Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AMERICAN PACIFIC CORP | d314764d8k.htm |

Presentation to Stockholders

13 March 2012

AMERICAN PACIFIC CORPORATION

2012: Value-Creating Growth

& Improved Profitability

Exhibit 99.1 |

2012 Annual

Meeting of Stockholders 1

Safe Harbor Statements and

Reconciliations of Non-GAAP Measures

Safe Harbor Statements

Some of the statements in this presentation constitute forward-looking

statements within the meaning of the Private Securities Litigation Reform

Act of 1995. All statements other than those of historical facts

included herein, including those related to the financial outlook, goals, business

strategy, projected plans and objectives of management of American Pacific

Corporation (the “Company”) for future operations and liquidity,

are forward-looking statements. Such forward-looking statements involve known and

unknown risks and uncertainties that may cause the actual results, performance or

achievements of the Company to be materially different from any future

results, performance or achievements, expressed or implied by such

forward-looking statements. Factors that could cause actual results to differ materially

from such forward-looking statements include risks and uncertainties detailed

in the Company’s Annual Report

on

Form

10-K

for

the

fiscal

year

ended

September

30,

2011

and

the

Quarterly

Report

on

Form

10-Q for the quarter ended December 31, 2011.

Reconciliation of Non-GAAP Measures

Throughout this presentation we provide both GAAP and Non-GAAP financial

measures. For additional information and the reconciliation of these

measures to the appropriate GAAP measure, as required by Securities

and

Exchange

Commission

Regulation

G,

please

refer

to

our

Form

8-Ks

dated

March

13,

2012 and December 14, 2011, which provide definitions of these Non-GAAP

measures and a reconciliation

of

these

Non-GAAP

measures

to

the

most

comparable

GAAP

measures.

This

presentation

and

the

Form

8-Ks

referred

to

herein

are

available

in

the

“Investors”

section

of

the

Company’s website at www.apfc.com. |

2012 Annual

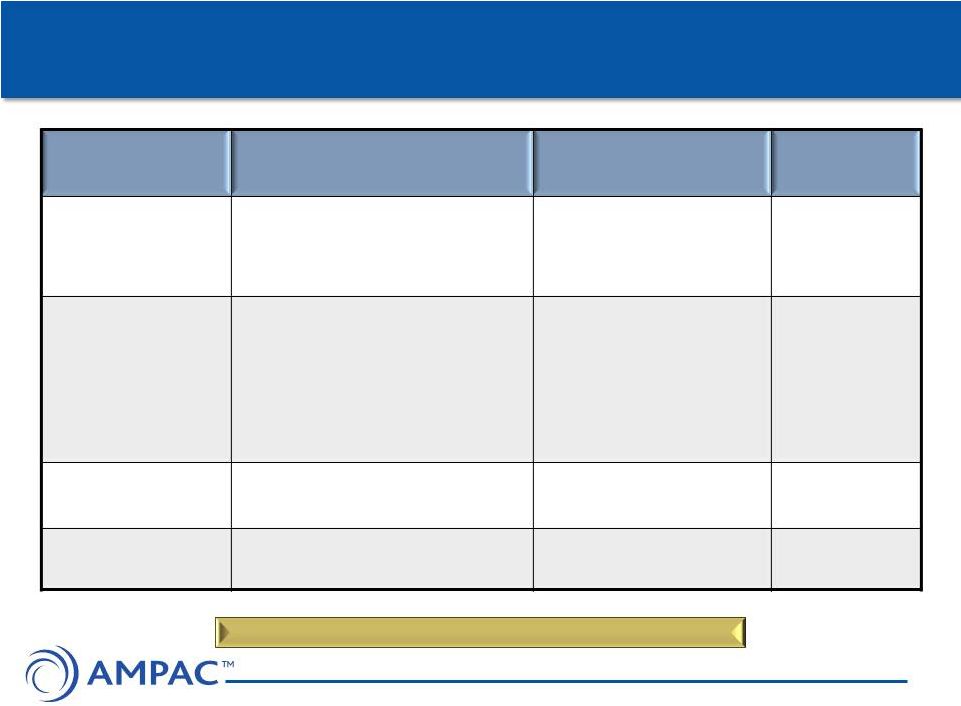

Meeting of Stockholders AMPAC Services Four Industries

Industry / Market

Products

Business Unit

Size

(% of FY11 Sales)

Pharmaceuticals

•

Active Ingredients

•

Registered Intermediates

•

Sodium Azide

•

Fine Chemicals

•

Specialty Chemicals

(Sodium Azide)

45%

Aerospace &

Defense

•

Perchlorates

•

Satellite Thrusters

•

Propulsion Systems

•

Aerospace Valves & Structures

•

Launch Vehicle Structures

•

Specialty Chemicals

(Wecco)

•

In-Space Propulsion

51%

Fire Suppression

•

Halotron I

•

Halotron II

•

Specialty Chemicals

(Halotron)

2%

Water Treatment

•

On-site Hypochlorite generation

systems

•

PEPCON Systems

2%

2

We manufacture mission critical products |

2012 Annual

Meeting of Stockholders 3

Strategic Objectives:

Drive for Value-Creating Growth

Protect the Core

Diversify the Customer Base

Expand Our Product Lines

Improve Profitability and Return on

Invested Capital

Mitigate Environmental Remediation

Liability |

2012 Annual

Meeting of Stockholders 4

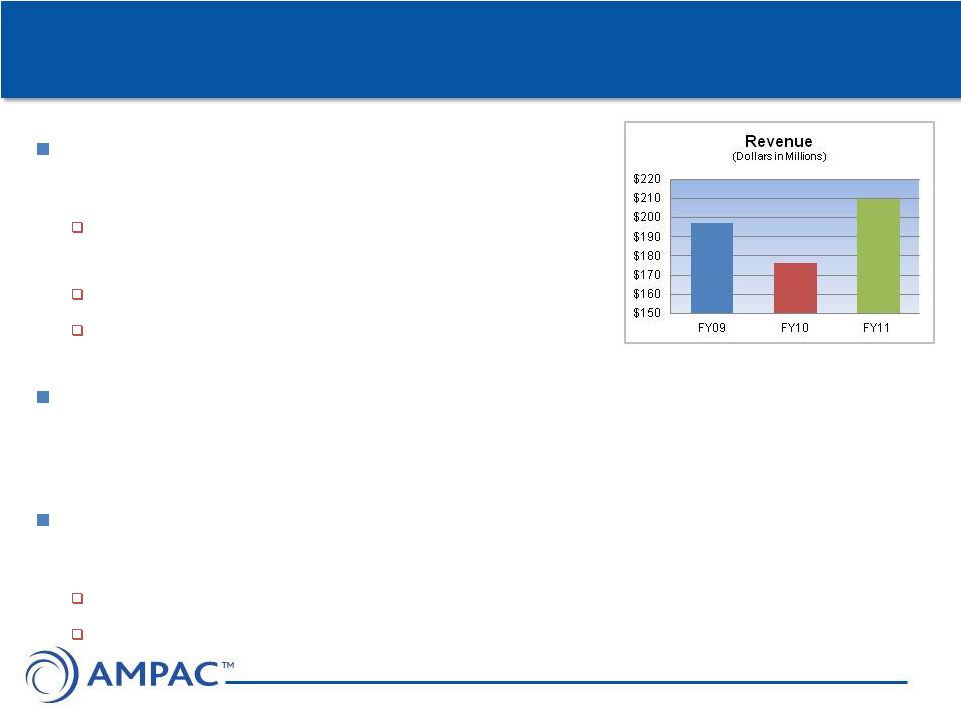

Focus on Objectives in FY11 Enabled Growth:

Revenues Increase 19%

Fine Chemicals led turnaround: 29%

revenue increase

Renewal of key three-year anti-viral product

agreement

Strong oncology and CNS product revenues

Development products exceeded 20% of

segment revenues

Tactical and Strategic missile programs provided sound

foundation for Specialty Chemicals segment revenues from

AP

30% Aerospace Equipment segment revenue growth

supported by key product lines

Key contract awards for in-space propulsion engines

Strong customer support |

2012 Annual

Meeting of Stockholders 5

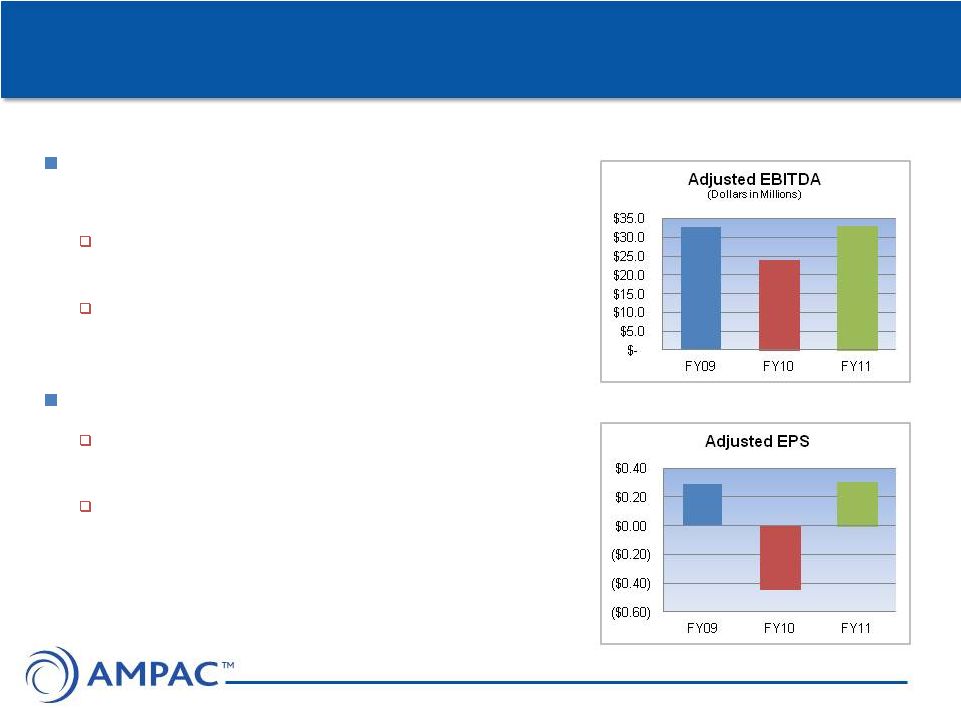

Focus on Objectives in FY11

Benefited Profitability

Corporate-wide initiatives drive

profit improvement

Focus on process improvements and

production efficiencies

Substantial reductions in general and

administrative expenses

Results:

Adjusted EBITDA increased 38% to

$33.0MM

Adjusted Diluted EPS of $0.30

compares to ($0.44) for the prior year |

2012 Annual

Meeting of Stockholders 6

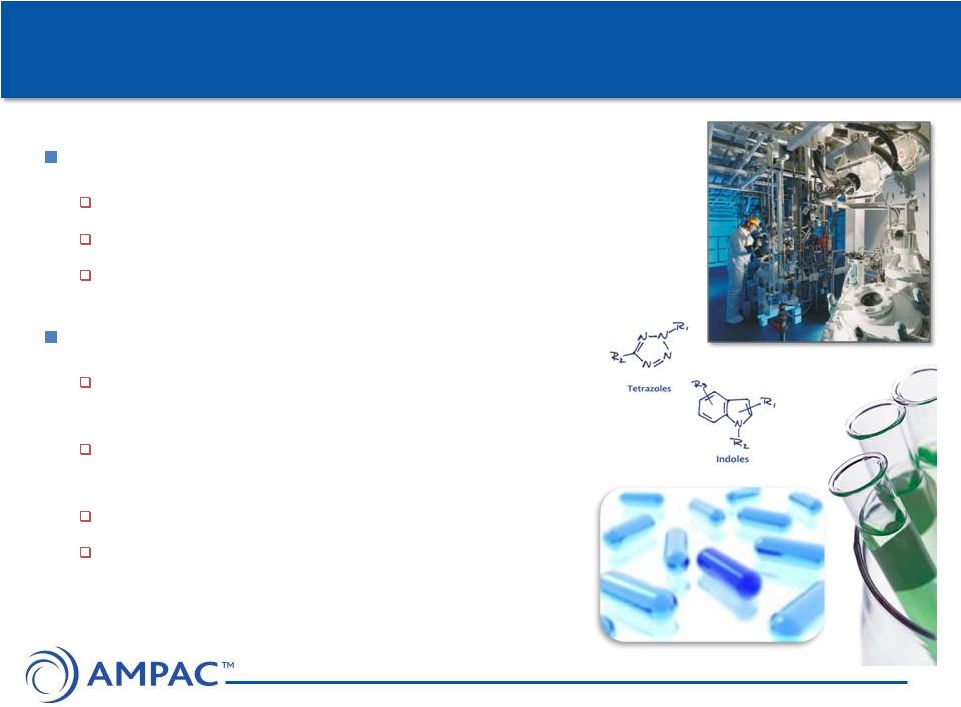

AMPAC Fine Chemicals:

Expect 15% growth in 2012

Core business strengthens

Anti-viral product orders increase

CNS product: 5-year add-on negotiated

Oncology remains stable –

albeit “lumpy”

New products provide growth path

Controlled

substance:

registration

approved –

new product to market

New

cancer

product:

customer

received

FDA approval –

new product to market

Chimerix:

validating

smallpox

medication

18

different

customers:

provide

development orders –

anticipate 20% of

2012 sales |

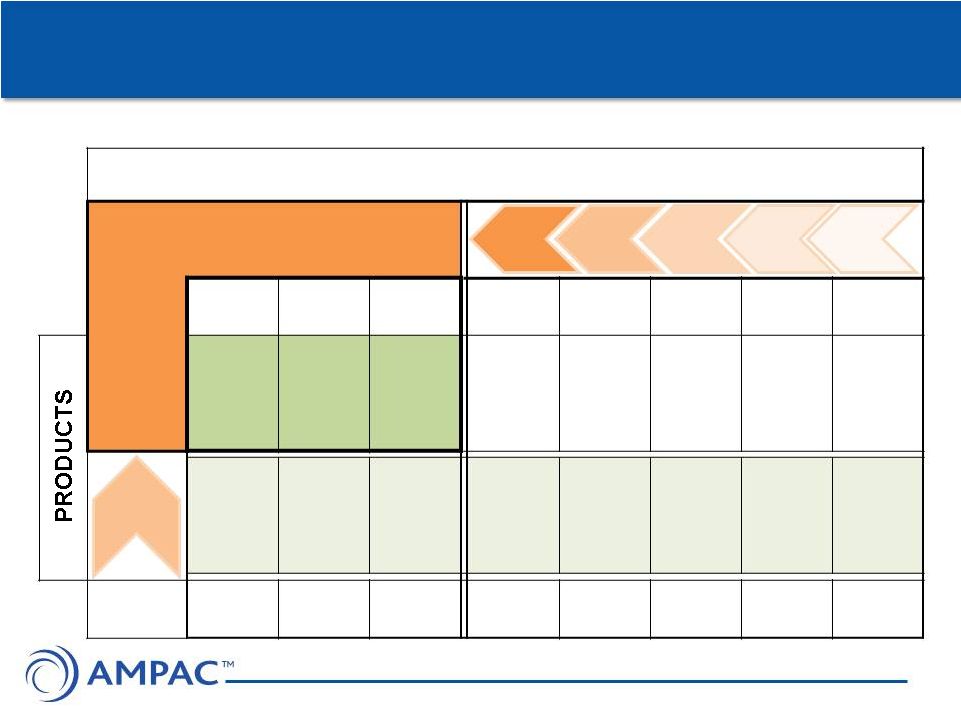

AFC

Growth: Requires Maturing Growth Areas and Product Pipeline

PIPELINE/

DEVELOPMENT

THERAPEUTIC

AREAS

Energetic/

Special

Chemistry

High

Potency

SMB

Controlled

Substances

Biocatalysis

Homeland

Security

Generics

Continuous

Processing

3

7

2

9

2

11

4

4

2

3

1

•

Anti-Viral

•

Cancer

•

Nerve Gas

Antidote

•

CNS

•

Cancer

•

Anti-Viral

•

Pain

•

Anti-Viral

•

Cancer

•

Polymers

•

Bio-

Terrorism

•

Cancer

•

Anti-Viral

•

Various

2012 Annual Meeting of Stockholders

7

GROWTH

CORE

CORE

BUSINESS LINES |

2012 Annual

Meeting of Stockholders 8

Specialty Chemicals: Business Remains Stable

Rocket-Grade Ammonium Perchlorate (AP)

Defense applications: stability of annual demand

•

fluctuations quarter-to-quarter

NASA requirements

•

Space Launch System well funded

•

Uses Shuttle-type solid booster rockets for initial test

flights

•

Solid rockets using AP will have an advantage for

production units post 2016

Fire Suppression Chemicals

Promising new applications

Sodium Products

New opportunity in alternative energy |

2012 Annual

Meeting of Stockholders 9

In-Space Propulsion Business

Continues to Penetrate Market

Sales Growth from $16MM in FY08

to $49MM in FY11

FY12 will be a stabilization year

Propulsion systems business opportunities

Platinum alloy thruster sales expected to

increase

Building a world-class technical team

European Market Penetration

Continues

OHB wins Galileo follow-on units

Development projects from European

Space Agency |

2012 Annual

Meeting of Stockholders 10

Fiscal

2012:

Improved

Outlook

as

Fine Chemicals Growth Continues

AMPAC revenue guidance of at least $220MM

Fine Chemicals revenue increase of at least 15%

Specialty Chemicals revenue decrease of up to 10%

–

within stable range for this segment

Modest revenue growth in Aerospace Equipment

AMPAC adjusted EBITDA guidance of at least

$35MM

Fine Chemicals improvement in profitability –

driven by

process improvements and increased base

Slight decline in Specialty Chemicals –

more typical

product mix |

2012 Annual

Meeting of Stockholders 11

2012 and Beyond:

Value-Creating Growth and Improved Returns

Maintain strong customer relationships –

reliably

provide value-added products and services

Protect the Core

Grow in alignment with our strategy

Diversify our Customer base

Expand our product lines

Control spending and improve operational

performance

Improve profitability and return on invested capital

Explore strategic alternatives to create value |

2012 Annual

Meeting of Stockholders 12

Questions |