Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Kips Bay Medical, Inc. | Financial_Report.xls |

| EX-10.52 - EX-10.52 - Kips Bay Medical, Inc. | a2208035zex-10_52.htm |

| EX-32.1 - EX-32.1 - Kips Bay Medical, Inc. | a2208035zex-32_1.htm |

| EX-31.1 - EX-31.1 - Kips Bay Medical, Inc. | a2208035zex-31_1.htm |

| EX-31.2 - EX-31.2 - Kips Bay Medical, Inc. | a2208035zex-31_2.htm |

| EX-32.2 - EX-32.2 - Kips Bay Medical, Inc. | a2208035zex-32_2.htm |

Use these links to rapidly review the document

Table of Contents

Item 8. Financial Statements and Supplementary Data

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2011 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

KIPS BAY MEDICAL, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation) |

000-1460198 (Commission File Number) |

20-8947689 (IRS Employer Identification No.) |

| 3405 Annapolis Lane North, Suite 200 | ||

| Minneapolis, Minnesota | 55447 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (763) 235-3540

Securities Registered Pursuant to Section 12(b) of the Act: Common Stock, $0.01 par value

Name of Each Exchange on Which Registered: The NASDAQ Stock Market LLC

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best or registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer o (Do not check if smaller reporting company) |

Smaller reporting company ý |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter: $10,800,000

As of March 9, 2012, there were 16,245,579 shares of the registrant's common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the proxy statement for the registrant's 2012 Annual Meeting of Stockholders are incorporated by reference into Items 10, 11, 12, 13 and 14 of Part III of this report.

1

Overview

We are a medical device company focused on developing, manufacturing and commercializing our proprietary external saphenous vein support technology, or eSVS MESH, for use in coronary artery bypass grafting ("CABG") surgery. Our eSVS MESH is a knitted, nitinol mesh sleeve that, when placed over a saphenous vein graft during CABG surgery, is designed to improve the structural characteristics and long-term performance of the vein graft. CABG is one of the most commonly performed surgeries in the United States, with the American Heart Association estimating that 416,000 CABG procedures were performed in the United States in 2009, the most recent year for which the American Heart Association has published such estimates. In a typical CABG procedure, surgeons harvest blood vessels, or conduits, including the left internal mammary artery from the chest and the saphenous vein from the leg, and attach the harvested vessels to bypass, or provide blood flow around, blocked coronary arteries. The effectiveness of the procedure, however, is often limited by the failure rate of saphenous vein grafts, which has been shown in various studies to range from 7% to 26% one year after surgery and 39% ten years after surgery. Failure of these grafts, typically evidenced by partial or complete blockage and reduced or stopped blood flow, can lead to the need for further coronary interventions up to and including performing additional, or re-do CABG procedures which are generally associated with mortality rates three to five times higher than the original CABG procedure. We believe the use of our eSVS MESH with saphenous vein grafts in CABG surgery can improve the long-term outcome of CABG procedures, including improved openness, or patency, and improved blood flow through the saphenous vein graft, resulting in a reduced need for costly and potentially complicated reoperations or revascularization procedures.

Physicians and patients may select among a variety of treatments to address coronary artery disease, including pharmaceutical therapy, balloon angioplasty, stenting with bare metal or drug-eluting stents, and CABG procedures, with the selection often depending upon the health of the individual patient, the stage of the disease and the presence of comorbidities such as valvular disease or heart failure, etc. The SYNTAX study, comparing CABG and implantation of drug-eluting stents, found that CABG is the more effective long-term treatment for coronary artery disease ("CAD") in patients with CAD in the left main coronary artery or in three or more coronary arteries, achieving the best long-term patient outcomes as measured by the composite rate of survival, myocardial infarction (heart attack), stroke or the need for re-intervention 12 to 36 months after surgery. Moreover, patients with severe and multi-vessel coronary artery disease often cannot be effectively treated with methods other than CABG. The prevalence of coronary artery disease and the success rates for CABG procedures versus other treatments for coronary artery disease has made CABG surgery one of the most commonly performed surgeries in the United States. It is generally accepted that the increased incidence and prevalence of diabetes, obesity, combined with aging populations and other environmental factors will mean that the addressable pool of patients eligible for CABG surgery will continue to endure into the future.

According to published reports, a typical CABG procedure involves an average of 3.3 bypass grafts. In CABG procedures the left internal mammary artery ("LIMA") is generally used for the first graft, generally to the left anterior descending artery ("LAD"), and saphenous veins are used for any remaining grafts. Saphenous vein grafts fail more frequently than LIMA grafts due to differences in structure and size of saphenous vein grafts as compared to LIMA grafts. Unlike the LIMA, which is a thick-walled artery intended to handle the high pressure blood flow from the heart, saphenous veins are thin-walled vessels that are intended for a low-pressure venous environment. Saphenous veins are also typically larger than the coronary arteries to which they are attached and this difference in size disrupts blood flow, adding stress to the vessel wall and increasing the risk of thrombosis, or blood clotting.

2

When the vein grafts used to bypass a blocked artery are exposed to the high pressure of arterial flow, there is significant stress on the thin wall of the veins. The vein responds to this injury by causing its inner walls to thicken, decreasing the inner diameter of the graft and often leading to failure of the bypass graft.

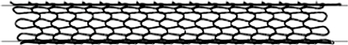

Our eSVS MESH is a nitinol mesh sleeve that is placed over the saphenous vein graft during CABG surgery and is designed to constrict the vein and prevent expansion of the vein graft and resulting injury due to increased pressure. The constriction of the vein graft also causes the diameter of the graft, or lumen, to more closely match the diameter of the target coronary artery to which it is attached, thereby reducing blood flow disruption. Our eSVS MESH is designed for quick deployment and is compatible with most current CABG surgery practices, including off-pump CABG, on-pump CABG and other less invasive methodologies. In addition, nitinol is commonly used in many other implantable medical devices.

In order to obtain authorization to apply the CE Mark to our product and begin sales in Europe, we conducted a 90 patient multi-center clinical trial outside the United States. The goals of this trial were to demonstrate that CABG surgery using our eSVS MESH was not inferior as to either safety or effectiveness as compared to traditional CABG surgery. We received our CE Mark in May 2010 based on data from angiographic studies nine to 12 months following surgery of the first 38 patients in the trial to complete such follow-up studies. Analysis of this data showed that the patency of vessels treated with our eSVS MESH was statistically equivalent and therefore non-inferior to the patency of untreated saphenous vein bypass vessels. The final results of the trial, which included angiographic data for 73 patients, differed from the results for the first 38 patients and were inconclusive as to whether the patency of eSVS MESH treated vessels was non-inferior to untreated vessels. Because our CE Mark submission was made pursuant to a protocol accepted by all participating clinical study sites and their respective Competent Authorities (government or government-appointed agencies in charge of approving medical device clinical studies prior to enrollment in such a study), and device and procedure safety have been demonstrated (no increase in adverse events as compared to published literature for CABG surgery), the final results do not impact the status or validity of our CE Mark. We began marketing and commenced shipments of our eSVS MESH in select European Union markets in June 2010, in the United Arab Emirates in October 2010 and in Turkey in January 2011. Our primary markets continue to be in select European countries and the United Arab Emirates.

In the trial, we evaluated the safety of our eSVS MESH by comparing the rate of major adverse cardiac and cerebral events, or MACCE, 30 days following surgery for patients treated with our eSVS MESH against the same rate reported in published literature for patients with traditional CABG surgery. We evaluated efficacy by comparing the patency of vessels treated with eSVS MESH against the patency of untreated saphenous vein bypass vessels as measured by angiographic studies nine to 12 months following implant. The safety data from this trial has indicated that our eSVS MESH and implant procedure do not result in an increase in patient complications during or after surgery. However, the effectiveness data from the trial is inconclusive primarily due to two complicating factors. First, one of the centers participating in the trial used implant methods incompatible with our eSVS MESH. Second, the amount of reduction in the diameter of the saphenous vein grafts, or downsizing, prescribed in our instructions for use and sizing tool was too aggressive, resulting in a higher than anticipated closure rate in saphenous vein grafts utilizing the eSVS MESH, particularly when our smallest device, 3.0 millimeters, was used. In response to this data, we have modified our instructions for use to provide clear direction on the surgical method to be used with our eSVS MESH, discontinued the use of our 3.0 millimeter eSVS MESH and reduced the amount of downsizing specified for other device sizes. We also exclude saphenous veins with walls thicker than 0.7 millimeters. We believe these steps have resolved the patency issues identified in the trial.

The U.S Food and Drug Administration ("FDA"), has reviewed and disapproved our most recent amendment to our application for an investigational device exemption ("IDE") in March 2011. At that

3

time, the FDA indicated that they intended to review our IDE information with outside experts before they provide further guidance to the Company. Due to internal delays, the FDA did not begin this review until August 2011. In September 2011 the FDA advised us that we had not provided sufficient data to support our request for an IDE for our eSVS MESH. Therefore, we intend to conduct a new feasibility trial in Europe based upon a protocol which incorporates additional guidance/requirements provided by the FDA. In November 2011 we began the process of recruiting study sites and expect to commence enrollment in the summer of 2012. Upon completion of this study, we expect to request an IDE for a pivotal study in the U.S. The results from this pivotal study are intended to provide the basis for filing of a pre-market approval application ("PMA"), which must be approved by the FDA prior to marketing the eSVS MESH in the United States. However, we could be delayed by adverse clinical results or regulatory complications, and we may never receive U.S. marketing approval.

In November 2011 we commenced enrollments in our first post-market study intended to support our international reimbursement and marketing activities with a clinical evaluation of the short-term (three to six months) and long-term (two years) post-implant patency of the eSVS MESH in the treatment of Saphenous Vein Grafts ("SVGs") used in Coronary Artery Bypass Grafting ("CABG"), as compared with prospective SVG CABG without the eSVS MESH. We intend to enroll up to 200 patients. Long term safety out to five years will also be assessed.

Our feasibility trial in Europe will be a multi-center, randomized study of external saphenous vein support using our eSVS MESH in CABG Surgery titled the "eMESH I" study. The objective of this study is to demonstrate the initial safety and performance of our eSVS MESH for use as an external SVG support device during coronary artery bypass procedures. The results of this study are intended to be used to obtain an approval from the FDA of an IDE for a pivotal study in the U.S. This feasibility study is also a prospective, randomized study and we will enroll a maximum of 120 patients.

See "Clinical Development of our eSVS MESH" below for additional information.

Our Strategy

Our objective is to achieve significant market adoption of our eSVS MESH technology in CABG and other vascular applications. Key elements of our strategy to achieve this objective include the following:

- •

- Work with respected medical centers and key thought leaders to demonstrate and communicate the potential benefits of our

eSVS MESH. We have commenced a post-market randomized study in Europe and are currently pursuing an additional feasibility

trial. The data from the feasibility study is intended to support our receipt of an approval for an IDE from the FDA for a pivotal study. The IDE approval will allow us to begin studying the eSVS MESH

clinically in the United States. We believe that it will be important to increase the awareness of our eSVS MESH by collaborating with key opinion leaders at leading academic and medical institutions

and supporting post-approval marketing studies and publication of peer-reviewed articles. We believe that we have formed strong relationships with surgeons at a growing number

of University-based and private cardiovascular surgery centers.

- •

- Commercialize our eSVS MESH in select European and other International markets. We received CE Mark approval in May 2010 and began marketing and commenced shipments of our eSVS MESH in select European markets in June 2010, in the United Arab Emirates in October 2010 and in Turkey in January 2011. We have engaged independent distributors for the United Arab Emirates and a number or European countries including: Switzerland, Italy, Spain, Belgium, the Netherlands, Luxembourg, the UK, Ireland, Greece, Denmark, Sweden, Norway, Turkey, Germany and, subsequent to year-end, France. We believe that we have engaged independent distributors experienced in their respective European markets to promote and sell our eSVS MESH. Concurrent with this effort, we have also engaged independent distributors in

4

- •

- Obtain regulatory approval and commercialize our eSVS MESH in the United States. The FDA has reviewed and disapproved our most recent amendment to our application for an IDE. As noted above, we intend to conduct a new feasibility trial in Europe based upon a protocol which incorporates additional guidance/requirements provided by the FDA. In November 2011 we began the process of identifying study sites and expect to commence enrollment in the summer of 2012. Upon completion of the feasibility study, we expect to request an IDE for a pivotal study in the U.S. In the U.S., a pivotal study is required to develop the clinical data to support an application for PMA approval from the FDA. If we receive the necessary regulatory approval, we plan to commercially introduce our eSVS MESH in the United States through independent distributors with access to key CABG centers and key physicians. However, we could be delayed by adverse clinical results or regulatory complications, and we may never receive U.S. marketing approval.

non-European countries and have commenced activities to seek regulatory approval to begin marketing in other international markets.

CABG Surgery

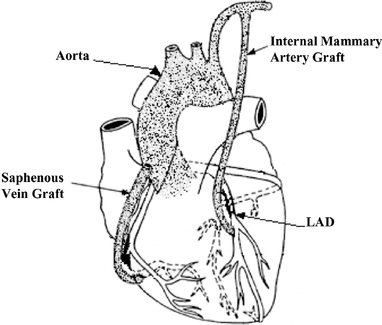

Coronary Artery Bypass Grafting involves the construction of an alternative path to bypass a narrowed or occluded coronary artery and restore blood flow from the aorta to an area past the blockage. This procedure is generally accomplished by harvesting and using saphenous veins from the patient's leg and the LIMA from the chest as bypass grafts. Most commonly, the LIMA is utilized for bypassing blockages in the left anterior descending artery ("LAD") of the heart, while saphenous veins are utilized for bypassing blockages in other coronary arteries.

For SVGs, one end of the harvested vessel is then generally attached to the aorta for blood inflow, and the opposite end is attached to the target coronary vessel. If a mammary artery is used as the bypass graft, it must be dissected from the chest wall, leaving one end in place on the aorta, while the opposite end is attached to the target vessel, providing uninterrupted blood flow from the arterial circulation. Once in place, these grafts provide blood flow to bypass the narrowed or occluded portion of the coronary artery. The following diagram illustrates the use of the internal mammary artery graft and SVGs in CABG surgery:

5

Current Disadvantages of Saphenous Vein Grafts

Since its first successful use in the 1960's, the SVG has been one of the most commonly used conduits in CABG surgery. Some of the main advantages of using the saphenous vein include its ease of accessibility, its ease of handling, and the number of grafts, typically three, that can be constructed from a single vein. Despite these advantages and the widespread use of saphenous veins in CABG surgery, several issues have been identified, such as:

- •

- Pressure normally exerted on veins is much lower than the pressure on arteries. Arterial pressure is normally

80-120 mm Hg while central venous pressure is normally about 3-7 mm Hg.

- •

- Veins do not have the strong muscular wall seen in arteries. Therefore, when placed under higher arterial pressures, the

veins typically dilate, or expand.

- •

- Veins have large lumens as compared to arteries, resulting in a mismatch of lumen diameters when an SVG is connected to a coronary artery. This size mismatch may result in slow, sluggish blood flow in the vein graft with more stress placed on the wall of the vein due to blood volume.

The higher pressure of arterial blood flow and the size mismatch that results when a saphenous vein is used as a graft in CABG surgery often cause the vein to expand, damaging the lining of the vein. The vein responds to this damage by causing its walls to thicken in a manner that often leads to failure of the bypass graft. Smooth muscle cells proliferate in the middle layer of the vein wall and migrate to the inner surface of the vein in a process known as neointimal hyperplasia. The resulting accumulation of activated smooth muscle cells secrete inflammatory and growth factors leading to a stenotic build-up, or constriction and narrowing of the graft, and graft failure over time. The failure rate of SVGs in CABG procedures is well documented in the scientific literature. A sampling of data from some of the larger benchmark studies is provided below:

| Saphenous Vein Graft Failure Rates | |||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

1 Year | 5 Year* | 10 Year* | |||||||||||||||||

Year

|

Author | Number of Patients |

Failure Rate |

Number of Patients |

Failure Rate |

Number of Patients |

Failure Rate |

||||||||||||||

1984 |

Barner, et al. |

248 | 7 | % | 112 | 26 | % | — | — | ||||||||||||

1996 |

Fitzgibbon, et al. |

3,993 | 19 | % | 1978 | 25 | % | — | — | ||||||||||||

2004 |

Goldman, et al. |

660 | 8 | % | 336 | 25 | % | 368 | 39 | % | |||||||||||

2005 |

Alexander |

2,000 | 26 | % | — | — | — | — | |||||||||||||

2009 |

Puskas, et al. |

183 | 18 | % | — | — | — | — | |||||||||||||

- *

- Five and ten year data is not available for those studies for which data is not presented in these columns.

Failure of these grafts typically evidenced by partial or complete blockage and reduced or stopped blood flow, can lead to chest pain or angina, congestive heart failure, irregular heartbeat, myocardial infarction, revascularization or death. A repeat of a CABG procedure to repair a failing or failed graft is a technically more difficult procedure with mortality rates three to five times higher than the original CABG procedure.

eSVS MESH—Our Solution

Our eSVS MESH is designed to improve the long-term outcome of CABG procedures by addressing limitations of unsupported saphenous veins. Our eSVS MESH is a highly flexible, semi-compliant, kink-resistant extra-vascular tubular prosthesis made of knitted nickel/titanium, or nitinol, wire mesh. Our eSVS MESH is designed to be fitted like a sleeve over vein grafts.

6

An artery has a thick muscular wall to handle higher pressures, and a relatively small lumen that produces higher blood velocities, offering less chance for blood to pool and clot. In contrast, a vein has a thinner, less muscular wall due to the lower pressures normally found in veins and a larger lumen designed to maintain these lower pressures. We believe that larger, thinner-walled veins will have greater potential benefit from our eSVS MESH.

Our eSVS MESH is designed to provide the vein graft with physiological attributes similar to those of an artery by reducing the lumen diameter and strengthening the vessel wall. We believe the key benefits of our eSVS MESH technology include:

- •

- Structural support designed to inhibit vessel expansion and resulting damage to the vessel, which can prevent a thickening

of the vessel wall over time, or hyperplasia, and resulting graft failure.

- •

- Radial constriction designed to cause the diameter of the graft, or lumen, to be consistent in size and more closely match

the diameter of the target coronary artery to which it is attached, thereby increasing blood flow velocities, reducing the potential for clot formation, and inhibiting hyperplasia.

- •

- Compatibility with current CABG procedures, including on-pump or off-pump procedures, and open or endoscopic saphenous vein harvest methods. On pump CABG procedures are performed on a non-beating heart with the patient on a heart-lung machine, and off-pump CABG procedures are performed on a beating heart. Open saphenous vein harvest involves a long incision in the leg to expose the entire length of vein being harvested, and endoscopic saphenous vein harvest involves only small slits at the beginning and end of the vein segment being harvested, with the use of an endoscopic device to harvest the vein segment. Except for the placement of our eSVS MESH on the SVG, the surgical steps to use a saphenous vein graft with our eSVS MESH are the same as would be performed for any coronary artery bypass procedure utilizing unsupported SVGs. We do not expect, nor have we seen, a significant increase in CABG procedure time due to eSVS MESH use.

Our eSVS MESH technology consists of the following:

- •

- eSVS MESH (25 cm length, and either 3.5, 4.0, or 4.5 mm in diameter);

- •

- INTRODUCER for use in placing our eSVS MESH on the saphenous vein (one for each diameter of our eSVS MESH);

- •

- SUTURE SNARE for use in loading our eSVS MESH onto the saphenous vein; and

7

- •

- SIZING TOOL for use in choosing the correct device size based on saphenous vein diameter.

Clinical Development of our eSVS MESH

European Post-Market Study

We are currently pursuing two post-market studies in Europe.

The first study is a prospective, multi-center, randomized, controlled study enrolling patients with multi-vessel coronary artery disease who require CABG of the right coronary artery ("RCA") and the left circumflex artery ("LCX") due to atherosclerotic coronary artery disease. Patients will serve as their own control, meaning that they will receive one SVG treated with our eSVS MESH and one untreated SVG. In addition, the use of the SVG treated with our eSVS MESH will be randomized between the RCA and the LCX.

The objective of this study is to support our international reimbursement and marketing activities with a clinical evaluation of the short (three to six months) and long-term (two years) post-implant patency of the eSVS MESH in the treatment of SVGs used in CABG surgery as compared with prospective SVG CABG without the eSVS MESH. Long term safety out to five years will also be assessed.

We intend to enroll up to 200 patients in this study at a maximum of six European hospitals. Clinical follow-up assessments consisting of a physical exam, laboratory testing, medication review, CT angiography for all enrolled patients will be performed at three or six months post procedure and coronary angiogram will be performed at 24 months. Additional yearly follow-ups through five years will be performed to assess safety.

Our second study will be performed at the University Hospital Basel, Clinic for Cardiac Surgery, in Basel, Switzerland. This study is also designed to evaluate the patency of SVGs treated with the eSVS MESH versus untreated SVGs 24 months after surgery. The study design is similar to the first study, except that patient follow-up will be at 30 days and six, 12 and 24 months after CABG and coronary angiograms will be performed at both the six and 24 month follow-up visits.

Feasibility Study for the FDA

We are currently recruiting study sites for a multi-center, randomized study of external saphenous vein support using our eSVS MESH in CABG Surgery. The title of this study is "The eMESH I Study" which will be performed at up to 10 sites in Europe.

The objective of this study is to demonstrate the initial safety and performance of our eSVS MESH for use as an external SVG support device during CABG surgery. The results of this study are intended to be used to obtain an approval from the FDA of an IDE for a pivotal study in the U.S. The study is a prospective, randomized study that will enroll a maximum of 120 patients.

8

The protocol for this study was reviewed by the FDA and is designed to collect the additional clinical data required by the FDA. As part of this study, each patient will be required to have two qualifying SVGs to be enrolled in the study. Additional SVGs are allowed but will not be included in the study evaluation. Each patient will serve as their own control, meaning that each study subject will be implanted with one SVG treated with our eSVS MESH and one untreated SVG. The two SVGs must be pre-specified during the procedure and the graft treated with our eSVS MESH will be randomized to either the right coronary artery ("RCA") or the left circumflex artery ("LCX") system.

The primary safety endpoint is the 30 day rate of major adverse coronary events (MACE) defined as the rate of the composite of total mortality, myocardial infarction (heart attack), and/or coronary target vessel revascularization (percutaneous coronary intervention or CABG) within 30 days of the procedure. The primary performance endpoint is the angiographic patency rate of the enrolled grafts, where patency is defined as < 75% stenosis, or blockage, of the SVG at six months.

Patients will be followed through hospital discharge, with follow-up visits at 30 days, three months, six months, one year and yearly thereafter through five years. Enrollment is expected to take nine to 12 months. Results through the six month follow-up visit will be submitted to the FDA with a request for an IDE approval of a pivotal study.

International Human Clinical Trial

The first human clinical trial of our eSVS MESH is a non-inferiority trial where each patient is randomized to receive an SVG with our eSVS MESH to bypass either the right coronary artery or the circumflex artery, two arteries commonly bypassed during CABG. The bypassed artery not chosen to receive our eSVS MESH serves as the control and receives a standard SVG. To ensure Good Clinical Practices compliance, outside resources are utilized for data collection and analysis, including a contract research organization for data entry and verification, a physician clinical events committee for the review and evaluation of adverse events, and an angiographic core lab for assessment of SVG patency.

Seven international centers enrolled 90 patients in this trial. Enrollment in this trial closed on July 21, 2009.

The international sites involved in this trial, and the number of patients enrolled at each site, is provided below:

Center Name

|

Number of Patients Enrolled |

|||

|---|---|---|---|---|

Schleswig-Holstein University Hospital, Kiel, Germany |

25 | |||

National University Hospital, Singapore |

21 | |||

University Of Cape Town, Cape Town, South Africa |

20 | |||

Hospital Regional De Sion, Sion, Switzerland |

9 | |||

Auckland City Hospital, Auckland, New Zealand |

8 | |||

Hospital Universitario 12 de Octubre, Madrid, Spain |

5 | |||

Prince Charles Hospital, Brisbane, Australia |

2 | |||

Total |

90 | |||

In this trial, our goal was to demonstrate that the use of our eSVS MESH results in no more major adverse cardiac and cerebral events, or MACCE, than standard CABG surgery. The primary safety endpoint of this trial was statistical non-inferiority based on the total rate of MACCE at 30-days post-implant as compared to published literature. MACCE is a composite of the following:

- •

- myocardial infarction, or heart attack;

- •

- stroke;

9

- •

- revascularization due to blocked vein grafts, including surgery or stenting; and

- •

- death.

In summary, there were four adverse events that met the protocol definition of MACCE, which compared favorably to the compilation of published literature that presented 30-day post-implant MACCE rates for CABG surgery patients, separating the MACCE category into the composite factors listed above.

A table summarizing these results is shown below:

| |

Trial Data | Objective Performance Criteria |

|||||

|---|---|---|---|---|---|---|---|

MI |

2(2.2 | )% | 2.8 | % | |||

Stroke |

2(2.2 | )% | 1.8 | % | |||

Revascularization |

0 | 0 | % | ||||

Death* |

0 | 4.8 | % | ||||

Total |

4(4.4 | )% | 9.4 | % | |||

- *

- One patient death eight months after surgery due to non-cardiac causes

The primary effectiveness endpoint of this trial is statistical non-inferiority of angiographic stenosis, or patency, of eSVS MESH vessels as compared to control vessels at nine to 12 months post-implant. A vessel is considered to be patent if there is less than 50% stenosis. This data has been inconclusive regarding the effectiveness of the eSVS MESH primarily due to the following two factors:

- •

- One center had implant methods incompatible with our eSVS MESH. Specifically, this center had issues with failure of the

proximal anastomotic site, resulting in graft closure. We have modified our instructions for use to provide clear direction to surgeons on how to make the proximal anastomotic site when using our eSVS

MESH.

- •

- The amount of reduction in the diameter of the SVGs, or downsizing, prescribed in our instructions for use and sizing tool was too aggressive, resulting in a higher than anticipated closure rate in SVGs utilizing the eSVS MESH, particularly when our smallest device, 3.0 millimeters, was used. This resulted in lumen diameters that were very small and did not remain patent. We have modified our instructions for use and sizing tool to decrease the amount of downsizing applied to SVGs by our eSVS MESH and discontinued the 3.0 millimeter size of our eSVS MESH.

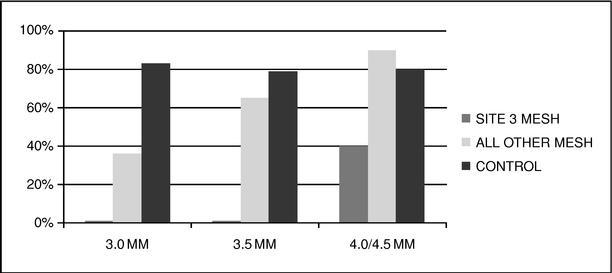

Of the 90 patients participating in the study, 73 patients returned for angiographic studies nine to 12 months following their implant. In this group, 49% (36 of 73) of the eSVS MESH vessels were patent and 81% (59 of 73) of the untreated vessels were patent. If, however, we exclude eSVS MESH grafts implanted at the center with the incompatible treatment methods and grafts treated with our 3.0 millimeter eSVS MESH, at nine to 12 months following the implant, 73% (24 of 33) of the eSVS MESH vessels were patent and 81% (59 of 73) of the untreated vessels were patent, statistically equivalent results. The following table shows the patency of (i) vessels treated with eSVS MESH implanted at the center with incompatible treatment methods ("Site 3" in the table below), (ii) vessels treated with eSVS MESH implanted at all other centers and (iii) untreated saphenous veins used as

10

controls, for each of the 3.0, 3.5 and 4.0/4.5 millimeter eSVS MESH sizes. We combined the 4.0 and 4.5 sizes since only one patient received the 4.5 millimeter eSVS MESH.

This trial formed the basis for our CE Mark application, which we submitted in February 2010 and received in May 2010. We began marketing and commenced shipments of our eSVS MESH in select European Union markets in June 2010, in the United Arab Emirates in October 2010 and in Turkey in January 2011.

European Trial to Support United States IDE Application

The FDA has reviewed and disapproved our most recent amendment to our application for an IDE in March 2011. At that time the FDA indicated that they intended to review our IDE information with outside experts before they provide further guidance to us. Due to internal delays, the FDA did not begin this review until August 2011. In September 2011, the FDA advised us that we had not provided sufficient data to support our request for an IDE for our eSVS MESH. Therefore, we intend to conduct a new feasibility trial in Europe based upon a protocol which incorporates additional guidance/requirements provided by the FDA. In November 2011, we began the process of recruiting study sites and expect to commence enrollment in the summer of 2012. Upon completion of this study, we expect to request an IDE for a pivotal study in the U.S. The results from this pivotal study are intended to provide the basis for filing of a PMA application, which must be approved by the FDA prior to marketing the eSVS MESH in the United States. However, we could be delayed by adverse clinical results or regulatory complications, and we may never receive U.S. marketing approval.

Pivotal Trial

The primary safety endpoint of a pivotal trial in the U.S. is expected to be statistical non-inferiority of major adverse cardiac events ("MACE") at 30-days post-implant in patients with SVGs treated with our eSVS MESH as compared with the reported total rate of MACE as published in prior CABG study reports. The primary effectiveness endpoint of this trial is expected to be statistical superiority of the patency of SVGs treated with our eSVS MESH vessels as compared to untreated SVG's at 12 months post-implant. This effectiveness endpoint is more rigorous than the effectiveness endpoint of our international trial, which was a non-inferiority comparison.

Until the requirements of the study are agreed to by the FDA, which includes the number of patients required, we cannot estimate the time required to complete enrollment on a pivotal study. However, prior to commercializing our eSVS MESH in the United States, we will be required to submit a PMA application to the FDA which includes the final results from a pivotal study. Approval

11

of a PMA by the FDA generally takes approximately one year after the application. We could be delayed by adverse clinical results or regulatory complications, and we may never receive marketing approval.

Preclinical Testing

Preclinical trials of our eSVS MESH technology have been presented in peer-reviewed journals, including The Journal of Thoracic and Cardiovascular Surgery in February 2008 and the Journal of Vascular Surgery in June 2009. Between 2002 and 2007, Medtronic, Inc. sponsored multiphase trials with the Cardiovascular Research Unit of the Christiaan Barnard Department of Cardiothoracic Surgery at the University of Cape Town in South Africa, or UCT, to evaluate the effects of various designs of external nitinol mesh sleeves on the vascular architecture of vein grafts used in CABG and peripheral bypass procedures. This multiphase research concluded that the use of our eSVS MESH showed a statistically significant decrease in intimal hyperplasia after six months of implantation. In addition to these trials, Medtronic, Inc. and UCT collaborated on stress, fatigue, durability, and finite element analysis of knitted eSVS MESH designs.

In October 2007, we acquired ownership of the core intellectual property relating to our eSVS MESH from Medtronic, Inc. and initiated additional work on the technology. This work included developing additional sizes of our eSVS MESH, completing required preclinical and biological testing of the product and accessories, developing packaging and labeling for our eSVS MESH, and creating product documentation intended to comply with relevant FDA and international standards.

In addition, we initiated and completed a series of animal trials utilizing sheep to confirm that our eSVS MESH, as manufactured by us, performed as expected, and produced the expected results. These animal trials showed a statistically significant inhibition of the formation of intimal hyperplasia when our eSVS MESH was used with an SVG in CABG procedures. However, sheep arterial pressures and vasculature differ from humans, and human clinical studies may not be consistent with animal trial results.

Additional eSVS MESH Applications

Additional development projects based on our eSVS MESH technology that we may explore and advance include:

Peripheral Grafts

In this clinical application, SVGs are used to bypass obstructed arterial vessels in the legs. We have begun initial preclinical trials for this application, utilizing SVGs with our eSVS MESH in place and have completed preliminary assessments of this procedure.

Coronary Allografts

In this clinical application, cadaver, or allograft, SVGs are used in CABG procedures for patients who do not have appropriate arterial or venous conduits. We have had discussions with suppliers of this allograft material to determine usage patterns.

Arteriovenous Fistula

In this clinical application, a fistula, or connection, is made between an artery and a vein, normally in the non-dominant arm, for circulatory system access in patients requiring chronic dialysis.

In light of and in response to developments with the FDA, our staff has been focused on advancing our clinical studies in Europe and developing the additional clinical information which the FDA has requested prior to allowing us to obtain an IDE approval for a US clinical trial. As a result,

12

we have not devoted substantial amounts of time to these development projects. We expect that our clinical trials will remain our primary focus for 2012 and we will devote time to the further development of our eSVS MESH and additional applications for the eSVS MESH as schedules and priorities permit.

Sales and Marketing

Europe and Other International Markets

On May 13, 2010, we obtained the CE Mark for our eSVS MESH. The CE Mark allows us to sell our eSVS MESH for use in CABG procedures in 32 countries within the European Union, the European Economic Area, and the European Free Trade Association. We began marketing and commenced shipments of our eSVS MESH in select European Union markets in June 2010. We have utilized independent distributors to commercialize our technology in Europe. We have entered into agreements with independent distributors for Switzerland, Italy, Spain, Belgium, the Netherlands, Luxembourg, the UK, Ireland, Greece, Denmark, Sweden, Norway, Turkey, Germany, and subsequent to year-end, France to conduct sales in these markets. These distribution agreements generally have terms of three years, restrict distributors from selling products competitive with our eSVS MESH and grant exclusivity within a territory, which is generally limited to a single country. In addition, we may terminate the distributor's exclusivity or the entire agreement if the distributor fails to achieve agreed upon sales targets. These distributors will be supported by our U.S.-based staff with regard to product and physician training and promotional materials.

We work with our distributors to drive clinical utilization in key centers within their respective territories. We have also identified other third parties that may be contracted to assist in obtaining country-specific product reimbursement where necessary. We were recently denied a government-sponsored supplemental reimbursement in Germany for our eSVS MESH for calendar year 2012, and will need to work with hospitals in Germany to obtain coverage for the eSVS MESH under a new or existing reimbursement code.

As the European cardiac surgery market is characterized by centralized, high-volume cardiac surgery centers, we believe this market can be effectively addressed through a small, highly-focused independent distributor network.

We are pursuing post-market clinical trials aimed at validating both the short and long-term outcomes of patients who receive our eSVS MESH. These post-market studies are designed so that a patient undergoing a three-vessel bypass surgical procedure will act as their own control, meaning they will receive the LIMA to the LAD and the eSVS MESH will be randomized to one of the two remaining vessels targeted for bypass. Follow-up imaging studies will then be used to compare patency rates of the untreated versus the eSVS MESH treated vein grafts. These studies are intended to show that bypass grafts treated with the eSVS MESH require less revascularization procedures than bypass grafts without the eSVS MESH, thereby also reducing the costs associated with revascularization procedures for the bypass grafts treated with the eSVS MESH. We envision that the results of these studies will be presented at scientific sessions and presented in peer-reviewed journals, thereby increasing the visibility and adoption of our eSVS MESH. These studies will also be used to support applications for public hospital reimbursement in those countries that require outcomes data for such reimbursement.

We believe that the CE Mark will allow us to begin regulatory submissions to obtain marketing approval in other select markets, including South Africa, Canada, New Zealand and Argentina. These markets require the CE Mark to begin the submission process, per their current medical device regulatory requirements. In addition, we have begun the regulatory submission process for Singapore, Hong Kong and Korea, and have entered into an agreement with an independent distributor for Singapore, Hong Kong, Thailand, Malaysia, Indonesia, the Philippines, Cambodia, Laos, Vietnam and

13

Brunei. We have also entered into an agreement and begun commercial sales with an independent distributor for the United Arab Emirates.

United States

We intend to utilize a combination of direct sales employees and independent distributors to commercialize our eSVS MESH in the U.S. We have identified and are in preliminary discussions with independent distributors that may be contracted to conduct sales, but we have not yet entered into any distribution agreements. We expect that these contracts will be on terms similar to those described above for our agreements with international distributors. These distributors will be supported by our staff with regard to training and promotional materials. We have contracted outside reimbursement experts to assist in obtaining Centers for Medicare & Medicaid Services, or CMS, product reimbursement.

We are required to obtain a PMA approval from the FDA in order to market our eSVS MESH in the United States. The timeline for obtaining such approval is subject to the requirements of the FDA. We may be delayed by adverse clinical results or regulatory complications, and we may never receive U.S. marketing approval.

Intellectual Property

As of March 1, 2012, we had six issued patents covering the eSVS MESH: two issued in the U.S. and one each issued in Japan, Europe, Canada and South Africa. The European patent has been validated and is enforceable in six European countries and we are presently engaged in the grant phase to validate this patent in two additional European countries. In addition, we have five patent applications pending in the U.S and eight patent applications pending in countries outside the U.S. covering various aspects of our eSVS MESH.

Our issued patents and pending patent applications include claims directed towards, among other things, the knitted, resilient structure of our eSVS MESH which is designed to provide structural support to inhibit vessel expansion and provide the vein graft with physiological attributes similar to those of an artery, and the surgical procedures relating to implanting our eSVS MESH.

During the examination process, the examiner assesses the patentability of the invention by comparing the pending claims to the relevant prior art. If the examiner determines that the claimed invention is unpatentable, the examiner will issue an "office action" providing the grounds for rejecting the claims. Such grounds for rejection can include, for example, that the claimed invention lacks novelty or is obvious in view of the relevant prior art. It is common for most U.S. patent applications to be rejected at least one time before issuing as a U.S. patent. To overcome the rejection, the applicant must generally reply by amending the claims and/or providing arguments to distinguish the claimed invention from the cited prior art. If the examiner is not persuaded by the amendments and/or arguments, the applicant can either continue to make amendments and/or arguments to the examiner, for example, by filing a Request for Continued Examination, or a RCE, or by appealing the examiner's decision to the Board of Patent Appeals and Interferences, or the BPAI.

Due to the indeterminate time frames in which patent examiners engage in prosecution and the uncertainty of how the examiners will respond to our submissions, it is difficult to accurately predict when the prosecution of our current patent applications will end. These pending patent applications may not issue as patents, or, if issued, may not issue in a form that is desirable or advantageous to us. Competitors can attempt to replicate some or all of the competitive advantages we derive from our eSVS MESH or design around our technology, and they might be able to market products and use manufacturing processes that are substantially similar to ours, each of which we believe would be highly likely if we are able to achieve significant market acceptance of our eSVS MESH.

14

In addition, third parties may assert that our eSVS MESH infringes the claims in their patents or seek to expand their patent claims to cover aspects of our eSVS MESH. An adverse determination in litigation or interference proceedings to which we may become a party could subject us to significant liabilities or require us to seek licenses. Although patent and intellectual property disputes in the medical device area have often been settled through licensing or similar arrangements, costs associated with these arrangements may be substantial and could include ongoing royalties. We may be unable to obtain necessary licenses on satisfactory terms, if at all, and we may be required to redesign our eSVS MESH to avoid infringement.

The core intellectual property relating to our eSVS MESH was sold to us by Medtronic, Inc. ("Medtronic") pursuant to an Assignment and License Agreement dated October 9, 2007. Pursuant to the Assignment and License Agreement, Medtronic also sold to us intellectual property relating to a brushed ePTFE vascular graft, or the Brushed Graft Product. As consideration for the sale of intellectual property relating to the eSVS MESH and the Brushed Graft Product and other rights granted by the Assignment and License Agreement, we have agreed to pay Medtronic an aggregate of $20.0 million upon the achievement of certain sales milestones relating to the eSVS MESH and the Brushed Graft Product and a royalty of 4% on sales of our eSVS MESH and the Brushed Graft Product. The royalty will terminate upon the earlier of the expiration of all of the patents and patent applications, or when the aggregate royalties paid reach $100.0 million.

Any or all licenses granted to us pursuant to our agreement with Medtronic may be terminated and potentially all of the core intellectual property and patent rights related to our eSVS MESH will revert to Medtronic, upon notice by Medtronic, if we become insolvent, make an assignment for the benefit of creditors, go into liquidation or receivership or otherwise lose legal control of our business.. Medtronic may also cause the core intellectual property and patent rights related to our eSVS MESH to revert to Medtronic if we determine to cease commercializing our eSVS MESH.

Competition

The development and commercialization of medical devices to treat cardiovascular disease is a highly competitive industry. Physicians and patients may select among a variety of treatments to address coronary artery disease, including pharmaceutical therapy, balloon angioplasty, stenting with bare metal or drug-eluting stents, and CABG procedures, with the selection often depending upon the health of the patient and the stage of the disease. If physicians or their patients choose alternative treatments to CABG surgery due to the disadvantages of CABG surgery, such as the failure rate of CABG surgery, or if additional alternative treatments for cardiovascular disease are developed, there may be a decrease in the number of CABG surgery procedures. The American College of Cardiology/ American Heart Association treatment guidelines state that CABG is the only recommended revascularization procedure for those patients with CAD in their left main coronary artery or CAD in three or more coronary arteries.

Our eSVS MESH is designed to improve the structural characteristics and long-term performance of vein grafts in CABG surgery. If our eSVS MESH is proven to do so successfully, we believe physicians may more frequently choose to perform CABG surgery over alternative treatments. We expect the primary competition for our eSVS MESH to be other products or techniques to improve the effectiveness of vein grafts in CABG surgery.

We are aware of three companies that have developed mesh devices to be used on the outside of blood vessels. Vascular Graft Solutions ("VGS"), an Israeli company is developing a product called the Fluent expandable external support system which is designed to reduce vein graft failures in CABG surgery. VGS is currently conducting its first in-human trial in the United Kingdom. According to information filed on ClinicalTrials.gov, VGS expects to enroll approximately 30 patients and complete data collection for their primary outcome measure in June 2012. Alpha Research, a Swiss company, has

15

developed a product known as the Biocompound Graft for use in coronary and peripheral bypass operations. The product is a stainless steel braided mesh, indicated for use in coronary or peripheral bypass with patients who have irregularly shaped veins. B. Braun, a German company, has developed a product known as ProVena for use in peripheral bypass operations. The product is a woven polymer mesh, indicated for use in peripheral artery bypass operations using vein grafts.

We believe that the VGS product will be a direct competitor to our eSVS MESH when and if the results of their on-going clinical trial in Great Britain allow VGS to secure a CE Mark approval for their product.

We believe that the Alpha Research and B. Braun products are not currently direct competitors to our eSVS MESH, and are not likely to become direct competitors in the near future, because the Biocompound Graft is intended for use only with irregularly shaped veins and the ProVena is intended for use with non-coronary procedures. However, it is possible that one or both of these companies, or other potential competitors, will seek approval to use these or similar devices for procedures with similar or identical indications for use as our eSVS MESH.

The key competitive factors affecting the success of our eSVS MESH are likely to be the effectiveness, safety profile and price of our eSVS MESH, as compared to existing methods for CABG surgery. We believe a potential disadvantage associated with our eSVS MESH is the possibility of allergic reaction to the implant materials. According to a July 2009 article in the Journal of Invasive Cardiology, nickel allergy after implantation of a nitinol-containing device is rare. This article described the rate of nickel allergy in cardiovascular implants to be between 0.002% and 0.02%. The article also stated that the patients with nickel allergy symptoms responded to medical management at the time of the reaction, did not require device explant, and no longer require medications for the reaction. In order to further safeguard against this rare occurrence, the eSVS MESH instructions for use state that it is contraindicated for patients with a known allergy to nitinol. We believe another potential disadvantage associated with our eSVS MESH is the possibility of damage to the saphenous vein during placement of our eSVS MESH. If the physician does not select the proper size eSVS MESH relative to the size of the vein, the saphenous vein may be damaged while placing our eSVS MESH over the vein. For example, if too small an eSVS MESH is chosen, there could be damage to the saphenous vein caused by stretching the vein while trying to place it inside our eSVS MESH. We have provided specific directions in the eSVS MESH instructions for use on how to properly size veins and place our eSVS MESH. In addition, we provide a sizing tool with our eSVS MESH to ensure proper vein sizing. The commercial success of our eSVS MESH will depend upon the results of clinical trials of the technology and experience with the technology in the commercial marketplace.

If the commercialization of our eSVS MESH technology is successful, we expect that other medical device companies, many of whom are larger and have greater financial resources than us, will seek to enter into this market by introducing competing technologies.

Manufacturing and Suppliers

We fabricate our eSVS MESH both at our facility and at a contract manufacturer. We conduct final assembly and packaging inside a controlled environment area within our facility that satisfies the requirements of a Class 10,000 level clean room. We have implemented systems to ensure that our manufacturing operations comply with relevant United States and International Good Manufacturing Practices requirements.

We have vendors for all of our key components and outsourced processes. We have identified alternate suppliers for each key component and outsourced process; however, in some cases, components are provided by single source suppliers at this time due to quality considerations, costs, or regulatory requirements. We have established redundancy for custom equipment used in the manufacture of our eSVS MESH. A third-party supplier performs sterilization services for our eSVS

16

MESH. We currently use four knitting machines that knit the mesh sleeve of our eSVS MESH, with three located at our facility and the fourth located off-site. We believe that these four machines will produce sufficient quantities of our eSVS MESH to meet our expected needs for the foreseeable future. In the event that one or all of our knitting machines were to become unavailable, we believe that we can obtain one or more replacement knitting machines, although the custom work required to enable the machines to produce our eSVS MESH may result in some delays in our production process.

Research and Development

During 2009, 2010 and 2011, we incurred $3.0 million, $2.5 million and $1.7 million, respectively, of research and development expenses. Research and development costs include the costs to design, develop, test, seek approval for, and enhance our eSVS MESH and production process. Expenses related to research and development consist primarily of personnel costs, including salaries, benefits and stock-based compensation, product development, pre-clinical and clinical trials, professional service fees, materials and supplies, and facilities-related costs. While our research and development expenses to date have been focused on product development and evaluating the feasibility of our eSVS MESH, we expect that a large percentage of our research and development expenses in the future will be incurred in support of our current and future clinical trials. As we develop further applications for our eSVS MESH, we intend to utilize internal resources, outside contract resources and facilities, and our Scientific Advisory Board.

Employees

As of March 1, 2012, we had 15 employees. We plan to continue to expand our research and development and commercialization activities. To support this growth, we will need to expand managerial, research and development, operations and other functions. None of our employees is represented by a labor union, and we consider our relationship with our employees to be good.

Government Regulation

United States Medical Device Regulation

The Federal Food, Drug, and Cosmetic Act, or FDCA, and the FDA's implementing regulations, govern medical device design and development, preclinical and clinical testing, pre-market clearance or approval, registration and listing, manufacturing, labeling, storage, advertising and promotion, sales and distribution, and post-market surveillance. Medical devices and their manufacturers are also subject to inspection by the FDA. The FDCA, supplemented by other federal and state laws, also provides civil and criminal penalties for violations of its provisions. We intend to manufacture and market a medical device that is regulated by the FDA, comparable state agencies and regulatory bodies in other countries.

Our eSVS MESH will require marketing authorization from the FDA prior to commercial distribution in the United States. The two primary types of FDA marketing authorization are pre-market notification (also called 510(k) clearance) and PMA approval. The type of marketing authorization applicable to a device—510(k) clearance or PMA approval—is generally linked to classification of the device. The PMA approval process is generally more stringent, time-consuming and expensive than the 510(k) clearance process.

The FDA classifies medical devices into one of three classes (Class I, II or III) based on the degree of risk FDA determines to be associated with a device and the extent of control deemed necessary to ensure the device's safety and effectiveness. Devices requiring fewer controls because they are deemed to pose lower risk are placed in Class I or II. Class I devices are deemed to pose the least risk and are subject only to general controls applicable to all devices, such as requirements for device labeling, pre-market notification, and adherence to the FDA's current Good Manufacturing Practice

17

requirements, as reflected in its Quality System Regulation, or QSR. Class II devices are intermediate risk devices that are subject to general controls and may also be subject to special controls such as performance standards, product-specific guidance documents, special labeling requirements, patient registries or post-market surveillance. Class III devices are those for which insufficient information exists to assure safety and effectiveness solely through general or special controls, and include life-sustaining, life-supporting, or implantable devices, and devices not "substantially equivalent" to a device that is already legally marketed.

Most Class I devices and some Class II devices are exempted by regulation from the 510(k) clearance requirement and can be marketed without prior authorization from FDA. Class I and Class II devices that have not been so exempted are eligible for marketing through the 510(k) clearance pathway. By contrast, devices placed in Class III generally require PMA approval prior to commercial marketing. To obtain 510(k) clearance for a medical device, an applicant must submit a pre-market notification to the FDA demonstrating that the device is "substantially equivalent" to a predicate device legally marketed in the United States. A device is substantially equivalent if, with respect to the predicate device, it has the same intended use and (1) the same technological characteristics, or (2) has different technological characteristics and the information submitted demonstrates that the device is as safe and effective as a legally marketed device and does not raise different questions of safety or effectiveness. A showing of substantial equivalence sometimes, but not always, requires clinical data. Generally, the 510(k) clearance process can exceed 90 days and may extend to a year or more.

After a device has received 510(k) clearance for a specific intended use, any modification that could significantly affect its safety or effectiveness, such as a significant change in the design, materials, method of manufacture or intended use, will require a new 510(k) clearance or (if the device as modified is not substantially equivalent to a legally marketed predicate device) PMA approval. While the determination as to whether new authorization is needed is initially left to the manufacturer, the FDA may review this determination and evaluate the regulatory status of the modified product at any time and may require the manufacturer to cease marketing and recall the modified device until 510(k) clearance or PMA approval is obtained. The manufacturer may also be subject to significant regulatory fines or penalties.

Our coronary eSVS MESH has been designated a Class III product by the FDA and will be required to go through the PMA process. Other indications of our eSVS MESH, including peripheral and arteriovenous fistula applications, have not been classified at this time.

The FDA will require us to file a PMA application with respect to our eSVS MESH and there is no assurance that PMA approval will be granted. A PMA application requires the payment of significant User Fees, and must be supported by valid scientific evidence, which typically requires extensive data, including technical, preclinical, clinical and manufacturing data, to demonstrate to the FDA's satisfaction the safety and effectiveness of the device. A PMA application also must include a complete description of the device and its components, a detailed description of the methods, facilities and controls used to manufacture the device, and proposed labeling. After a PMA application is submitted and found to be sufficiently complete, the FDA begins an in-depth review of the submitted information. During this review period, the FDA may request additional information or clarification of information already provided. Also during the review period, an advisory panel of experts from outside the FDA may be convened to review and evaluate the application and provide recommendations to the FDA as to the approvability of the device. In addition, the FDA will conduct a pre-approval inspection of the manufacturing facility to ensure compliance with the QSR, which requires manufacturers to follow design, testing, control, documentation and other quality assurance procedures.

18

FDA review of a PMA application is required by statute to take no longer than 180 days, although the process typically takes significantly longer, and may require several years to complete. The FDA can delay, limit or deny approval of a PMA application for many reasons, including:

- •

- the device may not be safe or effective to the FDA's satisfaction;

- •

- the data from our preclinical trials and clinical trials may be insufficient to support approval;

- •

- the manufacturing process or facilities we use may not meet applicable requirements; and

- •

- changes in FDA approval policies or adoption of new regulations may require additional data.

If the FDA evaluations of both the PMA application and the manufacturing facilities are favorable, the FDA will either issue an approval letter, or an approvable letter, which usually contains a number of conditions that must be met in order to secure final approval of the PMA. When and if those conditions have been fulfilled to the satisfaction of the FDA, the agency will issue a PMA approval letter authorizing commercial marketing of the device for certain indications. If the FDA's evaluation of the PMA or manufacturing facilities is not favorable, the FDA will deny approval of the PMA or issue a not approvable letter. The FDA may also determine that additional clinical trials are necessary, in which case the PMA approval may be delayed for several months or years while the trials are conducted and then the data submitted in an amendment to the PMA. The PMA process can be expensive, uncertain and lengthy and a number of devices for which FDA approval has been sought by other companies have never been approved for marketing. Even if a PMA application is approved, the FDA may approve the device with an indication that is narrower or more limited than originally sought. The agency can also impose restrictions on the sale, distribution, or use of the device as a condition of approval, or impose post approval requirements such as continuing evaluation and periodic reporting on the safety, effectiveness and reliability of the device for its intended use.

New PMA applications or PMA supplements may be required for modifications to the manufacturing process, labeling, device specifications, materials or design of a device that is approved through the PMA process. PMA approval supplements often require submission of the same type of information as an initial PMA application, except that the supplement is limited to information needed to support any changes from the device covered by the original PMA application and may not require as extensive clinical data or the convening of an advisory panel.

Clinical trials are almost always required to support a PMA application and are sometimes required for a 510(k) clearance. These trials generally require submission of an application for an investigational device exemption, or IDE, to the FDA. The IDE application must be supported by appropriate data, such as animal and laboratory testing results, showing that it is safe to test the device in humans and that the testing protocol is scientifically sound. The IDE application must be approved in advance by the FDA for a specified number of patients, unless the product is deemed a non-significant risk device and eligible for more abbreviated IDE requirements. Generally, clinical trials for a significant risk device may begin once the IDE application is approved by the FDA and the trial protocol and informed consent are approved by appropriate institutional review boards at the clinical trial sites.

FDA approval of an IDE allows clinical testing to go forward, but does not bind the FDA to accept the results of the trial as sufficient to prove the product's safety and effectiveness, even if the trial meets its intended success criteria. With certain exceptions, changes made to an investigational plan after an IDE is approved must be submitted in an IDE supplement and approved by the FDA (and by governing institutional review boards when appropriate) prior to implementation. All clinical trials must be conducted in accordance with regulations and requirements collectively known as Good Clinical Practice, or GCP. GCPs include the FDA's IDE regulations, which describe the conduct of clinical trials with medical devices, including the recordkeeping, reporting and monitoring responsibilities of sponsors and investigators, and labeling of investigation devices. They also prohibit

19

promotion, test marketing, or commercialization of an investigational device, and any representation that such a device is safe or effective for the purposes being investigated. GCPs also include FDA's regulations for institutional review board approval and for protection of human subjects (informed consent), as well as disclosure of financial interests by clinical investigators.

Required records and reports are subject to inspection by the FDA. The results of clinical testing may be unfavorable or, even if the intended safety and effectiveness success criteria are achieved, may not be considered sufficient for the FDA to grant approval or clearance of a product. The commencement or completion of any of our clinical trials may be delayed or halted, or be inadequate to support approval of a PMA application or clearance of a pre-market notification for numerous reasons, including, but not limited to, the following:

- •

- the FDA or other regulatory authorities do not approve a clinical trial protocol or a clinical trial (or a change to a

previously approved protocol or trial that requires approval), or place a clinical trial on hold;

- •

- patients do not enroll in clinical trials or follow up at the rate expected;

- •

- institutional review boards and third-party clinical investigators may delay or reject our trial protocol or changes to

our trial protocol;

- •

- third-party clinical investigators decline to participate in a trial or do not perform a trial on our anticipated schedule

or consistent with the clinical trial protocol, investigator agreements, good clinical practices or other FDA requirements;

- •

- third-party organizations do not perform data collection and analysis in a timely or accurate manner;

- •

- regulatory inspections of our clinical trials or manufacturing facilities, which may, among other things, require us to

undertake corrective action or suspend or terminate our clinical trials;

- •

- changes in governmental regulations or administrative actions;

- •

- the interim or final results of the clinical trial are inconclusive or unfavorable as to safety or effectiveness; and

- •

- the FDA concludes that our trial design is inadequate to demonstrate safety and effectiveness.

After a device is approved and placed in commercial distribution, numerous regulatory requirements apply. These include:

- •

- establishment registration and device listing;

- •

- the QSR, which requires manufacturers to follow design, testing, control, documentation and other quality assurance

procedures;

- •

- labeling regulations, which prohibit the promotion of products for unapproved or "off-label" uses and impose

other restrictions on labeling;

- •

- medical device reporting regulations, which require that manufacturers report to the FDA if a device may have caused or

contributed to a death or serious injury or malfunctioned in a way that would likely cause or contribute to a death or serious injury if malfunctions were to recur; and

- •

- corrections and removal reporting regulations, which require that manufacturers report to the FDA field corrections and product recalls or removals if undertaken to reduce a risk to health posed by the device or to remedy a violation of the FDCA caused by the device that may present a risk to health.

20

Also, the FDA may require us to conduct post-market surveillance studies or order us to establish and maintain a system for tracking our eSVS MESH through the chain of distribution to the patient level. The FDA enforces regulatory requirements by conducting periodic, announced and unannounced inspections and market surveillance. Inspections may include the manufacturing facilities of our subcontractors.

Failure to comply with applicable regulatory requirements, including those applicable to the conduct of our clinical trials, can result in enforcement action by the FDA, which may lead to any of the following sanctions:

- •

- warning letters or untitled letters;

- •

- fines and civil penalties;

- •

- unanticipated expenditures;

- •

- delays in clearing or approving or refusal to clear or approve products;

- •

- withdrawal or suspension of FDA approval;

- •

- product recall or seizure;

- •

- orders for physician notification or device repair, replacement, or refund;

- •

- production interruptions;

- •

- operating restrictions;

- •

- injunctions; and

- •

- criminal prosecution.

We and our contract manufacturers, specification developers and suppliers are also required to manufacture our eSVS MESH in compliance with current Good Manufacturing Practice requirements set forth in the QSR. The QSR requires a quality system for the design, manufacture, packaging, labeling, storage, installation and servicing of marketed devices, and includes extensive requirements with respect to quality management and organization, device design, buildings, equipment, purchase and handling of components, production and process controls, packaging and labeling controls, device evaluation, distribution, installation, complaint handling, servicing and record keeping. The FDA enforces the QSR through periodic announced and unannounced inspections that may include the manufacturing facilities of our subcontractors. If the FDA believes we or any of our contract manufacturers or regulated suppliers is not in compliance with these requirements, it can shut down our manufacturing operations, require recall of our eSVS MESH, refuse to clear or approve new marketing applications, institute legal proceedings to detain or seize products, enjoin future violations, or assess civil and criminal penalties against us or our officers or other employees. Any such action by the FDA would have a material adverse effect on our business.

Fraud and Abuse

Our operations will be directly, or indirectly through our customers, subject to various state and federal fraud and abuse laws, including, without limitation, the FDCA, the federal Anti-Kickback Statute and the False Claims Act. These laws may impact, among other things, our proposed sales, marketing and education programs. In addition, these laws require us to screen individuals and other companies, suppliers and vendors in order to ensure that they are not "debarred" by the federal government and therefore prohibited from doing business in the healthcare industry. The association or conduct of business with a "debarred" entity could be detrimental to our operations and result in a negative impact on our business.

21