Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Crestwood Midstream Partners LP | d312713d8k.htm |

Morgan Stanley MLP and Diversified

Natural Gas Corporate Access Day

March 8, 2012

Exhibit 99.1 |

Forward Looking Statements

2

This

presentation

contains

forward-looking

statements

and

projections,

made

in

reliance

on

the

safe

harbor

provisions

of

the

Private

Securities

Litigation

Reform

Act

of

1995,

regarding

future

events,

occurrences,

circumstances,

activities,

performance,

outcomes

and

results

of

Crestwood

Midstream

Partners

LP

(“Crestwood”

or

“CMLP”).

Although

these

statements

reflect

the

current

views,

assumptions

and

expectations

of

Crestwood’s

management,

the

matters

addressed

herein

are

subject

to

numerous

risks

and

uncertainties,

which

could

cause

actual

activities,

performance,

outcomes

and

results

to

differ

materially

from

those

indicated.

However,

a

variety

of

factors

could

cause

actual

results

to

materially

differ

from

Crestwood’s

current

expectations

in

financial

condition,

results

of

operations

and

cash

flows

including, without limitation, changes in general economic conditions; fluctuations

in natural gas prices; the extent and success

of

drilling

efforts,

as

well

as

the

extent

and

quality

of

natural

gas

volumes

produced

within

proximity

of

our

assets;

failure

or

delays

by

our

customers

in

achieving

expected

production

in

their

natural

gas

projects;

competitive

conditions

in

our

industry;

actions

or

inactions

taken

or

non-performance

by

third

parties,

including

suppliers,

contractors,

operators,

processors,

transporters

and

customers;

our

ability

to

consummate

acquisitions,

successfully

integrate

acquired

businesses,

and

realize

any

cost

savings

and

other

synergies

from

any

acquisition;

fluctuations

in

the

value

of

certain

of

our

assets

and

liabilities;

changes

in

the

availability

and

cost

of

capital;

operating

hazards,

natural

disasters,

weather-related

delays,

casualty

losses

and

other

matters

beyond

our

control;

timely

receipt

of

necessary

government

approvals

and

permits,

our

ability

to

control

the

costs

of

construction,

including

costs

of

materials,

labor

and

rights-of-way

and

other

factors

that

may

impact

our

ability

to

complete

projects

within

budget

and

on

schedule;

the

effects

of

existing

and

future

laws

and

governmental

regulations,

including

environmental

and

climate

change

requirements;

the

effects

of

existing

and

future

litigation;

and

risks

related

to

our

substantial

indebtedness;

and

other

factors

disclosed

in

Crestwood’s

filings

with

the

Securities

and

Exchange

Commission.

The

forward-looking

statements

included

in

this

presentation

are

made

only

as

of

the

date

of

this

presentation,

and

we

undertake

no

obligation

to

update

any

of

these

forward-looking

statements

to

reflect

new

information,

future

events

or

circumstances

except

to

the

extent

required

by

applicable

law. |

Table of Contents

1.

Antero Marcellus Overview

2.

Crestwood Update

3.

Financial Overview

3 |

Antero Marcellus Overview

4

*

*

*

*

*

* |

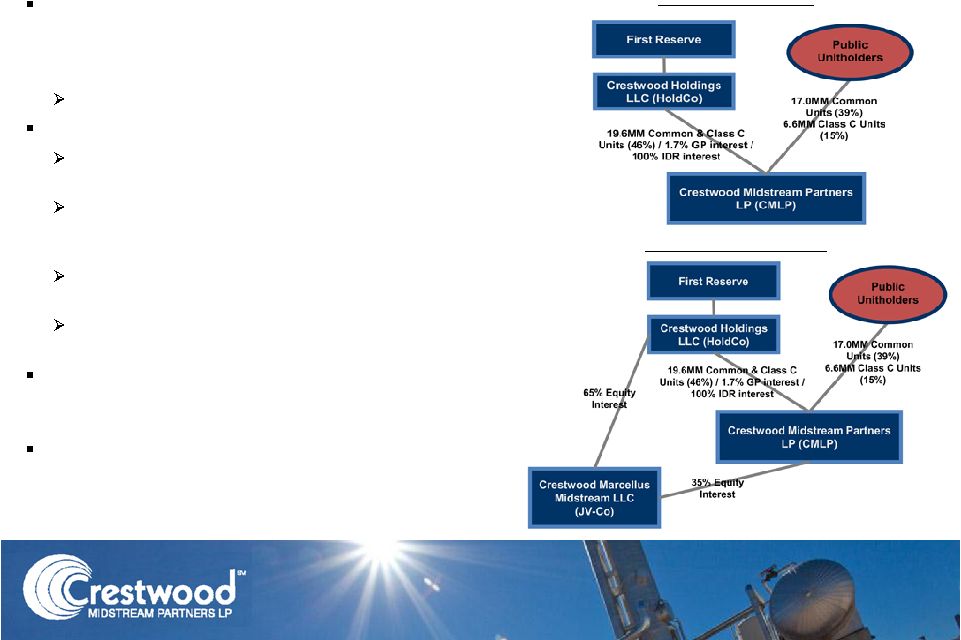

Transaction Overview

Current Structure

Joint venture (“JV-Co”) between CMLP and

Crestwood Holdings (Holdco) to acquire

gathering system assets in the Marcellus

Shale from Antero Resources

CMLP will be operator of JV-Co

Total purchase price of $375 million at closing

HoldCo to own 65% and CMLP to own 35% at

Closing

CMLP will fund its pro rata portion with

available borrowing capacity under its $500

MM revolving credit facility

New $200MM revolver at joint venture level will

fund growth capex

$40 MM potential earn-out to Antero if volumes

exceed thresholds during 2012 and 2013

Strategy for HoldCo to drop its 65% interest in

JV-Co to CMLP over time as the growth / build-

out stage is completed

CMLP has access to baked-in growth through

future drop-down acquisitions from HoldCo at

attractive multiples

5

Pro Forma Structure |

Enhances

Crestwood’s

long-term

growth

strategy

(5

th

acquisition

completed in past 18 months)

Provides material footprint in the Marcellus Shale, the premier shale

play in North America

Substantial rich-gas exposure

Provides further geographic and producer diversification

Antero is a leading unconventional gas producer with some of the

lowest F&D and net development costs in the industry

Maintains 95% fixed fee contract mix

Creates a drop-down opportunity with higher visibility to built-in growth

at CMLP

Significant downside protection through minimum volume

commitments extending through 2018

7 year right of first offer on additional rich gas acreage improves long-

term portfolio

Strategic Rationale

6 |

Transaction Merits

The Southwest portion of the Marcellus Shale is among the

most prolific natural gas play in North America

~45% of drilling locations in the rich gas window (>1075 Btu)

Increases exposure to liquids rich production areas that

provide producers greater drilling economics in today’s

low gas price environment

Opportunity to expand gathering relationship with Antero

through a 7 year right of first offer on any future

development of Antero’s Doddridge County acreage

adjacent to current Area of Dedication (“AOD”)

Substantial minimum volume commitments provide visibility

into the “ultimate downside”

risk for the transaction

At the minimum volume levels, net cash flows are sufficient to

provide accretion to CMLP’s distributable cash flow per unit

Volume commitments improve action ability for future drop-

downs

Assets Located in

Core Fairway of the

Marcellus Shale with

Material Rich Gas

Exposure

Downside

Protected by 7 Years

of Substantial

Minimum Volume

Commitments

7 |

Transaction Merits (cont’d)

Substantial experience developing unconventional resources

~300

horizontal

shale

wells

in

the

Barnett

Shale,

Woodford

Shale

and

Marcellus

Shale

Antero is drilling top-tier wells in the Marcellus Shale and has

consistenty been a low-cost leader across all unconventional plays

Antero currently has hedged 710 Bcfe of future production at average

NYMEX price of $5.53 / MMBtu; 84% of 2012E production hedged at

average NYMEX price of $5.69 / MMBtu

Over 35% of Antero operated Marcellus wells have an EUR of 10 Bcf or

higher

Antero to dedicate approximately 127,000 gross acres; operates 100% of

its acreage in the AOD

~2.8 Tcfe of net proved reserves attributable to Antero’s Marcellus

acreage Antero has drilled and completed 59 wells in the AOD

Average IPs of 13 MMcf/d and average EURs of 9 Bcf per well

2 years of production history to support EURs

Gross operated production within the AOD currently ~210 MMcfd

100% Fee-based, 20-year contracts

No direct commodity price exposure

Acreage Dedication

Area De-Risked

Through Substantial

Production History

100% Fee-Based

Contract Structure

Anchor Tenant with

Track Record as a

“Best In Class

Operator”

8 |

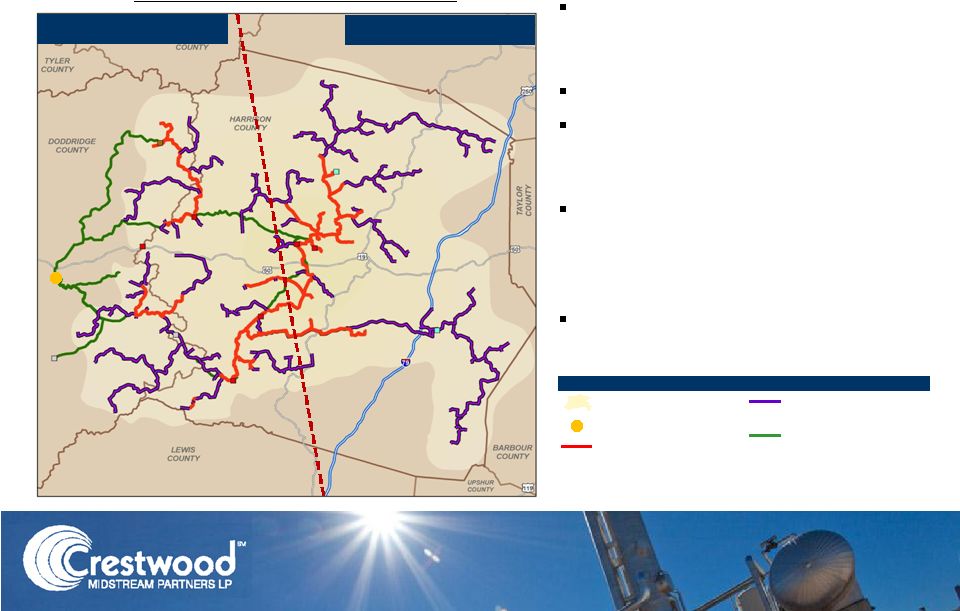

Antero Marcellus Midstream Overview

AOD encompasses ~260,000 gross

acres in most prolific gas play in

U.S.

~2.8 Tcfe of net proved reserves

Antero is currently running 6 rigs

in the AOD; ~210 MMcfd currently

flowing to the system

Significant acreage (~45%) of the

AOD in area of potential rich gas

wells that will be gathered to the

MWE Sherwood plant

Inventory of 800+ Antero wells and

300+ 3

rd

party wells

Rich Gas Service

Lean Gas Service

Legend

Area of Dedication (AOD)

Planned MWE Sherwood Plant

Pipeline in Service at YE 2012

Planned Pipeline (2013 –

2016)

Existing and Planned Third

Party Pipeline

5-Year Midstream Development Plan

9 |

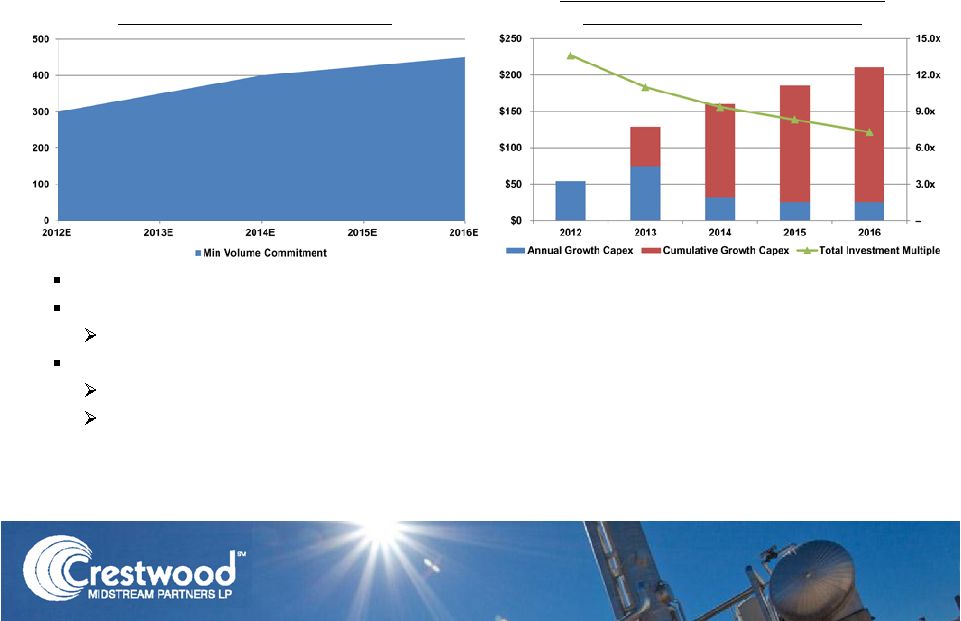

Volume Growth Drives Down Multiple

Minimum Volume Commitment

Estimated Capital Requirements and

Return on Capital Investment

(1)

1)

Return on Capital Investment represents the total cumulative capital investment for

Antero Marcellus JV (i.e. $375 MM purchase price at closing plus ~$210 MM in

estimated growth capital expenditures over the next five years) divided by the estimated cash flow attributable to the asset.

The multiple does not take capital

structure / financing plans into consideration (i.e. solely represents the cash

flow generated relative to the total capital requirements). MMcfd

($MM)

10

$375 million acquisition at closing (implied purchase multiple of 11x -

12x)

Expected future capital spend of ~$200+ million over the next five years

Financed with $200 million revolving credit facility at the JV entity

Antero’s current drilling plans generate substantial volume growth to the

system Drives

multiple

of

total

invested

capital

down

to

~6.5x

–

7.0x

by

2016

Minimum volume commitment provides high visibility to the projected growth

(significant portion of volumetric forecast over the next five years is

guaranteed) |

Crestwood Update

11

*

*

*

*

*

* |

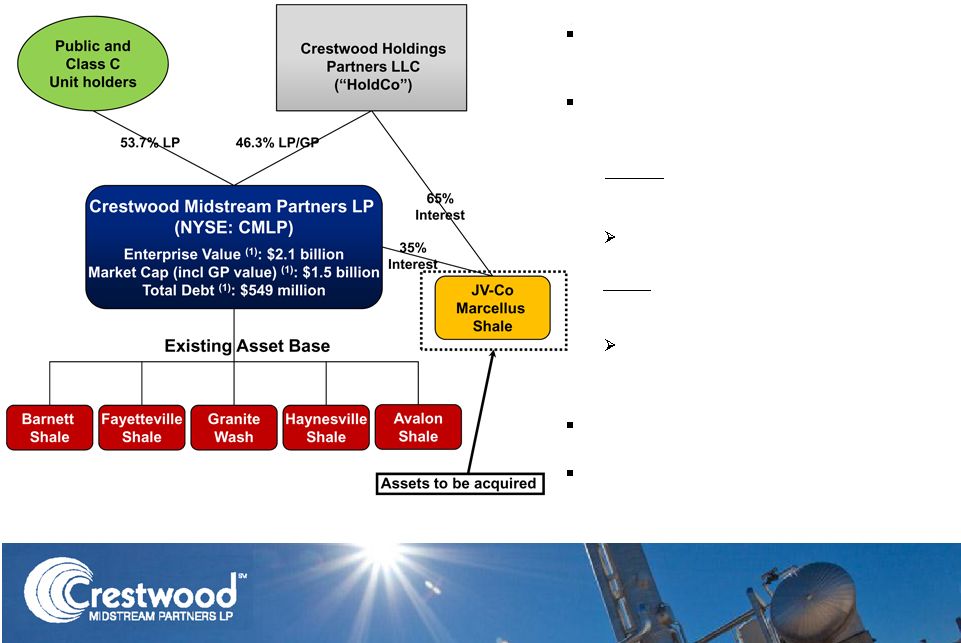

A

Consolidated Enterprise Capitalized for Growth 1)

Pro Forma CMLP’s funding of the 35% interest in the Antero Marcellus JV.

12

Capital structure provides competitive

advantage and positions Crestwood

for substantial growth

Strong sponsorship and financial

support provides access to multiple

“buckets”

of capital

HoldCo

–

First Reserve equity capital,

Term Loan B markets, JV-Co revolving

credit facility

Capital for early-stage acquisitions /

development projects

CMLP

–

equity capital markets, debt

capital markets, CMLP revolving

credit facility

Capital for acquisitions /

development projects that provide

immediate accretion to distributable

cash flow per unit

Opportunity

for

drop

down

of

assets

from

HoldCo

to

CMLP

Strategic

capital

allocation

and

financing

solutions

designed

to

maximize

value

creation |

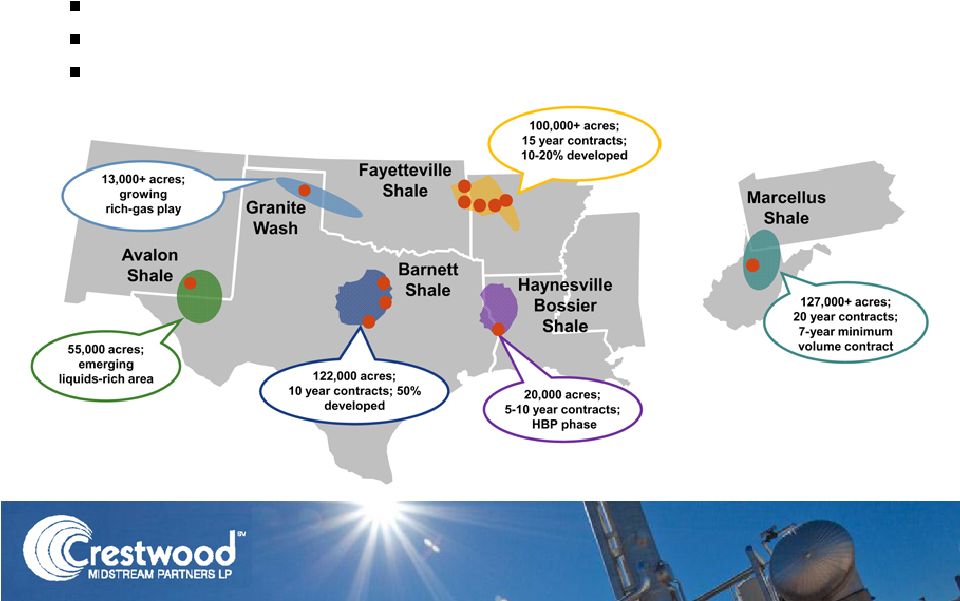

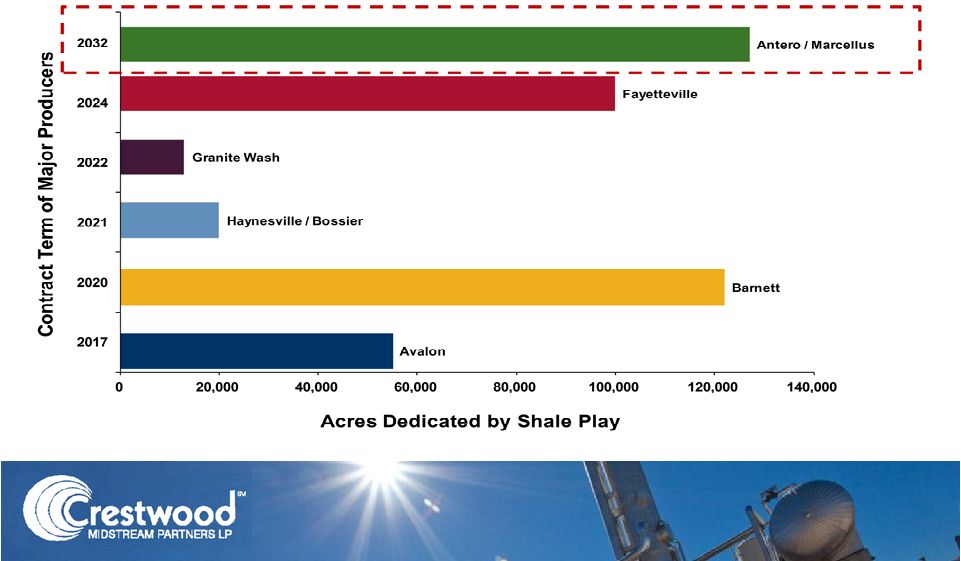

Assets in Leading Shale Plays

~437,000 acres dedicated to Crestwood pro forma for the Antero acquisition

Producer contracts extending through 2017-2032 enable long term

development Pace of drilling, well connects and capacity expansions drive

growth 13 |

Rich Gas

43%

Dry Gas

57%

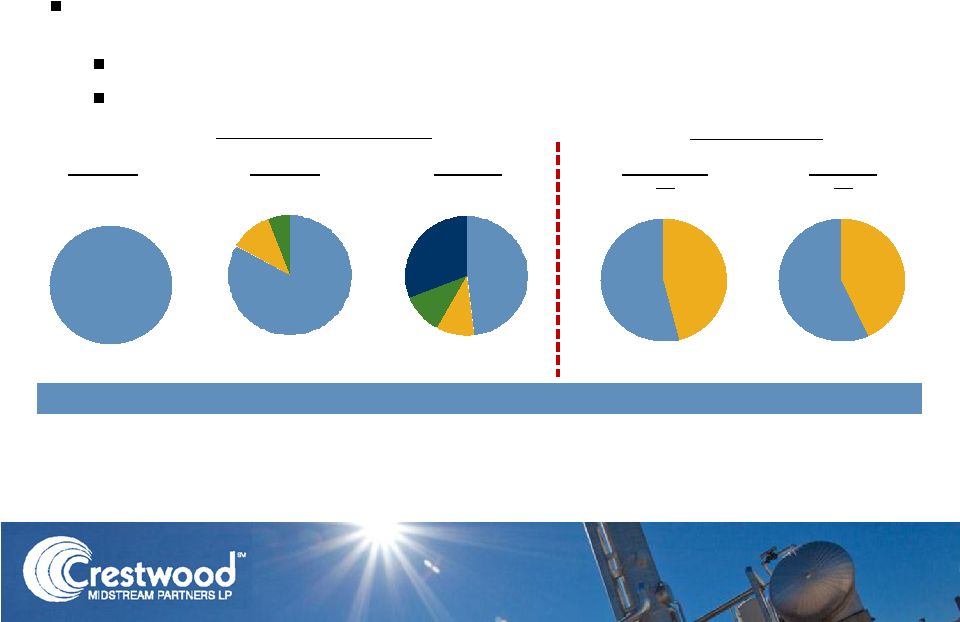

Continued Strategy of Diversification

2010A

2011A

2012E

1)

Includes Haynesville/Bossier Shale, Granite Wash, and Avalon Shale.

2)

Represents 100% of JV-Co volumes.

3)

Represents net revenues for each system (total revenues, net of product purchases).

On a gross basis, revenues from rich gas plays account for ~53% and ~51% of

total revenues in 2011 and 2012E, respectively. Revenues from dry gas plays include Alliance and Lake Arlington systems

in the Barnett Shale,

Fayetteville Shale, Haynesville/Bossier Shale and JV-Co revenues coming from

development of Antero’s dry gas acreage. Revenues from rich gas plays include

the Cowtown system in the Barnett Shale, Granite Wash, Avalon Shale and JV-Co

revenues coming from development of Antero’s rich gas acreage. Continued

Focus on De-Risking the Partnership through Diversification Expand presence

into new basins reducing single-producer and single-basin

dependence

Marcellus acquisition further reduces dependence on the Barnett Shale

~40% -

50% of Crestwood’s net revenues from rich gas plays

Barnett

100.0%

Barnett

83.0%

Other

5.7%

Fayetteville

11.3%

(1)

Fayetteville

10.1%

Barnett

48.1%

Other

10.6%

Marcellus

31.2%

(1)

Current

(3)

2012E

(3)

Rich Gas

46%

Dry Gas

54%

(2)

14

% of Gathering Volumes

% of Revenues |

Experienced Shale Producers

Barnett

Fayetteville

Haynesville

Marcellus

Granite

Wash

Eagle Ford

Quicksilver

Resources

BHP Billiton

BP

Chesapeake

XTO

Linn Energy

Comstock

Forest Oil

Devon

Antero

Note: Check marks represent areas of general operation for select producers; they

are not indicative of locations where Crestwood has contracts with select producers

15 |

Long Term Fixed Fee Contracts

Our contract portfolio is > 95% Fixed Fee

16 |

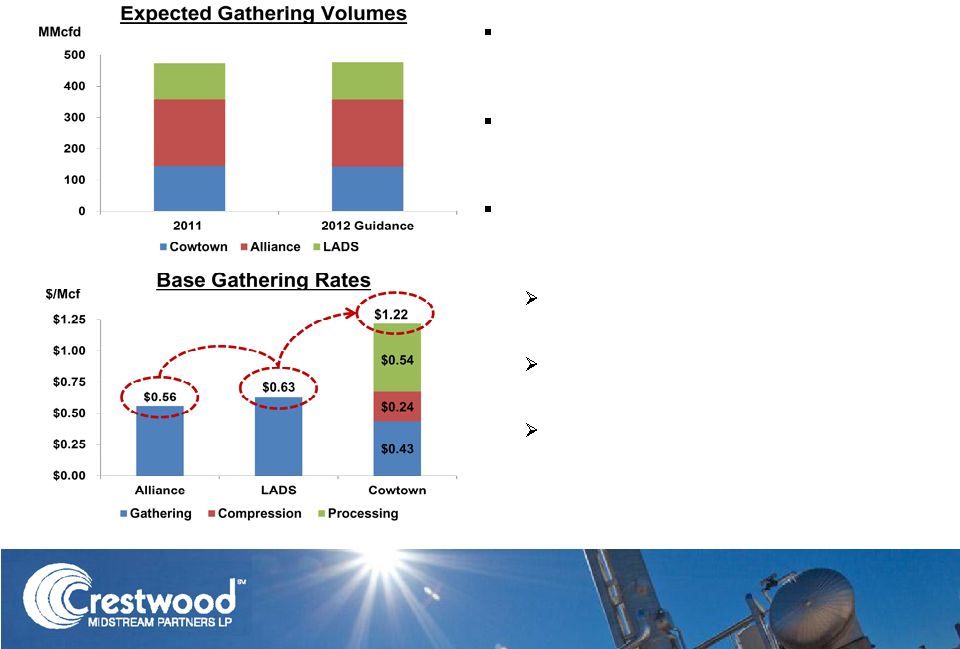

Barnett Shale Outlook

Volumes expected to be relatively flat in

Barnett Shale per latest guidance from

KWK

Significant shift in new drilling activity to

focus on liquids-rich corridor in Cowtown

gathering area

Combined gathering and processing fee in

Cowtown drives higher margin for

Crestwood

Favorable drilling economics with

current high NGL price environment

Largest acreage dedication with 10+

years of rich gas project inventory

Ample capacity to meet growing

processing demand

17 |

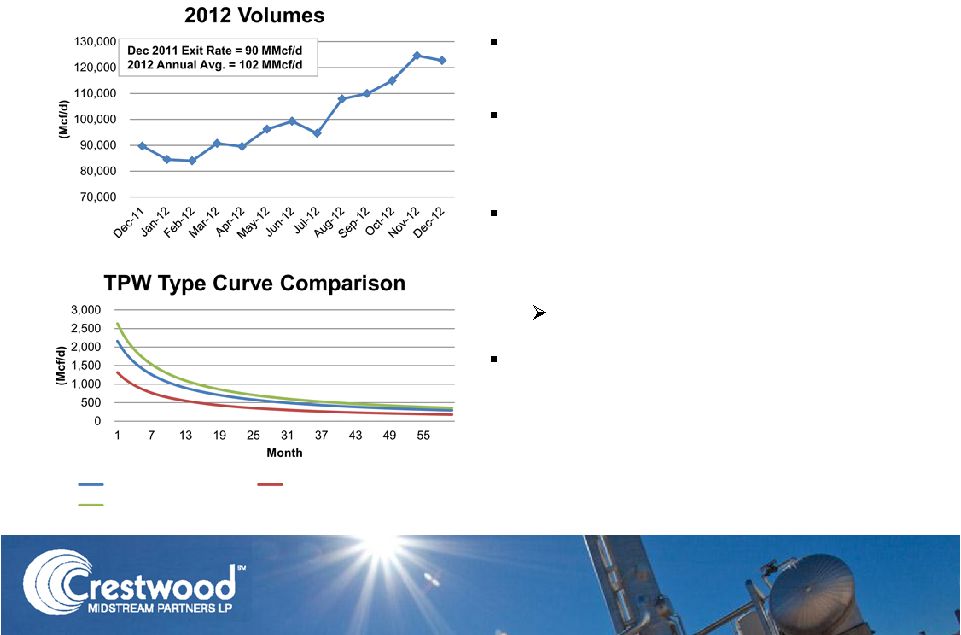

Fayetteville Shale Outlook

BHP currently running two drilling

rigs on CMLP acreage

Expected drilling and completion

activity for BHP in 2012 roughly flat

to activity from CHK in 2011

Type curve continues to outperform

the assumptions at completion of

the Frontier acquisition

Current EUR of ~3.0 Bcf

13% volume growth expected in

2012 over the December 2011 exit

rate of ~90 MMcfd

18

Acq. 2.7 Bcf EUR Curve

Acq. 1.5 Bcf EUR Curve

Updated 3.0 Bcf EUR Curve |

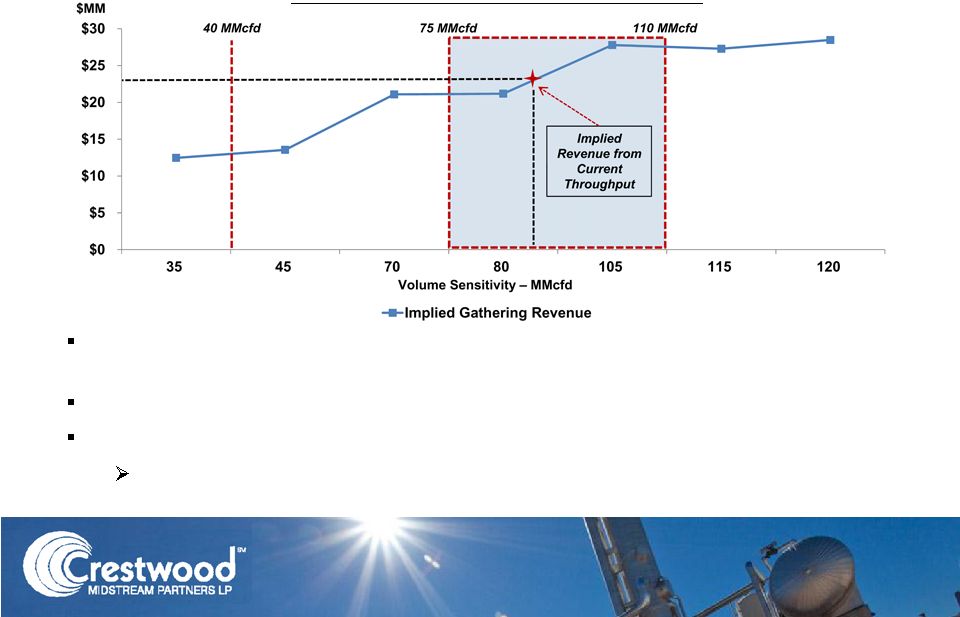

Fayetteville Shale Outlook (cont’d)

Sliding scale incentivizes producer to increase gathering volumes through

system (current rate of $0.725 / MMBtu plus treating fees)

Provides downside risk protection to Crestwood

Rate adjustments triggered at 40 MMcfd, 75 MMcfd and 110 MMcfd

Increases in throughput above 110 MMcfd produce linear increases in

revenues

Gathering Volume & Revenue Sensitivity

19 |

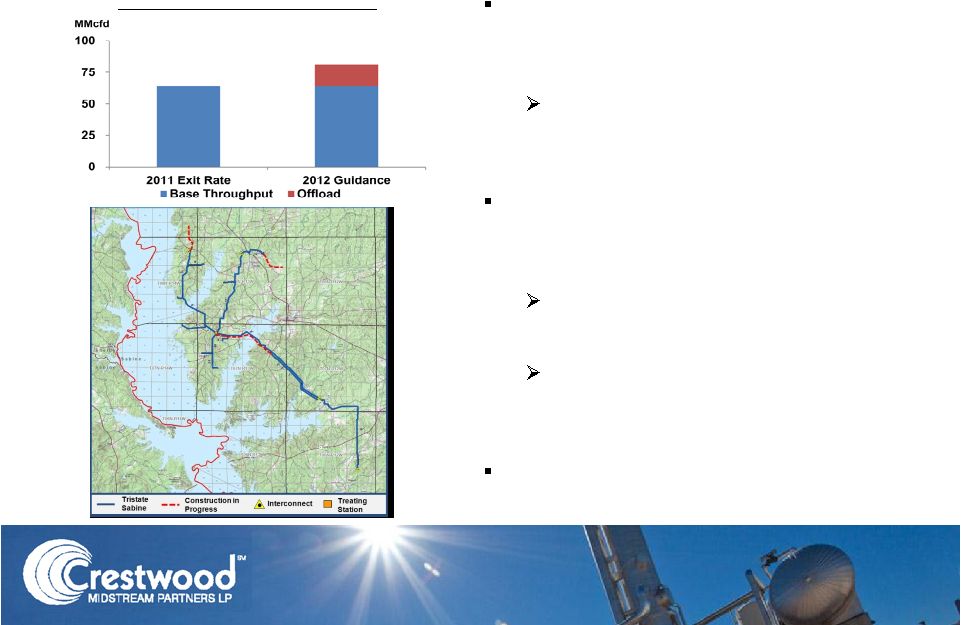

Haynesville/Bossier Outlook

Expected drilling activity in the area

continues to slow in weaker gas price

environment

Volumes from new completions

expected to be relatively flat in

2012 relative to 2011 exit rate

Total system volume growth driven by

recent off-load agreement with nearby

adjacent producer

Volumes near system capacity in

2012

Additional CO

2

treating facility

required to handle incremental

volumes

Tristate Sabine continues to prove out

as a reasonable value acquisition

Expected Gathering Volumes

20 |

Continued opportunity / optionality for CMLP’s rich gas systems (Granite Wash and

Avalon Shale) as producer activity continues to increase

No capital projects included in current 2012 guidance

Advanced discussions with existing producers continue to progress

CMLP to provide updates and adjustments to 2012 guidance once definitive agreements

are reached

120

MMcfd

and

60

MMcfd

processing

plants

available

for

immediate

installation

or

relocation

Competitive advantage over new-build projects that would likely have

multi-year lag prior to installation

Indian Creek –

Granite Wash

Granite Wash currently one of the most active plays in North America

Continued discussion with producers on opportunities for installation of available

processing capacity

Las Animas –

Avalon Shale

Substantial

increases

in

recent

drilling

activity

as

producers

work

to

“prove

up”

their

Avalon

/

Bone Spring positions

Upstream activity currently restrained by infrastructure limitations

CMLP’s footprint and readily available processing capacity provides potential

for “first mover”

advantage

Rich Gas Development Outlook

21 |

Financial Overview

22

*

*

*

*

*

*

*

* |

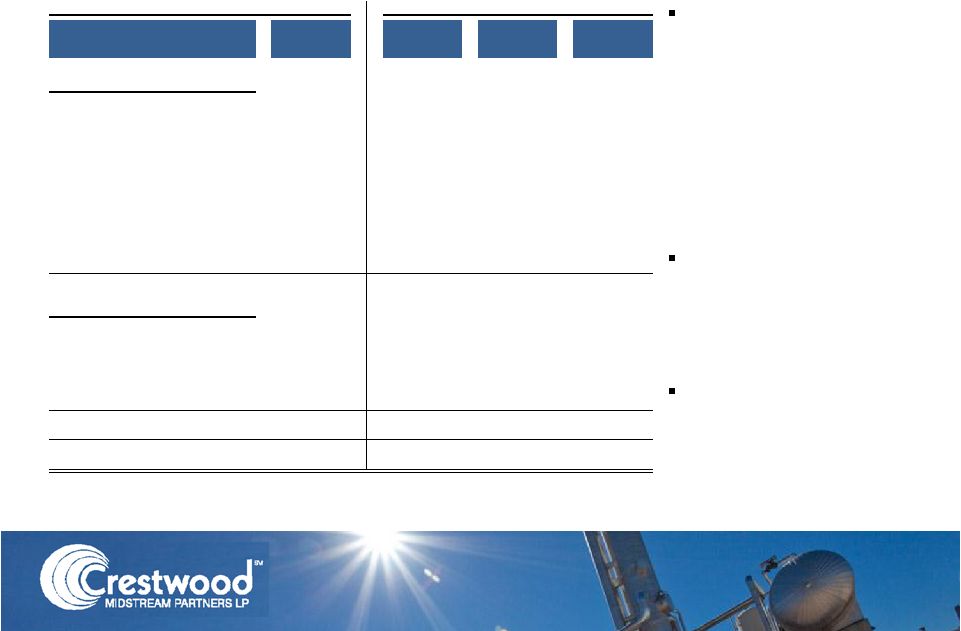

Strategically Financing Significant Growth

1)

Revolver paydown represents the balance of equity and debt financing in excess of

the actual capital requirements. 2)

$131 MM represents capital contribution for CMLP’s 35% proportionate interest

(total Antero purchase price of $375 MM). Utilization of a

consolidated capital

structure (including

continued support from

the General Partner) to

acquire and integrate

world-class assets will

always be a key

component of CMLP’s

strategy

In the last 18 months,

CMLP Management has

completed 5 acquisitions

with total transaction value

of ~$1.5 billion

Conservatively financed

growth with approximately

50% equity and 50% debt

23

Uses of Funds

Sources of Funds

Transaction

Capital

Investment

Equity

Debt

Total

Financing

Sources

($MM)

2011

Avalon Acquisition

5.1

$

-

$

5.1

$

5.1

$

Frontier Acquisition

344.6

$

153.0

$

200.0

$

353.0

$

May 2011 Follow-On Equity Offering

-

$

53.0

$

(53.0)

$

-

$

Tristate Acquisition

64.4

$

-

$

64.4

$

64.4

$

Capital Expenditures

48.4

$

-

$

48.4

$

48.4

$

Revolver Paydown

(1)

-

$

-

$

(8.4)

$

(8.4)

$

Total -

2011

462.5

$

206.0

$

256.5

$

462.5

$

2012

January 2012 Follow-On Equity

-

$

103.0

$

(103.0)

$

-

$

Antero Acquisition

(2)

131.3

$

-

$

131.3

$

131.3

$

Revolver Paydown

(1)

-

$

-

$

-

$

-

$

Total -

2012 YTD

131.3

$

103.0

$

28.3

$

131.3

$

Total -

Since January 2011

593.7

$

309.0

$

284.7

$

593.7

$

% of Total

52.0%

48.0%

100.0% |

2011 Performance

24

2011

2010

% Change

2011

2010

% Change

Volumes Gathered (MMcfd)

661.6

397.0

67%

570.3

343.3

66%

Volumes Processed (MMcfd)

148.3

125.9

18%

144.1

127.8

13%

($MM)

Revenues

59.3

$

31.3

$

205.8

$

113.6

$

Product purchases

(12.8)

-

(38.8)

-

O&M expense

(10.1)

(5.7)

(36.3)

(25.7)

G&A expense

(6.2)

(9.6)

(24.1)

(17.7)

Transaction related expenses

0.2

6.3

3.4

6.3

Adjusted EBITDA

30.4

$

22.3

$

36%

110.0

$

76.5

$

44%

Adjusted distributable cash flow

23.4

$

17.5

$

34%

87.8

$

63.3

$

39%

Cash distributions declared

20.7

$

14.3

$

70.5

$

52.4

$

Distribution coverage ratio

1.1x

1.2x

1.2x

1.2x

Retained cash flow

2.7

$

3.2

$

17.3

$

10.9

$

Distributions per Unit

0.49

$

0.43

$

14%

1.87

$

1.66

$

13%

Three Months Ended

Year Ended

December 31,

December 31, |

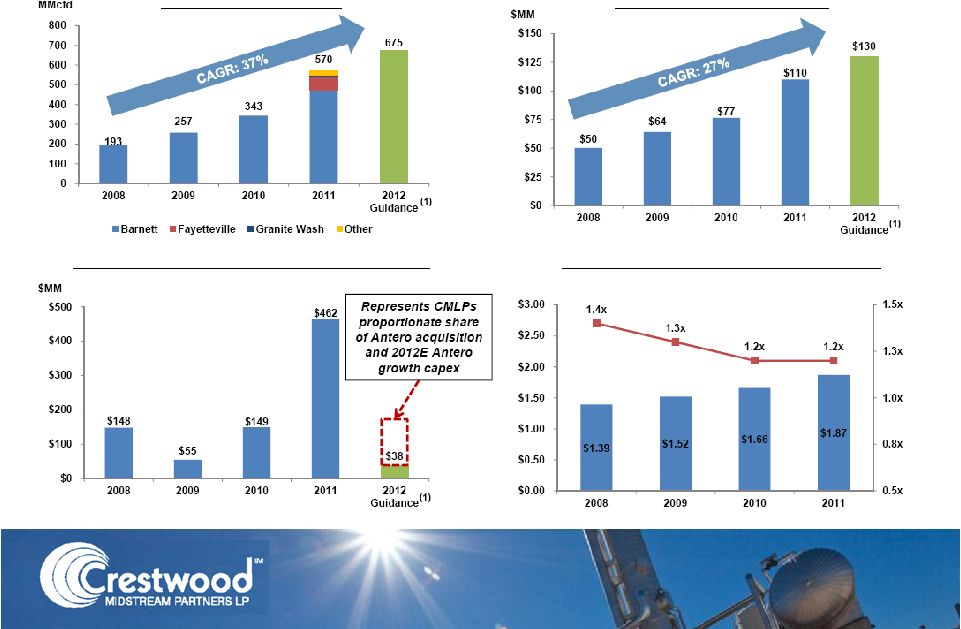

CMLP Historical Financial Summary

Throughput (MMcfd)

Adjusted EBITDA ($MM)

Capital Expenditures (Incl. Acquisitions)

Distributions per Unit and Coverage

1)

Represents the midpoint of 2012 guidance. Figures exclude contributions from the

recently announced Antero acquisition. 25 |

Capitalization and Leverage

26

Pro Forma

December 31,

Pro Forma

December 31,

Capitalization

$ Millions

2011

Adustments

2011

Revolving credit facility

312.5

$

28.5

$

(1)

341.0

$

7.75% Senior Notes

200.0

200.0

Total debt

512.5

28.5

541.0

Partners' capital

455.6

102.8

(1)

558.4

Total capitalization

968.1

$

131.3

$

1,099.4

$

Debt / Total capitalization

53%

49%

Pro Forma LTM Adjusted EBITDA

119.1

$

(2)

5.1

$

(3)

124.2

$

Debt / Pro Forma Adjusted EBITDA

4.3x

4.4x

Maximum Permitted Leverage

5.5x

5.5x

(Increase from 5.0x for 270 days post acquisition)

Borrowing Capacity at 5.5x Leverage

142.6

$

142.1

$

(1)

Adjusted for $102.8 million of proceeds received from follow-on equity

offering in January 2012 and CMLP's 35% interest in the Antero acquisition,

expected to close by March 31, 2012.

(2)

Includes $9.1 million of pro forma EBITDA for Frontier and Tristate acquisitions

as defined in CMLP's credit agreement. (3)

Represents CMLP's 35% interest of EBITDA for the last twelve months related to

Antero acquisition. |

Key

Investment Considerations Leading diversified portfolio of shale plays

Long-term fixed fee contracts with limited

commodity exposure

Growing cash flow as producers develop

dedicated acreage

14% YOY distribution growth with 1.2x

coverage ratio

Experienced management team and strong

general partner

27 |

Non-GAAP Financial Measures

The following slides of this presentation provide reconciliations of the

non-GAAP financial measures adjusted EBITDA and adjusted distributable

cash flow to their most directly comparable financial measures calculated and presented in

accordance with generally accepted accounting principles in the United States of

America ("GAAP"). Our non-GAAP financial measures should not be

considered as alternatives to GAAP measures such as net income or operating income

or any other GAAP measure of liquidity or financial performance.

We define adjusted EBITDA as net income from continuing operations adjusted for

interest expense, income taxes, depreciation, amortization and accretion

expense and certain non-recurring expenses, including but not limited to items

such as transaction related expenses and gains/losses on the exchange of property,

plant and equipment. Adjusted EBITDA is commonly used as a

supplemental financial measure by senior management and by external users of our

financial statements, such as investors, research analysts and rating agencies, to

assess the financial performance of our assets without regard to financing

methods, capital structures or historical cost basis. We define adjusted distributable cash

flow as net income from continuing operations adjusted for: (i) the addition of

depreciation, amortization and accretion expense; (ii) the addition of

income taxes; (iii) the addition of non-cash interest expense; (iv) the subtraction of

maintenance capital expenditures and (v) certain non-recurring expenses,

including but not limited to items such as transaction

related

expenses

and

gains/losses

on

the

exchange

of

property,

plant

and

equipment.

The

GAAP

measure

most directly comparable to adjusted distributable cash flow is net income from

continuing operations. 28 |

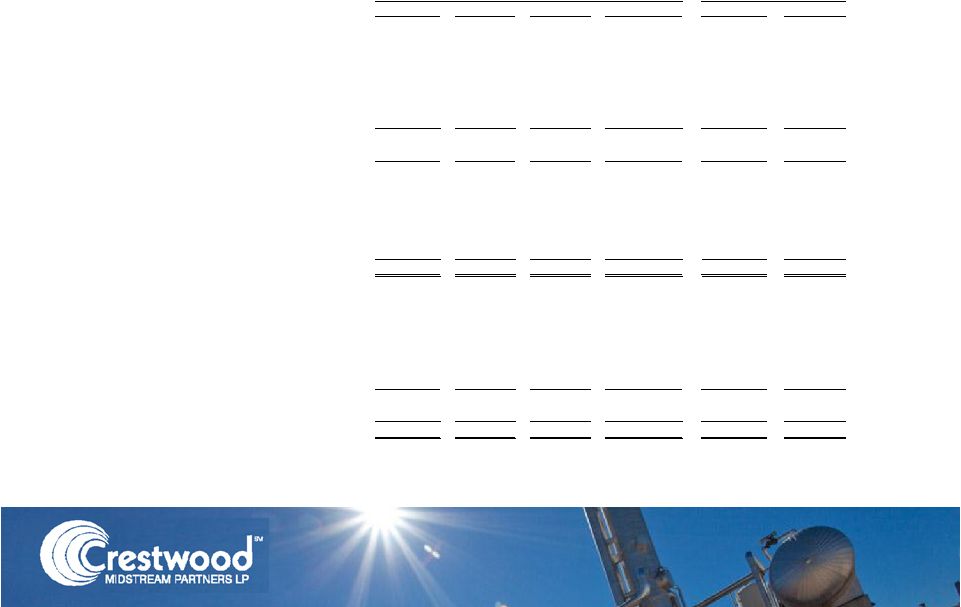

Non-GAAP Reconciliations

29

2008

2009

2010

2011

2010

2011

Total revenues

76,084

$

95,881

$

113,590

$

205,820

$

31,291

$

59,290

$

Product purchases

-

-

-

(38,787)

-

(12,777)

Operations and maintenance expense

(19,395)

(21,968)

(25,702)

(36,303)

(5,723)

(10,138)

General and administrative expense

(6,407)

(9,676)

(17,657)

(24,153)

(9,545)

(6,157)

Gain from exchange of property, plant and equipment

-

-

-

1,106

-

-

Other income

11

1

-

-

-

-

EBITDA

50,293

64,238

70,231

107,683

16,023

30,218

Non-recurring transaction related expenses

-

-

6,318

2,279

6,318

219

Adjusted EBITDA

50,293

64,238

76,549

109,962

22,341

30,437

Less:

Depreciation, amortization and accretion expense

13,131

20,829

22,359

33,812

5,663

9,831

Interest expense

8,437

8,519

13,550

27,617

4,742

7,692

Income tax provision (benefit)

253

399

(550)

1,251

(721)

353

Non-recurring transaction related expenses

-

-

6,318

2,279

6,318

219

Net income from continuing operations

28,472

$

34,491

$

34,872

$

45,003

$

6,339

$

12,342

$

Net income from continuing operations

28,472

$

34,491

$

34,872

$

45,003

$

6,339

$

12,342

$

Depreciation, amortization and accretion expense

13,131

20,829

22,359

33,812

5,663

9,831

Income tax provision (benefit)

253

399

(550)

1,251

(721)

353

Non-cash interest expense

6,096

3,836

4,961

3,473

1,638

931

Non-cash equity compensation

1,017

1,705

5,522

916

3,521

65

Maintenance capital expenditures

(1,890)

(10,000)

(6,600)

(1,409)

(1,650)

(384)

Distributable cash flow

47,079

51,260

60,564

83,046

14,790

23,138

Transaction related expenses and non-recurring gains

-

-

2,737

4,779

2,737

219

Adjusted distributable cash flow

47,079

$

51,260

$

63,301

$

87,825

$

17,527

$

23,357

$

Cash distributions declared for respective period

33,736

39,428

52,423

70,453

14,287

20,729

Distribution coverage

1.40x

1.30x

1.21x

1.25x

1.23x

1.13x

Year Ended December 31,

December 31,

Three Months Ended

($ in thousands) |

Non-GAAP Reconciliation: 2012 Forecast

Forecast

Year Ended

December 31, 2012

(1)

Adjusted EBITDA

$125 million to $135 million

Depreciation,amortization and accretion expense

$41 million

Interest expense, net

$28 million

Income tax provision

$1 million

Net income

$55 million to $65 million

(1)

Represents guidance provided on February 28, 2012. Amounts exclude the impact of the

joint venture with Crestwood Holdings, expected to close by March 31, 2012

30 |