Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DYCOM INDUSTRIES INC | form8k.htm |

Exhibit 99.1

BB&T Capital Markets

Investor Presentation

March 28, 2012

March 28, 2012

1

Forward-Looking Statements and Non-GAAP

Information

Information

Forward-Looking Statements and Non-GAAP

Information

Information

This presentation contains “forward-looking statements” which are statements relating to future events, future

financial performance, strategies, expectations, and competitive environment. All statements, other than

statements of historical facts, contained in this presentation, including statements regarding our future financial

position, future revenue, prospects, plans and objectives of management, are forward-looking statements.

Words such as “believe,” “expect,” “anticipate,” “estimate,” “intend,” “forecast,” “may,” “should,” “could,” “project,”

“looking ahead” and similar expressions, as well as statements in future tense, identify forward-looking

statements. You should not read forward looking statements as a guarantee of future performance or results.

They will not necessarily be accurate indications of whether or at what time such performance or results will be

achieved. Forward-looking statements are based on information available at the time those statements are

made and/or management’s good faith belief at that time with respect to future events. Such statements are

subject to risks and uncertainties that could cause actual performance or results to differ materially from those

expressed in or suggested by the forward-looking statements. Important factors that could cause such

differences include, but are not limited to factors described under Item 1A, “Risk Factors” of the Company’s

Annual Report on Form 10-K for the year ended July 30, 2011, and other risks outlined in the Company’s

periodic filings with the Securities and Exchange Commission (“SEC”). The forward-looking statements in this

presentation are expressly qualified in their entirety by this cautionary statement. Except as required by law, the

Company may not update forward-looking statements even though its situation may change in the future.

financial performance, strategies, expectations, and competitive environment. All statements, other than

statements of historical facts, contained in this presentation, including statements regarding our future financial

position, future revenue, prospects, plans and objectives of management, are forward-looking statements.

Words such as “believe,” “expect,” “anticipate,” “estimate,” “intend,” “forecast,” “may,” “should,” “could,” “project,”

“looking ahead” and similar expressions, as well as statements in future tense, identify forward-looking

statements. You should not read forward looking statements as a guarantee of future performance or results.

They will not necessarily be accurate indications of whether or at what time such performance or results will be

achieved. Forward-looking statements are based on information available at the time those statements are

made and/or management’s good faith belief at that time with respect to future events. Such statements are

subject to risks and uncertainties that could cause actual performance or results to differ materially from those

expressed in or suggested by the forward-looking statements. Important factors that could cause such

differences include, but are not limited to factors described under Item 1A, “Risk Factors” of the Company’s

Annual Report on Form 10-K for the year ended July 30, 2011, and other risks outlined in the Company’s

periodic filings with the Securities and Exchange Commission (“SEC”). The forward-looking statements in this

presentation are expressly qualified in their entirety by this cautionary statement. Except as required by law, the

Company may not update forward-looking statements even though its situation may change in the future.

This presentation includes certain “Non-GAAP” financial measures as defined by SEC rules. We believe that the

presentation of certain Non-GAAP financial measures provides information that is useful to investors because it

allows for a more direct comparison of our performance for the period with our performance in the comparable

prior-year periods. As required by the SEC, we have provided a reconciliation of those measures to the most

directly comparable GAAP measures on the Regulation G slides included at the end of this presentation. We

caution that Non-GAAP financial measures should be considered in addition to, but not as a substitute for, our

reported GAAP results.

presentation of certain Non-GAAP financial measures provides information that is useful to investors because it

allows for a more direct comparison of our performance for the period with our performance in the comparable

prior-year periods. As required by the SEC, we have provided a reconciliation of those measures to the most

directly comparable GAAP measures on the Regulation G slides included at the end of this presentation. We

caution that Non-GAAP financial measures should be considered in addition to, but not as a substitute for, our

reported GAAP results.

2

Positioned for strong equity returns

n A leading supplier of specialty contracting services to

telecommunication providers nationwide

telecommunication providers nationwide

n Telecommunications networks fundamental to economic progress

n End market opportunities driving organic growth, margin expansion

and increased earnings potential

and increased earnings potential

Ø Wireless backhaul

Ø Rural fiber networks

Ø Fiber deployments to businesses

Ø Wireless network upgrades

Ø FTTx deployments

n Footprint expansion with customers as market share increases

n Capital allocation strategy designed to produce strong equity

returns

returns

3

Nationwide Footprint and Significant

Resources

Resources

n Headquartered in Palm Beach Gardens, Florida

n Nationwide footprint

} Operates in 48 states and in Canada

} 31 operating subsidiaries and hundreds of field offices

n Fiscal 2012 second quarter revenues of $267.4 million grew organically 19.2% year

over year, highest organic growth in over 7 years

over year, highest organic growth in over 7 years

n Strong financial profile

} Cash and equivalents $86.2 million at January 28, 2012

} Availability on revolving credit agreement of $185.9 million at January 28, 2012

} 7.125% Senior Subordinated Notes due 2021

n Approximately 8,300 employees

Note: See “Regulation G Disclosure” slides for a reconciliation of GAAP to Non-GAAP financial measures.

4

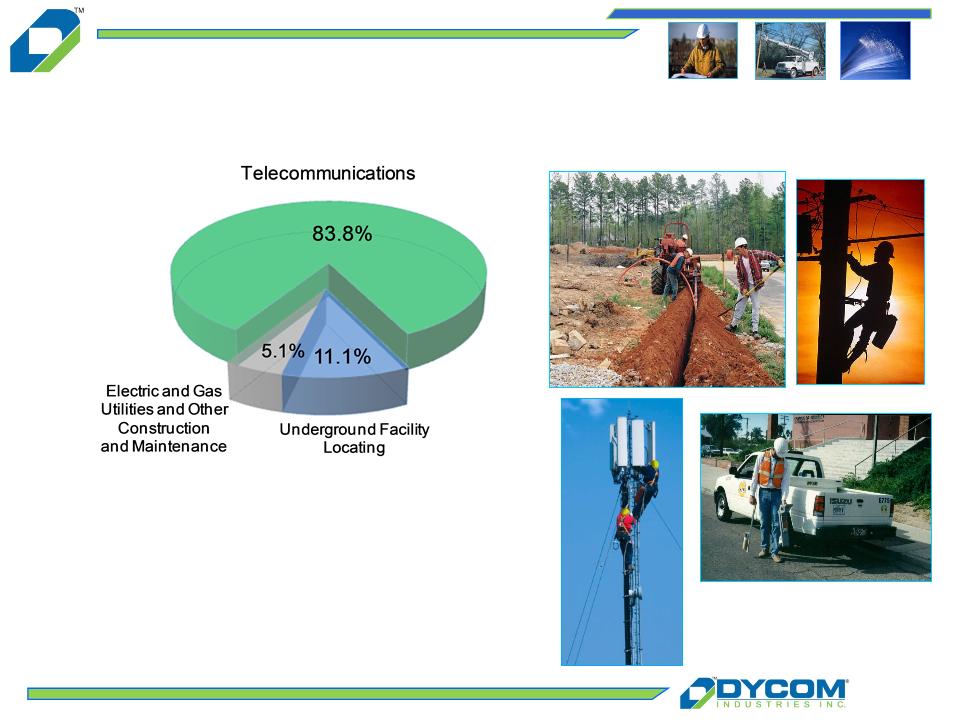

Intensely Focused on

Telecommunications Market

Telecommunications Market

Contract Revenue $267.4 million

Quarter Ended January 28, 2012

5

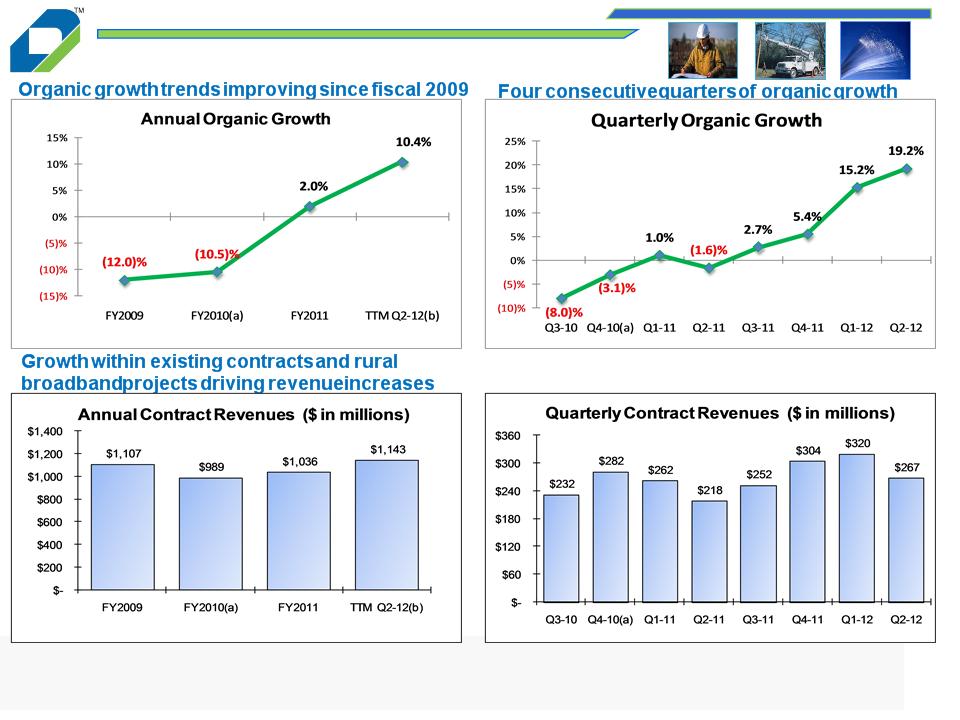

Contract Revenue Growth

Note: See “Regulation G Disclosure” slides for a reconciliation of GAAP to Non-GAAP financial measures.

(a)Fiscal 2010 includes an incremental week as the result of our 52/53 week fiscal year.

(b)Trailing Twelve Months Q2-12 (“TTM”) includes contract revenues of $587.0 million for the six months ended January 28, 2012, $303.7 million for the

three months ended July 30, 2011, and $252.4 million for the three months ended April 30, 2011.

three months ended July 30, 2011, and $252.4 million for the three months ended April 30, 2011.

Quarterly results exhibit seasonal weather patterns

6

Margins and Earnings Expansion

Note: See “Regulation G Disclosure” slides for a reconciliation of GAAP to Non-GAAP financial measures.

(a)The amounts and percentages for EBITDA - Adjusted and amounts for Income from continuing operations -Non-

GAAP are Non-GAAP financial measures adjusted to exclude certain items.

GAAP are Non-GAAP financial measures adjusted to exclude certain items.

Year over year expansion for six most recent quarters

Adjusted EBITDA expanding in recent periods

Earnings growth from higher revenues and tight

cost controls

cost controls

Adjusted EBITDA increasing despite seasonality

Supplemental schedules

Regulation G Disclosures

8

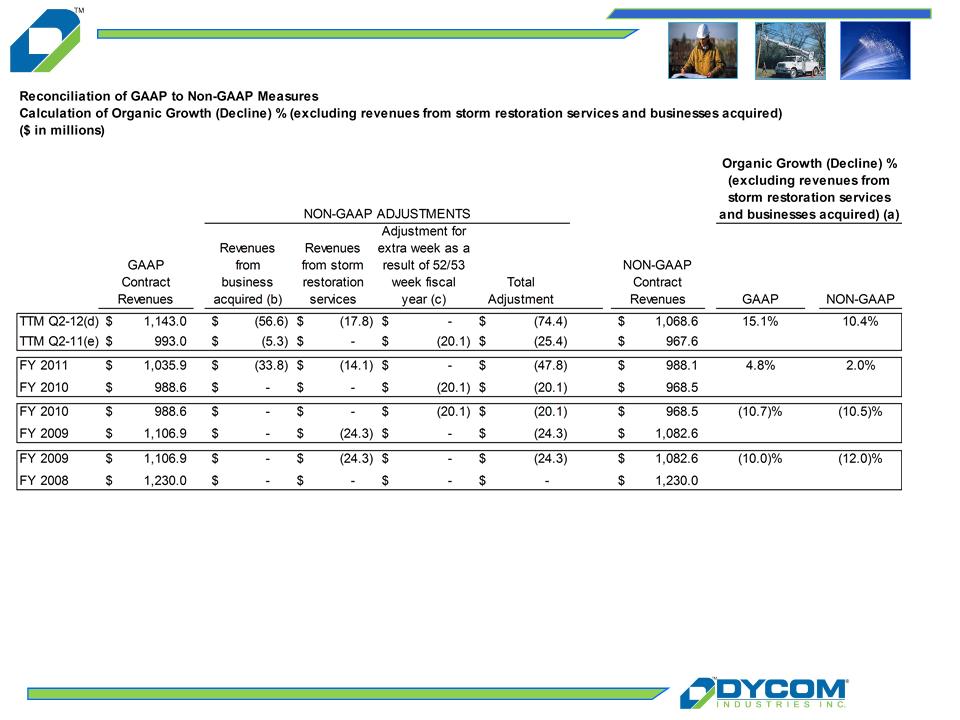

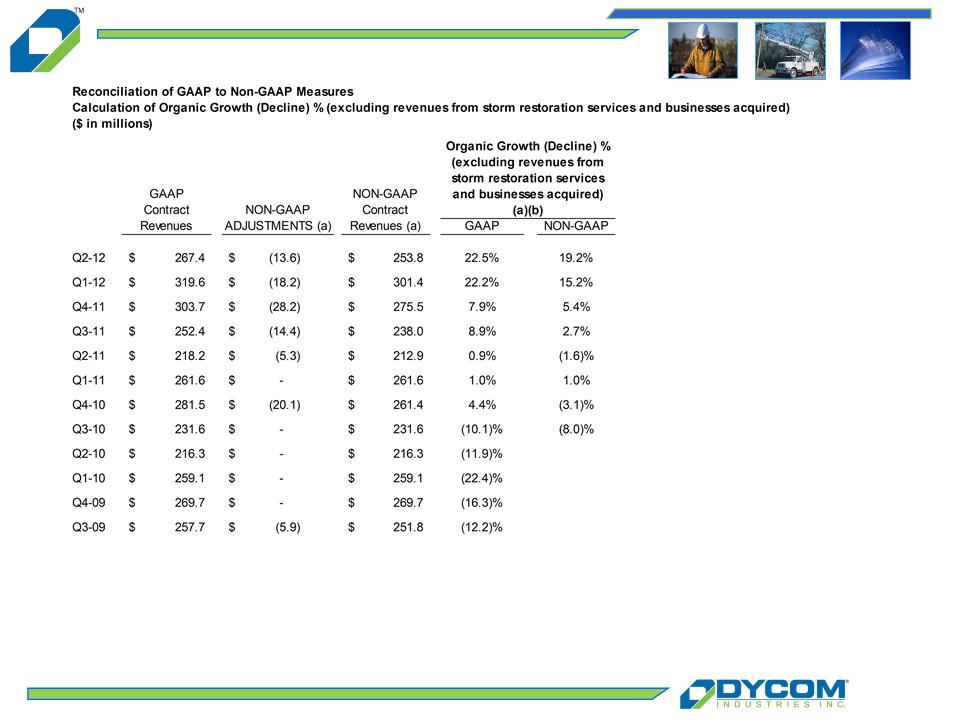

Regulation G Disclosure

(a) Year-over-year growth percentage is calculated as follows: (i) revenues in the current twelve month period less (ii) revenues in the comparative prior twelve month period;

divided by (ii) revenues in the comparative prior twelve month period.

divided by (ii) revenues in the comparative prior twelve month period.

(b) For the Trailing Twelve Months (“TTM “) Q2-12, TTM Q2-11, and FY 2011, revenues from business acquired reflect revenues from businesses acquired during Q2-11.

(c) Non-GAAP adjustments in FY 2010 reflect adjustments in Q4-10 result from the Company’s 52/53 week fiscal year of $20.1 million. The Q4-10 Non-GAAP adjustments

reflect the impact of the additional week in Q4-10 and are calculated by dividing contract revenues by 14 weeks. The result, representing one week of contract revenues, is

subtracted from the GAAP-contract revenues to calculate 13 weeks of revenue for Q4-10 on a Non-GAAP basis for comparison purposes.

reflect the impact of the additional week in Q4-10 and are calculated by dividing contract revenues by 14 weeks. The result, representing one week of contract revenues, is

subtracted from the GAAP-contract revenues to calculate 13 weeks of revenue for Q4-10 on a Non-GAAP basis for comparison purposes.

(d) Trailing Twelve Months Q2-12 includes contract revenues of $587.0 million for the six months ended January 28, 2012, $303.7 million for the three months ended July 30,

2011, and $252.4 million for the three months ended April 30, 2011.

2011, and $252.4 million for the three months ended April 30, 2011.

(e) Trailing Twelve Months Q2-11 includes contract revenues of $479.8 million for the six months ended January 29, 2011, $281.5 million for the three months ended July 31,

2010, and $231.6 million for the three months ended April 24, 2010.

2010, and $231.6 million for the three months ended April 24, 2010.

Amounts may not foot due to rounding.

9

Regulation G Disclosure

Amounts may not foot due to rounding.

(a) Non-GAAP adjustments in Q2-12, Q3-11 and Q2-11 reflect revenues from businesses acquired during Q2-11. Non-GAAP adjustments in Q1-12 reflect storm

restoration revenues ($3.7 million) and revenues from businesses acquired during Q2-11 ($14.5 million). Non-GAAP adjustments in Q4-11 reflect storm restoration

revenues ($14.1 million) and revenues from businesses acquired during Q2-11 ($14.1 million). Non-GAAP adjustments in Q4-10 result from the Company’s 52/53

week fiscal year. The Q4-10 Non-GAAP adjustments reflect the impact of the additional week in Q4-10 and are calculated by dividing contract revenues by 14 weeks.

The result, representing one week of contract revenues, is subtracted from the GAAP-contract revenues to calculate 13 weeks of revenue for Q4-10 on a Non-GAAP

basis for comparison purposes. Non-GAAP adjustments in Q3-09 reflect storm restoration revenues recognized during those periods.

restoration revenues ($3.7 million) and revenues from businesses acquired during Q2-11 ($14.5 million). Non-GAAP adjustments in Q4-11 reflect storm restoration

revenues ($14.1 million) and revenues from businesses acquired during Q2-11 ($14.1 million). Non-GAAP adjustments in Q4-10 result from the Company’s 52/53

week fiscal year. The Q4-10 Non-GAAP adjustments reflect the impact of the additional week in Q4-10 and are calculated by dividing contract revenues by 14 weeks.

The result, representing one week of contract revenues, is subtracted from the GAAP-contract revenues to calculate 13 weeks of revenue for Q4-10 on a Non-GAAP

basis for comparison purposes. Non-GAAP adjustments in Q3-09 reflect storm restoration revenues recognized during those periods.

(b) Year-over-year growth (decline) percentage is calculated as follows: (i) revenues in the quarterly period less (ii) revenues in the comparative prior year quarter

period; divided by (ii) revenues in the comparative prior year quarter period.

period; divided by (ii) revenues in the comparative prior year quarter period.

10

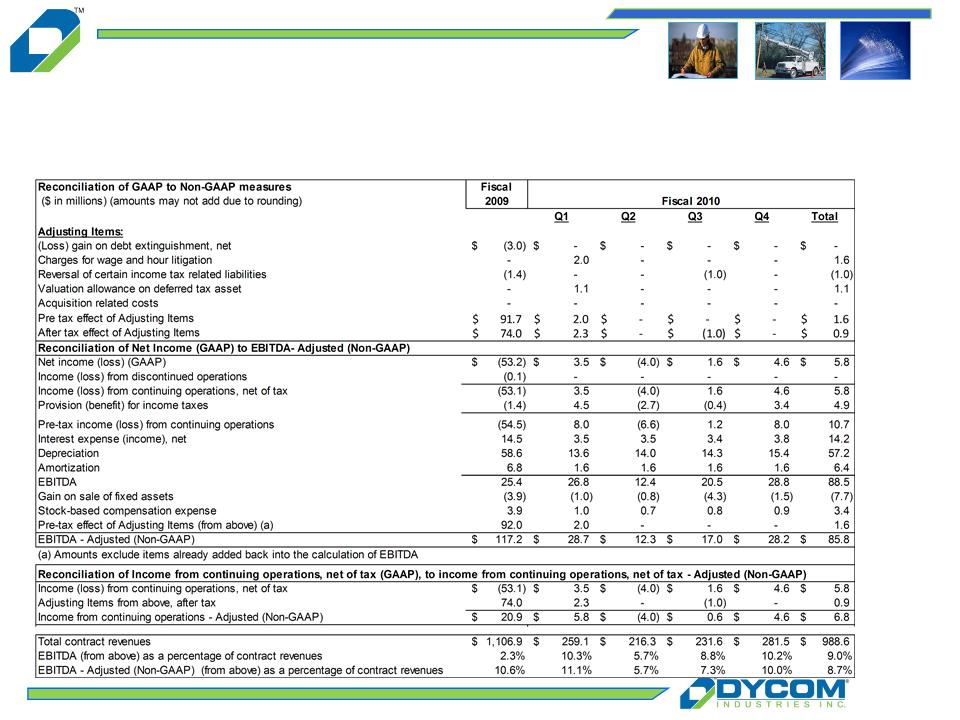

Regulation G Disclosure

The below table presents the Non-GAAP financial measures of EBITDA and Adjusted EBITDA for the respective periods. EBITDA and Adjusted EBITDA are Non-GAAP financial measures within the meaning of Regulation G

promulgated by the Securities and Exchange Commission. The Company defines EBITDA as earnings before interest, taxes, depreciation and amortization, and defines Adjusted EBITDA as earnings before interest, taxes,

depreciation and amortization, gain on sale of fixed assets, stock-based compensation expense and Adjusting items. The Company believes these Non-GAAP financial measures provide information that is useful to the Company’s

investors. The Company believes that this information is helpful in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionate positive or negative impact on the

Company’s results of operations in any particular period. Additionally, the Company uses these Non-GAAP financial measures to evaluate its past performance and prospects for future performance. EBITDA and Adjusted EBITDA

are not recognized terms under GAAP and do not purport to be an alternative to net income, operating cash flows, or a measure of earnings. Because all companies do not use identical calculations, this presentation of Non-GAAP

financial measures may not be comparable to other similarly titled measures of other companies. These tables present a reconciliation of EBITDA and Adjusted EBITDA to the most directly comparable GAAP measure.

promulgated by the Securities and Exchange Commission. The Company defines EBITDA as earnings before interest, taxes, depreciation and amortization, and defines Adjusted EBITDA as earnings before interest, taxes,

depreciation and amortization, gain on sale of fixed assets, stock-based compensation expense and Adjusting items. The Company believes these Non-GAAP financial measures provide information that is useful to the Company’s

investors. The Company believes that this information is helpful in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionate positive or negative impact on the

Company’s results of operations in any particular period. Additionally, the Company uses these Non-GAAP financial measures to evaluate its past performance and prospects for future performance. EBITDA and Adjusted EBITDA

are not recognized terms under GAAP and do not purport to be an alternative to net income, operating cash flows, or a measure of earnings. Because all companies do not use identical calculations, this presentation of Non-GAAP

financial measures may not be comparable to other similarly titled measures of other companies. These tables present a reconciliation of EBITDA and Adjusted EBITDA to the most directly comparable GAAP measure.

11

Regulation G Disclosure

The below table presents the Non-GAAP financial measures of EBITDA and Adjusted EBITDA for the respective periods. EBITDA and Adjusted EBITDA are Non-GAAP financial measures within the meaning of Regulation G

promulgated by the Securities and Exchange Commission. The Company defines EBITDA as earnings before interest, taxes, depreciation and amortization, and defines Adjusted EBITDA as earnings before interest, taxes,

depreciation and amortization, gain on sale of fixed assets, stock-based compensation expense and Adjusting items. The Company believes these Non-GAAP financial measures provide information that is useful to the Company’s

investors. The Company believes that this information is helpful in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionate positive or negative impact on the

Company’s results of operations in any particular period. Additionally, the Company uses these Non-GAAP financial measures to evaluate its past performance and prospects for future performance. EBITDA and Adjusted EBITDA

are not recognized terms under GAAP and do not purport to be an alternative to net income, operating cash flows, or a measure of earnings. Because all companies do not use identical calculations, this presentation of Non-GAAP

financial measures may not be comparable to other similarly titled measures of other companies. These tables present a reconciliation of EBITDA and Adjusted EBITDA to the most directly comparable GAAP measure.

promulgated by the Securities and Exchange Commission. The Company defines EBITDA as earnings before interest, taxes, depreciation and amortization, and defines Adjusted EBITDA as earnings before interest, taxes,

depreciation and amortization, gain on sale of fixed assets, stock-based compensation expense and Adjusting items. The Company believes these Non-GAAP financial measures provide information that is useful to the Company’s

investors. The Company believes that this information is helpful in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionate positive or negative impact on the

Company’s results of operations in any particular period. Additionally, the Company uses these Non-GAAP financial measures to evaluate its past performance and prospects for future performance. EBITDA and Adjusted EBITDA

are not recognized terms under GAAP and do not purport to be an alternative to net income, operating cash flows, or a measure of earnings. Because all companies do not use identical calculations, this presentation of Non-GAAP

financial measures may not be comparable to other similarly titled measures of other companies. These tables present a reconciliation of EBITDA and Adjusted EBITDA to the most directly comparable GAAP measure.

(a) Trailing Twelve Months (“TTM”) Q2-12 is comprised of the following periods above: Q2-12, Q1-12, Q4-11, and Q3-11.

BB&T Capital Markets

Investor Presentation

March 28, 2012

March 28, 2012