Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Guinness Exploration, Inc | Financial_Report.xls |

| EX-32.1 - GUINNESS EXPLORATION 10Q, CERTIFICATION 906, CEO/CFO - Guinness Exploration, Inc | guinnessexh32_1.htm |

| EX-31.1 - GUINNESS EXPLORATION 10Q, CERTIFICATION 302, CEO - Guinness Exploration, Inc | guinnessexh31_1.htm |

| EX-31.2 - GUINNESS EXPLORATION 10Q, CERTIFICATION 302, CFO - Guinness Exploration, Inc | guinnessexh31_2.htm |

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________

FORM 10-Q

x QUARTERLY REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the Quarter Ended February 29, 2012

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM _______________________ TO _______________________

Commission File # 000-53375

GUINNESS EXPLORATION, INC.

(Exact name of registrant as specified in its charter)

Nevada

(State or other jurisdiction of incorporation or organization)

98-0465540

(IRS Employer Identification Number)

Suite 12E, Eclipse, 156 Vincent West

Auckland, New Zealand 1010

(Address of principal executive offices) (Zip Code)

(509) 252-9157

(Registrant’s telephone no., including area code)

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated file.

| Large accelerated filer | o | Accelerated filer | o | |

| Non-accelerated filer | o | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Yes o No x

The issuer had 129,325,000 shares of common stock issued and outstanding as of March 29, 2012.

GUINNESS EXPLORATION, INC.

(An Exploration Stage Company)

Table of Contents

|

Page

|

|||

PART I – FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS (unaudited)

GUINNESS EXPLORATION, INC. AND SUBSIDIARY

(An Exploration Stage Company)

Consolidated Balance Sheets

|

February 29,

2012

(unaudited)

|

May 31,

2011

(See Note 1)

|

|||||||

|

ASSETS

|

||||||||

|

CURRENT ASSETS

|

||||||||

|

Cash

|

$ | 237 | $ | 54,382 | ||||

|

Prepaid expenses

|

174 | 3,119 | ||||||

|

Total current assets

|

411 | 57,501 | ||||||

|

Total assets

|

$ | 411 | $ | 57,501 | ||||

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

||||||||

|

CURRENT LIABILITIES

|

||||||||

|

Accounts payable and accrued expenses

|

$ | 220 | $ | 935 | ||||

|

Total current liabilities

|

$ | 220 | $ | 935 | ||||

|

COMMITMENTS AND CONTINGENCIES (Notes 2, 3, 4, 5, 7 and 8)

|

- | - | ||||||

|

STOCKHOLDERS’ EQUITY

|

||||||||

|

Preferred shares, 100,000,000 shares authorized with par value $0.001 authorized, 0 shares issued and outstanding

|

$ | - | $ | - | ||||

|

Common shares, 500,000,000 shares with par value $0.001 authorized, 129,325,000 issued and outstanding at February 29, 2012 and May 31, 2011, respectively (Note 7)

|

129,325 | 129,325 | ||||||

|

Paid-in Capital (Notes 4 and 7)

|

2,205,713 | 2,205,713 | ||||||

|

Accumulated deficit in the exploration stage

|

(2,339,834 | ) | (2,284,328 | ) | ||||

|

Accumulated other comprehensive income (Note 2)

|

4,987 | 5,856 | ||||||

|

Total stockholders’ equity

|

$ | 191 | $ | 56,566 | ||||

|

Total liabilities and stockholders’ equity

|

$ | 411 | $ | 57,501 | ||||

The accompanying notes to financial statements are an integral part of these consolidated financial statements

GUINNESS EXPLORATION, INC. AND SUBSIDIARY

(An Exploration Stage Company)

Consolidated Statements of Operations

(Unaudited)

|

Three months

ended

February 29,

2012

|

Three months

ended

February 28,

2011

|

Nine months

ended

February 29,

2012

|

Nine months

ended

February 28,

2011

|

July 15, 2005

(inception)

through

February 29,

2012

|

||||||||||||||||

|

EXPENSES:

|

||||||||||||||||||||

|

Exploration costs

|

$ | 1,500 | $ | 1,006 | $ | 6,000 | $ | 801,090 | $ | 1,033,762 | ||||||||||

|

Professional fees

|

14,479 | 34,232 | 34,273 | 116,979 | 551,395 | |||||||||||||||

|

Administrative expenses

|

4,636 | 21,443 | 13,369 | 79,244 | 84,393 | |||||||||||||||

|

Investor relations

|

60 | 13,785 | 1,865 | 62,997 | 112,528 | |||||||||||||||

|

Mineral property impairments

|

- | - | - | - | 1,021,653 | |||||||||||||||

|

Total expenses

|

20,675 | 70,466 | 55,507 | 1,060,310 | 2,803,731 | |||||||||||||||

|

Net (loss) from Operations

|

(20,675 | ) | (70,466 | ) | (55,507 | ) | (1,060,310 | ) | (2,803,731 | ) | ||||||||||

|

Interest expense

|

- | - | - | - | (8,037 | ) | ||||||||||||||

|

Net (loss) prior to other income

|

(20,675 | ) | (70,466 | ) | (55,507 | ) | (1,060,310 | ) | (2,811,768 | ) | ||||||||||

|

OTHER INCOME:

|

||||||||||||||||||||

|

Gain on cancelation of debt

|

- | - | - | 471,934 | 471,934 | |||||||||||||||

|

Net (loss)

|

$ | (20,675 | ) | $ | (70,466 | ) | $ | (55,507 | ) | $ | (588,376 | ) | $ | (2,339,834 | ) | |||||

|

Loss per common share, basic and diluted

|

$ | Nil | $ | Nil | $ | Nil | $ | Nil | ||||||||||||

|

Weighted average shares outstanding, basic and diluted

|

129,325,000 | 129,325,000 | 129,325,000 | 132,676,648 | ||||||||||||||||

|

OTHER COMPREHENSIVE (LOSS):

|

||||||||||||||||||||

|

Net loss

|

$ | (20,675 | ) | $ | (70,466 | ) | $ | (55,507 | ) | $ | (588,376 | ) | $ | (2,339,834 | ) | |||||

|

Foreign currency translation adjustment

|

64 | 2,327 | (868 | ) | 2,327 | 4,987 | ||||||||||||||

|

Total other comprehensive (loss)

|

$ | (20,611 | ) | $ | (68,139 | ) | $ | (56,375 | ) | $ | (586,049 | ) | $ | (2,334,847 | ) | |||||

The accompanying notes to financial statements are an integral part of these consolidated financial statements

GUINNESS EXPLORATION, INC. AND SUBSIDIARY

(An Exploration Stage Company)

Consolidated Statements of Cash Flows

(Unaudited)

|

Nine months

ended

February 29,

2012

|

Nine months

ended

February 28,

2011

|

July 15, 2005

(inception)

through

February 29,

2012

|

||||||||||

|

Cash flows from operating activities:

|

||||||||||||

|

Net loss for the period

|

$ | (55,507 | ) | $ | (588,376 | ) | $ | (2,339,834 | ) | |||

|

Reconciling adjustments:

|

||||||||||||

|

Adjustments to reconcile net loss

|

||||||||||||

|

to net cash used in operating activities:

|

||||||||||||

|

Gain on cancelation of debt

|

— | (471,934 | ) | (471,934 | ) | |||||||

|

Expense related to vesting of stock options

|

— | — | 219,738 | |||||||||

|

Mineral properties impairments

|

— | — | 1,021,653 | |||||||||

|

Net change in operating assets and liabilities

|

||||||||||||

|

Prepaid expenses

|

2,945 | 187,825 | (174 | ) | ||||||||

|

Accounts payable and accrued expenses

|

(715 | ) | (78,534 | ) | 220 | |||||||

|

Net cash (used) by operating activities

|

(53,277 | ) | (951,019 | ) | (1,570,331 | ) | ||||||

|

Cash flows from investing activities:

|

||||||||||||

|

Payments for Mineral Properties

|

— | — | (487,919 | ) | ||||||||

|

Net cash (used) by investing activities

|

— | — | (487,919 | ) | ||||||||

|

Cash flows from financing activities:

|

||||||||||||

|

Common stock issued for cash

|

— | — | 2,053,500 | |||||||||

|

Proceeds from loans by stockholders

|

— | — | 86,285 | |||||||||

|

Re-payments for loans by stockholders

|

— | — | (86,285 | ) | ||||||||

|

Net cash provided by financing activities

|

— | — | 2,053,500 | |||||||||

|

Effect of foreign currency translation

|

(868 | ) | 2,327 | 4,987 | ||||||||

|

Net increase (decrease) in cash

|

(54,145 | ) | (948,696 | ) | 237 | |||||||

|

Cash, beginning of period

|

54,382 | 973,227 | — | |||||||||

|

Cash, end of period

|

$ | 237 | $ | 24,535 | $ | 237 | ||||||

The accompanying notes to financial statements are an integral part of these consolidated financial statements

GUINNESS EXPLORATION, INC. AND SUBSIDIARY

(An Exploration Stage Company)

Consolidated Supplemental Disclosure of Cash Flow Information

(Unaudited)

|

Nine months

ended

February 29,

2012

|

Nine months

ended

February 28,

2011

|

July 15, 2005

(inception)

through

February 29,

2012

|

||||||||||

|

Cash paid for interest

|

$ | — | $ | — | $ | 8,037 | ||||||

Consolidated Supplemental Disclosure of Non-cash Investing and Financing Activities

(Unaudited)

|

Nine months

ended

February 29,

2012

|

Nine months

ended

February 28,

2011

|

July 15, 2005

(inception)

through

February 29,

2012

|

||||||||||

|

Common stock issued for property purchase payment (Note 4)

|

$ | — | $ | — | $ | 61,800 | ||||||

|

Note payable issued for property purchase payment (Note 4)

|

— | — | 471,934 | |||||||||

|

Cancellation of debt

|

— | (471,934 | ) | (471,934 | ) | |||||||

|

Cancellation of stock – adjustment to common shares

|

— | (5,000 | ) | (5,000 | ) | |||||||

|

Cancellation of stock – adjustment to additional paid-in capital

|

— | 5,000 | 5,000 | |||||||||

The accompanying notes to financial statements are an integral part of these consolidated financial statements

GUINNESS EXPLORATION, INC. AND SUBSIDIARY

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

(Unaudited)

Note 1 – Basis of Presentation

The financial statements included herein have been prepared by Guinness Exploration, Inc. (“Guinness”, “We”, the “Registrant”, or the “Company”) in accordance with accounting principles generally accepted in the United States for interim financial information. Certain information and footnote disclosures normally included in the financial statements prepared in accordance with generally accepted accounting principles have been condensed or omitted as allowed by such rules and regulations, and the Company believes that the disclosures are adequate to make the information presented not misleading. It is suggested that these financial statements be read in conjunction with the May 31, 2011 audited financial statements and the accompanying notes included in the Company’s Form 10-K filed with the Commission. While management believes the procedures followed in preparing these financial statements are reasonable, the accuracy of the amounts are in some respects dependent upon the facts that will exist, and procedures that will be followed by the Company later in the year. The results of operations for the interim periods are not necessarily indicative of the results for the full year. In management’s opinion all adjustments necessary for a fair presentation of the Company’s financial statements are reflected in the interim periods included, and are of a normal recurring nature. Amounts shown for May 31, 2011 are based upon the audited financial statements of that date.

Exploration Stage Activities

The Company has been in the exploration stage since its formation and has not yet realized any revenues from its planned operations. The Company was formed for the purposes of acquiring exploration and development stage mineral properties. The Company began exploration operations during fiscal 2010 in Yukon, Canada.

Note 2 – Summary of Significant Accounting Policies

This summary of significant accounting policies is presented to assist in understanding Guinness Exploration Inc.’s financial statements. The financial statements and notes are representations of the Company’s management, who are responsible for their integrity and objectivity. These accounting policies conform to generally accepted accounting principles in the United States of America and have been consistently applied in the preparation of the financial statements, which are stated in U.S. Dollars.

The financial statements reflect the following significant accounting policies:

Exploration Stage Company

The Company is devoting substantially all of its present efforts to establish a new business and none of its planned principal operations have commenced. As an exploration stage enterprise, the Company discloses the deficit accumulated during the exploration stage and the cumulative statements of operations and cash flows from inception to the current balance sheet date.

GUINNESS EXPLORATION, INC. AND SUBSIDIARY

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

(Unaudited)

Exploration Costs and Mineral Property Right Acquisitions

The Company is primarily engaged in the acquisition and exploration of mining properties. Mineral property exploration costs are expensed as incurred. Mineral property acquisition costs are initially capitalized when incurred. The Company assesses the carrying costs for impairment under Accounting Standards 930 Extractive Activities – Mining (AS 930) at each fiscal quarter end. An impairment is recognized when the sum of the expected undiscounted future cash flows is less than the carrying amount of the mineral property. Impairment losses, if any, are measured as the excess of the carrying amount of the mineral property over its estimated fair value. Capitalized costs will be amortized using the units-of-production method over the estimated life of the proven and probable reserves. If mineral properties are subsequently abandoned or impaired, any capitalized costs will be charged to operations.

Consolidation of Financial Statements

These financial statements include the accounts of the Company and its subsidiary Nantawa Resources Inc., on a consolidated basis. All inter-company accounts have been eliminated.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the period. Actual results could differ from those estimates.

Basic and Diluted Net Loss per Share

Basic loss per share is calculated by dividing the net loss available to common stockholders by the weighted average number of common shares outstanding for the period. Diluted net loss per share is computed by dividing the net loss available to common stockholders by the weighted average number of common shares outstanding, to include common stock equivalents.

At February 29, 2012, common stock equivalents outstanding totaled 4,225,000 and included: 2,500,000 common share purchase warrants; and 1,725,000 vested options. The warrants were issued as part of two unit offerings which completed on February 10, 2010 and May 10, 2010. These offerings were respectively comprised of 1,875,000 Units priced at US$0.80 per Unit; and 625,000 Units priced at US$0.80 per Unit. In each offering, each Unit consisted of one share of common stock of Guinness (each, a "Share"); and one common share purchase warrant (each a “Warrant”) subject to adjustment for stock splits, or stock dividends. Each whole Warrant is non-transferable and entitles the holder to purchase one common share of Guinness (each, a “Warrant Share”), as presently constituted, for a period of twenty four months beginning February 10, 2010 and May 10, 2010, respectively, at a price per Warrant Share of US$2.00. These Units were issued pursuant to Regulation S of the Securities Act of 1933, as amended (“Regulation S”) and Guinness did not engage in any general solicitation or advertising regarding this Unit offering. The options were issued on

GUINNESS EXPLORATION, INC. AND SUBSIDIARY

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

(Unaudited)

September 19, 2010, at which time the Board approved option grants to Directors, Officers and staff totalling 4,450,000 Options for purchase of 4,450,000 common shares of the Company. These Options have terms of 10 years; exercise prices ranging between $0.33 to $0.363 per share; and all vest in two equal parts on May 31, 2011 and May 31, 2012; or fully in the event of a takeover offer or sale of a significant body of assets of the Company. During the three months ended February 29, 2012, 1,000,000 options were cancelled. Net of this cancellation, at February 29, 2012, a total of 3,450,000 options to purchase 3,450,000 shares had been issued and 1,725,000 options to purchase 1,725,000 shares had vested under the Plan.

Diluted and basic loss per share are the same, as any inclusion of common stock equivalents would be anti-dilutive.

Fair Value of Financial Instruments

The carrying value of accounts payable, and other financial instruments reflected in the financial statements approximates fair value due to the short-term maturity of the instruments. It is management’s opinion that the Company is not exposed to significant interest, currency or credit risks arising from these financial instruments.

Income Taxes

The Company recognizes deferred tax liabilities and assets for the expected future tax consequences of events that have been recognized in the Company’s financial statements or tax returns using the liability method. Under this method, deferred tax liabilities and assets are determined based on the temporary differences between the financial statement carrying amounts and tax bases of assets and liabilities using enacted rates in effect in the years during which the differences are expected to reverse and upon the possible realization of net operating loss carry-forwards. Additionally, the Company has not recognized any amount for a tax position taken or expected to be taken on its tax return, or for any interest or penalties.

The Company’s accumulated net loss as of February 29, 2012 is $(2,339,834) and the related deferred tax asset of approximately $818,000 has been fully offset by a valuation allowance as the realization of this deferred tax asset is not likely.

Due to the change of control of the Company during the year ended May 31, 2011, under Section 382 of the Internal Revenue Code, there may be limitations on the amount of Net Operating Loss carryforwards the Company will be able to use in the future. Some of the loss carryforwards may be unusable.

Valuation of Long-Lived Assets

The Company periodically analyzes its long-lived assets for potential impairment, assessing the appropriateness of lives and recoverability of un-depreciated balances through measurement of undiscounted operation cash flows on a basis consistent with accounting principles generally accepted in the United States of America.

GUINNESS EXPLORATION, INC. AND SUBSIDIARY

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

(Unaudited)

Start-up Costs

The Company expenses the cost of start-up activities, including organizational costs, as those costs are incurred.

Foreign Currency

The books of the Company are maintained in United States dollars and this is the Company’s functional and reporting currency. Adjustments to translate the Company’s Canadian dollar cash account to the United States dollar are recorded in other comprehensive income. Transactions denominated in other than the United States dollar are translated as follows with the related transaction gains and losses being recorded in the Statements of Operations:

|

|

(i)

|

Monetary items are recorded at the rate of exchange prevailing at the balance sheet date;

|

|

|

(ii)

|

Non-Monetary items including equity are recorded at the historical rate of exchange; and

|

|

|

(iii)

|

Revenues and expenses are recorded at the period average in which the transaction occurred.

|

Cash and Cash Equivalents

The Company considers cash and cash equivalents to consist of cash on hand and demand deposits in banks with an initial maturity of 90 days or less.

Recent Accounting Pronouncements

We do not expect the adoption of any recent accounting pronouncements to have a material effect on our financial statements.

Note 3 – Going Concern

Generally accepted accounting principles in the United States of America contemplate the continuation of the Company as a going concern. However, the Company had a net loss for the nine month period ended February 29, 2012, of $(55,507). Additionally it has accumulated operating losses since its inception and has limited business operations, which raises substantial doubt about the Company’s ability to continue as a going concern. The continuation of the Company is dependent upon the continuing financial support of investors and stockholders of the Company. As of February 29, 2012, we projected the Company would need additional cash resources to operate during the upcoming 12 months. The Company intends to attempt to acquire additional operating capital through private equity offerings to the public and existing investors to fund its business plan. However, there is no assurance that equity or debt offerings will be successful in raising sufficient funds to assure the eventual profitability of the Company. The financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts of and classification of liabilities that might be necessary in the event the Company cannot continue in existence.

GUINNESS EXPLORATION, INC. AND SUBSIDIARY

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

(Unaudited)

Note 4 – Mineral Properties Agreements

Nantawa Agreement, as amended; and Nantawa Modification Agreement:

On October 12, 2010, the Company executed signed the 'Nantawa Modification Agreement' with Eagle Trail Properties Inc. ('ETPI'). The Nantawa Modification Agreement superseded the 'Nantawa Agreement' which had been which had been executed on November 19, 2009, and amended on February 4, 2010.

Under the Nantawa Modification Agreement, Guinness received full vesting of a 49% interest in 128 full or fractional mineral claims/leases located in the Mount Nansen area of the Whitehorse Mining District of the Yukon Territory, Canada (the “Mineral Claims”). The other 51% interest in the Mineral Claims were retained by ETPI.

The original Nantawa Agreement had been comprised of 175 mineral claims/leases. These were split between two packages: (i) a set of 47 mineral claims/leases referenced as the 'Tawa Claims'; and (ii) a set of 128 claims/leases referenced as the 'Mount Nansen Claims'. Guinness had contracted to purchase all 175 claims/leases from ETPI for total consideration of US$1,005,668 (comprised of: US$943,868 cash, in two parts, plus 60,000,000 restricted common shares of Guinness valued at US$0.00103 per share for a total share value of $61,800).

During the period ended February 28, 2010, Guinness made payments of $471,934 and 60,000,000 restricted common shares to ETPI. A further cash payment of $471,934 was due by February 28, 2011 and during the period leading to this deadline, the Company projected it would not have the resources to fulfill the second payment on-time. Based on this, the Board determined it was in the best interests of the Company to negotiate revised purchase terms from ETPI for the Mineral Claims. To provide consideration to ETPI, the Company agreed to waive its rights under the Nantawa Agreement to the Tawa Claims, which had lapsed while in trust with ETPI. Under the revised agreement ETPI also agreed to have canceled 5,000,000 of the restricted common shares it had received under the Nantawa Agreement. The Nantawa Modification Agreement had the net effect of resolving the Tawa Claims matter between Guinness and ETPI and provided the Company an immediate vesting of a 49% interest in the remaining 128 claims/leases without requirement to make further payments to ETPI.

Due to the elimination by ETPI on October 12, 2010 of the requirement for a payment to ETPI of $471,934 by February 28, 2011, our financial statements for the year ended May 31, 2011 include an entry to eliminate this liability. A corresponding non-cash 'Gain on cancelation of debt' income item of $471,934 was also recorded. During that period ETPI also submitted to the Company, and the Company has cancelled, 5,000,000 of the 60,000,000 restricted common shares previously issued to ETPI under the Nantawa Agreement. This cancellation was recorded through a reduction in Paid in Capital of $5,000.

Ansell Agreement:

On March 4, 2011, the Company executed an option agreement (the “Ansell Agreement”) with Ansell Capital Corp. (“Ansell”), ETPI and two individuals (the “Additional Parties”) to provide funding for the Charlotte Project (formerly named the “Nantawa Project”) in the Mount Nansen area of the Whitehorse Mining Division, of the Yukon Territory, Canada.

GUINNESS EXPLORATION, INC. AND SUBSIDIARY

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

(Unaudited)

Subject to the terms of the Ansell Agreement (incorporated herein by reference), Guinness, ETPI and the Additional Parties (collectively the “CSG Group”), agreed to grant Ansell an option to acquire up to an 85% undivided interest in the 128 mineral claims which form the Charlotte Project (formerly named the

'Nantawa Project') based on Ansell providing financing and expertise for development of the project. Under the Ansell Agreement, ETPI will hold the Charlotte Project claims (the “Properties”) in trust for all parties during the term of the Ansell Agreement. Upon Ansell earning an interest in the Properties, the parties have agreed to form a joint venture to further explore and develop the Properties, all upon and subject to the terms and conditions set out in the Ansell Agreement.

Ansell is now the Operator of the project and will bear all project expenditures going forward.

Note 5 – Note Payable

As referenced in Note 4, to confirm the cash payment requirements of the Nantawa Agreement we provided ETPI with a Promissory Note stating our indebtedness to ETPI in the amount of $943,868. On February 12, 2010 the Company paid to ETPI $471,934 and the second installment of $471,934 on the Note was waived by ETPI and no further amounts are owing to ETPI.

Note 6 – Impairments on Mineral Properties

On July 17, 2008, the Company determined it should abandon the mineral property asset which consisted of 100% ownership of a uranium mineral property staked in Saskatchewan, Canada. A related impairment loss of $15,985 is reflected in the attached statement of operations.

Per the terms of the Nantawa Agreement, the Company agreed to pay ETPI cash in the amount of $943,868 plus share payments with a deemed value of $61,800, for a total of $1,005,668. To account for this, $1,005,668 was recorded in the financial records of the Company as a mineral property asset. During the period ended May 31, 2010, the Company determined it did not have sufficient geological evidence to establish a reserves estimate and accordingly recorded an impairment loss on the mineral property asset of $1,005,668.

Note 7 – Common Stock

On February 7, 2006, the Company issued 39,000,000 shares of its common stock to its President for cash. This transaction was valued at a board approved value of $0.001 per share for total proceeds of $3,000.

During the fiscal year ending May 31, 2006, the Company issued 32,825,000 shares of its common stock in a private offering at $0.02 per share for total proceeds of $50,500.

GUINNESS EXPLORATION, INC. AND SUBSIDIARY

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

(Unaudited)

On May 26, 2008, the Company declared a 12 for 1 stock dividend. The Record date and Payment date for this stock dividend were June 4, 2008 and June 6, 2008 respectively. The Company instructed its Transfer Agent to round up to one for any fractional interest which resulted in the calculation of the dividend. This dividend had the effect of increasing the issued and outstanding share capital of the Company from 5,525,000 shares to 71,825,000 shares. All references in these financial statements to stock issued and stock outstanding have been retroactively adjusted as if the stock dividend had taken place on July 15, 2005 (inception).

On November 30, 2009, the Company submitted to a vote of the Company's security holders a proposal to increase the authorized common shares limit of the Company from 75,000,000 to 500,000,000 and add authorization for issuance of up to 100,000,000 preferred shares, par value $0.001, for which the Board of Directors may fix and determine the designations, rights, preferences or other variation to each class or series within each class of preferred shares. Shareholder approval for this change was received November 26, 2009 and a Definitive 14C was filed with the Securities Exchange Commission on December 9, 2009.

On December 29, 2009 to fulfill one of the payment terms of the Nantawa Agreement, the Company issued 60,000,000 restricted shares of its common stock valued at $0.00103 per share to Eagle Trail Properties, Inc. representing aggregate proceeds of $61,800. These shares were issued pursuant to Regulation S of the Securities Act of 1933, as amended and the Company did not engage in any general solicitation or advertising regarding these shares.

On February 10, 2010 Guinness completed a private placement which raised aggregate proceeds of $1,500,000 and was comprised a unit (‘Unit’) sale by Guinness of 1,875,000 Units priced at $0.80 per Unit. Each Unit consists of one common stock of Guinness (each, a "Share"); and one common share purchase warrant (each a “Warrant”) subject to adjustment for stock splits, or stock dividends. Each whole Warrant is non-transferable and entitles the holder to purchase one common share of Guinness (each, a “Warrant Share”), as presently constituted, for a period of twenty four months beginning February 10, 2010 at a price per Warrant Share of $2.00. These Units are being issued pursuant to Regulation S of the Securities Act of 1933, as amended (“Regulation S”) and Guinness did not engage in any general solicitation or advertising regarding this Unit offering.

On May 10, 2010 Guinness completed a private placement which raised aggregate proceeds of $500,000 and was comprised a unit (‘Unit’) sale by Guinness of 625,000 Units priced at $0.80 per Unit. Each Unit consists of one common stock of Guinness (each, a "Share"); and one common share purchase warrant (each a “Warrant”) subject to adjustment for stock splits, or stock dividends. Each whole Warrant is non-transferable and entitles the holder to purchase one common share of Guinness (each, a “Warrant Share”), as presently constituted, for a period of twenty four months beginning May 10, 2010 at a price per Warrant Share of $2.00. These Units are being issued pursuant to Regulation S of the Securities Act of 1933, as amended (“Regulation S”) and Guinness did not engage in any general solicitation or advertising regarding this Unit offering.

During the period ended November 30, 2010, ETPI submitted to the Company, and the Company has cancelled, 5,000,000 of the 60,000,000 restricted common shares previously issued to ETPI under the Nantawa Agreement. This cancellation was recorded through a reduction in Paid in Capital of $5,000.

GUINNESS EXPLORATION, INC. AND SUBSIDIARY

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

(Unaudited)

Note 8 – Stock Options

On July 12, 2010, the board approved and adopted the Company’s 2010 Equity Incentive Plan (the “Plan”), pursuant to which up to an aggregate of 10,000,000 options with a maximum exercise term of 10 years for 10,000,000 shares of the Corporation’s common stock are reserved for issuance to employees and non-employees, directors of, and consultants to the Company in connection with their retention and/or continued employment or provision of services to the Company. The Company uses the Fair Value Method to calculate compensation expenses related to its option grants.

On September 19, 2010, the Board approved option grants to Directors, Officers and staff totalling 4,450,000 Options for purchase of 4,450,000 common shares of the Company. These Options have terms of 10 years; exercise prices ranging between $0.33 to $0.363 per share; and all vest in two equal parts on May 31, 2011 and May 31, 2012; or fully in the event of a takeover offer or sale of a significant body of assets of the Company. Total compensation expense for these options grants has been calculated as $439,476 based on a valuation using a Black-Scholes option pricing model.

On May 31, 2011, 2,225,000 options vested under the Plan. This was recorded in these financial statements as an addition of $50,265 to Exploration Expenses and $169,473 to Professional Fees for the year ended May 31, 2011, for a total 2011 options grant compensation expense of $219,738.

The fair value of the options granted were calculated on the date of grant using a Black Scholes option pricing model with the following assumptions: (i) a risk-free interest rate of 0.16% (based on the US 90-day T-Bill rate on grant date); (ii) a dividend yield of zero (which is the projected dividend payment of the Company for the foreseeable future): (iii) a volatility factor of 26% (based on the 12 month standard deviation of Guinness' daily stock closing price); specific exercise prices, which ranged between $0.33 to $0.363 (such prices having been fixed based on the closing stock price on grant date); and an expected life of the options of ten years (which is equal to the term of the options and is the current assumed employment or contracted services tenure of all grantees). The fair value method requires the cost of options to be expensed over the period in which they vest, which in the case of these first option grants is in two equal parts, being one-half on May 31, 2011 and one-half on May 31, 2012. The fair value compensation cost arrived from these calculations has been credited to Additional Paid-In Capital on the Balance Sheet. In the event that the Board determines that any current grantees should be eliminated from the options plan due to events such as resignation or termination, future compensation cost adjustments will be made to reflect decreases in compensation costs related to any such events.

Mr. Alastair Brown, who is President and CEO of the Company and who classifies as a ‘10% shareholder’ for regulatory purposes, has received a grant of 2,000,000 options to purchase 2,000,000 common shares of Guinness at a price of $0.363 per share, with vesting of 1,000,000 options on May 31, 2011 and 1,000,000 options on May 31, 2012.

GUINNESS EXPLORATION, INC. AND SUBSIDIARY

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

(Unaudited)

Option grants are comprised of: 500,000 ‘Incentive Stock Options’ which were issued to employees; 950,000 ‘Non-Qualified Stock Options’ which were issued to non-employee contractors; and 2,000,000 which were issued to Mr. Alastair Brown, who is not eligible for ‘Incentive Option status’ because he is a 10% shareholder of the Company.

During the three months ended February 29, 2012, 1,000,000 options were cancelled. Net of this cancellation, at February 29, 2012, a total of 3,450,000 options to purchase 3,450,000 shares had been issued and 1,725,000 options to purchase 1,725,000 shares had vested under the Plan.

A summary of changes in issued and outstanding stock options for the nine month period ended February 29, 2012 is as follows:

|

Options Outstanding

|

Weighted Average Exercise Price

|

|

|

Balance at May 31, 2011

|

4,450,000

|

$0.343

|

|

Granted during fiscal 2012

|

Nil

|

-

|

|

Exercised during fiscal 2012

|

Nil

|

-

|

|

Cancelled/expired during fiscal 2012

|

(1,000,000)

|

(0.33)

|

|

Balance at February 29, 2012

|

3,450,000

|

$0.358

|

The following table summarizes information about the options issued and outstanding at February 29, 2012:

|

Options Outstanding

|

Options Exercisable

|

|||||||||

|

Exercise Prices

|

Options Outstanding

|

Weighted Average Exercise Price

|

Aggregate

Intrinsic

Value

|

Weighted Average Remaining Contractual Life (years)

|

Options Outstanding

|

Weighted Average Exercise Price

|

Aggregate

Intrinsic

Value

|

Weighted Average Remaining Contractual Life (years)

|

||

|

$0.330

|

500,000

|

$0.330

|

$Nil

|

8.6

|

250,000

|

$0.330

|

$Nil

|

8.6

|

||

|

$0.363

|

2,950,000

|

$0.363

|

$Nil

|

8.6

|

1,475,000

|

$0.363

|

$Nil

|

8.6

|

||

|

Totals

|

3,450,000

|

$0.358

|

$Nil

|

8.6

|

1,725,000

|

$0.358

|

$Nil

|

8.6

|

||

ITEM 2. MANAGEMENTS’ DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995

This quarterly report on Form 10-Q contains "forward-looking statements" relating to the registrant which represent the registrant's current expectations or beliefs including, statements concerning registrant’s operations, performance, financial condition and growth. Certain information contained herein, including any information as to our strategy, plans or future financial or operating performance and other statements that express management's expectations or estimates of future performance, constitute "forward-looking statements.” All statements, other than statements of historical fact, are forward-looking statements. The words "believe," "expect," "will," "anticipate," "contemplate," "target," "plan," "continue,” "budget," "may," "intend," "estimate," “project” and similar expressions identify forward-looking statements. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in the forward-looking statements, including, but not limited to, certain delays beyond the company's control with respect to mining operations, changes in the worldwide price of certain commodities; legislative, political or economic developments in the jurisdictions in which the Company carries on business; operating or technical difficulties in connection with mining or development activities; employee relations; contests over title to properties; and the risks involved in the exploration, development and mining business. The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by applicable law.

Overview

Guinness Exploration, Inc. (“Guinness”, “We”, the “Registrant”, or the “Company”) was incorporated in the State of Nevada on July 15, 2005 and incorporated its subsidiary, Nantawa Resources Inc., in Yukon, Canada on November 6, 2009. Guinness Exploration Inc. trades on the OTCBB and Pink Sheets under the symbol GNXP.

Our financial statements are prepared in accordance with U.S. generally accepted accounting principles and we have expensed all development expenses related to the establishment of the company. Our fiscal year end is May 31st.

Since inception the Company has not been involved in any bankruptcy, receivership or similar proceedings.

Since inception the Company has not been involved in any recapitalization, consolidation, or merger arrangements.

Recent Developments

Charlotte Project Assay Results

The third and final set of Assay results from the Charlotte Project 2011 summer exploration program, follow below.

Highlighting the assay analysis by Guinness' partner, Ansell Capital, are the following remarks:

"Drilling this year has intersected broad well-mineralized zones, enhancing the potential for a bulk mineable deposit to be hosted on the property."

"This year’s drilling confirmed and expanded known high grade gold and silver vein hosted mineralization. The strike length of the deposit, on the Flex Zone alone, has been extended to 580 metres long and up to 90 metres wide and remains open to the south, southwest and at depth."

"This year’s regional geochemistry soil program, along with geophysics and geological mapping, has identified 6 new targets, in addition to several other targets from previous work..."

Full text of the press release issued by Ansell Capital on January 16, 2012 is as follows:

Ansell Capital Corp. (“Ansell”) (ACP-TSX-V) is pleased to announce the final assay results from the summer 2011 drill program at the Charlotte gold project in the Tintina gold belt, Yukon.

Complete assays have now been received for all of the twenty-one diamond drill holes completed on the Flex and Orloff King Zones at the Charlotte property located in the prolific Tintina belt. Results for the first nine holes drilled were released by Ansell on September 6th, 2011. Results from an additional seven holes were released by Ansell on November 8th, 2011. This release is a release of the results from the remaining five holes.

The drill program for summer 2011 comprised of 21 holes for a total of 3654 metres.

Drilling this year has intersected broad well-mineralized zones, enhancing the potential for a bulk mineable deposit to be hosted on the property.

Highlights from the final holes include:

| ● |

DDH-11-271

|

8.19 g/t Au, 193.4 g/t Ag over 15.53m

|

| ● |

DDH-11-272

|

6.56 g/t Au, 162.5 g/t Ag over 16.66m

|

| ● |

DDH-11-274

|

5.84 g/t Au, 156.7 g/t Ag over 4.80m

|

| ● | and |

4.08 g/t Au, 212.5 g/t Ag over 12.02m

|

Detailed results are shown in the following tables:

|

From (m)

|

To (m)

|

Thk

|

g/t Au

|

g/t Ag

|

||

|

DDH-11-270

|

23.60

|

25.60

|

2.00

|

0.46

|

12.1

|

|

|

Az 065

|

39.63

|

44.75

|

5.12

|

0.49

|

7.8

|

|

|

Dip -45

|

|

|

|

|

|

|

|

Orloff King Zone: 70m SE of DDH-11-269 (Az 060, dip -65), following up on 2010 trench results

|

||||||

|

From (m)

|

To (m)

|

Thk

|

g/t Au

|

g/t Ag

|

||

|

DDH-11-271

|

35.62

|

51.15

|

15.53

|

8.19

|

193.4

|

|

|

Az 042

|

includes

|

36.60

|

38.00

|

1.40

|

51.84

|

557.7

|

|

Dip -50

|

includes

|

47.87

|

51.15

|

3.28

|

15.02

|

621.4

|

|

104.73

|

106.40

|

1.67

|

20.38

|

405.6

|

||

|

140.80

|

143.50

|

2.70

|

7.93

|

61.6

|

||

|

includes

|

142.10

|

142.85

|

0.75

|

21.10

|

133.0

|

|

|

150.35

|

153.10

|

2.75

|

0.51

|

2.5

|

||

|

Flex Zone: 6m step out due W of DDH-11-257 (Az 045, dip -50)

|

||||||

|

From (m)

|

To (m)

|

Thk

|

g/t Au

|

g/t Ag

|

||

|

DDH-11-272

|

47.71

|

50.50

|

2.79

|

1.01

|

6.8

|

|

|

Az 041

|

||||||

|

Dip -51

|

89.14

|

105.80

|

16.66

|

6.56

|

162.5

|

|

|

includes

|

99.70

|

105.80

|

6.10

|

17.42

|

440.2

|

|

|

includes

|

99.70

|

100.75

|

1.05

|

52.55

|

1865.0

|

|

|

includes

|

103.40

|

105.80

|

2.40

|

21.00

|

284.0

|

|

|

175.30

|

177.61

|

2.31

|

1.25

|

2.9

|

||

|

Flex Zone: 25m step out SW of DDH-11-243/DDH-11-257 (Az 045, dip -50)

|

||||||

|

From (m)

|

To (m)

|

Thk

|

g/t Au

|

g/t Ag

|

||

|

DDH-11-273

|

75.30

|

77.10

|

1.80

|

0.30

|

2.2

|

|

|

Az 073

|

||||||

|

Dip -50

|

122.87

|

127.30

|

4.43

|

0.49

|

2.1

|

|

|

135.50

|

136.50

|

1.00

|

0.78

|

10.0

|

||

|

141.80

|

145.60

|

3.80

|

1.80

|

67.4

|

||

|

181.40

|

185.50

|

4.10

|

2.86

|

11.8

|

||

|

Flex Zone: 25m step out SW of DDH-11-260/260b (Az 075, dip -50)

|

||||||

|

From (m)

|

To (m)

|

Thk

|

g/t Au

|

g/t Ag

|

||

|

DDH-11-274

|

74.17

|

76.30

|

2.13

|

0.56

|

14.1

|

|

|

Az 080

|

||||||

|

Dip -61

|

79.50

|

84.30

|

4.80

|

5.84

|

156.7

|

|

|

includes

|

81.00

|

81.71

|

0.71

|

34.65

|

589.0

|

|

|

|

||||||

|

118.90

|

130.92

|

12.02

|

4.08

|

212.5

|

||

|

includes

|

120.12

|

122.18

|

2.06

|

8.14

|

122.4

|

|

|

includes

|

125.10

|

127.80

|

2.70

|

10.79

|

762.3

|

|

|

|

||||||

|

176.22

|

181.20

|

4.98

|

1.69

|

87.3

|

||

|

Flex Zone: 25m step out SW of DDH-10-241 (Az 078, dip -60)

|

||||||

Laboratory analyses were performed by Acme Laboratories, of Vancouver. It should be noted that no cutting of high grade samples has been applied. A minimum cut-off grade of 0.25 g/t Au was applied when expending mineralized zones across lower grade material (i.e. the grade of an extension out from higher grade material must exceed 0.25 g/t Au).

Results are reported with down-hole widths. The Flex zone dips steeply to the west to southwest. With the holes being drilled perpendicular to the strike and with collar dips ranging from 50° to 65° from vertical, true widths will vary between 60% and 90% of down-hole widths. For the Orloff King zone, there has been insufficient drilling to determine the average dip and thus the true widths.

This year’s drilling confirmed and expanded known high grade gold and silver vein hosted mineralization. The strike length of the deposit, on the Flex Zone alone, has been extended to 580 metres long and up to 90 metres wide and remains open to the south, southwest and at depth.

The current working deposit model is similar to other surrounding vein deposits (the Webber, Huestis, and the past producing Brown-McDade as well as to the Flex deposit), forming a set of mineralizing shears. The mineralizing fluids filled in pockets formed during an extension period and have been subsequently faulted. The deposit is a braided series of gold-silver bearing quartz veins accompanied by significant base metal mineralization. The veins crosscut both the gneisses of the Yukon Terrane and the intruded feldspar and quartz feldspar porphyries of the Mt. Nansen volcanics. The northern extension of the deposit has been intersected by the Webber Creek fault, a dextral strike-slip fault with unknown horizontal and vertical displacement. It is hypothesised that the extension is to the NE, and this presents an attractive target for the 2012 exploration program

This year’s regional geochemistry soil program, along with geophysics and geological mapping, has identified 6 new targets, in addition to several other targets from previous work, located up to 5 km from the Flex Zone, but still on Ansell’s Charlotte Property.

Charlotte Property, Yukon

The property is located in the Whitehorse Mining District, Yukon, approximately 180 kilometres northwest of Whitehorse and 60 kilometres west of Village of Carmacks in the Yukon.

The property lies in a historic gold/silver mining district. Intense exploration activities have been carried out since 1899 in the area. Four distinct gold and silver-mineralized zones (the Brown-McDade zone, the Webber zone, the Huestis zone and the Flex zone) have been identified and all but the Flex Zone have been mined historically. The last operator on the property was BYG Natural Resources Ltd.

The Webber, Huestis and Flex zones are located on the property. The Brown-McDade zone, which was mined by open-pit methods, is located on an adjacent property to the South East. Precious metal veins on the surface and underground have been mined by various operators including Pesco Silver Minerals Ltd. and BYG Natural Resources Ltd.

In 2008, a geophysical survey was conducted on the property with the aim of locating and evaluating the extent and nature of the mineralization in the district. The results of this survey have added to the understanding of the property geology and are being used to guide continuing exploration. Gold and silver mineralization occurs in northwest-trending shear zones hosted by metamorphic rocks. The metamorphic rocks have been cut by narrow and linear intrusive dikes and sills. Precious metal mineralization commonly occurs in quartz-sulphide vein systems within the shear zones and is associated primarily with pyrite and lesser arsenopyrite.

Jevin Werbes, President of Ansell commented, “We are extremely pleased with these positive results and plan an aggressive drill program for 2012. The demonstrated extents and continuity of the Flex Zone clearly validate the exploration model we have applied.”

Chris M. Healey, P. Geo, a director of Ansell, is the qualified person responsible for the technical information in this release.

Exploration properties description and location

The Charlotte Project is located in the Whitehorse Mining District on NTS map sheet 105I-03 (Figures 1). The complete claim group includes 128 full or fractional quartz mineral claims (Table 1). Total size of the claim group is 2,336.14 square hectares. The central block of the Charlotte Project is some 185 km NNW of Whitehorse. The Charlotte Project claim group measure 8.7 km in the NS direction and 5.1 km in the EW direction. The approximate geographical location of the Charlotte Project claim block is shown in Table 2.

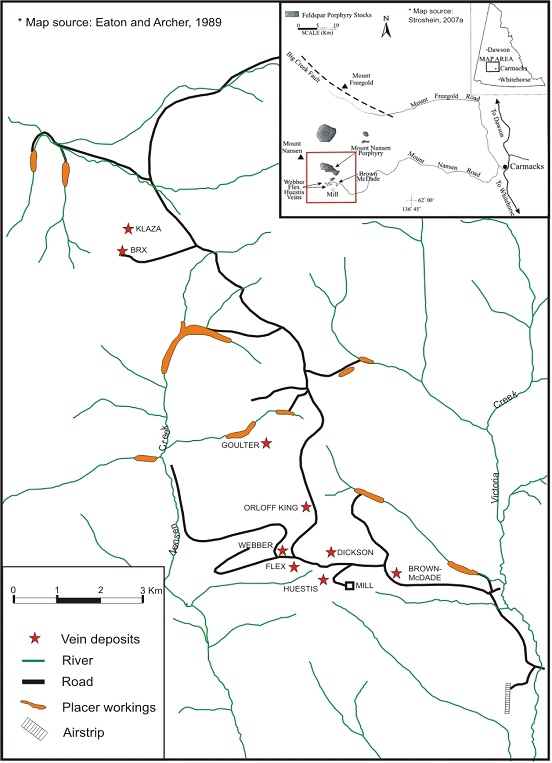

Figure 1: Road access to the Charlotte Project

(Modified from Eaton and Archer, 1989 and Stroshein, 2007a)

Table 1: Claim list for Charlotte Project

|

No.

|

Claim

|

Registered Claim

Owner

|

Grant Number

|

Expiry Date

|

Area (Ha)

|

Comments

|

|

1

|

ROSE

|

Eagle Trail Properties Inc.

|

04241

|

09/10/2019

|

20.42

|

Lease

|

|

2

|

Golden Eagle

|

Eagle Trail Properties Inc.

|

04278

|

09/10/2019

|

20.96

|

Lease

|

|

3

|

WAR EAGLE

|

Eagle Trail Properties Inc.

|

04279

|

09/10/2019

|

20.77

|

Lease

|

|

4

|

SHAMROCK

|

Eagle Trail Properties Inc.

|

04354

|

09/10/2019

|

20.73

|

Lease

|

|

5

|

SPOT

|

Eagle Trail Properties Inc.

|

04361

|

09/10/2019

|

19.92

|

Lease

|

|

6

|

ARLEP

|

Eagle Trail Properties Inc.

|

04368

|

09/10/2019

|

14.48

|

Lease

|

|

7

|

PHYLLIS

|

Eagle Trail Properties Inc.

|

04369

|

09/10/2019

|

20.26

|

Lease

|

|

8

|

RUB

|

Eagle Trail Properties Inc.

|

55633

|

09/10/2019

|

1.84

|

Lease

|

|

9

|

PUB

|

Eagle Trail Properties Inc.

|

55663

|

09/10/2019

|

1.93

|

Lease

|

|

10

|

SUN DOG

|

Eagle Trail Properties Inc.

|

55665

|

09/10/2019

|

3.20

|

Lease

|

|

11

|

CUB

|

Eagle Trail Properties Inc.

|

55666

|

09/10/2019

|

1.29

|

Lease

|

|

12

|

JAM

|

Eagle Trail Properties Inc.

|

55890

|

09/10/2019

|

11.64

|

Lease

|

|

13

|

PAM

|

Eagle Trail Properties Inc.

|

55892

|

09/10/2019

|

2.64

|

Lease

|

|

14

|

DOME 1

|

Eagle Trail Properties Inc.

|

73537

|

06/02/2014

|

15.10

|

-

|

|

15

|

DOME 2

|

Eagle Trail Properties Inc.

|

73538

|

06/02/2014

|

15.51

|

-

|

|

16

|

DOME 3

|

Eagle Trail Properties Inc.

|

73539

|

06/02/2014

|

17.29

|

-

|

|

17

|

DOME 4

|

Eagle Trail Properties Inc.

|

73540

|

06/02/2014

|

17.98

|

-

|

|

18

|

DOME 6

|

Eagle Trail Properties Inc.

|

73542

|

06/02/2014

|

17.32

|

-

|

|

19

|

DOME 7

|

Eagle Trail Properties Inc.

|

73543

|

06/02/2014

|

25.34

|

-

|

|

20

|

DOME 8

|

Eagle Trail Properties Inc.

|

73694

|

06/02/2014

|

12.47

|

-

|

|

21

|

DOME 14

|

Eagle Trail Properties Inc.

|

73700

|

06/02/2014

|

21.07

|

-

|

|

22

|

DOME 16

|

Eagle Trail Properties Inc.

|

73702

|

06/02/2014

|

20.61

|

-

|

|

23

|

DOME 17

|

Eagle Trail Properties Inc.

|

73703

|

06/02/2014

|

18.41

|

-

|

|

24

|

DOME 18

|

Eagle Trail Properties Inc.

|

73704

|

06/02/2014

|

18.56

|

-

|

|

25

|

DOME 19

|

Eagle Trail Properties Inc.

|

73705

|

06/02/2014

|

16.73

|

-

|

|

26

|

DOME 20

|

Eagle Trail Properties Inc.

|

73706

|

06/02/2014

|

13.42

|

-

|

|

27

|

JOANNE 1

|

Eagle Trail Properties Inc.

|

74283

|

06/02/2014

|

19.79

|

-

|

|

28

|

JOANNE 2

|

Eagle Trail Properties Inc.

|

74284

|

06/02/2014

|

19.51

|

-

|

|

29

|

JOANNE 3

|

Eagle Trail Properties Inc.

|

74285

|

06/02/2014

|

20.36

|

-

|

|

30

|

JOANNE 4

|

Eagle Trail Properties Inc.

|

74286

|

06/02/2014

|

14.78

|

-

|

|

31

|

JOANNE 5

|

Eagle Trail Properties Inc.

|

74287

|

06/02/2014

|

19.83

|

-

|

|

32

|

JOANNE 6

|

Eagle Trail Properties Inc.

|

74288

|

06/02/2014

|

19.69

|

-

|

|

33

|

DOME 25

|

Eagle Trail Properties Inc.

|

77746

|

06/02/2014

|

15.19

|

-

|

|

34

|

DOME 26

|

Eagle Trail Properties Inc.

|

77747

|

06/02/2014

|

22.54

|

-

|

|

35

|

DOME 27

|

Eagle Trail Properties Inc.

|

77748

|

06/02/2014

|

20.32

|

-

|

|

36

|

DOME 28

|

Eagle Trail Properties Inc.

|

77749

|

06/02/2014

|

21.74

|

-

|

|

37

|

DOME 33

|

Eagle Trail Properties Inc.

|

77754

|

06/02/2014

|

25.50

|

-

|

|

38

|

DOME 34

|

Eagle Trail Properties Inc.

|

77755

|

06/02/2014

|

23.29

|

-

|

|

39

|

DOME 35

|

Eagle Trail Properties Inc.

|

77756

|

06/02/2014

|

22.39

|

-

|

|

40

|

DOME 36

|

Eagle Trail Properties Inc.

|

77757

|

06/02/2014

|

23.97

|

-

|

|

No.

|

Claim

|

Registered Claim

Owner

|

Grant Number

|

Expiry Date

|

Area (Ha)

|

Comments

|

|

41

|

DOME 37

|

Eagle Trail Properties Inc.

|

77758

|

06/02/2014

|

14.23

|

-

|

|

42

|

DOME 38

|

Eagle Trail Properties Inc.

|

77759

|

06/02/2014

|

18.48

|

-

|

|

43

|

DOME 39

|

Eagle Trail Properties Inc.

|

77760

|

06/02/2014

|

14.95

|

-

|

|

44

|

DOME 40

|

Eagle Trail Properties Inc.

|

77761

|

06/02/2014

|

20.51

|

-

|

|

45

|

DOME 41

|

Eagle Trail Properties Inc.

|

77762

|

06/02/2014

|

20.76

|

-

|

|

46

|

DOME 42

|

Eagle Trail Properties Inc.

|

77763

|

06/02/2014

|

19.93

|

-

|

|

47

|

DOME 43

|

Eagle Trail Properties Inc.

|

77764

|

06/02/2014

|

20.47

|

-

|

|

48

|

DOME 49

|

Eagle Trail Properties Inc.

|

77770

|

06/02/2014

|

8.18

|

-

|

|

49

|

DOME 50

|

Eagle Trail Properties Inc.

|

77771

|

06/02/2014

|

18.83

|

-

|

|

50

|

DOME 51

|

Eagle Trail Properties Inc.

|

77772

|

06/02/2014

|

19.05

|

-

|

|

51

|

DOME 52

|

Eagle Trail Properties Inc.

|

77773

|

06/02/2014

|

21.85

|

-

|

|

52

|

DOME 53

|

Eagle Trail Properties Inc.

|

77774

|

06/02/2014

|

22.80

|

-

|

|

53

|

DOME 54

|

Eagle Trail Properties Inc.

|

77775

|

06/02/2014

|

14.69

|

-

|

|

54

|

DOME 55

|

Eagle Trail Properties Inc.

|

77776

|

06/02/2014

|

13.09

|

-

|

|

55

|

DOME 56

|

Eagle Trail Properties Inc.

|

77777

|

06/02/2014

|

13.35

|

-

|

|

56

|

DOME 57

|

Eagle Trail Properties Inc.

|

77778

|

06/02/2014

|

20.47

|

-

|

|

57

|

DOME 58

|

Eagle Trail Properties Inc.

|

77779

|

06/02/2014

|

19.41

|

-

|

|

58

|

DOME 60

|

Eagle Trail Properties Inc.

|

77781

|

06/02/2014

|

20.06

|

-

|

|

59

|

DOME 61

|

Eagle Trail Properties Inc.

|

77782

|

06/02/2014

|

18.91

|

-

|

|

60

|

DOME 63

|

Eagle Trail Properties Inc.

|

77784

|

06/02/2014

|

22.51

|

-

|

|

61

|

DOME 64

|

Eagle Trail Properties Inc.

|

77785

|

06/02/2014

|

22.88

|

-

|

|

62

|

DOME 65

|

Eagle Trail Properties Inc.

|

77786

|

06/02/2014

|

20.66

|

-

|

|

63

|

DOME 66

|

Eagle Trail Properties Inc.

|

77787

|

06/02/2014

|

21.18

|

-

|

|

64

|

DOME 78

|

Eagle Trail Properties Inc.

|

81842

|

06/02/2014

|

25.41

|

-

|

|

65

|

DOME 79

|

Eagle Trail Properties Inc.

|

81843

|

06/02/2014

|

24.10

|

-

|

|

66

|

DOME 80

|

Eagle Trail Properties Inc.

|

81844

|

06/02/2014

|

24.20

|

-

|

|

67

|

DOME 81

|

Eagle Trail Properties Inc.

|

81845

|

06/02/2014

|

22.52

|

-

|

|

68

|

DOME 82

|

Eagle Trail Properties Inc.

|

81846

|

06/02/2014

|

23.26

|

-

|

|

69

|

DOME 83

|

Eagle Trail Properties Inc.

|

81847

|

06/02/2014

|

18.72

|

-

|

|

70

|

DOME 84

|

Eagle Trail Properties Inc.

|

81848

|

06/02/2014

|

19.37

|

-

|

|

71

|

DOME 86

|

Eagle Trail Properties Inc.

|

81850

|

06/02/2014

|

20.76

|

-

|

|

72

|

HIW 9

|

Eagle Trail Properties Inc.

|

YA23835

|

06/02/2014

|

19.44

|

-

|

|

73

|

HIW 10

|

Eagle Trail Properties Inc.

|

YA23836

|

06/02/2014

|

20.83

|

Fractions

|

|

74

|

HIW 11

|

Eagle Trail Properties Inc.

|

YA23837

|

06/02/2014

|

21.55

|

Fractions

|

|

75

|

HIW 12

|

Eagle Trail Properties Inc.

|

YA23838

|

06/02/2014

|

19.93

|

Fractions

|

|

76

|

HIW 13

|

Eagle Trail Properties Inc.

|

YA23839

|

06/02/2014

|

20.72

|

-

|

|

77

|

HIW 14

|

Eagle Trail Properties Inc.

|

YA23840

|

06/02/2014

|

19.55

|

-

|

|

78

|

HIW 15

|

Eagle Trail Properties Inc.

|

YA23841

|

06/02/2014

|

20.15

|

-

|

|

79

|

HIW 16

|

Eagle Trail Properties Inc.

|

YA23842

|

06/02/2014

|

19.86

|

-

|

|

80

|

HIW 17

|

Eagle Trail Properties Inc.

|

YA23843

|

06/02/2014

|

19.92

|

-

|

|

No.

|

Claim

|

Registered Claim

Owner

|

Grant Number

|

Expiry Date

|

Area (Ha)

|

Comments

|

|

81

|

HIW 1

|

Eagle Trail Properties Inc.

|

YA24813

|

06/02/2014

|

4.74

|

Fractions

|

|

82

|

HIW 2

|

Eagle Trail Properties Inc.

|

YA24814

|

06/02/2014

|

5.15

|

Fractions

|

|

83

|

HIW 7

|

Eagle Trail Properties Inc.

|

YA24819

|

06/02/2014

|

3.01

|

Fractions

|

|

84

|

DD 1

|

Eagle Trail Properties Inc.

|

YA59596

|

06/02/2014

|

20.62

|

-

|

|

85

|

DD 2

|

Eagle Trail Properties Inc.

|

YA59597

|

06/02/2014

|

22.35

|

-

|

|

86

|

DD 15

|

Eagle Trail Properties Inc.

|

YA59610

|

06/02/2014

|

19.20

|

-

|

|

87

|

DD 16

|

Eagle Trail Properties Inc.

|

YA59611

|

06/02/2014

|

19.21

|

-

|

|

88

|

DD 17

|

Eagle Trail Properties Inc.

|

YA59612

|

06/02/2014

|

19.37

|

-

|

|

89

|

DD 18

|

Eagle Trail Properties Inc.

|

YA59613

|

06/02/2014

|

19.85

|

-

|

|

90

|

DD 19

|

Eagle Trail Properties Inc.

|

YA59614

|

06/02/2014

|

20.17

|

-

|

|

91

|

DD 20

|

Eagle Trail Properties Inc.

|

YA59615

|

06/02/2014

|

19.90

|

-

|

|

92

|

DD 21

|

Eagle Trail Properties Inc.

|

YA59616

|

06/02/2014

|

19.64

|

-

|

|

93

|

DD 22

|

Eagle Trail Properties Inc.

|

YA59617

|

06/02/2014

|

19.17

|

-

|

|

94

|

DD 23

|

Eagle Trail Properties Inc.

|

YA59618

|

06/02/2014

|

18.69

|

-

|

|

95

|

DD 24

|

Eagle Trail Properties Inc.

|

YA59619

|

06/02/2014

|

18.30

|

-

|

|

96

|

DD 25

|

Eagle Trail Properties Inc.

|

YA59620

|

06/02/2014

|

18.18

|

-

|

|

97

|

DD 26

|

Eagle Trail Properties Inc.

|

YA59621

|

06/02/2014

|

17.65

|

-

|

|

98

|

DD 27

|

Eagle Trail Properties Inc.

|

YA59622

|

06/02/2014

|

19.49

|

-

|

|

99

|

DD 28

|

Eagle Trail Properties Inc.

|

YA59623

|

06/02/2014

|

18.71

|

-

|

|

100

|

TBR 1

|

Eagle Trail Properties Inc.

|

YA86690

|

06/02/2014

|

8.92

|

-

|

|

101

|

TBR 2

|

Eagle Trail Properties Inc.

|

YA86691

|

06/02/2014

|

20.16

|

-

|

|

102

|

TBR 3

|

Eagle Trail Properties Inc.

|

YA86692

|

06/02/2014

|

20.03

|

-

|

|

103

|

TBR 4

|

Eagle Trail Properties Inc.

|

YA86693

|

06/02/2014

|

20.84

|

-

|

|

104

|

TBR 5

|

Eagle Trail Properties Inc.

|

YA86694

|

06/02/2014

|

18.34

|

-

|

|

105

|

TBR 6

|

Eagle Trail Properties Inc.

|

YA86695

|

06/02/2014

|

20.92

|

-

|

|

106

|

TBR 7

|

Eagle Trail Properties Inc.

|

YA86696

|

06/02/2014

|

15.96

|

-

|

|

107

|

TBR 8

|

Eagle Trail Properties Inc.

|

YA86697

|

06/02/2014

|

21.79

|

-

|

|

108

|

ONT 38

|

Eagle Trail Properties Inc.

|

YA87204

|

06/02/2014

|

20.26

|

-

|

|

109

|

ONT 40

|

Eagle Trail Properties Inc.

|

YA87206

|

06/02/2014

|

18.34

|

-

|

|

110

|

ONT 42

|

Eagle Trail Properties Inc.

|

YA87208

|

06/02/2014

|

5.73

|

-

|

|

111

|

EEK 1

|

Eagle Trail Properties Inc.

|

YA87210

|

06/02/2014

|

21.07

|

-

|

|

112

|

EEK 2

|

Eagle Trail Properties Inc.

|

YA87211

|

06/02/2014

|

20.08

|

-

|

|

113

|

EEK 3

|

Eagle Trail Properties Inc.

|

YA87212

|

06/02/2014

|

20.70

|

-

|

|

114

|

EEK 4

|

Eagle Trail Properties Inc.

|

YA87213

|

06/02/2014

|

20.68

|

-

|

|

115

|

EEK 5

|

Eagle Trail Properties Inc.

|

YA87214

|

06/02/2014

|

20.80

|

-

|

|

116

|

EEK 6

|

Eagle Trail Properties Inc.

|

YA87215

|

06/02/2014

|

19.58

|

-

|

|

117

|

EEK 7

|

Eagle Trail Properties Inc.

|

YA87216

|

06/02/2014

|

19.97

|

-

|

|

118

|

EEK 8

|

Eagle Trail Properties Inc.

|

YA87217

|

06/02/2014

|

21.91

|

-

|

|

119

|

EEK 9

|

Eagle Trail Properties Inc.

|

YA87218

|

06/02/2014

|

22.64

|

-

|

|

120

|

EEK 14

|

Eagle Trail Properties Inc.

|

YA87223

|

06/02/2014

|

21.36

|

-

|

|

121

|

EEK 15

|

Eagle Trail Properties Inc.

|

YA87224

|

06/02/2014

|

21.22

|

-

|

|

122

|

EEK 16

|

Eagle Trail Properties Inc.

|

YA87225

|

06/02/2014

|

21.76

|

-

|

|

123

|

EEK 17

|

Eagle Trail Properties Inc.

|

YA87226

|

06/02/2014

|

20.01

|

-

|

|

124

|

EEK 18

|

Eagle Trail Properties Inc.

|

YA87227

|

06/02/2014

|

20.74

|

-

|

|

125

|

ONT 44

|

Eagle Trail Properties Inc.

|

YA92655

|

06/02/2014

|

16.80

|

-

|

|

No.

|

Claim

|

Registered Claim

Owner

|

Grant Number

|

Expiry Date

|

Area (Ha)

|

Comments

|

|

126

|

ONT 45

|

Eagle Trail Properties Inc.

|

YA92656

|

06/02/2014

|

12.91

|

-

|

|

127

|

ONT 46

|

Eagle Trail Properties Inc.

|

YA92657

|

06/02/2014

|

18.48

|

-

|

|

128

|

ONT 47