Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Tower Group International, Ltd. | d317461d8k.htm |

1.

March 19, 2012

Investor Presentation

NYSSA 16th Annual Insurance Conference

Exhibit 99.1 |

| 1

Forward-Looking Statements

The Private Securities Litigation Reform Act of 1995 provides a "safe

harbor" for forward-looking statements. This press release and

any other written or oral statements made by or on behalf of Tower may

include forward-looking statements that reflect Tower's current views with

respect to future events and financial performance. All statements other

than statements of historical fact included in this press release are

forward-looking statements. Forward-looking statements can generally be identified by the use of

forward-looking terminology such as "may," "will,"

"plan," "expect," "project," "intend," "estimate,”

"anticipate," "believe" and "continue" or their

negative or variations or similar terminology. All forward- looking

statements address matters that involve risks and uncertainties. Accordingly, there are or will be

important factors that could cause the actual results of Tower to differ

materially from those indicated in these statements. Please refer to

Tower's filings with the SEC, including among others Tower's Annual

Report on Form 10-K for the year ended December 31, 2011 for a description

of the important factors that could cause the actual results of Tower to

differ materially from those indicated in these statements.

Forward-looking statements speak only as of the date on which they are

made, and Tower undertakes no obligation to update publicly or revise

any forward-looking statement, whether as a result of new

information, future developments or otherwise.

Notes on Non-GAAP Financial Measures

(1)

Operating income excludes realized gains and losses, acquisition-related

transaction costs and the results of the reciprocal business, net of

tax. Operating income is a common measurement for property and casualty

insurance companies. We believe this presentation enhances the understanding of our results of

operations by highlighting the underlying profitability of our insurance

business. Additionally, these measures are a key internal management

performance standard. Operating earnings per share is operating income

divided by diluted weighted average shares outstanding. Operating return on equity is annualized

operating income divided by average common stockholders' equity.

(2)

Total premiums include gross premiums written through our insurance

subsidiaries and produced as managing general agent on behalf of other

insurance companies. |

| 2

Presentation Outline

I. Overview of Tower

II. Strategy

III. Financial Review

IV. Summary |

I. Overview of Tower

3 |

4

Diversified

Property

and

Casualty

Insurance

Company

With

a

Niche

Focus

•

Headquartered in New York City

•

Over 20 year track record of excellent operating performance

•

Top 50 P&C insurance company in U.S., rated “A-" by A.M. Best

with positive outlook •

2011 GPW of $1.8B and over $1B in equity

Broad Product Offering

Expanding National Presence

•

20 offices nationwide

•

Over 1400 employees

Overview of Tower (“TWGP”)

Commercial General

Commercial Specialty

Personal Lines

Home and auto |

5

Our 20-Year History

Insurance company formation

in 1990/MGA in 1996

IPO in October, 2004;

CastlePoint formation in 2006

CastlePoint merger in 2009

80% of premiums transferred to

reinsurers and other insurance

companies

Approximately 50% of

premiums transferred to

CastlePoint

86% of premiums retained;

Deployed capital from CastlePoint

to make acquisitions; Implemented

organic growth initiative

Commercial lines and

homeowners business

Commercial lines and

homeowners business

Commercial/Specialty/ Personal

New York City

Northeast with limited

expansion nationally

Primarily U.S. with limited

international business

$0 to $230 million in premiums

$805 million in premiums in 2008

$1.8B in premiums in 2011

$2 million to $18 million in capital

$319 million in capital

$1B + in capital

Summary

Product / Geographical Focus

GPW & Managed / Capital |

II. Strategic Review

6 |

7

Strategies

Expand products, Geography

and Distribution

Focus on niche markets,

specialize and customize

Expand non-risk-bearing

sources of revenue

Generate organic growth

Acquire insurance companies

or make strategic investments

in distribution sources

Diversification and favorable

ratio of premium volume

opportunity to capital

Significantly outperform

industry results in growth and

profitability

Increase ROE by generating

commission and fee income

Achieve scale and expand into

targeted products and markets

Consolidate and expand into

targeted products and markets

Advantage

Tower’s Strategic Responses to Marketplace Challenges

|

8

Diversification Strategy

FY 2011

Products

•

Strong track record of developing and expanding

product lines

Geography

•

Leverage existing products across the country

Distribution

•

Build different distribution sources to capitalize on

market opportunities |

9

Business Segment Strategy

Commercial

Customers

Products

Underwriting

Strategy

Personal

General

Specialty

Comprehensive product

offering to small business

owners

Narrowly focused

customized specialty

products

Individual homeowners and

drivers

Apartment buildings, retail

stores, restaurants and

artisan contractors

Garage liability, commercial

construction, specialty

transportation, professional

employers organizations and

Lloyd’s business

Homeowners, auto and

package

Focus on personal package

policies to differentiate from

direct writers

Use reciprocal structures to

provide additional capacity

and generate fee income

Expand specialty classes of

business

Customize products for select

industries and key producers

Partner with specialty

underwriting managers,

including Lloyd’s syndicates

Focus on small segment

Improve scale and

automation

Leverage products across the

country |

10

Growth in Fee Income

Higher ROE Results From Generating Commission and Fee Income

•

Fully

leveraged

capital

in

our

own

company

after

the

CastlePoint

acquisition

in

2009

•

Began generating fee income by transferring premiums to reinsurers and other

insurance companies after the One Beacon personal lines acquisition in

July 2010 »

Generated

$63.3

million

in

commission

and

fee

income

in

2011,

up

from

$55.8

million in

same period last year. |

11

Organic Growth Initiative

Expand Products

•

Expand our product lines platform

•

Develop products for target industry and customer groups

•

Leverage existing products across the country

Develop entrepreneurs

•

Transform our existing business units into self-sufficient operating

units •

Create new business units to expand into new producers and markets

•

Acquire underwriting talent to support organic growth

Improve business processes related to organic growth

•

Create

a

new

department

to

research,

identify

and

analyze

growth

opportunities

•

Improve our ability to develop products

•

Improve corporate marketing and communication

•

Redesign business development to improve our ability to understand and deliver

products to meet the needs of our producers

•

Create a separate independent customer service department to ensure delivery

of superior customer service |

12

Improved Market Conditions and Outlook

Positive market trends emerged in 2011

•

Strong organic growth (10%) from two newly created business units

»

customized solutions and assumed reinsurance generated GPW of $158

million in 2011

•

Favorable pricing trends emerged in 4Q of 2011

»

2.3% renewal rate increase for all businesses excluding program business

and assumed reinsurance

Outlook for 2012

•

Continued implementation of organic growth initiative

»

New lines of business: Surety, inland marine and commercial property

»

Creating new business units and developing several joint ventures with

managing general agencies and Lloyd’s syndicates

»

Developing a growing pipeline of new products and market opportunities

•

Continue to drive meaningful pricing increases in 2012

»

Meaningful rate increases in certain areas, such as California

workers’ compensation and assumed reinsurance businesses

|

An Opportunistic Acquisition Strategy

Target small insurance and

managing general agencies

Strategic investments in

distribution sources

Seek acquisitions and make

strategic investments to expand

into new products, markets and

accomplish strategic objectives

Successful track record in

creating value through

expense reduction, re-

underwriting and cross selling

VALUE CREATION

PROFILE OF TARGETS

STRATEGY

13 |

III. Financial Review

14 |

15

2011 Highlights

Excluding the effect of storm losses, operating earnings would have been $104.3

million in 2011 compared to $109.2 million in 2010

Excluding the effect of storm losses, operating EPS would have been $2.55 in

2011 compared to $2.50 in 2010

Excluding the effect of storm losses, operating ROE would have been 9.8%

in 2011 and 10.4% in 2010.

Excluding

the

effect

of

storm

losses

,

Combined

Ratio

Excluding

the

Reciprocals

would have been 95.5% in 2011 and 93.9% in 2010.

|

16

Hurricane Irene’s Impact on Tower

Losses from Irene represented Tower’s single largest loss event in its

history •

Hurricane Irene was the first Hurricane to make landfall in the tri-state

region (NY, NJ and CT) since Gloria in 1985 and the first to make

landfall in NJ since 1903 •

$45M pre-tax loss from Irene is higher than Tower’s total catastrophe

losses throughout its history

•

Tower

was

ranked

6

with

3.9%

market

share

for

the

lines

of

business

affected

by

Irene

in

NJ,

NY

and

CT,

but

its

reported

loss

was

only

1%

of

the

total

estimated

industry

loss ($4.5B)

Tower’s property business has been historically very profitable and not

prone to catastrophe losses

•

Tower’s homeowners and commercial multiple peril ratio has averaged 50.7%

since 2005,

with

catastrophe

losses

contributing

only

a

minimal

amount

to

this

figure

•

Normal winter storm activity has historically had a minimal impact on

Tower’s earnings Favorable pricing trends and market

opportunity •

Homeowners and commercial property rates are expected to improve

•

Anticipate meaningful growth opportunity in 2012

th |

17

Strong and Consistent Track Record of Profitable Growth

AM Best and Company Data.

Total Premium Growth

Combined Ratio

Gross Premiums Written and Produced |

18

23.2

23.3

45.0

41.5

39.2

2007

2008

2009

2010

2011

Strong Track Record of Book Value Growth

Book Value Per Share*

*TWGP paid cash dividends of $0.15, $0.20, $0.26, $0.39 and $0.69 per share in

2007, 2008, 2009, 2010 and 2011 respectively.

Shareholders’

Equity

Shares Outstanding

$12.74

$13.67

$22.72

$25.19

$26.37

2007

2008

2009

2010

2011

$295

$319

$1,022

$1,045

$1,034

2007

2008

2009

2010

2011 |

19

$2.29

$2.76

$2.71

$2.23

$1.37

$0.27

$1.18

2007

2008

2009

2010

2011

Operating EPS

Severe Weather Related Losses

$52.9

$64.8

$107.3

$97.2

$56.0

$12.0

$48.3

2007

2008

2009

2010

2011

Operating Income

Severe Weather Related Losses

Strong Track Record of Operating Earnings and ROE

Operating Income

in millions

Operating Earnings Per Share

Operating ROE |

20

Declining Expense Ratio

Increase in premium volume is creating scale advantages for Tower

As systems initiatives relating to personal lines are completed,

we expect this scale advantage

to increase

Net Expense Ratio Excluding Reciprocals |

21

Loss Ratio and Reserves

2011 net adverse development of $17.0 million at Tower stock companies was from

December 2010 winter storm ($7M) and $10 M from discontinued programs

that we ceased underwriting in 2010 and 2011

|

22

Highly Rated Investments

Our high-quality investment portfolio had net unrealized pre-tax gains

of $115 million at December 31, 2011 attributable to Tower

shareholders •

Fixed income average quality of A+

•

Duration of 4.8 years

•

Tax equivalent book yield of 4.8%

Asset allocation

Asset quality |

23

Improving Investment Performance and Alternative

Investments Strategy

Strategy

•

Alternative investment commitment remains modest but should provide higher

yield and diversification from interest rate risk inherent in

fixed-income investments, and reduce capital markets

volatility •

Operating cash flows also invested in opportunistic repurchases of Tower

common stock since March 2010

Examples of Alternative Investments

•

Private equity type investments in small real estate projects

•

Minority ownership in distribution partners that have a strategic fit with

Tower $2,615

$2,701

12-31-2010

12-31-2011

Cash and Invested Assets

($millions)

4.7

4.6

4.8

6-30-2011

9-30-2011

12-31-2011

Tax-

Equivalent Fixed Income

Yield (%)

$106

$128

YTD 2010

YTD 2011

Net Investment Income

($millions) |

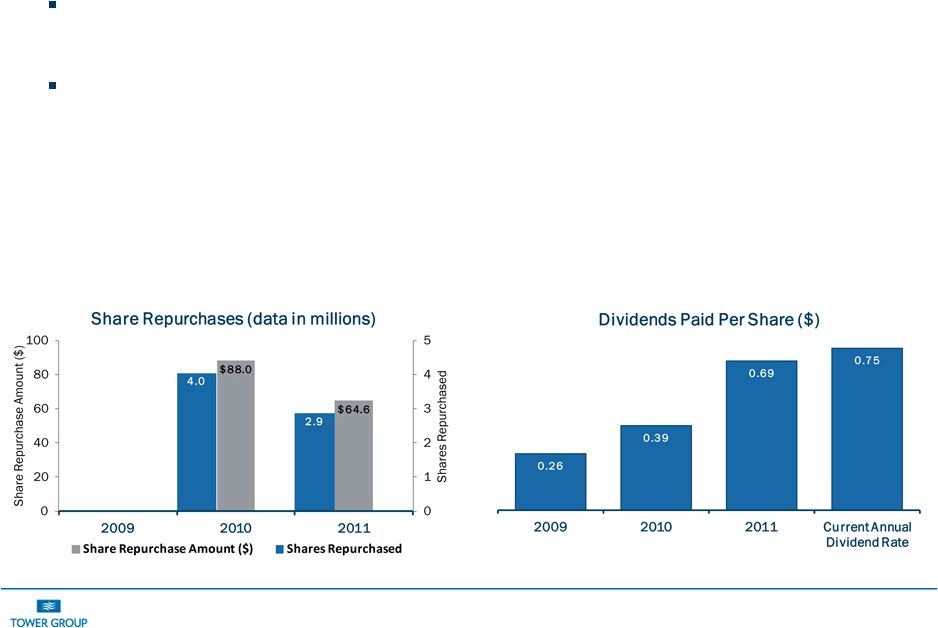

24

Capital Management

Strong Capitalization With Limited Need for Additional Capital

•

Significant growth in stockholders equity (from $319 million at December 2008

to $1 billion currently) •

Limited additional capital needed due to strong retained earnings and the use

of hybrid business model Use of Capital Management Tool to Deliver

Immediate Shareholder Value •

Repurchased 6.9 million shares of common stock totaling $153 million through

12/31/11 •

Quarterly dividend increased by 275%; dividend payout target at 25%

•

Share repurchases may slow in 2012 due to organic growth and improved market

conditions |

25

Guidance and Trends

($ in millions)

2010*

2011*

2012 Target*

Trend

beyond 2012

Annual GPW Growth

38.2%

21.0%

5% -

10%

Organic growth of 5% to 10% excluding growth from acquisitions

Loss Ratio

58.8%

62.3%

62%

-

63%

Loss ratio has stabilized close to 62% to 63% range

Expense Ratio

35.1%

33.2%

33.5%

-

34.5%

Expected decrease due to improved scale, automation and

lower acquisition cost

Combined Ratio

93.9%

95.5%

95.5%

-

97.5%

Future improvement will be driven primarily by expense ratio

savings from improved scale.

Investment Yield

4.7%

4.8%

4.7%

-

5.0%

Continued growth in invested assets with yield stabilization due

to alternative and strategic investments

Operating ROE & 2012

Guidance

10.4%

9.8%

9%

-

10%

$2.60

-

$2.70

Expect to see ROE’s below 10% in first half of 2012, with

improvements to 10%-12% range occurring in second half of

year and continuing beyond year end 2012.

*Excludes reciprocals and impact of Severe Weather Related Losses;

|

IV. Summary

26 |

27

Key Investment Considerations

Superior Track Record of Operating Performance

•

Consistently outperformed industry in terms of growth and profitability

•

Created significant value for shareholders since IPO in 2004

Diversified Business Platform With a Niche Market Focus

•

Provides organic growth opportunities

•

Allows allocation of capital to profitable market segments

Responsible Growth in Premiums and Fee Income

•

Premium growth achieved through acquisitions and new organic growth

initiatives •

Increasing commission and fee income

Proactive Capital Management

•

Share repurchase plan in effect

•

275% increase in dividends per share since 2008

Positive pricing trends and Outlook

•

Positive pricing trends and favorable outlook for organic growth

•

Full

deployment

of

capital

to

achieve

10%

-

12%

ROE |

28

Questions? |