Attached files

| file | filename |

|---|---|

| EX-23 - EXHIBIT 23 - ATRION CORP | a5019114ex23.htm |

| EX-21 - EXHIBIT 21 - ATRION CORP | a5019114ex21.htm |

| EX-31.2 - EXHIBIT 31.2 - ATRION CORP | a5019114ex31_2.htm |

| EX-32.2 - EXHIBIT 32.2 - ATRION CORP | a5019114ex32_2.htm |

| EX-31.1 - EXHIBIT 31.1 - ATRION CORP | a5019114ex31_1.htm |

| EX-32.1 - EXHIBIT 32.1 - ATRION CORP | a5019114ex32_1.htm |

| EX-10.V - EXHIBIT 10V - ATRION CORP | a50191194ex10_v.htm |

| EXCEL - IDEA: XBRL DOCUMENT - ATRION CORP | Financial_Report.xls |

| 10-K - ATRION CORPORATION 10-K - ATRION CORP | a50191194.htm |

Exhibit 13.1

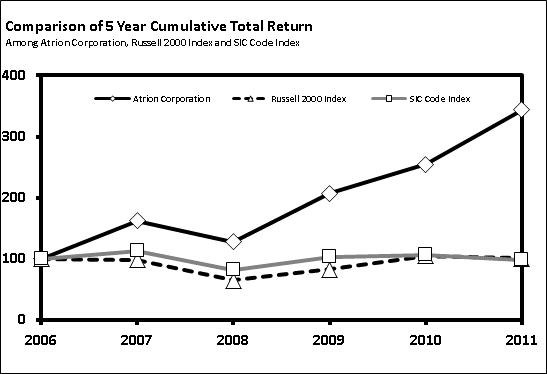

|

Company/Index

|

2006

|

2007

|

2008

|

2009

|

2010

|

2011

|

||||||||||||||||||

|

Atrion Corporation

|

$100.00 | $162.45 | $127.50 | $206.84 | $254.36 | $343.72 | ||||||||||||||||||

|

Russell 2000 Index

|

$100.00 | $98.44 | $65.18 | $82.89 | $105.16 | $100.77 | ||||||||||||||||||

|

SIC Code Index

|

$100.00 | $112.88 | $81.88 | $103.60 | $106.28 | $98.60 | ||||||||||||||||||

The graph set forth above compares the total cumulative return for the five-year period ended December 31, 2011 on the Company's common stock, the Russell 2000 Index and SIC Code 3841 Index--Surgical and Medical Instruments (compiled by Zacks Investment Research, Inc.), assuming $100 was invested on December 31, 2006 in our common stock, the Russell 2000 Index and the SIC Code Index and dividends were reinvested.