Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CarParts.com, Inc. | d313539d8k.htm |

1

U.S. Auto Parts Network, Inc.

Leading online source for automotive aftermarket parts and repair information

Investor Presentation

March 2012

Exhibit 99.1 |

Safe

Harbor 2

This presentation may contain certain forward-looking statements and

management may make additional forward-looking statements in response to

your questions. These statements do not guarantee future performance and

speak only as of the date hereof, and qualify for the safe harbor provided by

Section 21E of the Securities Exchange Act of 1934, as amended, and Section

27A of the Securities Act of 1933. We refer all of you to the risk factors

contained in US Auto Parts Annual Report on Form 10-K and quarterly

reports on Form 10-Q filed with the Securities and Exchange Commission,

for more detailed

discussion

on

the

factors

that

can

cause

actual

results

to

differ

materially from those projected in any forward-looking statements.

|

US

Auto Parts Competitive Advantages US Auto Parts is a dominant e-commerce

specialty retailer of aftermarket auto parts to the Do It Yourself market and

is uniquely positioned to win.

Incremental revenue above current levels has incremental EBITDA flow thru of

around 15% Low Cost Acquisition

Efficient Supply Chain

Significant Capacity

Reach over 14mm monthly

visitors at a less than a $8 CAC.

Over 40% of product directly

sourced from Asia.

Over 70% of corporate

employees located in off shore

low cost operations.

3 |

4

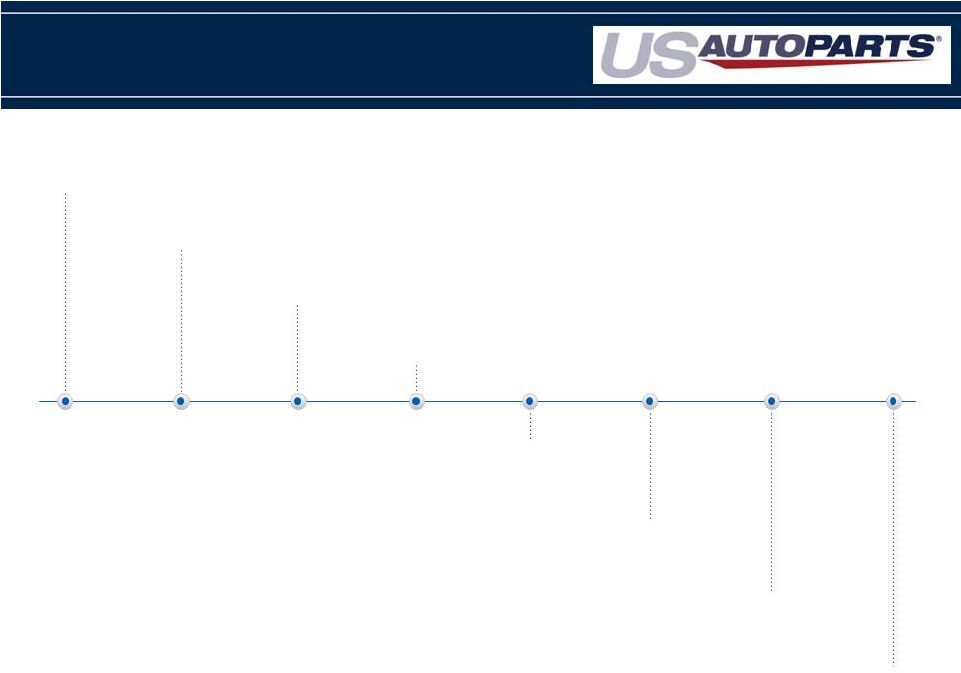

US Auto Parts History

1995

Founded and serviced local body shops in Los Angeles

2000

Launched first internet site selling automotive Body Parts

2000-2005

Launched a network of sites catered to consumer segments

2006

Acquired PartsBin -

Engine

2007

IPO (NASDAQ: PRTS), hired new CEO

2008-2009

Launched a network of sites catered to consumer segments

2010

Launched

AutoMD,

Acquired

JC

Whitney

–

Accessories

2011

Completed integration of JC Whitney |

$153.0

$176.0

$262.0

$327.0

2008

2009

2010

2011

$5.2

$13.5

$19.5

$16.2

2008

2009

2010

2011

5

Sales & Adjusted EBITDA

Consolidated Sales

Consolidated Adjusted EBITDA

($ In Millions)

($ In Millions)

1. Excludes legal cost associated with protecting our

intellectual property. 2. Excludes

legal

cost

associated

with

protecting

our

intellectual

property,

one

time

charge

for

revenue

recognition

change,

and

acquisition

costs

3. Includes about $80mm from acquisition of WAG

Adj. EBITDA Margin

(1)

(2)

3%

5%

8%

10%

Year Impacted by:

•

JCW Acquisition

•

$7.5m of restructuring

charges for JCW

•

Adjusted EBITDA for

USAP of $18.9m and

JCW with a loss of

($2.6m)

(3) |

6

•

Reflects Whitney Automotive Group, fully integrated

•

Excludes

stock

based

compensation,

depreciation

and

amortization

of

$2.5m

and

$16.2m,

respectively

•

For every incremental year required to achieve growth levels, fixed expenses

increase $1.2M Financial Sensitivity

Base

10%

20%

30%

40%

50%

Revenue

$327

$ 360

$392

$425

$ 458

$ 491

Gross Margin %

30.0%

-

33.0%

30.0%

-

33.0%

30.0%

-

33.0%

30.0%

-

33.0%

30.0%

-

33.0%

30.0%

-

33.0%

Variable:

Fulfillment

2.4%

2.4%

2.4%

2.4%

2.4%

2.4%

Marketing

9.5%

9.5%

9.5%

9.5%

9.5%

9.5%

Technology

0.7%

0.7%

0.7%

0.7%

0.7%

0.7%

G&A

2.0%

2.0%

2.0%

2.0%

2.0%

2.0%

Total Variable

14.6%

14.6%

14.6%

14.6%

14.6%

14.6%

Fixed:

Fulfillment

2.5%

2.3%

2.1%

1.9%

1.8%

1.7%

Marketing

3.8%

3.5%

3.2%

2.9%

2.7%

2.5%

Technology

1.3%

1.2%

1.1%

1.0%

0.9%

0.9%

G&A

3.4%

3.1%

2.8%

2.6%

2.4%

2.2%

Total Fixed

10.9%

9.9%

9.1%

8.4%

7.8%

7.3%

Adjusted EBITDA %

4.5%

-

7.5%

5.5%

-

8.5%

6.3%

-

9.3%

7.0%

-

10.0%

7.6%

-

10.6%

8.2%

-

11.2%

Adjusted EBITDA $

$15

-

$25

$20

-

$30

$25

-

$37

$30

-

$43

$35

-

$49

$40

-

$55

Our business model has significant cost leverage as revenues grow

|

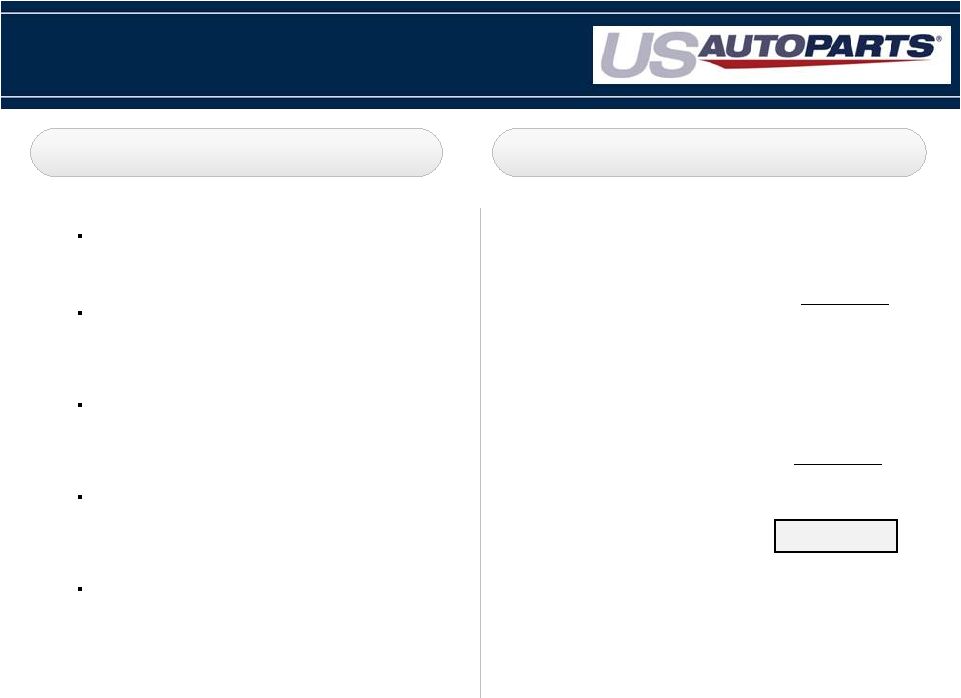

1)

Improve Customer Experience

Continue to improve all customer touch points

1)

Lower Prices

Launch disruptive price points through supply chain

efficiencies

2)

Increase Selection

Expand product offering within existing categories as

well as entering new categories

3)

Increase Unique Visitors

Drive increase unique visitors both organically and

through acquisitions

4)

Be the Consumer Advocate for Auto Repair

Reduce consumer spending on vehicle repair by

billions of dollars

Revenue

100%

Gross Margins

30% -

33%

Variable OPEX Costs

15%

Fixed Costs

0%

Incr EBITDA Flow Thru

15% -

18%

7

2012 Growth and Profitability

Revenue Growth

Incremental EBITDA Flow Thru |

8

Broad Product Offering Unavailable

from Traditional Off-Line Retailers

Brake Discs

Catalytic

Converters

Radiators

Headers

Oxygen

Sensors

Alternators

Exhaust

Driveshaft

Fuel Injection /

Delivery

Lamps

Mirrors

Bumpers

Hoods

Tailgates

Doors

Grills

Wheels

Window

Regulators

Seat Covers

Car Covers

Floor Mats /

Carpeting

Cold Air

Intakes

Vent Visors

Tonneau

Covers

Nerf Bars

Bug Shields

Car Bras

Body Parts

Engine Parts

Performance & Accessories

*Represents online mix, **Source; AAIA Factbook Research

21%

45%

34%

$15B

$15B

Revenue*

Overall Market**

$50B |

9

Source : Forrester; Wall Street research; Autopartswarehouse.com

Low Online Penetration-

Mobile Growth

Opportunity

Sep 2010

32,108

Oct 2011

117,501

45%

27%

24%

24%

21%

19%

19%

18%

13%

12%

11%

10%

10%

9%

9%

8%

6%

5%

4%

2%

1%

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

Mobile Daily Unique Visitors

(over last 13 months)

Retail Category e-Commerce Penetration Rates |

Online

vs. Brick and Mortar Customer – Mobile Growth Should Accelerate

Penetration 10

Los Angeles DMA

0.6%

0.6%

1.4%

5.6%

6.0%

8.4%

12.6%

7.3%

15.9%

18.7%

22.7%

0.1%

0.7%

0.1%

9.8%

14.9%

5.3%

9.6%

18.1%

5.1%

16.4%

19.8%

0.2%

0.6%

0.6%

6.2%

7.4%

7.6%

10.3%

11.3%

11.9%

16.0%

27.8%

Varying Lifestyles

Urban Essence

Rural Villages & Farms

Metro Fringe

Blue Collar Backbone

Small Town Contentment

American Diversity

Struggling Societies

Affluent Suburbia

Upscale America

Aspiring Contemporaries

All Households

Auto Zone

USAP

Compared to AutoZone and the general population, USAP

customers over-index in affluent segments, typical of

e-commerce shoppers

Affluent Suburbia

The wealthiest households in the U.S. living in exclusive suburban

neighborhoods enjoying the best of everything that life has to offer

Small Town Contentment

Middle-aged, upper-middle-class families living in small towns and

satellite cities with moderate educations employed in white-collar,

blue-collar and service professions

American Diversity

A diverse group of ethnically mixed singles and couples, middle-

aged and retired with middleclass incomes from blue-collar and

service industry jobs

In contrast, AutoZone store locations over-index in areas with

lower income, blue collar households

Struggling Societies

Young minorities, students and single parents trying to raise families

on low-level jobs in manufacturing, health care and food services

Blue Collar Backbone

Budget-conscious, young and old blue-collar households living in

older towns working in manufacturing, construction and retail trades

Metro Fringe

Racially mixed, lower-middle-class clusters in older single-family

homes, semi-detached houses and low-rise apartments in

satellite cities

*

*Auto zone distribution reflects population in zip codes of Auto Zone store

locations **Sources:

2008

Census

estimates;

autozone.com;

MOSAIC

lifestyle

segments |

US

Auto Parts Dominant Reach- Largest

Pure Play Internet Retailer

(some overlap of monthly visitors across websites)

11

USAP traffic includes traffic of USAP existing sites and WAG since the acquisition

Competitive sites’ traffic based on Comscore September 2011 reportsfor September *

Excludes growth from WAG acquisition |

Pricing Competitive Advantage Through

Supply Chain Efficiencies

12

Product margin/price competitiveness determined more by sourcing strategy

than product categories. Current margins range from 30% -

33%.

Margin %

In-Stock

(Asia Sourced)

Branded

(US Sourced)

40% -

70%

25% -

40%

10% -

25%

Drop Ship

Current

40%

60%

Current Mix

50%

50%

75%

25%

50%

50%

Goal

Goal

Private Label |

Low

Cost Operating Structure Reduces Overhead and Enables Scale

13

Acquisition/Retention Marketing

Website Product Development

Call Center Operations

Product Sourcing

Catalog

Finance

Accounting

Analysis

IT

HR

Corporate Functions

Job functions are shared between the US and Philippines with a majority of the work

being performed in the Philippines. Total Corporate Employees

300

1,000

Distribution Centers

Carson, California (150,000 sq. ft.)

Chesapeake, Virginia (110,000 sq. ft)

LaSalle, Illinois (300,000 sq. ft)

75

50

100

Total Distribution Employees

225 |

AutoMD-

Largest DIY Site

Repositioned to Target $140B DIFM Market

14 |

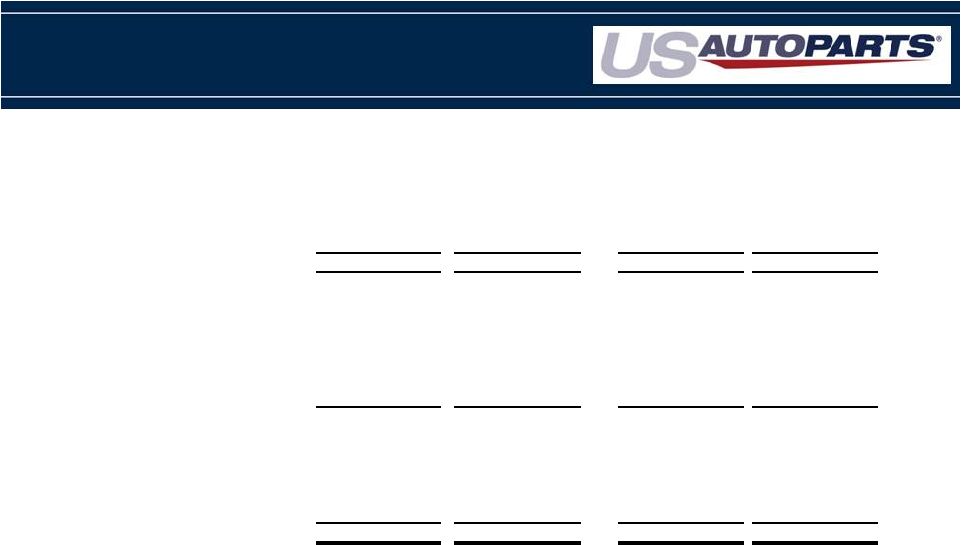

Adjusted EBITDA (Consolidated)

15

Thirteen Weeks

Ended

Thirteen Weeks

Ended

Fifty

-Two Weeks

Ended

Fifty

-Two Weeks

Ended

December 31

January 1

December 31

January 1

(Amounts shown

in thousands)

2011

2011

2011

2011

Net (loss) income

$

(7,020)

$

(2,896)

$

(15,137)

$

(13,926)

Interest expense (income) net

244

240

963

371

Income tax provision

(1,727)

64

(1,512)

12,218

Amortization of intangibles

345

1,640

3,673

2,804

Depreciation and amortization

3,494

2,982

12,695

9,466

EBITDA

(4,664)

2,030

682

10,933

Impairment loss on intangibles

5,138

-

5,138

-

Share-based compensation

660

630

2,607

2,742

Legal costs to enforce intellectual property rights

19

87

462

2,284

Charge for change in revenue recognition

-

-

-

411

Add back Restructuring

784

1,534

7,375

3,124

Adjusted EBITDA

$

1,937

$

4,281

$

16,264

$

19,494 |

Adjusted EBITDA excluding JC Whitney

16

Thirteen Weeks

Ended

Thirteen Weeks

Ended

Fifty-Two Weeks

Ended

Fifty-Two Weeks

Ended

December 31

January 1

December 31

January 1

(Amounts shown in thousands)

2011

2011

2011

2011

Net income

$

128

$

218

$

4,745

$

(7,909)

Interest expense (income) net

245

295

964

378

Income tax provision

(305)

29

(144)

12,182

Amortization of intangibles

125

125

500

494

Depreciation and amortization

2,564

2,325

9,928

8,458

EBITDA

2,756

2,992

15,993

13,603

Share-based compensation

660

630

2,607

2,742

Legal costs to enforce intellectual property

rights

19

87

462

2,284

Charge for change in revenue recognition

-

-

-

411

Adjusted EBITDA

$

3,436

$

3,709

$

19,062

$

19,040 |

Income Statement (Consolidated)

17

Thirteen Weeks

Ended

Thirteen Weeks

Ended

Fifty-Two Weeks

Ended

Fifty-Two Weeks

Ended

December 31

January 1

December 31

January 1

2011

2011

2011

2011

Net sales

$ 77,233

$ 80,450

$ 327,072

$

262,277 Cost of sales

53,408

53,051

220,072

172,668

Gross profit

23,825

27,399

107,000

89,609

Operating expenses:

Marketing

13,832

13,261

55,785

38,757

General and administrative

6,222

8,339

31,961

28,628

Fulfillment

5,116

4,677

19,164

14,946

Technology

1,743

2,062

7,274

5,902

Amortization of intangibles

345

1,640

3,673

2,804

Impairment loss on intangibles

5,138

-

5,138

-

Total operating expenses

32,396

29,979

122,995

91,037

(Loss) income from operations

(8,571)

(2,580)

(15,995)

(1,428)

Other income (expense):

Other income

84

(12)

364

191

Interest (expense) income

(260)

(240)

(1,018)

(471)

Other (expense) income, net

(176)

(252)

(654)

(280)

(Loss) income before income taxes

(8,747)

(2,832)

(16,649)

(1,708)

Income tax provision (benefit)

(1,727)

64

(1,512)

12,218

Net (loss) income

$ (7,020)

$ (2,896)

$

(15,137)

$

(13,926) Basic net (loss) income per share

$ (0.23)

$

(0.10)

$

(0.50)

$

(0.46) Shares used in computation of basic net income

(loss) per share 30,617,963

30,402,264

30,545,638

30,269,462

(Amounts shown in thousands) |

Balance Sheet

18

(Amounts shown in thousands)

December 31, 2011

January 1, 2011

ASSETS

Current assets:

Cash and cash equivalents

$

10,335

$

17,595 Short-term investments

1,125

1,062

Accounts receivable, net of allowance of $183 and $372,

respectively 7,922

5,339

Inventory

52,245

48,100

Deferred income taxes

446

359

Other current assets

3,548

5,646

Total current assets

75,621

78,101

Property and equipment, net

34,627

33,140

Intangible assets, net

9,984

18,718

Goodwill

18,854

18,647

Investments

2,104

4,141

Other non-current assets

1,026

790

Total assets

$ 142,216

$

153,537 LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

41,303

$

31,660 Accrued expenses

11,565

15,487

Notes Payable, current portion

6,250

6,125

Capital Leases payable, current portion

135

132

Other current liabilities

7,702

5,522

Total current liabilities

66,955

58,926

Non-current liabilities

Notes Payable, net of current portion

11,625

17,875

Capital Leases payable, net of current portion

37

185

Deferred tax liabilities

1,596

3,046

Other non current liabilities

1,079

701

Total liabilities

81,292

80,733

Commitments and contingencies

—

—

Stockholders’

equity:

Common

stock,

$0.001

par

value;

100,000,000

shares

authorized

at

December

31,

2011

and January 1,2011; 30,625,764 and 30,429,376 shares issued and

outstanding as of December 31, 2011 and January 1, 2011

respectively 31

30

Additional paid-in capital

157,140

153,962

Accumulated other comprehensive income

327

249

Accumulated deficit

(96,574)

(81,437)

Total stockholders’

equity

60,924

72,804

Total liabilities and stockholders’

equity

$ 142,216

$

153,537 |

Thank You

19 |