Attached files

| file | filename |

|---|---|

| 8-K - ON ASSIGNMENT INC 8-K 3-20-2012 - ASGN Inc | form8k.htm |

| EX-99.2 - EXHIBIT 99.2 - ASGN Inc | ex99_2.htm |

Exhibit 99.1

Acquisition of Apex Systems, Inc.

March 20, 2012

March 20, 2012

Peter Dameris

President & CEO

Jim Brill

CFO

Rand Blazer

COO, Apex Systems

Ted Hanson

CFO, Apex Systems

Mike McGowan

President, Oxford

2

Safe Harbor

Certain statements made in this presentation should be considered

forward-looking statements as defined in the Private Securities Litigation

Reform Act of 1995. These include statements about our future results of

operations and operating targets, the size of the markets in which we

operate, and our efforts to increase our market share and revitalize our

business. We caution investors that these forward-looking statements are

not guarantees of future performance, and actual results may differ

materially. Investors should consider the important risks and uncertainties

that may cause actual results to differ, including those discussed in our

annual report on Form 10-K for the year ended December 31, 2011 and

other filings we make with the Securities and Exchange Commission. We

assume no obligation to update this presentation, which speaks as of

today's date.

forward-looking statements as defined in the Private Securities Litigation

Reform Act of 1995. These include statements about our future results of

operations and operating targets, the size of the markets in which we

operate, and our efforts to increase our market share and revitalize our

business. We caution investors that these forward-looking statements are

not guarantees of future performance, and actual results may differ

materially. Investors should consider the important risks and uncertainties

that may cause actual results to differ, including those discussed in our

annual report on Form 10-K for the year ended December 31, 2011 and

other filings we make with the Securities and Exchange Commission. We

assume no obligation to update this presentation, which speaks as of

today's date.

3

Transaction Overview

On Assignment to acquire Apex Systems, a leading information technology and

workforce solutions firm, for $600 million in cash and stock

workforce solutions firm, for $600 million in cash and stock

– Cash consideration of $383 million

– On Assignment has secured committed financing for $540 million of credit facilities, consisting of a

$50 million revolving credit facility (undrawn at close) and a $490 million term loan

$50 million revolving credit facility (undrawn at close) and a $490 million term loan

– Existing On Assignment and Apex Systems debt to be refinanced as part of the transaction

– Estimated funded debt at close: 3.75x pro forma 3/31/12E LTM Adjusted EBITDA ¹ (excluding any

potential synergies)

potential synergies)

– Stock consideration of $217 million

– Stock consideration based on an ASGN share price of $13.79, subject to collar

– Based on a fixed price collar of +/- 10%, a maximum of 17.5 million and a minimum of 14.3 million

new ASGN shares will be issued to Apex Systems shareholders at transaction close

new ASGN shares will be issued to Apex Systems shareholders at transaction close

– Structured as a merger with a Section 338(h)(10) election, resulting in significant cash tax savings

(estimated to be approximately $14 million per year for 15 years)

(estimated to be approximately $14 million per year for 15 years)

– Apex Systems will operate as a division of On Assignment

– Transaction is expected to close in Q2 2012

– Standard closing conditions including HSR approval and On Assignment shareholder approval

Note:

1 Excludes transaction costs and certain non-material and non-recurring expenses

4

Transaction Highlights

Ease of Integration

• Immediately becomes the second largest IT staffing provider in the U.S. with approximately

$1 billion of revenue from IT staffing in 2011 (represents ~75% of total pro forma combined

revenue of $1.3 billion)

$1 billion of revenue from IT staffing in 2011 (represents ~75% of total pro forma combined

revenue of $1.3 billion)

• Uniquely positioned in the marketplace as the only company providing a “full spectrum” of IT

staffing solutions from high-end to mission-critical assignments

staffing solutions from high-end to mission-critical assignments

• Benefit from strong secular trend in IT staffing

• Expected industry growth of 12% in 2012

Apex & Oxford:

A Powerful

Combination in

IT Staffing

A Powerful

Combination in

IT Staffing

• Expected to be immediately accretive on both a GAAP and cash EPS basis

• The combined company benefits from the 338(h)(10) election, resulting in approximately $14

million of annual cash tax savings over 15 years

million of annual cash tax savings over 15 years

• Increased scale along with strong revenue and free cash flow generation results in rapid

deleveraging

deleveraging

Attractive Financial

Characteristics

Characteristics

• On Assignment is bolstered by Apex Systems’ senior management team and its impressive

track record of consistent revenue growth and industry leading margins

track record of consistent revenue growth and industry leading margins

• Veteran cadre of seasoned industry professionals

Experienced

Management Team

Management Team

Increased Scale in

an Attractive

Market

an Attractive

Market

• The On Assignment and Apex Systems combination creates one of the largest, fastest growing

and most profitable professional staffing companies in the U.S.

and most profitable professional staffing companies in the U.S.

• Transaction accretion excludes any potential synergy savings

• Pro forma combined 2011 revenue of $1.3 billion

4

• Seamless integration given that Apex and Oxford do not compete against one another

• Oxford specializes in high-end IT skills and Apex focuses on mission critical IT skills

• Minimal overlap in existing customer bases

• On Assignment has a proven track record of successful platform acquisitions

5

Transaction Rationale

|

Highly Complementary Acquisition

|

|

• Focused on different sets of IT skills

• No channel conflicts

• Limited integration required

• Similar business models and corporate cultures

|

|

Diversifies Revenues

|

|

• Broaden services offering across IT skills

• Vertical and geographical diversification

• Improve penetration into new customers

• Increases ability to expand customer base in the

Healthcare vertical • Expand permanent placement business

• Significant cross-selling opportunities

• Diversifies Apex revenue stream beyond IT

staffing |

|

Strong Financial Profile

|

|

• Accretive to revenue growth and earnings

• Strong conversion of EBITDA to cash flow

• Significant cash tax savings, resulting in rapid

debt paydown |

|

Potential Synergies

|

|

• Leverage highly scalable back-office infrastructure

• Consolidation of billing and payroll

• Leverage expertise in sales and recruiting

|

6

|

• Integration will be seamless to employees,

contract professionals and customers • Senior management of both On Assignment

and Apex remain in place and ultimately report to CEO Peter Dameris • No major changes to recruitment and sales

models and commission plans • No channel conflicts

|

Merger Integration

7

Apex & Oxford: A Powerful Combination in IT Staffing

IT

Overview

Selected

Positions

Average

Bill Rate

Contract

Professional /

Employees

Professional /

Employees

+

Other

• Mission critical IT staffing that

Fortune 1000 and mid-market

companies require to run daily

operations

Fortune 1000 and mid-market

companies require to run daily

operations

• Network Engineers

• Application Developers

• Social & Mobile App. Developers

• Help Desk

• $60 per hour

• Qualified Database: 400,000+

• Currently on assignment:

~16,500

~16,500

• Full-time employees: ~1,100

• Deep industry knowledge and

relationship with clients

relationship with clients

• Sales-driven culture

• Offers full spectrum of IT

staffing services from high-end

special projects to mission

critical daily operations

staffing services from high-end

special projects to mission

critical daily operations

• Flexible staffing services to

meet clients’ needs

meet clients’ needs

• Full spectrum of IT skills

• Bill rates and skill set

appropriate for high-end and

everyday IT projects

appropriate for high-end and

everyday IT projects

• Estimated combined average

bill rate of ~$75 per hour

bill rate of ~$75 per hour

=

• Diverse database of talent to

meet all IT needs

meet all IT needs

• Powerful combination of well-

respected, fast-growing IT

staffing firms

respected, fast-growing IT

staffing firms

IT / Engineering

• High-end IT and engineering

staffing that require hard-to-

find skills

staffing that require hard-to-

find skills

• Programmers

• Database Designers

• Enterprise Software Developers

• $116 per hour1

• Qualified Database: 35,000+

• Currently on assignment:

~1,400

~1,400

• Full-time employees: ~590

• Unsurpassed recruiting

capability to fulfill coveted, high

-end and scarce skill set

capability to fulfill coveted, high

-end and scarce skill set

7

1 Q4 2011 Average

8

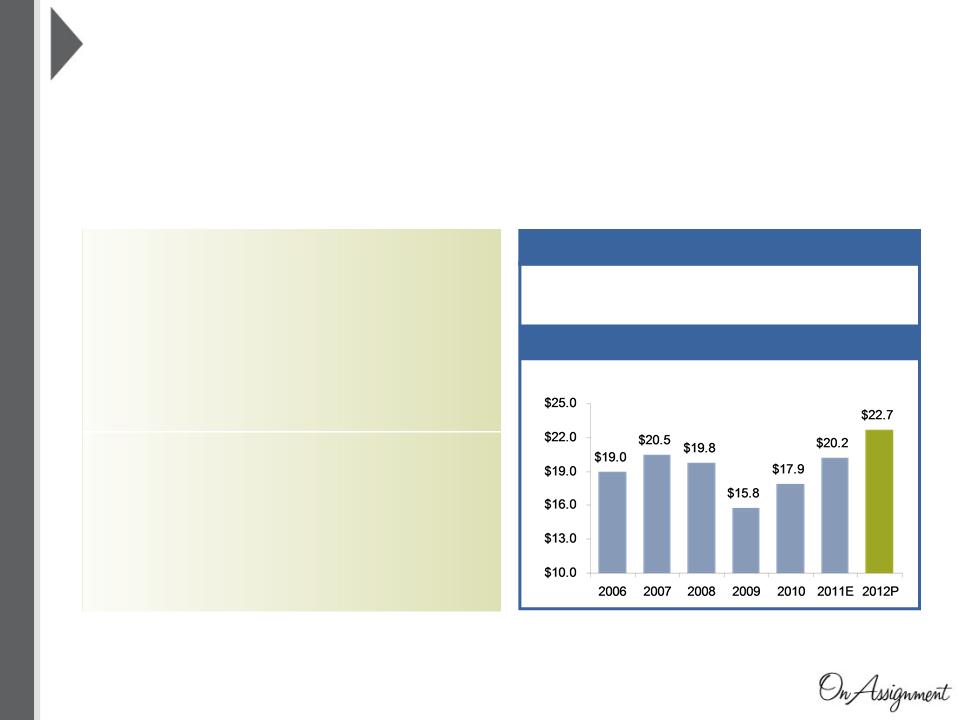

A Focus on Information Technology

Forecasted IT staffing revenues to be $22.7 billion in 20121

Growth Characteristics

• IT segment is estimated to grow by 13% in 2011 and

12% in 20121

12% in 20121

($ in billions)

Projected Market Size1

- IT staffing involves providing temporary professionals and placing full-time employees in areas ranging

from multiple platform systems integration to end-user support, including specialists in programming,

networking systems integration, database design and help desk support.

from multiple platform systems integration to end-user support, including specialists in programming,

networking systems integration, database design and help desk support.

Source:

1 Staffing Industry Analysts Insight: Staffing Industry Forecast (September 2011)

Industry

Potential

Shortage of

Talent

• IT has recovered quicker than most

other staffing segments; and is the

only professional staffing segment

expected to surpass 2008 levels in

the current year

other staffing segments; and is the

only professional staffing segment

expected to surpass 2008 levels in

the current year

• Growth in 2012 is expected to be

driven by demand in the healthcare

industry, given deadlines for

conversions implemented by the US

Dept. of Health & Human Services

driven by demand in the healthcare

industry, given deadlines for

conversions implemented by the US

Dept. of Health & Human Services

• One of the main constraints on

growth in this segment is a shortage

of talent, and not necessarily

demand, due to the exodus of many

mid-career professionals following

the tech bubble and a steady

decline in new computer science

graduates

growth in this segment is a shortage

of talent, and not necessarily

demand, due to the exodus of many

mid-career professionals following

the tech bubble and a steady

decline in new computer science

graduates

9

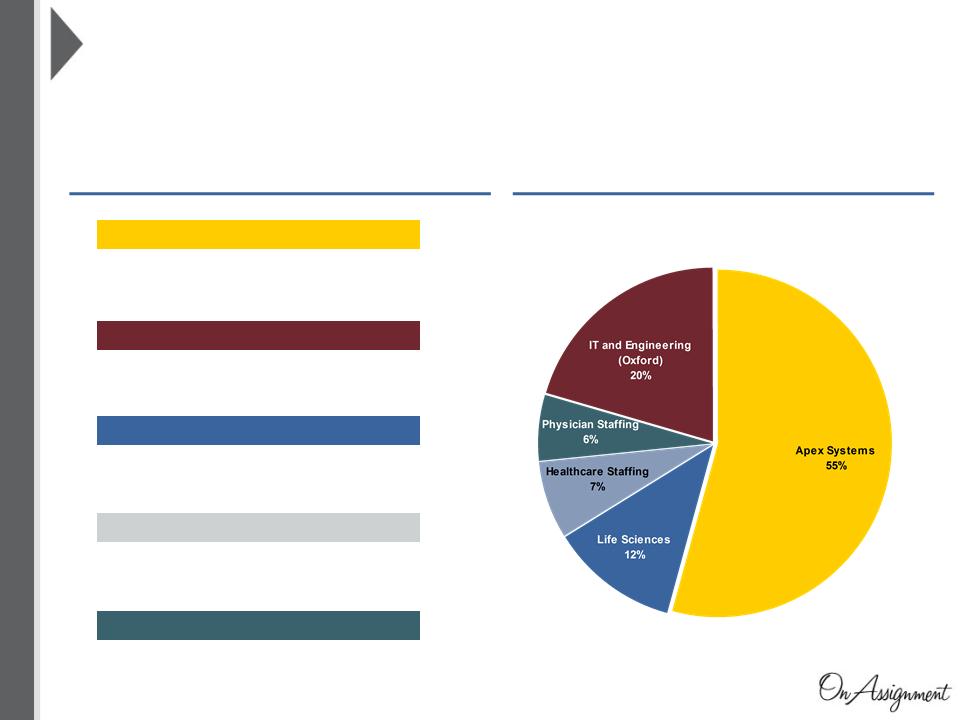

Pro Forma Business Diversification

|

LIFE SCIENCES

|

|

$155.3 million

|

|

HEALTHCARE STAFFING

|

|

$94.6 million

|

|

PHYSICIAN STAFFING

|

|

$80.6 million

|

|

IT AND ENGINEERING (OXFORD)

|

|

$266.7 million

|

|

APEX SYSTEMS

|

|

$705.2 million

|

2011 Revenue

Pro Forma 2011 Revenue Mix

Pro Forma 2011 Revenue: $1.3 billion

IT and Engineering staffing represents ~75% of pro forma revenue

10

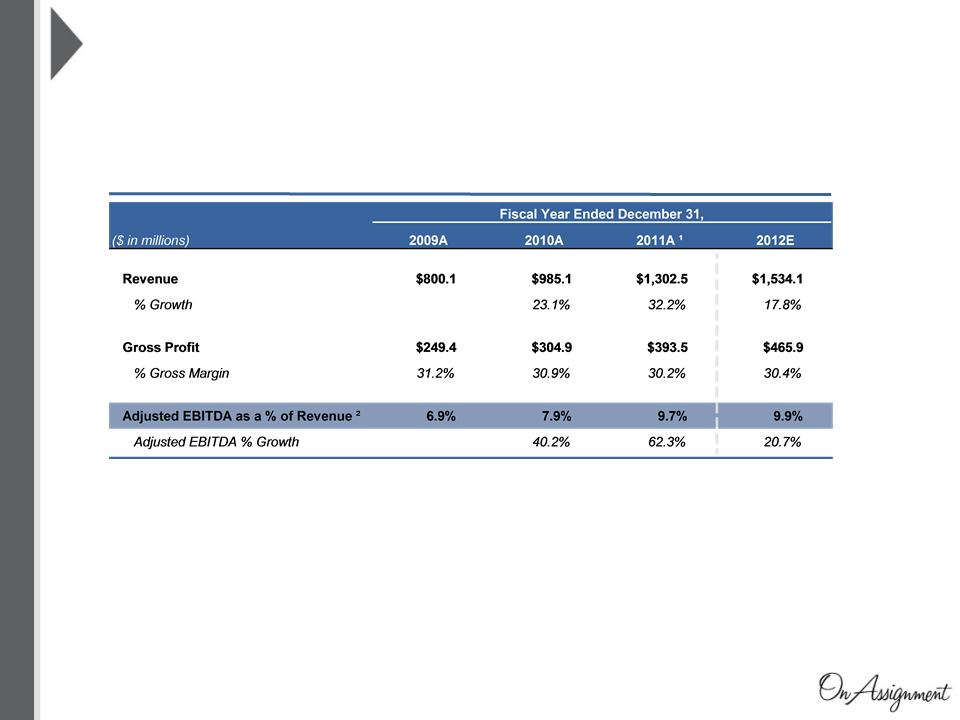

Pro Forma Combined Summary Financials

10

Excludes all transaction adjustments and potential synergies

Note:

1 Pro forma income statement will be included in the proxy statement to be filed by On Assignment with the SEC

2 Adjusted EBITDA adds back stock-based compensation, acquisition related expenses and non-recurring expenses

2009A - 2012E Pro Forma Combined Company Financials

11

11

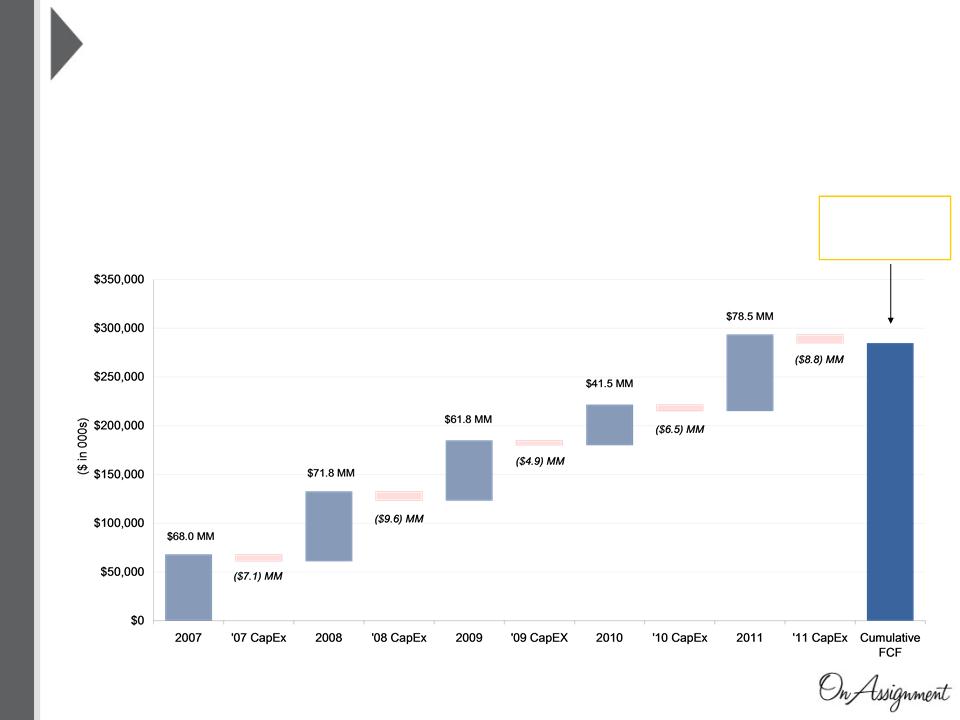

Pro Forma Cash Flow Generation

Cumulative FCF

Generated

Generated

$285 Million

Note: Chart dollars are in thousands

1 Free cash flow is defined as cash flow from operations less capital expenditures

Since 2007, On Assignment and Apex combined have generated

$285 million in Free Cash Flow from operations1

$285 million in Free Cash Flow from operations1

Both organizations have exhibited strong cash flow

generation, even through the financial crisis, and have the

ability to rapidly deleverage

generation, even through the financial crisis, and have the

ability to rapidly deleverage

12

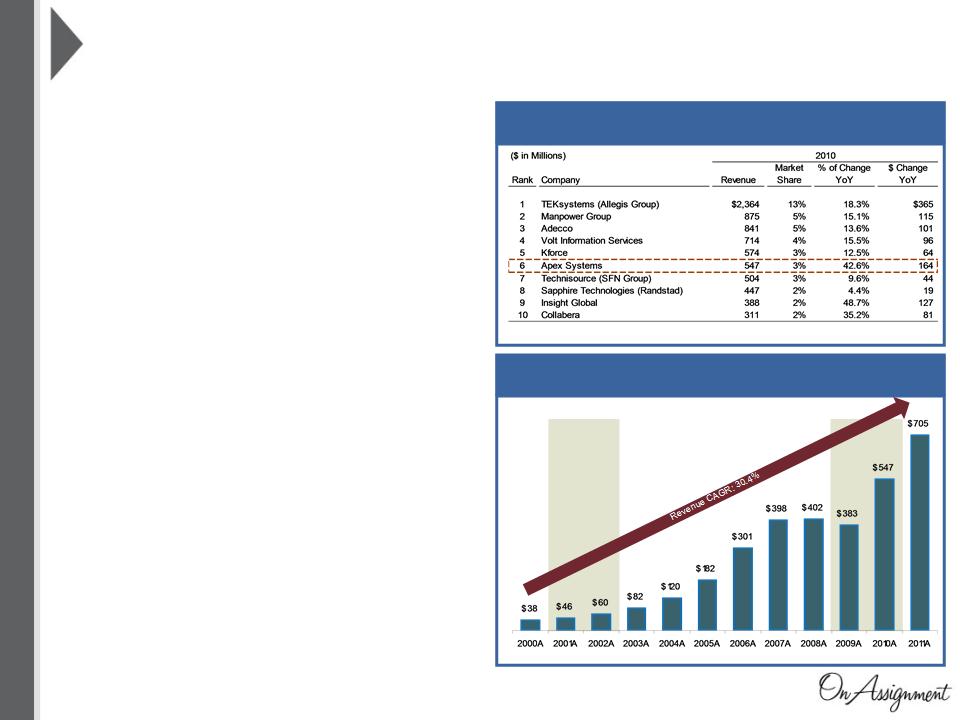

• Apex has capitalized on the

secular shift within IT Staffing

secular shift within IT Staffing

• One of the fastest growing

staffing firms in North America

staffing firms in North America

• Over 1,200 clients (mostly

Fortune 1000) with a presence in

49 markets

Fortune 1000) with a presence in

49 markets

• Over 16,000 temporary IT

professionals staffed annually

professionals staffed annually

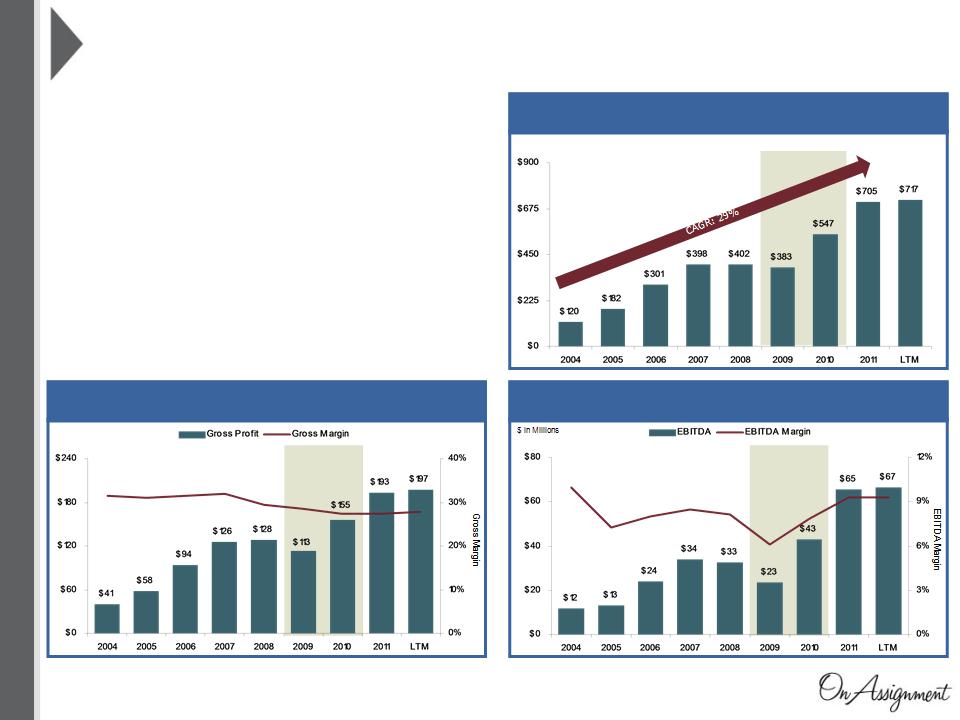

Note: Shaded regions indicate recessionary periods

($ in Millions)

Source: Staffing Industry Analysts

Apex Systems Overview

Largest IT Staffing firms in the U.S.

Strong Revenue Growth

13

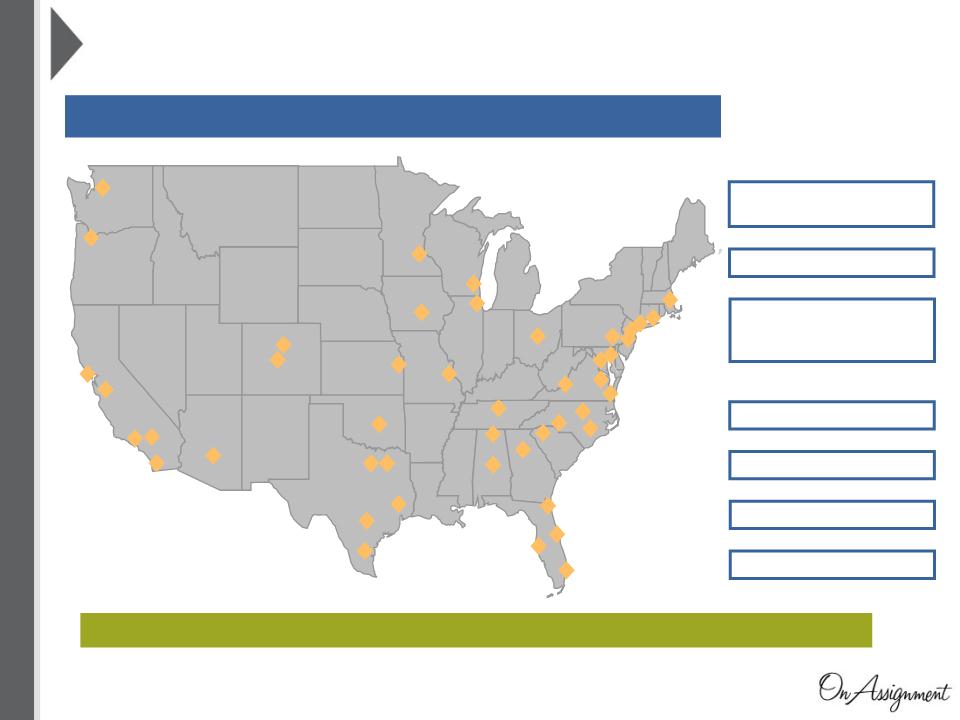

National Presence with Scale

Apex currently operates in 43 out of SIA’s Top 50 Markets

High Operating Leverage and Infrastructure to Support a Much Larger Company

13

900+ Sales & Recruiting

Staff

Staff

190+ Support Staff

1.4 million+ Candidates

National Training Center

1,200+ Clients

100+ National Accounts

6,000+ IT Professionals on

Billing with Clients Each

Week and Rapidly Growing

Billing with Clients Each

Week and Rapidly Growing

14

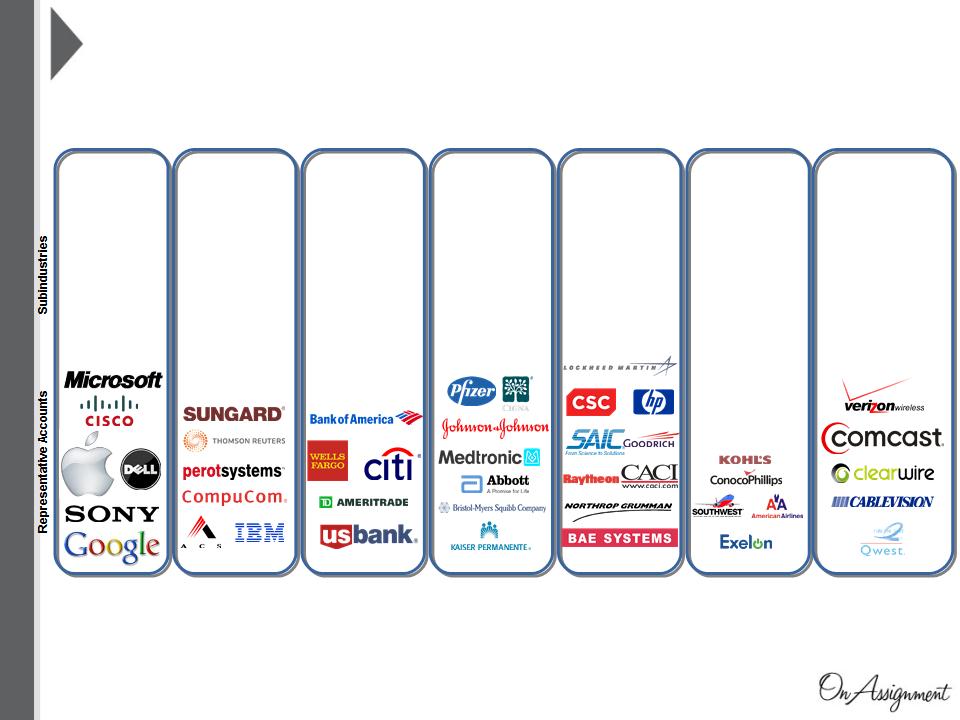

Enviable, Blue Chip Client Base Across All Industries

Information

Technology

Technology

Business

Services

Services

Financials

Healthcare /

Pharma

Pharma

Government

Services

Services

Consumer

Industrials

Industrials

Telecommunications

14

§ Outsourced

Services

Services

§ Data Processing

§ Computers

§ Peripherals

§ Hardware

§ Software

§ Semiconductors

§ Internet

§ Banks

§ Insurance

§ Capital Markets

§ Commercial

Banking

Banking

§ Mortgage

§ REIT

§ Biotechnology

§ Life Sciences

§ Health

Technology

Technology

§ Suppliers

§ Equipment

§ Government

Activities

Activities

§ Aerospace /

Defense

Defense

§ Compressus

§ Government

Contractor

Contractor

§ Food

§ Retail

§ Auto

§ Hotels

§ Machinery

§ Professional

Services

Services

§ Construction

§ Engineering

§ Utilities

§ Energy

§ Wireless

§ Wireline

§ Media

§ Cable

§ Communications

Equipment

Equipment

15

Rand Blazer

• Former CEO of Bearing Point

• Grew KPMG Consulting/Bearing Point from $700 million

to $3.4 billion in 7 years

to $3.4 billion in 7 years

• Former President and GM of SAP Public Services, Inc.

Ted Hanson

• 13 year tenure with Apex Systems

• Former Virginia CFO of the Year

• Former CFO of a telecommunications firm

Strong Second Tier Management

• 7 EVPs whose average tenure with Apex is 13 years

• 52 Principals who have contributed significantly to the performance of Apex with an average

tenure at Apex of 10 years

tenure at Apex of 10 years

Proven Leadership Team

16

Source: Company management

Note: Shaded regions indicate recessionary periods

1 LTM as of January 2012

Strong Financial Performance

• One of the fastest growing pure play IT firms in the

U.S.

U.S.

• Proven ability to perform well through economic

uncertainty

uncertainty

• Industry leading profit margins

• Large scale firm with potential to realize significant

operating leverage

operating leverage

Revenue

$ in Millions

EBITDA & EBITDA Margin

Gross Profit & Margin

$ in Millions

16

1

1

1

17

Source: Wall Street research, Staffing Industry Analysts (SIA) and company filings

Note: Shaded regions indicated recessionary periods and LTM as of January 2012

1 Revenue growth represents SIA’s staffing industry growth

2 Industry margin represents average EBITDA margins for ADEN, ASGN, KFRC, MAN, and RAND

Track Record of Outperforming the Competition

• Singular focus on IT staffing which benefits from

favorable secular and sector trends

favorable secular and sector trends

• National presence and robust infrastructure leading

to high operating leverage

to high operating leverage

• People-centric culture and sales-driven organization

• Best-in-class leadership

EBITDA & EBITDA Margin

EBITDA Margin 2

Revenue Growth 1

17

18

Additional Information and Where to Find It

In connection with the transaction, On Assignment will prepare a proxy statement to be filed with the SEC. When

completed, a definitive proxy statement and a form of proxy will be mailed to the shareholders of the Company. BEFORE

MAKING ANY VOTING DECISION, ON ASSIGNMENT’S SHAREHOLDERS ARE URGED TO READ THE PROXY

STATEMENT REGARDING THE TRANSACTION CAREFULLY AND IN ITS ENTIRETY BECAUSE IT WILL CONTAIN

IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. On Assignment’s shareholders will be able to

obtain, without charge, a copy of the proxy statement (when available) and other relevant documents filed with the SEC

from the SEC’s website at http://www.sec.gov. On Assignment’s shareholders will also be able to obtain, without charge, a

copy of the proxy statement and other relevant documents (when available) by directing a request by mail or telephone to

On Assignment, Inc., Attn: Investor Relations, 36745 Malibu Hills Road, Calabasas, California 91301, telephone: (818)

878-3136, or from the investor relations section of the company’s website, http://www.onassignment.com.

completed, a definitive proxy statement and a form of proxy will be mailed to the shareholders of the Company. BEFORE

MAKING ANY VOTING DECISION, ON ASSIGNMENT’S SHAREHOLDERS ARE URGED TO READ THE PROXY

STATEMENT REGARDING THE TRANSACTION CAREFULLY AND IN ITS ENTIRETY BECAUSE IT WILL CONTAIN

IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. On Assignment’s shareholders will be able to

obtain, without charge, a copy of the proxy statement (when available) and other relevant documents filed with the SEC

from the SEC’s website at http://www.sec.gov. On Assignment’s shareholders will also be able to obtain, without charge, a

copy of the proxy statement and other relevant documents (when available) by directing a request by mail or telephone to

On Assignment, Inc., Attn: Investor Relations, 36745 Malibu Hills Road, Calabasas, California 91301, telephone: (818)

878-3136, or from the investor relations section of the company’s website, http://www.onassignment.com.

On Assignment, Apex Systems and their respective directors and executive officers and other persons may be deemed to

be participants in the solicitation of proxies in respect of the transaction. Information regarding On Assignment’s directors

and executive officers is available in On Assignment’s notice of annual meeting and proxy statement for its most recent

annual meeting and On Assignment’s Annual Report on Form 10-K for the year ended December 31, 2011, which were

filed with the SEC on April 27, 2011 and March 14, 2012, respectively. Other information regarding the participants in the

solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the

proxy statement and other relevant materials to be filed with the SEC.

be participants in the solicitation of proxies in respect of the transaction. Information regarding On Assignment’s directors

and executive officers is available in On Assignment’s notice of annual meeting and proxy statement for its most recent

annual meeting and On Assignment’s Annual Report on Form 10-K for the year ended December 31, 2011, which were

filed with the SEC on April 27, 2011 and March 14, 2012, respectively. Other information regarding the participants in the

solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the

proxy statement and other relevant materials to be filed with the SEC.