Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - NEW JERSEY MINING CO | Financial_Report.xls |

| EX-32.2 - CERTIFICATIONS - NEW JERSEY MINING CO | exhibit32-2.htm |

| EX-31.2 - CERTIFICATIONS - NEW JERSEY MINING CO | exhibit31-2.htm |

| EX-31.1 - CERTIFICATIONS - NEW JERSEY MINING CO | exhibit31-1.htm |

| EX-32.1 - CERTIFICATIONS - NEW JERSEY MINING CO | exhibit32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2011

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period ______________ to ______________

Commission file number 000-28837

NEW JERSEY MINING COMPANY

(Name of small business issuer in its charter)

| Idaho | 82-0490295 |

| (State or other jurisdiction | (I.R.S. employer identification No.) |

| of incorporation or organization) |

89 Appleberg Road, Kellogg, Idaho 83837

(Address of principal executive offices) (zip code)

(208) 783-3331

Registrant’s telephone

number, including area code

Securities registered under Section 12(b) of the Exchange Act:

None

Securities registered under Section 12(g) of the Exchange Act:

Common Stock, No par value per share

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

[ ] No [X]

Indicate by check mark if the registrant is not required to file

reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [

] No [X ]

Indicate by check mark whether the issuer (1) filed all reports

required to be filed by Section 13 or 15(d) of the Securities Exchange Act of

1934 during the past 12 months (or for such shorter period that the registrant

was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days.

Yes [X] No

[ ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate website, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files).

Yes[X] No [ ]

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained herein, and no disclosure will be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “small reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer [ ] | Accelerated Filer [ ] |

| Non-Accelerated Filer [ ] | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company

(as defined in Rule 12b-2 of the Exchange Act

Yes [

] No [X]

The aggregate market value of all common stock held by non-affiliates of the registrant, based on the average of the bid and ask prices on June 30, 2011 was $8,020,000.

On March 1, 2012 there were 45,305,862 shares of the registrant’s Common Stock outstanding.

1

TABLE OF CONTENTS

2

GLOSSARY OF SIGNIFICANT MINING TERMS

Ag-Silver.

Au-Gold.

Alluvial-Adjectivally used to identify minerals deposited over time by moving water.

Argillites-Metamorphic rock containing clay minerals.

Arsenopyrite-An iron-arsenic sulfide. Common constituent of gold mineralization.

Ball Mill-A large rotating cylinder usually filled to about 45% of its total volume with steel grinding balls. The mill rotates and crushed rock is fed into one end and discharged through the other. The rock is pulverized into small particles by the cascading and grinding action of the balls.

Bedrock-Solid rock underlying overburden.

Cu-Copper.

CIL-A standard gold recovery process involving the leaching with cyanide in agitated tanks with activated carbon. CIL means "carbon-in-leach."

Crosscut-A nominally horizontal tunnel, generally driven at right angles to the strike of a vein.

Dip-Angle made by an inclined surface with the horizontal, measured perpendicular to strike.

Deposit-A mineral deposit is a mineralized body which has been intersected by sufficient closely-spaced drill holes or underground sampling to support sufficient tonnage and average grade(s) of metal(s) to warrant further exploration or development activities.

Development Stage-As defined by the SEC-includes all issuers engaged in the preparation of an established commercially mineable deposit (reserves) for its extraction which are not in the production stage.

Drift-A horizontal mine opening driven on the vein. Driving is a term used to describe the excavation of a tunnel.

Exploration Stage-As defined by the SEC-includes all issuers engaged in the search for mineral deposits (reserves) which are not in either the development or production stage.

Fault-A fracture in the earth's crust accompanied by a displacement of one side of the fracture with respect to the other and in a direction parallel to the fracture.

Flotation-A physiochemical process for the separation of finely divided solids from one another. Separation of these (dissimilar) discrete solids from each other is affected by the selective attachment of the particle surface to gas bubbles.

GPT-grams per metric tonne.

Galena-A lead sulfide mineral. The most important lead mineral in the Coeur d'Alene Mining District.

Grade-A term used to assign the concentration of metals per unit weight of ore. An example-ounces of gold per ton of ore (opt). One troy ounce per short ton is 34.28 parts per million or 34.28 grams per metric tonne.

Mill-A general term used to denote a mineral processing plant.

Mineralization-The presence of minerals in a specific area or geologic formation.

Net Smelter Royalty-A royalty, usually paid to a mineral claim owner, that is a percentage of the proceeds from the sale of metal-bearing concentrate or metal to a smelter or refinery. Also known as an NSR, the cost of smelting, refining, and transport to the smelter is deducted before the royalty is applied. However, the cost of mining and milling is not deducted. Typical net smelter royalty rates are from 1% to 5%.

Ore-A mineral or aggregate of minerals which can be mined and treated at a profit. A large quantity of ore which is surrounded by waste or sub-ore material is called an orebody.

Patented Claim-A mineral claim where the title has been obtained from the U.S. federal government through the patent process of the 1872 Mining Law. The owner of the patented claim is granted title to the surface and mineral rights.

Production Stage-As defined by the SEC-includes all issuers engaged in the exploitation of a mineral deposit (reserve).

Pyrite-An iron sulfide. A common mineral associated with gold mineralization.

Quartz-Crystalline silica (SiO2). An important rock-forming and gangue material in gold veins.

3

Quartzites-Metamorphic rock containing quartz.

Raise-An underground opening driven upward, generally on the vein.

Ramp-An underground opening usually driven downward, but not always, to provide access to an orebody for rubber-tired equipment such as loaders and trucks. Typically ramps are inclined at about a 15% grade.

Reserves-That part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves are subcategorized as either proven (measured) reserves, for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings, or drill holes, and grade and/or quality are computed from the results of detailed sampling, and (b) the sites for inspection, sampling, and measurement are spaced so closely and geologic character is so well defined that size, shape, depth, and mineral content are well-established; or probable (indicated) reserves, for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, yet the sites for inspection, sampling and measurement are farther apart.

Stope-An underground void created by the mining of ore.

Strike-The bearing or azimuth of the line created by the intersection of a horizontal plane with an inclined rock strata, vein or body.

Tellurium-Relatively rare chemical element found with gold and silver which can form minerals known as tellurides.

Tetrahedrite-Sulfosalt mineral containing copper, antimony, and silver.

Vein-A zone or body of mineralized rock lying within boundaries separating it from neighboring wallrock. A mineralized zone having a more or less regular development in length, width and depth to give it a tabular form and commonly inclined at a considerable angle to the horizontal.

Unpatented Claim-A mineral claim staked on United States Public Domain (USPD) that is open for mineral entry. Unpatented lode claims can be no more than 1,500 feet long by 600 feet wide. The claimant owns the mineral rights, but does not own the surface which is USPD. Any exploration or mining on the claim must first be submitted in a plan of operations (POO) for approval to the appropriate federal land management entity.

Wallrock-Usually barren rock surrounding a vein.

PART I

ITEM 1.

DESCRIPTION OF THE BUSINESS

BUSINESS DEVELOPMENT

With the exception of historical matters, the matters discussed in this report are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and involve risks and uncertainties that could cause actual results to differ materially from projections or estimates contained herein. Such forward-looking statements include statements regarding planned levels of exploration and other expenditures, anticipated mine lives, timing of production and schedules for development and permitting. Factors that could cause actual results to differ materially include, among others, metals price volatility, permitting delays, and the Company’s ability to secure funding. Most of these factors are beyond the Company’s ability to predict or control. The Company disclaims any obligation to update any forward-looking statement made herein. Readers are cautioned not to put undue reliance on forward-looking statements.

Form and Year of Organization

New

Jersey Mining Company (“the Company” or “NJMC”) is a corporation organized under

the laws of the State of Idaho on July 18, 1996. The Company was dormant until

December 31, 1996, when all of the assets and liabilities of the New Jersey

Joint Venture (a partnership) were transferred to the Company in exchange for

10,000,000 shares of common stock. The New Jersey Joint Venture, a partnership,

was formed in 1994 to develop the New Jersey mine.

Any Bankruptcy, Receivership or Similar

Proceedings

There have been no bankruptcy, receivership, or

similar proceedings.

Any Material Reclassification, Merger, Consolidation, or

Purchase or Sale of a Significant Amount of Assets Not in the

Ordinary Course of Business.

There have

been no material reclassifications, mergers, consolidations, purchases, or sales

not in the ordinary course of business for the past three years.

4

BUSINESS OF THE COMPANY

General Description of the Business

The Company is involved in exploring for and developing gold, silver,

and base metal ore resources in the Pacific Northwest of the USA. The Company

has a portfolio of mineral properties including: the Golden Chest mine, the

Niagara copper silver-deposit, the New Jersey mine and mill, the Toboggan

exploration project, and several other exploration prospects. The New Jersey

Mill Joint Venture is a consolidated subsidiary.

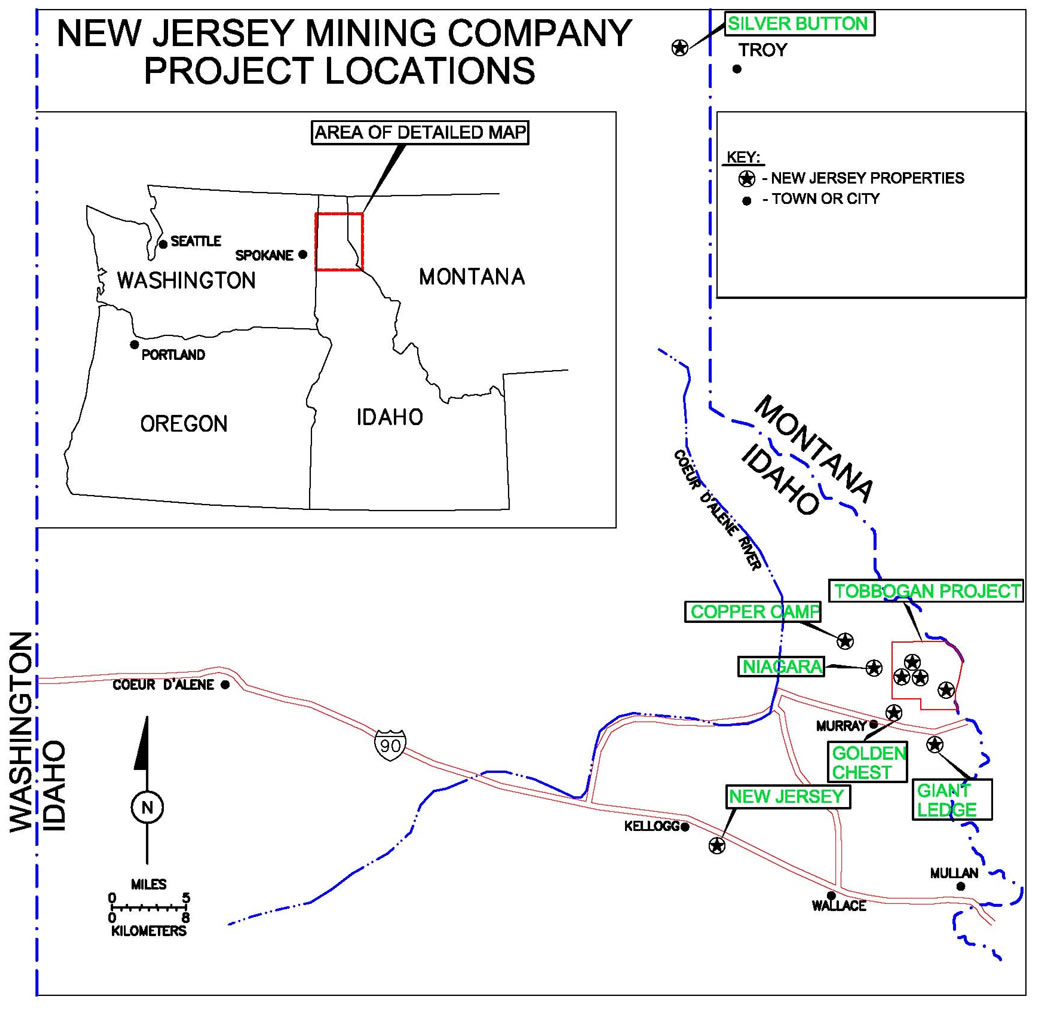

The Company is executing a strategy of mineral exploration that is focused on the Belt Basin area of northern Idaho and western Montana. See Location Map. The exploration focus for the Company is primarily gold with silver and base metals of secondary emphasis. In addition to mineral exploration, the Company is also the manager of the New Jersey Mill Joint Venture which will process both silver and gold ores through an expanded 350 tonnes per day flotation plant. The Company also provides contract drilling and engineering services to its joint venture partners which provides another source of revenue. The Company modified its strategy in 2010. The former strategy was to conduct exploration for gold, silver and base metal deposits in the greater Coeur d’Alene Mining District of northern Idaho while concurrently conducting mining and mineral processing operations on ore reserves it has located on its exploration properties. The new strategy now de-emphasizes the generation of cash by mining and milling and emphasizes the exploration of its properties in order to increase the amount of reserves before making a production decision. The new financial strategy involves forming joint ventures with partners who contribute cash to earn their interest. The strategy includes finding and developing ore reserves of significant quality and quantity to justify investment in mining and mineral processing facilities.

The new strategy is less reliant on private placements of common stock with qualified investors, though the Company’s exploration and development progress is still dependant on securing financing in one form or another.

Competitive Business Conditions

The

Company competes on several different fronts within the minerals exploration

industry. The Company competes with other junior mining companies for the

capital necessary to sustain its exploration and development programs. Recently,

the Company has been successful in completing two joint ventures, one at the

Golden Chest mine and the other to expand the throughput capacity of its New

Jersey mill.

We also compete with other mining companies for exploration properties especially for gold properties in the Coeur d’Alene mining district.

The Company also competes for skilled labor within the mining industry.

We are also subject to the risks inherent to the mineral industry. The primary risk of mineral exploration is the low probability of finding a major deposit of ore. We attempt to mitigate this risk by focusing our efforts in an area already known to host deposits, and also by acquiring properties we believe have the geologic and technical merits to host economic mineralization. Another significant risk is the price of metals such as gold and silver. If the prices of these metals were to fall substantially, it would, most likely, lead to a loss of investor interest in the mineral exploration sector which would make it more difficult to raise the capital necessary to move our exploration and development plans forward.

Effect of Existing or Probable Governmental Regulations

on the Business

Our business is subject to extensive federal,

state and local laws and regulations governing development, production, labor

standards, occupational health, waste disposal, the use of toxic substances,

environmental regulations, mine safety and other matters. The Company is subject

to potential risks and liabilities occurring as a result of mineral exploration

and production. Insurance against environmental risk (including potential

liability for pollution or other hazards as a result of the disposal of waste

products occurring from exploration and production) is not generally available

to the Company (or to other companies in the minerals industry) at a reasonable

price. To the extent that the Company becomes subject to environmental

liabilities, the satisfaction of any such liabilities would reduce funds

otherwise available to the Company and could have a material adverse effect on

the Company. Laws and regulations intended to ensure the protection of the

environment are constantly changing, and are generally becoming more

restrictive.

All operating and exploration plans have been made in consideration of existing governmental regulations. Regulations that most affect operations are related to surface water quality and access to public lands. An approved plan of operations (POO) and a financial bond are usually required before exploration or mining activities can be conducted on public land that is administered by the United States Bureau of Land Management (BLM) or United States Forest Service (USFS).

The New Jersey mine and the Golden Chest properties are part of the expanded Bunker Hill Superfund Site. Current plans for expanded cleanup do not include any of our mines. There is no known evidence that previous operations at the New Jersey mine prior to 1910 caused any groundwater or stream pollution or discharged any tailings into the South Fork of the Coeur d'Alene River; however, such evidence could be uncovered. The nature of the risk would probably be to clean up or cover old mine tailings that may have washed downstream from upstream mining operations. There are no mineral processing tailings deposits at the Golden Chest mine. However, at least two old adits have small water discharges. The Company could conceivably be required to conduct cleanup operations at its own expense, however, the Environmental Protection Agency’s (EPA) Record of Decision for the Bunker Hill Mining and Metallurgical Complex Operating Unit 3 does not include any cleanup activities at the Company’s mines. Recently, the EPA has proposed a new cleanup plan that greatly increases the number of historic mine sites to be reclaimed, however, the plan has not been approved. NJMC has not received any notifications that it could be liable for any environmental cleanup.

Estimate of the Amount Spent on Exploration for the Last

Two Years

During the years ended December 31, 2011 and 2010,

we spent $10,850 and $158,223, respectively, on exploration activities.

5

Costs and Effects of Compliance with Environmental Laws

(Federal, State and Local)

No major Federal permits are

required for the Golden Chest and New Jersey mines because the operations are on

private land and there are no process discharges to surface waters. However, any

exploration program conducted by the Company on unpatented mining claims,

usually administered by the BLM or USFS, requires a POO to be submitted. Our

exploration programs on public land can be delayed for significant periods of

time (one to two years) because of the slow permitting process applied by the

USFS. We believe the USFS permitting delays are caused by insufficient manpower,

complicated regulations, misplaced priorities, and sympathy for environmental

groups who oppose all mining projects.

The Company is also subject to the rules of the U.S. Department of Labor, Mine Safety and Health Administration (MSHA) for the New Jersey and Golden Chest operations. When an underground mine or mill is operating, MSHA performs a series of regular quarterly inspections to verify compliance with mine safety laws, and can assess financial penalties for violations of MSHA regulations. A typical mine citation order for a violation that is not significant or substantial is about $200.

The New Jersey mine has two important State of Idaho permits. The first is an Idaho Cyanidation Permit and the second is a reclamation plan for surface mining operations. No permit is required for the current flotation process as there is no discharge of water to surface waters and the tailings impoundments are less than 30 feet high from toe to crest. An Idaho cyanidation permit was granted October 10, 1995 [No. CN-000027]. Construction of the Concentrate Leach Plant (CLP) at the New Jersey mine was completed in November of 2007. The Idaho Cyanidation permit requires monthly surface water and quarterly groundwater monitoring during the operation of the CLP. It is estimated that water monitoring cost associated with operating the CLP is approximately $6,000 per year.

A surface mining reclamation plan for the New Jersey mine was approved by the Idaho State Department of Lands in 1993. The plan calls for grading of steep fill slopes and planting of vegetation on the area disturbed by the open pit mine. An annual reclamation fee of $133 is paid to the Idaho Department of Lands for surface disturbance associated with the New Jersey mine open pit. The Company has estimated its costs to reclaim the New Jersey mine site to be $21,000.

When the Company plans an exploration drilling program on public lands, it must submit a POO to either the BLM or USFS. Compilation of the plan can take several days of professional time and a reclamation bond is usually required to start drilling once the plan is approved. Bond costs vary directly with surface disturbance area, but a small, single set-up drilling program usually requires a bond amount of about $5,000. If a plan requires road building, the bond amount can increase significantly. Upon completion of site reclamation and approval by the managing agency, the bond amount is returned to the Company.

The Company complies with local building codes and ordinances as required by law.

Number of Total Employees and Number of Full Time

Employees

The Company's total number of employees is 18

including President Fred Brackebusch and Vice President Grant Brackebusch.

REPORTS TO SECURITY HOLDERS

The Company is not required to deliver an annual report to shareholders, however, it plans to deliver an annual report to shareholders in 2012. The annual report will contain audited financial statements. The Company may also rely on the Internet to deliver annual reports to shareholders.

The Company filed a Form 10-SB with the Securities and Exchange Commission on January 11, 2000. The filing became effective on January 27, 2000. The Company has filed the required annual 10K reports, quarterly 10-Q reports, and 8-K reports since that time.

The public may read a copy of any materials the Company files with the SEC at the SEC's Public Reference Room at 100 F Street, NE., Washington, D.C. 20549, on official business days during the hours of 10 a.m. to 3 p.m. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the Commission and SEC.

The Company maintains a website where recent press releases and other information can be found. A link to the Company’s filings with the SEC is provided on the Company’s website-www.newjerseymining.com.

6

ITEM 2.

DESCRIPTION OF PROPERTIES

Figure 1 - Project Location Map

NEW JERSEY MINE

Location

The New Jersey mine is an

underground mine and mill complex located four kilometers east of Kellogg,

Idaho, in the Coeur d'Alene Mining District. The property includes the gold

bearing Coleman vein system, a base metal Sullivan-type prospect known as the

Enterprise, and another gold prospect called the Scotch Thistle. The mine is

adjacent to U.S. Interstate 90 and is easily accessed by local roads throughout

the entire year. Three phase electrical power is supplied to the New Jersey mill

by Avista Utilities. The area is underlain by argillites and quartzites of the

Prichard Formation [member of Belt Supergroup] which commonly hosts gold

mineralization.

Mill Joint Venture Agreement

On

January 7, 2011, the Company signed a joint venture agreement with United Mine

Services (UMS), a wholly-owned subsidiary of United Silver Corporation, to

increase the capacity of the New Jersey mill. UMS is funding the expansion of

the mill to process 350 tonnes per day and will receive a 33% interest in joint

venture assets plus the right to process 7,000 tonnes of their ore per month.

NJMC is the manager of the joint venture and will retain a 67% interest in the

joint venture assets plus the right to process 3,000 tonnes per month of its own

ores. The property covered by the joint venture agreement includes the crushing

circuit, grinding circuit, flotation circuit, concentrate leach plant, patented

and unpatented claims (excluding mineral rights), and buildings.

7

Mineral Property

The Company owns 62

acres of patented mining claims, mineral rights to 108 acres of fee land, and

approximately 130 acres of unpatented mining claims. The unpatented claims are

on federal land administered by the BLM. The Coleman pit and the current

underground workings are located on the patented mining claims wholly owned by

the Company.

Mineral Leases

A mineral lease, known

as the Grenfel lease, with Mine Systems Design, Inc. (MSD) covers the mineral

rights to 68 acres located north of the New Jersey mine area. The lease has a

fifteen year term and thereafter so long as mining operations are deemed

continuous. The lessor may terminate the lease upon the Company's failure to

perform under the terms of the lease. A 3% net smelter return (NSR) royalty will

be paid to the lessor if production is achieved. However, the NSR royalty shall

not exceed 10% of the net proceeds, except the NSR royalty shall not be less

than 1%. No advance royalties or other advance payments are required by this

lease.

History

There are at least 14 gold

prospects in or near the New Jersey mine area. In the late 1800’s and early

1900’s more than 2,500 feet of development workings including drifts, crosscuts,

shafts, and raises, were driven by the New Jersey Mining and Milling Company (an

unrelated company) to develop the Coleman vein and the northwest branch of the

Coleman vein. A 10 stamp gravity mill was built and operated for a short period.

Present Condition and Work Completed on the

Property

The construction of an expanded mill capable of

processing 350 tonnes per day of sulfide ore to produce a single flotation

concentrate was started in 2011. The mill expansion is budgeted to cost

approximately $2.5 million which is funded completely by UMS. The expansion

project includes the installation of a new cone crusher, a new fine ore bin, new

conveyors, a new 2.4m by 4.0m ball mill, additional flotation cells, a new paste

thickener, associated pumps, and a new building. The Concentrate Leach Plant

(CLP) has not been renovated.

Since 2001, the Company has drilled 14 holes for a total of 1,765 meters to explore the Coleman vein and associated zones of gold mineralization. The drilling confirmed the continuity of the Coleman vein system and discovered a broad zone of low grade (0.70 gpt gold) gold mineralization known as the Grenfel zone. The best intercept was in DDH02-02 which assayed 2.76 gpt gold over 12.5 meters including 2.5 meters of 6.80 gpt gold. In 2008, about 400 meters of drilling was completed at the Scotch Thistle gold prospect revealing areas of silica enrichment and alteration, but no economic intervals of gold mineralization.

In 2008, the Company completed an underground exploration program of drifting on the Coleman vein on the 740 level. A total of 84 meters of drifting were completed with 20 meters of that on the vein before it was displaced by a fault. No exploration or development work was completed by the Company in 2009. In 2010, a raise was driven upward on the 740 level to explore a narrow high-grade vein that crosscut the main Coleman vein at nearly a right angle. This raise was driven about 12 meters vertically and produced 367 dry tonnes for the New Jersey mill that assayed 2.68 gpt gold. No exploration work was completed on the Coleman vein or other prospects at the New Jersey mine in 2011.

As of December 31, 2011, the Company had a net capital cost of $3,377,947 associated with the mineral processing plant and a capitalized development plus investment cost of $604,792 associated with the mine.

Exploration Plans

There are currently

no plans for exploration or mining at the New Jersey mine property.

Geology and Reserves

The description

of the geology of the New Jersey mine and the calculation of mineral resources

have been completed by the Company. The description of the geology of the area

can be verified from third party published reports by the U.S. Geological Survey

and unpublished reports by Oscar Hershey, former Coeur d'Alene District

geologist. The Company is solely responsible for the reserve calculations.

Geology

The Prichard Formation, which

is 25,000 feet in thickness, underlies the New Jersey mine area which is

adjacent to and north of the major Osburn fault. The Prichard Formation is

divided into nine rock units of alternating argillites, siltites, and

quartzites, and the units exposed in the New Jersey mine area appear to belong

to the lower members. Gold mineralization is associated with sulfide-bearing

quartz veins which cut the bedding in Prichard argillite and quartzite.

Associated sulfides are pyrite, arsenopyrite, chalcopyrite, low-silver

tennatite, galena, and sphalerite.

Reserves

The reserves at the New

Jersey mine, as of this date, are those contained in an underground mine plan.

The designed stope block extends from the surface to the Keyhole Tunnel level.

Grade estimation for the block is based upon calculated head grades from

production from the Coleman vein during the 2008 and 2010 exploration campaigns.

Underground Mine (Proven & Probable)

| Ore Block | Metric Tonnes | Gold Grade (grams per tonne) |

Ounces (gold) |

| Total | 51,604 | 3.20 | 5,310 |

The reserve tonnages are diluted. That is, the expected dilution from underground mining is accounted for in the grade and tonnage of the reserve block. The ounces stated in the above table are contained ounces. The cutoff grade used was 1.5 grams/tonne gold. The cutoff grade is based on historical costs of underground mining on the Coleman vein with a flotation processing plant recovering 85% of the gold. Gold prices used are based upon a three year average or $40.39/gram ($1,256.13/troy ounce). Proven and probable reserves are combined as they cannot be readily separated.

8

GOLDEN CHEST

Location

The Golden Chest mine is an

underground mine located in Reeder Gulch about 2.4 kilometers east of Murray,

Idaho along Forest Highway 9. The property consists of 24 patented mining claims

and 70 unpatented claims covering approximately 515 hectares (1,270 acres). The

site is accessible by an improved dirt road. A 30 ft by 20 ft steel-clad pole

building is present near the ramp portal and is used as a shop and a dry. A

second pole building 36 ft by 70 ft was erected on the site in 2011 and is used

for core logging and office space. Single phase electrical power supplied by

Avista Utilities has been installed to the portal site in Reeder Gulch and the

new core building.

Property Ownership

Beginning in December 2010,

the Golden Chest is owned by Golden Chest LLC (GC), which is owned 50% by the

Company (NJMC) and 50% by Marathon Gold Corporation through its wholly-owned US

subsidiary, Marathon Gold USA Corp. (MUSA). GC purchased the mine from Metaline

Contact Mines and J.W. Beasley Interests for $3,750,000 and paid $500,000 on the

closing date of December 16, 2010, made a second payment of $500,000 in December

2011, and has agreed to pay the sellers $500,000 each year for the next five

years with a final payment of $250,000 on the seventh anniversary. The sellers

have a first mortgage on the mine as security for future payment owing. There

are no production royalties underlying the Golden Chest property.

Present Condition and Work Completed on the

Property

The Company started work on the property in 2004. A

ramp 440 meters in length connecting the surface to the historic No. 3 level,

known as the North Ramp, was completed in the fourth quarter of 2008.

For each year from 2004 through 2008, the Company completed an exploration core drilling program on the Golden Chest property. A total of 3,415 meters of core drilling has been completed from the surface. The majority of these holes were targeted to extend the Idaho vein below the No. 3 and were successful. In 2011, the joint venture partners completed the most aggressive exploration project in the history of the mine which included 11,300 meters of surface core drilling. A total of 102 NQ-2 size drill holes were completed. Other surface work completed included the construction of a new core shed, construction of new roads, surface geologic work, surface and underground surveying, and the reestablishment of patented claim corners. Work completed underground included the rehabilitation of No. 3 level and an exploration crosscut on the Intermediate level. The exploration work culminated in the completion of a Canadian National Instrument 43-101 resource estimate report by an independent, third party consultant. The exploration program as well as the property payments were funded by Marathon Gold Corporation’s initial contribution of $4 million.

As of December 31, 2011, the Company had a capitalized development plus investment cost of $553,205 associated with the Golden Chest mine.

Exploration and Development Plans

Approximately 20,000 meters of core drilling, both surface and

underground, is planned for 2012. A reconnaissance surface exploration program

and the underground rehabilitation of the No. 3 drift are also planned for 2012.

Geology and Reserves

Company

geologists have completed the description of the geology of the Golden Chest

mine. Reserve calculations were completed by the Company’s geologist and

engineer. Verification of the area’s geology can be found from third party

published reports by Philip J. Shenon (Idaho Bureau of Mines Pamphlet No. 47)

and unpublished reports by Newmont Mining Corporation.

Geology

Gold mineralization occurs in

veins associated with a thrust fault that has exploited the top of a quartzite

unit on the east limb of a north-trending synclinal fold. The mineralization

occurs in two types of quartz veins which are generally conformable to bedding

of the Prichard Formation of Proterozoic age. Thin banded veins, occurring in

argillite, contain visible gold, pyrite, arsenopyrite, galena, and sphalerite.

Thicker, massive veins occur in quartzite and contain pyrite, sphalerite,

galena, chalcopyrite, scheelite and rare visible gold. Gold mineralization is of

Mesozoic age and related to granitic intrusive rocks.

Reserves

Ore grades and dimensions of

the reserve block are based on ten diamond drillholes through the Idaho vein

with an average spacing of 40 meters and 30 drift samples. Reserves were

calculated by the Company’s geologist and chief mine engineer using a polygonal

method with a cutoff grade of 2.0 gpt gold, and a minimum mining width of 2

meters. The reserves stated herein did not use the drilling information gathered

in 2011.

The reserves were calculated using estimated costs and operating parameters of a 100 tonne-per-day underground mining and mineral processing operation. The estimated costs are based on the Company’s actual costs of mining and processing ore from the Golden Chest. Overall metallurgical recovery of gold is expected to be 92% based on the Company’s experience at the New Jersey mill and CLP. Gold prices used are based upon a three year average or $40.39/gram ($1,256.13/troy ounce).

| Classification | Metric Tonnes | Gold Grade (grams per

tonne) |

Ounces of Gold |

| Proven & Probable | 242,058 | 5.10 | 39,694 |

The reserve tonnages are diluted. That is, the expected dilution from underground mining is accounted for in the grade and tonnage of the reserve blocks. Proven and probable reserves are combined as they cannot be readily separated.

9

NIAGARA PROJECT

Location

The Niagara copper-silver

deposit is located near the forks of Eagle Creek about seven kilometers

northwest of the Company's Golden Chest operation. The property is without known

ore reserves, and consists of 33 unpatented claims that cover about 650 acres.

Access to the site is maintained through the use of a USFS road which is closed

to the general public. No electrical energy is present at the site.

Mineral Agreement

In October of 2011,

the Company signed an exploration agreement and option to purchase mining claims

with Desert Copper USA Corporation (DUSA), a wholly-owned subsidiary of Desert

Copper Corporation, a Canadian corporation. The agreement covers the Niagara

project and the Copper Camp project. The agreement gives DUSA the exclusive

right to purchase the properties from the Company at any time for a term of five

years for the sum of $250,000 plus 3,500,000 shares of Desert Copper

Corporation. At closing, DUSA made an initial payment of $42,800 to NJMC and the

agreement calls for an annual payment of $20,000 on each anniversary of the

agreement during the option period. A minimum work expenditure of $250,000 is

also called for by the agreement. DUSA is also required to maintain, in good

standing, our underlying mining agreement with Revett Metals Associates (RMA).

History

An exploration program

completed by Earth Resources Company on the Niagara property in the 1970's

identified a large volume of copper-silver mineralization within the Revett

formation. Their exploration program included eight drill holes and six trenches

on the outcrop of the mineralized strata. Earth Resources also completed

metallurgical testwork that indicated conventional flotation will achieve

recoveries of 94% for copper and 90% for silver. Earth Resources also completed

preliminary economic studies on the deposit. Kennecott owned the claims that

cover the Niagara deposit for a period of time after Earth Resources. RMA

re-staked the property in 2004 after Kennecott dropped the claims.

Present Condition and Work Completed on the

Property

During 2008, the Company completed five holes of

core drilling for a total of 1,062 meters at the Niagara project. Three of the

holes were targeted to intercept the copper-silver deposit in the Revett

formation and were successful. The drilling increased the area of copper-silver

mineralization of the Niagara deposit. As an example, drillhole 08-9 drilled

through 19.4 meters grading 0.51% copper, 25 gpt silver and 0.029 gpt gold. A

preliminary engineering study assessing the economic potential of open pit

mining at the Niagara was completed. Two holes for a cumulative total of 413

meters were drilled in the hanging wall of the Murray Peak fault in the Prichard

formation to investigate a gold-in-soil anomaly and magnetic high. Low level,

anomalous gold and tellurium mineralization were found by this drilling. No work

was completed at the Niagara in 2011.

Exploration and Development Plans

Desert Copper is planning to complete the environmental permitting

necessary for a core drilling program with an eventual goal of completing a

Canadian National Instrument 43-101 report.

As of December 31, 2011, the Company had an investment cost of $42,500 associated with the Niagara project.

Geology

The Niagara deposit occurs in

a section of mineralized upper Revett Formation near the axis of a north-south

striking syncline. The western limb of the syncline has been truncated by the

north-south striking Murray Peak fault, a steep, west dipping reverse fault.

Other faults offset the mineralized zone slightly. In the Niagara deposit, the

mineralization occurs in the upper Revett Formation, which here is a light gray,

massive quartzite with thin siltite interbeds. The mineralized horizon crops out

along the East Fork Eagle Creek and is approximately 30 meters below the contact

with the overlying St. Regis Formation. Copper minerals include bornite,

chalcopyrite, chalcocite, native copper, and some copper oxide minerals. Silver

minerals include stomeyerite and jalpaite. Pyrite and galena also occur in trace

amounts

TOBOGGAN PROJECT

Location

The Toboggan project is an

exploration property without known ore reserves. The project consists of 284

unpatented lode claims covering an area of approximately 5,275 acres in and near

the East Fork of Eagle Creek drainage. The Toboggan project consists of the

following prospects: Gold Butte, Mineral Ridge, Golden Reward, Progress,

Snowslide, CA, Lost Eagle, and Independence. The claims can be accessed from May

through November using a USFS dirt road. No electrical energy is available at

the site.

Mineral Agreement

The Toboggan project

is comprised of 284 unpatented mining claims wholly owned by the Company.

History

Historic workings are present

at the Gold Butte prospect and consist of seven adits connected by a system of

narrow roads. Most of the underground work appears to have been completed by

1941. Two holes were drilled on the Gold Butte prospect in the 1980’s. Prior

geophysical exploration work by Cominco-American in the Toboggan Creek area in

the mid 1980’s found a large CSAMT geophysical anomaly, roughly two square

kilometers in area. In 1987, Cominco American drilled a hole 500 meters in depth

that was located on the eastern edge of the anomaly. It appears that the hole

was located too far to the east, and that it was not drilled deep enough to

investigate the large geophysical anomaly. Nord-Pacific completed a gold

exploration program in the Mineral Ridge area including a soil sampling program

and a reverse-circulation drilling program in 1992. Nord-Pacific identified

several anomalous gold zones with their soil sampling and completed nine holes

totaling 850 meters in their drilling program. All of the drillholes intercepted

anomalous gold mineralization including a 1.5 meter intercept of 18.9 gpt gold.

Historic workings at the Mineral Ridge prospect, which were completed before

Nord-Pacific’s work, include six adits as well as numerous pits and trenches.

The Independence area was originally staked in 1906 and was active

intermittently through the 1900’s. Work completed included four adits, and

numerous pits and trenches.

10

For the period from March 2008 through March 2011, the Toboggan project was an exploration joint venture between Newmont Mining Corporation and the Company. Newmont completed three seasons of exploration work spending approximately $2,000,000, and then dropped the project. Newmont quitclaimed all the mining claims back to the Company, and also returned the data generated from three seasons of exploration.

Present Condition and Work Completed on the

Property

During 2008, Newmont completed a comprehensive early-stage exploration

program. Work completed included the staking of additional claims significantly

increasing the area of the joint venture, soil sampling, rock sampling, geologic

mapping, a ground-based geophysical survey at the Gold Butte, and an airborne

geophysical survey over the entire joint venture area. During 2009, Newmont

completed a core drilling program that consisted of six holes for a total of

1,359 meters. Two holes were drilled at each of the following prospects: Mineral

Ridge, Golden Reward and Gold Butte. The best gold intercept drilled was at

the Gold Butte where a pyritic quartz vein was found at 24.0 meters below the

surface that assayed 2.5 gpt gold over 4.0 meters including a higher grade section

that assayed 7.15 gpt gold over 1.0 meter. Thick intercepts of anomalous, but

low-grade gold mineralization were drilled at the Mineral Ridge and the Golden

Reward prospects. Newmont also completed geologic mapping, surface rock sampling,

soil sampling, and additional claim staking. During 2010, Newmont completed

both core and reverse-circulation (RC) drilling at the Toboggan project. A total

of eight core holes totaling 914.2 meters and seven RC holes totaling 941 meters

were drilled. Six of the core holes were drilled at Gold Butte and intercepted

a fault with anomalous gold mineralization. The remaining two core holes were

drilled at Mineral Ridge and both holes were terminated before hitting the target

due to difficult ground conditions. The seven RC holes were drilled at various

prospects near Toboggan Creek and RC-7 was the most promising with 100 meters

of 100 ppb gold at the Golden Reward prospect. Newmont obtained the USFS permit

necessary to drill their best targets after the conclusion of the 2010 exploration

season. NJMC successfully obtained the extension of this permit until April

2012 at which time a reclamation bond of $82,000 is due to be posted. No exploration

work was completed on the project in 2011.

Exploration and Development Plans

The

Company intends to ask the USFS for an extension of one year for the required

bonding of Newmont’s drill permit. Joint venture partners will be sought to

advance the project.

Geology

Gold mineralization tends to

occur in structurally controlled zones within the Prichard Formation which are

associated with large potential feeder structures such as the Murray Peak fault,

the Bloom Peak fault, and the Niagara fault. The gold mineralization can occur

either as discrete, high-grade quartz veins or within wide zones of brecciation.

Geochemical analysis of soils and rocks has led to the discovery of very high

levels of tellurium associated with zones of higher grade gold mineralization.

Electron microprobe analysis has shown the presence of gold-silver electrum and

the telluride mineral petzite. The presence of telluride minerals along with the

presence of alkaline intrusive rocks and areas of potassic alteration has led

the Company to believe the gold mineralization is associated with a deeply

buried alkaline intrusion. Alkaline rocks are a type of igneous intrusive rock

characterized by high potassium and sodium and frequently associated with gold

mineralization.

GIANT LEDGE

The Giant Ledge prospect is an exploration project without known ore reserves. It lies about six kilometers southeast of Murray, Idaho, in the Granite Creek drainage and is accessed by an historic road that has been washed out in areas. No electrical power is present at the site. The Company’s land position consists of 29 wholly owned unpatented lode claims covering an area of 586 acres. The property hosts polymetallic lead, copper and gold mineralization in and along the contact of an igneous intrusive.

History

The Giant Ledge prospect was

active in the 1920’s when a 122 meter deep shaft was sunk and about 450 meters

of drift development was completed. A flotation mill was erected and a minor

amount of production was achieved. Bunker Hill Mining Company examined and

mapped the mine workings in the 1950’s. Sunshine Mining Company conducted

exploration at the Giant Ledge in the mid-1980’s and drilled two core holes.

Present Condition and Work Completed on the

Property

NJMC was able to procure the core from Sunshine’s drilling

program, and the core was re-logged and assayed. The best of the mineralization

showed 4.6 meters of 0.908 gpt gold and 0.24% combined copper and lead. An

extensive soil sampling program was completed in conjunction with a VLF and

magnetometer survey. Results of the soil sampling show a 600 meter diameter gold

anomaly and the magnetometer survey shows a magnetic low coincident with the

gold anomaly. No work was completed at the Giant Ledge property in 2011.

Exploration and Development Plans

If sufficient

funds are available, the Company will perform a ground-based geophysical survey

utilizing induced polarization (IP).

COPPER CAMP

Summary

The Copper Camp is an exploration

project without known ore reserves. Copper Camp lies about eight kilometers

northwest of Murray, Idaho and is accessed by the Lost Creek USFS road.

Electrical power is located adjacent to the site. The project is comprised of 9

unpatented mining claims covering about 180 acres. In October of 2011, the

Company signed an exploration agreement and option to purchase mining claims

with Desert Copper USA Corporation (DUSA), a wholly-owned subsidiary of Desert

Copper Corporation, a Canadian corporation. The agreement covers the Niagara

project and the Copper Camp project. The agreement gives DUSA the exclusive

right to purchase the properties from the Company at any time for a term of five

years for the sum of $250,000 plus 3,500,000 shares of Desert Copper

Corporation. At closing, DUSA made an initial payment of $42,800 to NJMC and the

agreement calls for an annual payment of $20,000 on each anniversary of the

agreement during the option period. A minimum work expenditure of $250,000 is

also called for by the agreement. DUSA is also required to maintain,

in good standing, our underlying exploration agreement with Revett Metals

Associates (RMA) The Copper Camp showing is an early-stage copper and silver

exploration project, having been explored with limited drilling by previous

operators which include Kennecott, Cominco, and U.S. Borax. Previous operators

drilled core holes down dip from the outcrop and three holes penetrated the

favorable Revett Formation beds showing low-grade copper-silver mineralization.

At least three intercepts were made averaging 10 meters in thickness and grading

0.10% to 0.20% copper and 1.7 to 3.3 grams per tonne (gpt) silver. One short

0.18 meter interval at 173.2 meters of depth had structurally controlled bornite

mineralization grading 4.45% copper and 84.0 gpt silver. The Company has

submitted a POO to the USFS for a core drilling program at Copper Camp. Approval

of the POO is expected in 2011. The timing of drilling will be dependent on the

Company’s ability to secure adequate funding. An additional 13 unpatented lode

claims were also staked increasing the property area to about 440 acres. No work

was completed on the Copper Camp prospect in 2011.

11

WISCONSIN-TEDDY PROSPECT

Summary

The Wisconsin-Teddy is an

exploration project without known ore reserves. The project area lies north of

the New Jersey mine and is accessed by a local frontage road. Electrical power

is available adjacent to the site. The Company's claims cover 83 acres. The

claims are unpatented and are on public land administered by the BLM. The

project is a base metal exploration project in the Prichard Formation. Several

tunnels with an aggregate length of 2,000 feet were driven on the property prior

to 1930. This development was related to two veins systems: a copper-gold vein

and a zinc-lead-silver vein. Work completed by the Company included the opening

of the Teddy underground workings, sampling on the surface and underground, and

geologic mapping. Two exploration holes were drilled in the summer of 2003 and

anomalous base metal mineralization was found. No exploration work has been

completed since 2003 and there are no plans for additional exploration work in

2012.

SILVER BUTTON/ROUGHWATER PROSPECT

Summary

The Silver Button is an

exploration project without known ore reserves, covers an area of 20 acres, and

is located in the Clark Fork mining district of northern Idaho. Clark Fork is

about 96 kilometers north of Kellogg, Idaho. The property was staked by the

Company in 2004 and is located in the Lightning Creek drainage. Float collected

from over a 100 m length of a vein subcrop on a talus slope contained silver

minerals as identified by microscopic and chemical analyses. Access to the site

is via foot trail and no electrical power is available at the site. Only

preliminary field sampling and claim staking have taken place at the prospect.

No additional exploration is planned at this time. As of December 31, 2011, the

Company had an investment cost of $25,500 associated with this property.

ITEM 3.

LEGAL PROCEEDINGS

The Company is currently a plaintiff along with Shoshone County, Idaho, and George E. Stephenson in a complaint against the USA, Secretary of the Department of Agriculture, Chief of the Forest Service, etc., for Declaratory Judgment and Quiet Title regarding a public right-of-way for the East Fork of Eagle Creek Road near Murray, Idaho. The complaint was filed on October 5, 2009 in the United States District Court, District of Idaho. The plaintiffs are bringing the action to adjudicate/declare under the Quiet Title Act, and under the Declaratory Judgment Act that the East Fork Eagle Creek Road is a public road as it crosses the lands owned by the USA in accordance with R.S. 2477. A hearing for Partial Summary Judgment was held by the federal court in Coeur d’Alene, Idaho in September of 2011. The hearing also included a walking tour of the East Fork of Eagle Creek right-of-way. The Company is currently waiting for the judge’s decision regarding the Partial Summary Judgment.

ITEM 4.

MINE SAFETY DISCLOSURES

Pursuant to Section 1503(a) of the recently enacted Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), issuers that are operators, or that have a subsidiary that is an operator, of a coal or other mine in the United States are required to disclose in their periodic reports filed with the SEC information regarding specified health and safety violations, orders and citations, related assessments and legal actions, and mining-related fatalities. During the fiscal year ended December 31, 2011, the Company had three violations of mandatory health or safety standards that could significantly and substantially (S&S citations) contribute to the cause and effect a mine safety or health hazard under section 104 of the Federal Mine Safety and Health Act of 1977. These three S&S citations resulted in $1,146 of penalties being remitted to the Mine Safety and Health Administration. There were no legal actions, mining-related fatalities, or similar events in relation to the Company’s United States operations requiring disclosure pursuant to Section 1503(a) of the Dodd-Frank Act.

12

PART II

ITEM 5.

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Market Information

The Company's

Common Stock currently trades on the OTCQB tier of the OTC Market under the

symbol "NJMC". The following table sets forth the range of high and low bid

prices as reported by the OTCQB for the periods indicated. These quotations

represent inter-dealer prices, without retail mark-up, markdown or commission

and may not represent actual transactions.

| Year Ending December 31, 2011 | High Bid | Low Bid |

| First Quarter | $0.32 | $0.24 |

| Second Quarter | $0.32 | $0.19 |

| Third Quarter | $0.23 | $0.18 |

| Fourth Quarter | $0.23 | $0.16 |

| Year Ending December 31, 2010 | High Bid | Low Bid |

| First Quarter | $0. 29 | $0. 19 |

| Second Quarter | $0. 28 | $0. 20 |

| Third Quarter | $0. 26 | $0. 18 |

| Fourth Quarter | $0. 35 | $0. 18 |

Shareholders

As of March 10, 2012

there were approximately 1,200 shareholders of record of the Company's Common

Stock.

Dividend Policy

The Company has not

declared or paid cash dividends or made distributions in the past and the

Company does not anticipate that it will pay cash dividends or make

distributions in the foreseeable future. The Company currently intends to retain

and reinvest future earnings, if any, to finance its operations.

Transfer Agent

The transfer agent for

the Company's Common Stock is Columbia Stock Transfer Company, 601 E. Seltice

Way Suite 202, Post Falls, Idaho 83854.

Securities Authorized for Issuance Under Equity

Compensation Plans

The Company has not adopted an equity

compensation plan for the award of options, warrants or rights to employees or

non-employees. The Company has in the past issued 2,000 shares as a safety award

to each employee, excluding management and directors, three times per year after

one year of service has been achieved. At a Board of Directors meeting on

November 9, 2009, the Directors approved a compensation plan for the Board of

Directors under which each Director receives 25,000 shares of unregistered

Common Stock. In 2010 and 2011 these shares were valued at $5,000, annually. No

additional fees are paid for attendance at Board of Directors’ meetings,

committee membership or committee chairmanship Equity Compensation Plan

Information

| Plan Category |

Number of securities to be

issued upon exercise of outstanding options, warrants and rights |

Weighted-average exercise price of outstanding options, warrants and rights |

Number of securities remaining available for

future issuance under equity compensation plans (excluding securities reflected in column (a)) |

| (a) | (b) | (c) | |

| Equity compensation plans approved by security holders | 0 | 0 | 0 |

| Equity compensation plans not approved by security holders | 0 | 0 | 0 |

| Total | 0 | 0 | 0 |

Occasionally, we pay for goods and services with restricted common stock. Our policy is to determine the fair value of the goods or services, and then issue the number of corresponding shares using the bid price for our common stock as quoted by the OTC Market.

Recent Sales of Unregistered Securities

For the year ended December 31, 2011, the Company issued 288,000 shares

of restricted common stock for cash management and director’s fees, equipment,

services, exploration, accounts payable, and mining lease payments. A value of

$58,040 (for an average value of $0.20 per share) was assigned to these fees,

services, and equipment. See the statement of shareholders' equity (Item 8

Financial Statements) for a detailed list. The transactions were strictly

limited to persons in the United States who met certain minimum financial

(accredited investors) or sophistication requirements. In management’s opinion,

the securities were issued pursuant to exemption from registration under Section

4(2) of the Securities Act of 1933, as amended.

ITEM 6.

SELECTED FINANCIAL DATA

Not required for smaller reporting companies.

13

ITEM 7

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

When we use the terms "New Jersey Mining Company," the "Company," "NJMC," "we," "us," or "our," we are referring to New Jersey Mining Company (the "Company") and its subsidiaries, unless the context otherwise requires.

Cautionary Statement about Forward-Looking Statements

This Report on Form 10-K includes certain statements that may be deemed

to be "forward-looking statements." All statements, other than statements of

historical facts, included in this Form 10-K that address activities, events or

developments that our management expects, believes or anticipates will or may

occur in the future are forward-looking statements. Such forward-looking

statements include discussion of such matters as:

-

The amount and nature of future capital, development and exploration expenditures;

-

The timing of exploration activities; and

-

Business strategies and development of our business plan.

Forward-looking statements also typically include words such as "anticipate," "estimate," "expect," "potential," "could" or similar words suggesting future outcomes. These statements are based on certain assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions, expected future developments and other factors we believe are appropriate in the circumstances. Such statements are subject to a number of assumptions, risks and uncertainties, including such factors as the volatility and level of metal prices, currency exchange rate fluctuations, uncertainties in cash flow, expected acquisition benefits, exploration mining and operating risks, competition, litigation, environmental matters, the potential impact of government regulations, and other matters related to the mining industry, many of which are beyond our control. Readers are cautioned that forward-looking statements are not guarantees of future performance and that actual results or developments may differ materially from those expressed or implied in the forward-looking statements.

The Company is under no duty to update any of these forward-looking statements after the date of this report. You should not place undue reliance on these forward-looking statements.

Plan of Operation

The Company is

conducting gold exploration in the Gold Belt of the Coeur d’Alene Mining

District of northern Idaho and it operates a mineral processing plant near

Kellogg, Idaho. The financial strategy involves forming joint ventures with

partners who contribute cash to earn their equity interest. The strategy

includes finding and developing ore reserves of significant quality and quantity

to justify investment in mining and mineral processing facilities. The Company’s

primarily focus is on gold with silver and base metals of secondary emphasis.

The Company receives revenue for providing core drilling and engineering

services from its joint venture partners, as well as management fees.

All exploration is now being done at the Golden Chest mine. Other exploration properties include the Toboggan, Niagara/Copper Camp, the Coleman, and the Giant Ledge.

Exploration activities at the Golden Chest during 2011 increased substantially compared to prior periods. Exploration activity increased because of the venture agreement with Marathon Gold USA (MUSA) that was signed in December 2010. MUSA contributed $4,000,000 by the end of 2011 for a 50% ownership of the venture. MUSA has the right to contribute an additional $3.5 million by November 30, 2012 to take its ownership interest to 60% of the venture. MUSA also has the option to accelerate any of these contributions. During 2011, 11,500 meters of drilling was completed. The Company conducted core drilling operations at the Golden Chest for the venture under a JV with Marathon Gold. In the first quarter of 2012, a 43-101 resource estimate was completed by an independent engineering firm.

The Toboggan Project is a group of prospects in the Murray, Idaho District that contain gold and silver telluride minerals. The Toboggan Project was being explored by Newmont North America Exploration Limited under a joint venture agreement. Newmont did not complete their earn-in by March 20, 2011 and the joint venture agreement was terminated. Newmont returned all the unpatented claims held by the venture to the Company. The Company is now actively searching for a new joint venture partner to continue exploration of the favorable gold prospects examined by Newmont.

The Niagara copper-silver deposit, also located in the Murray, Idaho area, in the Revett formation was drilled in the 1970’s, and the Company drilled five holes since which expanded the resource. Results of the recent drilling also indicate that gold would be a significant byproduct. Preliminary open pit mining studies have been completed. Early in the fourth quarter of 2011, an option agreement was signed with Desert Copper USA Corp. relating to the Niagara and Copper Camp properties. The terms of the agreement with Desert Copper include an option to purchase the properties from NJMC for $250,000 and 3.5 million shares of Desert Copper Corporation (the parent of Desert Copper USA Corp.). The option period is five years and Desert Copper is required to make annual payments of $20,000 to the Company as well as pay all costs associated with the properties. As a result of the option agreement with Desert Copper, the Company exercised its option with Revett Metals Associates to enter a mining agreement for the Niagara property.

The Silver Strand mine was sold in the fourth quarter of 2011 to Shoshone Silver/Gold Mines, Inc. for $1 million with $120,000 paid at closing and the remainder to be paid from a 20% share of net profits when the property is put into production.

14

At the Coleman underground mine, future plans are to conduct further drilling to locate higher grade reserves.

The New Jersey mineral processing plant is being expanded in order to process ore from the nearby Crescent silver mine. A letter of intent to form a joint venture with United Mine Services, Inc. (now United Silver Corp. who owns the Crescent silver mine) was signed in September 2010 and a definitive venture agreement was reached in January 2011. The plant is being expanded from a processing rate of 4 tonnes/hr to 15 tonnes/hr. USC is paying the expansion cost estimated to be $2.7 million. After completion of the expansion, the Company will own 2/3 of the venture and USC will own 1/3. The Company is the operator of the venture. USC will have a minimum quota of ore of 7,000 tonnes per month and the Company will have 3,000 tonnes per month. Each party will pay its processing costs and the Company will charge a management fee of $2.50/tonne. Currently, the plant construction is about 90% complete and commissioning will start in the first quarter of 2012 and be completed in the second quarter of 2012.

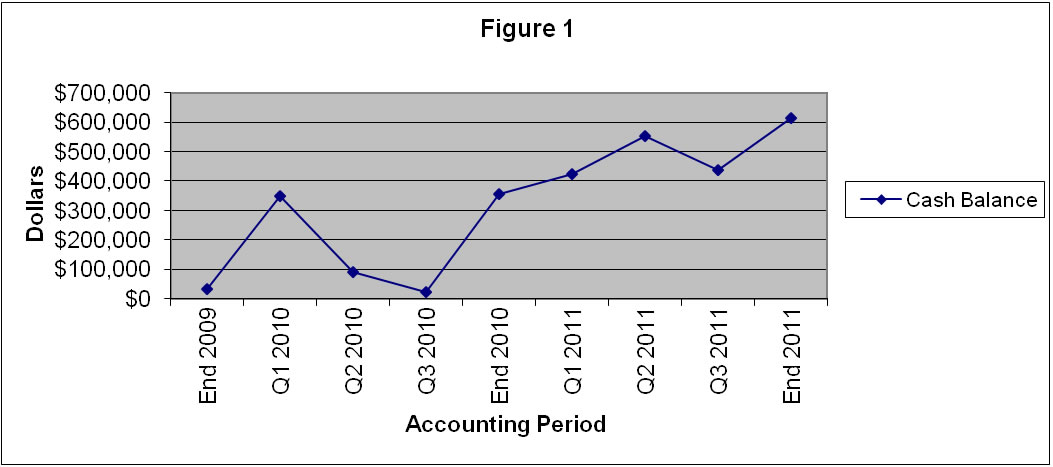

Changes in Financial Condition

The Company

maintains an adequate cash balance by increasing or decreasing its exploration

expenditures as limited by availability of cash from operations or from

financing activities. The cash balance at the end of 2011 was $612,989, and

Figure 1 shows the corresponding balances for previous accounting periods.

The cash balance increased during the year, from $357,317 to $612,989, primarily due to income from core drilling operations.

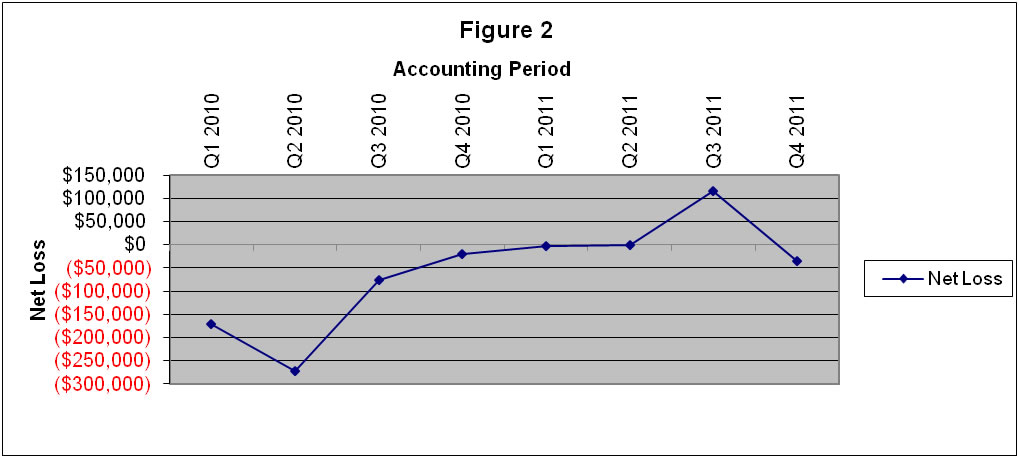

Results of Operations

Income Earned

during the development stage (revenue) for 2011 was $1,453,176 as compared to

$204,737 for 2010. Revenue was higher in 2011 due to drilling and exploration

contracting services. Figure 2 depicts net income (loss) attributable to the

Company by quarter which adds to $77,310 for 2011 compared to a loss of $540,828

for 2010. The net income for 2011 was higher than 2010 because of higher

revenue.

15

There was no gold production in 2011 compared to only 26 ounces in 2010. There are no plans for gold production in 2012 because only exploration activities are planned for the Golden Chest mine.

Plans at the Golden Chest mine include only exploration in 2012 in order to increase resources and reserves before making a production decision.

The New Jersey mineral processing plant will be commissioned in 2012. Development ore from the Crescent mine, owned by United Silver Corp., will be processed during the year.

The amount of money to be spent on exploration at the Company’s mines and prospects depends primarily on contributions of our joint venture partners, particularly at the Golden Chest. If new joint venture partners are engaged at the Toboggan Project, exploration activities would increase. Also, Desert Copper may conduct a drilling program under its option agreement at the Niagara and Copper Camp projects.

The Company provides surface drilling services at the Golden Chest and receives payment from Golden Chest LLC. Currently, Golden Chest LLC is funded 50% by Marathon Gold and 50% by the Company. The Company also receives a management fee as Manager of the venture. The Company receives payment for engineering services from United Mine Services for the mill expansion project. After completion of the mill expansion the Company will receive a management fee for processing ore for United Silver Corp. Additional financing activities may be necessary in 2012 if Marathon Gold does not exercise its option to increase its ownership of Golden Chest LLC to 60% by paying $3.5 million.

Changes in Joint Venture Receivables

Joint Venture receivables increased in 2011 compared to 2010 as a result

of increased activity with the Company's joint ventures.

Changes in Other Current Assets

Other

current assets increased in 2011 compared to 2010 because of an increase in

prepaid claim fees related to the Niagara property; previously claim fees were

paid by Newmont Exploration as part of an exploration agreement that is now

expired.

Deposits

Deposits increased in 2011

compared to 2010 because of a deposit on land for the mill that was recorded at

the end of 2011.

Changes in Property, Plant, and Equipment, net of

accumulated depreciation

Property, Plant and Equipment

increased in 2011 compared to 2010 because of increased investment in the New

Jersey Mill Joint Venture by our joint venture partner.

Reclamation Bonds

Reclamation bonds

decreased in 2011 compared to 2010 because the Silver Strand property they were

associated with was sold by the Company.

Accounts Payable and Accounts Payable United Mine

Services

Accounts payable increased in 2011 compared to 2010

because of activity related to the New Jersey Mill Joint Venture expansion.

Accrued Payroll and Related Payroll Expenses

Accrued payroll and related payroll expenses increased in 2011 compared

to 2010 because of increased activity related to the GC LLC and the Golden Chest

Mine.

Notes Payable

Notes payable increased

in 2011 compared to 2010 because of new notes that were incurred by the company

in 2011; most notably was a note for $204,000 for a new core drilling machine

that is being utilized on a contract basis by the Company at the Golden Chest

Mine to the GC LLC.

Asset Retirement Obligations

Asset

retirement obligations decreased in 2011 compared to 2010 because of the Silver

Strand sale and relief from its related obligation.

Noncontrolling interest in New Jersey Mill Joint

Venture

Noncontrolling interest in New Jersey Mill Joint

Venture increased in 2011 compared to 2010 because of investment in the New

Jersey Mill Joint Venture by the Company's joint venture partner United Mine

Services.

Drilling and Exploration Income

Drilling and exploration income increased for 2011 compared to 2010

because of drilling activity that was conducted at the Golden Chest under the

recently formed Joint Venture with Marathon Gold.

Joint Venture Management Fees

Joint

venture management fees are an income item related to the operation of the

recently formed Golden Chest joint venture.

Engineering Services Income

Engineering services income is received from UMS for engineering

services provided to them for the expansion of the mill.

16

Changes in Direct Production Costs

Direct

production costs decreased for 2011 compared to 2010 because efforts have been

redirected towards exploration.

Drilling and Exploration Contract Expense

Drilling and exploration contract expense has increased for 2011

compared to 2010 because of increased drilling activity at the Golden Chest.

Changes in Management Costs

Management

expenses decreased for 2011 compared to 2010 because some of the costs have been

absorbed by the joint ventures.

Changes in Exploration Costs

Exploration

expenses decreased for 2011 compared to 2010 because most employees have been

redirected to the Golden Chest or drilling activities.

(Gain) Loss on Sale of Equipment

Gain

on sale of equipment decreased in 2011 compared to 2010 because of the sale of

several pieces of equipment in the third quarter of 2010.

Gain on Sale of Mineral Property

Gain

on sale of mineral property decreased in 2011 compared to 2010 because in 2010

the default on a sale of property by a proposed joint venture partner was

recorded as a gain and in 2011 the sale of the Silver Strand resulted in a

current net loss on that particular transaction. If the buyers follow through

with production gains will be recognized as they are earned.

Depreciation

Depreciation increased in

2011 compared to 2010 most notably because of the new core drill which was

placed in service in June 2011.

General and Administrative

General and

administrative expenses have increased in 2011 compared to 2010 because of

increased activities involving two new joint ventures.

Interest

Interest expense has

decreased in 2011 compared to 2010 because 2011's interest expense was

capitalized as part of the mill expansion.

Sales of Common Stock and Exercise of Stock Purchase

Warrants

Sales of common stock and exercise of stock purchase

warrants have decreased in 2011 compared to 2010 because funding for operations

and exploration has been received from drilling and joint venture sources in

2011.

ITEM 7A.

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not required for smaller reporting companies.

17

ITEM 8.

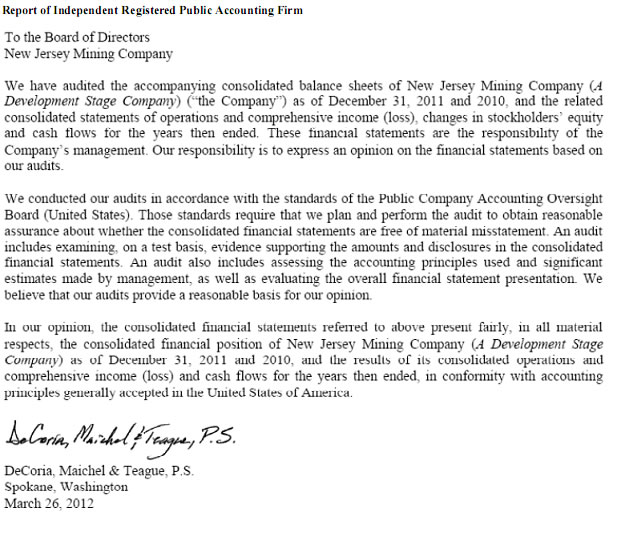

FINANCIAL STATEMENTS

18

New Jersey Mining Company

(A Development Stage

Company)

Table of Contents

19

New Jersey Mining Company

(A Development Stage

Company)

Consolidated Balance Sheets

December 31, 2011 and 2010

| ASSETS | ||||||

| 2011 | 2010 | |||||

| Current assets: | ||||||

| Cash and cash equivalents | $ | 612,989 | $ | 357,317 | ||

| Investment in marketable equity security at market (cost-$3,868) | 19,344 | 19,344 | ||||

| Joint venture receivables | 131,718 | 11,913 | ||||

| Other current assets | 55,442 | 15,392 | ||||

| Deposits | 44,280 | |||||

| Inventory | 18,410 | 16,381 | ||||

| Total current assets | 882,183 | 420,347 | ||||

| Property, plant and equipment, net of accumulated depreciation | 3,967,467 | 1,323,330 | ||||

| Mineral properties, net of accumulated amortization | 699,575 | 871,374 | ||||

| Investment in Golden Chest LLC | 553,205 | 553,205 | ||||

| Reclamation bonds | 121,133 | |||||

| Total assets | $ | 6,102,430 | $ | 3,289,389 | ||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||

| Current liabilities: | ||||||

| Accounts payable | $ | 122,060 | $ | 42,958 | ||

| Accrued payroll and related payroll expenses | 54,367 | 15,986 | ||||

| Account payable related party | 1,500 | |||||

| Obligations under capital lease, current | 30,153 | 13,246 | ||||

| Notes payable, current | 102,151 | 54,661 | ||||

| Total current liabilities | 310,231 | 126,851 | ||||

| Asset retirement obligation | 8,645 | 29,385 | ||||

| Obligations under capital lease-non-current | 58,376 | 1,403 | ||||

| Notes payable, non-current | 308,362 | 64,720 | ||||

| Total non-current liabilities | 375,383 | 95,508 | ||||

| Total liabilities | 685,614 | 222,359 | ||||

| Commitments (Note 5 and 7) | ||||||

| Stockholders’ equity: | ||||||

| Preferred stock, no par value,

1,000,000 shares authorized; no shares issued or outstanding Common stock, no par value, 2011-200,000,000 2010-50,000,000 shares authorized; 2011-45,305,862 and 2010-45,017,862 shares issued and outstanding |

10,423,469 | 10,365,429 | ||||

| Deficit accumulated during the development stage | (7,233,754 | ) | (7,313,874 | ) | ||

| Accumulated other comprehensive income: | ||||||

| Unrealized gain on marketable equity security | 15,475 | 15,475 | ||||

| Total New Jersey Mining Company stockholders’ equity | 3,205,190 | 3,067,030 | ||||

| Non-controlling interest in New Jersey Mill Joint Venture | 2,211,626 | |||||

| Total stockholders' equity | 5,416,816 | 3,067,030 | ||||

| Total liabilities and stockholders’ equity | $ | 6,102,430 | $ | 3,289,389 | ||

The accompanying notes are an integral part of these consolidated financial statements.

20

New Jersey Mining Company

(A Development Stage

Company)

Consolidated Statements of Operations and Comprehensive

Income (Loss)

For the Years Ended December 31, 2011 and 2010,

And from Inception (July 18, 1996) through December 31, 2011

| From Inception | |||||||||

| (July 18, 1996) | |||||||||

| December 31, | Through | ||||||||

| December 31, 2011 | |||||||||

| 2011 | 2010 | (Unaudited) | |||||||