Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Nasus Consulting, Inc. | narc_8k.htm |

EXHIBIT 10

STOCK PURCHASE AGREEMENT

This Stock Purchase Agreement {"Agreement") is entered into as of this 23rd day of March, 2012, between FRED DASILVA, whose address is 111 Panorama Hills Road, Calgary, Alberta, Canada T3K 5J1 (referred to as "Purchaser"); NATIONAL ASSET RECOVERY CORP., a Nevada corporation, whose principal place of business is 30 Skyline Drive, Suite 200, Lake Mary, Florida 32746 (the *Company"); BRADLEY WILSON, who maintains his address at 30 Skyline Drive, Suite 200, Lake Mary, Florida 32746 ("WILSON"} and WILLIAM GLYNN, who maintains his address at 30 Skyline Drive, Suite 200, Lake Mary, Florida 32746 ("GLYNN") Wilson and Glynn shall collectively be referred to in this Agreement as the "Selling Shareholders". The Purchaser, the Company and the Selling Shareholders may collectively be referred to in this Agreement as the "Parties".

RECITALS

WHEREAS, the Company is a public company whose common stock is listed through the OTCQB level of the OTC Markets Group quotation service under the trading symbol "REPO" and files periodic reports with the Securities & Exchange Commission ("SEC") pursuant to Section 13 or Section 15(d) of the Securities & Exchange Act of 1934 as■a "Smaller Reporting Company"; and

WHEREAS, the Selling Shareholders collectively own 95 million restricted shares of REPO common stock ("REPO Shares"), which, on the Closing Date as hereinafter defined, shall represent approximately 62% of the total issued and outstanding REPO Shares; and

WHEREAS, the Selling Shareholders are willing to sell, transfer and deliver all of their 95 million REPO Shares to the Purchaser in accordance with the terms and conditions as set forth herein; and

WHEREAS, the Purchaser is willing to acquire all of the 95 million REPO Shares owned by the Selling Shareholders in exchange for the cash and additional consideration as more fully described herein.

NOW, THEREFORE, in consideration of the mutual agreements, covenants and conditions provided herein, the Parties agree as follows:

1

ARTICLE I

RECITALS

1.1 Recitals. The Parties hereto agree that the above recitals are true and correct and are incorporated by reference herein.

ARTICLE II

DEFINITIONS

2.1 Definitions. As used in this Agreement and the Schedules hereto, the following terms have the respective meanings set forth below:

"Affiliate" means, with respect to any Person, any other Person that directly or indirectly controls, is controlled by or is under common control with the Person in question.

"Assets" shall mean all the business, assets, properties, goodwill and rights of the Company as a going concern of every nature, kind and description, tangible and intangible, wherever located and whether or not carried or reflected on the books and records of the Company (the "Assets"), including, without limitation: (i) all right, title and interest in and to the corporate names of the Company and all variations thereof; (ii) cash-on-hand and cash in the bank accounts of the Company, inclusive of cash equivalents, together with the bank account records relating to all bank accounts of the Company; (iii) all deposits and all cash, cash equivalents, marketable securities and other assets (iv) all rights, title and interest in and to ail contracts, licenses or agreements to which the Company is a party as of the date of this Agreement; (v) all accounts receivable, checks, negotiable instruments and chattel paper, payable to, or with respect to bearer instruments in the possession of the Company; (vi) all inventory and supplies; (vii) all furniture, fixtures, equipment and machinery; (viii) all leasehold interests and improvements thereon; (ix) all books and records, files and operating data relating to any business conducted by the Company; (x) with respect to each insurance policy or fidelity bond on which the Company is an insured, all rights of the Company, including the right to receive any amounts recovered or recoverable from the insurer after the date of this Agreement resulting from an occurrence which took place on or prior to the date of this Agreement and the right to receive any amounts recovered or recoverable from the insurer after the date of this Agreement, with respect to any loss resulting from a claim made on or prior to the date of this Agreement, together with all insurance policies or fidelity bonds of which the Company is the sole owner; (xi) all claims, causes of actions, and suits which the Company has or may have against third parties; and (xii) the business and operations of the Company as a going concern,

2

"Closing" shall have the meaning as described in Section 3.2 hereof.

"Closing Agent" shall have the meaning described in Section 3.3 hereof.

"Closing Date" shall have the meaning as described in Section 3.2 hereof.

"Closing Documents" shall mean to all other documents, agreements, certificates, Irrevocable Stock Transfer Powers, and other instruments contemplated by this Agreement to carry out and perform the transactions as set forth herein.

"Code" means the Internal Revenue Code of 1986, as amended.

"Confidential Information" means, with respect to each party, (a) all information concerning the business and affairs of that party, including financial information, business plans and strategies, technology, proprietary information, know-how, formulae, products, methods and operational information and techniques, (b) any information that the appropriate party is required by applicable law to preserve in confidence and (c) any other information reasonably identified by a party to the other party as confidential, but excluding (i) information known by the other party or generally available or in the public domain, (ii) information that was independently developed by the other party without the use of the first party's Confidential Information and (iii) information rightfully provided by a third party without continuing restrictions on its use.

"FINRA" means the Financial Industry Regulatory Authority and the rules and regulations promulgated thereby.

"GAAP" means United States generally accepted accounting principles, consistently applied.

"Governmental Agency" means any federal, state, local or foreign government or any court of competent jurisdiction, administrative agency or commission or other governmental authority, or instrumentality, domestic or foreign, and any interdealer market quotation service, including but not limited to the SEC, FINRA and the OTCQB.

3

"Irrevocable Stock Transfer Power" shall have the meaning as described in Section 3.2 hereof.

"Material Adverse Effect" means a material adverse effect on the business, assets, condition (financial or otherwise), results of operations or prospects of a party to this Agreement or the ability of a party to consummate the transactions contemplated by this Agreement.

"NGCL" shall mean the Nevada General Corporation Law.

"REPO Shares" shall mean shares of common stock that have been issued by the Company and are outstanding on the Closing Date.

"OTCQB" means the OTC Markets Group over the counter market quotation system.

"Permitted Liens" shall have the meaning as described in Section 4.8.

"Person" means an individual, any form of business enterprise, including a corporation, limited liability company, partnership or limited partnership, and any other legal entity or its representative, including a trust, trustee, estate, custodian, administrator, personal representative, nominee or any other entity acting on its own behalf or in a representative capacity.

"Purchase Investigation" shall have the meaning as described in Section 6.1.

"SEC" means the Securities and Exchange Commission.

"Seller Breach" shall have the meaning described in Section 3.6 hereof.

"Subsidiary" means each Person of which (a) a majority of the voting power of the voting equity securities or equity interest is owned, directly or indirectly, by such Person.

"Tax" or "Taxes" means federal, state, county, local, foreign or other income, gross receipts, ad valorem, franchise, profits, sales or use, transfer, registration, excise, utility, environmental, communications, real or personal property, capital stock, license, payroll, wage or other withholding, employment, social security, severance, stamp, occupation, alternative or addon minimum, estimated and other taxes of any kind whatsoever (including, without limitation, deficiencies, penalties, additions to tax, and interest attributable thereto) whether disputed or not.

4

"Tax Return" means any return, information report or filing with respect to Taxes, including any schedules attached thereto and including any amendment thereof.

"Transfer Agent" as used throughout this Agreement shall mean Manhattan Transfer Registrar Company who maintains its principal business at 57 Eastwood Road, Miller Place, New York 11764.

2.2 Construction. Whenever the context requires, the gender of all words used in this Agreement includes the masculine, feminine and neuter. Unless otherwise expressly provided herein, all references to Articles, Sections and Schedules refer to articles, sections and schedules of or to this Agreement. All Schedules are hereby incorporated in and made a part of this Agreement as if set forth in full herein. The headings and captions in this Agreement and the Schedules are for convenience and identification only and are in no way intended to define, limit or expand the scope and intent of this Agreement or any provision hereof.

ARTICLE III

THE STOCK ACQUISITION

3.1 Purchase Price. The total purchase price payable to the Selling Shareholders for 95 million REPO Shares, which represent approximately 62% of the total issued and outstanding REPO Shares as of the date of this Agreement, shall equal the sum of $200,000 (the "Purchase Price") and shall be paid by the Purchaser to the Selling Shareholders on or before September 22, 2012 ("Due Date").

3.2 Closing. The closing of the transactions contemplated by this Agreement (the "Closing"), will take place at the offices of the Company, or at any alternative location designated by the Parties hereto and shall take place five (5) days following the conclusion of the Purchase Investigation as provided for in Section 6.1 of this Agreement or such earlier date as the Parties may agree to {"Closing Date"). On the Closing Date, 95 million REPO Shares representing approximately 62% of the total issued and outstanding REPO Shares of the Company shall be sold, transferred and delivered by the Selling Shareholders to the Purchaser through duly executed irrevocable stock powers with signature guarantees ("Irrevocable Stock Power") in a form acceptable to the Transfer Agent. The REPO Shares to be delivered by the Selling Shareholders to the Purchaser at the Closing shall be validly issued, non-assessable and free and clear of any clams, liens or encumbrances of any kind except as otherwise disclosed on Schedule 4.14 hereto.

5

3.3 The Stock Acquisition. On or before the Closing, the Selling Shareholders agree and shall deposit duly executed Irrevocable Stock Powers representing 95,000,000 REPO Shares with the law firm of Snyderburn, Rishoi & Swann, LLP ("Closing Agent").

3.4 REPO Shares To Remain in Escrow. Upon all other conditions of Closing as set forth in section 7.2 hereof having been satisfied, the Selling Shareholders shall provide Closing Agent with written instructions to deliver the 95 million REPO Shares and the Irrevocable Stock Transfer Powers signed by the Selling Shareholders to the Transfer Agent in order to allow the Transfer Agent to cancel the certificates representing the 95 million Shares in the name of the Selling Shareholders and issue a new certificate representing 95 million REPO Shares in the name of Purchaser. The Parties agree to authorize and instruct the Transfer Agent to deliver the Purchaser's certificate representing 95 million REPO Shares to the Closing Agent who will then hold and retain the newly issued stock certificate in the name of Purchaser representing 95 million REPO Shares in escrow together with an Irrevocable Stock Power signed by Purchaser in favor of the Selling Shareholders, which is a condition of Closing, until such time as the Purchaser has either (i) paid the Purchase Price to Selling Shareholders on or before the Due Date; or (ii) a default of Purchasex-'s obligations has been declared by the Selling Shareholders at which time the Closing Agent shall be authorized to return the 95 million REPO Shares together with the Purchaser's Irrevocable Stock Transfer Power to the Selling Shareholders. The duties and obligations of the Closing Agent as contemplated by this Section 3.4 shall be subject to and set forth in an Escrow Agreement to be executed by the Parties after the .Closing Date.

3.5 REPO Shares Restricted. The 95 million REPO Shares to be transferred to the Purchasers shall be subject to restrictions on transferability under applicable federal and state securities laws and may not be resold or transferred by the Purchasers in the absence of registration or an available exemption therefrom. In addition, the Company is a "shell company" as defined under Section 12b-2 of the Securities and Exchange Act of 1934, as amended, and until such time as it is no longer considered as a "shell company", no shareholder who owns restricted securities of the Company may rely on or utilize the safe harbor resale exemption provided by Rule 144 of the Securities Act of 193 3, as amended.

3.6 Forfeiture of Purchase Price and Additional Consideration. In the event that Purchaser fails to pay the Purchase Price to the Selling Shareholders by the Due Date after receiving a written notice of default ("Notice of Default"} from the Selling Shareholders in accordance with Section 10 of this Agreement, the Purchase Price payable to the Selling Shareholders and any portion of the Additional Consideration provided or tendered by the Purchaser up to the date that a Notice of Default is delivered by the Selling Shareholders, shall be forfeited and waived and Purchaser shall be forever barred and estopped from any attempts to seek reimbursement or any refund of the Purchase Price or any Additional Consideration provided from any party.

6

ARTICLE IV

REPRESENTATIONS AHD WARRANTIES OF COMPANY AND SELLING SHAREHOLDERS

Except as otherwise disclosed in the Schedules as attached hereto, the Company and the Selling Shareholders hereby represent and warrant to the Purchaser that the statements contained in this Article IV are complete, true and accurate as of the date of this Agreement and the Closing Date and shall survive the Closing Date in accordance with Section 10.2 below.

4.1 Organization and Standing, The Company was duly incorporated in the State of Nevada as a corporation, (b) is validly existing and in good standing as a corporation under the laws of the State of Nevada, (c) has full corporate power and authority and possesses all governmental franchises, licenses, permits, authorizations and approvals necessary to enable the Company to own, lease or otherwise hold its properties and Assets and to carry on its business as presently conducted and (d) is duly qualified and in good standing to do business as a foreign corporation in the State of Florida each other jurisdiction in which the conduct or nature of its business or the ownership, leasing or holding of its properties makes such qualification necessary, except jurisdictions where the failux"e to be so qualified or in good standing, individually or in the aggregate, would not have a Material Adverse Effect.

4.2 Authority. The Company and the Selling Shareholders have all requisite power and authority to enter into this Agreement and the Closing Documents, to perform the obligations hereunder and to consummate the transactions contemplated hereby. Ail corporate acts and other proceedings required to be taken by the Company and the Selling Shareholders to authorize the execution, delivery and performance of this Agreement, the Closing Documents and the consummation of the transactions contemplated hereby have been duly and properly taken and/or will be undertaken by the Company and the Selling Shareholders as of the Closing Date. This Agreement and the Closing Documents have been duly executed and delivered by the Company and the Selling Shareholders and constitutes the legal, valid and binding obligations of the Company and the Selling Shareholders and is enforceable against the Company and the Selling Shareholders in accordance with its terms.

4.3 Licenses/Permits. The Company has all permits, licenses, registrations and authorizations required by all necessary Governmental Agencies for the conduct of its current business and has fully complied with all Governmental Agencies and any other industry, governmental, or self regulatory organizations required by law for the conduct of its present businesses. The Company is a public reporting company and has filed all reports required to be filed by Section 12 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Company was required to file such reports) and has been subject to such filing requirements for the past 90 days. The Company's reports as filed with the SEC have either been provided to the Purchaser or are available for Purchaser's review through the OTC Markets Group website at: otcmarkets.com.

7

4.4 Ho Conflicts; Consents. The execution and delivery of this Agreement and the Closing Documents by the Company and the Selling Shareholders does not, and the consummation of the transactions contemplated hereby and compliance with the terms hereof will not conflict with or result in any violation of, or default (with or without notice or lapse of time, or both) under, or give rise to a right of termination, cancellation, repurchase, redemption or acceleration of any obligation or to the loss of a material benefit to the Company or the Selling Shareholders under, or to any increased, additional, accelerated or guaranteed rights or entitlements of any Person other than the Company or the Selling Shareholders, or result in the creation of any lien, claim, encumbrance, security interest, option, charge or restriction of any kind upon any of the Assets of the Company under any provision of (a) the Articles of Incorporation, By-Laws or any amendments thereto of the Company, (b) any note, bond, mortgage, indenture, deed of trust, license, lease, contract, commitment, agreement or arrangement to which the Company or the Selling Shareholders are a party or by which any of Company's Assets is subject to or bound or (c) any judgment, order or decree, or statute, law, ordinance, rule or regulation applicable to the Company, its Assets or the Selling Shareholders. Except as otherwise provided for in this Agreement and as otherwise may be required by federal securities laws to report a "change of control" on Form 8-K, no consent, approval, license, permit, order or authorization of, or registration, declaration or filing with, any Governmental Agency is required to be obtained or made by or with respect to the Company or the Selling Shareholders in connection with the execution, delivery and performance of this Agreement and the Closing Documents or the consummation of the transactions contemplated hereby.

4.5 Books and Records. The Company has heretofore delivered or made available for inspection to Purchaser, accurate and complete copies of its Articles of Incorporation or By-Laws, each as amended to date; its minute books; its shareholder certificate ledger, current shareholder list and stock transfer books; and such other tax returns, financial statements, reports and filings made with all Governmental Agencies personnel records and all other documents that Purchaser have requested in connection with the Purchase Investigation. At the Closing, the Company shall provide Purchaser with copies of all financial records including checks, vendor invoices and other documents that support all financial statements, whether audited or not, that have been filed by the Company with any Governmental Agency and any other documents (defined as "Company Documents") pertaining to the Company that Purchaser may reasonably request in advance.

8

4.6 Capitalization of the Company. The authorized capital stock of the Company consists of 200,000,000 REPO Shares, par value . 001 per share of which 152,562,914 REPO Shares are issued and outstanding on the date hereof. The Selling Shareholders are the beneficial owner of 95 million REPO Shares. Except as otherwise set forth on Schedule 4.6 hereto, all of the outstanding REPO Shares have been duly authorized and validly issued and are fully paid and nonassessable. No REPO Share has been issued in violation of or is subject to any purchase option, call, right of first refusal, preemptive, subscription or similar rights under any provision of applicable law, the Certificate of Incorporation or Bylaws of the Company or any contract, agreement or instrument to which the Company is subj ect, bound or a party or otherwise affected by. There are no outstanding warrants, options, rights, "phantom" stock rights, agreements, preferred, convertible or exchangeable securities or other instruments or commitments (i) pursuant to which the Company is or may become obligated to issue, sell, purchase, return or redeem any REPO Shares or ether securities; or (ii) that give any Person the right to receive any benefits or rights similar to any rights enjoyed by or accruing to the holders of REPO Shares or other interests of the Company. There are no outstanding bonds, debentures, notes, other indebtedness or any other class or series of debt or equity securities having the right to vote on any matters on which the shareholders holding REPO Shares may vote.

4.7 Financial Statements. Set forth in Schedule 4.7 attached hereto are the following financial statements: audited balance sheets and statements of income, changes in shareholders' equity and cash flow as of and for the fiscal years ended December 31, 2010, and the unaudited balance sheet and statements of income as of September 30, 2011 of the Company (collectively, the "Financial Statements"). The Financial Statements (including the notes thereto) have all been prepared in accordance with GAAP and applied on a consistent basis throughout the periods covered thereby, present fairly the financial condition of the Company as of such dates and the results of operations of the Company for such periods, are correct and complete, and are consistent with the books and records of the Company which books and records are correct and complete, subject to, in the case of the unaudited balance sheet and statements of income as of September 30, 2011, the absence of schedules and normal year-end adjustments.

9

4.8 Assets.

(a) The Company has good and valid title to all Assets reflected on its Financial Statements or thereafter acquired, except those sold or otherwise disposed of for fair value since the dates of the Company's Financial Statements in the ordinary course of business consistent with past practices and not in violation of this Agreement, in each case free and clear of all obligations, debts, liens, security interests or encumbrances of any kind except (i) as set forth in Schedule 4.8, (ii) mechanics, material men, carriers, workmen, repairmen or other like liens arising or incurred in the ordinary course of business and being contested in good faith, liens arising under original purchase price conditional sales contracts and equipment leases with third parties entered into in the ordinary course of business which are reflected on the Financial Statements and liens for Taxes that are not due and payable, (iii} mortgages, liens, security interests and encumbrances that secure debt reflected as a liability on the Company's Financial Statements and the existence of which is indicated in the notes thereto and (iv) other imperfections of title or encumbrances, if any, that do not, individually or in the aggregate, materially impair the continued use and operation of the Assets to which they relate to the business of the Company as presently conducted (the mortgages, liens, security interests, encumbrances and imperfections of title described in clauses (ii) , (iii) and (iv) above are hereinafter referred, to in this Article IV as "Permitted Liens").

(b) All the material tangible personal property of the Company has been maintained in all material respects in accordance with good commercial practices. Each item of material tangible personal property of the Company is in all material respects in good operating condition and repair, ordinary wear and tear excepted. All leased personal property of the Company is in all material respects in the condition required by the terms of the applicable lease during the term of the lease and upon the expiration thereof,

(c) The Company does not own or lease any real property. The Company has been permitted to use its current office space by an unaffiliated third-party at no cost.

4.9 Absence of Undisclosed Liabilities. Except as set forth on the Financial Statements for the Company or through Schedule 4.9 attached hereto and except for obligations or liabilities which have arisen since the dates of the Financial Statements in the ordinary course of business (none of which is a liability resulting from a breach of contract, breach of warranty, tort, infringement, claim or lawsuit) , the Company has no debts obligations or liabilities, contingent or otherwise.

10

4.10 Absence of Changes. Except as set forth in Schedule 4.10 attached hereto or as otherwise contemplated by this Agreement there has not been any change in the Assets, liabilities, financial condition or operations of the Company from that reflected in the Financial Statements except changes in the ordinary course of business that have not resulted, either individually or in the aggregate, in a Material Adverse Effect. Except as set forth in Schedule 4,10 or as contemplated by this Agreement, since September 30, 2011 there has not been: (a) any extraordinary damage, destruction or loss, whether or not covered by insurance; (b) any waiver or compromise by the Company of a valuable right or of a material debt owed to it; (c) any loans or guarantees made by the Company to or for the benefit of its shareholders, employees, officers or directors or any shareholder of their immediate families other than advances made in the ordinary course of business; (d) any satisfaction or discharge of any lien, claim or encumbrance or payment of any obligation by the Company, except in the ordinary course of business; (e) any material or adverse change or amendment to a Material Contract; (f) any new hire or resignation or termination of employment of any key employee or any material change in any compensation arrangement or other employment terms of any key employee; (g) any sale, disposition, assignment or transfer of any of the Company's Assets or properties of the Company except in the ordinary course of business; (h) any security interest created by the Company, with respect to any of its respective material properties or Assets, except statutory liens for taxes not yet due or payable; (i) any declaration, setting aside or payment or other distribution in respect of any of the REPO Shares of the Company, or any direct or indirect redemption, purchase or other acquisition of any such REPO Shares by the Company; (j) any borrowing of any amount or incurrence or subjection to any material liabilities, except current liabilities incurred in the ordinary course of business and liabilities under contracts entered into in the ordinary course of business; (k) any issuance of any notes, bonds or other debt securities or any REPO Shares or other equity securities or any securities convertible, exchangeable or exercisable into any REPO Shares or other equity securities; (1) any investment in any other entity or steps taken to incorporate any Subsidiary; (m) any capital expenditures or commitments therefor; (n) any material change in the accounting methods, principles or practices used by the Company, (o) any other material transaction other than in the ordinary course of business; or (p) any other event or condition that might reasonably be expected to have a Material Adverse Effect.

4.11 Taxes. The Company has filed or obtained presently effective extensions with respect to all federal, state, county, local and foreign tax returns which are required to be filed, such returns are complete and accurate in all material respects and have been prepared in compliance with all applicable laws and regulations in all material respects. The Company in all material respects has paid all Taxes due and owing by it (whether or not such Taxes are shown on a Tax Return) and have withheld and paid over to the appropriate taxing authority all Taxes which they are required to withhold from amounts paid or owing to any employee, shareholder, creditor or other third party except for certain payroll taxes owed which are presently under the sum of $500. No Tax Return is now under audit or examination by any foreign, federal, state or local authority and there are no agreements, waivers or other arrangements providing for an extension of time with respect to the assessment or collection of any Tax or deficiency of any nature against the Company, or with respect to any of the Tax Returns, or any suits or other actions, proceedings, investigations or claims now pending or, to the Company's knowledge, threatened against the Company with respect to any Tax. The Company has not waived any statute of limitations with respect to any Taxes; the accrual for Taxes on the Financial Statements would be adequate to pay all Tax liabilities of the Company through the date of this Agreement; since the date of the Financial Statements, the Company has not incurred any liability for Taxes other than in the ordinary course of business; the assessment of any additional Taxes for periods for which Tax Returns have been filed by the Company shall not exceed the recorded liability therefor on the Financial Statements (excluding any amount recorded which is attributable solely to timing differences between book and Tax income).

11

4.12 Intellectual Property. Schedule 4.12 sets forth a true and complete list of (a) all patents and patent applications, including the status, registration or application numbers thereof, (b) all trademarks (registered or unregistered), including a list of all jurisdictions in which they are registered or applied for and all registration and application numbers thereof, (c) all service marks and copyrights and applications therefor and (d) all other material intellectual property and proprietary rights, whether or not subject to statutory registration or protection (collectively, "the Company's Intellectual Property"), owned, used, filed by or licensed to the Company. To the best knowledge of the Company and the Selling Shareholders, the conduct of thebusiness of the Company as presently conducted does not violate, conflict with or infringe upon the intellectual property rights of any other Person. Except as set forth in Schedule 4.14, no claims are pending or, to the knowl edge of the Company, threatened, against the Company by any Person with respect to any infringement by the Company of the intellectual property rights of any other Person.

4.13 Contracts.

(a) Schedule 4.13 and the Financial Statements for the Company set forth a correct and complete list of all material contracts to which the Company is a party. Except as set forth in Schedule 4.13 hereof or contained within the Financial Statements, the Company is not a party to or bound by any of the following:

(i)any employment or consulting agreement that is not terminable by the Company at will without liability;

(ii) covenant of the Company not to compete or otherwise restricting the operations of the Company;

(iii) agreement, contract or other arrangement with any current or former officer, director or employee of the Company or any Affiliate thereof other than employment and consulting agreements contemplated by clause (i) above;

(iv) lease or similar agreement with any person under which (A) the Company is lessee of or holds or uses any machinery, equipment, vehicle or other tangible personal property owned by any other Person or (B) the Company is a lessor or sublessor of, or makes available for use by any other Person, any tangible personal property owned or leased by either the Company, which in any case or in the aggregate have a total future liability or receivable, as the case may be, in excess of $5,0 00;

12

(v) (A) a continuing contract for the future purchase of materials, supplies or equipment, (B) management, service, consulting, or other similar type of contract or (C) advertising agreement or arrangement, which in any case or in the aggregate have a total future liability in excess of $5,000;

(vi) material license, option or other agreement including any license or other agreement under which either the Company is a licensee or licensor thereof that relates, in whole or in part, to any trade secrets, confidential information or other proprietary rights and processes of the Company;

(vii) agreement, contract or other instrument under which either the Company has borrowed any money from, or issued any note, bond, debenture or other evidence of indebtedness to, any other Person that is in excess of $5,000 in the aggregate;

(viii) agreement, contract or other instrument under which (A) any Person has directly or indirectly guaranteed indebtedness, liabilities or obligations of the Company or (B) either the Company has directly or indirectly guaranteed indebtedness, liabilities or obligations of any other Person;

(ix) agreement, contract or other instrument under which either the Company has, directly or indirectly, made any advance, loan, extension of credit or capital contribution to, or other investment in, any other Person;

(x) agreement, contract or other instrument providing for indemnification of any Person with respect to liabilities relating to any current or former business of either the Company; or

(xi) other agreement, contract or other instrument to which the Company is a party to or by or which it or any of its Assets or business is bound.

(b) Except as set forth in Schedule 4.13, all agreements, contracts or other instruments of the Company listed or required to be listed in the Schedules hereto (collectively, the "Material Contracts") are valid, binding and in full force and effect and are enforceable by the Company in accordance with their terms. Except as set forth in Schedule 4.13, the Company has performed all material obligations required to be performed by it to date under the Material Contracts and is not in breach or default in any material respect thereunder (with or without the lapse of time or the giving of notice, or both) nor has any other party to any of the Material Contracts notified the Company of that party's belief that either the Company is or is likely to become in breach or default in any material respect thereunder or of that party's intention to accelerate or modify in a manner adverse to the Company any of its obligations or rights thereunder and, to the knowledge of the Company, no other party to any of the Material Contracts is in breach or default in any material respect thereunder (with or without the lapse of time or the giving of notice, or both).

13

4.14 Litigation, Ail pending and threatened lawsuits, arbitration proceedings or claims against or that affect the Company, any of its properties. Assets, operations or business or the Selling Shareholders have been disclosed to the Purchaser and Purchaser is fully aware of these matters. The lawsuits or claims could have individually or in the aggregate, a Material Adverse Effect on the Company or the REPO Shares being sold to Purchaser. Neither the Company nor the Selling Shareholders are a party or subject to or in default under any judgment, order, injunction or decree of any Governmental Agency including the SEC or arbitration tribunal applicable to it or any of their properties, the Assets, operations or business. There is no lawsuit, arbitration proceeding or claim by the Company or the Selling Shareholders pending, or which the Company or the Selling Shareholders intend to initiate, against any other Person and to the knowledge of the Company and the Selling Shareholders, there is no pending or threatened action against, investigation of or that relates to the Company or the Selling Shareholders by any Governmental Agency.

4.15 Insurance. The Company does not currently maintain any policies of fire and casualty, liability, workman1s compensation, surety bonds and other forms of insurance.

4.16 Employees and Employee Benefit Matters.

(a) The Company does not maintain any deferred or incentive compensation agreements, bonus plans, incentive plans, profit sharing plans, retirement, vacation, sick leave, hospitalization, termination, severance agreements, employee benefit plans subject to the Employee Retirement Income Security Act of 1974, as amended ("ERISA"), other employee compensation agreements, written or oral and other material fringe benefit plans sponsored, maintained or contributed to or by the Company or with respect to which the Company has any liability (the "Plans"). The Company is not a participating or contributing employer in any "multiemployer plan" (as defined in Section 3(37) of ERISA) with respect to employees of the Company nor has the Company incurred any withdrawal liability with respect to any multiemployer plan or any liability in connection with the termination or reorganization of any multiemployer plan. The Company does not maintain, contribute to or have any liability under (or with respect to) any employee plan which is a tax-qualified "defined benefit plan" (as defined in Section 3(35) of ERISA), whether or not terminated and whether or not tax qualified. The Company does not maintain, contribute to or have any liability under (or with respect to) any employee plan which is a tax-qualified "defined contribution plan" (as defined in Section 3(34) of ERISA), whether or not terminated.

(b) The Company does not have any collective bargaining agreements with any of its employees. There is no labor union organizing activity pending or, to the knowledge of the Company, threatened with respect to the business of the Company. There are no threatened or actual strikes or work stoppages or grievances pending against the Company. Subject to applicable law and the terms and conditions of employment agreements which are included in the Material Contracts, the employment of each officer and employee of the Company are terminable at will unless otherwise disclosed on Schedule 4.13. The Company has complied in all material respects with all laws relating to the employment of labor (including, without limitation, provisions thereof relating to w^ages, hours, equal opportunity, collective bargaining and the payment of social security and other taxes), and the Company is not aware that it has any material labor relations problems {including, without limitation, any union organization activities, threatened or actual strikes or work stoppages or material grievances). No employee of the Company is subject to any noncompete, nondisclosure, confidentiality, employment, consulting or similar agreements relating to, affecting or in conflict with the present business activities of the Company, except for agreements between the Company and its present and former employees.

14

(c) The Company has not incurred and has no reason to expect that it will incur, any liability to the Pension Benefit Guaranty Corporation (other than premium payments) or otherwise under Title IV of ERISA (including any withdrawal liability) or under the Code with respect to any employee pension benefit plan that the Company or any other entity together is treated as a single employer under Section 414 of the Code, maintains or ever has maintained or to which any of them contributes, ever has contributed, or ever has been required to contribute.

(d) Each individual who has received compensation for the performance of services on behalf of the Company has been properly classified as an employee or independent contractor in accordance with applicable laws. Schedule 4.16 identifies the names and addresses of each employee of the Company as well as the compensation each employee currently receives from the Company.

4.17 Compliance with Applicable Laws. Except as set forth on Schedule 4.17, and to its knowledge, the Company is in compliance in all material respects with all applicable statutes, laws, ordinances, rules, orders and regulations of any Governmental

Agency applicable to its business and operations, including those relating to occupational health and safety (for purposes of this Section 4.17, "Applicable Laws").

4.18 Disclosure. No representation or warranty of the Company or the Selling Shareholders as contained in this Agreement, no statement contained in any document, certificate, exhibit or Schedule and no data provided prior to the date of this Agreement furnished or to be furnished by or on behalf of the Company or the Selling Shareholders to Purchaser or any of its representatives pursuant to this Agreement contains or will contain any untrue statement of a material fact or omits or will omit to state any material fact necessary, in light of the circumstances under which it was or will be made, in order to make the statements herein or therein not misleading or necessary to fully and fairly provide the information required to be provided therein.

4.19 Transactions with Affiliates. Except as set forth in Schedule 4.19 hereto, and to the best knowledge and belief of the Company, no shareholder, officer or director of the Company, or any person with whom any such shareholder, officer or director has any direct or indirect relation by blood, marriage or adoption, or any entity in which any of such person, owns any beneficial interest (other than a publicly-held corporation whose stock is traded on a national securities exchange or in the over-the-counter market) has any interest in (i) any contract, arrangement or understanding with, or relating to, the business or operations of the Company, (ii) any loan, arrangement, understanding, agreement or contract for or relating to any indebtedness with the Company, or (iii) any properties or Assets, tangible or intangible, used or currently intended to be used in, the business or operations of the Company.

15

4.20Survival of Representations and Warranties. The representations and warranties of the Company and Selling Shareholders set forth in Article IV of this Agreement shall survive the Closing Date.

ARTICLE V

REPRESENTATIONS AND WARRANTIES OF PURCHASER

Except as otherwise disclosed herein, the Purchaser hereby represents and warrants to the Company and the Selling Shareholders that the statements contained in this Article V are complete, true and accurate as of the date of this Agreement and the Closing Date and shall survive the Closing.

5.1 Authority. Purchaser has all requisite power and authority to enter into this Agreement, to perform the obligations hereunder and to consummate the transactions contemplated hereby. All acts and other proceedings required to be taken by Purchaser to authorise the execution, delivery and performance of this Agreement and the consummation of the transactions contemplated hereby have been duly and properly taken. This Agreement has been duly executed and delivered by the Purchaser and constitutes the legal, valid and binding obligation of Purchaser, enforceable against Purchasers in accordance with its terms.

5.2 No Conflicts; Consents. The execution and delivery of this Agreement by Purchasers does not, and the consummation of the transactions contemplated hereby and compliance with the terms hereof will not conflict with or result in any violation of or a default (with or without notice or lapse of time, or both) under, or give rise to a right of termination, cancellation, repurchase, redemption or acceleration of any obligation or loss of a material benefit to the Purchaser under, or to any increased, additional, accelerated or guaranteed rights or entitlements of any person other than Purchaser under, or result in the creation of any lien, claim, encumbrance, security interest, option, charge or restriction of any kind upon any of the properties or assets of the Purchaser under any provision of (a) any note, bond, mortgage, indenture, deed of trust, license, lease, contract, commitment, agreement or arrangement to which the Purchaser is a party or by which any of its properties or assets are bound or (b) any judgment, order or decree, or statute, law, ordinance, rule or regulation applicable to Purchaser or its properties or assets. Except as otherwise provided for in this Agreement or the Schedules attached hereto, no consent, approval, license, permit, order or authorization of, or registration, declaration or filing w7ith, any Governmental Agency is required to be obtained or made by or with respect to the Purchaser in connection with the execution, delivery and performance of this Agreement or the consummation of the transactions contemplated hereby or following the Closing Date except to report on Form 8-K with the Securities and Exchange Commission ("SEC") a change of control, and other material items that will affect the Company after Closing.

16

5.3Additional Representations and Warranties. The Purchaser further represents and warrants to the Selling Shareholders and the Company that the following statements are true and shall be true on the Closing Date.-

(a) The Purchaser confirms that, if requested, all documents, records, and books pertaining to the Company have been made available and the Purchaser further understands that the form of any such document so provided may be modified after its delivery.

(b) The Purchaser has had, if requested, an opportunity to ask questions of and receive satisfactory answers from the Selling Shareholders of the Company concerning the Company, and the terms and conditions relating to an investment in the REPO Shares and all such questions have been answered to the full satisfaction of the Purchaser.

(c) The Purchaser has no contract, undertaking, arrangement, or agreement with any person to sell, assign or transfer, or to have any person sell for the Purchaser all or any portion of the REPO Shares. The Purchaser has no present obligation, indebtedness, or commitment, nor is any circumstance in existence which will compel the Purchaser to secure funds from the sale of any of the REPO Shares, nor is the Purchaser a party to any plan or undertaking which would require or contemplate that proceeds from a sale of all or part of the REPO Shares be utilized in connection therewith, and the Purchaser does not now have any reason to anticipate any change in circumstances or other particular occasion or event which would cause the undersigned to transfer any REPO Shares.

(d) The Purchaser represents that it has been called to its attention by the Selling Shareholders that the purchase of REPO Shares in the Company involves a high degree of risk and no assurances are or have been made regarding the likelihood of a return of any portion of an investment in the REPO Shares.

(e) The Purchaser represents that by reason of its business and financial condition and experience, it has acquired the capacity to protect its own interest in investments of this nature. In reaching the conclusion that the Purchaser desires to purchase the REPO Shares, the Purchaser has evaluated carefully the Company's financial condition and the risks associated with the purchase of REPO Shares from the Selling Shareholders and acknowledges that the Purchaser is familiar with and able to bear any economic risks associated with this investment.

5.4 Investment Intent. The Purchaser is acquiring the REPO Shares for its own account for investment and not with a view to, or for sale in connection with, any distribution thereof, nor with any present intention of distributing or selling the same. The Purchasers understands that the REPO Shares have not been registered under the Securities Act by reason of a specific exemption from the registration provisions thereof which depends upon, among other things, the bona fide nature of its investment intent as expressed herein. The Purchaser will not transfer the REPO Shares except in compliance with applicable securities laws. Purchaser also acknowledges that the Company is a "shell company" as defined by Section 12b~2 of the Securities & Exchange Act of 1934 and that no shareholder may utilize the provisions of Rule 144 of the Securities Act of 1933 to resell any restricted REPO Shares.

17

ARTICLE VI COVENANTS PRIOR TO CLOSINGS

6.1 Purchase Investigation.

(a) From the date of this Agreement until the Closing Date, the Company and the Selling Shareholders shall provide the Purchaser and its representatives, consultants, counsel and accountants (for purposes of this Section 6.1, "Representatives"), ^pon request, access to the Company's personnel, properties, offices, books and records and promptly provide the Purchasers and its Representatives all available financial and operating data and other information and assistance with respect to the Company's business and properties as may be requested from time to time by the Purchaser and its Representatives ("Purchase Investigation"). Without limiting the foregoing, the Company and the Selling Shareholders shall cooperate with the Purchaser and its Representatives in their review of the business and operations of the Company and permit them to discuss the procedures and review the work papers used by the Company and its accountants in the preparation of its financial statements and filings with Governmental Agencies including filings made with the SEC since the Company's inception.

(b) Until the Closing Date, the Company and the Selling Shareholders shall have the continuing obligation to supplement or amend the Schedules referenced in this Agreement with respect to any matter hereafter arising or discovered that, if existing or known on the date of this Agreement, would have been required to be set forth or described in the Schedules.

(c) Each party shall promptly notify the other party of, and furnish any information the other party may reasonably request with respect to the occurrence of any event or condition or the existence to its knowledge of any fact that would cause any of the conditions to the other party's obligation to consummate the transactions contemplated hereby to be unfulfilled.

6.2 Conduct of Business Pending the Stock Acquisition

(a) From the date of this Agreement and unt i 1 the Closing Date, the Company will conduct its operations in the ordinary course of business in a manner consistent with its past practices.

18

(b) The Company wl 11 not (i) amend its Artides of Incorporation or By-Laws, (ii) declare or pay any dividend or make any other distribution to its shareholders upon any of REPO Shares, (iii) redeem or otherwise acquire any REPO Shares or issue or amend any REPO Shares or any option, warrant or right relating thereto or any securities convertible into or exchangeable for any REPO Shares, (iv) adopt or amend in any respect any employee benefit plan or collective bargaining agreement, except as required by law after providing written notice to Purchaser, (v) grant to any officer, director, employee or independent contractor any increase in compensation or benefits, except as may be required under existing agreements or as approved by the Purchaser, (vi) incur or assume any liabilities, obligations or indebtedness, in each case for borrowed money, or guarantee any liabilities, obligations or indebtedness, (vii) permit, allow or suffer any of its Assets to become subject to any mortgage, lien, security interest, encumbrance or other similar restriction of any nature, (viii) waive any claims or rights of value, (ix) pay, loan or advance any amount to, or sell, transfer or lease any of its Assets to, or enter into any agreement or arrangement with, any of its Affiliates, (x) make any change in any method of accounting or accounting practice or policy, (xi) acquire by merging or consolidating with, or by purchasing a substantial portion of the Assets of, or by any other means, any business or any corporation, partnership, association or other business organization or division thereof or otherwise acquire any Assets for an aggregate purchase price in excess of $5,000, (xii) make or incur any capital expenditure that individually or in the aggregate are in excess of $5,000, (xiii) sell, lease, license or otherwise dispose of any of its Assets or enter into any lease of real property, except any renewals of existing leases on market terms in the ordinary course of business, (xv) enter into or amend or supplement any Material Contract or (xvi) or agree, whether in writing or otherwise, to do any of the foregoing.

6.3 Confidentiality. The Parties (a) acknowledge that the transactions contemplated by this Agreement will require them to share Confidential Information and (b) agree that, if the Stock Acquisition, as contemplated by Article III, is not consummated within the time prescribed for in this Agreement or within such other time as may be agreed upon between the Parties, then each party will (i) hold the other party's Confidential Information in strict confidence, (ii) not copy the other party's Confidential Information or disclose any portion thereof to any third party without the prior written consent of the other party, (iii)" not make any use of the other party's Confidential Information except for the sole purpose of performing its Purchase Investigation hereunder and {iv) immediately return to the other party or destroy, as the other party may direct, all tangible records embodying the other party's Confidential Information in its possession, custody or control upon any termination of this Agreement.

19

6.4 Further Cooperation. At the request of any party hereto either before or after the Closing Date, each party shall take all actions and deliver all documents reasonably necessary or appropriate to carry out the terms and provisions of this Agreement including but not limited to the delivery of all Company Documents by the Company and the Selling Shareholders to the Purchaser as contemplated by section 4.5 of this Agreement. Each of the Parties will use all reasonable efforts to obtain any necessary waivers, consents and approvals from all Governmental Agencies and effect all necessary filings and take all actions necessary or appropriate to consummate the transactions contemplated by this Agreement.

6.5 Notice of Developments. Each party will give prompt written notice to the others of any material adverse development causing a breach of any of its own representations and warranties set forth herein or the occurrence of a Material Adverse Event (financial or otherwise) with respect to any Asset, the Company or its business. No disclosure by any party pursuant to this Section 6.5, however, shall be deemed to amend or supplement any Schedules hereto or to prevent or cure any misrepresentation, breach of warranty, or breach of any covenant.

6.6 Exclusivity. From the date of this Agreement until the Closing Date, unless this Agreement is earlier terminated in accordance with Article VIII hereof, the Company and the Selling Shareholders will not (and will not cause or permit any third party to) : (A) solicit, initiate, or encourage the submission of any proposal or offer from any person or entity relating to the acquisition of any REPO Shares or other voting securities of the Company; or (B) participate in any discussions or negotiations regarding, furnish any information with respect to, assist or participate in, or facilitate in any other manner any effort or attempt by any person or entity to do or seek any of the foregoing. The Company and the Selling Shareholders will notify the Purchasers immediately if any third party makes any proposal, offer, inquiry, or contact with respect to any of the foregoing.

ARTICLE VII CONDITIONS PRECEDENT

7.1 Conditions to Purchaser's Obligations. In addition to the conditions set forth in Article III hereof being satisfied, the obligation of Purchaser to effect the Stock Acquisition, as contemplated hereby, is subject to the satisfaction or the written waiver of the following conditions:

20

(a) No statute, rule, regulation, executive order, denial, decree, temporary restraining order, preliminary or permanent injunction or other order enacted, entered, promulgated, enforced or issued by any Govei~nmental Agency or other legal restraint or prohibition preventing the transaction contemplated by the Agreement from being completed shall be in effect.

(b) The Company and the Selling Shareholders shall have performed or complied in ail material respects with all obligations and covenants required by this Agreement to be performed or complied with by them either separately or collectively.

(c) The representations and warranties of the Company and the Selling Shareholders made in this Agreement shall be true and correct in all material x~espects as of the Closing Date though made as of that time, except to the extent they expressly relate to an earlier date, in which case they shall be true and correct in all material respects on and as of that earlier date.

(d) No action, suit, or proceeding shall be pending or threatened before any court or quasi-judicial or administrative agency of any federal, state, local, or foreign jurisdiction or Governmental Agency or before any arbitrator wherein an unfavorable injunction, judgment, order, decree, award, ruling, or charge would: (1) prevent consummation of any of the transactions contemplated by this Agreement, (2) cause any of the transactions contemplated by this Agreement to be rescinded following consummation, (3) if true, make any of the representations or warranties set forth in Article IV, not true or not correct; or (4) have a Material Adverse Effect on the right of the Purchasers to control and operate the Company.

(e) On the Closing Date, all of the officers and directors of the Company shall continue to hold their respective offices and serve in the positions that they presently hold and Purchaser shall be appointed to the Company's Board of Directors and shall serve as the President for the Company.

(f) On the Closing Date, the Company and the Selling Shareholders shall have delivered copies of all Company Documents to the Purchaser as contemplated by section 4.5 of this Agreement,

21

(g) At the Closing and subj ect to the provisions of Section 3,4, the Purchaser shall have received written instructions from the Closing Agent that it has received and is in possession of executed Irrevocable Stock Powers representing 9 5 million REPO Shares from the Selling Shareholders .

(h) The Company shall have delivered to Purchaser certificates dated as of the Closing Date and signed by an authorized officer for the Company together with the Selling Shareholders individually confirming that the conditions of paragraphs (a) through (g) of this Section 7.1 have been satisfied.

(i) All actions to be taken by the Company and Selling Shareholders in connection with consummation of the transactions contemplated hereby and all certificates, instruments, and other documents required to effect the transactions contemplated hereby will be satisfactory in form and substance to Purchasers.

7.2 Conditions to the Obligations of the Company and Selling Shareholders. In addition to the conditions set forth in Article III hereof being satisfied, the obligations of the Company and the Selling Shareholders to effect the transactions contemplated hereby are subj ect to the satisfaction or the written waiver of the following conditions:

(a) Purchaser shall have agreed to pay the Purchase Price to the Selling Shareholders by the Due Date.

(b) Purchaser shall have delivered to the Closing Agent a signed Irrevocable Stock Transfer Power in favor of the Selling Shareholders representing 95 million REPO Shares.

(c) Purchaser shall have performed or complied in all material respects with all obligations and covenants required by this Agreement to be performed or complied with by the Purchaser.

(d) The representations and warranties of the Purchaser made in this Agreement shall be true and correct in all material respects as of the Closing Date, except to the extent they expressly relate to an earlier date, in which case they shall be true and correct in all material respects on and as of that earlier date.

(e) No action, suit, or proceeding shall be pending or threatened before any court or quasi-judicial or administrative agency of any federal, state, local, or foreign jurisdiction or Governmental Agency or before any arbitrator wherein an unfavorable injunction, judgment, order, decree, award, ruling, or charge would: (1) prevent consummation of any of the transactions contemplated by this Agreement, or (2) cause any of the transactions contemplated by this Agreement to be rescinded following consummation.

22

(f) Purchaser shall have delivered to the Company and the Selling Shareholders certificates dated as of the Closing Date confirming that the conditions of paragraphs (a) through (e) of this section have been satisfied.

ARTICLE VIII

TERMINATION

The Parties may mutually terminate this Agreement in writing and may also terminate this Agreement for the following reasons:

8.1 Purchase Investigation Termination. If, for any reason whatsoever, the Purchaser is not satisfied with the results of the Purchase Investigation relating to the Company, the Purchaser may terminate this Agreement by giving written notice to the Company on or before March 22, 2012 after the date of this Agreement {the "Purchase Investigation Period"); provided, however, that if the Company or the Selling Shareholders do not comply with their obligations under this Section 8.1, then the Purchase Investigation Period shall be extended to the tenth day after the date the Company and the Selling Shareholders comply, in all respects, with their obligations hereunder. Any extension of the Purchase Investigation Period, however, shall not be deemed to relieve the Company or the Selling Shareholders from their obligations or liabilities on account of their non-compliance.

8.2 Purchasers' Termination Generally. Purchasers may terminate this Agreement by giving written notice to the Company at any time prior to the Closing, in the event the Company or the Selling Shareholders has breached any material representation, warranty, or covenant contained in this Agreement in any material respect and Purchasers have provided the Company and. the Selling Shareholders with five (5) days written notice of such breach and the breach has not been cured within the notice period.

8.3 Company Termination Generally. The Company or the Selling Shareholders may terminate this Agreement by giving written notice to the Purchaser at any time prior to the Closing, in the event the Purchaser has breached any material representation, warranty, or covenant contained in this Agreement in any material respect and the Company, the Selling Shareholders have provided Purchaser with five (5) days written notice of such breach and the breach has not been cured within the notice period.

8.4 Effect of Termination. If a party terminates this Agreement pursuant to this Article VIII, all rights and obligations of the Parties hereunder shall terminate without any liability of any party to the other party, except for any liability of a party then in breach or as otherwise provided for in this Agreement.

23

ARTICLE IX

INDEMNIFICATION

9.1 The Company and Selling Shareholders, jointly and severally, shall indemnify and hold Purchaser, their representatives and assigns, collectively and individually (the "Purchaser Indemnified Parties") harmless from any and all losses, claims, liabilities, damages, obligations, liens, encumbrances, costs and expenses, including reasonable attorney fees, arbitration, appellate, and court costs, that now exist or may hereafter arise or be asserted against or suffered by any of the Purchaser Indemnified Parties, collectively or individually, from time to time, as a result of: (A) any false or incomplete statement by the Company or the Selling Shareholders, or any noncompliance or breach by the Company or the Selling Shareholders, with respect to any of the terms, covenants, warranties or representations of this Agreement or the Schedules attached hereto.

9.2 Purchaser shall indemnify and hold the Company and the Selling Shareholders, collectively and individually (the "Company Indemnified Parties") harmless from any and all losses, claims, liabilities, damages, obligations, liens, encumbrances, costs and expenses, including reasonable attorney fees, arbitration and appellate, and court costs, that now exist or may hereafter arise or be asserted against or suffered by the Company Indemnified Parties, collectively or individually as a result of: (A) any false or incomplete statement by Purchaser, or any non-compliance or breach by Purchaser with respect to any of the terms, covenants, warranties or representations of this Agreement or any Schedule attached hereto.

ARTICLE X

DEFAULT

10. Default. After the Closing Date, the occurrence of one or more of the following events after thirty (30) days written notice from Selling Shareholders shall constitute a default by Purchaser ("Event of Default") under this Agreement, unless Purchaser substantially cures such Event of Default within the thirty (30) day notice period: (A) the failure of Purchaser to provide or tender the Additional Consideration in accordance with Schedule 3.1 hereto; (B) the making of an assignment by Purchaser for the benefit of its creditors; (C) the commencement of proceedings in bankruptcy, whether voluntary or involuntary, for reorganization of Purchaser or for the adjustment of his debts under the Bankruptcy Code or under any law, whether state, federal or foreign, now or hereafter existing for the relief of Purchaser, except, in the case of any bankruptcy or other similar insolvency or liquidation proceeding, only if such proceeding shall not have been dismissed on or within ninety (90) days of its commencement; (D) the appointment of a receiver for the Purchaser or any of the Purchaser's assets,* or (E) Purchaser becomes insolvent or unable to pay his debts as they mature.

24

ARTICLE XI

RIGHTS UPON DEFAULT

11. Rights Upon Default. Upon the occurrence of an Event of Default, Selling Shareholders may provide written notice to the Closing Agent in accordance with the terms of the Escrow Agreement and Closing Agent shall then deliver the Purchaser's stock certificate within its possession representing the 95 million REPO Shares and the Purchaser's Irrevocable Stock Transfer Power to the Selling Shareholders.

Upon this occurrence, Purchaser shall have no further rights, duties or obligations under this Agreement and shall cease to be a shareholder of the Company.

ARTICLE XII

MISCELLANEOUS PROVISIONS

12.1 Successors and Assigns. The provisions of this Agreement shall inure to the benefit of, and be binding upon, the permitted successors, assigns, heirs, executors and administrators of the parties to this Agreement. The Company and the Selling Shareholders either separately or collectively may not assign or transfer any right, duty or obligation under this Agreement. Purchasers, however, without the consent of the Company or the Selling Shareholders may assign their rights, duties and obligations under this Agreement to any Person whether controlled by Purchaser or not provided that such assignee agrees to assume the Purchaser's responsibilities and obligations arising under this Agreement.

12.2 Survival. Notwithstanding any investigation made by the Purchaser, each of the representations and warranties made by the Parties herein shall survive the Closing Date. All covenants made herein shall survive the execution and delivery of this Agreement and the Closing Date.

12.3 Expenses. Each party will bear its own expenses and costs of the transactions contemplated hereby, including, but not limited to, the fees of attorneys, consultants and financial advisors.

12.4 Severability. The invalidity or unenforceability of any provision of this Agreement shall not affect the validity or enforceability of any other provision of this Agreement.

12.5 Governing Law; Jurisdiction. This Agreement shall be governed by and construed in accordance with the internal laws of the State of Nevada (without reference to the conflicts of law provisions thereof).

25

12.6 Notices. All notices, requests, consents and other communications under this Agreement shall be in writing and shall be deemed delivered (I) three (3) business days after being sent by registered or certified mail, return receipt requested, postage prepaid, (ii) one (1) business day after being sent via a reputable nationwide overnight courier service guaranteeing next business day delivery, (iii) via facsimile, or (iv) by e-mail transmission, in each case to the intended recipient as set forth below;

If to the Company:

National Asset Recovery Corp.

30 Skyline Drive, Suite 200

Lake Mary, Florida 32746

If to Selling Shareholders:

Bradley Wilson

30 Skyline Drive, Suite 200

Lake Mary, Florida 32746

William A. Glynn

30 Skyline Drive, Suite 200

Lake Mary, Florida 32746

With a copy to:

Snyderburn, Rishoi & Swann, LLP

258 Southhall Lane, Suite 420

Maitland, Florida 32751

Telephone: (407) 647-2005

Facsimile: (4 07) 647-1522

Attention: K. Michael Swann, Esquire

26

If to Purchaser:

Fred DaSilva

111 Panorama Hills Road

Calgary, Alberta,

Canada T3K 5J1

Any party may give any notice, request, consent or other communication under this Agreement using any other customary means (including, without limitation, personal delivery, messenger service, telecopy, first class mail, facsimile or electronic mail) , but no such notice, request, consent or other communication shall be deemed to have been duly given unless and until it is actually received by the party for whom it is intended. Time is of the essence in giving notice. Any party may change the address to which notices, requests, consents or other communications hereunder are to be delivered by giving the other parties notice in the manner set forth in this Section.

12.7 Complete Agreement. This Agreement (including its Schedules) constitutes the entire agreement and understanding of the parties hereto with respect to the subject matter hereof and supersedes and replaces all prior agreements and understandings, whether oral or written, relating to such subject matter.

12.8 Amendments and Waivers. This Agreement may be amended or terminated and the observance of any term of this Agreement may be waived with respect to all Parties to this Agreement (either generally or in a particular instance and either retroactively or prospectively) with the written consent of the Parties. Any amendment, termination or waiver effected in accordance with this Section 10.8 shall be binding on all Parties hereto. No waivers of or exceptions to any term, condition or provision of this Agreement, in any one or more instances, shall be deemed to be, or construed as, a further or continuing waiver of any such term, condition or provision.

12.9 Construction. The Parties have participated jointly in the negotiation and drafting of this Agreement. In the event an ambiguity or question of intent or interpretation arises, this Agreement shall be construed as if drafted jointly by the Parties and no presumption or burden of proof shall arise favoring or disfavoring any party by virtue of the authorship of any of the provisions of this Agreement. Any reference to any federal, state, local or foreign statute or law shall be deemed also tc refer to all rules and regulations promulgated thereunder and any applicable common law, unless the context requires otherwise. The word "including" shall mean including without limitation and is used in an illustrative sense rather than a limiting sense. Terms used with initial capital letters will have the meanings specified, applicable to singular and plural forms, for all purposes of this Agreement. Whenever the context may require, any pronouns used in this Agreement shall include the corresponding masculine, feminine or neuter forms, and the singular form of nouns and pronouns shall include the plural, and vice versa.

27

12.10 Counterparts; Facsimile Signatures. This Agreement may be executed in any number of counterparts, each of which shall be deemed to be an original, and all of which shall constitute one and the same document. This Agreement may be executed by facsimile signatures of the Parties, which shall be deemed to be original signatures.

12.11 Section Headings and References. The section headings are for the convenience of the parties and in no way alter, modify, amend, limit or restrict the contractual obligations of the Parties. Any reference in this Agreement to a particular section or subsection shall refer to a section or subsection of this Agreement, unless specified otherwise.

12.12 Delays or Omissions. No delay or omission to exercise any right, power or remedy accruing to the respective Parties hereunder shall impair any such right, power or remedy of the Parties, nor shall it be construed to be a waiver of any breach or default under this Agreement, or an acquiescence therein, or of or in any similar breach or default thereafter occurring; nor shall any delay or omission to exercise any right, power or remedy or any waiver of any single breach or default be deemed a waiver of any other right, power or remedy or breach or default theretofore or thereafter occurring. All remedies, either under this Agreement, or by law otherwise afforded to the Parties shall be cumulative and not alternative.

12.13 Effect of Investigation. Any due diligence review, audit or other investigation or inquiry undertaken or performed by or on behalf of the Purchasers shall not limit, qualify, modify or amend the representations, warranties or covenants of, or indemnities by the Company and the Selling Shareholders made or undertaken pursuant to this Agreement, irrespective of the knowledge and information received (or which should have been received) therefrom by Purchaser.

12.14 Ho Third Party Beneficiaries. This Agreement shall not confer any rights or remedies upon any person other than the parties hereto and their successors and permitted assigns.

12.15 Further Cooperation. The parties hereto agree (a) to furnish upon request to each other such further information, (b) to execute and deliver to each other such other documents, and (c) to do such other acts and things, all as any other party to this Agreement may reasonably request either before or after the Closing Date, for the purpose of carrying out the intent of this Agreement and the documents referred to herein.

12.16 Arbitration. Any controversy arising between the Parties to this Agreement or any person claiming through or on behalf of them as it relates to this Agreement or the performance or breach thereof shall be resolved through arbitration, in the State of Florida in accordance with the then governing commercial arbitration rules of the American Arbitration Association in the City of Orlando, Florida, and judgment or decree may be entered upon the award made by any court of competent jurisdiction. The parties agree that any dispute between them shall be determined by one (1) arbitrator to be selected in accordance with the then governing commercial arbitration rules of the American Arbitration Association.

28

12.17 Attorneys' Fees. In the event of any litigation, arbitration or dispute arising under or relating to this Agreement, the prevailing party shall be entitled to recover its reasonable attorneys' fees from and against the non-prevailing party through and including all appeals and/or post-judgment proceedings.

[This Space Left Bank Intentionally]

29

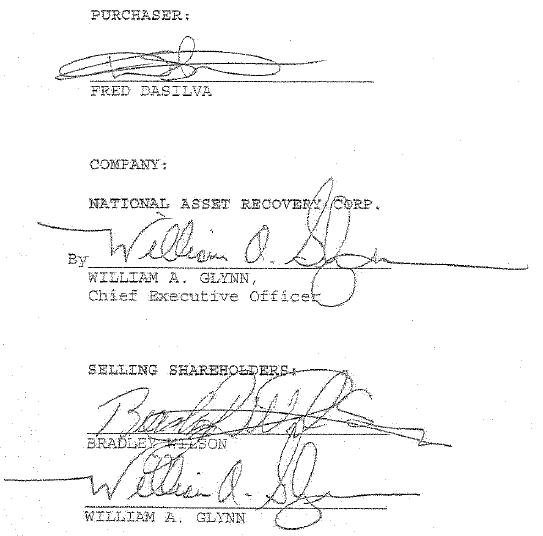

in Witness Whereor., tne^ parties nave executes, ihis Agreement els if the date first above written.

|

30

Schedule 4.7

Financial Statements

Financial Statements for the annual audited pei'iod ending for December 31, 2C10 as well as unaudited Financial Statements for the period ending September 30, 2011, are available for the Company through the website otcmarkets.com, trading symbol REPO.

31

Schedule 4.9

Absence of Undisclosed Liabilities

additional disclosures are required.

32

Schedule 4.10

Absence of Changes

No additional disclosures are reauired.

33

Schedule 4.12

Intellectual Property

The Company does not own any Intellectual Property.

34

Schedule 4.13

Material Contracts

The Company is a party to the following Material Contracts:

|

|

1. Employment Agreements in favor of each Selling Shareholder.

|

35

Schedule 4.17

Compliance With Applicable Laws

No additional disclosures are required.

36

Schedule 4.19

Transactions With Affiliates

The Company has entered into employment agreements with each of the Selling Shareholders.

37