Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FLEETCOR TECHNOLOGIES INC | d323878d8k.htm |

An

Introduction to FleetCor Technologies A Leading Global Provider of Fleet Cards

and Specialty Payments to Businesses March 2012

Exhibit 99.1 |

Safe

Harbor Provision This

presentation

contains

statements

that

express

our

opinions,

expectations,

beliefs,

plans,

objectives,

assumptions

or

projections regarding future events or future results, in contrast with statements

that reflect historical facts. In some cases, we have identified such

forward-looking statements with typical conditional words such as "anticipate," "intend," "believe,"

"estimate," "plan," "seek," "project" or

"expect," "may," "will," "would," "could" or "should," the negative of these terms or

other comparable terminology.

These forward-looking statements are not a guarantee of performance, and you

should not place undue reliance on such statements. We have based these

forward-looking statements largely on our current expectations and projections about

future events. Forward-looking statements are subject to many uncertainties and

other variable circumstances, such as delays or failures associated with

implementation; fuel price and spread volatility; changes in credit risk of customers and

associated losses; the actions of regulators relating to payment

cards; failure to maintain or renew key business

relationships; failure to maintain competitive offerings; failure to maintain or

renew sources of financing; failure to complete, or delays in completing,

anticipated new partnership arrangements or acquisitions and the failure to

successfully integrate or otherwise achieve anticipated benefits

from such partnerships or acquired businesses; failure to

successfully expand business internationally; the impact of foreign exchange rates

on operations, revenue and income; the effects of general economic

conditions on fueling patterns and the commercial activity of fleets, as well as the other

risks and uncertainties identified under the caption "Risk Factors" in our

Annual Report on Form 10-K for the year ended December

31, 2011. These factors could cause our actual results and experience to differ

materially from any forward- looking statement. Given these risks and

uncertainties, you are cautioned not to place undue reliance on these forward-

looking statements. The forward-looking statements included in this

presentation are made only as of the date hereof. We do not undertake, and

specifically decline, any obligation to update any such statements or to publicly announce the

results of any revisions to any of such statements to reflect future events or

developments. You may get FleetCor’s Securities

and

Exchange

Commission

(“SEC”)

Filings

for

free

by

visiting

the

SEC

Web

site

at

www.sec.gov

or

FleetCor’s

investor

relations

website

at

investor.fleetcor.com.

Trademarks

which

appear

in

this

presentation

belong

to

their

respective owners.

2 |

3

Company Overview

Key Investment Highlights

Growth Strategy

Financial Overview

Agenda |

FleetCor –

A Leading Global Fleet Card Company

Core

Products

Target

Customers

Special-purpose business charge cards

(e.g., fuel)

Value proposition: control and savings

Businesses and government entities

with vehicles

Major oils and fuel marketers with fuel

card programs (e.g. Partners)

4

Global

Scope

21 countries and 17 offices worldwide

One-third of revenue outside U.S.

1

67%

33%

Strong

Performance

28%

revenue

growth

2

(2003

–

2011)

41% adjusted net income growth

3

(2003 –

2011)

1

Based on consolidated revenue for year ended December 31, 2011

2

Revenue reported on a managed basis

³

Adjusted

net

income

is

defined

as

GAAP

net

income

+

amortization

(net

of

taxes)

+

stock

option

expense

(net

of

taxes) |

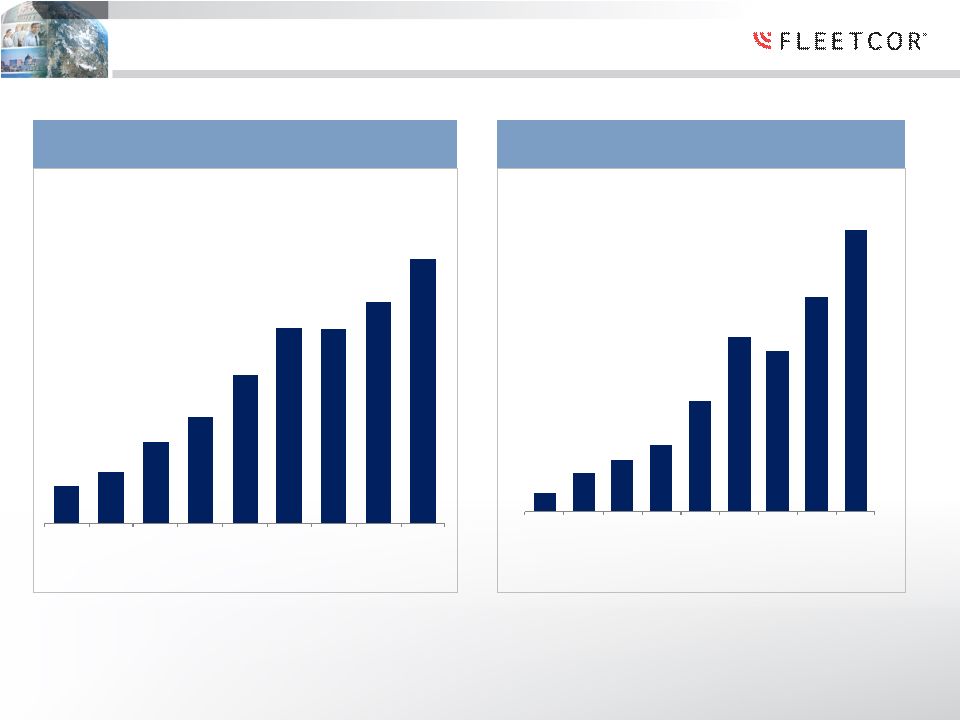

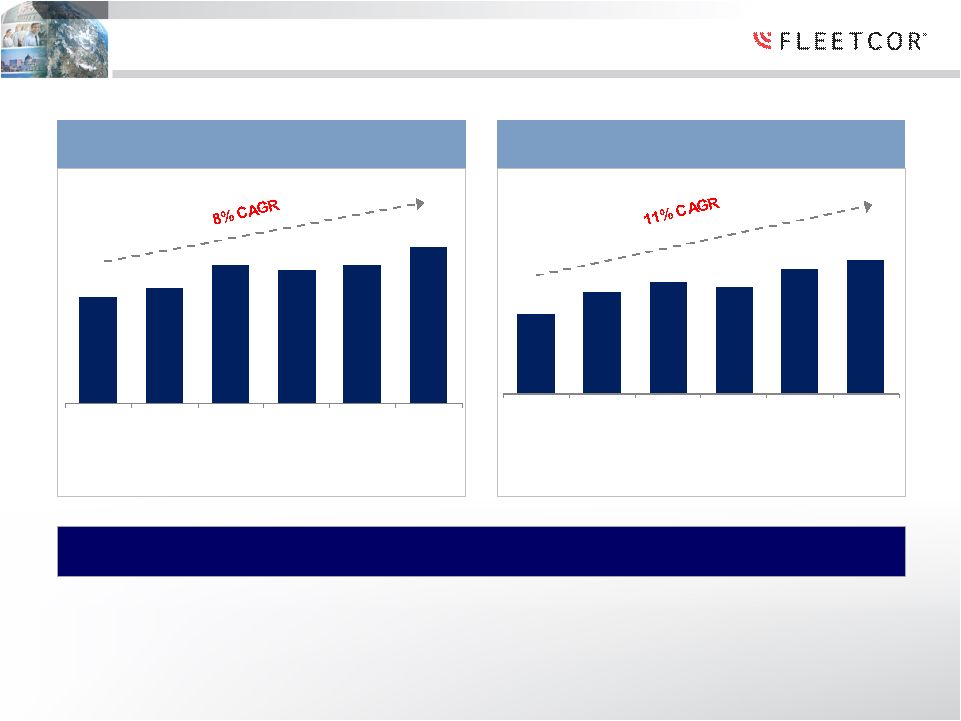

Track

Record of Growth… Proven Track Record of Solid Financial

Performance 1

Revenue reported on a managed basis

2

Adjusted

net

income

is

defined

as

GAAP

net

income

+

amortization

(net

of

taxes)

+

stock

option

expense

(net

of

taxes)

3

2010

is

reflected

on

a

pro

forma

basis

(to

reflect

the

impact

of

public

company

expenses,

loss

on

extinguishment

of

debt,

non-cash

compensation expenses associated with our stock plan and an increase in the

effective tax rate, effective during 2011) Revenue

1

($M)

Adjusted

Net

Income

2

($M)

$73

$100

$160

$210

$292

$384

$381

$434

$520

2003

2004

2005

2006

2007

2008

2009

2010

2011

$12

$25

$33

$43

$71

$113

$104

$139

$182

2003

2004

2005

2006

2007

2008

2009

2010

2011

2003-2011

3

CAGR

=

41%

2003-2011 CAGR = 28%

5 |

6

Company Overview

Key Investment Highlights

Growth Strategy

Financial Overview

Agenda |

Downside Protection…

Significant Barriers to Entry

Ten networks around the world with

more than 35,000 merchants contracted

individually

Proprietary

Networks

Differentiated

Technology

Broad

Distribution

Strong

Relationships

Specialized, next generation,

global processing system (GFN)

Distribution capabilities across multiple

channels, direct and via partners

Numerous, long-term relationships with

merchants, customers and partners

A difficult business to enter regardless of scale

7 |

Attractive Model…

An Attractive, Predictable Business Model

Transaction-based

Recurring, routine purchases

Recurring

Revenue

Diversified

Revenue

Highly

Profitable

33% of revenues outside the U.S. in 2011

55% from customers, 45% from merchants

Low customer concentration (~600k accounts)

~50% EBITDA margins

Resulting in a business you can plan

8

High

Operating

Leverage

Low variable costs

Low capex requirements |

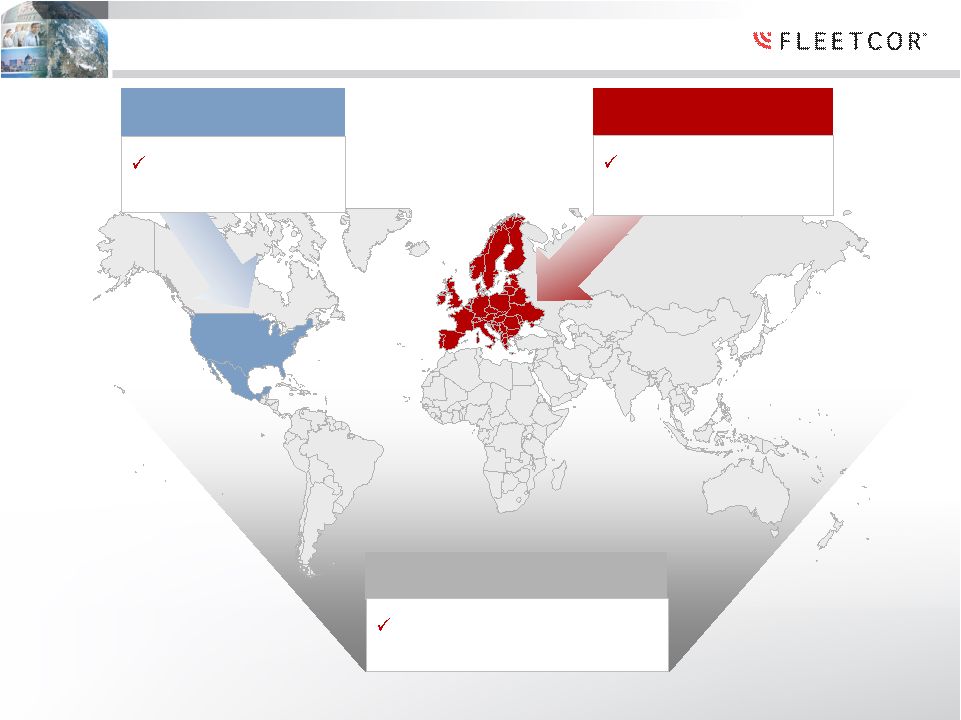

Large

Global Market… Lots of Room to Grow

U.S.

Europe

Rest of World

1

Gallons of commercial fuel purchased annually

2

Year ended December 31, 2011

3

2008 data from Packaged Facts, Commercial Payment Cards, December 2009

4

Based on 67.3bn litres of commercial fuel card volume (3.7854 litres = 1 gallon) and

59% penetration. Fuel card volume is 2009 data from Datamonitor, Commercial Fuel Cards Database 2010:

Europe, and covers the following 25 markets: Austria, Belgium, Czech Republic,

Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Lithuania, Luxembourg, Netherlands,

Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland,

United Kingdom 5

Based on 2009 global oil consumption, where the U.S. and developed European markets

consumed 38% and the remaining markets consumed 62% FleetCor

Penetration

Commercial

Fuel Volume¹

FleetCor

Fuel Volume

1,2

We want a piece of every commercial fuel transaction on the planet

9

Total

56B

3

3.4B

6%

30B

4

1.6B

5%

140B

5

0.1B

0.1%

226B

6.1B

3% |

10

Company Overview

Key Investment Highlights

Growth Strategy

Financial Overview

Agenda |

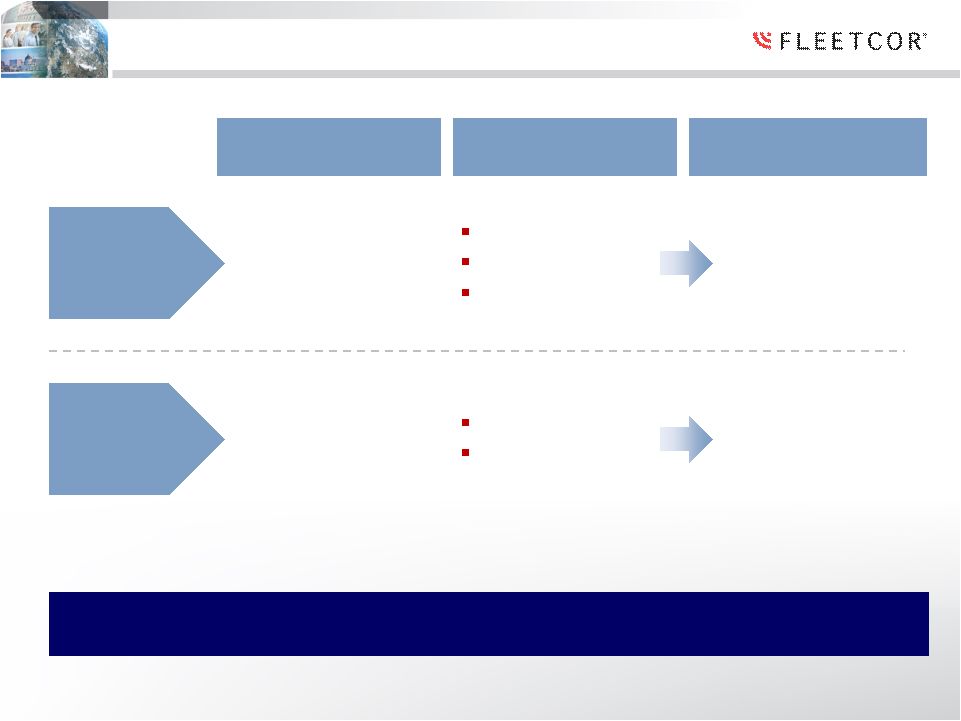

Big

Market…. Opportunity Varies By Geography

11

Partner Outsourcing

Manage major oil

in-house card programs

Share Shift

Win accounts from

competitors

Increase Adoption

Convert businesses to fuel cards

from other payment methods |

We

“build” the business we own by investing in sales and

marketing and product innovation

•

Spent over $34m on sales and marketing in 2011

•

Market our products through multiple sales

channels

•

“New”

(non field) channels accounted >50% of

US sales

Invest in Sales

and Marketing

Product

Innovation

Penetrate

Target Markets

Further

•

Grow revenue through new product features and

functionalities

•

Add new product offerings (Extended network

cards, Telematics, Price protection, Fleetwide,

Fleetsource, etc.)

•

Add more customers through investment in

sales and marketing new products

•

Enter into more strategic relationships

Fiscal Year 2011 transactions grew 12% and revenue per transaction

grew 8%

12 |

We

“buy” and improve performance of acquired companies

•Completed over 45

acquisitions •In 2011,

we completed two strategic acquisitions -Mexico Prepaid Card business -Allstar-leading UK Fuel Card provider

•Focus on emerging

markets -BRIC

countries Grow Through

Strategic

Acquisition

We Improve

the

Businesses

We Buy

•Economies of scale

•Leverage state-of-the-art processing systems •Run them the “FleetCor way”

13 |

We

“Partner” With Major Oil and Petroleum Marketers

•GFN

–

Industry

platform

•Revenue management

•Full program

outsourcing Services we

offer

14

•Euro Shell…the world’s largest commercial oil

portfolios

in

35

countries

•Pantry…awarded new long term contract

Recent partner

wins |

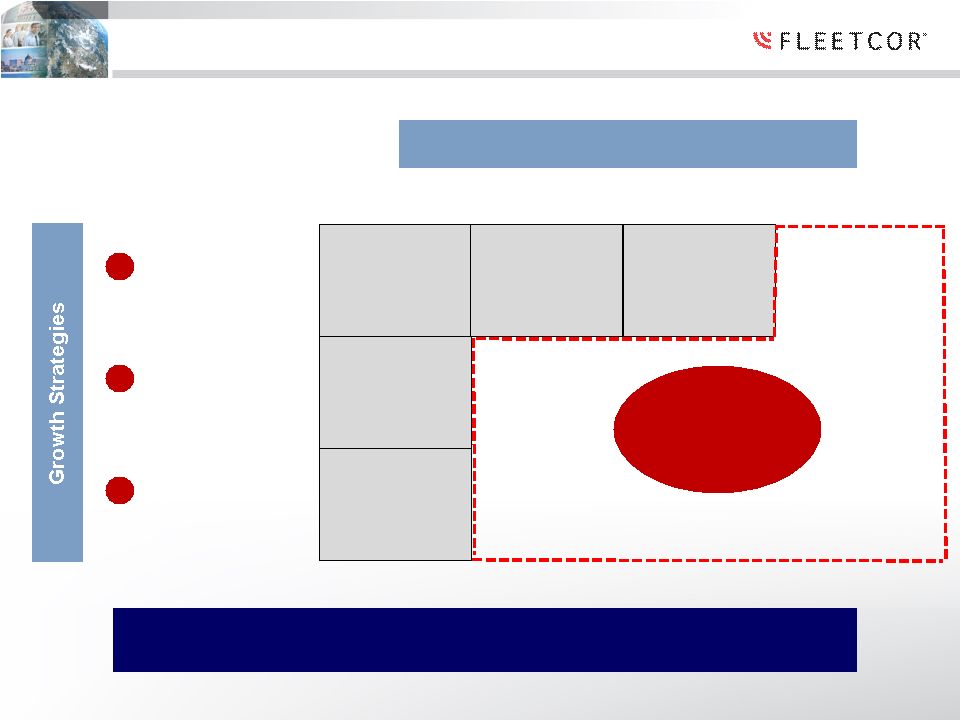

Growth Strategy…

An Attractive Growth Opportunity –

Emphasize ROW

US

Europe

Latin

America

BIG GROWTH

OPPORTUNITY

Geographies

Plan to focus more of our energy on emerging markets …

and

repeat the three-pronged approach that’s working in U.S. & Europe

15

Acquisitions

Buy & Improve

Partners

Sign to

Outsourcing

Innovation

New Products &

Sales Channels

1

2

3

Rest of World |

16

Company Overview

Key Investment Highlights

Growth Strategy

Financial Overview

Agenda |

Financial Highlights

28%

Revenue

growth

(2003

–

2011)

1

41%

Adjusted

net

income

growth

(2003

–

2011)

High

Growth

Strong Operating

Leverage

49%

2

Adjusted EBITDA margin (2011)

Highly leverageable cost structure

High cash flow fuels growth initiatives

>$500m

of

liquidity,

undrawn

revolver

3

Low

leverage

…

~1.30x

Adj.

EBITDA

4

Low

Capex

…

approximately

2.5%

of

revenue

5

Strong Balance Sheet

Predictable recurring revenue sources

Low fuel price sensitivity

Minimal credit risk

Stable and Predictable

1

Revenue reported on a managed basis

2

Calculated

as

Adjusted

EBITDA (excluding

stock

comp

expense)

divided

by

managed

revenue

3

As of December 31, 2011

4

Debt

outstanding

(excluding

the

securitization

facility)

divided

by

LTM

EBITDA

for

the

year

ended

December

31,

2011

5

For the year ended December 31, 2011

17 |

Driven By Both Volume and Rate Enhancement

Transaction

Volume

1

(M)

Revenue

per

Transaction

2

Strong

underlying

growth

trends

in

our

key

metrics

drive

revenue

growth

1

2006 transactions estimated based on 2007’s average gallons per

transaction 2

2006 –

2010 revenue reported on a managed basis

* 2010 transaction volume and revenue per transaction have been

adjusted to exclude the impact of a non-renewed partner contract in

Europe, inherited from an acquisition, which we chose not to renew.

146

158

189

184

190

215

2006

2007

2008

2009

2010*

2011

$1.45

$1.84

$2.02

$1.92

$2.27

$2.42

2006

2007

2008

2009

2010*

2011

18 |

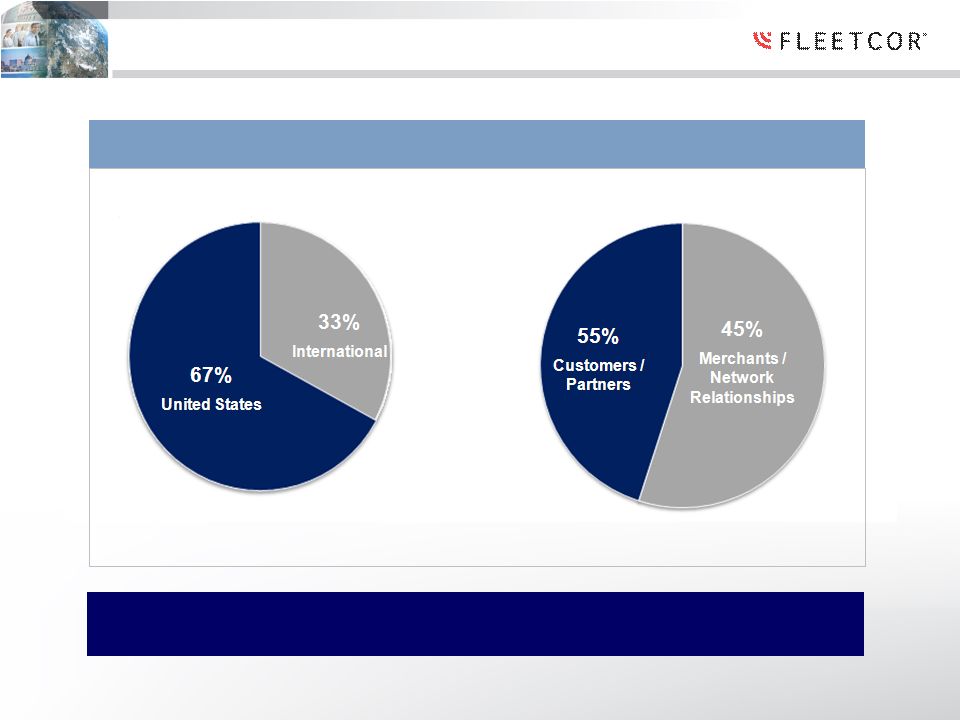

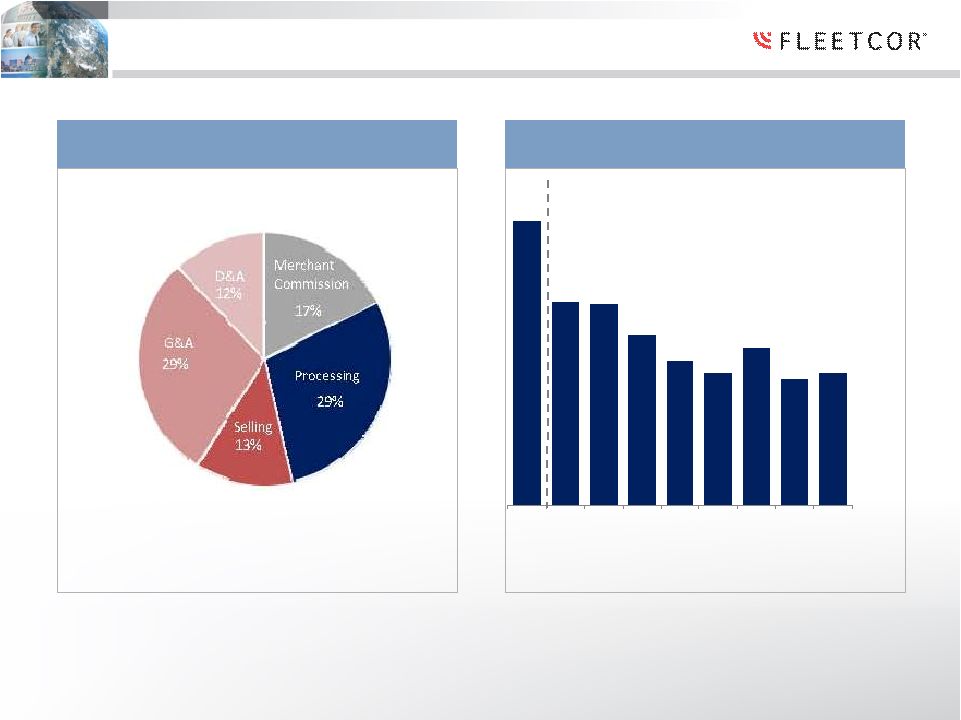

Well-Diversified Revenue Mix

19

Diverse

business

mix

reduces

top

line

volatility

from

geographic

and

macroeconomic factors

2011 Revenue Breakout (%) |

~20% of revenue tied

directly to fuel prices

No direct impact from

changes in fuel prices

Customers /

Partners

Limited Fuel Price Exposure

2011 Revenue

Revenue Type

Merchant /

Network

Relationships

Limited sensitivity to fuel price movements

20

Fuel Price Sensitivity

45%

55%

% of spend

Fixed fee

Spread-based

Program fees

Other fees |

Strong Operating Leverage with Low Credit Risk

21

Bad Debt as a % of Billed Revenue

0.45%

0.32%

0.32%

0.27%

0.23%

0.21%

0.25%

0.20%

0.21%

'06-

'09

Q1 10

Q2 10

Q3 10

Q4 10

Q1 11

Q2 11

Q3 11

Q4 11

2011

Expense

Breakdown

1

1

For the year ended December 31, 2011 FleetCor’s variable expenses were 37% of

total operating expenses. Variable expenses are expenses that are directly impacted by transaction volume. The

remaining 63% of total operating expenses are considered fixed expenses

|

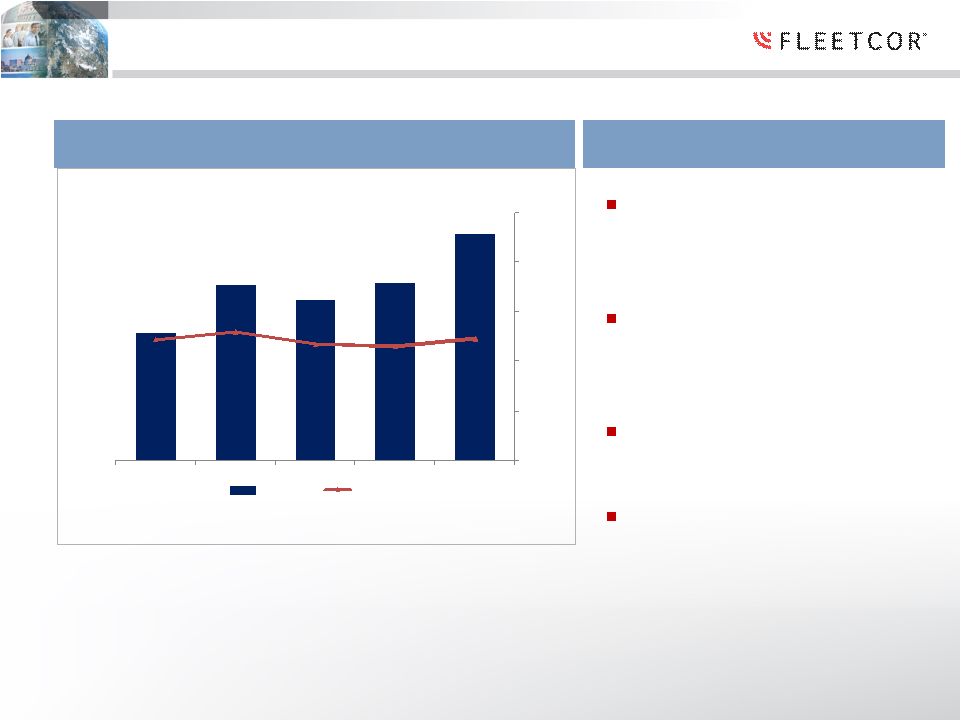

Strong EBITDA Margins and Operating Leverage

EBITDA

1

and

Adjusted

EBITDA

Margin

($M)

1

Adjusted EBITDA divided by managed revenue; Adjusted EBITDA is calculated as EBITDA

adjusted for the incremental interest expense attributable to the securitization facility

* 2010 is reflected on a pro forma basis (to

exclude the impact of a charge related to stock comp expense and to reflect the impact of public company expenses, loss on extinguishment

of

debt,

non-cash

compensation

expenses

associated

with

our

stock

plan

and

an

increase

in

the

effective

tax

rate,

effective

during

2011)

$143.8

$198.0

$180.6

$201.1

$256.2

49.0%

52.0%

47.0%

46.3%

49.3%

0.0%

20.0%

40.0%

60.0%

80.0%

100.0%

$-

$30.0

$60.0

$90.0

$120.0

$150.0

$180.0

$210.0

$240.0

$270.0

2007

2008

2009

2010*

2011

Adj. EBITDA

Margin %

22

Increasing revenue per

transaction

Highly scalable operating

model

Low variable costs

Low incremental capex

Superior Operating Leverage |

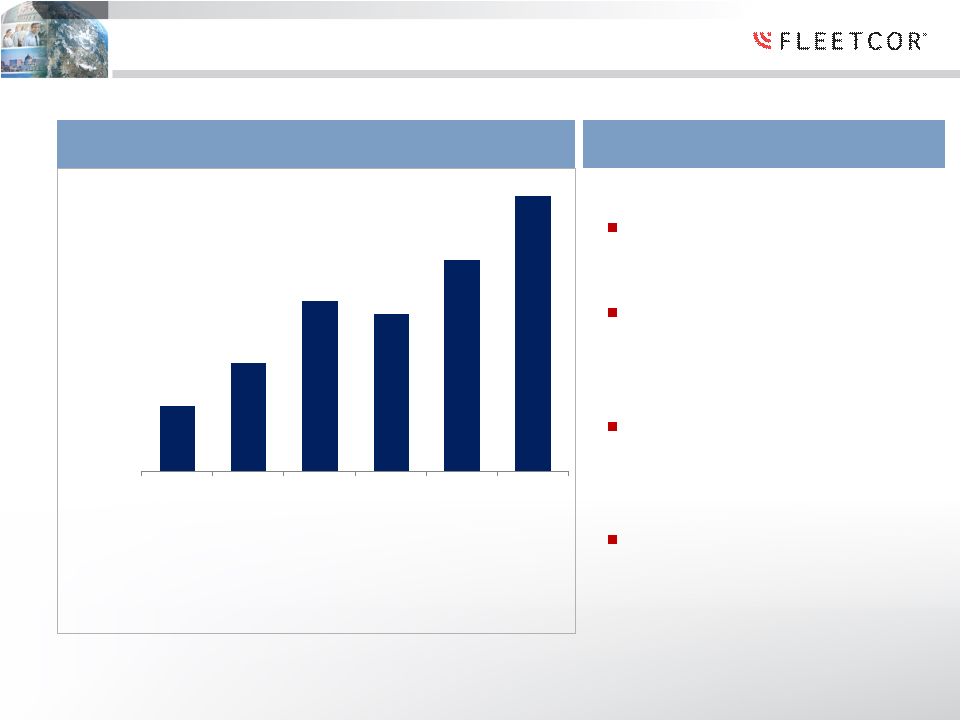

Solid Stable Cash Flow Generation

Adjusted

Net

Income

1

($M)

$43

$71

$113

$104

$139

$182

$(10)

$10

$30

$50

$70

$90

$110

$130

$150

$170

$190

2006

2007

2008

2009

2010*

2011

23

Adjusted

Net Income

($M)

Grow core business

Pursue selective

acquisitions

Continue new product

innovation

Enter new markets

Fueling Growth Initiatives

$5.3

$7.1

$7.1

$9.7

$13.5

Total Capex

($M)

2.5%

2.7%

2.1%

2.7%

2.6%

% revenue

+

1

Adjusted

net

income

is

defined

as

GAAP

net

income

+

amortization

(net

of

taxes)

+

stock

option

expense

(net

of

taxes),

and

is

comparable

to

free

cash

flow

defined

as

cash

flow

from

operations

–

capital

expenditures

•

2010

is

reflected

on

a

pro

forma

basis

(to

exclude

the

impact

of

a

one-time

charge

related

to

stock

comp

expense

and

to

reflect

the

impact

of

public

company

expenses,

loss

on

extinguishment

of

debt

non-cash

compensation

expenses

associated

with

our

stock

plan

and

an

increase

in

the

effective

tax

rate,

effective

during

2011)

+

Revenue is defined as reported revenue

$11.2

2.6% |

Appendix |

Reconciliation of Reported Revenue to Managed Revenue

Year Ended December 31,

($M)

2011

2010

2009

2008

2007

2006

Reported

Revenue

$519.6

$433.8

$354.1

$341.1

$264.1

$186.2

Adjustments:

Processing

Expense

_

_

21.9

27.4

11.3

10.4

Interest Expense,

Net

_

_

5.3

15.8

16.2

13.1

Managed

Revenue

$519.6

$433.8

$381.3

$384.3

$291.6

$209.7 |

Reconciliation of Net Income to EBITDA and Adjusted EBITDA

Year Ended December 31,

($M)

2011

2010

2009

2008

2007

2006

2005

Net income

$147.3

$107.9

$89.1

$97.3

$61.6

$38.0

$30.7

Provision for Income Taxes

63.5

43.4

40.6

37.4

26.0

22.0

18.7

Interest Expense, Net

13.4

20.5

17.4

20.3

19.7

11.9

7.6

Other Income

(0.6)

(1.3)

Depreciation and Amortization

36.2

33.7

28.4

27.2

20.3

12.6

7.4

Loss on extinguishment

2.7

EBITDA

$262.5

$204.2

$175.3

$182.2

$127.6

$84.4

$64.4

Securitzation Adjustment

5.3

15.8

16.2

13.1

7.0

Incremental Interest Expense

6.3

6.5

Adjusted EBITDA

$256.2

$197.7

$180.6

$198.0

$143.8

$97.5

$71.4

*

Beginning

in

2010,

the

Company’s

income

statement

no

longer

reflects

activity

related

to

its

retained

residual

interest

in

eligible

accounts

receivable

sold

to

Funding,

but

instead

reflect the activity related to its securitized accounts receivable and the

corresponding securitized debt, including interest income, fees generated from late payments, provision for

losses on accounts receivable and interest expense. Prior to 2010, interest expense

and the provision for losses on accounts receivable associated with the securitized accounts

receivable were included as a deduction from revenues, net in the consolidated

statements of income. Thus, prior to 2010, a securitization adjustment is necessary to present

comparable measures of Adjusted EBITDA. |

Reconciliation of Adjusted EBITDA to Pro Forma Adjusted

EBITDA

($M)

Year Ended 2010

Changes

Pro forma 2010

Net income

$107.9

$ (1.7)

$106.2

Provision for Income Taxes

43.4

2.4

45.8

Interest Expense, Net

20.5

-

20.5

Other Income

(1.3)

-

(1.3)

Depreciation and Amortization

33.7

-

33.7

Loss on extinguishment

2.7

2.7

EBITDA

$204.2

$3.40

$207.6

Incremental Interest Expense

6.5

6.5

Adjusted EBITDA

$197.7

$3.4

$201.1 |

Reconciliation of Net Income to Adjusted Net Income

Year Ended December 31,

($M)

2011

2010

2009

2008

2007

2006

2005

Net Income

$147.3

$107.9

$89.1

$97.3

$61.6

$38.0

$30.7

Stock-based

Compensation Expense

21.7

26.8

2.7

2.8

1.2

0.1

–

Amortization of

Intangible Assets

19.6

17.2

13.9

12.0

9.8

5.0

2.1

Amortization of

Premium on Receivables

3.3

3.3

3.3

5.5

1.7

1.4

0.6

Amortization of

Deferred Financing Costs

1.9

2.0

1.8

1.1

0.9

1.0

1.2

Loss on Extinguishment of Debt

2.7

0.0

0.0

0.0

0.0

0.0

0.0

Total Pre-tax Adjustments

$49.1

$49.2

$21.7

$21.4

$13.6

$7.5

$4.0

Income tax Impact of Pre-tax

Adjustments

(14.8)

(14.1)

(6.8)

(5.9)

(4.0)

(2.8)

(1.5)

Adjusted Net Income

$181.7

$143.0

$103.9

$112.7

$71.1

$42.8

$33.1 |

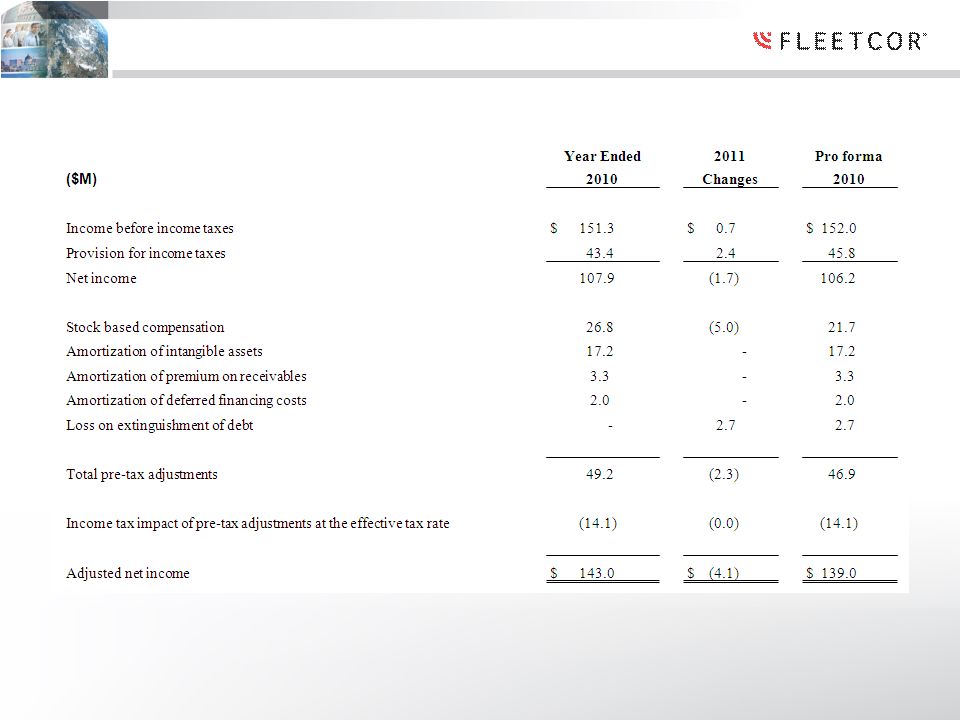

Reconciliation of Adjusted Net Income to Pro Forma Adjusted

Net Income |

Reconciliation of Revenue to Revenue Excluding the Impact of a

Non-Renewed Contract

Year Ended December 31,

($M)

2011

2010

2009

North America

Revenues, net

$ 348.8

287.8

$ 227.4

Excluding non-renewed contract revenues

-

-

-

Revenues, net, excluding the impact of a non-renewed contract

$ 348.8

$ 287.8

$ 227.4

International

Revenues, net

$ 170.8

$ 146.0

$ 126.7

Excluding non-renewed contract revenues

-

(0.8)

(1.3)

Revenues, net, excluding the impact of a non-renewed contract

$ 170.8

$ 145.2

$ 125.4

Consolidated

Revenues, net

$ 519.6

$ 433.8

$ 354.1

Excluding non-renewed contract revenues

-

(0.8)

(1.3)

Revenues, net, excluding the impact of a non-renewed contract

$ 519.6

$ 433.0

$ 352.8

* Calculation of revenue per transaction for our International segment and on a

consolidated basis for the years ended December 31, 2010 and 2009 excludes the impact of a

non-renewed partner contract in Europe, inherited from an acquisition, which we

chose not to renew. This non-renewed contract contributed approximately 3.6 million

transactions and $0.9 million in revenues, net to our International segment in the

year ended December 31, 2010 and approximately 6.9 million transactions and $1.3 million in

revenues, net to our International segment in the year ended December 31, 2009.

This contract had a high number of transactions and very little revenue and if we had included

it in the calculation would have reduced International segment revenue per

transaction by $0.25 negative and $0.38 in the years ended December 31, 2010 and 2009,

respectively.

The

table

above

reconciles

revenues,

net

per

GAAP

to

Revenues,

net,

excluding

the

impact

of

this

non-renewed

partner. |