Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PNC FINANCIAL SERVICES GROUP, INC. | d312473d8k.htm |

The PNC

Financial Services Group, Inc. Citigroup 2012 Financial Services Conference

March 8, 2012

Exhibit 99.1 |

2

DRAFT

Cautionary Statement Regarding Forward-Looking

Information and Adjusted Information

This presentation includes “snapshot” information about PNC used by way of

illustration. It is not intended as a full business or financial review and

should be viewed in the context of all of the information made available by PNC in its SEC

filings. The presentation also contains forward-looking statements regarding

our outlook for earnings, revenues, expenses, capital levels and ratios, liquidity levels, asset levels, asset quality and other

matters regarding or affecting PNC and its future business and operations.

Forward-looking statements are necessarily subject to numerous assumptions,

risks and uncertainties, which change over time.

The forward-looking statements in this presentation are qualified by the factors affecting

forward-looking statements identified in the more detailed Cautionary Statement

included in the Appendix, which is included in the version of the presentation materials posted on our corporate website at

www.pnc.com/investorevents. We provide greater detail regarding some of these factors in

our 2011 Form 10-K, including in the Risk Factors and Risk Management sections and

in the Legal Proceedings and Commitments and Guarantees Notes of the Notes to Consolidated Financial Statements in

that report, and in our subsequent SEC filings. Our forward-looking statements may

also be subject to other risks and uncertainties, including those we may discuss in

this presentation or in SEC filings, accessible on the SEC’s website at www.sec.gov and on PNC’s corporate website at

www.pnc.com/secfilings. We have included web addresses in this presentation as inactive

textual references only. Information on these websites is not part of this

presentation.

Future events or circumstances may change our outlook and may also affect the nature of the

assumptions, risks and uncertainties to which our forward-looking statements are

subject. Forward-looking statements in this presentation speak only as of the date of this presentation. We do not

assume any duty and do not undertake to update those statements. Actual results or

future events could differ, possibly materially, from those anticipated in

forward-looking statements, as well as from historical performance.

In this presentation, we sometimes refer to adjusted results to help illustrate the impact of

certain types of items. This information supplements our results as reported in

accordance with GAAP and should not be viewed in isolation from, or as a substitute for, our GAAP results. We believe that this

additional information and the reconciliations we provide may be useful to investors,

analysts, regulators and others as they evaluate the impact of these respective items

on our results for the periods presented due to the extent to which the items are not indicative of our ongoing operations. We

may also provide information on pretax pre-provision earnings (total revenue less

noninterest expense) and on tangible book value per share (calculated as book value per

share less total intangible assets, other than servicing rights, per share). We believe that pretax pre-provision earnings,

a non-GAAP measure, is useful as a tool to help evaluate the ability to provide for credit

costs through operations, and that tangible book value per share, a non-GAAP

measure, is useful as a tool to help to better evaluate growth of the company’s business apart from the amount, on a per share

basis, of intangible assets other than servicing rights included in book value. Where

applicable, we provide GAAP reconciliations for such additional information,

including in the Appendix.

In certain discussions, we may also provide information on yields and margins for all

interest-earning assets calculated using net interest income on a

taxable-equivalent basis by increasing the interest income earned on tax-exempt assets

to make it fully equivalent to interest income earned on taxable investments. We

believe this adjustment may be useful when comparing yields and margins for all earning assets. We may also use

annualized, proforma, estimated or third party numbers for illustrative or comparative

purposes only. These may not reflect actual results.

This presentation may also include discussion of other non-GAAP financial measures, which,

to the extent not so qualified therein or in the Appendix, is qualified by GAAP

reconciliation information available on our corporate website at www.pnc.com under “About PNC–Investor Relations.” |

DRAFT

Evolving Environment Presents Challenges and

Opportunities

Tepid U.S.

Economic

Recovery and

Extended Low

Rates

Regulatory

Change

Market

Dislocation

PNC’s position

Business model challenges

Improving commercial loan growth

Consumer deleveraging

Reinvestment yield pressure

Housing-related delinquencies

Lower fee income

Compliance risk

Impact on business composition

Basel II & III

Impact of shadow banking

Public distrust

GSE reform

European bank deleveraging

Industry impact

Capture relationship market share

Invest in products, people and services

Expansion in attractive growth markets

Maintain a moderate risk profile

Reduce funding cost

Lower cost to serve

“Play by the new rule book”

Rebalance the customer value proposition

Leverage scale advantage to absorb costs

Invest in innovative products and solutions

Leverage our improved brand recognition

Selectively grow distribution

3 |

DRAFT

Investing for Future Growth

Expand sales capacity by 16% across targeted growth markets, businesses

and new product initiatives

Nearly

$130

million

capital

expenditures

on

approximately

60

new

branches

Planned 2012 investments

Revenue

Generating

Product and

Business

Investments

Over $400 million investment in new technologies and product

capabilities to further drive customer retention and operating

efficiencies PNC

Wealth

Insight

SM

TM

4 |

DRAFT

5

A Strong Retail Franchise -

Adapting to a Challenging

Environment

Franchise positioning

Strategic priorities

Our footprint covers nearly half of the U.S.

population

Ranked

#6

in

U.S.

deposits

1

Serving nearly six million households

Gallup ranking above the industry average

for

“customer

confidence”

in

the

past

five

consecutive years

Grow checking relationships

Increase share of wallet

Lower cost to serve

Selectively invest to achieve profitable

growth

Earnings under pressure from low rate environment

Retail

Banking

pretax

pre-provision

earnings

2

3

$1.8

$0.9

$2.4

$-

$1

$2

$3

2008

2009

2010

2011

Actual

Assuming

Rates

Flat

to

2008

Interest

Rates

4

(1) Source: SNL DataSource. Rank based on U.S. deposits as of June 30, 2011 and, for PNC, the

deposits PNC acquired on March 2, 2012 in the RBC Bank (USA) transaction. (2) Pretax

pre-provision earnings, a non-GAAP measure, is calculated as total revenue less noninterest

expense. (3) 2008 adjusted to include proforma National City 2008 results. (4) Assumes the

application of 2008 interest rates (rather than the actual interest rates) to the

actual balances and related funds transfer pricing activities of four categories of core deposits for 2009,

2010 and 2011. Further information on footnotes 2, 3 and 4 is provided in the Appendix. |

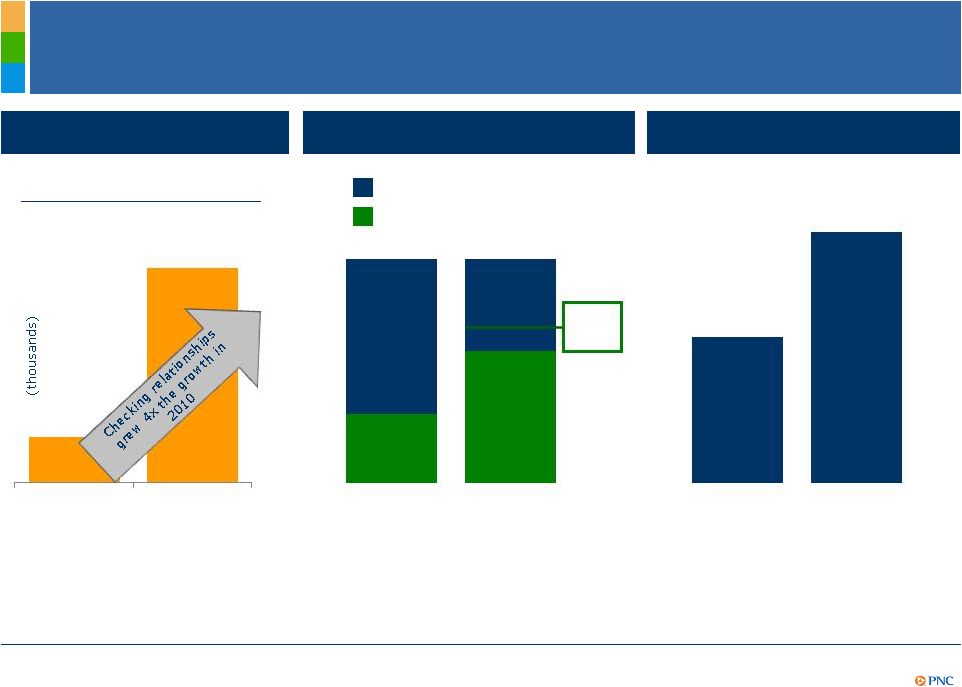

6

DRAFT

Customer Growth Provides Sustainable Revenue

Opportunity –

Retail Banking

Customer growth

Checking relationship growth

Relationship checking

Free checking

4Q10

4Q11

+75

+296

New originations

New consumer household

cross-sell penetration

2010

34%

2011

44%

2010

2011

70%

Goal

31%

59%

3

2

1

(1) Checking relationship growth refers to consumer and small business accounts including

41,000 relationships acquired by branch acquisitions in 2011. (2) Relationship checking

refers to accounts with a committed balance level or self-service accounts with lower cost of servicing. (3)

Percentage of new consumer households as measured within three months with a primary checking

account having at least two services and one additional bank deposit or loan product

with us. |

7

DRAFT

Serving Customers Tomorrow –

Retail Banking

Preserve our customer-centric service model while we evolve to a lower cost

structure Use our differentiated Customer Interaction Management capability to deliver

greater value Lower cost to serve by migrating certain customer transactions toward

lower cost channels Invest and grow “virtual”

customers”

Significant cost save opportunity with virtual sales kiosks and alternative formats

Goals

Cost per transaction

Active online banking customers

ATM channel migration

opportunity

3,519

3,057

Withdrawals

Deposits

Check

cashing

40%

potential

20%

potential

Branch

Call Center

ATM

Online/ Mobile

Business

Consumer

2010

2011

0

2

4

6

8

10

12

Teller

ATM |

8

DRAFT

Corporate & Institutional Banking –

A “Through-the-Cycle”

Relationship Bank

Franchise positioning

Strategic priorities

Multi-product and financing capabilities offered nationally

A leading middle market loan syndicator

New presence in attractive Southeast markets

Capitalize on market dislocation to grow long-term primary client

relationships

Leverage RBC Bank (USA) acquisition and de novo expansion into Southeast

Continue to invest in people, products and technologies

Build-out select industry verticals

(1) Source: Loan Pricing Corporation, 2011.

1 |

9

DRAFT

Customer growth

1,165

1,012

Cross-sell opportunities

Average quarterly loan growth

of select C&IB segments

4Q10

4Q11

Average revenue per new

Corporate Banking primary clients

$150

$250

+

Cross-sell

Corporate Banking new

primary

clients

1

0-1 year

Actual

Within 3 years

Goal

2010

2011

6.9

8.9

8.7

9.8

4.3

6.1

Business Credit

Middle Market

Corporate Finance

New primary

clients

$100

Customer Growth Provides Sustainable Revenue

Opportunity –

Corporate & Institutional Banking

(1) A Corporate Banking primary client is defined as a corporate banking relationship with

annual revenue generation of $50,000 or more or, within corporate banking, a commercial

banking client relationship with annual revenue generation of $10,000 or more. |

10

DRAFT

Asset Management Group –

Capturing Greater Market

Share

Franchise positioning

Strategic priorities

Top 10 bank-held wealth manager in the U.S.

Hawthorn -

Top 10 ultra-affluent provider in the U.S.

Over $240 billion in investable assets

Over 3,100 employees

4

with a broad market presence in 70 cities

Open architecture platform and strong performance in manufactured products

Achieve optimal staffing levels across markets

Leverage referral channels across the businesses

Drive growth in high potential and newly acquired markets

Offer seamless wealth and retirement products to all customer segments to

capture greater market share

(1) Source: Barron’s 2011 rankings. (2) Source: Family Wealth Alliance 2011 rankings. (3)

Company wide; includes $34 billion of brokerage assets. (4) As of 12/31/2011.

1

2

3 |

11

DRAFT

Customer Growth Provides Sustainable Revenue

Opportunity –

Asset Management Group

Strong referral channel driving higher sales

+52%

Discretionary

AUM

net

flows

2010 vs. 2011

+36%

Total sales

Capturing referral

channel

sales¹

2010

2011

2010 vs. 2011

-$0.6

$0.8

2

Non-core

activity

3

-$1.7

(1) Referral sales are new sales from clients referred to AMG by Retail Banking or Corporate

and Institutional Banking. (2) Total net flows defined as net change from clients

including dividends received. (3) Non-core activity represents short-term liquidity assets. |

DRAFT

Capturing the Wealth Opportunity

Call center

Internet

Branch

Salesforce

Call center

Internet

Branch

Call center

Internet

Mass Market

< $100K

(4 MM)

Affluent

$100K -

$1 MM

(1.6 MM)

High Net Worth

> $1 MM

(.4 MM)

Differentiated

Multi-Channel

Approach

Client -

Focused

“Go-to-Market”

Strategy

Focused on growth in the mass market and affluent

customer segments

Diverse channel approach to deepen customer

relationships and share of wallet

Distinctive “concierge”

branch service model which directs

customers to appropriate channel for highest service level

Single platform drives exceptional user experience

Strong product capabilities across all risk appetites

12 |

13

DRAFT

Continuous Improvement –

Expense Efficiencies

Provide Capacity to Invest

$8.7

$.6

($.4)

$.3-$.4

$9.2 -$9.3

RBC Bank (USA)

expense

(net of cost saves)

Efficiency

gains

Customer

enhancements

Product

innovation

2011

2012

Estimate

RBC Expenses

Continuous

Improvements

Investments

Mid-single

digit %

growth

estimate

Noninterest expense outlook

(1) Refer to the Cautionary Statement in the Appendix, including assumptions. (2) 2011

noninterest expense of $9.1 billion (GAAP) then adjusted for the $198 million

non-cash charge related to the trust preferred securities redemption in 2011 and the $240 million fourth

quarter 2011 charge for residential mortgage foreclosure-related expenses. (3) The 2012

expense base outlook includes ten months of RBC Bank (USA) estimated operating

costs of approximately $600 million. (4) Excludes the possible impact of legal and regulatory

contingencies, charges on further trust preferred redemptions, and RBC Bank (USA) integration

expenses in 2012.

2

4

1

3 |

14

DRAFT

Strong Capital and Liquidity Position

Highlights

Tier 1 common ratio

Target Basel III Tier 1 common ratio to reach

between 8.0-8.5%

1

during 2013

Capital priorities:

–

Build capital to support client growth and

business investment

–

Maintain appropriate capital in light of

economic uncertainty

–

Return excess capital to shareholders

Strong liquidity position at year-end 2011

–

Loan-to-deposit ratio of 85%

–

Parent company two year liquidity coverage

3

of 172%

Basel

III

requirements

2

8.0% -

8.5%

1

2013 Target

Basel III

(1) Proforma estimate is based on PNC’s Tier 1 common ratio of 10.3% as of 12/31/11, and

includes an assumed benefit of 1.7%, which reflects First Call 2012 and 2013

estimates and current dividend payout, as well an assumed decrease of 3.5%-4.0%, which reflects assumptions utilizing Basel II

methodology regarding credit, operating and market risk and includes the treatment of

BlackRock and sub-investment grade securities (assuming no AOCI double counting)

under Basel II and the addition of RBC Bank (USA) risk weighted assets. This estimate is subject to further regulatory guidance

and clarity. The estimate is based on the phase-in of Basel III framework in effect as of

2012. (2) Regulatory requirements include capital conservation buffer (but not any

potential additional surcharges or buffers) and are subject to further regulatory guidance and clarity. (3) Parent company liquidity

coverage defined as liquid assets divided by funding obligations within a two year period. |

15

DRAFT

Outlook

1

–

Full Year 2012 vs. 2011

PNC is Positioned to Deliver Strong Results in 2012.

PNC is Positioned to Deliver Strong Results in 2012.

Estimated % Change

3

Combined

2

Balance sheet

Loans

Increase mid to high teens

Total revenue

Increase mid to high single digits

Combined

2

Income

statement

Net interest income

Increase mid to high single digits

Noninterest income

Increase mid single digits

Noninterest expense

Increase

mid

single

digits

4

Loan loss provision

Stable

5

PNC stand-alone positioned for strong results in 2012

RBC Bank (USA) acquisition expected to be accretive in 2012, excluding

integration costs

(1) Refer to the Cautionary Statement in the Appendix, including assumptions. (2) Reflects

combined PNC and RBC Bank (USA). (3) Estimated change for 2012 is based on 2011

reported results. (4) Excluding legal and regulatory related contingencies, integration costs and any capital

actions related to TPS redemptions for both 2011 and 2012 periods. (5) Excluding legal and

regulatory related contingencies. |

16

DRAFT

Cautionary Statement Regarding Forward-Looking

Information

Appendix

This presentation includes “snapshot” information about PNC used by way of

illustration and is not intended as a full business or financial review. It

should not be viewed in isolation but rather in the context of all of the information made available by PNC in its SEC filings.

We also make statements in this presentation, and we may from time to time make other

statements, regarding our outlook for earnings, revenues, expenses, capital levels and

ratios, liquidity levels, asset levels, asset quality and other matters regarding or affecting PNC and its future

business and operations that are forward-looking statements within the meaning of the

Private Securities Litigation Reform Act. Forward-looking statements are

typically identified by words such as “believe,” “plan,” “expect,” “anticipate,” “see,” “look,” “intend,” “outlook,” “project,” “forecast,

“estimate,” “goal,” “will,” “should” and other similar

words and expressions. Forward-looking statements are subject to numerous assumptions,

risks and uncertainties, which change over time.

Forward-looking statements speak only as of the date made. We do not assume any duty

and do not undertake to update forward-looking statements. Actual results or

future events could differ, possibly materially, from those anticipated in forward-looking statements, as well as from

historical performance.

Our forward-looking statements are subject to the following principal risks and

uncertainties. •

Our businesses, financial results and balance sheet values are affected by business and

economic conditions, including the following::

o

Changes in interest rates and valuations in debt, equity and other financial markets.

o

Disruptions in the liquidity and other functioning of U.S. and global financial

markets.

o

The impact on financial markets and the economy of the downgrade by Standard & Poor’s

of U.S. Treasury obligations and other U.S. government-backed debt, as well as

issues surrounding the level of U.S. and European government debt and concerns regarding the

creditworthiness of certain sovereign governments in Europe.

o

Actions by Federal Reserve, U.S. Treasury and other government agencies, including those that

impact money supply and market interest rates.

o

Changes in customers’, suppliers’ and other counterparties’ performance and

creditworthiness.

o

Slowing or failure of the current moderate economic recovery.

o

Continued effects of aftermath of recessionary conditions and uneven spread of positive

impacts of recovery on the economy and our counterparties, including adverse impacts on

levels of unemployment, loan utilization rates, delinquencies, defaults and counterparty ability

to meet credit and other obligations.

o

Changes in customer preferences and behavior, whether due to changing business and economic

conditions, legislative and regulatory initiatives, or other factors.

•

Our forward-looking financial statements are subject to the risk that economic and

financial market conditions will be substantially different than we are currently

expecting. These statements are based on our current view that the modest economic expansion will persist in 2012 and

interest rates will remain very low. |

17

DRAFT

Cautionary Statement Regarding Forward-Looking

Information (continued)

Appendix

•

Legal and regulatory developments could have an impact on our ability to operate our

businesses, financial condition, results of operations, competitive position,

reputation, or pursuit of attractive acquisition opportunities. Reputational impacts could affect matters such as business

generation and retention, liquidity, funding, and ability to attract and retain

management. These developments could include:

o

Changes resulting from legislative and regulatory reforms, including broad-based

restructuring of financial industry regulation and changes to laws and regulations

involving tax, pension, bankruptcy, consumer protection, and other industry aspects, and changes in

accounting policies and principles. We will be impacted by extensive reforms provided

for in the Dodd-Frank Wall Street Reform and Consumer Protection Act and otherwise

growing out of the recent financial crisis, the precise nature, extent and timing of which, and their

impact on us, remains uncertain.

o

Changes to regulations governing bank capital and liquidity standards, including due to the

Dodd-Frank Act and to Basel III initiatives.

o

Unfavorable resolution of legal proceedings or other claims and regulatory and other

governmental investigations or other inquiries. In addition to matters relating

to PNC’s business and activities, such matters may include proceedings, claims, investigations, or inquiries

relating to pre acquisition business and activities of acquired companies, such as National

City. These matters may result in monetary judgments or settlements or other

remedies, including fines, penalties, restitution or alterations in our business practices and in additional

expenses and collateral costs, and may cause reputational harm to PNC.

o

Results of the regulatory examination and supervision process, including our failure to

satisfy requirements of agreements with governmental agencies.

o

Impact on business and operating results of any costs associated with obtaining rights in

intellectual property claimed by others and of adequacy of our intellectual property

protection in general.

•

Business and operating results are affected by our ability to identify and effectively manage

risks inherent in our businesses, including, where appropriate, through effective use

of third-party insurance, derivatives, and capital management techniques, and to meet evolving regulatory

capital standards. In particular, our results currently depend on our ability to manage

elevated levels of impaired assets.

•

Business and operating results also include impacts relating to our equity interest in

BlackRock, Inc. and rely to a significant extent on information provided to us by

BlackRock. Risks and uncertainties that could affect BlackRock are discussed in more detail by BlackRock in its

SEC filings.

•

Our acquisition of RBC Bank (USA) presents us with risks and uncertainties related both to the

acquisition itself and to the integration of the acquired businesses into PNC,

including:

o

Anticipated benefits of the transaction, including cost savings and strategic gains, may be

significantly harder or take longer to achieve than expected or may not be achieved in

their entirety as a result of unexpected factors or events.

o

Our ability to achieve anticipated results from this transaction is dependent also on the

extent of credit losses in the acquired loan portfolios and the extent of deposit

attrition, in part related to the state of economic and financial markets. Also, litigation and regulatory

and other governmental investigations that may be filed or commenced, as a result of this

transaction or otherwise, could impact the timing or realization of anticipated

benefits to PNC.

o

Integration of RBC Bank (USA)’s business and operations into PNC may take longer than

anticipated or be substantially more costly than anticipated or have unanticipated

adverse results relating to RBC Bank (USA)’s or PNC’s existing businesses. PNC’s ability to integrate

RBC Bank (USA) successfully may be adversely affected by the fact that this transaction

results in PNC entering several markets where PNC did not previously have any

meaningful retail presence. |

18

DRAFT

Cautionary Statement Regarding Forward-Looking

Information (continued)

Appendix

•

In addition to the RBC Bank (USA) transaction, we grow our business in part by acquiring from

time to time other financial services companies, financial services assets and related

deposits and other liabilities. These other acquisitions often present risks and uncertainties analogous to

those presented by the RBC Bank (USA) transaction. Acquisition risks include those

presented by the nature of the business acquired as well as risks and uncertainties

related to the acquisition transactions themselves, regulatory issues, and the integration of the acquired businesses into

PNC after closing.

•

Competition can have an impact on customer acquisition, growth and retention and on credit

spreads and product pricing, which can affect market share, deposits and

revenues. Industry restructuring in the current environment could also impact our business and financial

performance through changes in counterparty creditworthiness and performance and in the

competitive and regulatory landscape. Our ability to anticipate and respond to

technological changes can also impact our ability to respond to customer needs and meet competitive demands.

•

Business and operating results can also be affected by widespread disasters, dislocations,

terrorist activities or international hostilities through impacts on the economy and

financial markets generally or on us or our counterparties specifically.

We provide greater detail regarding some of these factors in our 2011 Form 10-K, including

the Risk Factors and Risk Management sections and the Legal Proceedings and Commitments

and Guarantees Notes of the Notes to Consolidated Financial Statements in that report, and our

subsequent SEC filings. Our forward-looking statements may also be subject to other

risks and uncertainties, including those we may discuss elsewhere in this presentation

or in SEC filings, accessible on the SEC’s website at www.sec.gov and on our corporate website at

www.pnc.com/secfilings. We have included these web addresses as inactive textual

references only. Information on these websites is not part of this document.

Any annualized, proforma, estimated, third party or consensus numbers in this presentation are

used for illustrative or comparative purposes only and may not reflect actual

results. Any consensus earnings estimates are calculated based on the earnings projections made by analysts

who cover that company. The analysts’ opinions, estimates or forecasts (and

therefore the consensus earnings estimates) are theirs alone, are not those of PNC or

its management, and may not reflect PNC’s or other company’s actual or anticipated results. |

19

DRAFT

Non-GAAP to GAAP Reconcilement

Appendix

$ in millions

Dec. 31, 2008 (1)

Dec. 31, 2009

Dec. 31, 2010

Dec. 31, 2011

Net interest income, as reported

$1,594

$3,522

$3,435

$3,280

Proforma adjustments:

National City

1,907

-

-

-

Adjusted proforma net interest income

$3,501

Noninterest income, as reported

$1,137

$2,199

$1,951

$1,762

Proforma adjustments:

National City

1,297

-

-

-

Adjusted proforma noninterest income

$2,434

Total revenue, as reported

$2,731

$5,721

$5,386

$5,042

Total revenue, adjusted proforma

$5,935

Noninterest expense, as reported

$1,789

$4,169

$4,056

$4,103

Proforma adjustments:

National City

2,305

-

-

-

Adjusted proforma noninterest expense

$4,094

Pretax pre-provision earnings (revenue less noninterest expense) (1)

$1,841

$1,552

$1,330

$939

Retail Banking results for the year ended

(1) 2008 adjusted to reflect PNC Retail Banking (as reported reclassified to reflect the

reporting of PNC Wealth Management in the Asset Management Group segment beginning in

2009) combined proforma with results of the National City retail banking business for that year.

PNC believes that pretax pre-provision earnings, a non-GAAP measure, is useful as a

tool to help evaluate the ability to provide for credit costs through operations. For

purposes of this comparison, adjustments have been made to 2008 in the table above to reflect including the National City

retail banking business results on a proforma basis to provide comparability.

|

20

DRAFT

Non-GAAP to GAAP Reconcilement

Appendix

$ in millions

Dec. 31, 2008

Dec. 31, 2009

Dec. 31, 2010

Dec. 31, 2011

Net interest income, as adjusted proforma for 2008 and as reported for 2009-2011

$3,501

$3,522

$3,435

$3,280

2008 interest rate adjustment:

Difference for holding interest rates flat to 2008 interest rates (1)

-

747

1,073

1,419

Net interest income, assuming 2008 rates

$3,501

$4,269

$4,508

$4,699

Noninterest income, as adjusted proforma for 2008 and as reported for 2009-2011

$2,434

$2,199

$1,951

$1,762

Total revenue, assuming 2008 rates

$5,935

$6,468

$6,459

$6,461

Noninterest expense, as adjusted proforma for 2008 and as reported for 2009-2011

$4,094

$4,169

$4,056

$4,103

Pretax pre-provision earnings, assuming 2008 interest rates

$1,841

$2,299

$2,403

$2,358

PNC believes that pretax pre-provision earnings, a non-GAAP measure, is useful as a

tool to help evaluate the ability to provide for credit costs through operations. PNC

also believes that results adjusted to assume 2008 interest rates provide useful information on the impact of the low interest rate

environment in the 2009-2011 period. For purposes of this comparison, adjustments have

been made to 2008 in the table above to reflect including the National City retail

banking business results on a proforma basis to provide comparability. Retail Banking

results for the year ended (1) Represents the difference in net interest income if you

apply the 2008 interest rates (rather than the actual interest rates) to the actual balances and

related funds transfer pricing activities for four categories of core deposits for 2009, 2010

and 2011. The four categories of core deposits include interest- bearing demand,

noninterest bearing demand, money market and savings deposits. This adjustment does not assume any change in customer behavior for

2009, 2010 and 2011 deposit balances due to the assumed 2008 interest rates.

|

21

DRAFT

Peer Group of Banks

Appendix

The PNC Financial Services Group, Inc.

PNC

BB&T Corporation

BBT

Bank of America Corporation

BAC

Capital One Financial, Inc.

COF

Comerica Inc.

CMA

Fifth Third Bancorp

FITB

JPMorgan Chase

JPM

KeyCorp

KEY

M&T Bank

MTB

Regions Financial Corporation

RF

SunTrust Banks, Inc.

STI

U.S. Bancorp

USB

Wells Fargo & Co.

WFC

Ticker |