Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - China Shengda Packaging Group Inc. | Financial_Report.xls |

| EX-10.14 - EXHIBIT 10.14 - China Shengda Packaging Group Inc. | exhibit10-14.htm |

| EX-21 - EXHIBIT 21 - China Shengda Packaging Group Inc. | exhibit21.htm |

| EX-31.1 - EXHIBIT 31.1 - China Shengda Packaging Group Inc. | exhibit31-1.htm |

| EX-32.2 - EXHIBIT 32.2 - China Shengda Packaging Group Inc. | exhibit32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - China Shengda Packaging Group Inc. | exhibit32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - China Shengda Packaging Group Inc. | exhibit31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31,

2011

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from

____________to _____________

Commission File No. 001-34997

CHINA SHENGDA PACKAGING GROUP INC.

(Exact name of registrant as specified in its charter)

| Nevada | 26-1559574 |

| (State or other jurisdiction of incorporation or | (I.R.S. Employer Identification No.) |

| organization) |

No. 2 Beitang Road

Xiaoshan Economic and

Technological Development Zone

Hangzhou, Zhejiang Province 311215

People’s Republic of China

(Address of principal executive

offices)

(86) 571-8283-8805

(Registrant’s telephone number,

including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files)

Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

[ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer [ ] | Accelerated Filer [ ] |

| Non-Accelerated Filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [X] |

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Act)

Yes [ ] No [X]

As of June 30, 2011 (the last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market value of the shares of the registrant’s common stock held by non-affiliates (based upon the closing sale price of such shares as reported on the NASDAQ Global Market) was approximately $25.4 million. Shares of the registrant’s common stock held by each executive officer and director and each by each person who owns 10% or more of the outstanding common stock have been excluded from the calculation in that such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

There were a total of 38,790,811 shares of the registrant’s common stock outstanding as of March 15, 2012.

DOCUMENTS INCORPORATED BY REFERENCE

None.

CHINA SHENGDA PACKAGING GROUP INC.

| Annual Report on Form 10-K |

| Year Ended December 31, 2011 |

TABLE OF CONTENTS

| PART I | ||

| Item 1. | Business. | 2 |

| Item 1A. | Risk Factors. | 19 |

| Item 1B. | Unresolved Staff Comments. | 35 |

| Item 2. | Properties. | 35 |

| Item 3. | Legal Proceedings. | 36 |

| Item 4. | Mine Safety Disclosures | 36 |

| PART II | ||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 36 |

| Item 6. | Selected Financial Data | 37 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. | 37 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk. | 47 |

| Item 8. | Financial Statements and Supplementary Data. | 47 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. | 47 |

| Item 9A. | Controls and Procedures. | 47 |

| Item 9B. | Other Information. | 48 |

| PART III | ||

| Item 10. | Directors, Executive Officers and Corporate Governance. | 48 |

| Item 11. | Executive Compensation. | 54 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | 55 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence. | 56 |

| Item 14. | Principal Accounting Fees and Services | 57 |

| PART IV | ||

| Item 15. | Exhibits, Financial Statement Schedules. | 58 |

Special Note Regarding Forward Looking Statements

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements include, among others, those concerning our expected financial performance; strategic and operational plans; management forecast; economies of scales; litigation; potential and contingent liabilities; management’s plans; taxes; as well as all assumptions, expectations, predictions, intentions or beliefs about future events. You are cautioned that any such forward-looking statements are not guarantees of future performance and that a number of risks and uncertainties could cause actual results of the Company to differ materially from those anticipated, expressed or implied in the forward-looking statements. The words “believe,” “expect,” “anticipate,” “project,” “targets,” “optimistic,” “intend,” “aim,” “will” or similar expressions are intended to identify forward-looking statements. All statements other than statements of historical fact are statements that could be deemed forward-looking statements. Risks and uncertainties that could cause actual results to differ materially from those anticipated include general economic conditions; our ability to overcome competition in our industry; the impact that a downturn or negative changes in the industries in which our products are sold could have on our business and profitability; any decrease in the availability, or increase in the cost, of raw materials and energy; our ability to simultaneously fund the implementation of our business plan and invest in new projects; economic, political, regulatory, legal and foreign exchange risks associated with international expansion; loss of key members of our senior management; and unexpected changes to China’s political or economic situation and legal environment. Additional disclosures regarding factors that could cause our results and performance to differ from results or performance anticipated by this report are discussed in Item 1A. “Risk Factors.”

Readers are urged to carefully review and consider the various disclosures made by us in this report and our other filings with the SEC. These reports attempt to advise interested parties of the risks and factors that may affect our business, financial condition and results of operations and prospects. The forward-looking statements made in this report speak only as of the date hereof and we disclaim any obligation to provide updates, revisions or amendments to any forward-looking statements to reflect changes in our expectations or future events.

Use of Terms

Except as otherwise indicated by the context and for the purposes of this report only, references in this report to:

- “the Company,” “our company,” “we,” “us,” or “our,” are to the combined business of China Shengda Packaging Group Inc., a Nevada corporation, and its consolidated subsidiaries: Evercharm, Great Shengda, Shengda Color, Hangzhou Shengming, Suzhou AA and Shuangsheng;

- “Evercharm” are to Evercharm Holdings Limited, a BVI company;

- “Great Shengda” are to Zhejiang Great Shengda Packaging Co., Ltd., a PRC company;

- “Shengda Color” are to Zhejiang Shengda Color Pre-:Printing Co., Ltd., a PRC company;

- “Hangzhou Shengming” are to Hangzhou Shengming Paper Co., Ltd., a PRC company;

- “Suzhou AA” are to Suzhou Asian & American Paper Products Co., Ltd., a PRC company;

- “Shuangsheng” are to Jiangsu Shuangsheng Paper Technology Development Co., Ltd., a PRC company;

- “SD Group” are to Shengda Group Co., Ltd.;

- “BVI” are to the British Virgin Islands;

- “PRC” and “China” are to the People’s Republic of China, excluding Hong Kong, Macau and Taiwan;

- “YRD” are to Yangtze River Delta Economic Zone, which includes Shanghai, Zheijiang Province and Jiangsu Province;

- “SEC” are to the Securities and Exchange Commission;

- “Securities Act” are to the Securities Act of 1933, as amended;

- “Exchange Act” are to the Securities Exchange Act of 1934, as amended;

- “Renminbi” and “RMB” are to the legal currency of China;

- “U.S. dollars,” “dollars” and “$” are to the legal currency of the United States; and

- “PBOC” are to People’s Bank of China.

1

PART I

| ITEM 1. | BUSINESS. |

Business Overview

We are a leading paper packaging company in China. Through our wholly-owned subsidiaries, Great Shengda, Shengda Color, Hangzhou Shengming and Suzhou AA, we are principally engaged in the design, manufacture and sale of flexo-printed and color-printed corrugated paper cartons in a variety of sizes and strengths. We also manufacture corrugated paperboards, which are used for the production of our flexo-printed and color-printed cartons.

We provide paper packaging solutions to a wide variety of industries, including food, beverage, cigarette, household appliance, consumer electronics, pharmaceuticals, chemicals, machinery and other consumer or industrial sectors. Our major products are single-layer paper cartons for food, drinks and medicine, double-layer paper cartons for garments, chemicals, furniture, refrigerators and air-conditioners, and triple-layer paper cartons for electrical machinery, motorcycles, and other heavy-duty products. Our sales volume in 2011 reached 322 million square meters with an annual production capacity of 545 million square meters in 2011.

Our production facilities are strategically located in the YRD, a manufacturing center in China, thus putting us in close proximity to a large number of paper carton customers. Due to the weight and bulk of paper products and the consequent high shipping costs, paper packaging companies are generally limited to servicing a geographic radius from their production site, usually between 300 and 500 kilometers, within which they can compete economically. The paper carton market, therefore, is highly influenced by regional supply and demand dynamics. Based from our four manufacturing facilities in the provinces of Zhejiang and Jiangsu, we have established a sales network with five customer service centers that can service customers throughout the YRD, which accounted for the majority of our revenues. As the leading paper packaging manufacturer in the YRD, we are well positioned to capitalize on the fast-growing demand for paper cartons driven by the concentration and success of the manufacturing companies in the region.

We serve a broad base of reputable customers, including some of the Fortune 500 companies and Top 500 Chinese enterprises. Our major customers include Nongfu Spring Co., Ltd., Hangzhou Cigarette Company, Samsung’s Chinese subsidiary Suzhou Samsung Electrical Co., Ltd. and Panasonic’s Chinese subsidiary Hangzhou Panasonic Home Electrical Appliance Company. We have developed long-term relationships with and loyalty from our customers, many of which have been with us for over five years. We have also engaged in strategic alliance relationships with ten customers as their preferred supplier. At the same time, we continue to attract new customers to generate higher demand for our products and increase market penetration. The number of our customers has increased substantially since 2004.

Our senior management has been involved in the paperboards and paper cartons business since 1999, when Zhejiang New Shengda, the company that sold to Great Shengda the assets that form the basis of our operations, was incorporated. We benefit from the industry connections and experience of our senior management, which enable us to develop a strong reputation among our customers and in our industry. Great Shengda was granted the “China Packaging Leading Enterprise Award” by the China Packaging Technology Association (the predecessor of China Packaging Federation), and was named a “Chinese Development and Production Base of Paper Packaging” by the State Economic and Trade Commission and China Packaging Federation. Our Shengda trademark was recognized as a Chinese Well-Known Trademark in 2010 as a result of the market reputation we have built over the years.

Our total revenues for the year ended December 31, 2011 were approximately $124.0 million, a decrease of $6.1 million, or 4.7%, from $130.1 million for the year ended December 31, 2010. Our net income attributable to the Company’s common stockholders for the year ended December 31, 2011 was approximately $9.6 million, a decrease of $9.7 million, or 50.1%, from approximately $19.3 million for the year ended December 31, 2010.

Corporate History and Background

We were incorporated in the State of Nevada on March 16, 2007 as a web-based service provider offering an online service where health practitioners (such as chiropractors, dentists, massage therapists, occupational therapists and counselors) could purchase products and services to improve their work and home lives, including books, CDs, clothing, and accessories geared towards the needs of these practitioners. However, we did not engage in any operations and were dormant from our inception until our reverse acquisition of Evercharm on April 8, 2010.

2

On April 8, 2010, we completed a reverse acquisition transaction through a share exchange with Evercharm and its sole shareholder, Shengda (Group) Holdings Ltd., or Shengda Holdings, whereby we acquired 100% of the issued and outstanding capital stock of Evercharm in exchange for 27,600,000 shares of our common stock, which constituted 92% of our issued and outstanding shares on a fully-diluted basis immediately after the consummation of the reverse acquisition. As a result of the reverse acquisition, Evercharm became our wholly-owned subsidiary and Shengda Holdings became our controlling stockholder. The share exchange transaction with Evercharm was treated as a reverse acquisition, with Evercharm as the accounting acquirer and the Company as the acquired party.

Subsequently on May 10, 2010, Shengda Holdings distributed the shares it received in the reverse acquisition to the family of Nengbin Fang, our Chairman, and certain other individuals. As a result, members of the Fang family own approximately 54.02% of our common stock.

Through our ownership of Evercharm and its principal PRC operating subsidiaries, Great Shengda, Shengda Color, Hangzhou Shengming and Suzhou AA, we design, manufacturer and sell paper cartons and offer packaging solutions to principally consumer and industrial goods manufacturing companies in China. Prior to the formation of Great Shengda, Zhejiang New Shengda operated our paper packaging business. Since 1999, the business had been managed under the leadership of Nengbin Fang, Zhejiang New Shengda's then general manager and our current Chairman. In 2004, when Great Shengda was incorporated, Zhejiang New Shengda transferred all of its paper packaging assets to Great Shengda and became a dormant company, and Mr. Fang became the Chairman of Great Shengda to continue to manage the business.

On September 22, 2011, we incorporated Shuangsheng in Jiangsu Province, PRC. On September 27, 2011, we received Shuangsheng’s business license from the local Administration of Industry and Commerce approving Shuangsheng to be engaged in the business of new paper making technology, related research and the development, application, transfer and consultation of such relevant technology. Pursuant to the business license, Shuangsheng has registered capital of RMB 88 million (approximately $13.7 million) with actually invested capital of RMB 22 million (approximately $3.4 million).

Our Corporate Structure

All of our business operations are conducted through our Chinese subsidiaries. The chart below presents our corporate structure as of the date of this report:

3

The Paper Packaging Market in China

China's packaging industry has grown steadily since the mid-1980s with one of the highest growth rates in the international packaging market. Corrugated packaging is the largest subsector of the paper packaging industry in China.

Compared to other countries, current per capita paper packaging consumption in China is very low. According to China Packaging Federation, each person in China consumes on average 55 kg of paper packaging annually, which is one-sixth that of the United States, one-fifth of Japan, a quarter of Europe and half of India. With per capita paper packaging consumption far below other large economies in the world, the Chinese paper packaging industry has considerable potential for sustainable growth. According to S&P Consulting, the production volume of corrugated paper cartons will grow to 39.2 million tons in 2013, and the market demand will grow to 62.6 billion square meters in 2013. According to China Packaging Federation, China is expected to overtake the United States as the largest corrugated paper packaging market by 2013.

Demand for Our Products

The main customers of the paper packaging industry are consumer and industrial goods manufacturers that use corrugated paper cartons for packaging and shipping of their products, including food and beverage, home appliances, IT and electronics, daily necessities, pharmaceuticals, chemicals and machinery. The continued robust growth in the retail sales of consumer goods has significant positive impacts on the demand for corrugated packaging products.

Other trends in our industry expected to impact our growth include customer migration toward paper as a more environmentally-responsible packaging material than plastic, glass, metal, or wood; government policies designed to encourage domestic consumption of consumer goods; increasing competition for high-quality, low-cost packaging; and greater consolidation among paper packaging suppliers.

Paper Packaging Market in East China

Our subsidiaries are located in the YRD of East China, which is the most affluent region amongst six major regions in China with the highest per capita gross domestic product, or GDP. The YRD consists of three areas, namely Shanghai, Jiangsu Province and Zhejiang Province, all ranked among top five in China in terms of per capita GDP. The high per capita GDP has led to strong purchasing power for various products, which in turn has generated high demand for corrugated cartons within the region.

Our Products

The corrugated paper cartons that we design, manufacture and sell are flexo-printed or color-printed paper boxes. Our corrugated paper cartons are used for a wide variety of products, such as food, beverage, cigarette, household appliance, consumer electronics, pharmaceuticals, chemicals, furniture, garments, machinery and other consumer and industrial goods. Our paper cartons are available in a wide range of sizes and strengths depending on the type, weight and size of the products and the manner in which these paper cartons are used. For the year ended December 31, 2011, approximately 72.9% and 27.1% of our sales revenue was generated from sales of our flexo-printed and color-printed boxes, respectively, as compared to approximately 73.5% and 26.5%, respectively, for the year ended December 31, 2010.

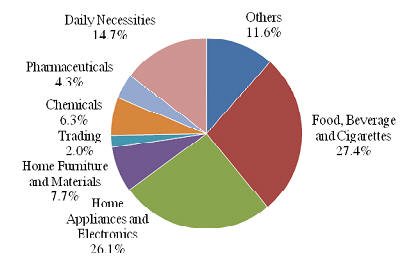

The following charts illustrate the sales revenue breakdown by paper carton type and end market for 2011:

4

Revenue Breakdown by Carton Type

Year Ended December 31, 2011

Revenue Breakdown by End Market

Year Ended December 31, 2011

Our paper cartons are made of corrugated paperboards machine-cut to the designed dimensions and then folded into paper cartons. We use single-layer, double-layer and triple-layer corrugated paperboards sandwiched between Kraft paper sheets (Kraft paper is a type of paper, which is strong and relatively coarse, produced from the chemical pulp of softwood under the Kraft process). The thickness of the paperboards and the type of corrugated paper sheets used are key determinants of the strength of the paper cartons manufactured.

Our paperboards and paper cartons are summarized below:

| Type of Paperboards | Type of Paper Cartons | Recommended Applications |

|

|

Single-layer paper cartons | Packaging for food, drinks and medicine |

|

|

Double-layer paper cartons | Packaging for garments, furniture, refrigerators and air-conditioners |

|

|

Triple-layer paper cartons | Packaging for electrical machinery, motorcycles, and other heavy-duty products |

5

Our corrugated paper cartons deliver marketing and performance benefits at a competitive cost. We supply corrugated paper cartons designed to protect and contain products while providing:

-

Convenience through ease of carrying, storage, delivery and removal of the products by the end consumers;

-

A smooth surface printed with various resolutions of flexo- or multi-color graphic images that help improve brand awareness and visibility of products; and

-

Durability, stiffness and wet and dry tear strength; leak, abrasion and heat resistance; barrier protection.

Manufacturing and Production

Manufacturing Facilities

Our production is carried out at Great Shengda, Shengda Color, Hangzhou Shengming and Suzhou AA, all of which are strategically located within the YRD, the PRC manufacturing belt. Great Shengda, Shengda Color, Hangzhou Shengming and Suzhou AA lease most of their manufacturing facilities which also contain administrative offices. They own all of their equipment and machines.

Great Shengda. Great Shengda's production facilities are located on a land parcel of approximately 112,437 square meters. We had 923 employees at Great Shengda as of December 31, 2011. Great Shengda manufactures paperboards and both flexo-printed and color-printed paper cartons. Great Shengda is equipped with (i) one BHS2800 paperboard production line from BHS, a German manufacturer; (ii) one Taiwan made XieXu 1800 paperboard production line; (iii) nine flexo printing slotters; (iv) two automatic gluing machines; (v) one computer-to-plate (CTP) system; (vi) three multi-color off-set printers; and (vii) five fully-automated machines for flexo printing and mould-cutting. The BHS2800 paperboard production line is among the world's most advanced paperboard production equipment.

Shengda Color. The gross production area of Shengda Color's facility is approximately 30,661 square meters. We had 165 employees at Shengda Color as of December 31, 2011. Shengda Color is equipped with (i) one Taiwan made XieXu 2500 paperboard production line; (ii) one 7-color pre-printing production line; (iii) one automatic die-cutting machine; and (iv) two flexo printing slotters.

Hangzhou Shengming. Hangzhou Shengming's production facilities are located on a land parcel of approximately 47,942 square meters. We had 293 employees at Hangzhou Shengming as of December 31, 2011. Hangzhou Shengming is equipped with (i) one BHS2500 paperboard production line; (ii) five Taiwan made multi-color printing slotters; (iii) one 4-color printing slotter; (iv) one Taiwan made multi-function automatic gluing machine; (v) one Taiwan made multi-function automatic packaging machine; and (vi) one Taiwan made automatic paperboard transmission system.

Suzhou AA. Suzhou AA's production facilities are located on a land parcel of approximately 11,938 square meters. We had 71 employees at Suzhou AA as of December 31, 2011. Suzhou AA is equipped with (i) one Taiwan made 4-color printing slotter; (ii) one 4-color printing slotter; and (iii) two Taiwan made 3-color printing slotters.

Utilities

Electricity is the principal source of energy for our manufacturing operations. If a power shortage or stoppage were to occur, we have back-up power supply in the form of our two-way power supply and our own power generators at each of our manufacturing facilities, which we believe are able to provide sufficient back-up power to ensure that our manufacturing operations will not be disrupted. To date, we have not experienced any prolonged power shortages or stoppages.

6

Maintenance

Our own staff carries out maintenance and servicing of our production equipment on a regular basis. As a result of our regular maintenance, we have not experienced any major shutdown or disruption to our manufacturing operations.

Production Capacity and Utilization

Our production capacity is limited by our production floor area, production equipment and manpower.

The following table illustrates the maximum production capacity and the actual production volume for our production lines for the manufacture of paperboards, flexo-printed paper cartons and color-printed cartons as of December 31, 2011 and 2010:

| Flexo-Printed | Color-Printed | ||||||||

| Paperboards | Paper Cartons | Paper Cartons | |||||||

| (square meters) | (square meters) | (square meters) | |||||||

| As of December 31, 2011 | |||||||||

| Annual Production Capacity(1) | 545 million | 363 million | 182 million | ||||||

| Actual Production Volume | 322 million | 246 million | 76 million | ||||||

| As of December 31, 2010 | |||||||||

| Annual Production Capacity(1) | 498 million | 333 million | 165 million | ||||||

| Actual Production Volume | 345 million | 263 million | 82 million |

| (1) |

Annual production capacity = (The approximate daily maximum production for paperboards, flexo-printed paper cartons or color-printed paper cartons) x 365 days. |

7

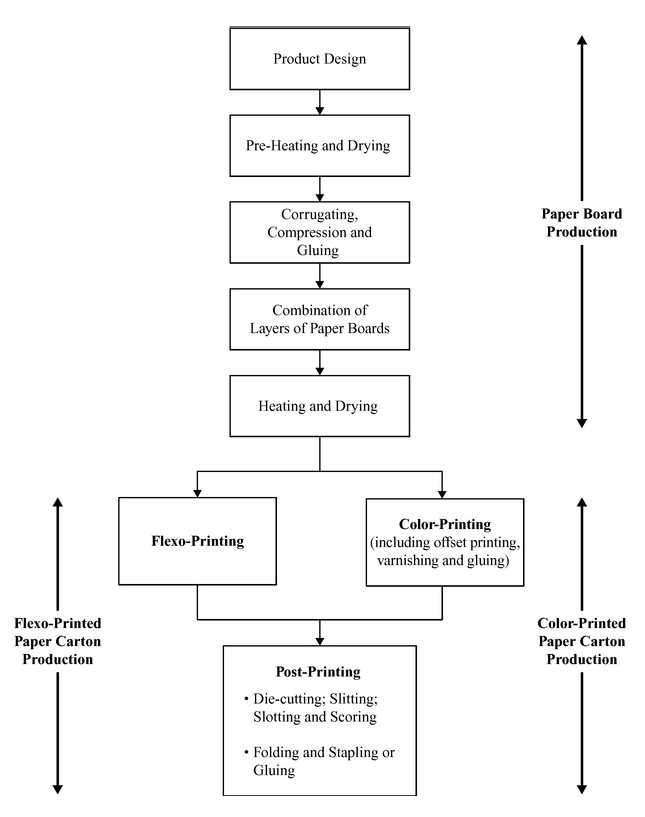

Manufacturing Process

The production process for our paperboards and paper cartons is illustrated below:

Product Design

After receiving orders from customers, we meet with our customers to understand their products and target consumer market, and then assist them in designing packaging that is suitable for their purposes and that appeals to their consumers.

8

While our customers typically provide us with their own packaging design and specifications, our production development team and our design team have also designed paper cartons for many of our customers. Our team works closely with our customers to meet their requirements with regard to the structure, function and graphic design.

Our production team then produces a sample product based on the designs. Tests will be conducted on this sample product at our in-house testing center to ensure that it meets the design specifications. Mass production begins once the sample is approved by the customer.

Corrugated Paperboard Production

Pre-heating and drying. The key raw materials used in the manufacture of our paperboards are Kraft paper and corrugating medium. Corrugating medium is fed into corrugator production machines (such as our BHS2800 corrugated paperboard production line), and pre-heated to reduce the moisture level in the corrugating process.

Corrugating, compression and gluing. The pre-heated paper is transformed into corrugated paper with different flute-depth through a corrugating process. Kraft paper is then glued to this corrugated paper to form a semi-completed paperboard.

Combination of layers of corrugated paperboards. Glue adhesive is applied to combine semi-completed paperboards with Kraft paper or other semi-completed paperboards to form single-layer, double-layer or triple-layer paperboards.

Heating and drying. The corrugated boards then pass through a heating process to dry the glue adhesive to improve the bonding strength between the layers of the corrugated boards before warehouse storage or the manufacture of paper cartons.

Paper Carton Production

Flexo-printing. Flexography (often abbreviated to flexo) is a printing process that utilizes a flexible relief plate and water based ink. It can be used for printing on almost any type of substrate including plastic, metallic films, cellophane, and paper. It is widely used for printing on the non-porous substrates required for various types of food packaging (it is also well suited for printing large areas of solid color). Our customer's approved artwork is transferred to a flexible plate with a plate making machine. Then the flexible plate is installed into a water-based ink printing machine, and the artwork is directly transferred onto the surface of the corrugated boards from the printing machine.

Color-printing. Offset color printing utilizes oil-based ink to print. The visual effect of color-printed artwork is superior to ink-printed artwork. Artwork pre-approved by customers are either captured on film and transferred onto printing plates, or transferred directly onto printing plates from the computer using the computer-to-plate, or CTP, method. CTP involves the transfer of digital images of artwork from computers directly onto printing plates without the use of film. CTP produces images that are closer to the customers' original artwork and produces cleaner and sharper results and saves time by eliminating the use of film.

Offset printing. Offset printing involves the transfer of ink on paper via a printing plate. The image areas of the printing plates are rendered ink receptive and water repellent, while the non-image areas of the printing plates are rendered water receptive and ink repellent. The printing plates will be mounted onto a cylindrical drum on the printing machine. The printing plates are dampened, first by water rollers then by ink rollers. The image area of the printing plates picks up the ink and water keeps ink out of non-image areas of the printing plates. Each plate transfers its image onto a rubber blanket cylinder, which then transfers the image onto paper.

Lamination and varnishing. Depending on the design specifications and the customer's requirements, the prints may need a layer of lamination or liquid varnishing. This makes the printed artwork water resistant and gives it a glossy appearance.

Gluing. The printing paper (containing the printed artwork) is then glued onto the semi-completed paperboard.

Die-Cutting, slitting, slotting and scoring. Flexo-printed and offset-printed paperboards undergo die-cutting and slitting to produce a pre-folded paper carton in accordance with the paper carton design, and also undergo slotting and scoring to create the fold-lines for folding.

9

Folding, and stapling or gluing. The pre-folded paper carton is then stapled or glued by the automated stapling and gluing machines to produce semi-folded paper cartons. These finished products are then prepared for delivery.

Raw Materials and Suppliers

Raw Materials

The key raw materials used in the manufacture of our paperboards are Kraft paper and corrugating medium. Raw materials are purchased only from pre-selected suppliers after evaluation by our purchasing, production and quality assurance departments based on stringent selection criteria such as pricing, the quality of raw materials and services, track record, financial condition and market reputation. Our major suppliers are all well-known PRC companies in the paper manufacturing industry with large capacities to satisfy our requirements. In 2011, only a minimal amount of our raw materials was imported.

Suppliers and Supplier Arrangements

Our major suppliers who accounted for 5% or more of our purchases for the years ended December 31, 2011 and 2010 are as follows:

| Year Ended December 31, | |||||||

| Supplier | 2011 | 2010 | |||||

| Zhejiang Jingxing Paper Group Papermaking Co., Ltd. | <5% | 7.3% | |||||

| Wuxi Rongcheng Paper Co., Ltd. | 6.5% | 6.8% | |||||

| Jiangsu Chang Feng Paper Factory | 5.9% | 7.3% | |||||

| Jiangsu Lee & Man Paper Manufacturing Co., Ltd. | <5% | 8.1% | |||||

| Zhejiang Rongcheng Paper Co. Ltd. | 8.6% | 13.3% | |||||

The typical term of a supply contract is less than six months. The purchase prices are generally negotiated every month or every two to three months. In some cases, the prices for raw materials per ton may be fixed in the contract. Our suppliers generally allow us 60 to 120 days’ credit.

Our Customers

We have a diversified customer base in a broad range of end markets. In 2011, we had more than 900 customers. Our three largest customers are Hangzhou Panasonic Home Electrical Appliance Co., Ltd., Nongfu Spring Co., Ltd. and Hangzhou Cigarette Company, all of whom are Top 500 Chinese Enterprises. We also have Fortune 500 company clients such as Suzhou Samsung Electrical Co., Ltd., Zhejiang Shell Chemical Engineering Petroleum Co., Ltd. and Hangzhou Zhongcui Foods Co., Ltd., a major sales agent of The Coca-Cola Company. We strive to continually increase and diversify our customer base.

For the periods indicated, our major customers who accounted for 5% or more of our total revenue are as follows:

| Year Ended December 31, | |||||||

| Customer | 2011 | 2010 | |||||

| Suzhou Samsung Electrical Co., Ltd | <5% | 5.2% | |||||

| Hangzhou Cigarette Company | 5.5% | <5% | |||||

| Nongfu Spring Co., Ltd. | 5.6% | <5% | |||||

| Hangzhou Panasonic Home Electrical Appliance Co., Ltd. | 5.7% | 6.6% | |||||

We generally provide customized products to our customers, so we negotiate individual contracts with our customers based on their particular requirements. We usually start with a base product price for the specific product category and quantity, then consider process requirements, technical difficulties, level of competition in the market and specific process required for the particular product to arrive at the final price for a product. We are responsible for delivery, and the transportation cost will be included in the price. We generally allow our customers 60 to 120 days’ credit. For 2011 and 2010, our accounts receivable turnover days were 104 days and 70 days, respectively. See also the discussion under Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources.”

10

We have also engaged in strategic alliance relationships with ten customers, including our three largest customers, namely, Hangzhou Panasonic Home Electrical Appliance Co., Ltd., Nongfu Spring Co., Ltd. and Hangzhou Cigarette Company. We give our strategic alliance relationship customers priority in fulfilling their orders, and, in exchange, such customers give us priority as a supplier when they place their orders. We also cooperate with these customers in the development of new packaging for their products. We believe that these strategic alliances will strengthen the reliability of our services and help us maintain our key customers.

We are not aware of any information or arrangements that would lead to a cessation or termination of our current relationship with any of our major customers.

Backlog

We do not believe backlog is material to an understanding of our business as our backlog generally does not have a material impact on our revenues. Most customer orders are processed with a lead time of two weeks or less. Orders for existing customers are generally processed in one week and orders for new customer are generally processed within 15 days. Therefore, the amount of our backlog is generally very small. We generally enter into framework sales contracts with most major customers every year. Pursuant to these contracts, the customers contract us as a priority supplier when they place regular orders, and, in exchange, we provide priority fulfillment of their orders.

Sales and Marketing

Our sales and marketing department has 52 sales personnel and marketing executives as of December 31, 2011. Our sales and marketing department is responsible for setting sales and marketing strategies and promoting our products.

Our sales and marketing strategies include (1) direct sales and marketing activities, (2) advertisements and publications and (3) participation in trade fairs and exhibitions.

Our sales team regularly meets with our existing customers to better understand their requirements and promote our new products. The team also reaches out to prospective customers to promote our products.

We advertise through a variety of channels including billboards, industry publications, such as the China Packaging Industry and the Packaging World, our corporate website, www.cnpti.com, and industry websites, such as the China Packaging website, www.pack.cn. Because we principally rely on our long-term relationship and our reputation as an efficient producer of high-quality paper cartons in the YRD, we place less emphasis on advertising and have not spent significant sums on advertising.

We participate regularly in trade fairs and exhibitions in the PRC such as the PRC Corrugated Paper Cartons and Machinery Exhibition and the PRC International Corrugated Exhibition. Those trade fairs and exhibitions provide us with a platform to showcase our new products, establish contact with potential customers and gather information on the latest products.

Customer Service

Our customer service department was comprised of 35 customer service personnel as of December 31, 2011. The customer service department provides pre-sales services such as sample designs; sales services such as production monitoring to ensure timely delivery of products; and after-sales customer service such as feedback and guidance on product usage. Our after-sales customer service is available to our customers 24 hours a day throughout the year.

Our customer service department oversees our five customer service centers in Hangzhou, Suzhou, Taizhou, Ningbo and Shanghai, where many Fortune 500 companies and Top 500 Chinese enterprises are located. These customer services centers have enabled us to provide timely service to our existing customers and have increased our presence and facilitated our sales and marketing activities in these regions.

11

Research and Development (R&D)

R&D is one of the key factors that has helped us maintain our competitive strengths and leading position in the industry. As of December 31, 2011, our R&D team consisted of 35 experienced professionals, many of whom are certified engineers. Our R&D team includes several key experts who have extensive knowledge about and experience in our industry. In addition to conducting our own research, our R&D department enters into collaborative agreements with reputable academic and research institutions, principally in the YRD, from time to time to carry out specific R&D projects. We have worked with Zhejiang University, China Packaging Federation and Zhejiang Province Paper Packaging Industry Technology Centre. Our current collaborative partners include Zhejiang Sci-Tech University and Zhejiang University of Technology and Science. Under such R&D collaborative partnerships, these institutions provide technical expertise to complement our existing R&D capabilities, while we provide the necessary funding for the R&D projects. We have ownership of the results of the research and the proprietary rights of the products and technology developed through these collaborative projects. We believe that we will continue to improve our research and development capabilities by leveraging our strong R&D platform and expertise of these institutions. With our in-house R&D capabilities and collaborative programs, we have developed 15 items of technical know-how, patents for all of which have been approved by the Intellectual Property Office of China.

We have expended more effort and resources on R&D activities in recent years. R&D costs amounted to $4,065,733 and $2,645,641 for the years ended December 31, 2011 and 2010, respectively. In order to maintain our competitiveness, we will continue to strengthen our R&D capabilities through staff training, equipment upgrade and collaborations with academic and research institutions. We will focus our efforts on the expansion of our product portfolio to meet the changing needs of our customers and the growing demand for packaging products. Moreover, we intend to develop technologies that would help us improve production efficiency and product quality, while lowering production costs. For example, our ongoing research and development projects include waterproof paper cartons with low-temperature endurance and high-strength corrugated paper agglutination technique.

Competition

The packaging market in China is highly fragmented and competitive. There are over 20,000 paperboard manufacturers in China, most of which are relatively small in size. The top ten manufacturers only have an aggregate of less than 10% of the Chinese market.

Due to the geographic radius limitation, we currently only compete with domestic and international corrugated paper packaging companies located within the YRD region. Our major competitors include: Ningbo Asia Paper Tube Paper Carton Co., Ltd., Salfo Package Group Co., Ltd., Zhejiang Dahua Packaging Group Co., Ltd., Zhejiang Zhongbao Pactiv Packaging Co., Ltd., Yuen Foong Yu Paper Enterprise (Kunshan) Co., Ltd. and International Paper (Shanghai) Co., Ltd. We also face competition from upstream paper mills when they expand their business into paper carton manufacturing, and such companies include Zhejiang Jingxing Paper Co., Ltd, Anhui Shanying Paper Industry Co., Ltd, and others.

The primary barriers to enter the market include obtaining a printing license and significant capital investment in large-scale production facilities. We believe our competitive advantages over domestic players are better cost-efficiencies due to economies of scale and significant order volumes, early mover with long standing relationships with customers, advanced technologies and equipment deployed in our manufacturing process, high product quality with competitive cost structure and well-known brand name. Our competitive advantages over international players include significant production capacity, large amount of existing customer base, the flexibility to customize our products, better local knowledge and connections, lower price resulting from lower cost structure and competitive product quality. We believe we have better economies of scale, more experience and better market knowledge than most of the paper mill new market entrants.

Seasonality

Our operating results and operating cash flows historically have not been subject to seasonal variations. This pattern may change, however, as a result of new market opportunities or new product introductions.

12

Intellectual Property

Great Shengda owns the trademark for

![]() , registered in the

PRC (trademark number 1275491). The trademark expires on May 20, 2019, but may

be extended.

, registered in the

PRC (trademark number 1275491). The trademark expires on May 20, 2019, but may

be extended.

We believe that our trademark has significant value and is important for marketing and building brand recognition. We are not aware of any third party currently using a trademark similar to our Shengda trademark in the PRC for the same types of products.

We have been granted the following patents, each of which will expire 10 years from the application date:

|

Patent |

Type | Application Date | Issue Date | |||||||

|

Foldable water containing paper |

Utility model | April 13, 2009 | March 31, 2010 | |||||||

|

Corrugated paper boxes with preservation device |

Utility model | April 13, 2009 | March 31, 2010 | |||||||

|

Interior structure for circular packing |

Utility model | April 13, 2009 | March 31, 2010 | |||||||

|

Spraying device for hot board of corrugated machine |

Utility model | April 13, 2009 | March 31, 2010 | |||||||

|

Paper packing box for textiles |

Utility model | April 13, 2009 | March 31, 2010 | |||||||

|

Movable supermarket display shelf |

Utility model | April 13, 2009 | March 31, 2010 | |||||||

|

Structure of hand handler on packing box |

Utility model | April 13, 2009 | March 31, 2010 | |||||||

|

Paper display shelf |

Utility model | April 13, 2009 | March 31, 2010 | |||||||

|

Air abstractor box for corrugated machine |

Utility model | April 13, 2009 | March 31, 2010 | |||||||

|

Double-layer paper board with inclined corrugation for tray |

Utility model | November 25, 2010 | June 8, 2011 | |||||||

|

Packaging buffer |

Utility model | November 25, 2010 | August 10, 2011 | |||||||

|

Double-layer corrugated paper board with high flat crush strength |

Utility model | November 25, 2010 | August 17, 2011 | |||||||

|

Triple-layer corrugated paper board with high flat crush strength |

Utility model | November 25, 2010 | August 17, 2011 | |||||||

|

Corrugated paper board with synclastic corrugation |

Utility model | November 25, 2010 | August 24, 2011 | |||||||

|

Strengthened paper board for tray |

Utility model | November 25, 2010 | August 24, 2011 |

Environmental Matters

Our manufacturing facilities are subject to various pollution control regulations with respect to air, water, solid and noise pollution and the disposal of waste and hazardous materials. We also are subject to periodic inspections by local environmental protection authorities. Our operating subsidiaries have received certifications issued on February 22, 2010 by Hangzhou Xiaoshan Environmental Protection Bureau indicating that, as of the date of these certifications, their business operations are in material compliance with the relevant PRC environmental laws and regulations. We are not currently subject to any pending actions alleging any violations of applicable PRC environmental laws.

Each of Great Shengda, Shengda Color and Hangzhou Shengming holds a pollutant discharge permit issued by the local environmental protection bureau. The pollutants discharged by Great Shengda, Shengda Color and Hangzhou Shengming include solid waste, such as used printing ink containers, paper scraps and garbage, waste water, which contain chemicals such as resin, waste print ink and isopropyl alcohol, and waste chemicals, including waste print ink. Also, we produce noise during manufacturing. Some of the chemicals we use for printing may be classified as potential health hazards. However, our employees generally have minimal contact with these chemicals, and the chemicals are packaged in containers that we believe meet government safety standards and are dispensed directly from the containers in the printing process (much like the ink from ink-jet printing cartridges). Also, with respect to any noise pollution produced, we have made appropriate filings with the local bureaus of health. We believe our pollutant and waste discharge processes meet government standards.

Neither existing environmental and similar laws nor the costs of our compliance with these laws has had a material adverse effect on our financial condition or results of operations, and management does not believe they will in the future. In addition, we have not incurred, and do not expect to incur, any material costs or liabilities due to environmental contamination at our facilities. However, we cannot predict the impact of new or changed laws or regulations on facilities we currently own or may acquire in the future. We have no current plans for substantial capital expenditures with respect to compliance with environmental and similar laws.

Regulation

Because our operating subsidiaries are located in the PRC, we are subject to national and local laws of the PRC.

13

Paper Packaging Industrial Laws and Regulations

We are subject to governmental regulations related to paper printing and packaging industry. The Regulations on the Administration of Printing Industry requires us to obtain a printing license before production. Great Shengda, Hangzhou Shengming and Suzhou AA each possess a printing license for package decoration printing and Shengda Color has a printing license for package decoration printing and printing of other printed matters. The printing licenses held by Great Shengda, Shengda Color and Hangzhou Shengming are valid until December 31, 2012, and the printing license held by Suzhou AA is valid until November 17, 2013, each of which is renewable at expiration by application to the relevant authorities.

Other rules and regulations for the printing industry that impact the packaging industry include:

-

Administrative Regulations on Fulfilling Printing Orders, which were issued by the General Administration of Press and Publication together with the Ministry of Public Security. Under these regulations, companies engaged in the printing business are required to verify clients' legal documents, such as business licenses and trademark registration certificates, and to file the printing records kept by the companies with competent authorities. We believe we are in material compliance with such requirement;

-

Interim Provisions on the Establishment of Foreign-invested Printing Enterprises jointly issued by the General Administration of Press and Publication and the former Ministry of Foreign Trade and Economic Cooperation. Under these provisions, approvals by the press and publication administration are required for the establishment of foreign invested enterprises engaging in the printing business. In addition, foreign-invested printing enterprises are not allowed to set up branches; and

-

Interim Measures on the Qualifications of Printing Operators issued by the General Administration of Press and Publication. These measures specify the qualifications required for enterprises engaged in printing operations. Printing operators must satisfy such qualification requirements in order to obtain approval for their establishment and printing licenses from the press and publication administration. The legal representative or major responsible person must obtain a Training Certificate in Printing Regulations issued by the municipal press and publication administration. The legal representative of Great Shengda, Shengda Color and Shengming, Wuxiao Fang, has obtained the Training Certificate in Printing Regulations (No.0820064) granted by Hangzhou Xiaoshan Culture, Radio, TV, Film, Press and Publication Bureau.

China also has a series of national standards regarding paper packaging production. Such national standards include, but are not limited to, National Standards on Single and Double Corrugated Paper Cartons for Transportation of Packages. These standards relate to the structure, material, size and quality requirement for classification of cartons for transporting different kinds of merchandise. These standards are not compulsory but are followed by many manufacturers.

As a paper packaging production company, we need to reproduce trademarks owned by our customers. As a consequence, the Trademark Printing Administration Measures are applicable to us, which require us to examine the trademark registration certificates and other relevant documents of our customers to verify the trademark ownership. We believe we are in material compliance with such requirement.

Environmental Regulations

Our production processes mainly generate noise, wastewater and solid wastes. The major PRC environmental regulations applicable to us include the Environmental Protection Law of the PRC, the Environmental Impact Appraisal Law of the PRC, the Law of the PRC on the Prevention and Control of Water Pollution, the Law of the PRC on Prevention and Control of Environmental Pollution Caused by Solid Waste, the Law of the PRC on Prevention and Control of Air Pollution and the Law of the PRC on Prevention and Control of Environmental Noise Pollution.

The Environmental Protection Law of the PRC sets out the legal framework for environmental protection in the PRC. The Ministry of Environmental Protection of the PRC, or the MEP, is primarily responsible for the supervision and administration of environmental protection work nationwide and formulating national waste discharge limits and standards.

14

Local environmental protection authorities at the county level and above are responsible for environmental protection in their jurisdictions.

Companies that discharge contaminants must report and register with the MEP or the relevant local environmental protection authorities. Companies discharging contaminants in excess of the discharge limits prescribed by the central or local authorities must pay discharge fees for the excess in accordance with applicable regulations and are also responsible for the treatment of the excessive discharge. Companies that directly or indirectly discharge industrial waste water into the water or are required by law to obtain the pollutant discharge permit before discharging waste water or sewage shall also obtain the pollutant discharge permit.

In addition, the Circular Economy Promotion Law and Law of Promoting Clean Production also apply to our business which requires paper packaging production companies to mitigate environmental pollution by utilizing environmentally friendly raw materials and designs. Where feasible we use recycled paper as raw material. In addition, all of our cartons are recyclable.

Regulation on Labor Protection

The Labor Contract Law of the PRC, effective on January 1, 2008, governs the establishment of employment relationships between employers and employees, and the conclusion, performance, termination of, and the amendment to employment contracts. To establish an employment relationship, a written employment contract must be signed. In the event that no written employment contract was signed at the time of establishment of an employment relationship, a written employment contract must be signed within one month after the date on which the employer starts engaging the employee.

Regulations on Protection of Intellectual Property Rights

China has adopted legislation governing protection of intellectual property rights, including copyrights, trademarks and patents. China is a signatory to the main international conventions governing protection of intellectual property rights and became a member of the Agreement on the Trade Related Aspects of Intellectual Property Rights upon its accession to the World Trade Organization in December 2001.

Patents

The PRC Patent Law, adopted in 1984 and revised in 1992, 2000 and 2008, respectively, and the Implementing Rules of the PRC Patent Law, promulgated by the State Council in 2001 and revised in 2002 and 2010 respectively, govern and protect the proprietary rights to registered patents. The State Intellectual Property Office, or SIPO, handles patent registration and grants a term of twenty years to inventions and a term of ten years to utility models and designs. The protection to patent rights may be terminated before expiry of the term granted as a result of the failure of the registrant to pay the annual registration fee accordingly. Patent license agreements and transfer agreements must be filed with the SIPO for record.

Foreign Currency Regulations

Under the PRC foreign currency exchange regulations applicable to us, RMB is convertible for current account items, including the distribution of dividends, interest payments, trade and service-related foreign exchange transactions. Currently, our PRC operating subsidiaries may purchase foreign currencies for settlement of current account transactions, including payments of dividends to us, employee salaries (even if employees are based outside of China), and payment for equipment purchases outside of China, without the approval of the State Administration of Foreign Exchange of the People’s Republic of China, or SAFE, by complying with certain procedural requirements. Conversion of RMB for capital account items, such as direct investment, loan, security investment and repatriation of investment, however, is still subject to the approval of SAFE. In particular, if our PRC operating subsidiaries borrow foreign currency through loans from us or other foreign lenders, these loans must be registered with SAFE, and if we finance the subsidiaries by means of additional capital contributions, these capital contributions must be approved by certain government authorities, including the Ministry of Commerce, or MOFCOM, or their respective local branches. These limitations could affect our PRC operating subsidiaries’ ability to obtain foreign exchange through debt or equity financing. In the event of a liquidation of our PRC subsidiaries, SAFE approval is required before the remaining proceeds can be expatriated from China.

15

Taxation

On March 16, 2007, the National People's Congress of China passed a new Enterprise Income Tax Law, or the EIT Law, and on November 28, 2007, the State Council of China passed its implementing rules, which took effect on January 1, 2008. Before the implementation of the EIT Law, foreign invested enterprises, or FIEs, established in the PRC, unless granted preferential tax treatments by the PRC government, were generally subject to an earned income tax, or EIT, rate of 33.0%, which included a 30.0% state income tax and a 3.0% local income tax. The EIT Law and its implementing rules impose a unified EIT of 25.0% on all domestic-invested enterprises and FIEs, unless they qualify under certain limited exceptions. Despite these changes, the EIT Law gives FIEs established before March 16, 2007, or Old FIEs, a five-year grandfather period during which they can continue to enjoy their existing preferential tax treatments. During this five-year grandfather period, the Old FIEs which enjoyed tax rates lower than 25% under the original EIT law will be subject to gradually increased EIT rates over a 5-year period until their tax rate reaches 25%. In addition, the Old FIEs that are eligible for other preferential tax treatments by the PRC government under the original EIT law are allowed to continue enjoying their preference until these preferential treatment periods expire.

In addition to the changes to the current tax structure, under the EIT Law, an enterprise established outside of China with “de facto management bodies” within China is considered a resident enterprise and will normally be subject to an EIT of 25% on its global income. The implementing rules define the term “de facto management bodies” as “an establishment that exercises, in substance, overall management and control over the production, business, personnel, accounting, etc., of a Chinese enterprise.” If the PRC tax authorities subsequently determine that we should be classified as a resident enterprise, then our organization’s global income will be subject to PRC income tax of 25%. For detailed discussion of PRC tax issues related to resident enterprise status, see Item 1A “Risk Factors—Risks Related to Doing Business in China—Under the New Enterprise Income Tax Law, we may be classified as a ‘resident enterprise’ of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC stockholders.”

In addition, the EIT Law and its implementing rules generally provide that an income tax rate of 10% will normally be applicable to dividends payable to investors that are “non-resident enterprises,” or non-resident investors, which (i) do not have an establishment or place of business in the PRC or (ii) have an establishment or place of business in the PRC, but the relevant income is not effectively connected with the establishment or place of business to the extent such dividends are derived from sources within the PRC. The State Council of the PRC or a tax treaty between China and the jurisdictions in which the non-PRC investors reside may reduce such income tax.

Pursuant to the Provisional Regulation of China on Value Added Tax and its implementing rules, all entities and individuals that are engaged in the sale of goods, the provision of repairs and replacement services and the importation of goods in China are generally required to pay value added tax, or VAT, at a rate of 17.0% of the gross sales proceeds received, less any deductible VAT already paid or borne by the taxpayer. Further, when exporting goods, the exporter is entitled to some or all of the refund of VAT that it has already paid or borne.

Dividend Distributions

PRC regulations restrict the ability of our PRC subsidiaries to make dividends and other payments to their offshore parent company. PRC legal restrictions permit payments of dividends by our PRC subsidiaries only out of their accumulated after-tax profits, if any, determined in accordance with PRC accounting standards and regulations. Our PRC subsidiaries are also required under PRC laws and regulations to allocate at least 10% of their annual after-tax profits determined in accordance with PRC GAAP to a statutory general reserve fund until the amounts in said fund reaches 50% of our registered capital. Allocations to these statutory reserve funds can only be used for specific purposes and are not transferable to us in the form of loans, advances, or cash dividends.

Circular 75

On November 1, 2005, SAFE issued the Notice on Relevant Issues Concerning Foreign Exchange Administration for Domestic Residents to Engage in Overseas Financing and Round Trip Investment via Overseas Special Purpose Vehicles, or Circular 75, which regulates the foreign exchange matters in relation to the use of a special purpose vehicle, or SPV, by PRC residents to seek offshore equity financing and conduct “round trip investment” in China. Under Circular 75, a SPV refers to an offshore entity established or controlled, directly or indirectly, by PRC residents or PRC entities for the purpose of seeking offshore equity financing using assets or interests owned by such PRC residents or PRC entities in onshore companies, while “round trip investment” refers to the direct investment in China by the PRC residents through the SPVs, including, without limitation, establishing FIEs and using such FIEs to purchase or control onshore assets through contractual arrangements. Circular 75 requires that, before establishing or controlling a SPV, PRC residents and PRC entities are required to complete foreign exchange registration with the local offices of SAFE for their overseas investments.

16

Circular 75 applies retroactively. PRC residents who have established or acquired control of the SPVs which have completed “round-trip investment” before the implementation of Circular 75 shall register their ownership interests or control in such SPVs with the local offices of SAFE before March 31, 2006. An amendment to the registration is required if there is a material change in the SPV, such as increase or reduction of share capital and transfer of shares. Failure to comply with the registration procedures set forth in Circular 75 may result in restrictions on the foreign exchange activities of the relevant FIEs, including the payment of dividends and other distributions, such as proceeds from any reduction in capital, share transfer or liquidation, to its offshore parent or affiliate and the capital inflow from the offshore parent, and may also subject relevant PRC residents to penalties under PRC foreign exchange administration regulations.

As we stated under Item 1A “Risk factors—Risks Related to Doing Business in China—Failure to comply with PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may subject our PRC resident stockholders to personal liability, limit our ability to acquire PRC companies or to inject capital into our PRC subsidiaries, limit our PRC subsidiaries’ ability to distribute profits to us or otherwise materially adversely affect us,” we have asked our stockholders, who are PRC residents as defined in Circular 75, to register with the relevant branch of SAFE, as currently required, in connection with their equity interests in us and our acquisitions of equity interests in our PRC subsidiaries. However, many of the terms and provisions in Circular 75 remain unclear and implementation by central SAFE and local SAFE branches of Circular 75 have been inconsistent since their adoption. Therefore, we cannot predict how Circular 75 will affect our business operations or future strategies. For example, our present and prospective PRC subsidiaries’ ability to conduct foreign exchange activities, such as the remittance of dividends and foreign currency-denominated borrowings, may be subject to compliance with Circular 75 by our PRC resident beneficial holders.

Employee Stock Option Plans or Incentive Plans

In December 2006, the People’s Bank of China promulgated the Administrative Measures on Individual Foreign Exchange, or the Individual Foreign Exchange Regulations, setting forth the requirements for foreign exchange transactions by individuals (both PRC or non-PRC citizens) under the current account and the capital account. In January 2007, SAFE issued the implementation rules for the Individual Foreign Exchange Regulations which, among other things, specified the approval and registration requirement for certain capital account transactions such as a PRC citizen’s participation in employee share ownership and share option plans of overseas listed companies.

Pursuant to the implementation rules of Circular 75 issued by the SAFE on May 29, 2007, employee share ownership plans of SPVs and employee share option plans of SPVs must be filed with the SAFE while applying for the registration for the establishment of the SPVs. After employees exercise their options, they must apply for an amendment to the registration for the SPV with the SAFE.

On March 28, 2007, SAFE promulgated the Operating Procedures on Administration of Foreign Exchange for PRC Individuals’ Participation in Employee Share Ownership Plans and Employee Share Option Plans of Overseas Listed Companies, or the Share Option Rules. Under the Share Option Rules, PRC citizens who are granted incentive stock or stock options by an overseas-listed company according to its employee stock option or stock incentive plan are required to entrust their employers (including the overseas listed companies and the subsidiaries or branch offices of such offshore listed companies in China), or engage other qualified PRC agents, to register with SAFE and complete certain other procedures related to the stock option or stock incentive plan. Foreign exchange income from the sale of stock or dividends distributed by the overseas-listed company must be remitted into China. In addition, the overseas-listed company or its PRC subsidiary or any other qualified PRC agent is required to appoint an asset manager or administrator and a custodian bank, and open foreign currency accounts to handle transactions relating to the stock option or stock incentive plan. As of the date of this report, we have not granted any incentive stock or stock options to our PRC citizen employees, however, if we do so in the future, our PRC citizen employees who are granted restricted stock or stock options will be subject to these rules upon the listing and trading of our common stock.

17

Our Employees

As of December 31, 2011, we had a total of 1,452 full-time employees. The following table sets forth the number of employees by function:

| Department | Number of Employees | |||

| Senior Management | 8 | |||

| Sales and Marketing | 52 | |||

| Development Strategies Department | 23 | |||

| Engineering Department | 40 | |||

| Quality Control | 82 | |||

| Human Resources & Administration | 8 | |||

| Accounting | 18 | |||

| Manufacturing Staff | 1,221 | |||

| TOTAL | 1,452 |

As required by applicable PRC law, we have entered into employment contracts with most of our officers, managers and employees. We are working towards entering employment contracts with those employees who do not currently have employment contracts with us. We believe that we maintain a satisfactory working relationship with our employees, and we have not experienced any significant disputes or any difficulty in recruiting staff for our operations. We are required under PRC law to make contributions to the employee benefit plans at specified percentages of the after-tax profit. In addition, we are required by the PRC law to cover employees in China with various types of social insurance. We believe that we are in material compliance with the relevant PRC laws.

Our employees in China participate in a state pension scheme organized by PRC municipal and provincial governments. We are currently required to contribute to the scheme in accordance with government requirements.

In addition, companies operating in China must comply with a variety of labor laws, including certain social insurance, housing fund and other staff welfare-oriented payment obligations. While there are existing uncertainties as to the interpretation, implementation and enforcement of such obligations, we believe that we are in material compliance with the relevant PRC laws.

We do not currently pay housing fund for our employees as required under the PRC law. The local Xiaoshan housing fund authority issued a certification to us on July 6, 2010, which certifies that the housing fund system is not fully implemented in Xiaoshan district, that the local Xiaoshan housing fund authority will extend the housing fund system to us in the near future and that the local Xiaoshan housing fund authority will not require retrospect performance of our past obligations in relation to the housing fund. See Item 1A “Risk Factors—Risks Related to Doing Business in China—Our failure to fully comply with PRC labor laws exposes us to potential liability.”

Insurance

We have purchased the following insurance policies: (1) property all-risks insurance in respect of our existing fixed assets and properties under construction, and inventories; and (2) insurance against damage of selected key equipment, such as the BHS2800 paperboard production line and EMBA multi-purpose paper carton flexo-printing production lines. All the policies are effective and the premiums have been paid. These insurance policies are reviewed annually to ensure that the coverage is adequate.

Our management believes that the coverage from these insurance policies is adequate for our present operations. However, significant damage to our operations or any of our properties, whether as a result of fire or other causes, may still have a material adverse impact on our results of operations or financial condition.

According to industry practice, we have not purchased any product liability insurance and business interruption insurance.

18

| ITEM 1A. | RISK FACTORS. |

Investing in our common stock is highly speculative in nature, involves a high degree of risk and should be purchased only by persons who can afford to lose the entire amount invested in our common stock. Before purchasing any of our common stock, you should carefully consider the following factors relating to our business and prospects. You should pay particular attention to the fact that we conduct all of our operations in China and are governed by a legal and regulatory environment that in some respects differs significantly from the environment that may prevail in the U.S. and other countries. If any of the following risks actually occurs, our business, financial condition or operating results will suffer, the trading price of our common stock could decline, and you may lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

We may not be able to sustain our rapid growth, and the continuation of rapid growth may strain our resources.

Our business has grown and evolved rapidly since our establishment as demonstrated by our growth in revenue from approximately $79.1 million in 2007 to $124.0 million in 2011. Our net income attributable to our common stockholders has grown from approximately $7.9 million in 2007 to $9.6 million in 2011. We may not be able to achieve similar growth in future periods. Therefore, our historical operating results may not provide a meaningful basis for evaluating our business, financial performance and prospects in the future. Our ability to achieve satisfactory operating results at higher sales volumes is unproven. In addition, our rapid expansion could significantly strain our resources, management and operational infrastructure, which could impair our ability to meet increased demand for our products and hurt our business results. You should not rely on our past results or our historical rate of growth as an indication of our future performance.

We are vulnerable to shortages in raw paper supply and electricity, and fluctuations in raw paper prices.

The main raw material used in manufacturing our paper cartons is raw paper. The cost of raw paper has historically constituted approximately 65% to 80% of our cost of goods sold. We source our raw paper in China.

In order to ensure timely delivery of quality products to our customers at competitive prices, we need to obtain sufficient quantities of quality raw materials at acceptable prices in a timely manner. We also require a significant amount of electricity in order to maintain our operations. We have not experienced any significant shortage in raw material supply or electricity thus far. There is no assurance that we will be able to obtain sufficient quantities of raw materials of acceptable quality from our suppliers at acceptable prices in a timely manner or that we will not suffer from electricity shortages in the future.

Furthermore, as raw paper is a commodity, we are vulnerable to the risk of rising raw paper prices, which are determined by demand and supply conditions in the global and the PRC markets. Should there be any significant increases in the price of raw paper, and if we are unable to pass on such increases in costs to our customers or find alternative suppliers who are able to supply us raw paper at reasonable prices, our business and profitability would be adversely affected.

We may be adversely affected by a significant or prolonged economic downturn in the level of consumer spending in the industries and markets served by our customers.

Our business is affected by the number of orders that we are able to secure from our customers, which is determined by the level of business activity of our customers. The level of business activity of our customers is in turn determined by the level of consumer spending in the markets our customers serve.

We sell most of our products to consumer goods manufacturers in the YRD. Certain of these customers produce consumer goods for overseas markets, in addition to the PRC market. Any significant or prolonged decline of the PRC economy or economy of such other markets will affect consumers' disposable income and consumer spending in these markets, and lead to a decrease in demand for consumer products. To the extent that such decrease in demand for consumer products translates into a decline in the demand for paper packaging products such as our paper cartons, our performance will be adversely affected.

19

A large percentage of our sales revenue is derived from sales to a limited number of customers, and our business will suffer if sales to these customers decline.

Sales to our three major customers, Hangzhou Panasonic Home Electrical Appliance Co., Ltd., Nongfu Spring Co., Ltd. and Hangzhou Cigarette Company accounted in aggregate for approximately 16.9% of our revenue for 2011.

Our ability to retain these major customers is important to our continued success. There is, however, no assurance that these customers will continue to purchase our products at the current levels in the future. There is also no assurance that we will be able to decrease our dependence on these major customers over time. In the event that these major customers cease or reduce significantly their purchase of our products and we are unable to obtain substitute orders of comparable size, there will be a material adverse impact on our financial performance and position.