Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ONVIA INC | d323120d8k.htm |

|

TABLE

OF CONTENTS

Safe Harbor

Proxy Communication Statement

Investment Case for Turnaround Plan

Appendix: Business Summary

*

*

* |

| This

presentation may contain, in addition to historical information, forward-looking statements as defined in the Private Securities Litigation Reform Act

of 1995. Words such as "believe," "demonstrate,"

"expect," "estimate," "anticipate," "should" and "likely" and similar expressions identify forward-

looking statements. In addition, statements that are not historical should

also be considered forward-looking statements. Forward-looking statements

contained in this presentation may relate to, but are not limited to, statements

regarding Onvia’s future results of operations, the progress to be made by

Onvia’s

turnaround

plan,

the

future

financial

impact

of

Onvia’s

new

business

model,

future

options

for

Onvia

to

maximize

value

for

stockholders,

Onvia’s

future

product

offerings,

and

Onvia’s

ability

to

use

its

net

operating

losses

to

offset

future

taxable

net

income.

Such

forward-looking

statements

are

based on current expectations that involve a number of known and

unknown risks, uncertainties and other factors, which may cause

actual events to be

materially different from those expressed or implied by such forward-looking

statements. The following factors, among others, could cause actual

results to differ materially from those described in the forward-looking

statements: Onvia's "targeted accounts" strategy may fail to increase contract

value of new customers; identifying partners to distribute Onvia's content may be

slower than expected; client adoption of Onvia's enterprise solutions may be

slower than expected; Onvia's market driven product development process may fail to improve sales penetration and client retention rates; and

Onvia's technology may fail to handle the increased demands on its infrastructure

caused by increasing network traffic and the volume of aggregated

data.

Additional

information

on

factors

that

may

impact

these

forward-looking

statements

can

be

found

in

the

"Business,"

"Management's

Discussion

and Analysis of Financial Condition and Results of Operations" and "Risk

Factors" sections, as applicable, in Onvia's Annual Report on Form 10-K for

the year December 31, 2010 and Quarterly Report on Form 10-Q for the quarter

ended September 30, 2011. Although Onvia believes that the

expectations reflected in the forward-looking statements are reasonable, you should not rely upon forward-looking

statements as predictions of future events.

Onvia cannot guarantee that future results, levels of activity,

performance or events and circumstances

reflected in the forward-looking statement will be achieved or occur.

The

information

contained

in

this

presentation

is

as

of

the

date

indicated.

Onvia

assumes

no

obligation

(and

expressly

disclaims

any

such

obligation)

to

update

any

forward-looking

statements

contained

in

this

presentation

as

a

result

of

new

information,

future

events

or

developments,

or

otherwise.

SAFE HARBOR

3

*

* |

| PROXY

COMMUNICATIONS STATEMENT This presentation may be deemed to be solicitation

material in respect of the solicitation of proxies from stockholders in

connection with the 2012 annual meeting of stockholders. Onvia, Inc.

(“Onvia”) and its directors and certain executive officers are deemed

participants

in

the

solicitation

of

proxies

from

stockholders

in

connection

with

the

2012

Annual Meeting of Stockholders (the “2012 Annual Meeting”). Onvia plans

to file a preliminary proxy statement with the Securities and Exchange

Commission (the “SEC”) relating to the 2012 Annual Meeting.

Information regarding the interests of such participants will be included in

the Preliminary Proxy Statement. WE URGE INVESTORS TO READ THE PRELIMINARY

PROXY STATEMENT (INCLUDING ANY SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT

DOCUMENTS THAT ONVIA WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION.

Stockholders

will

be

able

to

obtain,

free

of

charge,

copies

of

the

Preliminary

Proxy

Statement

and

any

other

documents

filed

by

Onvia

with

the

SEC

in

connection with the 2012 Annual Meeting at the SEC’s website at

http://www.sec.gov and Onvia’s website at http://www.onvia.com.

*

* |

INVESTMENT CASE FOR TURNAROUND PLAN

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

* |

KEY

POINTS Developing a high value added, proprietary database

Significant progress made against turnaround plan, operating risks mitigated

Continual value creation for clients and stockholders

Risks are manageable

Execution of turnaround plan will maximize stockholder value

Onvia Board and stockholder interests are aligned

*

*

* |

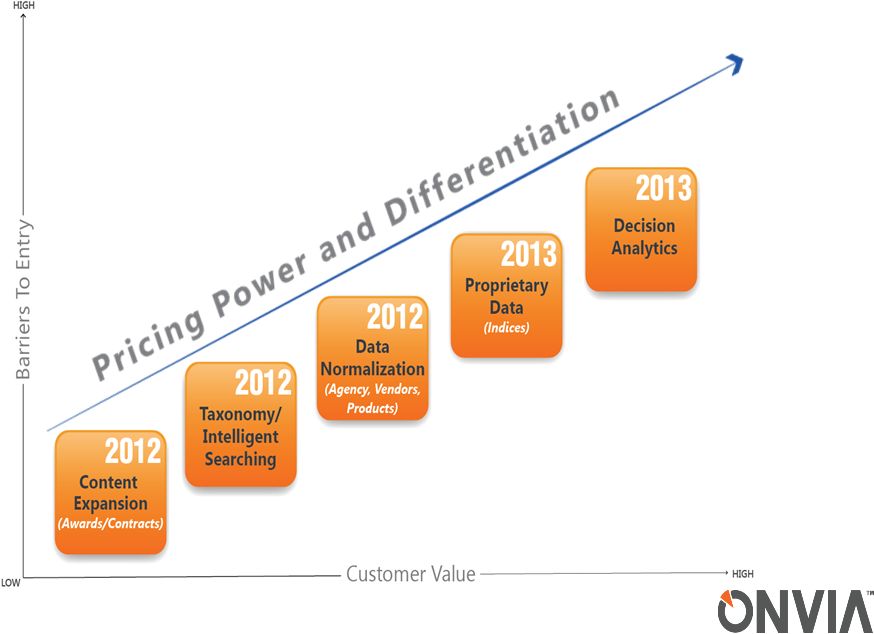

DEVELOPING A HIGH VALUE ADDED PROPRIETARY

DATABASE

•

Database and decision

analytics company

•

Proprietary content

•

Significant barriers to

entry

•

“Must have”

solutions

•

Pricing power based on

value delivered

•

Strong customer loyalty/

retention

•

Best in class consultative

selling organization

•

Exceptional domain

knowledge

•

Profitable, sustainable growth

•

Highly predictable financial

performance

•

Strong operating leverage

•

Potential for 30%

EBITDA margins

•

95% of EBITDA

converts to net income

•

Generates free cash flow

•

Significant investment

in infrastructure in

2008-2010

•

No federal income taxes

•

Compelling options to

maximize stockholder value in

the next few years:

•

Sale: go private with

strategic or financial

buyer

•

Sale: public buyer

•

Stay public: build scale

with acquisitions and

organic growth

* |

SIGNIFICANT PROGRESS MADE, OPERATING

RISKS MITIGATED

Onvia Attributes

January 2011

March 2012

Culture

Insular

Customer-Centric

Target Market

Poorly Defined

Low Lifetime Value

New

client

ACVC

-

$3,900

Targeted Accounts

High Lifetime Value

New

Client

ACVC

–

nearly

doubled

to

$6,800

Business Model

Transactional

Growth without Profit

Solution-Based

Monetize Added Value

Sales Process

Lack of Repeatable Process

SMB is Disciplined and Effective

Imposing Same Process on Enterprise

Database Platform

Difficult to Use

Onvia 5 Launched 2/12

Database Strategy

No Value-Add

Data Not Normalized

Low Barrier to Entry

Adding Enhanced, Differentiated Content

Data Normalization Initiated

Increasing Barriers

Value Proposition

Sales Leads Only

Commodity Vendor

Product Roadmap Expands Client Value

Becoming a High Value Business Partner

Financial Results

EBITDA -

$1.8MM

Net Loss –

($805k)

EBTIDA -

$3.8MM

Net Income –

$1.6MM

8 |

CONTINUAL VALUE CREATION FOR CLIENTS

AND STOCKHOLDERS

9

* |

RISKS

ARE MANAGEABLE Execution Risk

Magnitude

Mitigation Strategy

Content Expansion

Low

Core Competency

Taxonomy

Low

Hired Skillset in 2011

Data Normalization

Medium

Using Third Party Tools

Develop Decision Analytics

Medium

Content Capture 2012

Third Party Applications

Sell Analytics

Low

Market Validation Complete

Solution Selling Successful in H2 2011

Delay in Execution of

Strategy

Medium

Leverage Third Party Tools

**

** |

EXECUTION OF TURNAROUND PLAN WILL

MAXIMIZE STOCKHOLDER VALUE

Moving to a Business Model with Higher Stockholder Value

—

Higher valuations for Database vs. Lead Generation companies

—

Scalable business model with significant operating leverage

Value Creation at Each Stage of Turnaround Plan

—

Continued increases in EBITDA, Cash and Net Income in each year of

turnaround

Leverage Significant Technology Investment from 2008-2010 with Right

Strategy, Leadership, Organization and Culture

* |

EXECUTION OF TURNAROUND PLAN WILL

MAXIMIZE STOCKHOLDER VALUE

Market Validation for Product Roadmap

—

Doubled ACVC in 2011

Management Team Has Proven It Can Execute Successfully in 18 Months

—

Defined Strategy and Product Roadmap

—

Aligned Organization to Execute Strategy

—

Institutionalized Customer-Centric Culture

—

Redefined Market

—

Moved from Transactional to Solutions Selling

—

Executed Phase One of Roadmap (Onvia 5)

—

Began to Normalize Data (Public Sector Agencies)

Board of Directors In Alignment with Stockholders

* |

ONVIA

BOARD AND STOCKHOLDER INTERESTS ARE ALIGNED

Our Board, consistent with its fiduciary duties, remains receptive to

any option that would maximize value for ALL our stockholders but

believes

that

any

sale

of

Onvia

now

would

likely

be

a

“fire

sale”

that

would deprive our stockholders of the opportunity to share in the

future growth and profitability of Onvia

* |

BUSINESS SUMMARY

*

*

*

*

*

*

*

* |

TABLE

OF CONTENTS

Business Overview

Products

Financial Results

Tax Benefit Preservation Plan

Board of Directors

Corporate Governance

*

* |

$23 million revenue provider of solutions that connects businesses to

government agency buyers, primarily within the highly decentralized state and

local government marketplace

Focused on a very targeted market of companies with a strategic,

long-term

interest in the public sector

Strong business intelligence for actionable sales and marketing activities,

expanding into data and analytics for enterprise-wide strategic planning

Solutions are organized around targeted industries

—

Architecture, Engineering, Construction

—

IT Telecom

—

Operations and Transportation

Business Information Services

ONVIA OVERVIEW |

Onvia

Database Annual subscription

Categorized 89,000 government agencies, 275,000

company profiles, & 700,000 government personnel

Applications within the Onvia Database

Project Center

Included in core database subscription

Identify and qualify projects for specific goods and

services

Refine target markets and identify new

markets/buyers

Identify and monitor potential competitors

Evaluate awards for pricing information

CURRENT PRODUCTS

17 |

Applications within the Onvia Database (cont)

Agency Center

Included in core database subscription

Provides insight into buying patterns, projects and

competition at the government agency level

Spending Forecast Center

Annual subscription (additional to base price)

Database of capital improvement plans, budget

documents

Used for strategic planning, such as demand

forecasting, resource allocation

CURRENT PRODUCTS

18 |

Onvia

Guide Annual subscription

Daily sales leads from “real time”

market events

Custom Management Reports

Target upcoming contract renewals, identify

agency buyers, and inform the proposal

development process

Term contracts, contact lists, winning proposals

CURRENT PRODUCTS (CONT)

19 |

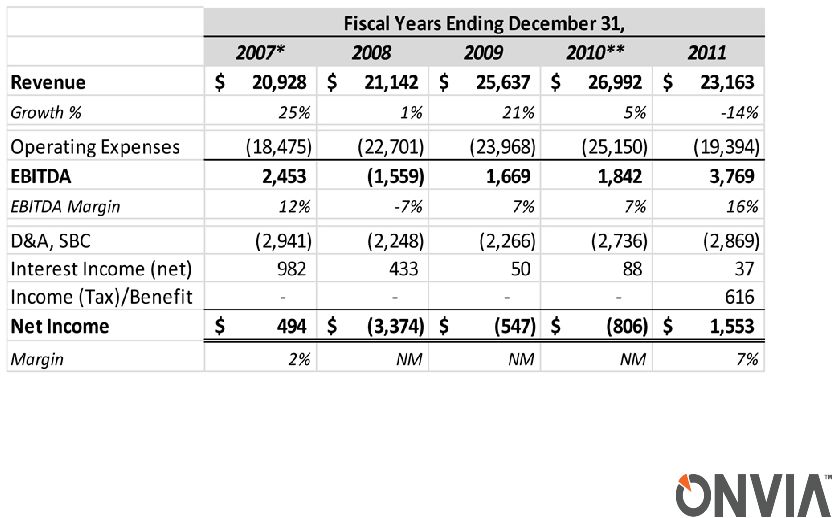

2011

RESULTS HIGHLIGHTS Revenue: Decreased 14% to $23.2MM

Annual Contract Value (ACV): Decreased 16% to $18.5MM

Gross margin: Stable at 85%

Adjusted EBITDA: Increased 105% to $3.8MM vs. adjusted EBITDA

of $1.8MM

Net Income: Increased to $1.6MM vs. net loss of ($806k) in 2010

Cash: $11.5MM or $1.36 per share

Year ended December 31, 2011 vs. 2010

20 |

21

INCOME STATEMENTS

(IN THOUSANDS)

*2007 results include $2.7MM gain on impaired office lease

**2010 results include $967k loss on impaired capitalized software costs

|

REVENUES

Growth Rates are Down but Improving Sequentially

0.9% |

ADJUSTED EBITDA

Record Adjusted EBITDA in 2011 despite declining revenues

|

ANNUAL

CONTRACT VALUE PER CLIENT We are acquiring and retaining our best clients

|

25

BALANCE SHEETS

(IN THOUSANDS)

Assets

2009A

2010A

2011A

Cash and Equivalents

14,279

$

10,883

$

11,527

$

Current Assets

2,974

2,765

2,355

Fixed Assets

1,226

1,419

1,275

Internal Use Software

6,615

6,587

6,175

Total Assets

25,094

$

21,654

$

21,332

$

Liabilities

Current Liabilities

2,859

$

2,164

$

1,461

$

Unearned Revenue

11,545

10,010

8,488

Deferred Rent

920

832

714

Total Liabilities

15,324

13,005

10,663

Stockholders Equity

9,770

8,649

10,669

Total Liab and SE

25,094

$

21,654

$

21,332

$

As of December 31, |

26

PRESERVATION OF NOLS IS IN BEST

INTERESTS OF ALL STOCKHOLDERS

Company has $73MM in net operating losses (“NOLs”) to offset future

taxable net income

—

NOLS expire beginning 2021 through 2031 –

a long-term asset

IRS rules limit the use of NOLs if there is an ownership change (greater than

50% increase involving 5% shareholders) over a three-year rolling

period. This is different than a change-in-control for other

legal purposes. Tax Benefit Preservation Plan enacted in March 2011 to

protect this long-term, significant asset from being impaired due to

such ownership changes Board of Directors retains sole discretion to exempt

any stockholder from the penalties imposed by the Rights Plan

—

All new 5% positions and >1% changes for existing 5%

shareholders |

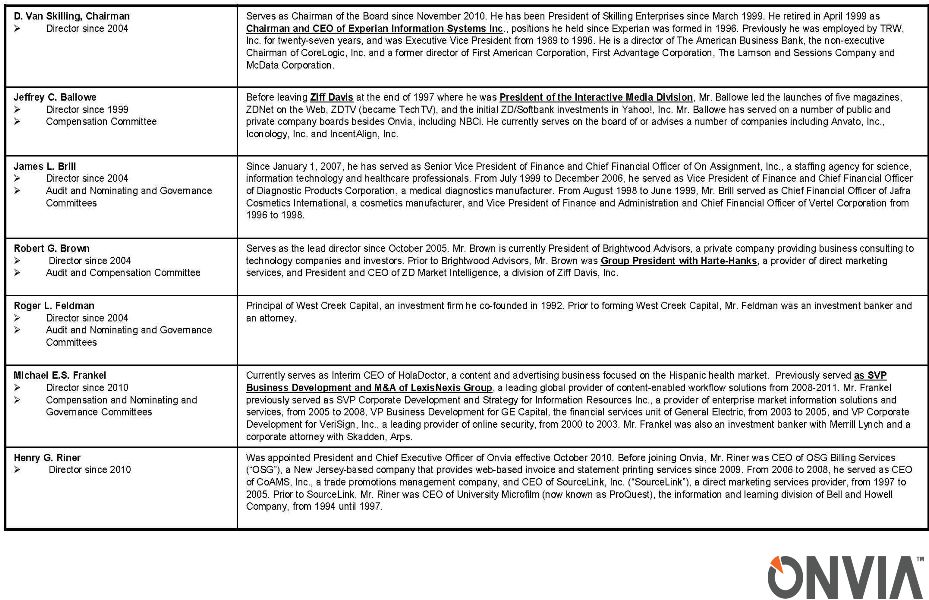

BOARD

OF DIRECTORS Insiders own ~8% of the Company (more with stock options)

—

Directors have been buying stock in the market

Board is paid primarily in stock options (total cash compensation $20-$30k

annually depending on responsibility).

—

Focus is realizing value not collecting fees

Independent Board with significant, relevant experience

—

Two Directors recommended by large stockholders

—

Former senior executives at major information companies (Lexis,

Experian, Harte Hanks, Ziff Davis) |

28

BOARD OF DIRECTORS |

CORPORATE GOVERNANCE

Six of seven current directors are independent

Separate Chairman and CEO positions with independent Chairman

Audit, Compensation, Governance and Nominating Committees comprised

solely of independent directors and meet regularly in executive sessions

without management

No related-party transactions

* |

| Hank

Riner,

President

&

CEO

Cameron

Way,

Chief

Financial

Officer

CONTACTS

Onvia Headquarters

509 Olive Way, Suite 400

Seattle, WA 98101

Tel 206.282.5170 •

Fax 206.373.8961

www.Onvia.com

30 |

Adjusted

EBITDA:

Adjusted

EBITDA

is

not

a

financial

measure

calculated

and

presented

in

accordance with U.S. generally accepted accounting principles (“GAAP”)

and should not be considered as an alternative to net income, operating

income or any other financial measures so calculated and presented, nor as

an alternative to cash flow from operating activities as a measure of

the

company’s

liquidity.

Onvia

defines

Adjusted

EBITDA

as

net

income

before

interest

expense

and

other non-cash financing costs; taxes; depreciation; amortization; and

non-cash stock-based compensation. Other companies (including

the company’s competitors) may define adjusted EBITDA

differently. The company presents Adjusted EBITDA because it believes Adjusted EBITDA

to be an important supplemental measure of performance that is commonly used by

securities analysts, investors and other interested parties in the

evaluation of companies in similar industries and size. Management also uses

this information internally for forecasting and budgeting. It may not

be indicative of the historical operating results of Onvia nor is it intended to be

predictive of potential future results. Investors should not consider

Adjusted EBITDA in isolation or as a substitute for analysis of results as

reported under GAAP. GLOSSARY

31 |

| Annual

Contract

Value

(ACV):

ACV

represents

the

annualized

aggregate

revenue

value

of

all

subscription contracts as of the end of the quarter.

ACV

is

driven

by

Annual

Contract

Value

per

Client

(ACVC)

and

the

growth

in

the

number

of

clients. Most of the company’s revenues are generated from subscription

contracts, which are typically prepaid and have a minimum term of one year,

with revenues recognized ratably over the term of the subscription.

The company also receives revenues from multi-year content reseller licenses,

management reports, document download services, and list rental services,

which are not included in the calculation of ACV.

ACV is not a financial measure calculated and presented in accordance with U.S.

generally accepted accounting principles (“GAAP”) and should not

be considered as an alternative to revenue or any other financial measures

so calculated. Management uses this information as a basis for planning and

forecasting core business activity for future periods and believes it is useful

in understanding the results of its operations.

GLOSSARY

32

* |

END

PRESENTATION *

*

*

*

*

*

*

* |