Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Cooper-Standard Holdings Inc. | d315274d8k.htm |

Cooper Standard 4Q & Full Year 2011

Fourth Quarter and Full Year Earnings Call

March 14, 2012

Exhibit 99.1 |

cooperstandard

Introduction & Agenda

•

Introduction:

Glenn

Dong,

Treasurer

•

Executive

Overview:

Jim

McElya,

CEO

•

Business

Highlights:

Keith

Stephenson,

COO

•

Financial

Review

&

2012

Guidance:

Allen

Campbell,

CFO

•

Questions

&

Answers

2 |

cooperstandard

Safe Harbor

3

This presentation includes forward-looking statements as contemplated by the 1995 Private

Securities Litigation Reform Act, reflecting management’s current analysis and

expectations, based on what are believed to be reasonable assumptions. The words

“estimates,” “expects,” “anticipates,” “projects,” “plans,” “intends,” “believes,” “forecasts,” or future

or conditional verbs, such as “will,” “should,” “could,” or

“may,” and variations of such words or similar expressions are intended to identify

forward-looking statements. Forward-looking statements may involve known and unknown risks,

uncertainties and other factors, which may cause actual results to differ materially from those

projected, stated or implied, depending on many factors, including, without limitation: our

dependence on the automotive industry; further restructuring of our customers; availability and

cost of raw materials; pricing pressures and volume requirements of our customers; the ability

to meet significant increase in customer demand; increased costs negatively impacting our profitability; competition

in the automotive industry; sovereign and other risks related to our conducting operations outside the

United States; foreign currency fluctuations; our ability to achieve benefits from our joint

venture operations not operated for our sole benefit; our exposure to the uncertainty of

political disruptions and increased violence in Mexico; the uncertainty of our ability to

achieve expected cost reduction savings; our dependence on certain major customers and platforms; our

exposure to product liability and warranty claims; labor conditions; our ability to attract and retain

key personnel; our ability to meet customers’ needs for new and improved products in a

timely manner; our ability to select and integrate attractive business acquisitions; our legal

rights to our intellectual property portfolio; environmental and other regulations; the outcome

of legal proceedings the Company is or may become party to; volatility in our expected annual effective tax rate;

impact of our capital structure on our financial condition and ability to obtain financing in the

future; our ability to generate cash to meet our debt and other cash obligations; our pension

plans; any impairment of a significant amount of our goodwill or other intangible asset;

potential conflicts of interest between our owners and us; limitations on flexibility in

operating our business contained in our debt agreements; our exposure to natural disasters; and other

risks described from time to time in the Company’s Securities and Exchange Commission

filings. There may be other factors that may cause the company’s actual results to

differ materially from those projected in any forward-looking statement. Accordingly, there

can be no assurance that Cooper Standard will meet future results, performance or achievements expressed or

implied by such forward-looking statements. This paragraph is included to provide a safe harbor

for forward-looking statements, which are not generally required to be publicly revised as

circumstances change and which Cooper Standard does not intend to update. The

forward-looking statements in this presentation are made as of the date hereof, and the

Company does not assume any obligation to update, amend or clarify them to reflect events, new

information or circumstances occurring after the date hereof. |

Jim

McElya Chairman & CEO

Executive Overview

4Q & Full Year 2011 |

cooperstandard

Executive Overview: 2011 & Q4 Review

•

Full Year 2011:

•

Sales up 18.2%

•

Adjusted EBITDA margin of 11.4%

•

•

5

* Based on currently estimated production volumes for the future

periods pertaining to the

awards; includes new, replacement and conquest business.

Net new business awards of $403 million*

Q4 2011:

Driven By:

•

Sales up 15.2%

•

Adjusted EBITDA margins of 9.6%

Higher industry volumes, favorable foreign currency movement, and

acquisitions

– |

cooperstandard

Executive Overview

6

2011 Priorities

Actions

Successfully launch new technologies

Launched

pumps

with

Renault-Nissan

and

PSA

Customer awards on:

•

Obstacle Detection Systems (ODS)

•

Wastegate actuators

•

Throttle valves

•

Next generation fuel rails

Aggressively pursue business on global

platforms

Expanded product capability in multiple regions

Continue expansion in Asia & South America

Added India and new Brazil site

Manage raw material costs and supply

Secured key raw material price adjustments at

key customers

Leverage global alliance with Nishikawa

Purchased 20% Nishikawa Thailand

Sold 10% NISCO

Furthered European plan |

cooperstandard

7

Executive Overview: Industry Trends

•

Production volumes to grow

•

Stress of excess capacity on OEMs and supply

base in Europe

•

Emphasis on fuel economy and alternative

powertrains

•

Impact of higher fuel prices |

cooperstandard

8

2012 Priorities

•

Focus on top-line growth

•

Expand advanced technology in fluid business

•

Leverage customer relationships and footprint to

win global platform awards

•

Additional expansion into emerging markets

•

Improve our European cost structure

•

Manage raw material costs |

Business Highlights

4Q & Full Year 2011

Keith Stephenson

Chief Operating Officer |

Business Highlights 4

th

Quarter

•

Solid revenue growth including new joint

venture relationships

•

Key program launches and continued growth of

global platforms

•

Cooper Standard France joint venture

increases opportunities for global business

wins

•

On-going global footprint evolution

•

Continued operational execution

cooperstandard

10 |

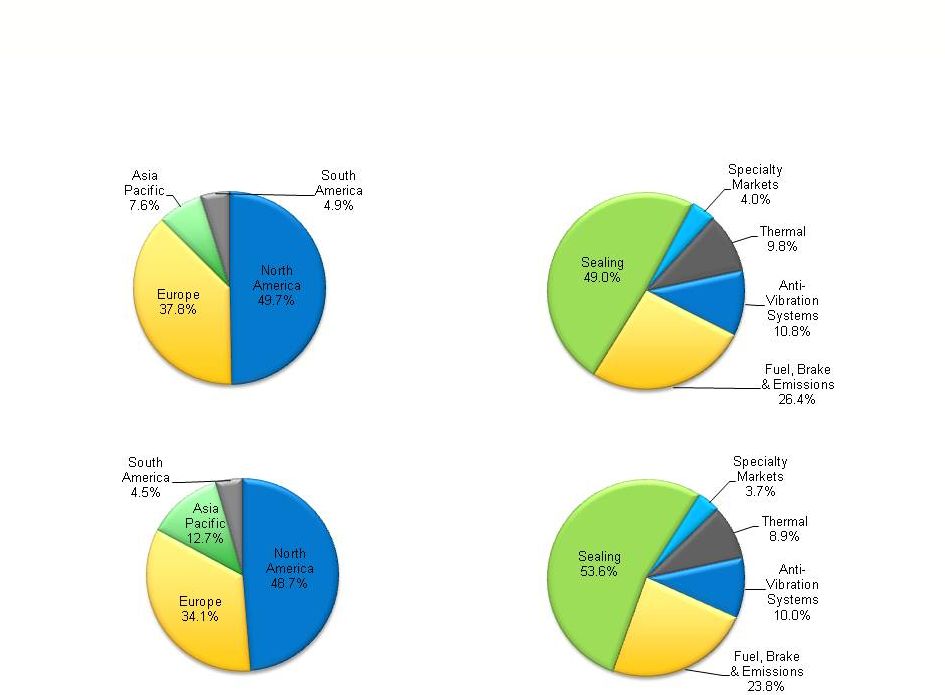

2011

Sales By Region & Product Groups *Sales by Region

Including Joint Venture Sales

*Sales by Product

Including Joint Venture Sales

Consolidated Sales by Region

Consolidated Sales by Product

*Includes JV sales with Hasco (SAIC), Sujan, Nisco N.A. and Nishikawa

Thailand cooperstandard

11 |

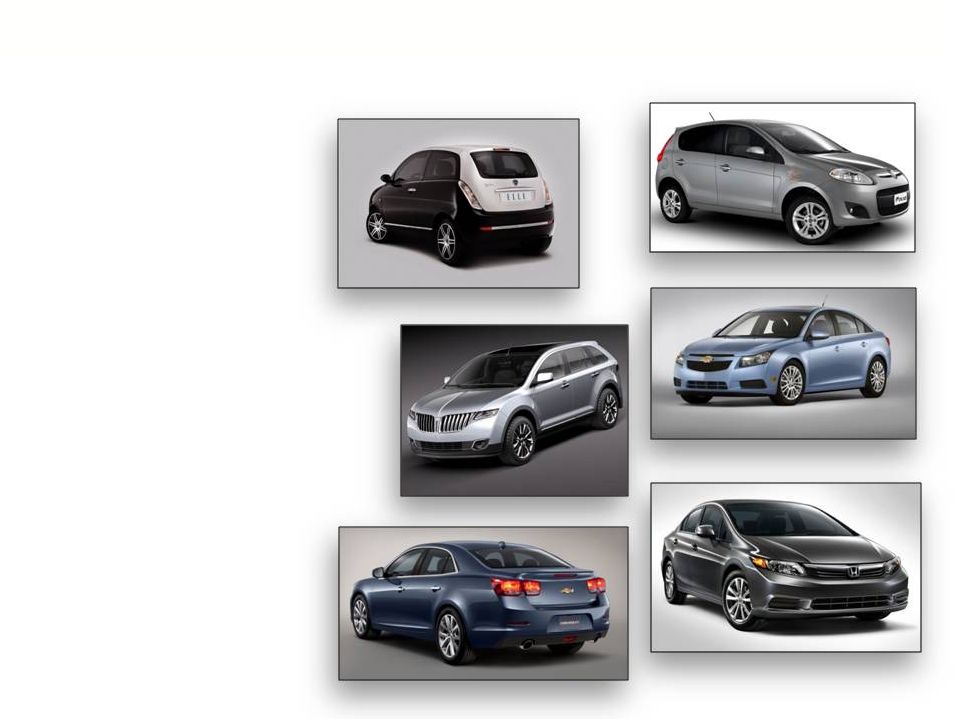

Vehicle Launches 4

th

Quarter 2011

12

–

Fiat –

Panda

(Europe)

Sealing

–

Fiat –

Palio

(South America)

Sealing, Trim

–

Ford –

Lincoln

MKX

(North America)

Fuel & Brake, Thermal Oil Cooling

–

GM –

Chevrolet

Cruze

(North America & Asia)

Sealing, Fuel & Brake

–

GM –

Chevrolet Malibu

(Asia)

Sealing, Fuel & Brake

–

Honda –

Civic

(South America)

Sealing

Ford MKX

GM Chevrolet Cruze

Fiat Palio

Honda Civic

Fiat Panda

Note: Photos are representative and may not reflect final production models

GM Chevrolet Malibu

cooperstandard |

cooperstandard

13

CS France Overview

•

Completed in Q2 2011

•

Strategic Objectives

–

Extend global sealing

leadership position

–

Expand hose and AVS

capabilities

–

Strengthen relationship with

global OEMs

–

Consolidate supplier base

while broadening footprint in

E. Europe and India

–

Fund the rationalization of

W. Europe capacity

51%

49%

•

Equity split –

CSA France 51% / FMEA 49%

•

FMEA contributed cash of EUR 24 million

•

Incremental sales of $150 million in 2011

CS

France

Plants

Technology

Management

SPBT Shares

Plants

Management

Cash Funding |

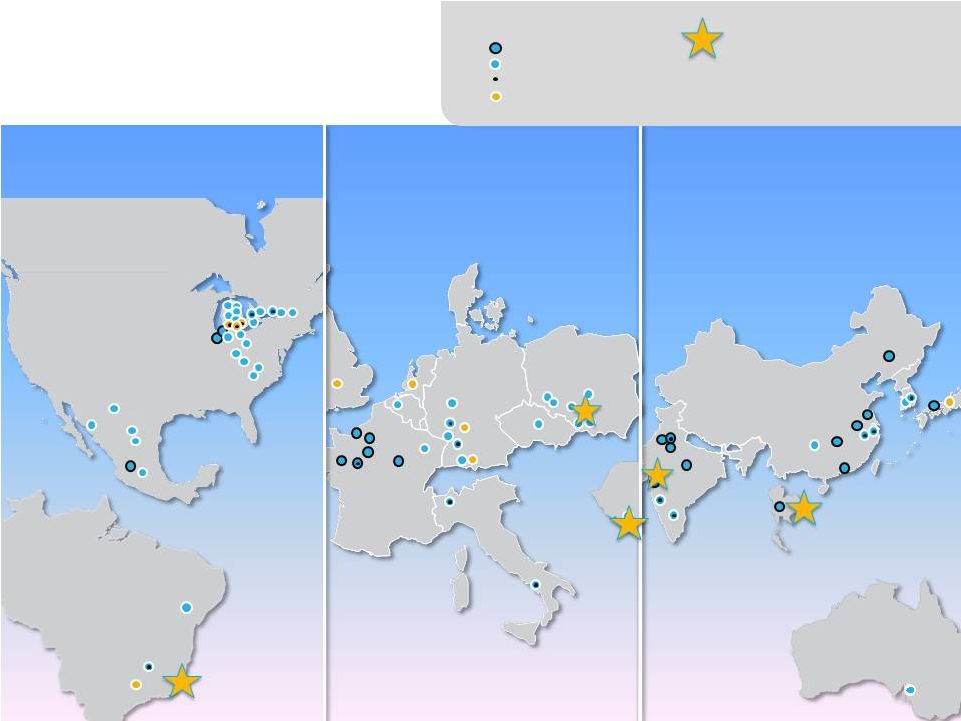

Global Footprint

Actions

Recent Footprint Expansion:

•

•

•

•

•

Joint Venture

Operation

Manufacturing

Technical Center

Sales / Administration

Americas

Europe

Asia Pacific

Craiova, Romania

Czestochowa, Poland

Mumbai, India

Nakhonratchasima, Thailand

Sao Paulo, Brazil |

cooperstandard

15

Continued Operational Execution

•

Flexing our cost structure consistent with

regional market conditions

•

Achieved significant lean savings despite raw

material challenges

•

Integrating recent acquisitions

•

Numerous customer awards for quality and

service |

Financial Overview

4Q & Full Year 2011

Allen Campbell

Chief Financial Officer |

cooperstandard

Q4 and Full Year 2011 Performance

17

$ Millions

Q4 2010

Q4 2011

Net Sales

$603.7

$695.7

Operating Profit

$ 25.7

$ 22.9

Gross Profit

$ 96.8

$ 97.6

FY 2010

FY 2011

$2,414.1

$2,853.5

$ 142.2

$ 125.2

$ 409.6

$ 450.6

Net Income

$ 14.8

$ 23.2

$ 320.3

$ 102.8

Adjusted EBITDA

$ 66.6

$ 276.5

$ 324.1

$ 61.7

% Margin

9.6%

11.5%

10.2%

11.4%

SGA

$ 67.9

$ 66.7

$ 251.7

$ 257.6 |

cooperstandard

EBITDA and Adjusted EBITDA Reconciliation

18

$ USD Millions

2010

2011

Net income

$ 320.3

$ 102.8

Provision for income tax expense

45.0

EBITDA

$ 537.2

$ 288.2

Restructuring

6.4

32.3

Adjusted EBITDA

$ 276.5

$ 324.1

20.8

12 Months Ended December 31st

Net Interest expense

69.5

40.5

Depreciation and amortization

102.4

124.1

Stock based compensation

6.6

Other / foreign exchange

21.6

10.8

(7.9)

EDITDA and Adjusted EBITDA are Non-GAAP measures. Reference comments on slide

24. Reorganization / Fresh Start

--

Inventory write-up

8.1

0.7

EBITDA excl. Reorganization

288.2

233.8

303.4 |

cooperstandard

19

Base Business vs Joint Venture Financial Summary

Adjusted EBITDA margin

12.0%

7.3%

11.4%

Parent &

Wholly Owned

Joint

$ USD Millions

Subsidiaries

Ventures

Total

Sales

$2,458.8

$394.7

$2,853.5

Gross Profit

$417.2

$33.4

$450.6

Restructuring

$11.5

$40.7

$52.2

Equity Earnings

$0.8

$4.6

$5.4

Other Income (Expense)

($0.2)

$7.4

$7.2

Noncontrolling Interests

$0.0

$26.3

$26.3

Net Income

$102.8

$0.0

$102.8

Adjusted EBITDA

$295.2

$28.9

$324.1

Year Ended December 31, 2011

Gross Profit margin

17.0%

8.5%

15.8% |

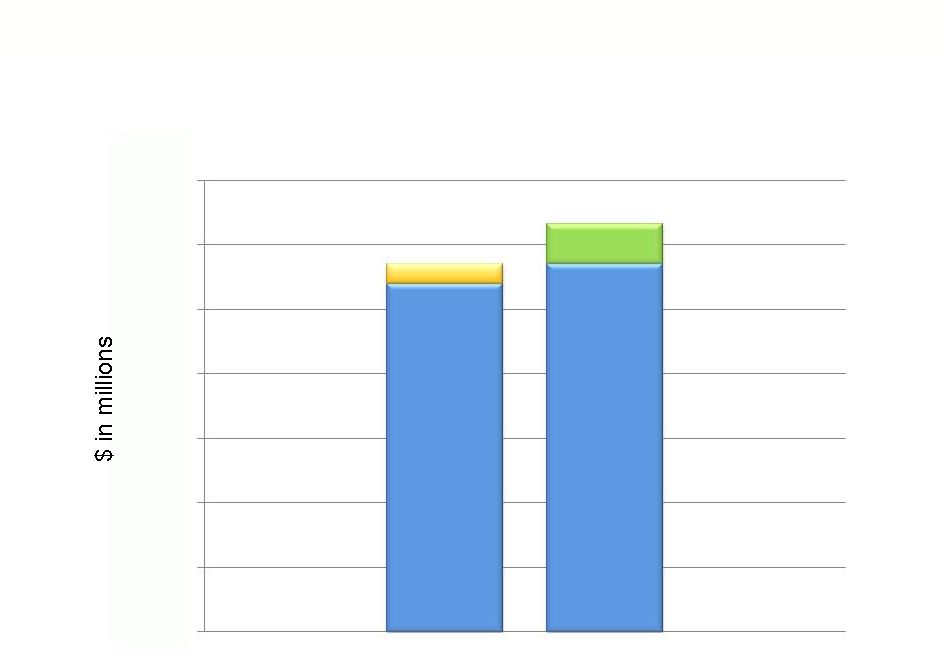

Cooper Standard Sales -

2011

Total $2,853.5

Total $3,158.9

*Includes JV sales with Hasco (SAIC), Sujan, Nisco N.A. and Nishikawa

Thailand Base

$2,695.6

Acquisitions

$157.9

Consolidated

$2,853.5

Unconsolidated

JVs

$305.4

0

500

1000

1500

2000

2500

3000

3500

cooperstandard

20 |

cooperstandard

Cash Flow 4Q 2011

21

Cash Balance as of December 31, 2010

294.5

$

Cash generated

67.3

Cash Balance as of December 31, 2011

361.7

$

($ in Millions)

Q4 -

2011

YTD -

2011

Cash from business

$ 56.2

$ 202.4

Pension

funding

-

US

(3.0)

(34.4)

Changes in operating assets & liabilities

73.4

4.3

Cash from operations

$ 126.6

$ 172.3

Capital expenditures

(38.1)

(108.3)

Cash from operations less CAPEX

$ 88.5

$ 64.0

Acquisition of business, plus cash acquired

(2.4)

28.5

Proceeds from partial sale of joint venture

-

16.0

Investment in affiliate

-

(10.5)

Dividends –

Preferred Stock

(1.7)

(7.1)

Financing activities

(2.3)

(10.0)

Foreign exchange/other

0.8

(6.1)

Repurchase of preferred stock

(7.5)

(7.5)

Net cash generated

$ 75.4

$ 67.3

Note: Numbers subject to rounding |

cooperstandard

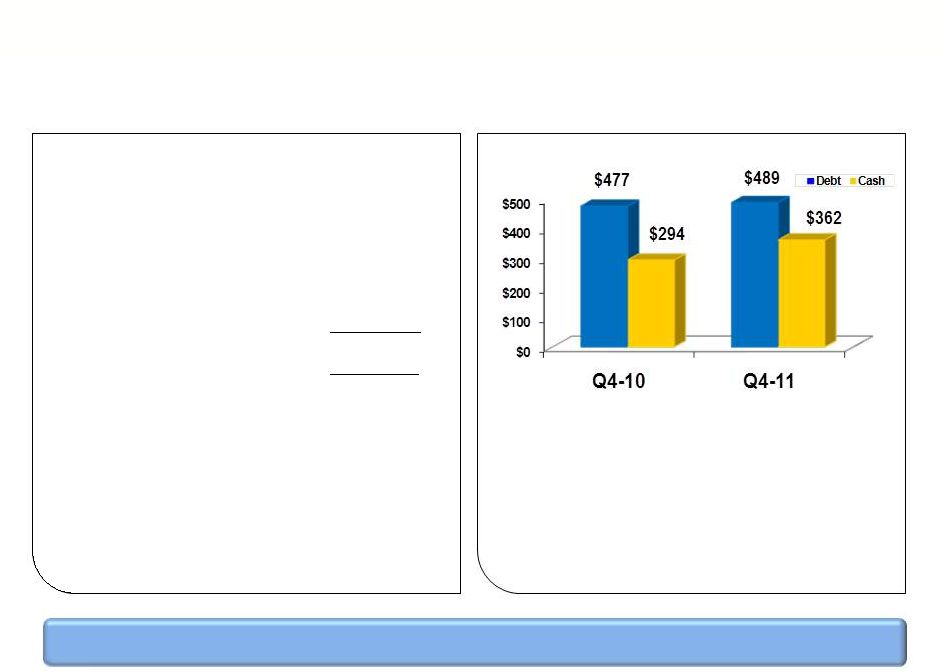

22

Liquidity as of December 31, 2011

Cash on Balance Sheet

$361.7M

ABL Revolver

125.0M

Letters of Credit

(29.8)M

Total Liquidity

$456.9 M

Flexible capital structure allows for future growth opportunities

•

26% increase in cash from the prior

quarter

•

ABL Revolver undrawn

•

Net leverage = $127 million

•

Net leverage ratio = 0.4x

•

No major debt maturity until 2018

Note: Numbers subject to rounding |

cooperstandard

2012 Guidance*

•

Sales: $2.85 billion -

$2.95 billion

•

Capital expenditures: $110 million -

$120 million

•

Cash restructuring: $45 million -

$55 million

•

Cash taxes: $25 million -

$30 million

* Guidance is based on North American production of 14.4 million,

and Europe (including Russia) production of

19.2 million. cooperstandard

23 |

cooperstandard

Non-GAAP Financial Measures

24

EBITDA and adjusted EBITDA are measures not recognized under Generally

Accepted Accounting Principles (GAAP) which exclude certain non-cash and

non-recurring items.

When analyzing the company’s operating performance, investors should use

EBITDA and adjusted EBITDA in addition to, and not as alternatives for, net

income (loss), operating income, or any other performance measure derived in

accordance with GAAP, or as an alternative to cash flow from operating

activities as a measure of the company’s performance. EBITDA and adjusted

EBITDA have limitations as analytical tools and should not be considered in

isolation or as substitutes for analysis of the company’s results of operations as

reported under GAAP. Other companies may report EBITDA and adjusted

EBITDA differently and therefore Cooper Standard’s results may not be

comparable to other similarly titled measures of other companies. |

Questions & Answers |

cooperstandard

Summary

•

Continue expansion in Asia & South America

•

Aggressively pursue business on global platforms

•

Leverage global alliance with Nishikawa

•

Successfully launch new technologies

•

Manage raw material costs and supply

26

Ready to Thrive in the New Competitive Landscape

and Drive Shareholder Value |

Appendix |

cooperstandard

28

Q4 2011 Adjusted EBITDA

(1)

Includes cash and noncash.

(2)

Proportionate share of restructuring costs related to Cooper Standard France joint

venture. (3)

Non-cash stock amortization expense and non-cash stock option

expense. (4)

Severance costs associated with the right sizing of German facilities.

(5)

Costs related to corporate development activities.

$USD Millions

Three Months Ended

December 31, 2010

Three Months Ended

December 31, 2011

Net income

$

14.8

$

23.2

Provision for income tax benefit

(0.2)

(6.0)

Interest expense, net of interest income

10.8

10.3

Depreciation and amortization

29.7

32.1

EBITDA

$

55.1

$

59.6

Restructuring

(1)

(0.7)

4.1

Non-controlling interest restructuring

(2)

-

(0.9)

Stock-based compensation

(3)

2.8

2.5

Severance

(4)

5.8

-

Other

(5)

(1.3)

1.3

Adjusted EBITDA

$

61.7

$

66.6 |

cooperstandard

29

Base Business vs Joint Venture Financial

Adjusted EBITDA –

Full Year 2011

Parent &

Wholly Owned

Joint

$ USD Millions

Subsidiaries

Ventures

Total

Net Income

102.8

$

-

$

102.8

$

Provision for income tax expense

18.7

2.1

20.8

Net interest expense

39.4

1.1

40.5

Depreciation and amoritization

108.8

15.3

124.1

EBITDA

269.7

$

18.5

$

288.2

$

Restructuring

(1)

11.5

40.7

52.2

Noncontrolling

interest

restructuring

(2)

-

(19.9)

(19.9)

Acquisition

costs

(3)

1.7

0.5

2.2

Inventory

write-up

(4)

0.1

0.6

0.7

Net

gain

on

partial

sale

of

joint

venture

(5)

-

(11.4)

(11.4)

Stock

based

compensation

(6)

10.8

-

10.8

Other

(7)

1.3

-

1.3

Adjusted EBITDA

295.1

$

29.0

$

324.1

$

(1)

Includes cash and non-cash restructuring.

(2)

Proportionate share of of restructuring costs related to the Cooper Standard

joint venture. (3)

Costs incurred in relationship to the Cooper Standard joint venture

agreement. (4)

Write-up of inventory to fair value at the date of acquisition of USi Inc. and

the FMEA joint venture, net of noncontrolling interest. (5)

Net gain on partial sale of ownership percentage in joint venture.

(6)

Non-cash stock amortization expense and non-cash stock option expense for

grants issued at emergence from bankruptcy. (7)

Costs related to corporate development activities. Year Ended December 31,

2011 |