Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DRIL-QUIP INC | d323119d8k.htm |

Howard Weil

40

th

Annual

Energy Conference

March 26, 2012

Howard Weil

40

th

Annual

Energy Conference

March 26, 2012

Exhibit 99.1

Dril-Quip, Inc. |

The

information furnished in this presentation contains “forward-looking statements”

within the meaning of the Federal Securities laws. Forward-looking statements

include goals, projections, estimates, expectations, forecasts, plans and

objectives, and are based on assumptions, estimates and risk analysis made

by management of Dril-Quip in light of its experience and perception of

historical trends, current conditions, expected future

developments

and

other

factors.

No

assurance

can

be

given

that

actual

future

results will not differ materially from those contained in the forward-looking

statements in this presentation.

Although Dril-Quip believes that all such statements contained in this

presentation are based

on

reasonable

assumptions,

there

are

numerous

variables

of

an

unpredictable

nature or outside of Dril-Quip’s control that could affect

Dril-Quip’s future results and the value

of

its

shares.

Each

investor

must

assess

and

bear

the

risk

of

uncertainty

inherent

in the forward-looking statements contained in this presentation.

Please refer to Dril-Quip’s filings with the SEC for additional discussion

of risks and uncertainties that may affect Dril-Quip’s actual

future results. Dril-Quip undertakes no obligation to update the

forward-looking statements contained herein. Forward-Looking

Statements |

•

Pure play in worldwide offshore market

•

Emphasis on deep water

•

Strong balance sheet

•

Strong backlog

•

Superior margins

•

Positioned for growth

DRQ -

Investment Highlights |

Rig

Count Source: ODS-Petrodata Active Floating Rigs

Revenue

Consistent Track Record of Growth

$0

$100

$200

$300

$400

$500

$600

$700

-

50

100

150

200

250

300

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011 |

Strong Global Presence

Worldwide offices located near key demand centers

Worldwide offices located near key demand centers

Dril-Quip manufacturing,

sales and service

Dril-Quip sales

and/or service

World Headquarters

Houston, Texas

Asia Pacific Headquarters

Singapore

Brazil

Dril-Quip sales

representatives

Eastern Hemisphere Headquarters

Aberdeen,

Scotland |

Suppliers | Offshore Operators |

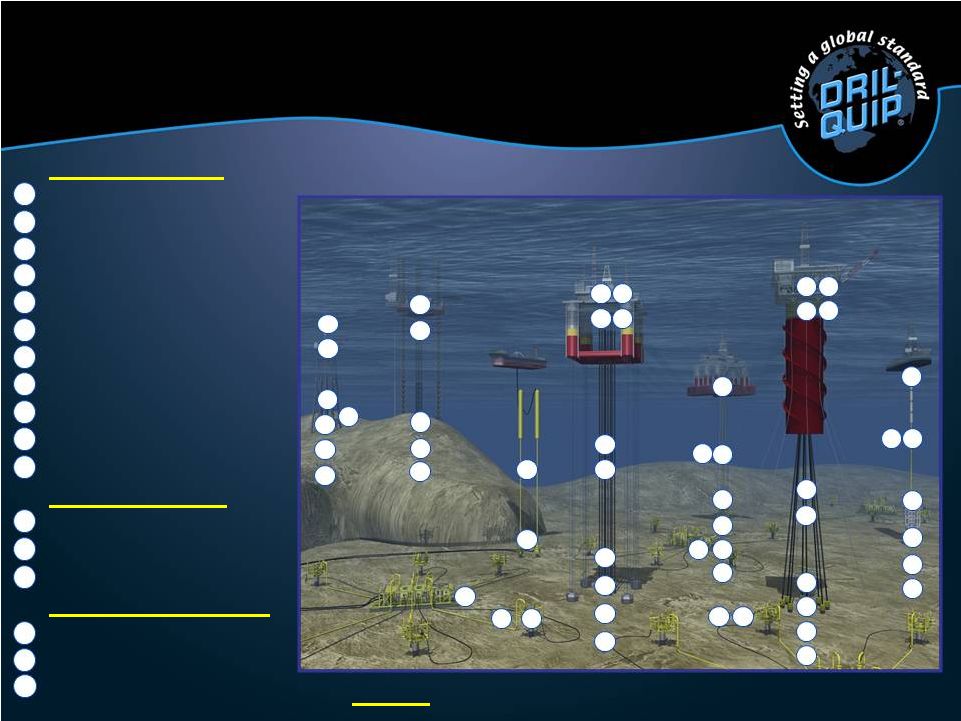

Subsea Equipment

Specialty Connectors

Mudline Suspension

Subsea Wellheads

Tie-Back Connectors

Template Systems

Subsea Trees

Control Systems

Subsea Manifolds

Production Risers

Liner Hangers

Completion Risers

Surface Equipment

Surface Wellheads

Surface Trees

Riser Tensioners

Offshore Rig Equipment

Drilling Risers

Wellhead Connectors

Diverters

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

12

13

Platform

Jack-Up

FPSO

TLP

Spar

Drillship

Semi

4

5

2

1

10

12

17

2

1

10

9

4

9

4

3

1

10

17

15

7

6

13

12

14

3

8

1

10

13

12

17

9

4

3

1

10

17

15

16

3

1

10

8

7

6

17

14

Services

Reconditioning,

Rental Tools, Field Installation

15

14

Product and Services Summary

11

11

16 |

Utilized on subsea wells

drilled by floating rigs

•

Specialty Connectors

•

Subsea Wellheads

•

Liner Hangers

Subsea Well Systems |

Utilized by Spars and TLPs

Surface Trees

Surface Wellheads

Riser Tensioners

Production Risers

Tie-Back Connectors

Subsea Wellheads

Specialty Connectors

Liner Hangers

Dry Tree Completion Systems |

Utilized with FPSO and

Subsea Developments

•

Subsea Trees

•

Control Systems

•

Subsea Manifolds

•

Subsea Wellheads

•

Specialty Connectors

•

Liner Hangers

Subsea Completion Systems |

Utilized on Drilling Rigs

•

Drilling Risers

•

Wellhead Connectors

•

Diverters

Offshore Rig Equipment |

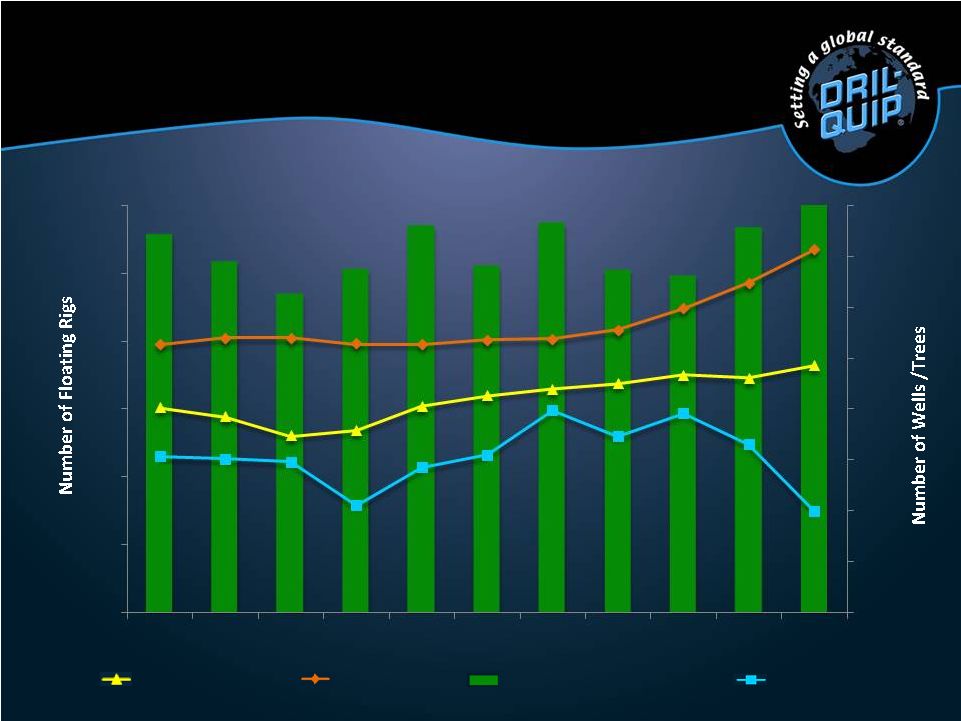

Source: IHS Petrodata, BofA Merrill Lynch, Quest QSDB

Total Subsea Wells Drilled

Working Floating Rigs

0

50

100

150

200

250

300

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

0

100

200

300

400

500

600

700

800

Total Floating Rigs

Wells Drilled from Floating Rigs

Tree Startups |

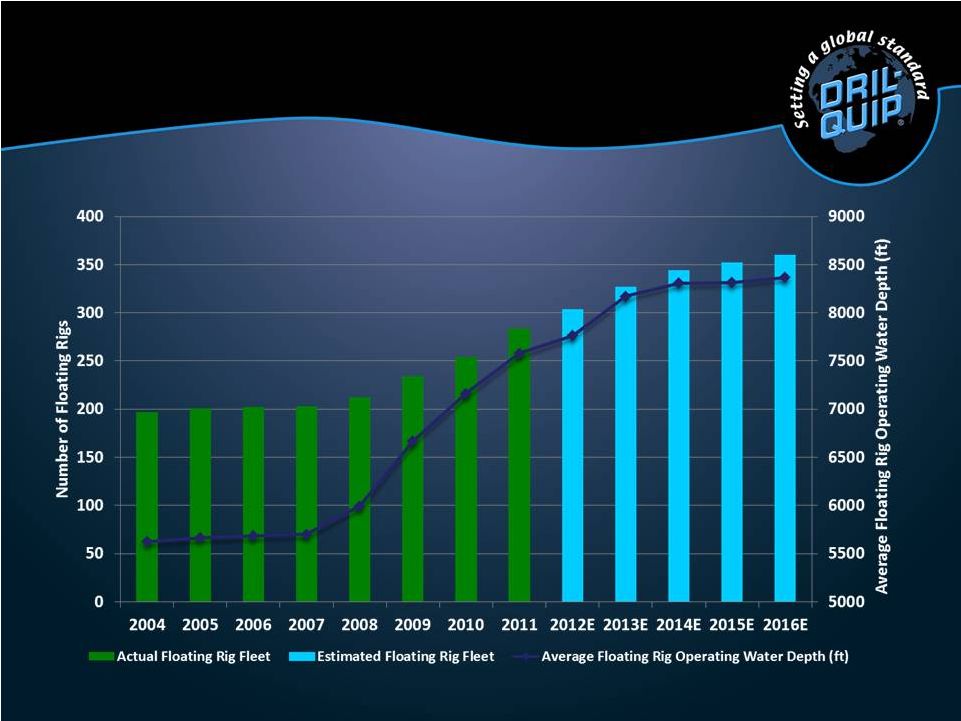

Growth of Floating Rig Fleet

Source: IHS Petrodata, March 21, 2012

Assumes no attrition of rig fleet |

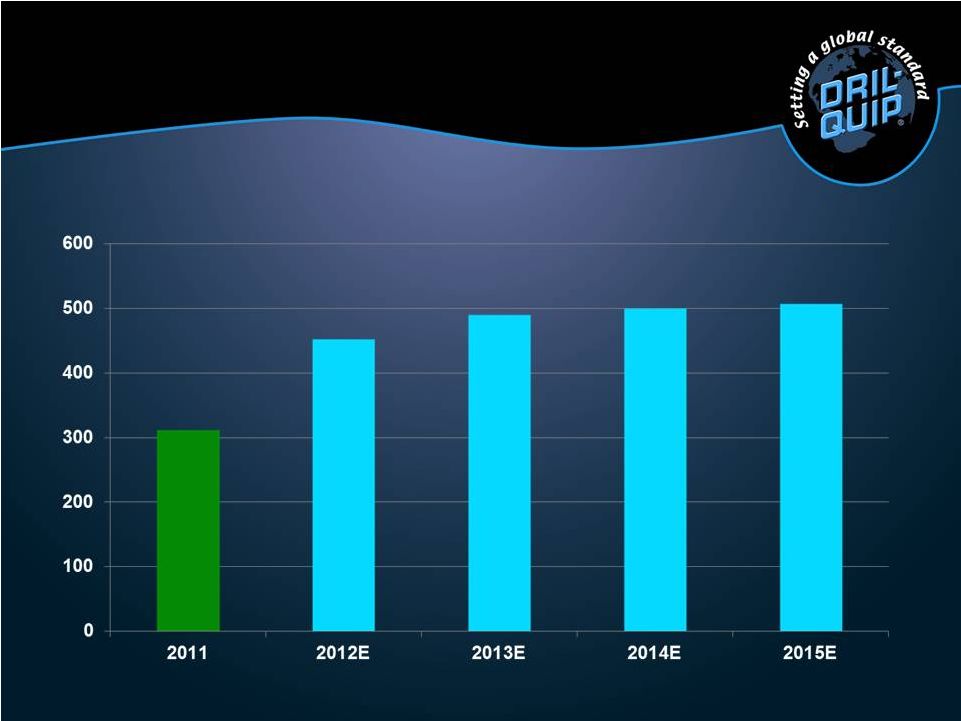

Source: Quest Floating Production Database, Mar 21, 2012

FPSO, SPAR and TLP Awards

Worldwide Floating Production

Units Forecast |

Source: Quest Subsea Forecast Awards, Feb 20, 2012

Subsea Tree Awards Forecast Base Case

Worldwide Subsea Tree Forecast |

Assets

Current assets

$ 799

$

688

Property, plant and equipment, net

275

247

Other assets

12

13

Total assets

$ 1,086

$ 948

Liabilities and Stockholders’

Equity

Current liabilities

$ 151

$ 111

Long-term debt

-

-

Deferred taxes

10

9

Total liabilities

161

120

Stockholders’

equity

925

828

$ 1,086

$ 948

(Millions of USD)

Dec. 31, Dec. 31,

2011

2010 Condensed

Consolidated Balance Sheets |

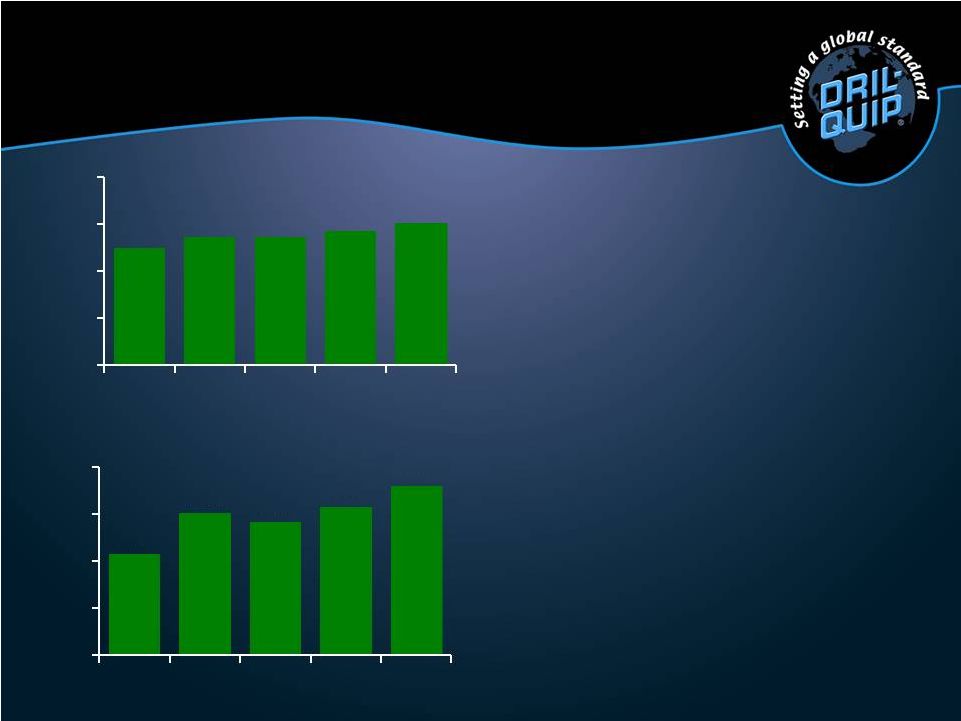

•

Consistent revenue

and backlog

growth

Revenue

($mm)

Worldwide Revenues and Backlog

Backlog

($mm)

601

566

540

543

496

2011

2010

2009

2008

2007

0

200

400

600

800

2011

2010

2009

2008

2007

0

200

400

600

800

716

627

563

603

429 |

EBIT

(Operating

Income)

Margin

*

(%)

Net

Income

Margin

**

(%)

* Represents Operating Income divided by Revenue

** Represents Net Income divided by Revenue

•

Superior margins due

to:

-

Vertical

integration

-

Machine

rebuilding

Proven Track Record of Profitability

21.6

24.5

26.3

26.1

27.9

2011

2010

2009

2008

2007

0

5

10

15

20

25

30

2011

2010

2009

2008

2007

0

5

10

15

20

25

21.8

19.5

19.5

18.1

15.8 |

Finishing

Operations

Houston

Finishing

Operations

Finishing

Operations

Finishing

Operations

Purchase Raw

Materials

Forge

Heat Treat

Rough

Machine

Aberdeen

Singapore

Brazil

Vertically Integrated Manufacturing |

Machine Rebuilding

Purchase used

Rebuild in-house with

new CNC controls

Purpose built machines

Resulting in reduced

capital expenditures

machines |

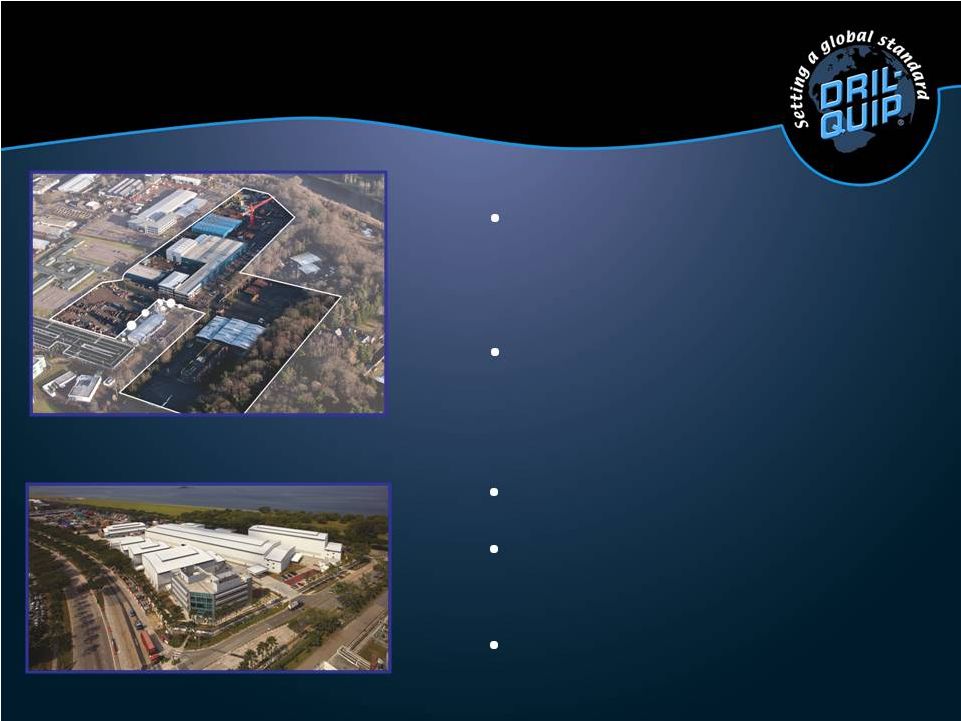

Macaé, Brazil (11 acres)

Houston Eldridge

(218 acres)

Manufacturing Locations

Nine new machines

planned for 2012

Additional machine shop

complete

Brazil

Four new machines

planned for 2012

Additional forge

expansion in process

Headquarters expansion

complete

Houston |

Singapore (11 acres)

Aberdeen, Scotland (24

acres)

Manufacturing Locations

Four new machines

planned for 2012

All machines relocated

by Q2 2012

New facilities complete

Singapore

Two new machines

planned for 2012

Seven acre site added in

Q4

2010

-

Integrated

into Operation in 2011

Aberdeen |

Machines and Machinists

1.00

1.10

1.20

1.30

1.40

150

200

250

300

350

400

1.50

Dec-09

Dec-10

Dec-11

Dec-08

Dec-06

Dec-07

Machines

Machinists

Ratio

Dec-12E |

2012 Planned Capital Expenditures

•

Machines

•

Rental Tools

•

Buildings

•

R&D Facilities

•

Other

Total

$60

(Millions of USD)

$28

17

7

3

5 |

•

Continued emphasis on the growing

deep water offshore sector

•

Increase market share of dry tree and subsea

completion systems

–

Expand engineering staff

–

Expand project management and sales staff

–

Utilization of recent facility expansions

•

Continue introduction of new products

•

Maintain strong financial position

Looking Ahead |