Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GenOn Energy, Inc. | d324234d8k.htm |

Bank of America/Merrill Lynch

Megawatt Round-up Conference

March 28, 2012

Edward R. Muller

Chairman and CEO

Morgantown Generating Station

Charles County, MD |

Safe Harbor Statement

2

Forward-Looking Statements This presentation

contains statements, estimates or projections that are “forward-looking statements” as defined under U.S. federal

securities laws. In some cases, one can identify forward-looking statements by words such as

“will,” “expect,” “estimate,” “think,”

“forecast,” “guidance,” “outlook,” “plan,” “lead,”

“project” or comparable words. Forward-looking statements are subject to certain risks

and uncertainties that could cause actual results to differ materially from our historical experience

and our present expectations or projections. These risks include, but are not limited to: (i)

legislative and regulatory initiatives or changes affecting the electric industry; (ii)

changes in, or changes in the application of, environmental or other laws and regulations; (iii)

failure of our generating facilities to perform as expected, including outages for unscheduled

maintenance or repair;

(iv)

changes in market conditions or the entry of additional competition in our markets; and (v)

those factors contained in our periodic reports filed with the SEC, including in the “Risk

Factors” section of our most recent Annual Report on Form 10-K. The forward-looking

information in this document is given as of the date of the particular statement and we assume no duty to update

this information. Our filings and other important information are also available on the Investor

Relations page of our web site at www.genon.com. |

GenOn and the Industry

•

Cross-State Air Pollution Rule (CSAPR) stayed

•

Mercury and Air Toxics Standards (MATS) compliance required in April 2015

•

Expect to deactivate 3,140 MWs of the GenOn fleet as forecasted returns on

investments necessary to comply with environmental regulations are

insufficient •

PJM identified 15,531 MWs

1

of announced and projected retirements in PJM

through

2015

related

to

environmental

rules

–

approximately

8%

of

PJM’s

capacity

•

Expect GenOn will invest ~$586 -

$726 million for major environmental controls

over the next 10 years

3

We expect higher earnings from price increases resulting from

industry retirements will more than offset reduced earnings from

GenOn unit deactivations

1.

Source document: PJM ISO “Generator-Owner (GO) Response to EPA Rules Preliminary

Summary Update” dated March 26, 2012. |

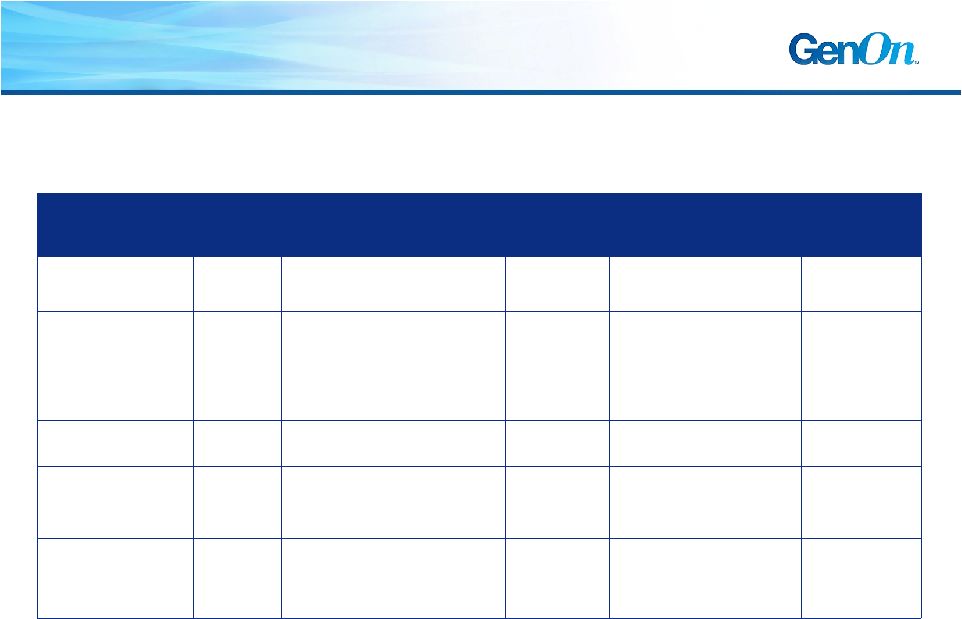

Expected Changes in Generation Fleet

4

Plant

Location

MWs

Expected Timing

Driver

Elrama

PA

460

June 2012

MATS and market conditions

Niles

OH

217

June 2012

Portland

PA

401

January 2015

Cumulative effect of various environmental regulations

Avon Lake

OH

732

April 2015

MATS

New Castle

PA

330

April 2015

MATS

Shawville

PA

597

April 2015

Cumulative effect of various environmental regulations

Titus

PA

243

April 2015

MATS

Glen Gardner

NJ

160

May 2015

NJ High Energy Demand Day (HEDD) regulations

Subtotal

3,140

Indian River

FL

586

January 2012

Sold for $11.5 million

Vandolah

FL

630

May 2012

Tolling agreement expires

Potomac River

VA

482

October 2012

Retiring based on agreement with the City of Alexandria, VA

Contra Costa

CA

674

May 2013

Expected to retire upon expiration of PPA

Total reductions

5,512

Marsh Landing

CA

719

Mid-2013

Under construction –

on schedule and on budget

19,490 MWs of generating capacity after 2015

Units to be deactivated

Other fleet reductions

Fleet addition

1

1.

Our initial analysis indicates the forecasted return on environmental investments is insufficient. If

the analysis is confirmed, we anticipate retiring the coal-fired units in 2015. |

Expected Environmental Investments

5

•

Expect investments of ~$586 -

$726 million in major controls over the next

10 years to meet current and anticipated environmental rules

Plant

Location

Control Technology

Expected

Timing

Driver

Investments

($ millions)

Kendall

MA

Backpressure steam turbine +

air-cooled condenser

2012 -

2014

Water regulations

$32 -

$35

Gilbert

NJ

SCR

2012 -

2015

New Jersey HEDD

regulations

$129 -

$151

Sayreville

Werner

Conemaugh

PA

Scrubber upgrade + SCR

2012 -

2015

MATS

$93 -

$102

Mandalay

CA

Variable speed pumps

2018 -

2019

Water regulations

$17 -

$20

Ormond Beach

Chalk Point

-

Unit 2

MD

SCR

2018 -

2021

More

stringent

PM

2.5

and

Ozone NAAQS

$315 -

$418

Dickerson

1.

Based on GenOn percentage (leased).

1 |

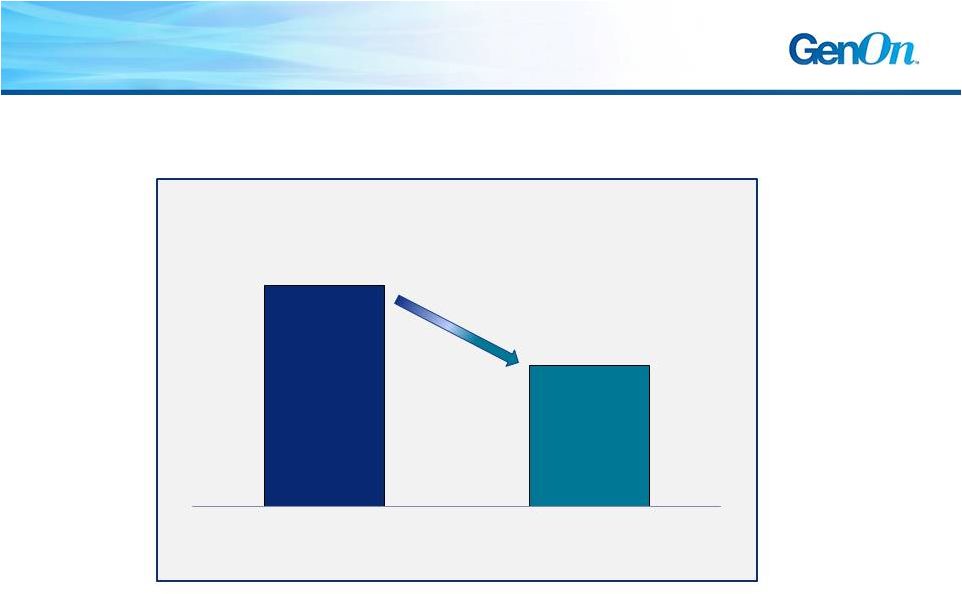

Impact of Environmental Rules

•

Supply and demand tightening as a result of industry deactivations in PJM

6

Total PJM

Reserve Margin

2015E

16%

25%

1.

Pre-MATS estimated reserve margin is prior to and Post-MATS is after the

15.5 GW of total announced and projected retirements in the PJM ISO “GO

Response

to

EPA

Rules

Preliminary

Summary

Update”

dated

March

26,

2012.

Post-MATS

also

includes

retirements

related

to

NJ

High

Energy

Demand

Day NOx limits and only known additions that are not likely sensitive to

price. Pre-MATS

Post-MATS

1 |

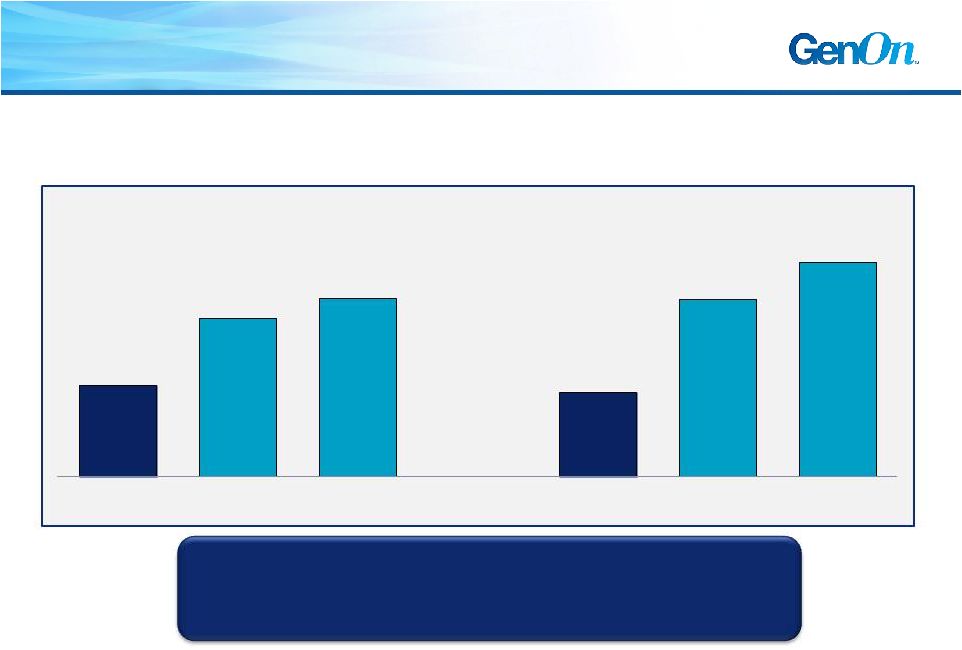

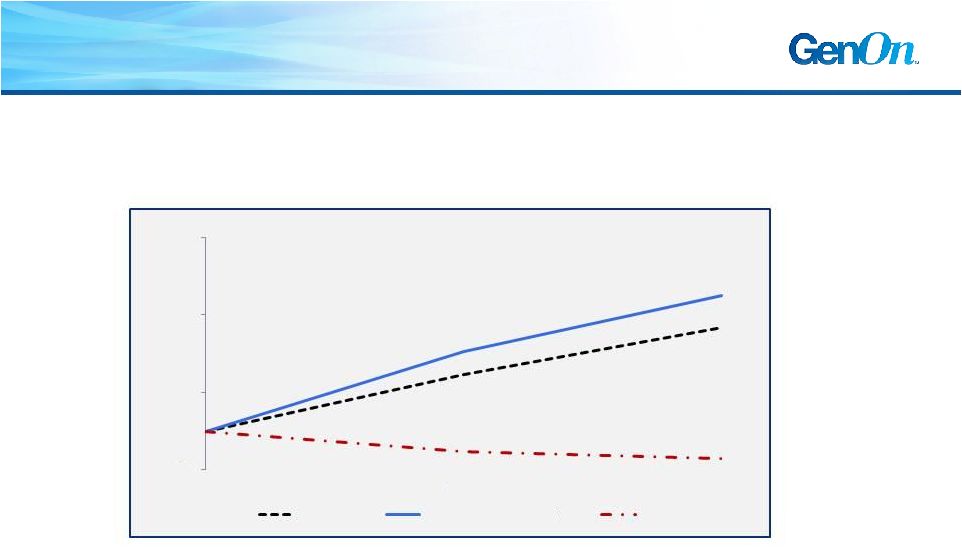

•

Over time, capacity prices should increase toward the Cost of New Entry

(Net CONE) as supply and demand tightens

7

Capacity Prices

We expect higher earnings from

increases in capacity prices

RTO

$/MW-day

MAAC

$/MW-day

1

2

1.

MAAC Combined Cycle (CC) Net CONE is based on PJM Area 4 (Rest of MAAC).

2.

RTO CC Net CONE is based on PJM Area 3 (Rest of RTO, excluding Dominion).

$136.50

$237.93

$267.61

$125.99

$266.04

$320.63

Clearing Price

(PY 2014/15)

Net CONE for CC

(PY 2015/16)

Net CONE for CT

(PY 2015/16)

Clearing Price

(PY 2014/15)

Net CONE for CC

(PY 2015/16)

Net CONE for CT

(PY 2015/16) |

8

Energy Prices

•

Forward prices do not show an expansion in market implied heat rates

(MIHRs) as a result of announced deactivations

Based on forward prices as of March 16, 2012

1.

Around the clock PJM West hub power prices.

2.

NYMEX plus Transco zone 6 less non-NY basis.

•

Reduced supply generally leads to heat rate expansion

-5%

5%

15%

25%

2013

2014

2015

Power

Delivered Natural Gas

MIHR

2

1 |

Summary

•

GenOn will invest only if expected return exceeds cost of capital

•

Expect to deactivate 3,140 MWs because forecasted returns on

investments necessary to comply with environmental regulations are

insufficient

•

Expect investments of ~$586 -

$726 million for major environmental

controls over the next 10 years

•

After 2015, GenOn will have 19,490 MWs after giving effect to the

deactivations, other fleet reductions and the addition of Marsh Landing

9

We expect higher earnings from price increases resulting from

industry retirements will more than offset reduced earnings from

GenOn unit deactivations |

Bank of America/Merrill Lynch

Megawatt Round-up Conference

March 28, 2012

Edward R. Muller

Chairman and CEO

Morgantown Generating Station

Charles County, MD |