Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SMITH & WESSON BRANDS, INC. | d313475d8k.htm |

EXHIBIT 99.1

| James Debney, President & CEO Jeffrey Buchanan, EVP & CFO March, 2012 |

| Safe Harbor Certain statements contained in this presentation may be deemed to be forward- looking statements under federal securities laws, and the Company intends that such forward-looking statements be subject to the safe-harbor created thereby. Such forward-looking statements include but are not limited to statements regarding the Company's markets and strategies, the Company's vision and mission, the Company's new products and product development, the outcome of the divestiture of the Company's Security Solutions business, anticipated sales, gross profit margin, and operating expenses for the Company, the opportunity for growth of the Company, the demand for the Company's products and services, the Company's focus and objectives, and the Company's financial and operational goals for the current fiscal year and future periods. The Company cautions that these statements are qualified by important factors that could cause actual results to differ materially from those reflected by such forward-looking statements. Such factors include the demand for the Company's products, the Company's growth opportunities, the ability of the Company to obtain operational enhancements, the success of new products, the success of the planned divestiture of the Company's Security Solutions business, and other risks detailed from time to time in the Company's reports filed with the SEC. 2 |

| Business Highlights U.S. Market Leader for Firearms: Handguns, Modern Sporting Rifles (MSR)159 years of rich historyIconic brand with 93% aided awarenessSmith & Wesson(r) Brand = RevolverInnovative product portfolio serving broad user groupsRevolver, Polymer Pistol, Metal Pistol, Pocket Pistol, Bolt Action, Black Powder, Modern Sporting RifleDiverse sales sources: Consumer: Sporting GoodsProfessional: International, Law Enforcement, Government, MilitaryHealthy balance sheetSolid, experienced management teamStrong strategic direction 3 |

| Vision / Mission Our Vision: The leading firearms manufacturer Our Mission: To allow our employees to design, produce, and market high-quality, innovative firearms that meet the needs and desires of our consumer and professional customers 4 |

| Focus, Simplify, Execute Strategy - Focus on FirearmsSale of Security Solutions - Perimeter Security Business (formerly USR)U.S. Consumer - leverage professional marketsFamily of brands:Smith & Wesson(r)Walther(r)Thompson/Center Arms(tm)M&P(tm)M&P(tm) - Brand and product platform: Pistols and modern sporting riflesOperations: Consolidate and expand capacity - some production lines have reached record levelsDeliver new products that meet needs of user groups 5 |

| Experienced Leadership Team James Debney, President & CEO 20+ years: multinational consumer and business-to- business environments including President of Presto Products Co., a $500 million business unit of Alcoa Consumer ProductsJeffrey Buchanan, EVP & CFO25+ years: private and public company experience in financial management and law: CFO for publicly traded, global manufacturing company, law firm partner, public company board member 6 |

| Experienced Management Team MarioPasantesSr. VP Marketing and Global Professional SalesAlcoa, Inc.Coca-ColaPillsbury Mark SmithVP Manufacturing and Supply Chain ManagementAlvarez & MarsalEcolab Robert CiceroVP, General Counseland Chief Compliance OfficerChemtura Corp.Shearman & SterlingMorgan Lewis & Bockius Mike BrownVP Sporting Goods SalesCamfour, Inc.KPMG 7 International Market DevelopmentStrong Global BrandsStrategyCustomer Development Multi-Site OpsCapacity ExpansionMPS/MRP SystemsS&OP MgmtInventory MgmtLean Six Sigma Public Co LeadershipCorp GovernanceCross-border M&AGlobal ComplianceFinance & Pensions Labor & Employment Multiple Leadership Roles inHunting & ShootingSports IndustriesSales StrategyTeam Development |

| Q3 FY12 Highlights (Jan 31, 2012) Double digit sales growth, a leader in expanding key firearm categoriesTotal net sales +23.8% YOYM&P polymer pistol unit sales +23.4% YOYM&P modern sporting rifle unit sales +161.9% YOYOverall unit growth +20.4% vs. market growth +20.0% (Adjusted NICS) Exceeded high end of sales guidance & raised FY12 full year revenue guidanceImproved gross margins and delivered positive net income vs. year-agoLaunched Dimension - innovative interchangeable bolt-action platformLaunched two new modern sporting rifle modelsBegan manufacturing new handgun for launch at NRA show in AprilSold foundry business in New Hampshire; marketed real estateContinued to work on divesting Security Solutions business (Discontinued Ops)Completed Thompson/Center Arms consolidation (on time - on budget)Paid down $30 million of debt without accessing line of credit 8 |

| SWHC: Financial Highlights (From Continuing Operations) Fiscal Year April 30 Sales (in Millions) Q3FY12 Actual:Sales $98.1M (+23.8%)Backlog $198.5MGross Profit Margin 30.6%Op. Expense 20.1%Working capital $92.4MCash $25.7MQ4FY12 Guidance:Sales $113.0M - $118.0MGross Profit Margin 32.0% - 33.0%Op. Expense Approx. $22.0M (19.0%)Full Fiscal 2012 Guidance:Sales $395.0M - $400.0M (15.0%+)Gross Margins Approaching 30%Op. Expense Approx. 21.0% *FY2012 EstimateNote: All financial information and guidance reflects information that we provided on March 8, 2012. We are not updatingthis information to the present date nor does its inclusion constitute a reiteration or modification of this information. 9 $296 $335 $358 $342 $395 - 400 2008 2009 2010 2011 2012(E)* |

| *National Shooting Sports Foundation (NSSF) adjusts FBI NICS data to eliminate background checks associated with permit applications and checks on active CCW permit databases, in order to provide a more accurate picture of market conditions. Adjusted NICS Checks* NICS: Strength in Consumer Firearms Market 10 (CHART) |

| Strong Industry Sales Indications Through Q3 CY11 Wholesale projected sales based on excise tax collections. YTD Q3 2011 excise tax collections exceeded prior YTD Q3 2010. Category growth of over 30% in the past 5 years. Source: Federal Excise Tax collections, Wholesale Value*Long guns include all rifles, shotguns and muzzle loaders 11 (CHART) (CHART) (CHART) (in Millions) 9-MO YTD 9-MO YTD - - - - - - - - - - - - - - - - - - (Q4 Data Due Out May, 2012) |

| Industry: Pistols Driving Handgun Growth U.S. handgun growth has been driven by pistols, which now represent 80% of units sold. Source: BATF annual firearms mfg and export report. USITC import data. 12 (2011 Data Due Out May, 2012) |

| Industry: Pistols vs. Revolvers Pistols & revolvers have different attributes, but pistols win on self-defense and have attracted younger consumers into the handgun market. Pistol advantages versus revolvers:CapacityRate of fire High tech/cutting edgeModern shapeTrigger pullSafety featuresRevolver advantages versus pistols:Slightly better for beginners Easy maintenance Reliability Source: 12/10 Strategic Platform and Extendibility Study 13 |

| SWHC Firearms Growth Drivers Consumer Market - U.S.Focus on Concealed Carry, Personal Protection, RecreationExpand Market Share: Polymer Pistol Unit Growth (M&P(tm), BODYGUARD(r), The Sigma Series(r)) Robust New Product Pipeline is RequiredLeverage Positive Halo Effect from Professional MarketsProfessional MarketLaw Enforcement - ongoing sidearm and rifle replacements, upgradesFederal Government - agencies can purchase M&P Pistol on ATF Contract Military - M9 pistol replacement & M4 bolt carrier assembly opportunitiesInternational - large orders, e.g. Belgium 14 |

| Major Focus: M&P(tm) Pistol Growth Current Situation:Pistol category is 80% of handgunsCompact and full-size polymer pistols are increasing in popularityM&P(tm) products well received by retail and consumerOur Focus:Grow M&P(tm) Pistol market share:Increased consumer advertisingIncreasing capacity to satisfy growing ordersMake it easier for dealers to support the M&P(tm) platform:Strong merchandising and store programsArmorer's Training and On-The-Hip Program 15 |

| M&P - Proven Performance M&P - Proven Performance Strong & Marketable Differences 16 |

| Demonstrated Track Record of New Products 2006 2007 2008 2009 2010 2011 2012 WaltherPPS S&W M&P 15 S&W M&P Pistols WaltherPK380 S&W M&P15-22 WaltherPPQ S&W M&P15 Sport S&WBG380 S&WBG 38 S&W M&P15 Whisper S&WM&P 22 Thompson/Center Venture S&WGovernor T/C Dimension 17 |

| New Models for the M&P(tm) Platform New and exciting entries for polymer pistol categoryConcealed Carry and Personal ProtectionConsumer and ProfessionalAdditional calibers and models for the M&P Modern Sporting Rifle platform:TacticalHuntingWill only announce new product introductions when ready - capable and right timingExciting new handgun ready for launch at NRA in April 18 |

| Our Strategic Direction: Focus on Firearms Grow sales and increase profitabilityExpand manufacturing capacity intelligentlyFocus on M&P pistol platformOptimize expenses on a company-wide basisFocus on improving gross marginsMaintain robust new product pipelineLaunch new products strategicallyLeverage existing product portfolio Objective: Deliver Enhanced Stockholder Value 19 |

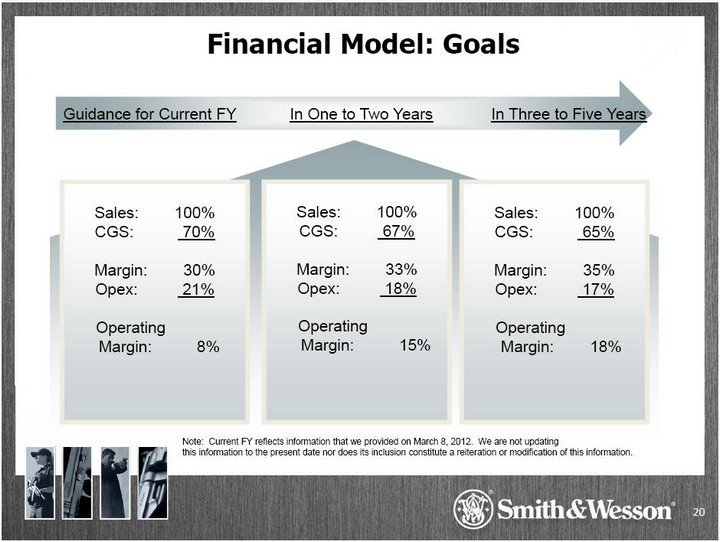

| Financial Model: Goals Sales: 100%CGS: 70%Margin: 30%Opex: 21% Operating Margin: 8% 20 Sales: 100%CGS: 67%Margin: 33%Opex: 18% Operating Margin: 15% Sales: 100%CGS: 65%Margin: 35%Opex: 17% Operating Margin: 18% Guidance for Current FYIn One to Two YearsIn Three to Five Years Note: Current FY reflects information that we provided on March 8, 2012. We are not updatingthis information to the present date nor does its inclusion constitute a reiteration or modification of this information. |

| Question & Answers For Investor Information contact Liz Sharp at lsharp@smith-wesson.com , (480) 949-9700 |