Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Matador Resources Co | d323354d8k.htm |

Investor

Presentation March 2012

Exhibit 99.1 |

1

Forward-Looking Statements

This

presentation

and

statements

made

by

representatives

of

Matador

Resources

Company

(“Matador”

or

the

“Company”)

during

the

course

of

this

presentation

include

“forward-looking

statements”

within

the

meaning

of

Section

27A

of

the

Securities

Act

of

1933,

as

amended,

and

Section

21E

of

the

Securities

Exchange

Act

of

1934,

as

amended.

“Forward-looking

statements”

are

statements

related

to

future,

not

past,

events.

Forward-looking

statements

are

based

on

current

expectations

and

include

any

statement

that

does

not

directly

relate

to

a

current

or

historical

fact.

In

this

context,

forward-looking

statements

often

address

expected

future

business

and

financial

performance,

and

often

contain

words

such

as

“could,”

“believe,”

“would,”

“anticipate,”

“intend,”

“estimate,”

“expect,”

“may,”

“should,”

“continue,”

“plan,”

“predict,”

“potential,”

“project”

and

similar

expressions

that

are

intended

to

identify

forward-looking

statements,

although

not

all

forward-looking

statements

contain

such

identifying

words.

Actual

results

and

future

events

could

differ

materially

from

those

anticipated

in

such

statements.

These

forward-looking

statements

involve

certain

risks

and

uncertainties

and

ultimately

may

not

prove

to

be

accurate,

including,

but

not

limited

to,

the

following

risks

related

to

our

financial

and

operational

performance:

general

economic

conditions;

our

ability

to

execute

our

business

plan,

including

the

success

of

our

drilling

program;

changes

in

oil,

natural

gas

and

natural

gas

liquids

prices

and

the

demand

for

oil,

natural

gas

and

natural

gas

liquids;

our

ability

to

replace

reserves

and

efficiently

develop

our

current

reserves;

our

costs

of

operations,

delays

and

other

difficulties

related

to

producing

oil,

natural

gas

and

natural

gas

liquids;

our

ability

to

make

acquisitions

on

economically

acceptable

terms;

availability

of

sufficient

capital

to

execute

our

business

plan,

including

from

our

future

cash

flows,

increases

in

our

borrowing

base

and

otherwise;

weather

and

environmental

conditions;

and

other

important

factors

which

could

cause

actual

results

to

differ

materially

from

those

anticipated

or

implied

in

the

forward-looking

statements.

For

further

discussions

of

risks

and

uncertainties,

you

should

refer

to

Matador’s

SEC

filings,

including

the

“Risk

Factors”

section

of

Matador’s

Prospectus

dated

February

1,

2012.

Matador

undertakes

no

obligation

and

does

not

intend

to

update

these

forward-looking

statements

to

reflect

events

or

circumstances

occurring

after

the

date

of

this

presentation,

except

as

required

by

law.

You

are

cautioned

not

to

place

undue

reliance

on

these

forward-looking

statements,

which

speak

only

as

of

the

date

of

this

presentation.

All

forward-looking

statements

are

qualified

in

their

entirety

by

this

cautionary

statement. |

2

Company Overview

Completed IPO of 14,883,334 shares (12,209,167 primary) including overallotment at

$12.00/share in March 2012 Exchange: Ticker

NYSE: MTDR

Shares Outstanding

55.27 million common shares

Share Price as of March 20, 2012

$11.84/share

Market Capitalization as of March 20, 2012

$654.4 million

2012 Guidance Summary

2012 Estimated Capital Spending

$313 million

2012 Estimated Total Oil Production

1.4 to 1.5 million barrels

2012 Estimated Exit Rate for Oil Production

5,000 to 5,500 barrels per day

2012 Estimated Total Natural Gas Production

12.5 to 13.5 billion cubic feet |

Founded by Joe Foran in 1983

Foran Oil funded with $270,000 in

contributed capital from 17 friends and

family members

Rolled into Matador Petroleum Corporation

in 1988

Grown primarily through acquire and exploit

strategy

Delivered 21% average annual rate of

return over 15 years

Sold

to

Tom

Brown,

Inc.

(1)

in

June

2003

for

an enterprise value of $388 million in an all-

cash transaction

Foran Oil & Matador Petroleum

3

Matador History

Matador Resources Company

Founded by Joe Foran in 2003

Attracted start-up capital from long-time

shareholders; diverse and unique shareholder

group including over 400 friends and neighbors

Proven management, technical team and

Board of Directors

Grown entirely through drill bit, with focus on

unconventional reservoir plays

Strong growth since 2008

Daily

production

has

increased

over

4x

(2)

Adjusted

EBITDA

(3)

has

more

than

doubled

(2)

Proved

reserves

have

increased

9x

(4)

Predecessor Entities

(1)

Tom Brown purchased by Encana in 2004

(2) Year ended December 31, 2011 compared to year ended December 31,

2008 (3)

Adjusted

EBITDA

is

a

non-GAAP

financial

measure.

For

a

definition

of

Adjusted

EBITDA

and

a

reconciliation

of

Adjusted

EBITDA

to

our

net

income

(loss)

and

net

cash

provided

by

operating

activities,

see

slide

28

(4) At December 31, 2011 as compared to at December 31, 2008

Matador Today |

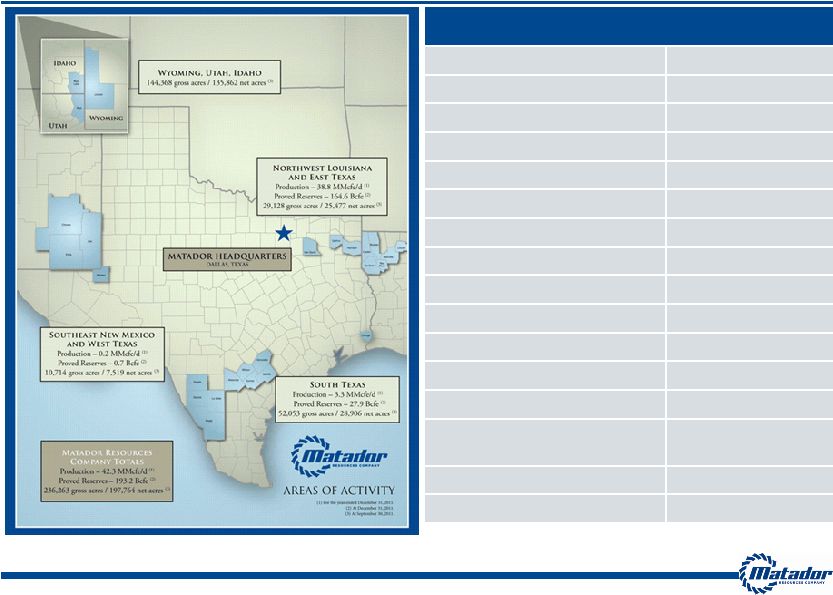

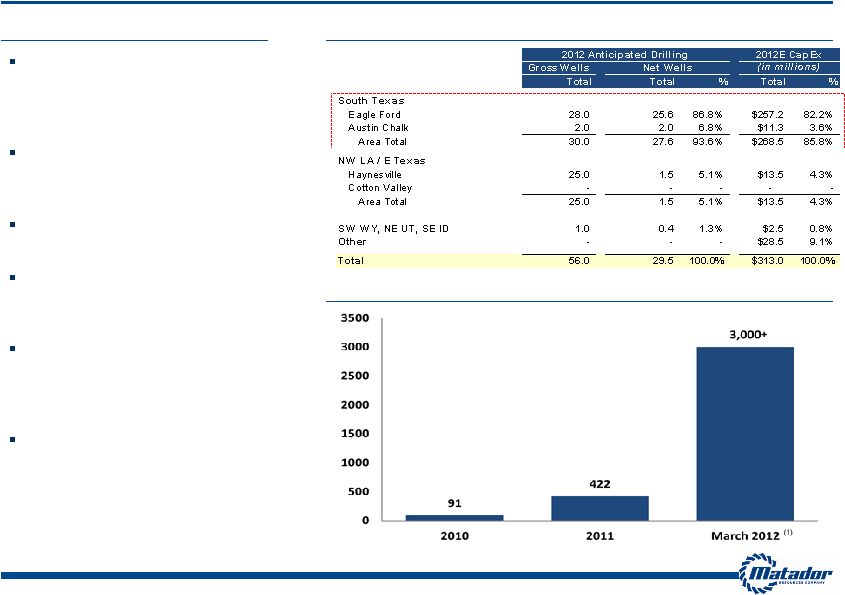

4

Daily Production

(1)

55 MMcfe/d

% Oil

33%

Proved Reserves @ 12/31/11

193.2 Bcfe

% Proved Developed

33.7%

% Oil

12% (and growing)

2012E CapEx

$313 million

% Eagle Ford

84%

% Oil and Liquids

94%

2012E Anticipated Drilling

29.5 net wells

Eagle Ford / Austin Chalk

27.6 net wells

Haynesville

1.5 net wells

Gross Acreage

(2)

236,263 acres

Net Acreage

(2)

197,764 acres

Identified Drilling

Locations

(2)

818 gross / 313 net

Eagle Ford / Austin Chalk

(2)

213 gross / 173 net

Haynesville / Cotton Valley

(2)

605 gross / 140 net

(1)

Average daily production from March 1 to March 15, 2012

(2)

As of September 30, 2011

Matador Resources Snapshot |

5

Investment Highlights

Strong Growth Profile with Increasing Focus on Oil / Liquids

Oil

production

up

almost

five-fold

in

2011

and

projected

to

increase

nearly

10x

in

2012

94%

(1)

of

2012E

capital

expenditure

program

focused

on

oil

/

liquids

exploration

and

development

High

Quality

Asset

Base

in

Attractive

Areas

Eagle

Ford

provides

immediate

oil-weighted

value

and

upside

Other

key

assets

provide

long-term

option

value

on

natural

gas,

with

Haynesville,

Bossier

and

Cotton

Valley

assets

all

essentially

HBP

Significant Multi-year Drilling Inventory

173

net

drilling

locations

across

28,900

net

acres

in

Eagle

Ford

(157)

and

Austin

Chalk

(16)

(2)

140

net

drilling

locations

across

25,500

net

acres

in

Haynesville

(104)

and

Cotton

Valley

(36)

(2)

Strong

Financial

Position

and

Long-Term

Institutional,

Industry

and

Individual

Shareholders

Proven

Management,

Technical

Team

and

Active

Board

of

Directors

Management

averaging

over

25

years

of

industry

experience

Board

with

extensive

industry

experience

and

expertise

as

well

as

significant

company

ownership

Strong

record

of

stewardship

for

over

28

years

Low

Cost

Operations

LOE

for

year

ended

December

31,

2011

was

$0.47

per

Mcfe,

a

23%

reduction

since

year

end

2010

Active

Exploration

Effort

Using

Science

and

Technology

Ongoing

pipeline

of

new

oil

and

natural

gas

opportunities,

with

strong

emphasis

on

science

and

technology

to

create

value

(1)

Calculated as percent of anticipated CapEx focused on oil weighted Eagle Ford and

Austin Chalk drilling and acreage and includes $20 million to acquire oil

prospective acreage in New Mexico and West Texas (2)

As of September 30, 2011 |

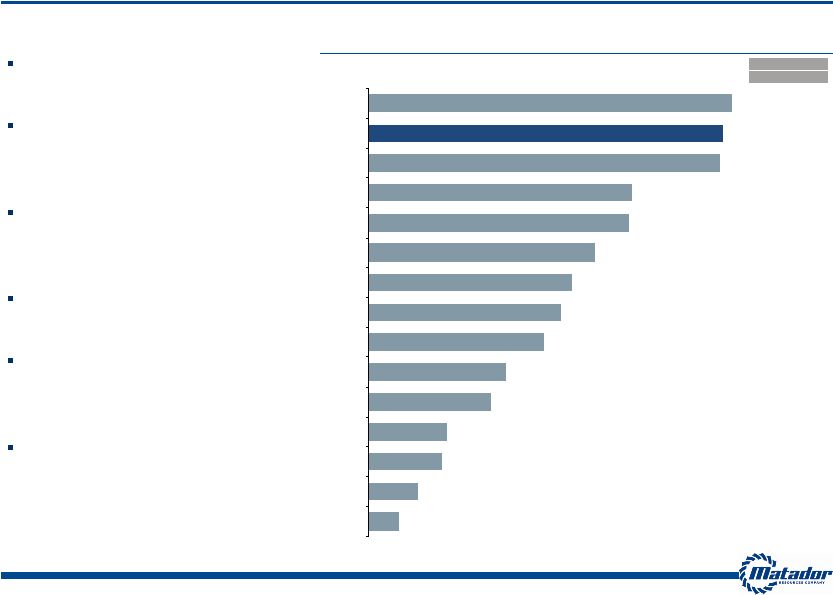

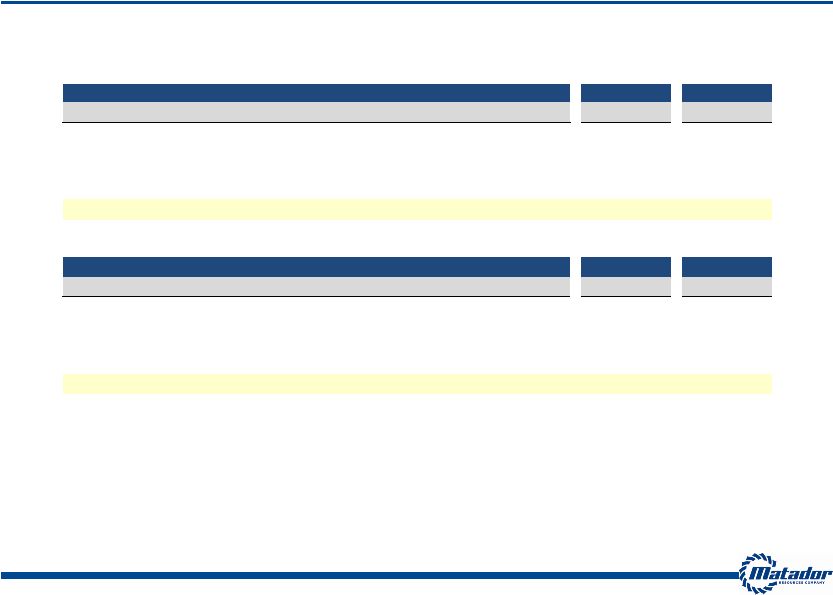

Leverage to Eagle Ford (Net Eagle Ford Acres / EV)

(Net Acres / $mm)

6

Leading Eagle Ford Exposure

Matador offers significant leverage

and focus to the Eagle Ford

Approximately 85% of Eagle Ford

acreage is in the prospective oil

and liquids window

All 2012E Eagle Ford drilling

focused in the prospective oil and

liquids window

84% of 2012 estimated CapEx

allocated to Eagle Ford

One rig running in the eastern and

one in the western portions of the

Eagle Ford play

Eagle Ford acreage well-

positioned throughout the play

Note:

Reflects

companies

with

greater

than

50

Bcfe

of

proved

reserves.

Data

sourced

from

public

filings;

stock

price

data

as

of

03/20/2012

2012E Capex

% Eagle Ford

44.4

43.3

42.9

32.2

31.8

27.6

24.9

23.5

21.3

16.8

14.9

9.5

9.0

6.0

3.7

SFY

MTDR

NFX

SM

FST

GDP

PVA

CRZO

ROSE

MHR

CHK

PXD

APA

PXP

APC

84%

48%

34%

N/A

N/A

N/A

78%

92%

N/A

N/A

62%

25%

73%

85%

5.2% |

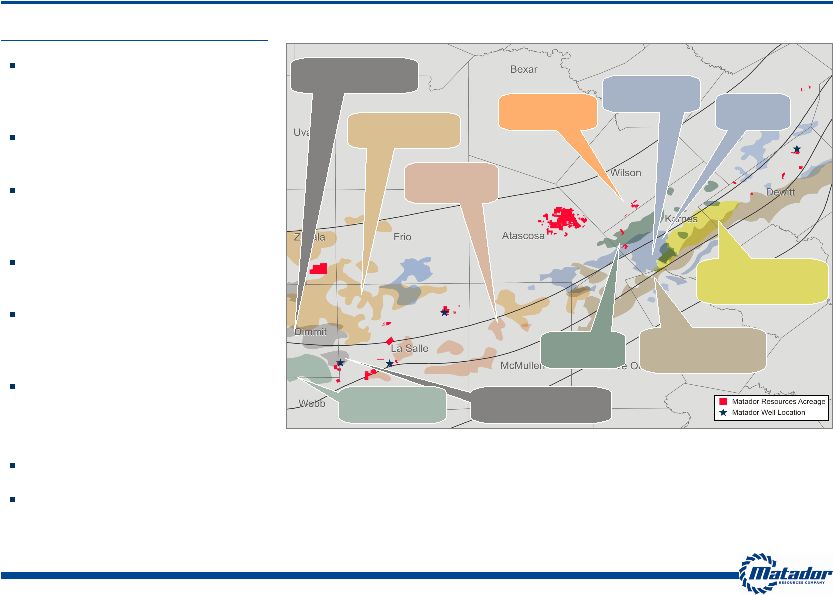

Highlights

7

Eagle Ford Properties are Well Positioned

MTDR acreage in counties with

robust transaction activity –

“good neighborhoods”

Transaction values ranging from

$10,000 to $25,000 / acre

Our Eagle Ford position has

grown to almost 30,000 net

acres

Acreage in both the eastern and

western areas of the play

Approximately 85% of acreage in

prospective oil and liquids

windows

Acreage offers potential for

Austin Chalk, Buda, Olmos,

Pearsall and other formations

Note:

Information

for

precedent

transactions

based

on

public

filings

Good reputation with land and mineral owners

80% of Eagle Ford acreage HBP or not burdened with lease expirations before

2013 COMBO LIQUIDS /

GAS FAIRWAY

DRY GAS

FAIRWAY

OIL FAIRWAY

TALISMAN-STATOIL / SM ENERGY

June 2011

$14,610 / acre

SHELL / HARRISON RANCH

March 2010

$10,000 / acre

CNOOC / CHESAPEAKE

October 2010

$11,011 / acre

MARATHON / HILCORP

June 2011

$24,823 / acre

KKR / HILCORP

June 2010

$10,000 / acre

TALISMAN-STATOIL / ENDURING

October 2010

$13,660 / acre

RELIANT / PIONEER NEWPEK

June 2010

$11,070 / acre

PLAINS / HUGHES

October 2010

$9,633 / acre

TALISMAN / COMMON

March 2010

$9,730 / acre

HUNT / MARUBENI

January 2012

+$20,000 / acre

MITSUI / SM ENERGY

June 2011

$18,846 / acre

COMBO LIQUIDS /

GAS FAIRWAY

DRY GAS

FAIRWAY

OIL FAIRWAY

TALISMAN-STATOIL / SM ENERGY

June 2011

$14,610 / acre

SHELL / HARRISON RANCH

March 2010

$10,000 / acre

CNOOC / CHESAPEAKE

October 2010

$11,011 / acre

MARATHON / HILCORP

June 2011

$24,823 / acre

KKR / HILCORP

June 2010

$10,000 / acre

TALISMAN-STATOIL / ENDURING

October 2010

$13,660 / acre

RELIANT / PIONEER NEWPEK

June 2010

$11,070 / acre

PLAINS / HUGHES

October 2010

$9,633 / acre

TALISMAN / COMMON

March 2010

$9,730 / acre

HUNT / MARUBENI

January 2012

+$20,000 / acre

MITSUI / SM ENERGY

June 2011

$18,846 / acre |

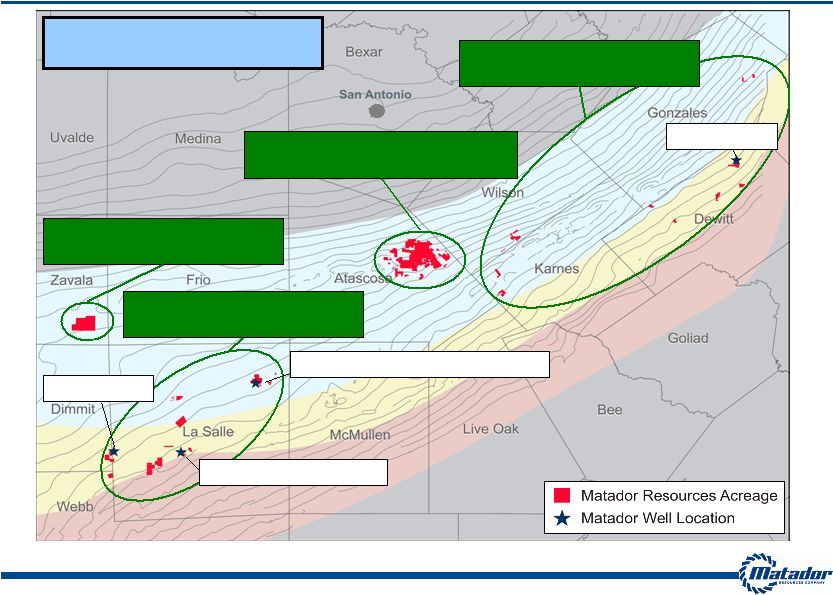

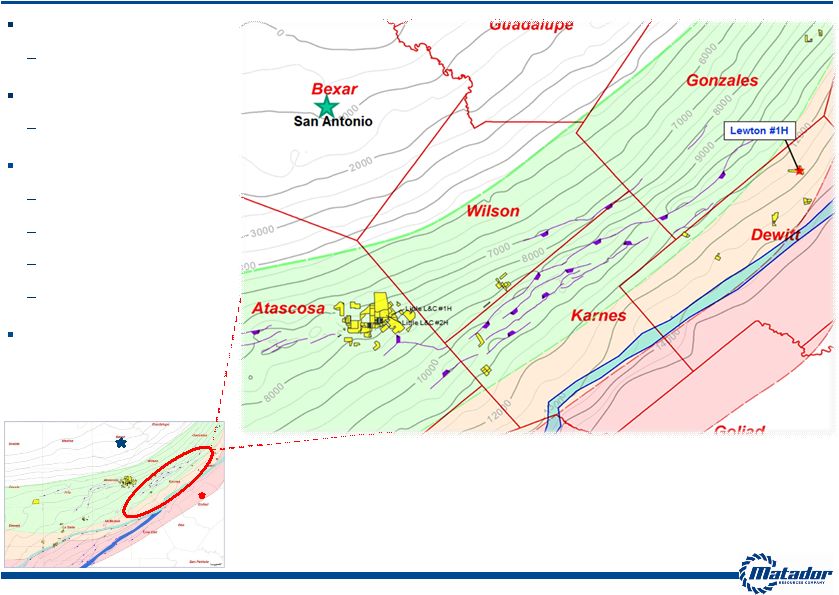

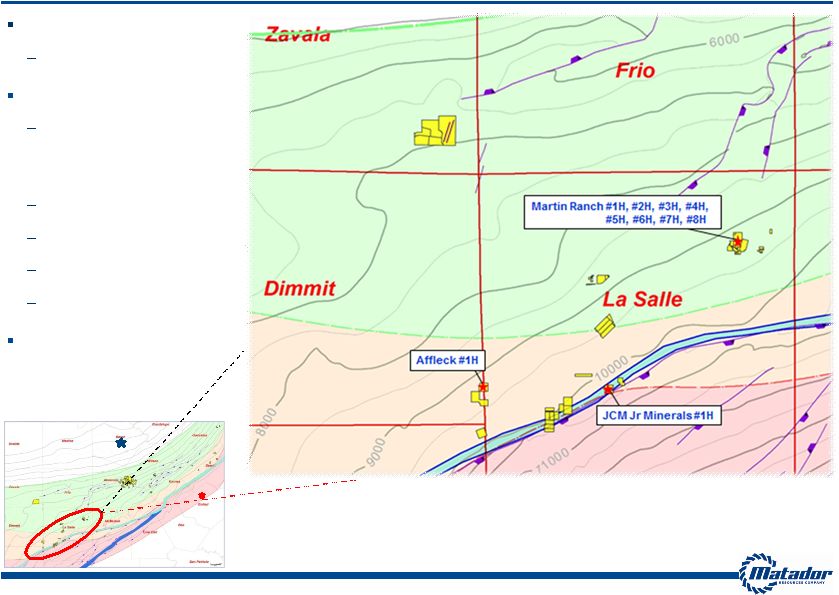

8

Eagle Ford and Austin Chalk Properties

COMBO LIQUIDS /

GAS FAIRWAY

DRY GAS FAIRWAY

OIL FAIRWAY

EOG OPERATED, MTDR WI = 21%

23,420 gross / 4,631 net acres

Lewton #1H

GLASSCOCK (WINN) RANCH

8,891 gross / 8,891 net acres

Martin Ranch #1H, #2H, #3H, #5H

EAGLE FORD WEST

13,472 gross / 10,510 net acres

EAGLE FORD EAST

6,270 gross / 4,874 net acres

EAGLE FORD ACREAGE TOTALS

52,053 gross / 28,906 net acres

Affleck #1H

JCM Jr. Minerals #1H

COMBO LIQUIDS /

GAS FAIRWAY

DRY GAS FAIRWAY

OIL FAIRWAY

EOG OPERATED, MTDR WI = 21%

23,420 gross / 4,631 net acres

Lewton #1H

GLASSCOCK (WINN) RANCH

8,891 gross / 8,891 net acres

Martin Ranch #1H, #2H, #3H, #5H

EAGLE FORD WEST

13,472 gross / 10,510 net acres

EAGLE FORD EAST

6,270 gross / 4,874 net acres

EAGLE FORD ACREAGE TOTALS

52,053 gross / 28,906 net acres

Affleck #1H

JCM Jr. Minerals #1H

Note:

All

acreage

values

are

as

of

September

30,

2011 |

9

Eagle Ford and Austin Chalk Overview

Acreage positioned in some of the most

active counties for Eagle Ford and Austin

Chalk (including “Chalkleford”)

Two rigs running, primarily focused on oil

and liquids

Eleven operated wells drilled, completed

and producing; Four additional operated

wells in completion phase

94%

(5)

of 2012E capital expenditure

program focused on oil / liquids

exploration and development

Drilling locations are based on 120 acre

spacing

Anticipate oil production to constitute

approx. 35-40% of our total production

volume and oil revenues to constitute

approx. 75-80% of our total oil and

natural gas revenues in 2012

Proved Reserves @ 12/31/11

4.7 MMBoe

% Proved Developed

37.9%

% Oil / Liquids

78.1%

Daily Production

(1)

3,000+ Boe/d

Gross Acres

(2)

52,053 acres

Net Acres

(2)

28,906 acres

Eagle Ford

(2)(3)

28,906 acres

Austin Chalk

(2)(3)

14,849 acres

Identified Drilling Locations

(2)

173.1 net

2012E Anticipated Drilling

27.6 net wells

2012E CapEx Budget

$268.5 million

% HBP or no short term expirations

(4)

80%

(1)

Average

daily

production

from

March

1

to

March

15,

2012

(2)

As

of

September

30,

2011

(3)

Some

of

the

same

leases

cover

the

net

acres

shown

for

Eagle

Ford

&

Austin

Chalk.

Therefore,

the

sum

for

both

formations

is

not

equal

to

the

total

net

acreage

(4)

80%

of

Eagle

Ford

acreage

HBP

or

not

burdened

with

lease

expirations

before

2013

(5)

Calculated

as

percent

of

anticipated

CapEx

focused

on

oil

weighted

Eagle

Ford

and

Austin

Chalk

drilling

and

acreage

and

includes

$20

million

to

acquire

oil

prospective

acreage

in

New

Mexico

and

West

Texas |

10

Eagle Ford East (Dewitt, Gonzales, Wilson and Karnes Counties)

Acreage

Position

(1)

6,270 gross / 4,874 net

Producing Wells

Lewton #1H

Wells drilled in Q1 2012

Sickenius #1H

Danysh #1H

Danysh #2H

Pawelek #1H (drilling)

Running one rig throughout

2012

San Antonio

(1) Acreage as of September 30, 2011 |

11

Eagle Ford West (Dimmit, La Salle and Zavala Counties)

Acreage Position

(1)

13,472 gross / 10,510 net

Wells Drilled

Martin Ranch #1H, #2H,

#3H, #4H, #5H, #6H, #7H,

#8H

Affleck #1H

JCM Jr Minerals #1H

Northcut #1H

Northcut #2H (drilling)

Running one rig throughout

2012

San Antonio

(1) Acreage as of September 30, 2011 |

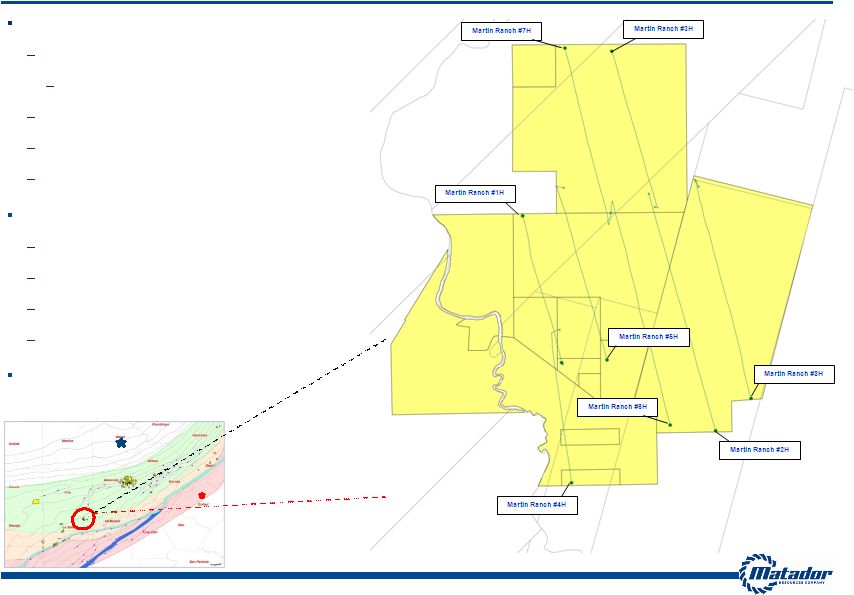

12

Martin Ranch Overview

Approximate Current Production

Martin Ranch #1H –

235 Bbls/d and 0.8 MMcf/d

12-month production of 138,000 barrels

Martin Ranch #2H –

545 Bbls/d and 1.35 MMcf/d

Martin Ranch #3H –

650 Bbls/d and 0.3 MMcf/d

Martin Ranch #5H –

715 Bbls/d and 0.15 MMcf/d

Wells Drilled, Completed and Producing

Martin Ranch #4H

Martin Ranch #6H

Martin Ranch #7H

Martin Ranch #8H

5 additional wells scheduled for 2012

San Antonio

2,485 gross / 2,483 net acres |

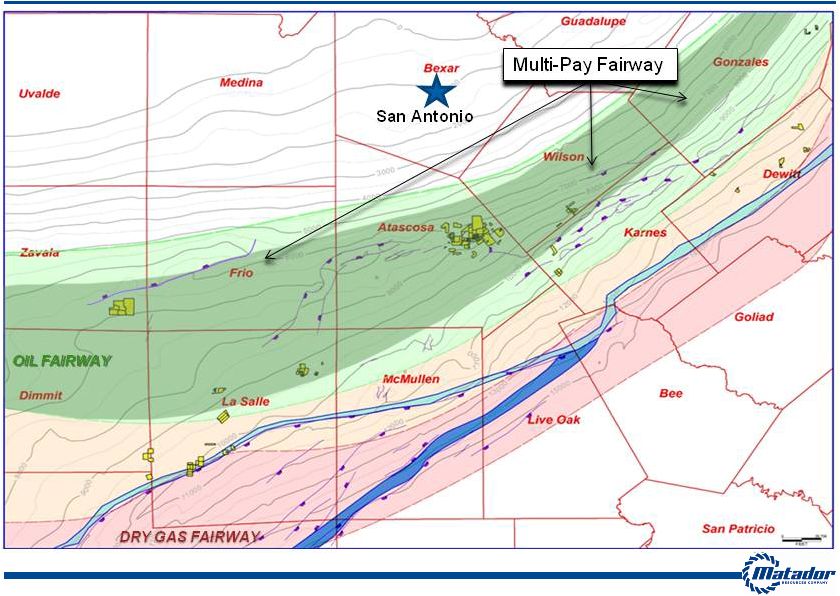

13

Emerging Multi-Pay Area in Eagle Ford Oil Fairway and MTDR Acreage

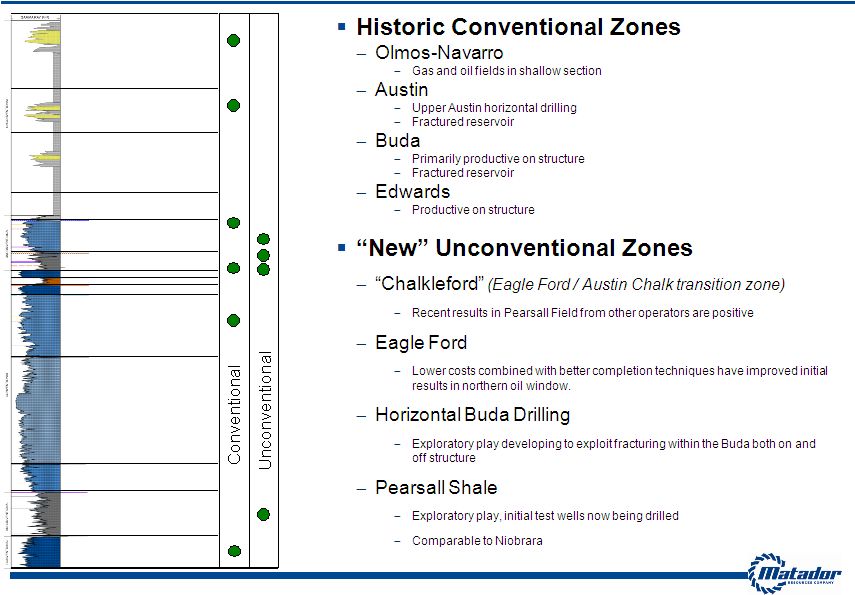

|

14

Multi-Pay Fairway: Productive and Prospective Pay Zones

Austin Chalk

Eagle Ford

Buda

Georgetown

Del Rio

Edwards

Glen Rose

Rodessa

Pearsall

Sligo

Olmos

Navarro

ANCC |

15

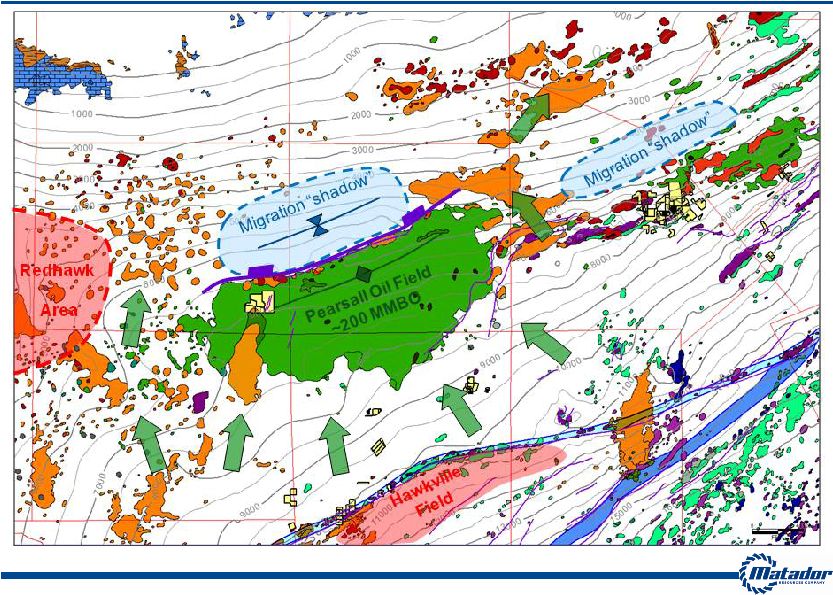

South Texas Multi-Pay Petroleum Systems:

Petroleum Charge focus towards Glasscock Ranch

Note: Information for Pearsall Oil Field sourced from public information

|

16

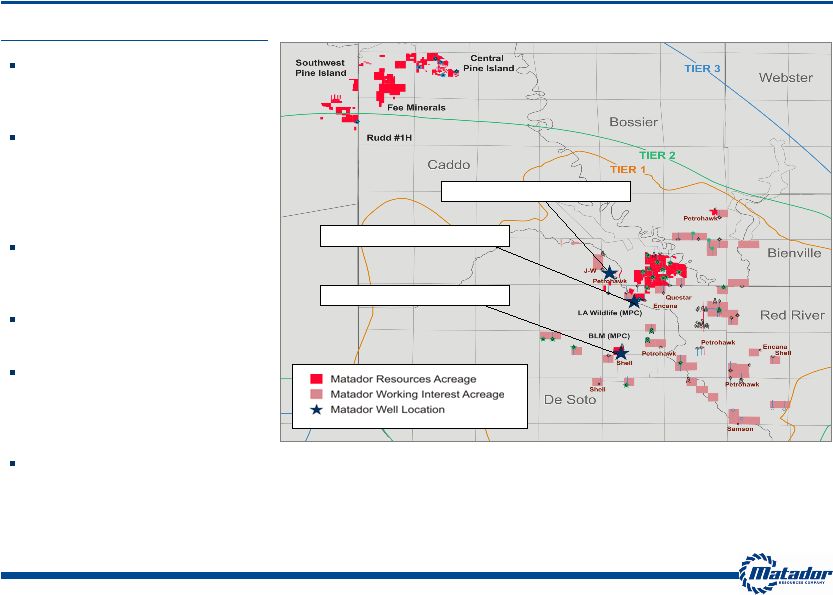

Northwest Louisiana / East Texas Properties Overview

Proved Reserves @ 12/31/11

164.6 Bcfe

% Proved Developed

32.7%

% Natural Gas

99.8%

Daily

Production

(1)

38.8 MMcfe/d

Gross

Acres

(2)

29,128 acres

Net Acres

(2)

25,477 acres

Haynesville

(2) (3)

14,705 acres

Cotton Valley

(2) (3)

23,236 acres

Identified Drilling Locations

(2)

139.9 net wells

2012E Anticipated Drilling

1.5 net wells

2012E CapEx Budget

$13.5 million

% HBP

Over 90%

(1)

Production data for the year ended December 31, 2011

(2)

As of September 30, 2011

(3) Some of the same leases cover the net acres shown

for Haynesville & Cotton Valley. Therefore, the sum for both formations

is not equal to the total net acreage Participated in over 110 operated and

non-operated Haynesville wells at December 31, 2011

Haynesville proved reserves grew from zero at year end

2008 to 164.6 Bcfe at December 31, 2011

LA Wildlife H#1 and Williams 17 H#1 operated wells

produced approximately 3.4 Bcfe (9.3 MMcfe/d) and

1.83 Bcfe (6.7 MMcfe/d) in their first 12 and 9 months,

respectively

Tigner Walker H#1 Alt (CV)

LA Wildlife H#1 Alt. (HV)

Williams 17 H#1 (HV)

Tigner Walker H#1 Alt (CV)

LA Wildlife H#1 Alt. (HV)

Williams 17 H#1 (HV)

Note: Matador operates two sections, including the LA Wildlife and the BLM

sections, in Tier 1; all other acreage in Tier 1 is non-operated. |

Highlights

17

Haynesville Positioning

Approximately 12,000 gross and

5,500 net acres in Haynesville

Tier 1 core area

Almost all Tier 1 core acreage is

HBP, as is over 90% of all

prospective Haynesville acreage

–

provides “natural gas bank”

for

future development

MTDR active as both operator

and non-operator in Haynesville

play

Approximately 1,700 net acres

with Bossier potential

Haynesville acreage also

prospective for shallower targets

–

Cotton Valley, Hosston –

in

many areas

Approximately 10,000 net HBP

acres prospective for Cotton

Valley Horizontal play at Elm

Grove / Caspiana

Tigner Walker H#1 Alt (CV)

LA Wildlife H#1 Alt. (HV)

Williams 17 H#1 (HV)

Tigner Walker H#1 Alt (CV)

LA Wildlife H#1 Alt. (HV)

Williams 17 H#1 (HV)

Note: Matador operates two sections, including the LA Wildlife and the BLM

sections, in Tier 1; all other acreage in Tier 1 is non-operated. |

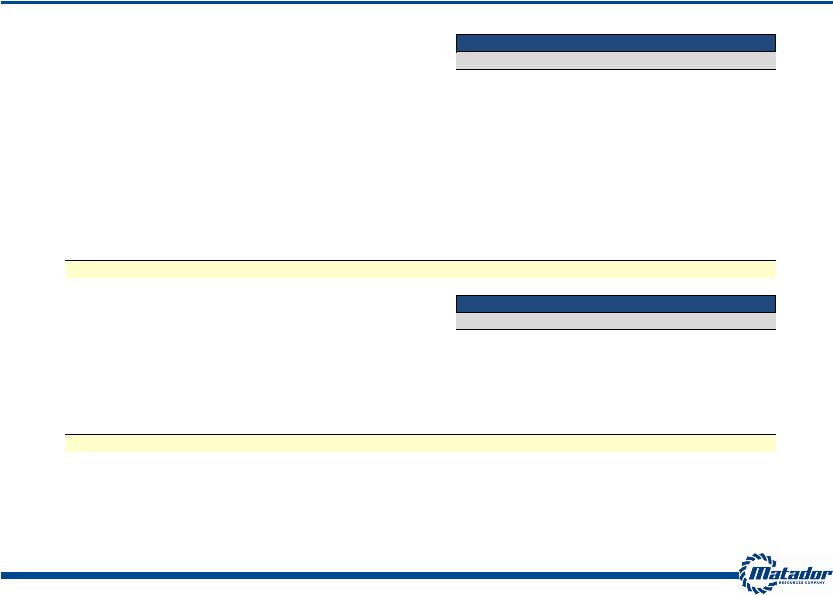

Liquids Focused CapEx in 2012E

Commentary

Oil Production Growth Over Time (Bbls/d)

18

Approximately 90% of 2012E

capital budget focused on Eagle

Ford (84%) and

Austin Chalk (6%)

Oil production up about five-fold

year-over-year at December 31,

2011

Oil production expected to

increase nearly 10x in 2012

All 2012 Eagle Ford and Austin

Chalk drilling locations targeting

oil and liquids

Only 14% of our identified Eagle

Ford and 5% of our identified

Haynesville locations being

drilled in 2012

From March 1, 2012 through

March 15, 2012, oil production in

excess of 3,000 bbl per day

Strong Growth Profile Focused on Liquids

(1) From March 1, 2012 through March 15, 2012, oil production in excess of 3,000 bbl per day |

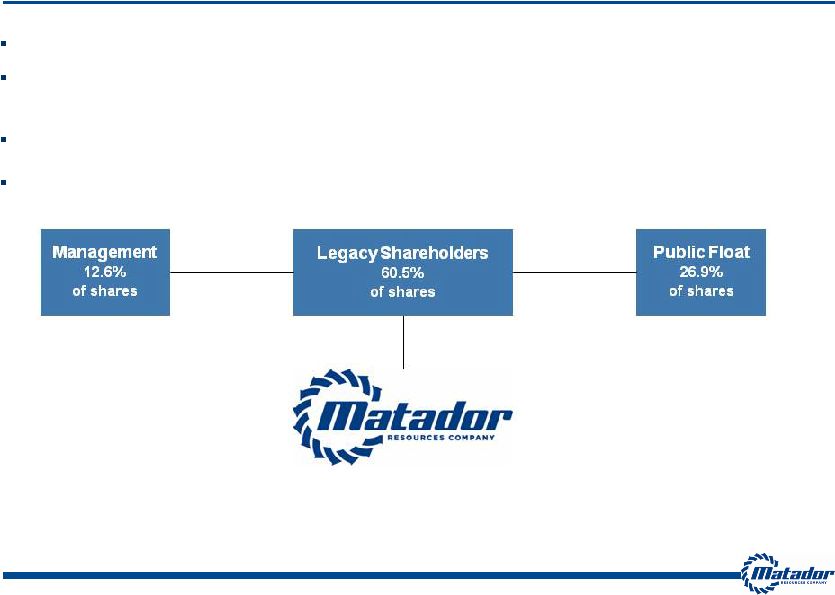

Diversified Investor Composition

19

Given management’s significant equity position, interests are well aligned with

public shareholders Unique and diverse investor base includes institutional

and industry shareholders with significant experience investing in the oil

and gas sector Most initial capital was provided by investor base of

predecessor company, Matador Petroleum Corporation 99.2% of shares outside

the public float locked-up for 180 days following February 1, 2012 |

Business Strategy to Deliver Growth and Value

20

Exploration and Development

Dedicating

approximately

94%

(1)

of

2012E

CapEx

to

oil

and

liquids

opportunities

Approximately 80% of Eagle Ford and approximately 90% of Haynesville acreage either

HBP or not burdened by near-term lease expirations

Balanced Portfolio

Growing Eagle Ford contributes to a diversified portfolio mix between oil and

natural gas Active,

ongoing

exploration

effort

continues

to

identify

new

oil

prospects

and

opportunities

Pursue Opportunistic Acquisitions

Ability to identify high return, operated opportunities at attractive prices

History of significant acquisitions and joint ventures

Maintain Financial Discipline

Keep balance sheet strong and control expenses

Work with industry participants to control costs for non-operated

properties Leverage Industry Relationships

Leverage expertise of our industry partners, exchange data and information and

build upon existing relationships

Continue active participation in industry consortia and professional

societies Build Upon Director and Management Team Experience and Success in

Unconventional Plays (1)

Calculated

as

percent

of

anticipated

capital

expenditure

focused

on

oil

weighted

Eagle

Ford

and

Austin

Chalk

and

includes

$20

million

to

acquire

acreage

for

oil

opportunities

in

New

Mexico

and

West

Texas |

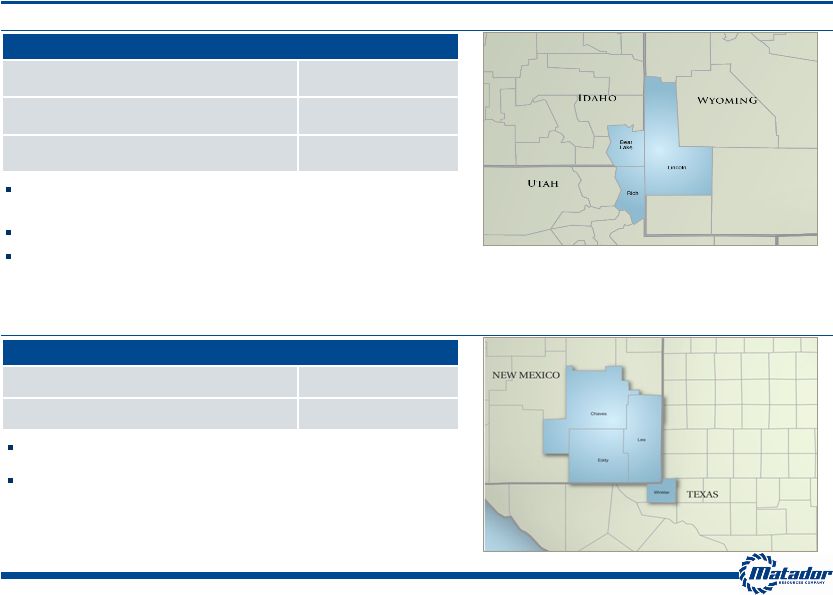

21

Matador Today

Gross

Acres

(1)

144,368 acres

Net Acres

(1)

135,862 acres

2012E CapEx Budget

$2.5 million

Matador Today

Gross Acres

(1)

10,714 acres

Net Acres

(1)

7,519 acres

Wyoming, Utah and Idaho (Meade Peak Shale)

Option Value in Large Unevaluated Acreage Positions

Initial test well drilled to 8,200 feet and cored through the

Meade Peak shale

Detailed petrophysical and rock properties testing in progress

Carried participation interest provided by an affiliate of Alliance

Bernstein

Foothold of existing production and reserves

Budgeted $20 million in 2012 to acquire acreage in oil-

focused opportunities

Southeast New Mexico / West Texas

(1)

As of September 30, 2011 |

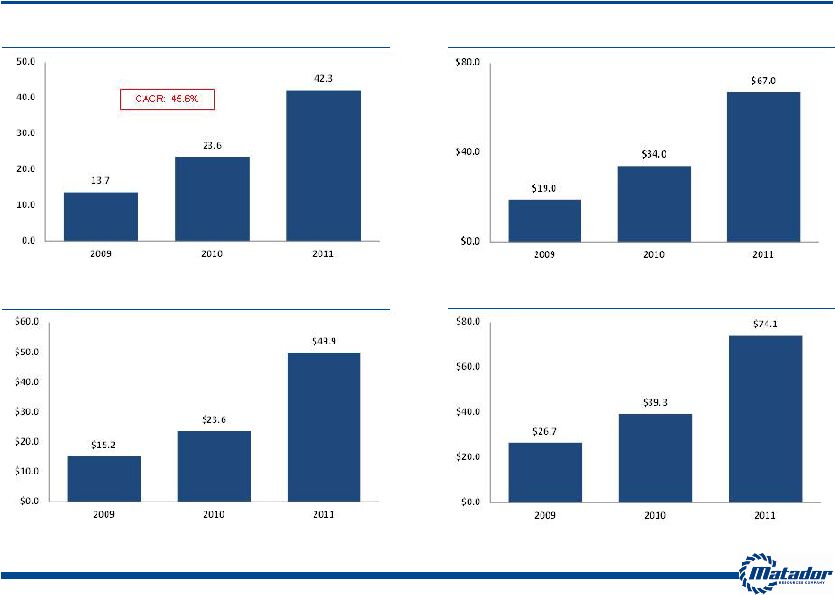

22

Financial Performance

Oil and Natural Gas Revenues

($ in mm)

Total

Realized

Revenues

(2)

($ in mm)

Adjusted

EBITDA

(1)

($ in mm)

Average Daily Production

(MMcfe/d)

Note: CAGR stands for compounded annual growth rate (1)

Adjusted EBITDA is a non-GAAP financial measure. For a definition of Adjusted EBITDA and a

reconciliation of Adjusted EBITDA to our net income (loss) and net cash provided by

operating activities, see slide 28

(2) Includes realized gain on derivatives |

23

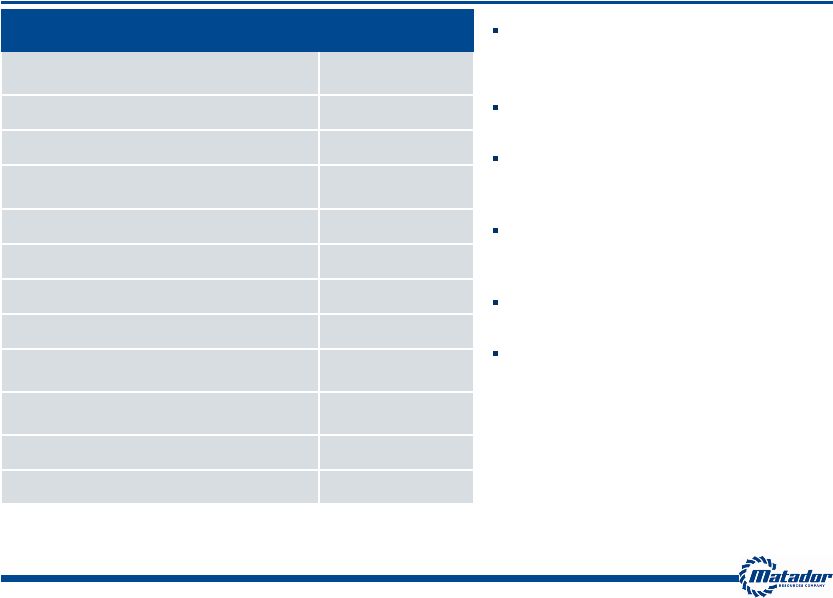

Selected Historical Financials

(Revenues and Adjusted EBITDA in millions)

(2) Adjusted EBITDA is a non-GAAP financial measure. For a

definition of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to our net income (loss) and

net cash provided by operating activities, see slide 28

(1) 2011 numbers unaudited

Year Ended December 31,

2009

2010

2011

Production Summary

Oil Production (MBbls)

30.0

33.0

154.0

Gas Production (Bcf)

4.8

8.4

14.5

Total Annual Production (Bcfe)

5.0

8.6

15.4

Realized Prices (Including hedges)

Oil ($/ Bbl)

$57.72

$76.39

$93.80

Natural Gas ($/ Mcf)

$5.17

$4.38

$4.11

Revenues

(1)

Oil and Gas Production Revenues

$19.0

$34.0

$67.0

Realized Oil & Gas Hedging Gain / (Loss)

7.6

5.3

7.1

Unrealized Oil & Gas Hedging Gain / (Loss)

(2.4)

3.1

5.1

Total Revenues

$24.3

$42.5

$79.2

Operating Expenses ($/ Mcfe)

Lease Operating

$0.94

$0.61

$0.47

Production Taxes and Marketing

0.22

0.23

0.41

General and Administrative

1.42

1.13

0.87

Total Expenses

$2.58

$1.97

$1.75

Adjusted EBITDA

(2)

$15.2

$23.6

$49.9 |

24

Hedging Profile

Oil Hedges

2012

2013

Total Volume Hedged by Ceiling (Bbl)

1,180,000

1,260,000

Weighted Average Price ($ / Bbl)

$109.84

$110.26

Total Volume Hedged by Floor (Bbl)

1,180,000

1,260,000

Weighted Average Price ($ / Bbl)

$90.51

$87.14

Natural Gas Hedges

2012

2013

Total Volume Hedged by Ceiling (Bcf)

7.20

1.05

Weighted Average Price ($ / MMBtu)

$5.78

$5.75

Total Volume Hedged by Floor (Bcf)

7.20

1.05

Weighted Average Price ($ / MMBtu)

$4.44

$4.50 |

25

Financial Flexibility

Plan

to

fund

2012

capital

budget

with

a

portion

of

IPO

net

proceeds,

anticipated

cash

flows

from

operations

and

available

borrowings

under

credit

facility

Intend

to

seek

redeterminations

of

borrowing

base

as

a

result

of

any

increases

in

oil

and

natural

gas

proved

reserves

during

the

year

-

May,

November

and

one

additional

redetermination

available

in

2012

Borrowing

base

of

$125

million,

based

on

February

2012

redetermination

-

19%

of

current

market

capitalization

(1)

$15

million

in

debt

outstanding

as

of

March

19,

2012

(1) As of March 20, 2012 close |

26

Investment Highlights

Strong Growth Profile with Increasing Focus on Oil / Liquids

High Quality Asset Base in Attractive Areas

Significant Multi-year Drilling Inventory

Strong Financial Position and Long-Term Institutional, Industry and Individual

Shareholders

Proven Management and Technical Team and Active Board of Directors

Low Cost Operations

Active Exploration Effort Using Science and Technology

|

Appendix |

28

Adjusted EBITDA Reconciliation

The following table presents our calculation of Adjusted EBITDA and reconciliation

of Adjusted EBITDA to the GAAP financial measures of net income (loss) and

net cash provided by operating activities, respectively. Year Ended December 31,

(In thousands)

2008

2009

2010

2011

Unaudited Adjusted EBITDA reconciliation to Net Income (Loss):

Net income (loss)

$103,878

($14,425)

$6,377

($10,309)

Interest expense

-

-

3

683

Total income tax provision (benefit)

20,023

(9,925)

3,521

(5,521)

Depletion, depreciation and amortization

12,127

10,743

15,596

31,754

Accretion of asset retirement obligations

92

137

155

209

Full-cost ceiling impairment

22,195

25,244

-

35,673

Unrealized (gain) loss on derivatives

(3,592)

2,375

(3,139)

(5,138)

Stock option and grant expense

605

622

824

2,362

Restricted stock grants

60

34

74

44

Net (gain)/loss on asset sales and inventory impairment

(136,977)

379

224

154

Adjusted EBITDA

$18,411

$15,184

$23,635

$49,911

Year Ended December 31,

(In thousands)

2008

2009

2010

2011

Unaudited Adjusted EBITDA reconciliation to Net Cash Provided

by Operating Activities:

Net cash provided by operating activities

$25,851

$1,791

$27,273

$61,868

Net change in operating assets and liabilities

(17,888)

15,717

(2,230)

(12,594)

Interest expense

-

-

3

683

Current income tax provision (benefit)

10,448

(2,324)

(1,411)

(46)

Adjusted EBITDA

$18,411

$15,184

$23,635

$49,911

We

believe

Adjusted

EBITDA

helps

us

evaluate

our

operating

performance

and

compare

our

results

of

operation

from

period

to

period

without

regard

to

our

financing methods or capital structure. We define Adjusted EBITDA as earnings

before interest expense, income taxes, depletion, depreciation and

amortization,

property

impairments,

unrealized

derivative

gains

and

losses,

non-recurring

income

and

expenses

and

non-cash

stock-based

compensation

expense,

including

stock

option

and

grant

expense

and

restricted

stock

grants.

Adjusted

EBITDA

is

not

a

measure

of

net

income

(loss)

or

cash

flows

as

determined

by

GAAP.

Adjusted

EBITDA

should

not

be

considered

an

alternative

to,

or

more

meaningful

than,

net

income

or

cash

flows

from

operating

activities

as

determined

in

accordance

with

GAAP

or

as

an

indicator

of

our

operating

performance

or

liquidity. |

Board

of Directors and Special Board Advisors 29

Board Members

and Advisors

Professional Experience

Business Expertise

Charles L. Gummer

Director

-

Former Chairman, President and CEO, Comerica Bank –Texas

Banking

Dr. Stephen A. Holditch

Director

-

Professor and Former Head of the Department of Petroleum

Engineering, Texas A&M University

-

Founder / President S.A. Holditch & Associates

-

Past President of Society of Petroleum Engineers

Oil & Gas Operations

David M. Laney

Director

-

Past Chairman, Amtrak Board of Directors

-

Former Partner, Jackson Walker LLP

Law

Gregory E. Mitchell

Director

-

President / CEO, Toot’n Totum Food Stores

Petroleum Retailing

Dr. Steven W. Ohnimus

Director

-

Retired VP and General Manager, Unocal Indonesia

Oil & Gas Operations

Michael C. Ryan

Director

-

Partner, Berens Capital Management

International Business and

Finance

Margaret B. Shannon

Director

-

Retired VP and General Counsel, BJ Services Co.

-

Former Partner, Andrews Kurth LLP

Law and

Corporate Governance

Marlan W. Downey

Special Board Advisor

-

Retired President, ARCO International

-

Former President, Shell Pecten International

-

Past President of American Association of Petroleum Geologists

Oil & Gas Exploration

Edward R. Scott, Jr.

Special Board Advisor

-

Former Chairman, Amarillo Economic Development Corporation

-

Law Firm of Gibson, Ochsner & Adkins

Law, Accounting and Real

Estate Development

W.J. “Jack”

Sleeper

Special Board Advisor

-

Retired President, DeGolyer and MacNaughton (Worldwide

Petroleum Consultants)

Oil & Gas Executive

Management |

Experienced Leadership

30

Management Team

Background and Prior Affiliations

Industry

Experience

Matador

Experience

Joseph Wm. Foran

Founder, Chairman and CEO

-

Matador Petroleum Corporation, Foran Oil Company,

J Cleo Thompson Jr. and Thompson Petroleum Corp.

31 years

Since Inception

David E. Lancaster

EVP, COO and CFO

-

Schlumberger, S.A. Holditch & Associates, Inc., Diamond

Shamrock

32 years

Since 2003

Matthew V. Hairford

EVP, Operations

-

Samson, Sonat, Conoco

27 years

Since 2004

Wade I. Massad

EVP, Capital Markets

-

Cleveland Capital Management, LLC, KeyBanc Capital

Markets, RBC Capital Markets

22 years

Since 2010

David F. Nicklin

Executive Director, Exploration

-

ARCO, Senior Geological Assignments in UK, Angola,

Norway and the Middle East

40 years

Since 2007

Scott E. King

Co-Founder, VP, Geophysics

and New Ventures

-

Matador Petroleum Corporation, Enserch, BP, Sohio

28 years

Since Inception

Bradley M. Robinson

VP, Reservoir Engineering

-

Schlumberger, S.A. Holditch & Associates, Inc.,

Marathon

34 years

Since Inception

Kathryn L. Wayne

Controller and Treasurer

-

Matador Petroleum Corporation, Mobil

27 years

Since Inception |