Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Good Hemp, Inc. | Financial_Report.xls |

| EX-31.1 - EXHIBIT 31.1 - Good Hemp, Inc. | v306897_ex31-1.htm |

| EX-32.1 - EXHIBIT 32.1 - Good Hemp, Inc. | v306897_ex32-1.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2011

¨ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______ to _______.

LONE STAR GOLD, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 333-159561 | 45-2578051 | ||

| (State of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

6565 Americas Parkway NE, Suite 200, Albuquerque, NM 87110

(Address of principal executive offices)

Registrant's telephone number: (505) 563-5828

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 par value

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the issuer as of June 30, 2011 was $8,586,987.60, using 55,399,920 shares at $0.155 per share. For purposes of this computation, all executive officers, directors and 10% shareholders were deemed affiliates. Such a determination should not be construed as an admission that such 10% shareholders are affiliates.

As of March 23, 2012 there were 88,141,068 shares of common stock, $0.001 par value (“Common Stock”) of the issuer issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

| PAGE | ||

| PART I | ||

| ITEM 1. | BUSINESS | 1 |

| ITEM 1A. | RISK FACTORS | 8 |

| ITEM 1B. | UNRESOLVED STAFF COMMENTS | 12 |

| ITEM 2. | PROPERTIES | 12 |

| ITEM 3. | LEGAL PROCEEDINGS | 12 |

| ITEM 4. | MINE SAFETY DISCLOSURES | 12 |

| PART II | ||

| ITEM 5. | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 13 |

| ITEM 6 | SELECTED FINANCIAL DATA | 14 |

| ITEM 7 | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 14 |

| ITEM7A | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 15 |

| ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | F-1 |

| ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 16 |

| ITEM 9A | CONTROLS AND PROCEDURES | 16 |

| ITEM 9B. | OTHER INFORMATION | 17 |

| PART III | ||

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 18 |

| ITEM 11. | EXECUTIVE COMPENSATION | 20 |

| ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS. | 20 |

| ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 21 |

| ITEM 14. | PRINCIPAL ACCOUNTING FEES AND SERVICES | 22 |

| ITEM 15. | EXHIBITS, FINANCIAL STATEMENT SCHEDULES | 23 |

| SIGNATURES | 24 | |

| EXHIBIT INDEX |

PART I

Forward Looking Statements

This Form 10-K contains "forward-looking" statements including statements regarding our expectations of our future operations. For this purpose, any statements contained in this Form 10-K that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, words such as "may," "will," "expect," "believe," "anticipate," "estimate," or "continue" or comparable terminology are intended to identify forward-looking statements. These statements by their nature involve substantial risks and uncertainties, and actual results may differ materially depending on a variety of factors, many of which are not within our control. These factors include, but are not limited to, economic conditions generally and in the industries in which we may participate and competition within our chosen industry. In light of these risks and uncertainties, you are cautioned not to place undue reliance on these forward-looking statements. Except as required by law, we undertake no obligation to publicly announce revisions we make to these forward-looking statements to reflect the effect of events or circumstances that may arise after the date of this report. All written and oral forward-looking statements made subsequent to the date of this report and attributable to us or persons acting on our behalf are expressly qualified in their entirety by this section.

ITEM 1. BUSINESS

General Overview

We are a start-up exploration stage company in the business of gold and mineral exploration, acquisition and development. Our principal office is located at 6565 Americas Parkway NE, Suite 200, Albuquerque, New Mexico 87110. Our telephone number is (505) 563-5828.

Lone Star Gold, Inc., formerly known as Keyser Resources, Inc., was incorporated in the State of Nevada on November 26, 2007. The Company’s business was initially to acquire an option to purchase a mining interest in Canada. After a change in control in November 2010, the Company explored a merger with another company in order to obtain an option to purchase several oil and gas leases in the state of Nevada. A merger agreement was signed in January 2011. The then-current management of the Company decided not to pursue the merger, and the merger agreement was terminated by mutual agreement of the parties as of March 18, 2011.

On March 29, 2011, the Company underwent another change in management. On March 29, 2011, Daniel M. Ferris was elected to serve as the sole director. Mr. Ferris subsequently appointed himself President, Secretary and Treasurer.

Following the appointment of Daniel M. Ferris as sole director and officer of the Company, the Company has changed its focus to that of a company engaged in the acquisition, exploration and development of gold and silver mining properties. To further reflect this change in business focus, the Company changed its name to “Lone Star Gold, Inc.” on June 14, 2011. In addition, to create a more flexible capital structure, the Company increased the number of authorized shares of its Common Stock from 75,000,000 to 150,000,000 on June 14, 2011. A 20:1 forward stock split was declared to stockholders of record as of June 17, 2011.

Agreements

La Candelaria

On May 31, 2011, Metales HBG, S.A. de C.V. (“Metales”), a company organized under the laws of Mexico, was formed, with the Company owning 70% of the issued and outstanding shares of capital stock. The remaining 30% of the issued and outstanding capital stock of Metales was issued to Homero Bustillos Gonzalez, a resident of Mexico (“Gonzalez”). On June 10, 2011, Gonzalez assigned to Metales eight gold and silver mining concessions (the “Concessions”) covering property located in the town of Guachochi, state of Chihuahua, Mexico. The Concessions cover 800 hectares, or approximately 1,976 acres.

Gonzalez transferred the Concessions to Metales pursuant to an agreement previously entered into with a third party, American Gold Holdings, Ltd., a company formed under the laws of the British Virgin Islands (“American Gold”). American Gold paid Gonzalez an aggregate of $125,000 prior to the formation of Metales, as required by its agreement with Gonzalez. On August 17, 2011, in connection with its investment in Metales and the exploration and development of the Concessions, the Company, American Gold, and Gonzalez executed an Assignment Agreement (the “Assignment Agreement”) pursuant to which (a) American Gold assigned to the Company all of its right and interest in and to a Letter of Intent between American Gold and Gonzalez, and an Option to Purchase Agreement between American Gold and Gonzalez dated January 11, 2011 (the “Option Agreement”), (b) the Company accepted the assignment of all of the rights and interest of American Gold in and to the Letter of Intent and the Option Agreement, and (c) the Company assumed all of the duties and obligations of American Gold under the Letter of Intent and the Option Agreement with Gonzalez. In connection with the execution of the Assignment Agreement, American Gold released any claims against the Company, Metales or Gonzalez in connection with the (i) $125,000 payment it made to Gonzalez, (ii) the LOI or Option Agreement, or (iii) the Assignment Agreement.

Pursuant to the Assignment Agreement, the Company has taken or has agreed to take the following actions that are required under the Option Agreement and the Letter of Intent, in connection with transfer of the Concessions to Metales:

| 1 |

| 1. | The Company has issued 125,000 shares of its Common Stock to North American Gold Corp, a company organized under the laws of the Marshall Islands (“North American”), as repayment of the $125,000 that American Gold paid Gonzalez in connection with the Option Agreement. The shares were issued to North American in satisfaction of the Company’s obligations under the Assignment Agreement, with the agreement of American Gold. |

| 2. | The Company has issued 300,000 shares of its Common Stock to Gonzalez. |

| 3. | The Company has paid Gonzalez an additional $125,000. |

| 4. | The Company, either alone or through Metales, is obligated to fund $150,000 per year of development costs for three years, for a total of $450,000 (the “Work Plan”). |

Gonzalez retains a 2% Net Smelter Returns Royalty on the Concessions. In addition, the Company is obligated to issue 1,000,000 shares of its Common Stock to Gonzalez upon the discovery of a 1 million-ounce equivalent gold deposit, as defined by industry standards as set forth by a recognized exchange in North America. Metales is obligated to undertake work necessary to bring the existing geological survey on the property up to NI 43-101 standards. Finally, the Company has granted anti-dilution rights to Gonzalez, such that the Company must allow Gonzalez the opportunity to maintain his percentage stock ownership in the Company until the date on which the Company has complied fully with its obligations under the Option Agreement or January 11, 2014, whichever comes first. Gonzalez has waived the exercise of his anti-dilution rights with respect to issuances of Common Stock to North American under the Investment Agreement.

If the Company fails to comply with all its obligations under the Option Agreement before January 11, 2014, the Option Agreement will terminate and the Company will be obligated to return the Concessions to Gonzalez.

A copy of the Option Agreement was attached as Exhibit 10.8 to the Company’s Quarterly Report on Form 10-Q filed on November 10, 2011. A copy of the Assignment Agreement was filed as Exhibit 10.3 to the Company’s Quarterly Report filed on August 22, 2011.

The Company advanced approximately $122,341 to Metales in the first year of the Work Plan, which, together with payments made to Gonzalez that were credited to the Work Plan, satisfied its obligations for that first year. The Company has paid approximately $50,000 towards the payments required in the second year of the Work Plan, and intends to make additional payments totaling $100,000 in 2012 as required under the Work Plan.

La Candelaria Concessions

The concession numbers, file numbers, dates of term, surface area and location of the Concessions are as follows:

Mine Concessions “La Candelaria”

|

Concession Number: 234759 File number: 016/37587 Term: August 14, 2009- August 13, 2059 Surface Area: 100 hectares Municipality and State: Guachochi, Chihuahua |

Concession Number: 234760 File number: 016/37588 Term: August 14, 2009- August 13, 2059 Surface Area: 100 hectares Municipality and State: Guachochi, Chihuahua |

|

Concession Number: 234761 File number: 016/37589 Term: August 14, 2009- August 13, 2059 Surface Area: 100 hectares Municipality and State: Guachochi, Chihuahua |

Concession Number: 234762 File number: 016/37590 Term: August 14, 2009- August 13, 2059 Surface Area: 100 hectares Municipality and State: Guachochi, Chihuahua |

|

Concession Number: 235690 File number: 016/38785 Term: February 16, 2010- February 15, 2060 Surface Area: 100 hectares Municipality and State: Guachochi, Chihuahua |

Concession Number: 235691 File number: 016/38786 Term: February 16, 2010- February 15, 2060 Surface Area: 100 hectares Municipality and State: Guachochi, Chihuahua |

|

Concession Number: 235692 File number: 016/38787 Term: February 16, 2010- February 15, 2060 Surface Area: 100 hectares Municipality and State: Guachochi, Chihuahua |

Concession Number: 235693 File number: 016/38788 Term: February 16, 2010- February 15, 2060 Surface Area: 100 hectares Municipality and State: Guachochi, Chihuahua |

All references to “La Candelaria” herein refer to all eight concessions unless otherwise indicated.

| 2 |

The Concessions in the La Candelaria project are without known proven (measured) or probable (indicated) reserves, as defined under SEC Industry Guide 7, and the exploration program described in “History and Plan of Operation” below is exploratory in nature. See “No Proven or Probable Reserves” below.

The transfer of the Concessions to Metales must be registered under Mexican law. The Company has been advised that the transfer of the Concessions from Gonzalez to Metales is in the process of being registered with the appropriate Mexican authorities. Under Mexican law, a mining concession gives the holder both exploration and exploitation rights for any minerals found in the property. To maintain the concession, the holder must pay appropriate taxes, perform assessment work, comply with environmental laws, and file a production report each year with the appropriate authorities. Foreign individuals and companies wanting to hold concessions must do so through ownership in a Mexican corporation or through a joint venture, and they may not hold mining concessions directly. Because of those requirements, the Company will have to rely on persons associated with Metales, and its employees and consultants in Mexico, to perform all acts necessary to comply with the legal requirements necessary to maintain the Concessions.

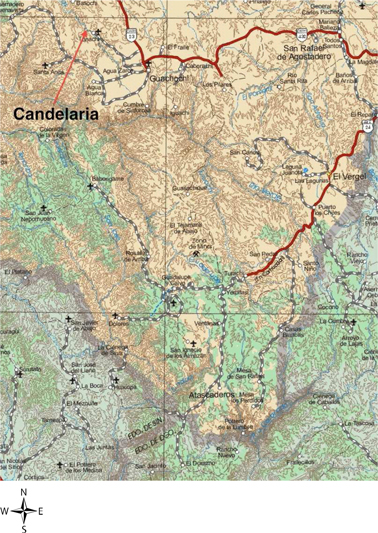

Location and Access

The property covered by the Concessions is located approximately 125 miles southwest of the city of Chihuahua, Mexico, in the municipality of Guachochi. The town of Tonachi is approximately 3 miles southeast from the border of the Concessions. Guachochi may be reached by a paved road from all directions, including from Chihuahua. The road from Guachochi is an established paved road, with the final 20 miles (36 km) being good quality dirt roads capable of handling trucks and other vehicles. The closest airstrip is located just outside Guachochi, but Chihuahua remains the main hub.

A map of the location of the La Candelaria Concessions is set forth below:

History and Plan of Operation

The Company, either alone or through Metales, is obligated to fund $150,000 per year of development costs for three years, for a total of $450,000 (the “Work Plan”). The Work Plan consists of a 3-phase, $450,000 exploration program. Phase 1 exploration work includes mapping of the property; defining 10-15 core drill targets; and equipping a regional satellite office in Chihuahua to conduct work programs on the property while providing a secure sample transfer location for delivery to the ALS CHEMEX regional office/processing plant. The geological team will conduct layers of geo-chemical and geo-physical analysis of the entire property to increase the Company's geo-chemical data. In addition, the team will isolate surface areas of interest and define any underground structures and faults systems. Phase 2 exploration work will include drilling the initial targets identified in Phase 1. Phase 3 exploration work will include further defining underground structures in the most economical areas on the property based on previous drill results.

| 3 |

The Company has been involved in Phase 1 exploration, including gathering as much drill data as possible from the previously identified low sulphidation epithermal system; identifying drill targets; and beginning initial drilling. In terms of gathering data, existing data and the Company's new data (from approximately 150 rock chip, outcrop, quartz vein and sediment samples) will undergo a geo-physical study and ongoing analysis, including full spectral results. To date, much of the data has been mapped and processed in Lone Star's Chihuahua office. In November 2011, a team of Geologists drilled ten drill holes to a depth of approximately 200 meters (650 feet). The Company is waiting for the results of the drilling from the ALS CHEMEX laboratories. The Company has received initial drilling results from a local laboratory, which showed hydrothermal chemical alterations that have potential for a silver or gold deposit at deeper levels. Lone Star's VP of Exploration has suggested the need to drill deeper to further test the property's mineral potential. If results from the initial drilling stage indicate further drilling is justified, a larger drill unit will be used, capable of reaching depths of 500 meters or more (1,600 feet).

Mineralization

The mineralization is believed to be a low sulphadation epithermal deposit, likely caused by a nearby magma chamber or caldera. If that is true, then this would be classified as a large low grade deposit.

Mine Tailings Project.

On January 26, 2012, the Company, acting through a newly-formed subsidiary, entered into a Joint Venture Agreement (the “JV Agreement”) with Miguel Angel Jaramillo Tapia (“Jaramillo”), a resident of Mexico. Under the JV Agreement, Amiko Kay, S. de R.L. de C.V., a company organized under the laws of Mexico (“Amiko Kay”), and Jaramillo formed a joint venture to process 1,200,000 tons of mine tailings located in the city of Hidalgo Del Parral in the state of Chihuahua, Mexico (the “Tailings”), and, after processing, to use, market and sell any minerals extracted from the Tailings. The Company owns 99% of the issued and outstanding membership interests of Amiko Kay.

The Tailings consists of approximately 1.2 million tons of mine tailings from previous mining activity in the Chihuahua area over the last 100 years or more. Mine tailings represent the refuse remaining after ore has been processed. The joint venture between Amiko Kay and Jaramillo (the “Joint Venture”) has been formed to re-process the mine tailings heap to extract minerals that were not extracted during the initial processing, and to market and sell any minerals extracted from the Tailings.

As consideration for Jaramillo’s contribution of the right to process the Tailings to the Joint Venture, the Company paid Jaramillo $25,000 when it signed a letter of intent for a proposed acquisition of an interest in the Tailings, and another $75,000 when it signed the JV Agreement. The Company agreed to pay Jaramillo an additional $200,000 no later than January 26, 2013.

In addition, the Company or Amiko Kay will fund an amount up to $1,000,000 for the benefit of the Joint Venture over its first two years, as follows:

| . | $250,000 within the first year of the Joint Venture for the purchase of used heavy equipment, miscellaneous equipment and materials for processing the Tailings, and taxes, permits, and general operating expenses. |

| . | $750,000 within the second year of the Joint Venture for the construction of a heap leach system and floatation plant on the Property. |

The Company may make an additional $250,000 available to the Joint Venture, if additional processing equipment is justified and required to maximize the liberation of precious metals in the Tailings material.

As further consideration, the Company is obligated to issue 600,000 shares of the common stock, $0.001 par value, of the Company (“Common Stock”), to Jaramillo as follows:

| (a) | 100,000 shares of Common Stock have been issued as of the date of this filing. |

| (b) | 200,000 shares of Common Stock within 6 months of signing the JV Agreement. |

| (c) | 300,000 shares of Common Stock within 12 months of signing the JV Agreement. |

The shares of Common Stock will be restricted shares and are being issued with appropriate legends to that effect. Jaramillo executed a Share Issuance Agreement concurrently with the execution of the JV Agreement, with respect to the shares of Common Stock to be issued under the JV Agreement.

The Joint Venture will initially process 100-200 tons of the Tailings per day at a processing plant in Parral, a short distance from the Property. The Company plans for the amount processed to be increased up to 600-800 tons per day during the first year, depending on the Joint Venture’s ability to employ more equipment and workers at the Property and to complete construction of the heap leach system and flotation plant on the Property, as described in “History and Plan of Operation” below.

| 4 |

Jaramillo will manage the day-to-day affairs associated with processing the Tailings, selling the minerals extracted from the Tailings (“Extracted Minerals”), and other activities of the Joint Venture. Jaramillo will pay all expenses associated with the processing of the Tailings, the sale of any Extracted Minerals from the Tailings, and other obligations of the Joint Venture from the funds received under the Work Commitment and, eventually, from revenues from operations. All net revenues from the sale of any Extracted Minerals or other sources, after deducting expenses, will be distributed and paid monthly, with 65% of net revenues paid to Amiko Kay and 35% of the net revenues paid to Jaramillo. It is anticipated that the portion to be paid to Amiko Kay will be paid directly to the Company. Jaramillo will provide a monthly accounting of all revenues and expenses associated with the operations of the Joint Venture.

Title to the Property and the Tailings will remain in Jaramillo’s name. Jaramillo will be responsible for obtaining all permits, approvals and authorizations associated with the processing of the Tailings. He is also responsible for causing the Joint Venture to comply with all applicable laws, rules and regulations, and to maintain insurance on the Property. Amiko Kay will have access to the Property and the Tailings at all times during the term of the JV Agreement.

Amiko Kay and Jaramillo will mutually develop plans and programs to process the Tailings. Jaramillo will prepare a detailed budget setting forth the expenses to be paid under the Work Commitment, which will be approved by Amiko Kay. Finally, Jaramillo will provide quarterly financial reports to Amiko Kay.

If either party defaults under the JV Agreement, the defaulting party’s rights to participate in the Joint Venture will be immediately suspended, and the defaulting party will have no right to share in the revenues of the Joint Venture until the breach is cured. If the defaulting party is Jaramillo, then Amiko Kay may perform the duties of Jaramillo under the Agreement. The nondefaulting party may also sue for damages incurred as a result of the event of default.

The JV Agreement will terminate upon completion of processing the Tailings, as determined by Amiko Kay in its sole discretion. If Jaramillo materially breaches the JV Agreement, Amiko Kay may terminate the JV Agreement upon 30 days notice to Jaramillo. Jaramillo has no right to terminate the JV Agreement before the processing of the Tailings is complete.

Jaramillo provides independent consulting services to the Company on the La Candelaria project. He acts as Vice President of Exploration on the La Candelaria project (although he is not an executive officer, or an employee, of the Company, Metales or Amiko Kay). See Item 10, Directors, Executive Officers and Corporate Governance, below.

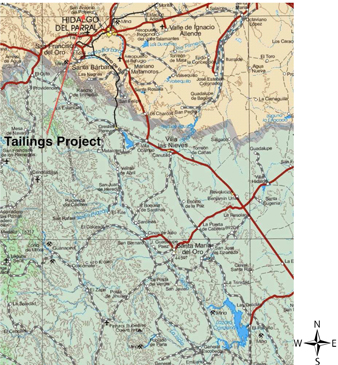

Location

The Tailings Property (the “Property”) is identified as San Antonio del Potrero, Mineral de Jal, comprising approximately 75 hectares. It is registered with the San Antonio Ejido and the city of Hidalgo del Parral. The city of Hidalgo del Parral is located approximately 220 kilometers from the city of Chihuahua, Mexico. Hidalgo del Parral may be reached by a paved road from all directions, including from Chihuahua. The closest airport is located in Chihuahua.

A map of the location of the Tailings property is set forth below:

| 5 |

History and Plan of Operation

The Company has obtained the results of 29 test samples performed by ALS CHEMEX. The samples were taken from the Tailings in late 2010 by the previous owner. The results of analysis of the test samples showed an average of 113 grams per ton of silver, with additional by-product of gold, zinc, lead and copper. The Company expects to receive the results of recent testing performed on the Tailings in the next few weeks.

In addition, the Company’s consultants in Mexico performed additional testing by having a sample of approximately 40 kilograms (approximately 88 pounds) of ore processed and analyzed. Grade assays based on the sampling were received from SGM (Servicio Geologico Mexicano). The results of the analysis showed 115 grams per ton of silver and 0.7 grams per ton of gold, with 1% per ton of lead and zinc. The grade assays are not recognized as NI 43-101 standard.

The Tailings are without known proven (measured) or probable (indicated) reserves, as defined under SEC Industry Guide 7, and the exploration program described in “History and Plan of Operation” is exploratory in nature. See “No Proven or Probable Reserves” below.

In late February 2012, the Company began shipping 100 tons of Tailings per day to a processing plant.

The Company has decided to construct a basic wash plant and jig circuit on the property on which the Tailings are located. The wash plant’s simple processing circuit will separate the heavy, mineral-rich material from the lighter, worthless material in the Tailings. It is anticipated that the wash plant will have a capacity of approximately 30 tons of Tailings per hour. The Company expects the construction of the wash plant to cost approximately $70,000 and take between 6 to 8 weeks once construction has begun.

LOI Regarding the Ocampo Property

On September 29, 2011, the Company entered into a letter of intent (the “LOI”) with Antonio Aguirre Rascon, a resident of Mexico, to acquire a 70% interest in mining concessions covering approximately 570 hectares located in the municipality of Ocampo in the state of Chihuahua, Mexico (the “Ocampo Property”). The LOI was intended to serve as the basis for a definitive agreement to be negotiated between the parties. If the definitive agreement was not executed within 90 days of the date of the LOI, the LOI would expire unless extended by mutual agreement of the parties. The Company allowed the LOI to expire by its terms as of December 29, 2011.

No Proven or Probable Reserves

We are a start-up, exploration-stage company engaged in the search for gold and related minerals. No proven (measured) or probable (indicated) reserves have been established with respect to the La Candelaria project or the Tailings project, and the proposed program of exploration and development for the La Candelaria project and the Tailings project is exploratory in nature. There is no assurance that a commercially viable mineral deposit, or reserve, exists on the property covered by the Concessions or the Tailings project or can be shown to exist until sufficient and appropriate exploration is done, and a comprehensive evaluation of such work concludes that the extraction of such a mineral deposit, if found, can be economically and legally feasible.

Competition

The mining industry is intensely competitive. Competition includes large established mining companies with substantial capabilities and with greater financial and technical resources than we have. As a result of this competition, we may be unable to acquire additional attractive mining claims or financing on terms we consider acceptable. We also compete with other mining companies in the recruitment and retention of qualified managerial and technical employees. If we are unable to successfully compete for financing or for qualified employees, our exploration and development programs may be slowed down or suspended.

Compliance with Governmental Regulation

The Company is committed to complying with all governmental and environmental regulations applicable to the Company, its properties and its business. Permits from a variety of regulatory authorities are required for many aspects of mine operation. The Company relies on its consultants in Mexico to obtain and maintain all permits, authorizations and approvals necessary or desirable to maintain our business and properties. The Company has been informed that it has the necessary permits and approvals to proceed with the operation of the Tailings joint venture, including a preliminary approval for the construction of a plant on the Tailings Property.

Employees

Currently, the sole employee of the Company is Daniel M. Ferris, our President, Treasurer, Secretary and sole director. Mr. Ferris is employed under an Employment Agreement, which is described more fully in Item 10, Directors, Executive Officers and Corporate Governance.

| 6 |

We engage independent contractors and consultants from time to time to consult with our geologic and exploration program. See Item 10, Directors, Executive Officers and Corporate Governance.

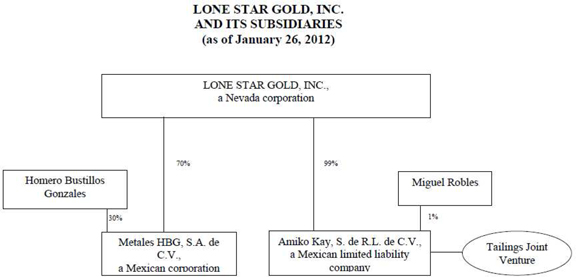

Subsidiaries

Our Company has two subsidiaries. Both Metales and Amiko Kay are companies organized under the laws of Mexico.

The Company owns 70% of the issued and outstanding shares of stock of Metales. Our President, Mr. Ferris, is the sole administrator of Metales. As sole administrator, he assumes the duties of a Board of Directors. Miguel Robles, the Company’s attorney in Mexico, and his associates have limited duties for the day-to-day operation of Metales.

The Company owns 99% of the issued and outstanding membership interests of Amiko Kay. Miguel Robles, the Company’s attorney in Mexico, owns a 1% ownership interest to satisfy Mexican law requirements for there being at least two owners.

Intellectual Property

We do not own any patents or trademarks.

| 7 |

ITEM 1A. RISK FACTORS

An investment in the Common Stock involves a high degree of risk. In addition to the other information in this Report, the following risk factors should be considered carefully in evaluating the Company and our business. We have sought to identify what we believe to be the most significant risks to our business, but we cannot predict whether, or to what extent, any of such risks may be realized nor can we guarantee that we have identified all possible risks that might arise. Investors should carefully consider all of such risk factors before making an investment decision with respect to our Common Stock. If you decide to buy our Common Stock, you should be able to afford a complete loss of your investment.

The Company is an exploration stage company with a history of operating losses and expects to continue to realize losses in the near future. The Company currently has no operations that are producing revenue, and currently relies on investments by third parties to fund its business. Even when the Company begins to generate revenues from operations, the Company may not become profitable or be able to sustain profitability.

The Company is an exploration stage company, and since inception, the Company has incurred significant net losses and has not realized any revenue from its operations. The Company has reported a net loss of $1,697,717 from the date of inception through December 31, 2011. The Company expects to continue to incur net losses and negative cash flow from operations in the near future, and we will continue to experience losses for at least as long as it takes our Company to generate revenue by selling Extracted Minerals from the Tailings, or through its mining operations. The size of these losses will depend, in large part, on whether the Company finds gold or other minerals in its properties and is able to extract and sell the minerals in a profitable manner. To date, the Company has not had any operating revenues, nor has it found any minerals or developed any mineral deposits. Because the Company does not yet have a revenue stream resulting from sales or other operations, there can be no assurance that the Company will achieve material revenues in the future. Should the Company achieve a level of revenues that make it profitable, there is no assurance the Company can maintain or increase profitability levels in the future. An investment in the Common Stock involves a high degree of risk. In addition to the other information in this Report, the following risk factors should be considered carefully in evaluating the Company and our business. If you decide to buy our securities, you should be able to afford a complete loss of your investment.

There is substantial doubt as to whether we will continue operations. If we discontinue operations, you could lose your investment.

The following factors raise substantial doubt regarding the ability of our business to continue as a going concern: (i) the losses we incurred since our inception; (ii) our lack of operating revenues since inception through the date of this Current Report; and (iii) our dependence on the sale of equity securities to continue in operation. We have signed an Investment Agreement with a third party, North American, for up to $15,000,000 through sales of our Common Stock. However, the investor has the option to refuse to fund any request for investment if market conditions are not favorable. We anticipate that we will incur increased expenses without realizing enough revenues from operations. We therefore expect to incur significant losses in the foreseeable future. The financial statements do not include any adjustments that might result from the uncertainty about our ability to continue our business. If we are unable to obtain additional financing from outside sources and eventually produce enough revenues, we may be forced to curtail or cease our operations. If this happens, you could lose all or part of your investment.

Our lack of any operating history makes it difficult for us to evaluate our future business prospects and make decisions based on those estimates of our future performance.

We do not have any material operating history, which makes it impossible to evaluate our business on the basis of historical operations. Furthermore, the Company has pursued the business of mineral exploration and development for a short time, and thus our business carries both known and unknown risks. As a consequence, our past results may not be indicative of future results. Although this is true for any business, it is particularly true for us because of our lacking any material operating history.

The Company recently underwent two separate changes in management, and the current management had no experience in mining or mineral exploration prior to joining the Company.

The Company underwent a change in management in November 2010 and again in March 2011. The new director and sole executive officer of the Company was not previously an employee of or otherwise involved in the management of the Company. While Mr. Ferris has prior business experience, he had no prior experience in mining or mineral exploration or development before joining the Company.

Together, two of our stockholders have the ability to significantly influence any matters to be decided by the stockholders, which may prevent or delay a change in control of our company.

Mr. Ferris and one other stockholder currently own approximately 34.27% of our common stock on a fully diluted basis, as a group. As a result, they could exert considerable influence over the outcome of any corporate matter submitted to our stockholders for approval, including the election of directors and any transaction that might cause a change in control, such as a merger or acquisition. Any stockholders in favor of a matter that is opposed by these two stockholders would have to obtain a significant number of votes to overrule the collective votes of Mr. Ferris and the other principal stockholder.

| 8 |

Mr. Ferris is our sole director and officer and the loss of Mr. Ferris could adversely affect our business.

Since Mr. Ferris is currently our sole director and officer, if he were to die, become disabled, or leave our company, we would be forced to retain individuals to replace him. There is no assurance that we can find suitable persons to replace him if that becomes necessary. We have no “Key Man” life insurance at this time.

We may conduct further offerings in the future in which case investors' shareholdings will be diluted.

Since our inception, we have relied on sales of our common stock and warrants to fund our operations. The Investment Agreement grants North American the ability to buy a substantial number of shares of Common Stock of the Company in a series of private placement transactions at a price that is at a discount to the market price. In addition, under the Option Agreement, the Company must allow Gonzalez the opportunity to maintain his percentage stock ownership in the Company until the date on which the Company has complied fully with its obligations under the Option Agreement or January 11, 2014, whichever comes first, so any issuance of common stock or equivalents will result in even greater dilution because of the shares or share equivalents that will have to be issued to Jaramillo as a result. Finally, Jaramillo is entitled to 600,000 shares of Common Stock as partial consideration under the JV Agreement. We may conduct further equity offerings in the future to finance our current projects or to finance subsequent projects that we decide to undertake. If Common Stock is issued in return for additional funds, the price per share could be lower than that paid by our current stockholders. We anticipate continuing to rely on equity sales of our common stock in order to fund our business operations. If we issue additional stock, investors' percentage interests in us will be diluted. The result of this could reduce the value of current investors' stock.

Because the SEC imposes additional sales practice requirements on brokers who deal in our shares which are penny stocks, some brokers may be unwilling to trade them. This means that you may have difficulty reselling your shares and this may cause the price of the shares to decline.

A penny stock is generally a stock that is not listed on a national securities exchange or NASDAQ, is listed in the "pink sheets" or on the OTC Bulletin Board, has a price per share of less than $5.00, and is issued by a company with net tangible assets less than $5 million.

The penny stock trading rules impose additional duties and responsibilities upon broker-dealers and salespersons effecting purchase and sale transactions in Common Stock and other equity securities, including determination of the purchaser's investment suitability, delivery of certain information and disclosures to the purchaser, and receipt of a specific purchase agreement before effecting the purchase transaction.

Many broker-dealers will not effect transactions in penny stocks, except on an unsolicited basis, in order to avoid compliance with the penny stock trading rules. In the event our Common Stock becomes subject to the penny stock trading rules:

| · | such rules may materially limit or restrict the ability to resell our Common Stock, and |

| · | the liquidity typically associated with other publicly traded equity securities may not exist. |

Because of the significant restrictions on trading penny stocks, a public market may never emerge for our securities. If this happens, you may never be able to publicly sell your shares.

We do not intend to pay dividends and there will be fewer ways in which you can make a gain on any investment in us.

We have never paid any cash dividends and currently do not intend to pay any dividends for the foreseeable future. Because we do not intend to declare dividends, any gain on an investment in us will need to come through appreciation of the stock’s price.

The Company holds the Concessions through a Mexican subsidiary, Metales, in which it owns a 70% interest. Therefore, the Company’s ability to realize revenues from the La Candelaria project will depend in part upon the payment of dividends by Metales and thus is dependent on Mexican corporate and other law.

As a US company, Lone Star Gold cannot hold the Concessions directly. Instead, Mexican law requires that a company formed in Mexico own the Concessions. The Company has invested in Metales in order to comply with this law. Therefore, Metales must comply with Mexican laws regarding the declaration and payment of dividends in order to distribute profits to its stockholders, including the Company. If it fails to do so, the Company could fail to realize revenues from the project and you could lose all or part of your investment.

Risks Relating to Mining Activities

We have no known mineral reserves and we may not find any gold or, if we find gold, it may not be in economic quantities. If we fail to find any gold or if we are unable to find gold in economic quantities, we will have to suspend operations.

The chance of finding gold, silver or other mineral reserves on any individual parcel of land is almost infinitesimal. It is not uncommon to spend millions of dollars on a potential project, complete many phases of exploration and still not obtain reserves that can be economically exploited. Therefore, the chances of the Company finding economically viable mineral reserves are remote.

| 9 |

We have no known mineral reserves. Even if the Company finds gold or silver deposits, it may not be of sufficient quantity to warrant recovery. Additionally, even if the Company finds gold or silver deposits in sufficient quantity to warrant recovery, it ultimately may not be recoverable. Finally, even if any gold or silver is recoverable, we may be unable to recover at a profit. Failure to locate deposits in economically recoverable quantities will cause us to cease operations.

We face a high risk of business failure because of the unique difficulties and uncertainties inherent in mineral exploration ventures.

Potential investors should be aware of the difficulties generally encountered by new mineral exploration companies and their high rate of failure. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays that we may encounter in our mining activities. These potential problems may lead to additional costs and expenses that exceed current estimates. Problems such as unusual or unexpected formations and other adverse conditions often result in unsuccessful exploration efforts. If the results of our exploration do not reveal viable commercial mineralization, we may decide to abandon the Concessions and acquire new properties for exploration. The acquisition of additional properties will depend on whether we possess sufficient capital resources at the time. If no funding is available, we may be forced to abandon our mining operations.

The Tailings may fail to yield Extracted Minerals in amounts or grades that are sufficient to produce a steady source of revenue to the Joint Venture. If the Joint Venture fails to produce sufficient revenue to offset the substantial costs incurred in exploration and development of the site, we may lose all amounts invested in the Joint Venture.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. The payment of such liabilities may have a material adverse effect on our financial position.

We may not have access to all of the supplies and materials we need to explore our properties, which could delay or suspend our operations.

Competition and unforeseen limited sources of supplies in the industry or in the region in which we operate could result in occasional spot shortages of supplies, such as explosives, and certain equipment such as bulldozers and excavators. If we cannot find the products and equipment we need, we will have to suspend our exploration plans until we do find the products and equipment we need.

We face intense competition in the mining industry. We will have to compete for financing and for qualified managerial and technical employees.

The mining industry is intensely competitive. Competition includes large established mining companies with substantial capabilities and with greater financial and technical resources than we have. As a result of this competition, we may be unable to acquire additional attractive mining claims or financing on terms we consider acceptable. We also compete with other mining companies in the recruitment and retention of qualified managerial and technical employees. If we are unable to successfully compete for financing or for qualified employees, our exploration and development programs may be slowed down or suspended.

Our properties are located in Mexico and are subject to changes in Mexican political conditions and government regulations.

The Concessions and Tailings are located in Mexico. In the past, Mexico has been subject to political and social instability. Change and uncertainty in Mexico could lead to changes in existing government regulations affecting mineral exploration and mining. Our business activities in Mexico may be adversely affected by changing governmental regulations relating to the mining industry. More generally, shifts in political conditions may increase the cost of conducting our business or maintaining our properties. Finally, Mexico’s status as a developing country may make it more difficult to obtain required financing for our projects.

Our business operations may be adversely affected by social and political unrest in Chihuahua, or by violence and crime in Mexico.

Both La Candelaria and the Mine Tailings Project are located in the state of Chihuahua, Mexico. Our business operations could be negatively impacted if Chihuahua or other areas of Mexico experiences a period of social and political unrest. Various areas in Mexico are affected by persistent violence and crime, which has been well-publicized in the US. Our exploration and construction program in La Candelaria, or the processing of the Tailings, could be interrupted if we are unable to hire qualified personnel or if we are denied access to our properties. We may be required to make additional expenditures to provide increased security in order to protect our property or personnel located at our sites. Significant delays in exploration or increases in expenditures will likely have a material adverse effect on our financial condition and results of operations.

| 10 |

Our operations in Mexico may be adversely affected by factors outside our control, such as changing political, local and economic conditions, any of which could materially adversely affect our financial position or results of operations.

The La Candelaria Concessions are mineral concessions granted by the Mexican government. We hold the Mine Tailings Project in a joint venture with a Mexican national.

Both of these projects are subject to the laws of Mexico. Exploration and potential development activities are potentially subject to political and economic risks, including:

| · | Cancellation or renegotiation of contracts; |

| · | Competition from companies not subject to US laws and regulations, such as the Foreign Corrupt Practices Act; |

| · | Changes in Mexican laws and regulations; |

| · | Changes in tax laws; |

| · | Royalty and tax increases or claims by Mexican governmental authorities; |

| · | Expropriation or nationalization of property; |

| · | Foreign exchange controls; |

| · | Import and export regulations; |

| · | Environmental controls; |

| · | Risks of loss due to civil strife, war, guerilla activity, insurrection and terrorism; |

| · | Other risks arising out of foreign sovereignty over the areas in which our business is operated. |

Our business in Mexico is dependent on our consultants.

We are almost entirely dependent on the services of consultants in Mexico to operate our business in Mexico and to advise the Company on matters vital to its continued viability and success. For example, Adam Whyte is responsible for overseeing the day to day operation of the La Candelaria property, while Miguel Jaramillo operates the Mine Tailings Project. We rely on such persons for advice on matters such as permitting and environmental compliance, as well as mining operations. In addition, we rely on legal counsel in Mexico to maintain the registration of our properties, to form our subsidiaries and to advise us on other matters involving Mexican law. The loss of these persons or our inability to attract and train additional skilled employees may adversely affect our business, future operations and financial condition.

We require substantial funds merely to determine if mineral reserves exist on our Concessions.

Any potential development and production of minerals on our Concessions depends upon the results of exploration programs, feasibility studies and the recommendations of qualified engineers and geologists. Such activities require substantial funding. Before deciding to explore for, and then produce or develop, mineral reserves, we must consider several significant factors, including, but not limited to:

| • | Costs of bringing the property into production; |

| • | Availability and costs of financing; |

| • | Ongoing costs of production; |

| • | Market prices for the products to be produced; |

| • | Environmental compliance regulations and restraints; and |

| • | Political climate and/or governmental regulation and control. |

There is no assurance that Extracted Minerals from the Tailings will be produced in amounts that will make the Joint Venture commercially viable.

The 1.2 million tons of Tailings located on the Property must be processed at a plant operated by a third party to determine whether any gold, silver or other minerals may be extracted. There is no assurance that any valuable minerals will be extracted after processing. Even if valuable minerals are extracted from the Tailings, there is no assurance that they will be in sufficient quantities, or of sufficient grades, to allow the processing to be commercially viable for the Company. If we cannot make a profit by processing the Tailings, the Joint Venture may fail, and we may lose our investment in the Joint Venture. The failure of the Joint Venture to provide a source of current revenue to the Company may also force us to abandon or curtail our other operations.

The Assignment Agreement, and the Option Agreement underlying the Assignment Agreement, obligates the Company to fund certain exploration costs under the Work Plan. If we fail to satisfy those obligations, Gonzalez could demand a return of the Concessions.

Under the terms of the Option Agreement, if the Company fails to comply with its obligations to make expenditures under the Work Plan before January 11, 2014, the Option Agreement will terminate and the Company will be obligated to return the Concessions to Gonzalez. If this occurs, Company would lose all of its investment in the Concessions.

| 11 |

Since most of our expenses are paid in Mexican pesos, and our outside investors fund the Company in United States dollars, we are subject to adverse changes in currency values that may adversely affect our results of operations.

Our operations in the future could be affected by changes in the value of the Mexican peso against the United States dollar. The appreciation of non-U.S. dollar currencies such as the peso against the U.S. dollar increases expenses and the cost of purchasing capital assets in U.S. dollar terms in Mexico, which can adversely impact our operating results and cash flows. Conversely, depreciation of the non-U.S. dollar currencies usually decreases operating costs and capital asset purchases in U.S. dollar terms. The value of cash and cash equivalents denominated in foreign currencies also fluctuates with changes in currency exchange rates.

Title to some of our properties may be defective or challenged.

While we believe that we have satisfactory title to our properties, some titles may be defective or subject to challenge. In addition, certain of our Mexican properties could be subject to rights of the Ejido, as discussed below.

Our ability to develop our property in Mexico is subject to the rights of the Ejido (local inhabitants) to use the surface for agricultural purposes.

Our ability to mine minerals is subject to maintaining satisfactory arrangements with the Ejido for access and surface disturbances. Ejidos are groups of local inhabitants who were granted rights to conduct agricultural activities on the property. We must negotiate and maintain a satisfactory arrangement with these residents in order to disturb or discontinue their rights to farm. While we have successfully negotiated and signed such agreements related to the Joint Venture, our ability to maintain these agreements or consummate similar agreements for new projects could impair or impede our ability to successfully mine the properties.

In the event of a dispute regarding title or any other matter related to our operations in Mexico, we might be subject to Mexican courts or dispute resolution entities, where we would be faced with unfamiliar laws and procedures.

The resolution of disputes in foreign countries can be costly and time consuming. In a foreign country we would be faced with the additional burden of understanding unfamiliar laws and procedures. We would also be faced with the necessity of hiring lawyers and other professionals who are familiar with the foreign laws. For these reasons, we may incur unforeseen losses if we are forced to resolve a dispute in Mexico or any other foreign country.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. DESCRIPTION OF PROPERTIES

The Company leases its office at 6565 Americas Parkway NE, Suite 200, Albuquerque, New Mexico.

The Company owns a 70% interest in the Concessions through its ownership interest in Metales. See the description of the Concessions in Item 1, “Business”, above.

Amiko Kay has entered into the Joint Venture to process the Tailings and sell any Extracted Minerals from the Tailings. See the description of the Tailings in Item 1, “Business”, above.

ITEM 3. LEGAL PROCEEDINGS

We are not aware of any pending legal proceedings which involve the Company or any of our properties.

ITEM 4. MINE SAFETY DISCLOSURES

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Act”) and Item 104 of Regulation S-K require certain mine safety disclosures to be made by companies that operate mines regulated under the Federal Mine Safety and Health Act of 1977. However, the requirements of the Act and Item 104 of Regulation S-K do not apply to our mining activities, all of which are located and operated outside the United States. Therefore, the Company is not required to make such disclosures.

| 12 |

PART II

ITEM 5. MARKET FOR REGISTRANTS COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Since June 20, 2011, shares of our common stock have been quoted on the OTCBB under the symbol “LSTG”, following the change in name of the Company to “Lone Star Gold, Inc.” From October 27, 2010 to June 20, 2011, our shares of Common Stock were quoted on the OTCBB under the symbol “KYSR”. Our stock began trading on October 27, 2010 at $0.155 and the stock price did not change until the July 2011. Accordingly, there are no high and low bids for the Common Stock before the third quarter 2011.

The following table summarizes the high and low historical closing prices reported by the OTCBB Historical Data Service for the periods indicated. OTCBB quotations reflect inter-dealer prices, without retail mark-up, mark down or commissions, so those quotes may not represent actual transactions.

| High | Low | |||||||

| Third Quarter 2011 | $ | 1.40 | $ | 0.80 | ||||

| Fourth Quarter 2011 | $ | 1.21 | $ | 0.60 | ||||

| First Quarter 2012 (through March 16) | $ | 0.66 | $ | 0.28 | ||||

We had approximately 10 record holders of our common stock as of March 7, 2012, according to the books of our transfer agent. A number of shares are held in street name, so the Company believes that the number of beneficial owners is significantly higher.

Dividends.

There are no restrictions in our articles of incorporation or bylaws that restrict us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where, after giving effect to the distribution of the dividend:

| 1. | we would not be able to pay our debts as they become due in the usual course of business; or |

| 2. | our total assets would be less than the sum of our total liabilities, plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving the distribution. |

We have not declared any dividends. We do not plan to declare any dividends in the foreseeable future.

Equity Compensation Plans

Other than the shares of Common Stock to be issued to Mr. Ferris under his Employment Agreement, as described more fully in Item 6, “Executive Compensation” below, we have no equity compensation program, including no stock option plan, and none are planned for the foreseeable future.

Recent Sales of Unregistered Securities Not Previously Reported

On March 21, 2012, the Company completed a private placement of 625,000 shares of Common Stock to North American. The Company sold the shares of Common Stock at a price of $0.40 per share, resulting in total proceeds of approximately $250,000 to the Company. The sale of the shares to North American represents the fifth sale of Common Stock under the Investment Agreement.

A portion of the proceeds will be used to fund the exploration and development of the Concessions, according to a work plan established for the project, and to make the annual payments for the property and concession taxes associated with the La Candelaria project. The Company will also use the proceeds to commence payments in connection with the JV Agreement, such as shipping, trucking and on-site wash plant construction, and other expenses under the work plan established for the Tailings project. Finally, a portion of the proceeds will be used for general corporate expenses associated with the Company’s exploration and development activities.

The issuance of the shares of Common Stock to North American was not registered under the Securities Act of 1933. Instead, the sale was completed in reliance upon an exemption from registration pursuant to Regulation S promulgated under the Securities Act of 1933. North American has represented to the Company that it is not a “U.S. person” as defined in Regulation S, and that it is acquiring the securities issued by the Company for investment purposes only and not with a view towards distribution. The shares of Common Stock issued to North American will be “restricted securities” and any subsequent resale or transfer of those shares will have to be made pursuant to an exemption from or registration under the Securities Act of 1933, as amended.

Purchase of Equity Securities by Issuer in Fourth Quarter

None.

| 13 |

ITEM 6. SELECTED FINANCIAL DATA

N/A

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Results of Operations

We have not generated any revenue since our inception. For the years ended December 31, 2010 and December 31, 2011, we had the following expenses:

| For the year ended December 31, 2010 | For the year ended December 31, 2011 | Accumulated from November 26, 2007 to December 31, 2011 | ||||||||||

| General and administrative | $ | 62,241 | $ | 486,741 | $ | 621,246 | ||||||

| Exploration cost | - | 530,925 | 553,198 | |||||||||

| Management fees | - | 543,974 | 556,454 | |||||||||

| $ | 62,241 | $ | 1,561,640 | $ | 1,730,898 | |||||||

During the year ended December 31, 2010, we incurred $62,241 in general and administrative expenses. Our general and administrative fees were primarily for transfer agent and filing fees and legal, accounting and auditing fees.

For the year ended December 31, 2011, we incurred $486,741 in general and administrative expenses, $530,925 in exploration costs and $543,974 in management fees. Our general and administrative fees were primarily for legal costs and accounting and auditing fees. Management fees include cash compensation and the value of the equity compensation paid to Mr. Ferris. Exploration costs include direct costs associated with La Candelaria of $201,925 and the value of stock issued to Gonzalez of $303,000.

Liquidity and Capital Resources

The following is a summary of our balance sheet as of December 31, 2010 and December 31, 2011:

| December 31, 2010 | December 31, 2011 | |||||||

| Cash | $ | 9,977 | $ | 215,737 | ||||

| Current Liabilities | 67,636 | 74,375 | ||||||

| Working Capital | 233,533 | 143,600 | ||||||

| Stockholders’ Equity | $ | 233,533 | $ | 214,925 | ||||

As of December 31, 2010, we had a working capital balance as a result of notes receivable offset by accounts payable and accrued liabilities. As of December 31, 2011, our cash position has increased because of investments made by North American Gold Corp. (“North American”) under an Investment Agreement, which is described below. The Company reasonably anticipates earning revenues from the Tailings project by the second or third quarter of 2012.

On August 29, 2011, the Company and North American executed an Investment Agreement (the “Investment Agreement”). Under the Investment Agreement, North American agreed to invest up to $15,000,000 to purchase the Company’s Common Stock in increments of $100,000 or an integral multiple thereof, at the Company’s option at any time through August 31, 2013 (the “Open Period”). During the Open Period, the Company has the option to deliver a put notice (a “Put Notice”) to North American that states the number of shares of Common Stock the Company proposes to sell to North American (the “Put Shares”), and the price per share for those Put Shares (the “Share Price”). The Share Price is equal to 90% of the volume weighted average closing price of the Common Stock for the 20 days immediately preceding the date of the Put Notice. The closing for the sale of the Put Shares pursuant to a Put Notice shall take place no later than 10 Trading Days after the date of such Put Notice. A “Trading Day” is defined as a day in which the NASDAQ stock market or OTC Bulletin Board is open for business. North American has the right to refuse to close any requested sale of Put Shares because of negative market conditions affecting the Common Stock.

| 14 |

The Investment Agreement was amended to allow the Company to use the net proceeds from the sale of the Put Shares to fund the exploration and development of gold and silver mining concessions in the La Candelaria project and other projects approved in advance by the Company and North American. The Company and North American have agreed that the proceeds may be used to fund expenses incurred in connection with the Mine Tailings Project.

The sales of Put Shares will not be registered under the Securities Act of 1933, but will be issued under an exemption from the registration requirements of the Securities Act of 1933. Any Put Shares issued and sold to North American will be “restricted securities” and will be subject to applicable restrictions on resale.

As of the date of this filing, North American has purchased 1,966,148 Put Shares from the Company, resulting in gross proceeds to the Company (before any wire transfer or other fees) of $1,150,000. North American owns a total of 2,291,148 shares of Common Stock, or 2.6% of the issued and outstanding shares.

There are no assurances that we will be able to achieve further sales of our common stock or any other form of additional financing.

Going Concern

We have not attained profitable operations and are dependent upon obtaining financing to pursue any extensive exploration activities. For these reasons our auditors stated in their report that they have substantial doubt we will be able to continue as a going concern.

Accounting and Audit Plan

We intend to continue to have our outside consultant assist us in the preparation of our quarterly and annual financial statements and have these financial statements reviewed or audited by our independent auditor. Our outside consultant is expected to charge us approximately $5,000 to prepare our quarterly financial statements and approximately $10,000 to prepare our annual financial statements. In the next twelve months, we anticipate spending approximately $60,000 to pay for our accounting and audit requirements.

Off-balance sheet arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to stockholders.

Critical Accounting Policies

Our financial statements are impacted by the accounting policies used and the estimates and assumptions made by management during their preparation. A complete summary of these policies is included in Note 2 of the notes to our historical financial statements. We have identified below the accounting policies that are of particular importance in the presentation of our financial position, results of operations and cash flows and which require the application of significant judgment by management.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We do not use derivative financial instruments in our investment portfolio and have no foreign exchange contracts. Our financial instruments consist of cash and cash equivalents, trade accounts receivable and accounts payable.

| 15 |

ITEM 8. CONSOLIDATED FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

Lone Star Gold Inc.

(formerly known as Keyser Resources, Inc.)

(An Exploration Stage Company)

December 31, 2011

| Index | |

| Reports of Independent Registered Public Accounting Firm | F–2 |

| Consolidated Balance Sheets | F–4 |

| Consolidated Statements of Operations | F–5 |

| Consolidated Statements of Cash Flows | F–6 |

| Consolidated Statements of Stockholders’ Equity (Deficit) | F–7 |

| Notes to the Consolidated Financial Statements | F–8 |

| F-1 |

LBB & ASSOCIATES LTD., LLP

10260 Westheimer Road, Suite 310

Houston, TX 77042

Phone: (713) 800-4343 Fax: (713) 456-2408

Report of Independent Registered Public Accounting Firm

To the Board of Directors of

Lone Star Gold, Inc.

(formerly known as Keyser Resources, Inc.)

(An Exploration Stage Company)

Albuquerque, New Mexico

We have audited the accompanying consolidated balance sheets of Lone Star Gold, Inc. (the “Company”) as of December 31, 2011 and 2010, and the related consolidated statements of operations, stockholders' equity (deficit), and cash flows for the years then ended and for the period from November 26, 2007 (inception) through December 31, 2011. These consolidated financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits. We did not audit the statements of operations, stockholders’ deficit and cash flows for the period from November 26, 2007 (inception) to December 31, 2009, which totals reflected a deficit of $107,017 accumulated during the exploration stage. Those financial statements and cumulative totals were audited by other auditors whose report dated April 12, 2010, expressed an unqualified opinion on those statements and cumulative totals, and included an explanatory paragraph regarding the Company’s ability to continue as a going concern. Our opinion, insofar as it relates to amounts included for that period is based on the report of other independent auditors, mentioned above.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, based on our audits and the report of other auditors, the financial statements referred to above present fairly, in all material respects, the consolidated financial position of Lone Star Gold, Inc. as of December 31, 2011 and 2010, and the results of its operations and its cash flows for each of the years then ended and for the period from November 26, 2007 (inception) through December 31, 2011 in conformity with accounting principles generally accepted in the United States of America.

As discussed in Note 1 to the consolidated financial statements, the Company's absence of significant revenues, recurring losses from operations, and its need for additional financing in order to fund its projected loss in 2012 raise substantial doubt about its ability to continue as a going concern. The 2011 consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ LBB & Associates Ltd., LLP

LBB & Associates Ltd., LLP

Houston, Texas

March 22, 2012

| F-2 |

SEALE AND BEERS, CPAs

PCAOB & CPAB REGISTERED AUDITORS

www.sealebeers.com

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors

Keyser Resources, Inc

(An Exploration Stage Company)

We have audited the accompanying balance sheet of Keyser Resources, Inc. (An Exploration Stage Company) as of December 31, 2009, and the related statements of operations, stockholders’ equity (deficit) and cash flows for the years ended December 31, 2009 and since inception on November 26, 2007 through December 31, 2009. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conduct our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Keyser Resources, Inc. (An Exploration Stage Company) as of December 31, 2009, and the related statements of operations, stockholders’ equity (deficit) and cash flows for the years ended December 31, 2009 and since inception on November 26, 2007 through December 31, 2009, in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company has had a loss from operations of $93,034, an accumulated deficit of $107,017, a working capital deficit of $22,992 and has earned no revenues since inception, which raises substantial doubt about its ability to continue as a going concern. Management’s plans concerning these matters are also described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Seale and Beers, CPAs

Seale and Beers, CPAs

Las Vegas, Nevada

April 12, 2010

50 S. Jones Blvd. Suite 202 Las Vegas, NV 89107 Phone: (888)727-8251 Fax: (888)782-2351

| F-3 |

Lone Star Gold Inc.

(formerly known as Keyser Resources, Inc.)

(An Exploration Stage Company)

Consolidated Balance Sheets

| December 31, 2011 | December 31, 2010 | |||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash | $ | 215,737 | $ | 9,977 | ||||

| Prepaid expenses | 2,238 | - | ||||||

| Notes and interest receivable (related party) | - | 291,192 | ||||||

| Total current assets | 217,975 | 301,169 | ||||||

| Property and equipment, net | 46,325 | - | ||||||

| Mining assets | 25,000 | - | ||||||

| Total Assets | $ | 289,300 | $ | 301,169 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current Liabilities | ||||||||

| Accounts payable | $ | 21,767 | $ | 5,726 | ||||

| Accrued liabilities | 13,698 | 23,000 | ||||||

| Due to related party | 38,910 | 38,910 | ||||||

| Total current liabilities | 74,375 | 67,636 | ||||||

| Total Liabilities | 74,375 | 67,636 | ||||||

| Commitments | ||||||||

| Stockholders’ Equity | ||||||||

| Common stock, 150,000,000 shares authorized, $0.001 par value; 116,791,068 and 121,299,920 shares issued and outstanding as of December 31, 2011 and 2010, respectively | 116,791 | 121,300 | ||||||

| Additional paid-in capital | 1,812,532 | 280,299 | ||||||

| Deficit accumulated during the exploration stage | (1,697,717 | ) | (168,066 | ) | ||||

| Total Lone Star Gold, Inc. Stockholders’ Equity | 231,606 | 233,533 | ||||||

| Noncontrolling interest in subsidiary | (16,681 | ) | - | |||||

| Total Stockholders’ Equity | 214,925 | 233,533 | ||||||

| Total Liabilities and Stockholders’ Equity | $ | 289,300 | $ | 301,169 | ||||

(The Accompanying Notes are an Integral Part of These Financial Statements)

| F-4 |

Lone Star Gold Inc.

(formerly known as Keyser Resources, Inc.)

(An Exploration Stage Company)

Consolidated Statements of Operations

| For the Year Ended December 31, 2011 | For the Year Ended December 31, 2010 | Accumulated from November 26, 2007 (Date of Inception) to December 31, 2011 | ||||||||||

| Revenue | $ | – | $ | – | $ | – | ||||||

| Operating Expenses | ||||||||||||

| General and administrative | 486,741 | 62,241 | 621,246 | |||||||||

| Exploration costs | 530,925 | - | 553,198 | |||||||||

| Management fees | 543,974 | - | 556,454 | |||||||||

| Total Operating Expenses | (1,561,640 | ) | (62,241 | ) | (1,730,898 | ) | ||||||

| Other income | ||||||||||||

| Interest Income | 8,647 | 1,192 | 9,839 | |||||||||

| Gain on settlement of note receivable | 5,161 | - | 5,161 | |||||||||