Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Patriot Coal CORP | d322118d8k.htm |

Exhibit

99.1 |

1

Some of the following information contains forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934, as amended, and is intended to come within the safe-harbor

protection provided by those sections. Forward-Looking Statements

Certain statements in this presentation are forward-looking as defined in the Private

Securities Litigation

Reform

Act

of

1995.

These

statements

involve

certain

risks

and

uncertainties

that

may

be

beyond our control and may cause our actual future results to differ materially from

expectations. We do not undertake to update our forward-looking

statements. Factors that could affect our results include, but are not limited

to: U.S. and international financial, economic and political conditions; coal price

volatility and demand, particularly in higher margin products; geologic, equipment and operational

risks associated with mining; reductions of purchases or deferral of deliveries by major

customers; changes in general global economic conditions, including coal, power and

steel market conditions; availability and prices of competing energy resources for

electricity generation; changes in the interpretation, enforcement of application of

existing and potential laws and regulations affecting the production and use of our

products; the availability and costs of credit, surety bonds and letters of credit;

weather patterns and conditions affecting energy demand or disrupting supply; our ability to

identify and implement cost effective solutions for selenium water treatment; the passage of

new or expanded regulations that could limit our ability to mine, increase our mining

costs, or limit our customers’

ability to utilize coal as fuel for electricity generation; existing or new environmental

laws and regulations, including those related to selenium, and changes in the

interpretation, enforcement or application thereof; failure to comply with debt

covenants; the outcome of pending or future litigation; changes in the costs to

provide healthcare to eligible active employees and certain retirees under

postretirement benefit obligations; increases to contribution requirements to

multi-employer retiree healthcare and pension plans; our ability to attract and

retain qualified personnel; negotiation of labor contracts, labor availability and

relations; customer performance and credit risks; inflationary trends; downturns in

consumer and company spending; supplier and contract miner performance and the

availability and cost of key equipment and commodities; availability and costs of

transportation; the Company’s ability to replace coal reserves; the outcome of

commercial negotiations involving sales contracts or other transactions; our ability

to respond to changing customer preferences; and the effects of mergers, acquisitions

and divestitures. The Company undertakes no obligation (and expressly disclaims

any such obligation) to publicly update or revise any forward-looking statement,

whether as a result of new information, future events or otherwise. For additional

information concerning

factors

that

could

cause

actual

results

to

materially

differ

from

those

projected

herein,

please refer to the Company’s Form 10-K and Form 10-Q reports.

Statement on Forward-Looking Information |

2

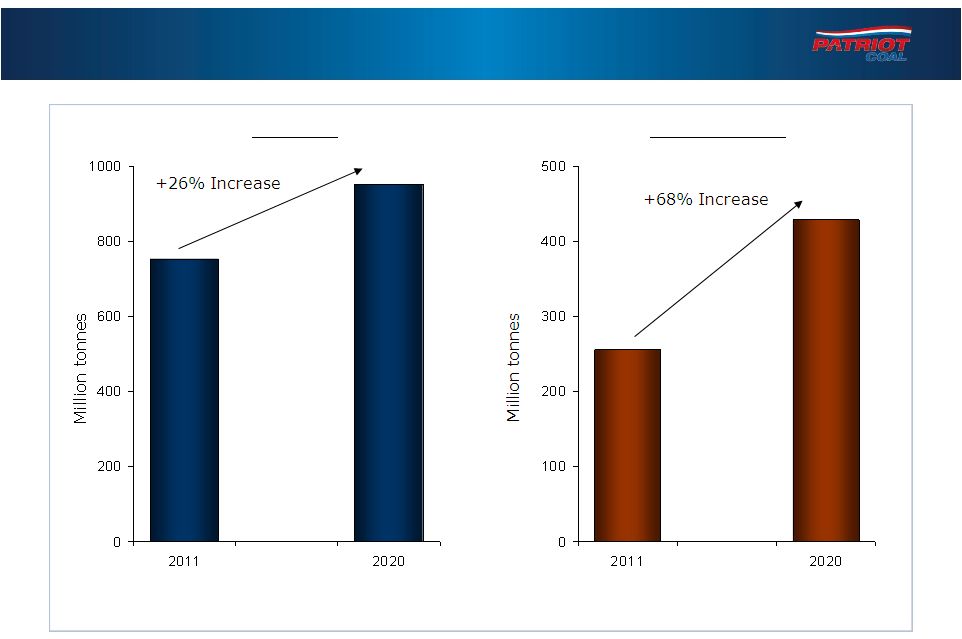

Long-Term Growth in Global Coal Markets |

Strong

Long-Term Global Seaborne Coal Demand Thermal

Metallurgical

Long-term sustainable seaborne demand, led by Asia

Source: McCloskey

3 |

4

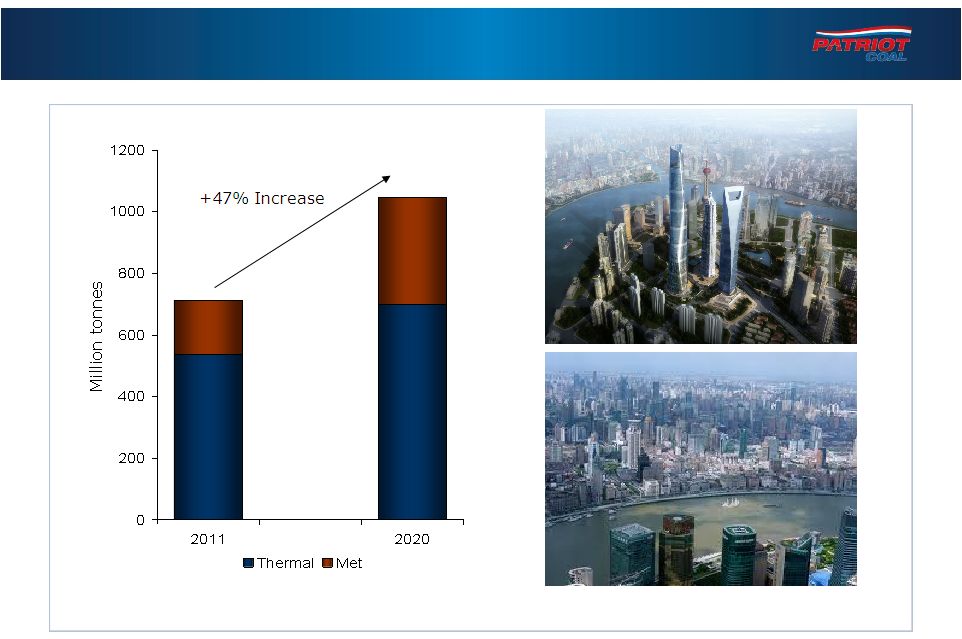

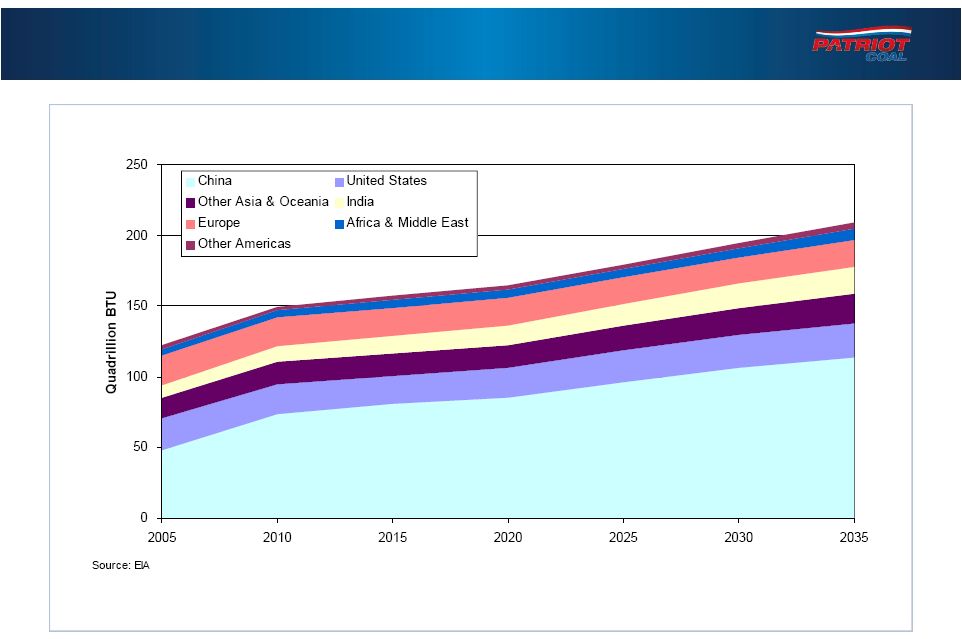

Drivers of Global Coal Demand

Global met & thermal coal demand driven by China & India

Asian Seaborne Demand |

World Thermal Coal

Consumption by Region 5

Global thermal coal consumption expected to steadily grow |

6

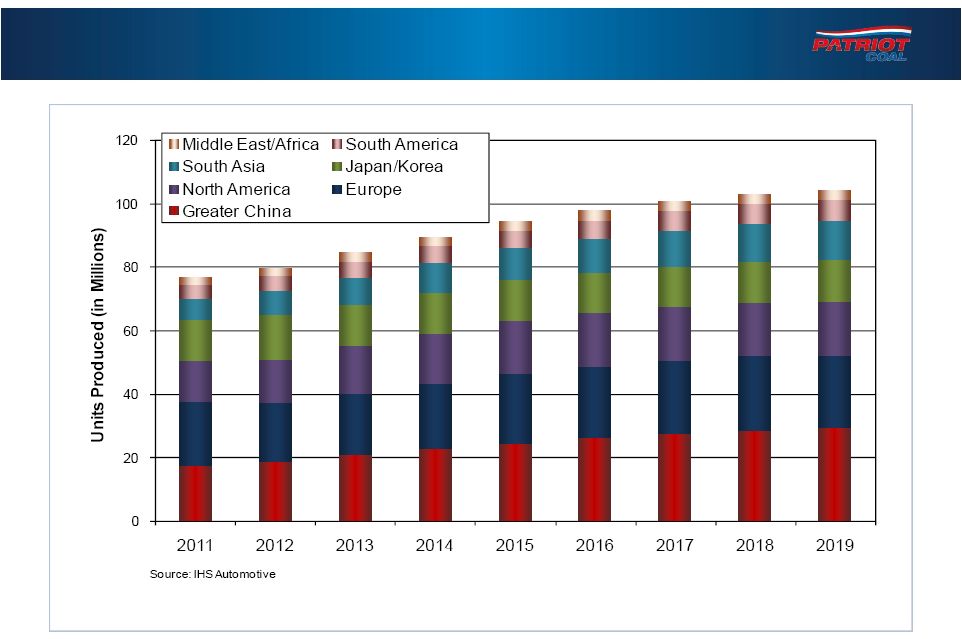

Increasing Global Vehicle Production

Global production expected to grow over 35% by 2019 |

7

Recovering North American Vehicle Production

Production expected to reach pre-recession levels in 2013 |

8

Current Global Coal Markets |

Metallurgical

Current Market Conditions

Current market weakness leading to reduced U.S. coal production

9

Thermal

“Perfect Storm”

in the U.S.

Low natural gas prices

Mild winter

Increased regulation

Industrial production not

yet fully recovered

U.S. exports to Europe

expected to be sustainable

U.S. production being idled

Strengthening U.S. demand

Weaker international demand

European sovereign debt

issues

Chinese growth rate

declining slightly

U.S. exports may soften, but

expected to remain at

historically high levels

Australian production

increasing after 2011 flooding

U.S. production being idled

Demand

Supply |

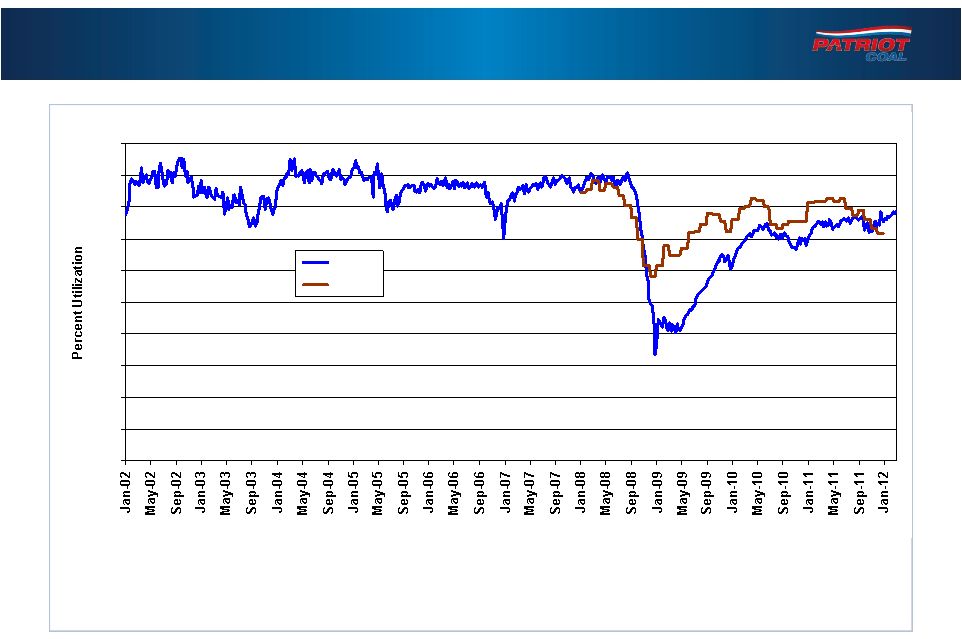

Domestic &

Global Steel Mill Utilization Both domestic & global steel mill utilization rates are

at 70-80% Global utilization has weakened in recent months

10

0

10

20

30

40

50

60

70

80

90

100

U.S.

Global

Updated:

03/03/12 |

11

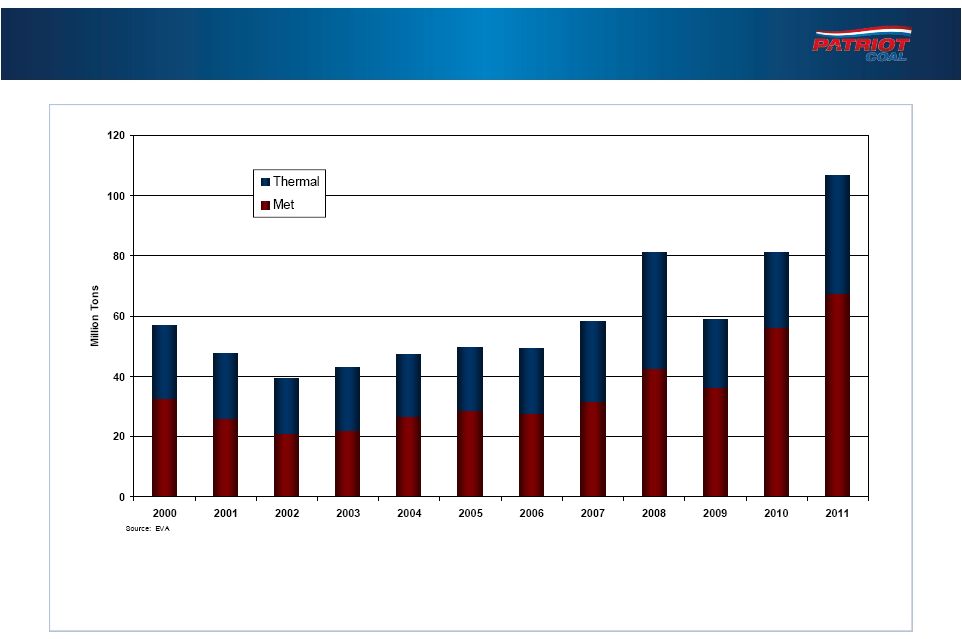

Increasing U.S. Total Coal Exports

U.S. coal exports of more than 100 million tons in 2011

International buyers looking for geographic diversity of supply |

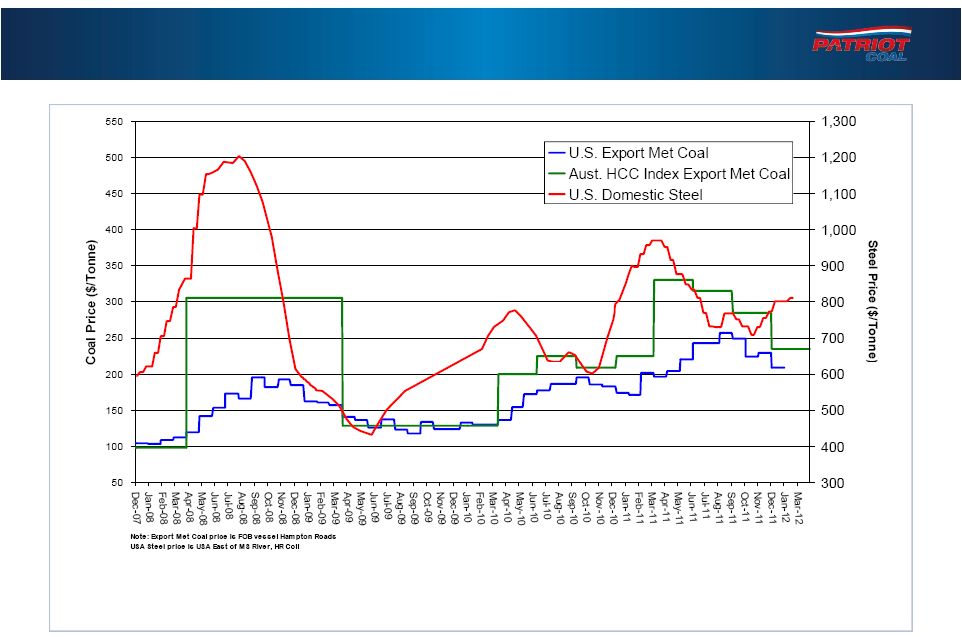

Export Coal &

Steel Prices Met coal pricing remains strong by historical standards

Historical re-basing to higher lows and higher highs

12 |

International

Thermal Coal Prices 13 |

14

Overview of Patriot |

Patriot’s

Strengths 15

Focused on evolving growth markets

–

Metallurgical coal production

–

Increasing exports

–

Modular mine portfolio to adjust to demand

Leverage to the market

–

Met Build-Out program

–

Legacy thermal contract roll-off

Culture

–

Experienced management team

–

Comprehensive safety program & environmental stewardship

–

Disciplined approach, focused on planning and execution

Future growth

–

Organic –

Strong and accessible reserve base, particularly high-quality met

–

M&A –

Bolt-on and transformational

Product & transportation flexibility |

16

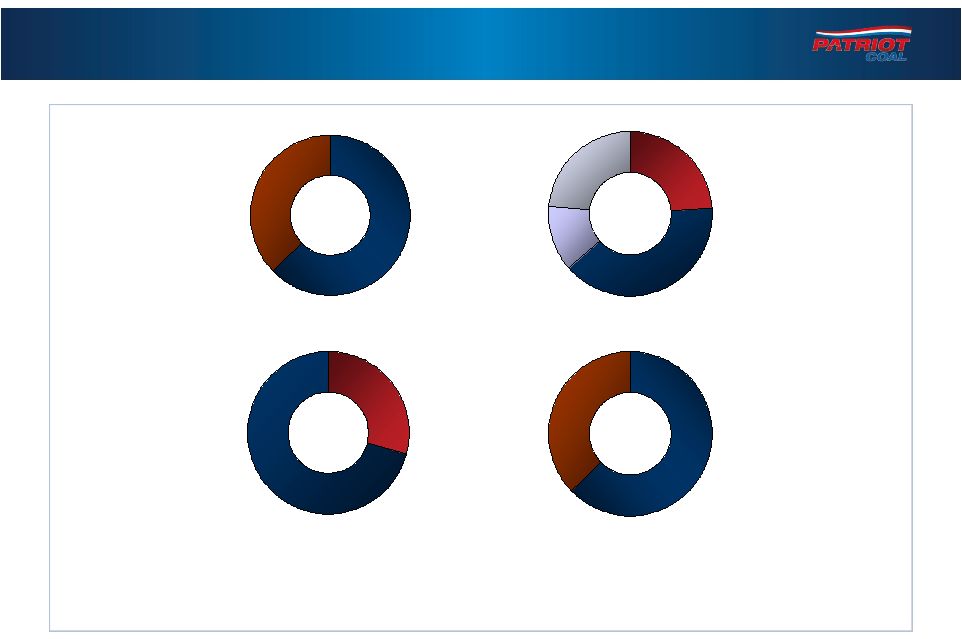

Product Diversification

Diverse locations, products & mining methods

Significant met & thermal coal exports

APP

ILB

CAPP

Met

CAPP

Thermal

NAPP

ILB

Export

Domestic

Surface

Reserves

1.9 Billion Tons

2011 Shipments

2011 Tons Sold

31.1 Million Tons

Mining Method

Underground |

17

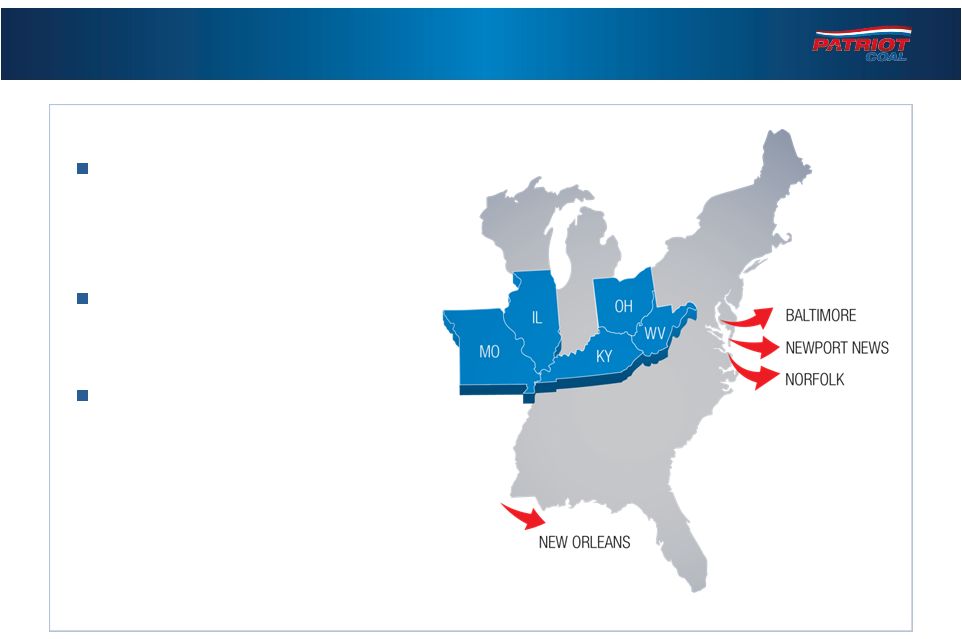

Advantage of Diversity

Multiple quality & transportation options

Multiple Basins

–

1 NAPP complex

–

9 CAPP complexes

–

3 ILB complexes

Multiple Coal Qualities

–

5 Met coal complexes

–

8 Thermal coal complexes

Transportation Optionality

–

Rail

–

Barge

–

East Coast & Gulf exports |

18

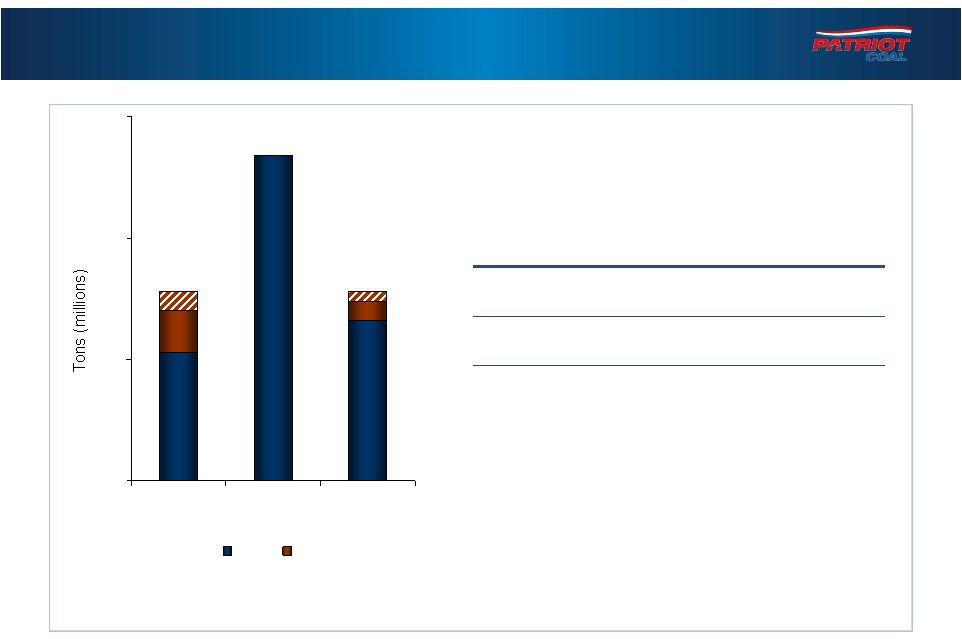

Limited volumes remain unpriced, although some customers

requesting deferrals

Priced Position in 2012

Priced

Business

Current

Market

Metallurgical

$144

TBD

Appalachia

Thermal

65

$55 –

$67

Illinois Basin

50

45 –

60

0

5

10

15

Metallurgical

Appalachia

Thermal

Illinois Basin

Priced

Unpriced |

19

Thermal production likely to decline from above level as year

progresses

Priced Position in 2013

Priced

Business

Current

Market

Metallurgical

NA

TBD

Appalachia

Thermal

$67

$60 –

$75

Illinois Basin

50

40 –

55

Includes the re-pricing of a legacy

contract expiring in 2012 |

20

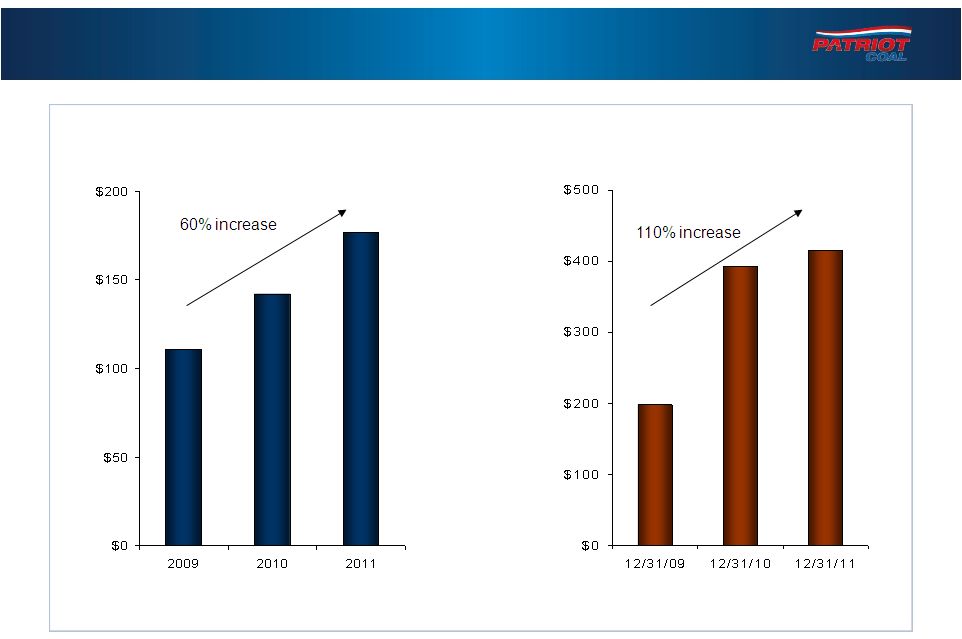

Financial Metrics

EBITDA

(in Millions)

Steady improvement in EBITDA and liquidity

Available Liquidity

(in Millions) |

21

How Patriot is Responding to Current Markets |

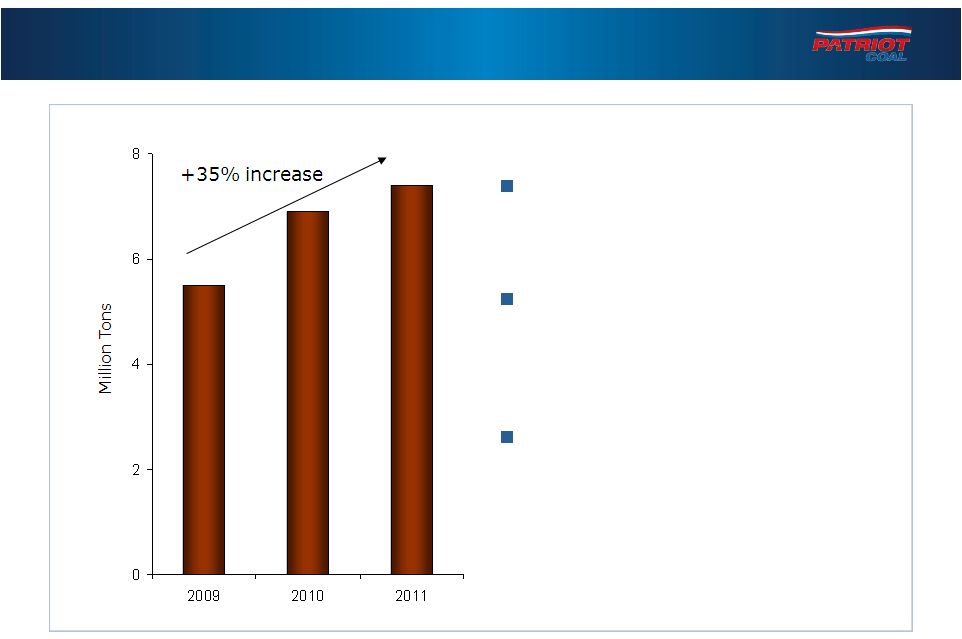

Increasing

Exports Expect double-digit exports in 2012

22 |

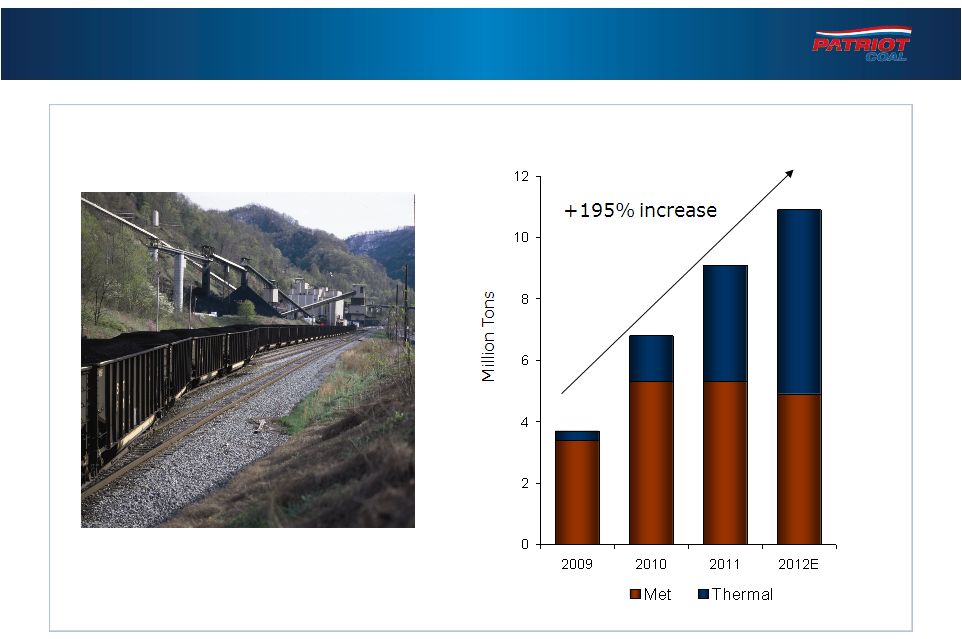

Met Build-Out

Program Multi-year plan to increase our

base of higher-margin

metallurgical coal products

Increase in metallurgical tons

sold, as well as met being a

higher percentage of our total

sales

Modular mine portfolio allowing

the versatility to dial our met

production up or down in a timely

manner in response to market

conditions

23 |

Recent Actions to

Match Production to Demand Metallurgical

–

Reducing production at Rocklick

and Wells complexes

–

Idling Gateway Eagle mine and one CM unit at Black Oak mine

–

Idling certain contractor mines

–

Gateway Eagle and Black Oak on “hot idle”

to quickly bring

production back on-line

Thermal

–

Idling Big Mountain complex, which produced 1.8 million tons

in 2011

–

“Sold out”

for 2012 deliveries of Appalachian thermal coal

24

Short-term inventory build and lower first half of 2012 shipments

|

25

Patriot’s Long-Term Strengths |

Patriot’s

Strengths 26

Focused on evolving growth markets

–

Metallurgical coal production

–

Increasing exports

–

Modular mine portfolio to adjust to demand

Leverage to the market

–

Met Build-Out program

–

Legacy thermal contract roll-off

Culture

–

Experienced management team

–

Comprehensive safety program & environmental stewardship

–

Disciplined approach, focused on planning and execution

Future growth

–

Organic –

Strong and accessible reserve base, particularly high-quality met

–

M&A –

Bolt-on and transformational

Product & transportation flexibility |

|

28

Reconciliation of EBITDA to Net Income (Loss)

($ in Millions)

2009

2010

2011

EBITDA

$110.7

$141.9

$176.7

Depreciation, Depletion & Amortization

(205.3)

(188.1)

(186.3)

Sales Contract Accretion, net

298.6

121.5

55.0

Asset Retirement Obligation Expense

(35.1)

(63.0)

(81.6)

Restructuring & Impairment Charge

(20.2)

(15.2)

(13.6)

Interest Expense & Other

(38.1)

(57.4)

(65.5)

Interest Income

16.6

12.8

0.2

Income Tax Provision

-

(0.5)

(0.4)

Net Income (Loss)

$127.2

$(48.0)

$(115.5) |