Attached files

| file | filename |

|---|---|

| 8-K - 8-K - M&T BANK CORP | d312920d8k.htm |

Citigroup 2012 Financial Services Conference

March 8, 2012

Exhibit 99 |

2

This presentation

contains

forward

looking

statements

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act giving the Company's expectations or predictions of future financial or business

performance or conditions. Forward-looking statements are typically

identified by words such as "believe," "expect," "anticipate," "intend,"

"target," "estimate," "continue," "positions,"

"prospects" or "potential," by future conditional verbs such as "will,"

"would," "should," "could" or "may," or by variations of such

words or by similar expressions. These forward-looking statements are subject

to numerous assumptions, risks and uncertainties which change over time. Forward-looking

statements

speak

only

as

of

the

date

they

are

made

and

we

assume

no

duty

to

update

forward-looking

statements.

In addition to factors previously disclosed in our SEC reports and those identified elsewhere

in this presentation, the following factors among others, could cause actual results to

differ materially from forward-looking statements or historical performance:

changes in asset quality and credit risk; the inability to sustain revenue and earnings growth;

changes in interest rates and capital markets; inflation; customer acceptance of M&T

products and services; customer borrowing,

repayment,

investment

and

deposit

practices;

customer

disintermediation;

the

introduction,

withdrawal,

success and timing of business initiatives; competitive conditions; the inability to realize

cost savings or revenues or to implement integration plans and other consequences

associated with mergers, acquisitions and divestitures; economic conditions; and the

impact, extent and timing of technological changes, capital management activities, and other

actions of the Federal Reserve Board and legislative and regulatory actions and reforms,

including those associated with the Dodd-Frank Wall Street Reform and Consumer

Protection Act. Annualized, pro forma, projected and estimated numbers are used for

illustrative purpose only, are not forecasts and may not reflect actual results.

Disclaimer |

3

Today’s Agenda

Who is M&T Bank?

2011 Highlights

Consistent, conservative operating philosophy

Wilmington Trust

Outlook |

4

Top 20 US-based full-service commercial

bank holding company by assets and Top 15

by market cap

Founded in 1856

$78 billion total assets

776

domestic branches and more than 2,000

ATMs

15,666 employees located in New York,

Maryland, Pennsylvania, Washington, D.C.,

Virginia, West Virginia and Delaware

Over 2 million consumer/retail household

customers

Approximately 220,000 commercial

customers

M&T Bank Corporate Profile

As of 12/31/11 |

5

Most honored bank in 2011 Greenwich Excellence Awards for Small Business

Banking: 12 national awards and 2 regional awards

Highest number of awards among all 750 banks rated by business customers

Received the highest possible Community Reinvestment Act (CRA) rating on every

exam since 1982

M&T Charitable Foundation has contributed over $147 million to

not-for-profit organizations in its communities over the past 10

years Contributed $40 million to M&T Charitable Foundation in 2011

More than 3,000 M&T employees volunteer with

5,100 different not-for-profit organizations

Strong long-term returns for shareholders

Recognition from Customers, Communities & Shareholders

|

6

Strong Presence In Our Communities

We lend in the markets where we live and work to people and enterprises whom we

know #1 Small Business Lender in:**

Baltimore

Binghamton

Buffalo

Philadelphia

Rochester

Syracuse

Washington, DC

Wilmington

Ranked 6

th

Nationally

Ranked 3

rd

in Eastern U.S.

#1 lead bank market share

among middle market clients in:*

Baltimore

Binghamton

Buffalo

Harrisburg

Northern Pennsylvania

Rochester

Syracuse

State of Maryland overall

State of Delaware overall

* Independent market research

** Small Business Administration

#1 or #2 deposit market share

in 8 of top 10 communities:

#2 in Baltimore

#1 in Binghamton

#1 in Buffalo

#2 in Harrisburg

#2 in Rochester

#1 in Syracuse

#1 State of Delaware / Wilmington City

#1 in York |

7

Summary of Full Year 2011 Results

12% increase in diluted GAAP & Net Operating EPS

Net operating return on tangible common equity of 17.96%

Increased tangible book value per common share by 14%

No secondary equity offering

Consummated Wilmington Trust merger in May

Expansion into new markets, encompassed by the Wilmington

Trust Diversification into a wider array of

trust and fiduciary businesses, Completed integration of core banking

systems at end of 3Q franchise |

8

Executed on 2011 Capital Plan

Retired $330 million of WT’s TARP preferred stock from US Treasury

Redeemed additional $370 million of M&T’s TARP preferred stock

Issued $500 million of 6.875% perpetual preferred stock to bolster Tier 1

capital

Unchanged $2.80 per share dividend

Built capital ratios

while absorbing WT and supporting loan growth

Tier 1 common capital ratio up 35bp to 6.86% at year-end 2011

Tangible

common

equity

ratio

up

21bp

to

6.40%

at

year

end

2011. |

9

Strong

credit

through

crisis

Focused

on returns

Consistent

capital

generation

(1)

The Efficiency Ratio and Pre-tax, Pre-provision Earnings are non-GAAP

financial measures. A reconciliation of GAAP to non-GAAP financial

measures is available in the appendix. The Efficiency Ratio reflects

non-interest expense (excluding amortization expense associated with

intangible assets and merger-related expenses) as a percentage of fully taxable

equivalent net interest income and non-interest revenues (excluding

gains or losses from securities transactions and merger-related gains).

(2)

Excludes merger-related gains and expenses and amortization expense associated

with intangible assets. (1)

Key Ratios

2006

2007

2008

2009

2010

2011

Net Interest Margin

3.70%

3.60%

3.38%

3.49%

3.84%

3.73%

Efficiency Ratio -

Tangible

(1)

51.51%

52.77%

54.35%

56.50%

53.71%

60.43%

Pre-tax, Pre-provision Earnings ($MM)

1,312

1,156

1,152

1,123

1,461

1,495

Allowance to Loans (As At)

1.51%

1.58%

1.61%

1.69%

1.74%

1.51%

Net Charge-Offs to Loans

0.16%

0.26%

0.78%

1.01%

0.67%

0.47%

Net Operating Return on

Tangible Assets

(2)

1.67%

1.27%

0.97%

0.71%

1.17%

1.26%

Tangible Common Equity

(2)

29.55%

22.58%

19.63%

13.42%

18.95%

17.96%

Common

Equity

to

Assets

-

Tangible

5.84%

5.01%

4.59%

5.13%

6.19%

6.40%

Tier 1 Common Capital Ratio

6.42%

5.62%

6.08%

5.66%

6.51%

6.86%

Tier 1 Capital Ratio

7.74%

6.84%

8.83%

8.59%

9.47%

9.67%

Total Capital Ratio

11.78%

11.18%

12.83%

12.30%

13.08%

13.26%

Leverage Ratio

7.20%

6.59%

8.35%

8.43%

9.33%

9.28%

TBV per Share

28.57

27.98

25.94

28.27

33.26

37.79

Superior

pre-credit

earnings |

10

Consistent, Conservative Operating Philosophy

Focus on return, not volume

Solid underwriting

Efficient provider of basic banking services

Prudent capital allocation

Disciplined approach to acquisitions

Acquirer of choice -

superior returns for our partners

Management, employees & Board own or control >20% of

M&T stock

Owner-operators

|

11

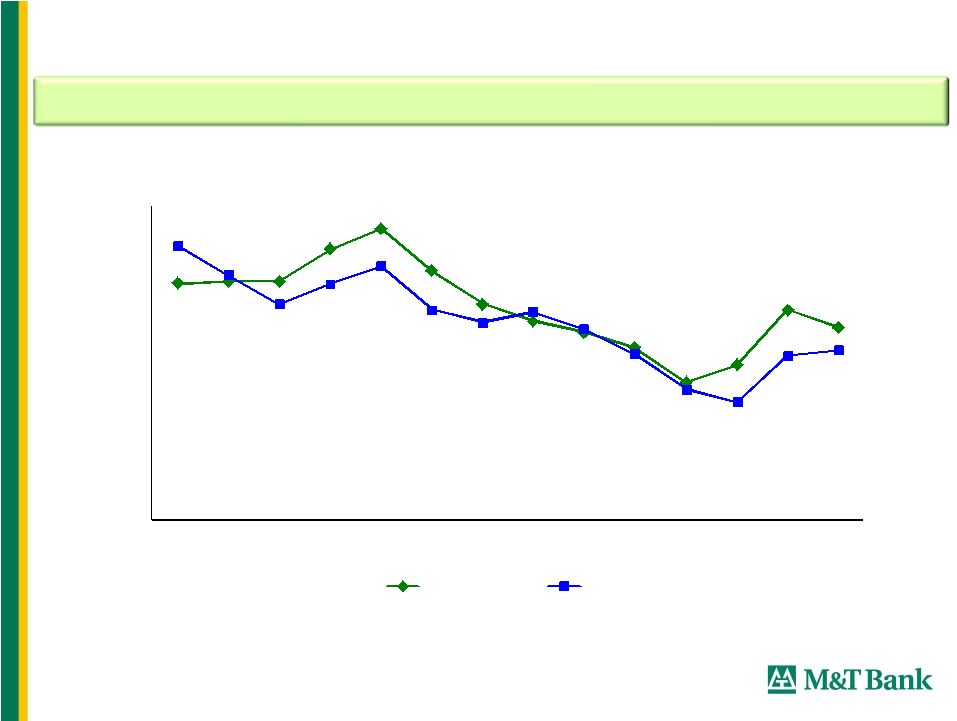

4.01

3.73

4.25

3.58

2.5

3.0

3.5

4.0

4.5

'98

'99

'00

'01

'02

'03

'04

'05

'06

'07

'08

'09

'10

'11

MTB

Peer Median

Disciplined margin management

Note: Taxable Equivalent net interest margin used for M&T and for peer banks

when available.

Net Interest Margin

M&T focuses on returns and relationships rather than volumes

|

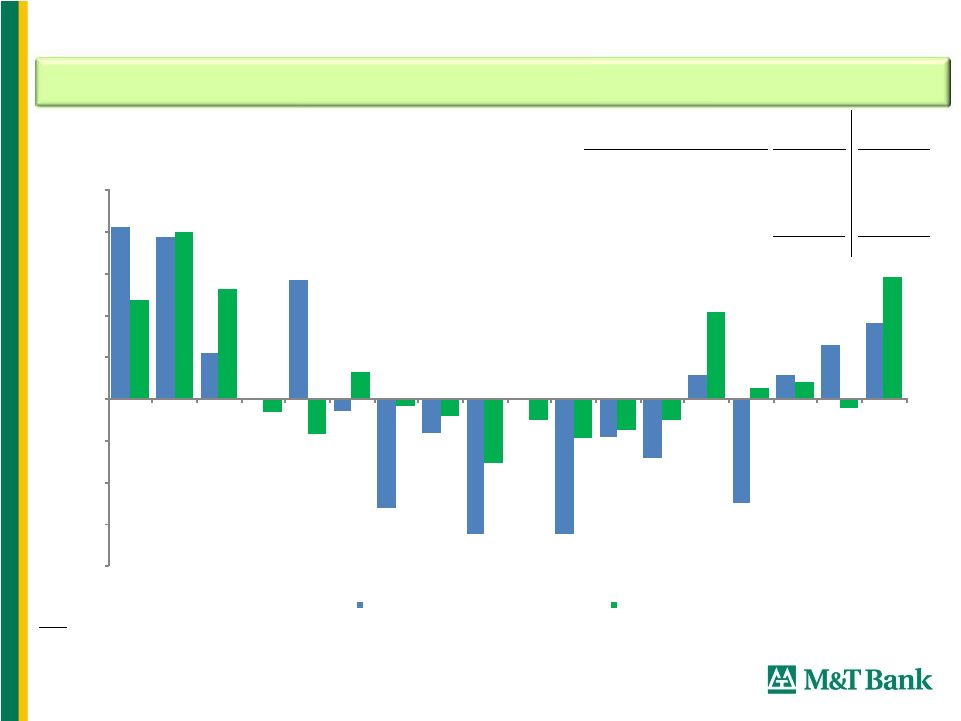

12

Notes:

1) Source: Industry data was obtained from the 1/6/2012 H8 prepared by the Federal

Reserve. 2) Loan growth at Domestically Chartered Commercial Banks, adjusted

to exclude the March 31, 2010 impact of FAS 167 balance sheet consolidation

and September 2008 addition of Washington Mutual.

3) Industry

Commercial

loans

include

both

“C&I

and

Other

Loans”

and

“Commercial

Real

Estate

Loans”

as

outlined

in

the

H8

report.

4) The 1Q11 decline in industry loans is unadjusted for Citigroup’s sale of

$26 billion in consumer loans to Sallie Mae. 5) MTB loan growth

acquisition adjusted for Partners and First Horizon (Dec-07), Provident (Jun-09), Bradford (Sep-09), K Bank (Dec-10), and

Wilmington Trust (Jun-11)

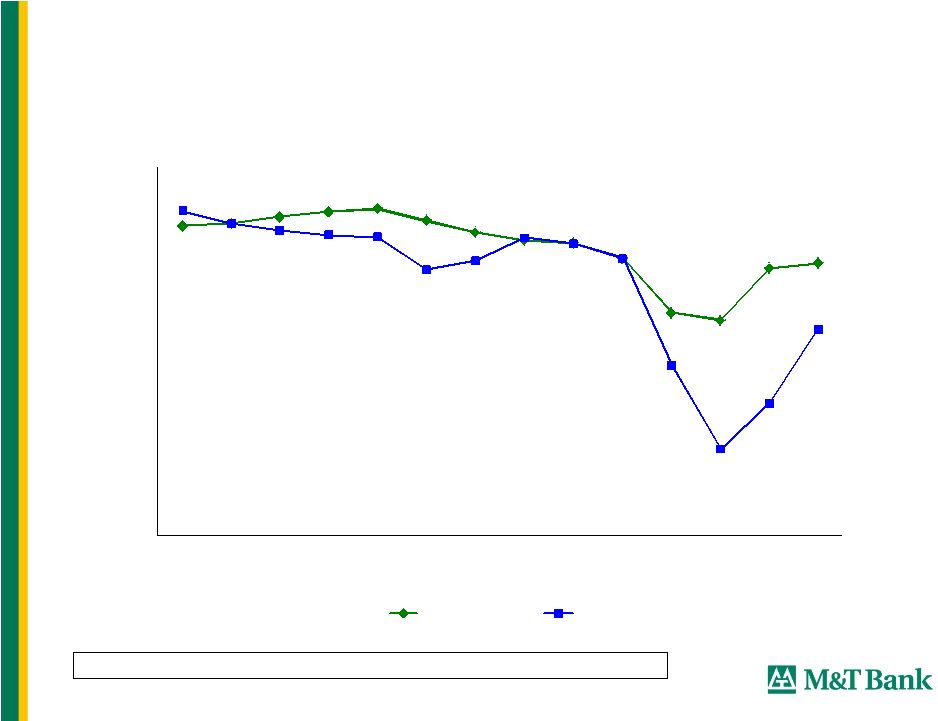

Linked Quarter Loan Growth

M&T has outperformed the industry through the credit cycle

Total

Industry

MTB

Commercial Loans

2.1%

2.5%

Res. Real Estate Loans

1.8%

10.3%

Consumer Loans

1.3%

-0.6%

Total Loans & Leases

1.8%

2.9%

4Q11 Linked Qtr Loan Growth

Domestic Unnualized

4.1%

3.9%

1.1%

0.0%

2.8%

-0.3%

-2.6%

-0.8%

-3.2%

0.0%

-3.3%

-0.9%

-1.4%

0.5%

-2.5%

0.5%

1.3%

1.8%

2.4%

4.0%

2.6%

-0.3%

-0.9%

0.6%

-0.2%

-0.4%

-1.5%

-0.5%

-0.9%

-0.7%

-0.5%

2.1%

0.2%

0.4%

-0.2%

2.9%

-4.0%

-3.0%

-2.0%

-1.0%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

Sep-07

Dec-07

Mar-08

Jun-08

Sep-08

Dec-08

Mar-09

Jun-09

Sep-09

Dec-09

Mar-10

Jun-10

Sep-10

Dec-10

Mar-11

Jun-11

Sep-11

Dec-11

Domestically Chartered Commercial Banks

MTB |

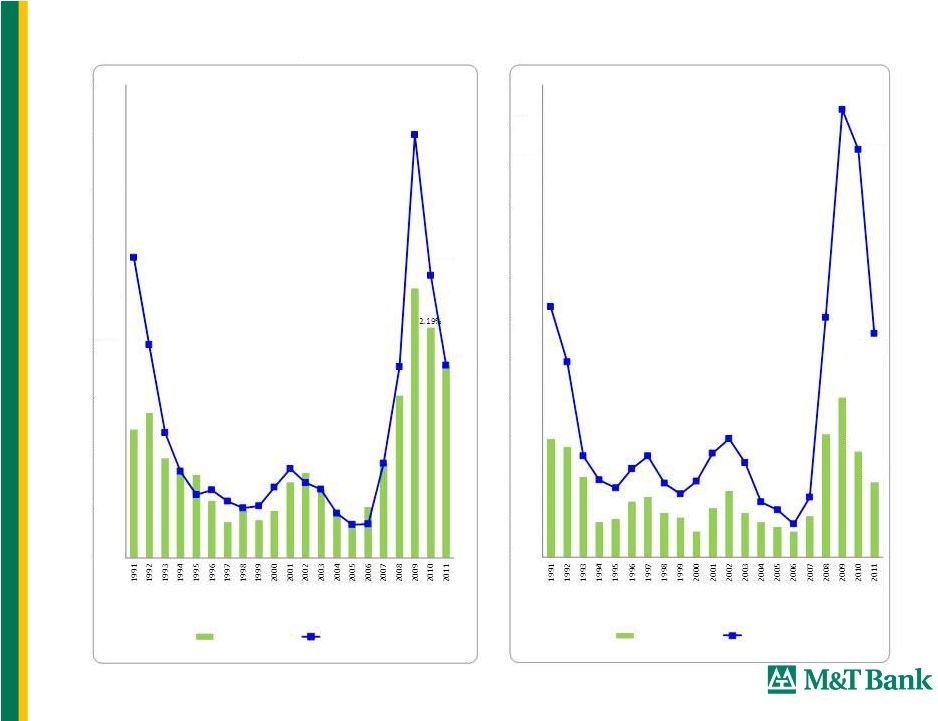

13

Historical Credit Cycle: 1991 -

2011

Source: SNL Interactive. Regulatory and GAAP filings

* Top 25 publicly traded banks in each year.

0.67%

0.47%

2.59%

1.42%

0.00%

0.25%

0.50%

0.75%

1.00%

1.25%

1.50%

1.75%

2.00%

2.25%

2.50%

2.75%

3.00%

NCOs / Average Loans

MTB

Top 25 Median*

1.83%

2.68%

1.83%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

4.50%

Nonaccrual Loans / Total Loans

MTB

Top 25 Median* |

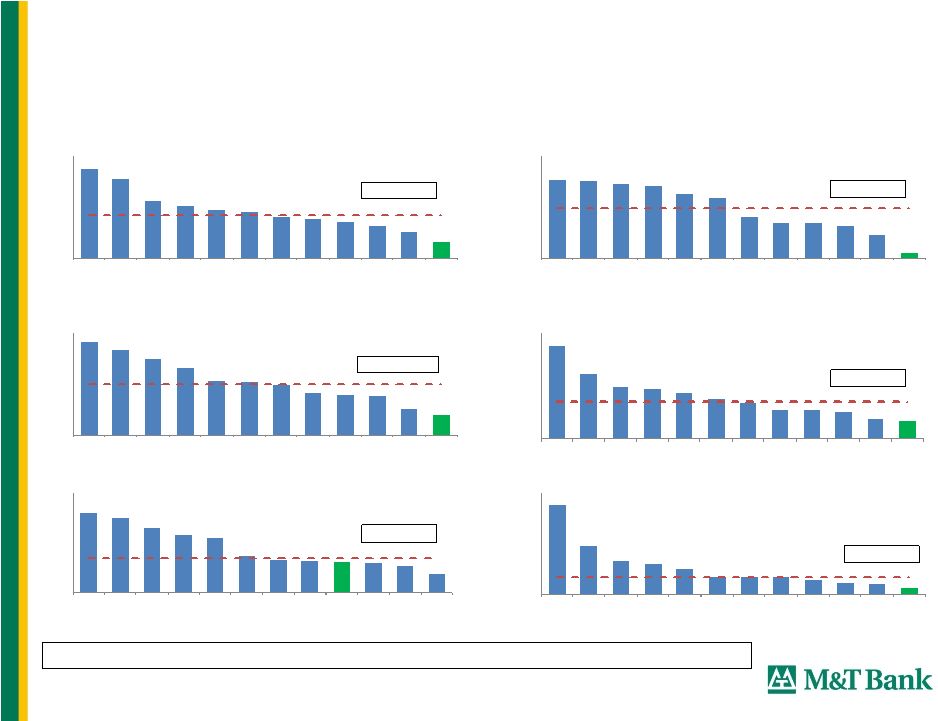

14

17.5%

15.7%

11.1%

10.4%

9.4%

9.1%

8.0%

7.7%

7.0%

6.1%

5.1%

3.1%

Median 8.5%

0%

5%

10%

15%

20%

Peer 1

Peer 2

Peer 3

Peer 4

Peer 5

Peer 6

Peer 7

Peer 8

Peer 9

Peer 10

Peer 11

MTB

Total Loans

9.3%

9.1%

8.7%

8.5%

7.5%

7.1%

4.8%

4.1%

4.0%

3.8%

2.8%

0.6%

Median 5.9%

0%

3%

6%

9%

12%

Peer 1

Peer 2

Peer 3

Peer 4

Peer 5

Peer 6

Peer 7

Peer 8

Peer 9

Peer 10

Peer 11

MTB

Comm. Real Estate

36.5%

33.2%

29.9%

26.4%

21.3%

20.8%

19.8%

16.6%

15.7%

15.3%

10.2%

8.0%

Median 20.3%

0%

10%

20%

30%

40%

Peer 1

Peer 2

Peer 3

Peer 4

Peer 5

Peer 6

Peer 7

Peer 8

Peer 9

Peer 10

Peer 11

MTB

Construction

15.7%

11.0%

8.9%

8.5%

7.7%

6.7%

6.1%

5.0%

4.9%

4.5%

3.4%

2.9%

Median 6.4%

0%

5%

9%

14%

18%

Peer 1

Peer 2

Peer 3

Peer 4

Peer 5

Peer 6

Peer 7

Peer 8

Peer 9

Peer 10

Peer 11

MTB

Commercial & Industrial

12.0%

11.2%

9.8%

8.7%

8.2%

5.5%

5.0%

4.7%

4.7%

4.4%

3.9%

2.7%

Median 5.2%

0%

3%

6%

9%

12%

15%

Peer 1

Peer 2

Peer 3

Peer 4

Peer 5

Peer 6

Peer 7

Peer 8

MTB

Peer 9

Peer 10

Peer 11

Residential Mortgage

26.4%

14.3%

9.8%

9.1%

7.3%

5.3%

5.2%

5.2%

4.5%

3.3%

3.3%

1.8%

Median 5.3%

0%

6%

12%

18%

24%

30%

Peer 1

Peer 2

Peer 3

Peer 4

Peer 5

Peer 6

Peer 7

Peer 8

Peer 9

Peer 10

Peer 11

MTB

HELOC

Loss Experience Through Financial Crisis 3Q07 –

4Q11*

* Represents

cumulative

net

credit

losses

from

3Q07

through

4Q11

as

percentage

of

average

loans

over

that

period |

15

3.78%

3.32%

3.96%

2.52%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

4.50%

'98

'99

'00

'01

'02

'03

'04

'05

'06

'07

'08

'09

'10

'11

MTB

Peer Median

Balancing risk and rewards in lending

Risk-Adjusted Net Interest Margin*

1998-2011

*Reflects FTE Net Interest Income less Net Charge-offs as percentage of average

earning assets |

16

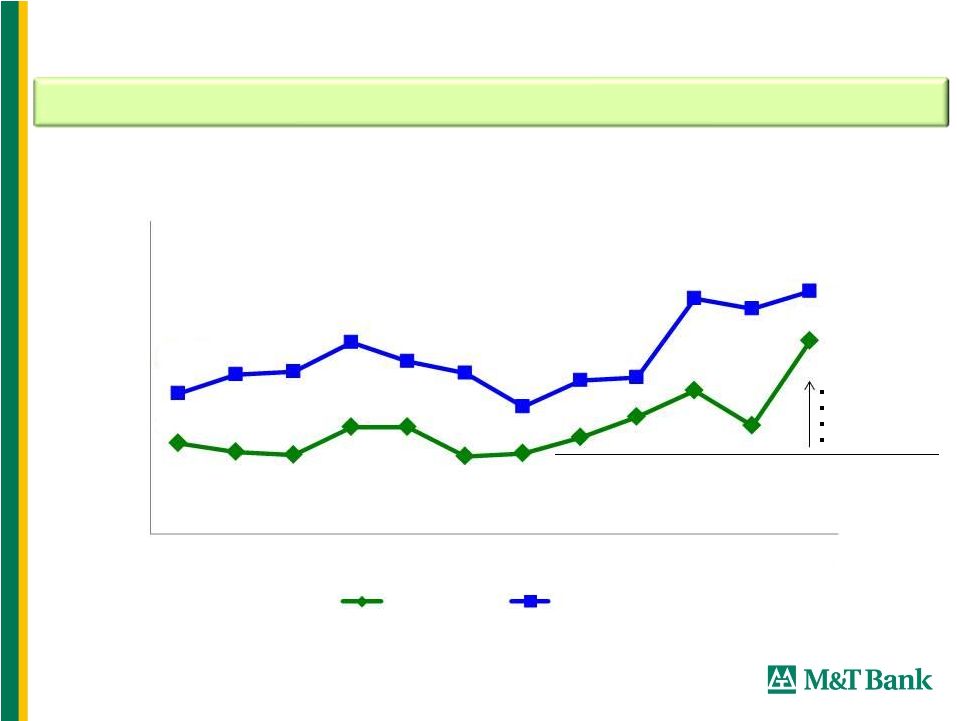

Efficiency Ratio

M&T’s philosophy relies on efficiently delivering banking services

2011 results influenced by Wilmington Trust and noteworthy 4Q items

Wilmington Trust

FDIC

Fee Regulation

Credit Cycle

52.25%

60.43%

56.28%

64.33%

45%

50%

55%

60%

65%

70%

'00

'01

'02

'03

'04

'05

'06

'07

'08

'09

'10

'11

MTB

Peer Median

Efficiency Ratio reflects non-interest expense (excluding amortization expense associated with

intangible assets, merger-related expenses and other non-recurring expenses) as a

percentage of fully taxable equivalent net interest income and non-interest revenues (excluding

gains from securities transactions and merger-related gains). The Efficiency Ratio is a

non-GAAP measure. See Appendix for a reconciliation to GAAP measures. |

17

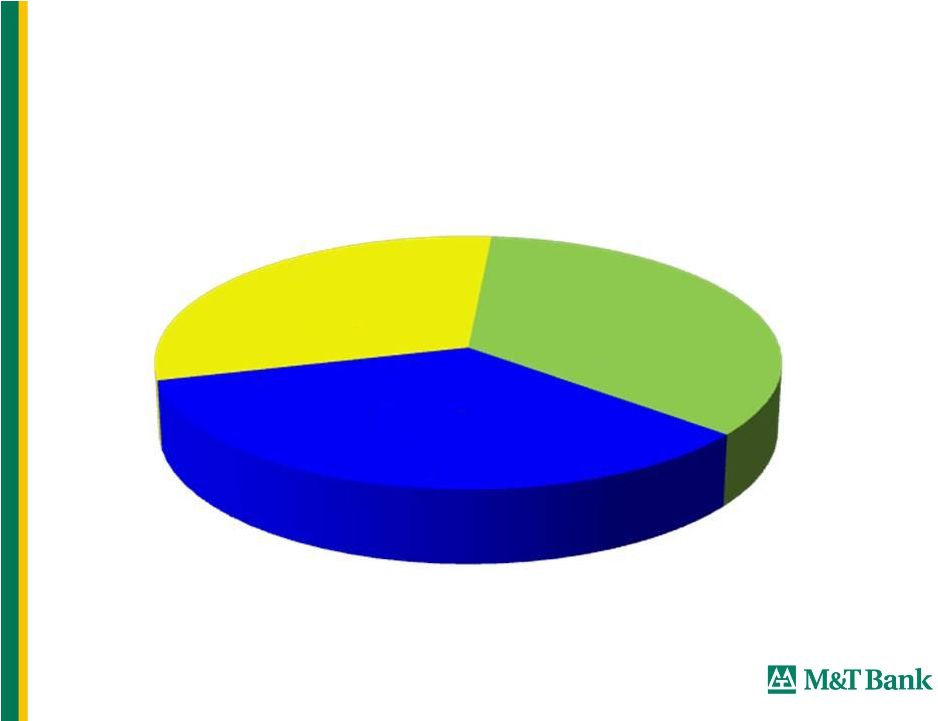

Prudent Capital Allocation

Cumulative Capital Retained, Dividends and Share Repurchases

1983 –

2011

Share

Repurchases

34%

Dividends

31%

Capital

Retained

35% |

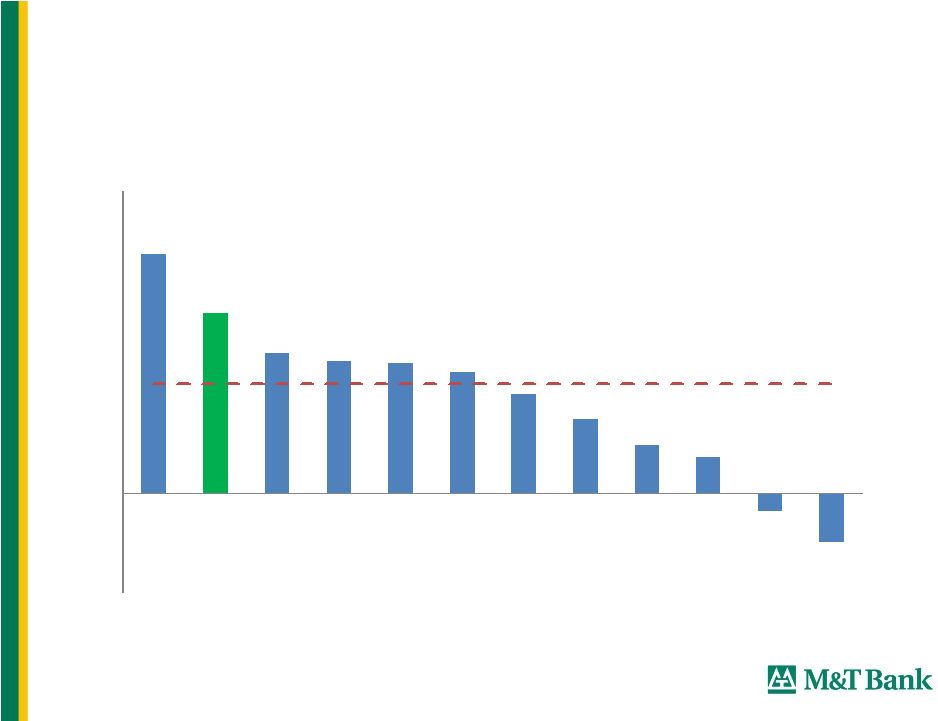

18

23.8%

18.0%

14.0%

13.2%

13.0%

12.0%

10.0%

7.4%

4.7%

3.6%

-1.7%

-4.9%

-10%

0%

10%

20%

30%

Peer 1

MTB

Peer 2

Peer 3

Peer 4

Peer 5

Peer 6

Peer 7

Peer 8

Peer 9

Peer 10

Peer 11

Peer Median 10.9%

Net Operating Return on Tangible Common Equity –

FY-2011

Note: Excludes amortization of intangibles and goodwill impairment,

merger-related items, and other nonrecurring items as noted by SNL. |

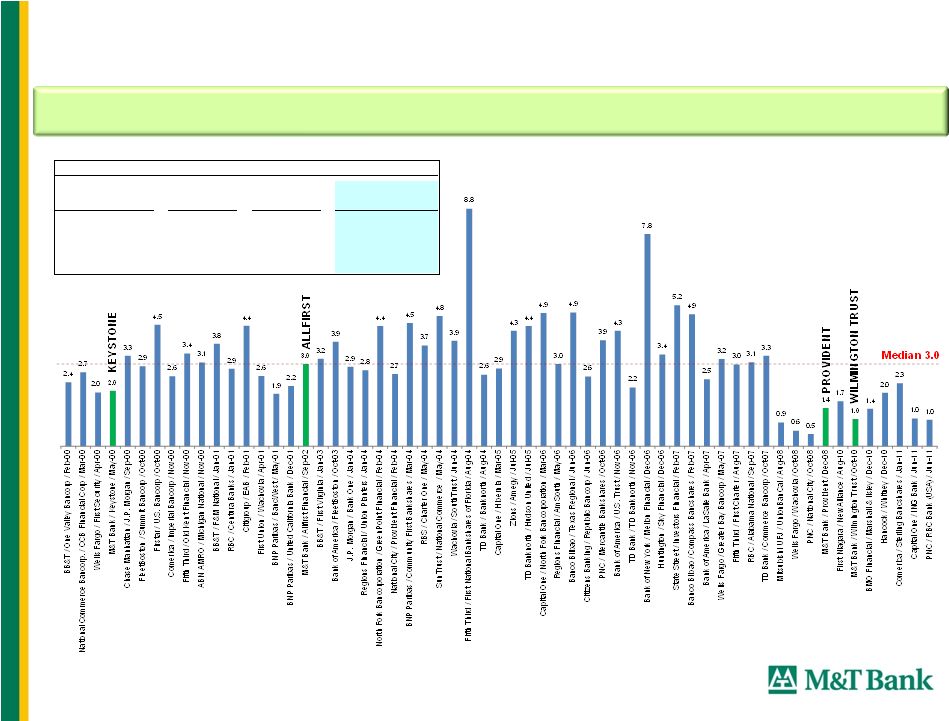

Acquistion

MTB Total

Return

BKX Total

Return

Outperformance

Wilmington Trust

9.0%

1.9%

7.2%

Provident

63.6%

9.4%

54.2%

Allfirst

30.4%

-17.1%

47.5%

Keystone

169.2%

-20.4%

189.6%

Total Returns to Date Since Acquisition Announcement*

M&T’s Acquisitions vs. Bank Deals > than $1B since 2000:

Deal Value / Tangible Common Equity

The M&T strategy: Value accrues to seller over time

(1)

Deal Value at Announcement and Tangible Common Equity at Most Recent Quarter before

Announcement (2)

Although Provident and Wilmington were both less than $1.0 billion in Deal Value,

they have been included for reference (2)

Source: SNL

Financial,

SNL

Total

Return

for

MTB,

Bloomberg

-

BKX

Total

Return

* Return calculated from first closing price post-announcement [Wilmington:

11/1/2010, Provident: 12/19/2008, Allfirst: 9/26/2002, Keystone: 5/17/2000] through 3/5 /12

19 |

20

Overview of Wilmington Trust Acquisition, May 2011

M&T consummated Wilmington Trust merger May 2011

o

Completed

integration

of

core

banking

systems

at

end

of

3

Quarter

2011

Compelling partnership:

o

Wilmington’s #1 market share in Delaware combined with M&T’s leading

Mid-Atlantic commercial bank presence provides top-tier scale

o

M&T’s ability to leverage and grow the established value of the

Wilmington Trust brand in trust, wealth management and corporate

services o

Increased fee income diversifies revenue and enhances M&T’s ROE

o

Shared values for community banking creates added returns for communities

rd |

21

WT merger targets announced at acquisition –

11/1/10:

High single-digit 2012 GAAP EPS accretion

Low double-digit 2012 net operating EPS accretion

Merger synergies about 15% of WT expense base -

$80 million annualized by

end of 2012

Merger-related expenses likely won’t exceed $100 million excl. purchase

accounting & Capex

2012 EPS impact consistent with original targets

$13 million of merger synergies realized in 4Q11

On track to realize full annual run-rate by 4Q12 following Trust systems

integration

$84 million merger-related expenses incurred through y/e 2011

Up to $10 million remaining merger-related expenses in 1H12

Update on Wilmington Trust merger

Update at Investor Conference -

September 2011

First Quarter 2012 status: |

22

Wilmington Trust is comprised of 2 Complementary Businesses

Corporate Client Services (CCS)

2011

post–acquisition

fee

revenues

-

$119

million

Four discrete business groups

Corporate Trust / Capital Markets

Retirement & Institutional Services

M&T Insurance Agency

Investment Management

Wealth Advisory Services (WAS)

2011

post-acquisition

fee

revenues

-

$87

million

Two distinct customer segments:

Opportunities typically arise through referrals

from lawyers, accountants, record keepers,

investment bankers, financial advisors and

consultants.

Provide administrative and/or fiduciary solutions

to corporations, governments & large institutions

for complex transactions and legal structures.

M&T’s middle market customer base includes

some 8,500 commercial clients; we believe

expanding Commercial/Wealth relationships will

be a strong generator of new business.

Wealth

creators

-

entrepreneurs

and

privately

held business owners that need both

traditional commercial loan

and deposit services

for their business plus fiduciary and investment

services for personal wealth

Multigenerational

wealth

“family

offices”

with

complex fiduciary, investment and private

banking needs. |

23

One-time NIM expansion from 4Q11’s 3.60% as excess liquidity held at Fed

over 2H11 has been deployed or withdrawn

For FY2012, expect NIM slightly lower than FY2011’s 3.73%

NIM outlook combined w/ mid-single digit loan growth implies growth in

NII Remain cautious with our outlook for credit

Expect continued, slow, steady improvement

Focused on expenses

Reminder: Seasonal expense surge in 1Q due to equity compensation grants

Outlook Consistent with Remarks on January earnings call

|

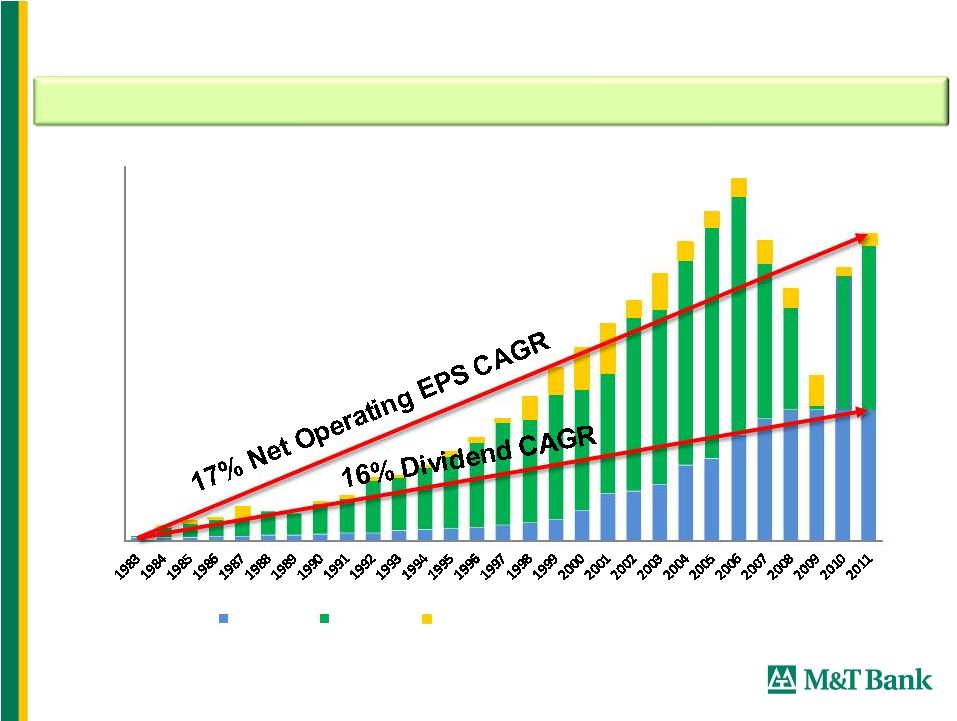

24

Earnings & Dividend Growth: 1983 -

2011

Note: Data

prior

to

1998

does

not

include

provisions

of

SFAS

No.

123

and

No.

148

stock

option

expensing.

M&T maintained its dividend and experienced no losses through the recent crisis

Net Operating Income and Net Operating EPS are non-GAAP financial

measures. Refer to the Appendix for a reconciliation between these measures

and GAAP 2.80

2.80

5.84

6.55

$0.00

$1.00

$2.00

$3.00

$4.00

$5.00

$6.00

$7.00

$8.00

Dividends

GAAP EPS

Impact of Amortization and Merger-related expenses |

25

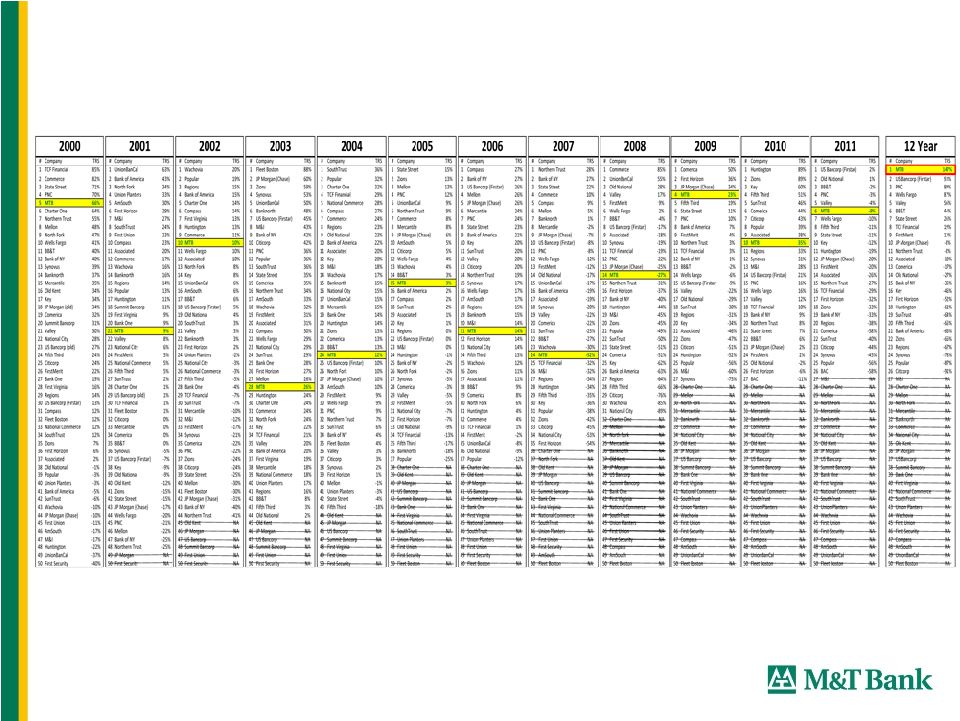

Strong Long-term Returns to Shareholders

Highest annual stock price appreciation among top 100 banks since 1983

19.3% annual total return since 1980

Highest total return among top 50 banks since 2000

19 highest return among top 50 banks in 2011

th |

Citigroup 2012 Financial Services Conference

March 8, 2012 |

27

1 1983 Stock Prices Source: Compustat and/or SNL

M&T Bank Corporation…

a solid investment

Stock

Closing Price at

Return

2/29/2012

3/31/1983

CAGR

Rank

Company Name

Ticker

($)

($)

1

(%)

1

M&T Bank Corporation

MTB

81.62

1.34

15.3

2

State Street Corporation

STT

42.23

1.06

13.6

3

U.S. Bancorp

USB

29.40

0.92

12.7

4

Northern Trust Corporation

NTRS

44.41

1.51

12.4

5

Wells Fargo & Company

WFC

31.29

1.18

12.0

23

—

—

2.8

Median

—

—

7.6

MTB Price @ Median Growth Rate

11.09

1.34

7.6

Of the largest 100

banks operating in

1983, only 23 remain

today

Among the

remaining, M&T

ranks 1

st

in stock

price growth |

28

19.3% Annual rate of return since 1980*

–

22

nd

best return of the entire universe of over 700 U.S. based

stocks that have traded publicly since 1980

$3,418 invested in M&T in 1980 would be worth $1 million today

*CAGR calculated assuming reinvestment of dividends through February 29,

2012. M&T Bank Corporation…

a solid investment

Rank

Company Name

Industry

Annual Return

1

Eaton Vance Corp.

Financials

25.1

2

Limited Brands Inc.

Consumer Discretionary

23.3

3

Gap Inc.

Consumer Discretionary

22.8

4

Progressive Corp.

Financials

22.8

5

TJX Cos.

Consumer Discretionary

22.6

6

Stryker Corp.

Health Care

22.2

7

Wal-Mart Stores Inc.

Consumer Staples

21.8

8

Hasbro Inc.

Consumer Discretionary

21.6

9

Mylan Inc.

Health Care

21.6

10

Precision Castparts Corp.

Industrials

21.4

11

Leucadia National Corp.

Financials

20.9

12

Raven Industries Inc.

Industrials

20.9

13

Valspar Corp.

Materials

20.7

14

State Street Corp.

Financials

20.3

15

HollyFrontier Corp.

Energy

20.3

16

Danaher Corp.

Industrials

20.3

17

Berkshire Hathaway Inc. Cl A

Financials

20.2

18

Robert Half International Inc.

Industrials

19.8

19

Forest Laboratories Inc.

Health Care

19.8

20

Family Dollar Stores Inc.

Consumer Discretionary

19.4

21

Graco Inc.

Industrials

19.4

22

M&T Bank Corp.

Financials

19.3 |

29

Total Returns to Shareholders

(1)

Largest 50 banks by market capitalization as of January 1, 2000

(1) Total Return To Shareholder from 12/31/1999 to 12/31/2011, as sourced

from Barclays Capital and SNL Financial. |

30

Appendix |

31

2011 Peer Group -

Largest 12 Regional Banks

BB&T Corporation

M&T Bank Corporation

Capital One Financial Corporation

PNC Financial Services Group, Inc.

Comerica Incorporated

Regions Financial Corporation

Fifth Third Bancorp

Synovus Financial Corp.

SunTrust Banks, Inc.

Huntington Bancshares Incorporated

Zions Bancorporation

KeyCorp |

32

Reconciliation of GAAP and Non-GAAP Measures

Net

Income

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

$'s in millions

Net income

$268.2

$353.1

$456.7

$573.9

$722.5

$782.2

$839.2

$654.3

$555.9

$379.9

$736.2

$859.5

Intangible amortization*

56.1

99.4

32.5

47.8

46.1

34.7

38.5

40.5

40.5

39.0

35.3

37.6

Merger-related items*

16.4

4.8

-

39.2

-

-

3.0

9.1

2.2

36.5

(16.3)

(12.8)

Net operating income

$340.7

$457.3

$489.2

$660.9

$768.6

$816.9

$880.7

$703.8

$598.6

$455.4

$755.2

$884.3

Pre-Tax,

Pre-Provision

Income

GAAP Pre-tax Income

$422.3

$551.6

$675.9

$850.7

$1,066.5

$1,170.9

$1,231.6

$963.5

$739.8

$519.3

$1,092.8

$1,224.6

Provision for credit losses

38.0

103.5

122.0

131.0

95.0

88.0

80.0

192.0

412.0

604.0

368.0

270.0

Pre-Tax, Pre-Provision Income

$460.3

$655.1

$797.9

$981.7

$1,161.5

$1,258.9

$1,311.6

$1,155.5

$1,151.8

$1,123.3

$1,460.8

$1,494.6

Earnings

Per

Share

Diluted earnings per share

$3.24

$3.58

$4.78

$4.95

$6.00

$6.73

$7.37

$5.95

$5.01

$2.89

$5.69

$6.35

Intangible amortization*

0.67

1.00

0.34

0.41

0.38

0.30

0.33

0.37

0.36

0.34

0.29

0.30

Merger-related items*

0.20

0.05

-

0.34

-

-

0.03

0.08

0.02

0.31

(0.14)

(0.10)

Diluted net operating

earnings per share

$4.11

$4.63

$5.12

$5.70

$6.38

$7.03

$7.73

$6.40

$5.39

$3.54

$5.84

$6.55

Efficiency Ratio

$'s in millions

Non-interest expenses

$718.6

$980.6

$961.6

$1,448.2

$1,516.0

$1,485.1

$1,551.7

$1,627.7

$1,727.0

$1,980.6

$1,914.8

$2,478.1

less: intangible amortization

69.6

121.7

51.5

78.2

75.4

56.8

63.0

66.5

66.6

64.3

58.1

61.6

less: merger-related expenses

26.0

8.0

-

60.4

-

-

5.0

14.9

3.5

89.2

0.8

83.7

Non-interest operating expenses

$623.0

$850.9

$910.1

$1,309.6

$1,440.6

$1,428.3

$1,483.7

$1,546.3

$1,656.8

$1,827.2

$1,856.0

$2,332.8

Tax equivalent revenues

$1,189.4

$1,653.3

$1,773.6

$2,446.2

$2,694.9

$2,761.3

$2,883.1

$2,804.1

$2,900.6

$3,125.7

$3,399.6

$3,998.6

less: gain/(loss) on sale of securities

(3.1)

1.9

(0.6)

2.5

2.9

1.2

2.6

1.2

34.4

1.2

2.8

150.2

less: net OTTI losses recognized

-

-

-

-

-

(29.4)

-

(127.3)

(182.2)

(138.3)

(86.3)

(77.0)

less: merger-related gains

-

-

-

-

-

-

-

-

-

29.1

27.5

64.9

Denominator for efficiency ratio

$1,192.5

$1,651.4

$1,774.2

$2,443.7

$2,692.0

$2,789.5

$2,880.5

$2,930.2

$3,048.4

$3,233.7

$3,455.6

$3,860.5

Net operating efficiency ratio

52.3%

51.5%

51.3%

53.6%

53.5%

51.2%

51.5%

52.8%

54.4%

56.5%

53.7%

60.4%

*Net of tax |

33

Reconciliation of GAAP and Non-GAAP Measures

Average Assets

2006

2007

2008

2009

2010

2011

$'s in millions

Average assets

55,839

$

58,545

$

65,132

$

67,472

$

68,380

$

73,977

$

Goodwill

(2,908)

(2,933)

(3,193)

(3,393)

(3,525)

(3,525)

Core deposit and other

intangible assets

(191)

(221)

(214)

(191)

(153)

(168)

Deferred taxes

38

24

30

33

29

43

Average tangible assets

52,778

$

55,415

$

61,755

$

63,921

$

64,731

$

70,327

$

Average Common Equity

$'s in millions

Average common equity

6,041

$

6,247

$

6,423

$

6,616

$

7,367

$

8,207

$

Goodwill

(2,908)

(2,933)

(3,193)

(3,393)

(3,525)

(3,525)

Core deposit and other

intangible assets

(191)

(221)

(214)

(191)

(153)

(168)

Deferred taxes

38

24

30

33

29

43

Average tangible common equity

2,980

$

3,117

$

3,046

$

3,065

$

3,718

$

4,557

$ |