Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - DBUB GROUP, INC | v306678_ex32-1.htm |

| EX-31.1 - CERTIFICATION - DBUB GROUP, INC | v306678_ex31-1.htm |

| EX-32.2 - CERTIFICATION - DBUB GROUP, INC | v306678_ex32-2.htm |

| EX-31.2 - CERTIFICATION - DBUB GROUP, INC | v306678_ex31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2010

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________ to ____________

Commission file number 000-28767

CHINA 3C GROUP

(Exact name of registrant as specified in its charter)

| Nevada | 88-0403070 |

|

(State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

368 HuShu Nan Road

HangZhou City, Zhejiang Province, China 310014

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: 086-0571-88381700

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 par value

Title of class

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | |

|

Non-accelerated filer x (Do not check if a smaller reporting company) |

Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the 44,861,327 shares of voting and non-voting common equity stock held by non-affiliates of the registrant was approximately $13,458,398 as of June 30, 2010, the last business day of the registrant’s most recently completed second fiscal quarter, based on the last sale price of the registrant’s common stock on such date of $0.30 per share, as reported on the OTC Bulletin Board.

As of May 17, 2011, there were 58,511,327 shares of the registrant’s common stock outstanding.

Documents incorporated by reference: None.

Explanatory Note

This Amendment No. 1 to our Annual Report on Form 10-K/A ("Form 10-K/A") is being filed to amend our Annual Report on 10-K for the year ended December 31, 2010 ("Form 10-K"), which was originally filed with the Securities and Exchange Commission (the "SEC") on May 18, 2011. We are filing this amendment to include disclosure consistent with comments received by the SEC. We are amending and restating Items 1, 7, 8, 9 and 15 in this Form 10-K/A.

Except as indicated above, no changes other than corrections of typographical errors have been made.

CHINA 3C GROUP

Table of Contents

| PAGE | |||

| PART I | 4 | ||

| Item 1 | Business | 4 | |

| Item 1A | Risk Factors | 12 | |

| Item 1B | Unresolved Staff Comments | 17 | |

| Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 17 | |

| Item 7A | Quantitative and Qualitative Disclosure About Market Risk | 38 | |

| Item 8 | Financial Statements and Supplementary Data | 39 | |

| Item 9 | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 39 | |

| Item 9A(T) | Controls and Procedures | 39 | |

| Item 9B | Other Information | 41 | |

| Item 15 | Exhibits, Financial Statement Schedules | 41 | |

| Index to Consolidated Financial Statements | F-1 |

| 2 |

Forward Looking Statements

We have included and from time to time may make in our public filings, press releases or other public statements, certain statements, including, without limitation, those under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7. In some cases these statements are identifiable through the use of words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “project,” “target,” “can,” “could,” “may,” “should,” “will,” “would” and similar expressions. You are cautioned not to place undue reliance on these forward-looking statements. In addition, our management may make forward-looking statements to analysts, investors, representatives of the media and others. These forward-looking statements are not historical facts and represent only our beliefs regarding future events, many of which, by their nature, are inherently uncertain and beyond our control.

| 3 |

PART I

ITEM 1. BUSINESS

Overview

China 3C Group (including our subsidiaries unless the context indicates otherwise, the “Company”, “China 3C,” “China 3C Group,” “we,” or “us”) was incorporated on August 20, 1998 under the laws of the State of Nevada. Before July 2009, we were only engaged in the resale and distribution of third party products and generated 100% of our revenue from resale of items such as mobile phones, facsimile machines, DVD players, stereos, speakers, MP3 and MP4 players, iPods, electronic dictionaries, CD players, radio Walkmans and audio systems. On July 6, 2009, we acquired Jinhua Baofa Logistic Ltd. (“Jinhua”). At that point, we started providing transportation logistics services to businesses in Eastern China.

In 2007 we began operating under a “store in store” business model. As of December 31, 2010 we established and operated 821 “stores in stores.” We operate under the brand names Hangzhou Wang Da, Yiwu YongXin, Shanghai Joy & Harmony and Hangzhou Sanhe. The “store in store” business operation model resulted in expanded marketing channels, thus, positively stimulated the growth of sales in 2007 and 2008. However, starting in 2009, we had declining sales under the “stores in stores” model due to increased competition from direct stores and large department stores as well as the impact of the economic slow down. Therefore, we decided to open direct stores and franchises. As of December 31, 2010, Zhejiang has three direct and two franchise stores in operation.

On July 6, 2009, China 3C and its subsidiary Zhejiang (as defined below) and Yiwu (as defined below) acquired 100% of Jinhua. Jinhua provides transportation logistics services to businesses.

Under the stores in stores model, we distribute our products mainly via so-called concessionaire agreements with larger department stores, supermarkets, large electronics retail stores, and other retailers. The retail distribution of many products in China, including those we sell, is conducted through the concessionaire model. Under this model, companies such as China 3C own their own outlets within larger stores and in so doing assume responsibility for most financial and operational aspects of those outlets including capital cost, inventory, wages, selection, pricing, and general management. Our retail partners are compensated via margin they earn on the products we sell. This model is similar to that employed by many department stores in the US. However, this model is different from the model found at large electronic retailers like Best Buy and general retailers like Wal-Mart. We have found that many investors are curious as to why the model in China differs from the one found in the US. We believe the main reasons are:

| · | We decrease the financial risk for our retail partners by assuming responsibility for the inventory and capital expense associated with distributing our products. |

| · | We decrease operational risk for our retail partners by hiring and managing employees and handling logistics issues such as wholesale purchase and delivery and returns and after-sales service. |

| · | We decrease merchandising risk for our retail partners by bringing product expertise and specific market knowledge that is difficult for large retailers to develop on their own across a broad range of product categories. |

| · | China’s size, regional differences, logistical difficulties, managerial challenges, underdeveloped credit markets, and rapid growth rate increases risk for all retailers and drive the need to mitigate risk which is why our retail partners rely on us. |

| 4 |

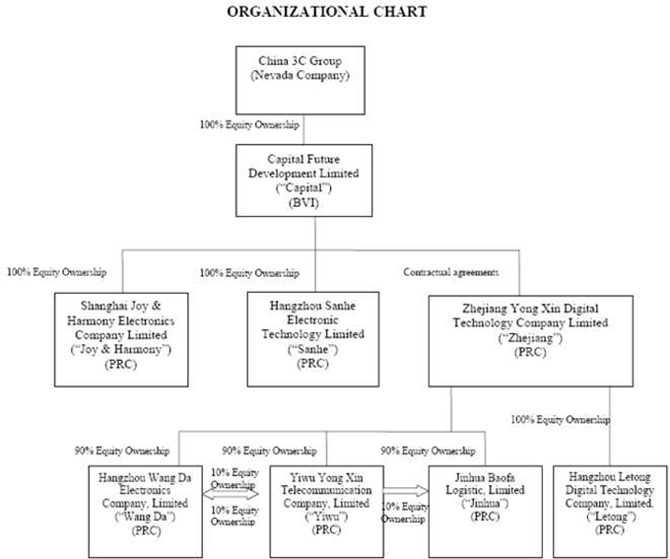

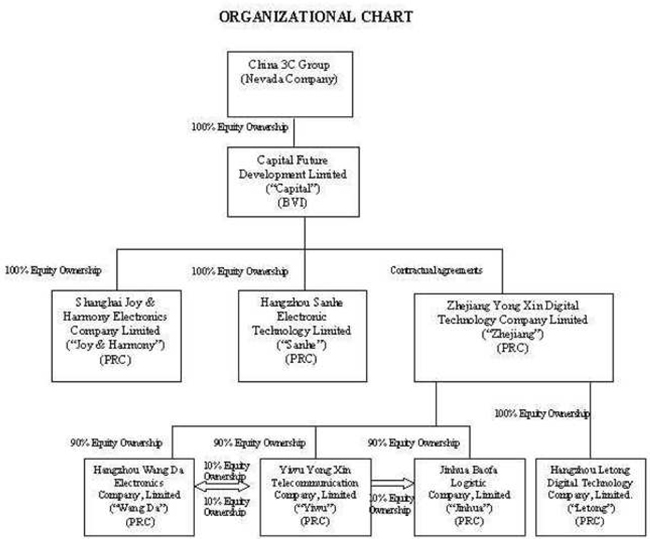

Organizational Structure

(All dollar amounts in thousands)

China 3C was incorporated on August, 20, 1998 under the laws of the State of Nevada. Capital Future Developments Limited (“CFDL”) was incorporated on July 22, 2004 under the laws of the British Virgin Islands. Zhejiang Yong Xin Digital Technology Company Limited (“Zhejiang”), Yiwu Yong Xin Communication Limited (“Yiwu”), Hangzhou Wandda Electronics Company Limited (“Wang Da”), Hangzhou Sanhe Electronic Technology, Limited (“Sanhe”), and Shanghai Joy & Harmony Electronic Development Company Limited (“Joy & Harmony”) were incorporated under the laws of the Peoples Republic of China (“PRC” or “China”) on July 11, 2005, July 18, 1997, March 30, 1998, April 12, 2004, and August 25, 2003, respectively. China 3C owns 100% of CFDL and CFDL own 100% of the capital stock of Joy & Harmony and Sanhe. Until August 14, 2007, when it made the change to its ownership structure described in the next paragraph in order to comply with certain requirements of PRC law, CFDL owned 100% of the capital stock of Zhenjiang. Zhejiang owns 90% and Yiwu owns 10% of Wang Da. Zhejiang owns 90% and Wang Da owns 10% of Yiwu. On March 10, 2009 Zhejiang set up a new operating entity, Hangzhou Letong Digital Technology Co., Ltd. (“Letong”) to establish an electronic retail franchise operation for China 3C Group. On July 6, 2009, Zhejiang and Yiwu acquired Jinhua. Jinhua was incorporated under the laws of PRC on December 27, 2001.

On December 21, 2005, CFDL became a wholly owned subsidiary of China 3C through a merger with a wholly owned subsidiary of the Company (the “Merger Transaction”). China 3C acquired all of the issued and outstanding capital stock of CFDL pursuant to a Merger Agreement dated at December 21, 2005 by and among China 3C, XY Acquisition Corporation, CFDL and the shareholders of CFDL (the “Merger Agreement”). Pursuant to the Merger Agreement, CFDL became a wholly owned subsidiary of China 3C and, for the CFDL shares, China 3C issued 35,000,000 shares of its common stock to the shareholders of CFDL, representing 93% of the issued and outstanding capital stock of China 3C at that time and cash of $500.

On August 3, 2006, Capital acquired a 100% interest in Sanhe for a cash and stock transaction valued at approximately $8,750. The consideration consisted of 915,751 newly issued shares of the Company’s common stock and $5,000 in cash.

On November 28, 2006, Capital acquired a 100% interest in Joy & Harmony for a cash and stock transaction valued at approximately $18,500. The consideration consisted of 2,723,110 shares of the Company’s common stock and $7,500 in cash.

On August 15, 2007, we executed a series of contractual agreements between Capital and Zhejiang. The contractual agreements give Capital and its equity owners an obligation, and having ability to absorb, any losses, and rights to receive returns; however, these contractual agreements did not change the equity ownership of Zhejiang. We did not dispose Capital’s actual equity ownership of Zhejiang when we execute the contractual agreements. Capital entered into share-holding entrustment agreements with five individuals: Zhenggang Wang, Yimin Zhang, Huiyi Lv, Xiaochun Wang and Zhongsheng Bao to hold 35%, 20%, 20%, 15% and 10%, respectively, of the equity interest of Zhejiang on behalf of Capital on November 21, 2005. The entrustment agreements confirm that CFDL is the actual owner of Zhejiang. CFDL enjoys the actual shareholder’s rights and has the right to obtain any benefits received by the nominal holders. Zhenggang Wang is the CEO and shareholder of China 3C Group. Yimin Zhang, Huiyi Lv, Xiaochun Wang and Zhongsheng Bao have no other relationship with China 3C Group. No consideration was given to these individuals who held the equity of Zhejiang on behalf of CFDL.

| 5 |

On July 6, 2009, China 3C’s subsidiaries, Zhejiang and Yiwu acquired Jinhua, a company organized under the laws of the PRC. Zhejiang acquired 90% and Yiwu acquired 10% of the entire equity interests in Jinhua from the shareholders of Jinhua for a purchase price of RMB 120,000,000 ($17,500) in cash.

Yiwu, Wangda, Sanhe, Joy & Harmony are engaged in the business of resale and distribution of third party products and generate approximately 100% of their revenue from resale of items such as mobile phones, facsimile machines, DVD players, stereos, speakers, MP3 and MP4 players, iPod, electronic dictionaries, CD players, radios, Walkmans, and audio systems. We sell and distribute products through retail stores and secondary distributors. We operate most of our retail operations through our “store in store” model. Under this model, the Company leases space in major department stores and retailers. Leasing costs can vary based on a percentage of sales, or can be fixed. In 2010, 2009 and 2008, all of our stores in stores leases were variable based on sales.

In 2009, Zhejiang started establishing direct electronic retail stores and franchise operation.

Following the acquisition of Jinhua, the Company began providing logistic service to businesses in addition to its traditional business of resale and distribution of third party products such as mobile phones, facsimile machines, DVD players, stereos, speakers, MP3 and MP4 players, iPods, electronic dictionaries, CD players, radio Walkmans and audio systems.

| 6 |

Our corporate structure as of December 31, 2010 is as follows:

Our Business

Information About Our Segments

During fiscal 2010, we operated in five reportable segments:

| a. | Yiwu Yong Xin Telecommunication Company, Limited, or “Yiwu,” focuses on the selling, circulation and modern logistics of fax machines and cord phone products. |

| b. | Hangzhou Wang Da Electronics Company, Limited, or “Wang Da,” focuses on the selling, circulation and modern logistics of cell phones, cell phones products, and digital products, including digital cameras, digital camcorders, PDAs, flash disks, and removable hard disks. |

| c. | Hangzhou Sanhe Electronic Technology Limited “Sanhe,” focuses on the selling, circulation and modern logistics of home electronics, including DVD players, audio systems, speakers, televisions and air conditioners. |

| 7 |

| d. | Shanghai Joy & Harmony Electronics Company Limited or “Joy & Harmony,” focuses on the selling, circulation and modern logistics of consumer electronics, including MP3 players, MP4 players, iPod, electronic dictionary, radios, and Walkmans. |

| e. | Jinhua Baofa Logistic Company Litmited or “Jinhua” provides transportation logistics services to businesses. Jinhua operates primarily in Eastern China and covers many of the most developed cities in the Eastern China such as Shanghai, Hangzhou and Nanjing |

Financial information about our segments is included in Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations, and Note 13, Segment Information, of the Notes to Consolidated Financial Statements, included in Item 8, Financial Statements and Supplementary Data, of this Annual Report on Form 10-K.

Yiwu Yong Xin Telecommunication Company, Limited (“Yiwu”)

Yiwu is an authorized sales agent, focusing on the selling, circulation and modern logistics of fax machines and cord phone products in China. Yiwu mainly distributes Philips fax machines and China’s local brands Feng Da and CJT fax machines. Yiwu sells its products through retail “stores in stores” in major department stores throughout the Huadong Region of China (consisting of the Chinese provinces of Zhejiang, Jiangsu and Anhui). Yiwu had 211 retail locations in 2010. Yiwu contributed 12.6% of the Company’s revenue in 2010.

The five largest suppliers and customers of Yiwu for 2010 are as follows:

| Top 5 suppliers | Top 5 customers | |

| Yiwu are Fengda Technology Company Limited | Zhejiang Suning Appliance Company Limited | |

| Ninbo Zhongxun Electronics Company Limited | Shanghai Suning Appliance Company Limited | |

| Shanghai Zhongfang Electronics Company Limited | Suning Appliance Company Limited | |

| Hangzhou Senruida Trade Company Limited | Yongle China Appliance Company Limited | |

| Shanghai Hongyi Office Supplies Company Limited | Shanghai GOME Electrical Appliances Limited |

The top five suppliers contributed 84.2% of purchases of Yiwu in 2010 and the top five customers contributed 32.9% of revenue of Yiwu in 2010.

Yiwu has a diverse customer base and, the loss of any single customer is not expected to have a material adverse affect on its business and operations. Yiwu did not spend a material amount of money on research and development in 2010.

The main competitors of Yiwu are Hangzhou Xinfeng Office Equipment Co, Ltd., Hangzhou Sihai Office Equipment Co, Ltd. and Shanghai Xunbo Office Equipment Co, Ltd.

Hangzhou Wang Da Electronics Company, Limited (“Wang Da”)

Wang Da is an authorized sales agent focusing on the selling, circulation and modern logistics of cell phones, cell phone products, IT products (including notebook or laptop computers), and digital products (including digital cameras, digital camcorders, MP3 players, PDAs, flash disks, and removable hard disks) in China. Wang Da mainly distributes its products through retail “stores in stores” located in major department stores throughout the “Huadong” region of China (consisting of the Chinese provinces of Zhejiang, Jiangsu and Anhui). Wang Da had 215 retail locations in 2010. Wang Da contributed 28.5% of the Company’s revenue in 2010.

| 8 |

The five largest suppliers and customers for Wang Da in 2010 are as follows:

| Top 5 suppliers | Top 5 customers | |

| Shenzhen Tianyin Telecommunication Company Limited | Zhejiang Suning Appliance Company Limited | |

| Hangzhou Weihua Telecommunication Company Limited | Shanghai Jiadeli Supermarket Group | |

| Hangzhou Tianchen Digital Telecommunication Company Limited | Shanghai Guangda Comunication Terminal Products Sales Company Limited | |

| Hangzhou Liandong Telecommunication Equipment Company Limited | Suzhou Meijia Supermarket Group | |

| Shanghai Post&Telecom Appliances Company (Hangzhou) | Huarun Vanguard Supermarket (Zhejiang) Company Limited |

The five largest suppliers contributed 60.9% of the purchases of Wang Da in 2010 and the five largest customers contributed 15.7% of revenue of Wang Da in 2010.

Wang Da has a diverse customer base and the loss of any single customer is not expected to have a material adverse affect on the Company’s business and operations. Wang Da did not spend a material amount of money on research and development and did not have a significant backlog as of December 31, 2010.

The main competitors of Wang Da include Telephone World, Hangzhou Yindun, Shanghai Guangda, Changjiang Tianyin and Hangzhou Zhenghua. Additionally, there are Ningbo Haishu and Zhongyu. Wang Da has many years of experiences in mobile phone sales. Wang Da has a wide distribution network in Zhejiang, Shanghai, Jiangsu and other regions. These competitors use a variety of business models such as “store in stores”, free standing stores and distribution channels. The competitors have smaller scale of operation and smaller distribution regions compared to Wang Da. Therefore, these competitors typically have only a fraction of our sales.

Hangzhou Sanhe Electronic Technology Limited (“Sanhe”)

Sanhe is a home electronics retail chain in Eastern China, headquartered in HangZhou City. In 2010, it had 210 retail “store in stores” in Shanghai City, Zhejiang Province and Jiangsu Province. Sanhe specializes in the sale of home electronics, including air conditioners, audio systems, speakers, DVD players and TV. Sanhe contributed 27.7% of the Company’s revenue in 2010.

The five largest suppliers and customers for Sanhe in 2010 are as follows:

| Top 5 suppliers | Top 5 customers | |

| Hangzhou Xietong Trade Company Limited | Lianhua Supermarket Group | |

| Zhejiang Zhuocheng Digital Electronics Company Limited | Hangzhou Lianhua Huashang Group | |

| Shanghai Haier Industrial and Trade Company | Shanghai Lotus Supercenter | |

| Shenzhen Chuangwei-RGB Electronics Company | Jiangsu Times Supermarket Company Limited | |

| TCL Electronics Company Limited | Huarun Vanguard Supermarket (Zhejiang) Company Limited |

The five largest suppliers contributed 68.8% of the purchases of Sanhe in 2010 and the top five customers contributed 31.9% of revenue of Sanhe in 2010.

| 9 |

Sanhe has a diverse customer base and, the loss of any one customer would not likely have an adverse effect on the Company’s sales. The Company did not spend a material amount of money on research and development, and did not have a significant backlog as of December 31, 2010.

The main competitors of Sanhe include Hangzhou Meidi, Hangzhou Danong, Nanjing Mingci, Shanghai Feitong and Jiangshu Huayi. Sanhe has many years of experience in the sale of home electronics which has allowed it to build good relationships with brand name companies such as TCL, Skyworth, Meidi, Longdi and Galanz. In addition, Sanhe has the competitive advantage of maintaining an extensive distribution network.

Shanghai Joy & Harmony Electronics Company Limited (“Joy & Harmony”)

Joy & Harmony is a consumer electronics retail chain in Eastern China. It had 196 retail locations in Shanghai City and Jiangsu Province in 2010. Joy & Harmony specializes in the sale of consumer electronics, including MP3 players, MP4 players, iPods, electronic dictionaries, CD players, radios, Walkmans, audio systems and speakers. The company is the authorized sales agent for well-known manufacturers in China, including Tecsun Radio and Changhong ZARVA. Joy & Harmony contributed 23.5% of the Company’s revenue in 2010.

The five largest suppliers and customers for Joy & Harmony in 2010 are as follows:

| Top 5 suppliers | Top 5 customers | |

| SONY (China) Company Limited (Shanghai) | Shanghai Xinzehui Digital Technology Company Limited | |

| Shanghai Ganshun Trade Company Limited | Shanghai Sanmen Tesco Company Limited | |

| Huaqi Information Digital Technology Company Limited (Shanghai) | Shanghai Jiading Tesco Company Limited | |

| Shanghai Caitong Digital Technology Company Limited | Shanghai Jinshan Tesco Company Limited | |

| Shanghai Bohui Electronics Company Limited | Suzhou Auchan Supermarket Company Limited |

The five largest suppliers contributed 65.2% of the purchases of Joy & Harmony in 2010and the top five customers contributed 3.7% of revenue of Joy & Harmony in 2010.

As a retailer with hundreds of locations, the Company is not reliant on any one customer or on a few customers. The loss of any one customer would not likely have an adverse effect on Joy & Harmony’s sales. Joy & Harmony did not have any material backlog of orders at December 31, 2010. Joy & Harmony did not spend a material amount of money on research and development in 2010.

The main competitors of Joy & Harmony include Zhejiang Yifeng Technology Co., Ltd, Shanghai Yuanmai Trade Co, Ltd and Shanghai Like Digital Technology Co, Ltd. Joy & Harmony has a large number of retail locations compared to its competitors. In addition, Joy & Harmony has built good relationships with suppliers of well-known brands such as Apple, Sony, Meizu, Tecsun and Aigo.

Jinhua Baofa Logistic Litmited (“Jinhua”)

Jinhua has been in operation since 2001. Jinhua transports electronics, machinery and equipment, metal products, chemical materials, garments and handcrafted goods for businesses in the Eastern China region in which China 3C operates, such as Shanghai, Hangzhou and Nanjing. Jinhua contributed 7.2% of revenue to the Company in 2010.

| 10 |

The five largest vendors and customers for Jinhua in 2010 are as follows:

| Top 5 suppliers | Top 5 customers | |

| Zhejiang Sheng Tong Logistic Company Limited | Xiamen Shida Transportation Company Limited | |

| Hangzhou Shenzhou Transportation Company Limited | Guangzhou Shuntong Transportation Company Limited | |

| Shanghai Sheng Hui Transportation Company Limited | Wuhan Tianda Express Company Limited | |

| Shanghai Hong Wei Transportation Company Limited | Fuzhou Zhilian Logistics Company Limited | |

| Jiaxingshi Guohong Vehicle Transportation Company Limited | Suzhou Auchan Supermarket Company Limited Zhuhai Zhijie Express Company Limited |

The five largest vendors contributed to 34.0% of direct cost of Jinhua in 2010 and the top five customers contributed 8.3% of revenue of Jinhua in 2010.

The main competitors of Jinhua include Hangzhou Hongrun Transportation Co., Ltd, Hangzhou Tianzhao Logistics Co., Ltd, Hangzhou Huishen Logistics Co., Ltd, Terry Logistics Group Co., Ltd, Shanghai Yanfu Logistics Co., Ltd, Shanghai Zhicheng Logistics Co., Ltd and Shanghai Jiaje Express Co., Ltd.

Intellectual Property

We consider our logos important to our business. We applied to register 10 logos with the State Administration of Industry and Commerce in China in 2007 and are currently awaiting the administration’s approval.

Seasonality and Quarterly Fluctuations

Our businesses experience fluctuations in quarterly performance. Traditionally, the first quarter has a greater amount of sales reflected by our electronics business due to the New Year holidays in China occurring during that period. Nevertheless, at times, China can experience particularly inclement weather in January and February which can disrupt the Company’s supply chain management systems. As our business model is to operate only on several days of inventory, the effects of such weather disruptions can be severe in certain years.

Working Capital

We fund our business operations through a combination of available cash and equivalents, short-term investments and cash flows generated from operations. We believe our currently available working capital, primarily cash from operations, is adequate to execute our current business plan.

Customers

We do not have a significant concentration of sales to any individual customer and, therefore, the loss of any one customer would not have a material impact on our business. No single customer has accounted for 10% or more of our total revenue in 2010 and 2009.

Backlog

We do not have a material amount of backlog orders.

Government Contracts

No material portion of our business is subject to renegotiation of profits or termination of contracts or subcontracts at the election of the Chinese government.

| 11 |

Competition

We compete against other consumer electronics retailers and wholesalers. We compete principally on the basis of product assortment and availability and value pricing, customer service; store location and convenience and after-sales services. We believe our broad product assortment, competitive pricing and convenient store locations differentiate us from most competitors. Our stores compete by emphasizing a complete product and service solution and value pricing. In addition, our trained and knowledgeable sales and service staffs allow us to tailor the offerings to meet the needs of our customers.

Research and Development

We have not engaged in any material research and development activities during the past two fiscal years.

Environmental Matters

We are subject to China’s National Environmental Protection Law, as well as a number of other national and local laws and regulations regulating air, water and noise pollution and setting pollutant discharge standards. We believe that all our operations are in material compliance with all applicable environmental laws. We did not incur any costs to comply with environmental laws in 2010 and 2009.

Employees

The Company currently has 2,271 employees, all of which are full time employees located in China. Zhejiang has 52 employees, Yiwu has 297 employees, Wang Da has 525 employees, Sanhe has 521 employees, Joy & Harmony has 352 employees and Jinhua has 524 employees.

The Company has no collective bargaining agreements with any unions.

ITEM 1A. RISK FACTORS

Risk Factors Associated with Our Business

A general economic downturn, a recession in China or sudden disruption in business conditions may affect consumer purchases of discretionary items, including consumer and business products, which could adversely affect our business. Consumer spending is generally affected by a number of factors, including general economic conditions, the level of unemployment, inflation, interest rates, energy costs, gasoline prices and consumer confidence generally, all of which are beyond our control. Consumer purchases of discretionary items tend to decline during recessionary periods, when disposable income is lower, and may impact sales of our products. In addition, sudden disruptions in business conditions as a result of a terrorist attack, retaliation and the threat of further attacks or retaliation, war, adverse weather conditions and climate changes or other natural disasters, pandemic situations or large scale power outages can have a short or, sometimes, long-term impact on consumer spending. A downturn in the economies in China, including any recession or a sudden disruption of business conditions in China’s economy, could adversely affect our business, financial condition, and results of operation.

Non-performance by our suppliers may adversely affect our operations by delaying delivery or causing delivery failures, which may negatively affect demand, sales and profitability. We purchase various products from our suppliers. We would be materially and adversely affected by the failure of our suppliers to perform as expected. We could experience delivery delays or failures caused by production issues or delivery of non-conforming products if its suppliers failed to perform, and we also face these risks in the event any of its suppliers becomes insolvent or bankrupt.

| 12 |

With the markets being highly competitive, we may not be able to compete successfully. Many of our competitors have substantially greater revenues and financial resources than we do. We may not be able to compete favorably and increased competition may substantially harm our business, business prospects and results of operations. If we are not successful in our target markets, our sales could decline, our margins could be negatively impacted and we could lose market share, any of which could materially harm our business, results of operations and profitability.

If we are unable to successfully integrate the businesses we acquire, our ability to expand our product offerings and geographic reach may be significantly limited. In order to expand our product offerings and grow our customer base by reaching new customers through expanded geographic coverage, we may continue to acquire businesses we believe are complementary to our growth strategy. Acquisitions involve numerous risks, including difficulties in the assimilation of acquired operations, loss of key personnel, distraction of management’s attention from other operational concerns, failure to maintain supplier relationships, inability to maintain goodwill of customers from acquired businesses, and the inability to meet projected financial results that supported how much was paid for the acquired businesses.

Our business will be harmed if we are unable to maintain our supplier alliance agreements with favorable terms and conditions. We have certain exclusive licensing/distribution agreements with key suppliers in a number of product categories in the Eastern China area, in particular Zhejiang and Jiangsu province and Shanghai City. Our business will be harmed if we are unable to maintain these favorable agreements or are limited in our ability to gain access to additional like agreements with our key suppliers.

If we do not anticipate and respond to changing consumer preferences in a timely manner, our operating results could materially suffer. Our business depends, in large part, on our ability to introduce successfully new products, services and technologies to consumers, the frequency of such introductions, the level of consumer acceptance, and the related impact on the demand for existing products, services and technologies. Failure to predict accurately constantly changing consumer tastes, preferences, spending patterns and other lifestyle decisions, or to address effectively consumer concerns, could have a material adverse effect on our revenue, results of operations and standing with our customers.

We have a material weakness in our internal control over financial reporting, and if we fail to maintain an effective system of internal control over financial reporting, we may be unable to accurately report our financial results or prevent fraud, and investor confidence and the market price of our shares may be adversely affected. We and our independent registered public accounting firm, in connection with the audit of the consolidated financial statements for the fiscal year ended December 31, 2010, have identified the following material weaknesses in our internal control over financial reporting: the ability of the Company to record transactions and provide disclosures in accordance with accounting principles generally accepted in the United States (US GAAP).

A “material weakness” is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the company’s annual or interim financial statements will not be prevented or detected on a timely basis. We plan to take measures to remediate these deficiencies, such as providing additional training to our accounting staff in US GAAP. However, the implementation of these measures may not fully address the control deficiencies in our internal control over financial reporting. Our failure to address any control deficiency could result in inaccuracies in our financial statements and could also impair our ability to comply with applicable financial reporting requirements and related regulatory filings on a timely basis. Moreover, effective internal control over financial reporting is important to prevent fraud. As a result, our business, financial condition, results of operations and prospects, as well as the trading price of our shares, may be negatively impacted by a failure to accurately report financial results.

| 13 |

Because our operating/business model continues to evolve it is difficult to predict our future performance, and our business is difficult to evaluate. Our business model continues to evolve over time. We do not have an extensive operating history upon which you can easily and accurately evaluate our business, or our ongoing financial condition. As our model evolves over time and due to our numerous acquisitions, we face risks and challenges due to a lack of meaningful historical data upon which we can develop budgets and make forecasts.

Future acquisitions may result in potentially dilutive issuances of equity securities, the incurrence of further indebtedness, and increased amortization expense. Our growth model has in the past and most probably in the future will involve acquisitions that may result in potentially dilutive issuances of equity securities or the incurrence of debt and unknown liabilities. Such acquisitions may result in significant write-offs and increased amortization expenses that could adversely affect our business and the results of our operations.

If our products fail to perform properly our business could suffer significantly. Although we do not currently develop or manufacturer our existing products, should they fail to perform we may suffer lost sales and customer goodwill, ongoing liability claims, license terminations, severe harm to our brand and overall reputation, unexpected costs, and reallocation of resources to resolve product issues.

Rapid and substantial growth is the key to our overall strategy, if we are unable to manage our growth profitably and effectively, we may incur unexpected expenses and be unable to meet our financial and customer obligations. For us to meet our financial objectives we will need to expand our operations to achieve necessary market share. We cannot be certain that our IT infrastructure, financial controls, systems, and processes will be adequate to support our expansion. Our future results will depend on the ability of our officers and key employees to manage changing business conditions in administration, reporting, controls, and operations.

If we are unable to obtain additional financing for our future needs we may be unable to respond to competitive pressures and our business may be impaired. We cannot be certain that financing with favorable terms, or at all, will be available for us to pursue our expansion initiatives. We may be unable to take advantage of favorable acquisitions or to respond to competitive pressures. This inability may harm our operations or financial results.

If we are forced to lower our prices to compete, our financial performance may be negatively impacted. We derive our sales from the resale of products from a number of our suppliers. If we are forced to lower our prices due to added competition, inferior feature offerings, excess inventory, pressure for cash, declining economic climate, or any other reason, our business may become less profitable.

If we are unable to maintain existing supplier relationships or form new ones, our business and financial condition may suffer. We rely on our current suppliers along with new suppliers to provide us access to competitive products for resale. If we are unable to gain access to suppliers with needed product on favorable terms our business may be negatively impacted.

If we incur costs that exceed our existing insurance coverage in lawsuits brought to us in the future, it could adversely affect our business and financial condition. We maintain third party insurance coverage against liability risks associated with lawsuits. While we believe these arrangements are an effective way to insure against liability, the potential liabilities associated with such risks or other events could exceed the coverage provided by such insurance.

We depend on the continued services of our executive officers and the loss of key personnel could affect our ability to successfully grow our business. We are highly dependent upon the services of our senior management team, particularly Zhenggang Wang, our Chairman and Chief Executive Officer and Jian Zhang, our Chief Financial Officer. The permanent loss for any of our key executives, could have a material adverse effect upon our operating results. We may not be able to locate suitable replacements for our executives if their services were lost. We do not maintain key man life insurance on any of these individuals.

| 14 |

Risks Related to Doing Business in China

Our business operations take place primarily in China. Because Chinese laws, regulations and policies are continually changing, our Chinese operations will face several risks summarized below.

Limitations on Chinese economic market reforms may discourage foreign investment in Chinese businesses. The value of investments in Chinese businesses could be adversely affected by political, economic and social uncertainties in China. The economic reforms in China in recent years are regarded by China’s central government as a way to introduce economic market forces into China. Given the overriding desire of the central government leadership to maintain stability in China amid rapid social and economic changes in the country, the economic market reforms of recent years could be slowed, or even reversed.

Certain political and economic considerations relating to China could adversely affect our company. China is transitioning from a planned economy to a market economy. While the PRC government has pursued economic reforms since its adoption of the open-door policy in 1978, a large portion of the Chinese economy still operates under five-year and annual state plans. Through these plans and other economic measures, such as control on foreign exchange, taxation and restrictions on foreign participation in the domestic market of various industries, the PRC government exerts considerable direct and indirect influence on the economy. Many of the economic reforms carried out by the PRC government are unprecedented or experimental, and are expected to be refined and improved. Other political, economic and social factors can also lead to further readjustment of such reforms. This refining and readjustment process may not necessarily have a positive effect on our operations or future business development. Our operating results may be adversely affected by changes in China’s economic and social conditions as well as by changes in the policies of the PRC government, such as changes in laws and regulations, or the official interpretation thereof, which may be introduced to control inflation, changes in the interest rate or method of taxation, and the imposition of additional restrictions on currency conversion.

Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties or joint ventures.

Due to various restrictions under PRC laws on the distribution of dividends by our PRC operating companies, we may not be able to pay dividends to our stockholders. The Wholly Foreign Owned Enterprise Law (1986), as amended and The Wholly Foreign Owned Enterprise Law Implementing Rules (1990), as amended, contain the principal regulations governing dividend distributions by wholly foreign owned enterprises. Under these regulations, wholly foreign owned enterprises, such as Zhejiang, Wang Da and Joy & Harmony, may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. Additionally, Zhejiang, Wang Da and Joy & Harmony are required to set aside a certain amount of any accumulated profits each year (a minimum of 10%, and up to half of its registered capital), to fund certain reserve funds. These reserves are not distributable as cash dividends except in the event of liquidation and cannot be used for working capital purposes. The PRC government also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. If we ever determine to pay a dividend, we may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of such dividends from the profits of Zhejiang, Wang Da and Joy & Harmony.

Currency conversion and exchange rate volatility could adversely affect our financial condition and the value of our common stock. The PRC government imposes control over the conversion of Renminbi, or RMB, into foreign currencies. Under the current unified floating exchange rate system, the People’s Bank of China, or PBOC, publishes an exchange rate, which we refer to as the PBOC exchange rate, based on the previous day’s dealings in the inter-bank foreign exchange market. Financial institutions authorized to deal in foreign currency may enter into foreign exchange transactions at exchange rates within an authorized range above or below the PBOC exchange rate according to market conditions.

| 15 |

Pursuant to the Foreign Exchange Control Regulations of the PRC issued by the State Council which came into effect on April 1, 1996, and the Regulations on the Administration of Foreign Exchange Settlement, Sale and Payment of the PRC which came into effect on July 1, 1996, regarding foreign exchange control, conversion of RMB into foreign exchange by Foreign Investment Enterprises, or FIEs, for use on current account items, including the distribution of dividends and profits to foreign investors, is permissible. FIEs are permitted to convert their after-tax dividends and profits to foreign exchange and remit such foreign exchange to their foreign exchange bank accounts in China. Conversion of RMB into foreign currencies for capital account items, including direct investment, loans, and security investment, is still under certain restrictions. On January 14, 1997, the State Council amended the Foreign Exchange Control Regulations and added, among other things, an important provision, which provides that the PRC government shall not impose restrictions on recurring international payments and transfers under current account items.

Enterprises in China, including FIEs, which require foreign exchange for transactions relating to current account items, if within a certain limited amount may, without approval of the State Administration of Foreign Exchange, or SAFE, effect payment from their foreign exchange account or convert and pay at the designated foreign exchange banks by providing valid receipts and proofs.

Convertibility of foreign exchange for capital account items, such as direct investment and capital contribution, is still subject to certain restrictions, and prior approval from the SAFE or its relevant branches must be sought.

Our wholly owned subsidiaries, Zhejiang, Wang Da and Joy & Harmony are FIEs to which the Foreign Exchange Control Regulations are applicable. There can be no assurance that we will be able to obtain sufficient foreign exchange to pay dividends or satisfy other foreign exchange requirements in the future.

Between 1994 and 2004, the exchange rate for RMB against the US dollar remained relatively stable, most of the time in the region of RMB8.28 to US$1.00. However, in 2005, the Chinese government announced it would begin pegging the exchange rate of the RMB against a number of currencies, rather than just the US dollar. As our operations are primarily in China, any significant revaluation of the RMB may materially and adversely affect our cash flows, revenues, financial condition and the value of our common stock. For example, to the extent that we need to convert US dollars into RMB for our operations, appreciation of this currency against the US dollar could have a material adverse effect on our business, financial condition, results of operations and the value of our common stock. Conversely, if we decide to convert our Renminbi into US dollars for the purpose of declaring dividends on our common stock or for other business purposes and the US dollar appreciates against the RMB, the US dollar equivalent of our earnings from our subsidiaries in China would be reduced.

The legal system in China has inherent uncertainties that may limit the legal protections available in the event of any claims or disputes with third parties. The legal system in China is based on written statutes. Prior court decisions may be cited for reference but have limited precedential value. Since 1979, the central government has promulgated laws and regulations dealing with economic matters such as foreign investment, corporate organization and governance, commerce, taxation and trade. As China’s foreign investment laws and regulations are relatively new and the legal system is still evolving, the interpretation of many laws, regulations and rules is not always uniform and enforcement of these laws, regulations and rules involve uncertainties, which may limit the remedies available in the event of any claims or disputes with third parties. In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management attention.

| 16 |

Risks Associated With Our Common Stock

There is a limited public market for our common stock. There is currently a limited public market for the common stock. Holders of our common stock may, therefore, have difficulty selling their common stock, should they decide to do so. In addition, there can be no assurances that such markets will continue or that any shares of common stock will be able to be sold without incurring a loss. Any such market price of the common stock may not necessarily bear any relationship to our book value, assets, past operating results, financial condition or any other established criteria of value, and may not be indicative of the market price for the common stock in the future. Further, the market price for the common stock may be volatile depending on a number of factors, including business performance, industry dynamics, news announcements or changes in general economic conditions.

Our common stock may be deemed penny stock with a limited trading market. Our common stock is currently listed for trading in the OTC Bulletin Board (“OTCBB”), which is generally considered to be a less efficient market than markets such as NASDAQ or other national exchanges, and which may cause difficulty in conducting trades and difficulty in obtaining future financing. Further, our securities are subject to the “penny stock rules” adopted pursuant to Section 15 (g) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The penny stock rules apply to non-NASDAQ companies whose common stock trades at less than $5.00 per share or which have tangible net worth of less than $5,000,000 ($2,000,000 if the company has been operating for three or more years). Such rules require, among other things, that brokers who trade “penny stock” to persons other than “established customers” complete certain documentation, make suitability inquiries of investors and provide investors with certain information concerning trading in the security, including a risk disclosure document and quote information under certain circumstances. Many brokers have decided not to trade “penny stock” because of the requirements of the penny stock rules and, as a result, the number of broker-dealers willing to act as market makers in such securities is limited. In the event that we remain subject to the “penny stock rules” for any significant period, there may develop an adverse impact on the market, if any, for our securities. Because our securities are subject to the “penny stock rules,” investors will find it more difficult to dispose of our securities. Further, for companies whose securities are traded in the OTCBB, it is more difficult: (i) to obtain accurate quotations, (ii) to obtain coverage for significant news events because major wire services, such as the Dow Jones News Service, generally do not publish press releases about such companies, and (iii) to obtain needed capital.

We do not intend to pay dividends on our common stock. We have no plans for declaring or paying dividends in the foreseeable future. We intend to retain earnings, if any, to provide funds for the implementation of our new business plan. Therefore, there can be no assurance that holders of common stock will receive any additional cash, stock or other dividends on their shares of common stock until we have funds, which the Board of Directors determines, can be allocated to dividends. Also, see risk factor titled “Due to various restrictions under PRC laws on the distribution of dividends by our PRC operating companies, we may not be able to pay dividends to our stockholders.”

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with the Consolidated Financial Statements and Notes thereto appearing elsewhere in this Form 10-K. The following discussion contains forward-looking statements. Our actual results may differ significantly from those projected in the forward-looking statements. Factors that may cause future results to differ materially from those projected in the forward-looking statements include, but are not limited to, those discussed in “Risk Factors” and elsewhere in this Form 10-K.

| 17 |

Overview (All dollar amounts in thousands)

China 3C owns 100% of CFDL and CFDL own 100% of the capital stock of Joy & Harmony and Sanhe. Until August 14, 2007, when it made the change to its ownership structure described in the next paragraph in order to comply with certain requirements of PRC law, CFDL owned 100% of the capital stock of Zhenjiang. Zhejiang owns 90% and Yiwu owns 10% of Wang Da. Zhejiang owns 90% and Wang Da owns 10% of Yiwu. On March 10, 2009 Zhejiang set up a new operating entity, Hangzhou Letong Digital Technology Co., Ltd. (“Letong”) to establish an electronic retail franchise operation for China 3C Group. On July 6, 2009, Zhejiang and Yiwu completed the acquisition of Jinhua Baofa Logistic Ltd (“Jinhua”). Jinhua was incorporated under the laws of PRC on December 27, 2001.

On December 21, 2005, CFDL became a wholly owned subsidiary of China 3C through a merger with a wholly owned subsidiary of the Company (the “Merger Transaction”). China 3C acquired all of the issued and outstanding capital stock of CFDL pursuant to a the Merger Agreement dated at December 21, 2005 by and among China 3C, XY Acquisition Corporation, CFDL and the shareholders of CFDL (the “Merger Agreement”). Pursuant to the Merger Agreement, CFDL became a wholly owned subsidiary of China 3C and, in exchange for the CFDL shares, China 3C issued 35,000,000 shares of its common stock to the shareholders of CFDL, representing 93% of the issued and outstanding capital stock of China 3C at that time and cash of $500. On August 15, 2007, we executed a series of contractual agreements between Capital and Zhejiang. The contractual agreements give Capital and its equity owners an obligation, and having ability to absorb, any losses, and rights to receive returns; however, these contractual agreements did not change the equity ownership of Zhejiang. We did not dispose Capital’s actual equity ownership of Zhejiang when we execute the contractual agreements. Capital entered into share-holding entrustment agreements with five individuals: Zhenggang Wang, Yimin Zhang, Huiyi Lv,Xiaochun Wang and Zhongsheng Bao to hold 35%, 20%, 20%, 15% and 10%, respectively, of the equity interest of Zhejiang on behalf of Capital on November 21, 2005. The entrustment agreements confirm that CFDL is the actual owner of Zhejiang. CFDL enjoys the actual shareholder rights and has the right to obtain any benefits received by the nominal holders. Zhenggang Wang is the CEO and shareholder of China 3C Group. Yimin Zhang, Huiyi Lv, Xiaochun Wang and Zhongsheng Bao have no other relationship with China 3C Group. No consideration was given to these individuals who held the equity of Zhejiang on behalf of CFDL.

As a result of the Merger Agreement, the reorganization was treated as an acquisition by the accounting acquiree that is being accounted for as a recapitalization and as a reverse merger by the legal acquirer for accounting purposes. Pursuant to the recapitalization, all capital stock shares and amounts and per share data have been retroactively restated. Accordingly, the financial statements include the following:

(1) The balance sheet consists of the net assets of the accounting acquirer at historical cost and the net assets of the legal acquirer at historical cost.

(2) The statements of operations include the operations of the accounting acquirer for the period presented and the operations of the legal acquirer from the date of the merger.

Pursuant to a share exchange agreement, dated August 3, 2006, we issued 915,751 shares of restricted common stock to the former shareholders of Sanhe, valued at $3,750, which was the fair value of the shares at the date of the share exchange agreement. This amount is included in the cost of net assets and goodwill purchased.

Pursuant to a share exchange agreement, dated November 28, 2006, we issued 2,723,110 shares of newly issued shares of common stock to the former shareholders of Joy & Harmony, valued at $11,000, which was the fair value of the shares at the date of exchange agreement. This amount is included in the cost of net assets and goodwill purchased.

On July 6, 2009, China 3C’s subsidiaries, Zhejiang and Yiwu completed acquisition of Jinhua, a company organized under the laws of the PRC. Zhejiang acquired 90% and Yiwu acquired 10% of the entire equity interests in Jinhua from the shareholders of Jinhua for a purchase price of RMB 120,000 ($17,500) in cash.

| 18 |

Yiwu, Wangda, Sanhe, Joy & Harmony are engaged in the business of resale and distribution of third party products and generates approximately 100% of its revenue from resale of items such as mobile phones, facsimile machines, DVD players, stereos, speakers, MP3 and MP4 players, iPod, electronic dictionaries, CD players, radios, Walkmans, and audio systems. We sell and distribute products through retail stores and secondary distributors. We operate most of our retail operations through our “store in store” model. Under this model, the Company leases space in major department stores and retailers. Leasing costs can vary based on a percentage of sales, or can be fixed. In 2010 and 2009, all of our stores in stores leases were variable based on sales.

In 2009, Zhejiang started establishing direct electronic retail stores and franchise operation. As of December 31, 2010, the Company has two franchise stores and three direct retail stores in operation, all of which are located in Zhejiang province. For the years ended December 31, 2010 and 2009, the direct stores and franchise stores had revenue of $138 and $258. The direct store and franchise operation is still in the early stage and does not represent a significant part of our business as of December 31, 2010.

Following the acquisition of Jinhua, the Company began providing logistic service to businesses in addition to its traditional business of resale and distribution of third party products such as mobile phones, facsimile machines, DVD players, stereos, speakers, MP3 and MP4 players, iPods, electronic dictionaries, CD players, radio Walkmans and audio systems.

Results of Operations

Year Ended December 31, 2010 compared to Year Ended December 31, 2009

Reportable Operating Segments

The Company reports financial and operating information in the following five segments:

| a) | Yiwu Yong Xin Telecommunication Company, Limited or “Yiwu” |

| b) | Hangzhou Wang Da Electronics Company, Limited or “Wang Da” |

| c) | Hangzhou Sanhe Electronic Technology Limited or “Sanhe” |

| d) | Shanghai Joy & Harmony Electronics Company Limited or “Joy & Harmony” |

| e) | Jinhua Baofa Logistic Limited or “Jinhua” |

| a) | Yiwu Yong Xin Telecommunication Company, Limited or “Yiwu” |

Yiwu focuses on the selling, circulation and modern logistics of fax machines and cord phone products.

| 19 |

All amounts, except percentage of revenues, in thousands of US dollars.

| Year Ended December 31, | Percentage | |||||||||||

| Yiwu | 2010 | 2009 | Change | |||||||||

| Revenue | $ | 20,251 | $ | 44,375 | (54.4 | )% | ||||||

| Gross Profit | $ | 2,328 | $ | 5,129 | (54.6 | )% | ||||||

| Gross Margin | 11.5 | % | 11.6 | % | (0.1 | )% | ||||||

| Operating (Loss) | $ | (2,456 | ) | $ | (612 | ) | (301.3 | )% | ||||

For the year ended December 31, 2010, Yiwu generated revenue of $20,251, a decrease of $24,124 or 54.4% compared to $44,375 for the year ended December 31, 2009. Gross profit decreased $2,801 or 54.6% from $5,129 for the year ended 2009 to $2,328 for the year ended 2010. Such decrease in revenue was primarily due to the shrinking market in office communication products. The decrease in revenue was also a result of closing 73 stores in stores in 2010. Operating losses was $2,456 in 2010; operating loss increased $1,844 or 301.3% compared to $612 in 2009. The increase in operating losses was primarily a result of higher labor cost and management fees paid to department stores as a percentage of sales.

Gross profit margin decreased from 11.6% in 2009 to 11.5% in 2010, a decrease of 0.1%. Such decrease is primarily due to the more competitive fax machines and telephone market in China compared to 2009. To maintain market share, we had to launch more promotions which negatively affected our gross margin. In addition, purchase rebate paid to suppliers, accounted for as an addition to cost of sales, as a percentage of sales increased in 2010, which led to lower gross margin of Yiwu.

| b) | Hangzhou Wang Da Electronics Company, Limited or “Wang Da” |

Wang Da focuses on the selling, circulation and modern logistics of cell phones, cell phones products, and digital products, including digital cameras, digital camcorders, PDAs, flash disks, and removable hard disks.

All amounts, except percentage of revenues, in thousands of US dollars.

| Year Ended December 31, | Percentage | |||||||||||

| Wang Da | 2010 | 2009 | Change | |||||||||

| Revenue | $ | 43,801 | $ | 58,744 | (25.4 | )% | ||||||

| Gross Profit | $ | 3,728 | $ | 6,600 | (43.5 | )% | ||||||

| Gross Margin | 8.5 | % | 11.2 | % | (2.7 | )% | ||||||

| Operating (Loss) | $ | (3,156 | ) | $ | (262 | ) | (1,104.6 | )% | ||||

For the year ended December 31, 2010, Wang Da generated revenue of $43,801, a decrease of $14,943 or 25.4% compared to $58,744 for the year ended December 31, 2009. Gross profit decreased $2,872 or 43.5% from $6,600 for the year ended 2009 to $3,728 for the year ended 2010. The decrease in revenue was primarily due to increased competition from government-owned large telecommunication service providers. Telecommunication service providers opened their direct operating stores to sell communication products. The number of electronics stores opened in the same area where Wang Da’s stores are located has increased in 2010. These government-owned companies also launched promotions such as “free phone with service contract” which drove the Wang Da’s revenue further down. Operating losses was $3,156 in 2010, increased $2,894 or 1,104.6% compared to operating loss of $262 in 2009. The increase in operating losses was primarily a result of higher labor cost and management fees paid to department stores as a percentage of sales.

Gross profit margin decreased from 11.2% in 2009 to 8.5% in 2010. The decrease was due to lower unit price of old model mobile phones as a result of the introduction of the 3G phones.

| c) | Hangzhou Sanhe Electronic Technology Limited or “Sanhe” |

Sanhe focuses on the selling, circulation and modern logistics of home electronics, including DVD players, audio systems, speakers, televisions and air conditioners.

| 20 |

All amounts, except percentage of revenues, in thousands of US dollars.

| Year Ended December 31, | Percentage | |||||||||||

| Sanhe | 2010 | 2009 | Change | |||||||||

| Revenue | $ | 42,427 | $ | 53,385 | (20.5 | )% | ||||||

| Gross Profit | $ | 4,426 | $ | 8,627 | (48.7 | )% | ||||||

| Gross Margin | 10.4 | % | 16.2 | % | (5.8 | )% | ||||||

| Operating (Loss) | $ | (4,122 | ) | $ | (741 | ) | (456.3 | )% | ||||

For the year ended December 31, 2010, Sanhe generated revenue of $42,427, a decrease of $10,958 or 20.5% compared to $53,385for the year ended December 31, 2009. Gross profit decreased $4,201 or 48.7% from $8,627 for the year ended 2009 to $4,426 for the year ended 2010. The decrease in revenue was primarily due to the shrinking market in DVD players and small home electronics as well as the closing of 11 stores in 2010. Operating losses was $4,122 in 2010, increased $3,381 or 456.3% compared to $741 in 2009. The increase in operating losses was primarily a result of higher labor cost and management fees paid to department stores as a percentage of sales.

Gross profit margin decreased from 16.2% in 2009 to 10.4% in 2010. The decrease in gross profit and operation income was primarily due to the change in sales revenue mix. Due to the lesser sales of DVD players and other small home electronics, we increased sales volume of TV sets, which has a lower margin, to maintain the market share. Therefore, gross margin for Sanhe decreased in 2010.

Goodwill Impairment

We recorded non-cash goodwill impairment charge of $1,347 for the year ended December 31, 2010 to reduce the carrying amount of Sanhe’s goodwill to its estimated fair value based upon the impairment test conducted during the fourth quarter of 2010. For further discussion of goodwill impairment charges see Note 2 – “SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES – Impairment of Goodwill” to the Consolidated Financial Statements.

| d) | Shanghai Joy & Harmony Electronics Company Limited or “Joy & Harmony” |

Joy & Harmony focuses on the selling, circulation and modern logistics of consumer electronics, including MP3 players, MP4 players, iPod, electronic dictionary, radios, and Walkman.

All amounts, except percentage of revenues, in thousands of US dollars.

| Year Ended December 31, | Percentage | |||||||||||

| Joy & Harmony | 2010 | 2009 | Change | |||||||||

| Revenue | $ | 40,247 | $ | 56,660 | (29.0 | )% | ||||||

| Gross Profit | $ | 5,460 | $ | 9,421 | (42.0 | )% | ||||||

| Gross Margin | 13.6 | % | 16.6 | % | (3.0 | )% | ||||||

| Operating Income (Loss) | $ | (3,151 | ) | $ | 1,012 | (411.4 | )% | |||||

For the year ended December 31, 2010, Joy & Harmony generated revenue of $40,247, a decrease of $16,413 or 29.0% compared to $56,660 for the year ended December 31, 2009. Gross profit decreased $3,961 or 42.0% from $9,421 for the year ended 2009 to $5,460 for the year ended 2010. The decrease in revenue was primarily due to a more competitive consumer electronics market as well as closing of 22 stores in 2010. The number of electronics stores located in the area where Joy & Harmony’s stores are located has increased in 2010. In addition, many small manufacturers closed down and large manufacturers raised the price of consumer electronics, which forced Joy & Harmony to discontinue some of its products. This caused sales to decline. Operating losses was $3,151 in 2010, a decrease of $4,163 or 411.4% compared to operating income of $1,012 in 2009.

| 21 |

Gross profit margin decreased from 16.6% in 2009 to 13.6% in 2010. The global financial crisis caused many small electronics manufacturers to exit the market and large manufacturers to raise the price of consumer electronics. Therefore, the cost for Joy & Harmony increased, which led to a significant decline in gross margin.

Goodwill Impairment

We recorded non-cash goodwill impairment charge of $8,243 for the year ended December 31, 2010 to reduce the carrying amount of Joy & Harmony’s goodwill to its estimated fair value based upon the impairment test conducted during the fourth quarter of 2010. For further discussion of goodwill impairment charges see Note 2 – “SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES – Impairment of Goodwill” to the Consolidated Financial Statements.

| e) | Jinhua Baofa Logistic Limited or “Jinhua” |

Jinhua provides transportation service to business and transports freight, including electronics, machinery and equipment, metal products, chemical materials, garments and handicraft goods, in more than 20 cities in Eastern China. Its transportation services cover many of the most developed cities in Eastern China such as Shanghai, Hangzhou and Nanjing.

China 3C acquired Jinhua on July 6, 2009. Therefore, the consolidated statement of income (loss) and comprehensive income (loss) of China 3C for the year ended December 31, 2009 includes Jinhua’s operating results from the date of acquisition to December 31, 2009.

All amounts, except percentages of revenues, are in thousands of US dollars.

| Jinhua | Year Ended December 31, 2010 | For the period from July 1 to December 31, 2009 | ||||||

| Revenue | $ | 10,691 | $ | 5,573 | ||||

| Gross Profit | $ | 1,402 | $ | 1,713 | ||||

| Gross Margin | 13.1 | % | 30.7 | % | ||||

| Operating Income (Loss) | $ | (68 | ) | $ | 1,098 | |||

Gross margin decreased 17.6% from 30.7% in 2009 to 13.1% in 2010 primarily due to the increased fuel cost. Operating income decreased primarily due to decreased gross margin. Higher operating expenses, in particular, also caused operating income to decrease. The labor cost of Jinhua increased 30% or $1,080 in 2010 due to the mandated government policy as well as higher inflation.

Net sales

Net sales for 2010 totaled $158,094, a year-over-year decrease of $60,900 or 27.8% compared to $218,994 for 2009. The decrease was attributable to the closing of 107 stores in stores in 2010 as well as the increased competition in the electronics market in China.

Percentage of sales

In 2010, the Company earned 68.8% of its sales from its retail operations and 31.2% from its wholesale operations compared to 68.9% from retail operations and 31.1% from wholesale in 2009.

| 22 |

Percentage of sales from retail and wholesale operations for each segment is as follows:

| Yiwu | Wang Da | Sanhe | Joy & Harmony | Total | ||||||||||||||||

| Retail | 66.2 | % | 68.3 | % | 70.1 | % | 70.6 | % | 68.8 | % | ||||||||||

| Wholesale | 33.8 | % | 31.7 | % | 29.9 | % | 29.4 | % | 31.2 | % | ||||||||||

Cost of Sales

Cost of sales for 2010 totaled $140,668, or 89.0% of net sales compared to $187,476, or 85.6% for 2009. The decrease in the cost of sales was a result of the decrease in sales. The cost of sales as a percentage increased during 2010 primarily due to increased costs of electronics products. The increase in purchase rebate paid to supplier, accounted for as an addition to cost of sales, also contributed to the increase in cost of sales.

Top Ten Suppliers of Each of Our Subsidiaries in 2010

| Yiwu | Wang Da | Sanhe | Joy & Harmony | Jinhua | ||||||

| 1 | Fengda Technology Company Limited | Shenzhen Tianyin Telecommunication Company Limited | Hangzhou Xietong Trade Company Limited | SONY(China) Company Limited (Shanghai) | Zhejiang Sheng Tong Logistic Company Limited | |||||

| 2 | Ninbo Zhongxun Electronics Company Limited | Hangzhou Weihua Telecommunication Company Limited | Zhejiang Zhuocheng Digital Electronics Company Limited | Shanghai Ganshun Trade Company Limited | Hangzhou Shenzhou Transportation Company Limited | |||||

| 3 | Shanghai Zhongfang Electronics Company Limited | Hangzhou Tianchen Digital Telecommunication Company Limited | Shanghai Haier Industrial and Trade Company | Huaqi Information Digital Technology Company Limited (Shanghai) | Shanghai Sheng Hui Transportation Company Limited | |||||

| 4 | Hangzhou Senruida Trade Company Limited | Hangzhou Liandong Telecommunication Equipment Company Limited | Shenzhen Chuangwei-RGB Electronics Company | Shanghai Caitong Digital Technology Company Limited | Shanghai Hong Wei Transportation Company Limited | |||||

| 5 | Shanghai Hongyi Office Supplies Company Limited | Shanghai Post&Telecom Appliances Company (Hangzhou) |

TCL Electronics Company Limited

|

Shanghai Bohui Electronics Company Limited | Jiaxingshi Guohong Vehicle Transportation Company Limited | |||||

| 6 | Shanghai Guangdian Equipment Company Limited | Hangzhou Qiuxin Internet Equipment Company Limited | Qingdao Haixin Electronics Limited Hangzhou branch | Shanghai Yiqike Industrial and Trade Company Limited | Guangzhou Shuntong Transportation Company Limited |

| 23 |

| 7 | Yiwu Wantong Telecom Equipment Company Limited | Shenzhen Liansheng Technology Company Limited | Shenzhen Asicer Electronics Company Limited | Shanghai Tande Electronics Technology Company Limited | Shanghai Shenghui Transportation Company Limited | |||||

| 8 | Jiaxing Yage Electronics Company Limited | Hangzhou Jiuxin Telecommunication Appliances Company Limited | Dongguang Lebang Electronics Limited | Shenzhen Dejing Electronics Company Limited | Hefei Yuan Shun Da Transportation Company Limited | |||||

| 9 | Shanghai Huoke Electronics Company Limited | Hangzhou Fuyin Trade Company Limited | Zhejiang Saixin Technology Limited | Chongqing Zhaohua Digital Technology Company Limited | Zhuhai Zhijie Transportation Company Limited | |||||

| 10 | Shanghai Rongduo Business Company Limited | Shenzhen Jinfeng Datong Technology Company Limited | Zhongshan Longdi Electronics Limited | Dongguan Gemei Technology Company Limited | Sanming Yunlin Vehicle Transportation Company Limited |

Gross Profit Margin

Gross profit margin in 2010 decreased to 11.0% compared to 14.4% in 2009. The gross profit margin decrease was mainly attributed to the fact that many small manufacturers of computers, communication and consumer products exited the market and large manufacturers raised the cost of goods due to the global economic slowdown. In addition, the increased competition led the Company to launch more promotional sales to attract customers. These events caused gross margin to decrease. The decrease in gross margin was also due to the increase in sales rebate paid to suppliers.

Because the Company does not include the costs for its distribution network in cost of sales, its gross profit and gross profit as a percentage of net sales (“gross profit margin”) may not be comparable to those of other retailers that may include distribution costs in cost of sales and in gross profit and gross margin.

General and Administrative Expenses

General and administrative expenses for 2010 totaled $42,263, or 26.7% of net sales, compared to $32,126, or 14.7% of net sales for 2009. General and administration expense increased 31.6% primarily due to a 16.4% increase in labor cost, increase in management fees paid to department stores and goodwill impairment of $9,591 charged in 2010.

Income (Loss) from Operations

Operating loss for 2010 was $24,837, or (16.7)% of net sales compared to $608, or (0.3)% of net sales for 2009. Declined sales and gross margin and increased general and administration expenses led to the decline in income from operations.

| 24 |

Provision for income taxes

Provision for income taxes for 2010 was $52, representing year-over-year decrease of 92.7% compared to $714 for 2009. The decrease in income tax expenses was due to Yiwu, Wang Da and Sanhe and Joy & Harmony having net losses in 2010 and therefore not having income tax expenses. Zhejiang was the only subsidiary having net income but the tax expense was not significant. Although Jinhua had net losses, Jinhua paid a small amount of income taxes based on the simplified tax system.

Net Income (loss)

Net loss was $(24,927) or (16.8)% of net sales for 2010 compared to $1,213 or (0.6) % of net sales for 2009. Net income decreased primarily due to a decrease in sales and gross margin and an increase in general administration expenses.

Foreign currency translation adjustments

The impact of foreign translation from our accounts in RMB to US dollar on China 3C’s operating results was not material. During the translation process, the assets and liabilities of all PRC subsidiaries are translated into US dollars at period-end exchange rates. The revenues and expenses are translated into US dollars at average exchange rates of the periods. Resulting translation adjustments are recorded as acomponent of accumulated other comprehensive income within stockholders’ equity.

| 2010 | 2009 | |||||||

| RMB/US$ exchange rate at year end | 0.15170 | 0.14626 | ||||||

| Average RMB/US$ exchange rate for the years | 0.14792 | 0.14618 | ||||||

Transaction gains or losses arising from exchange rate fluctuation on transactions denominated in a currency other than the functional currency were included in the consolidated results of operations. As a result of the translation, China 3C recorded a foreign currency gain of $1,526 in 2010 and loss of $92 thousand in 2009, which is a separate line item on the Statements of Operations.

Year Ended December 31, 2009 compared to Year Ended December 31, 2008

The Company reports financial and operating information in the following five segments:

| a) | Yiwu Yong Xin Telecommunication Company, Limited or “Yiwu” |

| b) | Hangzhou Wang Da Electronics Company, Limited or “Wang Da” |

| c) | Hangzhou Sanhe Electronic Technology Limited or “Sanhe” |

| d) | Shanghai Joy & Harmony Electronics Company Limited or “Joy & Harmony” |

| e) | Jinhua Baofa Logistic Limited or “Jinhua” |

| a) | Yiwu Yong Xin Telecommunication Company, Limited or “Yiwu” |