Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FIRSTMERIT CORP /OH/ | d326155d8k.htm |

Management Say-on-Pay

Proposal Presentation

FirstMerit

Corporation

March 29, 2012

EXHIBIT 99.1 |

This presentation contains forward-looking statements relating to present or

future trends or factors affecting the banking industry, and specifically

the financial condition and results of operations, including without

limitation, statements relating to the earnings outlook of FirstMerit Corporation (the

“Corporation”), as well as its operations, markets and products. Actual

results could differ materially from

those

indicated.

Without

limiting

the

foregoing,

the

word

“believes”

and

similar

expressions

are

intended to identify forward-looking statements. Among the important factors

that could cause results to differ materially are interest rate changes,

continued softening in the economy, which could

materially

impact

credit

quality

trends

and

the

ability

to

generate

loans,

changes

in

the

mix

of

the

Corporation’s

business,

competitive

pressures,

changes

in

accounting,

tax

or

regulatory

practices

or

requirements

and

those

risk

factors

detailed

in

the

Corporation's

periodic

reports

and

registration statements filed with the Securities and Exchange Commission. The

Corporation undertakes no obligation to release revisions to these

forward-looking statements or reflect events or circumstances after the

date of this release. Forward-Looking

Statement

Disclosure

2 |

This presentation was prepared by the Corporation on behalf of its Board of

Directors (the “Board”) for use by those employees of the

Corporation authorized to communicate with shareholders of the Corporation

pursuant to its internal policies. The members of the Board may have an interest in the

Corporation’s proposals regarding director elections and the approval of named

executive officer compensation (“Say-on-Pay Proposal”) to

be presented at the 2012 Annual Meeting of Shareholders (“2012 Annual

Meeting”). The Corporation’s security holders should read the Corporation’s 2012

definitive proxy statement for its 2012 Annual Meeting because it contains

important information. Security holders may obtain the

Corporation’s 2012 definitive proxy statement and 2011 Annual Report

for

free

at

www.firstmerit.com.

This

document

may

be

deemed

“soliciting

material”

within

the

meaning

of

the rules and regulations of the Securities and Exchange Commission promulgated

under the Securities Exchange Act of 1934, as amended.

Explanatory Note

3 |

Management Say-on-Pay Proposal

4

•

Say-on-pay analysis by certain proxy advisors seems to reach the wrong

conclusion on vote recommendation

because

it

fails

to

take

into

account

performance

criteria

that

are

specific

to

our

industry, our organization structure, and our business strategy in

particular. Most importantly, the analysis:

•

As described in great detail in our proxy statement we believe we operated a fair

and effective compensation

program

in

2011

that

helped

us

motivate,

reward

and

retain

executive

talent

with

the

skills

and experience necessary to achieve our business goals and create long-term

shareholder value Overemphasized short-term (1 & 3-year)

relative total shareholder return (“RTSR”) results in

a

volatile

economic

climate

while

ignoring

our

strong

RTSR

results

versus

peers

over

the long-term (5 & 10-year), as described in the proxy statement

Did not recognize and appreciate the performance-based structure and operation

of our short-term

incentive

compensation

plan,

specifically

redesigned

for

2011

to

enable

our

Compensation Committee to make sound compensation decisions reflecting internal

goals and considering relative peer performance given an uncertain/changing

economic and regulatory climate, while not encouraging excessive

risk-taking Judged our CEO pay decisions against a group that includes

companies not within our geographic proximity and with whom we do not

compete with for executive talent Failed

to

appreciate

our

strong

performance

in

2011

with

respect

to

the

key

quantitative

and qualitative performance metrics that we believe drive shareholder value

creation in our business over time, and the critical role our CEO played in

achieving these results |

Strength of Underlying Corporate Performance

5

•

51 consecutive quarters of profitability as of fourth quarter, 2011

•

Full year 2011 net income of $120 mm, up 16% from 2010

$1.10 per diluted share

Return on total average assets of 0.82%

Return

on

average

shareholders’

equity

of

7.72%

•

2011 total commercial loan production increased 38% over 2010

14% increase in average commercial* loans from 4Q10 to 4Q11

$394 mm in commercial loans originated in Illinois

•

Solid asset quality trends

Net charge-offs/Average loans at 0.85%, compared with 1.23% in 2010

Nonperforming

assets/Total

loans

and

ORE

at

1.06%,

compared

with

1.78%

in

2010

•

84% of deposits are “Core”

14% increase in average core deposits from 4Q10 to 4Q11

*excluding covered loans |

6

•

The

proxy

advisors’

methodology

disregards

the

relative

strength

of

our

stock

price

at

the

beginning

of

the

3-year

RTSR

measurement

period.

More

importantly,

the

methodology

ignores

our

continued

superior performance against key corporate metrics that are unique to the banking

industry, which was achieved notwithstanding the fee reductions resulting

from the Durbin amendment •

The pre-dominant emphasis on RTSR in the methodology may have lead the advisors

to the wrong conclusion since:

It did not take into account the short-term fluctuations and arbitrary nature

of the financial markets, which have been especially volatile with all bank

stocks in recent years Using RTSR as the sole metric for assessing Board

compensation decisions (a metric not totally controllable by management) on

the level of pay to the CEO fails to reflect the real value the Board

believes the CEO provides in executing our business strategy •

We believe the design of our compensation program is sound and that it

appropriately rewards our executives for achieving Board-approved

strategic objectives, as described in the proxy Short-Term RTSR vs.

Underlying Corporate Performance |

History of Superior

Performance Continued in 2011….. 2011

FirstMerit

Peers

7.72%

5.07%

0.82%

0.60%

0.85%

1.83%

1.06%

2.68%

3.84%

3.81%

2010

FirstMerit

Peers

Return on average

shareholders’

equity

7.82%

1.66%

Return on total

average assets

0.76%

0.17%

Net charge-offs/

Average loans

1.23%

2.26%

Nonperforming assets/

Total loans and ORE

1.78%

3.05%

Net interest margin

3.98%

3.76%

7

Critical Financial Performance Metrics Relative to Peer Averages

Source:

SNL

Financial

Peer

Group

Includes:

Associated

Banc-Corp,

Citizens

Republic,

Bancorp,

F.N.B.

Corporation,

First

Commonwealth,

First

Midwest

Bancorp,

Fulton

Financial,

MB Financial, Old National Bancorp, Park National Bancorp, Susquehanna Bancshares, TCF Financial

|

2009

FirstMerit

Peers

8.09%

-1.78%

0.76%

-0.25%

1.22%

1.88%

1.48%

2.76%

3.58%

3.56%

2008

FirstMerit

Peers

Return on average

shareholders’

equity

12.76%

2.53%

Return on total

average assets

1.13%

0.19%

Net charge-offs/

Average loans

0.68%

0.83%

Nonperforming assets/

Total loans and ORE

0.77%

1.68%

Net interest margin

3.72%

3.65%

8

Critical Financial Performance Metrics Relative to Peer Averages

Source:

SNL Financial

Peer

Group

Includes:

Associated

Banc-Corp,

Citizens

Republic,

Bancorp,

F.N.B.

Corporation,

First

Commonwealth,

First

Midwest

Bancorp,

Fulton

Financial,

MB Financial, Old National Bancorp, Park National Bancorp, Susquehanna Bancshares, TCF Financial

…..Following Historical Trends |

9

Source:

Bloomberg Financial

Peer

Group

Includes:

Associated

Banc-Corp,

Citizens

Republic,

Bancorp,

F.N.B.

Corporation,

First

Commonwealth,

First

Midwest

Bancorp,

Fulton

Financial,

MB Financial, Old National Bancorp, Park National Bancorp, Susquehanna Bancshares,

TCF Financial FMER

Peers

KBW Bank Index

S&P Diversified Financials

-8.1%

-48.1%

-50.9%

-60.0%

Superior Relative Stock Performance Throughout Financial Crisis

Four-Year Total Shareholder Return 12/31/07-12/30/11

|

10

Superior Relative Stock Performance Over Longer Term

Source:

Bloomberg Financial

Peer

Group

Includes:

Associated

Banc-Corp,

Citizens

Republic,

Bancorp,

F.N.B.

Corporation,

First

Commonwealth,

First

Midwest

Bancorp,

Fulton

Financial,

MB Financial, Old National Bancorp, Park National Bancorp, Susquehanna Bancshares,

TCF Financial Ten Year Total Shareholder Return

12/31/01-12/30/11 -11.3%

-38.6%

-

46.5%

-58.1%

FMER

KBW Bank Index

S&P Diversified Financials

Peers |

Successful Execution of Strategic Initiatives

11

•

Successful

Execution

of

Chicago

Strategy

—

We

successfully

increased

our

growth

and

footprint

in

greater Chicago:

Increasing our Chicago-area commercial loan production by over 120% from

2010 Significant increases in our greater Chicago non-covered loan

portfolio Fully staffing our Illinois indirect lending office and signing up

130 Chicago-area dealers for indirect lending

•

Growth

in

Market

Share

—

We

continued

to

develop

and

execute

on

initiatives

to

grow

our

market

share for various products:

Launching marketing campaigns regarding our home equity line of credit, credit

card, mortgage and checking products

Conducting quarterly cross sell campaigns to target single service and next best

product offers

Raising brand awareness through various targeted promotional activities in key

geographic areas |

Successful Execution of Strategic Initiatives (cont’d.)

12

Increasing our customers’

use of electronic banking statements

Developing a comprehensive e-mail and online marketing strategy

Increasing our offering of mobile banking applications

•

New

Product

Build

Out

—

We

successfully

designed,

launched

and

executed

a

slate

of

redefined

products:

Consumer deposit products

Private banking products

Commercial banking products

•

Dynamic

Market

Response

the wake of the recent financial crisis:

—

We

continued

to

enhance

our

ability

to

react

to

market

changes

in |

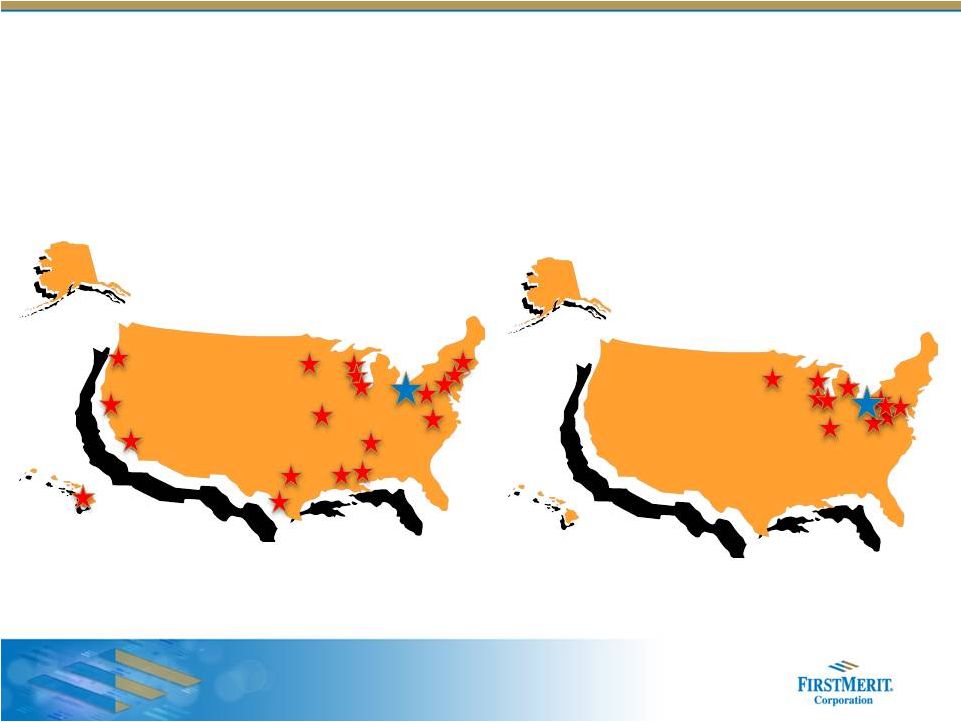

Peer Group Disparity

13

FirstMerit Peer Group:

Proxy Advisory Firm Peer Group:

•

•

Developed with the assistance of our independent compensation consultant to

benchmark CEO compensation

Consists of 11 regional banking institutions carefully selected to (1) include

companies against which we compete for executive talent, based on asset

size, and (2) take into account our geographic market since we face similar

economic trends with companies in that market Consists

of

24

institutions

developed

based

on

a

“one-size

fits

all”

model

using

asset

size

and

then within Global Industry Compliance Services code

Is

not

a

peer

group

that

is

comprised

of

companies

with

which

we

compete

for

executive

talent

We do not compete with regional banks in Hawaii, Oregon, California, Texas,

Louisiana, Mississippi, Connecticut, or New Jersey (which are in the

advisor’s peer group) End

result

is

a

peer

group

containing

many

institutions

that

are

not

suitable

for

comparison

with FirstMerit for making performance and pay decisions

|

Peer Group Disparity (cont’d.)

14

Proxy Advisory Peer Group

FirstMerit Peer Group

•

Generally far from Akron, OH

•

We don’t recruit talent from

all over the United States

•

Near Akron, OH

•

Represents the region from

which we draw talent

vs. |

2011 Short-Term Incentive Compensation Program

15

•

As described in detail in our proxy, we re-designed our annual incentive

compensation program (ICP) in 2011 to more effectively align pay and

performance, while retrospectively taking into account the effect of

unsettled financial services markets, general volatility and low interest rates in

the economy, and unexpected regulatory changes in our industry

The ICP is first based upon a combination of 1) specific corporate objectives and

assessment criteria, 2) performance relative to bank company peers, and 3)

individual performance criteria evaluated over the course of the fiscal

year Second,

final

ICP

determinations

are

made

by

the

Board

Committee

using

structured

(defined

assessment criteria) discretion to take into account unanticipated factors

that occurred during the course of the year, either positively or

negatively Third, the ICP approach provides for a formula-based

design within structured discretion that is

considered

a

“best

practice”

from

a

bank

regulatory

perspective

•

We believe that our proxy provides significant detail on the criteria the Committee

used in deciding on our CEO’s pay for 2011

Goal of the new incentive approach is to balance management’s focus between

annual performance and long-term performance with incentive

programs |

2011 Long-Term Equity Based Grants

16

•

Our equity based program is focused on providing a direct line of sight for

participants to the link between their performance and pay and the

long-term success of our company, while balancing the expectations

of

multiple

constituencies

--

shareholders,

bank

regulators

and

compensation

requirements in our industry

Banks in our peer group grant a majority of their equity in the form of

full-value shares. We are

consistent

with

our

peer

group

by

granting

restricted

stock,

which

for

FirstMerit

vests

over

three years

The total shares granted annually to the participant group is based upon corporate

performance

using

structured

discretion

which

takes

into

account

financial

measures

that

are

consistent with shareholder value. These factors are evaluated against

internal and external criteria before a final Committee decision

Granting

restricted

stock

annually

helps

our

executives

meet

our

stock

ownership

guidelines

and directly aligns their interests with those of shareholders in preserving and

enhancing shareholder value (On a long-term basis, our CEO is required

to hold five times his base salary in the form of stock and our non-CEO

Section 16 officers are required to hold two and one half times their base

salary) |

•

Proxy advisor analysis of CEO pay compared to peers did not account for all

factors •

The proxy advisors’

methodology for evaluating the reasonableness of CEO pay compared to peers

seems to reach the wrong conclusion when considering the unique circumstances of

our CEO when accounting for and reporting the annual accrual value of his

retirement income •

30% of our CEO’s total compensation for 2011 consistent of an accrual for

retirement benefits which will not be realized for several years

•

Deducting unrealized retirement accrual amounts from both our CEO’s total

compensation and from the compensation of the proxy advisor’s CEO peer

group provides a different perspective Our CEO’s total direct

compensation falls to approximately 1.58 times the mean of CEO pay for the

proxy advisor’s peer group and 2.19 times the mean of CEO pay of the FMER peer

group

Five of the 11 FMER peer institutions held TARP funds in 2011 which restricts

compensation (3 of the peer institutions held TARP at year-end)

Impact of Year-over-Year Change in Compensation Value

17 |

Important Facts about Excise Tax Gross-Up

18

•

Proxy advisory firms expressed concerns that 280G gross-up provisions could

result in substantial increases in termination payments to executives or

could encourage executives to enter into corporate transactions that are not

in a company’s best interests •

These

concerns,

although

reasonable,

will

not

come

into

play

for

our

executives

since:

The

CEO

is

the

only

executive

entitled

to

a

280G

gross-up

–

all

other

executives

are

subject

to a 280G cut-back

Changes in the contracts with three other executives would have resulted in saving

the Corporation nearly $2 million based on a potential December 30, 2011

change in control and termination

The CEO cannot unilaterally enter into a change in control discussion without

Board approval –

his

change

in

control

agreement

provides

that

if

he

does

so,

he

will

not

be

entitled

to

any

payments under the agreement |

•

Proxy advisors have not taken into account the following facts regarding our

succession planning: Our current organization structure does NOT include a

Chief Operating Officer by design and thus creates a high compensation

ratio to other named executives, even though the policy level of pay for

other named executives is consistent with market rates for similar positions

Management meets semi-annually to assess high-level potential talent and

the progress of its development plans and provides an annual report of its

findings to the Board, including internal talent for the CEO position

The Corporation has a recent history of promoting existing FirstMerit employees to

key executive roles

Robust Succession Planning Process in Place

19 |

Contacts for Discussion

20

•

Tom O’Malley –

SVP, Director of Investor Relations & Corporate Communication

•

Judy Steiner –

Executive Vice President, Risk Management, Corporate Secretary and General

Counsel |