Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HOMEAWAY INC | d325994d8k.htm |

EXHIBIT 10.1

2012 Executive Officer Performance Bonus Plan

Plan Goal

The purpose of the HomeAway 2012 Executive Officer Performance Bonus Plan (the “Plan”) is to motivate exceptional performance by the executive officers of HomeAway U.S. (the “Company”) throughout the year by rewarding the achievement of pre-established business objectives. The Plan is to be administered by the Compensation Committee of the Board of Directors of the Company (the “Committee”).

Plan Year

The term of the Plan is January 1 – December 31, 2012.

Eligibility

All U.S. based executive officers of the Company who are not eligible to participate in another Company incentive plan (for example, the Company’s commission-based incentive plan) (the “Executive Officers”) are eligible to participate in the Plan. Plan eligibility for newly hired Executive Officers begins on the first day of the fiscal quarter following their hire date.

Target Bonus

The annual target bonus opportunity for the Chief Executive Officer is 100% of his base salary. The annual target bonus opportunity for the Chief Operating Officer is 75% of his base salary; the target bonus opportunity for all other Executive Officers is 60% of their base salary. For purposes of determining an Executive Officer’s annual target bonus opportunity, “base salary,” means the cumulative base salary earnings for the Plan year.

Budget

The annual Plan budget is the sum of each annual target bonus opportunity (expressed as a percentage of base salary) multiplied by the respective cumulative base salary earnings for each Executive Officer.

Bonus Calculation

Bonuses will be considered earned and accrued as of December 31, 2012. The bonuses for the Executive Officers are to be calculated using the performance grids approved by the Committee.

The performance grids are based upon an acceptable range of business results with the expectation that the Executive Officers may need to make trade offs between GAAP Revenue and Adjusted GAAP EBITDA during the course of the year.

While this is the case, the Committee requires that GAAP revenue reach a specific level before paying overachievement on Adjusted GAAP EBITDA.

Using a straight-line bonus calculation made by the Committee at fiscal year-end, the Company’s GAAP Revenue and Adjusted GAAP EBITDA results, together with the results for each Executive Officer’s individual performance objectives (the “MBOs”), will be evaluated by the Committee to determine the total bonus credits for the Plan year.

This calculation may be expressed as the following formula:

(GAAP Revenue Bonus Credit + Adjusted GAAP EBITDA Bonus Credit + MBO Bonus Credit) * Annual Bonus Target) multiplied by the cumulative base salary earnings for each Executive Officer.

Performance Measures

Within the first 90 days of the Plan year the Committee will identify an acceptable range of business results for the GAAP Revenue and Adjusted GAAP EBITDA performance measures. Once established, these ranges will be communicated to the Executive Officers in the form of performance grids. These performance grids are subject to change by the Committee in the event of acquisitions, dispositions or other events (other than company performance) having a material impact on GAAP Revenue or Adjusted GAAP EBITDA.

The MBO portion of each Executive Officer’s annual target bonus opportunity will be discretionary based upon the achievement of qualitative performance objectives assigned and evaluated by the Chief Executive Officer, the Committee, and/or the Board of Directors.

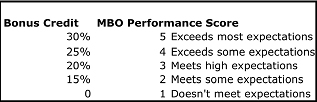

MBO Performance

Bonus Payments

The Executive Officers will receive any earned bonus payments after the end of the Plan year, typically in February or March, following confirmation of the achievement of the performance measures s by the Committee. See “Bonus Calculation” below for additional information.

Payment Type

Bonus payments will be made via direct deposit or live check with all applicable taxes withheld. Bonus payments will be subject to the applicable federal income tax withholding rate (currently, 25%), in addition to applicable FICA, state, and local taxes. In addition, any current Section 401(k) contribution, as applicable, will be deducted from a bonus before payment is made. Bonus payments will be excluded from the calculation of benefits payable under any other Company benefits plan or program, with the exception of Company-paid life insurance, accidental death and disability insurance, and disability insurance.

Program Administration, Amendment & Termination

Final authority on all issues related to the Plan will reside with the Committee. The Plan may be modified, terminated, or rescinded in whole or in part at any time by the Committee and/or the Board of Directors, provided, however, that no revision or termination that would have an adverse effect on any outstanding awards earned. No modification or exception to the Plan is valid or enforceable unless approved in writing by the Committee. Executive Officers’ target bonus opportunities may be modified at the discretion of the Committee at any time.

At-Will Employment

The Plan does not affect the “at will” employment status of the Executive Officers. Neither the attainment of goals nor the continuous service requirement necessary to earn a bonus alters the ability of an Executive Officer or the Company to terminate employment at any time, with or without reason and with or without advance notice.

Discretionary Nature of Plan and Award Payments

No individual has a vested entitlement to any payment under the Plan; all awards are paid at the sole discretion of the Committee. Specifically, regardless of whether an award has been consistently paid over any period of time, the Committee, at its sole discretion, reserves the right to (i) increase or decrease targets and target bonus award percentages, (ii) terminate the participation of any individual in the Plan at any time for any legal reason, and/or (iii) modify, terminate, or rescind the Plan, in whole or in part, all with or without notice or cause.

Application of Deferred Compensation Rules

The Plan is generally to be operated in a manner that complies with Section 409A of the Internal Revenue Code and, as such, all awards paid under the Plan will be paid as set forth above.

Effective Date

The Plan shall take effect on January 1, 2012 and will supersede and replace all other bonus plans applicable to eligible employees. The Plan will terminate on December 31, 2012.