Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Vericel Corp | Financial_Report.xls |

| EX-23.1 - EX-23.1 - Vericel Corp | a11-31698_1ex23d1.htm |

| EX-21 - EX-21 - Vericel Corp | a11-31698_1ex21.htm |

| EX-31.2 - EX-31.2 - Vericel Corp | a11-31698_1ex31d2.htm |

| EX-32.1 - EX-32.1 - Vericel Corp | a11-31698_1ex32d1.htm |

| EX-31.1 - EX-31.1 - Vericel Corp | a11-31698_1ex31d1.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

for the fiscal year ended December 31, 2011

or

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 0-22025

Aastrom Biosciences, Inc.

(Exact name of registrant as specified in its charter)

|

Michigan |

|

94-3096597 |

|

(State or other jurisdiction of |

|

(I.R.S. Employer |

|

incorporation or organization) |

|

Identification No.) |

24 Frank Lloyd Wright Drive,

P. O. Box 376,

Ann Arbor, MI 48106

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (800) 556-0311

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of Class |

|

Name of Each Exchange on Which Registered |

|

|

|

Common Stock (No par value) |

|

The NASDAQ Stock Market, Inc. |

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer - o |

|

Accelerated filer - x |

|

|

|

|

|

Non-accelerated filer - o |

|

Smaller reporting company - o |

|

(Do not check if a smaller reporting company) |

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the registrant’s Common Stock, no par value (“Common Stock”), held by non-affiliates of the registrant (based on the closing sales price of the Common Stock as reported on the NASDAQ Capital Market) on June 30, 2011 was approximately $105,712,991. This computation excludes shares of Common Stock held by directors, officers and each person who holds 5% or more of the outstanding shares of Common Stock, since such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of March 13, 2012, 38,755,642 shares of Common Stock, no par value, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

|

Document |

|

Form 10-K Reference |

|

Proxy Statement for the Annual Meeting of Shareholders scheduled for May 3, 2012 |

|

Items 10, 11, 12, 13 and 14 of Part III |

AASTROM BIOSCIENCES, INC.

ANNUAL REPORT ON FORM 10-K

|

|

|

Page |

|

|

1 | |

|

1 | ||

|

13 | ||

|

22 | ||

|

22 | ||

|

23 | ||

|

23 | ||

|

|

24 | |

|

24 | ||

|

27 | ||

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

28 | |

|

37 | ||

|

38 | ||

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

54 | |

|

54 | ||

|

55 | ||

|

|

56 | |

|

56 | ||

|

56 | ||

|

Security Ownership of Certain Beneficial Owners and Management, and Related Shareholder Matters |

56 | |

|

Certain Relationships and Related Transactions, and Director Independence |

56 | |

|

56 | ||

|

|

57 | |

|

57 | ||

|

58 | ||

|

59 | ||

|

62 | ||

Except for the historical information presented, the matters discussed in this Report, including our product development and commercialization goals and expectations, our plans and anticipated timing and results of clinical development activities, potential market opportunities, revenue expectations and the potential advantages and applications of our products and product candidates under development, include forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from the results discussed in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed under the caption “Risk Factors.” Unless the context requires otherwise, references to “we,” “us,” “our” and “Aastrom” refer to Aastrom Biosciences, Inc.

Change in Fiscal Year End

In 2010, our Board of Directors approved the change in our fiscal year end from June 30 to December 31. The change became effective at the end of the quarter ended December 31, 2010. All references to “years”, unless otherwise noted, refer to the 12-month fiscal year, which prior to July 1, 2010, ended on June 30, and beginning with December 31, 2010, ends on December 31, of each year.

General Information

We were incorporated in 1989 and are a regenerative medicine company focused on the development of innovative cell therapies to repair or regenerate damaged or diseased tissues. We are developing patient-specific, expanded multicellular therapies for use in the treatment of severe, chronic ischemic cardiovascular diseases. We believe ixmyelocel-T (the new generic name approved by the U.S. Food and Drug Administration (FDA) and United States Adopted Names (USAN) Council in March 2011 for our multicellular therapy) is a disease modifying therapy with multi-functional properties including: tissue remodeling, immuno-modulation and the promotion of angiogenesis. Our proprietary cell-manufacturing technology enables the manufacture of multicellular therapies, expanded from an adult’s own bone marrow, and delivered directly to damaged tissues. Preclinical and clinical data suggest that ixmyelocel-T may be effective in treating patients with severe, chronic ischemic cardiovascular diseases such as CLI. Preliminary data utilizing ixmyelocel-T in dilated cardiomyopathy (DCM) have provided indications of efficacy and safety. Nearly 200 patients have been treated in recent clinical trials using ixmyelocel-T (over 400 patients safely treated since our inception). We recently released positive Phase 2b data from our RESTORE-CLI trial and launched our pivotal Phase 3 REVIVE trial in CLI in February 2012. We also plan to start a randomized, placebo-controlled, double-blinded Phase 2b trial in DCM by mid-2012.

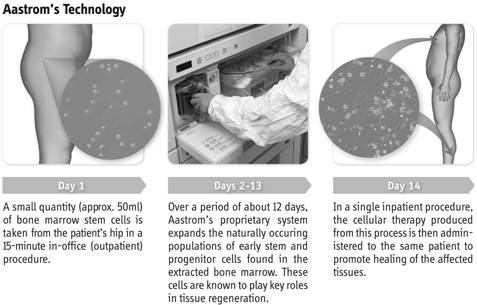

Our Therapy

Ixmyelocel-T is a patient specific, expanded multicellular therapy developed using our proprietary, automated processing system. Ixmyelocel-T is a product derived from an adult’s own bone marrow but it is significantly enhanced compared with the original bone marrow. Our process enhances the patient’s bone marrow mononuclear cells by expanding the mesenchymal stromal cells and alternatively activated macrophages while retaining many of the hematopoietic cells. The manufacture of our patient specific, expanded multicellular therapies is done under current Good Manufacturing Practices (cGMP) and current Good Tissue Practices (cGTP) guidelines required by the FDA.

Our therapy has several features that we believe are primarily responsible for success in treating adult patients with severe, chronic cardiovascular diseases:

Patient specific (autologous) — we start with the patient’s own cells, which are accepted by the patient’s immune system allowing the cells to integrate into existing functional tissues. This characteristic of our therapy, we believe, eliminates both the risk of rejection and the risk of having to use immunosuppressive therapy pre- or post-therapy. Our data also suggests that ixmyelocel-T provides the potential for long-term engraftment and tissue repair.

Expanded — we begin with a small amount of bone marrow from the patient (up to 60 ml) and significantly expand the number of certain cell types, primarily CD90+ (mesenchymal stromal cells or MSCs) and CD14+auto+ (alternatively activated

macrophages) to far more than are present in the patient’s own bone marrow (up to 200 times the number of certain cell types compared with the starting bone marrow aspirate). Ixmyelocel-T is derived from the patient’s own bone marrow but it is significantly enhanced compared with the starting bone marrow.

Multicellular — we believe the multiple cell types in ixmyelocel-T, which are normally only found in bone marrow but in smaller quantities, possess the key functions required for tissue remodeling, immuno-modulation and the promotion of angiogenesis.

Minimally invasive — our procedure for taking bone marrow (an “aspirate”) can be performed in an out-patient setting and takes approximately 15 minutes. For diseases such as CLI, the administration of ixmyelocel-T is performed in an out-patient setting (e.g. a physician’s office) in a one-time, approximately 20 minute procedure.

Safe — bone marrow and bone marrow-derived therapies have been used safely and efficaciously in medicine for over three decades. Our product, ixmyelocel-T, a bone marrow-derived, patient specific, expanded multicellular therapy leverages this body of scientific study and medical experience.

Our therapy is produced at our cell manufacturing facility in the United States, located at our headquarters in Ann Arbor, Michigan.

The following graphic summarizes the treatment process:

Clinical Development Programs

Our clinical development programs are focused on addressing areas of high unmet medical needs in severe, chronic ischemic cardiovascular diseases. We have completed a successful Phase 2b clinical trial in CLI. We have reached agreement with the FDA on CMC which has allowed us to launch our pivotal Phase 3 REVIVE clinical trial in the first quarter of 2012 with a protocol approved by FDA through the Special Protocol Assessment (SPA) process. Our CLI development program has also received Fast Track Designation from the FDA. We have completed our Phase 1/2 clinical trials in DCM and plan to begin a randomized, placebo-controlled, double-blinded Phase 2b trial by mid-2012. Our DCM development program has received Orphan Disease Designation from the FDA.

The following summarizes the status of our active clinical programs:

Results to date in our clinical trials may not be indicative of results obtained from subsequent patients enrolled in those trials or from future clinical trials. Further, our future clinical trials may not be successful or we may not be able to obtain the required Biologic License Application (BLA) approval to commercialize our products in the United States in a timely fashion, or at all. See “Risk Factors”.

Critical Limb Ischemia

Background

CLI is the most serious and advanced stage of peripheral arterial disease (PAD). PAD is a chronic atherosclerotic disease that progressively restricts blood flow in the limbs and can lead to serious medical complications. This disease is often associated with other serious clinical conditions including hypertension, cardiovascular disease, hyperlipidemia, diabetes, obesity and stroke. CLI is used to describe patients with the most severe forms of PAD: those with chronic ischemia-induced pain (even at rest) or tissue loss (ulcers or gangrene) in the limbs, often leading to amputation and death. Many CLI patients are considered “no option” patients as they have exhausted all other treatment options with the exception of amputation. The one-year and four-year mortality rates for no option CLI patients that progress to amputation are approximately 25% and 70%, respectively. Ixmyelocel-T, our disease modifying therapy with multiple functions, has shown significant promise in the treatment of CLI patients with existing tissue loss and no option for revascularization. Currently, there are an estimated 250,000 no option CLI patients in the U.S.

Phase 2b Clinical Program — RESTORE CLI

Our U.S. Phase 2b RESTORE-CLI program was a multi-center, randomized, double-blind, placebo-controlled clinical trial. This clinical trial was designed to evaluate the safety and efficacy of ixmyelocel-T in the treatment of patients with CLI and no option for revascularization. It was the largest multi-center, randomized, double-blind, placebo-controlled cellular therapy study ever conducted in no option CLI patients. We completed enrollment of this trial in February 2010 with a total of 86 patients at 18 sites across the United States, with the last patient treated in March 2010. These patients were followed for a period of 12 months after treatment. In addition to assessing the safety of our product, efficacy endpoints included time to first occurrence of treatment failure — the trial’s primary efficacy end-point — (defined as major amputation, all-cause mortality, doubling in wound surface area and de novo gangrene), amputation-free survival (defined as major amputation and all-cause mortality), major amputation rates, level of amputation, wound healing, patient quality of life and pain scores. The primary purpose of the trial was to assess performance of our therapy and, if positive, prepare for a Phase 3 program.

Results to date of the RESTORE-CLI trial have included two planned interim analyses and a final 12-month report:

· In June 2010, we reported interim results at the Society of Vascular Surgery Meeting. The interim analysis included the six-month results for the first 46 patients enrolled in the trial and twelve-month results for the first 30 patients enrolled in the

trial. Results of this analysis demonstrated that the study achieved both its primary safety endpoint and primary efficacy endpoint of time to first occurrence of treatment failure. The results related to the primary endpoint were statistically significant (p=0.0053). Analysis of the data for amputation free survival, a secondary efficacy endpoint which the study was not powered to demonstrate, were positive and showed a statistically significant reduction in event rates in favor of our therapy (p=0.038). Other endpoints measured (e.g., major amputation rate, complete wound healing, change in Wagner wound scale) showed encouraging trends, but did not reach statistical significance at the interim analysis.

· In November 2010, we presented six-month data on all 86 patients enrolled in the trial and twelve-month data on the first 72 patients at the VEITHsymposium™ non-CME satellite session. Results of this analysis showed that the study again achieved both its primary safety endpoint and primary efficacy endpoint of time to first occurrence of treatment failure. The findings related to time to first occurrence of treatment failure were statistically significant (p=0.0132). Further analyses showed a clinically meaningful reduction of 56% in treatment failure events. Analysis of the data for amputation-free survival, showed a clinically meaningful reduction in event rates of 24%, but did not show statistical significance (p=0.5541).

· In November 2011, the final 12-month data on all patients from the RESTORE-CLI trial were presented at the American Heart Association Scientific Sessions. Patients in the treatment arm showed a 62% reduction in risk relative to placebo in the primary efficacy endpoint of time to first occurrence of treatment failure (p=0.0032). While the study was not powered to show statistical significance in the secondary endpoint of amputation free survival, results from a subgroup of 45 patients with wounds at baseline (the approximate profile of the Phase 3 patient population) showed a positive trend in this measure (21% ixmyelocel-T treated vs 44% control event rate; p=0.0802). The study also met the primary safety endpoint with no meaningful differences between the treated and control groups.

Phase 3 Clinical Program — REVIVE

In February 2012, we began screening patients in the pivotal Phase 3 REVIVE clinical trial for patients with CLI and no option for revascularization. The first patient is expected to be randomized and aspirated in March 2012. Leading up to the launch of the REVIVE pivotal trial, we received Fast Track Designation from the FDA for use of ixmyelocel-T for CLI in October 2010 and reached agreement with the FDA on a Special Protocol Assessment (SPA) in July 2011. The Phase 3 REVIVE No Option Trial that we agreed to with the FDA under the SPA process includes 594 no option CLI patients with tissue loss (ulcers and gangrene) at baseline. Patients will be randomized 1:1 and followed for 12 months for the primary efficacy endpoint of amputation-free survival. Patients will be followed for an additional 6 months for safety. We anticipate that enrollment will occur at approximately 80 sites across the U.S.

Dilated Cardiomyopathy

Background

DCM is a severe, chronic cardiovascular disease that leads to enlargement of the heart, reducing the pumping function of the heart to the point that blood circulation is impaired. Patients with DCM typically present with symptoms of congestive heart failure, including limitations in physical activity and shortness of breath. It is currently estimated that there are approximately 125,000 ischemic DCM patients in the U.S. There are two types of DCM: ischemic and non-ischemic. Ischemic DCM, the most common form representing an estimated 60% of all DCM patients, is associated with atherosclerotic cardiovascular disease. Patient prognosis depends on the stage and cause of the disease but is typically characterized by a very poor quality of life and a high mortality rate.

Current treatments for DCM patients include both heart transplantation and left ventricular assist devices (LVADs). There are less than 2,500 heart transplantations in the U.S. each year, many DCM patients are not eligible, and they’re expensive at an estimated cost of over $750,000. LVADs are also expensive at an estimated cost of over $175,000 and have a mortality rate of 50% at 2 years.

In February 2007, the FDA granted Orphan Drug Designation to ixmyelocel-T for the treatment of DCM. Our DCM development program is currently in Phase 2. We recently completed follow up on two U.S. Phase 1/2 trials investigating surgical and catheter-based delivery for our product in the treatment of DCM in reporting stages. We plan to initiate a randomized, placebo-controlled, double-blinded Phase 2b trial using catheter delivery for 60 — 80 ischemic DCM patients in the U.S. in mid-2012.

Surgical Trial Program — DCM

We completed enrollment of 40 DCM patients in the IMPACT-DCM clinical trial in January 2010 and the final patient was treated in March 2010. Participants in the IMPACT-DCM clinical trial were required to have New York Heart Association (NYHA) functional class III or IV heart failure, a left ventricular ejection fraction (LVEF) of less than or equal to 30% (60-75% is typical for a healthy person), and meet other eligibility criteria, including optimized medical therapy. Patients were randomized in an approximate 3:1 ratio of treatment to control group. Patients in the treatment group received our therapy through direct injection into the heart muscle during minimally invasive-surgery (involving a chest incision of approximately 2 inches). The primary objective of this study was to assess the safety of ixmyelocel-T in patients with DCM. Efficacy measures include cardiac dimensions and tissue mass, cardiac function (e.g. cardiac output, LVEF, cardiopulmonary exercise testing parameters), cardiac perfusion and viability, as well as other efficacy endpoints. NYHA functional class and quality of life are also assessed. Patients were followed for 12 months after treatment.

Six-month data from the IMPACT-DCM interim analysis were presented at The Sixth International Conference on Cell Therapy for Cardiovascular Disease in January 2011. Results indicated that ixmyelocel-T is safe and showed that serious adverse events were associated with the surgical procedure and not the cellular therapy. Adverse events after the initial peri-operative period were roughly equal between the control and treatment groups. Efficacy findings include positive trends in clinical endpoints, quality of life, functional, and structural parameters in the treatment group as compared with the control group.

Twelve-month data on all 40 patients enrolled in the IMPACT-DCM trial were presented at the 15th Annual Heart Failure Society of America Scientific Meeting in September 2011. Results were consistent with the six-month interim analysis, indicating that ixmyelocel-T is safe and showed that serious adverse events were associated with the surgical procedure and not the therapy. Efficacy results were also consistent with the six-month results and demonstrated promising efficacy results in patients with ischemic DCM.

Catheter Trial Program — DCM

The Catheter-DCM clinical trial was designed to explore catheter-based direct injection delivery of ixmyelocel-T to treat DCM patients. This multi-center, randomized, controlled, prospective, open-label, Phase 2 study enrolled approximately 11 patients with ischemic DCM and 10 patients with non-ischemic DCM at clinical sites across the United States. Participants met the same criteria as stated above for the IMPACT-DCM surgical trial. The first patient was enrolled into the trial in April 2010 and enrollment concluded in December 2010 with 21 patients enrolled.

In September 2011, we reported results from a six-month interim analysis of patients treated in the Catheter-DCM Phase 2 trial. In this analysis, efficacy parameters were consistent with those seen in the IMPACT-DCM trial results. In addition, the adverse event profile suggests that catheter administration of ixmyelocel-T is safe and appears to cause fewer adverse events compared to surgical administration. We expect to report 12-month results from the Catheter-DCM Phase 2 trial in Q2 2012. We plan to launch a randomized, placebo-controlled, double-blind Phase 2b trial in mid-2012 in approximately 60 — 80 ischemic DCM patients in the U.S. and using catheter administration.

Production

Cell Manufacturing and Cell Production Components

We operate a centralized cell manufacturing facility in Ann Arbor, Michigan. The facility supports the current U.S. clinical trials and has sufficient capacity, with minor modifications, to supply our early commercialization requirements. We may establish and operate larger commercial-scale cell manufacturing facilities for the U.S. market in the future to accommodate potential market growth.

We have established relationships with manufacturers that are registered with the FDA as suppliers of medical products to produce various components of our patented cell manufacturing system.

We have established relationships with various third parties who manufacture and/or supply certain components, equipment, disposable devices and other materials used in our cell manufacturing process to develop our cell products, as well as our final

assemblies, component parts, subassemblies and associated spare parts used in the instrumentation platform of our cell production system.

There can be no assurance that we will be able to continue our present arrangements with our manufacturers and/or suppliers, supplement existing relationships or establish new relationships, or that we will be able to identify and obtain certain components, equipment, disposable devices, other materials, including ancillary materials that are necessary to develop our product candidates or that are used in our cell manufacturing and cell production components processes. Our dependence upon third parties for the supply and manufacture of such items could adversely affect our ability to develop and deliver commercially feasible cell products on a timely and competitive basis. See “Risk Factors.”

Our Arrangement with Vention Medical (formerly ATEK)

In October 2010, we entered into a contract manufacturing and supply agreement (Supply Agreement) with ATEK Medical, LLC (ATEK) for the manufacture of our proprietary cell cassette for use in our manufacturing process. In November 2011, ATEK was purchased by Vention Medical (Vention) and currently operates as a division of Vention. There have been no changes to the terms of the Supply Agreement as a result of this purchase.

Pursuant to the terms of the Supply Agreement, we have granted Vention the exclusive right to manufacture our proprietary cell cassette, which includes assembly, labeling, packaging and sterilization. Vention will be responsible for obtaining all of our approved components pertaining to the cassettes and we are obligated to order and purchase the cassettes from Vention on an agreed upon schedule and in agreed upon quantities. In addition, we will provide Vention with reasonable engineering support to initiate and ramp up manufacturing of the cassettes and will supply all manufacturing equipment.

The Supply Agreement has an initial term of four years and will terminate automatically without notice unless prior to that time the term is extended by mutual written consent delivered at least six months prior to the termination date. The minimum term extension is generally to be no less than two years.

The Supply Agreement provides that we may discontinue the manufacture of the cassettes at our sole discretion. In such event, we agree to use commercially best efforts to notify Vention at least 120 days prior to our intention to discontinue manufacture of the cassettes. Failure to provide such notice will not be a breach of the Supply Agreement, but without such notice, we agree to purchase from Vention (i) certain finished goods that are in usable condition and (ii) certain components or raw materials inventory or work in process in each case to the extent convertible into finished cassettes.

We or Vention may terminate the Supply Agreement if the other party materially defaults in the performance of any provision of the Supply Agreement and, should any such default occur, then the non-defaulting party may give written notice to the defaulting party that if the default is not cured within 45 days, the Supply Agreement will be terminated. If the non-defaulting party gives such notice and the default is not cured during the 45 day period, then the Supply Agreement shall automatically terminate at the end of such period unless an extension is mutually agreed to by Vention and us. In addition to other remedies, either party may terminate the Supply Agreement at any time if either of us breach our respective confidentiality obligations under the Supply Agreement, in which case termination shall be effective immediately upon receipt of notice from the non-breaching party of the breach and of termination. Either party may immediately terminate the Supply Agreement by written notice if the other party is or becomes insolvent, appoints or has appointed a receiver for all or substantially all of its assets, or makes an assignment for the benefit of its creditors. In addition, either party may terminate the Supply Agreement by written notice if the other party files a voluntary petition, or has filed against it an involuntary petition, for bankruptcy and such petition is not dismissed within 90 days.

Upon termination of the Supply Agreement, Vention agrees to provide reasonable technical support at Vention’s published engineering rates for the transfer of manufacturing technology to an alternative manufacturer chosen by us to conduct final manufacture, package and test of the cassettes in the event that Vention, for a period of 150 days from the date of receipt of the associated purchase order, is unable to manufacture all of our orders for any reason, or if Vention fails or refuses to meet our orders for cassettes pursuant to the terms of the Supply Agreement.

There can be no assurance that we will be able to continue our present arrangement with Vention. Our dependence upon our arrangement with Vention for the supply and manufacture of our proprietary cell cassette could adversely affect our ability to develop and deliver commercially feasible cell products on a timely and competitive basis. See “Risk Factors.”

Research & Development

Our therapy is produced from the patient’s bone marrow using Aastrom’s proprietary manufacturing system. The product is composed of a mixture of cell types normally found in bone marrow but at different quantities. For example, the mesenchymal stromal cells, identified with the CD90+ cell surface marker, as well as monocytes and activated macrophages, identified with CD14 marker, are expanded approximately 50 and 200 fold, respectively, while other CD45+ mononuclear cells from the bone marrow remain during the manufacturing process. We have demonstrated in the laboratory that the cells in our therapy are capable of multiple biological activities thought to play a critical role in repairing diseased and damaged tissues. These activities include aspects of tissue remodeling, promotion of angiogenesis and resolution of inflammation. In addition to these properties demonstrated in vitro, we have also shown that the therapy increases blood perfusion in both rat and mouse models of critical limb ischemia. In addition to these initial preclinical observations, we have on-going preclinical studies designed to further characterize the mechanism of action of our product in the treatment of cardiovascular diseases. These data support our current clinical-stage research where we are exploring the use of our therapies to regenerate tissue in patients with CLI and DCM.

In addition, our proprietary cell manufacturing system has demonstrated the capability to produce other types of cells. In the future, we may continue to explore the application of our manufacturing technology for the production of other cell types where there are potential opportunities to collaborate in the development of new cell therapies.

Patents and Proprietary Rights

Our success depends in part on our ability, and the ability of our licensors, to obtain patent protection for our products and processes. We have exclusive rights to approximately 25 unexpired issued U.S. patents. 15 of these are material patents that protect our cellular therapy. We own 8 of these patents and 6 of these patents have been licensed exclusively from the University of Michigan; 5 of the University of Michigan patents will expire in 2012. These patents present various claims relating to (i) the composition of our cellular therapy, (ii) methods to manufacture or administer the cellular therapy, and (iii) the bioreactor device (the Aastrom Replicell System) that is used to make our product. The number of U.S. patents of each type with expiration range is listed in the table below. Patents expiring in 2012 are not included in the table.

|

Patent Type |

|

Number |

|

Expiry (Years) |

|

|

Composition of Matter |

|

2 |

|

2 and 17 |

|

|

Methods |

|

1 |

|

17 |

|

|

Bioreactor Device |

|

7 |

|

2 — 3 |

|

Certain patent equivalents to the U.S. patents have also been issued in other jurisdictions including Australia, Japan, the Republic of Korea and Canada and under the European Patent Convention. In addition, we have filed applications for patents in the United States and equivalent applications in certain other countries claiming other aspects of our cell products and manufacturing processes. An important patent that protects the composition of the cellular therapy directly, “Mixed cell populations for tissue repair and separation technique for cell processing” (US Patent 7,871,605), was issued in January 2011 and will expire in 2029. A divisional application of 7,871,605 for administration of this composition to patients was allowed by the USPTO in January 2012 and is expected to be issued in the second quarter of 2012; this patent is categorized under Methods in the table above. Patents that protect our automated bioreactor device and culture system expire in 2015, but we will continue to rely on trade secrets and un-patentable know-how.

The validity and breadth of claims in medical technology patents involve complex legal and factual questions and, therefore, may be highly uncertain. No assurance can be given that any patents based on pending patent applications or any future patent applications by us, or our licensors, will be issued, that the scope of any patent protection will exclude competitors or provide competitive advantages to us, that any of the patents that have been or may be issued to us or our licensors will be held valid if subsequently challenged or that others will not claim rights in or ownership of the patents and other proprietary rights held or licensed by us. Furthermore, there can be no assurance that others have not developed or will not develop similar products, duplicate any of our products or design around any patents that have been or may be issued to us or our licensors. Since patent applications in the U.S. are maintained in secrecy until they are published 18 months after filing, we also cannot be certain that others did not first file applications

for inventions covered by our and our licensors’ pending patent applications, nor can we be certain that we will not infringe any patents that may be issued to others on such applications.

We rely on certain licenses granted by the University of Michigan for certain patent rights. If we breach such agreements or otherwise fail to comply with such agreements, or if such agreements expire or are otherwise terminated, we may lose our rights in such patents.

We also rely on trade secrets and un-patentable know-how that we seek to protect, in part, by confidentiality agreements. It is our policy to require our employees, consultants, contractors, manufacturers, outside scientific collaborators and sponsored researchers and other advisors to execute confidentiality agreements upon the commencement of employment or consulting relationships with us. These agreements provide that all confidential information developed or made known to the individual during the course of the individual’s relationship with us is to be kept confidential and not disclosed to third parties except in specific limited circumstances. We also require signed confidentiality or material transfer agreements from any company that is to receive our confidential information. In the case of employees, consultants and contractors, the agreements generally provide that all inventions conceived by the individual while rendering services to us shall be assigned to us as the exclusive property of Aastrom. There can be no assurance, however, that these agreements will not be breached, that we would have adequate remedies for any breach, or that our trade secrets or un-patentable know-how will not otherwise become known or be independently developed by competitors.

Our success will also depend in part on our ability to develop commercially viable products without infringing the proprietary rights of others. We do not believe any of our currently contemplated products or processes infringe any existing valid issued patent. However, the results of patent litigation are unpredictable, and no assurance can be given that patents do not exist or could not be filed which would have an adverse effect on our ability to market our products or maintain our competitive position with respect to our products. If our technology components, designs, products, processes or other subject matter are claimed under other existing U.S. or foreign patents, or are otherwise protected by third party proprietary rights, we may be subject to infringement actions. In such event, we may challenge the validity of such patents or other proprietary rights or we may be required to obtain licenses from such companies in order to develop, manufacture or market our products. There can be no assurances that we would be able to obtain such licenses or that such licenses, if available, could be obtained on commercially reasonable terms. Furthermore, the failure to either develop a commercially viable alternative or obtain such licenses could result in delays in marketing our proposed products or the inability to proceed with the development, manufacture or sale of products requiring such licenses, which could have a material adverse effect on our business, financial condition and results of operations. If we are required to defend ourselves against charges of patent infringement or to protect our proprietary rights against third parties, substantial costs will be incurred regardless of whether we are successful. Such proceedings are typically protracted with no certainty of success. An adverse outcome could subject us to significant liabilities to third parties and force us to curtail or cease our development and sale of our products and processes.

Certain of our and our licensors’ research has been or is being funded in part by the Department of Commerce and by a Small Business Innovation Research Grant obtained from the Department of Health and Human Services. As a result of such funding, the U.S. Government has certain rights in the technology developed with such funding. These rights include a non-exclusive, fully paid-up, worldwide license under such inventions for any governmental purpose. In addition, the U.S. Government has the right to require us to grant an exclusive license under any of such inventions to a third party if the U.S. Government determines that: (i) adequate steps have not been taken to commercialize such inventions; (ii) such action is necessary to meet public health or safety needs; or (iii) such action is necessary to meet requirements for public use under federal regulations. Additionally, under the federal Bayh Dole Act, a party which acquires an exclusive license for an invention that was partially funded by a federal research grant is subject to the following government rights: (i) products using the invention which are sold in the United States. are to be manufactured substantially in the United States, unless a waiver is obtained; (ii) the government may force the granting of a license to a third party who will make and sell the needed product if the licensee does not pursue reasonable commercialization of a needed product using the invention; and (iii) the U.S. Government may use the invention for its own needs.

Sales and Marketing

We currently do not have the sales or marketing resources required to fully commercialize our therapeutic products. We intend to advance our programs to a point where we can evaluate the options to seek a development and/or commercialization partnership, or to make the investment to complete development and commercialize a product alone. We may also choose to undertake some pilot level of sales and marketing activity while seeking a commercial partnership.

Government Regulation

Our research and development activities and the manufacturing and marketing of our products are subject to the laws and regulations of governmental authorities in the United States and other countries in which our products will be marketed. Specifically, in the United States, the FDA, among other activities, regulates new product approvals to establish safety and efficacy of these products. Governments in other countries have similar requirements for testing and marketing. In the United States, in addition to meeting FDA regulations, we are also subject to other federal laws, such as the Occupational Safety and Health Act and the Environmental Protection Act, as well as certain state laws.

Our cell products will be regulated as somatic cell therapies/biologics/pharmaceuticals. With this classification, commercial production of our products will need to occur in registered/licensed facilities in compliance with Good Manufacturing Practice (GMP) for biologics (cellular products) or drugs.

Regulatory Process

Our products are subject to regulation as biological products under the Public Health Service Act and the Food, Drug and Cosmetic Act. Different regulatory requirements may apply to our products depending on how they are categorized by the FDA under these laws. The FDA has indicated that it intends to regulate products based on our technology as licensed biologics through the Center for Biologics Evaluation and Research. As current regulations exist, the FDA will require regulatory approval for certain human cellular- or tissue-based products, including our cell products, through a BLA submission.

Approval of new biological products is a lengthy procedure leading from development of a new product through preclinical and clinical testing. This process takes a number of years and the expenditure of significant resources. There can be no assurance that our product candidates will ultimately receive regulatory approval.

Regardless of how our product candidates are regulated, the Federal Food, Drug, and Cosmetic Act and other Federal and State statutes and regulations govern or influence the research, testing, manufacture, safety, labeling, storage, record-keeping, approval, distribution, use, product reporting, advertising and promotion of such products. Noncompliance with applicable requirements can result in civil penalties, recall, injunction or seizure of products, refusal of the government to approve or clear product approval applications or to allow us to enter into government supply contracts, withdrawal of previously approved applications and criminal prosecution.

Product Approval

In order to obtain FDA approval of a new medical product, sponsors must submit proof of safety and efficacy. In most cases, such proof entails extensive preclinical studies and clinical trials. The testing, preparation of necessary applications and processing of those applications by the FDA is expensive and may take several years to complete. There can be no assurance that the FDA will act favorably or in a timely manner in reviewing submitted applications, and we may encounter significant difficulties or costs in our efforts to obtain FDA approvals, in turn, which could delay or preclude us from marketing any products we may develop. The FDA may also require post-marketing testing and surveillance of approved products, or place other conditions on the approvals. These requirements could cause it to be more difficult or expensive to sell the products, and could therefore restrict the commercial applications of such products. Product approvals may be withdrawn if compliance with applicable regulations is not maintained or if problems occur following commercialization. For patented technologies, delays imposed by the governmental approval process may materially reduce the period during which we will have the exclusive right to exploit such technologies.

If clinical trials of a proposed medical product are required, the manufacturer or distributor of a drug or biologic will have to submit an IND application with the FDA prior to commencing human clinical trials. The submission must be supported by data, typically including the results of preclinical and laboratory testing. Following submission of the IND, the FDA has 30 days to review the application and raise safety and other clinical trial issues. If we are not notified of objections within that period, clinical trials may be initiated, and human clinical trials may commence at a specified number of investigational sites with the number of patients approved by the FDA. We have submitted several INDs for our cell products, and we have conducted clinical trials under these INDs.

Our products will be regulated by the FDA as a licensed biologic, although there can be no assurance that the FDA will not choose to regulate this product in a different manner in the future. The FDA categorizes human cell- or tissue-based products as either minimally manipulated or more than minimally manipulated, and has determined that more than minimally manipulated products require clinical trials to demonstrate product safety and efficacy and the submission of a BLA for marketing authorization. For products that may be regulated as biologics, the FDA requires: (i) preclinical laboratory and animal testing; (ii) submission to the FDA of an IND application, which must be approved prior to the initiation of human clinical trials; (iii) adequate and well-controlled clinical trials to establish the safety and efficacy of the product for its intended use; (iv) submission to the FDA of a BLA; and (v) review and approval of the BLA as well as inspections of the manufacturing facility by the FDA prior to commercial marketing of the product.

We conduct preclinical testing for internal use and as support for submissions to the FDA. Preclinical testing generally includes various types of in-vitro laboratory evaluations of our products as well as animal studies to assess the safety and the functionality of the product. Clinical trials are identified by phases (i.e., Phase 1, Phase 2, Phase 3, etc.). Depending on the type of preclinical and/or clinical data available, the trial sponsor will submit a request to the FDA to initiate a specific phase study (e.g., a Phase 1 trial represents an initial study in a small group of patients to test for safety and other relevant factors; a Phase 2 trial represents a study in a larger number of patients to assess the safety and efficacy of a product; and, Phase 3 trials are initiated to establish safety and efficacy in an expanded patient population at multiple clinical trial sites).

The results of the preclinical tests and clinical trials are submitted to the FDA in the form of a BLA for marketing approval. The testing, clinical trials and approval process are likely to require substantial time and effort and there can be no assurance that any approval will be granted on a timely basis, if at all. Additional animal studies or clinical trials may be requested during the FDA review period that may delay marketing approval. After FDA approval for the initial indications, further clinical trials may be necessary to gain approval for the use of the product for additional indications. The FDA requires that adverse effects be reported to the FDA and may also require post-marketing testing to monitor for adverse events, which can involve significant expense.

Under current requirements, facilities manufacturing biological products for commercial distribution must be licensed. To accomplish this, an establishment registration must be filed with the FDA. In addition to the preclinical studies and clinical trials, the BLA includes a description of the facilities, equipment and personnel involved in the manufacturing process. An establishment registration/license is granted on the basis of inspections of the applicant’s facilities in which the primary focus is on compliance with GMPs and the ability to consistently manufacture the product in the facility in accordance with the BLA. If the FDA finds the results of the inspection unsatisfactory, it may decline to approve the BLA, resulting in a delay in production of products.

As part of the approval process for human biological products, each manufacturing facility must be registered and inspected by the FDA prior to marketing approval. In addition, state agency inspections and approvals may also be required for a biological product to be shipped out of state.

Commercial Strategy

We are currently focused on utilizing our technology to produce expanded, patient specific multicellular products for use in severe, chronic ischemic cardiovascular indications. At such time as we satisfy applicable regulatory approval requirements, we expect the sales of our cell-based products to constitute nearly all of our product sales revenues.

We do not expect to generate positive cash flows from our consolidated operations for at least the next several years and then only if we achieve significant product sales. Until that time, we expect that our revenue sources from our current activities will consist of only minor sales of our cell products and manufacturing supplies to our academic collaborators, grant revenue, research funding and potential licensing fees or other financial support from potential future corporate collaborators.

We expect that we will need to raise significant additional funds or pursue strategic transactions or other strategic alternatives in order to complete our product development programs, complete clinical trials needed to market our products, and commercialize our products. To date, we have financed our operations primarily through public and private sales of our equity securities, and we expect to continue to seek to obtain the required capital in a similar manner. As a development stage company, we have never been profitable and do not anticipate having net income unless and until significant product sales commence. With respect to our current activities, this is not likely to occur until we obtain significant additional funding, complete the required clinical trials for regulatory approvals,

and receive the necessary approvals to market our products. Through December 31, 2011, we have accumulated a net loss of approximately $240,880,000. We cannot provide any assurance that we will be able to achieve profitability on a sustained basis, if at all, obtain the required funding, obtain the required regulatory approvals, or complete additional corporate partnering or acquisition transactions.

We believe, based on our current projections of cash utilization, our available cash and cash equivalents of approximately $5,500,000 as of December 31, 2011 and the net proceeds of $37,800,000 from the Series B financing that closed in March 2012 is adequate to finance our planned operations at least until December 31, 2012. The Series B preferred stock consist of Series B-1 non-voting convertible preferred stock, which we issued at the closing, and Series B-2 voting convertible preferred stock. The Series B-1 preferred stock will not be entitled to vote on matters on which the common shareholders are generally entitled to vote. The Series B-2 preferred stock will be entitled to vote with the holders of the common stock as a single class, with each share of Series B-2 voting convertible preferred stock having the number of votes equal to the number of shares of common stock issuable upon conversion of such Series B-2 preferred stock. Any holder of Series B-1 preferred stock may exchange its shares for shares of Series B-2 preferred stock on a one-for-one basis if the shareholder approval required in accordance with Nasdaq Marketplace Rule 5635(b) has been obtained and subject to certain terms and limitations. The Series B preferred stock will, with respect to dividend rights and rights on liquidation, winding-up and dissolution, rank on parity with any other class or series of Aastrom capital stock that we may issue in the future which is designated as being on parity with the Series B preferred stock, and rank senior to our common stock and Series A preferred stock. The Series B preferred stock is convertible, at the option of the holder thereof at any time after the five year anniversary of the closing of the offering, into shares of our common stock at a conversion price of $3.25 per share of common stock, subject to the Company obtaining any shareholder approval required in accordance with Nasdaq Marketplace Rule 5635(b). At any time after the five year anniversary of issuance, Aastrom may elect to convert any or all outstanding shares of Series B preferred stock into shares of our common stock, subject to certain limitations. Dividends on the Series B preferred stock will be cumulative and compound daily, at a rate of 11.5% per annum, payable upon conversion, liquidation, redemption or other similar events, and payable in Series B preferred stock until the five year anniversary of issuance. Following the five year anniversary of issuance and until the earlier of the tenth anniversary of the closing of the offering and the date no Series B preferred stock remain outstanding, dividends will accrue at a rate of 8% per annum and will be payable in cash or Series B preferred stock, at our option. Unless prohibited by Michigan law governing distributions to shareholders, the Series B-1 preferred stock shall be redeemable at the option of holder of the Series B-1 preferred stock commencing at any time after the five year anniversary of issuance, liquidation, winding up, dissolution or other similar events, subject to certain terms and limitations.

However, we will need to raise a significant amount of additional funds in order to complete our product development programs, complete clinical trials needed to market our products, and commercialize these products. We cannot be certain that such funding will be available on favorable terms, if at all. Some of the factors that will impact our ability to raise additional capital and our overall success include: the rate and degree of progress of our product development, the rate of regulatory approval to proceed with clinical trial programs, the level of success achieved in clinical trials, fulfillment of the requirements for marketing authorization from regulatory bodies in the United States and other countries, the liquidity and market volatility of our equity securities, regulatory and manufacturing requirements and uncertainties, technological developments by competitors, the U.S. economic conditions regarding the availability of investment capital and other factors. If we cannot raise such funds, we may not be able to develop or enhance products, take advantage of future opportunities, or respond to competitive pressures or unanticipated requirements, which would likely have a material adverse impact on our business, financial condition and results of operations.

Competitive Environment

The biotechnology and medical device industries are characterized by rapidly evolving technology and intense competition. Our competitors include major multi-national medical device companies, pharmaceutical companies, biotechnology companies and stem cell companies operating in the fields of tissue engineering, regenerative medicine, cardiac, vascular, orthopedics and neural medicine. Many of these companies are well-established and possess technical, research and development, financial, and sales and marketing resources significantly greater than ours. In addition, many of our smaller potential competitors have formed strategic collaborations, partnerships and other types of joint ventures with larger, well established industry competitors that afford these companies potential research and development and commercialization advantages in the technology and therapeutic areas currently being pursued by us. Academic institutions, governmental agencies and other public and private research organizations are also conducting and financing research activities which may produce products directly competitive to those being commercialized by us. Moreover, many of these competitors may be able to obtain patent protection, obtain FDA and other regulatory approvals and begin commercial sales of their products before us.

Our potential commercial products address a broad range of existing and emerging therapeutic markets, in which cell-based therapy is a new and as of yet, unproven, commercial strategy. In a large part, we face primary competition from existing medical devices and drug products. Some of our competitors have longer operating histories and substantially greater resources. These include companies such as Baxter International, Inc. (Baxter), Biomet, Inc., Johnson & Johnson, Inc., Miltenyi Biotec, Medtronic, Inc. (Medtronic), and others.

In the general area of cell-based therapies, we potentially compete with a variety of companies, most of whom are specialty medical products or biotechnology companies. Some of these, such as Baxter, Johnson & Johnson, Medtronic and Miltenyi Biotec are well-established and have substantial technical and financial resources compared to ours. However, as cell-based products are only just emerging as viable medical therapies, many of our most direct competitors are smaller biotechnology and specialty medical products companies. These include Advanced Cell Technology, Inc., Cytomedix, Inc. (formerly Aldagen, Inc.), Arteriocyte Medical Systems, Inc., Athersys, Inc., Bioheart, Inc., Cytori Therapeutics, Inc., Genzyme Corporation, Terumo Medical Corporation (formerly Harvest Technologies Corporation), Mesoblast, Osiris Therapeutics, Inc., Pluristem, Inc. and others.

Employees

As of December 31, 2011, we employed 71 individuals on a full-time equivalent basis. A significant number of our management and professional employees have had prior experience with pharmaceutical, biotechnology or medical product companies. None of our employees are covered by collective bargaining agreements, and management considers relations with our employees to be good.

Executive Officers

|

Name |

|

Position |

|

Age |

|

Executive |

|

Timothy M. Mayleben |

|

President and Chief Executive Officer |

|

51 |

|

2009 |

|

Ronnda L. Bartel, Ph.D. |

|

Chief Scientific Officer |

|

53 |

|

2010 |

|

Sharon M. Watling, Pharm.D. |

|

Vice President Clinical Development |

|

48 |

|

2011 |

|

Brian D. Gibson |

|

Vice President of Finance |

|

33 |

|

2011 |

Timothy M. Mayleben — Mr. Mayleben joined Aastrom as a member of the Company’s Board of Directors in June 2005, and has served as our President and Chief Executive Officer since December 2009. Mr. Mayleben was formerly an advisor to life science and healthcare companies through his advisory and investment firm, ElMa Advisors. Prior to this, he served as the President and Chief Operating Officer and a Director of NightHawk Radiology Holdings, Inc. Mr. Mayleben was also formerly the Chief Operating Officer of Esperion Therapeutics, which later became a division of Pfizer Global Research & Development. He joined Esperion in late 1998 as Chief Financial Officer. While at Esperion, Mr. Mayleben led the raising of more than $200 million in venture capital and institutional equity funding and later negotiated the acquisition of Esperion by Pfizer in December 2003. Prior to joining Esperion, Mr. Mayleben held various senior and executive management positions at Transom Technologies, Inc., now part of Electronic Data Systems, Inc., and Applied Intelligent Systems, Inc., which was acquired by Electro-Scientific Industries, Inc. in 1997. Mr. Mayleben holds a Masters of Business Administration, with distinction, from the J.L. Kellogg Graduate School of Management at Northwestern University, and a Bachelor of Business Administration degree from the University of Michigan Ross School of Business. He is on the Advisory Board for the Wolverine Venture Fund and serves as a director for several private life science companies.

Ronnda L. Bartel, Ph.D. — Dr. Bartel joined Aastrom in 2006 and is responsible for research, development and manufacturing and engineering operations. Dr. Bartel has more than 20 years of research and product development experience and most recently was Executive Director, Biological Research at MicroIslet and Vice president, Scientific Development at StemCells, Inc. Earlier in her career, she was Senior Principal Scientist, Cell Biology at Advanced Tissue Sciences and was involved in the development and approval of two of the first three cell based products approved by the FDA. She has also worked as Senior Director, Science and Technology at SRS Capital, LLC evaluating life science investments and has also held positions in clinical development, drug delivery, business development and manufacturing. Dr. Bartel holds a Ph.D. in Biochemistry from the University of Kansas, completed postdoctoral work at the University of Michigan and received a B.A. in Chemistry and Biology from Tabor College.

Sharon M. Watling, Pharm.D — Dr. Watling joined Aastrom in February 2010 and is responsible for clinical development and clinical operations. She has over 12 years of experience in clinical development, with an emphasis on translational science, clinical development, and clinical strategies. Her industry career started in late stage development within Warner-Lambert/Parke Davis and evolved while at Pfizer to include an early clinical leadership role in cardiovascular-metabolic diseases. Following Pfizer, she was site leader and senior director, clinical development at Metabasis, Inc. Most recently, she served as the research and development strategy leader at Cognigen Corporation, working with multiple companies to incorporate modeling and simulation practices into their development strategies. Prior to industry, she was an intensive care unit clinical specialist at various academic institutions. Dr. Watling holds a Pharm.D. from the University of Michigan College of Pharmacy.

Brian D. Gibson — Mr. Gibson joined Aastrom in July 2010 and is Vice President of Finance. He brings more than 11 years of finance and accounting experience to Aastrom. Prior to joining Aastrom, Mr. Gibson was a senior manager at PricewaterhouseCoopers, with broad experience in multiple industries, including life sciences and healthcare. Mr. Gibson holds a BA in accounting with high honor from the Eli Broad College of Business at Michigan State University and is a certified public accountant.

Available Information

Additional information about Aastrom is contained at our website, www.aastrom.com. Information on our website is not incorporated by reference into this report. We make available on our website free of charge our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K as soon as reasonably practicable after those reports are filed with the Securities and Exchange Commission. Our reports filed with the Securities and Exchange Commission are also made available to read and copy at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. You may obtain information about the Public Reference Room by calling the SEC at 1-800-SEC-0330. Reports filed with the SEC are also made available on its website at www.sec.gov. The following Corporate Governance documents are also posted on our website: Code of Business Conduct and Ethics, Code of Ethics for Senior Financial Officers, Board Member Attendance at Annual Meetings Policy, Director Nominations Policy, Shareholder Communications with Directors Policy and the Charters for each of the Committees of the Board of Directors.

Our operations and financial results are subject to various risks and uncertainties, including those described below, that could adversely affect our business, financial condition, results of operations, cash flows, and trading price of our common stock. The risks and uncertainties described below are not the only ones we face. There may be additional risks and uncertainties that are not known to us or that we do not consider to be material at this time. If the events described in these risks occur, our business, financial condition, and results of operations would likely suffer.

Risks Related to our Business

Our past losses and expected future losses cast doubt on our ability to operate profitably.

We were incorporated in 1989 and have experienced substantial operating losses since inception. As of December 31, 2011, we have incurred a cumulative net loss totaling approximately $240,880,000 and we have continued to incur losses since that date. These losses have resulted principally from costs incurred in the research and development (including clinical trials) of our cell culture technologies and our cell manufacturing system, general and administrative expenses, and the prosecution of patent applications. We expect to continue to incur significant operating losses over the next several years and at least until, and probably after, product sales increase, primarily owing to our research and development programs, including preclinical studies and clinical trials, and the establishment of marketing and distribution capabilities necessary to support commercialization efforts for our products. We cannot predict with any certainty the amount of future losses. Our ability to achieve profitability will depend, among other things, on successfully completing the development of our product candidates, timely initiation and completion of clinical trials, obtaining regulatory approvals, establishing manufacturing, sales and marketing arrangements with third parties, maintaining supplies of key manufacturing components, acquisition and development of complementary activities and raising sufficient cash to fund our operating activities. Therefore, we may not be able to achieve or sustain profitability.

We may not be able to raise the required capital to conduct our operations and develop and commercialize our products.

Despite the proceeds we received from our March 2012 financing, we will require substantial additional capital resources in order to conduct our operations, complete our product development programs, complete our clinical trials needed to market our products (including a Phase 3 clinical trial for CLI), and commercialize these products and cell manufacturing facilities. In order to grow and expand our business, to introduce our new product candidates into the marketplace and to acquire or develop complementary business activities, we will need to raise a significant amount of additional funds. We will also need significant additional funds or a collaborative partner, or both, to finance the research and development activities of our cell product candidates for additional indications. Accordingly, we are continuing to pursue additional sources of financing.

Our future capital requirements will depend upon many factors, including:

|

· |

continued scientific progress in our research, clinical and development programs; |

|

|

|

|

· |

costs and timing of conducting clinical trials and seeking regulatory approvals; |

|

|

|

|

· |

competing technological and market developments; |

|

|

|

|

· |

avoiding infringement and misappropriation of third-party intellectual property; |

|

· |

obtaining valid and enforceable patents that give us a competitive advantage; |

|

|

|

|

· |

our ability to establish additional collaborative relationships; |

|

|

|

|

· |

our ability to effectively launch a commercial product; |

|

|

|

|

· |

the effect of commercialization activities and facility expansions, if and as required; and |

|

|

|

|

· |

complementary business acquisition or development opportunities. |

In November 2010, we terminated the common stock purchase agreement with Fusion Capital Fund II entered into June 2009. As a result, we no longer have access to the potential funding from Fusion Capital under that agreement. We entered into an At the Market Sales Agreement (ATM) on June 16, 2011, which allows us to raise approximately $20,000,000 through sales of our common stock from time to time. However, there are certain factors, such as volume of trading in our stock and the stock price, which limit the amount that can be raised in a short period of time through the ATM. Regardless of the usage of the ATM, we need to raise additional capital in order to fund the phase 3 clinical trial of ixmyelocel-T for CLI, complete our product development programs, complete clinical trials needed to market our products and commercialize these products. We believe that with our existing cash and cash equivalents and the net proceeds of $37,800,000 from the financing that closed in March 2012, we have adequate liquidity to finance our operations, including development of our products and product candidates, through at least December 31, 2012. While our budgeted cash usage and operating plan through December 31, 2012 does not currently contemplate taking additional actions to reduce the use of cash over that period, we could, if necessary, delay or forego certain budgeted discretionary expenditures such as anticipated hiring plans or certain non-critical research and development expenditures, as well as slow down or delay certain clinical trial activity such that we believe that we will have sufficient cash on hand through at least December 31, 2012.

Notwithstanding the proceeds we received from our March 2012 financing, we will need to raise additional funds in order to complete our product development programs, complete clinical trials needed to market our products (including clinical trials for our CLI and DCM programs), and commercialize these products. Because of our long-term funding requirements, we may try to access the public or private equity markets if conditions are favorable to complete a financing, even if we do not have an immediate need for additional capital at that time, or whenever we require additional operating capital. In addition, we may seek collaborative relationships, incur debt and access other available funding sources. This additional funding may not be available to us on reasonable terms, or at all. Some of the factors that will impact our ability to raise additional capital and our overall success include:

|

· |

the rate and degree of progress for our product development; |

|

|

|

|

· |

the rate of regulatory approval to proceed with clinical trial programs; |

|

|

|

|

· |

the level of success achieved in clinical trials; |

|

|

|

|

· |

the requirements for marketing authorization from regulatory bodies in the United States and other countries; |

|

|

|

|

· |

the liquidity and market volatility of our equity securities; and |

|

|

|

|

· |

regulatory and manufacturing requirements and uncertainties, technological developments by competitors. |

If adequate funds are not available in the future, we may not be able to develop or enhance our products, take advantage of future opportunities, or respond to competitive pressures or unanticipated requirements and we may be required to delay or terminate research and development programs, curtail capital expenditures, and reduce business development and other operating activities. Should the financing we require to sustain our working capital needs be unavailable or prohibitively expensive when we require it, the consequences could have a material adverse effect on our business, operating results, financial condition and prospects.

Failure to obtain and maintain required regulatory approvals would severely limit our ability to sell our products.

We must obtain the approval of the FDA before commercial sales of our cell product candidates may commence in the United States, which we believe will ultimately be the largest market for our products. We will also be required to obtain additional approvals from various foreign regulatory authorities to initiate sales activities of cell products in those jurisdictions. If we cannot demonstrate the safety, purity and potency of our product candidates, including our cell product candidates, produced in our production system, the FDA or other regulatory authorities could delay or withhold regulatory approval of our product candidates.

Finally, even if we obtain regulatory approval of a product, that approval may be subject to limitations on the indicated uses for which it may be marketed. Even after granting regulatory approval, the FDA and regulatory agencies in other countries continue to review and inspect marketed products, manufacturers and manufacturing facilities, which may create additional regulatory burdens. Later discovery of previously unknown problems with a product, manufacturer or facility may result in restrictions on the product or manufacturer, including a withdrawal of the product from the market. Further, regulatory agencies may establish additional regulations that could prevent or delay regulatory approval of our products.

Our product development programs are based on novel technologies and are inherently risky.

We are subject to the risks of failure inherent in the development of products based on new technologies. The novel nature of our therapeutics creates significant challenges in regard to product development and optimization, manufacturing, government regulation, third party reimbursement and market acceptance. For example, if regulatory agencies have limited experience in approving cellular therapies for commercialization, the development and commercialization pathway for our therapies may be subject to increased uncertainty, as compared to the pathway for new conventional drugs.

Any changes in the governmental regulatory classifications of our products could prevent, limit or delay our ability to market or develop our products.

The FDA establishes regulatory requirements based on the classification of a product. Because our product development programs are designed to satisfy the standards applicable to biological licensure for our cellular products, any change in the regulatory classification or designation would affect our ability to obtain FDA approval of our products. Each of these cell products is, under current regulations, regulated as a biologic, which requires a BLA.

Our inability to complete our product development activities successfully would severely limit our ability to operate or finance operations.

In order to commercialize our cell product candidates in the United States, we must complete substantial clinical trials and obtain sufficient safety, purity and potency results to support required registration approval and market acceptance of our cell product candidates. We may not be able to successfully complete the development of our product candidates, or successfully market our technologies or product candidates. We, and any of our potential collaborators, may encounter problems and delays relating to research and development, regulatory approval and intellectual property rights of our technologies and product candidates. Our research and development programs may not be successful, and our cell culture technologies and product candidates may not facilitate the production of cells outside the human body with the expected results. Our technologies and cell product candidates may not prove to be safe and efficacious in clinical trials, and we may not obtain the requisite regulatory approvals for our technologies or product candidates and the cells produced in such products. If any of these events occur, we may not have adequate resources to continue operations for the period required to resolve any issues delaying commercialization and we may not be able to raise capital to finance our continued operation during the period required for resolution of any such issues.

We must successfully complete our clinical trials to be able to market certain of our products.

To be able to market therapeutic cell products in the United States, we must demonstrate, through extensive preclinical studies and clinical trials, the safety and efficacy of our processes and product candidates. If our clinical trials are not successful, our products may not be marketable. The results of early stage clinical trials do not ensure success in later clinical trials, and interim results are not necessarily predictive of final results.

Our ability to complete our clinical trials in a timely manner depends on many factors, including the rate of patient enrollment. Patient enrollment can vary with the size of the patient population, the proximity of suitable patients to clinical sites, perceptions of the utility of cell therapy for the treatment of certain diseases, and the eligibility criteria for the study. For example, patients enrolling in our studies need to provide an adequate amount of bone marrow to process and expand for injection and some patients may not be able to provide sufficient starting material despite our study inclusion and exclusion criteria designed to prevent this. Bone marrow is an inherently variable starting material. We have experienced delays in patient accrual in our previous clinical trials. If we experience

future delays in patient enrollment, we could experience increased costs and delays associated with clinical trials, which would impair our product development programs and our ability to market our products.