Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - DATALINK CORP | Financial_Report.xls |

| EX-32.1 - EX-32.1 - DATALINK CORP | a2208070zex-32_1.htm |

| EX-23.1 - EX-23.1 - DATALINK CORP | a2208070zex-23_1.htm |

| EX-31.1 - EX-31.1 - DATALINK CORP | a2208070zex-31_1.htm |

| EX-10.18 - EX-10.18 - DATALINK CORP | a2208070zex-10_18.htm |

| EX-10.19 - EX-10.19 - DATALINK CORP | a2208070zex-10_19.htm |

QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

| (Mark one) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2011 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For The Transition Period From To |

||

Commission file number: 000-29758

DATALINK CORPORATION

(Exact name of registrant as specified in its charter)

| MINNESOTA | 41-0856543 | |

| (State or other jurisdiction of incorporation) | (IRS Employer Identification Number) |

8170 UPLAND CIRCLE

CHANHASSEN, MINNESOTA 55317-8589

(Address of Principal Executive Offices)

(952) 944-3462

(Registrant's Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.001 par value.

Indicate by check mark if the registrant is a well known seasoned issuer as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulations S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company.

| Large Accelerated Filer o | Accelerated Filer ý | Non-Accelerated Filer o | Smaller Reporting Company ý |

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act). Yes o No ý

Aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant at June 30, 2011: $91,887,646.

At March 12, 2012, the number of shares outstanding of the registrant's classes of common stock was 18,019,534.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant's Proxy Statement for its 2012 Annual Meeting of Stockholders are incorporated by reference to Part III of this Form 10-K.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

The Private Securities Litigation Reform Act of 1995 provides a "safe harbor" for certain forward-looking statements. This Annual Report on Form 10-K (Annual Report) contains forward-looking statements. These forward-looking statements are subject to certain risks and uncertainties, including those identified below, which could cause actual results to differ materially from historical results or those anticipated. The words "aim," "believe," "expect," "anticipate," "intend," "estimate" and other expressions which indicate future events and trends identify forward-looking statements. Actual future results and trends may differ materially from historical results or those anticipated depending upon a variety of factors, including, but not limited to: the level of continuing demand for data center solutions and services including the effects of current economic and credit conditions and the ability of organizations to outsource data center infrastructure-related services to service providers such as us; the migration of organizations to virtualized server environments, including using a private cloud computing infrastructure; the extent to which customers deploy disk-based backup recovery solutions; the realization of the expected trends identified for advanced network infrastructures; reliance by manufacturers on their data service partners to integrate their specialized products; continued preferred status with certain principal suppliers; competition and pricing pressures and timing of our installations that may adversely affect our revenues and profits; fixed employment costs that may impact profitability if we suffer revenue shortfalls; our ability to hire and retain key technical and sales personnel; continued productivity of our sales personnel; our dependence on key suppliers; our ability to adapt to rapid technological change; risks associated with integrating current and possible futures acquisitions; fluctuations in our quarterly operating results; future changes in applicable accounting rules; and volatility in our stock price. Further, our revenues for any particular quarter are not necessarily reflected by our backlog of contracted orders, which also may fluctuate unpredictably.

These statements reflect our current views with respect to future events and are based on assumptions subject to risks and uncertainties. We do not intend to update or revise any forward-looking statements whether as a result of new information, future events or otherwise. Additional factors that may cause actual results to differ from our assumptions and expectations include those set forth in the Form 10-K. All forward-looking statements are quantified by, and should be considered in conjunction with, such cautionary statements. For additional discussion of the risks and uncertainties applicable to us, see the "Risk Factors" section of this Form 10-K.

Overview

Datalink Corporation was incorporated in Minnesota in 1987. We provide solutions and services that make data centers more efficient, manageable and responsive to changing business needs. Focused on mid and large-size companies, we assess, design, deploy, manage, and support unified infrastructures such as servers, storage and networks. We leverage hardware and software from the industry's leading original equipment manufacturers (OEMs) as part of our data center optimization offerings

Our portfolio of solutions and services spans four practices:

- •

- Consolidation and virtualization

Our consolidation and virtualization solutions and services allow data center infrastructures to be flexible, shared, and manageable. Our consolidation solutions and services enable organizations to share server and storage resources, thereby reducing the number of systems to be managed and maintained. Our virtualization portfolio supports near-term needs (for example, virtualizing server and storage environments) and enables organizations to develop and execute long-term strategies for data center efficiency (for example, "private cloud" computing and data center

1

- •

- Data storage and protection

- •

- Advanced network infrastructures

- •

- Business continuity and disaster recovery solutions

build-outs). Our virtualization infrastructure assessments provide end-to-end views of existing resources, including servers (both physical and virtual), applications and storage.

Our enhanced data protection and storage services and solutions help customers safeguard their information, as well as meet internal and external requirements for accessing, protecting, and retaining these assets. Our solutions include network-attached, direct-attached, and private cloud-based storage, local and remote backup, disaster recovery, archive, and compliance. We align each solution with customer service level agreements and business needs in mind. Our backup audits and assessments provide customers with backup operation performance metrics and recommendations for improvement. We also offer managed backup services whereby customers engage us to assume day-to-day management of their backup operations. In addition, we offer data capacity planning services that help organizations plan for data growth, as well as maximize utilization of all storage systems.

We assess, design, and deploy robust network infrastructures. We help companies consolidate, converge, and optimize their networks. Our solutions vary in scope from entire networks to enhanced router, switch, WLAN, security/VPN, and WAN optimization technologies. Our network architectural review services include an assessment of a customer's current network design, recommendations for improvement, and a roadmap for migrating to consolidated and converged network. We also provide contracts administration services as part of our SmartNet service.

By integrating our best-practice methods and business continuity expertise into an individualized process, we turn business continuity and disaster recovery into an overall change process. We believe this collaborative strategy helps organizations view their investments in enterprise technology not as individual servers or applications, but as a cohesive pool of computing resources able to rapidly adjust to new demands and reduce the risk of disruption.

We offer a full suite of practice-specific consulting, analysis, design, implementation, management, and support services. We deliver these services through our experienced team. Our team consists of approximately 165 engineering professional and support services members that are based throughout the United States.

We have a robust physical laboratory that customers can visit in Minneapolis. This lab enables customers to participate in physical demonstrations of a wide variety of technologies, including: site-to-site replication, data recovery, WAN optimization, de-duplication, and virtual data center architectures. Alternatively, customers can participate in a virtual demonstration from the convenience of their own office.

In addition to demonstrations, we leverage this lab to test, validate and compare technologies from the leading manufacturers and software developers, perform configuration services, troubleshoot support issues and train our professional and support services teams.

Industry Highlights

Mid and large size enterprises, which are typically greater than 500 employees, are increasingly focused on transforming their data centers in order to increase agility, enhance service levels, and reduce costs. Information technology (IT) departments are faced with a daunting challenge of rapidly

2

expanding amounts of data to manage. Gartner, Inc.,1 an industry analyst group ("Gartner"), expects (Source: Data Center Executives Must Address Many Issues in 2012, Mike Chuba, January 2012) that enterprise data will grow by 800% over the next five years. Coupled with this growth are increasing demands for availability of this data for day-to-day business and to meet regulatory requirements. At the same time, organizations are seeking greater operational efficiency and lower costs. As a result, we expect customers will continue to look for alternatives to simplify management of storage, network, and server infrastructures and increase productivity of existing IT teams. Transformational technologies and approaches, like virtualization and private cloud computing, help achieve each of these objectives. Virtualization and private cloud computing enable organizations to more quickly adapt to changing business requirements, improve service levels via simplified management, and reduce costs through higher utilization rates.

Gartner, reports (Source: Private Cloud Computing Ramps Up in 2011, Thomas Bittman, March 2011) that through 2014, IT organizations will spend more money on private cloud computing investments than on offerings from public cloud providers. We anticipate the virtualization of servers, storage and networks and migration to unified virtual data center architectures will primarily occur in stages, with a focus on building a foundation to support future private cloud strategies. We expect this will result in continued demand for shared storage, as well as backup and disaster recovery infrastructures tuned to virtualized server environments. We expect this will result in continued demand for shared storage, as well as backup and disaster recovery infrastructures tuned to virtualized server environments. We also expect that the increased bandwidth requirements of high density virtualized server environments will drive demand for high bandwidth integrated converged networks.

Employees, customers and suppliers demand uninterrupted access to mission-critical data 24 hours a day, 7 days a week. As a result, organizations continue to require flexible, scalable and highly available server, storage and network solutions.

In 2012, we believe that capital investment priorities of the customers in our industry will include:

- •

- Virtualization and consolidation

- •

- Enhanced data protection capabilities

Virtualization will play a key role in data center transformation strategies. Virtualization and private cloud computing enable organizations to reduce costs, increase agility, and improve management and utilization.

Our customers need a comprehensive virtualization strategy encompassing server, storage and network environments. Without this unified data center approach, companies cannot realize the full benefits of virtualization.

We expect organizations will continue to seek the professional services of a provider, like us, to assess their environment, conduct a gap analysis, and develop virtual data center migration path that will enable them to protect and leverage each investment as they migrate to a private-cloud computing infrastructure. We expect that most of our customers will continue to deploy virtual data center infrastructures in a phased-in or total build out approach. We also expect that organizations will continue to seek the services of a provider that has unified data center expertise (server, storage, networks) and provides a full life cycle of services from consulting and design to deployment and ongoing support.

Increased need for high throughput performance, greater frequency of backups, quick restoration of data and stringent data availability requirements are key drivers in data center

- 1

- The Gartner Report(s) described herein, (the "Gartner Report(s)") represent(s) data, research opinion or viewpoints published, as part of a syndicated subscription service, by Gartner, Inc. ("Gartner"), and are not representations of fact. Each Gartner Report speaks as of its original publication date (and not as of the date of this Form 10-K) and the opinions expressed in the Gartner Report(s) are subject to change without notice.

3

- •

- Advanced network infrastructures

- •

- Acceptance and growing need for data center services.

decision making. We expect these requirements will continue to drive the continued migration to disk-based protection solutions. Many of our customers have deployed disk-based backup and recovery solutions. With the convergence of key technologies, such as data de-duplication, WAN optimization, and advanced heterogeneous replication and snapshot software, we expect the benefits customers receive from disk-based backup will increase, resulting in increased demand.

We expect that two trends will continue to drive the continued evolution of data center networking. The advancement of data center virtualization increases the need to update networking infrastructure to support increased bandwidth with networking infrastructure and management that is more integrated with server virtualization and private cloud initiatives. In addition, those seeking simplified management, cost reductions, and increased flexibility will consolidate and converge disparate networks (e.g. storage and data management) and migrate to unified fabrics.

We expect IT organizations to increasingly outsource data center infrastructure-related services, including consulting, implementation, management and support to a company who can provide a holistic solution. An increased focus on technologies that provide greater efficiency and business value, the growing complexity of networked environments and flat IT department headcount growth in light of current economic conditions facilitate this trend.

The Datalink Opportunity

The movement toward computing environments that offer more adaptable and scalable IT services drives demand for data center-focused solutions and services providers, such as us. Both potential customers and data center infrastructure manufacturers are looking to providers, such as us, primarily for the following reasons:

Pressures on Customers. Migrating data centers to those that are more efficient, scalable, and flexible, is complex. Private cloud computing is transformational in nature. It impacts the relationship between the business and IT, as well as how IT organizations are structured and operate. As a result, we believe customers are looking for solution providers, to sort through their options, define migration plans, and execute accordingly. In addition, we believe organizations will increasingly look outside their in-house technical staff to leverage the expertise of companies, for strategy definition and execution.

Pressures on Manufacturers. We believe manufacturers increasingly rely on channel partners such as us for two principal reasons:

- •

- Sophisticated, virtualized storage, network, and server solutions require the integration of highly specialized products

made by a variety of manufacturers. A virtual data center, for instance, can utilize components such as software, disk systems, routers, switches, and servers, each from a different manufacturer.

Manufacturers generally focus on only a portion of the overall data center, leaving companies like us to integrate comprehensive solutions from the best available products and technologies.

- •

- Gross profit margins have been under pressure for many manufacturers. Because of the high cost of maintaining a large national sales and marketing organization, we believe manufacturers have found value in leveraging the sales and marketing functions of channel partners, such as us.

We believe we are uniquely positioned to capitalize on this significant opportunity for the following reasons:

Expertise. We have implemented data center solutions for over 20 years. This experience has given us significant expertise in understanding and applying storage, server, and networking

4

technologies either as individual technologies or in unified data center architecture. We continually invest in training to adapt to the ever-changing needs of our customers and capitalize on opportunities.

Not Tied to One Manufacturer. Unlike many of our competitors, we are not tied to one or a limited number of manufacturers or particular technologies. This gives us the flexibility to be consultative in our approach. Our customers rely on us to choose the best available hardware and software and tailor it to their individual needs.

The Datalink Solution

We combine our expertise and comprehensive services portfolio with quality products from leading manufacturers to meet each customer's specific needs. Our services include:

Consulting

Our consultants deliver highly customized research, advice, and action plans to help customers optimize their data centers. Our independent recommendations help customers respond to challenges in the following areas: data center optimization and consolidation, business continuity, disaster recovery, and IT governance.

Analysis

At the beginning of an engagement, we place considerable emphasis on formulating a needs analysis based on each customer's business initiatives, operating environment and current and anticipated unified data center requirements. While our focus is on each customer's unique situation, we bring to each engagement our extensive product knowledge and the experience we have gained from providing data center solutions for over twenty years to customers in numerous industries.

Our assessment services provide customers with objective guidance on developing virtualization and consolidation, backup and recovery, and advanced network infrastructures that optimize their resources, leverage their existing environments and facilitate cost-effective growth for the future. These services provide an independent viewpoint to align people, processes and technologies with business objectives. They also help organizations maximize current investments, outline recommendations for future purchases and provide assurance that server, storage and networking infrastructures are efficient, reliable and scalable.

Design

Once we have completed our initial analysis, we begin the design phase of the project. Our professional services teams work together to design a system that meets the customer's server, storage and networking needs and budget. Our customers are able to choose from a wide range of technologies in order to fuse together the appropriate hardware, software and services for each project.

We design data center infrastructures based on each customer's detailed business requirements. The engagement begins with a definition of the project's objectives, scope and key milestones. Our team then prepares an outline of the schedule and deliverables. Following a thorough analysis, the team prepares a comprehensive blueprint of the infrastructure, including a detailed design schematic, key implementation milestones and recommendations for handling potential configuration issues to ensure a smooth transition to new server, storage and networking environments.

Implementation

Once we design a solution, we formulate a detailed project implementation plan with our customers to meet their financial and operating objectives and minimize disruption to their operations. We oversee the timely delivery of hardware and software products to the customer's location. We then

5

coordinate the installation with our professional services teams, or personnel from equipment manufacturers, and complete the installation at the customer's site using industry best practices.

Support

We provide our customers advanced 24 × 7 technical support from a team of customer support and field engineers. Our extensive experience with data center solutions enables our staff to deliver expert configuration and usage assistance, technical advice and prompt incident detection and resolution. The support team also acts as our primary interface with manufacturers' technical support organizations.

Our support services offer additional flexible levels of service to help organizations maximize the return on their technology investments. We believe that our customer support program is one of very few customer service plans that provide support across multiple storage product lines and manufacturers.

We provide our analysis, design, implementation, management and support services to customers through either a stand-alone services engagement or as a part of an overall project that includes a server, storage and networking solutions and services.

Management

We relieve burdened internal IT teams with a growing portfolio of managed services. Our services enhance the productivity of our customer's IT teams, as well as drive greater operational efficiency. Our backup reporting service enables customers to gain visibility of key performance metrics, enabling them to quickly pinpoint and resolve issues, improve operational efficiency, and mitigate risk. Our storage capacity manager reporting service provides visibility of key storage utilization metrics, enabling customers to improve utilization rates, improve application availability, and provide chargeback reporting. Reporting services, such as these, can be coupled with our OneCall support services, thereby providing the opportunity for proactive monitor and alert service by our team of experts. We also augment the staff of our customers by offering onsite professional services resources. These resources provide services including backup and recovery administration, project management, storage administration and our managed services offerings.

Our Strategy

Our strategy is to improve our position as a data center solutions and services provider and to develop a customer-focused, high performance company with sustainable profitable growth. To achieve these objectives, we intend to build upon our record of successfully addressing the evolving needs of our customers. Key elements of our strategy include:

Increase Sales Team Productivity

Although we believe that our sales productivity is high, we believe it can be improved. We continue to accelerate the learning and productivity curve of our newer sales professionals and enhance the skills of seasoned executives through implementation of techniques and best practices learned from our top producers.

Scale Existing Locations and Expand into New Locations via Acquisitions

We continue to scale our existing geographic locations to increase market share, leverage fixed expenses and provide higher quality service levels. We expect to drive this growth by hiring experienced, quality account executives and field engineers to gain sales productivity and field engineering utilization. In the past we have made acquisitions to grow our business including our acquisition of

6

Midwave Corporation in 2011 (as discussed in more detail below). We intend to continue to grow our business via select acquisitions. We seek acquisition targets that align closely with our data center portfolio offerings.

Expand Customer Support Revenues

We significantly increased our customer support capabilities and performance over the last several years and will continue to make this a focus. We believe that our customers appreciate our quality support services, which we believe will continue to be a key differentiator and growth driver for us.

Enhance Our Consulting and Professional Services Business

Consulting services represents a sizable opportunity to drive additional professional services and follow-on hardware and software revenues in both existing and new accounts. Consulting services enable us to differentiate ourselves from our competition, as well as build executive-level relationships within the accounts we serve. In addition, by improving our assessment, audit and implementation service methodologies and sales tools, we plan to enhance our solution selling capabilities. We believe hiring additional experienced, data center consultants, and providing our sales teams with the tools they need to uncover consulting opportunities, will increase consulting services, with additional hardware and software revenues, in 2012.

Expand Managed Services Portfolio

Providing our customers with value-driven, recurring services represents a significant opportunity for differentiation and growth for us along with increasing reoccurring revenue. We will launch a suite of managed services designed to free up the IT teams of our customers so that they can focus on high-impact projects, while at the same time helping them to drive greater data center efficiencies and services levels. Our managed services will initially span backup and network operations.

Suppliers and Products

We do not manufacture server, storage, or networking products. Instead, we continually evaluate and test new and emerging technologies from leading manufacturers to ensure that our solutions incorporate state-of-the-art, high performance, cost-effective technologies. This enables us to maintain our technological leadership, identify new and innovative products and applications and objectively help our customers align their data center solutions with their business needs.

We have strong, established relationships with the major storage, server, and networking hardware and software suppliers. Our expertise in open system environments includes UNIX, Microsoft Windows, Linux, Solaris, and in-depth knowledge of all major hardware and software technologies manufactured by industry leaders. This expertise has earned us preferred status with many of our principal suppliers. Preferred status often enables us to participate in our suppliers' new product development, evaluation, introduction and marketing programs. These collaborations enable us to identify and market innovative new hardware and software products and exchange critical information in order to maximize customer satisfaction.

7

Some of our major suppliers and the products they provide are listed below:

Products

|

Suppliers | |

|---|---|---|

Disk Storage |

EMC Corporation Hitachi Data Systems Corporation NetApp Inc. Oracle Systems Quantum Corporation |

|

Tape Automation |

Oracle Systems |

|

Software |

Akorri, Inc. |

|

Servers |

Cisco Systems, Inc. |

|

Switches/Directors/Storage Networking |

Brocade Communications Systems, Inc. |

We have not had difficulty in obtaining any of the products that we use in our business from our current suppliers. In addition, we do not rely on one or a few suppliers for the products we use in our business.

Customers

Customer engagements range from specialized professional assessment and design services, to complex, virtual data center implementations. We also provide hardware and software to our customers on an as-needed basis in order to enable one of our designs or to increase the capacity of their current infrastructures. We serve customers throughout the United States in a diverse group of data intensive industries. Our broad industry experience enables us to understand application and business issues specific to each customer and to design and implement appropriate networked storage solutions.

In 2011, 2010 and 2009, we had no customers that accounted for at least 10% of our revenues. However, our top five customers collectively accounted for 11%, 12%, and 17% of our 2011, 2010 and 2009 revenues, respectively.

Sales and Marketing

We market and sell our products and services throughout the United States primarily through a direct sales force. In addition to our Minneapolis headquarters, as of December 31, 2011, we have 29 field sales offices, including home offices, in order to efficiently serve our customers' needs.

Our field account executives and account associates work closely with our technical services team in evaluating the data center project needs of existing and prospective customers and in designing high quality, cost effective solutions. To ensure quality service, we assign each customer a specific field

8

account executive and account associate. Our accounts and technical teams generated a total of 290 new customers in 2011 and sold product and services to 2,000 current customers.

In addition to the efforts of our field account executives, account associates, and technical services team we engage in a variety of other marketing activities designed to attract new business and retain customer loyalty. We regularly execute integrated, demand generation campaigns, gain exposure through online and print trade publications, hold information seminars, and use social media channels to share information about topics, such as virtual data centers, private cloud computing, storage, data protection and disaster recovery and business continuity trends and best practices.

Competition

Competition for the solutions we provide is fragmented, and we compete with numerous large and small competitors. For data center solutions we compete with other technology infrastructure solution providers and system integrators, and technology value added resellers that focus on providing data center solutions. Our competitors are primarily either resellers that provide solutions using many of the same products from the manufacturers that we represent such as Cisco, EMC, Hitachi, NetApp, Symantec, VMware or they also may provide solutions using other competing manufacturer's products such as IBM, HP and others. We may also compete directly against some of these manufacturers when they are involved in selling to the customer directly.

We believe that the principal competitive factor when marketing our solutions is our overall business model where we are focused on making data centers more efficient, manageable and responsive to our customer's business needs. Other important factors include total cost, technical competence, the strength of our relationship with the customer, the quality of our support services, and the quality of our relationship with the manufacturer of the products being supplied as part of a data center solution.

Employees

As of December 31, 2011, we had a total of 389 employees, all of which are full-time employees. We have no employment agreements with any of our employees, except for Mr. Lidsky, our President and Chief Executive Officer, Mr. Barnum, our Vice President of Finance and Chief Financial Officer and Mr. O'Grady, our Executive Vice President of Field Operations. None of our employees are unionized or subject to a collective bargaining agreement. We have experienced no work stoppages.

Backlog

Effective January 1, 2011, our revenue recognition policy requires us to recognize product revenues upon shipment as compared to upon installation under our old revenue recognition method. We configure products to customer specifications and generally ship them shortly after we receive our customer's purchase order. Customers may change their orders with little or no penalty. Customer constraints, including customer readiness, and the availability of engineering resources may impact when we can complete our installation and configuration services, which represent approximately 5% of our revenues. Therefore, we do experience a backlog of orders. Our backlog, which represents firm orders we expect to recognize as revenue within the next 90 days, was $59.4 million and $47.0 million at December 31, 2011 and 2010, respectively.

Acquisitions

Midwave Corporation. In October 2011, we entered into an asset purchase agreement with Midwave Corporation ("Midwave") and its shareholders. Under the asset purchase agreement we purchased and acquired from Midwave substantially all of the assets used in Midwave's business. Midwave is an IT consulting firm that offers both professional services and sells products to business'

9

IT organizations utilizing the product portfolios of certain information technology manufacturers, in the specific domains of data center services, networking services, managed services and advisory services. We paid a purchase price of approximately $19.1 million, comprised of a cash payment delivered at closing of approximately $16.1 million and issued 220,988 shares of our common stock with a value of approximately $1.6 million and approximately $1.4 million related to working capital adjustments subsequent to closing.

This acquisition expanded our footprint in Minnesota making us the dominant data center services and infrastructure provider in the region. The acquisition also doubled our Cisco technology and services revenues, expanded our managed services portfolio with the addition of a data center infrastructure monitoring service, added an established security practice including product, services and consulting and doubled the size of our consulting services team. We expect to experience operational synergies and efficiencies through the combined general and administrative corporate functions. Our results for 2011 reflect the addition of Midwave during the fourth quarter. Please see Note 2 to our financial statements for further information.

Reseller Business of Incentra, LLC. In December 2009, we acquired the reseller business of Incentra, LLC ("Incentra"). Under the Asset Purchase Agreement, we paid Incentra $13.8 million. We paid $8.8 million at closing in cash, of which we held back $440,000 as security for certain indemnification obligations of Incentra. In addition, we paid Incentra $5.0 million for the working capital associated with Incentra's reseller business through the delivery of $2.0 million in cash and a $3.0 million secured promissory note. The promissory note was paid on March 31, 2010. During 2010 the final working capital adjustment was agreed to and the amount held back for indemnification was released, the net effect was a decrease in the purchase price of $32,000. This acquisition doubled our presence in Chicago and the Northeast and provided us with a significant presence in the West. Our combined team now has expanded experience to design and implement complex data center solutions, which will deliver increased productivity and efficiency for our customers. This acquisition also added to our team of network engineers that are certified by Cisco, which allowed us to attain Cisco's Gold and Data Center Advanced Technology Partner certifications. We have experienced operational synergies and efficiencies through combined general and administrative corporate functions. Our results for 2009 reflect the addition of Incentra's reseller business for thirteen days. Please see Note 2 to our financial statements for further information.

Networking Solutions Division of Cross Telecom. In October 2009, we acquired the networking solutions division of Minneapolis-based Cross Telecom ("Cross"), which qualified as a business combination. We completed an asset purchase of $2.0 million paid in cash. Under the terms of the purchase agreement, Cross entered into a services agreement with us under which it agreed to purchase at least $1.8 million of Cisco networking products and services from us over the next three years. The acquisition of this team of certified Cisco networking experts who have obtained Cisco's Silver certification, has increased our expertise in designing, implementing and managing sophisticated virtualized data center, storage and backup recovery solutions.

In conjunction with our Cross acquisition, we entered into a three year products and services agreement, which required Cross to purchase at least $1.8 million of networking products and services from us over three years. The agreement was entered into outside of the acquisition and was assigned no fair value. Pursuant to the agreement, Cross agreed to pay any shortfall between customer purchases and the guaranteed annual purchase amount. In September 2010 and 2011, the first and second years of the three year agreement came to an end and there was a shortfall paid by Cross of $503,000 and $574,000, respectively, which was recorded as other income since we had assumed that the revenue targets would be met. In October 2011, we entered into an agreement with Cross to allow for an early buyout of the remaining year of the agreement for which Cross paid $553,000.

10

Available Information

Our website address is www.datalink.com. The material on our website is not part of this report. We make available at our website, free of charge, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

The public may also read and copy any materials we file with the SEC at the SEC's Public Reference Room at 100 F Street NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. All SEC filings are also available at the SEC's website at www.sec.gov.

Executive Officers of the Registrant

Set forth below are the names, ages and titles of the persons serving as our executive officers:

Name

|

Age | Position | ||

|---|---|---|---|---|

| Paul F. Lidsky | 58 | President and Chief Executive Officer | ||

Gregory T. Barnum |

57 |

Vice President, Finance and Chief Financial Officer |

||

M. Shawn O'Grady |

49 |

Executive Vice President, Field Operations |

Paul F. Lidsky was elected as a director in June 1998 and became our President and Chief Executive Officer in July 2009. Mr. Lidsky was the President and Chief Executive Officer of Calabrio, Inc. from October 2007 until July 2009. From December 2005 until September 2007, Mr. Lidsky served as Chief Operating Officer for Spanlink Communications, Inc. Between 2003 and 2004, Mr. Lidsky was President and Chief Executive Officer of Computer Telephony Solutions. From 2002 to 2003, Mr. Lidsky was President and Chief Executive Officer of VigiLanz Corporation. From 1997 until 2002, Mr. Lidsky was the President and Chief Executive Officer of OneLink Communications, Inc. Between 1985 and 1997, Mr. Lidsky was employed by Norstan, Inc, most recently as Executive Vice President of Strategy and Business Development.

Gregory T. Barnum became our Vice President of Finance and Chief Financial Officer in March 2006. From January 2006 until the time he became our executive officer, he was a member of our Board of Directors. Prior to joining us, he served as Vice President of Finance, Chief Financial Officer and Corporate Secretary of Computer Network Technology Corporation from 1997 until the company's acquisition by McData Corporation in 2005. Between 1992 and 1997, Mr. Barnum served as Senior Vice President of Finance and Administration, Chief Financial Officer and Corporate Secretary of Tricord Systems, Inc., an enterprise server manufacturer. Between 1988 and 1992, he was Executive Vice President, Finance, Chief Financial Officer, Treasurer and Corporate Secretary of Cray Computer Corporation, a development stage company engaged in the design of supercomputers. Prior to that time, Mr. Barnum served in various accounting and financial management capacities for Cray Research, Inc., a manufacturer of supercomputers. Mr. Barnum is a graduate of the University of St. Thomas.

M. Shawn O'Grady became our Executive Vice President, Field Operations in December 2009, upon our Incentra acquisition. Prior to joining us, he served Incentra and its affiliates since 2005 in various executive positions, most recently, as its President and Chief Executive Officer. Incentra filed for bankruptcy protection in 2009 while Mr. O'Grady served as an officer. Prior to his employment with Incentra, Mr. O'Grady was employed by Siemens Business Services, the information technology services division of Siemens AG, since 2000 in various capacities including its Senior Vice President and Business Unit General Manager, Consulting and Integration.

11

As indicated in this Annual Report under the caption "Note Regarding Forward-Looking Statements," certain information contained in this Annual Report consists of forward-looking statements. Important factors that could cause actual results to differ materially from the forward-looking statements made in this Annual Report include the following:

Worldwide adverse economic conditions negatively impact our business.

Over the past few years, financial markets in the United States, Europe and Asia have experienced extreme disruption, including, among other things, extreme volatility in security prices, severely diminished liquidity and credit availability, rating downgrades of certain investments and declining valuations of others. We have been impacted by these economic developments in that they continue to adversely affect the ability of our customers and suppliers to obtain financing for significant purchases and operations, and have reduced orders for our products and services. These economic conditions will continue to negatively impact us to the extent our customers defer purchasing decisions, thereby lengthening our sales cycles. In addition, our customers' may have constrained budgets affecting their ability to purchase our products at the same level. Our customers' ability to pay for our products and services may also be impaired, which may lead to an increase in our allowance for doubtful accounts and write-offs of accounts receivable. We are unable to predict the likely duration and severity of the current disruption in financial markets and adverse economic conditions in the U.S. Should these economic conditions result in us not meeting our revenue objectives, our operating results, financial condition and stock price could be adversely affected.

Competition could prevent us from increasing or sustaining our revenues or profitability.

The enterprise-class information storage, server and networking market is rapidly evolving and is highly competitive. As technologies change rapidly, we expect that competition will increase in the future. Current economic conditions also place pressure on our competitors to lower their prices and seek opportunities of size and scale different than in the past. We compete with independent storage, server and networking system suppliers in the mid to large enterprise market and numerous value-added resellers, distributors and consultants. We also compete in the storage, server and networking systems market with computer platform suppliers. Many of our current and potential competitors have significantly greater financial, technical, marketing, purchasing and other resources than we do. As a result, they may respond more quickly to changes in economic conditions and customer requirements and to new or emerging technologies, devote greater resources to the development, promotion and sale of products and deliver competitive products at lower end-user prices.

Our suppliers are often our competitors. We are not the exclusive reseller of any data storage, server or networking product we offer. Instead, our suppliers market their products through other independent data storage, server and networking solution providers, OEMs, and through their own internal sales forces. We believe direct competition from our suppliers is likely to increase if, as expected, the server, storage and networking industries continues to consolidate and also converge with providers of server and networking technologies. This consolidation would likely result in fewer suppliers with greater resources to devote to internal sales and marketing efforts. In addition, our suppliers have established and will probably continue to establish cooperative relationships with other suppliers and other data storage, server and networking solution providers. These cooperative relationships are often intended to enable our suppliers to offer comprehensive storage, server and networking solutions, which compete with those we offer. If our relationships with our suppliers become adversarial, we could lose the preferred provider status we maintain with certain suppliers. If that were to occur, it would be more difficult for us to stay ahead of industry developments and provide our customers with the type of service and wide range of technology choices they expect from us.

12

Most of our customers already employ in-house technical staffs. To the extent a customer's in-house technical staff develops sophisticated server, storage and networking systems expertise, the customer may be less likely to seek our services. Further, we compete with storage service providers who manage, store and backup their customers' data at off-site, networked data storage locations.

Mergers or other strategic transactions involving our competitors could weaken our competitive position, which could harm our operating results.

Our industry is highly fragmented, and we believe it is likely that our existing competitors will continue to consolidate or will be acquired. In addition, some of our competitors may enter into new alliances with each other or may establish or strengthen cooperative relationships with systems integrators, third-party consulting firms or other parties. Any such consolidation, acquisition, alliance or cooperative relationship could lead to pricing pressure and our loss of market share and could result in a competitor with greater financial, technical, marketing, service and other resources, all of which could have a material adverse effect on our business, operating results and financial condition.

Our business is dependent on the trend toward outsourcing data center infrastructure-related services.

Our business and growth depend in large part on the industry trend toward outsourced data center infrastructure-related services. Outsourcing means that an entity contracts with a third party, such as us, to provide data center infrastructure-related services such as consulting, implementation, management and support. To the extent a customer's in-house technical staff develops sophisticated server, storage and networking systems expertise, the customer may be less likely to seek our services. Further, we compete with storage service providers who manage, store and backup their customers' data at off-site, networked data storage locations. There can be no assurance that this trend will continue, as organizations may elect to perform such services themselves. A significant change in this trend could have a material adverse effect on our business, financial condition and results of operations. Additionally, there can be no assurance that our cross-selling efforts will cause clients to purchase additional services from us or adopt a single-source outsourcing approach.

Our financial results would suffer if the market for IT services and solutions does not continue to grow.

Our services and solutions are designed to address the growing markets for data center consolidation and virtualization services (including private cloud computing), data center implementation services (including storage and data protection services and the implementation of virtualization solutions), and managed services (including operational support and client support). These markets are still evolving. A reduction in the demand for our services and solutions could be caused by, among other things, lack of client acceptance, weakening economic conditions, competing technologies and services or reductions in corporate spending. Our future financial results would suffer if the market for our data center services and solutions does not continue to grow.

With continued market demand for greater data center agility, scalability, and efficiency, we have been increasingly developing and marketing virtual data center and private cloud computing infrastructures and services. If businesses do not find our virtual data center and private cloud computing solutions compelling, our revenue growth and operating margins may decline.

Our data center optimization portfolio is based on the virtualization of storage, computing, and network platforms within on-premises data centers. Our success depends on organizations and customers perceiving technological and operational benefits and cost savings associated with services-oriented, virtual data center and private cloud computing-based infrastructures. Although the use of virtualization technologies on servers has become broadly accepted for enterprise-level applications, the extent to which organizations will adopt virtualization across the data center and migrate to private

13

cloud computing remains uncertain. Accordingly, as the market for our virtual data center and private cloud computing infrastructures mature and the scale of our business increases, the rate of growth in our infrastructure and services sales could be lower than those we have experienced in earlier periods. In addition, to the extent that our newer private cloud computing infrastructure solutions and services are adopted more slowly or less comprehensively than we expect, our revenue growth rates may slow materially or our revenue may decline substantially.

Our acquisition strategy poses substantial risks.

As part of our growth strategy, we made two acquisitions in 2009, one acquisition in October 2011 and plan to continue to pursue acquisitions in the future. We may not be able to identify suitable acquisition candidates or, if suitable candidates are identified, we may not be able to complete the acquisition on commercially acceptable terms. We may need to raise additional equity to consummate future acquisitions, which may not be feasible, could be on terms we do not consider favorable, would cause dilution to existing investors and could adversely affect our stock price. We also could incur substantial indebtedness in connection with an acquisition, which could decrease the value of our equity. The process of exploring and pursuing acquisition opportunities requires significant management and financial resources, which diverts attention from our core operations.

Integration of acquisitions is very challenging and we cannot assure you that any acquisition will increase our revenues, earnings or stock price. Even if we are able to consummate an acquisition, such as our recent acquisitions, the transaction may present many risks. These risks include, among others: failing to achieve anticipated synergies and revenue increases; difficulty incorporating and integrating the acquired technologies or products with our existing product lines; coordinating, establishing or expanding sales, distribution and marketing functions, as necessary; disruption of our ongoing business and diversion of management's attention to transition or integration issues; unanticipated and unknown liabilities; the loss of key employees, customers, partners and channel partners of our company or of the acquired company; and difficulties implementing and maintaining sufficient controls, policies and procedures over the systems, products and processes of the acquired company. If we do not achieve the anticipated benefits of our acquisitions as rapidly or to the extent anticipated by our management and financial or industry analysts or if others do not perceive the same benefits of the acquisition as we do, there could be a material, adverse effect on our business, financial condition, results of operations or stock price

Our continued growth could strain our personnel resources and infrastructure, and if we are unable to implement appropriate controls and procedures to manage our growth, we will not be able to implement our business plan successfully.

We have experienced a period of rapid growth in our headcount and operations. To the extent that we are unable to sustain such growth, it will place a significant strain on our management, administrative, operational and financial infrastructure. Our success will depend in part upon the ability of our senior management to manage this growth effectively. To do so, we must continue to hire, train and manage new employees as needed. If our new hires perform poorly, or if we are unsuccessful in hiring, training, managing and integrating these new employees, or if we are not successful in retaining our existing employees, our business would be harmed. To manage the expected growth of our operations and personnel, we will need to continue to improve our operational, financial and management controls and our reporting systems and procedures. The additional headcount we are adding will increase our cost base, which will make it more difficult for us to offset any future revenue shortfalls by reducing expenses in the short term. If we fail to successfully manage our growth, we will be unable to execute our business plan.

14

Our ability to recognize revenue can be adversely affected by product availability.

We sell complex enterprise-class data storage, server and networking solutions, which include installation and configuration services. We generally recognize revenues from our sale of hardware and software products when shipment has been completed. We rely on our vendors to supply the hardware and software products we sell. We cannot control the availability and shipment of these products. Delays due to component availability, natural disasters and other unforeseen events can prevent us from recognizing revenue on products we ship and may adversely affect our quarterly reported revenues. As a result, our stock price may decline.

Our key vendors could change or discontinue their incentive programs, which could adversely affect our business.

Several of our key vendors have offered incentive programs to us over the past several years based on our achievement of particular sales levels of their products and early pay discounts. In addition, they have offered margin enhancement programs which provide enhanced discounts for particular products or new customer orders. These programs contributed to our profitability in 2011, 2010 and 2009. We cannot assure that these programs will continue or that the sales quotas for our participation will not increase, adversely affecting our ability to take advantage of the incentives. If for any reason, we cannot obtain the same benefits from incentive programs as in the past, it may significantly impact our profitability in the future.

We derive a significant percentage of our revenues from a small number of customers.

In 2011, 2010 and 2009, we had no customers that accounted for at least 10% of our revenues. However, our top five customers collectively accounted for 11%, 12%, and 17% of our 2011, 2010 and 2009 revenues, respectively. Because we intend to continue to seek out large projects, we expect that a significant percentage of our revenues will continue to come from a small number of customers, although the composition of our key customers is likely to change from year to year. Current economic conditions likely will continue to adversely affect the number of and size of large projects available for us. If we fail to obtain a growing number of large projects each year, our revenues and profitability will likely be adversely affected. In addition, our reliance on large projects makes it more likely that our revenues and profits will fluctuate unpredictably from quarter to quarter and year to year. Unpredictable revenue and profit fluctuations may make our stock price more volatile and lead to a decline in our stock price.

Our business depends on our ability to hire and retain technical personnel and highly qualified sales people.

Our future operating results depend upon our ability to attract, retain and motivate qualified engineers and sales people with enterprise-class data storage, server and networking solutions experience. If we fail to recruit and retain additional engineering and sales personnel, or if losses require us in the future to terminate employment of some of these personnel, we will experience greater difficulty realizing our business strategy, which could negatively affect our business, financial condition and stock price.

We generally do not have employment agreements with our key employees.

Our future operating results depend in significant part upon the continued contributions of our executive officers, managers, sales people, engineers and other technical personnel, many of whom have substantial experience in our industry and would be difficult to replace. Except as to our President and Chief Executive Officer, Vice President of Finance and Chief Financial Officer, Executive Vice President of Field Operations, we do not have employment agreements with our employees.

15

Accordingly, our employees may voluntarily leave us at any time and work for our competitors. Our growth strategy depends in part on our ability to retain our current employees and hire new employees. Any failure to retain our key employees will make it much more difficult for us to maintain our operations and attain our growth objectives and could therefore be expected to adversely affect our operating results, financial condition and stock price.

Our long sales cycle may cause fluctuating operating results, which may adversely affect our stock price.

Our sales cycle is typically long and unpredictable, making it difficult to plan our business. Current economic conditions increase this uncertainty. Our long sales cycle requires us to invest resources in potential projects that may not occur. In addition, our long and unpredictable sales cycle may cause us to experience significant fluctuations in our future annual and quarterly operating results. It can also result in delayed revenues, difficulty in matching revenues with expenses and increased expenditures. Our business, operating results or financial condition and stock price may suffer as a result of any of these factors.

Our failure to raise additional capital or generate cash flows necessary to expand our operations and invest in new technologies could reduce our ability to compete successfully and adversely affect our results of operations.

We may need to raise additional funds, and we may not be able to obtain additional debt or equity financing on favorable terms, if at all. If we raise additional equity financing, our security holders may experience significant dilution of their ownership interests and the value of shares of our common stock could decline. If we engage in debt financing, we may be required to accept terms that restrict our ability to incur additional indebtedness, force us to maintain specified liquidity or other ratios or restrict our ability to pay dividends or make acquisitions. If we need additional capital and cannot raise it on acceptable terms, we may not be able to, among other things:

- •

- continue to expand our technology development, sales and marketing organizations;

- •

- hire, train and retain employees; or

- •

- respond to competitive pressures or unanticipated working capital requirements.

Our inability to do any of the foregoing could reduce our ability to compete successfully and adversely affect our results of operations.

If the storage, server and networking solutions industries fail to develop compelling new technologies, our business may suffer.

Rapid and complex technological change, frequent new product introductions and evolving industry standards increase demand for our services. Because of this, our future success depends in part on the storage, server and networking solutions industry's ability to continue to develop leading-edge storage and related server and networking technology solutions. Our customers utilize our services in part because they know that newer technologies offer them significant benefits over the older technologies they are using. If the data storage industry ceases to develop compelling new storage, server and networking solutions, or if a single data storage, server and networking standard becomes widely accepted and implemented, it will be more difficult to sell new data storage, server and networking systems to our customers. The continued tightened budgets among established data storage, server and networking technology manufacturers and the difficulty of raising new capital for innovative, start-up companies, under current economic conditions may also stifle development of new data storage, server and networking technologies.

16

Our data center services and web site may be subject to intentional disruption

Although we believe we have sufficient controls in place to prevent intentional disruptions, such as software viruses specifically designed to impede the performance of our data center services, we may be affected by such efforts in the future, Further, despite the implementation of security measures, this infrastructure or other systems that we interface with, including the Internet and related systems, may be vulnerable to physical break-ins, hackers, improper employee or contractor access, programming errors, attacks by third parties or similar disruptive problems, resulting in the potential misappropriation of our proprietary information or interruptions of our services. Any compromise of our security, whether as a result of our own systems or systems that they interface with, could substantially disrupt our operations, harm our reputation and reduce demand for our services.

Control by our existing shareholders could discourage the potential acquisition of our business.

Currently, our executive officers and directors beneficially own approximately 15.6% of our outstanding common stock. Acting together, these insiders may be able to significantly impact the election of our Board of Directors and may have a significant impact on the outcome of all other matters requiring shareholder approval. This voting concentration may also have the effect of delaying or preventing a change in our management or otherwise discourage potential acquirers from attempting to gain control of us. If potential acquirers are deterred, you may lose an opportunity to profit from a possible acquisition premium in our stock price.

Our stock price is volatile.

The market price of our common stock fluctuates significantly, and, especially in light of current stock market and worldwide economic conditions, may continue to be volatile. We cannot assure you that our stock price will increase, or even that it will not decline significantly from the price you pay. Our stock price may be adversely affected by many factors, including:

- •

- actual or anticipated fluctuations in our operating results, including those resulting from changes in accounting rules;

- •

- general market conditions, including the effects of current economic conditions;

- •

- announcements of technical innovations;

- •

- new products or services offered by us, our suppliers or our competitors;

- •

- changes in estimates by securities analysts of our future financial performance;

- •

- our compliance with SEC and NASDAQ rules and regulations, including the Sarbanes-Oxley Act of 2002;

- •

- the timing of stock sales under 10b5-1 plans or otherwise; and

- •

- war and terrorism threats.

Our quarterly results of operations may fluctuate in the future, which could result in volatility in our stock price.

Our quarterly revenues and results of operations have varied in the past and may fluctuate as a result of a variety of factors, including the success of our new offerings. If our quarterly revenues or results of operations fluctuate, the price of our common stock could decline substantially. Fluctuations in our results of operations may be due to a number of factors, including, but not limited to, those listed below and identified throughout this "Risk Factors" section:

- •

- our ability to retain and increase sales to customers and attract new customers;

17

- •

- the timing and success of introductions of new solutions or upgrades by us or our competitors;

- •

- the strength of the economy;

- •

- changes in our pricing policies or those of our competitors;

- •

- competition, including entry into the industry by new competitors and new offerings by existing competitors;

- •

- the amount and timing of our expenses, including stock-based compensation and expenditures related to expanding our

operations, supporting new customers or introducing new solutions; and

- •

- changes in the payment terms for our solutions.

We do not intend to declare dividends on our stock in the foreseeable future.

We currently intend to retain all future earnings for the operation and expansion of our business and, therefore, do not anticipate declaring or paying cash dividends on our common stock in the foreseeable future. Any payment of cash dividends on our common stock will be at the discretion of our board of directors and will depend upon our results of operations, earnings, capital requirements, financial condition, future prospects, contractual restrictions and other factors deemed relevant by our board of directors. Therefore, you should not expect to receive dividend income from shares of our common stock.

Our governing documents and Minnesota law may discourage the potential acquisitions of our business.

Our Board of Directors may issue additional shares of capital stock and establish their rights, preferences and classes, in some cases without shareholder approval. In addition, we are subject to anti-takeover provisions of Minnesota law. These provisions may deter or discourage takeover attempts and other changes in control of us not approved by our Board of Directors. If potential acquirers are deterred, you may lose an opportunity to profit from a possible acquisition premium in our stock price.

Future finite lived intangibles and goodwill impairment may unpredictably affect our financial results.

We perform analyses of impairment to our finite lived intangibles when a triggering event occurs and to our goodwill at least annually or when we believe there may be impairment. Future events could cause us to conclude that impairment indicators exist and that goodwill and/or the finite lived intangibles associated with our acquired businesses are impaired. With the overall decline in the stock market, over the past several years, future potential decline in our stock price and the continued impact of the global economic downturn, it may become more likely that we would need to write down the carrying value of our assets and incur a current period charge to our earnings. Any resulting impairment loss could have a material adverse impact on our financial condition and results of operations.

Item 1B. Unresolved Staff Comments.

None.

We lease 106,000 square feet of an office and warehouse facility in Chanhassen, Minnesota. We occupy 54,000 of the 106,000 square feet as our corporate headquarters, including our principal technical operations and our integration, assembly and support service operations. The lease for this property expires April 2012 and we have notified our landlord that we will not be renewing our lease

18

and vacating the building as of the expiration date. As of December 31, 2011, our other 21 leased locations (which house sales and technical staffs) are small-to-medium-sized offices throughout the United States with terms ending from 2016.

In December 2004, we agreed to sublease approximately 52,000 of the 106,000 square feet we then occupied as our corporate headquarters in Chanhassen, Minnesota. The initial sublease term is co-terminal with our lease and is for 85 months starting in April 2005 and ending in April 2012. The sublessee will pay us rent ranging from approximately $55,000 per month at the beginning of the term to approximately $60,000 per month by the end of the term. In conjunction with the termination of our lease in April 2012 this sublease will also terminate.

As a result of our acquisition of certain assets of Midwave in October 2011, as tenant, we are the successor interest to a lease ("Original Lease") dated August 9, 2010. The Original Lease was for 20,851 square feet of office space. In December 2011, we entered into a First Amendment to Lease (the "Amendment") to the Original Lease for approximately 32,906 additional square feet of office space ("Expansion Space"), which provides us with approximately 54,000 total square feet available for our operations. We will be moving our corporate headquarters to this new location in April 2012. Under the terms of the Amendment, the term of the Original Lease is extended for 42 months from March 1, 2016 through August 31, 2019 and the term of the lease for the Expansion Space is for seven years and six months, commencing on March 1, 2012. We have the option to extend the term of the Lease for an additional five year term as long as certain conditions are met.

In addition, under the terms of the Amendment an allowance of up to $658,120 is available from our landlord for costs related to tenant improvements. If the cost of our tenant improvement is less than the allowance, then we may receive the remaining portion of the allowance, up to a maximum of $164,530, as a credit towards our rent payments.

In addition to our 22 leased facilities, we also have 8 additional office locations. Based on our present plans, we believe our current facilities, and the facilities that we will be occupying beginning in April 2012, will be adequate to meet our anticipated needs for at least the remaining terms of our respective leases.

We are not currently involved in any material legal proceedings.

Item 4. Mine Safety Disclosures.

Not applicable.

19

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Our common stock is quoted on the NASDAQ Global Market under the symbol "DTLK". The table below sets forth, for the calendar quarters indicated, the high and low per share closing sale prices of our common stock as reported by the NASDAQ Global Market.

| |

High | Low | |||||

|---|---|---|---|---|---|---|---|

Year Ended December 31, 2011 |

|||||||

First Quarter |

$ | 8.76 | $ | 4.50 | |||

Second Quarter |

8.16 | 5.94 | |||||

Third Quarter |

10.79 | 6.35 | |||||

Fourth Quarter |

9.87 | 7.08 | |||||

Year Ended December 31, 2010 |

|||||||

First Quarter |

4.69 | 4.16 | |||||

Second Quarter |

4.93 | 3.79 | |||||

Third Quarter |

3.92 | 2.93 | |||||

Fourth Quarter |

4.81 | 3.00 | |||||

On March 12, 2012, the closing price per share of our common stock was $9.38. We urge potential investors to obtain current market quotations before making any decision to invest in our common stock. On March 8, 2011, there were approximately 115 holders of common stock, including record holders and shareholders whose shares are held by a bank, broker or other nominee. However, we estimate that our shares are held through a small number of record holders by over 2,100 beneficial owners.

We have paid no dividends on our common stock since our initial public offering in 1999. We intend to retain future earnings for use in our business, and we do not anticipate paying any cash dividends on our common stock in the foreseeable future.

We did not purchase any of our securities during 2011, 2010, or 2009.

In October 2011, we entered into an asset purchase agreement with Midwave and its shareholders. Under the asset purchase agreement, we acquired substantially all of the assets used in Midwave's business. We paid a purchase price of approximately $19.1 million for Midwave. This was comprised of a cash payment of approximately $16.1 million and issuance of 220,988 shares of our common stock with a value of approximately $1.6 million delivered at closing and approximately $1.4 million related to working capital adjustments subsequent to closing. We issued the common stock to Midwave on October 3, 2011. The issuance of such shares were exempt from the registration requirement of the Securities Act of 1933, as amended, pursuant to Section 4(2) thereof and Rule 506 promulgated under Regulation D because, among other things such issuance did not involve a public offering and the shares were issued solely to an accredited investor. We did not have any unregistered sales of equity securities during 2010 or 2009.

You can find additional information about our equity compensation plans in Part III, Item 11 of this Annual Report.

20

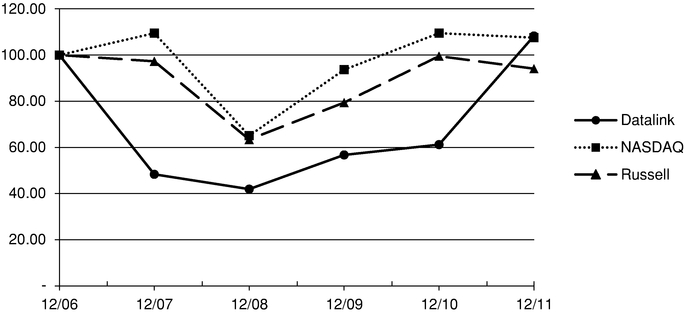

Stock Performance Graph

The graph below shows a comparison for the period commencing on December 31, 2006 and ending on December 31, 2011 of the annual percentage change in the cumulative total shareholder return for our common stock, assuming the investment of $100.00 on December 31, 2006, with the cumulative total shareholder returns for the NASDAQ Composite Index and the Russell 2000 Index, assuming the investment of $100.00 respectively on December 31, 2006. The shareholder returns over the indicated periods below are weighted based on market capitalization at the beginning of each measurement point and are not indicative of, or intended to forecast, future performance of our common stock. Data for the NASDAQ Composite Index and the Russell 2000 Index assumes reinvestment of dividends. We have never declared or paid dividends on our common stock and have no present plans to do so.

COMPARISON OF 5 YEAR CUMMULATIVE TOTAL RETURN

Among Datalink Corporation, The NASDAQ Composite Index

And The Russell 2000 Index

| |

12/31/06 | 12/31/07 | 12/31/08 | 12/31/09 | 12/31/10 | 12/31/11 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Datalink Corporation |

100.00 | 48.36 | 41.94 | 56.75 | 61.21 | 108.26 | |||||||||||||

NASDAQ Composite |

100.00 | 109.45 | 65.08 | 93.64 | 109.48 | 107.51 | |||||||||||||

Russell 2000 Index |

100.00 | 97.28 | 63.43 | 79.42 | 99.52 | 94.09 | |||||||||||||

21

Item 6. Selected Financial Data.