Attached files

| file | filename |

|---|---|

| 8-K - DIGITAL SYSTEMS, INC. 8-K - Digital Systems, Inc. | digitalsystems8k.htm |

Exhibit 99.1

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF KANSAS

KANSAS CITY DIVISION

| IN RE: | ) | |

| ) | Case No. 11-20140-11-rdb | |

| DIGITAL SYSTEMS, INC. | ) | Chapter 11 |

| Debtor. | ) | |

| ) |

DEBTOR'S STANDARD MONTHLY OPERATING REPORT (BUSINESS)

FOR THE PERIOD

FROM February 1, 2012 TO February 29, 2012

Comes now the above-named debtor and files its Monthly Operating Reports in accordance with the Guidelines established by the United States Trustee and FRBP 2015.

| /s/ Joanne B. Stutz | ||

| Attorney for Debtor’s Signature | ||

| Debtor's Address | Attorney's Address | |

| and Phone Number: | and Phone Number: | |

| 15621 W. 87th Street, Box 355 | 7225 Renner Road, Suite 200 | |

| Lenexa, KS 66219 | Shawnee, KS 66217 | |

| (913) 962-8700; (913) 962-8701 (FAX) | ||

Note: The original Monthly Operating Report is to be filed with the court and a copy simultaneously provided to the United States Trustee Office. Monthly Operating Reports must be filed by the 21st day of the following month.

For assistance in preparing the Monthly Operating Report, refer to the following resources on the United States Trustee Program Website, http://www.justice.gov/ust/r20/index.htm.

|

1)

|

Instructions for Preparations of Debtor’s Chapter 11 Monthly Operating Report

|

|

2)

|

Initial Filing Requirements

|

|

3)

|

Frequently Asked Questions (FAQs)http://www.usdoj.gov/ust/

|

MOR-1

SCHEDULE OF RECEIPTS AND DISBURSEMENTS

FOR THE REPORTING PERIOD BEGINNING February 1, 2012 and ending February 29, 2012

Name of Debtor: Digital Systems, Inc. Case Number: 11-20140-11-rdb

Date of Petition: January 21, 2011

|

Current

|

Cumulative

|

||||||||||||

|

Month

|

to Petition Date

|

||||||||||||

|

1. FUNDS AT BEGINNING OF PERIOD

|

$ | 141,774.79 |

(a)

|

$ | 24,201.83 |

(b)

|

|||||||

|

2. RECEIPTS:

|

|||||||||||||

|

A. Cash Sales

|

- | ||||||||||||

|

Minus: Cash Refunds

|

- | ||||||||||||

|

Net Cash Sales

|

- | ||||||||||||

|

B. Accounts Receivable

|

207,739.09 | ||||||||||||

|

C. Other Receipts (See MOR-3)

|

9,043.88 | 763,102.70 | |||||||||||

|

(If you receive rental income,

|

- | ||||||||||||

|

you must attach a rent roll.)

|

|||||||||||||

|

3. TOTAL RECEIPTS (Lines 2A+2B+2C)

|

970,841.79 | ||||||||||||

| 4. TOTAL FUNDS AVAILABLE FOR OPERATIONS (Line 1 + Line 3) | $ | 150,818.67 | $ | 995,043.62 | |||||||||

|

5. DISBURSEMENTS

|

|||||||||||||

|

A. Advertising

|

- | ||||||||||||

|

B. Bank Charges

|

1,775.00 | ||||||||||||

|

C. Contract Labor

|

4,630.00 | 66,664.85 | |||||||||||

|

D. Fixed Asset Payments (not incl. in “N”)

|

- | ||||||||||||

|

E. Insurance

|

41,943.00 | ||||||||||||

|

F. Inventory Payments (See Attach. 2)

|

- | ||||||||||||

|

G. Leases

|

- | ||||||||||||

|

H. Manufacturing Supplies

|

- | ||||||||||||

|

I. Office Supplies

|

1,647.33 | ||||||||||||

|

J. Payroll - Net (See Attachment 4B)

|

167,780.49 | ||||||||||||

|

K. Professional Fees (Accounting & Legal)

|

4,056.00 | 199,328.74 | |||||||||||

|

L. Rent

|

750.00 | 53,375.66 | |||||||||||

|

M. Repairs & Maintenance

|

- | ||||||||||||

|

N. Secured Creditor Payments (See Attach. 2)

|

186,977.59 | ||||||||||||

|

O. Taxes Paid - Payroll (See Attachment 4C)

|

83,905.08 | ||||||||||||

| P. Taxes Paid - Sales & Use (See Attachment 4C) | - | ||||||||||||

|

Q. Taxes Paid - Other (See Attachment 4C)

|

6,630.52 | ||||||||||||

|

R. Telephone

|

91.70 | 9,312.61 | |||||||||||

|

S. Travel & Entertainment

|

4,185.62 | ||||||||||||

|

Y. U.S. Trustee Quarterly Fees

|

5,525.00 | ||||||||||||

|

U. Utilities

|

248.49 | 7,346.68 | |||||||||||

|

V. Vehicle Expenses

|

- | ||||||||||||

|

W. Other Operating Expenses (See MOR-3)

|

25,896.85 | ||||||||||||

|

6. TOTAL DISBURSEMENTS (Sum of 5A thru W)

|

9,776.19 | 863,045.02 | |||||||||||

|

7. ENDING BALANCE (Line 4 Minus Line 6)

|

$ | 141,042.48 |

(c)

|

$ | 141,042.48 |

(c)

|

|||||||

MOR-2

I declare under penalty of perjury that this statement and the accompanying documents and reports are true and correct to the best of my knowledge and belief.

| This 20th day of March, 2012. | /s/ David C. Owen |

| By: David C. Owen, Chairman/CEO |

(a)This number is carried forward from last month’s report. For the first report only, this number will be the balance as of the petition date.

(b)This figure will not change from month to month. It is always the amount of funds on hand as of the date of the petition.

(c)These two amounts will always be the same if form is completed correctly.

MOR-3

MONTHLY SCHEDULE OF RECEIPTS AND DISBURSEMENTS (cont’d)

Detail of Other Receipts and Other Disbursements

OTHER RECEIPTS:

Describe Each Item of Other Receipt and List Amount of Receipt. Write totals on Page MOR-2, Line 2C.

|

Description

|

Current Month

|

Cumulative

Petition to Date

|

|

| TOTAL OTHER RECEIPTS | Refunds | $ 9,043.88 | $772,146.58 |

“Other Receipts” includes Loans from Insiders and other sources (i.e. Officer/Owner, related parties directors, related corporations, etc.). Please describe below:

|

Loan Amount

|

Source

of Funds

|

Purpose

|

Repayment Schedule

|

OTHER DISBURSEMENTS:

Describe Each Item of Other Disbursement and List Amount of Disbursement. Write totals on Page MOR-2, Line 5W.

|

Description

|

Current Month

|

Cumulative

Petition to Date

|

|||

| TOTAL OTHER DISBURSEMENTS | |||||

NOTE: Attach a current Balance Sheet and Income (Profit & Loss) Statement.

ATTACHMENT 1

MONTHLY ACCOUNTS RECEIVABLE RECONCILIATION AND AGING

Name of Debtor: Digital Systems, Inc. Case Number: 11-20140-11-rdb

MOR-4

FOR THE REPORTING PERIOD BEGINNING February 1, 2012 and ending February 29, 2012

ACCOUNTS RECEIVABLE AT PETITION DATE:

ACCOUNTS RECEIVABLE RECONCILIATION

(Include all accounts receivable, pre-petition and post-petition, including charge card sales which have not been received):

| Beginning of Month Balance | $ 171,144.17 (a) | |

| PLUS: Current Month New Billings | ||

| MINUS: Collection During the Month | $ (b) | |

| PLUS/MINUS: Adjustments or Writeoffs | $ * | |

| End of Month Balance | $ 171,144.17 (c) |

*For any adjustments or Write-offs provide explanation and supporting documentation, if applicable:

Customer receipts paid to FCG offset against interest and penalty fees

Adjustment made to refund overpayment on account.

POST PETITION ACCOUNTS RECEIVABLE AGING

(Show the total for each aging category for all accounts receivable)

|

|

0-30 Days

|

31-60 Days

|

61-90 Days

|

Over 90Days

|

Total

|

For any receivables in the “Over 90 Days” category, please provide the following:

|

Customer

|

Receivable

Date

|

Status (Collection efforts taken, estimate of collectability,

write-off, disputed account, etc.)

|

||

(a)This number is carried forward from last month’s report. For the first report only, this number will be the balance as of the petition date.

(b)This must equal the number reported in the “Current Month” column of Schedule of Receipts and

Disbursements (Page MOR-2, Line 2B).

(c)These two amounts must equal.

MOR-5

ATTACHMENT 2

MONTHLY ACCOUNTS PAYABLE AND SECURED PAYMENTS REPORT

Name of Debtor: Digital Systems, Inc. Case Number: 11-20140-11-rdb

FOR THE REPORTING PERIOD BEGINNING February 1, 2012 and ending February 29, 2012

In the space below list all invoices or bills incurred and not paid since the filing of the petition. Do not include amounts owed prior to filing the petition. In the alternative, a computer generated list of payables may be attached provided all information requested below is included.

POST-PETITION ACCOUNTS PAYABLE

|

Date

Incurred

|

Days

Outstanding

|

Vendor

|

Description

|

Amount

|

|||||

| See Attached | |||||||||

| TOTAL AMOUNT | (b) | ||||||||

X Check here if pre-petition debts have been paid. Attach an explanation and copies of supporting

documentation.

ACCOUNTS PAYABLE RECONCILIATION (Post Petition Unsecured Debt Only)

| Opening Balance | $ 4,941.02 (a) |

| PLUS: New Indebtedness Incurred This Month | $ |

| MINUS: Amount Paid on Post Petition, | |

| Accounts Payable This Month | $ |

| PLUS/MINUS: Adjustments | $ * |

| Ending Month Balance | $ 4,941.02 (c) |

*For any adjustments provide explanation and supporting documentation, if applicable.

SECURED PAYMENTS REPORT

List the status of Payments to Secured Creditors and Lessors (Post Petition Only). If you have entered into a modification agreement with a secured creditor/lessor, consult with your attorney and the United States Trustee Program prior to completing this section).

|

Secured

Creditor/

Lessor

|

Date

Payment

Due This

Month

|

Amount

Paid This

Month

|

Number

of Post

Petition

Payments

Delinquent

|

Total

Amount of

Post Petition

Payments

Delinquent

|

||||

| TOTAL | (d) |

(a)This number is carried forward from last month’s report. For the first report only, this number will be zero.

(b, c)The total of line (b) must equal line (c).

(d)This number is reported in the “Current Month” column of Schedule of Receipts and Disbursements (Page MOR-2, Line 5N).

MOR-6

ATTACHMENT 3

INVENTORY AND FIXED ASSETS REPORT

Name of Debtor: Digital Systems, Inc. Case Number: 11-20140-11-rdb

FOR THE REPORTING PERIOD BEGINNING February 1, 2012 and ending February 29, 2012

INVENTORY REPORT

| INVENTORY BALANCE AT PETITION DATE: | $ | |

| INVENTORY RECONCILIATION: | ||

| Inventory Balance at Beginning of Month | $ 0.00 (a) | |

| PLUS: Inventory Purchased During Month | $ | |

| MINUS: Inventory Used or Sold | $ | |

| PLUS/MINUS: Adjustments or Write-downs | $ * | |

| Inventory on Hand at End of Month | $ 0.00 | |

METHOD OF COSTING INVENTORY: FIFO

*For any adjustments or write-downs provide explanation and supporting documentation, if applicable.

Sale of Assets March 2011.

INVENTORY AGING

|

Less than 6

months old

|

6 months to

2 years old

|

Greater than

2 years old

|

Considered

Obsolete

|

Total Inventory

|

||||

| % | 100% | % | % | = | 100%* |

* Aging Percentages must equal 100%.

☐ Check here if inventory contains perishable items.

Description of Obsolete Inventory:

FIXED ASSET REPORT

| FIXED ASSETS FAIR MARKET VALUE AT PETITION DATE: | $ 1.219.241.95(b) | |

| (Includes Property, Plant and Equipment) | ||

| BRIEF DESCRIPTION (First Report Only): | ||

| FIXED ASSETS RECONCILIATION: | ||

| Fixed Asset Book Value at Beginning of Month | $ -0- (a)(b) | |

| MINUS: Depreciation Expense | $ | |

| PLUS: New Purchases | $ | |

| PLUS/MINUS: Adjustments or Write-downs | $ | |

|

Ending Monthly Balance

|

$ -0-__________

|

|

*For any adjustments or write-downs, provide explanation and supporting documentation, if applicable.

Asset Sale March 2011.

BRIEF DESCRIPTION OF FIXED ASSETS PURCHASED OR DISPOSED OF DURING THE REPORTING PERIOD:

(a)This number is carried forward from last month’s report. For the first report only, this number will be the

balance as of the petition date.

(b)Fair Market Value is the amount at which fixed assets could be sold under current economic conditions.

Book Value is the cost of the fixed assets minus accumulated depreciation and other adjustments.

MOR-7

ATTACHMENT 4A

MONTHLY SUMMARY OF BANK ACTIVITY - OPERATING ACCOUNT

Name of Debtor: Digital Systems, Inc. Case Number: 11-20140-11-rdb

FOR THE REPORTING PERIOD BEGINNING February 1, 2012 and ending February 29, 2012

Attach a copy of current month bank statement and bank reconciliation to this Summary of Bank Activity. A standard bank reconciliation form can be found at http://www.justice.gov/ust/r20/index.htm. If bank accounts other than the three required by the United States Trustee Program are necessary, permission must be obtained from the United States Trustee prior to opening the accounts. Additionally, use of less than the three required bank accounts must be approved by the United States Trustee.

NAME OF BANK: FNB Olathe BRANCH:

ACCOUNT NAME: Operating Account ACCOUNT NUMBER: 0139602

PURPOSE OF ACCOUNT: OPERATING

| Ending Balance per Bank Statement |

$ 137,334.16

|

|

| Plus Total Amount of Outstanding Deposits | $ | |

| Minus Total Amount of Outstanding Checks and other debits |

$ 126.09 *

|

|

| Minus Service Charges | $ | |

| Ending Balance per Check Register | $ 140,084.15**(a) |

*Debit cards are used by

**If Closing Balance is negative, provide explanation:

4C: TAXES PAID-OTHER

Amount Payee Purpose

The following disbursements were paid in Cash (do not includes items reported as Petty Cash on Attachment 4D: ( ☐ Check here if cash disbursements were authorized by United States Trustee)

|

Date

|

Amount

|

Payee

|

Purpose

|

Reason for Cash Disbursement

|

TRANSFERS BETWEEN DEBTOR IN POSSESSION ACCOUNTS

“Total Amount of Outstanding Checks and other debits”, listed above, includes:

$________________Transferred to Payroll Account

$________________Transferred to Tax Account

(a) The total of this line on Attachment 4A, 4B and 4C plus the total of 4D must equal the amount reported as

“Ending Balance” on Schedule of Receipts and Disbursements (Page MOR-2, Line 7).

MOR-8

ATTACHMENT 5A

CHECK REGISTER - OPERATING ACCOUNT

Name of Debtor: Case Number:

Reporting Period beginning Period ending

NAME OF BANK: BRANCH:

ACCOUNT NAME:

ACCOUNT NUMBER:

PURPOSE OF ACCOUNT: OPERATING

Account for all disbursements, including voids, lost checks, stop payments, etc. In the alternative, a computer generated check register can be attached to this report, provided all the information requested below is included.

|

DATE

|

CHECK

NUMBER

|

PAYEE

|

PURPOSE

|

AMOUNT

|

||||

| SEE ATTACHED | ||||||||

| TOTAL | $ |

MOR-9

ATTACHMENT 4B

MONTHLY SUMMARY OF BANK ACTIVITY - PAYROLL ACCOUNT

Name of Debtor: Digital Systems, Inc. Case Number: 11-20140-11-rdb

FOR THE REPORTING PERIOD BEGINNING February 1, 2012 and ending February 29, 2012

Attach a copy of current month bank statement and bank reconciliation to this Summary of Bank Activity. A standard bank reconciliation form can be found at http://www.justice.gov/ust/r20/index.htm.

NAME OF BANK: FNB Olathe BRANCH:

ACCOUNT NAME: Payroll Account ACCOUNT NUMBER: 0149527

PURPOSE OF ACCOUNT: PAYROLL ACCOUNT CLOSED

| Ending Balance per Bank Statement |

$ 0.00*

|

|

| Plus Total Amount of Outstanding Deposits | $ | |

| Minus Total Amount of Outstanding Checks and other debits |

$ 0.00*

|

|

| Minus Service Charges | $ | |

| Ending Balance per Check Register | $ 0.00**(a) |

*Debit cards must not be issued on this account.

**If Closing Balance is negative, provide explanation:

The following disbursements were paid by Cash: ( ☐ Check here if cash disbursements were authorized by United States Trustee)

| Date | Amount | Payee | Purpose | Reason for Cash Disbursement | ||||

The following non-payroll disbursements were made from this account:

| Date | Amount | Payee | Purpose | Reason for disbursement from this account | ||||

(a)The total of this line on Attachment 4A, 4B and 4C plus the total of 4D must equal the amount reported as

“Ending Balance” on Schedule of Receipts and Disbursements (Page MOR-2, Line 7).

MOR-10

ATTACHMENT 5B

CHECK REGISTER - PAYROLL ACCOUNT

Name of Debtor: Case Number:

Reporting Period beginning Period ending

NAME OF BANK: BRANCH:

ACCOUNT NAME:

ACCOUNT NUMBER:

PURPOSE OF ACCOUNT: PAYROLL

Account for all disbursements, including voids, lost payments, stop payment, etc. In the alternative, a computer generated check register can be attached to this report, provided all the information requested below is included.

|

DATE

|

CHECK

NUMBER

|

PAYEE

|

PURPOSE

|

AMOUNT

|

||||

| SEE ATTACHED | ||||||||

| TOTAL | $ | |||||||

MOR-11

ATTACHMENT 4C

MONTHLY SUMMARY OF BANK ACTIVITY - TAX ACCOUNT

Name of Debtor: Digital Systems, Inc. Case Number: 11-20140-11-rdb

FOR THE REPORTING PERIOD BEGINNING February 1, 2012 and ending February 29, 2012

Attach a copy of current month bank statement and bank reconciliation to this Summary of Bank Activity. A standard bank reconciliation form can be found on the United States Trustee website, http://www.justice.gov/ust/r20/index.htm.

NAME OF BANK: BRANCH: ACCOUNT CLOSED

ACCOUNT NAME: ACCOUNT NUMBER:

PURPOSE OF ACCOUNT: TAX

| Ending Balance per Bank Statement |

$

|

|

| Plus Total Amount of Outstanding Deposits | $ | |

| Minus Total Amount of Outstanding Checks and other debits |

$ *

|

|

| Minus Service Charges | $ | |

| Ending Balance per Check Register | $ **(a) |

*Debit cards must not be issued on this account.

**If Closing Balance is negative, provide explanation:

The following disbursements were paid by Cash: ( ☐ Check here if cash disbursements were authorized by United States Trustee)

| Date | Amount | Payee | Purpose | Reason for Cash Disbursement | ||||

The following non-tax disbursements were made from this account:

| Date | Amount | Payee | Purpose |

Reason for disbursement from this account

|

||||

(a)The total of this line on Attachment 4A, 4B and 4C plus the total of 4D must equal the amount reported as

“Ending Balance” on Schedule of Receipts and Disbursements (Page MOR-2, Line 7).

MOR-12

ATTACHMENT 5C

CHECK REGISTER - TAX ACCOUNT

Name of Debtor: Case Number:

Reporting Period beginning Period ending

NAME OF BANK: BRANCH:

ACCOUNT NAME: ACCOUNT #

PURPOSE OF ACCOUNT: TAX

Account for all disbursements, including voids, lost checks, stop payments, etc. In the alternative, a computer-generated check register can be attached to this report, provided all the information requested below is included.

http://www.usdoj.gov/ust.

|

DATE

|

CHECK

NUMBER

|

PAYEE

|

PURPOSE

|

AMOUNT

|

|||||

| TOTAL | (d) | ||||||||

| SUMMARY OF TAXES PAID | |||||||||

| Payroll Taxes Paid | (a) | ||||||||

| Sales & Use Taxes Paid | (b) | ||||||||

| Other Taxes Paid | (c) | ||||||||

| TOTAL | (d) | ||||||||

(a) This number is reported in the “Current Month” column of Schedule of Receipts and Disbursements

(Page MOR-2, Line 5O).

(b) This number is reported in the “Current Month” column of Schedule or Receipts and Disbursements

(Page MOR-2, Line 5P).

(c) This number is reported in the “Current Month” column of Schedule of Receipts and Disbursements

(Page MOR-2, Line 5Q).

(d) These two lines must be equal.

MOR-13

ATTACHMENT 4D

INVESTMENT ACCOUNTS AND PETTY CASH REPORT

INVESTMENT ACCOUNTS

Each savings and investment account, i.e. certificates of deposits, money market accounts, stocks and bonds, etc., should be listed separately. Attach copies of account statements.

Type of Negotiable

|

Instrument

|

Face Value

|

Purchase Price

|

Date of Purchase

|

Current

Market Value

|

||||

| TOTAL | (a) |

PETTY CASH REPORT

The following Petty Cash Drawers/Accounts are maintained:

|

Location of

Box/Account

|

|

(Column 2)

Maximum

Amount of Cash

in Drawer/Acct.

|

(Column 3)

Amount of Petty

Cash On Hand

At End of Month

|

(Column 4)

Difference between

(Column 2) and

(Column 3)

|

||

| TOTAL | $ | (b) |

For any Petty Cash Disbursements over $100 per transaction, attach copies of receipts. If there are no receipts, provide an explanation

TOTAL INVESTMENT ACCOUNTS AND PETTY CASH(a + b) $ (c)

(c)The total of this line on Attachment 4A, 4B and 4C plus the total of 4D must equal the

amount reported as “Ending Balance” on Schedule of Receipts and Disbursements (Page

MOR-2, Line 7).

MOR-14

ATTACHMENT 6

MONTHLY TAX REPORT

Name of Debtor: Digital Systems, Inc. Case Number: 11-20140-11-rdb

FOR THE REPORTING PERIOD BEGINNING February 1, 2012 and ending February 29, 2012

TAXES OWED AND DUE

Report all unpaid post-petition taxes including Federal and State withholding FICA, State sales tax, property tax, unemployment tax, State workmen's compensation, etc.

| Name of

Taxing

Authority

|

Date

Payment

Due

|

Description

|

Amount

|

Date Last

Tax Return

Filed

|

Tax Return

Period

|

|||||

| TOTAL | $ |

MOR-15

ATTACHMENT 7

SUMMARY OF OFFICER OR OWNER COMPENSATION

SUMMARY OF PERSONNEL AND INSURANCE COVERAGES

Name of Debtor: Digital Systems, Inc. Case Number: 11-20140-11-rdb

FOR THE REPORTING PERIOD BEGINNING February 1, 2012 and ending February 29, 2012

Report all forms of compensation received by or paid on behalf of the Officer or Owner during the month. Include car allowances, payments to retirement plans, loan repayments, payments of Officer/Owner’s personal expenses, insurance premium payments, etc. Do not include reimbursement for business expenses Officer or Owner incurred and for which detailed receipts are maintained in the accounting records.

Name of Officer or Owner Title Description Amount Paid

David Owen CEO Services $2,000.00

David Owen continues to provide services as the Debtor winds down at the hourly rate of $2,000 per month.

PERSONNEL REPORT

| Full Time | Part Time | ||

|

Number of employees at beginning of period

|

0 | 0 | |

| Number hired during the period | |||

| Number terminated or resigned during period | |||

| Number of employees on payroll at end of period | 0 | 0 |

CONFIRMATION OF INSURANCE

List all policies of insurance in effect, including but not limited to workers' compensation, liability, fire, theft, comprehensive, vehicle, health and life. For the first report, attach a copy of the declaration sheet for each type of insurance. For subsequent reports, attach a certificate of insurance for any policy in which a change occurs during the month (new carrier, increased policy limits, renewal, etc.).

| Agent

and/or

Carrier

|

Phone

Number

|

Policy

Number

|

Coverage

Type

|

Expiration

Date

|

Date

Premium

Due

|

|

CBIZ Insurance, Kathy Beamis

|

913-234-1918

|

||||

| CBIZ/Acuity Insurance Co. | X13725 | General Liab | 4/1/2012 | 4/1/2012 | |

| CBIZ/Nat’l Union Fire | 01-146-63-00 | D&O | 9/30/10 | 1/1/18 |

The following lapse in insurance coverage occurred this month:

| Policy

Type

|

Date

Lapsed

|

Date

Reinstated

|

Reason for Lapse

|

|||

|

G

|

Check here if U. S. Trustee has been listed as Certificate Holder for all insurance policies.

|

MOR-16

ATTACHMENT 8

SIGNIFICANT DEVELOPMENTS DURING REPORTING PERIOD

Information to be provided on this page, includes, but is not limited to: (1) financial transactions that are not reported on this report, such as the sale of real estate (attach closing statement); (2) non-financial transactions, such as the substitution of assets or collateral; (3) modifications to loan agreements; (4) change in senior management, etc. Attach any relevant documents.

Disclosure Statement and Plan of Liquidation have been filed.

MOR-17

|

DIGITAL SYSTEMS, INC P&L STATEMENT

|

2/29/2012

|

|||||

|

Ordinary Income/Expense

|

||||||

|

Expense

|

||||||

|

0-60400 · Professional & Contract Service

|

||||||

|

0-60410 · Consulting

|

||||||

|

2-60410 · Consulting - Admin

|

2,000.00 | |||||

|

Total 0-60410 · Consulting

|

2,000.00 | |||||

|

Legal Fees

|

||||||

|

2-60430 · Legal Expense

|

4,056.00 | |||||

|

Total Legal Fees

|

4,056.00 | |||||

|

0-60470 · Outside Services

|

||||||

|

2-60470 · Outside Services - Admin

|

2,500.00 | |||||

|

Total 0-60470 · Outside Services

|

2,500.00 | |||||

|

0-60400 · Professional & Contract Service - Other

|

130.00 | |||||

|

Total 0-60400 · Professional & Contract Service

|

8,686.00 | |||||

|

0-60500 · Facilities & Maintenance Costs

|

||||||

|

2-60550 · Rent Building

|

750.00 | |||||

|

2-60590 · Utility Expense

|

248.49 | |||||

|

Total 0-60500 · Facilities & Maintenance Costs

|

998.49 | |||||

|

0-60800 · Telecommunications

|

||||||

|

6-60830 · Telephone Expense

|

91.7 | |||||

|

Total 0-60800 · Telecommunications

|

91.7 | |||||

|

0-61400 · Sales & Use; Property Taxes

|

||||||

|

2-61430 · Taxes - Corporate

|

-9,043.88 | |||||

|

Total 0-61400 · Sales & Use; Property Taxes

|

-9,043.88 | |||||

|

0-61900 · Other Office Expenses

|

||||||

|

2-61910 · Licenses/Permits

|

54.00 | |||||

|

Total 0-61900 · Other Office Expenses

|

54.00 | |||||

|

Total Expense

|

786.31 | |||||

|

Net Ordinary Income

|

-786.31 | |||||

|

Net Income

|

-786.31 | |||||

MOR-18

|

DIGITAL SYSTEMS, INC BALANCE SHEET

|

2/29/2012

|

|||||

|

ASSETS

|

||||||

|

Current Assets

|

||||||

|

Checking/Savings

|

||||||

|

Cash Accounts

|

||||||

|

0-10070 · FNB Olathe Checking 013-960-2

|

140,084.15 | |||||

|

Total Cash Accounts

|

140,084.15 | |||||

|

Foreign Cash Accounts

|

||||||

|

0-10200 · YEN Bank of America 11407006

|

-3,465.15 | |||||

|

0-10210 · Yen Currency Fluctuation

|

3,465.15 | |||||

|

Total Foreign Cash Accounts

|

0 | |||||

|

Total Checking/Savings

|

140,084.15 | |||||

|

Accounts Receivable

|

||||||

|

Accounts Receivable

|

||||||

|

0-11000 · Accounts Receivable - Trade

|

247,880.90 | |||||

|

0-11010 · Accounts Receivable - Dealers

|

23,719.75 | |||||

|

0-11100 · Allowance for Doubtful Accounts

|

-100,456.68 | |||||

|

Total Accounts Receivable

|

171,143.97 | |||||

|

Total Accounts Receivable

|

171,143.97 | |||||

|

Other Current Assets

|

||||||

|

Prepaid Expenses

|

||||||

|

0-13000 · Prepaid Expenses

|

7,650.00 | |||||

|

0-13010 · Prepaid Insurance

|

-29 | |||||

|

Total Prepaid Expenses

|

7,621.00 | |||||

|

Other Current Assets

|

||||||

|

0-14000 · Deposits

|

-1,000.00 | |||||

|

Total Other Current Assets

|

-1,000.00 | |||||

|

Total Other Current Assets

|

6,621.00 | |||||

|

Total Current Assets

|

317,849.12 | |||||

|

TOTAL ASSETS

|

317,849.12 | |||||

|

LIABILITIES & EQUITY

|

||||||

|

Liabilities

|

||||||

|

Current Liabilities

|

||||||

|

Accounts Payable

|

||||||

|

Accounts Payable

|

||||||

|

0-20000 · Accounts Payable

|

1,190,520.49 | |||||

|

0-20100 · Accounts Payable - Chpt 11

|

4,941.02 | |||||

|

Total Accounts Payable

|

1,195,461.51 | |||||

|

Total Accounts Payable

|

1,195,461.51 | |||||

|

Other Current Liabilities

|

||||||

|

Accrued Liabilities

|

||||||

|

Accrued Expenses

|

||||||

|

0-21000 · Accrued Expenses - Other

|

52,257.40 | |||||

|

0-21010 · Accrued Property Taxes

|

26,686.29 | |||||

|

0-21020 · Accrued Sales Tax

|

3,366.29 | |||||

|

Total Accrued Expenses

|

82,309.98 | |||||

|

Total Accrued Liabilities

|

82,309.98 | |||||

|

Total Other Current Liabilities

|

82,309.98 | |||||

|

Total Current Liabilities

|

1,277,771.49 | |||||

|

Total Liabilities

|

1,277,771.49 | |||||

|

Equity

|

||||||

|

Shareholders' Equity - CS

|

||||||

|

0-30000 · Bridge Warrant 2005 Proceeds

|

164,991.75 | |||||

|

0-30010 · Stock Option Proceeds

|

52,650.00 | |||||

|

0-30020 · Public Warrant Proceeds

|

769,171.09 | |||||

|

0-30040 · Common Stock

|

36,343,227.14 | |||||

|

0-30050 · Common Stock Restricted

|

1,560,000.00 | |||||

|

0-30060 · Options Outstanding

|

2,076,270.47 | |||||

|

0-30065 · Warrants

|

88,660.94 | |||||

|

0-30070 · Offering Costs

|

-2,250,025.22 | |||||

|

Total Shareholders' Equity - CS

|

38,804,946.17 | |||||

|

Other Comprehensive Income

|

||||||

|

0-31000 · Deferred currency exchange

|

3,465.15 | |||||

|

Total Other Comprehensive Income

|

3,465.15 | |||||

|

0-32000 · Retained Deficit

|

-39,757,970.20 | |||||

|

Net Income

|

-10,363.49 | |||||

|

Total Equity

|

-959,922.37 | |||||

|

TOTAL LIABILITIES & EQUITY

|

317,849.12 | |||||

MOR-19

03/09/12

ICOP DIGITAL, INC. Reconciliation Summary

|

Feb 29, 12

|

||||

|

Beginning Balance

|

141,739.55 | |||

|

Cleared Transactions

|

||||

|

Checks and Payments

|

-10,480.19 | |||

|

Deposits and Credits

|

9,043.88 | |||

|

Total Cleared Transactions

|

-1,436.31 | |||

|

Cleared Balance

|

140,303.24 | |||

|

Uncleared Transactions

|

||||

|

Checks and Payments - 3 items

|

-219.09 | |||

|

Total Uncleared Transactions

|

-219.09 | |||

|

Register Balance as of 02/29/2012

|

140,084.15 | |||

|

New Transactions

|

||||

|

Checks and Payments - 2 items

|

-2,750.00 | |||

|

Total New Transactions

|

-2,750.00 | |||

|

Ending Balance

|

137,334.15 | |||

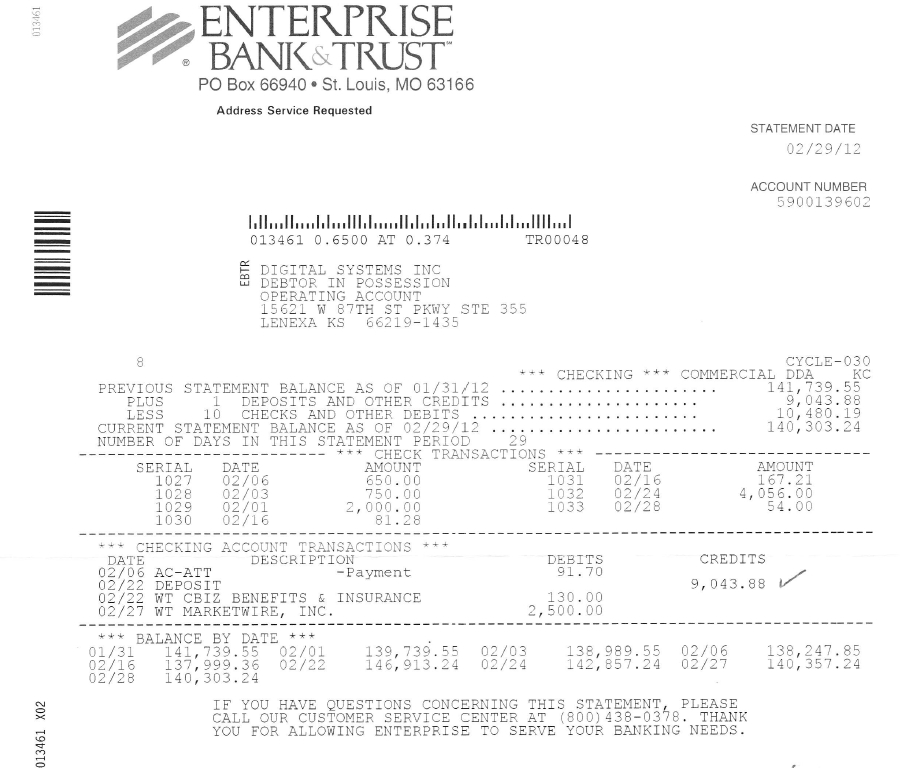

PO Box 66940 • St. Louis, MO 63166 Address Service Requested STATEMENT DATE 02/29/12 ACCOUNT NUMBER 5900139602 013461 0.6500 AT 0.374 TR0004S £ DIGITAL SYSTEMS INC uj DEBTOR IN POSSESSION OPERATING ACCOUNT 15621 W 87TH ST PKWY STE 355 LENEXA KS 66219-1435 8 CYCLE-030 *** CHECKING *** COMMERCIAL DDA KC PREVIOUS STATEMENT BALANCE AS OF 01/31/12 141,739.55 PLUS 1 DEPOSITS AND OTHER CREDITS 9,043.88 LESS 10 CHECKS AND OTHER DEBITS 10,480.19 CURRENT STATEMENT BALANCE AS OF 02/29/12 140,303.24 NUMBER OF DAYS IN THIS STATEMENT PERIOD 29 *** CHECK TRANSACTIONS *** SERIAL DATE AMOUNT SERIAL DATE AMOUNT 02/06 650.00 1031 02/16 167.21 02/03 750.00 1032 02/24 4,056.00 02/01 2,000.00 1033 02/2854.00 02/16 81.28 CHECKING ACCOUNT TRANSACTIONS *** DATE DESCRIPTION DEBITS CREDITS 02/06 AC-ATT –Payment 91.70 / 02/22 DEPOSIT 9,043.88 02/22 WT CBIZ BENEFITS & INSURANCE 130.00 02/27 WT MARKETWIRE, INC. 2,500.00 1 BALANCE BY DATE *** 01/31 141,739.55 02/01 139,739.55 02/03 138,989.55 02/06 138,247.85 02/16 137,999.36 02/22 146,913.24 02/24 142,857.24 02/27 140,357.24 02/28 140,303.24 IF YOU HAVE QUESTIONS CONCERNING THIS STATEMENT, PLEASE CALL OUR CUSTOMER SERVICE CENTER AT (800)438-0378. THANK YOU FOR ALLOWING ENTERPRISE TO SERVE YOUR BANKING NEEDS.EBTR-002-013461-001-001-120301 -13461 X02 66219143521 MEMBER FDIC

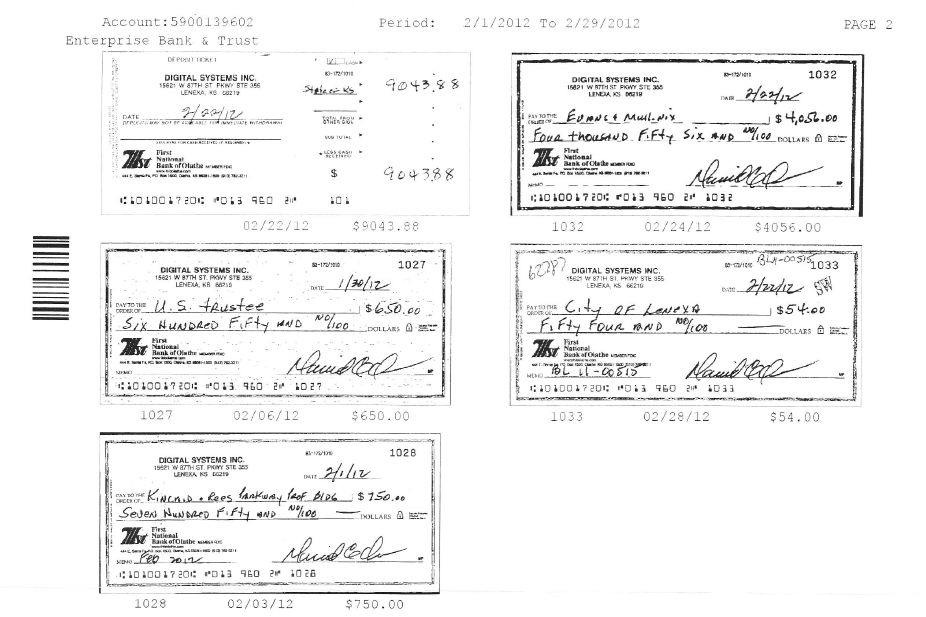

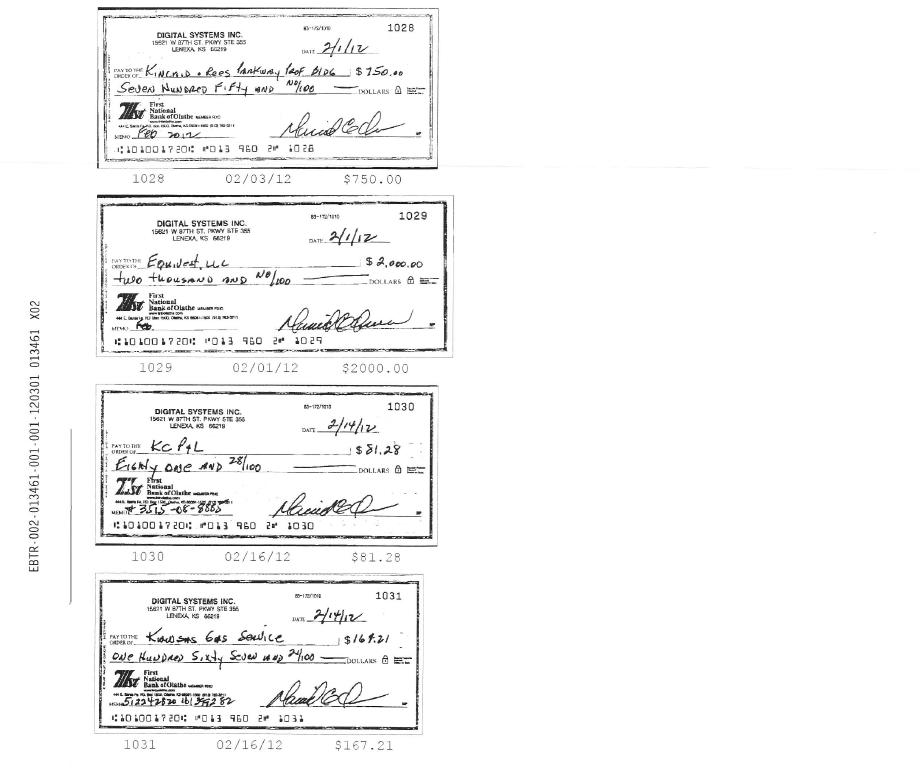

Account: 5900139602 Perrod: 2/1/2012 to 2/29/2012 PAGE 2 Enterprise Bank & Trust 02/22/12 $9043.88 1032 02/24/12 $4056.00 1027 02/06/12 $650.00 1033 02/28/12 $54.00 1028 02/03/12 $750.00 1029 02/01/12 $2000.00 1030 02/16/12 $81.28 1031 02/16/12 $167.21 EBTR-002-013461-001-001-120301 -13461 X02 66219143521