Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ACCO BRANDS Corp | f8k_032212.htm |

EXHIBIT 99.1

ACCO Brands

Corporation

Corporation

March 26, 2012

Barclays Capital High Yield Bond and

Syndicated Loan Conference

Syndicated Loan Conference

1

Forward-Looking Statement & Reg. G

q This presentation contains statements which may constitute "forward-looking" statements as that term is defined in the Private Securities Litigation Reform Act of 1995.

These forward-looking statements are subject to certain risks and uncertainties, are made as of the date hereof and the company assumes no obligation to update them.

ACCO Brands' ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Because actual results may differ from those predicted by

such forward-looking statements, you should not place undue reliance on them when deciding to buy, sell or hold the company’s securities. Among the factors that

could cause our plans, actions and results to differ materially from current expectations are: fluctuations in the cost and availability of raw materials; competition within

the markets in which the company operates; the effects of both general and extraordinary economic, political and social conditions, including any volatility and disruption

in the capital and credit markets; the effect of consolidation in the office products industry; the liquidity and solvency of our major customers; our continued ability to

access the capital and credit markets; the dependence of the company on certain suppliers of manufactured products; the risk that targeted cost savings and synergies

from previous business combinations may not be fully realized or take longer to realize than expected; future goodwill and/or impairment charges; foreign exchange rate

fluctuations; the development, introduction and acceptance of new products; the degree to which higher raw material costs, and freight and distribution costs, can be

passed on to customers through selling price increases and the effect on sales volumes as a result thereof; increases in health care, pension and other employee welfare

costs; as well as other risks and uncertainties detailed in the company’s Annual Report on Form 10-K for the year ended December 31, 2011, under Item 1A, “Risk

Factors,” and in the company's other SEC filings.

These forward-looking statements are subject to certain risks and uncertainties, are made as of the date hereof and the company assumes no obligation to update them.

ACCO Brands' ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Because actual results may differ from those predicted by

such forward-looking statements, you should not place undue reliance on them when deciding to buy, sell or hold the company’s securities. Among the factors that

could cause our plans, actions and results to differ materially from current expectations are: fluctuations in the cost and availability of raw materials; competition within

the markets in which the company operates; the effects of both general and extraordinary economic, political and social conditions, including any volatility and disruption

in the capital and credit markets; the effect of consolidation in the office products industry; the liquidity and solvency of our major customers; our continued ability to

access the capital and credit markets; the dependence of the company on certain suppliers of manufactured products; the risk that targeted cost savings and synergies

from previous business combinations may not be fully realized or take longer to realize than expected; future goodwill and/or impairment charges; foreign exchange rate

fluctuations; the development, introduction and acceptance of new products; the degree to which higher raw material costs, and freight and distribution costs, can be

passed on to customers through selling price increases and the effect on sales volumes as a result thereof; increases in health care, pension and other employee welfare

costs; as well as other risks and uncertainties detailed in the company’s Annual Report on Form 10-K for the year ended December 31, 2011, under Item 1A, “Risk

Factors,” and in the company's other SEC filings.

q Forward-looking statements relating to the proposed merger involving ACCO Brands and the Consumer & Office Products business of MeadWestvaco Corporation

include, but are not limited to: statements about the benefits of the proposed merger, including future financial and operating results; ACCO Brands’ plans, objectives,

expectations and intentions; the expected timing of completion of the merger; and other statements relating to the merger that are not historical facts. With respect to the

proposed merger, important factors could cause actual results to differ materially from those indicated by such forward-looking statements, including, but not limited to:

risks and uncertainties relating to the ability to obtain the requisite ACCO Brands Corporation shareholder approval; the risk that ACCO Brands or MeadWestvaco

Corporation may be unable to obtain governmental and regulatory approvals required for the merger; the risk that a condition to closing of the merger may not be

satisfied; the length of time necessary to consummate the merger; the risk that the cost savings and any other synergies from the transaction may not be fully realized or

may take longer to realize than expected and the impact of additional indebtedness. These risks, as well as other risks associated with the proposed merger, are more

fully discussed in the proxy statement/prospectus included in the registration statement on Form S-4 that ACCO Brands filed with the United States Securities and

Exchange Commission (“SEC”) on March 22, 2012 in connection with the proposed merger.

include, but are not limited to: statements about the benefits of the proposed merger, including future financial and operating results; ACCO Brands’ plans, objectives,

expectations and intentions; the expected timing of completion of the merger; and other statements relating to the merger that are not historical facts. With respect to the

proposed merger, important factors could cause actual results to differ materially from those indicated by such forward-looking statements, including, but not limited to:

risks and uncertainties relating to the ability to obtain the requisite ACCO Brands Corporation shareholder approval; the risk that ACCO Brands or MeadWestvaco

Corporation may be unable to obtain governmental and regulatory approvals required for the merger; the risk that a condition to closing of the merger may not be

satisfied; the length of time necessary to consummate the merger; the risk that the cost savings and any other synergies from the transaction may not be fully realized or

may take longer to realize than expected and the impact of additional indebtedness. These risks, as well as other risks associated with the proposed merger, are more

fully discussed in the proxy statement/prospectus included in the registration statement on Form S-4 that ACCO Brands filed with the United States Securities and

Exchange Commission (“SEC”) on March 22, 2012 in connection with the proposed merger.

q In connection with the proposed merger, the registration statement filed by ACCO Brands on March 22, 2012 has been declared effective by the SEC. This registration

statement includes a proxy statement of ACCO Brands that also constitutes a prospectus of ACCO Brands, and has been mailed to the shareholders of ACCO Brands.

Shareholders are urged to read the proxy statement/prospectus and any other relevant documents, because they contain important information about ACCO Brands and

the proposed merger. The proxy statement/prospectus and other documents relating to the proposed merger can be obtained free of charge from the SEC’s website at

www.sec.gov. The proxy statement/prospectus and other documents can also be obtained free of charge from ACCO Brands upon written request to ACCO Brands

Corporation, Investor Relations, 300 Tower Parkway, Lincolnshire, Illinois 60069, or by calling (847) 484-3020.

statement includes a proxy statement of ACCO Brands that also constitutes a prospectus of ACCO Brands, and has been mailed to the shareholders of ACCO Brands.

Shareholders are urged to read the proxy statement/prospectus and any other relevant documents, because they contain important information about ACCO Brands and

the proposed merger. The proxy statement/prospectus and other documents relating to the proposed merger can be obtained free of charge from the SEC’s website at

www.sec.gov. The proxy statement/prospectus and other documents can also be obtained free of charge from ACCO Brands upon written request to ACCO Brands

Corporation, Investor Relations, 300 Tower Parkway, Lincolnshire, Illinois 60069, or by calling (847) 484-3020.

q This communication is not a solicitation of a proxy from any security holder of ACCO Brands. However, ACCO Brands and certain of its directors and executive officers

may be deemed to be participants in the solicitation of proxies from shareholders in connection with the proposed merger under the rules of the SEC. Information about

the directors and executive officers of ACCO Brands may be found in its 2011 Annual Report on Form 10-K filed with the SEC on February 23, 2012, and its definitive

proxy statement relating to its 2011 Annual Meeting of Shareholders filed with the SEC on April 4, 2011.

may be deemed to be participants in the solicitation of proxies from shareholders in connection with the proposed merger under the rules of the SEC. Information about

the directors and executive officers of ACCO Brands may be found in its 2011 Annual Report on Form 10-K filed with the SEC on February 23, 2012, and its definitive

proxy statement relating to its 2011 Annual Meeting of Shareholders filed with the SEC on April 4, 2011.

Non-GAAP Financial Measures

q “Adjusted” results exclude all unusual tax items. Adjusted supplemental EBITDA from continuing operations also excludes other non-operating items, including other

income/expense and stock-based compensation expense and costs associated with the pending acquisition of the MeadWestvaco’s Consumer and Office Products

business. Adjusted results and supplemental EBITDA from continuing operations are non-GAAP measures. There could be limitations associated with the use of non-

GAAP financial measures as compared to the use of the most directly comparable GAAP financial measure. Management uses the adjusted measures to determine the

returns generated by its operating segments and to evaluate and identify cost-reduction initiatives. Management believes these measures provide investors with helpful

supplemental information regarding the underlying performance of the company from year to year. These measures may be inconsistent with measures presented by

other companies.

income/expense and stock-based compensation expense and costs associated with the pending acquisition of the MeadWestvaco’s Consumer and Office Products

business. Adjusted results and supplemental EBITDA from continuing operations are non-GAAP measures. There could be limitations associated with the use of non-

GAAP financial measures as compared to the use of the most directly comparable GAAP financial measure. Management uses the adjusted measures to determine the

returns generated by its operating segments and to evaluate and identify cost-reduction initiatives. Management believes these measures provide investors with helpful

supplemental information regarding the underlying performance of the company from year to year. These measures may be inconsistent with measures presented by

other companies.

2

Our Vision

q To be the leading branded player within the categories we serve

q Compete effectively in all relevant channels

q Expand global presence

q Leverage a scaleable and cost efficient operating platform

3

Combination with MWV C&OP is a Significant

and Enabling Step

and Enabling Step

q One of the world’s largest office supply

manufacturers with a portfolio of leading

brands

manufacturers with a portfolio of leading

brands

§ Leading brands include Swingline®,

Kensington ®, GBC ®, Day-Timer ®,

Rexel, Marbig, Quartet ®, NOBO and

Wilson Jones ®

Kensington ®, GBC ®, Day-Timer ®,

Rexel, Marbig, Quartet ®, NOBO and

Wilson Jones ®

q Customers include contract stationers,

wholesalers, dealer buying groups, “big box”

office suppliers, and mass channel resellers

wholesalers, dealer buying groups, “big box”

office suppliers, and mass channel resellers

q Products distributed primarily through

commercial and retail channels (~70% / 30%

split)

commercial and retail channels (~70% / 30%

split)

q 2011 Sales: $1.3B

q 2011 EBITDA: $168M

q MWV C&OP has operated as a division of

MeadWestvaco Corporation (NYSE: MWV)

MeadWestvaco Corporation (NYSE: MWV)

q A leading school and office supply and time-

management manufacturer in North America

and Brazil

management manufacturer in North America

and Brazil

§ Leading brands include AT-A-

GLANCE®, Day Runner®, Five-Star®,

Mead®, Grafons, Tilibra and Hilroy

GLANCE®, Day Runner®, Five-Star®,

Mead®, Grafons, Tilibra and Hilroy

q Customers include market leaders in retail,

commercial and wholesale

commercial and wholesale

q Products distributed primarily through retail

and commercial channels (~70% / 30% split)

and commercial channels (~70% / 30% split)

q 2011 Sales: $744M

q 2011 EBITDA: $152M

MWV C&OP

ACCO Brands

4

Right

Opportunity

Opportunity

Right Team

q Existing ACCO Brands business positioned for growth

q Consolidating global industry

q Volatile market environment creating attractive strategic opportunities

Right Time

Right Time, Right Opportunity, Right Team

q Consistent with our strategy to be the leading branded player within the categories

we serve

we serve

q Expands our channel and geographic presence

q Enhances our product innovation, category management expertise and customer

relevance

relevance

q Leverages our cost efficient operating platform

q Strengthens financial profile

q Strong and experienced management teams with consistent track records of

meeting or exceeding goals

meeting or exceeding goals

q Right leadership team in place to integrate the businesses and drive future growth

q Board focused on continuing to create value for shareholders

q Similar values and cultures

5

Transaction Rationale

Bolsters the #1 pure play office and school products company and positions ACCO Brands well

within the office supply sector

Scale Player

In a Global Industry

¡ Enhances our position as a scale player in a

global industry

global industry

¡ Creates a partner of choice for customers

¡ Supports brand leadership strategy

Enhances Global and Channel

Presence

Presence

¡ Increases presence in emerging markets, such

as Brazil

as Brazil

¡ Doubles size in Canada

¡ Expands presence in key consumer channels;

expands presence in mass channels

expands presence in mass channels

¡ Improves channel diversification

Strengthens Portfolio of

Leading Brands

Leading Brands

¡ Increases focus on consumer recognized brands

¡ Complementary leading brands and products

portfolio

portfolio

¡ Expands product offering

¡ Enhances consumer insight and category

management capabilities

management capabilities

Financially Compelling

¡ Significantly EPS accretive pre-synergies

¡ Margin expansion

¡ Deleveraging transaction at close

¡ Significantly improves capital structure

¡ Enhances cash flow generation

Attractive Synergies and

Value Creation

Value Creation

¡ $20 million of cost synergy potential

¡ Great cultural fit

¡ Integration focused on U.S. / Canada

Most stable geographies and

organizations

organizations

Most consolidated customer

base

base

6

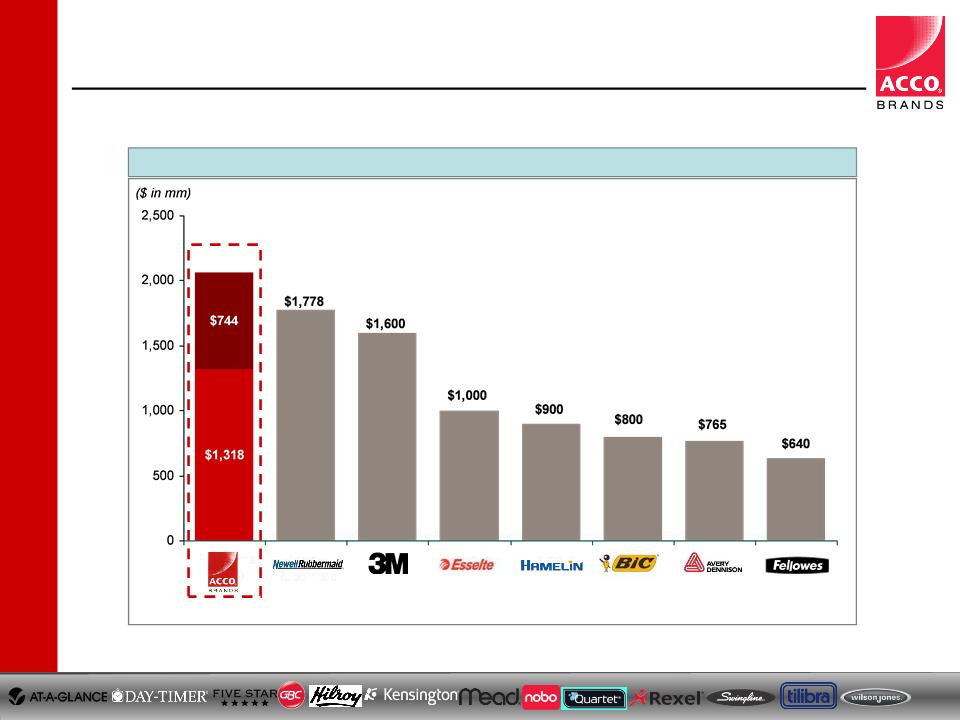

2011 Office Products Sales

___________________________

Source: Company filings and estimates.

1. 1/3/2011: 3M to acquire the consumer and office products business of Avery Dennison; expected completion in H2 2012.

Solidifies A Leading Position in Global Industry

Pro Forma

$2,062

(1)

(1)

7

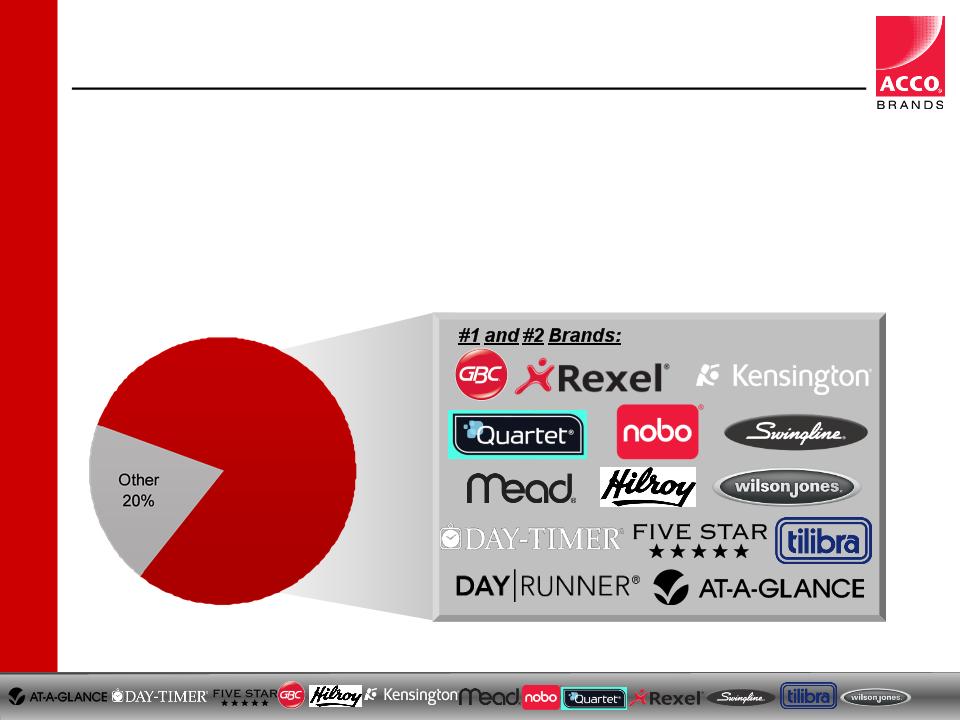

q Leading brands represent more than 80% of combined portfolio

§ ACCO Brands will be the brand leader in a broad base of product categories: binding, laminating,

boards/easels, stapling/punching, notebooks, planning products, presentation/storage and laptop

physical security

boards/easels, stapling/punching, notebooks, planning products, presentation/storage and laptop

physical security

• Enhances ability to offer good, better, best price points

• Strengthens position as a category leader and innovator

Broadens Portfolio of Leading Brands

#1 and #2

Brands

Brands

80%

8

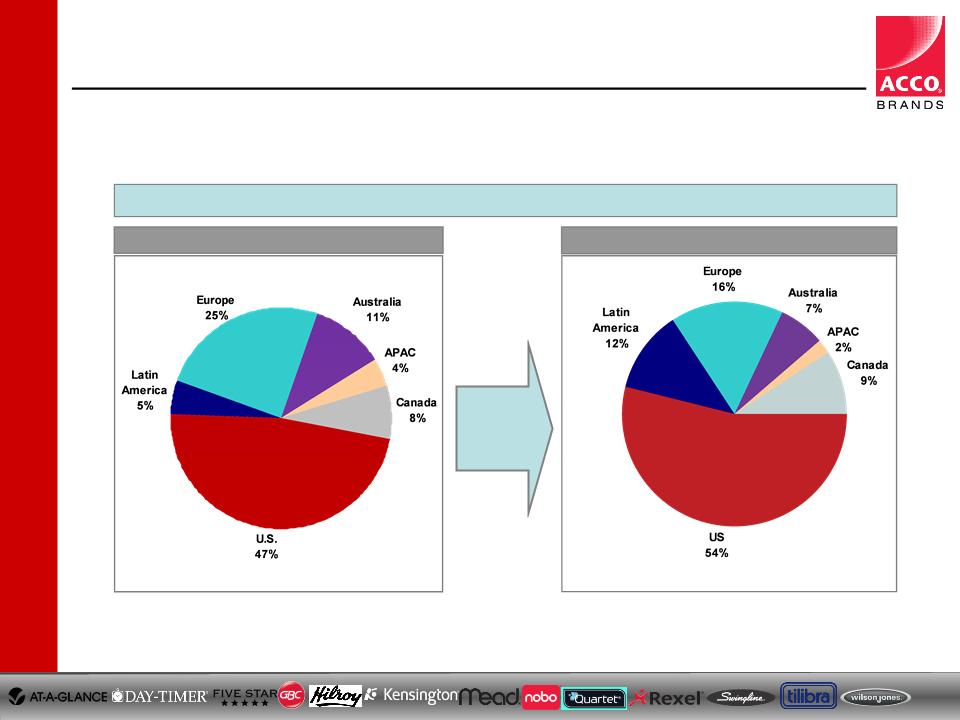

Extends Geographic Reach

ACCO Brands Standalone

Pro Forma Company

q Provides opportunities for substantial cross-selling as well as further organic growth

through geographic expansion into emerging and faster-growing markets

through geographic expansion into emerging and faster-growing markets

FY 2011 Sales by Geography

9

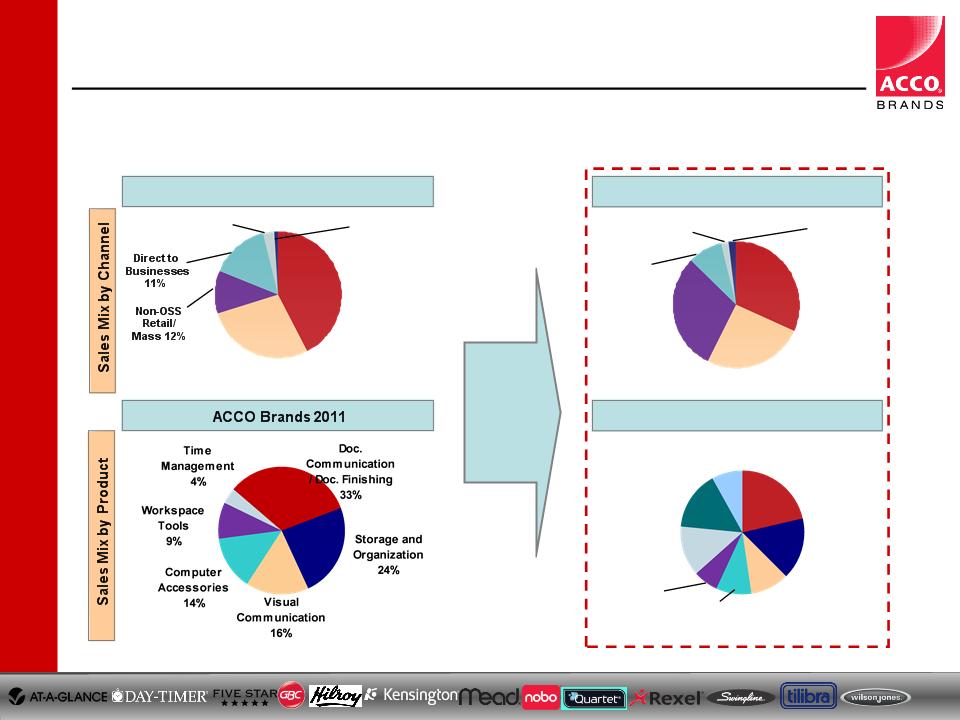

q Extends reach into key consumer retail channels

q MWV C&OP is a world-class manager of trade relationships and channel investment strategies

§ Invests in category management, consumer-focused marketing, forecasting and supply chain analytics

Pro Forma Company

Improves Channel and Product Mix Diversification

Pro Forma Company

ACCO Brands 2011

Commercial

(Non-OSS ) 44%

OSS Sales 29%

Pure

e-commerce

1%

e-commerce

1%

Direct to

Consumers

3%

Consumers

3%

Computer

Accessories

9%

9%

Workspace

Tools

6%

6%

Visual

Communication

10%

10%

Storage and

Organization

16%

16%

Doc.

Communication /

Doc. Finishing

21%

Time

Management

13%

School

Products

16%

Other

9%

Commercial

(Non-OSS) 32%

OSS Sales 26%

Direct to

Businesses

9%

Businesses

9%

Non-OSS

Retail/

Mass 30%

Retail/

Mass 30%

Pure

e-commerce

2%

e-commerce

2%

Direct to

Consumers

2%

Consumers

2%

___________________________

OSS = Office Super Stores

10

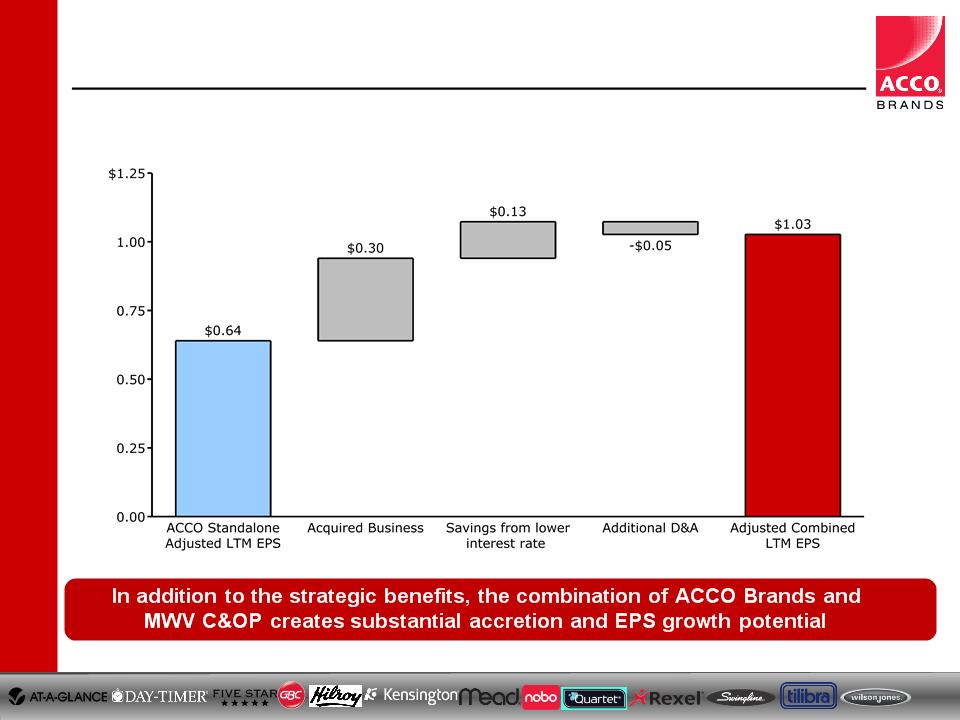

Enhances Earnings Growth (Pre-Synergies) (1)

___________________________

1. Based on adjusted combined numbers for the trailing twelve month period ended Dec. 31, 2011 and assumes 115 million shares outstanding.

11

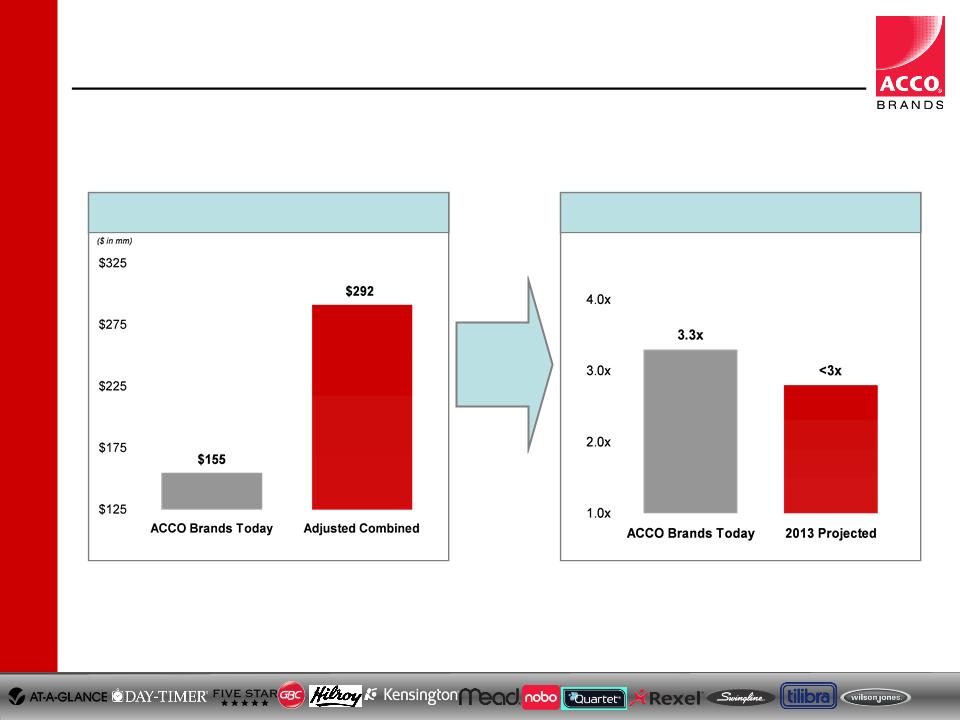

Strengthens Cash Flow

EBITDA - CAPEX(1)

___________________________

1. For the period ended Dec. 31, 2011

2. Net debt / projected adjusted combined supplemental EBITDA

q Enhanced cash flow generation provides significant deleveraging capabilities

Net Leverage(2)

(1)

12

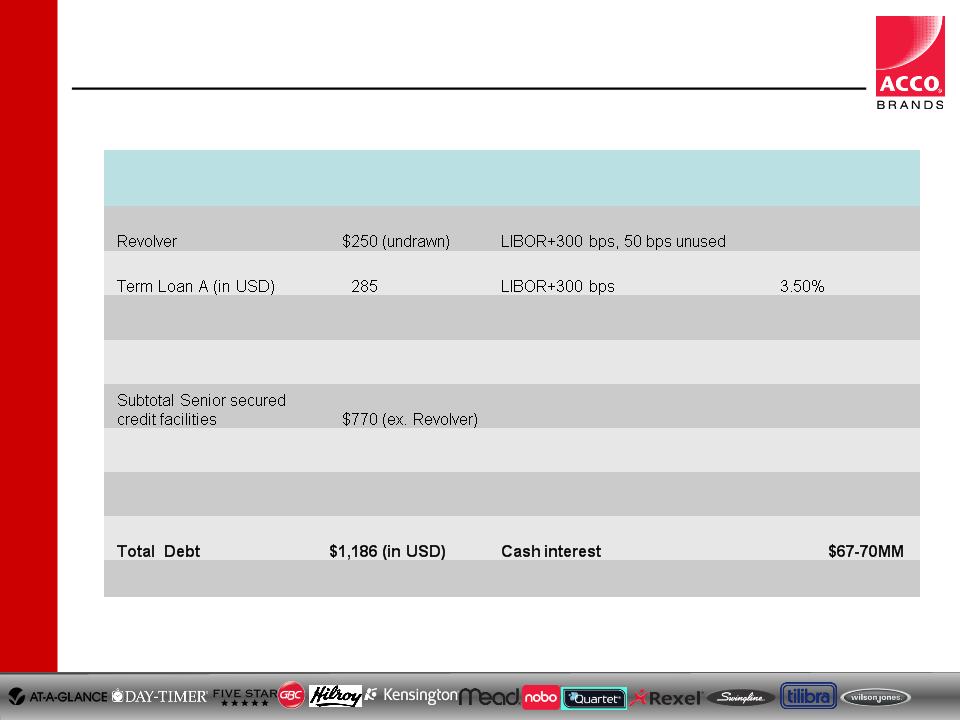

Expected Capital Structure (Subject to Completion)(1)

___________________________

1. Assumes LIBOR is 50 bps, Canadian LIBOR is 130 bps

2. Scenario: upsize the TLB by $100 million to redeem a portion of the Senior subordinated notes. Refer to the 8-Ks filed February 29, 2012 and March 12,2012.

3. Pursuant to an engagement letter contemplating the sale of the Spinco securities to be issued to MWV. Proceeds from the sale of the Spinco securities will be used to fund a portion of the

special dividend to MWV.

special dividend to MWV.

|

Facility

|

Facility Size(2)

|

Interest Rate Methodology

|

Rate(1)

|

|

|

|

|

|||

|

|

||||

|

Term Loan A (in CAD)

|

35

|

Canadian LIBOR+300 bps

|

4.30%

|

|

|

Term Loan B

|

450

|

LIBOR+325 bps, 1% LIBOR floor,

issued at 99 OID

|

4.25%

|

|

|

|

|

|

||

|

Spinco securities(3)

|

270

|

|

TBD

|

|

|

Senior subordinated notes

|

151

|

7.625% fixed

|

7.625%

|

|

|

|

||||

|

|

|

Book interest expense

|

|

$73-76MM

|

13

Credit Ratings

|

|

FYE 2011

|

Post Close

|

|

Net debt

|

548

|

1,186

|

|

Net leverage

|

x3.3

|

x3.3

|

|

|

|

|

|

Secured Debt Ratings

|

FYE 2011

|

Post Close

|

|

Moody’s

|

B1

|

Ba2 (BB)

|

|

S&P

|

BB-

|

BB+

|

|

Fitch

|

|

BB+

|

|

|

|

|

|

|

|

|

14

Summary

Enhances Global

and Channel

Presence

and Channel

Presence

Financially

Compelling

Compelling

Scale Player

In a Global Industry

Strengthens Portfolio

Brands

Brands

Attractive

Synergies and

Value Creation

Synergies and

Value Creation

Appendix

16

Period Ended December 31, 2011

Pro Forma Financial Profile

|

ACCO Brands (1)

|

Pro Forma (2)

(Pre-Synergies)

|

Adjusted Combined (3)

(Pre-Synergies)

|

|

$1318

|

$2062

|

$2062

|

|

$415

|

$660

|

$668

|

|

31.5%

|

32.0%

|

32.0%

|

|

$115

|

$204

|

$231

|

|

8.7%

|

9.9%

|

11.2%

|

|

$168

|

$302

|

$321

|

|

12.8%

|

14.6%

|

15.5%

|

Total Net Sales

EBITDA

EBITDA Margin

EPS

Accretion

Cash Flow(4)

Gross Profit

Gross Margin

Operating Income

Operating Margin

Leverage

|

$155

|

$273

|

$292

|

|

3.3x

|

3.4x

|

3.2x

|

|

$0.64

|

$0.55

|

$1.03

|

|

|

|

87%

|

___________________________

1. Adjusted basis. Refer to the company’s February 15, 2012 press release and 8-K filing for a reconciliation of adjusted results to GAAP.

2. Includes carve-out accounting adjustments, including stepped-up depreciation, amortization and inventory, and excludes one-time transaction-related costs.

3. Includes estimated increases in depreciation and amortization, but excludes inventory step-up, one-time transaction-related costs and certain allocations from MWV which will not continue as

part of the combined company. Assumes a 30% normalized effective tax rate and anticipated interest expense post re-financing.

part of the combined company. Assumes a 30% normalized effective tax rate and anticipated interest expense post re-financing.

4. Defined as EBITDA - Capex.

17

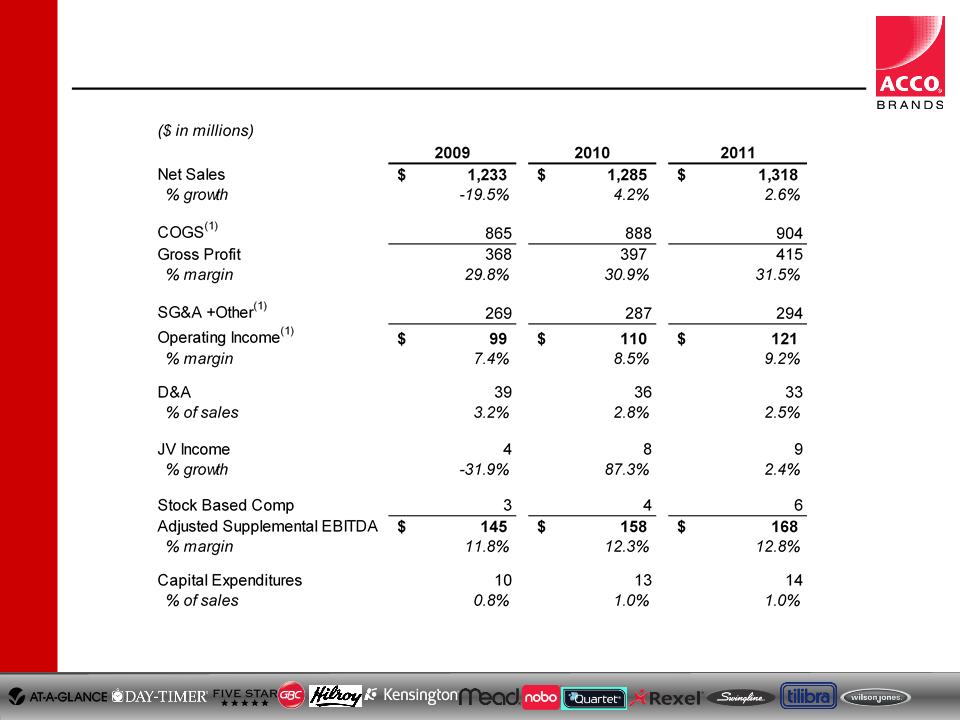

ACCO Brands Historical Financials

___________________________

1. 2011 excludes $6 million of transaction-related costs reported in SG&A. 2009 excludes other charges of $3 million reported in COGS and $1 million reported in SG&A, and $19 million of

restructuring and impairment charges.

restructuring and impairment charges.

18

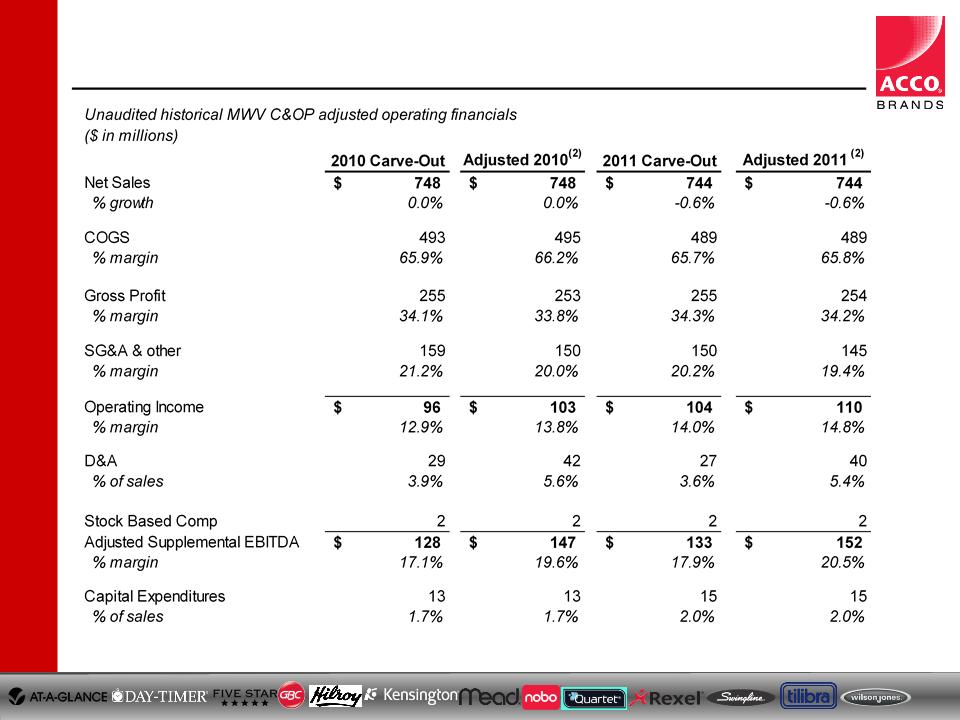

MWV C&OP Adjusted Operating Financials(1)

___________________________

1. Refer to pages 20-21 for the “Reg G” reconciliation of Carve-Out results to Adjusted Results.

2. MC&OP U.S. GAAP Carve-out financials, including stepped-up pro forma depreciation and amortization, but excluding inventory step-up amortization, one-time transaction costs and certain

allocations from the MWV parent which will not continue as part of the combined ACCO Brands.

allocations from the MWV parent which will not continue as part of the combined ACCO Brands.

19

|

(U.S. $ in millions, adjusted basis)

|

Year 1 Estimate

|

|

Capital Expenditures

|

$55

|

|

Cash Restructuring (over ~24 mo)

|

$30-40

|

|

Cash Interest

|

$67-70

|

|

Book Interest

|

$73-76

|

|

Net Working Capital

|

Use

|

|

Depreciation

|

$46

|

|

Amortization

|

$27

|

|

Amort. of Stock Comp

|

$15

|

|

Cash Taxes

|

$45

|

|

Effective Tax Rate4

|

30-32%

|

|

Diluted Shares

|

115

|

5

Pro Forma Modeling Assumptions(1)

___________________________

1. Directional information for modeling purposes only.

20

5

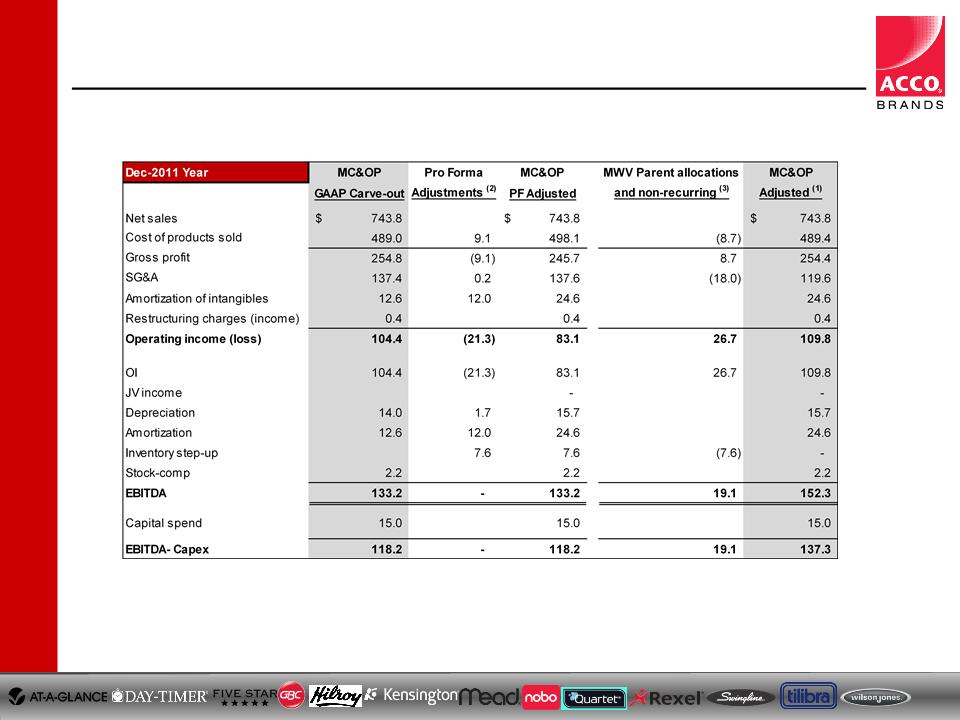

Reg G - Mead C&OP 2011 Adjusted Results

___________________________

1. MC&OP U.S. GAAP Carve-out financials, including stepped-up pro forma depreciation and amortization, but excluding inventory step-up amortization, one-time transaction costs and certain

allocations from the MWV parent which will not continue as part of the combined ACCO Brands.

allocations from the MWV parent which will not continue as part of the combined ACCO Brands.

2. Pro forma adjustments include: amortization of $7.6M for the step-up in the fair value of finished goods inventory and $1.5M of incremental depreciation expense in cost of products sold; $0.2M of

incremental depreciation expense in SG&A; and incremental amortization of intangibles of $12.0M associated with the fair value assigned to trade names, developed technology and customer

relationships.

incremental depreciation expense in SG&A; and incremental amortization of intangibles of $12.0M associated with the fair value assigned to trade names, developed technology and customer

relationships.

3. MWV parent allocations excluded from the ongoing entity include amortization of $7.6M for the step-up in the fair value of finished goods inventory and LIFO expense of $1.1M in cost of products

sold, and corporate costs of $20.4M and gain on property sales of $2.4M in SG&A.

sold, and corporate costs of $20.4M and gain on property sales of $2.4M in SG&A.

21

5

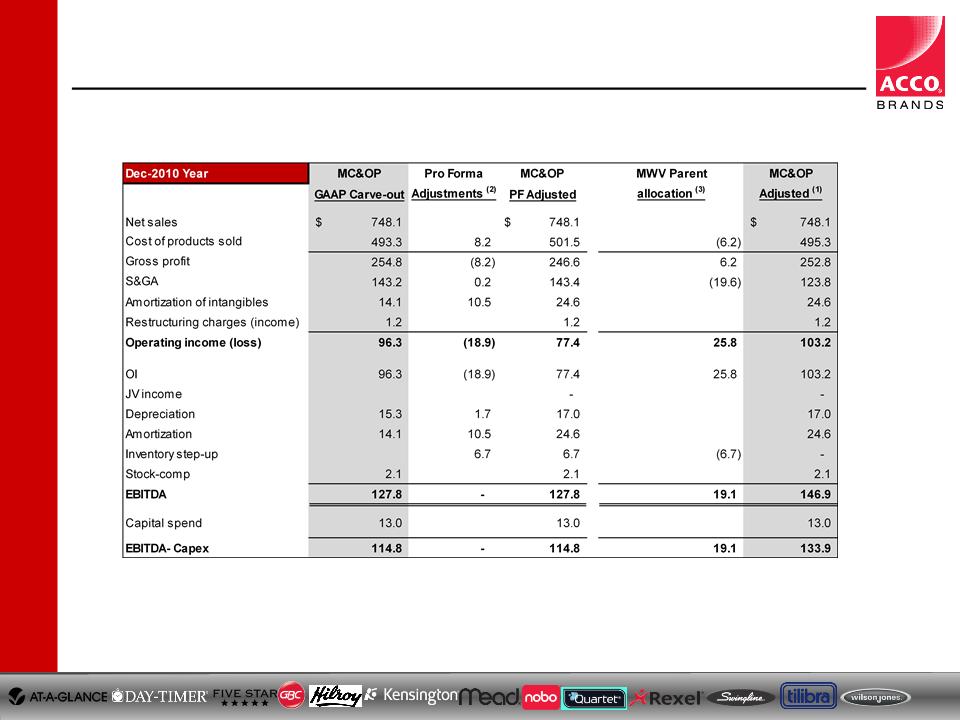

Reg G - Mead C&OP 2010 Adjusted Results

___________________________

1. MC&OP U.S. GAAP Carve-out financials, including stepped-up pro forma depreciation and amortization, but excluding inventory step-up amortization, one-time transaction costs and certain

allocations from the MWV parent which will not continue as part of the combined ACCO Brands.

allocations from the MWV parent which will not continue as part of the combined ACCO Brands.

2. Pro forma adjustments include: amortization of $6.7M for the step-up in the fair value of finished goods inventory and $1.5M of incremental depreciation expense in cost of products sold; $0.2M of

incremental depreciation expense in SG&A; and incremental amortization of intangibles of $10.5M associated with the fair value assigned to trade names, developed technology and customer

relationships.

incremental depreciation expense in SG&A; and incremental amortization of intangibles of $10.5M associated with the fair value assigned to trade names, developed technology and customer

relationships.

3. MWV parent allocations excluded from the ongoing entity include amortization of $6.7M for the step-up in the fair value of finished goods inventory and LIFO income of $0.5M in cost of products

sold, and corporate costs of $19.6M in SG&A.

sold, and corporate costs of $19.6M in SG&A.

ACCO Brands Corporation