies in the developing world are more susceptible to destabilization resulting from domestic and international developments.

In the case of the Republic of Colombia, a significant decline in the economic growth of any of its major trading partners, such as the United States, Venezuela and Ecuador, could have a material adverse impact on Colombia’s balance of trade, and adversely affect Colombia’s economic growth. In addition, a “contagion” effect, in which an entire region or class of investment is disfavored by international investors, could negatively affect Colombia or other economies where we operate.

| 19 |

The current global economic downturn, which began in the U.S financial sector and then spread to different economic sectors and countries around the world, has had, and is expected to continue to have, adverse effects on the economies of the countries where we operate.

Government policies in the jurisdictions where we operate could significantly affect the local economy and, as a result, our business and financial condition.

Our business and financial condition could be adversely affected by changes in policy, or future judicial interpretations of such policies, involving exchange controls and other matters such as currency depreciation, inflation, interest rates, taxation, laws and regulations and other political or economic developments in or affecting the Republic of Colombia or the other jurisdictions where we operate.

In particular, the government of the Republic of Colombia has historically exercised substantial influence over its economy, and its policies are likely to continue to have an important effect on market conditions and prices and rates of return on securities of local issuers (including our securities). Future developments in government policies could impair our business or financial condition or the market value of our securities.

Any additional taxes resulting from changes to tax regulations or the interpretation thereof in the Republic of Colombia or other countries where we operate, could adversely affect our consolidated results.

Uncertainty relating to tax legislation poses a constant risk to us. Colombian national authorities have levied new taxes in recent years. Changes in legislation, regulation and jurisprudence can affect tax burdens by increasing tax rates and fees, creating new taxes, limiting stated expenses and deductions, and eliminating incentives and non-taxed income.

Additional tax regulations could be implemented that could require us to make additional tax payments, negatively affecting our financial condition, results of operation, and cash flow. In addition, either national or local taxing authorities may not interpret tax regulations in the same way that we do. Differing interpretations could result in future tax litigation and associated costs.

Risks Related to Our Common Stock

We have not paid, and do not intend to pay, dividends on our common stock and therefore, unless our common stock appreciates in value, our investors may not benefit from holding our common stock.

We have not paid any cash dividends on our common stock since inception. We do not anticipate paying any cash dividends our common stock in the foreseeable future. As a result, investors in our common stock will not be able to benefit from owning our common shares unless the market price of our common stock becomes greater than the price paid for the stock by these investors.

The public trading market for our common stock is volatile and may result in higher spreads in stock prices.

Our common stock trades in the over-the-counter market and is quoted on the OTC QX. The over-the-counter market for securities has historically experienced extreme price and volume fluctuations during certain periods. These broad market fluctuations and other factors, such as our ability to implement our business plan pertaining to our coal mining properties in the Republic of Colombia, as well as economic conditions and quarterly variations in our results of operations, may adversely affect the market price of our common stock. In addition, the spreads on stock traded through the over-the-counter market are generally unregulated and higher than on stock exchanges, which means that the difference between the price at which shares could be purchased by investors in the over-the-counter market compared to the price at which they could be subsequently sold would be greater than on these exchanges. Significant spreads between the bid and asked prices of the stock could continue during any period in which a sufficient volume of trading is unavailable or if the stock is quoted by an insignificant number of market makers. Historically our trading volume has been insufficient to significantly reduce this spread and we have had a limited number of market makers sufficient to affect this spread. These higher spreads could adversely affect investors who purchase the shares at the higher price at which the shares are sold, but subsequently sell the shares at the lower bid prices quoted by the brokers. Unless the bid price for the stock exceeds the price paid for the shares by the investor, plus brokerage commissions or charges, the investor could lose money on the sale. For higher spreads such as those on over-the-counter stocks, this is likely a much greater percentage of the price of the stock than for exchange listed stocks. There is no assurance that at the time an investor in our common stock wishes to sell the shares, the bid price will have sufficiently increased to create a profit on the sale.

| 20 |

Our board of directors can, without stockholder approval, cause preferred stock to be issued on terms that adversely affect common stockholders.