UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8–K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15 (d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): March 29, 2012

CRIMSON EXPLORATION INC.

(Exact Name of Registrant as Specified in Charter)

|

Delaware

(State or Other Jurisdiction of Incorporation)

|

001-12108

(Commission File Number)

|

20-3037840

(IRS Employer Identification No.)

|

717 Texas Ave., Suite 2900, Houston Texas 77002

(Address of Principal Executive Offices)

(713) 236-7400

(Registrant’s telephone number, including area code)

_____________________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 14d-2(b))

[] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 8.01

|

Other Events.

|

On March 29, 2012, Crimson Exploration Inc. issued a press release announcing Woodbine Oil Discovery in Madison County, Texas. A copy of the press release is attached hereto as Exhibit 99.1.

The information furnished pursuant to Item 8.01 in this report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liability of that section, unless the Company specifically states that the information is to be considered “filed” under the Exchange Act or incorporates it by reference into a filing under the Securities Act of 1933 or the Exchange Act.

Item 9.01 Financial Statements and Exhibits.

|

(d)

|

Exhibits

|

|

Exhibit Number

|

Description

|

|

99.1

|

Press Release dated March 29, 2012

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

CRIMSON EXPLORATION INC.

|

|

|

Date: March 29, 2012

|

/s/ E. Joseph Grady

|

|

E. Joseph Grady

|

|

|

Senior Vice President and Chief Financial Officer

|

Exhibit Index

|

Exhibit Number

|

Description

|

|

99.1

|

Press Release dated March 29, 2012

|

EXHIBIT 99.1

Crimson Exploration Inc. Announces Woodbine Oil Discovery in Madison County, Texas at an Initial Rate of 1,203 Boepd

Houston, TX – (BUSINESS WIRE) – March 29, 2012 - Crimson Exploration Inc. (NasdaqGM: CXPO) announced today the successful completion of the Mosley #1H (84.3% WI), its first horizontal Woodbine oil well in Madison County, Texas, at a gross initial production rate of 1,203 Boepd, or 1,017 barrels of oil, 87 barrels of natural gas liquids and 595 mcf, on a 30/64th choke and 601 psi of tubing pressure. The well was drilled to a total measured depth of 15,650 feet, including a 6,300 foot lateral, and was completed using 23 stages of fracture stimulation.

Additionally, Crimson is actively drilling two horizontal wells targeting the Woodbine formation in Madison County, the Grace Hall #1H (82.4% WI) and the Vick Trust #1H (75% WI). The Grace Hall #1H, located approximately 1.2 miles north of the Mosley #1H, has reached a total measured depth of 16,000 feet, including a 7,500 foot lateral, and the Vick Trust #1H, located approximately 6 miles east of the Mosley #1H, is currently drilling at 11,469 feet toward a total measured depth of 15,200 feet, including an estimated 6,500 foot lateral. Both wells are expected to be completed with 20 – 25 stages of fracture stimulation. Production from these wells is anticipated to commence mid-second quarter. Upon completion of the drilling of the Vick Trust #1H, Crimson will move that rig to the A. Yates #1H (50% WI) location.

The Woodbine formation is a Cretaceous aged series of sandstones and siltstones that reside within the prolific Eagle Ford source rock and is generally described as being between the overlying Austin Chalk formation and the underlying Buda formation. The productive Woodbine sands in the Madison and Grimes County area are a lower porosity and permeability extension of the prolific 100 Mmbo Kurten Field in adjacent Brazos County. Previous to the current horizontal drilling and multi-stage frac completions, the Woodbine was developed through conventional vertical completions. The lower porosity and permeability in Madison and Grimes counties had a significant negative impact on initial rates and recoveries from these vertical completions; however, with the advent of horizontal drilling and multi-stage frac completions, a 10 – 20 fold increase in rates and recoveries are recognized. Crimson recognizes that this newer technology can also be applied to other formations that have historically low volumes associated with vertical or open hole horizontal completions, specifically the Austin Chalk, Buda, Georgetown, Glenrose and the other multiple sand lobes within the Woodbine formation.

Crimson has approximately 17,500 net acres in Madison and Grimes counties, Texas. Expectations are that this area will deliver a multi-year inventory of impactful and superior rate of return projects which will contribute significantly to Crimson’s growth story. Crimson has a total of 9 wells planned for Madison and Grimes counties in 2012 and could easily expand that number with continued success. The net initial rate from the Mosley well represents a 28% increase in Crimson’s current daily net oil production rate, illustrating the significant impact this drilling program provides. Overall, the Company believes that the estimated net potential, in the Woodbine alone, ranges between 30 - 40 Mmboe on the Crimson leasehold.

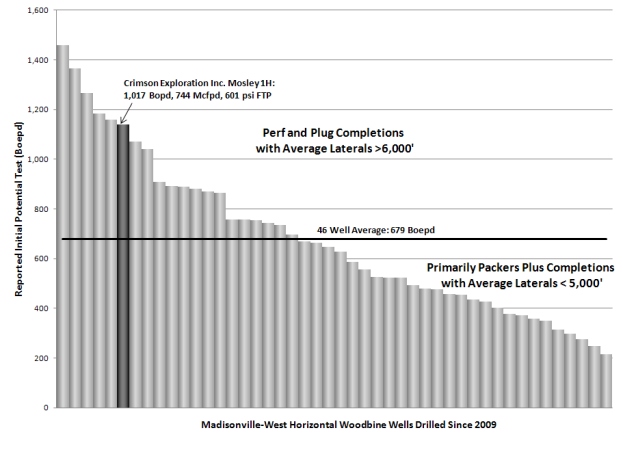

The Mosley’s initial production rate places it in the top of its class of wells drilled to date in the area. The chart below shows an average initial production rate of 679 Boepd from 46 horizontal Woodbine wells drilled in Madison, Brazos, and Grimes counties since January 2009. The high average initial production performance of the offset wells, demonstrates that this area is a repeatable and very economic source of oil production growth.

(Source: PI Dwight’s. Note: Reported initial potential test rates do not include natural gas shrink and NGL volumes associated with downstream processing.)

Allan D. Keel, President and Chief Executive Officer, commented, “We are very pleased with the results of the Mosley #1H and believe this success validates the quality of Crimson’s position in the Madison and Grimes County area where we own approximately 17,500 net acres. We believe that recent drilling successes, and sale transactions immediately offsetting our acreage position in this area, implies the Woodbine represents current incremental value of $5 per share for the Company’s shareholders, and could be worth two to three times that as we continue to develop the Woodbine. This estimated value also does not include additional value that could come from successful development of the Georgetown, Eagle Ford and other objectives believed to be prospective in the area. The coming months will be an exciting time for Crimson as we continue to pursue our plan for this area. We remain very optimistic that the increased cash flow attributed to our oil production in the Woodbine will begin to be reflected in shareholder value.”

Crimson Exploration is a Houston, TX-based independent energy company engaged in the acquisition, development, exploitation and production of crude oil and natural gas, primarily in the onshore Gulf Coast regions of the United States. The Company owns and operates approximately 74,000 acres of conventional properties in Texas, Louisiana, Colorado and Mississippi, approximately 5,700 net acres in the Haynesville Shale, Mid-Bossier, and James Lime plays in San Augustine and Sabine counties in East Texas, approximately 8,625 net acres in the Eagle Ford Shale in South Texas, approximately 17,500 net acres in Madison and Grimes counties in Southeast Texas and approximately 11,000 net acres in the Denver Julesburg Basin of Colorado.

Additional information on Crimson Exploration Inc. is available on the Company's website at http://crimsonexploration.com.

This press release includes “forward-looking statements” as defined by the Securities and Exchange Commission (“SEC”) and applicable securities laws. Such statements include those concerning Crimson’s strategic plans, expectations and objectives for future operations. All statements included in this press release that address

activities, events or developments that Crimson expects, believes or anticipates will or may occur in the future are forward-looking statements. These statements are based on certain assumptions Crimson made based on its experience and perception of historical trends, current conditions, expected future developments and other factors it believes are appropriate under the circumstances. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond Crimson’s control. Statements regarding future production, revenue, cash flow operating results, leverage, drilling rigs operating, drilling locations, funding, derivative transactions, pricing, operating costs and capital spending, tax rates, and descriptions of our development plans are subject to all of the risks and uncertainties normally incident to the exploration for and development and production of oil and gas. These risks include, but are not limited to, commodity price changes, inflation or lack of availability of goods and services, environmental risks, the proximity to and capacity of transportation facilities, the timing of planned capital expenditures, uncertainties in estimating reserves and forecasting production results, operating and drilling risks, regulatory changes and the potential lack of capital resources. All forward-looking statements are based on our forecasts for our existing operations and do not include the potential impact of any future acquisitions. Investors are cautioned that any such statements are not guarantees of future performance and that actual results or developments may differ materially from those projected in the forward-looking statements. Please refer to our filings with the SEC, including our Form 10-K for the year ended December 31, 2011, and subsequent filings for a further discussion of these risks. Existing and prospective investors are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise.

Contact:

|

Crimson Exploration Inc.

|

|

E. Joseph Grady, 713-236-7400

|

|

Senior Vice President and Chief Financial Officer

|

|

or

|

|

Josh Wannarka, 713-236-7400

|

|

Manager of Investor Relations and FP&A

|