Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GEORESOURCES INC | d320599d8k.htm |

GeoResources, Inc.

INVESTOR PRESENTATION

MARCH 2012

Exhibit 99.1 |

Forward-Looking Statements

Information included herein contains forward-looking statements that involve

significant risks and uncertainties, including our need to replace

production and acquire or develop additional oil and gas reserves, intense

competition in the oil and

gas

industry,

our

dependence

on

our

management,

volatile

oil

and

gas

prices

and costs, uncertain effects of hedging activities and uncertainties of our oil

and gas estimates of proved reserves and resource potential, all of which

may be substantial. In addition, past performance is no guarantee of

future performance or results. All statements or estimates made by

the Company, other than statements of historical fact, related to matters

that may or will occur in the future are forward-looking

statements. Readers are encouraged to read our December 31, 2011 Annual

Report on Form 10-K and any and all of our other documents filed with

the SEC regarding information about GeoResources for meaningful cautionary

language in respect of the forward-looking statements herein.

Interested persons are able to obtain copies of filings containing

information about GeoResources, without charge, at the

SEC’s

internet

site

(http://www.sec.gov).

There

is

no

duty

to

update

the

statements herein. |

Balanced Portfolio

Long-Term

Growth

–

79,000

net

acres

in

two

premier

U.S. liquids-rich resource plays

Strong Current Cash Flow/Profitability

6,116

Boe/d

net

production

in

4Q

2011

(67%

oil)

(1)

6,982

Boe/d

including

acquisition

(62%

oil)

(2)

Geographic

and

Geologic

Diversity

–

Oil

and

gas

assets

in multiple basins

Significant Producing Bakken Position

55,000 net acres (40,000 operated)

Continuing to add to leasehold

Growing to three operated rigs in second quarter of

2012

Substantial Eagle Ford Position

24,000 net acres (primarily operated)

Strong recent drilling results

Two operated rigs currently running

Strong Financial Position

Strong cash flow

Significant liquidity

(1)

Does not include interests in affiliated partnerships. See Additional Disclosures

in Appendix. (2)

Includes 4Q 2011 production generated by assets acquired in February 2012 in the

Austin Chalk trend. 3

Company Highlights |

1992-1996

Hampton Resources Corp

Gulf Coast

SOLD TO BELLWETHER EXPL.

Preferred investors –

30% IRR

Initial investors –

7x return

2005-2007

Southern Bay Energy, LLC

Gulf Coast, Permian Basin

REVERSE MERGED INTO

GEORESOURCES, INC.

Initial investors –

40% IRR

1997-2001

Texoil Inc.

Gulf Coast, Permian Basin

SOLD TO OCEAN ENERGY

Preferred investors –

2.5x return

Follow-on investors –

3x return

Initial investors –

10x return

2001-2004

AROC Inc.

Gulf Coast, Permian Basin, Mid-Con.

DISTRESSED ENTITY TURNED

AROUND AND MONETIZED

Preferred investors –

17% IRR

Initial investors –

4x return

Track record of creating value and liquidity

Success with multiple entities over multiple

years

Several long-term repeat shareholders

Extensive industry and financial

relationships

Significant technical and financial

experience

Team has been together for up to 23 years

through multiple entities

4

Investors in GEOI have experienced a 4.9x return on capital and a 38%

annualized IRR

(1)

since management took over in 2007

(1)

Return and IRR calculated based on GEOI stock price of $6.77 on date of merger

between Southern Bay Energy and GeoResources, Inc. (April 17, 2007) and stock price of

$32.91 as of March 8, 2012.

Management Track Record |

(1)

Reserves

based

on

SEC

pricing

as

of

1/1/12

and

excludes

interests

in

two

affiliated

partnerships.

See

Additional

Disclosures

in

Appendix.

(2)

Adjusted

EBITDAX

is

a

non-GAAP

financial

measure.

Please

see

Appendix

for

a

definition

of

Adjusted

EBITDAX

and

a

reconciliation

to

net

income.

(3)

Includes

4Q

2011

production

and

estimated

1/1/12

proved

reserves

associated

with

assets

acquired

in

February

in

the

Austin

Chalk

trend.

(4)

Excludes impact of revolver draw down in February 2012 related to acquisition of

assets in the Austin Chalk trend. Reserve and Production Snapshot

(1)

Operations focused on Bakken,

Eagle Ford and Austin Chalk

Oil-weighted production and reserves

from primarily operated properties

Growing production profile

Significant low-risk drilling inventory

in two leading oil-rich resource plays

(Bakken, Eagle Ford)

Additional upside associated with

legacy assets (Austin Chalk, South

Louisiana, Permian)

Strong cash flow generation

Adjusted

EBITDAX

of

$89

MM

(2)

for

year ended December 31, 2011

Significant liquidity

$219MM of cash and revolver

availability

as

of

December

31,

2011

(4)

24,000 net acres

55,000 net acres

200,000+ net acres

5

GEOI

Including

Pre-Acquisition

Acquisition

(3)

01/01/12 Proved Reserves (Mmboe)

29.2

31.7

Oil % (Proved Reserves)

67%

64%

Proved Developed %

70%

70%

4Q 2011 Production (Boe/d)

6,116

6,982

Oil % (Production)

67%

62%

Operated Proved Reserves

75%

77%

Company Overview

Eagle Ford

Bakken

Austin Chalk |

6

Reserves and Production –

SEC 1/1/12

(1)

2.4

15.7

14.6

20.7

24

29.2

0

5

10

15

20

25

30

35

2006

2007

2008

2009

2010

2011

768

1,826

3,388

4,589

5,090

6,116

1,000

2,000

3,000

4,000

5,000

6,000

7,000

2006

2007

2008

2009

2010

2011

PDP,

55%

PDNP,

15%

PUD,

30%

Oil,

67%

Gas,

33%

Bakken,

24%

Eagle

Ford,

4%

Austin

Chalk,

20%

Other,

52%

January

1,

2012

Proved

Reserves

–

29.2

MMBOE

(1)

Proved

Reserves

(1)(2)

Average

Daily

Production

(BOE/d)

(1)

(1)

Data excludes interests in two affiliated partnerships and also excludes estimated 1/1/12 proved

reserves associated with assets acquired in February 2012 in the Austin Chalk trend.

(2)

2006 – 2011 proved reserves based on SEC pricing. 2008 reserves reflect lower prices and

divestitures. See Additional Disclosures in Appendix. |

FOCUSED ON

DEVELOPMENT

Asset Overview

OIL-WEIGHTED |

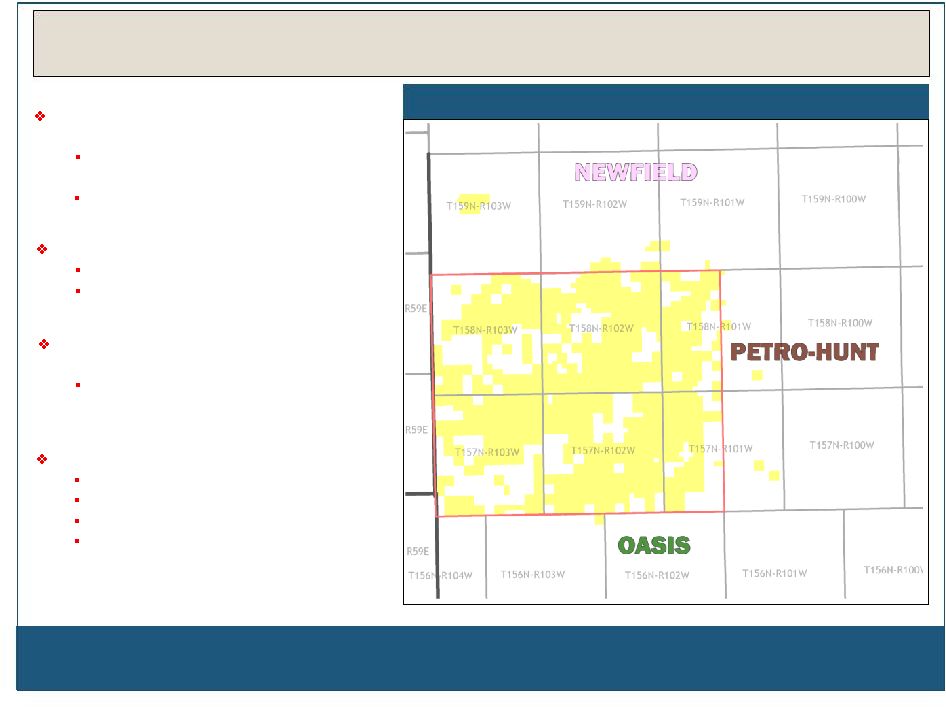

Williams County Project (28,000 net acres)

Primarily operated with average WI of ~34%

19 gross wells drilled to date (14 producing)

20 to 24 gross wells planned for 2012

Eastern Montana Project (13,000 net acres)

Primarily operated with average WI of ~50%

One operated well drilled to date

Third operated rig to drill in this area beginning in

2Q 2012

Three to five gross Bakken wells planned for 2012

Mountrail County Project (10,000 net acres)

Operated primarily by Slawson Exploration

Average WI of ~8%

Three to four rigs currently running

45-60 gross wells planned for 2012

McKenzie Line Project (4,000 net acres)

Operated primarily by Zavanna, LLC

WI range from 7% to 20% (11% avg.)

One rig running, three wells waiting on completion

Six to eight gross wells planned for 2012

Bakken Shale Overview

8 |

9

Williams County Project Drilling Results

397 bo/d

(9 Wells)

389 bo/d

(10 Wells)

375 bo/d

(5 Wells)

282 bo/d

(6 Wells)

312 bo/d

(3 Wells)

276 bo/d

(3 Wells)

245 bo/d

(1 Well)

345 bo/d

(3 Wells)

MARATHON

500 bo/d

(2 Wells)

216 bo/d

(3 Wells)

Peak Month Average Rates In Project Area

Concentrated 28,000 net acre block

in NW Williams Co., ND 20 to 24 gross operated wells planned to

be spud in 2012 (6 spud as of mid-March)

25% - 35% WI Multi-year drilling inventory 2 dedicated rigs currently running Maintain 2 rig program throughout 2012

Successful initial drilling has de-risked

acreage 265 bo/d peak month average rate on

GEOI operated wells

Focused on cost containment

Targeting $7.0 to $8.0 million well costs Pad drilling Building oil and gas gathering system Installing saltwater disposal wells

production and excludes months with less than 20 days of production. Source of all production

data is NDIC website.

information

as

of

March

2012.

Peak

Month

Avg.

rate

calculated

as

maximum

average

daily

production

rate

within

first

four

calendar

months

of

Note: Peak month average |

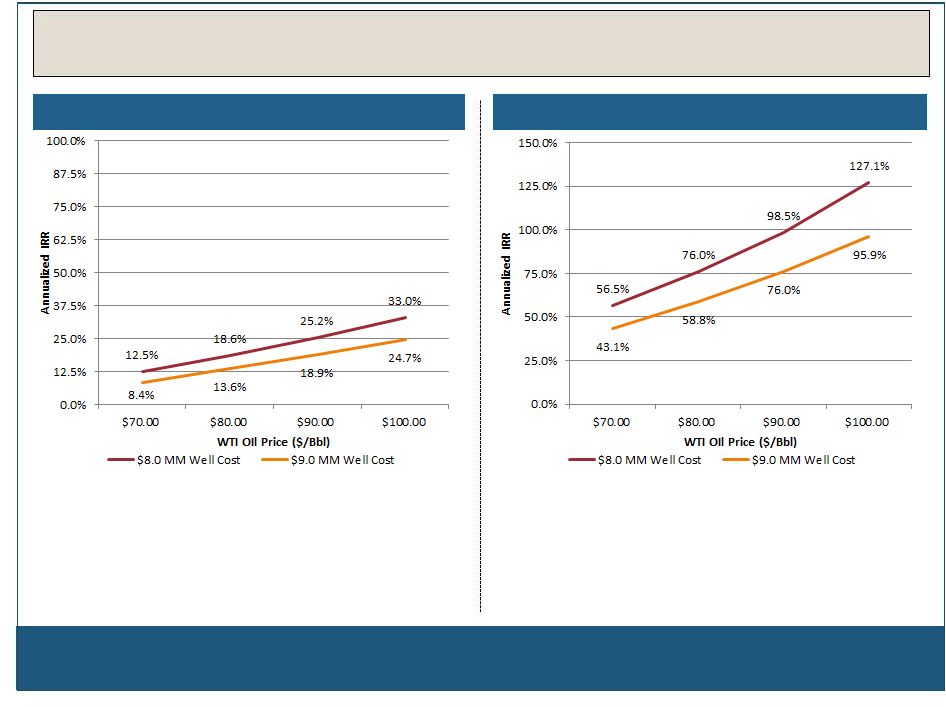

10

300 Mboe Case Returns

(1)(2)

450 Mboe Case Returns

(1)(2)

(1)

Dry gas price held constant at $4.50/Mcf. See additional assumptions in Appendix.

(2)

EUR refers to management’s internal estimates of reserves potentially recoverable from successful

drilling of wells. See Additional Disclosures in Appendix.

Williams County/Eastern Montana Economics |

11

Bakken Resource Potential

Undeveloped Bakken Acreage Provides Net

Resource Potential of ~45 to ~68 MMboe

Net Resource Potential

(1)

Bakken

Bakken

(Williams,

McKenzie,

E.

Montana)

(Mountrail County)

300 Mboe

450 Mboe

400 Mboe

600 Mboe

Assumed Spacing Unit Size (Acres)

1,280

1,280

1,280

1,280

Estimated # Wells per Spacing Unit (Bakken Only)

4

4

3

3

# Acres per Well (Spacing Unit / # Wells per Unit)

320

320

427

427

Estimated 1/1/12 Remaining Net Undeveloped Acres

43,500

43,500

5,000

5,000

Number of Potential Net Drilling Locations

136

136

12

12

Estimated EUR per Well (Mboe)

300

450

400

600

Net Resource Potential (Mboe)

40,781

61,172

4,688

7,031

(1)

Data is for illustrative purposes only and is based on management assumptions. Resource

potential estimate excludes developed acreage on which proved reserves are already

booked. EUR refers to management’s internal estimates of reserves potentially recoverable

from successful drilling of wells. See Additional Disclosures in Appendix. |

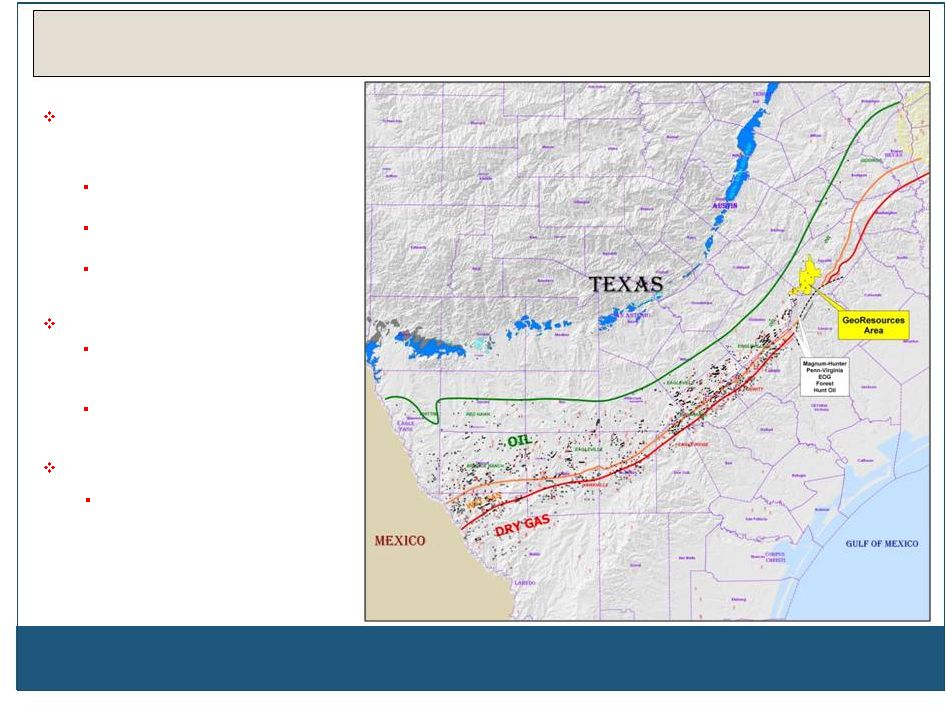

Concentrated 24,000 net acre

block in volatile oil window in

Fayette/Gonzales Counties

Note:

Information

as

of

March

2012.

12

Primarily operated with average WI

of 35% -

55%

10 gross wells drilled to date (7

producing)

20 to 24 gross operated wells to be

spud in 2012

Eagle Ford AMI

Partnered with Ramshorn

Investments, Inc., an affiliate of

Nabors Industries, Ltd.

GEOI retained 50% WI and

operations

Multi-year drilling inventory

Two dedicated rigs under contract

and drilling

Eagle Ford Shale Overview |

13

Note:

Source

of

GeoResources’

data

is

internal

figures.

Information

as

of

March

2012.

Eagle Ford Drilling Results

Peebles #1H

30 day Avg. Rate: 436 Boe/d

Black Jack Springs #1H

30 day Avg. Rate: 369 Boe/d

Arnim #1H & 2H

10 day Avg. Rate: 636 Boe/d

Flatonia East #1H & #2H

30 day Avg. Rate: 428 Boe/d

Newtonville #1H

30 day Avg. Rate: 566 Boe/d

12 wells spud to date

Seven wells drilled, completed and on

production

445 boe/d 30-day avg. rate (excluding

most recently completed Arnim wells)

Positive offset operator activity

Magnum Hunter Resources

Penn Virginia

EOG

Austin Chalk upside on acreage block

Participated in oily Chalk well in 2011 with

another operator on block

Recently spud first operated oily Chalk

location

Successful drilling has de-risked

acreage |

(1)

Dry gas price held constant at $4.50/Mcf. See additional assumptions in

Appendix. (2)

EUR refers to management’s internal estimates of reserves potentially

recoverable from successful drilling of wells. See Additional Disclosures in Appendix.

14

325 Mboe Case Returns

(1)(2)

500 Mboe Case Returns

(1)(2)

Eagle Ford Economics |

15

(1)

Data is for illustrative purposes only and is based on management

assumptions. Resource potential estimate excludes developed acreage on which proved reserves

are already booked. EUR refers to management’s internal estimates of

reserves potentially recoverable from successful drilling of wells. See Additional Disclosures

in Appendix.

Undeveloped Eagle Ford Acreage Provides Net

Resource Potential of ~50 to ~80 MMboe

Eagle Ford Shale

325 Mboe

500 Mboe

Assumed Spacing Unit Size (Acres)

900

900

# Wells per Spacing Unit

6

6

# Acres per Well (Spacing Unit / # Wells per Unit)

150

150

Estimated 1/1/12 Remaining Net Undeveloped Acres

23,750

23,750

Number of Potential Net Drilling Locations

158

158

Estimated EUR per Well (Mboe)

325

500

Net Resource Potential (Mboe)

51,458

79,167

Eagle Ford Resource Potential

Resource Potential

(1) |

Drilling without intermediate casing

Pad drilling

Walking rigs

Recent well drilled in just 21 days

16

Improving drilling efficiencies

Improving drilling efficiencies

Efforts to date have reduced drilling time from

~30 to ~20 days resulting in cost savings of

~$900K compared to first several wells

Additional cost savings expected with future

pad drilling and walking rigs

Improving frac efficiencies

Simultaneous / back-to-back frac jobs

300 feet or less between frac stages

Increased proppant size and volume

Resin-coated sand

Enhancing knowledge

Taking cores

Micro-seismic

Pilot holes

Monitoring peer activity

Improving frac efficiencies

Simultaneous / back-to-back frac jobs

Mass sliding sleeves

Infrastructure development

Oil and gas gathering lines being installed

Saltwater disposal wells being developed

Enhancing knowledge

Taking cores

Micro-seismic

Monitoring peer activity

Improving Economics

Eagle Ford

Bakken |

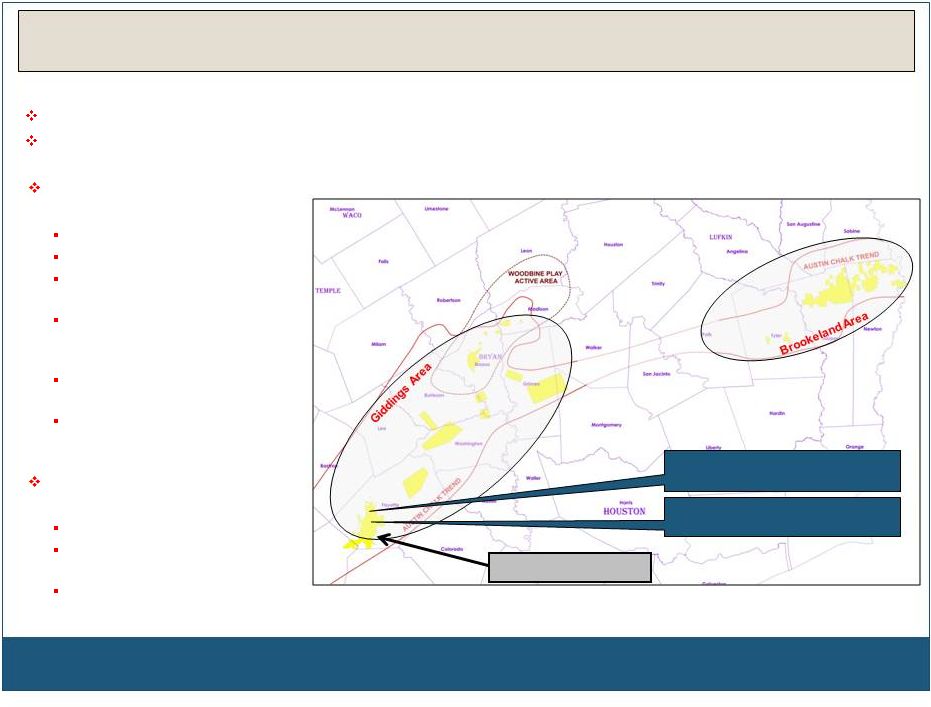

Austin Chalk

17

(1)

Includes 4Q 2011 production associated with assets acquired in February 2012 in the

Austin Chalk trend. Giddings Area (~30,000 net

acres):

17 wells drilled –

100% success

WI ranges from 37% -

53%

Majority of acreage held-by-

production

20+ remaining gassy locations -

Valuable “option”

on future gas

prices

Recently drilled two successful

oily Chalk wells

Recently commenced drilling

the Rightmer A #2HRE (50%

WI) in Fayette County

Brookeland Area (~170,000

net acres)

WI averages ~70%

Majority of acreage held-by-

production

Multiple drilling locations

identified (~50% liquids)

Eagle Ford AMI

Rightmer A #2HRE

Currently Drilling

Tilicek #1H

30 Day Avg.: 326 Boe/d (93% oil)

200,000 operated net acres across Giddings and Brookeland field areas of the

Austin Chalk trend Acreage provides potential for multiple targets across

large geographic region (Austin Chalk, Woodbine, Buda, Wilcox, Edwards,

etc.) |

FOCUSED ON

MAXIMIZING

SHAREHOLDER

VALUE

Financial Overview |

2012 capital plan of $194 MM to $272 MM

(excluding Q1 2012 acquisitions)

Current project allocations favor lower-risk,

high cash flow oil-weighted projects primarily

in Bakken and Eagle Ford

2012 Capital and Production Guidance

19

Year Ending December 31, 2012

7,300 to 8,300 boe/d estimated daily rate

70% to 75% oil

Drilling and completion efficiencies provide

opportunity to achieve high end of range

($ in millions)

Low

High

Notes

Bakken (Williams County Project Area)

$45

$58

20-24 gross wells at $7.5-$8.0 (30% WI)

Bakken (Eastern Montana Project Area)

10

18

3-5 gross wells at $7.5-$8.0 (45% WI)

Bakken (Mountrail County Project Area)

19

28

46-60 gross wells at $5.5-$8.5 (6% WI)

Bakken (McKenzie Line Project Area)

6

8

6-8 gross wells at $9.5-$10.5 (10% WI)

Eagle Ford

73

98

20-24 gross wells at $8.0-$9.0 (46% WI)

Austin Chalk

3

7

2-4 gross wells at $2.8-$3.3 (50% WI)

Other Drilling

10

14

Other conventional/legacy properties

Total Drilling Capital Expenditures

$166

$231

Acreage and Seismic

25

35

Bakken and Eagle Ford Primarily

Infrastructure and Other

3

6

Saltwater disposal, etc.

Total Capital Expenditures Excluding Acquisitions

$194

$272

1Q 2012 Acquisitions (Bakken and Chalk)

53

53

Total Capital Expenditures

$247

$325

McKenzie Line & Brookeland Acquisitions

Capital Allocation

Production Guidance

2012 Capital Budget |

Conservative use of leverage to maintain strong balance sheet

Ability to fund 2012 capital budget with cash flow and undrawn debt

capacity Year

ended

12/31/11

Adjusted

EBITDAX

(1)

=

$89.2

MM

$219 MM of liquidity

(2)

-

Undrawn

revolver

with

$180

MM

borrowing

base

(2)

-

December 31, 2011 cash balance of $39 MM

($ in millions)

Strong Financial Position

20

(1)

EBITDAX is a non-GAAP financial measure. See Additional Disclosures in

Appendix. (2)

Excludes revolver draw down in February 2012 related to acquisition of assets in

the Austin Chalk trend. Debt / Trailing 12 Mos. Adj. EBITDAX

(1)

Adjusted EBITDAX

(1)

$49.0

$45.8

$66.7

$89.2

$0.0

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

$70.0

$80.0

$90.0

$100.0

2008

2009

2010

2011

0.8x

1.5x

1.3x

0.0x

-

0.2

0.4

0.6

0.8

1.0

1.2

1.4

1.6

2008

2009

2010

2011 |

Long-Term Growth Potential Imbedded in Eagle Ford and Bakken positions

Multi-year drilling inventory

100+ Mmboe of undeveloped net resource potential

Ongoing leasing and acquisition program to further expand acreage positions

Solid Proved Reserve and Production Base

31.7

MMBOE

of

proved

reserves

(including

acquisitions)

(1)

with

bias

towards

liquids

High level of operating control

Additional oil and gas upside identified in conventional assets

Strong Financial Position to Execute Development Plans

Significant free cash flow from existing assets to invest in resource plays

Unlevered balance sheet

Experienced Management and Technical Team with Large Ownership Stake

Successful

track

record

of

creating

value

and

liquidity

for

shareholders

Cost

effective

operator

with

significant

operating

experience

in

unconventional

resource

plays

Board and management own more than 20% of the company

Summary Investment Highlights

21

(1)

Reserve data as of January 1, 2012. Reserves based on SEC pricing as of

1/1/12. Reserves include February 2012 acquisition of producing properties in the Austin Chalk

trend. Data excludes interests in two affiliated partnerships.

See Additional Disclosures in Appendix. |

Financials

Production

Reserves

Hedging

Additional Disclosures

Appendix |

Select Historical Operating and Financial Data

Historical Performance

23

(1)

EBITDAX and adjusted net income are non-GAAP financial measure. See

Additional Disclosures in Appendix. Years Ended December 31,

2011

2010

2009

2008

Key Data:

Avg. realized oil price after hedges ($/Bbl)

88.42

$

70.33

$

61.09

$

82.42

$

Avg. realized natural gas price after hedges ($/Mcf)

5.36

$

5.30

$

3.97

$

8.12

$

Oil production (MBbl)

1,222

1,060

851

743

Natural gas production (MMcf)

4,209

4,789

4,944

2,962

% Oil

64%

57%

51%

60%

($ in millions except per share data)

Total revenue

137.7

$

107.0

$

81.0

$

94.6

$

Reported net income attributable to GeoResources

31.3

$

23.3

$

9.8

$

13.5

$

Adjusted net income

(1)

34.9

$

24.3

$

10.9

$

16.3

$

Adjusted earnings

per share (diluted)

1.36

$

1.21

$

0.66

$

1.03

$

Adjusted EBITDAX

(1)

89.2

$

66.7

$

45.8

$

49.0

$ |

(1)

As

used

herein,

Adjusted

EBITDAX

is

calculated

as

net

income

attributable

to

GeoResources,

Inc.

before

interest,

income

taxes,

depreciation,

depletion

and

amortization,

and

exploration

expense

and

further

excludes

non-cash

compensation,

impairments,

hedge

ineffectiveness

and

income

or

loss

on

derivative

contracts.

Adjusted

EBITDAX

should

not

be

considered as an alternative to net income (as an indicator of operating

performance) or as an alternative to cash flow (as a measure of liquidity or ability to service debt obligations)

and is not in accordance with, nor superior to, generally accepted accounting

principles, but provides additional information for evaluation of our operating performance.

Reconciliation of Non-GAAP Measures

24

Adjusted EBITDAX Reconciliation

Years Ended December 31,

2011

2010

2009

2008

($ in millions)

Net Income Attributable to GeoResources

31.3

$

23.3

$

9.8

$

13.5

$

Adjustments:

(Gain) on sale of property and equipment

(0.9)

(1.0)

(1.4)

(4.4)

Interest and other income

(0.4)

(1.5)

(1.0)

(0.8)

Interest Expense

1.9

4.7

5.0

4.8

Income Taxes

20.0

11.9

5.1

7.8

Depreciation, depletion and amortization

27.7

24.7

22.4

16.0

Unrealized (gain) / loss on hedge and derivatives

0.6

(0.9)

0.3

0.4

Non-cash Compensation

2.1

1.1

1.4

0.6

Exploration

0.9

0.8

1.4

2.6

Impairments

6.0

3.4

2.8

8.3

Adjusted EBITDAX

(1)

89.2

$

66.7

$

45.8

$

49.0

$ |

Adjusted Net Income Reconciliation

(1) Tax impact is estimated as 38.1% and 37.6% of the pre-tax adjustment

amounts for 2011 and prior years respectively. (2) As used

herein, adjusted net income is calculated as net income attributable to GeoResources, Inc. excluding (gains) and losses on property sales, impairment of proved and

unproved

properties

and

an

unrealized

(gains)

and

losses

related

to

hedge

ineffectiveness

and

income

or

loss

on

derivative

contracts.

Adjusted

net

income

should

not

be

considered

as an alternative to net income (as an indicator of operating performance) or as an

alternative to cash flow (as a measure of liquidity or ability to service debt obligations) and is not in

accordance with, nor superior to, generally accepted accounting principles, but

provides additional information for evaluation of our operating performance.

Reconciliation of Non-GAAP Measures

25

Years Ended December 31,

2011

2010

2009

2008

($ in millions)

Net Income Attributable to GeoResources

31.3

$

23.3

$

9.8

$

13.5

$

Adjustments:

Unrealized (gain) / loss on hedge and derivatives

0.6

(0.9)

0.3

0.4

Impairments

6.0

3.4

2.8

8.3

(Gain) on sale of property and equipment

(0.9)

(1.0)

(1.4)

(4.4)

Tax impact

(1)

(2.2)

(0.6)

(0.7)

(1.7)

Adjusted Net Income

(2)

34.9

$

24.3

$

10.9

$

16.3

$ |

Diverse production base from multiple areas

Oil-weighted production continues to accelerate

Production by Area

26

(Boe/d)

3 Mos Ended 12/31/11

3 Mos Ended 9/30/11

Rate

% Oil

Rate

% Oil

Growth

Bakken

1,998

93%

1,582

92%

26%

Eagle Ford

176

94%

281

98%

-37%

Austin Chalk

1,716

26%

1,513

20%

13%

Other

2,226

80%

2,169

72%

3%

Total

6,116

67%

5,545

65%

10%

(1)

Data excludes estimated production associated with the February 2012 acquisition of

producing properties in the Austin Chalk trend. Daily Production by

Area (1) |

(1)

Data excludes estimated reserves associated with the February 2012 acquisition of

producing properties in the Austin Chalk trend. (2)

PV-10% is a non-GAAP financial measure. See reconciliation of SEC

PV-10 to standardized measure in Appendix. ($ in millions)

Oil

Gas

Total

% of

MMBO

BCF

MMBOE

Total

PV-10

(2)

PDP

10.8

31.9

16.1

55.1%

$376.7

PDNP

3.1

6.6

4.2

14.4%

109.5

PUD

5.8

18.8

8.9

30.5%

128.7

Total Proved Corporate Interests

19.7

57.3

29.2

100.0%

$614.9

Partnership Interests

0.1

7.0

1.2

11.2

Total Proved Corporate and Partnerships

19.8

64.3

30.4

$626.1

% Oil and % Gas

64.8%

35.2%

Proved Reserve Summary

27

GEOI Proved Reserves

(1)

–

SEC Pricing at 1/1/12 |

SEC PV-10 Reconciliation to Standardized Measure

(1)

(1)

PV-10 is not a measure of financial or operating performance under GAAP, nor

should it be considered in isolation or as a substitute for the standardized measure of

discounted future net cash flows as defined under GAAP.

(2)

Through two affiliated partnerships.

Standardized Measure

28

($ in millions)

1/1/2012

Direct interest in oil and gas reserves:

Present value of estimated future net revenues (PV-10)

$614.9

Future income taxes at 10%

(188.1)

Standardized measure of discounted future net cash flows

$426.8

Indirect interest in oil and gas reserves:

(2)

Present value of estimated future net reserves (PV-10)

$11.2

Future income taxes at 10%

(4.2)

Standardized measure of discounted future net cash flows

$7.0 |

Oil Hedges

GeoResources uses commodity price risk management in order to execute its

business plan throughout commodity price cycles

Natural Gas Hedges

Hedging

Collar

Swap

Weighted Average Oil Hedge Price

2012

2013

$96.21

$102.18

Weighted Average Gas Hedge Price

2012

2013

$5.15

$4.18

29 |

The disclosures below apply to the contents of this presentation:

In April 2007, GeoResources, Inc. (“GEOI” or the “Company”)

merged with Southern Bay Oil & Gas, L.P. (“Southern Bay”)

and a subsidiary of Chandler Energy, LLC and acquired certain oil and gas

properties (collectively, the “Merger”). The Merger was

accounted for as a reverse acquisition of GEOI by Southern Bay. Therefore, any information prior to 2007

relates solely to Southern Bay.

Cautionary Statement – The SEC has established specific guidelines related

to reserve disclosures, including prices used in calculating PV-10 and

the standardized measure of discounted future net cash flows. PV-10 is not a measure of financial or

operating performance under General Accepted Accounting Principles (GAAP), nor

should it be considered in isolation or as a substitute for the

standardized measure of discounted future net cash flows as defined under GAAP. In addition, alternate

pricing methodologies, such as the NYMEX forward strip price curve, are not

provided for under SEC guidelines and therefore do represent GAAP.

PV-10 is not a measure of financial or operating performance under GAAP, nor

should it be considered in isolation or as a substitute for the

standardized measure of discounted future net cash flows as defined under GAAP. PV-10 for SEC price

calculations are based on the 12-month unweighted average prices at

year-end 2011 of $96.19 per Bbl for oil and $4.11 per Mmbtu for

natural gas. These prices were adjusted for transportation, quality, geographical differentials, marketing

bonuses or deductions and other factors affecting wellhead prices

received. Actual realized prices will likely vary materially from

the NYMEX strip. The Company’s independent engineers are Cawley, Gillespie & Associates, Inc.

BOE is defined as barrel of oil equivalent, determined using a ratio of six MCF

of natural gas equal to one barrel of oil equivalent.

EUR estimates do not necessarily represent reserves as defined under SEC rules

and by their nature are more speculative and substantially less certain of

recovery. Further, no discount or risk adjustment is included in the presentation. Actual

locations drilled and quantities that may be ultimately recovered from the

Company’s interests could differ substantially. Additional Disclosures |