Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - Morningstar, Inc. | morn_exhibitx312x12312011a.htm |

| EX-31.1 - EX-31.1 - Morningstar, Inc. | morn_exhibitx311x12312011a.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 10-K/A | ||||

Amendment No. 1 | ||||

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2011

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-51280

MORNINGSTAR, INC.

(Exact Name of Registrant as Specified in its Charter)

Illinois | 36-3297908 | |

(State or Other Jurisdiction of | (I.R.S. Employer | |

Incorporation or Organization) | Identification Number) | |

22 West Washington Street

Chicago, Illinois

60602

(Address of Principal Executive Offices)

(312) 696-6000

(Registrant's Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common stock, no par value | The NASDAQ Stock Market LLC | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | ||

(Do not check if a smaller reporting company) | |||||

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of shares of common stock held by non-affiliates of the Registrant as of June 30, 2011 was $1,498,106,979. As of February 17, 2012, there were 50,134,439 shares of the Registrant's common stock, no par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain parts of the Registrant's Definitive Proxy Statement for the 2012 Annual Meeting of Shareholders are incorporated into Part III of this Form 10-K.

EXPLANATORY NOTE

On February 24, 2012, Morningstar, Inc. (the Company) filed its Annual Report on Form 10-K for the year ended December 31, 2011 with the Securities and Exchange Commission. The Company is providing Item 1 of Part I of Form 10-K in this Form 10-K/A filing to correctly reflect the totals for retirement plan participants, plan sponsors, and plan providers who had access to its Retirement Solutions programs (24.7 million, approximately 192,000, and 25, respectively) as of December 31, 2011. Except as set forth above, no other changes are made to the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2011.

Table of Contents

Part I

Item 1. Business

Morningstar is a leading provider of independent investment research to investors around the world. Since our founding in 1984, our mission has been to create great products that help investors reach their financial goals. Through our Investment Information segment, we offer an extensive line of data, software, and research products for individual investors, financial advisors, and institutional clients. We also provide asset management services for advisors, institutions, and retirement plan participants through our Investment Management segment. In addition to our U.S.-based products and services, we offer local versions of our products designed for investors in Asia, Australia, Canada, Europe, Latin America, and South Africa. Morningstar serves approximately 8 million individual investors, 250,000 financial advisors, and 4,500 institutional clients. We have operations in 27 countries.

We maintain a series of comprehensive databases on many types of investments, focusing on investment vehicles that are widely used by investors globally. After building these databases, we add value and insight to the data by applying our core skills of research, technology, and design. As of December 31, 2011, we provided extensive data on approximately 375,000 investments, including:

• | 31,700 mutual fund share classes in the United States; |

• | 91,500 mutual funds and similar vehicles in international markets; |

• | 8,800 exchange-traded funds (ETFs); |

• | 1,600 closed-end funds |

• | 32,000 stocks; |

• | 7,200 hedge funds; |

• | 8,100 separate accounts and collective investment trusts; |

• | 120,500 variable annuity/life subaccounts and policies; |

• | 49,900 insurance, pension, and life funds; |

• | 12,100 unit investment trusts; and |

• | 4,300 state-sponsored college savings plan portfolios (commonly known as Section 529 College Savings Plans). |

Our investment database also includes:

• | 85 years of capital markets data capturing performance of several major asset classes; |

• | Extensive cash flow, ownership, and biographical data on directors and officers; |

• | Security-level identification information; |

• | Regulatory documents, disclosure filings, and conference-call transcripts; |

• | Real-time market data on more than 8 million exchange-traded equities, derivatives, commodities, futures, foreign exchanges, precious metals, news, company fundamentals, and analytics; and |

• | Real-time price quotes for global foreign currencies. |

Our business model is based on leveraging our investments in these databases by selling a wide variety of products and services to individual investors, financial advisors, and institutions around the world.

Our data and proprietary analytical tools such as the Morningstar Rating for mutual funds, which rates past performance based on risk- and cost-adjusted returns, and the Morningstar Style Box, which provides a visual summary of a mutual fund's underlying investment style, have become important tools that millions of investors and advisors use in making investment decisions. We've created other tools, such as the Ownership Zone, Sector Delta, and Market Barometer, which allow investors to see how different investments work together to form a portfolio and to track its progress. We developed a popular Portfolio X-Ray tool that helps investors reduce risk and understand the key characteristics of their portfolios based on nine different factors.

5

We offer a variety of qualitative measures such as Stewardship Grades, which help investors identify companies and funds that have demonstrated a high level of commitment to shareholders and stewardship of investors' capital. In 2011, we introduced our forward-looking Morningstar Analyst Rating for funds, a global, qualitative measure based on our analyst research. We also offer qualitative research and ratings on exchange-traded funds; closed-end funds; 529 plans; target-date funds, and stocks.

In 2009, we began publishing credit ratings and associated research on corporate debt issuers. We currently provide ratings on more than 600 companies and also provide research and ratings on commercial mortgage-backed securities.

Since 1998, we've expanded our research efforts on individual stocks and have worked to popularize the concepts of economic moat, a measure of competitive advantage originally developed by Warren Buffett; and margin of safety, which reflects the size of the discount in a stock's price relative to its estimated value. The Morningstar Rating for stocks is based on the stock's current price relative to our analyst-generated fair value estimates, as well as the company's level of business risk and economic moat.

We've also developed in-depth advice on security selection and portfolio building to meet the needs of investors looking for integrated portfolio solutions. We believe many investors rely on these tools because they offer a useful framework for comparing potential investments and making decisions. Our independence and our history of innovation make us a trusted resource for investors.

6

7

Growth Strategies

In keeping with our mission, we are pursuing five key growth strategies, which we describe below. We review our growth strategies on a regular basis and refine them to reflect changes in our business.

1. Enhance our position in each of our key market segments by focusing on our three major web-based platforms.

We believe that individual investors, financial advisors, and institutional clients increasingly want integrated solutions as opposed to using different research tools for different parts of their portfolios. To help meet this need, our strategy is to focus our product offerings on our three major platforms:

• | Morningstar.com for individual investors; |

• | Morningstar Advisor Workstation for financial advisors; and |

• | Morningstar Direct for institutional professionals. |

These products all include integrated research and portfolio tools, allowing investors to use our proprietary information and analysis across multiple security types. With each platform, we believe we can continue expanding our reach with our current audience, as well as extending to reach new market segments.

With Morningstar.com, we're continuing to expand the range of content and market updates on the site, including third-party content. We've also been focusing on mobile development, as well as expanding data and functionality to increase the site's value to both registered users and Premium members. With Advisor Workstation, we plan to build on our large installed base by expanding our mid- and back-office capabilities, improving the product's interface and design, and integrating real-time data and other functionality. With Morningstar Direct, we're pursuing an aggressive development program to provide data and analysis on securities and investments around the world. We're adding third-party data and content and enhancing our technology to allow the product to function as a purely web-based solution. We also plan to expand into new global markets, enhance our capabilities in portfolio management and accounting, and significantly increase the amount of equity research content and functionality.

2. | Create a premier global investment database. |

Our goal is to continue building or acquiring new databases for additional types of investments, including various types of funds outside the United States and other widely used investment products.

As detailed on page 5, we currently provide extensive data on approximately 375,000 investments globally, including managed investment products, individual securities, capital markets data, real-time stock quotes from nearly all of the world's major stock exchanges, and a live data feed that covers exchange-traded equities, derivatives, commodities, futures, foreign exchanges, precious metals, news, company fundamentals, and analytics.

8

Our data is the foundation for all of the products and services we offer. We focus on proprietary, value-added data, such as our comprehensive data on current and historical portfolio holdings for mutual funds and variable annuities. Within each database, we continuously update our data to maintain timeliness and expand the depth and breadth of coverage. Our strategy is to continuously expand our databases, focusing on investment products that are widely used by large numbers of investors. In particular, we're focusing on expanding our fundamental equity data. We also strive to establish our databases as the pre-eminent choice for individual investors, financial advisors, and institutional clients around the world, as well as continuing to invest in world-class data quality, processing, and delivery.

Over the past 10 years, we've developed a series of proprietary indexes based on our investment data. The Morningstar Indexes are rooted in our proprietary research and can be used for precise asset allocation and benchmarking and as tools for portfolio construction and market analysis. We've expanded the range of indexes we offer and are working to expand our index business globally.

3. Continue building thought leadership in independent investment research.

We believe that our leadership position in independent investment research offers a competitive advantage that would be difficult for competitors to replicate. Our goal is to continue producing investment insights that empower investors and focus our research efforts in three major areas:

• | Extend leadership position in global fund research. Over the past several years, we have expanded our analyst coverage in fund markets outside of the United States. We've built an integrated team of locally based fund experts to expand our research coverage in additional markets around the world. As of December 31, 2011, we had approximately 95 fund analysts globally, including teams in North America, Europe, Asia, and Australia. We currently produce qualitative analyst research on more than 3,500 funds around the world. As part of these research efforts, we currently provide Morningstar Analyst Ratings for approximately 500 funds globally. We plan to continue expanding the number of funds that have Morningstar Analyst Ratings and in-depth qualitative research reports. |

• | Continue leveraging our capabilities in stocks. Our equity research complements our approach to mutual fund analysis, where we focus on analyzing the individual stocks that make up each fund's portfolio. As of December 31, 2011, we provided analyst research on approximately 2,100 companies globally. |

We're committed to maintaining the broad, high-quality coverage we've become known for as one of the largest providers of independent equity research. We're working to expand distribution of our equity research through a variety of channels, including financial advisors, institutional investment firms, and companies outside of the United States. We believe that investors' increasing awareness of the value of independent research will strengthen our business over the long term. We've also expanded our proprietary stock database, which we view as an important complement to our analyst research.

• | Build business in credit research and ratings. We began publishing research and ratings on corporate credit issuers in December 2009 and currently produce research and ratings on more than 600 corporate credit issuers. We view credit ratings as a natural extension of the equity research we've been producing for the past decade. We believe we have a unique viewpoint to offer on company default risk that leverages our cash-flow modeling expertise, proprietary measures like economic moat, and in-depth knowledge of the companies and industries we cover. |

We're including this research on our three major software platforms to provide investors with an additional perspective on fixed-income investments. We also plan to monetize the ratings through enterprise licenses and subscriptions to our institutional equity research clients, who have access to the forecasts, models, and scores underlying the ratings.

We also expanded our fixed-income capabilities with our May 2010 acquisition of Realpoint, a Nationally Recognized Statistical Rating Organization (NRSRO) now known as Morningstar Credit Ratings that specializes in research and ratings on commercial mortgage-backed securities (CMBS). We believe investors are looking for better research on these securities and that we're well-positioned to meet this need.

9

4. Become a global leader in fund-of-funds investment management.

The large number of managed investment products available has made assembling them into well-constructed portfolios a difficult task for many investors. Consequently, fund-of-funds offerings have seen strong growth within the mutual fund, variable annuity, and hedge fund industries. Cerulli Associates estimates that global multimanager assets--including publicly offered funds that invest in other funds as well as investment vehicles managed by multiple subadvisors--totaled approximately $1.7 trillion as of July 2011. We believe assembling and evaluating funds of funds is a natural extension of our expertise in understanding managed investment products.

Our fund-of-funds programs combine managed investment vehicles--typically mutual funds--in portfolios designed to help investors meet their financial goals. When we create portfolios made up of other funds, our goal is to simplify the investment process and help investors access portfolios that match their level of risk tolerance, time horizon, and long-term investment objectives. We draw on our extensive experience analyzing funds and combine quantitative research with a qualitative assessment of manager skill and investment style.

We had a total of $140.4 billion in assets under advisement in our Investment Consulting business as of December 31, 2011. Our advisory business focuses on relationships and agreements where we act as a portfolio construction manager or asset allocation program designer for a mutual fund or variable annuity and receive a basis-point fee. We plan to continue building this business by expanding to reach new markets outside of the United States, expanding our capabilities in areas such as alternative investment strategies, developing more ways to incorporate risk protection and insurance, expanding to reach additional client segments, and focusing on performance and client support.

We also offer managed retirement account services through our Retirement Solutions platform, and had $19.9 billion in assets under management in our managed retirement accounts as of December 31, 2011. We offer these services for retirement plan participants who choose to delegate management of their portfolios to our managed account programs, which are quantitative systems that select investment options and make retirement planning choices for the participants. We believe retirement plan participants will continue to adopt managed accounts because of the complexity involved in retirement planning.

Morningstar Managed Portfolios is a fee-based discretionary asset management service that includes a series of mutual fund, ETF, and stock portfolios tailored to meet specific investment time horizons and risk levels. As of December 31, 2011, we had $3.0 billion in assets under management invested with Morningstar Managed Portfolios.

5. | Expand our international brand presence, products, and services. |

Our operations outside of the United States generated $184.9 million in revenue in 2011 compared with $157.1 million in 2010 and represent an increasing percentage of our consolidated revenue. Our strategy is to expand our non-U.S. operations (either organically or through acquisitions) to meet the increasing demand for wide-ranging, independent investment insight by investors around the globe. Because more than half of the world's investable assets are located outside of the United States, we believe there are significant opportunities for us. We're focusing our non-U.S. sales efforts on our major products, including Morningstar Advisor Workstation and Morningstar Direct, as well as opportunities such as real-time data, qualitative investment research and ratings, investment indexes, and investment management services. We also plan to explore new regions, such as Latin America, Eastern Europe, and the Middle East; continue expanding our databases to be locally and globally comprehensive; introduce new products in markets where we already have operations; and expand our sales and product support infrastructure around the world.

Acquisitions

Throughout our 28-year history, we have focused primarily on organic growth by introducing new products and services and expanding our existing products. From 2006 through 2010, we also completed 24 acquisitions to support our five key growth strategies (as detailed above). While we may make additional acquisitions to support these strategies, our primary focus now is on integrating previous acquisitions. We did not make any acquisitions in 2011.

10

For information about the acquisitions we made in 2009 and 2010, refer to Note 6 of the Notes to our Consolidated Financial Statements.

Business Segments, Products, and Services

We operate our business in two segments:

• | Investment Information, which includes all of our data, software, and research products and services. These products are typically sold through subscriptions or license agreements; and |

• | Investment Management, which includes all of our asset management operations, which operate as registered investment advisors and earn more than half of their revenue from asset-based fees. |

The table below shows our revenue by business segment for each of the past three years:

2011 | 2010 | 2009 | |||||||||||||||||||

Revenue by Segment ($000) | Amount | % | Amount | % | Amount | % | |||||||||||||||

Investment Information | $ | 500,909 | 79.3 | % | $ | 444,957 | 80.1 | % | $ | 386,642 | 80.7 | % | |||||||||

Investment Management | 130,491 | 20.7 | 110,394 | 19.9 | 92,354 | 19.3 | |||||||||||||||

Consolidated revenue | $ | 631,400 | 100.0 | % | $ | 555,351 | 100.0 | % | $ | 478,996 | 100.0 | % | |||||||||

For information on segment operating income (loss) refer to Note 4 of the Notes to our Consolidated Financial Statements.

Investment Information

The largest products in this segment based on revenue are Licensed Data, a set of investment data spanning all of our investment databases, including real-time pricing data, and available through electronic data feeds; Morningstar Advisor Workstation, a web-based investment planning system for independent financial advisors as well as advisors affiliated with larger firms; Morningstar.com, which includes both Premium Memberships and Internet advertising sales; Morningstar Direct, a web-based institutional research platform; and Integrated Web Tools (formerly Site Builder and Licensed Tools), services that help institutional clients build customized websites or enhance their existing sites with Morningstar's online tools and components.

Other major products within the Investment Information segment include Principia, our CD-ROM-based software for independent financial advisors; Morningstar Commodity Data (formerly Logical Information Machines), which aggregates energy, commodity, and financial data from more than 200 sources; equity and corporate credit research; and Morningstar Structured Credit Ratings and Research (formerly Realpoint).

We also offer a variety of financial communications materials, real-time data and desktop software, investment software for financial advisors and institutions, and investment indexes, as well as several print and online publications.

In 2011, 32.8% of Investment Information segment revenue was from outside of the United States, compared with 31.8% in 2010 and 31.6% in 2009.

Most of our products for individual investors are designed for investors who are actively involved in the investing process and want to take charge of their own investment decisions. We also reach individuals who want to learn more about investing and investors who seek out third-party sources to validate the advice they receive from brokers or financial planners.

We sell our advisor-related products both directly to independent financial advisors and through enterprise licenses, which allow financial advisors associated with the licensing enterprise to use our products. Our institutional clients include banks, brokerage firms, insurance companies, mutual fund companies, media outlets, and retirement plan sponsors and providers. We also have data reselling agreements with third-party providers of investment tools and applications, allowing us to increase the distribution of our data with minimal additional cost.

11

We believe the Investment Information segment has a modest amount of seasonality. We've historically had higher revenue in the second quarter because we hold our largest annual investment conference during the quarter. Other products in this segment generally have not shown marked seasonality.

Our largest customer in the Investment Information segment made up approximately 2% of segment revenue in 2011.

Licensed Data

Licensed Data gives institutions access to a full range of proprietary investment data spanning numerous investment databases, including real-time pricing data. We offer data packages that include access to our proprietary statistics, such as the Morningstar Style Box and Morningstar Rating, and a wide range of other data, including information on investment performance, risk, portfolios, operations data, fees and expenses, cash flows, and ownership. Institutions can use Licensed Data in a variety of investor communications, including websites, print publications, and marketing fact sheets, as well as for internal research and product development. We deliver Licensed Data through a password-protected website and provide daily updates to clients. Pricing for Licensed Data is based on the number of funds or other securities covered, the amount of information provided for each security, and the level of distribution.

In 2011, we continued to expand our data-delivery options, including a set of client-facing interfaces that make it easier for clients to access the most current data. We also developed data to support intra-day information on ETF pricing, as well as other ETF data points. On the database side, we've expanded our separate accounts coverage and launched an ETF Managed Portfolios database. We also added additional equity data sets including information on capital structure, earnings estimate, equity ownership, and conference call transcripts.

For Licensed Data, our primary competitors are Bloomberg, Europerformance, eVestment Alliance, FactSet Research Systems, Financial Express, Interactive Data Corporation, Mergent, Standard & Poor's, and Thomson Reuters.

Licensed Data was our largest product in 2011 and accounted for 16.9%, 17.7%, and 19.1% of our consolidated revenue in 2011, 2010, and 2009, respectively.

Morningstar Advisor Workstation

Morningstar Advisor Workstation, a web-based investment planning system, provides financial advisors with a comprehensive set of tools for conducting their core business-including investment research, planning, and presentations. It allows advisors to build and maintain a client portfolio database that can be fully integrated with the firm's back-office technology and resources. Moreover, it helps advisors create customized reports for client portfolios that combine mutual funds, stocks, separate accounts, variable annuity/life subaccounts, ETFs, hedge funds, closed-end funds, 529 plans, offshore funds, and pension and life funds.

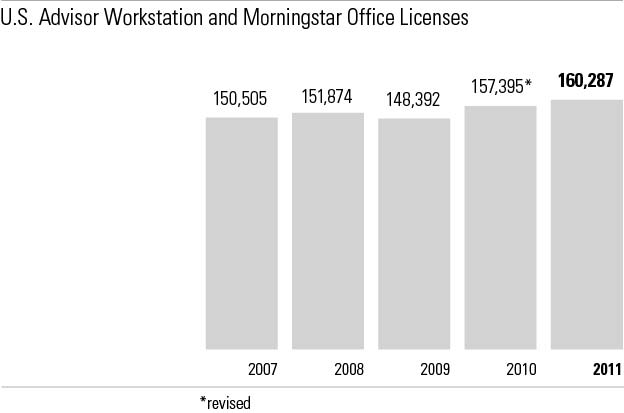

As of December 31, 2011, 160,287 advisors in the United States were licensed to use Advisor Workstation, which is available in two versions: Morningstar Office (formerly Advisor Workstation Office Edition) for independent financial advisors and a configurable enterprise version for financial advisors affiliated with larger firms. The enterprise version includes four core modules: Clients & Portfolios, Research, Sales/Hypotheticals, and Planning. We also offer a variety of other applications, including tools for defined contribution plans; Morningstar Document Library, which helps firms comply with pre- and post-sale document delivery requirements by providing access to prospectuses and supplements in HTML or PDF formats; Analyst Research Center, which complements the quantitative data in Advisor Workstation with independent, qualitative research on stocks, mutual funds, exchange-traded funds, and initial public offerings; and Presentation Library, which gives advisors access to compelling client presentation materials. These applications can be purchased as stand-alone products or combined as part of a full Workstation license.

12

Pricing for Morningstar Advisor Workstation varies based on the number of users, as well as the level of functionality offered. We typically charge about $3,300 per licensed user for a base configuration of Morningstar Advisor Workstation, but pricing varies significantly based on the scope of the license. For clients who purchase more limited tools-only licenses, the price per user is substantially less. We generally charge $5,700 per user for an annual license for Morningstar Office.

In 2011, we entered into an agreement with Interactive Data Corporation to offer information on corporate, municipal, and Treasury bonds through Advisor Workstation. We also migrated more than half of our client base to Morningstar Advisor Workstation 2.0, a new platform launched in 2010 that incorporates significant technology upgrades along with interface and usability improvements. We introduced an iPad version of Hypothetical Illustrator for fund wholesalers and rolled out a new, interactive version of our popular Investment Detail reports.

With Morningstar Office, we introduced several new features for portfolio reporting, accounting, report generation, and workflow management features.

Major competitors for Morningstar Advisor Workstation and Morningstar Office include Advent Software, Charles Schwab, EISI, eMoney Advisor, Standard & Poor's, SunGard, Tamarac, and Thomson Reuters.

Morningstar Advisor Workstation is our third-largest product based on revenue and made up 12.3% 12.5%, and 13.7% of our consolidated revenue in 2011, 2010, and 2009, respectively.

Morningstar.com

Our largest website for individual investors is Morningstar.com in the United States, which includes both Premium Membership revenue (which made up about 60% of Morningstar.com's revenue base in 2011) and Internet advertising sales (which made up the remaining 40%). As of December 31, 2011, the free membership services offered through Morningstar.com had approximately 8 million registered users worldwide, who have access to comprehensive data on stocks, mutual funds, ETFs, closed-end funds, 529 plans, commodities, options, bonds, and other investments to help them conduct research and track performance. In addition, Morningstar.com features extensive market data, articles, proprietary portfolio tools, and educational content to help investors of all levels access timely, relevant investment information. Morningstar.com also includes Portfolio X-Ray and a variety of other portfolio tools that help investors reduce risk and understand key characteristics of their portfolios.

We also offer more than 40 regional investing websites customized to the needs of investors worldwide. Many of these sites feature coverage in local languages with tools and commentary tailored to specific markets.

13

We use our free content as a gateway into paid Premium Membership, which includes access to written analyst reports on more than 1,300 stocks, 1,500 mutual funds, 400 ETFs, 100 closed-end funds, as well as our Portfolio X-Ray, asset allocation and portfolio management tools, proprietary stock data, Stewardship Grades, and premium stock and fund screeners. We currently offer Premium Membership services in Australia, Canada, China, Italy, the United Kingdom, and the United States.

In 2011 we introduced a new, improved report format for ETFs; new reports for money market funds and preferred stocks; and additional data points for stocks, funds, and closed-end funds. We launched new centers focusing on closed-end funds, bonds, and new exchange-traded fund launches, as well as several week-long special reports on focused topic areas. Morningstar's mobile applications were also recognized as leading personal finance apps by Kiplinger's, The Wall Street Journal, and Money.

Morningstar.com competes with the personal finance websites of AOL Money & Finance, Google Finance, Marketwatch.com, The Motley Fool, MSN Money, Seeking Alpha, TheStreet.com, Yahoo! Finance, and The Wall Street Journal Online.

As of December 31, 2011, we had 130,354 paid Premium subscribers for Morningstar.com in the United States plus an additional 15,000 paid Premium subscribers in Australia, Canada, China, Italy, and the United Kingdom. We currently charge $21.95 for a monthly subscription, $189 for an annual subscription, $319 for a two-year subscription, and $419 for a three-year subscription for Morningstar.com's Premium service in the United States. We also sell advertising space on Morningstar.com.

Morningstar.com (including local versions outside of the United States) is one of our five largest products based on revenue and accounted for 8.6% of our consolidated revenue in 2011, compared with 8.9% in 2010 and 8.2% in 2009.

Morningstar Direct

Morningstar Direct is a web-based institutional research platform that provides advanced research on the complete range of securities in Morningstar's global database. This comprehensive platform allows research and marketing professionals to conduct advanced performance comparisons and in-depth analyses of a portfolio's underlying investment style. Morningstar Direct includes access to numerous investment universes, including U.S. mutual funds; European and offshore funds; funds based in most major markets around the world; stocks; separate accounts; hedge funds; closed-end funds; exchange-traded funds; global equity ownership data; variable annuity and life portfolios; and market indexes.

14

In 2011, we introduced new asset allocation and forecasting functionality that allows investors to create optimal asset allocation strategies that take into account “fat-tailed” (statistically unlikely or extreme) return distributions and measure downside risk. Based on research from Morningstar and our Ibbotson Associates subsidiary, these new tools allow investors to create optimal asset allocation strategies that take into account “fat-tailed” return distributions and measure downside risk. We introduced Portfolio Analysis, a web-based workspace that incorporates real-time data, charts, and news to help portfolio managers monitor and adjust their portfolios. We also enhanced functionality for our asset flows, Report Studio, and Custom Database features. Morningstar Direct also includes new global databases such as open-end funds in Brazil, Chilean insurance funds, and French insurance wrappers.

Morningstar Direct's primary competitors are Bloomberg, eVestment Alliance, FactSet Research Systems, Markov Processes International, PSN, Thomson Reuters, Wilshire Associates, and Zephyr Associates.

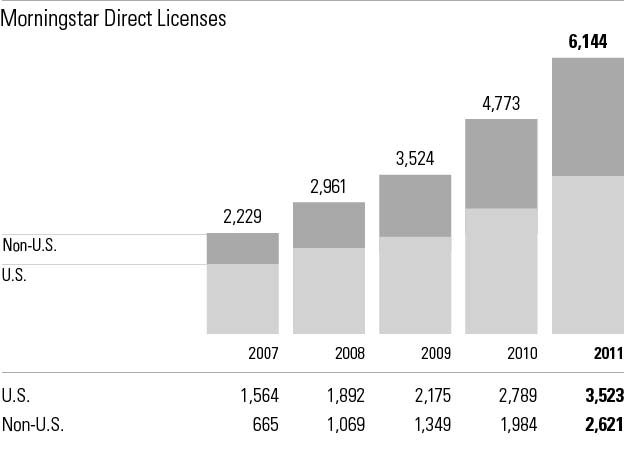

Morningstar Direct had 6,144 licensed users worldwide as of December 31, 2011.

Pricing for Morningstar Direct is based on the number of licenses purchased. We charge $17,000 for the first user, $10,500 for the second user, and $9,000 for each additional user.

Morningstar Direct is one of our five largest products based on revenue and accounted for 8.3%, 6.9%, and 6.3% of our consolidated revenue in 2011, 2010, and 2009, respectively.

Morningstar Integrated Web Tools

Morningstar Integrated Web tools (formerly Site Builder and Licensed Tools) are services that help institutional clients build customized websites or enhance their existing sites with Morningstar's online tools and components. We offer a series of integrated components, editorial content, and reports that investment firms can license to use to build or enhance their websites for financial advisors and individual investors. Outside the United States, clients can customize our offerings with capabilities for regional markets, multiple languages, and local currencies. Our suite of components can be customized to analyze a set of investments, focus on client-defined data points, or perform calculations required by specific products or services. We also offer licenses for investment research, editorial content, and portfolio analysis tools. Integrated Web Tools can be integrated with clients' existing websites and allow users to drill down into the underlying data when researching a potential investment.

15

In 2011, we introduced nine new tools for ETFs, including the Total Cost Analyzer, Cost Analyzer, Correlation Analyzer, and ETF Exposure Evaluator. We also integrated fixed-income data and reports into our suite of portfolio components and added a Multiple Fund Comparison tool to our product lineup that allows users to compare and contrast numerous securities side-by-side.

Competitors for Integrated Web Tools include Financial Express, Interactive Data (IDMS), Markit on Demand (formerly Wall Street on Demand), and Thomson Reuters.

Pricing for Integrated Web Tools depends on the audience, the level of distribution, and the scope of information and functionality licensed.

Morningstar Principia

Principia is our CD-ROM-based investment research and planning software for financial planners and had 31,270 subscriptions as of December 31, 2011. The modules offered in Principia provide data on mutual funds, ETFs, stocks, separate accounts, variable annuity/life subaccounts, closed-end funds, asset allocation, hypotheticals, presentations and education, and defined contribution plans. Each module is available separately or together and features searching, screening, and ranking tools. Principia allows advisors to conduct research on client portfolios and includes a three-page Portfolio Snapshot reports that provide a comprehensive picture of the client's portfolio. The Snapshot report shows overall style and sector weightings as well as the cumulative exposure to individual stocks. The Snapshot report is among those approved by the National Association of Securities Dealers for financial advisors to distribute and review with their clients.

In 2011, we enhanced the functionality of the CAMS (Client Account Management System) module, which offers performance reporting and portfolio accounting. We also continued increasing the percentage of subscribers receiving electronic delivery, reducing our fulfillment costs and giving clients more timely access to the most recent updates.

Principia prices generally range from approximately $765 per year for monthly updates on one investment database to $3,345 per year for monthly updates on the complete package spanning all investment universes, or $7,805 for all investment universes plus additional modules for asset allocation, defined contribution plans, and portfolio management.

Major competitors for Principia include Standard & Poor's and Thomson Reuters.

Morningstar Commodity Data

Morningstar Commodity Data (formerly LIM) is a leading provider of data and analytics for the energy, financial, and agriculture sectors. It provides market pricing data, securities reference data, historical event data, predictive analytics, and advanced data management solutions that help customers manage large sets of time-series data. Morningstar Commodity Data collects, unifies, and conducts quality assurance on data from more than 200 sources in the energy, financial, and agriculture sectors and provides clients with one central source for data intelligence and analysis. Clients can also use our tools to analyze their own proprietary data. Clients include some of the world's largest asset managers, banks, oil companies, power and natural gas trading firms, utilities, risk managers, and agriculture and commodities trading firms.

In 2011, we launched a cloud-based solution for delivering commodity and energy market data. This option provides clients around the world with greater access to commodity data with faster processing time and easier implementation. We also released a new version of the Commodity Add-In, which is a high-powered tool that brings consolidated market data along with Morningstar’s rigorous quality-assurance checks into Microsoft Excel.

Pricing for Morningstar Commodity Data is based on the number of users, the type of data licensed, the number of data sources, and the size of the data sets licensed. We had approximately 150 institutional clients for Morningstar Commodity Data as of December 31, 2011.

Major competitors for Morningstar Commodity Data include DataGenic, GlobalView, Sungard FAME, and ZE Power.

16

Investment Profiles and Guides

Our Investment Profiles assemble essential facts about an investment into an easy-to-understand report. These one-page reports, available in print or web format, are designed for use when communicating with clients, as well as for employers to communicate with retirement plan participants. They also help investment companies meet requirements for investment education, board reporting, and plan sponsor reviews. Investment Profiles also help companies make sure their communications comply with Financial Industry Regulatory Authority (FINRA) and Department of Labor guidelines.

We offer Investment Profiles on a broad range of investments, including mutual funds, stocks, separate accounts, collective investment trusts, variable annuity subaccounts, insurance group separate accounts, ETFs, money market funds, stable value funds, closed-end funds, hedge funds, and private funds. Clients can customize the format, design and branding, data elements, and delivery to meet their needs. We also offer on-demand publishing for HTML and PDF file formats, allowing companies to save money through electronic delivery and printing. We also offer Investment Guides, which are a collection of Investment Profiles, summary information, and educational articles.

In 2011, we developed a series of comparative charts and enhanced Investment Profile pages to help clients meet new regulatory requirements for disclosure to retirement plan participants.

Our Investment Profiles and Guides compete with Thomson Reuters, Xinnovation, and third-party printing companies, as well as internal production for plan providers that are able to produce their own reports. Pricing for Investment Profiles and Guides is based on the number of securities covered, the amount of information we provide, and the level of distribution.

Structured Credit Research and Ratings

Morningstar Credit Ratings, LLC (formerly Realpoint) is a Nationally Recognized Statistical Ratings Organization (NRSRO) that provides timely new issue and surveillance ratings and analysis for commercial mortgage-backed securities (CMBS), as well as operational risk assessment services.

We rate new issue CMBS securities using a bottom-up approach that blends qualitative, quantitative, and legal analysis of the loan, portfolio, and issuing trust, with detailed underwriting information for 100% of the underlying assets. We provide surveillance ratings and analysis on nearly 10,000 CMBS securities including the loans and properties securing them. We also publish DealView credit reports on CMBS transactions and update our analysis and forecasts monthly. We rated 32% of all new issue CMBS deals in 2011--making us the third-largest player in terms of deals rated.

We recently introduced a beta version of our new ratings and surveillance analytics service on residential mortgage-backed securities (RMBS). This service will provide institutional investors with cutting edge analytics, Morningstar’s monthly DealView Credit Analysis, and timely letter ratings on thousands of secondary market RMBS transactions.

We also offer operational risk assessments that evaluate mortgage servicers, loan originators, and third-party service providers. These assessments focus on non-credit-related operational risks and the likelihood of maintaining current performance levels given ongoing market conditions.

Our structured credit research and ratings business competes with several other firms, including DBRS, Fitch, Kroll, Bond Ratings, Moody's, and Standard & Poor's.

Morningstar Credit Ratings primarily charges license-based fees for surveillance ratings and analysis, which are paid for by the user. For new-issue ratings, it charges asset-based fees that are paid by the issuer on the rated balance of the transaction.

17

Morningstar Equity and Credit Research

As of December 31, 2011, we offered independent equity research on approximately 2,100 companies globally. Our approach to stock analysis focuses on long-term fundamentals. Our analysts evaluate companies by assessing each firm's competitive advantage, analyzing the level of business risk, and completing an in-depth projection of future cash flows. For the companies we cover, our analysts prepare a fair value estimate, a Morningstar Rating for stocks, a rating for business risk, and an assessment of the company's economic moat. Economic moat is a concept originally developed by Warren Buffett that describes a company's competitive advantage relative to other companies. For the remaining stocks included in our database, we offer quantitative grades for growth, profitability, and financial health, as well as an explanation of the company's business operations.

We offer Morningstar Equity Research to institutional investors who use it to supplement their own research, as well as broker/dealers who provide our research to their affiliated financial advisors or to individual investors. We also deliver our equity research through several other Morningstar products, including our Premium Membership service on Morningstar.com. From June 2004 through July 2009, we provided research to six major investment banks under the terms of the Global Analyst Research Settlement (GARS). In 2003 and 2004, 12 leading Wall Street investment banks agreed to a $1.5 billion settlement with the SEC, the New York Attorney General, and other securities regulators to resolve allegations of undue influence of investment banking interests on securities research. Approximately $450 million of the $1.5 billion in fines that the investment banks agreed to pay in the settlement was designated for independent research over a period of five years, with the independent research provided by companies that are not engaged in the investment banking industry.

Although the period covered by the Global Analyst Research Settlement expired in July 2009, and the banks covered by it are no longer required to provide independent investment research to their clients, we remain committed to maintaining the broad, high-quality coverage we’ve become known for as one of the largest providers of independent equity research.

We currently provide analyst reports on virtually all of the most widely held stocks in major U.S. market indexes, as well as numerous companies based outside the United States. On the credit research side, we provide credit ratings and analysis for more than 600 of the largest corporate bond issuers worldwide, including global banks and captive finance subsidiaries. We had approximately 165 equity and credit analysts around the world as of December 31, 2011, compared with 145 as of December 31, 2010.

In 2011, we began building a new advisor-facing research platform that will help us expand our reach to additional broker/dealers. We also launched an enhanced version of our institutional web portal that surfaces our best ideas and allows clients to access our analysts' discounted cash flow models to explore their own valuation assumptions.

On the credit research side, we rolled out New Issue Notes, where we provide a valuation opinion on new bond issues. We publish these timely notes shortly after a new issue is announced, allowing our clients time to consider our opinion before making an investment decision. We launched our "Safe & Sound Credit Pick List" publication designed for financial advisors and their clients. We added our institutional credit research to a third-party platform that aggregates fixed-income research from global banks and independent providers.

Our Equity Research services compete with The Applied Finance Group, Credit Suisse HOLT, Renaissance Capital, Standard & Poor's, Value Line, Zacks Investment Research, and several smaller research firms. For institutional clients, we compete with sell-side firms, internal providers, and smaller boutique firms. Competitors for our credit research include Credit Sights, Fitch, Gimme Credit, Moody's, and Standard & Poor's.

Pricing for Morningstar Equity and Credit Research varies based on the level of distribution, the number of securities covered, the amount of custom coverage and client support required, and the length of the contract term.

18

Morningstar Indexes

We offer an extensive set of investment indexes that can be used to benchmark the market and create investment products. Our index family includes a series of U.S. equity indexes that track the U.S. market by capitalization, sector, and investment style; a dividend index; a focused stock index capturing performance of “wide moat” stocks with the most attractive valuations; a series of bond indexes that track the U.S. market by sector and term structure; global bond and equity indexes; commodity indexes; and asset allocation indexes. Investment firms can license the Morningstar Indexes to create investment vehicles, including mutual funds, ETFs, and derivative securities. We charge licensing fees for the Morningstar Indexes, with fees consisting of an annual licensing fee as well as fees linked to assets under management.

We currently license the Morningstar Indexes to numerous institutions that offer ETFs and exchange-traded notes based on the indexes.

In 2011, we introduced several new indexes focusing on dividend yield, natural resources, hedge funds, Canadian banks, and a Factor Tilt Index slightly weighted toward small-capitalization value stocks. We believe we're the only index provider that offers indexes spanning all asset categories, which allows us to develop indexes that blend various asset classes.

Key competitors for the Morningstar Indexes include Barclays Capital, Dow Jones, the Financial Times, Markit, MSCI, Russell Investments, and Standard & Poor's.

Investment Management Segment

The largest products and services in this segment based on revenue are Investment Consulting, which focuses on investment monitoring and asset allocation for funds of funds, including mutual funds and variable annuities; Retirement Solutions, including the Morningstar Retirement Manager and Advice by Ibbotson platforms; and Morningstar Managed Portfolios, a fee-based discretionary asset management service that includes a series of mutual fund, exchange-traded fund, and stock portfolios tailored to meet a range of investment time horizons and risk levels that financial advisors can use for their clients' taxable and tax-deferred accounts.

Our client base in this segment includes banks, brokerage firms, insurance companies, mutual fund companies, and retirement plan sponsors and providers. We currently offer investment management services in the United States, Europe, Asia, and Australia. Our license agreements in the Investment Management segment have an average contract term of approximately three years, although some of our agreements allow for early termination.

About 15.8% of Investment Management segment revenue was from outside the United States in 2011, compared with 14.2% in 2010 and 7.7% in 2009.

Many of our largest customers are insurance companies, including variable annuity providers, followed by mutual fund companies and other asset management firms, retirement plan sponsors and providers, broker-dealers, and banks. We plan to develop additional distribution channels to reach other client types, including foundations and endowments, defined contribution plans, defined benefit plans, and wealth management firms. We also expect to continue expanding our Investment Management business outside the United States.

For Morningstar Managed Portfolios, our target audience consists of home offices of insurance companies, broker-dealers, and registered investment advisors, as well as independent financial advisors.

We market our Investment Management services almost exclusively through our institutional sales team, which includes both strategic account managers and more specialized sales representatives. We employ a consultative sales approach and often tailor customized solutions to meet the needs of larger institutions. We have a regional sales team responsible for expanding relationships for Morningstar Managed Portfolios.

We believe our institutional clients value our independence, breadth of information, and customized services; in addition, we believe our research, tools, and advice reach many individual investors through this channel. We also reach approximately 2,500 financial advisors through our Managed Portfolios platform.

19

The Investment Management segment has not historically shown seasonal business trends; however, business results for this segment are typically more variable because of our emphasis on asset-based fees, which change along with market movements and other factors.

Our largest customer in the Investment Management segment made up approximately 17% of segment revenue in 2011. On February 17, 2012, we received notification from this client that it will be moving to in-house management of several fund of funds portfolios in April 2012. We received about $12.4 million in Investment Consulting revenue from our work on these portfolios in 2011, which represented 9.5% of Investment Management segment revenue.

Investment Consulting

Our Investment Consulting area provides institutional investment advisory and management services for asset management firms, broker/dealers, insurance providers, and investment fiduciaries. We offer Investment Consulting services through Morningstar Associates, Inc.; Morningstar Associates, LLC; Morningstar Associates Europe, Ltd; Ibbotson Associates, Inc.; Ibbotson Associates Australia Limited; Morningstar Denmark; OBSR Advisory Services Limited; and Seeds Finance SA, which are registered investment advisors and wholly owned subsidiaries of Morningstar, Inc.

Drawing on research and methodologies from both Morningstar Associates and Ibbotson Associates, which we acquired in 2006, we deliver four core service offerings: asset allocation, portfolio management, manager evaluation, and board fiduciary services. We focus on delivering customized solutions that improve the investor experience and help our clients build their businesses. Many of our Investment Consulting agreements focus on investment monitoring and asset allocation for funds of funds, including mutual funds and variable annuities. We emphasize contracts where we're paid a percentage of assets under management for ongoing investment management and advice, as opposed to one-time relationships where we're paid a flat fee.

We offer these advisory services to clients in the United States, Asia, Australia, Canada, and Europe, including insurance companies, investment management companies, mutual fund companies, and broker-dealers. We also provide services for retirement plan sponsors and providers, including developing plan lineups, creating investment policy statements, and monitoring investment performance.

In late 2010, we announced the creation of a unified investment management organization to provide integrated, institutionally focused research, consulting, and advisory services globally. As part of this initiative, in 2011 we combined many of the capabilities offered by Morningstar Associates and Ibbotson Associates to better leverage the core capabilities of each group. We also worked with several broker/dealer clients to create new investment strategies, including active/passive, momentum, and diversified alternatives. We implemented a new global tactical asset allocation fund with a large insurance company and partnered with another company to create new fund lists. We also established several new investment advisory relationships in the United States, Europe, and Australia.

Our Investment Consulting business competes primarily with Mercer, Mesirow Financial, Russell Investments, Thomson Reuters, and Wilshire Associates, as well as some smaller firms in the retirement consulting business and various in-house providers of investment advisory services.

Pricing for the Investment Consulting services we provide through Morningstar Associates, Ibbotson Associates, and our other subsidiaries is based on the scope of work and the level of service required. In the majority of our contracts, we receive asset-based fees, reflecting our work as a portfolio construction manager or subadvisor for a mutual fund or variable annuity.

Investment Consulting was our second-largest product based on revenue in 2011 and accounted for 12.4%, 11.9%, and 11.8% of our consolidated revenue in 2011, 2010, and 2009, respectively.

20

Retirement Solutions

Our Retirement Solutions offerings help retirement plan participants plan and invest for retirement. We offer these services both through retirement plan providers (typically third-party asset management companies that offer proprietary mutual funds) and directly to plan sponsors (employers that offer retirement plans to their employees). Clients can select either a hosted solution or our proprietary installed software advice solution. Clients can integrate the installed customized software into their existing systems to help investors accumulate wealth, transition into retirement, and manage income during retirement.

Morningstar Retirement Manager is our advice and managed accounts program that helps plan participants reach their retirement goals. It helps investors determine how much to invest and which investments are most appropriate for their portfolios. The program gives guidance explaining whether participants' suggested plans are on target to meet their retirement goals. As part of this service, we deliver personalized recommendations for a target savings goal, a recommended contribution rate to help achieve that goal, a portfolio mix based on risk tolerance, and specific fund recommendations. Participants can elect to have their accounts professionally managed through our managed account service or build their own portfolios using our recommendations as a guide.

Morningstar Retirement Manager also helps plan sponsors meet their fiduciary obligations. Morningstar works with plan sponsors to better understand regulatory safe harbors and stay ahead of changes in the marketplace. We can act as a fiduciary and monitor or direct a broad range of diversified plan options to maintain ERISA compliance and minimize risk. In addition to our consulting solutions, we also manage plan data and provide administrative support, developing plan documents, summary plan descriptions, and other compliant employee communications.

In 2011, we worked on combining Ibbotson Associates' Wealth Forecasting Engine methodology with Morningstar Retirement Manager; we expect to transition clients to the combined platform during 2012. This integration allows us to offer new features, including more personalized savings rate recommendations, retirement age recommendations, both enhanced and optimized strategy recommendations, tax considerations, and the ability to consider other ongoing and retirement expenses.

In addition, we built a tool that helps reduce the operational and administrative requirements for clients that offer our plan sponsor advice service. We also launched additional services for plan sponsor advice, in which we act as a fiduciary with full discretionary powers for selecting, monitoring, and adjusting the investment options in qualified retirement plans. We enhanced our Advice by Ibbotson program by allowing participants to model and enroll in a SMART savings program and compare it to an optimized strategy. This will allow participants to make more informed decisions for their retirement planning. We also completed the design of a new product, Goal Planner, which uses the Wealth Forecasting Engine methodology and capabilities to help retail and advisor audiences construct personalized investment strategies. These strategies are aimed at helping users achieve a specific goal, such as saving for a car, house, or retirement.

As of December 31, 2011, approximately 24.7 million plan participants had access to Retirement Solutions through approximately 192,000 plan sponsors and 25 plan providers. Pricing for Retirement Solutions depends on several different factors, including the level of services offered, the number of participants, our fiduciary role, the level of systems integration required, and the availability of competing products.

In the retirement advice market, we compete primarily with Financial Engines and Guided Choice.

Morningstar Managed Portfolios

The Morningstar Managed Portfolios program is offered through Morningstar Investment Services, Inc., a registered investment advisor, registered broker-dealer, member of the Financial Industry Regulatory Authority, Inc. (FINRA), and wholly owned subsidiary of Morningstar, Inc.

Morningstar Managed Portfolios is a fee-based discretionary asset management service that includes a series of mutual fund, ETF, and stock portfolios tailored to meet specific investment time horizons and risk levels. This program is only available through financial advisors. Our team of investment professionals uses a disciplined process for asset allocation, fund selection, and portfolio construction. They actively monitor the portfolios and make adjustments as needed. We complement these asset management services with online client-management functions such as risk profiling and access to client statements, transaction capabilities, and performance reports.

21

In 2011, Morningstar Investment Services introduced several new portfolios including a contrarian ETF series, a real return portfolio, and a set of portfolios subadvised by Ibbotson Associates. We also signed an agreement with Fiserv to support our middle-office functionality. We'll be able offer enhanced trade management efficiency and scale, broader connectivity with custodians, support additional types of portfolios, and provide composite performance reporting. It will also help us meet the requirements of larger accounts for more sophisticated analysis and account management capabilities.

We had approximately $3.0 billion in assets under management with about 2,500 financial advisors using the service as of December 31, 2011. We charge asset-based fees for Morningstar Managed Portfolios. The management fee is based on a tiered schedule that depends on the client's average daily portfolio balance. Fees for our mutual fund and exchange-traded fund portfolios generally range from 30 to 40 basis points. We charge 55 basis points for the Select Stock Baskets, which are a managed account service consisting of individually customized stock portfolios based on Morningstar's proprietary indexes and independent equity research.

For Morningstar Managed Portfolios, our primary competitors are Brinker Capital, Curian Capital, Envestnet PMC, Genworth Financial, Loring Ward, SEI Investments, and Symmetry Partners.

Marketing and Sales

We promote our print, software, web-based products and services, and consulting services with a staff of sales and marketing professionals, as well as an in-house public relations team. Our marketing staff includes both product specialists and a corporate marketing group that manages company initiatives. Our sales team includes several strategic account managers who oversee all aspects of our largest institutional client relationships. We also have a sales operations staff, which focuses on tracking and forecasting sales and other tasks to support our sales team. Across our business, we emphasize high levels of product support to help our customers use our products effectively and provide our product managers with feedback from customers. We had approximately 560 sales and marketing professionals on staff as of December 31, 2011.

International Operations

We conduct our business operations outside of the United States, which have been increasing as a percentage of our consolidated revenue, through wholly owned or majority-owned operating subsidiaries doing business in each of the following countries: Australia, Brazil, Canada, Chile, Denmark, France, Germany, India, Italy, Japan, Korea, Luxembourg, Mexico, the Netherlands, New Zealand, Norway, People's Republic of China (both Hong Kong and the mainland), Singapore, South Africa, Spain, Switzerland, Taiwan, Thailand, United Arab Emirates, and the United Kingdom. See Note 4 of the Notes to our Consolidated Financial Statements for additional information concerning revenue from customers and long-lived assets from our business operations outside the United States.

In addition, we hold minority ownership positions in operating companies based in Japan and Sweden. As of December 31, 2011, we owned a minority ownership position (approximately 33% of the outstanding shares) in Morningstar Japan K.K. (MJKK) and our share had a market value of approximately $36.1 million. MJKK is publicly traded under ticker 4765 on the Osaka Stock Exchange “Hercules Market.” See Note 7 of the Notes to our Consolidated Financial Statements for information about our investments in unconsolidated entities.

To enable these companies to do business in their designated territories, we provide them with the rights to the Morningstar name and logo and with access to certain of our products and technology. Each company is responsible for developing marketing plans tailored to meet the specific needs of investors within its country and working with Morningstar's data collection and development centers to create and maintain databases, develop new products, and enhance existing products.

See Item 1A-Risk Factors for a discussion of the risks related to our business operations outside of the United States.

22

Intellectual Property and Other Proprietary Rights

We treat our brand, product names and logos, software, technology, databases, and other products as proprietary. We try to protect this intellectual property by using trademark, copyright, patent and trade secrets laws; licensing and nondisclosure arrangements; and other security measures. For example, in the normal course of business, we only provide our intellectual property to third parties through standard licensing agreements. We use these agreements to define the extent and duration of any third-party usage rights and provide for our continued ownership in any intellectual property furnished.

Because of the value of our brand name and logo, we have tried to register one or both of them in all of the relevant international classes under the trademark laws of most of the jurisdictions in which we maintain operating companies. As we move into new countries, we consider adding to these registrations. In some jurisdictions, we also register certain product identifiers. We have registered our name and/or logo in numerous countries and the European Union and have applied for registrations in several other countries.

“Morningstar” and the Morningstar logo are registered marks of Morningstar in the United States and in certain other jurisdictions. The table below includes some of the trademarks and service marks that we use:

Advice by Ibbotson ® | Morningstar ® Integrated Web Tools SM | |

Ibbotson Associates ® | Morningstar ® Investment Profiles TM and Guides | |

Morningstar ® Advisor Workstation SM | Morningstar ® Licensed Data SM | |

Morningstar ® Advisor Workstation SM | Morningstar ® Managed Portfolios SM | |

Morningstar Analyst Rating TM | Morningstar ® Managed Portfolios SM Select Stock Baskets | |

Morningstar ® Analyst Research Center SM | Morningstar Market Barometer SM | |

Morningstar ® Annuity Intelligence SM | Morningstar Office SM | |

Morningstar ® Corporate Credit Research | Morningstar ® Ownership Zone SM | |

Morningstar ® Document Research SM | Morningstar ® Portfolio X-Ray ® | |

Morningstar Direct SM | Morningstar ® Principia ® | |

Morningstar ® Enterprise Data Management | Morningstar ® QuoteSpeed SM | |

Morningstar ® Equity Research ServicesSM | Morningstar Rating ™ | |

Morningstar ® Essentials TM | Morningstar ® Retirement Manager SM | |

Morningstar ® Fund Research Report | Morningstar ® Stewardship Grade SM | |

Morningstar ® Hypothetical Illustrator SM | Morningstar Style Box ™ | |

Morningstar ® Indexes | Morningstar.com ® | |

In addition to trademarks, we currently hold several patents in the United States and Canada. We believe these patents represent our commitment to developing innovative products and tools for investors.

License Agreements

In the majority of our licensing agreements, we license our products and/or other intellectual property to our customers for a fee. We generally use our standard agreements, whether in paper or electronic form, and we do not provide our products and services to customers or other users without having an agreement in place.

We maintain licensing agreements with all of our operating companies. We put these agreements in place so these companies can use our intellectual property, such as our products and trademarks, to develop and market similar products under our name in their operating territories.

In the ordinary course of our business, we obtain and use intellectual property from a wide variety of sources, including licensing it from third-party sources, developing it internally, and obtaining it directly from public filings.

23

Seasonality

We believe our business has a modest amount of seasonality. Some of our smaller products, such as the Ibbotson Stocks, Bonds, Bills, and Inflation Yearbook and our largest annual investment conference, generate the majority of their revenue in the first or second quarter of the year. Most of our products are sold with subscription or license terms of at least one year, though, and we recognize revenue ratably over the term of each subscription or license agreement. This tends to moderate seasonality in sales patterns for individual products.

We believe market movements generally have more influence on our performance than seasonality. The amount of revenue we earn from asset-based fees depends on the value of assets on which we provide advisory services, and the size of our asset base can increase or decrease along with trends in market performance.

Largest Customer

In 2011, our largest customer accounted for less than 5% of our consolidated revenue. On February 17, 2012, we received notification from this client that it will be moving to in-house management of several fund of funds portfolios in April 2012. We received about $12.4 million in Investment Consulting revenue from our work on these portfolios in 2011, which represented 2.0% of our consolidated revenue.

Competitive Landscape

The economic and financial information industry has been marked by increased consolidation over the past several years, with the strongest players generally gaining market share at the expense of smaller competitors. Some of our major competitors include Bloomberg; Standard & Poor's, a division of The McGraw-Hill Companies; Thomson Reuters; and Yahoo!. These companies have financial resources that are significantly greater than ours. We also have a number of smaller competitors in our two business segments, which we discuss in Business Segments, Products, and Services above.

We believe the most important competitive factors in our industry are brand and reputation, data accuracy and quality, breadth of data coverage, quality of investment analysis and analytics, design, product reliability, and value of the products and services provided.

Major Competitors by Product

Licensed Data | Investment Consulting | Morningstar Advisor Workstation | Morningstar.com | Morningstar Direct | Retirement Solutions | |||||||

Advent Software | • | |||||||||||

Bloomberg | • | • | ||||||||||

eVestment Alliance | • | • | ||||||||||

FactSet Research Services | • | • | ||||||||||

Financial Engines | • | |||||||||||

Financial Express | • | • | ||||||||||

Interactive Data Corporation | • | |||||||||||

Mercer | • | |||||||||||

News Corporation* | • | |||||||||||

Russell Investments | • | |||||||||||

Standard & Poor's | • | • | ||||||||||

Thomson Reuters** | • | • | • | • | ||||||||

Wilshire Associates | • | • | ||||||||||

Yahoo! | • | |||||||||||

Zephyr Associates | • | |||||||||||

* News Corporation includes Dow Jones, MarketWatch, and SmartMoney

** Thomson Reuters includes Lipper

24

Research and Development

A key aspect of our growth strategy is to expand our investment research capabilities and enhance our existing products and services. We strive to rapidly adopt new technology that can improve our products and services. We have a flexible technology platform that allows our products to work together across a full range of investment databases, delivery formats, and market segments. As a general practice, we manage our own websites and build our own software rather than relying on outside vendors. This allows us to control our development and better manage costs, enabling us to respond quickly to market changes and to meet customer needs efficiently. As of December 31, 2011, our technology team consisted of approximately 900 programmers and technology and infrastructure professionals.

In 2011, 2010, and 2009 our development expense represented 8.4%, 8.9%, and 8.0%, respectively, of our revenue. We expect that development expense will continue to represent a meaningful percentage of our revenue in the future.

Government Regulation

United States

Investment advisory and broker-dealer businesses are subject to extensive regulation in the United States at both the federal and state level, as well as by self-regulatory organizations. Financial services companies are among the nation's most extensively regulated. The SEC is responsible for enforcing the federal securities laws and oversees federally registered investment advisors and broker-dealers.

As of December 31, 2011, three of our subsidiaries, Ibbotson Associates, Inc., Morningstar Associates, LLC, and Morningstar Investment Services, Inc. are registered as investment advisors with the SEC under the Investment Advisers Act of 1940, as amended (Advisers Act). As registered investment advisors, these companies are subject to the requirements and regulations of the Advisers Act. Such requirements relate to, among other things, record-keeping, reporting, and standards of care, as well as general anti-fraud prohibitions. As registered investment advisors, all three subsidiaries are subject to on-site examination by the SEC.

In addition, because these three subsidiaries provide investment advisory services to retirement plans and their participants, they may be acting as fiduciaries under the Employee Retirement Income Security Act of 1974 (ERISA). As fiduciaries under ERISA, they have duties of loyalty and prudence, as well as duties to diversify investments and to follow plan documents to comply with the applicable portions of ERISA.

Morningstar Investment Services is a broker-dealer registered under the Securities Exchange Act of 1934 (Exchange Act) and a member of FINRA. The regulation of broker-dealers has, to a large extent, been delegated by the federal securities laws to self-regulatory organizations, including FINRA. Subject to approval by the SEC, FINRA adopts rules that govern its members. FINRA and the SEC conduct periodic examinations of the brokerage operations of Morningstar Investment Services. Broker-dealers are subject to regulations that cover all aspects of the securities business, including sales, capital structure, record-keeping, and the conduct of directors, officers, and employees. Violation of applicable regulations can result in the revocation of a broker-dealer license, the imposition of censures or fines, and the suspension or expulsion of a firm or its officers or employees. Morningstar Investment Services is subject to certain net capital requirements under the Exchange Act. The net capital requirements, which specify minimum net capital levels for registered broker-dealers, are designed to measure the financial soundness and liquidity of broker-dealers.

Morningstar Credit Ratings, LLC is a Nationally Recognized Statistical Rating Organization (NRSRO) specializing in rating structured finance investments. As an NRSRO, Morningstar Credit Ratings, LLC is subject to the requirements and regulations under the Exchange Act. Such requirements relate to, among other things, record-keeping, reporting, governance, and conflicts of interest. As of result of its NRSRO registration, Morningstar Credit Ratings is subject to annual examinations by the SEC.

25

Australia