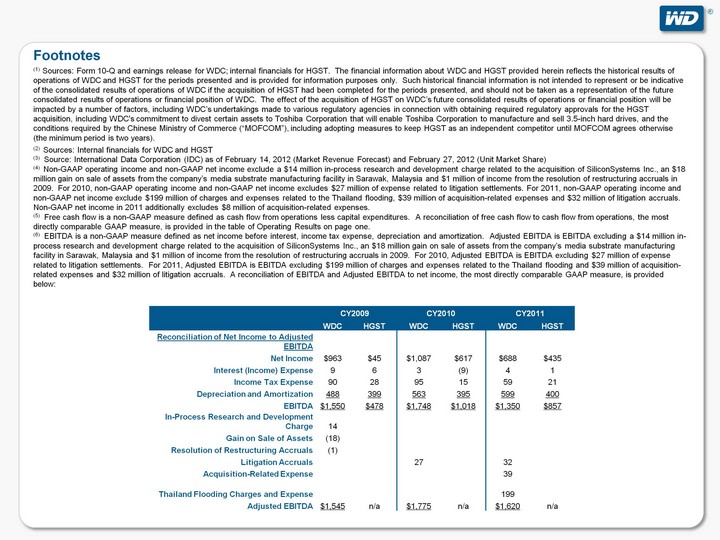

| (r) CY2009 CY2009 CY2010 CY2010 CY2011 CY2011 WDC HGST WDC HGST WDC HGST Reconciliation of Net Income to Adjusted EBITDA Net Income $963 $45 $1,087 $617 $688 $435 Interest

(Income) Expense 9 6 3 (9) 4 1 Income Tax Expense 90 28 95 15 59 21 Depreciation and Amortization 488 399 563 395 599 400 EBITDA $1,550 $478 $1,748 $1,018 $1,350 $857 In-Process Research and Development Charge 14 Gain on Sale of Assets (18)

Resolution of Restructuring Accruals (1) Litigation Accruals 27 32 Acquisition-Related Expense 39 Thailand Flooding Charges and Expense 199 Adjusted EBITDA $1,545 n/a $1,775 n/a $1,620 n/a Footnotes(1) Sources: Form 10-Q and earnings release for

WDC; internal financials for HGST. The financial information about WDC and HGST provided herein reflects the historical results of operations of WDC and HGST for the periods presented and is provided for information purposes only. Such historical

financial information is not intended to represent or be indicative of the consolidated results of operations of WDC if the acquisition of HGST had been completed for the periods presented, and should not be taken as a representation of the future

consolidated results of operations or financial position of WDC. The effect of the acquisition of HGST on WDC's future consolidated results of operations or financial position will be impacted by a number of factors, including WDC's undertakings

made to various regulatory agencies in connection with obtaining required regulatory approvals for the HGST acquisition, including WDC's commitment to divest certain assets to Toshiba Corporation that will enable Toshiba Corporation to manufacture

and sell 3.5-inch hard drives, and the conditions required by the Chinese Ministry of Commerce ("MOFCOM"), including adopting measures to keep HGST as an independent competitor until MOFCOM agrees otherwise (the minimum period is two years). (2)

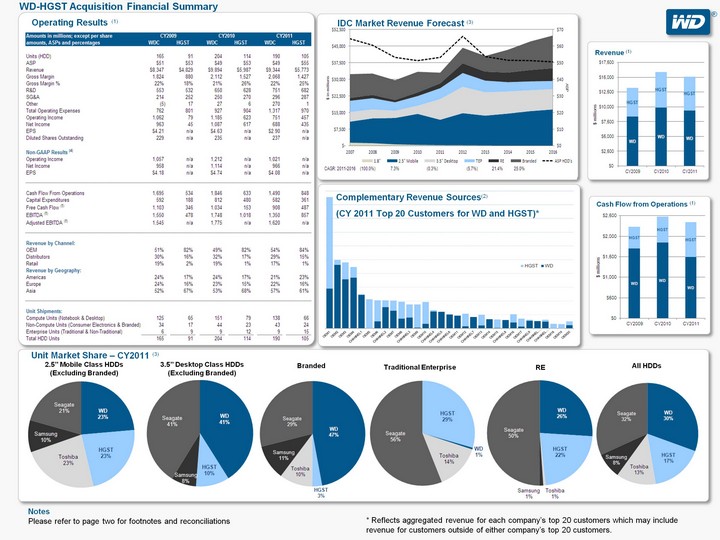

Sources: Internal financials for WDC and HGST(3) Source: International Data Corporation (IDC) as of February 14, 2012 (Market Revenue Forecast) and February 27, 2012 (Unit Market Share)(4) Non-GAAP operating income and non-GAAP net income exclude a

$14 million in-process research and development charge related to the acquisition of SiliconSystems Inc., an $18 million gain on sale of assets from the company's media substrate manufacturing facility in Sarawak, Malaysia and $1 million of income

from the resolution of restructuring accruals in 2009. For 2010, non-GAAP operating income and non-GAAP net income excludes $27 million of expense related to litigation settlements. For 2011, non-GAAP operating income and non-GAAP net income exclude

$199 million of charges and expenses related to the Thailand flooding, $39 million of acquisition-related expenses and $32 million of litigation accruals. Non-GAAP net income in 2011 additionally excludes $8 million of acquisition-related

expenses.(5) Free cash flow is a non-GAAP measure defined as cash flow from operations less capital expenditures. A reconciliation of free cash flow to cash flow from operations, the most directly comparable GAAP measure, is provided in the table of

Operating Results on page one.(6) EBITDA is a non-GAAP measure defined as net income before interest, income tax expense, depreciation and amortization. Adjusted EBITDA is EBITDA excluding a $14 million in- process research and development charge

related to the acquisition of SiliconSystems Inc., an $18 million gain on sale of assets from the company's media substrate manufacturing facility in Sarawak, Malaysia and $1 million of income from the resolution of restructuring accruals in 2009.

For 2010, Adjusted EBITDA is EBITDA excluding $27 million of expense related to litigation settlements. For 2011, Adjusted EBITDA is EBITDA excluding $199 million of charges and expenses related to the Thailand flooding and $39 million of

acquisition- related expenses and $32 million of litigation accruals. A reconciliation of EBITDA and Adjusted EBITDA to net income, the most directly comparable GAAP measure, is provided below: |