Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - HALOZYME THERAPEUTICS, INC. | Financial_Report.xls |

| EX-31.2 - CERTIFICATION OF CHIEF FINANCIAL OFFICER - HALOZYME THERAPEUTICS, INC. | d295326dex312.htm |

| EX-23.1 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - HALOZYME THERAPEUTICS, INC. | d295326dex231.htm |

| EX-31.1 - CERTIFICATION OF CHIEF EXECUTIVE OFFICER - HALOZYME THERAPEUTICS, INC. | d295326dex311.htm |

| EX-32 - CERTIFICATION OF CHIEF EXECUTIVE OFFICER AND CHIEF FINANCIAL OFFICER - HALOZYME THERAPEUTICS, INC. | d295326dex32.htm |

Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) |

| OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2011 |

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) |

| OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to |

Commission File Number: 001-32335

Halozyme Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 88-0488686 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 11388 Sorrento Valley Road, San Diego, California |

92121 (Zip Code) | |

| (Address of principal executive offices) |

(858) 794-8889

(Registrant’s Telephone Number, Including Area Code)

Securities registered under Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, $0.001 Par Value | The NASDAQ Stock Market, LLC |

Securities registered under Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. x Yes ¨ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer x | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2011 was approximately $581.9 million based on the closing price on the NASDAQ Stock Market reported for such date. Shares of common stock held by each officer and director and by each person who is known to own 10% or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of March 1, 2012, there were 112,093,601 shares of the registrant’s $0.001 par value common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the issuer’s Definitive Proxy Statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A in connection with the registrant’s 2012 Annual Meeting of Stockholders, to be filed subsequent to the date hereof, are incorporated by reference into Parts II and III of this Annual Report.

Table of Contents

Table of Contents

PART I

This Annual Report on Form 10-K contains forward-looking statements regarding our business, financial condition, results of operations and prospects. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “thinks,” “may,” “could,” “will,” “would,” “should,” “continues,” “potential,” “likely,” “opportunity” and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this Annual Report. Additionally, statements concerning future matters such as the development or regulatory approval of new products, enhancements of existing products or technologies, third party performance under key collaboration agreements, revenue and expense levels and other statements regarding matters that are not historical are forward-looking statements.

Although forward-looking statements in this Annual Report reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include without limitation those discussed under the heading “Risk Factors” below, as well as those discussed elsewhere in this Annual Report. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report. We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Annual Report. Readers are urged to carefully review and consider the various disclosures made in this Annual Report, which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

Overview

We are a biopharmaceutical company dedicated to developing and commercializing innovative products that advance patient care. Our research targets the extracellular matrix, an area outside the cell that provides structural support in tissues and orchestrates many important biological activities, including cell migration, signaling and survival. Over many years, we have developed unique scientific expertise that allows us to pursue this target-rich environment for the development of future therapies.

Our research focuses primarily on human enzymes that alter the extracellular matrix. Our lead enzyme, the recombinant human hyaluronidase or rHuPH20, temporarily degrades hyaluronan, or HA, a matrix component in the skin, and facilitates the dispersion and absorption of drugs and fluids. We are also developing novel enzymes that may target other matrix structures for therapeutic benefit. Our Enhanze™ technology is the platform for the delivery of proprietary small and large molecules. We apply our research to develop products in partnership with other companies as well as for our own proprietary pipeline in therapeutic areas with significant unmet medical need, such as diabetes, oncology and dermatology.

Our operations to date have involved: (i) organizing and staffing our operating subsidiary, Halozyme, Inc.; (ii) acquiring, developing and securing our technology; (iii) undertaking product development for our existing products and a limited number of product candidates; (iv) supporting the development of partnered product candidates; and (v) selling Hylenex® recombinant (hyaluronidase human injection). We continue to increase our focus on our proprietary product pipeline and have expanded investments in our proprietary product candidates. We currently have multiple proprietary programs in various stages of research and development. In addition, we currently have collaborative partnerships with F. Hoffmann-La Roche, Ltd and Hoffmann-La Roche, Inc., or Roche, Baxter Healthcare Corporation, or Baxter, ViroPharma Incorporated, or ViroPharma, and Intrexon Corporation, or Intrexon, to apply Enhanze technology to the partners’ biological therapeutic compounds. We

1

Table of Contents

also had another partnership with Baxter, under which Baxter had worldwide marketing rights for our marketed product, Hylenex recombinant, or the Hylenex Partnership. We and Baxter mutually agreed to terminate the Hylenex Partnership in January 2011. Currently, we have received only limited revenue from the sales of Hylenex recombinant, in addition to other revenues from our partnerships.

In February 2007, we and Baxter amended certain existing agreements relating to Hylenex recombinant and entered into the Hylenex Partnership for kits and formulations with rHuPH20. In October 2009, Baxter commenced the commercial launch of Hylenex recombinant. Hylenex recombinant was voluntarily recalled in May 2010 because a portion of the Hylenex recombinant manufactured by Baxter was not in compliance with regulatory requirements. During the second quarter of 2011, we submitted the data that the U.S. Food and Drug Administration, or FDA, had requested to support the reintroduction of Hylenex recombinant. The FDA approved the submitted data and granted the reintroduction of Hylenex recombinant and we reintroduced Hylenex recombinant to the market in December 2011.

Effective January 7, 2011, we and Baxter mutually agreed to terminate the Hylenex Partnership and the associated agreements. In June 2011, we entered into a commercial manufacturing and supply agreement with Baxter, under which Baxter fills and finishes Hylenex recombinant for us. On July 18, 2011, we and Baxter entered into an agreement setting forth certain rights, data and assets to be transferred by Baxter to us during a transition period, or the Transition Agreement. The termination of these agreements does not affect the other relationships between the parties, including the application of our Enhanze technology to Baxter’s GAMMAGARD LIQUID™.

We and our partners have product candidates in the research, preclinical and clinical stages, but future revenues from the sales and/or royalties of these product candidates will depend on our partners’ abilities and ours to develop, manufacture, obtain regulatory approvals for and successfully commercialize product candidates. It may be years, if ever, before we and our partners are able to obtain regulatory approvals for these product candidates. We have incurred net operating losses each year since inception, with an accumulated deficit of approximately $245.0 million as of December 31, 2011.

We reincorporated from the State of Nevada to the State of Delaware in November 2007. Our principal offices and research facilities are located at 11388 Sorrento Valley Road, San Diego, California 92121. Our telephone number is (858) 794-8889 and our e-mail address is info@halozyme.com. Additional information about the Company can be found on our website at www.halozyme.com, and in our periodic and current reports filed with the SEC. Copies of our current and periodic reports filed with the SEC are available at the SEC Public Reference Room at 450 Fifth Street, N.W., Washington, D.C. 20549, and online at www.sec.gov and our website at www.halozyme.com.

Technology

Our existing products and our products under development are based primarily on intellectual property covering the family of human enzymes known as hyaluronidases. Hyaluronidases are enzymes (proteins) that break down HA, which is a naturally occurring space-filling, gel-like substance that is a major component of both normal tissues throughout the body, such as skin and cartilage, and abnormal tissues such as tumors. Our primary technology, Enhanze technology, is a proprietary delivery platform using rHuPH20, a human recombinant version of hyaluronidase. rHuPH20 is a naturally occurring enzyme that temporarily degrades HA, thereby facilitating the penetration and diffusion of other drugs and fluids that are injected under the skin or in the muscle. rHuPH20 is the active compound in our first commercially approved product, Hylenex recombinant. Our proprietary rHuPH20 technology is applicable to multiple therapeutic areas and may be used to both expand existing markets and create new ones through the development of our own proprietary products. Through partnerships or other collaborations, the rHuPH20 technology may also be applied to existing and developmental products of biopharmaceutical companies that market drugs requiring or benefiting from injection via the subcutaneous route of administration.

2

Table of Contents

Strategy

We are dedicated to the development and commercialization of recombinant human enzymes that either transiently modify tissue under the skin to facilitate injection of other therapies or correct diseased tissue structures for clinical benefit. By expanding upon our scientific expertise in the extracellular matrix, we hope to develop therapeutic and aesthetic drugs. Our lead enzyme, rHuPH20 hyaluronidase, facilitates the delivery of drugs and fluids through the extracellular matrix and into circulation. rHuPH20 is the underlying drug delivery technology of Hylenex recombinant for small molecules and fluids, and Enhanze technology for the delivery of proprietary small and large molecules. We continue to seek ways to combine rHuPH20 with previously approved drugs to develop new proprietary products, with potentially new patent protection.

We are also expanding our scientific work in the extracellular matrix by developing other enzymes and agents that target unique aspects of the extracellular matrix, giving rise to potential new molecular entities targeting indications in endocrinology, oncology and dermatology. For instance, we are developing a formulation of rHuPH20 and insulin for the treatment of diabetes mellitus. We are also developing a PEGylated version of the rHuPH20 enzyme, or PEGPH20, that lasts longer in the bloodstream, and may therefore better target solid tumors by clearing away the surrounding HA and reducing the interstitial fluid pressure within malignant tumors to allow better penetration by chemotherapeutic agents. In addition, we are developing an extracellular matrix-modifying enzyme that targets components of the skin and subcutaneous tissues that may have both therapeutic and aesthetic applications within dermatology. Key aspects of our corporate strategy include the following:

| • | Develop our own proprietary products based on our PH20 enzyme; |

| • | Develop other new molecular entities or enzymes for the extracellular matrix; |

| • | Seek partnerships for our Enhanze technology drug delivery platform; |

| • | Support product development and commercialization under our Enhanze technology collaborations; and |

| • | Increase sales and continue to drive physician adoption of Hylenex recombinant in the United States. |

3

Table of Contents

Product and Product Candidates

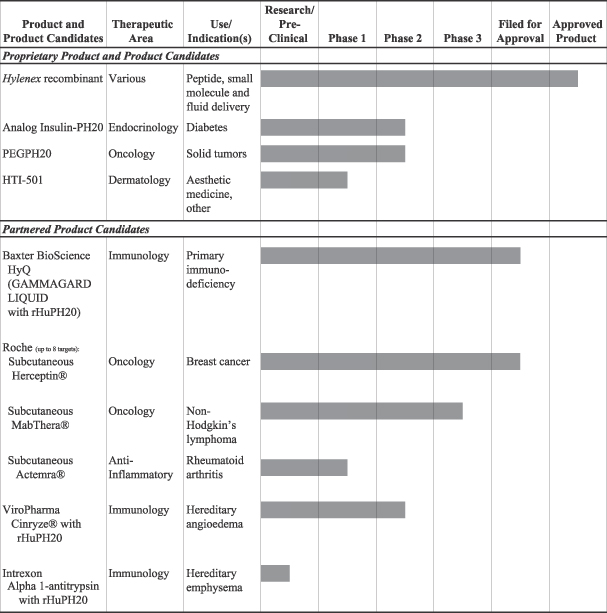

We have one marketed product and multiple product candidates targeting several indications in various stages of development. The following table summarizes our proprietary product and product candidates as well as our partnered product candidates:

Ultrafast Insulin Program

Our lead proprietary program focuses on the formulation of rHuPH20 with prandial (mealtime) insulins for the treatment of diabetes mellitus. Diabetes mellitus is an increasingly prevalent, costly condition associated with substantial morbidity and mortality. Attaining and maintaining normal blood sugar levels to minimize the long-term clinical risks is a key treatment goal for diabetic patients. We have combined rHuPH20 with a rapid acting analog insulin, e.g., insulin lispro (Humalog®), or Lispro-PH20, insulin aspart (Novolog®), or Aspart-PH20, and

4

Table of Contents

insulin glulisine (Apidra®), or each such combination, Analog-PH20, to accelerate their action. These Analog-PH20 combinations facilitate faster insulin dispersion in, and absorption from, the subcutaneous space into the vascular compartment, leading to faster insulin response. By making mealtime insulin onset faster, i.e., providing earlier insulin to the blood and thus earlier glucose lowering activity, Analog-PH20 may yield a better profile of insulin effect, more like that found in healthy, non-diabetic people.

The primary goal of our ultrafast insulin program is to develop a best-in-class insulin product, with demonstrated clinical benefits for type 1 and 2 diabetes mellitus patients, in comparison to the current standard of care analog products. With a more rapidly absorbed, faster acting insulin product, we seek to demonstrate one or more significant improvements relative to existing treatment, such as improved glycemic control, less hypoglycemia, and less weight gain. A number of Phase 1 and Phase 2 clinical pharmacology trials and registration trial-enabling treatment studies in connection with our ultrafast insulin program investigating the various attributes of our insulin candidates, have been completed, are ongoing or planned. The status of some of these trials is summarized below:

| • | In June 2011, we reported results from the first stage of an insulin pump study comparing Aspart-PH20 versus aspart alone at the Scientific Sessions of the American Diabetes Association in San Diego, California. The results demonstrated that Aspart-PH20 has pharmacokinetic and glucodynamic profiles that were accelerated and showed more consistent absorption and action rates over infusion set life as compared to analog alone, and the Aspart-PH20 also provided a reduction of post-meal glycemic excursions relative to aspart alone. |

| • | In October 2011, we announced positive results from the second stage of an insulin pump study in patients with type 1 diabetes at the Diabetes Technology Meeting in San Francisco, California, which took place from October 27 to 29, 2011. This Phase 1b study was conducted as a randomized, double-blind, crossover design, to determine insulin pharmacokinetics, glucodynamics, safety and tolerability of rHuPH20 as a single injection prior to the start of three days of commercially available mealtime insulin aspart pump infusion therapy. The data demonstrated that pre-administration of rHuPH20 led to a consistent and faster insulin exposure profile over the infusion set life and superior glucose control following meals. Compared to insulin aspart alone, pre-administration with rHuPH20 reduced the variability in insulin exposure and action profiles observed with continuous insulin infusion and provided a consistent ultrafast profile over three days of use. In the test meal setting, the consistent ultrafast profile with pre-administration of rHuPH20 led to consistently reduced postprandial excursions. Insulin aspart infusion with and without rHuPH20 pretreatment was similarly well tolerated. |

| • | In October 2011, we announced the positive results from two Phase 2 clinical trials of our ultrafast Analog-PH20 injection formulations in patients with type 1 and type 2 diabetes. More than 110 patients enrolled in each of the trials and received an insulin analog alone or an Analog-PH20 treatment for 12 weeks along with basal insulin, followed by the opposite treatment for an additional 12 weeks in a 2-way double blind crossover design. The primary endpoint of each study was a comparison of glycemic control, the main measurement that people with diabetes use to assess treatment effectiveness, as assessed by the change in HbA1C from baseline. Data regarding post-prandial glucose levels, the proportion of patients that safely achieve HbA1C targets, rates of hypoglycemia, weight change and additional endpoints were collected as well. Both trials met the primary endpoint of non-inferiority for HbA1C, which reflects average blood sugar level over a prolonged period of time, compared to the insulin analog comparator, with superior reductions in post-prandial glucose excursions in the Analog-PH20 arms. Compared to insulin analog alone, Analog-PH20 use resulted in a greater than 50% increase in the proportion of both type 1 and type 2 patients able to consistently achieve AACE (American Association of Clinical Endocrinologists) post-prandial glucose targets at both one and two hours. In the study of patients with type 1 diabetes, overall hypoglycemia (defined either as blood glucose <70 mg/dL or <56 mg/dL) was modestly but statistically significantly reduced for both definitions of hypoglycemia compared to analog alone; in the study of patients with type 2 diabetes hypoglycemia rates were comparable between treatment groups. Hypoglycemia events were generally mild, and adverse events with Analog-PH20 |

5

Table of Contents

| formulations were similar to those observed during the insulin analog comparator phase. We currently expect to present the detailed results of these studies at a major medical meeting in 2012. |

We view Analog-PH20 for injection and pump therapy as distinct product opportunities that could be pursued separately. Based on the data we have seen thus far, we believe that a large biotech or pharmaceutical company with global access to the primary care markets would be best positioned to maximize the value of the injectable market, and therefore entering into a collaboration would be an attractive option for us to exploit this opportunity. We believe that the pre-administration of rHuPH20 could be the best product offering for the pump market. The next step will be for us to evaluate this opportunity using Hylenex recombinant in a clinical study (rHuPH20 is the underlying drug delivery technology in Hylenex recombinant). We expect to present results from this study at an appropriate scientific meeting in 2012.

PEGPH20

We are developing an investigational PEGylated form of rHuPH20, or PEGPH20, a new molecular entity as a candidate for the systemic treatment of tumors that accumulate HA. PEGylation refers to the attachment of polyethylene glycol to rHuPH20, now known as PEGPH20, which converts rHuPH20 from a transient and short-lived enzyme to a more stable entity in blood that can be used to treat systemic disease.

Certain cancers, including pancreatic, lung, breast, colon and prostate cancers, have been shown to accumulate high levels of HA. Aberrant accumulation of this component of the tumor’s infrastructure supports a protective network that surrounds certain tumors. This pathologic accumulation of HA along with other matrix components creates a unique microenvironment for the growth of tumor cells compared to normal cells. We believe that depleting the HA component of the tumor architecture with PEGPH20 disrupts the tumor microenvironment and opens the previously constricted vessels to allow anti-cancer therapies to have greater access to the tumor, which may enhance the chemotherapy’s treatment effect. Increased blood flow may also enhance radiotherapy treatment effect. We have generated data showing that disrupting the specialized environment around tumors will directly inhibit the growth. Because HA accumulates in about 25% of all solid tumors, we believe that PEGPH20 has the potential to help patients with many different kinds of cancer.

We are currently conducting a Phase 1 clinical trial with PEGPH20 in the treatment of solid tumors. This trial incorporates the use of oral dexamethasone as prophylactic treatment for all patients prior to receiving intravenous administration of PEGPH20 and subsequent post-dose oral dexamethasone. We are also conducting a Phase 2 clinical trial, with a Phase 1b run-in period, for patients with metastatic pancreatic cancer. In the on-going Phase 1b portion, the patients will receive PEGPH20 in combination with gemcitabine. The objective of the phase 1b is to identity the recommended phase 2 dose of PEGPH20 in combination with gemcitabine. The phase 2 will be a randomized, double-blind, placebo-controlled study to assess safety, tolerability, and efficacy of PEGPH20 in combination with gemcitabine versus gemcitabine alone.

HTI-501

HTI-501, a recombinant human proteinase known as cathepsin L, is a lysosomal proteinase that acts by degrading collagen and is our first conditionally-active biologic. Collagen is an abundant protein in the body, particularly in connective tissue, and is present in high amounts in the extracellular matrix in the form of collagen fibers. Collagens are a class of helical proteins that are assembled into macromolecular fibrils and fibers. The collagen fiber network provides a structural scaffolding framework in the extracellular matrix. In the skin, these collagen fibers connect the superficial epithelial tissues to the underlying connective tissues. Collagen abnormalities contribute to a number of conditions, including frozen shoulder, Dupuytren’s contracture, Peyronie’s disease and cellulite.

A conditionally active biologic is a molecule that is only active under certain physiological conditions. HTI-501 is active under mildly acidic conditions and inactive at the pH normally found in the tissue. The enzyme

6

Table of Contents

is combined with a low pH buffer and injected in its active state. The enzyme is only active locally and for a short period of time. Once the mildly acidic conditions of the HTI-501 administration have been neutralized by the body, the enzyme becomes inactive. We intend to harness this conditional activity to exert control over the duration and location of the enzyme’s therapeutic activity, potentially improving the efficacy or safety of this product candidate for both medical and aesthetic conditions.

We are exploring HTI-501 as an approach to the treatment of edematous fibrosclerotic panniculopathy, also known as cellulite. The condition affects 80 to 90 percent of post-adolescent women and is prevalent in all races. The collagen fibers, or fibrous septa, anchor the epidermis against the swelling of subcutaneous fat, which creates the dimpled appearance associated with the condition. We believe that HTI-501 acts by releasing the tension in the collagenous fibrous septa and smooth the dimpled appearance of the skin. HTI-501 has the potential to be studied as a treatment for other conditions involving collagen, such as frozen shoulder, Dupuytren’s contracture, Peyronie’s disease, keloids and hypertrophic scarring.

In September 2011, we initiated a Phase 1/2 clinical trial of HTI-501 in women with moderate to severe cellulite. The Phase 1 dose escalation portion of the trial evaluates a single injection of different HTI-501 formulations into dimpled lesions of the skin followed by a Phase 2 portion of the trial where multiple lesions will be targeted with the optimal dose and formulation. Up to 48 and 76 subjects may be enrolled in the Phase 1 and Phase 2 portions of the trial, respectively. We presented interim results from the Phase 1 proof-of-concept and local tolerability study of HTI-501 at the 8th World Congress of the International Academy of Cosmetic Dermatology in Cancun, Mexico, which was held from January 31- February 3, 2012. In the ongoing Phase 1 portion of the clinical trial, no serious or severe adverse events have been reported and the injection has been well tolerated. The most common adverse event has been mild to moderate pain at the injection site that was generally bilateral (present at both investigational drug and buffer control injection sites), lasted a few minutes and did not require treatment. Data from this study support commencement of the future Phase 2 portion of the clinical trial.

Enhanze Technology

Enhanze technology is a proprietary delivery platform using rHuPH20. This enzyme temporarily degrades HA. We believe this temporary degradation creates an opportunistic window for the improved subcutaneous delivery of injectable biologics, such as monoclonal antibodies and other large therapeutic molecules, as well as small molecules and fluids. The HA reconstitutes its normal density within several days and, therefore, we anticipate that any effect of the rHuPH20 on the architecture of the subcutaneous space is temporary. By using our rHuPH20 enzyme, many therapeutics that could normally only be injected intravenously can now be administered subcutaneously. This change in the route of delivery to subcutaneous from intravenous, or IV, can often improve patient convenience, enhance pharmacokinetics, boost efficacy, extend the product lifecycle and reduce cost.

We currently have Enhanze technology partnerships with Roche, Baxter, ViroPharma and Intrexon. We are currently pursuing additional partnerships with biopharmaceutical companies that market drugs requiring or benefiting from injection via the subcutaneous route of administration.

Roche Partnership

In December 2006, we and Roche entered into an agreement under which Roche obtained a worldwide, exclusive license to develop and commercialize product combinations of rHuPH20 with up to thirteen Roche target compounds, or the Roche Partnership. Roche initially had the exclusive right to apply rHuPH20 to only three pre-defined Roche biologic targets with the option to exclusively develop and commercialize rHuPH20 with ten additional targets. As of December 31, 2011, Roche has elected a total of five exclusive targets and retains the option to develop and commercialize rHuPH20 with three additional targets through the payment of annual license maintenance fees. Pending the successful completion of various clinical, regulatory and sales

7

Table of Contents

events, Roche will be obligated to make milestone payments to us, as well as royalty payments on the sales of products that result from the partnership.

Clinical trials have commenced for compounds directed at three of the five Roche exclusive targets under the Roche Partnership. One compound formulated with rHuPH20 (subcutaneous Herceptin®) has completed a Phase 3 clinical trial, one compound formulated with rHuPH20 (subcutaneous MabThera®) is in a Phase 3 clinical trial and one compound formulated with rHuPH20 (subcutaneous Actemra®) has completed a Phase 1 clinical trial.

In October 2011, Roche announced positive top line results from the Phase 3 clinical trial in women with early HER2-positive breast cancer who received a fixed dose of a new subcutaneously delivered version of Roche’s anticancer biologic, Herceptin (trastuzumab), or Herceptin SC. In the study, the subcutaneous formulation showed comparable results to Herceptin given as an IV infusion, or Herceptin IV. Herceptin SC takes about 5 minutes to administer whereas Herceptin IV takes about 30 minutes to infuse. Roche is also developing an auto-injector device that should further simplify the process and could enable patients to be dosed at home or in the doctor’s office rather than at an infusion clinic or hospital. The ready to use formulation may also significantly reduce pharmacy time as no medicine preparation time is required. This Phase 3 clinical trial was an open-label trial involving 596 women with HER2-positive early breast cancer. The trial was designed to compare trastuzumab concentration in the blood (pharmacokinetics), efficacy (pathologic complete response) and safety of Herceptin SC to that of Herceptin IV. The trial met its co-primary endpoints that were trastuzumab concentration in the blood (serum concentrations) and efficacy. No new safety signals were observed and adverse events were overall consistent with Herceptin IV. Herceptin is approved to treat HER2-positive breast cancer and currently is given intravenously. Breast cancer is the most common cancer among women worldwide. Each year, more than 1.4 million new cases of breast cancer are diagnosed worldwide, and nearly 450,000 people will die of the disease annually. In HER2-positive breast cancer, increased quantities of the HER2 protein are present on the surface of the tumor cells. This is known as ‘HER2 positivity’ and affects approximately 15-20% of people with breast cancer. Roche recently announced that data from this trial will be presented at the European Breast Cancer Conference in Vienna, which will be held from March 21 to 24, 2012. In early March 2012, we announced that Roche has submitted a Line Extension Application to the European Medicines Agency for Herceptin SC.

In February 2011, Roche began a Phase 3 clinical trial for a subcutaneous formulation of MabThera (rituximab) or MabThera SC. The study investigates pharmacokinetics, efficacy and safety of MabThera SC. IV administered MabThera is approved for the treatment of non-Hodgkin’s lymphoma (NHL) and Chronic Lymphocytic Leukemia (CLL), types of cancer that affects lymphocytes, or white blood cells. An estimated 66,000 new cases of NHL were diagnosed in the U.S. in 2009 with approximately 125,000 new cases reported worldwide. Roche has stated that they will present data from the program in 2012 and plans to file a marketing application to regulatory authorities in the European Union in 2012.

In 2009, Roche completed a Phase 1 clinical trial for a subcutaneous formulation of Actemra. This trial investigated the safety and pharmacokinetics of subcutaneous Actemra in patients with rheumatoid arthritis. The results from this Phase 1 trial suggest that further exploration may be warranted. Actemra administered intravenously is approved for the treatment of rheumatoid arthritis. Roche is separately developing a subcutaneous form of Actemra that does not use rHuPH20 and is being investigated for weekly or biweekly administration.

Additional information about the Phase 3 subcutaneous Herceptin and Phase 3 subcutaneous MabThera clinical trials can be found at www.clinicaltrials.gov and www.roche-trials.com. Information available on these websites is not incorporated into this report.

8

Table of Contents

Baxter Gammagard Partnership

GAMMAGARD LIQUID is a current Baxter product that is indicated for the treatment of primary immunodeficiency disorders associated with defects in the immune system. In September 2007, we and Baxter entered into an agreement under which Baxter obtained a worldwide, exclusive license to develop and commercialize product combinations of rHuPH20 with GAMMAGARD LIQUID, or HyQ, or the Gammagard Partnership. Pending the successful completion of various regulatory and sales milestones, Baxter will be obligated to make milestone payments to us, as well as royalty payments on the sales of products that result from the partnership. Baxter is responsible for all development, manufacturing, clinical, regulatory, sales and marketing costs under the Gammagard Partnership, while we will be responsible for the supply of the rHuPH20 enzyme. We perform research and development activities at the request of Baxter, which are reimbursed by Baxter under the terms of the Gammagard Partnership. In addition, Baxter has certain product development and commercialization obligations in major markets identified in the Gammagard License. Baxter filed for regulatory approval of HyQ in the US in the second quarter of 2011. In September 2011, Baxter announced that it had submitted an application to the European Medicines Agency’s Committee for Human Medicinal products seeking marketing approval for HyQ.

ViroPharma Partnership

Effective May 10, 2011, we and ViroPharma entered into a collaboration and license agreement under which ViroPharma obtained a worldwide exclusive license for the use of rHuPH20 enzyme in the development of a subcutaneous injectable formulation of ViroPharma’s commercialized product, Cinryze® (C1 esterase inhibitor [human]), or the ViroPharma Partnership. In addition, the license provides ViroPharma with exclusivity to C1 esterase inhibitor and to the hereditary angioedema indication, along with three additional orphan indications. ViroPharma is solely responsible for the development, manufacturing, regulatory approval and marketing of any products resulting from this partnership. We are entitled to receive payments for research and development services and supply of bulk formulation of rHuPH20 (active pharmaceutical ingredients, or API), if requested by ViroPharma. We are also entitled to receive milestone payments and royalties on product sales by ViroPharma. ViroPharma may terminate the agreement prior to expiration for any reason on a product-by-product basis upon 90 days’ prior written notice to us. Upon any such termination, the license granted to ViroPharma (in total or with respect to the terminated product, as applicable) will terminate.

In September 2011, ViroPharma announced that they had initiated an open-label, multiple-dose Phase 2 clinical trial designed to evaluate the safety, pharmacokinetics and pharmacodynamics of subcutaneous administration of Cinryze in combination with rHuPH20 in 12 subjects with hereditary angioedema. Hereditary angioedema is a rare, debilitating and potentially fatal genetic disease. On December 6, 2011, we and ViroPharma announced positive top line data from this Phase 2 study of subcutaneous delivery of Cinryze in combination with rHuPH20, which are informative for the trial design of the upcoming Phase 2 dose ranging combination study. The preliminary data suggest that rHuPH20 enhances the delivery and absorption of Cinryze and increases systemic exposure to C1 esterase inhibitor relative to subcutaneous Cinryze administered alone. We believe this product candidate could improve flexibility and convenience, and potentially allow prevention-minded patients living with hereditary angioedema to self administer every three or four days, just as they do today with the current IV formulation, but with a single subcutaneous injection.

Intrexon Partnership

Effective June 6, 2011, we and Intrexon entered into a collaboration and license agreement under which Intrexon obtained a worldwide exclusive license for the use of rHuPH20 enzyme in the development of a subcutaneous injectable formulation of Intrexon’s recombinant human alpha 1-antitrypsin (rHuA1AT), or the Intrexon Partnership. In addition, the license provides Intrexon with exclusivity for a defined indication, or Exclusive Field. Intrexon is solely responsible for the development, manufacturing, regulatory approval and marketing of any products resulting from this partnership. We are entitled to receive payments for research and

9

Table of Contents

development services and supply of rHuPH20 API if requested by Intrexon. We are also entitled to receive milestone payments and royalties on product sales. Intrexon may terminate the agreement prior to expiration for any reason on a product-by-product basis upon 90 days’ prior written notice to us. Upon any such termination, the license granted to Intrexon (in total or with respect to the terminated product, as applicable) will terminate. Intrexon’s chief executive officer and chairman of its board of directors is also a member of our board of directors.

For the years ended December 31, 2011, 2010 and 2009, 19%, 52% and 76% of total revenues, respectively, were from Roche and 42%, 42% and 20% of total revenues, respectively, were from Baxter. In addition, for the year ended December 31, 2011, 22% and 16% of total revenues were from Viropharma and Intrexon, respectively. For information regarding our revenues from external customers, please see Note 2, Summary of Significant Accounting Policies — Concentrations of Credit Risk, Sources of Supply and Significant Customers, in our consolidated financial statements included elsewhere in this report.

Hylenex Recombinant

Hylenex recombinant is a formulation of rHuPH20 that has received FDA approval to facilitate subcutaneous fluid administration for achieving hydration; to increase the dispersion and absorption of other injected drugs; and in subcutaneous urography for improving resorption of radiopaque agents.

In February 2007, we and Baxter amended certain existing agreements relating to Hylenex recombinant and entered into the Hylenex Partnership for kits and formulations with rHuPH20. In October 2009, Baxter commenced the commercial launch of Hylenex recombinant. Hylenex recombinant was voluntarily recalled in May 2010 because a portion of the Hylenex recombinant manufactured by Baxter was not in compliance with regulatory requirements. During the second quarter of 2011, we submitted the data that the FDA had requested to support the reintroduction of Hylenex recombinant. The FDA approved the submitted data and granted the reintroduction of Hylenex recombinant and we reintroduced Hylenex recombinant to the market in December 2011.

Effective January 7, 2011, we and Baxter mutually agreed to terminate the Hylenex Partnership and the associated agreements. In June 2011, we entered into a commercial manufacturing and supply agreement with Baxter, under which Baxter fills and finishes Hylenex recombinant for us. On July 18, 2011, we and Baxter entered into a Transition Agreement setting forth certain rights, data and assets to be transferred by Baxter to us during a transition period. The termination of these agreements does not affect the other relationships between the parties, including the application of our Enhanze technology to Baxter’s GAMMAGARD LIQUID.

Patents and Proprietary Rights

Patents and other proprietary rights are essential to our business. Our success will depend in part on our ability to obtain patent protection for our inventions, to preserve our trade secrets and to operate without infringing the proprietary rights of third parties. Our strategy is to actively pursue patent protection in the United States and certain foreign jurisdictions for technology that we believe to be proprietary to us and that offers us a potential competitive advantage. Our patent portfolio includes thirteen issued patents, including one granted European patent, and a number of pending patent applications. We are the exclusive licensee of the University of Connecticut under a patent covering the DNA sequence that encodes human hyaluronidase. This patent expires in 2015. We have a patent issued by the U.S. Patent and Trademark Office pertaining to recombinant human hyaluronidase which expires in 2027. A European patent, EP1603541, claiming rHuPH20 was granted to us on November 11, 2009 with claims to the human PH20 glycoprotein, PEGylated variants, a method of producing the glycoprotein produced by recombinant methods, and pharmaceutical compositions with other agents, including antibodies, insulins, cytokines, a chemotherapeutic agent and additional therapeutic classes. A third party opposed this patent in the European Patent Office in 2010, but withdrew the opposition in March 2012. We are currently attempting to resolve the opposition with the European Patent Office, and although we expect to obtain

10

Table of Contents

European patent protection that would be no less broad than claims previously issued in a counterpart United States patent (U.S. Patent No. 7,767,429), there can be no assurance that we will be able to do so. In addition, we have under prosecution throughout the world, multiple patent applications that relate to the recombinant human hyaluronidase and methods of using and manufacturing recombinant human hyaluronidase (expiration of which applications can only be definitely determined upon maturation to our issued patents). We believe our patent filings represent a barrier to entry for potential competitors looking to utilize these hyaluronidases.

In addition to patents, we rely on unpatented trade secrets, proprietary know-how and continuing technological innovation. We seek protection of these trade secrets, proprietary know-how and innovation, in part, through confidentiality and proprietary information agreements. Our policy is to require our employees, directors, consultants, advisors, partners, outside scientific collaborators and sponsored researchers, other advisors and other individuals and entities to execute confidentiality agreements upon the start of employment, consulting or other contractual relationships with us. These agreements provide that all confidential information developed or made known to the individual or entity during the course of the relationship is to be kept confidential and not disclosed to third parties except in specific circumstances. In the case of employees and some other parties, the agreements provide that all inventions conceived by the individual will be our exclusive property. Despite the use of these agreements and our efforts to protect our intellectual property, there will always be a risk of unauthorized use or disclosure of information. Furthermore, our trade secrets may otherwise become known to, or be independently developed by, our competitors.

We also file trademark applications to protect the names of our products and product candidates. These applications may not mature to registration and may be challenged by third parties. We are pursuing trademark protection in a number of different countries around the world. There can be no assurances that registered or unregistered trademarks or trade names of our company will not infringe on third parties rights or will be acceptable to regulatory agencies.

Research and Development Activities

Our research and development expenses consist primarily of costs associated with the development and manufacturing of our product candidates, compensation and other expenses for research and development personnel, supplies and materials, costs for consultants and related contract research, clinical trials, facility costs and amortization and depreciation. We charge all research and development expenses to operations as they are incurred. Our research and development activities are primarily focused on the development of our various product candidates.

Since our inception in 1998 through December 31, 2011, we have incurred research and development expenses of $259.1 million. From January 1, 2009 through December 31, 2011, approximately 30% and 16% of our research and development expenses were associated with the development of our ultrafast insulin and PEGPH20 product candidates, respectively. Due to the uncertainty in obtaining the FDA and other regulatory approvals, our reliance on third parties and competitive pressures, we are unable to estimate with any certainty the additional costs we will incur in the continued development of our proprietary product candidates for commercialization. However, we expect our research and development expenses to increase as our product candidates advance into later stages of clinical development.

Manufacturing

We have existing supply agreements with contract manufacturing organizations Avid Bioservices, Inc., or Avid, and Cook Pharmica LLC, or Cook, to produce supplies of bulk rHuPH20 API. These manufacturers each produce API under current Good Manufacturing Practices, or cGMP, for clinical uses. In addition, Avid currently produces API for Hylenex recombinant. Avid and Cook will also provide support for the chemistry, manufacturing and controls sections for FDA and other regulatory filings. We rely on their ability to successfully manufacture these batches according to product specifications, though Cook has limited experience

11

Table of Contents

manufacturing our API. In addition, as a result of our contractual obligations to Roche, we have been required to significantly scale up our commercial API production at Cook during the last two years. The ability of Cook to obtain status as a cGMP-approved manufacturing facility and the ability of both manufacturers to (i) retain their status as cGMP-approved manufacturing facilities; (ii) to successfully scale up our API production; or (iii) manufacture the API required by our proprietary and partnered products and product candidates is essential to our corporate strategy.

In June 2011, we entered into a commercial manufacturing and supply agreement with Baxter, a cGMP-approved manufacturing facility. Under the terms of the manufacturing agreement with Baxter, Baxter provides the final fill and finish steps in the production process of Hylenex recombinant. The initial term of the agreement with Baxter extends until December 2012 and is renewable for one additional year upon mutual agreement. In June 2011, we entered into a services agreement with another third party manufacturer for the technology transfer and fill and finish of Hylenex recombinant in order to increase capacity and allow more favorable pricing.

Sales, Marketing and Distribution

HYLENEX Recombinant

We reintroduced Hylenex recombinant to the market in December 2011 after resolution of the voluntary recall and the return by Baxter of marketing rights to us. Upon its return to the market, we intend to take advantage of the initial marketing inroads achieved by Baxter. We are continuing to assess our commercial and strategic options for the product to address additional uses.

We sell Hylenex recombinant in the United States to wholesale distributors, who in turn sell to hospitals, ambulatory surgery centers and other end-users. Decisions made by the customers of the wholesale distributors regarding the levels of inventory they hold, and thus the amount of Hylenex they purchase, may affect the level of product sales in any particular period.

We have engaged Integrated Commercial Solutions, or ICS, a division of AmerisourceBergen Specialty Group, a subsidiary of AmerisourceBergen, to act as our exclusive distributor for commercial shipment and distribution of Hylenex recombinant to our customers in the United States. In addition to distribution services, ICS provides us with other key services related to logistics, warehousing, returns and inventory management, contract administration and chargeback processing and accounts receivable management. In addition, we utilize third parties to perform various other services for us relating to regulatory monitoring, including call center management, adverse event reporting, safety database management and other product maintenance services.

Competition

HYLENEX Recombinant

Other manufacturers have FDA-approved products for use as spreading agents, including ISTA Pharmaceuticals, Inc., with an ovine (ram) hyaluronidase, Vitrase®. In addition, some commercial pharmacies compound hyaluronidase preparations for institutions and physicians even though compounded preparations are not FDA-approved products.

12

Table of Contents

Government Regulations

The FDA and comparable regulatory agencies in foreign countries regulate extensively the manufacture and sale of the pharmaceutical products that we have developed or currently are developing. The FDA has established guidelines and safety standards that are applicable to the laboratory and preclinical evaluation and clinical investigation of therapeutic products and stringent regulations that govern the manufacture and sale of these products. The process of obtaining regulatory approval for a new therapeutic product usually requires a significant amount of time and substantial resources. The steps typically required before a product can be produced and marketed for human use include:

| • | animal pharmacology studies to obtain preliminary information on the safety and efficacy of a drug; or |

| • | laboratory and preclinical evaluation in vitro and in vivo including extensive toxicology studies. |

The results of these laboratory and preclinical studies may be submitted to the FDA as part of an investigational new drug, or IND, application. The sponsor of an IND application may commence human testing of the compound 30 days after submission of the IND, unless notified to the contrary by the FDA.

The clinical testing program for a new drug typically involves three phases:

| • | Phase 1 investigations are generally conducted in healthy subjects (in certain instances, Phase 1 studies that determine the maximum tolerated dose and initial safety of the product candidate are performed in patients with the disease); |

| • | Phase 2 studies are conducted in limited numbers of subjects with the disease or condition to be treated and are aimed at determining the most effective dose and schedule of administration, evaluating both safety and whether the product demonstrates therapeutic effectiveness against the disease; and |

| • | Phase 3 studies involve large, well-controlled investigations in diseased subjects and are aimed at verifying the safety and effectiveness of the drug. |

Data from all clinical studies, as well as all laboratory and preclinical studies and evidence of product quality, are typically submitted to the FDA in a new drug application, or NDA. The results of the preclinical and clinical testing of a biologic product candidate are submitted to the FDA in the form of a biologic license application, or BLA, for evaluation to determine whether the product candidate may be approved for commercial sale. In responding to a BLA or NDA, the FDA may grant marketing approval, request additional information, or deny the application. Although the FDA’s requirements for clinical trials are well established and we believe that we have planned and conducted our clinical trials in accordance with the FDA’s applicable regulations and guidelines, these requirements, including requirements relating to testing the safety of drug candidates, may be subject to change as a result of recent announcements regarding safety problems with approved drugs. Additionally, we could be required to conduct additional trials beyond what we had planned due to the FDA’s safety and/or efficacy concerns or due to differing interpretations of the meaning of our clinical data. (See Part I, Item 1A, “Risk Factors.”)

The FDA’s Center for Drug Evaluation and Research must approve an NDA and the FDA’s Center for Biologics Evaluation and Research must approve a BLA for a drug before it may be marketed in the United States. If we begin to market our proposed products for commercial sale in the U.S., any manufacturing operations that may be established in or outside the United States will also be subject to rigorous regulation, including compliance with cGMP. We also may be subject to regulation under the Occupational Safety and Health Act, the Environmental Protection Act, the Toxic Substance Control Act, the Export Control Act and other present and future laws of general application. In addition, the handling, care and use of laboratory animals are subject to the Guidelines for the Humane Use and Care of Laboratory Animals published by the National Institutes of Health.

Regulatory obligations continue post-approval, and include the reporting of adverse events when a drug is utilized in the broader patient population. Promotion and marketing of drugs is also strictly regulated, with

13

Table of Contents

penalties imposed for violations of FDA regulations, the Lanham Act and other federal and state laws, including the federal anti-kickback statute.

We currently intend to continue to seek, directly or through our partners, approval to market our products and product candidates in foreign countries, which may have regulatory processes that differ materially from those of the FDA. We anticipate that we will rely upon pharmaceutical or biotechnology companies to license our proposed products or independent consultants to seek approvals to market our proposed products in foreign countries. We cannot assure you that approvals to market any of our proposed products can be obtained in any country. Approval to market a product in any one foreign country does not necessarily indicate that approval can be obtained in other countries.

From time to time, legislation is drafted and introduced in Congress that could significantly change the statutory provisions governing the approval, manufacturing and marketing of drug products. In addition, FDA regulations and guidance are often revised or reinterpreted by the agency or reviewing courts in ways that may significantly affect our business and development of our product candidates and any products that we may commercialize. It is impossible to predict whether additional legislative changes will be enacted, or FDA regulations, guidance or interpretations changed, or what the impact of any such changes may be.

Segment Information

We operate our business as one segment, which includes all activities related to the research, development and commercialization of human enzymes that either transiently modify tissue under the skin to facilitate injection of other therapies or correct diseased tissue structures for clinical benefit. This segment also includes revenues and expenses related to (i) research and development activities conducted under our collaboration agreements with third parties and (ii) product sales of Hylenex recombinant. The chief operating decision-makers review the operating results on an aggregate basis and manage the operations as a single operating segment. We had no foreign based operations and no long-lived assets located in foreign countries for the years ended December 31, 2011, 2010 and 2009.

Executive Officers of the Registrant

Information concerning our executive officers, including their names, ages and certain biographical information can be found in Part III, Item 10. “Directors, Executive Officers and Corporate Governance.” This information is incorporated by reference into Part I of this report.

Employees

As of March 1, 2012, we had 135 full-time employees, including 95 engaged in research and clinical development activities. Included in our total headcount are 41 employees who hold Ph.D. or M.D. degrees. None of our employees are unionized and we believe our relationship with our employees is good.

Risks Related To Our Business

We have generated only minimal revenue from product sales to date; we have a history of net losses and negative cash flow, and we may never achieve or maintain profitability.

Relative to expenses incurred in our operations, we have generated only minimal revenues from product sales, licensing fees, milestone payments and research reimbursements to date and we may never generate sufficient revenues from future product sales, licensing fees and milestone payments to offset expenses. Even if we ultimately do achieve significant revenues from product sales, licensing fees, research reimbursements and/or milestone payments, we expect to incur significant operating losses over the next few years. We have never been profitable, and we may never become profitable. Through December 31, 2011, we have incurred aggregate net losses of approximately $245.0 million.

14

Table of Contents

If our proprietary and partnered product candidates do not receive and maintain regulatory approvals, or if approvals are not obtained in a timely manner, such failure or delay would substantially impair our ability to generate revenues.

Approval from the FDA is necessary to manufacture and market pharmaceutical products in the United States and the other countries in which we anticipate doing business have similar requirements. The process for obtaining FDA and other regulatory approvals is extensive, time-consuming and costly, and there is no guarantee that the FDA or other regulatory bodies will approve any applications that may be filed with respect to any of our proprietary or partnered product candidates, or that the timing of any such approval will be appropriate for the desired product launch schedule for a product candidate. We, and our partners, attempt to provide guidance as to the timing for the filing and acceptance of such regulatory approvals, but such filings and approvals may not occur on the originally anticipated timeline, or at all. Only one of our partnered product candidates is currently in the regulatory approval process and there are no proprietary product candidates currently in the regulatory approval process. We and our partners may not be successful in obtaining such approvals for any potential products in a timely manner, or at all. See “ — Our proprietary and partnered product candidates may not receive regulatory approvals for a variety of reasons, including unsuccessful clinical trials” for additional information relating the approval of product candidates.

Additionally, in order to continue to manufacture and market pharmaceutical products, we must maintain our regulatory approvals. If we or any of our partners are unsuccessful in maintaining our regulatory approvals, our ability to generate revenues would be adversely affected.

If our contract manufacturers are unable to manufacture significant amounts of the API used in our products and product candidates, our product development and commercialization efforts could be delayed or stopped and our collaborative partnerships could be damaged.

We have existing supply agreements with contract manufacturing organizations Avid and Cook to produce bulk API. These manufacturers each produce API under cGMP for clinical uses. In addition, Avid currently produces API for Hylenex recombinant. Avid and Cook will also provide support for the chemistry, manufacturing and controls sections for FDA and other regulatory filings. We rely on their ability to successfully manufacture these batches according to product specifications and Cook has relatively limited experience manufacturing our API. In addition, as a result of our contractual obligations to Roche, we have been required to significantly scale up our commercial API production at Cook during the last two years. If Cook is unable to obtain status as a cGMP-approved manufacturing facility, or if either Avid or Cook: (i) are unable to retain status as cGMP-approved manufacturing facilities; (ii) are unable to otherwise successfully scale up our API production; or (iii) fail to manufacture the API required by our proprietary and partnered products and product candidates for any other reason, our business will be adversely affected. We have not established, and may not be able to establish, favorable arrangements with additional API manufacturers and suppliers of the ingredients necessary to manufacture the API should the existing manufacturers and suppliers become unavailable or in the event that our existing manufacturers and suppliers are unable to adequately perform their responsibilities. We have attempted to mitigate the impact of supply interruption through the establishment of excess API inventory, but there can be no assurances that this safety stock will be maintained or that it will be sufficient to address any delays, interruptions or other problems experienced by Avid and/or Cook. Any delays, interruptions or other problems regarding the ability of Avid and/or Cook to supply API on a timely basis could: (i) cause the delay of clinical trials or otherwise delay or prevent the regulatory approval of proprietary or partnered product candidates; (ii) delay or prevent the effective commercialization of proprietary or partnered products and/or (iii) cause us to breach contractual obligations to deliver API to our partners. Such delays would likely damage our relationship with our partners under our key collaboration agreements and they would have a material adverse effect on our business and financial condition.

15

Table of Contents

If any party to a key collaboration agreement, including us, fails to perform material obligations under such agreement, or if a key collaboration agreement, or any other collaboration agreement, is terminated for any reason, our business could significantly suffer.

We have entered into multiple collaboration agreements under which we may receive significant future payments in the form of maintenance fees, milestone payments and royalties. In the event that a party fails to perform under a key collaboration agreement, or if a key collaboration agreement is terminated, the reduction in anticipated revenues could delay or suspend our product development activities for some of our product candidates, as well as our commercialization efforts for some or all of our products. In addition, the termination of a key collaboration agreement by one of our partners could materially impact our ability to enter into additional collaboration agreements with new partners on favorable terms, if at all. In certain circumstances, the termination of a key collaboration agreement would require us to revise our corporate strategy going forward and reevaluate the applications and value of our technology.

Most of our current proprietary and partnered products and product candidates rely on the rHuPH20 enzyme.

rHuPH20 is a key technological component of Enhanze technology, our ultrafast insulin program, our PEGPH20 program, Hylenex recombinant and other proprietary and partnered products and product candidates. An adverse development for rHuPH20 (e.g., an adverse regulatory determination relating to rHuPH20, we are unable to obtain sufficient quantities of rHuPH20, we are unable to obtain or maintain material proprietary rights to rHuPH20 or we discover negative characteristics of rHuPH20) would substantially impact multiple areas of our business, including current and potential partnerships, as well as proprietary programs.

Our proprietary and partnered product candidates may not receive regulatory approvals for a variety of reasons, including unsuccessful clinical trials.

Clinical testing of pharmaceutical products is a long, expensive and uncertain process and the failure or delay of a clinical trial can occur at any stage. Even if initial results of preclinical studies or clinical trial results are promising, we or our partners may obtain different results that fail to show the desired levels of safety and efficacy, or we may not, or our partners may not, obtain applicable regulatory approval for a variety of other reasons. Clinical trials for any of our proprietary or partnered product candidates could be unsuccessful, which would delay or prohibit regulatory approval and commercialization of the product candidates. In the United States and other jurisdictions, regulatory approval can be delayed, limited or not granted for many reasons, including, among others:

| • | clinical results may not meet prescribed endpoints for the studies or otherwise provide sufficient data to support the efficacy of our product candidates; |

| • | clinical and nonclinical test results may reveal side effects, adverse events or unexpected safety issues associated with the use of our product candidates; |

| • | regulatory review may not find a product candidate safe or effective enough to merit either continued testing or final approval; |

| • | regulatory review may not find that the data from preclinical testing and clinical trials justifies approval, or they may require additional studies that would significantly delay or make continued pursuit of approval commercially unattractive; |

| • | a regulatory agency may reject our trial data or disagree with our interpretations of either clinical trial data or applicable regulations; |

| • | the cost of a clinical trial may be greater than what we originally anticipate, and we may decide to not pursue regulatory approval for such a trial; |

16

Table of Contents

| • | a regulatory agency may not approve our manufacturing processes or facilities, or the processes or facilities of our partners, our contract manufacturers or our raw material suppliers; |

| • | a regulatory agency may identify problems or other deficiencies in our existing manufacturing processes or facilities, or the existing processes or facilities of our partners, our contract manufacturers or our raw material suppliers; |

| • | a regulatory agency may change its formal or informal approval requirements and policies, act contrary to previous guidance, adopt new regulations or raise new issues or concerns late in the approval process; or |

| • | a product candidate may be approved only for indications that are narrow or under conditions that place the product at a competitive disadvantage, which may limit the sales and marketing activities for such product candidate or otherwise adversely impact the commercial potential of a product. |

If a proprietary or partnered product candidate is not approved in a timely fashion on commercially viable terms, or if development of any product candidate is terminated due to difficulties or delays encountered in the regulatory approval process, it could have a material adverse impact on our business and we will become more dependent on the development of other proprietary or partnered product candidates and/or our ability to successfully acquire other products and technologies. There can be no assurances that any proprietary or partnered product candidate will receive regulatory approval in a timely manner, or at all.

We anticipate that certain proprietary and partnered products will be marketed, and perhaps manufactured, in foreign countries. The process of obtaining regulatory approvals in foreign countries is subject to delay and failure for the reasons set forth above, as well as for reasons that vary from jurisdiction to jurisdiction. The approval process varies among countries and jurisdictions and can involve additional testing. The time required to obtain approval may differ from that required to obtain FDA approval. Foreign regulatory agencies may not provide approvals on a timely basis, if at all. Approval by the FDA does not ensure approval by regulatory authorities in other countries or jurisdictions, and approval by one foreign regulatory authority does not ensure approval by regulatory authorities in other foreign countries or jurisdictions or by the FDA.

Our key partners are responsible for providing certain proprietary materials that are essential components of our partnered product candidates, and any failure to supply these materials could delay the development and commercialization efforts for these partnered product candidates and/or damage our collaborative partnerships.

Our partners are responsible for providing certain proprietary materials that are essential components of our partnered product candidates. For example, Roche is responsible for producing the Herceptin and MabThera required for its subcutaneous product candidates and Baxter is responsible for producing the GAMMAGARD LIQUID for its product candidate. If a partner, or any applicable third party service provider of a partner, encounters difficulties in the manufacture, storage, delivery, fill, finish or packaging of either components of the partnered product candidate or the partnered product candidate itself, such difficulties could: (i) cause the delay of clinical trials or otherwise delay or prevent the regulatory approval of partnered product candidates; and/or (ii) delay or prevent the effective commercialization of partnered products. Such delays could have a material adverse effect on our business and financial condition. For example, Baxter received a Warning Letter from the FDA in January 2010 regarding Baxter’s GAMMAGARD LIQUID manufacturing facility in Lessines, Belgium. The FDA indicated in March 2010 that the issues raised in the Warning Letter had been addressed by Baxter and we do not expect these issues to impact the development of the GAMMAGARD LIQUID product candidate.

If we have problems with third parties that either distribute API on our behalf or prepare, fill, finish and package our products and product candidates for distribution, our commercialization and development efforts for our products and product candidates could be delayed or stopped.

We rely on third parties to store and ship API on our behalf and to also prepare, fill, finish and package our products and product candidates prior to their distribution. If we are unable to locate third parties to perform

17

Table of Contents

these functions on terms that are acceptable to us, or if the third parties we identify fail to perform their obligations, the progress of clinical trials could be delayed or even suspended and the commercialization of approved product candidates could be delayed or prevented. For example, Hylenex recombinant was voluntarily recalled in May 2010 because a portion of the Hylenex recombinant manufactured by Baxter was not in compliance with the requirements of the underlying Hylenex recombinant agreements. During the second quarter of 2011, we submitted the data that the FDA had requested to support the reintroduction of Hylenex recombinant. The FDA approved the submitted data and granted the reintroduction of Hylenex recombinant and we reintroduced Hylenex recombinant to the market in December 2011. In June 2011, we entered into a commercial manufacturing and supply agreement with Baxter, under which Baxter will fill, finish and package Hylenex recombinant product for us. Under our commercial manufacturing and supply agreement with Baxter, Baxter has agreed to fill and finish Hylenex recombinant product for us for a limited period of time. The initial term of the commercial manufacturing and supply agreement with Baxter expires on December 31, 2012 and is renewable for one additional year upon mutual agreement. In June 2011, we entered into a services agreement with a third party manufacturer for the technology transfer and manufacture of Hylenex recombinant. While we expect to enter into a commercial manufacturing and supply agreement with a new manufacturer of Hylenex recombinant, if we are unable to find a suitable manufacturer of Hylenex recombinant prior to the expiration of the commercial manufacturing and supply agreement with Baxter or if a new manufacturer encounters difficulties in the manufacture, fill, finish or packaging of Hylenex recombinant, our business and financial condition could be adversely effected.

We may wish to raise additional capital in the next twelve months and there can be no assurance that we will be able to obtain such funds.

During the next twelve months, we may wish to raise additional capital to continue the development of our product candidates or for other current corporate purposes. Our current cash position and expected revenues during the next few years may not constitute the amount of capital necessary for us to continue the development of our proprietary product candidates and to fund general operations. In addition, if we engage in acquisitions of companies, products or technology in order to execute our business strategy, we may need to raise additional capital. We will need to raise additional capital in the future through one or more financing vehicles that may be available to us. Potential financing vehicles include: (i) the public or private issuance of securities; (ii) new collaborative agreements; and/or (iii) expansions or revisions to existing collaborative relationships.

Considering our stage of development, the nature of our capital structure and general market conditions, if we are required to raise additional capital in the future, the additional financing may not be available on favorable terms, or at all. If additional capital is not available on favorable terms when needed, we will be required to significantly reduce operating expenses through the restructuring of our operations. If we are successful in raising additional capital, a substantial number of additional shares may be issued and these shares will dilute the ownership interest of our current investors.

If we are unable to sufficiently develop our sales, marketing and distribution capabilities or enter into successful agreements with third parties to perform these functions, we will not be able to fully commercialize our products.

We may not be successful in marketing and promoting our existing product, Hylenex recombinant, product candidates or any other products we develop or acquire in the future. Our sales, marketing and distribution capabilities are very limited. In order to commercialize any products successfully, we must internally develop substantial sales, marketing and distribution capabilities or establish collaborations or other arrangements with third parties to perform these services. We do not have extensive experience in these areas, and we may not be able to establish adequate in-house sales, marketing and distribution capabilities or engage and effectively manage relationships with third parties to perform any or all of such services. To the extent that we enter into co-promotion or other licensing arrangements, our product revenues are likely to be lower than if we directly marketed and sold our products, and any revenues we receive will depend upon the efforts of third parties, whose

18

Table of Contents

efforts may not meet our expectations or be successful. These third parties would be largely responsible for the speed and scope of sales and marketing efforts, and may not dedicate the resources necessary to maximize product opportunities. Our ability to cause these third parties to increase the speed and scope of their efforts may also be limited. In addition, sales and marketing efforts could be negatively impacted by the delay or failure to obtain additional supportive clinical trial data for our products. In some cases, third party partners are responsible for conducting these additional clinical trials and our ability to increase the efforts and resources allocated to these trials may be limited. For example, in January 2011 we and Baxter mutually agreed to terminate the Hylenex Partnership and the associated agreements.

If we or our partners fail to comply with regulatory requirements, regulatory agencies may take action against us or them, which could significantly harm our business.