Attached files

| file | filename |

|---|---|

| 8-K - 8-K SEATTLE BANK 2011 MEMBER UPDATE - Federal Home Loan Bank of Seattle | a8-kyearend2011meeting.htm |

William V. Humphreys Chairman of the Board Seattle Bank Senior Management Team March 23, 2012 Federal Home Loan Bank of Seattle 2011 Member Update

2 Forward-Looking Statements This member presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including expectations regarding operations of the Federal Home Loan Bank of Seattle (Seattle Bank). Forward-looking statements are subject to known and unknown risks and uncertainties. Actual financial performance and condition and actions may differ materially from that expected or implied in forward-looking statements because of many factors. Such factors may include, but are not limited to: changes in general economic and market conditions (including effects on, among other things, U.S. debt obligations and mortgage-related securities); regulatory and legislative actions and approvals (including those of the Federal Housing Finance Agency); business and capital plan and policy adjustments and amendments; demand for advances; the Seattle Bank's ability to meet adequate capital levels; accounting adjustments or requirements (including changes in assumptions and estimates used in the bank's financial models); changes in the bank's management and Board of Directors; competitive pressure from other Federal Home Loan Banks (FHLBanks) and alternative funding sources; interest-rate volatility; shifts in demand for the bank’s products and consolidated obligations; changes in projected business volumes; the bank's ability to appropriately manage its cost of funds; the cost-effectiveness of the bank's funding; changes in the bank's membership profile or the withdrawal of one or more large members; and hedging and asset-liability management activities. Additional factors are discussed in the Seattle Bank's 2011 annual report on Form 10-K and subsequent quarterly reports on Form 10-Q filed with the SEC. The Seattle Bank does not undertake to update any forward-looking statements made in this announcement. 2

2011 Financial Results Risk Profile / Risk Management Balance Sheet Management 2012 Business Initiatives A Vision for the Seattle Bank Q&A Agenda 3

Stabilizing Our Business and Implementing a Framework for a Return to Normal Operations 2011 Seattle Bank Focus 4 Addressing the Requirements of Consent Arrangement: • Achieve and maintain certain thresholds to begin repurchasing capital stock at par • Achieve and maintain certain additional financial and operational metrics and remediate certain regulatory concerns to begin redeeming capital stock and paying dividends • Obtain Finance Agency approval to repurchase and redeem capital stock, and to pay dividends Stabilization Goals: • Strengthen our balance sheet while employing sound risk management strategies • Strengthen our capital position through growth in retained earnings • Close the gap between our market value of equity (MVE) and par value of capital stock (PVCS)

Consent Arrangement Compliance: • The bank has made substantial progress on all stabilization goals. • With the exception of its retained earnings requirement on June 30, 2011, the bank met all minimum financial metrics at each quarter end during the Stabilization Period. Additional Accomplishments: • Improved financial performance. • Hired President and CEO Michael L. Wilson, who joined the bank on January 30, 2012. Progress in 2011 5

2011 Financial Results Christina Gehrke SVP / Chief Accounting and Administrative Officer 6

$84.0 million of net income in 2011 vs. $20.5 million in 2010, primarily due to: • $73.9 million pre-assessment gain on $1.3 billion sale of mortgage loans in Q3 — Sold $1.3 billion of seasoned fixed-rate loans in July and reported a gain of $73.9 million in Q3 2011 financials — Benefits: Monetized gains in mortgage portfolio and reduced credit risk exposure • Reduction in additional credit-related charges on private-label mortgage-backed securities (MBS) classified as other-than-temporarily impaired; $91.2 million of additional charges in 2011 vs. $106.2 million in 2010 $9.3 million of Affordable Housing Program (AHP) / Home$tart Program funding for 2012 • $5.3 million for AHP • $4.0 million for Home$tart and Home$tart Plus 2011 Financial Results 7

Total Assets: $40.2 billion • Investments: $27.4 billion • Advances: $11.3 billion • Mortgage loans held for portfolio: $1.4 billion Accumulated Other Comprehensive Loss (AOCL): $(611) million Total Regulatory Capital: $3.0 billion Risk-Based Capital Surplus: $866 million 2011 Financial Results 8

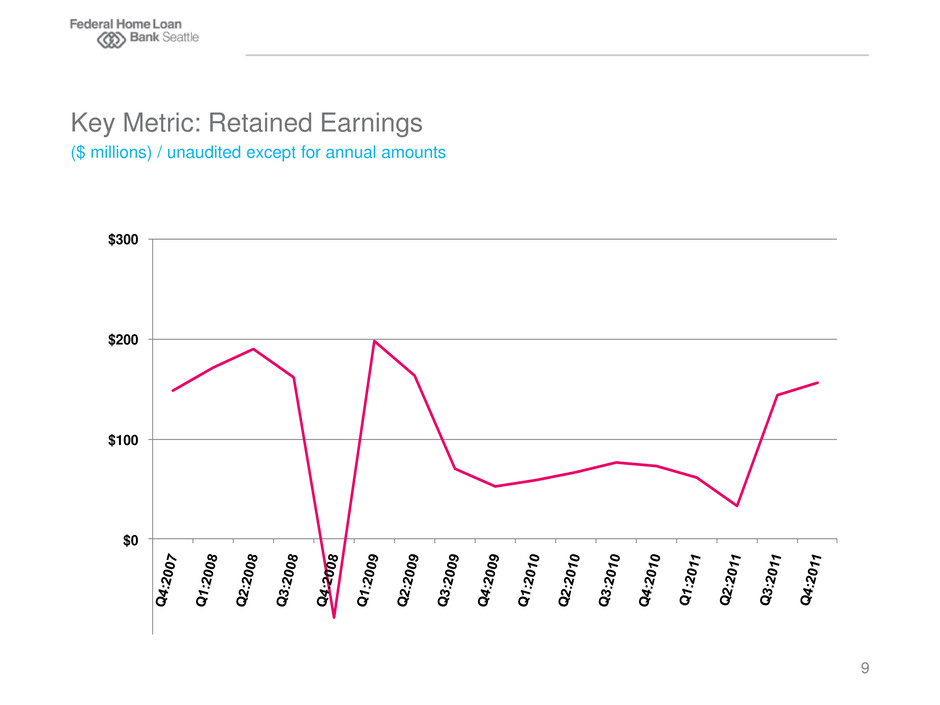

($ millions) / unaudited except for annual amounts Key Metric: Retained Earnings 9 ($100) $0 $100 $200 $300

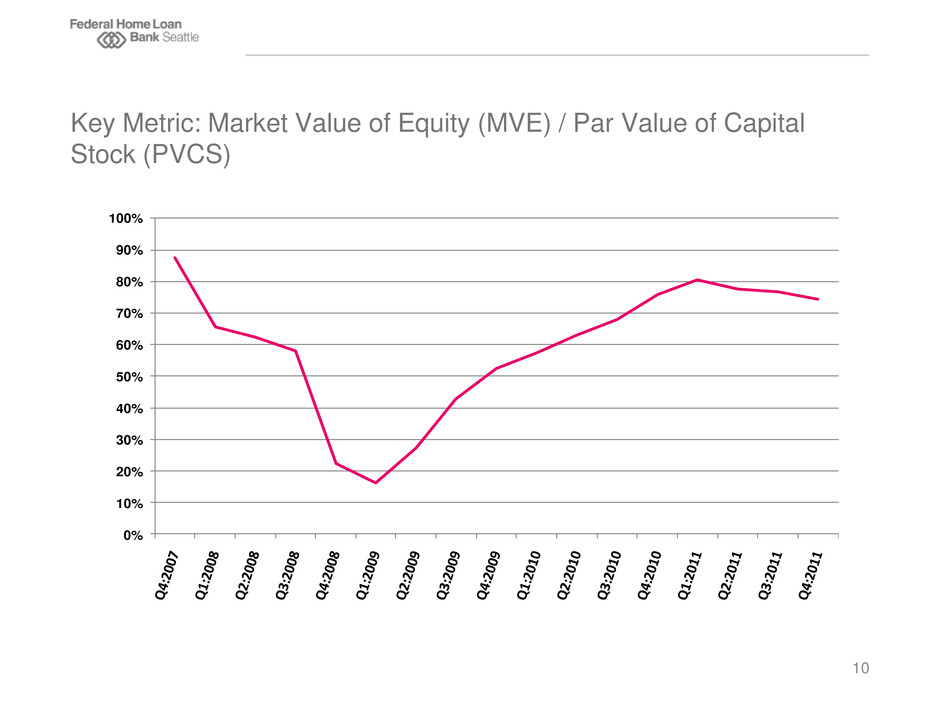

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Key Metric: Market Value of Equity (MVE) / Par Value of Capital Stock (PVCS) 10

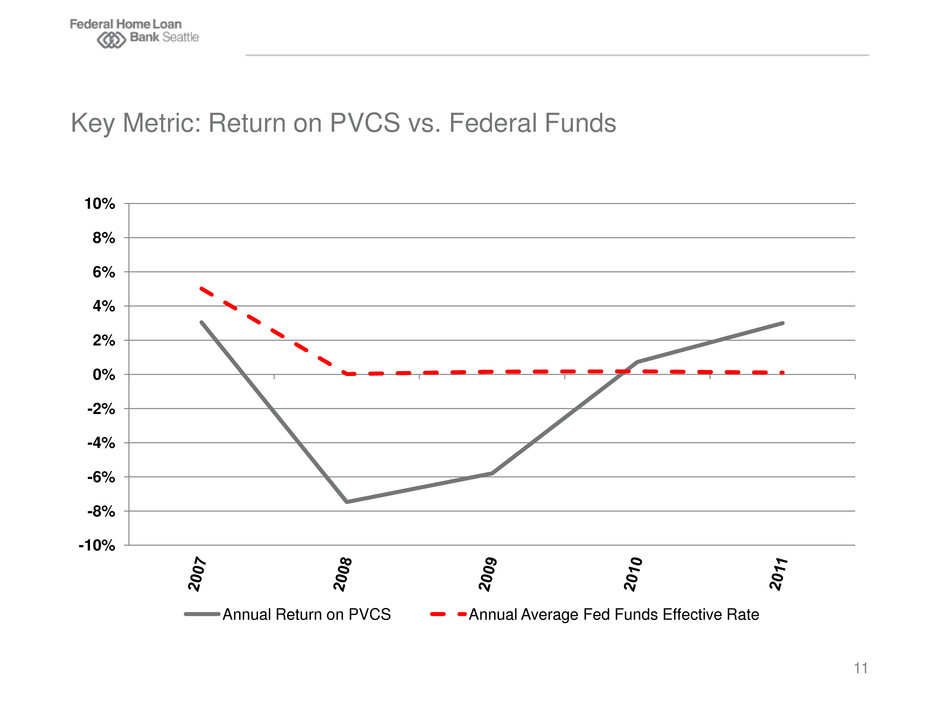

Key Metric: Return on PVCS vs. Federal Funds 11 -10% -8% -6% -4% -2% 0% 2% 4% 6% 8% 10% Annual Return on PVCS Annual Average Fed Funds Effective Rate

Risk Profile / Risk Management John Stewart SVP / Chief Risk Officer 12

Improved Capital Position • Regulatory risk-based capital surplus increased 18% in 2011. • Retained earnings improved 115% in 2011. Effects of Mortgage Loan Sale • Reduced exposure to $1.4 billion from $3.2 billion at the end of 2010. • Increased relative delinquency to 5.3% from 2.1% driven primarily by adverse selection. • No credit losses to date. • Portfolio remains well-seasoned, primarily 2002 – 2004 originations. Reduced Exposure to Private-Label MBS Risk • The unpaid principal balance of our Alt-A securities declined 12%, from $3.4 billion as of December 31, 2010 to $3.0 billion as of December 31, 2011. • AOCL improved from $667 million to $611 million as the values of our private-label MBS improved. • Additional credit-related OTTI charges have declined. Risk Profile / Risk Management Update 13

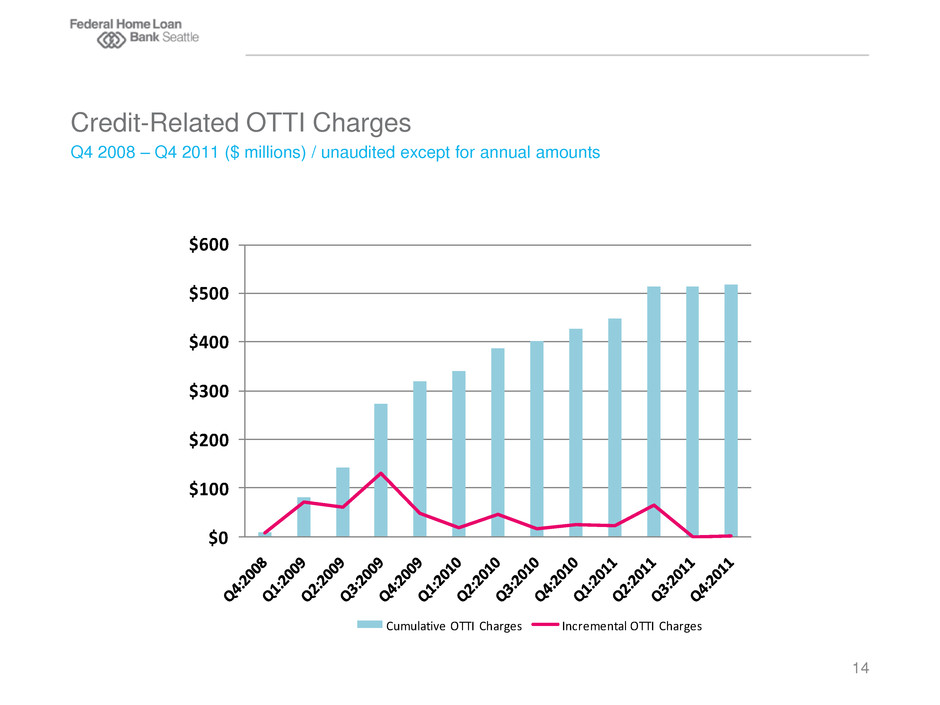

Q4 2008 – Q4 2011 ($ millions) / unaudited except for annual amounts Credit-Related OTTI Charges 14 $0 $100 $200 $300 $400 $500 $600 Cumulative OTTI Charges Incremental OTTI Charges

Significant Progress in Credit and Collateral Management Practices Member Health Continues to Improve • Fewer members “critical.” • Less collateral held in physical possession: 11% of the par value of outstanding advances is on physical possession, down from 24% as of December 31, 2010. Short-Term, Unsecured Investments Declined 14% Low Advance Levels Remain a Concern Risk Profile / Risk Management Update 15

Balance Sheet Management in the Current Market Environment Vincent Beatty SVP / Chief Financial Officer 16

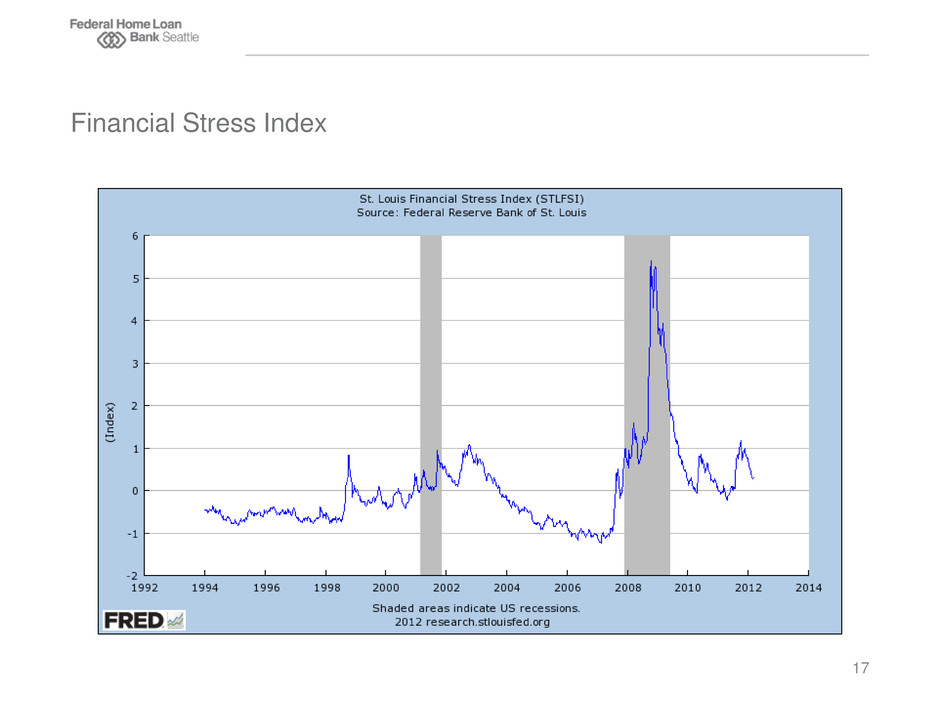

Financial Stress Index 17

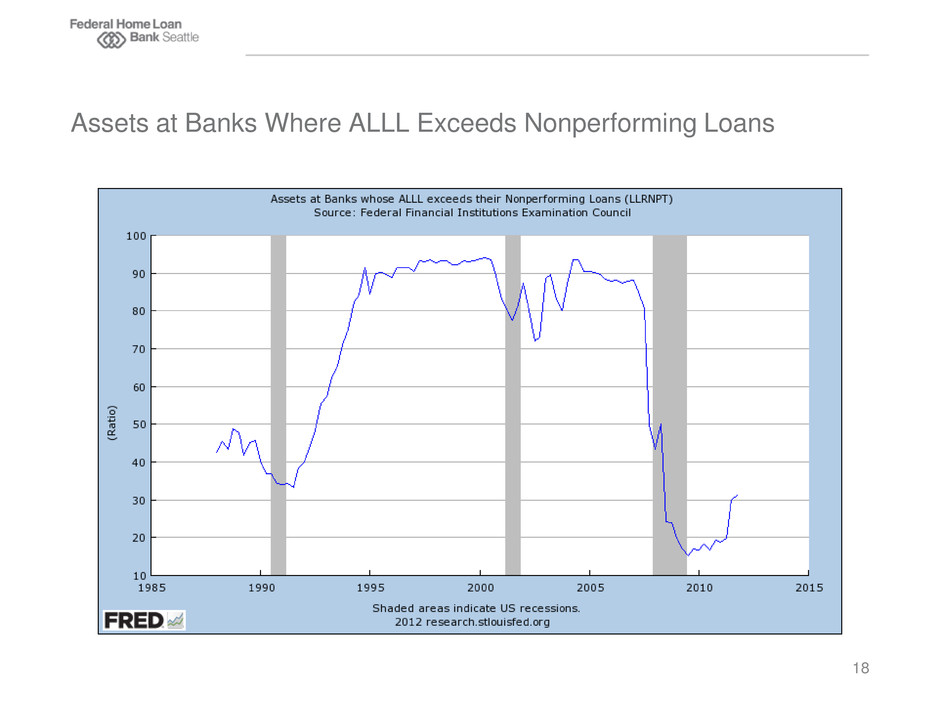

Assets at Banks Where ALLL Exceeds Nonperforming Loans 18

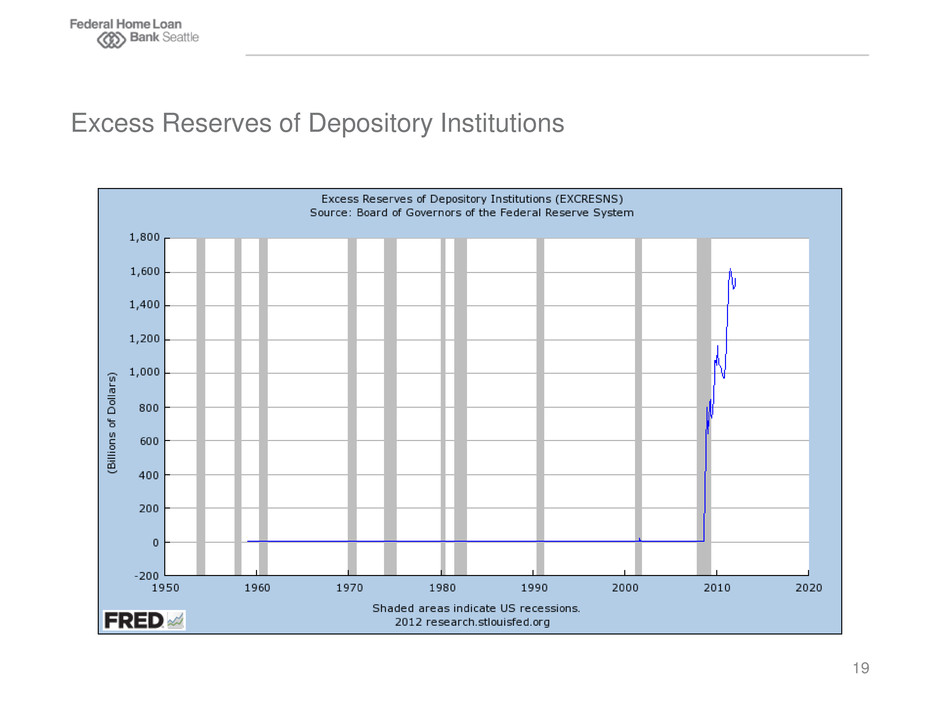

Excess Reserves of Depository Institutions 19

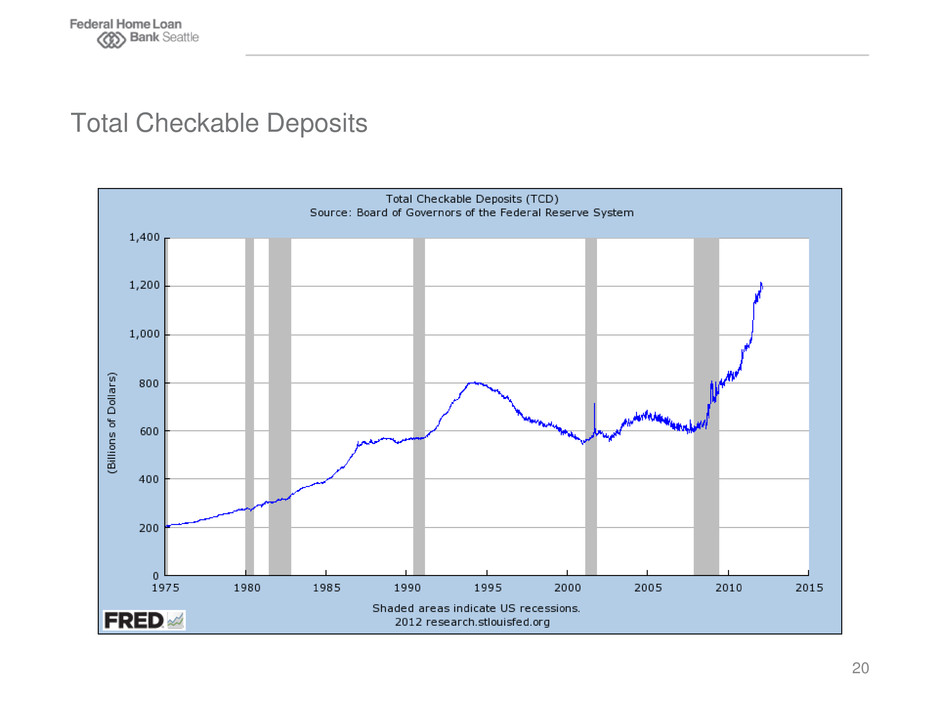

Total Checkable Deposits 20

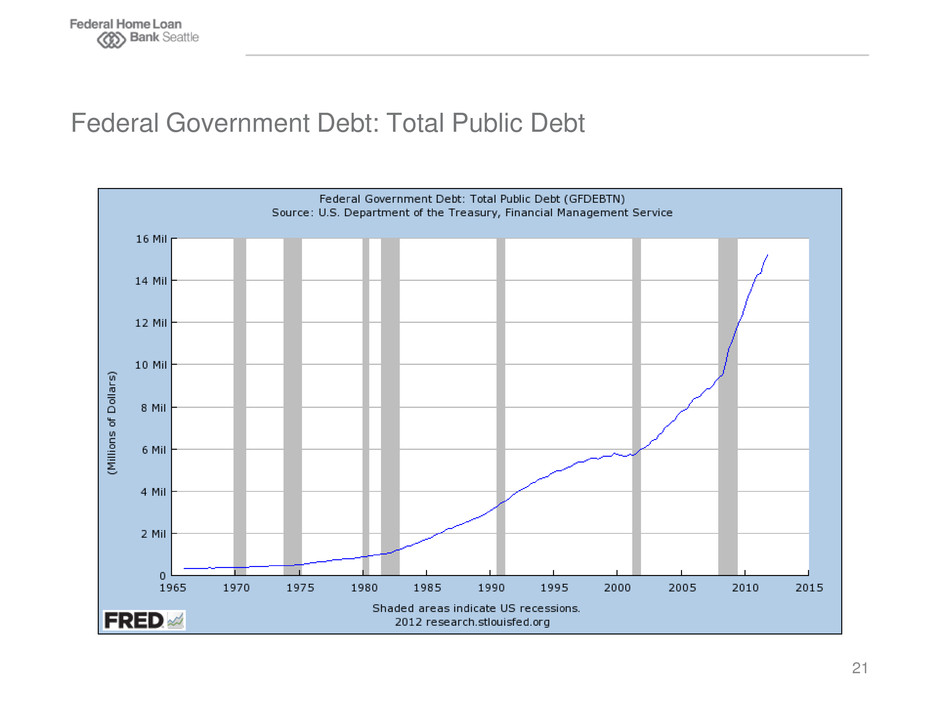

Federal Government Debt: Total Public Debt 21

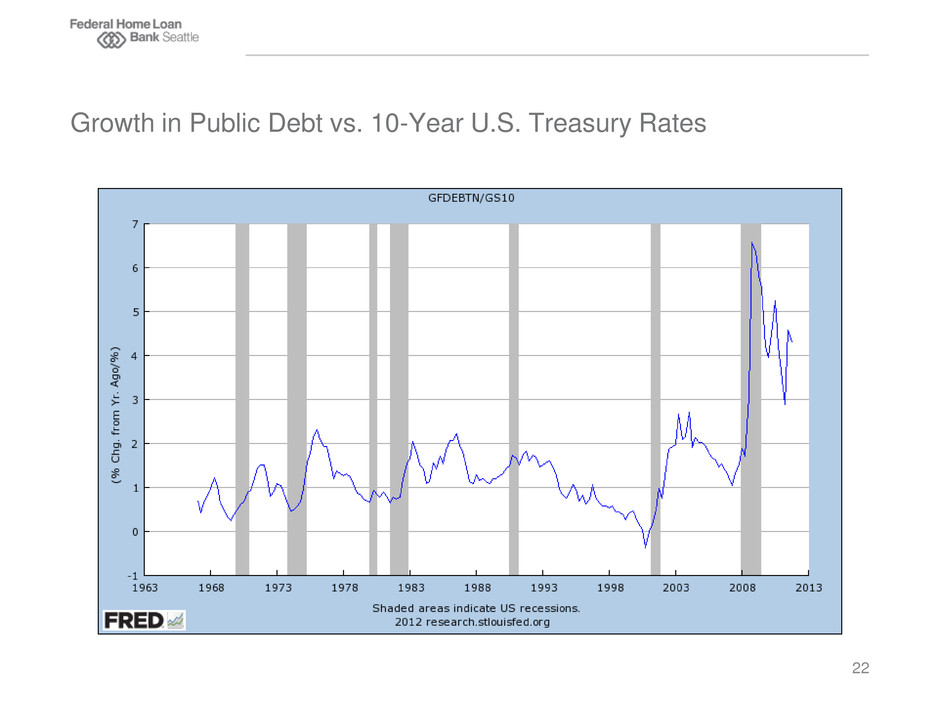

Growth in Public Debt vs. 10-Year U.S. Treasury Rates 22

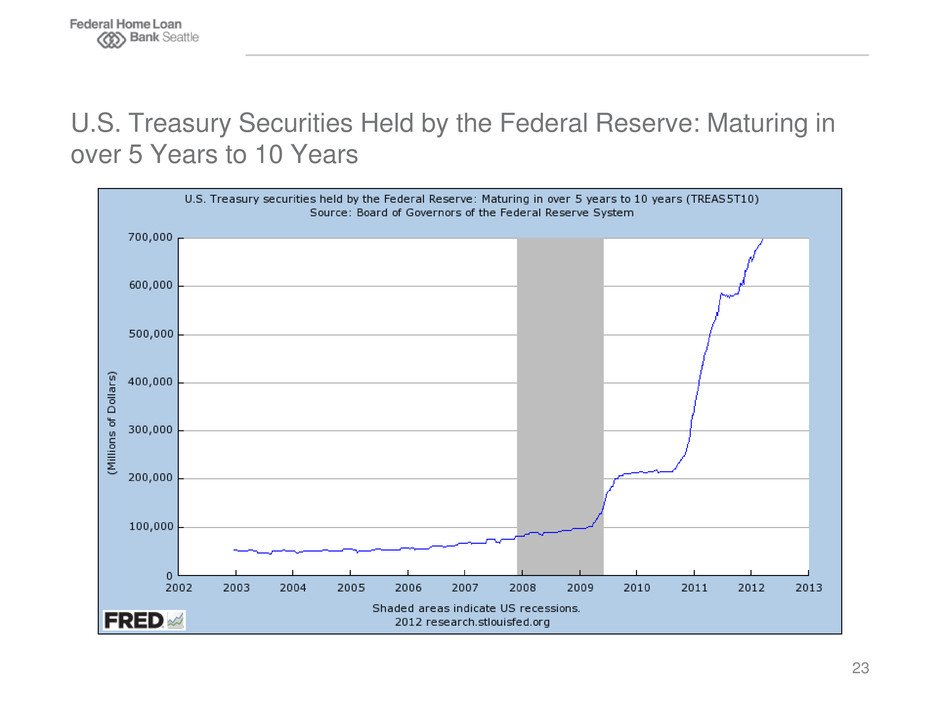

U.S. Treasury Securities Held by the Federal Reserve: Maturing in over 5 Years to 10 Years 23

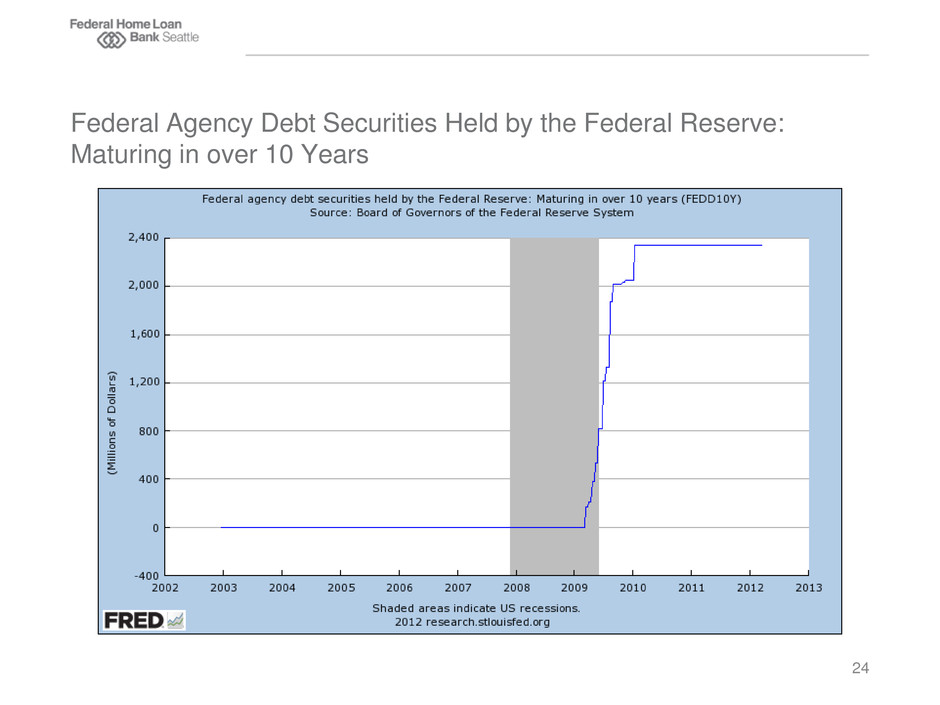

Federal Agency Debt Securities Held by the Federal Reserve: Maturing in over 10 Years 24

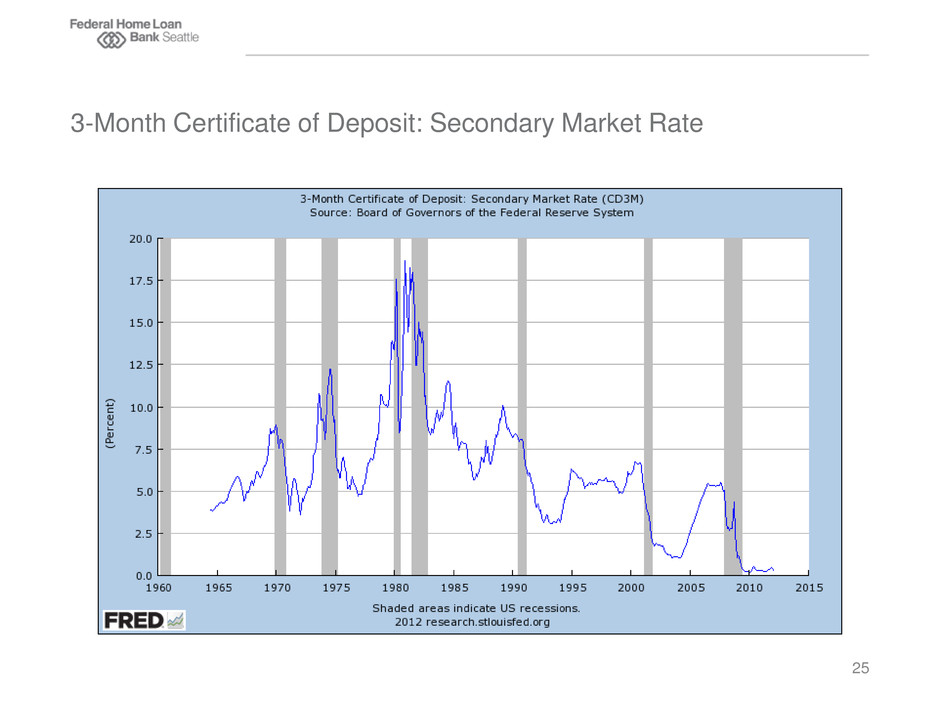

3-Month Certificate of Deposit: Secondary Market Rate 25

Advance demand will continue to be muted as banks work through loan quality / reserve issues. • As this turns around, members will first deploy their excess reserves. The actions taken by the U.S. Government and the Federal Reserve to restart the economy were extraordinary. • We should watch for other potential impacts these actions might have. In particular, there is a prospect for rapidly increasing rates. • The Seattle Bank positions new investments to withstand rate increases of over 500 basis points while avoiding margin compression. Summary 26

2012 Business Initiatives Glen Simecek FVP / Chief Business Officer 27

Enhancing advance products to meet members’ liquidity and interest-rate risk management needs • Symmetrical Prepayment and Forward Settling Advances to address extension risk and the possibility of rising rates • Competitively priced, short-term funding via Auction Advances • Opportunistic advance offerings Improving our collateral program • Enhanced borrowing capacity rates based on market values • Expanded collateral types • Reducing collateral exception rates for members Expanding our educational programming • Enterprise risk management: a central theme in our programming • Funding and investing strategies • Community investment product usage Meeting Member Needs to Encourage Advances Growth 28

Expanding our customer base • Credit unions • Insurance companies • Housing finance agencies Pursuing new opportunities and developing new tools and resource • Acceptance of municipal securities as collateral • Introduction of our Marginal Cost of Funds Analysis Tool – Coming Soon • Remember: Our best ideas come from our members! Expanding Market Reach to Promote Advances Growth 29

Community Investment Products and Services • AHP: Direct subsidy and subsidized advances for affordable housing • Home$tart: Downpayment assistance grants to first-time homebuyers • CIP / EDF: Reduced-rate advances for affordable housing and economic development in areas up to 115% of area median income AHP / Home$tart: $9.3 million available for 2012 • $5.3 million for AHP (application deadline: 8/1/12) • $4.0 million for Home$tart (program year begins: 4/1/12) Community Investment Advantage: • Reduce funding costs • Attract new customers and build customer loyalty • Increase mortgage volumes • Foster community relationships / raise your community profile • Enhance your ability to fulfill CRA requirements Community Investments 30

A Vision for the Seattle Bank Michael L. Wilson President and Chief Executive Officer 31

The Seattle Bank exists to provide members with funding and liquidity. • Advances are our core business. Reliability is crucial. • We must be available at all points in an economic cycle and during a member’s lifecycle. We want to be innovative to help members thrive in a challenging environment. • We work to anticipate member needs, and value our members’ input. We have an obligation to safeguard the capital our members have entrusted to us. • We must be able to redeem/repurchase stock at par. Any dividend must be reasonable. • We are not a profit maximizing entity. Our Vision for the Seattle Bank 32

• Continue working with the Finance Agency to return the bank to health, using the Consent Arrangement as a framework, not as the Seattle Bank’s long-term strategic plan. • Continue working to reduce short-term unsecured investments and replace them with variable- rate, longer-term, secured investments, while retaining our ability to meet our members’ funding needs. • Encourage our members’ use of advances through the introduction of new advance structures and additional forms of collateral, and by enhancing our capital plan. • Strive to repurchase some amount of excess stock in 2012. • Continue our efforts to expand our membership. • Collaborate with other FHLBanks to reduce operating expenses. • Continue pursuing lawsuits against private-label MBS issuers, but building the bank’s future on that outcome. How We Will Achieve Our Vision 33

As a cooperative, our mission is to serve as a reliable source of liquidity and funding for our members. Our members’ use of the cooperative – as active borrowers – is key to our long-term viability. Thank you for your continued support and use of the Federal Home Loan Bank of Seattle. 34

Questions? 35