Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2011

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 1-35416

U.S. Silica Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 26-3718801 | |

| (State or other jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

8490 Progress Drive, Suite 300

Frederick, Maryland 21701

(Address of Principal Executive Offices) (Zip Code)

(301) 682-0600

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Securities Act:

| Title of each class: |

Name of each exchange on which registered: | |

| Common Stock, par value $0.01 per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Securities Act: None

Indicate by a check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15 (d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically and posted on its website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

As of June 30, 2011, the last business day of the registrant’s most recently completed second fiscal quarter, there was no established public trading market for the registrant’s common stock.

As of March 20, 2012, 52,941,176 shares of the common stock of the registrant were issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Table of Contents

U.S. Silica Holdings, Inc.

FORM 10-K

For the Fiscal Year Ended December 31, 2011

| Page | ||||||

| PART I | ||||||

| Item 1. |

4 | |||||

| Item 1A. |

24 | |||||

| Item 1B. |

46 | |||||

| Item 2. |

47 | |||||

| Item 3. |

57 | |||||

| Item 4. |

58 | |||||

| PART II | ||||||

| Item 5. |

59 | |||||

| Item 6. |

61 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

64 | ||||

| Item 7A. |

81 | |||||

| Item 8. |

83 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

122 | ||||

| Item 9A. |

122 | |||||

| Item 9B. |

122 | |||||

| PART III | ||||||

| Item 10. |

123 | |||||

| Item 11. |

129 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

147 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

148 | ||||

| Item 14. |

152 | |||||

| PART IV | ||||||

| Item 15. |

153 | |||||

| S-1 | ||||||

1

Table of Contents

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements that are subject to risks and uncertainties. All statements other than statements of historical fact included in this Annual Report on Form 10-K are forward-looking statements. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “will,” “should,” “can have,” “likely” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. For example, all statements we make relating to our estimated and projected costs, expenditures, cash flows, growth rates and financial results, our plans and objectives for future operations, growth or initiatives, strategies or the expected outcome or impact of pending or threatened litigation are forward-looking statements. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected, including:

| • | fluctuations in demand for commercial silica; |

| • | the cyclical nature of our customers’ businesses; |

| • | operating risks that are beyond our control, such as changes in the price and availability of transportation, natural gas or electricity; unusual or unexpected geological formations or pressures; cave-ins, pit wall failures or rock falls; or unanticipated ground, grade or water conditions; |

| • | our dependence on two of our plants for a significant portion of our sales; |

| • | the level of activity in the natural gas and oil industries; |

| • | decreased demand for frac sand or the development of either effective alternative proppants or new processes to replace hydraulic fracturing; |

| • | federal, state and local legislative and regulatory initiatives relating to hydraulic fracturing and the potential for related regulatory action or litigation affecting our customers’ operations; |

| • | our rights and ability to mine our properties and our renewal or receipt of the required permits and approvals from governmental authorities and other third parties; |

| • | our ability to implement our capacity expansion plans within our current timetable and budget and our ability to secure offtake agreements for our increased production capacity, and the actual operating costs once we have completed the capacity expansion; |

| • | our ability to succeed in competitive markets; |

| • | loss of, or reduction in, business from our largest customers; |

| • | increasing costs or a lack of dependability or availability of transportation services or infrastructure; |

| • | increases in the prices of, or interruptions in the supply of, natural gas and electricity, or any other energy sources; |

| • | increases in the price of diesel fuel; |

| • | diminished access to water; |

| • | our ability to effectively integrate the manufacture of resin-coated sand with our existing processes; |

| • | our ability to successfully complete acquisitions or integrate acquired businesses; |

| • | our ability to make capital expenditures to maintain, develop and increase our asset base and our ability to obtain needed capital or financing on satisfactory terms; |

| • | substantial indebtedness and pension obligations; |

| • | restrictions imposed by our indebtedness on our current and future operations; |

2

Table of Contents

| • | the accuracy of our estimates of mineral reserves and resource deposits; |

| • | substantial costs of mine closures; |

| • | a shortage of skilled labor and rising costs in the mining industry; |

| • | our ability to attract and retain key personnel; |

| • | our ability to maintain satisfactory labor relations; |

| • | our reliance on trade secrets and contractual restrictions, rather than patents, to protect our proprietary rights; |

| • | silica-related health issues and corresponding litigation; |

| • | our significant unfunded pension obligations and post-retirement health care liabilities; |

| • | our ability to maintain effective quality control systems at our mining, processing and production facilities; |

| • | seasonal and severe weather conditions; |

| • | fluctuations in our sales and results of operations due to seasonality and other factors; |

| • | interruptions or failures in our information technology systems; |

| • | our reliance on different sources for our 2010 and 2011 industry and market data than for the same data in prior years; |

| • | the impact of a terrorist attack or armed conflict; |

| • | our failure to maintain adequate internal controls; |

| • | extensive and evolving environmental, mining, health and safety, licensing, reclamation and other regulation (and changes in their enforcement or interpretation); |

| • | our ability to acquire, maintain or renew financial assurances related to the reclamation and restoration of mining property; and |

| • | other factors disclosed in Item 1A, “Risk Factors” and elsewhere in this Annual Report on Form 10-K. |

We derive many of our forward-looking statements from our operating budgets and forecasts, which are based on many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and it is impossible for us to anticipate all factors that could affect our actual results. Important factors that could cause actual results to differ materially from our expectations, or cautionary statements, are disclosed under Item 1A, “Risk Factors” and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Annual Report on Form 10-K. All written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by these cautionary statements as well as other cautionary statements that are made from time to time in our other filings with the Securities and Exchange Commission (the “SEC”) and public communications. You should evaluate all forward-looking statements made in this Annual Report on Form 10-K in the context of these risks and uncertainties.

We caution you that the important factors referenced above may not contain all of the factors that are important to you. In addition, we cannot assure you that we will realize the results or developments we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our operations in the way we expect. The forward-looking statements included in this Annual Report on Form 10-K are made only as of the date hereof. We undertake no obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

3

Table of Contents

PART I.

| ITEM 1. | BUSINESS |

Unless we state otherwise or the context otherwise requires, the terms “we,” “us,” “our,” “U.S. Silica,” “the Company,” “our business,” “our company” refer to U.S. Silica Holdings, Inc. and its consolidated subsidiaries as a combined entity.

Our Company

Business Overview

We are the second largest domestic producer of commercial silica, a specialized mineral that is a critical input into a variety of attractive end markets. During our 111-year history, we have developed core competencies in mining, processing, logistics and materials science that enable us to produce and cost-effectively deliver over 200 products to customers across these end markets. In our largest end market, oil and gas proppants, our frac sand is used to stimulate and maintain the flow of hydrocarbons in horizontally drilled oil and natural gas wells. This segment of our business is experiencing rapid growth due to recent technological advances in the hydraulic fracturing process, which have made the extraction of large volumes of oil and natural gas from U.S. shale formations economically feasible. Our commercial silica is also used as an economically irreplaceable raw material in a wide range of industrial applications, including glassmaking and chemical manufacturing. Additionally, in recent years a number of attractive new end markets have developed for our high-margin, performance silica products, including solar panels, specialty coatings, wind turbines, polymer additives and geothermal energy systems.

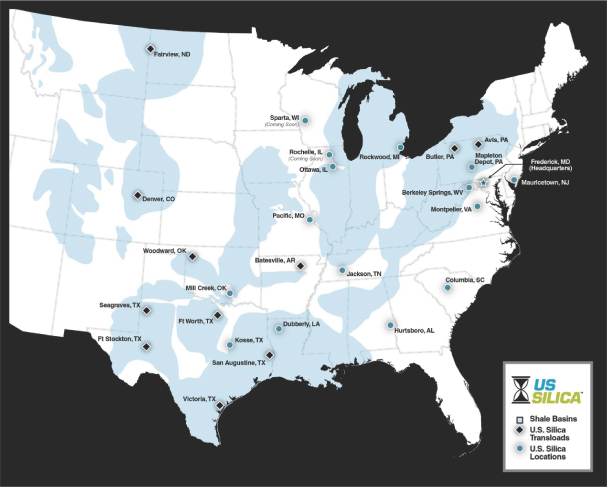

We operate 13 production facilities across the United States and control 316 million tons of reserves, including approximately 148 million tons of reserves that can be processed to meet the American Petroleum Institute (“API”) frac sand size specifications. We produce a wide range of frac sand sizes and are one of the few commercial silica producers capable of rail delivery of large quantities of API grade frac sand to each of the major U.S. shale basins. We believe that due to a combination of these favorable attributes and robust drilling activity in the oil and natural gas industry, we have become a preferred commercial silica supplier to our customers in the oil and gas proppants end market and, consequently, are experiencing high demand for our frac sand. To meet this demand, in 2011 we invested significant resources to increase our proppant production, including expanding our frac sand capabilities by approximately 1.2 million tons, or approximately 75% above tons sold in 2010, and are currently constructing a new facility to produce resin-coated sand, which significantly expands our addressable proppant market.

Our operations are organized into two segments based on end markets served: (1) Oil & Gas Proppants and (2) Industrial & Specialty Products. Our segments are complementary because our ability to sell to a wide range of customers across end markets allows us to maximize recovery rates in our mining operations, optimize our asset utilization and reduce the cyclicality of our earnings. In 2011, we generated approximately $295.6 million of sales, $93.6 million of Adjusted EBITDA and $30.3 million of net income. These figures represent increases of 21%, 30% and 166%, respectively, compared to 2010. In particular, the Oil & Gas Proppants segment contribution margin grew by 57% in 2011 and represented approximately 56% of total segment contribution margin, compared to 48% for the prior year.

Corporate History

In August 2007, we were acquired by an affiliate of Harvest Partners, LLC. Soon thereafter, in October 2007, we were acquired by Hourglass Acquisition I, LLC, a direct, wholly owned subsidiary of Harbinger Capital Partners. In November 2008, Hourglass Acquisition I, LLC was acquired by U.S. Silica Holdings, Inc., formerly GGC USS Holdings, Inc., a wholly-owned subsidiary of GGC USS Holdings, LLC, an affiliate of Golden Gate Capital (“Golden Gate Capital”). The Company was formed by Golden Gate Capital as a Delaware corporation to effect the acquisition of Hourglass Acquisition I, LLC, and through that acquisition U.S. Silica Company, our principal operating subsidiary, became an indirect, wholly owned subsidiary of the Company.

4

Table of Contents

On January 31, 2012, simultaneous with the initial public offering of our common stock, GGC USS Holdings, LLC contributed to the Company, all of the stock of its wholly-owned subsidiary, GGC RCS Holdings, Inc., whose operating subsidiary is Coated Sand Solutions, LLC (“Coated Sand Solutions”). Coated Sand Solutions is developing resin-coated sand proppants for sale into the oil and gas market for use in the hydraulic fracturing process.

Our Strengths

We attribute our success to the following strengths:

| • | Large-scale producer with a diverse and high-quality reserve base. Our 13 geographically dispersed production facilities control 316 million tons of reserves, including API size frac sand and large quantities of silica with distinct characteristics, giving us the ability to sell over 200 products to over 1,400 customers. Our large-scale production capabilities and long reserve life make us a preferred commercial silica supplier to our customers. A consistent, reliable supply of large quantities of silica gives our customers the security to customize their production processes around our commercial silica. Furthermore, our scale provides us earnings diversification and a larger addressable market. |

| • | Geographically advantaged footprint with intrinsic transportation advantages. The strategic location of our facilities and our logistics capabilities enable us to enjoy high customer retention and a larger addressable market. In our Oil & Gas Proppants segment, our network of frac sand producing plants with access to on-site rail and the strategic locations of our transloads serve to expand our addressable market to every major U.S. shale basin. We believe we are one of the few frac sand producers capable of delivering API grade frac sand cost-effectively to most all of the major U.S. shale basins by on-site rail. Additionally, due to the high weight-to-value ratio of many silica products in our Industrial & Specialty Products segment, the proximity of our facilities to our customers’ facilities often results in us being their sole supplier. This advantage has enabled us to enjoy strong customer retention in this segment, with our top five Industrial & Specialty Products segment customers purchasing from us for an average of over 50 years. |

| • | Low-cost operating structure. We believe the combination of the following factors contributes to our low-cost structure and our high margins: |

| • | our ownership of the vast majority of our reserves, resulting in mineral royalty rates that were less than 0.4% of our sales in 2011; |

| • | the close proximity of our mines to their respective processing plants, which allows for a cost-efficient and highly automated production process; |

| • | our processing expertise, which enables us to create over 200 products with unique characteristics while minimizing waste material; |

| • | our integrated logistics management expertise and geographically advantaged facility network, which enables us to reliably ship products by the most cost-effective method available, whether by truck, rail or barge; |

| • | our large customer base across numerous end markets, which allows us to maximize our mining recovery rate and asset utilization; and |

| • | our large overall and plant-level operating scale. |

| • | Strong reputation with our customers and the communities in which we operate. We believe that we have built a strong reputation during our 111-year operating history. Our customers know us for our dependability and our high-quality, innovative products, as we have a long track record of timely delivery of our products according to customer specifications. We also have an extensive network of technical resources, including materials science and petroleum engineering expertise, which enables us to collaborate with our customers to develop new products and improve the performance of their |

5

Table of Contents

| existing applications. We are also well known in the communities in which we operate as a preferred employer and a responsible corporate citizen, which generally serves us well in hiring new employees and securing difficult-to-obtain permits for expansions and new facilities. |

| • | Experienced management team. The members of our senior management team bring significant experience to the dynamic environment in which we operate. Their expertise covers a range of disciplines, including industry-specific operating and technical knowledge as well as experience managing high-growth businesses. We believe we have assembled a flexible, creative and responsive team with a mentality that is particularly well suited to the rapidly evolving unconventional oil and natural gas drilling landscape, which is the principal driver of our growth. |

Our Strategy

The key drivers of our growth strategy include:

| • | Expand our proppant production capacity and product portfolio. We are currently executing several initiatives to increase our frac sand production capacity and augment our proppant product portfolio. At our Ottawa, Illinois facility, we recently implemented operating improvements and installed a new dryer and six mineral separators to increase our annual frac sand production capacity by 900,000 tons. At our Rockwood, Michigan facility, we recently added 250,000 tons of annual frac sand production capacity by installing an entirely new processing circuit to run on a continuous basis alongside our existing state-of-the-art low-iron silica circuit. These two projects were completed during the fourth quarter of 2011. We are also in the initial stages of building a new facility to produce resin-coated sand that will be designed to coat up to 400 million pounds annually, which is scheduled for completion and start-up in 2013. We expect to fund all of these projects through a combination of cash on our balance sheet and cash generated from our operations. |

| • | Increase our exposure to attractive industrial and specialty products end markets. We intend to increase our exposure and market share in certain industrial and specialty products end markets that we believe are poised for growth. For example, at our Rockwood facility, we have doubled our production capacity for low-iron silica, which is used to maximize light transmission in ultra-clear architectural glass and solar panels. In addition, we recently opened a representative office in Shanghai, China to market our fine ground silica products across the Asia Pacific region for use in specialty end markets. We are also exploring opportunities to grow our presence in the specialty coatings and polymer additives end markets, where our ultra-fine ground silica is used to enhance strength, scratch resistance and stability. |

| • | Optimize product mix and further develop value-added capabilities to maximize margins. We will continue to actively manage our product mix at each of our plants to ensure we are maximizing our profit margins. This requires us to use our proprietary expertise in balancing key variables, such as mine geology, processing capacities, transportation availability, customer requirements and pricing. In 2011, while our tons sold increased by 5%, we believe this expertise helped enable us to increase our operating income by 31%. We also expect to continue investing in ways to increase the value we provide to our customers by expanding our product offerings, increasing our transportation assets, improving our supply chain management and upgrading our information technology. We hope to use these strategies to increase our operating income faster than our tons sold into the future. |

| • | Evaluate both Greenfield and Brownfield expansion opportunities. We will continue to leverage our reputation, processing capabilities and infrastructure to increase production, as well as explore other opportunities to expand our reserve base. We may accomplish this by developing Greenfield projects, where we can capitalize on our technical knowledge of geology, mining and processing and our strong reputation within local communities. For instance, on December 30, 2011, we purchased land in Sparta, Wisconsin, for which we recently received initial permitting for a new mining and production facility that will add to our annual frac sand production capacity. Our board of directors has approved $10.0 |

6

Table of Contents

| million in spending for initial site development, engineering and the procurement of certain equipment and materials that have long lead times. However, we are currently in the engineering and design phase of the facility and the ultimate production capacity and process flow are yet to be finalized. |

We are also continuously exploring potential Brownfield projects, such as the possibility of increasing the capacity at some subsequent date of the new resin-coating facility that we are currently constructing. Additionally, we may pursue “bolt on” and other opportunistic acquisitions, taking advantage of our asset footprint, our management’s experience with high-growth businesses and our strong customer relationships. We may also evaluate international acquisitions as unconventional oil and natural gas drilling expands globally.

| • | Maintain financial strength and flexibility. We intend to maintain financial strength and flexibility to enable us to pursue acquisitions and new growth opportunities as they arise. As of December 31, 2011, we had $59.2 million of cash on hand and $24.0 million of available borrowings under our credit facilities. |

Our Industry

The commercial silica industry consists of businesses that are involved in the mining, processing and sale of commercial silica. Commercial silica, also referred to as “silica,” “industrial sand and gravel,” “silica sand” and “quartz sand,” is a term applied to sands and gravels containing a high percentage of silica (silicon dioxide, SiO2) in the form of quartz. Commercial silica deposits occur throughout the United States, but mines and processing facilities are typically located near end markets and in areas with access to transportation infrastructure. Other factors affecting the feasibility of commercial silica production include deposit composition, product quality specifications, land-use and environmental regulation, including permitting requirements, access to electricity, natural gas and water and a producer’s expertise and know-how.

Market and Industry Data

We obtained the industry, market and competitive position data throughout this Annual Report on Form 10-K from our own internal estimates and research as well as from industry and general publications and research, surveys and studies conducted by third parties. We have relied upon publications of the United States Geological Survey (the “USGS”) and The Freedonia Group, Inc. (“Freedonia”) as our primary sources for third-party market and industry data. Industry publications, surveys and studies generally state that the information contained therein has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe that each of these publications, surveys and studies is reliable, we have not independently verified market and industry data from third-party sources. While we believe our internal company research is reliable and the definitions of our market and industry are appropriate, neither such research nor these definitions have been verified by any independent source.

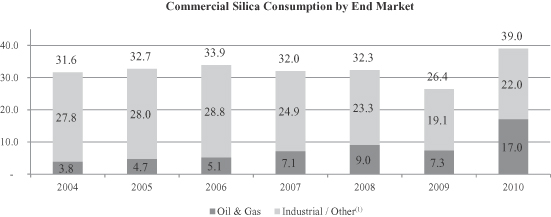

The Minerals Yearbook produced by the USGS is the only comprehensive third-party publication of which we are aware that compiles data on the U.S. commercial silica industry as a whole. The data in the Minerals Yearbook is voluntarily self-reported by U.S. silica producers and there can be no assurance that all major U.S. silica producers have reported data or that the data that has been reported is reliable. The most recent Minerals Yearbook pertains to 2010, and it estimates that 39.0 million tons of silica was consumed that year, with the Industrial & Specialty Products segment generating 22.0 million tons of demand and the Oil & Gas Proppants segment generating 13.3 million tons of demand. Based on our internal estimates and consultations with third parties, we believe that such data, as it relates to the Industrial & Specialty Products segment, is accurate at the reasonable assurance level and we have included it throughout this Annual Report on Form 10-K. However, based on our experience and results of operations in 2010 and 2011, we believe that our internal estimate of 2010 market demand in the Oil & Gas Proppants segment of 17.0 million tons is more accurate than the USGS estimate.

7

Table of Contents

The reason for this discrepancy results from the unprecedented demand that we saw in 2010 and 2011 for our frac sand products from our customers in the Oil & Gas Proppants segment. Our estimates for 2010 are based on the demand we experienced for our own products, as well as discussions with our customers regarding their aggregate demand for frac sand. In addition, our familiarity with competitive sources of frac sand supply, as well as shipment data from major logistics providers, confirmed our estimates of the overall size and growth of the frac sand market.

Extraction and Production Processes

Commercial silica deposits are formed from a variety of sedimentary processes and have distinct characteristics that range from hard sandstone rock to loose, unconsolidated dune sands. While the specific extraction method utilized depends primarily on the deposit composition, most silica is mined using conventional open-pit bench extraction methods and begins after clearing the deposit of any overlaying soil and organic matter. The silica deposit composition and chemical purity also dictate the processing methods and equipment utilized. For example, broken rock from a sandstone deposit may require one, two or three stages of crushing to liberate the silica grains required for most markets. Unconsolidated deposits may require little or no crushing, as silica grains are not tightly cemented together.

After extracting the ore, the silica is washed with water to remove fine impurities such as clay and organic particles. In some deposits, these fine contaminants or impurities are tightly bonded to the surface of the silica grain and require attrition scrubbing to be removed. Other deposits require the use of flotation to collect and separate contaminates from the silica. When these contaminants are weakly magnetic, special high intensity magnets may be utilized in the process to improve the purity of the final commercial silica product. After the silica has been washed, most output is dried prior to sale.

The final step in the production process involves the classification of commercial silica products according to their chemical purity, particle shape and particle size distribution. Generally, commercial silica is produced and sold in whole grain (unground) form and in ground form. Whole grain silica generally ranges from 12 to 140 mesh (the number of openings per linear inch on a sizing screen). Whole grain silica products are sold in a range of shapes, sizes and purity levels to be used in a variety of industrial applications, such as glass, foundry, building products, oil and natural gas recovery, filtration and recreation. Some whole grain silica is further processed to ground silica of much smaller particle sizes, ranging from 5 to 250 microns (one-millionth of a meter).

Product Distribution

Most commercial silica is shipped in bulk to customers by truck or rail. According to the 2010 USGS Minerals Yearbook, of the total commercial silica produced in the United States in 2010, approximately 52% was transported by truck from the plant to the site of first sale or use, 20% was transported by rail and 28% by unspecified modes of transportation. There has been a shift away from truck to rail, as more volumes have been directed to the oil and gas proppants end market, which typically utilizes rail transportation.

For bulk commercial silica, transportation cost represents a significant portion of the overall product cost. Consequently, the majority of production transported by truck is sold within approximately 200 miles of the producing facility. This limitation emphasizes the importance of rail or barge access for low cost delivery outside of the 200-mile truck radius. As a result, facility location is one of the most important considerations for producers and customers. These factors dictate the all-in delivered cost of silica production. Exceptions to this include frac sands used in oil and natural gas recovery and finer grade commercial silica, where transporting the materials long distances is economically feasible due to their relatively high unit values.

In addition to bulk shipments, commercial silica products can be packaged and shipped in 50 to 100 pound bags or bulk super sacks. Bag shipments are usually made to smaller customers with batch operations, warehouse distributor locations or for ocean container shipments made overseas. The products that are shipped in bags are often higher-value products, such as ground and fine ground industrial silica.

8

Table of Contents

Primary End Markets

The special properties of commercial silica—chemistry, purity, grain size, color, inertness, hardness and resistance to high temperatures—make it critical to a variety of industries. Commercial silica is a key input in the well completion process, specifically, in the hydraulic fracturing techniques used in unconventional oil and natural gas wells. In the industrial and specialty products end markets, stringent quality requirements must be met when commercial silica is used as an ingredient to produce thousands of everyday applications, including glass, building and foundry products and metal castings, as well as certain specialty applications such as solar panels, wind turbines, geothermal energy systems and catalytic converters. Due to the unique properties of commercial silica, it is an economically irreplaceable raw material in a wide range of industrial applications. Major end markets include:

Oil and Gas Proppants

Commercial silica is used as a proppant by companies involved in oil and natural gas recovery in unconventional resource plays. Unconventional oil and natural gas production requires fracturing and other well stimulation techniques to recover oil or natural gas that is trapped in the source rock and typically involves horizontal drilling. Frac sand is pumped down oil and natural gas wells at high pressures to prop open rock fissures in order to increase the flow rate of hydrocarbons from the wells. Additionally, every 4 to 5 years proppants may be used to “re-fracture” the shale and keep the fractures open. Proppants represent the single largest class of materials used in the stimulation of oil and natural gas wells, accounting for more than 40% of market value in 2010 according to a Freedonia report dated April 2011. The 2010 USGS Minerals Yearbook reports that sales of commercial silica products for oil and natural gas recovery accounted for approximately 41% by volume and 54% by value of total commercial silica product sales in 2010. Based on our own internal and other third-party estimates, we believe commercial silica used by the oil and gas proppants end market increased significantly in 2010 and likely accounted for approximately 48% of total commercial silica volumes.

Glass

Commercial silica is a critical input into and accounts for 60% to 70% of the raw materials in glass production. According to the 2010 USGS Minerals Yearbook, approximately 27% by volume and 19% by value of all commercial silica products sold in the United States in 2010 were used in glassmaking. The glassmaking markets served by commercial silica producers include containers, flat glass, specialty glass and fiberglass. Demand typically varies within each of these end markets.

The container glass, flat glass and fiberglass end markets are generally mature end markets. Demand for container glass has historically grown in line with population growth, and we expect similar growth in the future. Flat glass and fiberglass tend to be correlated with construction and automotive production activity, and as a result remain depressed relative to peak demand given the contraction of these end markets over the past few years. To the extent construction and domestic automotive production activity continues its recovery in the coming years (which is difficult to predict given current economic uncertainty), we expect that demand in these end markets will continue to increase. See “Risk Factors—Risks Related to Our Business—Our operations are subject to the cyclical nature of our customers’ businesses, and we may not be able to mitigate that risk.”

The demand for low-iron glass, which is utilized in glass for solar panels and certain grades of architectural glass has been experiencing more rapid growth. In addition, glass fibers are being incorporated in high strength wind turbines, a fast growing alternative energy source. Commercial silica used in production of these products is generally of higher quality and tighter specifications than the commercial silica used in the manufacturing of other glass products.

9

Table of Contents

Building Products

Commercial silica is used in the manufacturing of building products for commercial and residential construction. The 2010 USGS Minerals Yearbook reports that commercial silica sold to manufacturers of building products accounted for approximately 7% by volume and 7% by value of all commercial silica sold in the United States in 2010. Whole grain commercial silica products are used in flooring compounds, mortars and grouts, specialty cements, stucco and roofing shingles. Ground commercial silica products are used by building products manufacturers as functional extenders and to add durability and weathering properties to cementious compounds. In addition, geothermal wells are a fast growing alternative energy source that require specialized ground silica products in their well casings for effectiveness. The market for commercial silica used to manufacture building products is driven primarily by the demand in the construction markets. The historical trend for this market has been one of growth, especially in demand for cementious compounds for new construction, renovation and repair. Although the housing construction market has recently declined, to the extent the housing market recovers in the coming years (which is difficult to predict given current economic uncertainty), we expect that demand in this end market will increase. See “Risk Factors—Risks Related to Our Business—Our operations are subject to the cyclical nature of our customers’ businesses, and we may not be able to mitigate that risk.”

Foundry

According to the 2010 USGS Minerals Yearbook, in 2010, commercial silica products used for foundry purposes represented approximately 11% by volume and 6% by value of all commercial silica products sold in the United States. Commercial silica products are used in the production of molds for metal castings and in metal casting products. In addition, commercial whole grain silica is sold to coaters of foundry silica who then sell their product to foundries for cores and shell casting processes. The demand for foundry silica depends on the rate of automobile and light truck production, construction and production of heavy equipment like rail cars. Over the past decade, there has been some movement of foundry supply chains to Mexico and other offshore production areas. In 2010, foundry demand decreased significantly in 2010 as a result of the decrease in automotive and heavy equipment production however, we began seeing increases in foundry demand throughout 2011. To the extent production levels recover in the coming years (which is difficult to predict given current economic uncertainty), we expect foundry demand to improve. See “Risk Factors—Risks Related to Our Business—Our operations are subject to the cyclical nature of our customers’ businesses, and we may not be able to mitigate that risk.”

Chemicals

In 2010, sales of commercial silica products to manufacturers of chemicals equaled approximately 3% by volume and 2% by value of the total commercial silica products sold in the United States according to the 2010 USGS Minerals Yearbook. Both whole grain and ground silica products are used in the manufacturing of silicon-based chemicals, such as sodium silicate, that are used in a variety of applications, including food processing, detergent products, paper textiles and specialty foundry applications. This end market is driven by the development of new products by the chemicals manufacturers, including specialty coatings and polymer additives. We expect this end market to grow as these manufacturers continue their product and applications development.

Fillers and Extenders

According to the 2010 USGS Minerals Yearbook, in 2010, commercial silica products sold for use as fillers represented approximately 1% by volume and 2% by value of all commercial silica products sold in the United States. Commercial silica products are sold to producers of paints and coating products for use as fillers and extenders in architectural, industrial and traffic paints and are sold to producers of rubber and plastic for us in the production of epoxy molding compounds and silicone rubber. The commercial silica products used in this end market are most often ground silica, including finer ground classifications. The market for fillers and extenders is

10

Table of Contents

driven by demand in the construction and automotive production industries as well as by demand for materials in the housing remodeling industry. Although construction, domestic automotive production and housing remodeling demand decreased in 2009, to the extent these industries continue to recover in the coming years (which is difficult to predict given current economic uncertainty), we expect demand to improve. See “Risk Factors—Risks Related to Our Business—Our operations are subject to the cyclical nature of our customers’ businesses, and we may not be able to mitigate that risk.”

Demand Trends

From 1980 to 2008, U.S. commercial silica industry volumes generally grew in line with U.S industrial production, primarily influenced by the manufacture of glass, building materials, foundry moldings and chemicals. The economic downturn of 2008 and 2009 decreased demand for commercial silica products, particularly in the glassmaking, foundry, specialty coatings and building products end markets. With the recent economic recovery, however, we estimate overall demand for commercial silica increased greater than 45% in 2010. Demand for commercial silica in industrial and specialty products end markets once again began to grow. We also continue to see increased demand for new specialty applications, such as solar panels, specialty coatings, wind turbines, polymer additives and geothermal energy systems.

In addition to rebounding industrial end markets and increasing demand for commercial silica products for certain specialty applications, the significant demand growth in 2010 and 2011 was primarily driven by acceleration in demand for frac sand. Based on industry data and our own internal estimates, we believe frac sand demand has grown by more than 28% per annum since 2004.

The following chart depicts consumption in each of the oil and gas proppants and industrial and specialty products end markets from 2004 through 2010.

Data Source: For years 2004 through 2009, the 2009 USGS Minerals Yearbook; for 2010, internal estimates compiled through consultation with third parties and management; see “Market and Industry Data.”

| (1) | Industrial/Other end markets include glassmaking, foundry, metallurgical, abrasives, filtration, recreational, traction/engine, coal washing, roofing granules, and fillers and other, as defined by the USGS. |

The 2010 USGS Minerals Yearbook estimated the value of the commercial silica market value at approximately $1,020.0 million. The oil and gas proppants end market was estimated at $556.1 million, while remaining industrial segments aggregated to $463.9 million. Given our estimates of the significant growth in frac sand production in 2010, as well as the recovery in industrial end markets, we believe the overall commercial silica market exceeded $1.1 billion in 2010, with the oil and gas proppants end market contributing in excess of $600.0 million.

11

Table of Contents

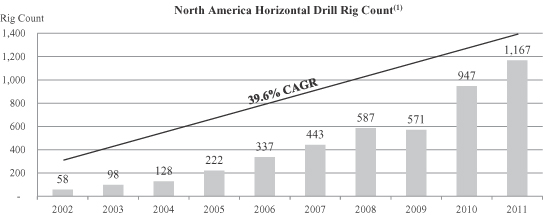

We believe that commercial silica consumption increased at an average annual rate of 9.9% from 2008 to 2010 and that this growth was principally driven by the acceleration in growth in frac sand demand. This demand growth is primarily due to technological developments, such as improvements in horizontal drilling that have made the extraction of oil and natural gas increasingly cost-effective in areas that historically would have been economically impractical to develop. Frac sand is an essential component in the efficient exploitation of these reservoirs, and as more of these reservoirs have been developed, the demand for frac sand has correspondingly increased. The following chart identifies trends in the number of horizontal drill rigs from 2002 to 2011 and the CAGR over such period.

Data Source: Baker Hughes, Inc., January 2012

| (1) | Data reported as year-end rig count for period (2002-2011). As of March 16, 2012, the horizontal drill rig count was 1,180. |

In addition to the increase in the number of horizontal drill rigs, the growth in demand is also the product of an increase in the amount of frac sand used per rig, which is growing as a result of the following factors:

| • | improved drill rig productivity, resulting in more wells drilled per year, per rig; |

| • | the increase in the number of fracturing sites within each well where fracturing occurs and proppant is needed; |

| • | the increase in the length of the horizontal distance covered in lateral wells due to advances in horizontal drilling technologies; and |

| • | the increase in proppant use per foot completed in each fracturing stage. |

Based on these drivers, demand for all proppants is projected to increase approximately 16% per year to $5.1 billion in 2015, and, more specifically, demand for frac sand and resin-coated sand in the United States and Canada is projected to increase 15% per year to $1.9 billion in 2015, according to a Freedonia report dated April 2011.

12

Table of Contents

Supply

Supplies of commercial silica have failed to keep pace with demand for approximately the past 24 months. During the economic downturn of 2008 and 2009, demand for commercial silica from customers in various industrial and specialty products end markets decreased. As a result, there was no significant expansion of domestic commercial silica. This, combined with the continued growth in demand for frac sand in 2010 and 2011, and the rebound in industrial and specialty products end markets, has created a supply-demand disparity over approximately the past 24 months. We believe that if the present level of demand growth continues for the foreseeable future (which is difficult to predict given current economic uncertainty), a significant expansion in the supply of commercial silica will be needed to balance the market. However, there are several key constraints to increasing production on an industry-wide basis, including:

| • | the difficulty of finding silica reserves suitable for use as frac sand, which, according to the API, must meet stringent technical specifications, including, among others, sphericity, grain size, crush resistance, acid solubility, purity and turbidity; |

| • | the difficulty of securing contiguous reserves of silica large enough to justify the capital investment required to develop a mine and processing plant; |

| • | a lack of industry-specific geological, exploration, development and mining knowledge and experience needed to enable the identification, acquisition and development of high-quality reserves; |

| • | the difficulty of identifying reserves with the above characteristics that either are located in close proximity to oil and natural gas reservoirs or have the rail access needed for low-cost transportation to major shale basins; |

| • | the difficulty of securing mining, production, water, air, refuse and other federal, state and local operating permits from the proper authorities, a process that can require up to three years; and |

| • | the difficulty of assembling a large, diverse portfolio of customers to optimize operations. |

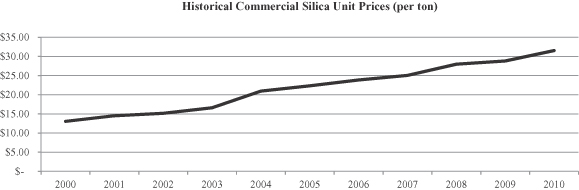

Pricing

Historically, commercial silica has been characterized by regional markets created by the high weight-to-value ratio of silica. According to a USGS report dated October 2010, from 1970 to 2000, commercial silica prices increased at an average annual rate of 4.5%. Since 2000, the increased demand for commercial silica from our customers in both the oil and gas proppants end market and industrial and specialty products end markets and limited supply increases have resulted in favorable pricing trends in both of our operating segments. From 2000 to 2010, commercial silica prices increased at an average annual rate of 9.0%.

The following chart presents historical silica prices from 2000 to 2010.

Data Source: USGS, October 2010

13

Table of Contents

If the use of hydraulic fracturing continues to increase, and if the general economic recovery continues to result in increased demand from our customers in industrial and specialty products end markets, we expect the prices that our products command will continue to increase.

Our Products

In order to serve a broad range of end markets, we produce and sell a variety of commercial silica products, including whole grain and ground products, as well as other industrial mineral products that we believe complement our commercial silica products.

Whole Grain Silica Products—We sell whole grain commercial silica products in a range of shapes, sizes and purity levels. We sell whole grain silica that has a round shape and high crush strength to be used as frac sand in connection with oil and natural gas recovery, and we have begun investing in the construction of a production facility for resin-coated sand. We also sell whole grain silica products in a range of size distributions, grain shapes and chemical purity levels to our customers involved in the manufacturing of glass products, including a low-iron whole grain product sold to manufacturers of architectural and solar glass applications. In addition, we sell over 80 grades of whole grain round silica to the foundry industry and provide whole grain commercial silica to the building products industry. In 2011, sales of whole grain commercial silica products accounted for approximately 78% of our total sales revenue.

Ground Silica Products—Our ground commercial silica products are inherently inert, white and bright, with high purity. We market our ground silica in sizes ranging from 40 to 250 microns for use in plastics, rubber, polishes, cleansers, paints, ceramic frits and glazes, textile fiberglass and precision castings. We also produce and market fine ground silica in sizes ranging from 5 to 40 microns for use in premium paints, specialty coatings, sealants, silicone rubber and epoxies. We believe we are currently the only commercial silica producer in the United States that manufactures a 5-micron product. In 2011, sales of ground silica products accounted for approximately 16% of our total sales revenue.

Other Industrial Mineral Products—We also produce and sell certain other industrial mineral products, such as aplite, calcined kaolin clay and magnesium silicate. Aplite is a mineral used to produce container glass and insulation fiberglass and is a source of alumina that has a low melting point and a low tendency to form defects in glass. Calcined kaolin clay is a mineral primarily used as a functional extender. Calcined kaolin clay is chemically inert, has a high covering power, gives desirable flow properties and reduces the amount of expensive pigments required. These characteristics make calcined kaolin clay an ideal functional extender in paints, plastics, specialty coatings and rubber. We also produce and sell a highly selective adsorbent made from a mixture of silica and magnesium, used extensively in preparative and analytical chromatography. In 2011, sales of these other industrial mineral products accounted for approximately 6% of our total sales revenue.

Our Primary End Markets and Customers

We sell our products to a variety of end markets. At the end of 2008, we began investing heavily in our capacity to supply frac sand to customers in the oil and gas proppants end market. Our high-quality reserves of frac sand have enabled us to quickly build a presence in this fast-growing market, and we are currently investing in our capacity to offer resin-coated sand for the same purpose. Our customers in the oil and gas proppants end market include, among others, Schlumberger Ltd., Halliburton Company, Nabors Industries Ltd., Weatherford International Ltd. and Baker Hughes, Inc. Sales to the oil and gas proppants end market comprised approximately 36%, 28% and 19% of our total sales revenue in 2011, 2010 and 2009, respectively.

Our primary markets have historically been core industrial end markets with customers engaged in the production of glass, building products, foundry products, chemicals and fillers and extenders. Our diverse customer base drives high recovery rates across our production. We also benefit from strong and long-standing relationships with our customers in each of the industrial and specialty products end markets we serve. In our industrial and specialty products end markets, our customers include such industry leaders as Owens-Illinois,

14

Table of Contents

Inc., Owens Corning, Saint-Gobain Glass, The Sherwin-Williams Company and PPG Industries. Sales to our industrial and specialty products end markets comprised approximately 64%, 72% and 81% of our total sales revenue in 2011, 2010 and 2009, respectively.

We primarily sell our products under short term price agreements or at prevailing market rates. For a limited number of our customers, particularly in the oil and gas proppants end market, we sell under long-term, competitively-bid contracts. These long-term contracts are at fixed prices that are presently below market, and these below-market prices are adjustable only for certain cost increases. Sales under these long-term contracts collectively accounted for 17%, 18% and 9% of total sales revenue in 2011, 2010 and 2009, respectively. Although these long-term contracts would provide us with some downside protection if there were to be a significant reduction in demand for frac sand, we believe that there is, and that there will continue to be, sufficient demand for frac sand such that we would not experience an adverse effect if these long-term contracts are not renewed or are canceled. Historically we have not entered into long-term contracts with our customers in the industrial and specialty products end markets because of the high cost to our customers of switching providers. We typically renegotiate our price agreements with these customers annually.

The following table provides more detail regarding the end markets that we serve and our significant customer relationships in those markets:

| End Market |

Primary Customers | |

| Oil and Gas Proppants |

Schlumberger Limited, Halliburton Company, Nabors Industries Ltd., Weatherford International Ltd., Baker Hughes, Inc. | |

| Glass |

PPG Industries, Owens-Illinois, Inc., Owens Corning, Saint-Gobain Glass | |

| Building Products |

Owens Corning, BASF Corporation | |

| Foundry |

Porter Warner Industries, LLC, Thyssen Krupp Waupaca | |

| Chemicals |

PQ Corporation, Occidental Chemical Corporation | |

| Fillers and Extenders |

The Sherwin-Williams Company, Dow Corning Corporation |

Production

Our 13 production facilities are located primarily in the eastern half of the United States, with operations in Alabama, Illinois, Louisiana, Michigan, Missouri, New Jersey, Oklahoma, Pennsylvania, South Carolina, Tennessee, Texas, Virginia and West Virginia.

We conduct only surface mining operations and do not operate any underground mines. Mining methods at our facilities include conventional hard rock mining, hydraulic mining, surface or open-pit mining of loosely consolidated silica deposits and dredge mining. Hard rock mining involves drilling and blasting in order to break up sandstone into sizes suitable for transport to the processing facility by truck or conveyer. Hydraulic mining involves spraying high-pressure water to break up loosely consolidated sandstone at the mine face. Surface or open-pit mining involves using earthmoving equipment, such as bucket loaders, to gather silica deposits for processing. Lastly, dredging involves gathering silica deposits from mining ponds and transporting them by slurry pipelines for processing. We may also use slurry pipelines in our hydraulic and open-pit mining efforts to expedite processing. Silica mining and processing typically has less of an environmental impact than the mining and processing of other minerals, in part because it uses fewer chemicals.

Our processing plants are equipped to receive the mined sand, wash away impurities, eliminate oversized or undersized particles and remove moisture through a multi-stage drying process. Each of our facilities operates year-round, typically in shift schedules designed to optimize facility utilization in accordance with market

15

Table of Contents

demand. Our facilities receive regular preventative maintenance, and we make additional capital investments in our facilities as required to support customer volumes and internal performance goals. For more information related to our production facilities, see Item 2, “Properties”.

In connection with expanding our presence in the oil and gas proppants end market, we are in the process of constructing a facility to produce resin-coated sand for use in the hydraulic fracturing process. In advance of opening that facility, we are negotiating a tolling agreement with a third party whereby we will ship sand processed at our facilities to a third-party facility to be coated in resin. The resin-coated sand will then be shipped back to us to be sold to customers.

Quality Control

We maintain a standard of excellence through our ISO 9001-registered quality systems at our mining and processing facilities. We use automated process control systems that efficiently manage the majority of the mining and processing functions, and we monitor the quality and consistency of our products by conducting hourly tests throughout the production process to detect variances. We generally test each customer load prior to shipment, and all of our major facilities operate a testing laboratory to evaluate and ensure the quality of our products and services. We also provide customers with documentation verifying that all products shipped meet customer specifications. These quality assurance functions ensure that we deliver quality products to our customers and maintain customer trust and loyalty.

In addition, we have certain company-wide quality control mechanisms. We maintain a company-wide quality assurance database that facilitates easy access and analysis of product and process data from all plants. We also have a fully staffed and equipped corporate laboratory that provides critical technical expertise, analytical testing resources and application development to promote product value and cost savings. The lab consists of four departments: a foundry lab, a paint and coatings lab, an analytical lab and a minerals-processing lab. The foundry lab is fully equipped for analyzing foundry silica based on grain size distribution, acidity, acid demand value and turbidity, which is a measure of silica cleanliness. The paint and coatings lab provides formulation, application, and testing of paints, coatings and grouts for end use in fillers and extenders as well as building products. The analytical lab performs various analyses on products for quality control assessment. The minerals-processing lab models plant production processes to test variations in deposits and improve our ability to meet customer requirements, and also performs some limited testing of our frac sand products to verify that they meet API size and crush specifications.

Distribution

We ship our commercial silica products direct to our customers by truck, rail or barge. Generally, we utilize trucks for shipments of 200 miles or less from our plant sites and to distribute our bagged products. Given the weight-to-value ratio of most of our products, the majority of our shipments outside this 200-mile radius are by rail. We frequently utilize rail-truck transfer stations to deliver our products to the oil and natural gas industry when this method of transportation provides us with lower delivery costs to specific customers or regions. We are continuously looking to increase the number of available transload points to which we have access. When cost effective, we also occasionally ship products by barge, both domestically and internationally. All three methods of shipping are typically performed with equipment owned by third parties. Both we and our customers lease a significant number of railcars for shipping purposes, as well as to facilitate the short-term storage of our products, particularly our frac sand products. The railcar leasing market is increasingly tight due to rising demand, and we expect to require additional rail cars as we continue to expand our commercial silica production. As of December 31, 2011, we had a leased fleet of 1,087 rail cars and are currently negotiating additional leases. We believe that we will have access to a sufficient supply of railcars to meet our needs.

For some of our high-margin, finer ground commercial silica and other specialty products such as calcined kaolin clay, we can effectively distribute our products nationally and, in some cases, internationally. These sales are typically made through distributors and are shipped by rail for North American locations and by ocean going barge for international locations.

16

Table of Contents

Our Reserves

We believe we have a broad and high-quality mineral reserves base due to our strategically located mines and facilities. At December 31, 2011, we estimate that we had a total of approximately 316 million tons of proven and probable recoverable mineral reserves. The quantity and nature of the mineral reserves at each of our properties are estimated by our internal geologists and mining engineers. Our internal geologists and engineers update our reserve estimates annually, making necessary adjustments for operations at each location during the year and additions or reductions due to property acquisitions and dispositions, quality adjustments and mine plan updates. Before acquiring new reserves, we perform surveying, drill core analysis and other tests to confirm the quantity and quality of the acquired reserves. In some instances, we acquire the mineral rights to reserves without actually taking ownership of the properties. For more information related to our production facilities, deposits and reserves, see Item 2, “Properties”.

Commercial Team

Our commercial team consists of more than 40 individuals responsible for all aspects of our sales process, including pricing, marketing, transportation and logistics, product development and general customer service. This necessitates a highly organized staff and extensive coordination between departments. For example, product development requires the collaboration of our sales team, our production facilities and our corporate laboratory. Our sales team interacts directly with our customers in determining their needs, our production facilities fulfill the orders and our corporate laboratory is responsible for ensuring that our products meet those needs.

Our commercial team can be divided into four units:

| • | Sales—Our sales team is organized by both region and end market. Domestically, we have an experienced group of regional sales managers underneath a national sales director, along with dedicated team members for the oil and gas proppants and the industrial and specialty end markets. Our oil and gas proppants team is based out of an office in Houston staffed by a petroleum engineer and other experts with in-depth market and technical knowledge. Internationally, we opened our first office abroad in 2011 in Shanghai, China, which will establish key partnerships with local industry leaders and develop business opportunities across the Asia Pacific region. As we make decisions to enter or expand our presence in certain end markets or regions, we will continue to add dedicated team members to support that growth. |

| • | Marketing—Our marketing team coordinates all of our new and existing customer outreach efforts. This includes producing exhibits for trade shows and exhibitions, manufacturing product overview materials, participating in regional industry meetings and other trade associations and managing our advertising efforts in trade journals. |

| • | Transportation and Logistics—Our transportation and logistics team manages over 100,000 domestic and international shipments annually by directing inbound and outbound rail and truck traffic, supervising equipment maintenance, coordinating with rail carriers to ensure equipment availability, ensuring compliance with shipping regulations and strategically planning for future growth. |

| • | Technical—Our technical team is anchored by our corporate laboratory in Berkeley Springs, West Virginia. At this facility, we perform a variety of analyses including: |

| • | analytical chemistry by X-Ray Fluorescence (XRF) and Inductively Coupled Plasma (ICP) spectroscopy; |

| • | particle characterization by sieve, SediGraph, Brunauer, Emmett and Teller (BET) surface area and microscopy; |

| • | ore evaluation by mineral processing, flotation and magnetic separation; |

| • | API frac sand evaluation, including crush resistance; and |

| • | AFS green sand evaluation by various foundry sand tests. |

17

Table of Contents

We utilize these analytical capabilities to develop new product offerings for customers in the solar panels, ceramics and fillers and extenders end markets, among others. Many other product analyses are performed locally at our 13 production facilities to support plant operations and customer quality requirements.

We also have a variety of other technical competencies including process engineering, equipment design, facility construction, maintenance excellence, environmental engineering, geology and mine planning and development. Effective integration of these capabilities has been a critical component of our business success and has allowed us to establish and maintain an extensive, high-quality silica sand reserve base, maximize the value of our reserves by producing and selling a wide range of high-quality products, optimize processing costs to provide strong value to customers and prioritize operating in a safe and environmentally sustainable manner.

Competition

Both of our reporting segments operate in highly competitive markets that are characterized by a small number of large, national producers and a larger number of small, regional or local producers. According to the 2010 USGS Minerals Yearbook, in 2010, there were 68 producers of commercial silica with a combined 113 active operations in 33 states within the United States. Competition in the industry across both of our reporting segments is based on price, consistency and quality of product, site location, distribution capability, customer service, reliability of supply, breadth of product offering and technical support. As transportation costs are a significant portion of the total cost to customers of commercial silica—in many instances transportation costs can represent more than 50% of delivered cost—the commercial silica market is typically local, and competition from beyond the local area is limited. Notable exceptions to this are the frac sand and fillers and extenders markets, where certain product characteristics are not available in all deposits and not all plants have the requisite processing capabilities, necessitating that some products be shipped for extended distances.

We believe the five leading producers of commercial silica across both of our reporting segments represented in excess of 60% of total industry production in 2010 and we compete with these large, national producers such as Unimin Corporation, Fairmount Minerals, Ltd., Preferred Sands and Carmeuse Industrial Sands. Our larger competitors may have greater financial and other resources than we do, may develop technology superior to ours or may have production facilities that are located closer to key customers than ours.

Because the markets for our products are typically local, we also compete with smaller, regional or local producers. For instance, in recent years there has been an increase in the number of small producers servicing the frac sand market due to an increased demand for hydraulic fracturing services.

Intellectual Property

Other than operating licenses for our mining and processing facilities, there are no third party patents, licenses or franchises material to our business. Our intellectual property primarily consists of trade secrets, know-how and trademarks, including our name “U.S. Silica” and products such as “OTTAWA WHITE.” We strategically rely on trade secrets, rather than patents, to protect our proprietary processes, methods, documentation and other technologies, as well as certain other business information. Patent protection requires a costly and uncertain federal registration process that would place our confidential information in the public domain. Typically, we utilize trade secrets to protect the formulations and processes we use to manufacture our products and to safeguard our proprietary formulations and methods. We believe we can effectively protect our trade secrets indefinitely through the use of confidentiality agreements and other security measures.

Condition of Physical Assets and Insurance

Our business is capital intensive and requires ongoing capital investment for the replacement, modernization and/or expansion of equipment and facilities. For more information, see Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources”.

18

Table of Contents

We maintain insurance policies against property loss and business interruption and insure against risks that are typical in the operation of our business, in amounts that we believe to be reasonable. Such insurance, however, contains exclusions and limitations on coverage, particularly with respect to environmental liability and political risk. There can be no assurance that claims would be paid under such insurance policies in connection with a particular event. See Item 1A, “Risk Factors”.

Employees

As of December 31, 2011, we employed a workforce of 701 employees, the majority of whom are hourly wage plant workers living in the areas surrounding our mining facilities. The majority of our hourly employees are represented by labor unions that include the Teamsters, United Steelworkers, Paper Allied-Industrial Chemical & Energy, Glass/Molders/Pottery/Plastics and Laborers. We believe that we maintain good relations with our workers and their respective unions and have not experienced any material strikes or work stoppages since 1987.

The majority of our employees have tenure with us of approximately 15 years, and we have an annual employee turnover rate of less than 1.0%. We believe this low turnover rate has directly contributed to improved process efficiencies and safety, which in turn help drive cost reductions. We believe our labor rates compare favorably to other mining and manufacturing facilities in the same geographic areas. We maintain workers’ compensation coverage in amounts required by law and have no material claims pending. We also offer all full-time employees a competitive package of employee benefits, which includes medical, dental, life and disability coverage.

See Item 10, “Directors, Executive Officers and Corporate Governance” for information about our executive officers.

Seasonality

Our business is affected to some extent by seasonal fluctuations in weather that impact our production levels and our customers’ business needs. For example, in the second and third quarters, we sell more commercial silica to our customers in the building products and recreation end markets due to the seasonal rise in construction driven by more favorable weather conditions. Our sales and sometimes our production levels are lower in the first and fourth quarters due to lower market demand and due to our customers in these end markets experiencing slowdowns largely as a result of adverse weather conditions.

Regulation and Legislation

Mining and Workplace Safety

Federal Regulation

The U.S. Mine Safety and Health Administration (“MSHA”) is the primary regulatory organization governing the commercial silica industry. Accordingly, MSHA regulates quarries, surface mines, underground mines and the industrial mineral processing facilities associated with quarries and mines. The mission of MSHA is to administer the provisions of the Federal Mine Safety and Health Act of 1977 and to enforce compliance with mandatory safety and health standards. MSHA works closely with the Industrial Minerals Association, a trade association in which we have a significant leadership role, in pursuing this mission. As part of MSHA’s oversight, representatives perform at least two unannounced inspections annually for each above-ground facility. To date these inspections have not resulted in any citations for material violations of MSHA standards. For additional information regarding mining and workplace safety, including MSHA safety and health violations and assessments in 2011, see Item 4, “Mine Safety Disclosures”.

We also are subject to the requirements of the U.S. Occupational Safety and Health Act (“OSHA”) and comparable state statutes that regulate the protection of the health and safety of workers. In addition, the OSHA Hazard Communication Standard requires that information be maintained about hazardous materials used or

19

Table of Contents

produced in operations and that this information be provided to employees, state and local government authorities and the public. OSHA regulates the customers and users of commercial silica and provides detailed regulations requiring employers to protect employees from overexposure to silica through the enforcement of permissible exposure limits and the OSHA Hazard Communication Standard.

Internal Controls

We adhere to a strict occupational health program aimed at controlling exposure to silica dust, which includes dust sampling, a respiratory protection program, medical surveillance, training and other components. Our safety program is designed to ensure compliance with the standards of our Occupational Health and Safety Manual and MSHA regulations. For both health and safety issues, extensive training is provided to employees. We have safety committees at our plants made up of salaried and hourly employees. We perform annual internal health and safety audits and conduct semi-annual crisis management drills to test our plants’ abilities to respond to various situations. Health and safety programs are administered by our corporate health and safety department with the assistance of plant Environmental, Health and Safety Coordinators.

Environmental Matters

We and the commercial silica industry are subject to extensive governmental regulation on, among other things, matters such as permitting and licensing requirements, plant and wildlife protection, hazardous materials, air and water emissions and environmental contamination and reclamation. A variety of state, local and federal agencies conduct this regulation.

Federal Regulation

At the federal level, we may be required to obtain permits under Section 404 of the Clean Water Act from the U.S. Army Corps of Engineers for the discharge of dredged or fill material into waters of the United States, including wetlands and streams, in connection with our operations. We also may be required to obtain permits under Section 402 of the Clean Water Act from the EPA (or the relevant state environmental agency in states where the permit program has been delegated to the state) for discharges of pollutants into waters of the United States, including discharges of wastewater or storm water runoff associated with construction activities. Failure to obtain these required permits or to comply with their terms could subject us to administrative, civil and criminal penalties as well as injunctive relief.

The U.S. Clean Air Act and comparable state laws regulate emissions of various air pollutants through air emissions permitting programs and the imposition of other requirements. These regulatory programs may require us to install expensive emissions abatement equipment, modify our operational practices and obtain permits for our existing operations, and before commencing construction on a new or modified source of air emissions, such laws may require us to reduce emissions at existing facilities. As a result, we may be required to incur increased capital and operating costs because of these regulations. We could be subject to administrative, civil and criminal penalties as well as injunctive relief for noncompliance with air permits or other requirements of the U.S. Clean Air Act and comparable state laws and regulations.