Attached files

| file | filename |

|---|---|

| 8-K - ESSEX PROPERTY TRUST INC 8-K 3-12-2012 - ESSEX PROPERTY TRUST, INC. | form8k.htm |

EXHIBIT 99.1

Citigroup CEO Conference

March 12-14, 2012

Via - Sunnyvale, CA

Safe Harbor Disclosure

Certain statements in this presentation, which are not historical facts, may be

considered forward-looking statements within the meaning of the federal

securities laws. The forward looking statements, some of which can be identified

by terms and phrases such as “forecast”, “estimate”, “expect”, “anticipate”,

“should”, “could”, “may”, and similar expressions, reflect the current views of

Essex Property Trust, Inc. (“Essex” or the “Company”) and its affiliates with respect

to future events and are subject to risks and uncertainties. Such forward-looking

statements involve the risk that actual results could be materially different from

those described in such forward-looking statements. Factors that could cause

actual results to be materially different are discussed under the caption “Risk

Factors” in Item 1A of the Company’s Report on Form 10-K for the year ended

December 31, 2011. All forward-looking statements and reasons why results may

differ included in this presentation are made of the date hereof, and we assume

no obligation to update any such forward-looking statements or reasons why

actual results may differ.

considered forward-looking statements within the meaning of the federal

securities laws. The forward looking statements, some of which can be identified

by terms and phrases such as “forecast”, “estimate”, “expect”, “anticipate”,

“should”, “could”, “may”, and similar expressions, reflect the current views of

Essex Property Trust, Inc. (“Essex” or the “Company”) and its affiliates with respect

to future events and are subject to risks and uncertainties. Such forward-looking

statements involve the risk that actual results could be materially different from

those described in such forward-looking statements. Factors that could cause

actual results to be materially different are discussed under the caption “Risk

Factors” in Item 1A of the Company’s Report on Form 10-K for the year ended

December 31, 2011. All forward-looking statements and reasons why results may

differ included in this presentation are made of the date hereof, and we assume

no obligation to update any such forward-looking statements or reasons why

actual results may differ.

2

Essex Property Trust, Inc.

Page

Section I. About Essex & Performance Record 3-6

Section II. National Fundamental Drivers 7-9

Section III. West Coast Apartment Outlook 10-20

Section IV. Company Information 21-30

Table of Contents

3

Essex Property Trust, Inc.

At IPO, Essex owned 16 multifamily properties (4,410 units); currently, Essex has ownership

in 160 apartment communities (32,913 units)

in 160 apartment communities (32,913 units)

§ Multifamily REIT dedicated to supply-constrained markets

- Formed in 1971

- Initial Public Offering in June 1994

• IPO stock price was $19.50 a share

• Today the stock trades around $140 per share

§ Cumulative Dividend paid in excess of $50 per share since IPO

§ Consistent operating philosophy through numerous market cycles

- Research-based strategy

- Rigorous underwriting leveraging real-time platform operating data

- Total return driven

§ Experienced management team - top executives have worked together for an average

tenure of 20 years

4

Section I. About Essex & Performance Record

About Essex Property Trust

Southern CA - 50% of NOI

Northern CA - 33% of NOI

Seattle - 17% of NOI

Essex Property Trust, Inc.

Performance Record

5

Source: NAREIT. Represents the value of a $100 investment and reinvestment of all dividends.

Essex Property Trust, Inc.

Essex Property Trust, Inc.

6

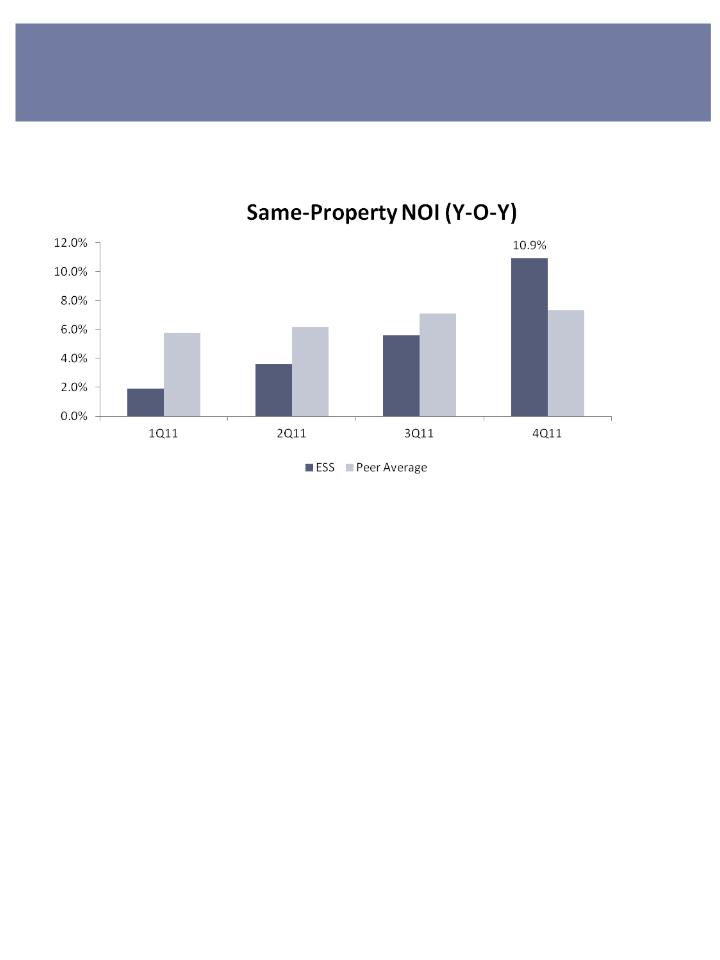

In 4Q 2011 Industry Leading NOI Growth

Accelerating and Industry Leading Same-Property NOI Growth

Source: Peer group includes 11 multifamily REITs

Essex Property Trust, Inc.

7

Section II. National Fundamental Drivers

Job growth accelerating and jobless claims abating

20-34 year olds is a key renter cohort

§ Lost fewer jobs in the recession

§ Gaining a greater percentage of jobs during the recovery

2008-2009 Share of Job Losses

2010-2011* Share of Job Gains

*Through December 2011

Source: BLS

Echo Boomers will Drive Demand with Higher Propensity to Rent

National Multifamily Fundamental Drivers

Source: U.S. Census Bureau, Robert Charles Lesser & Co., and Green Street Advisors.

Essex Property Trust, Inc.

9

Residential Supply Distortion

Essex Property Trust, Inc.

The “Distressing Gap” for homebuilders has benefited multifamily

owners as it indicates home values are too low to support for-sale

construction. Thus, we believe that new home construction will not

return in a meaningful way until distressed home sales abate. The

best indicator of this will be increasing home prices.

owners as it indicates home values are too low to support for-sale

construction. Thus, we believe that new home construction will not

return in a meaningful way until distressed home sales abate. The

best indicator of this will be increasing home prices.

Critical Factors:

§ West Coast rents declined further and recovered later relative to

other major U.S. metros

§ Better than average job growth prospects, especially in high paying

industries

§ New supply remains muted, <1% annual addition to residential stock

in Essex markets

§ High cost of for-sale housing limits transitions from renters to home

owners

Section III. West Coast Apartment Outlook

Why Essex is Maintaining the West Coast Focus?

10

Essex Property Trust, Inc.

Source: Axiometrics

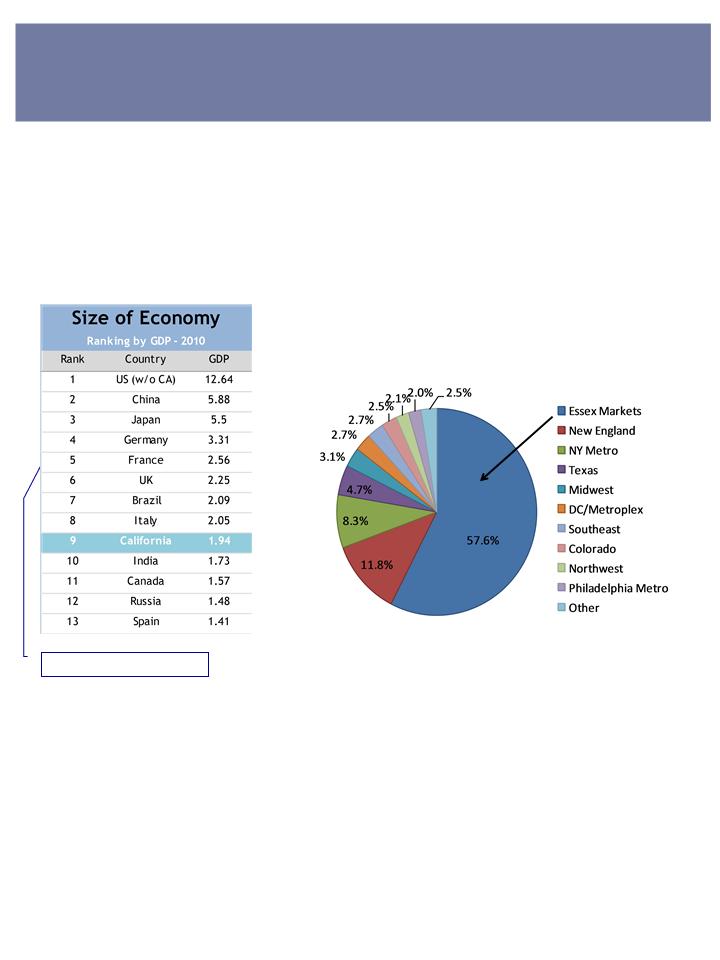

Approximately 63% of Essex’s NOI is located in the top five projected rent

growth markets in the nation over the next five years

growth markets in the nation over the next five years

Drivers of strong continued demand in Essex markets

§ California and Washington combined are the 6th largest economy in the world

§ 58% of Venture Capital spending is in our markets - key driver of growth industries & jobs

§ Incoming Echo Boomers (64 million) & quality of life factors favor the West Coast

§ Higher percentage of educated workers

Source: PriceWaterhouseCoopers

Source: World Development Indicators

Database, World Bank, 1 July 2011 & BEA

GDP of CA+WA = $2.29

The West Coast is a Dominant Economic Player

11

$3.8 billion

Essex Property Trust, Inc.

Venture Capital Spending (4Q 2011)

California Outperforms U.S. Average - Population & Jobs

|

Source: US Census

|

|

Source: BLS

|

12

Essex Property Trust, Inc.

6 Months of Outperformance

CA Outperforms

December Y-Y Job Growth: Selected Metros by % Growth

(000’s)

13

Source: BLS

§ Tech/ Energy based markets are leading the way

§ LA job growth improving and expected to be 1% in 2012

Essex Portfolio Contains Leading Job Growth Markets

Job Growth: 1.8 million jobs created in U.S. and 157,000 in Essex markets in

2011

2011

Essex Property Trust, Inc.

|

Top 20 Markets

|

Absolute

Change |

% Growth

|

|

|

|

|

|

San Jose

|

25.7

|

3.0%

|

|

Houston

|

75.8

|

3.0%

|

|

|

|

|

|

San Diego

|

26.9

|

2.2%

|

|

|

|

|

|

San Francisco

|

19.7

|

2.1%

|

|

Inland Empire

|

22.9

|

2.0%

|

|

Miami

|

18.2

|

1.8%

|

|

Jacksonville

|

10.6

|

1.8%

|

|

Orange County

|

24.6

|

1.8%

|

|

|

|

|

|

Ventura

|

4.6

|

1.7%

|

|

Dallas Ft Worth

|

45.7

|

1.6%

|

|

Boston

|

37.9

|

1.5%

|

|

Portland

|

14.3

|

1.5%

|

|

Detroit

|

24.6

|

1.4%

|

|

Baltimore

|

17.1

|

1.3%

|

|

Newark NJ

|

12.7

|

1.3%

|

|

Minneapolis

|

19.8

|

1.2%

|

|

|

|

|

|

US

|

1,767

|

1.3%

|

14

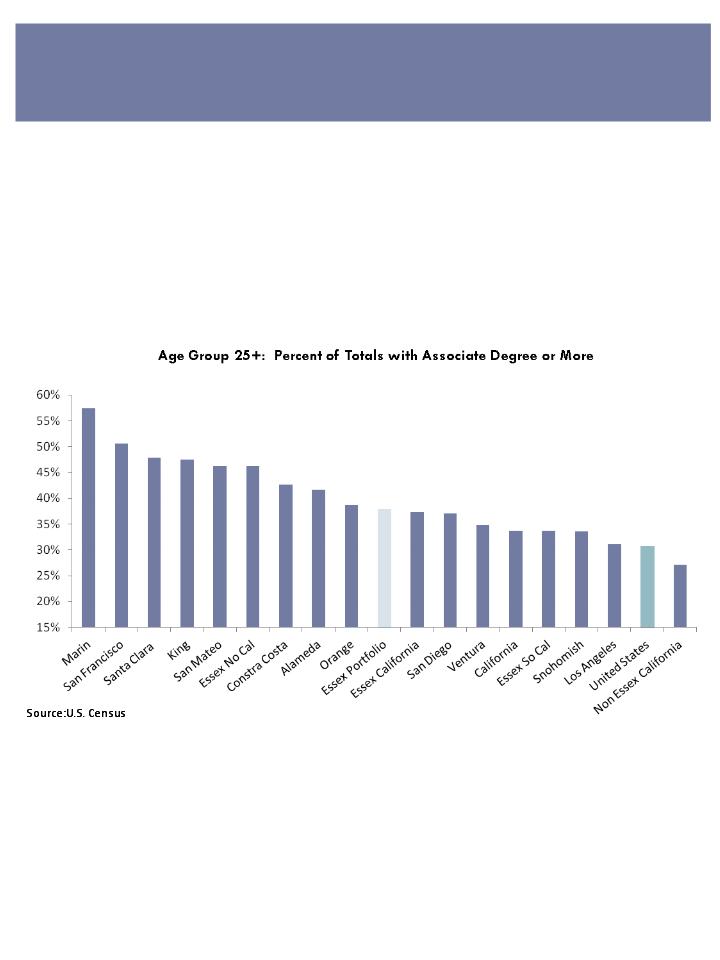

Education Data for Essex Counties & State/U.S. Data

§ Essex’s tech markets have a significantly higher percentage of college

educated workers.

§ These markets should continue to lead job and personal income growth

§ Concentrated in the highest skilled California counties

Essex Attracts Higher Wage Renters

Essex Property Trust, Inc.

15

§ High Single-Family Prices Restrict Homeownership

§ Despite the fall in home prices since 2008, prices remain high in

supply-constrained markets

|

Source: National Association of Realtors, Dataquick, Essex

|

Expensive Single Family Housing

Essex Property Trust, Inc.

16

Conclusions:

§ When single family supply recovers, we expect a sharp rebound in

the non-constrained markets

§ The coastal rental markets will have less competition from for-sale as

compared to 2003 - 2007, due to more restrictive lending standards and

higher housing costs

|

Source: U.S. Census

|

For-Sale Supply Risk Low

Essex Property Trust, Inc.

Essex Portfolio Average

Seattle Market Review

Average Rent

as a % of

Median Household Income

(in 000’s)

Job Growth

vs.

Total Residential Supply

(% change)

Actual Job Growth by Sector:

Dec. ‘11 vs. Dec. ‘10

Gap = 7.5% of

current rents

current rents

17

Source: Essex, U.S. Census, BLS

Office Absorption: 2.0% in 2011

Total Jobs Created (000’s) 36.9

0.2

11.2

6.3

0.7

-1.3

13.5

6.0

3.1

Boeing

- Expanding facilities

- Backlog of $300 billion

- Renewed commitment to WA state

Amazon

- Expands by 3 million sq ft.

0.8

-3.6

Northern California Market Review

(San Jose MSA Example)

Average Rent

as a % of

Median Household Income

(in 000’s)

Job Growth

vs.

Total Residential Supply

(% change)

Actual Job Growth by Sector:

Dec. ‘11 vs. Dec. ‘10

18

Gap = 1% of

current rents

current rents

Source: Essex, U.S. Census, BLS

Office Absorption: 3.9% in 2011

25.7

3.1

3.9

2.8

3.7

0.3

3.7

7.6

-0.2

Total Jobs Created (000’s)

1.6

-0.8

Southern California Market Review

(Los Angeles MSA Example)

Average Rent

as a % of

Median Household Income

(in 000’s)

Job Growth

vs.

Total Residential Supply

(% change)

Actual Job Growth by Sector:

Dec. ‘11 vs. Dec. ‘10

19

Gap = 9.7% of

current rents

current rents

Source: Essex, U.S. Census, BLS

Office Absorption: 0.6% for 2nd half

of 2011

of 2011

17.3

1.3

-3.7

3.1

5.4

7.2

-2.1

7.9

-0.7

-Government/construction job losses

are abating

are abating

- Y-o-Y job growth trends up in the

2nd half of 2011

2nd half of 2011

-Professional and business services

strengthening

strengthening

Total Jobs Created (000’s)

-0.6

-0.5

20

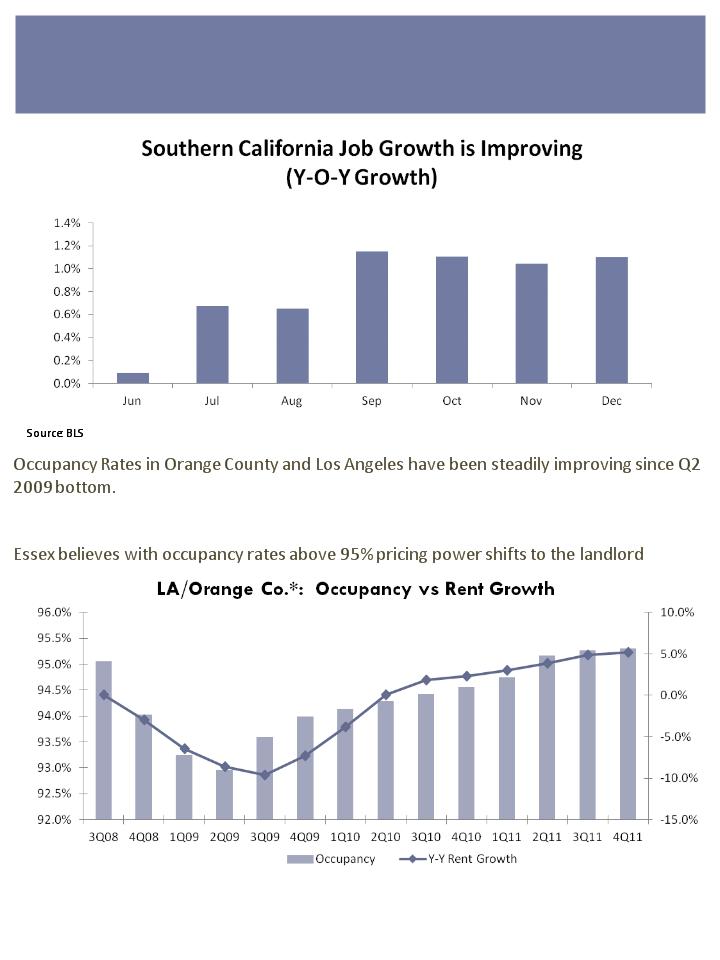

Southern California Market Review

Occupancy breaks through 95% for both markets for the first time since Q4 2007.

Essex Property Trust, Inc.

|

Source: Axiometrics, Realfacts

|

|

*LA/Orange Numerical Average

|

§ To Grow FFO/share, consistent with NAV Growth, in the top tier of

multifamily REITs

• Focus on improving operating platform

• Target acquisitions generating an unlevered return of 8.5-9%

• Target development generating at least 10% unlevered returns and

for unfunded commitments to represent 5-7% of total capital

• Target redevelopment generating unlevered returns of 8-10%

• Actively upgrade the portfolio through investment and property

sales

Section IV. Company Information

Essex Intermediate Goals

21

Essex Property Trust, Inc.

Multiple Investment Platforms

Committed approximately $2 billion of investments in acquisitions,

developments, redevelopments and co-investments since the beginning of 2010

developments, redevelopments and co-investments since the beginning of 2010

§ Acquisitions

- Targeting markets with high rent growth potential to enhance the quality

of the portfolio and to accelerate portfolio growth

- Since 2010, Essex has acquired over $1.2 billion of high quality and well-

located properties

§ Development

- Upgrading the portfolio

- Started five developments totaling $423 million in 2011

§ Co-Investments & Preferred Equity Investments

- Diversifying capital sources

- Enhancing risk adjusted returns

- Moderating portfolio volatility

§ Redevelopment

- Repositioning the portfolio and augmenting internal growth

- Capitalizing on the strategy of owning Class B quality assets in “A” locations

22

Essex Property Trust, Inc.

Active Acquirer Early in the Cycle

§ The 2010 and 2011 acquisitions are expected to generate

approximately a 5.5% yield in 2012

approximately a 5.5% yield in 2012

§ Upgraded the quality of our portfolio:

§ Average age of new investments is below the portfolio average

§ Average rents are higher as compared to the existing portfolio

Represents the consolidated same property portfolio as of 12/31/11 and the consolidated acquisitions as of 12/31/11.

23

Essex Property Trust, Inc.

Essex Skyline - Santa Ana, CA

24

416 on Broadway - Glendale, CA

Santee Court - Los Angeles, CA

Delano - Redmond, WA

Bon Terra - Redmond, WA

Reveal - Woodland Hills, CA

Anavia - Orange, CA

Allegro - Valley Village, CA

DEVELOPMENT PIPELINE

Currently have 5 active development projects totaling $423 million.

|

|

|

|

|

|

Estimated

Units |

|

Estimated retail

sq. feet |

|

Incurred to

Date |

|

Estimated

Total Cost |

|

Construction

Complete |

|

Project Name

|

|

Location

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Queen Anne (JV)

|

|

Seattle, WA

|

|

275

|

|

17,000

|

|

$33.5

|

|

$79.1

|

|

Mar-13

|

|

|

Epic (JV)

|

|

San Jose, CA

|

|

280

|

|

|

|

$36.7

|

|

$98.6

|

|

May-13

|

|

|

West Dublin (JV)

|

|

Dublin, CA

|

|

309

|

|

|

|

$23.1

|

|

$94.5

|

|

Jun-13

|

|

|

Santa Monica (JV)

|

|

West Hollywood, CA

|

|

184

|

|

12,750

|

|

$19.7

|

|

$75.4

|

|

Jul-14

|

|

|

Fountain at La Brea (JV)

|

|

West Hollywood, CA

|

|

187

|

|

18,200

|

|

$27.0

|

|

$75.0

|

|

Feb-14

|

|

|

Total Active Development Pipeline

|

|

1,235 |

|

47,950

|

|

$140.0 |

|

$422.6

|

|

|

||

ACTIVE DEVELOPMENT PIPELINE

(Dollars in Millions)

25

Essex Property Trust, Inc.

Queen Anne - Seattle, WA

Santa Monica - West Hollywood, CA

§ Capitalize on the strategy of owning Class B quality assets in “A” locations - supply

constraint in Essex markets results in older housing stock which leads to greater

renovation potential

§ Selective repositioning: rent justified improvements to maximize NOI and value

Highridge - Rancho Palos Verde, CA

255 units

$16.6 million renovation cost

$65,000 cost per unit

9.25% return

Redevelopment

Before

After

Before

After

The Pointe at Cupertino - Cupertino, CA

116 units

$8.0 million renovation cost

$69,000 cost per unit

9.5% return

REDEVELOPMENT

26

Fund & Joint Ventures

27

The co-investment program facilitates external growth via private capital,

provides a diversified source of equity and enhances risk adjusted returns.

This platform represents 19% of the units in Essex’s total portfolio.

Current Co-Investment Programs Consists of:

§ Fund II

- 14 well-positioned assets with dispositions beginning in 2012/2013

§ Programmatic Joint Ventures

- Wesco I - a 50/50 joint venture to acquire apartments. The joint

venture has invested $425 million to date.

- Wesco II - a 50/50 joint venture in preferred equity investment of $175

million

million

- Canada Pension Plan Investment Board (“CPPIB”) - 55% Essex/45%

CPPIB joint venture to develop Epic and West Dublin.

§ Single Asset Joint Venture

- Essex Skyline at MacArthur Place - a 50/50 joint venture investment in a

349-unit high-rise condominium

§ Development Joint Ventures with Regional Developers:

- Queen Anne- a 50/50 joint venture to develop and operate a 275-unit

community

community

- Fountain at La Brea - a 50/50 joint venture to develop and operate a 187-

unit community

unit community

- Santa Monica - a 50/50 joint venture to develop and operate a 184-unit

community

community

Essex Property Trust, Inc.

§ Leverage of 34% on a debt to total market capitalization basis, one of the lowest

within the multifamily peer group.

within the multifamily peer group.

§ Debt to adjusted EBITDA is expected to be approximately 7.0X by year-end 2012.

§ Nearly $400 million in available liquidity from cash on hand, marketable

securities, and unused balance on our line of credit

securities, and unused balance on our line of credit

§ Unencumbered NOI was 44% at year end 2011 vs 35% at year end 2010. Expect

to be at +50% by year end 2012.

to be at +50% by year end 2012.

§ Limited near term debt maturing with less than 15% of debt coming due over the

next 3 years

next 3 years

§ Achieved investment grade ratings : S&P: BBB; Moody’s: Baa2; and Fitch: BBB

Conservatively Proportioned and Flexible Balance Sheet

28

Source: Company filings as of 12/31/11

Essex Property Trust, Inc.

2012 Guidance

FFO Per Share Guidance

$6.50-$6.80

Same Property Revenue Growth (Midpoint)

6.0%

Same Property NOI Growth of the Consolidated portfolio (Midpoint) *

7.7%

Market Expectations

2012

2012

2012

Market

Market

Market

Job Growth

Rent Growth

Occupancy

Southern California

1.2%

6.2%

95.6%

Northern California

1.7%

8.0%

96.8%

Seattle Metro

1.8%

9.0%

95.5%

Weighted Average

1.4%

7.4%

96.0%

US Economic Assumptions

GDP Growth of 2.6%

Job Growth of 1.3%

Target Acquisitions

$300 million - $500 million

* Excludes joint ventures which have greater exposure to Seattle and Northern California

29

Essex Property Trust, Inc.

Key Strengths

§ Attractive market fundamental in our West Coast markets

§ Strong growth prospects

§ Internal growth is forecast at 7.7% in ’12

§ External growth through development and acquisitions

§ Strong balance sheet with ample financial flexibility to take

advantage of attractive opportunities as they arise

§ Proven management team with superior results

30

Essex Property Trust, Inc.

___________________________

___________________________

___________________________

___________________________

___________________________

___________________________

___________________________

___________________________

___________________________

___________________________

___________________________

___________________________

___________________________

NOTES

Via - Sunnyvale, CA

416 on Broadway - Glendale, CA

Joule - Seattle, WA

For additional information, please contact the Company’s

Investor Relations department at (650) 849-1600.

Investor Relations department at (650) 849-1600.

Fourth & U - Berkeley, CA

Axis 2300 - Irvine, CA

Arbors at Park Rose - Oxnard, CA