Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EXXON MOBIL CORP | d307721d8k.htm |

| EX-99.3 - FREQUENTLY USED TERMS AND ADDITIONAL INFORMATION. - EXXON MOBIL CORP | d307721dex993.htm |

| EX-99.1 - TRANSCRIPT - EXXON MOBIL CORP | d307721dex991.htm |

2012 Analyst Meeting

March 8, 2012

New York Stock Exchange

Exhibit 99.2 |

Cautionary Statement

2 |

3

Agenda

9 AM

Welcome

David

Rosenthal,

Vice

President,

Investor

Relations

Business Overview

Financial & Operating Results

Rex

Tillerson,

Chairman

and

CEO

Competitive Advantages

BREAK

Mark

Albers,

Senior

Vice

President

Andy

Swiger,

Senior

Vice

President

Outlook

Summary

Q&A

12 PM

Meeting Concludes

Rex

Tillerson,

Chairman

and

CEO

Unlocking Greater Value in the

Upstream |

4

Chairman and CEO

Rex Tillerson

Business Overview |

5

Business Environment

Global environment offers a broad mix of challenges and opportunities

Near-term slowdown in global recovery with rising economic risks

Developing economies show signs of slowing but still outpace OECD economies

Significant regulatory initiatives continue while climate policies remain

uncertain Long-term outlook for energy and petrochemical demand remains

robust |

6

Energy Demand to 2040

Global energy demand likely to grow approximately 30% by 2040

Energy Demand

Quadrillion BTUs

Oil

Gas

Coal

Other*

Annual Growth

Rate to 2040

1.6%

-0.2%

1.7%

0.7%

Pace of demand growth moderated

by efficiency gains across the world

Mix gradually shifts with oil and

natural gas remaining prominent

Strong growth in natural gas driven

by power generation needs

Source: ExxonMobil 2012 Outlook for Energy

* Other includes nuclear, hydro, geothermal, biomass, wind, solar, and

biofuels. 2040

2010

0

100

200

300 |

7

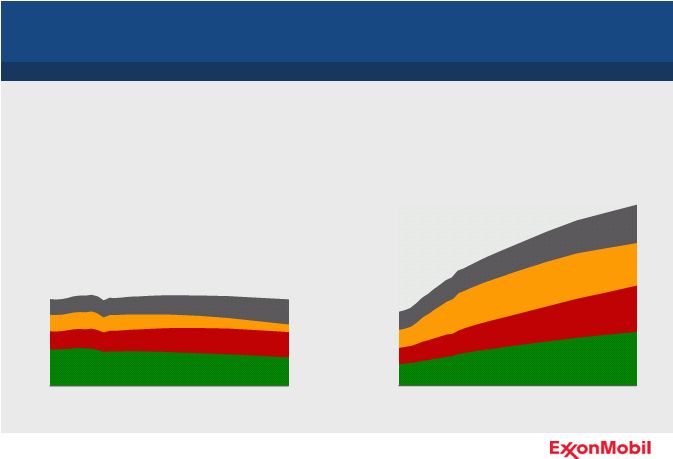

Developing Economies Lead Growth

Energy Demand: OECD Countries*

Quadrillion BTUs

Non-OECD Countries

Oil

Gas

Other

Coal

Asia Pacific demand growth accounts for nearly 60% of global increase

Source: ExxonMobil 2012 Outlook for Energy

* OECD: Organization for Economic Co-operation and Development

0

100

200

300

400

500

2000

2020

2040

0

100

200

300

400

500

2000

2020

2040 |

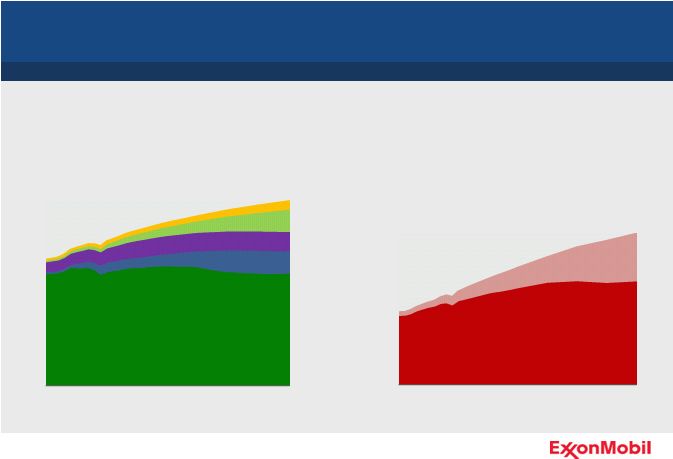

8

Liquids and Gas Supplies Expand and Diversify

Technology continues to expand economic supplies

Natural Gas

GCFD

Conventional

Unconventional

Liquids

MOEBD

Conventional Crude & Condensate

Deepwater

Natural Gas Liquids

Biofuels

Unconventional

Source: ExxonMobil 2012 Outlook for Energy

0

20

40

60

80

100

120

2000

2020

2040

0

100

200

300

400

500

600

700

2000

2020

2040 |

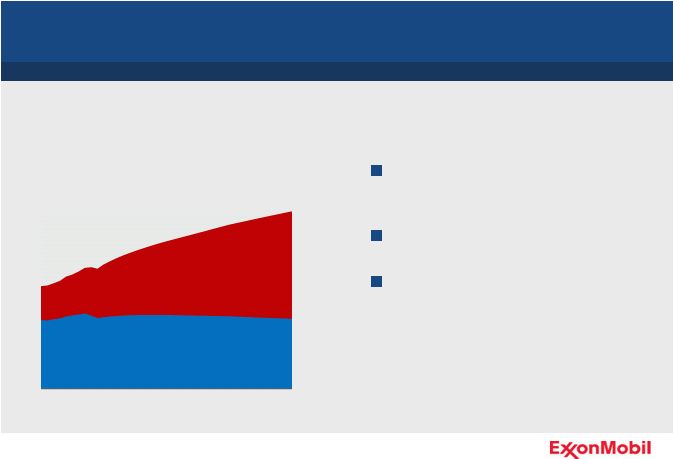

9

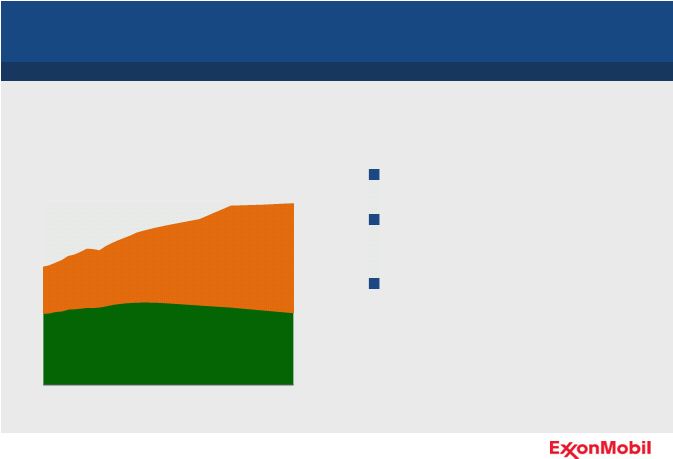

Global Downstream Demand

Transportation energy demand increases nearly 45% percent by 2040

Developing countries driving growth,

especially Asia Pacific

OECD demand is flat

New capacity, alternative fuels, and

efficiency gains required

Transportation Energy Demand

MOEBD

OECD Countries

Non-OECD Countries

Source: ExxonMobil 2012 Outlook for Energy

0

25

50

75

2000

2020

2040 |

10

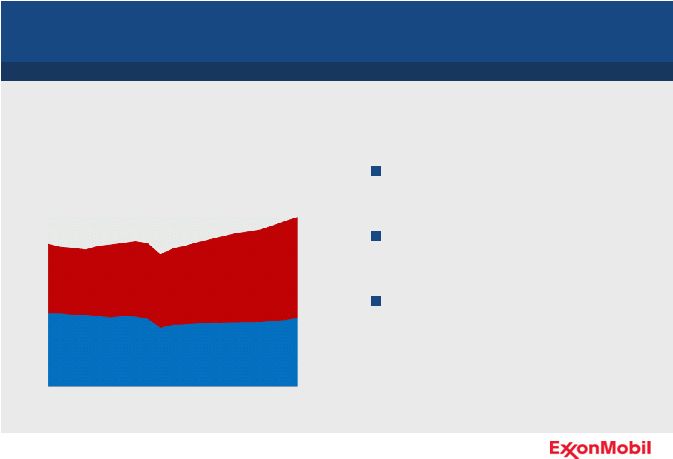

Transportation Product Mix

Heavy duty transportation leads demand growth

Source: ExxonMobil 2012 Outlook for Energy

* Excludes other petroleum products (e.g., heating oil, fuel oil, LPG, kerosene, jet

fuel, naphtha). Petroleum Product Demand*

MOEBD

Gasoline

Diesel

0

25

50

2000

2020

2040

Significant shift in product mix

Diesel

growing

in

all

regions,

driven by economic activity

Gasoline flat to down, reflecting

efficiencies |

11

Global Lubricants Demand

Demand expected to be nearly 20 percent higher in 2020 versus 2000

Demand growth of 1 percent per

year, driven by Asia Pacific

Global synthetics demand growing

6 percent per year

OECD demand flat but significant

growth within synthetics sector

* ExxonMobil assessment of industry demand

Lubricants Demand*

MB per Year

300

200

100

0

’00

’20

’15

’10

’05

OECD Countries

Non-OECD Countries |

12

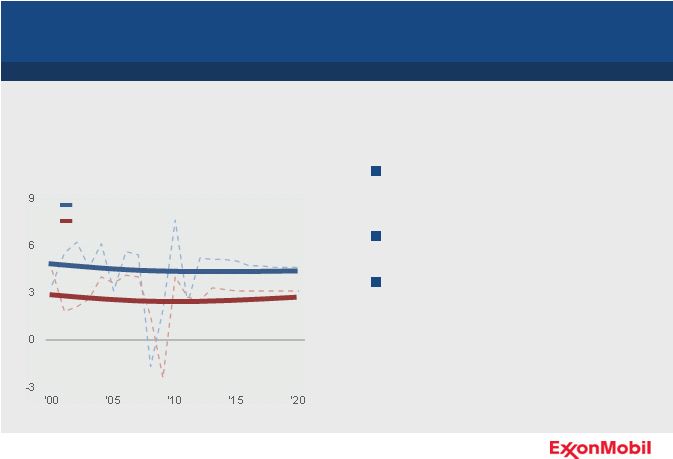

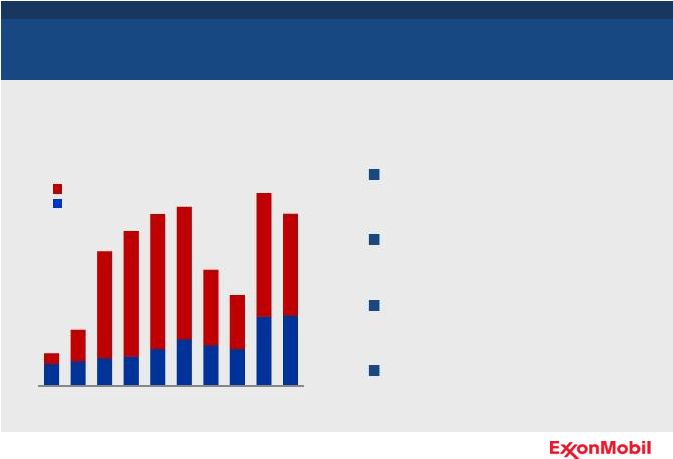

Global Chemical Demand

Chemical demand growth driven by Asia Pacific

Demand growth above GDP as

standards of living improve

Two-thirds of growth in Asia Pacific

Growth driven by preferred material

attributes

Demand and Global GDP*

Year-on-Year Percent Change

Demand Growth

Global GDP

Sources: ExxonMobil estimates and third-party GDP consensus opinions

* Chemical demand shown is polyethylene, polypropylene, and paraxylene. Bold

lines are trend lines. |

13

The Energy Challenge

Meeting the world’s growing energy needs safely and responsibly

Requires broad-based economic solutions

Demands a commitment to innovation and technology

Calls for unprecedented levels of investment and diversity of supply

Requires sound, stable government policies

Demands effective risk management and operational excellence

|

14

Risk Management

Risk management is fundamental to our business

Well-developed and clearly-defined

policies and procedures

Management accountability

High standards of design

Employee and contractor training

Rigorously applied management

systems |

15

Operations Integrity Management System

Disciplined framework for the management of risk

Common global expectations

Integrated into daily operations -

it’s how we operate

Provides framework to meet or

exceed regulations

Ongoing assessments and

incorporation of learnings |

Chairman and CEO

Rex Tillerson

Financial and Operating Results

16 |

17

2011 Financial and Operating Results

Strong results across all key measures and business lines

Relentless Focus on Operational Excellence

Strong Financial and Operating Results

Disciplined Investments Focused on Long-Term Value

Unmatched Shareholder Distributions |

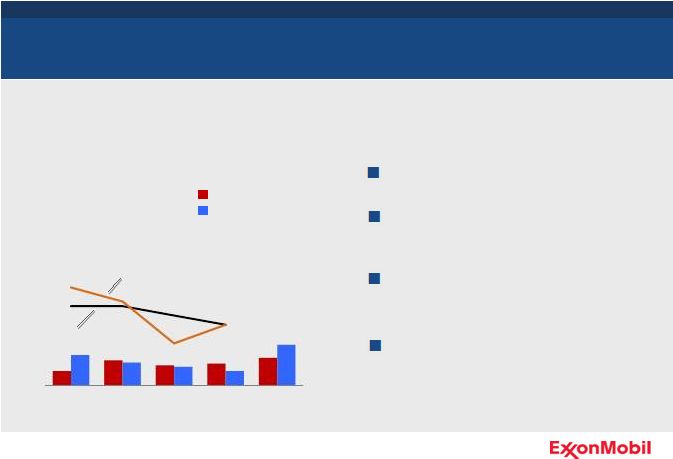

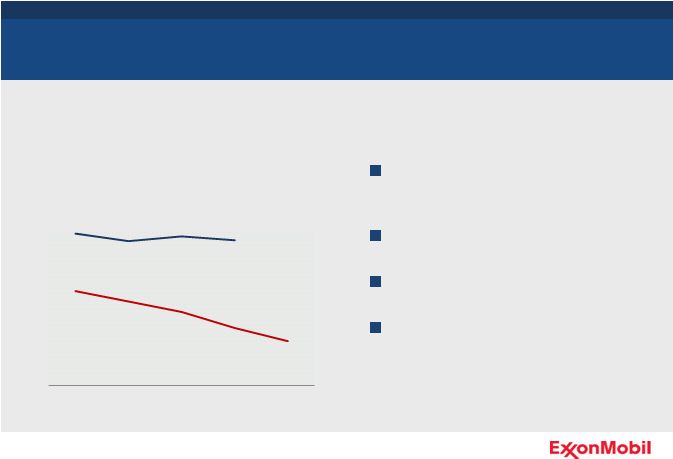

18

Safety

Safety performance remains strong in industry

Relentless Focus on Operational Excellence

Our vision: Nobody Gets Hurt

Focus

on

operational

excellence

and

risk management

XTO implementing proven safety

management systems

Committed to continuously improving

safety performance

* 2011 industry data not available.

** XTO included beginning 2011.

Lost Time Incident Rate

Incidents per 200K hours

U.S. petroleum industry

contractor benchmark*

U.S. petroleum

industry employee benchmark*

Employee

Contractor

0.0

0.1

0.2

0.3

0.4

'07

'08

'09

'10

'11** |

19

Environmental Performance

Committed to reducing environmental impact

Relentless Focus on Operational Excellence

* XTO included beginning 2011.

Hydrocarbon Flaring from

Upstream Oil & Gas Production

Million Metric Tons

0

2

4

6

8

'07

'08

'09

'10

'11*

Strong environmental

management

Improving energy efficiency

Reducing flaring, emissions,

releases

Protect Tomorrow. Today. |

20

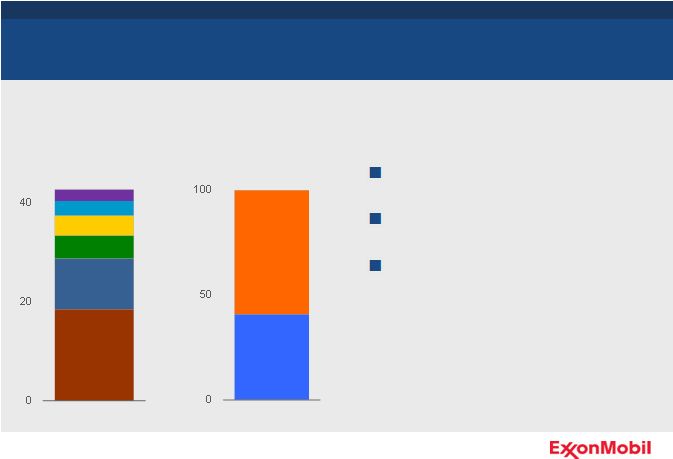

Earnings

Earnings of $41B in 2011, an increase of 35 percent over 2010

Strong Financial and Operating Results

Strong performance across all

business lines

Leveraging integration advantages

Maximizing value of asset base

Upstream

Downstream

Chemical

Total Earnings

0

10

20

30

40

50

'07

'08

'09

'10

'11

$B

Earnings Excluding Special Items |

21

Upstream portfolio continues to deliver strong earnings per barrel

Upstream Earnings per Barrel

Balanced portfolio well-positioned

throughout business cycle

Disciplined approach to cost

management

Relentless focus on maximizing value

of each asset

Strong Financial and Operating Results

0

5

10

15

20

25

'07

'08

'09

'10

'11

Earnings per Barrel

$ per OEB |

22

Upstream Volumes Growth

Project ramp-ups and strong unconventional performance drive growth

Strong Financial and Operating Results

-12

-10

-8

-6

-4

-2

0

2

2011 Volume Growth

Percent

XOM

CVX

RDS

BP

1 percent growth from 2010

Supported by risk management

and operational excellence

Largest

non

-government-owned

producer

of

oil and gas

at

4.5

MOEBD |

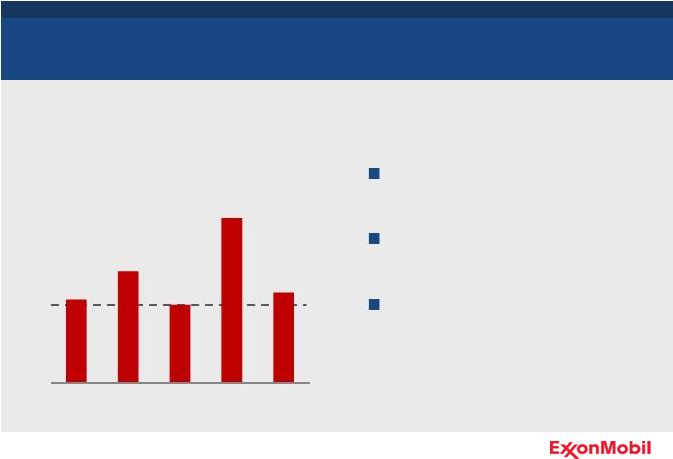

Reserves Replacement

Strong Financial and Operating Results

Replaced 116 percent of 2011

production

Additions exceeded production for

the 18

th

consecutive year

Proved reserves increased to 24.9

BOEB

Proved Reserves Replacement*

Percent

* Reserves replacement based on SEC pricing bases and excluding

asset sales, except as noted in the Cautionary Statement.

0

50

100

150

200

250

'07

'08

'09

'10

'11

Consistently replaced more reserves than produced

23 |

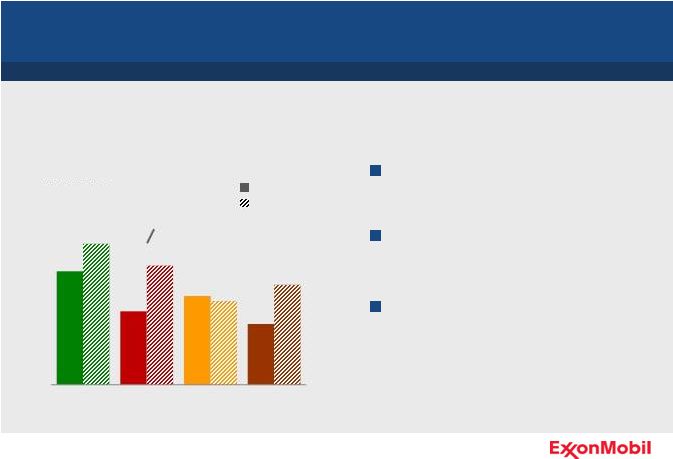

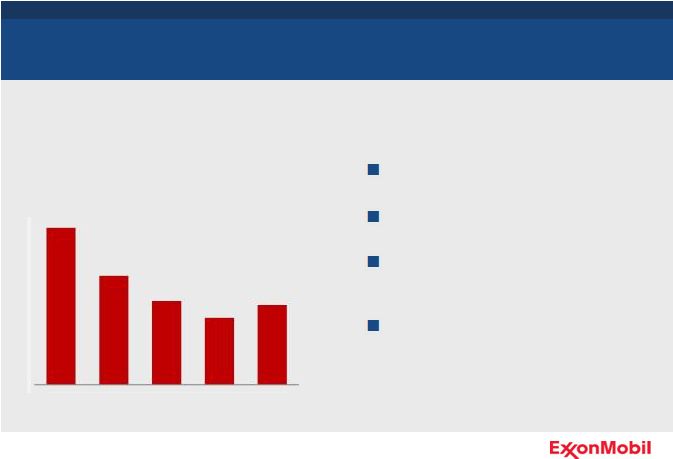

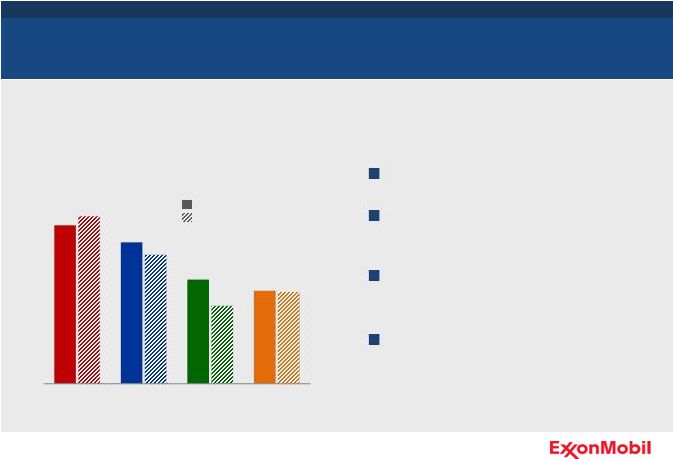

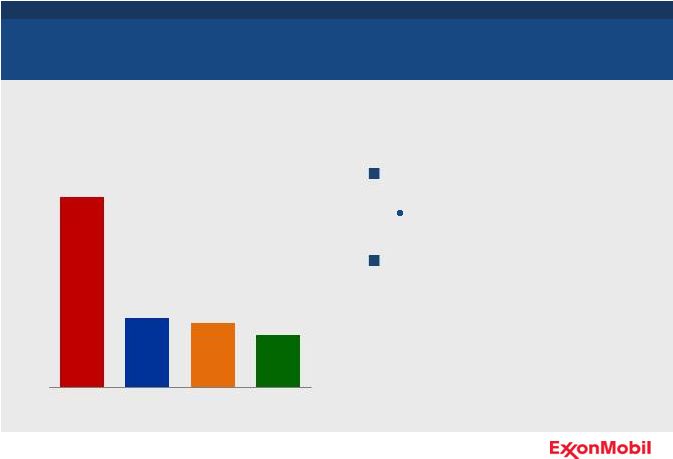

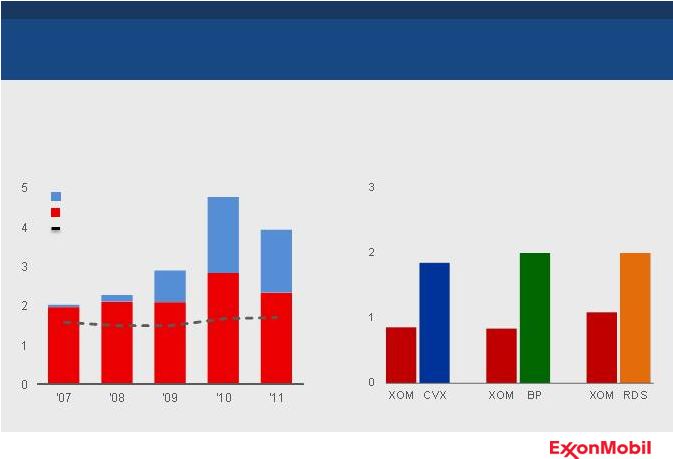

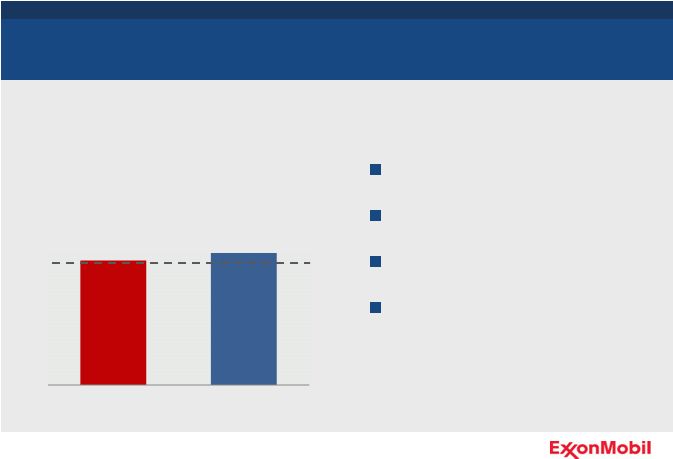

Return on Capital Employed

Return on Average Capital Employed*

Percent

2011

’07 –

’11, average

* Competitor data estimated on a consistent basis with ExxonMobil

and based on public information.

Strong Financial and Operating Results

0

5

10

15

20

25

30

XOM

CVX

BP

RDS

ROCE leadership supported by consistent business model

ROCE of 24 percent in 2011

Investments position long-term

performance

Disciplined investment through the

business cycle

Strength of integrated portfolio,

project management, and

technology application

24 |

Cumulative

Proceeds

Associated

with

Asset

Sales;

2007

–

2011

$B

Capital Management

Strong Financial and Operating Results

Ongoing portfolio management

fundamental to business model

Targeted divestments across all

business lines

Retained assets which hold longer-

term shareholder value

Active asset divestments enhance shareholder value

0

10

20

30

'07

'08

'09

'10

'11

25 |

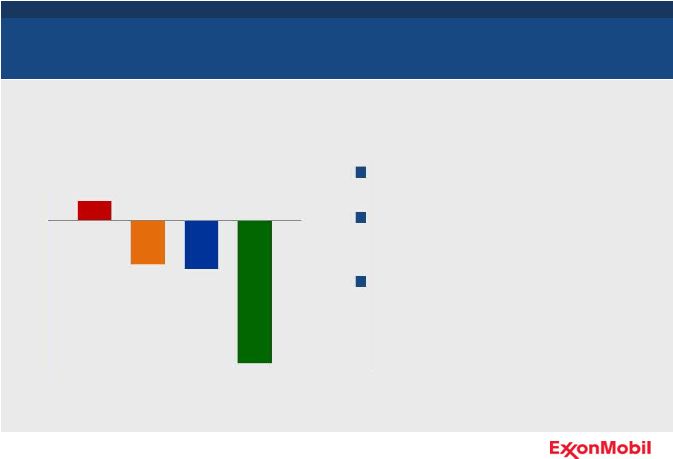

2011 Cash Flow

Strong Financial and Operating Results

Strong cash flow, up nearly 30

percent from 2010

Year-end cash balance over $13B

Funded all attractive investment

opportunities

Continued to pay growing dividend

* Represents cash flow from operations and asset sales of $66.5 billion, including

$11.1 billion from asset sales. ** PP&E Adds / Investment &

Advances: Property, Plant, and Equipment ($31.0 billion) and Investments & Advances ($2.4 billion)

2011 Cash Flow

$B

YE’10

Cash

Cash

Flow*

PP&E

Adds/

Investment

&

Advances**

Share-

holder

Distri-

butions

Financing /

Other

YE’11

Cash

Share Purchases

Dividends

8

66

33

29

1

13

26

Superior cash generation provides investment and distribution flexibility

0

20

40

60

80 |

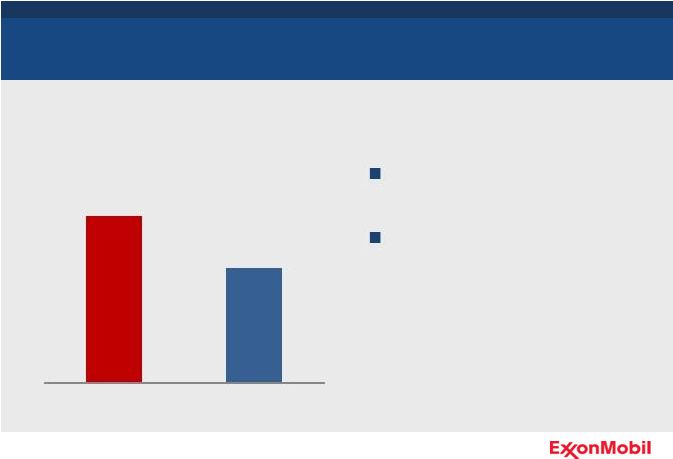

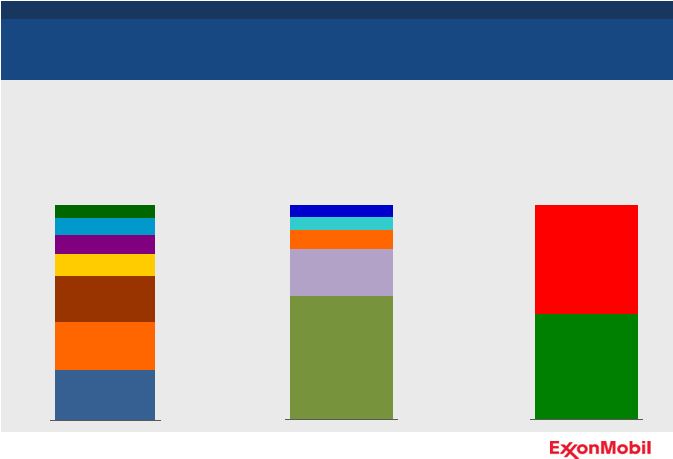

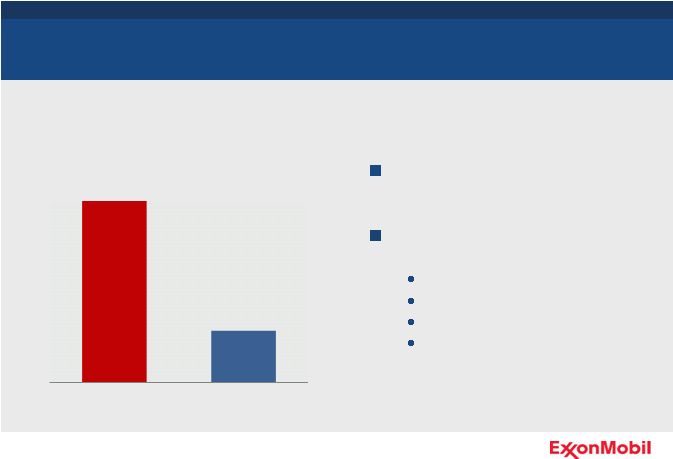

Free Cash Flow Generation

Cash generation unmatched among peers

Total free cash flow generation of

$146B since beginning of 2007

Higher than competitors combined

Strong cash generation provides

capacity for shareholder distributions

* Competitor data estimated on a consistent basis with ExxonMobil and

based on public information.

Total

Free

Cash

Flow

(’07

–

’11)*

$B

Strong Financial and Operating Results

0

25

50

75

100

125

150

XOM

CVX

RDS

BP

27 |

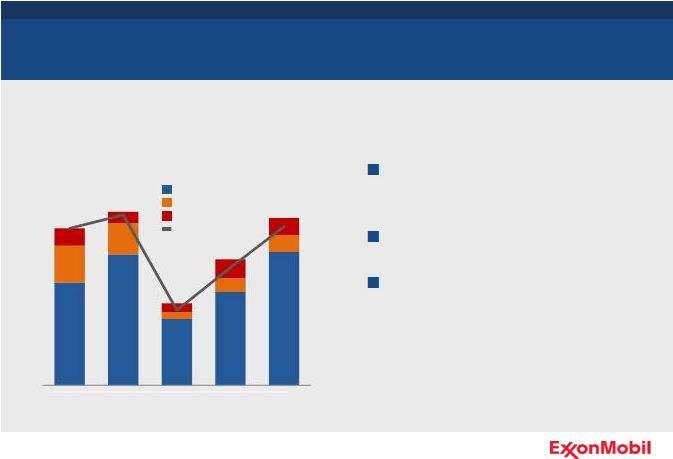

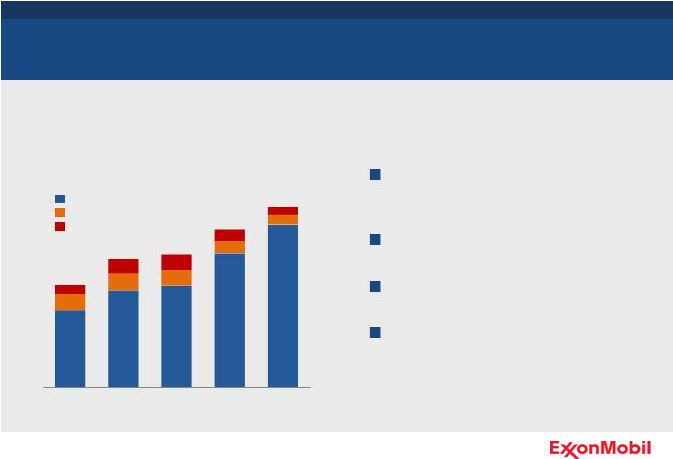

Capex

Disciplined Investments Focused on Long-Term Value

Capex by Business Line

$B

Invested $143B during the past five

years

Executed strategic acquisitions

Progressing major projects

Maintained capital efficiency and

discipline

Maintained focus on selective investments to deliver superior returns

0

10

20

30

40

'07

'08

'09

'10

'11

Upstream

Downstream

Chemical / Other

28 |

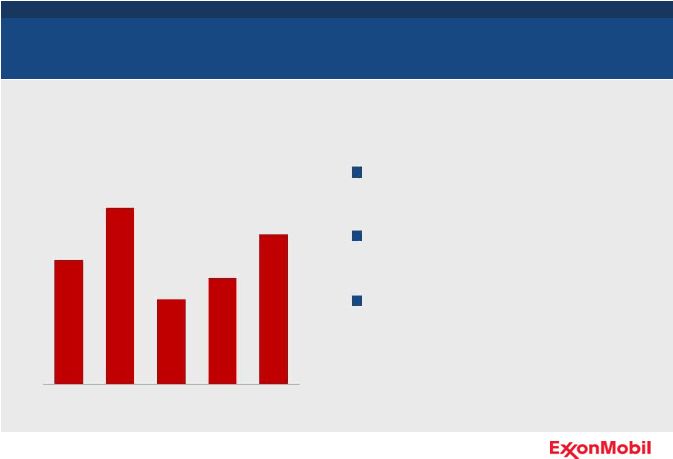

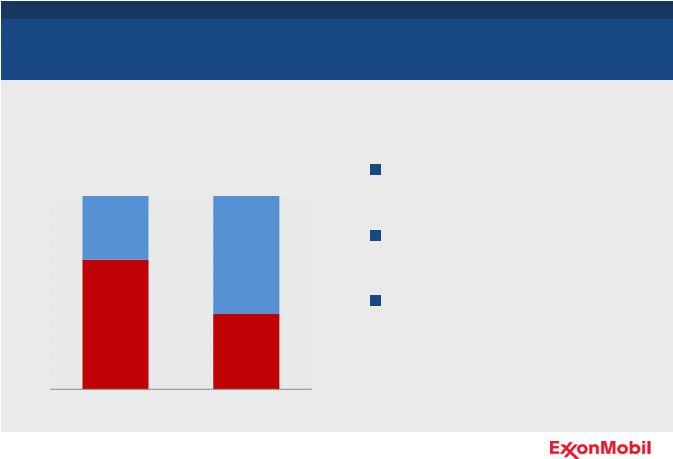

Distribution Yield

Unmatched Shareholder Distributions

Total distribution yield of 34 percent

since beginning of 2007

Average distribution yield of 7.3

percent versus competitor average

of 5.1 percent

* Yield based on 2006 year-end market capitalization.

** RDS, BP, and CVX.

Total

Distribution

Yield

(’07

–

’11)*

Dividends

&

Share

Repurchases

Percent

0

5

10

15

20

25

30

35

ExxonMobil

Competitor Average**

29

Industry-leading shareholder distributions |

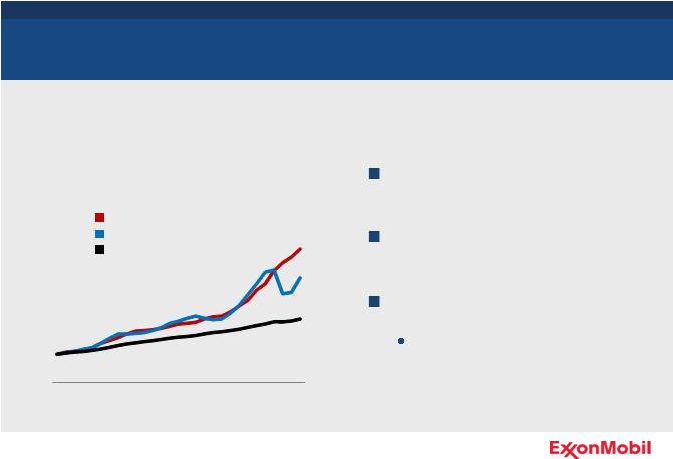

Dividends

* S&P and CPI indexed to 1983 Exxon dividend.

** CPI based on historical yearly average from Bureau of Labor Statistics.

Dividend Growth since 1983*

$ per share

XOM

S&P 500

CPI**

Unmatched Shareholder Distributions

’83

’11

’01

’91

0.00

0.50

1.00

1.50

2.00

2.50

Reliable and growing dividends; $9 billion distributed in 2011

30

Over $40B distributed to

shareholders over past five years

Dividend has grown every year since

1983

Annualized growth rate

of

5.7 percent

Almost two times inflation |

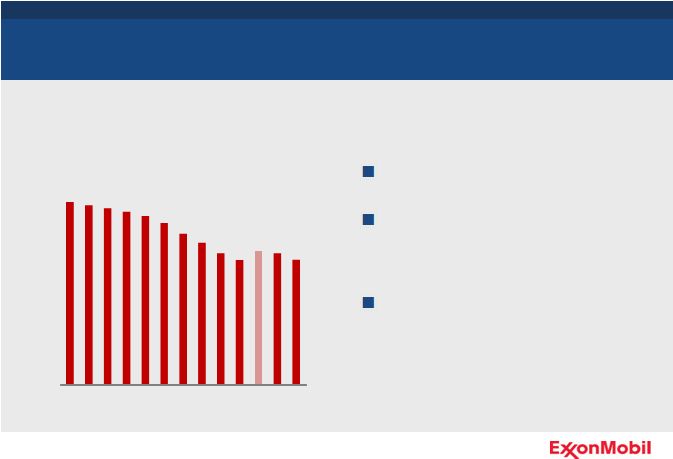

Share Reductions

Share purchases efficiently return cash to shareholders

$20B in shares purchases in 2011

Over 30 percent reduction in shares

outstanding since Exxon and Mobil

merger

Expect number of shares issued for

XTO to be repurchased by end of

1Q12

Shares Outstanding

Millions of Shares

* XTO acquisition occurred 2Q10.

Unmatched Shareholder Distributions

31

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

'00

'02

'04

'06

'08

2Q10*

'11 |

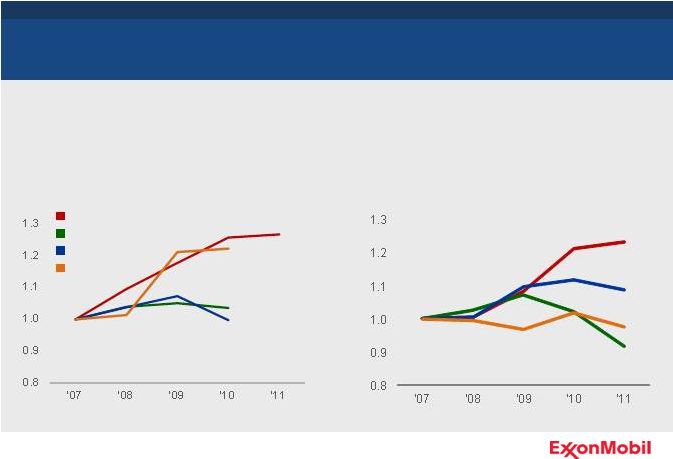

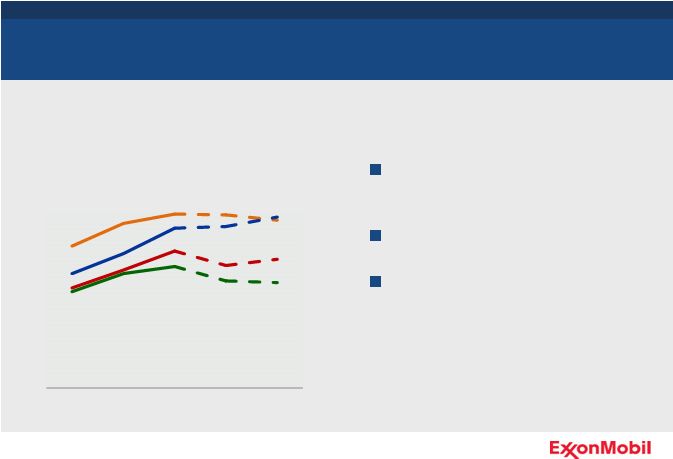

Increasing Ownership

* Competitor data estimated on a consistent basis with ExxonMobil and based on

public information. ** Reserves

based

on

SEC

pricing

bases,

including

oil

sands

and

equity

companies.

2011

competitor

data

not

yet

available.

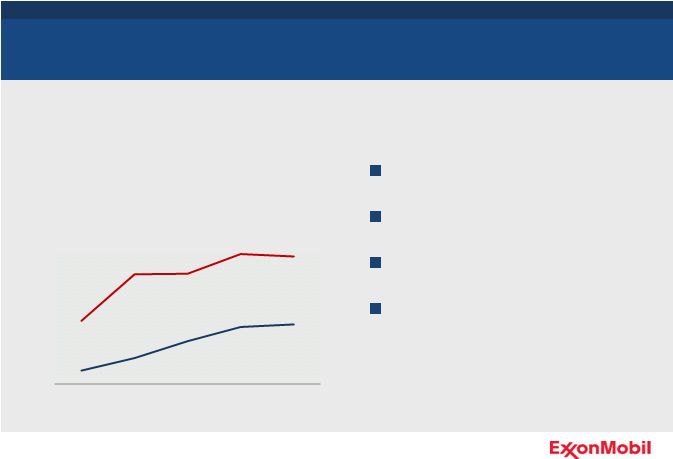

Production Growth per Share since 2007*

Indexed; 2007 = 100

Indexed Growth

Reserves Growth per Share since 2007* **

Indexed; 2007 = 100

XOM

BP

CVX

RDS

Indexed Growth

Unmatched Shareholder Distributions

32

Enhanced per share interest in ExxonMobil reserves and production

|

33

2011 Financial and Operating Results

Strong results across all key measures and business lines

Relentless Focus on Operational Excellence

Strong Financial and Operating Results

Disciplined Investments Focused on Long-Term Value

Unmatched Shareholder Distributions |

34

Competitive Advantages

Chairman and CEO

Rex Tillerson |

35

Competitive Advantages

ExxonMobil possesses unique competitive advantages

Balanced Portfolio

Disciplined Investing

High-Impact Technologies

Operational Excellence

Global Integration |

36

Competitive Advantages

ExxonMobil possesses unique competitive advantages

Balanced Portfolio

Disciplined Investing

High-Impact Technologies

Operational Excellence

Global Integration |

37

2011 Resource Base

Balanced Portfolio

Upstream

Diverse resource base of over 87 billion oil-equivalent barrels

0

30

60

90

Africa

Australia/Oceania

Asia

Americas

Europe

Geography

0

30

60

90

Liquids

Gas

Liquids / Gas

0

30

60

90

Resource Base (BOEB)

Type

Unconventional

Oil and Gas

Arctic

Conventional

Heavy Oil /

Oil Sands

Deepwater

Acid / Sour

LNG |

Resource Base Growth

Consistently adding quality resources at attractive finding costs

* Excludes XTO acquisition and the proved portion of discovered undeveloped

additions. ** Sources: Chevron Analyst Presentation (3/11), BP Strategy

Presentation (3/10), Shell Strategy Update (3/11) Annual Resource

Additions* BOEB

Discovered Undeveloped

By-the-Bit

Production

Upstream

$/OEB

Finding Cost (as reported)**

’02 -

’09

’04 -

’08

’08 -

’10

Balanced Portfolio

38 |

Global Liquids Position

Upstream

Robust liquids portfolio of quality operations and advantaged projects

12.2 BOEB proved liquid reserves

Strong growth potential

Significant long-plateau volumes

LNG/Unconv

Heavy Oil /

Oil Sands

Conventional

Acid / Sour

Deepwater

Arctic

Liquids Resource Base

BOEB

2011 Liquids Production

Normal

Depletion

Long-

Plateau

Percent

Balanced Portfolio

39 |

Global Gas Position

Upstream

Gas portfolio diverse in resource type, markets, and contract structures

76 TCF proved gas reserves

Large, diverse resource base

Leading unconventional position with

significant growth potential

LNG

Shale Gas

Conventional

Deep-

water

Acid / Sour

Tight Gas

Arctic

CBM/Other

Gas Resource Base

BOEB

Markets

BCFD

Europe

Asia

Americas

Africa

Middle East

Balanced Portfolio

40 |

41

Production and Contract Mix

Upstream

Significant portion of production linked to oil pricing

0

1

2

3

4

5

Gas

Oil

Production Mix

MOEBD

Gas

Oil

2011

2015 Estimated

0

1

2

3

4

5

Oil

Oil

Indexed

Gas

Indexed

Oil

Oil

Indexed

Gas

Indexed

Contract Mix

MOEBD

2011

2015 Estimated

Balanced Portfolio |

42

New Opportunity Growth

Upstream

Balanced Portfolio

Growing global portfolio of high-quality resource opportunities

Horn River

Alberta Tight Oil

Athabasca

Beaufort

Summit Creek

Gulf of Mexico

Guyana

Permian Basin

Rockies

Woodford

Utica

Colombia

Marcellus

Kara Sea

Vietnam

Indonesia

Russian Black

Sea

Norway

West

Greenland

Romania

Tanzania

Nigeria

PNG

Australia

Angola

Faroe Islands

Madagascar

Ireland

Argentina

China

Germany

Poland

Abu Dhabi

Iraq

New Play Tests

Unconventional

Conventional Discov’d/Undev.

Established Conventional Basin

Play Type |

43

Scale Advantage

Largest global refiner with the highest level of integration

Average Refinery Size*

KBD

Downstream

Refineries 60 percent larger

than industry average

Leveraging scale to improve

profitability

* ExxonMobil average global refinery capacity compared to industry equity share

capacity; year-end 2011. Equity share capacity calculated on a

consistent basis using public information. Source: Oil & Gas Journal.

Balanced Portfolio

100

120

140

160

180

200

220

ExxonMobil

Industry Average

Cost efficiencies

Circuit optimization

Reliability

Feed flexibility |

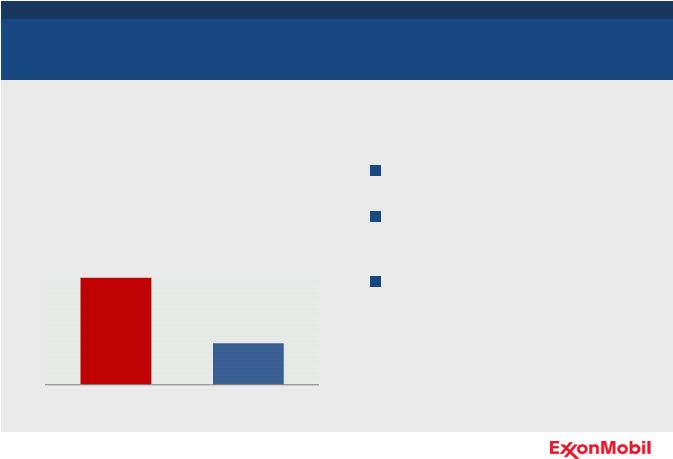

44

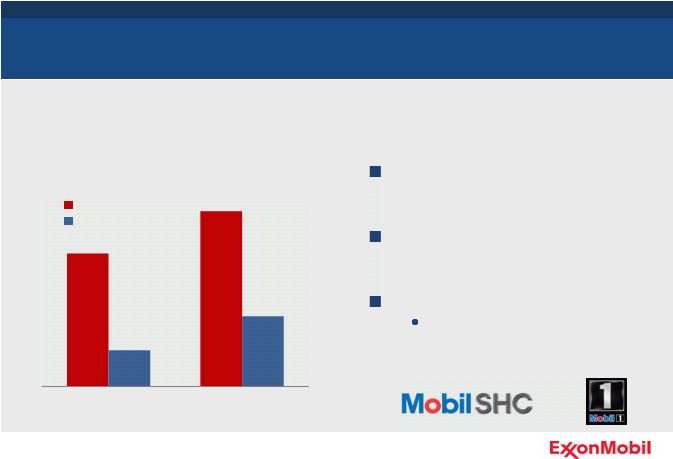

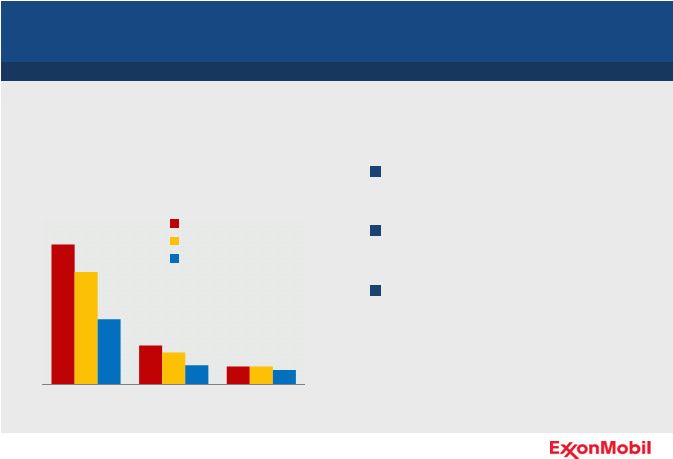

Lubricants Leadership Position

Largest basestock manufacturer and leading marketer of synthetics

Downstream

Global synthetics demand growing 6

percent per year

Industry leadership in basestocks and

synthetic lubricants

Well-positioned to capture growth

Market Position

Percent share

ExxonMobil

Competitor Average*

* ExxonMobil estimate of key competitor market share based on Kline industry

data and public information. Competitors include BP, RDS, and CVX.

Balanced Portfolio

0

5

10

15

20

Basestocks

Synthetic Lubes

Supported by advanced technology

and brand leadership |

45

World-Class Brands

A leading marketer of high-quality products with trusted brands

Downstream

Global reach

Diverse sales channels

Global brands trusted for product

quality and supply reliability

Global Fuels Marketing Sales

Aviation

Marine

Retail

Industrial and

Wholesale

Percent, sales

Balanced Portfolio |

Balanced Portfolio Maximizes Value

Facilities strategically located,

supplying all major growth regions

Commodities provide scale and

upside earnings capture

Specialties generate stable yet

growing earnings base

Proprietary technology underpins

portfolio

Earnings

$B

Commodities

Specialties

Chemical

Balanced Portfolio

0

1

2

3

4

5

'02

'03

'04

'05

'06

'07

'08

'09

'10

'11

46

Industry-leading Chemical performance driven by strong portfolio

|

Competitive Advantages

ExxonMobil possesses unique competitive advantages

Balanced Portfolio

Disciplined Investing

High-Impact

Technologies

Operational Excellence

Global Integration

47 |

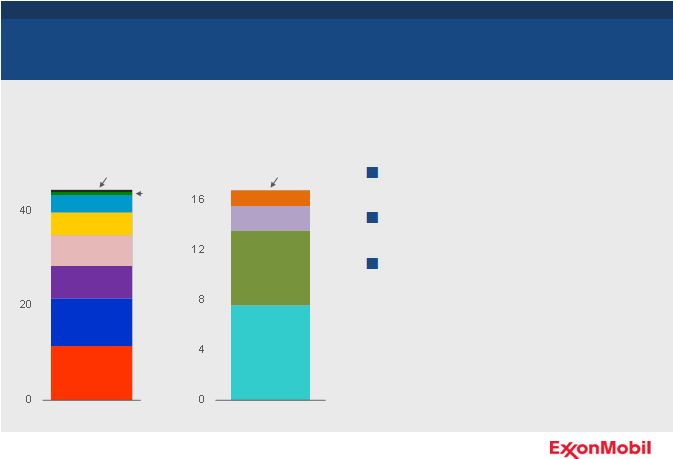

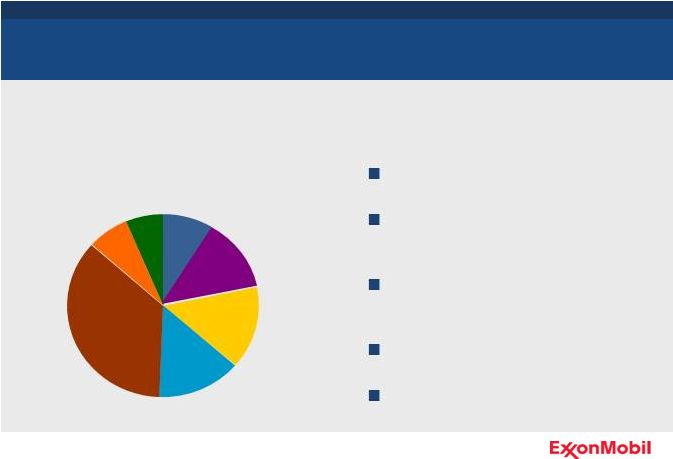

Project Inventory

Disciplined Investing

Upstream

Extensive portfolio supports selective investment decisions

Portfolio of 120+ projects

Developing 23 net BOEB across all

regions and resource types

Industry-leading project

management

High-impact technology

Investment selectivity

Project Distribution by Type

Percent, resource

Arctic

Heavy Oil /

Oil Sands

Conventional

Unconventional

Deepwater

LNG

Acid / Sour

9%

13%

15%

14%

36%

7%

6%

48 |

Near-Term Project Start-Ups

Upstream

21 major project start-ups are planned between 2012 and 2014

Acid / Sour

Kashagan Phase 1

Oil Sands

Kearl

Nigeria

Satellites

LNG

Papua New Guinea

Arctic

Arkutun-Dagi

Deepwater Angola

Satellites

Deepwater GOM

Hadrian South / Lucius

Conventional

Kipper / Tuna

Disciplined Investing

49 |

Major Project Production Outlook

Upstream

Significant new production supports long-term volumes

Over 1 MOEBD added by 2016

80 percent liquids volumes

Significant long-plateau volumes

Long-term growth supported by

diverse portfolio

* Outlook based on 2011 average prices (Brent crude $111/B).

Major Project Production Outlook*

MOEBD

Papua New Guinea

Gorgon Jansz

Hadrian South

Gas

Liquids

Usan

Kearl

Banyu Urip

AB17 Pazflor

West Qurna I

Upper Zakum 750

Kashagan Phase 1

Syncrude Aurora North

Kizomba Satellites Phase 1

Disciplined Investing

0.0

0.4

0.8

1.2

'11

'12

'13

'14

'15

'16

50 |

Selective Investments

Increasing high-value diesel production for growing markets

Downstream

Global diesel demand expected to

rise by 85 percent through 2040

Recent investments contributed to

record ULSD production in 2011

Progressing additional investments to

supply more lower-sulfur fuels

Ultra-Low Sulfur Diesel Production

ExxonMobil, indexed

Disciplined Investing

100

150

200

250

300

'06

'07

'08

'09

'10

'11

51 |

Portfolio Management

Downstream

Disciplined Investing

Global Asset Sales

(2003 -

2011)

Refineries

11

Pipeline Miles

5.9k

Terminals

145

Countries Exited

65

Retail Stations

16.8k

Ongoing portfolio management delivers value

52 |

53

Effects from Portfolio Highgrading

Improved capital efficiency

Divestments reduced capital

employed more than 20 percent since

2003

Relatively low impact to earnings

Disciplined and ongoing approach to

capital management

Disciplined Investing

Downstream

Impact of Divestments / Restructuring

Percent, 2011 versus 2003; Downstream only

Capital

Employed

-23%

+5%

ROCE

Restructuring has driven a material decrease in our capital employed

|

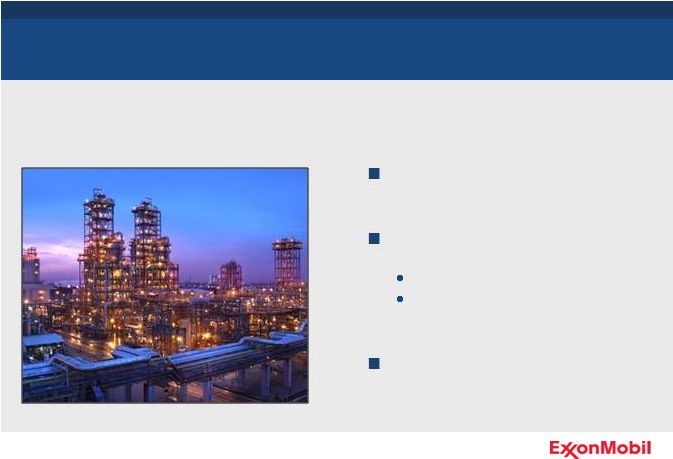

54

Singapore Expansion

Establishing world-class integrated platform to support Asia growth

Chemical

Two-thirds of chemical growth from

Asia Pacific

Once complete, largest refining-

chemical complex in our circuit

2.6 million tonnes of new capacity

98 percent mechanically complete

with units progressively starting up

Value capture accelerates as global

economy strengthens

Disciplined Investing |

55

Competitive Advantages

ExxonMobil possesses unique competitive advantages

Balanced Portfolio

Disciplined Investing

High-Impact Technologies

Operational Excellence

Global Integration |

56

Technology Leadership

Developing fundamental science to meet the world’s energy challenges

Metallurgy solutions

for challenging

arctic conditions

Feed flexibility

advantage through

molecule

management

Corporate Strategic Research

Unique, world-class scientific

research capability

Fundamental research enables

identification of technology

opportunities

Foundation for technology

development in the business lines

Corporate

High-Impact Technologies |

57

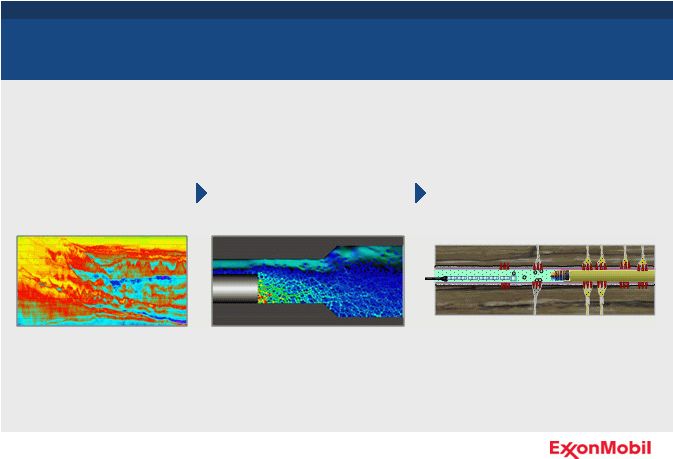

Research and Development

Progressing breakthrough research to develop high-reward, risk

reduction technologies across the Upstream business

Upstream

Imaging

Shale Gas / Tight Oil

Stimulation

Extended Reach

Drilling

Exploration

Development

Production

High-Impact Technologies |

58

Extended Reach Drilling

Developing and applying integrated technologies to unlock greater value

Upstream

Horizontal Displacement

1980’s

1990’s

2000’s

Canada

California

Sakhalin

Drilled 23 of 27 longest-reach wells

Integrated suite of technologies from

modeling to wellbore planning

Increased capital efficiency and

access to additional reserves

High-Impact Technologies |

59

Margin Improvement

Advantaged technologies enable our ability to improve margins

Downstream

Lower raw materials costs

Expanded feed flexibility

Increased refining utilization

Higher product realizations

“Discounted”

Crudes*

Percent, indexed

ExxonMobil

Industry Average

Source: ExxonMobil estimate based on public information.

* Includes “challenged”

crudes which are discounted in the market due to properties that make them

challenging to process. High-Impact Technologies

50

100

150

200

'04

'06

'08

'10

'11 |

60

Feedstock Flexibility

Significant flexibility to process advantaged feedstocks

Facilities configured to run wide

range of feedstock

Access to range of feeds to

capitalize on lowest-cost options

Proprietary molecule management

technologies maximize value

Chemical

Worldwide Feedstock*

Percent

Advantaged

feeds

Benchmark

feeds

Source: IHS Chemical; full-year estimate as of September 2011.

* Ethylene feedstock; ExxonMobil data includes share of JV production.

High-Impact Technologies

0

25

50

75

100

ExxonMobil

Industry Average |

61

Higher-Value Products

Advantaged technologies improve our products

Downstream / Chemical

Industry-leading

synthetic lubes

Higher-quality

fuel products

Premium chemical

products

High-Impact Technologies |

62

Competitive Advantages

ExxonMobil possesses unique competitive advantages

Balanced Portfolio

Disciplined Investing

High-Impact Technologies

Operational Excellence

Global Integration |

63

People

Operational Excellence

Operational excellence begins with exceptional employees

Culture of excellence

Tailored, world-class training

Diverse, global work experiences

Host country workforce development

Corporate |

64

Reliability and Cost Management

Best practices deliver strong reliability and life-cycle cost performance

Upstream

Strong reliability performance

Operated uptime >3 percent higher

than assets operated-by-others over

the last five years

-

Operational Excellence

Maintaining integrity of facilities

Disciplined global operating and

maintenance systems |

65

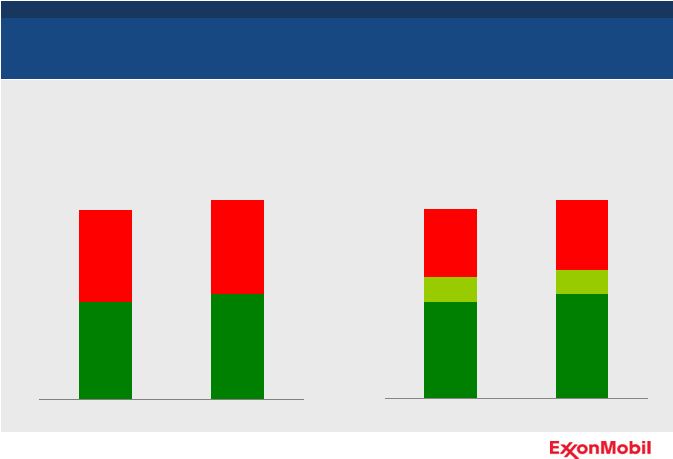

Project Execution

Proven execution performance and delivery of complex projects

Rigorous project management

Superior cost and schedule delivery

Maximize efficiencies

Reappraisal to continuously improve

project performance

Upstream

* Actual versus funded cost variance (%); ’07 to ’11 project start-ups in ExxonMobil portfolio

Cost Performance*

2007 –

2011 Average

Percent

109%

103%

Operational Excellence

0

50

100

150

ExxonMobil Operated

Operated-by-Others |

66

Cost Management

Disciplined and consistent approach to cost management

Continual effort to maximize the

value of each asset

Mature contracting strategies

Ongoing portfolio management

Upstream

* Upstream technical costs using 10-K/20-F information; beginning in 2009

equity companies and oil sands mining operations are included.

Total Costs per OEB*

$/OEB

CVX

RDS

BP

XOM

Operational Excellence

0

5

10

15

20

25

'06

'07

'08

'09

'10 |

67

Angola and Sakhalin Developments

Delivering significant life-cycle value from frontier developments

Upstream

Enabling frontier developments with

differentiating technologies

Delivering operational excellence

Over 1.7 billion barrels produced

Over 95 percent uptime

Rapidly nationalizing the workforce

Maintaining strong government

relations

Operational Excellence |

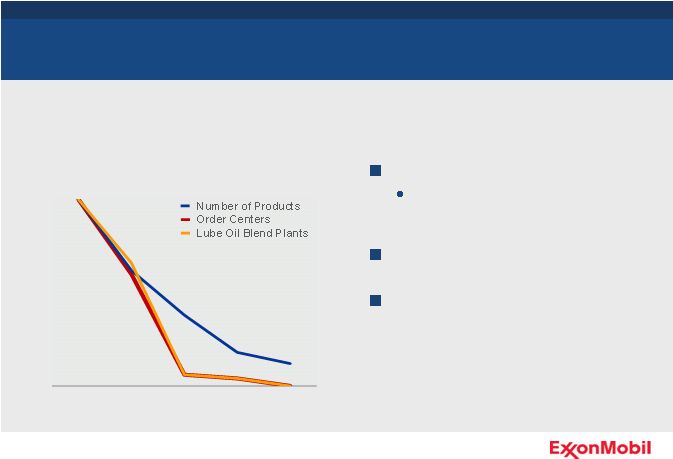

68

Improving Productivity

Focus on optimizing productivity delivers competitive advantage

Downstream

Ongoing consolidation activities

Integrated marketing company

announced in 2011

Streamlined product offering

Global organization, systems, and

processes driving lower operating

expenses

Supply Chain Operating Efficiencies

Indexed

Operational Excellence

50

60

70

80

90

100

'04

'06

'08

'10

'11 |

69

Operating Efficiency

Sustaining high levels of operating efficiency

Downstream / Chemical

Refining and Chemical expanding

energy efficiency advantage

Globally shared best practices

Advanced technologies

Targeted investments

Refining Energy Intensity*

Indexed

ExxonMobil

Industry Average

* Data indexed to ExxonMobil (’04). Source:

Solomon Associates fuels refining benchmarking data; available for even

years. 2011 data estimated by ExxonMobil. Operational Excellence

90

95

100

105

110

'04

'06

'08

'10

'11 |

70

Higher Operating Rates

Technology enables higher capacity utilization

Chemical

Reliability focus

Feedstock flexibility expands range of

economic operation

Fast-growing and high-value

derivatives

Global Steam Cracker Capacity Utilization

2007 –

2011 Average

Percent

ExxonMobil

Source: IHS Chemical

Operational Excellence

85

86

87

88

89

90

Industry Average |

71

Competitive Advantages

ExxonMobil possesses unique competitive advantages

Balanced Portfolio

Disciplined Investing

High-Impact Technologies

Operational Excellence

Global Integration |

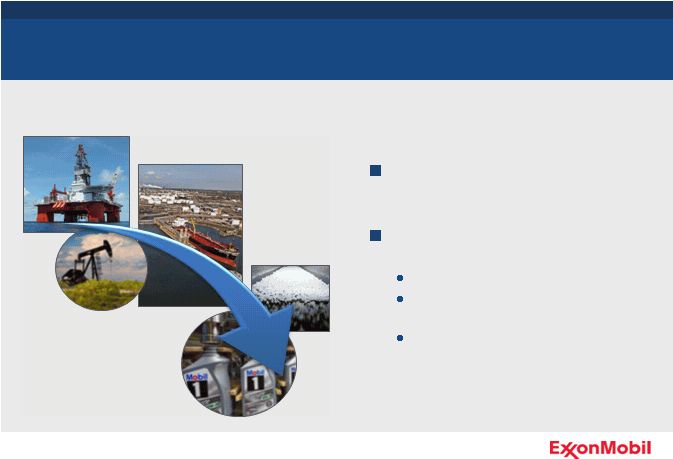

72

Maximizing Value through Integration

Global Integration

Corporate

Maximize value from Upstream

resource through to finished products

Leverage global functional

organization

Broadly deploy best practices

Economies of scale, shared support

services, purchasing

Maximize technology potential

Continuing to create value through the integrated business model

|

73

Marketing New Crudes

Early integration across the supply chain enhances resource value

Upstream / Downstream

Upstream leveraging Downstream to

optimize equity crude value

Consistent integrated approach

Molecular assays

Crude valuation

Technical readiness

Refining capability and placement

Global Integration |

74

Integrated Manufacturing

ExxonMobil has integration advantages that are difficult to replicate

Higher-value products

Integrated molecular optimization

Assets with unparalleled feed

flexibility

Common site management, utilities,

and infrastructure

Refining Integration with Chemicals/Lubes*

Percent

Downstream / Chemical

Source: Parpinelli Tecnon database

* Calculated on a consistent basis using public information; year-end

2011. Global Integration

20

40

60

80

ExxonMobil

Industry Average* |

75

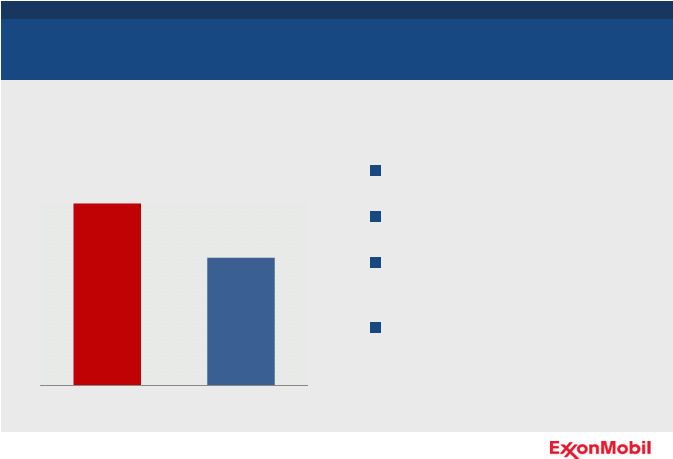

Industry-Leading Results

Downstream / Chemical

Proven business strategies enabled

by technology

Businesses optimized together to

maximize shareholder value

2008 –

2011 average annual

results:

Earnings of $8 billion

19 percent ROCE; nearly three

times the competitor average

* Competitor data estimated on a consistent basis with ExxonMobil and

based on public information. Competitors include BP, RDS, and CVX.

Downstream and Chemical Combined ROCE

Percent

ExxonMobil

Competitor Range

Global Integration

0

10

20

30

40

'08

'09

'10

'11

Downstream and Chemical businesses outperform competition

|

76

Competitive Advantages

ExxonMobil possesses unique competitive advantages

Balanced Portfolio

Disciplined Investing

High-Impact Technologies

Operational Excellence

Global Integration |

77

Senior Vice President

Mark Albers

Unlocking Greater Value in the Upstream

Senior Vice President

Andy Swiger |

78

Upstream

Consistent execution of our strategies, underpinned by a relentless

focus on operational excellence, drives delivery of superior results

High-quality resources captured at

attractive costs

Effective partnerships

Distinguishing technologies

Proven project execution

Operational excellence |

79

Meeting the Energy Challenge

Diverse and material portfolio across resource types of growing

importance in meeting global energy demand

0

30

60

90

2011 ExxonMobil Resource Base

Unconventional

Oil and Gas

Conventional

Heavy Oil / Oil Sands

Deepwater

Liquefied Natural Gas

Arctic

Acid / Sour

BOEB

* Source: ExxonMobil 2012 Outlook for Energy

World Oil and Gas Supply Growth*

MOEBD

2010 Production

2040 Production

Conventional

Deepwater

LNG

Unconventional

Oil and Gas

Heavy Oil /

Oil Sands

0.3%

2.8%

3.5%

5.3%

4.8%

Annual Growth

Rate to 2040

0

50

100

150 |

80

Conventional

Delivering significant value from conventional resources

Note: Conventional includes arctic and acid/sour resource types

|

Banyu Urip, Indonesia

Significant onshore oil development progressing on schedule

Conventional

450 MB oil resource

Early production of 20 KBD

165 KBD full field capacity

5 Full Field EPC contracts awarded

Anticipated start-up in 2014

81

Central

Processing

Facilities

Floating Storage &

Offloading Vessel |

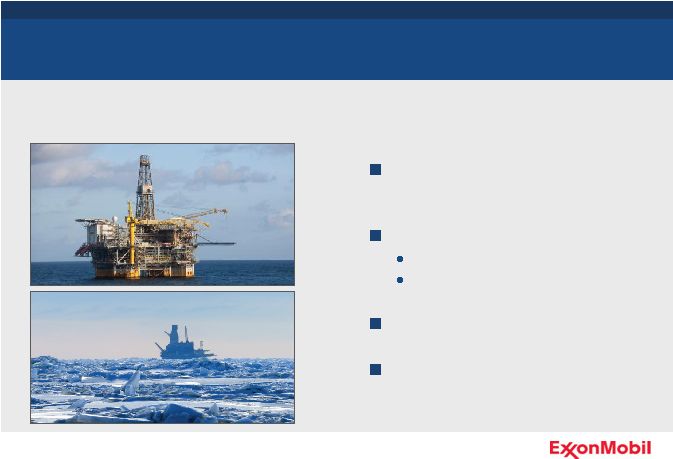

Sakhalin and Hebron

Applying proven arctic capabilities to progress additional developments

Arctic

Odoptu holds world record for extended

reach well

Arkutun-Dagi fabrication in progress and

on schedule for 2014 start-up

Initial engineering under way

82

Sakhalin

Hebron |

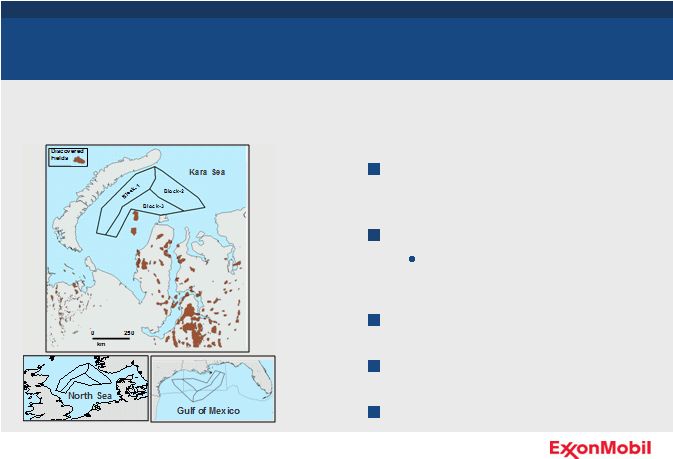

Russia

Extending capabilities to significant new arctic acreage position

Arctic

Entered into Strategic Cooperation

Agreement with Rosneft

Kara Sea –

31 million acres

Extension of prolific West Siberia

hydrocarbon province

Progressing definitive agreements

Pursuing fiscal improvements

Commencing exploration activities

83 |

Technology

Continuing to advance new technology solutions for arctic resources

Arctic

90 years of arctic technology

development

Progressing next-generation

technologies

Advanced arctic characterization

Ice management systems

Floating drilling

Gravity-based structures

Laboratory Ice Management Trials

Floating Arctic Drillship

84 |

Deepwater

Building on established deepwater capability

Innovative design approaches

Early Production Systems

“Design One, Build Multiple”

Progressing

exploration

activities

West and East Africa

Black Sea

Gulf of Mexico

85

Cost-effective subsea satellite field

development

Exploration

Major Projects

Production Operations |

Gulf of Mexico

Progressing development of discoveries in the Gulf of Mexico

Deepwater

Large, high-quality acreage position

Significant discoveries at Hadrian and

Lucius

Progressing developments

Lucius / Hadrian South funded

Hadrian North FEED under way

Julia Phase 1 FEED under way

Maturing prospect inventory

Oil Discovery

Gas Discovery

ExxonMobil Lease

Well

Lucius and Hadrian Discoveries

GOM Project Development Costs*

$/OEB (2012$)

Hadrian

South

Lucius

Hadrian

North

2 Miles

40

* Source: Wood Mackenzie

Discovery

ExxonMobil Participation

Industry

0

20

86 |

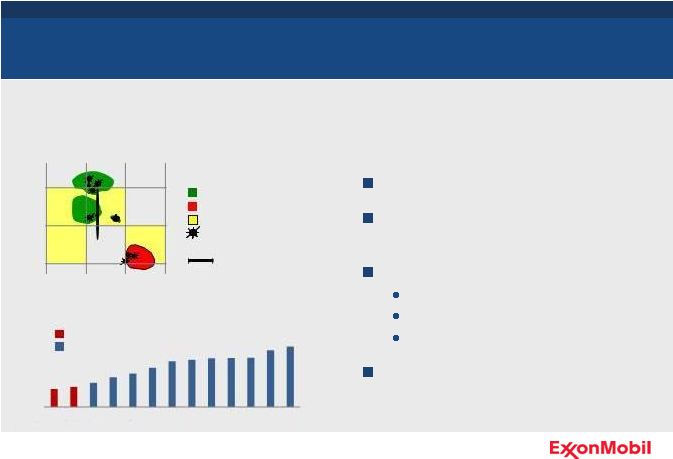

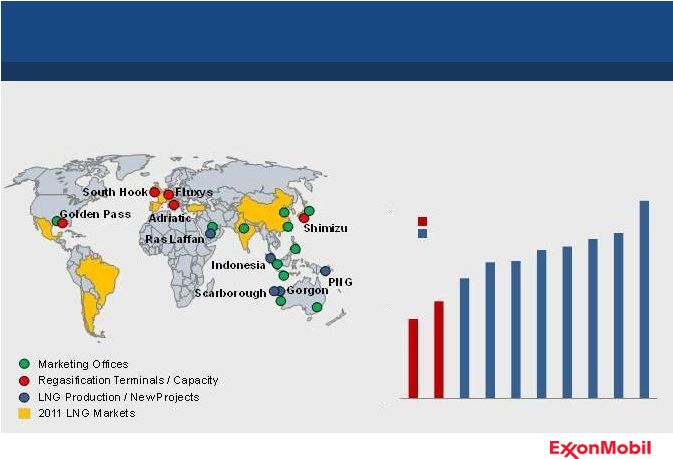

Liquefied Natural Gas

ExxonMobil has leading global liquefied natural gas capability

ExxonMobil Participation

Industry

LNG Project

LNG Development Costs*

$/OEB (2012$)

* Source: Wood Mackenzie

0

10

20

87 |

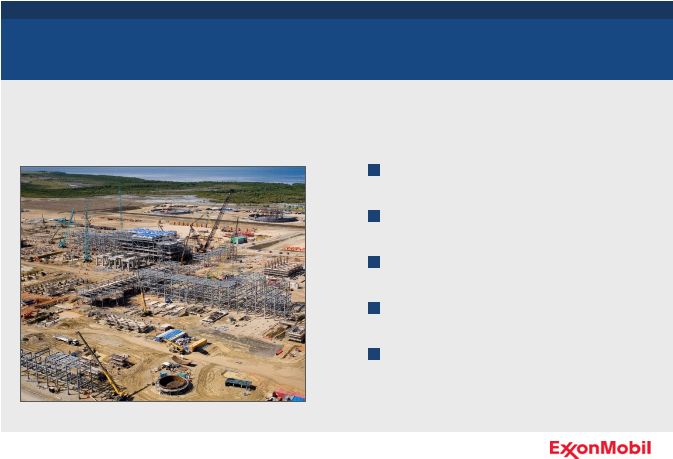

Papua New Guinea

Extending global LNG experience and project execution capabilities

Liquefied Natural Gas

High-quality 9 TCF resource

Two-train 6.6 MTA LNG plant

Progressing on schedule

Anticipate start-up in 2014

Active exploration program

88 |

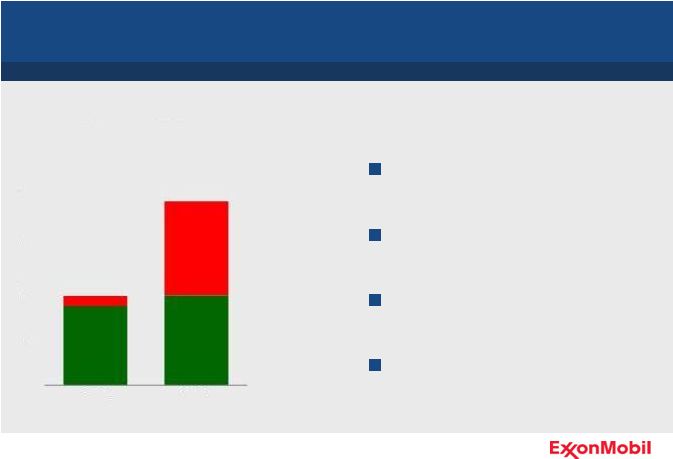

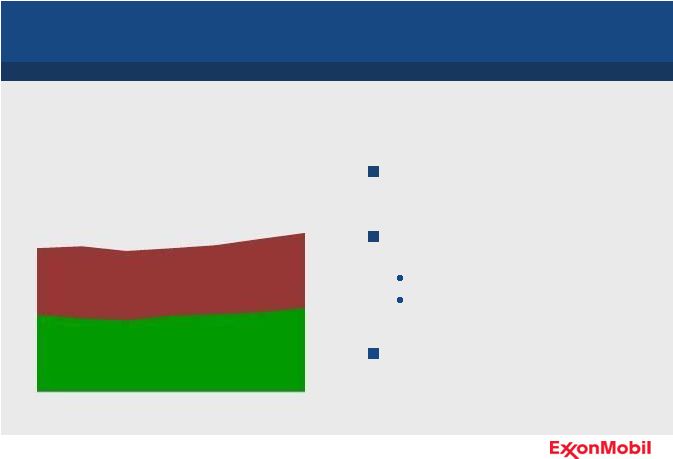

Unconventional Resources

Unconventional resource base

doubled since 2005

Accounts for over 40 percent of total

resource base

Gas growth balanced by strong

position in heavy oil / oil sands

Deep inventory of attractive

opportunities

Unconventional Resource Base

BOEB*

Unconventional

Oil and Gas

Heavy Oil /

Oil Sands

* Resource base at year end

89

0

10

20

30

40

Industry-leading global unconventional resource base

2005

2011 |

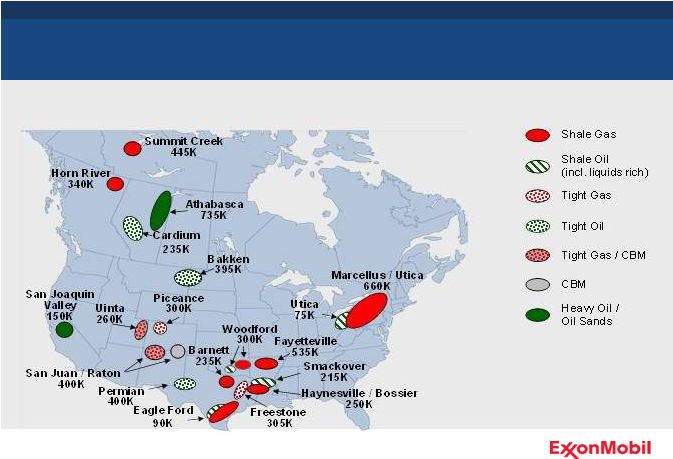

North America

Unconventional Resources

Material position in unconventional resource plays across N. America

90 |

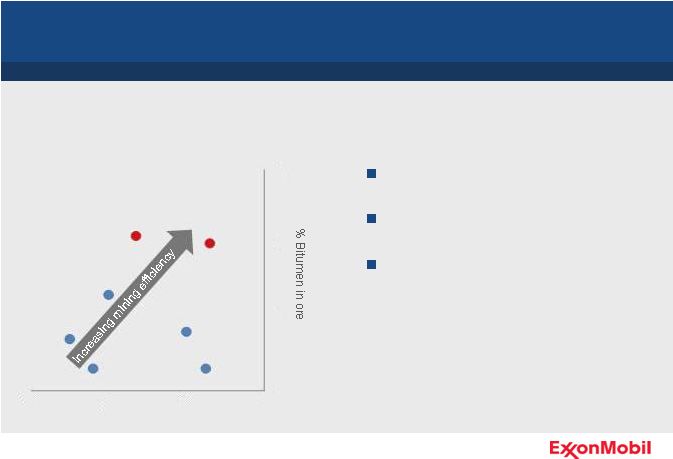

Oil

Sands High-quality oil sands resource underpins long-term resource

value Kearl

Firebag

Ratio of material moved to bitumen in-place

Oil Sands Mining Resource Quality

10

11

12

13

6

8

10

12

Significant acreage position

Among the highest quality

Growth

area, material, long-plateau

production

91 |

Kearl

High-quality resource and enabling technologies deliver long-term value

Oil Sands

Long-term plateau production profile

On schedule to commence operations

year-end 2012

Expansion Project fully funded with

start-up year-end 2015

Proprietary technology

Attractive returns

0

200

400

Debottleneck

Expansion

Debottleneck

Initial Development

Kearl Development

KOEBD

Kearl Development

KOEBD

92 |

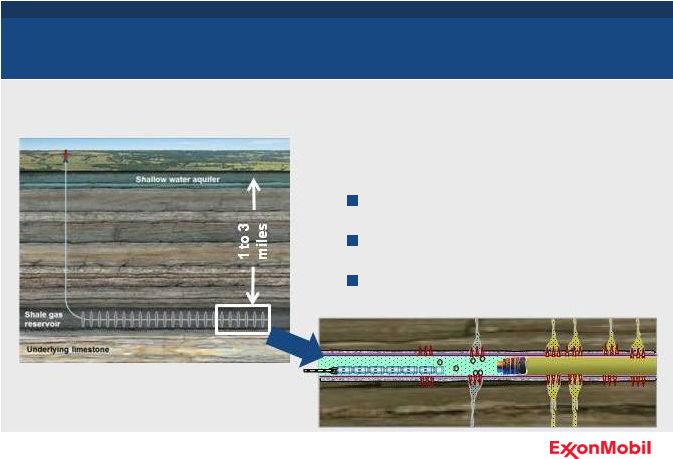

Technology

Emerging new technologies to further unlock oil sands value

Oil Sands

Paraffinic Froth Treatment

Eliminates need for on-site upgrader

Reduces GHG emissions and cost

Wet Tailings

Lowers tailings handling costs

Non-Aqueous Extraction

Significantly reduces water use

Avoids new wet tailings ponds

Higher bitumen recoveries

93 |

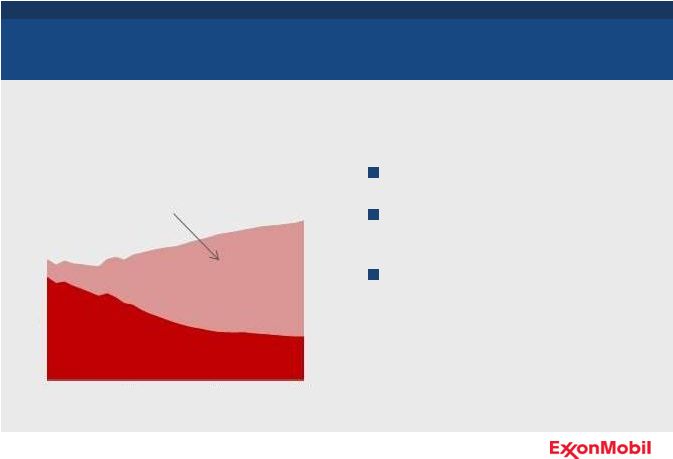

North America Gas

Technology unlocking new supplies

Significant unconventional growth to

offset conventional decline

About 70 percent of North America

demand is met by unconventional

production by 2030

Source: ExxonMobil 2012 Outlook for Energy

Local Production to Meet Demand

Unconventional

Conventional

GCFD

4.4% avg annual

growth

Unconventional Oil and Gas

0

40

80

120

'00

'10

'20

'30

Significant gas production growth required to meet demand

94 |

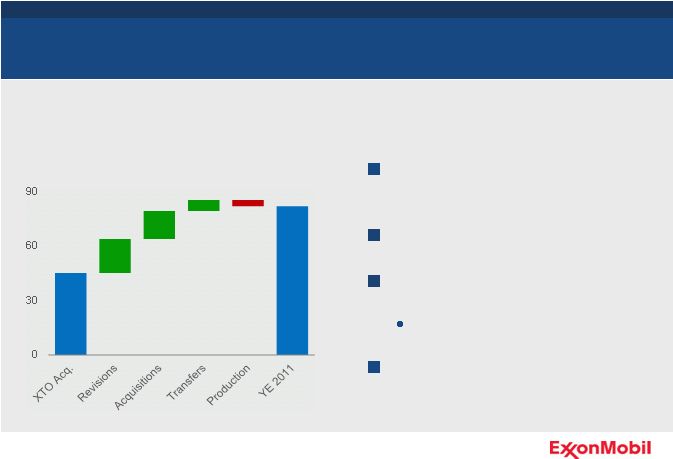

Unconventional Capability

XTO established the foundation of our global unconventional capability

Unconventional Oil and Gas

Key enabler to unlocking global

unconventional resource value

XTO managing 82 TCFE at year-end

Adding quality acquisitions at attractive

costs

15 TCFE at $0.23/KCFE

Leveraging XTO capability in global

pursuits

95

XTO Resource Base Evolution (U.S.)

TCFE |

Liquids-Rich Plays

Unconventional Oil and Gas

Legacy tight oil positions in the Bakken

and Permian

Expanding Woodford Ardmore play

Over 170K net acres; 9 operated rigs

Develop ~600 MOEB at <$10/OEB

Growing portfolio of emerging plays

including Cardium in Canada

Gas

Liquids

96

Woodford Ardmore Development Scenario

KOEBD

0

40

80

2012

2017

2022

Well-positioned in liquids-rich unconventional plays

|

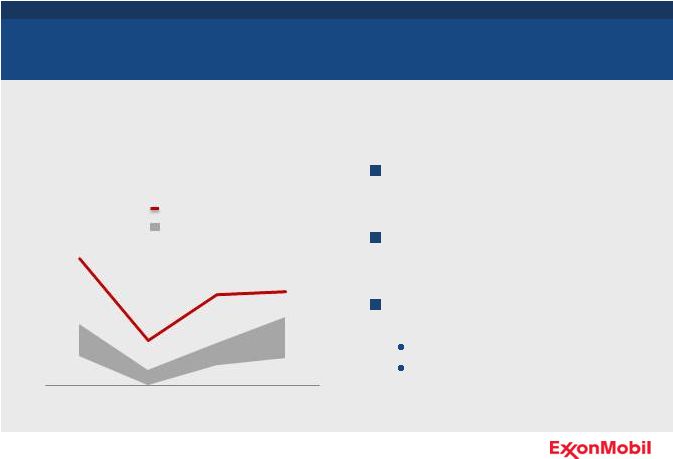

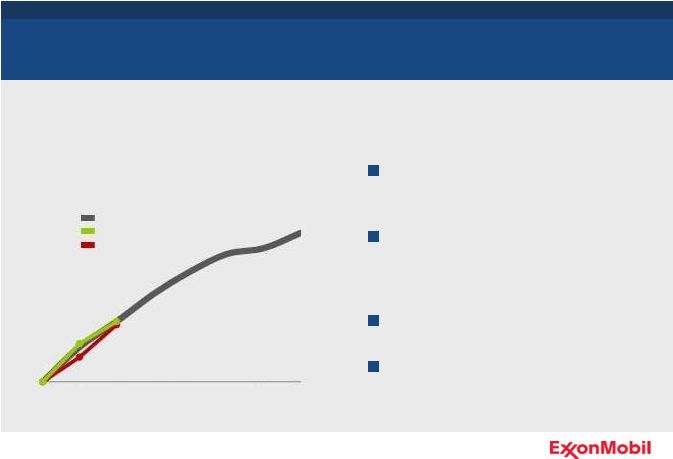

Operational Excellence

Unconventional Oil and Gas

Mature play learnings being applied

to new plays

Continue to extract value even as

wells have become more complex to

drill

Systematic approach

Apply approach to global portfolio

Drilling Days Evolution

Percent Improvement

Time (years)

0

40

80

1

2

3

4

5

6

7

8

Operational efficiency and technology capture additional value

Barnett

Haynesville

Fayetteville

97 |

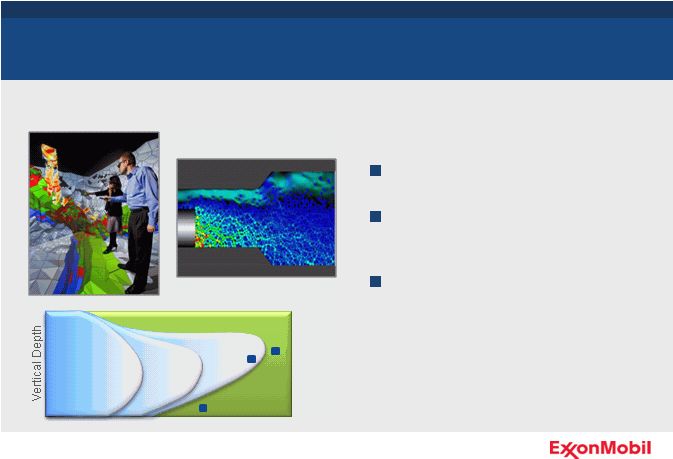

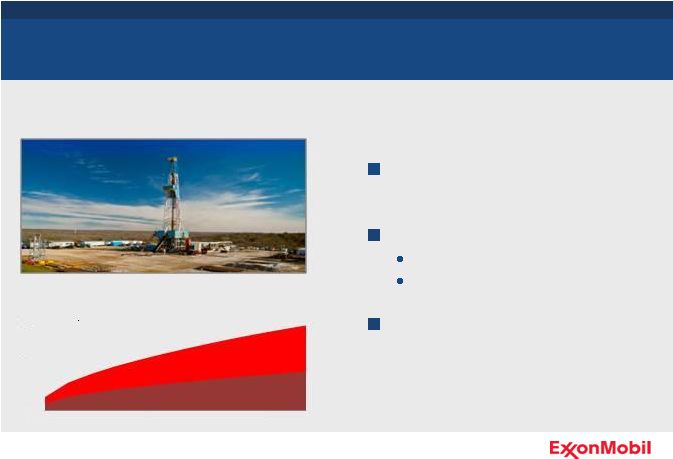

Technology

Unconventional Oil and Gas

Enhanced perforating and stimulation

technologies

Reduce completion costs

Improve recovery

Enable water reuse

New technologies are further enhancing unconventional value

98 |

Global Portfolio

Unconventional Resources

Growing global portfolio with early-mover, quality acreage pursuits

99

Indonesia

China

Canada

USA

Europe

Play Type

Colombia

Argentina

Shale Gas

Tight Gas

Coal Bed Methane

Tight / Shale

Oil

Heavy Oil / Oil Sands |

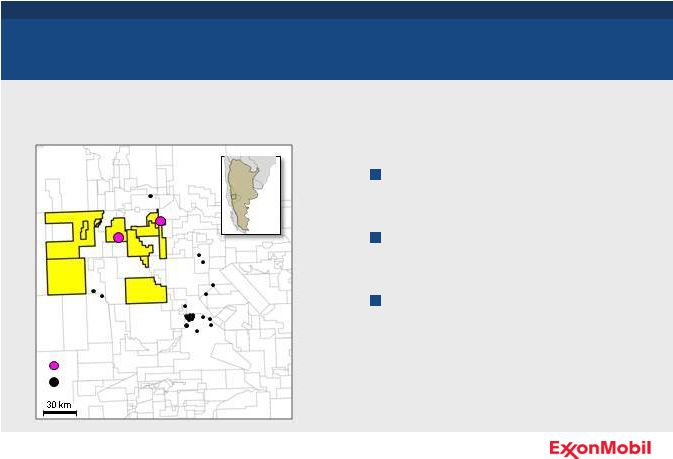

Argentina

Unconventional Resources

100

ExxonMobil Current Drilling

Industry Vaca Muerta Exploration Well

Material position in the Vaca

Muerta play of the Neuquén Basin

Drilling commenced to evaluate

liquids and gas potential

Leveraging ExxonMobil

unconventional capabilities globally

Commencing exploration activities in a promising unconventional play

|

101

Unlocking Greater Value

Superior value creation relies on high-quality resources, growth

markets, enabling technologies, and growing organizational capability

High-quality resources captured at

attractive costs

Effective partnerships

Distinguishing technologies

Proven project execution

Operational excellence

0

30

60

90

2011 ExxonMobil Resource Base

Unconventional

Oil and Gas

Conventional

Heavy Oil / Oil Sands

Deepwater

Liquefied Natural Gas

Arctic

Acid / Sour

BOEB |

102

Chairman and CEO

Rex Tillerson

Outlook |

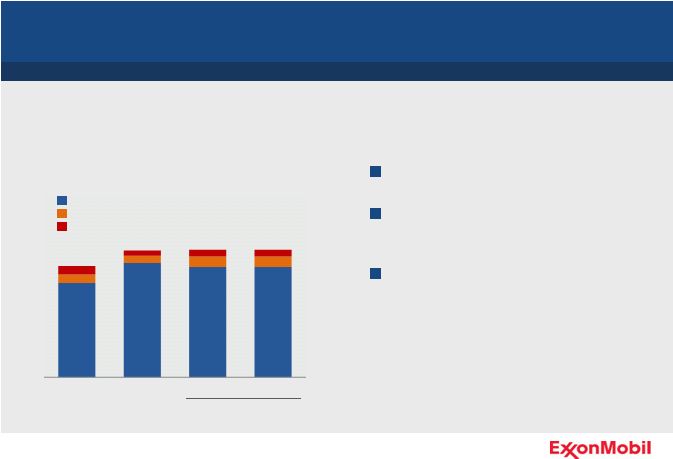

103

Committed to investing through the business cycle

Investment Plan

Capex by Business Line

$B

Upstream

Downstream

Chemical / Other

Estimate ~$37B/yr

Disciplined, resilient investments

Progressing large inventory of

high-quality projects

Expect to invest approximately

$37 billion per year 2012 –

2016

0

10

20

30

40

50

'10

'11

'12

'13 -'16 |

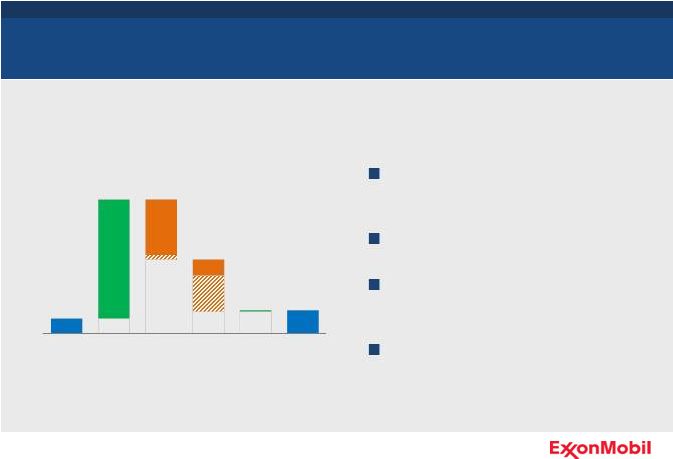

104

Upstream Production Outlook

Production in line with long-term growth estimates

2011 Production

MOEBD

* Excludes impact of future divestments and OPEC quota effects.

** 2011 Outlook as communicated in 2011 Analyst Meeting.

2009 to 2014 Growth Projections*

Percent Growth

4.0

4.3

4.6

2011

Analyst

Meeting

Outlook**

Price /

Entitlements

Performance

2011

Actual

2

3

4

5

2011

Analyst

Meeting

Outlook**

Price /

Entitlements

Performance

2012

Analyst

Meeting |

105

Upstream Production Outlook

Production driven by strong performance, quality projects and resources

* Excludes impact of future divestments and OPEC quota effects.

Total Production Outlook*

MOEBD

Base Production

Project Volumes

0

2

4

6

'10

'11

'12

'13

'14

'15

'16

Projections based on 2011

average prices ($111/B Brent)

Volume outlook:

2011 to 2012: down 3 percent

2011 to 2016: up 1 to 2 percent/yr

Base decline rate of 3 percent

Unconventional and long-plateau

volumes mitigate

decline |

Upstream Production Outlook

Balanced portfolio with strong contributions from liquids and gas

Projections based on 2011 average

prices ($111/B Brent)

Major projects and strong work

program drive growth

Liquids: 2 to 3 percent per year

Gas: 0.5 to 1 percent per year

Growing contribution of long-plateau

volumes

Total Production Outlook*

MOEBD

* Excludes impact of future divestments and OPEC quota effects.

Liquids

Gas

0

2

4

6

'10

'11

'12

'13

'14

'15

'16

106 |

107

Chairman and CEO

Rex Tillerson

Summary |

108

Long-term performance exceeds competitor average and S&P 500

Financial results and stock market

returns best viewed over long term

Reflects strong financial and

operating performance

Competitive advantages maximize

shareholder value

* RDS, BP, and CVX

Shareholder Returns

Value of $1,000 Invested (as of YE 2011)

$K

ExxonMobil

Competitor Average*

S&P 500

Share Performance

0

3

6

9

12

20 Years

10 Years

5 Years |

Meeting the World’s Energy Challenges

Expanded supply

Expanded supply

of traditional fuels

of traditional fuels

•

Large, diverse resource base

•

Strong LNG portfolio

•

Strategic projects

•

World-class R&D programs

•

Technology to unlock value

•

Financial strength

•

Disciplined, resilient investments

Meeting Asia

Meeting Asia

Pacific demand

Pacific demand

growth

growth

Technology

Technology

advances

advances

Unprecedented

Unprecedented

levels of

levels of

investment

investment

Development of

Development of

new sources of

new sources of

energy

energy

•

Leadership in unconventional

resource development

Meeting the world’s growing

energy needs requires:

ExxonMobil has:

109 |

ExxonMobil Strengths

Relentless focus on maximizing long-term shareholder value

Strong Financial and Operating Performance

Balanced Portfolio

Disciplined Investing

High-Impact Technologies

Operational Excellence

Global Integration

110 |