Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MOSAIC CO | d318096d8k.htm |

North American Phosphate Outlook

Dr. Michael Rahm

Vice President

Market and Strategic Analysis

CRU Phosphates 2012 Conference

Hotel Mazagan

El-Jadida, Morocco

March 19-21, 2012

Exhibit 99.1 |

2

Safe Harbor Statement

This presentation contains forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about

future financial and operating results. Such statements are based upon the current beliefs and

expectations of The Mosaic Company’s management and are subject to significant risks and

uncertainties. These risks and uncertainties include but are not limited to the predictability and volatility of, and

customer expectations about, agriculture, fertilizer, raw material, energy and transportation

markets that are subject to competitive and other pressures and economic and credit market

conditions; the level of inventories in the distribution channels for crop nutrients; changes in

foreign currency and exchange rates; international trade risks; changes in government policy; changes in

environmental and other governmental regulation, including greenhouse gas regulation, and

implementation of the U.S. Environmental Protection Agency’s numeric water quality

standards for the discharge of nutrients into Florida lakes and streams or possible efforts to

reduce the flow of excess nutrients into the Gulf of Mexico; further developments in the lawsuit

involving the federal wetlands permit for the extension of the Company’s South Fort Meade,

Florida, mine into Hardee County, including orders, rulings, injunctions or other actions by the

court or actions by the plaintiffs, the Army Corps of Engineers or others in relation to the

lawsuit, or any actions the Company may identify and implement in an effort to mitigate the

effects of the lawsuit; other difficulties or delays in receiving, or increased costs of, necessary governmental permits or

approvals; the effectiveness of our processes for managing our strategic priorities; adverse weather

conditions affecting operations in Central Florida or the Gulf Coast of the United States,

including potential hurricanes or excess rainfall; actual costs of various items differing from

management’s current estimates, including, among others, asset retirement, environmental

remediation, reclamation or other environmental regulation, or Canadian resources taxes and royalties;

accidents and other disruptions involving Mosaic’s operations, including brine inflows at its

Esterhazy, Saskatchewan potash mine and other potential mine fires, floods, explosions, seismic

events or releases of hazardous or volatile chemicals, as well as other risks and uncertainties

reported from time to time in The Mosaic Company’s reports filed with the Securities and

Exchange Commission. Actual results may differ from those set forth in the forward-looking

statements. |

Topics

Current Situation and Near Term Outlook

Long Term Outlook

Evolving Role of U.S. Industry

3 |

Current Situation and Near Term Outlook |

Expected

Features

Positive crop nutrient demand drivers

Record global phosphate shipments but . . .

A slow start followed by a fast finish this year

Lower and less volatile raw materials costs

Several supply and demand uncertainties

Impacted by sentiment and intangibles

5 |

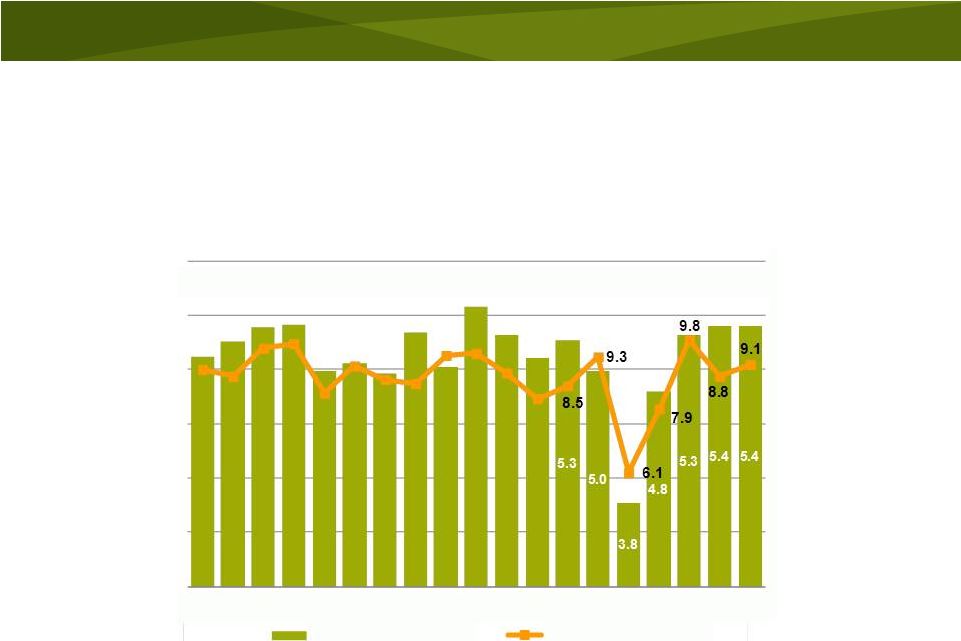

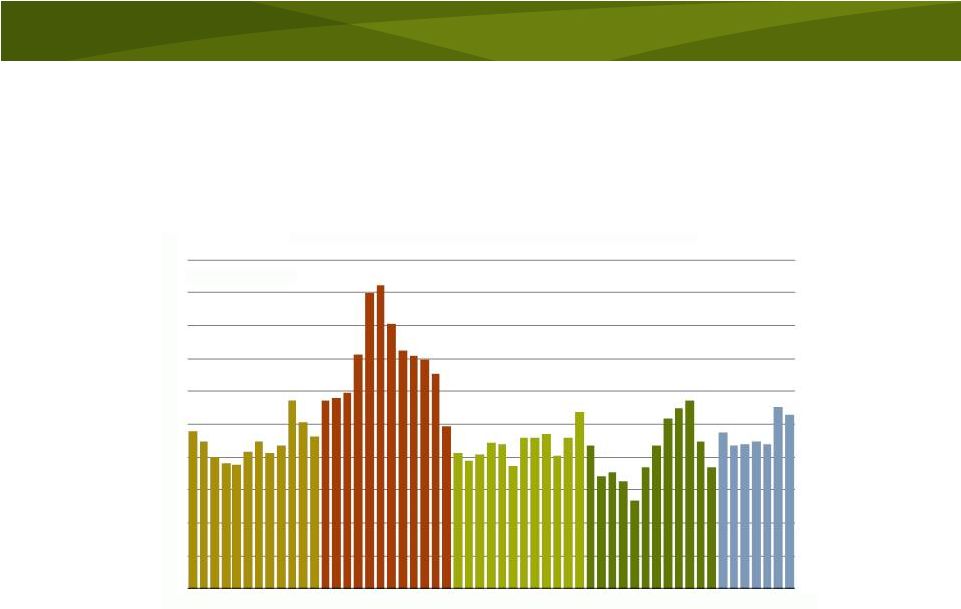

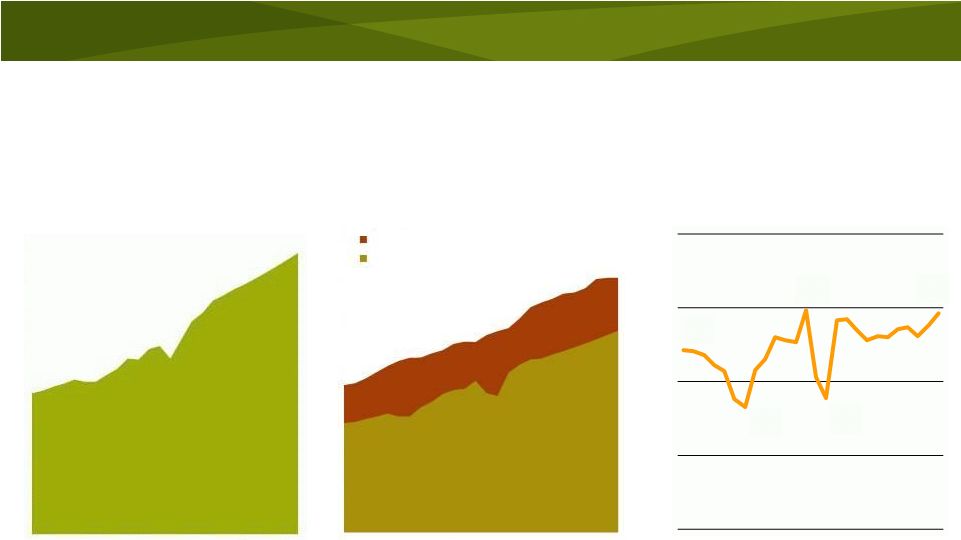

Positive crop nutrient demand drivers

6

Markets still signaling for more area and yield

3.50

4.00

4.50

5.00

5.50

6.00

6.50

7.00

7.50

8.00

O

N

D

J

F

M

A

M

J

J

US$ BU

New Crop Corn Prices

Daily Close of the New Crop Option October 1 to June 30

2008

2009

2010

2011

2012

Source: CBOT

7.00

8.00

9.00

10.00

11.00

12.00

13.00

14.00

15.00

16.00

O

N

D

J

F

M

A

M

J

J

US$ BU

New Crop Soybean Prices

Daily Close of the New Crop Option October 1 to June 30

2008

2009

2010

2011

2012

Source: CBOT |

High

prices in 2011 did not move the needle 7

300

350

400

450

500

550

600

650

00/01

01/02

02/03

03/04

04/05

05/06

06/07

07/08

08/09

09/10

10/11E11/12F12/13F13/14F

Mil Tonnes

World Grain & Oilseed Stocks

Source: USDA and Mosaic

2013/14 Grain and Oilseed Scenario Assumptions

Low

Medium

High

Harvested Area Change

0.00%

0.25%

0.50%

Yield Deviation from Trend *

Largest Negative

0.0%

Largest Positve

Demand Growth

1.75%

2.00%

2.25%

* Largest deviation from the 11-year trend 2000-2010

Trend yields in 2012

and

2013

don’

t

keep pace with 2%

demand growth! |

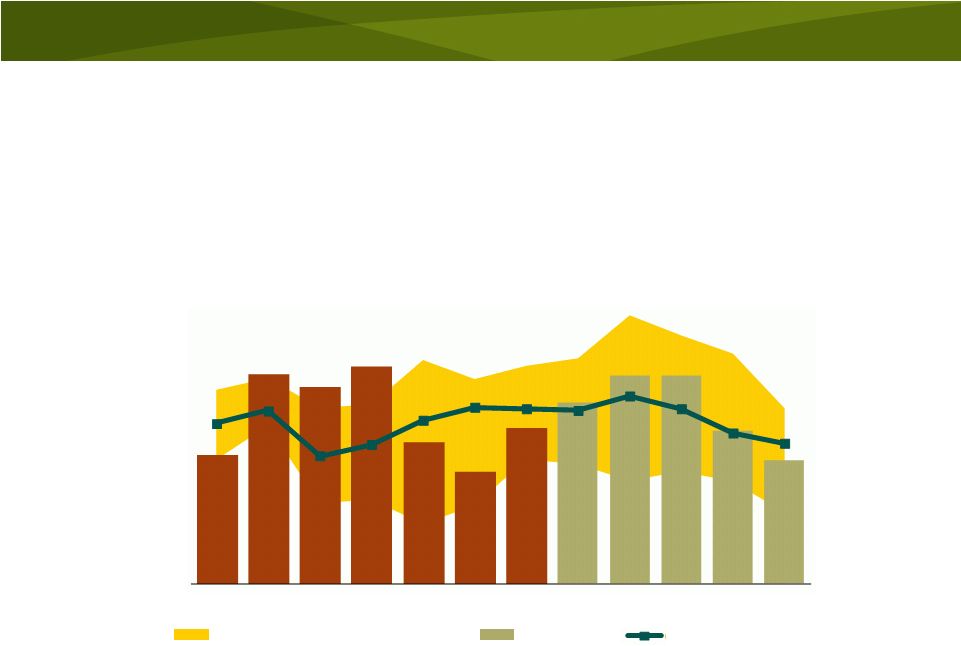

Potential for a strong supply response

8

2.40

2.50

2.60

2.70

2.80

2.90

3.00

3.10

780

800

820

840

860

880

900

920

00/01

01/02

02/03

03/04

04/05

05/06

06/07

07/08

08/09

09/10

10/11

11/12

MT Ha

Mil Ha

World Grain and Oilseed Area and Yields

Harvested Area

Yield

Trend

Source: USDA

2000

2100

2200

2300

2400

2500

2600

2700

2800

2900

3000

00/01

01/02

02/03

03/04

04/05

05/06

06/07

07/08

08/09

09/10

10/11E

11/12F

12/13F

Mil Tonnes

World Grain & Oilseed Production

Historical

2012/13 Range

2012/13 Medium Scenario

Source: USDA and Mosaic

Record harvested area record average

yield record production global

demand in 2011/12 +

=

= |

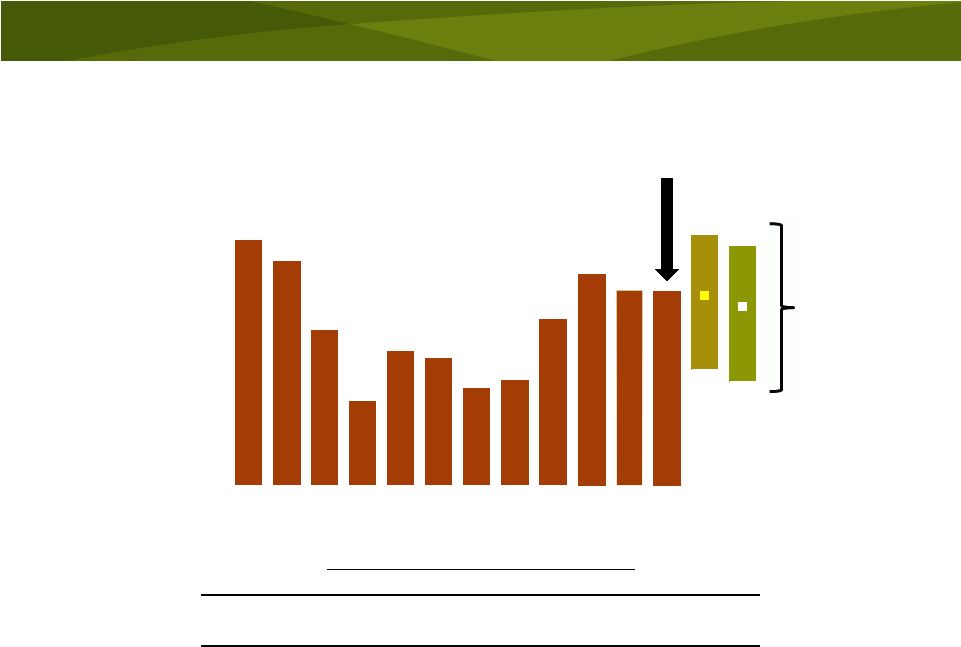

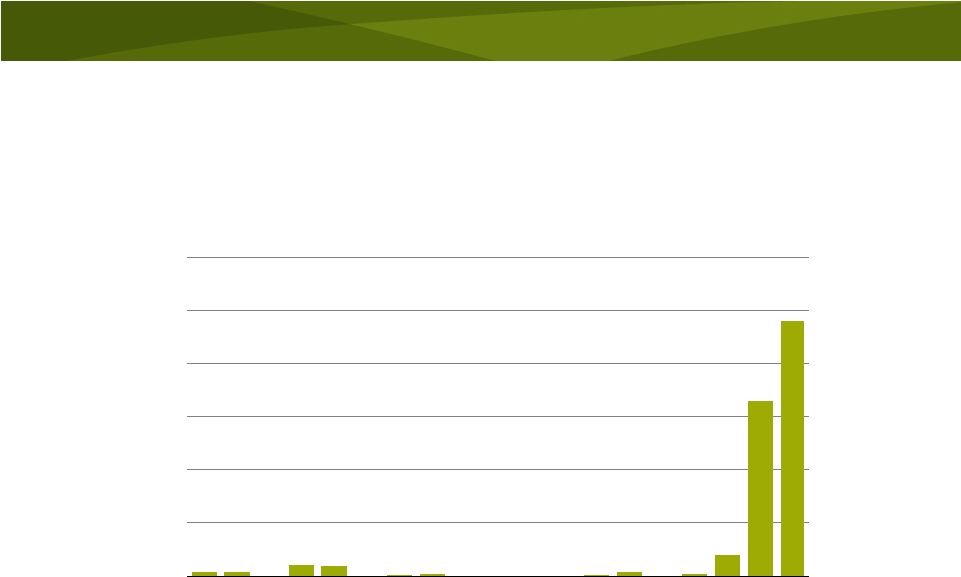

Positive drivers underpin record phosphate

shipment forecasts

9

Source: Fertecon and Mosaic

51

47

52

58

60

62-64

64-66

0

10

20

30

40

50

60

70

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11E

12F

13F

Mil Tonnes

DAP/MAP/MES/TSP

World Processed Phosphate Shipments |

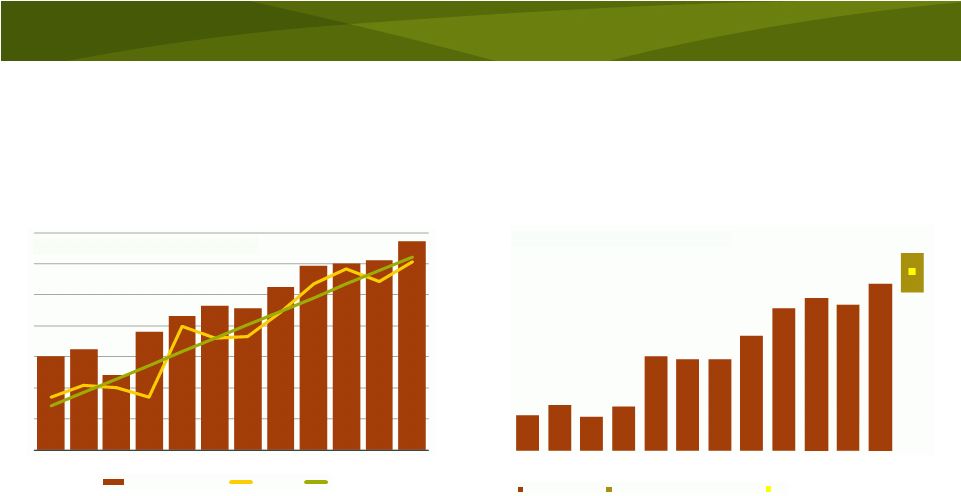

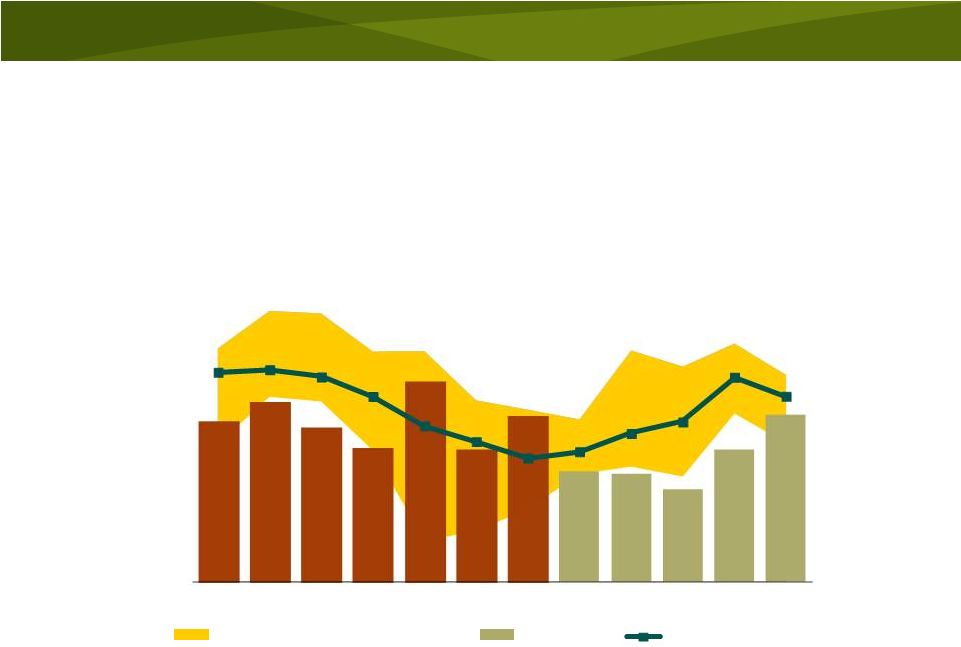

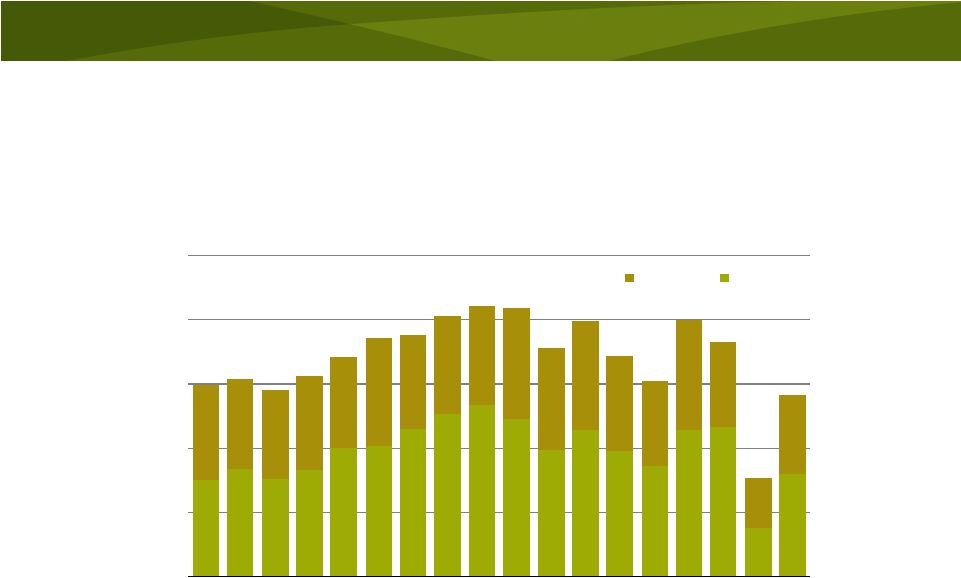

North American phosphate shipments and

use have recovered to high levels

10

3.0

4.5

6.0

7.5

9.0

10.5

12.0

3.0

3.5

4.0

4.5

5.0

5.5

6.0

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11E12F

13F

Mil Tons

Product

Mil Tons

P

2

O

5

NA Phosphate Use and DAP/MAP/MES/TSP Shipments

Phosphate Use

Total Shipments

Source: AAPFCO, TFI, IFA and Mosaic

Fertilizer Year Ending June 30 |

Strong U.S. shipments last Fall followed by

slow movement this Winter

11

0.0

0.2

0.4

0.6

0.8

1.0

1.2

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

Apr

May

Jun

Mil Tons

U.S. DAP and MAP/MES Domestic Shipments

2011/12 Fcst

6-Yr Olympic Avg

Source: TFI and Mosaic

MIN MAX Range (2005/06-2010/11) |

Average North American shipments expected

this Spring

12

Source: TFI, USDC and Mosaic

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

Jul-Dec

Jan

Jun

Mil Tons

Implied North American Phosphate Shipments

5

Yr Min-Max Range

2011/12

5-Yr Average

-

- |

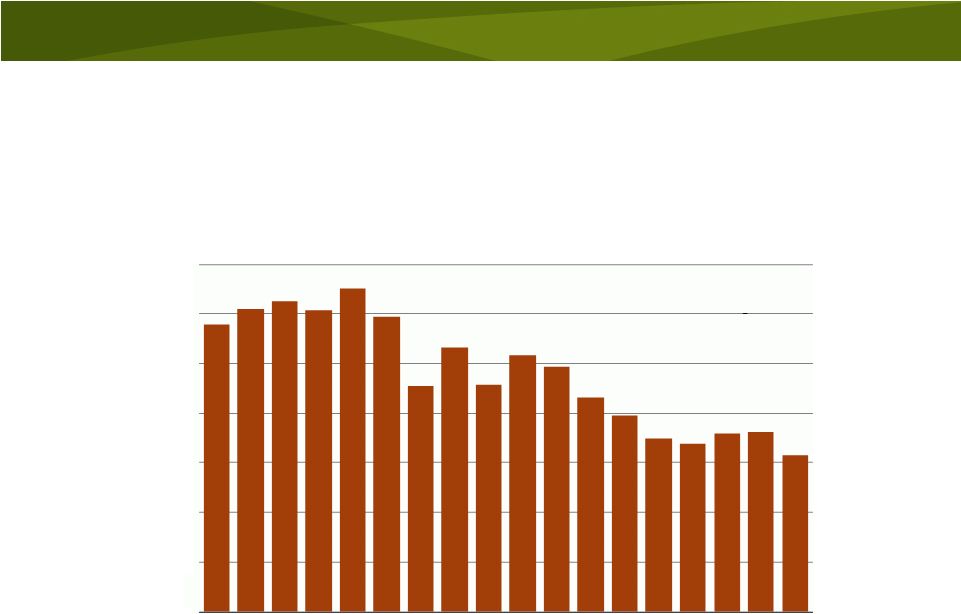

U.S. exports have stabilized in the 6-7 million

ton range during the last five years

13

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11

12F

0.0

2.0

4.0

6.0

8.0

10.0

12.0

14.0

Mil Tons

U.S. DAP and MAP/MES Exports

Source: TFI and Mosaic

Fertilizer Year Ending June 30 |

Low

shipments during the FH of 2012 expected to

reduce

U.S.

exports

this

fertilizer

year

14

0.0

0.2

0.4

0.6

0.8

1.0

1.2

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

Apr

May

Jun

Mil Tons

U.S. DAP and MAP/MES Exports

MIN

MAX

Range

(2005/06-2010/11)

2011/12 Fcst

6-Yr Olympic Avg

Source: TFI and Mosaic |

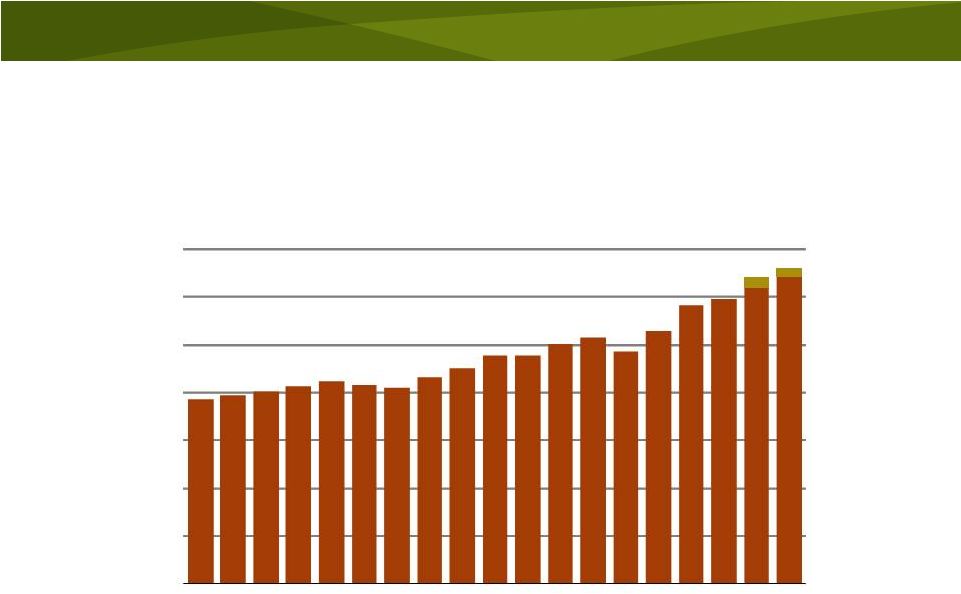

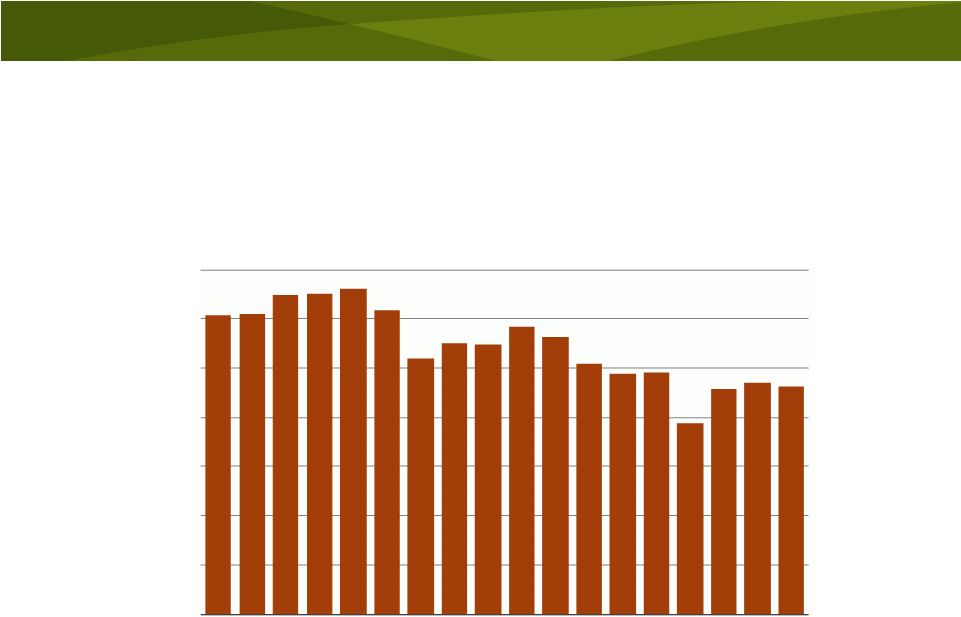

U.S. DAP/MAP/MES production has

remained steady at about 14 million tons

15

0.0

3.0

6.0

9.0

12.0

15.0

18.0

21.0

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11

12F

Mil Tons

U.S. DAP and MAP/MES Production

Source: TFI and Mosaic

Fertilizer Year Ending June 30 |

Record shattering U.S. imports in 2010/11

but significantly less expected in 2011/12

16

0.0

0.2

0.4

0.6

0.8

1.0

1.2

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11

12F

Mil Tons

U.S. DAP and MAP Imports

Source: TFI, USDOC, and Mosaic

Fertilizer Year Ending June 30 |

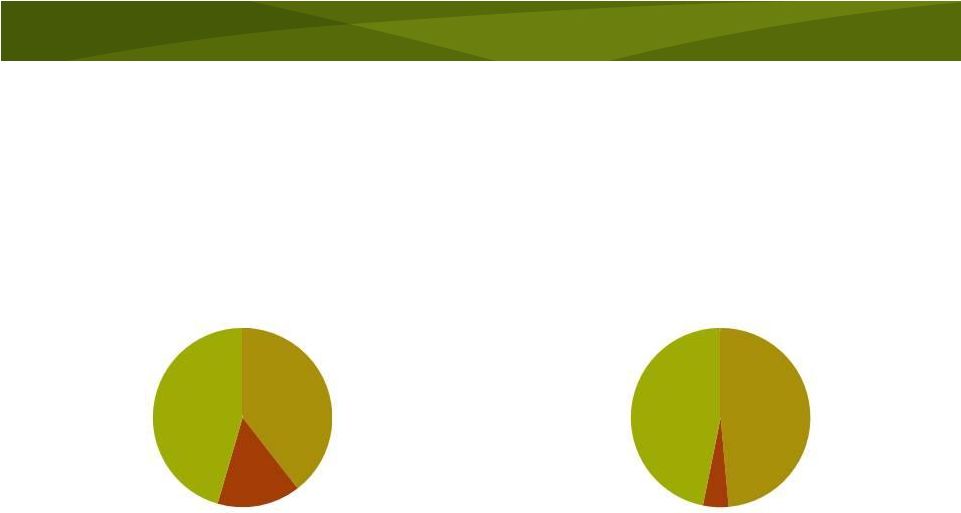

North American offshore imports have

declined from record levels in 2010/11

17

Mosaic 39.5%

Imports

15.0%

Other NA

45.5%

North American Phosphate Shipments

2010/11

Mosaic 48.6%

Imports 4.6%

Other NA

46.8%

North American Phosphate Shipments

2011/12 YTD |

U.S. DAP/MAP producer stocks have

increased but remain within recent ranges

18

0.0

0.2

0.4

0.6

0.8

1.0

1.2

1.4

1.6

1.8

2.0

Jul

07/08

Oct

Jan

Apr

Jul

08/09

Oct

Jan

Apr

Jul

09/10

Oct

Jan

Apr

Jul

10/11

Oct

Jan

Apr

Jul

11/12

Oct

Jan

Mil Tons

U.S. DAP and MAP Producer Stocks

Source: TFI |

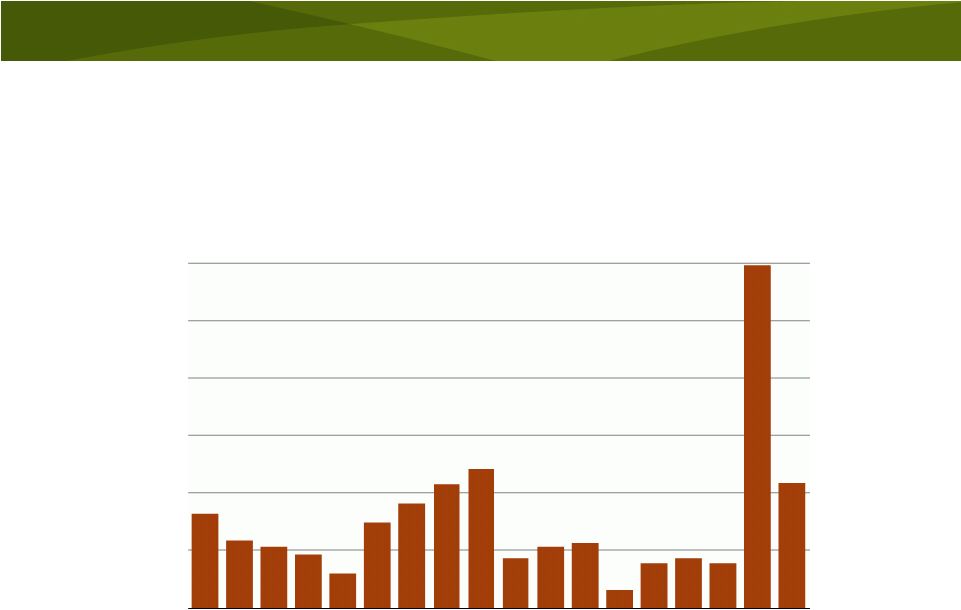

Lower and less volatile raw materials costs

19

0

100

200

300

400

500

600

700

05

06

07

08

09

10

11

12

$ LT

Sulphur Prices

c&f Tampa

Source: Green Markets

0

50

100

150

200

250

05

06

07

08

09

10

11

12

$ MT

Phosphate Rock Prices

fob Morocco

Source: Fertilizer Week |

Lower and less volatile raw materials costs

20

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

Jan 05

Jan 06

Jan 07

Jan 08

Jan 09

Jan 10

Jan 11

Jan 12

$ MM Btu

Henry Hub Natural Gas Price

Daily Closing Price of the Front Month Contract

Source: NYMEX

0

100

200

300

400

500

600

700

800

900

1000

05

06

07

08

09

10

11

12

$ MT

Ammonia Prices

c&f Tampa

Source: Fertecon |

Several Uncertainties

Indian demand

Chinese exports

Ma’aden ramp-up

Arab Spring production disruptions

21 |

Impact of higher retail prices on Indian demand

22

Rupees Tonne Unless Noted

2010/11

2011/12 FH

2011/12 SH

2012/13A

2012/13B

2012/13C

(1)

DAP Contract Price c&f India (US$ Tonne)

$500

$612

$677

$525

$565

$600

(2)

Rupee/US$ (Average for Period or Forecast)

45.6

45.3

50.6

49.5

49.5

49.5

(3)

DAP Contract Price c&f India Duty Unpaid

22,785

27,703

34,262

25,988

27,968

29,700

(4)

DAP Contract Price c&f India Duty/Taxes Paid+Insurance

23,998

29,464

36,425

27,643

29,744

31,583

(5)

Estimated Bogey from Vessel to Retail Shelf

2,400

2,400

2,400

2,400

2,400

2,400

(6)

Estimated Cost Retail Shelf

26,398

31,864

38,825

30,043

32,144

33,983

(7)

Subsidy (excluding primary and secondary freight subsidy)

16,268

19,763

19,763

14,348

14,348

18,288

(8)

Implied Retail Price

10,130

12,101

19,062

15,695

17,796

15,695

(9)

Percent Change

8%

19%

88%

-18%

-7%

-18%

The Maximum Retail Price of DAP was unchanged at R9350 from April 2002 to

April 2010. Scenario A - Based on recent bids for spot cargos at

$525 tonne c&f India and the approved subsidy level of R14,348 tonne.

Scenario B - Based on Q1 acid price of $960 tonne c&f India, a spot

ammonia price of $375 tonne c&f India and the approved subsidy of R14,348 tonne.

Scenario C - Based on spot price plus a risk premium for potential

sulphur and ammonia price increases. Solves for subsidy to achieve Scenario A retail price.

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

9.0

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11E

Mil Tonnes

India Processed Phosphate Import Demand

Source: Fertecon, IFA and Mosaic

TSP

MAP

DAP |

Chinese exports in 2012

23

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11E

Mil Tonnes

China Processed Phosphate Export Supply

TSP

MAP

DAP

Source: Fertecon, IFA, China Customs and Mosaic |

Ma’aden ramp-up

24

0.0

0.5

1.0

1.5

2.0

2.5

3.0

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11E

12F

13F

Mil Tonnes

Saudi Arabia DAP Export Supply

Source: Fertecon |

Arab Spring production disruptions

25

0.0

0.5

1.0

1.5

2.0

2.5

95

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11E

12F

Mil Tonnes

Tunisia Processed Phosphate Export Supply

TSP

DAP

Source: Fertecon |

Key Factors to Handicap

Agricultural commodity prices

-

Weather

–

beware

a

big

supply

response

-

Political

and

economic

developments

–

impact

on

energy

prices and the value of the dollar

-

Speculative positions

The Uncertainties

-

Indian demand

-

Chinese exports

-

Ma’aden ramp-up

-

Arab Spring

Sentiment and Intangibles

-

Buyer caution

-

Price expectations and channel inventories

-

Marketing strategies of suppliers with new capacity or new

product mix

26 |

Long Term Outlook |

Expected

Developments

28

Strong demand growth underpinned by the food

and energy stories

-

Relatively high commodity prices

-

Profitable farm economics

-

Global phosphate demand growth of 2.5%-3.0% per year

-

DAP/MAP/TSP shipment growth of ~3% per year

Net capacity increases expected to keep pace

with demand growth

Nearly all of the projected demand and capacity

growth outside North America

North American industry projected to remain a

large and stable producer and exporter |

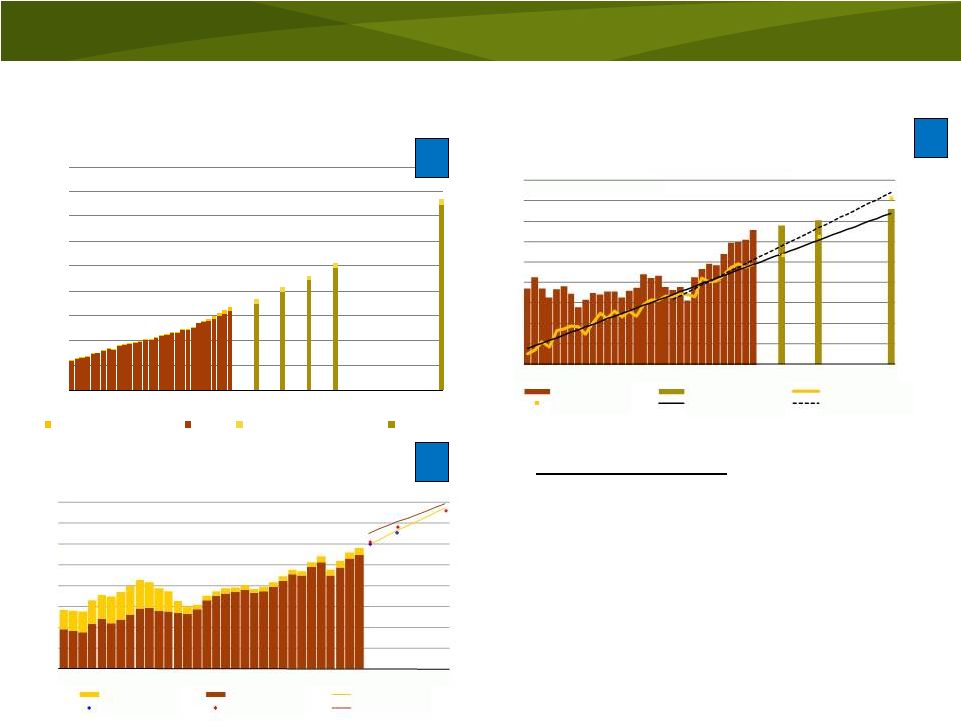

The

food story by the numbers 29

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

5,000

5,500

80

85

90

95

00

05

10

15

20

25

30

50

Mil Tonnes

Source: USDA and Mosaic

World Grain and Oilseed Use

Actual for U.S. Ethanol

Actual

Forecast for U.S. Ethanol

Forecast

1.

Population growth and increases in per capital GDP

are expected to generate steady and predictable

increases in global grain and oilseed (food) demand.

2.

Farmers around the globe will need to harvest record

area and produce yields that exceed the 30-year

trend in order to meet projected demand.

3.

Additional harvested area and higher yields will drive

continued increases in crop nutrient demand.

2

3

1

Connecting

the

Dots

60

80

100

120

140

160

180

200

220

80

85

90

95

00

05

10

15

20

Mil Tonnes

World Crop Nutrient Use

Actual -

FSU

Actual -

ROW

Mosaic Model

IFA

Fertecon

Mosaic Survey

1.75

2.00

2.25

2.50

2.75

3.00

3.25

3.50

3.75

4.00

750

775

800

825

850

875

900

925

950

975

80

85

90

95

00

05

10

15

20

25

30

MT Ha

Mil Ha

Source: USDA and Mosaic

World Harvested Area and Average Yield

Actual Area

Forecast Area

Actual Yield

Required Yield

1980-10 Yield Trend

2000-10 Yield Trend |

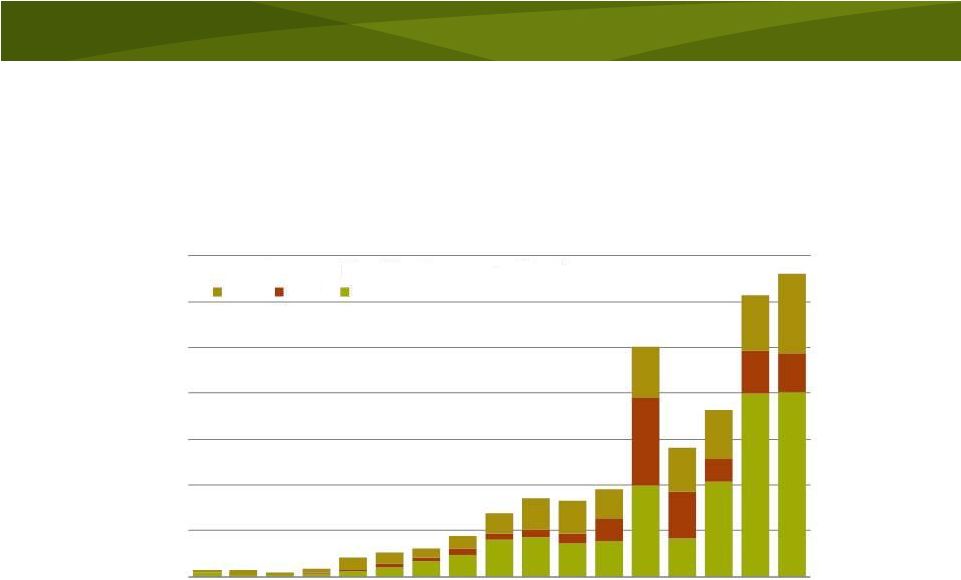

Positive long term outlook

30

World Acid Production

Million Tonnes P

O

5

2

0

10

20

30

40

50

60

70

95

00

05

10

15

20

Capacity

Production to Meet Demand

0

10

20

30

40

50

60

70

80

95

00

05

10

15

20

World Phosphate Shipments

Million Tonnes DAP/MAP/MES/TSP

74%

66%

80%

68%

79%

50%

60%

70%

80%

90%

95

00

05

10

15

20

World Acid Operating Rates |

The Evolving Role of the U.S. Industry |

Expected

Evolution

32

Lesser role in a growing global market but . . .

Still a large and stable U.S. industry

Focus on maintaining a competitive advantage

-

Florida

–

large

scale,

low

cost

rock

mining

operations

-

Louisiana

–

cost

advantaged

sulphur,

ammonia

and

access

to major U.S. agricultural regions

Focus on productivity/efficiency enhancements

Focus on innovative premium products

More limited geographic reach but . . .

-

Moving further down the value chain

-

Marketing innovative premium products

-

Focusing on high productivity agricultural systems

-

Shipping to freight advantaged regions

The next generation of crop nutrients for the next generation of farming |

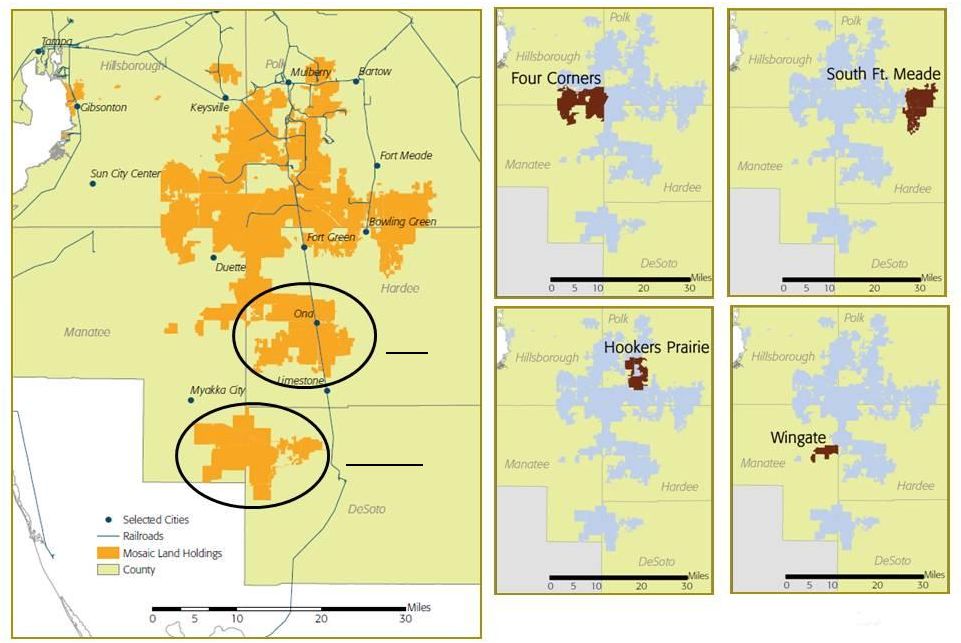

33

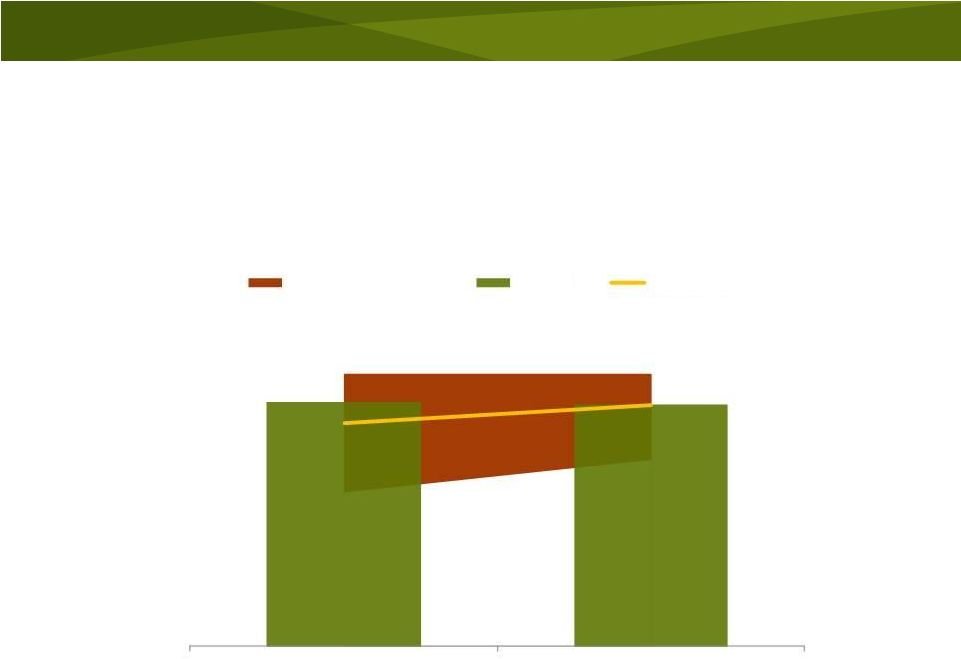

Rock is our competitive advantage in Florida

Ona

DeSoto |

Our

Florida operations have more than 45 years of rock reserves

34

Our Florida chemical plants require

about 11.8 million tonnes of rock per

year when running at 90% of

capacity.

Our current reserves are sufficient

to run our Florida operations for

more than 45 years.

Source: Mosaic 2010/11 10-K.

Phosphate Rock Reserves

Reserve

Average

Percent

Unit: million tonnes

Tonnes

BPL

P

2

O

5

Active Mines

Four Corners, FL

53.6

65.9

30.2

South Fort Meade, FL

53.8

64.2

29.4

Hookers Prairie, FL

5.7

65.5

30.0

Wingate, FL

36.5

63.5

29.1

Total Active Mines

149.6

64.2

29.4

Future Mines

Ona

245.5

63.5

29.0

DeSoto

148.0

64.8

29.7

Total Future Mining

393.5

64.0

29.3

Total Mining

543.1

64.2

29.4 |

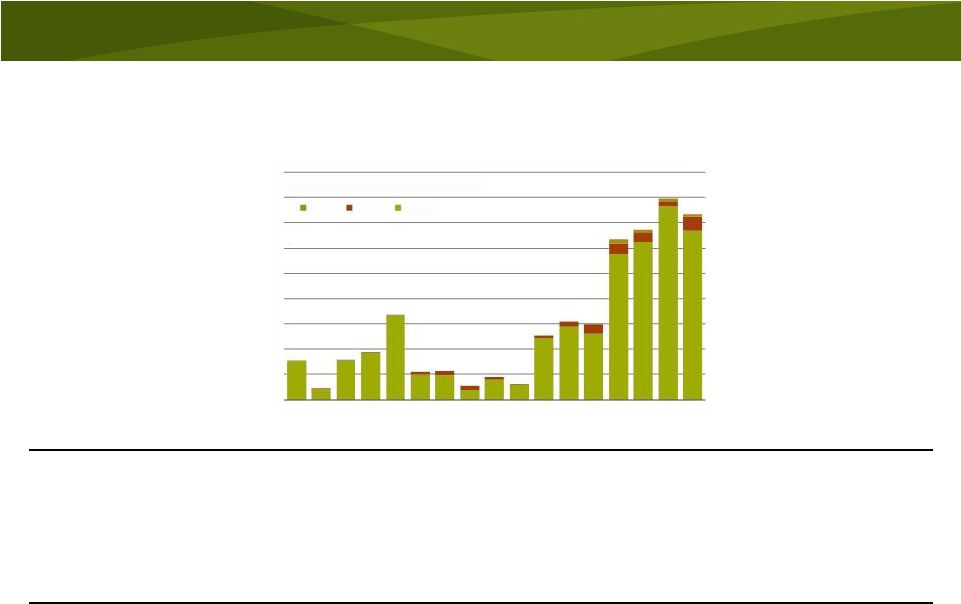

35

Innovative Premium Products

MicroEssentials

®

deliver significant value

-

Sulphur in elemental and sulphate form as well as

micronutrients ribboned throughout each granule

-

Yield increases of 3%-7% based on field trials conducted

during the last 10 years

-

Largest yield boost in the most intensive cropping systems

Rapid adoption of MicroEssentials

®

-

Production of 1.3 million tonnes in CY 2011, up from 1.0

million tonnes in 2010

-

Marketed to strategic customers in both North America and

key offshore geographies

Investing in expected future demand growth

-

Produced today in two granulation plants at Bartow and

Riverview with annual capacity of ~1.5 million tonnes

-

Capacity will increase to 2.3 million tonnes in April 2012

with the conversion of our Faustina C train

-

Projects under evaluation to increase capacity to match

expected demand growth |

North American Phosphate Outlook

Dr. Michael Rahm

Vice President

Market and Strategic Analysis

CRU Phosphates 2012 Conference

Hotel Mazagan

El-Jadida, Morocco

March 19-21, 2012

Thank You! |