Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DUKE REALTY CORP | d312271d8k.htm |

RELIABLE. ANSWERS.

Investor Presentation

Exhibit 99.1

March 8, 2012 |

40

Years Timeline 2

2011 Duke Realty Corporation

RELIABLE. ANSWERS |

RELIABLE. ANSWERS.

2011

Duke

Realty

Corporation

3

2009

2010 and 2011

FOCUS:

Liquidity

More than $1.5 billion

capital raised

Strategy refined

FOCUS:

Strategy execution

Operating

fundamentals

Balance sheet

strength

FOCUS:

Asset quality

Cash flow growth

Shareholder return

Where we’ve been and where we’re going…

2012 and beyond |

RELIABLE. ANSWERS.

2011 Duke Realty Corporation

Suburban Office Market Still Challenging

Economic and federal budget uncertainty limiting business investment and expansion

decisions Recovery

is

still

chugging

along

though,

with

Q4

overall

vacancy

declining

to

12.7%,

down

50

bps

from

previous

year,

with

class

A

only

space

vacancy

declining

80

bps

from

prior

year

Absorption for Q3 and Q4 modest, but strongest since 2007 and supply additions at

record low Re-leasing capital expenditures remain elevated

Medical Office Traction Remains

Operators now making expansion decisions after two year pause

Relationships are a key driver of on campus MOB business

Demographics and economics positive growth drivers

Medical office development and acquisition activity continues

4

Market Outlook

Still challenging, but trends improving in all product types

Industrial Market Continues Slow Recovery

Net absorption in U.S. for Q4 2011 was positive for the 7th consecutive

quarter Strong

demand

for

large,

modern

product

remains,

Q4

vacancy

down

230bps

over

prior

year

Rents beginning to improve, occupancy levels getting closer to equilibrium and

limited new supply ISM index has been slowly climbing after a moderate

trough in mid-2011 Manufacturing sector, wholesale trade and

transportation realizing a majority of recent job growth Source: PPR and

Duke Realty |

RELIABLE. ANSWERS.

2011

Duke

Realty

Corporation

Focus on:

Increasing cash flow

Maximizing return on

assets

5

Strategy for Success

Focus on:

Improving coverage ratios

Improving ratings

Focus on:

Portfolio repositioning

Strategic acquisitions &

dispositions

Development opportunities

Strategies for delivering shareholder value |

RELIABLE. ANSWERS.

2011

Duke

Realty

Corporation

Strategic Focus

2011 Goals and Objectives

Q4 2011 Update

•

Lease-up portfolio, manage cap ex; reach

positive same property income growth

•

Balance execution with capital strategy relative

to level and quality of cash flow and same

property NOI; Debt to EBITDA <7.0x

•

Development starts of $100 to $200 million

focus on medical office and build-to-suit

•

Total portfolio occupancy as of December 31, 2011 of 90.7%;

industrial portfolio at 91.9%

•

Approximately 5.1 million square feet of leases completed

•

Debt to EBITDA @ 6.0x*; 4.7% Same Property NOI growth

•

$12.7 million development start; a 52% pre-leased medical office

•

Continue strong momentum from 2010 on

repositioning of portfolio

•

Pursue acquisitions of medical and industrial

assets

•

Planned asset dispositions of primarily Midwest

office

•

Closed on over $388 million of acquisitions during the quarter

•

$1.11 billion in dispositions of non-core assets

•

Closed 79 building, $1.06 billion suburban office portfolio

sale to Blackstone

•

Opportunistically access capital markets . . .

push out maturity schedule further

•

Continue improving our coverage ratios

•

Maintain minimal balance on line of credit

•

YTD Fixed charge ratio of 1.82x versus 1.79x for 2010

•

Paid off $167 million of 3.75% Convertible Debt at maturity

•

Zero credit facility balance and $212MM of cash at quarter end,

primarily due to proceeds from Blackstone sale

•

Renewed $850MM line of credit for up to 5 year term (including

the 1 year extension option) at lower cost

Asset

Strategy

Operations

Strategy

Capital

Strategy

6

Strong Q4 finish and executing across all three aspects of our strategy

* Timing of Blackstone transaction; Including adjustments to EBITDA for Blackstone

transaction results in recast Debt to EBITDA of 7.03x |

2011

Duke

Realty

Corporation

OPERATIONS STRATEGY

7 |

2011

Duke

Realty

Corporation

8

Focus on Fundamentals

LEASING OF

PORTFOLIO

STRATEGIC

NEW DEVELOPMENT

AND LAND DISPOSITION

AFFO PAYOUT

OPERATIONS STRATEGY

Maximize return on assets |

2011

Duke

Realty

Corporation

9

New, High Quality Portfolio with Long-term Leases

OPERATIONS STRATEGY

Premier portfolio of assets

Portfolio average

Bulk

Industrial

Suburban Office

Medical

Office

Property age

10.6 years

13.2 years

4.1 years

Property size

217,000 SF

116,000 SF

89,000 SF

Lease term

7.1 years

7.3 years

11.4 years

Tenant size

72,000 SF

12,000 SF

10,000 SF |

Consistent Operating Performance

Stabilized Occupancy (%)

Strong

historical

stabilized

occupancy

–

fundamentals

improving

Lease Renewals (%)

Strong lease renewal percentages

Stabilized occupancy

In-service occupancy

80%

72%

79%

77%

69%

2007

2008

2009

2010

2011

29.9

21.4

22.7

25.9

2007

2008

2009

2010

2011

Leasing Activity

New

Leases

and

Renewals

–

Consistent

Execution

(in

millions

of

square feet)

Lease Maturity Schedule

Lease maturities are well balanced with no one year accounting for

more than 12%

24.5

OPERATIONS STRATEGY

Demonstrated ability to

maintain consistency through economic cycles

2011

Duke

Realty

Corporation

10

95%

92%

92%

89%

88%

91%

91%

89%

89%

87% |

2011 Duke Realty Corporation

1.5%

(0.2%)

(0.2%)

3.2%

(0.6%)

0.2%

(1.0%)

0.0%

1.0%

2.0%

3.0%

4.0%

Suburban Office Peers

Industrial Peers

5-Year Avg.

1-Year Avg.

Annual Same-Store

NOI Growth

(1)

%, y-y

Sources SNL and company filings

Duke Realty

Suburban Office Peers

(2)

Industrial Peers (3)

Consistent NOI Growth Outperformance

Relative Performance vs. Peers

OPERATIONS STRATEGY

11

1.

Based on simple average of year-over-year annual same-property cash NOI growth, includes

2007 - 2011 2.

Suburban Office Peers include BDN, CLI, HIW, LRY and PKY; weighted by historical market cap 3.

Industrial includes DCT, EGP, FR, FPO, PSB, AMB and PLD; weighted by historical market cap Notes

|

RELIABLE. ANSWERS.

2011

Duke

Realty

Corporation

12

Office Average: $4,857

58.6%

46.0%

52.2%

44.8%

38.0%

41.3%

53.6%

33.9%

40.2%

43.7%

0%

20%

40%

60%

80%

BDN

OFC

HIW

CLI

LRY

DRE

FR

DCT

PLD

EGP

91.3%

86.5%

90.7%

94.7%

92.5%

87.9%

89.7%

88.9%

88.2%

88.3%

80%

83%

86%

89%

92%

95%

LRY

HIW

CLI

OFC

BDN

DRE

EGP

PLD

DCT

FR

8.9x

7.2x

7.1x

9.5x

7.3x

7.4x

6.7x

6.3x

5.0x

5.2x

0.0x

3.0x

6.0x

9.0x

12.0x

OFC

BDN

HIW

LRY

CLI

DRE

PLD

FR

DCT

EGP

DRE Benchmarking Statistics

Source: SNL Financial, 3/6/12

Industrial Average: 7.7x

Industrial Average: 91.2%

$27,541

Industrial Average: $8,841

Office Average: 88.6%

Office Average: 6.5x

Office Average: 46.0%

Industrial Average: 44.1%

Total Market Cap ($ in millions)

(1)

Total Debt / Total Market Cap

Portfolio Occupancy

Total Debt / 2012E EBITDA

(1)

Key:

Office: LRY=Liberty; CLI=Mack-Cali; HIW=Highwoods; BDN=Brandywine

Industrial: PLD=Prologis; FR=First Industrial; DCT=DCT Industrial Trust; EGP=

Eastgroup; FPO= First Potomic (1) Pro forma for $1Bn suburban office

portfolio sale to Blackstone: debt by $452MM and preferred decreased by $168MM

6,561

4,760

2,835

2,798

2,190

4,086

4,355

4,523

8,279

$0

$2,000

$4,000

$6,000

$8,000

LRY

CLI

OFC

HIW

BDN

DRE

PLD

FR

DCT

EGP

$28,000 |

RELIABLE. ANSWERS.

2011

Duke

Realty

Corporation

13

Industrial Average: 15.8x

Office Average: 11.1x

6.3%

5.7%

5.5%

4.9%

4.9%

4.3%

0.0%

5.4%

3.3%

4.5%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

CLI

LRY

BDN

HIW

OFC

DRE

DCT

EGP

PLD

FR

8.6%

7.2%

7.3%

8.1%

6.9%

6.2%

6.1%

7.6%

7.6%

7.5%

5.5%

6.0%

6.5%

7.0%

7.5%

8.0%

8.5%

9.0%

CLI

BDN

LRY

HIW

OFC

DRE

FR

DCT

PLD

EGP

17.8x

16.1x

18.9x

28.6x

28.0x

14.4x

24.6x

21.1x

16.2x

15.6x

10.0x

14.0x

18.0x

22.0x

26.0x

30.0x

LRY

HIW

OFC

BDN

CLI

DRE

PLD

FR

DCT

EGP

13.3x

11.8x

11.6x

8.0x

13.3x

20.4x

14.2x

10.7x

15.7x

12.9x

6.0x

10.0x

14.0x

18.0x

22.0x

LRY

HIW

OFC

CLI

BDN

DRE

PLD

EGP

DCT

FR

DRE Valuation Statistics

Industrial Average: 25.6x

Source: SNL Financial, 3/6/12

(1) Per Wall Street research as of 2/21/12

Industrial Average: 3.5%

Industrial Average: 6.8%

Office Average: 16.0x

Office Average: 5.5%

Office Average: 7.7%

Price / 2012E FFO

Implied Cap Rate

(1)

Dividend Yield

Price / 2012E AFFO

Key:

Office: LRY=Liberty; CLI=Mack-Cali; HIW=Highwoods; BDN=Brandywine

Industrial: PLD=Prologis; FR=First Industrial; DCT=DCT Industrial Trust; EGP=

Eastgroup; FPO= First Potomic |

2011 Duke Realty Corporation

RELIABLE. ANSWERS.

14

Positioned for NAV Growth

KEY NAV GROWTH DRIVERS

Lease up

existing

vacancy

Increased

management/

service fees

Accretive

future

development

Upside from

land holdings

Portfolio occupancy of 90.7%; 100-200 bps below historical levels

Strong leasing pipeline

Demonstrated track record of 70-80% renewal rate

Will benefit from uptick in third party and JV partners development &

construction activity

Property

management

and

leasing

fees

-

will

trend

higher

as

occupancy

improves

Current pipeline of 569K SF of medical office and 344K SF of suburban office

2012 estimated development starts of $200 to $300 million

Attractive basis enhances accretive developments

Potential upside from impaired carrying value

Will opportunistically assess development and disposition alternatives

Increase Rents/

Reduced Capex

Rent roll downs burning off and positive same property NOI performance

Research forecasts market wide average annual rent growth of 3.2% from

2013-16 |

2011

Duke

Realty

Corporation

15

Land and Development Capabilities

OPERATIONS STRATEGY

HELD FOR DEVELOPMENT

Midwest

26.3

2.8

Indianapolis, Chicago,

Cincinnati, Columbus,

Minneapolis, and

St. Louis major

positions

East

3.8

2.1

New Jersey,

Baltimore,

Washington D.C., and

Raleigh

Southeast

8.5

1.3

Atlanta, Central

Florida, and, South

Florida

Southwest

5.8

0.7

Phoenix, Dallas, and

Houston

Total

44.4 million SF

6.9 million SF

Attractive positions contribute to future development and value

Development –

Amounts in million SF

$498

million

Office

30%

Industrial

70%

Office

Industrial |

2011

Duke

Realty

Corporation

16

Atlanta -

Office

OPERATIONS STRATEGY

Strategic new development on Duke Realty land

•

Headquarters

Build

to

Suit

for

Primerica,

A2/AA-

rated

financial

services

Company

•

345,000 square feet

•

Fifteen year lease term

•

Owned land at Legacy Office Park in Gwinnett County, 37 acres

•

First development at this park

•

$65 million project |

2011

Duke

Realty

Corporation

17

Indianapolis –

Medical Office

OPERATIONS STRATEGY

Grow Medical Office

•

Wishard Faculty Office Building

•

Aa2 rated system sponsored by Marion County

•

275,000 square feet

•

Thirty year lease term

•

50/50 Joint Venture with Hospital System

•

On campus of new hospital to open in 2013

•

$90 million project |

2011

Duke

Realty

Corporation

18

2011 PERFORMANCE

Average portfolio occupancy of 89.7%

Industrial at 91.9% occupancy

Nearly 25 million SF of leases executed

Same property NOI increase of 3.2%

2012 GOALS

Average portfolio occupancy of 91%

Achieve positive rent increases on renewals

Further improve lease quality (Cap Ex / NER)

Strong positive same property performance…again

OPERATIONS STRATEGY

Quality, well-positioned assets to drive performance |

2011

Duke

Realty

Corporation

ASSET STRATEGY

19 |

2011

Duke

Realty

Corporation

$1 Billion

20

Track Record

Flex disposition

$1 Billion

2005

2006

Savannah

Washington DC

2007

Healthcare

2009

Asset Strategy

2010

Dugan

CBRERT

Premier

Suburban

Office

Disposition

2011

Proven ability to execute

ASSET STRATEGY |

2011

Duke

Realty

Corporation

21

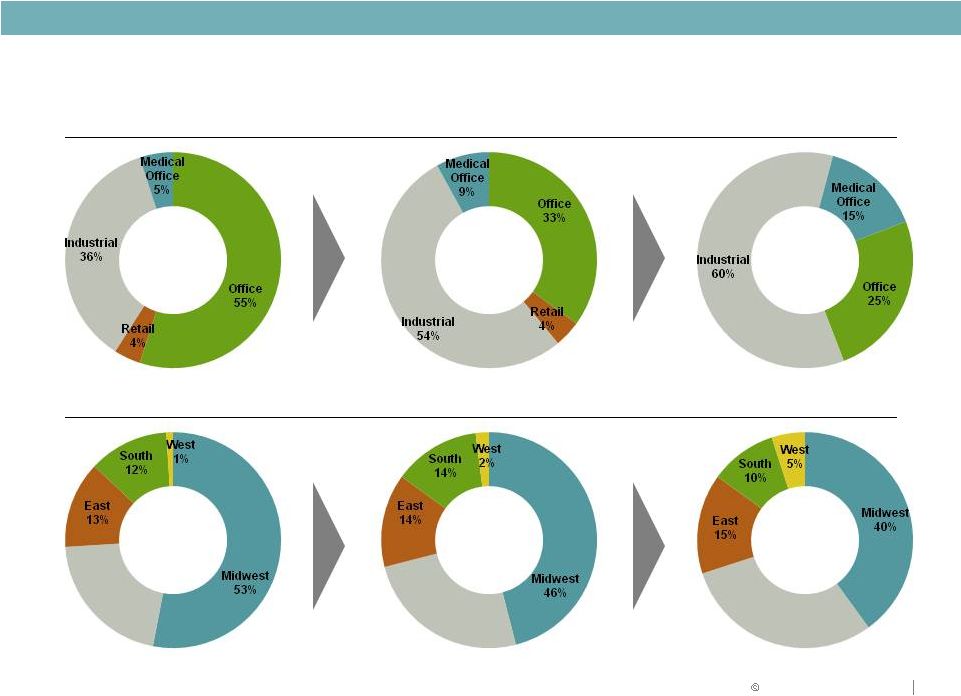

Portfolio Strategy

December 31, 2011

BY PRODUCT

2009

2013

BY GEOGRAPHY

ASSET STRATEGY

2009

2013

2011

Southeast

21%

Southeast

24%

Southeast

30%

2011 |

2011

Duke

Realty

Corporation

22

Asset Strategy –

Quarterly Repositioning Activities

ACQUISITIONS

(1)

DISPOSITIONS

2010

Q1 2010

$9

Q1 2010

$123

Q2 2010

28

Q2 2010

31

Q3 2010

442

Q3 2010

43

Q4 2010

440

Q4 2010

302

2010 Total

$919

2010 Total

$499

2011

Q1 2011

$140

Q1 2011

$456

Q2 2011

$116

Q2 2011

$ 58

Q3 2011

$103

Q3 2011

$ 6

Q4 2011

$388

Q4 2011

$1,114

2011 Total

$747

2011 Total

$1,634

Total

$1,666

Total

$2,133

(1)

Stabilized Costs

ASSET STRATEGY

($ in millions) |

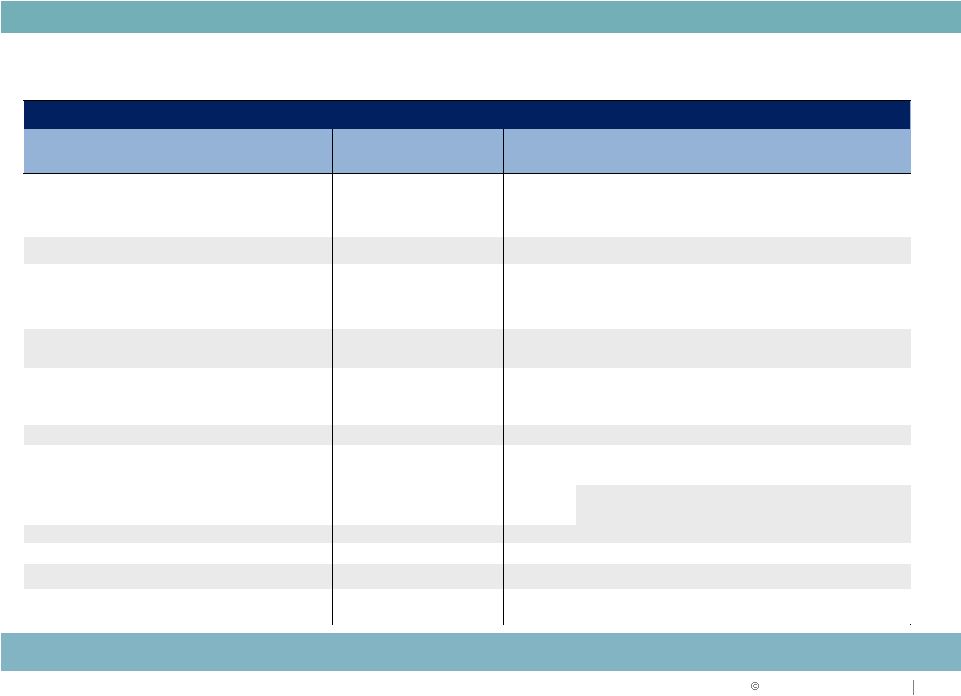

2011

Duke

Realty

Corporation

23

Asset Strategy: Road Map

($ in millions)

Investment

12/31/10

Investment

12/31/11

ACTION PLAN

Investment

2013

PRODUCT TYPE

Amount

%

Amount

%

Acquisitions /

Developments /

Repositioning

Amount

%

Industrial

$3,645

45%

$4,129

54%

$809

$4,920

60%

Office

3,770

46%

2,555

33%

(420)

2,050

25%

Medical Office

515

6%

732

9%

498

1,230

15%

Retail

280

3%

304

4%

(314)

0

0%

$8,210

100%

$7,720

100%

$573

$8,200

100 %

REGION

Midwest

$3,970

48%

$3,564

46%

($209)

$3,280

40%

Southeast

2,270

28%

1,839

24%

630

2,460

30%

East

955

11%

1,064

14%

172

1,230

15%

South

950

12%

1,091

14%

(268)

820

10%

West

65

1%

162

2%

248

410

5%

$8,210

100%

$7,720

100%

$573

$8,200

100%

Portfolio sale accelerates suburban office repositioning

ASSET STRATEGY |

2011

Duke

Realty

Corporation

24

ASSET STRATEGY

Asset Strategy: Progress To Date

BUILDING ACQUISITIONS

BUILDING DISPOSITIONS

Q4 2009

15

Q4 2009

144

2010

919

2010

499

2011

747

2011

1,634

Proforma Total

$1,681

Proforma Total

$2,277

PRO FORMA

PROGRESS TO DATE

TOTAL

VALUE

ASSUMED

DEBT

NET

Dispositions

$2,277

($0)

$2,277

Acquisitions

$1,681

($651)

$1,030

Excess Cash

$1,247

Only

100 Bps

difference in

Cap Rates

Matching

acquisitions

with

dispositions

.

.

.

limiting

earnings

impact

($ in millions) |

2011

Duke

Realty

Corporation

25

2011 PERFORMANCE

$1.6 billion of dispositions

$747 million of acquisitions

Over $200 million of development starts

Made significant progress on strategic plan

2012 GOALS

$250 million of dispositions

$400 million of acquisitions

$250 million of development starts

Continue making progress on strategic plan

ASSET STRATEGY

Quality portfolio further improving with asset strategy

|

2011

Duke

Realty

Corporation

CAPITAL STRATEGY AND 2011 GUIDANCE

26 |

2011

Duke

Realty

Corporation

Capital Strategy Focus

27

Reducing leverage

Increasing coverage ratios

Maintaining size and quality of unencumbered asset base

Executing portfolio repositioning in alignment with capital strategy

objectives

Further improve balance sheet strength and ratings

CAPITAL STRATEGY

1

2

3

4 |

2011

Duke

Realty

Corporation

28

Key Metrics & Goals

2009

Actual

2010

Actual

2011

Actual

Goal

Debt to Gross Assets

44.5%

46.3%

46.8%

45.0%

Debt + Preferred to Gross

Assets

54.9%

55.5%

55.6%

50.0%

Fixed Charge Coverage Ratio

1.79 : 1

1.79 : 1

1.82 : 1

2.00 : 1

Debt/EBITDA

6.65

7.31

6.02*

< 6.00

Debt + Preferred/EBITDA

8.47

8.88

7.34*

< 7.75

CAPITAL STRATEGY

Progressing toward strategic plan goals

Timing of Blackstone transaction; Including adjustments to EBITDA for Blackstone transaction results

in recast Debt to EBITDA of 7.03x and Debt+Preferred/EBITDA of 8.35x *

|

2011

Duke

Realty

Corporation

29

CAPITAL STRATEGY

Continue to execute on capital strategy objectives

CAPITAL SOURCE

2007

2008

2009

2010

2011

TOTAL

Common Stock

$230

-

$575

$311

-

$1,116

Preferred Stock

-

$300

-

-

-

$300

Unsecured Debt

$300

$325

$500

$250

-

$1,375

Secured Debt

-

-

$270

-

-

$270

Asset Dispositions

$785

$475

$300

$533

$1,650

$3,344

TOTAL

$1,115

$1,100

$1,645

$1,094

$1,650

$6,405

•

Investment grade rated debt for over 15 years

•

Proven access to multiple capital sources

•

Available line of credit -

$850 million capacity

•

Dividend covered by AFFO

Continue to strengthen balance sheet

($ in millions) |

2011 Duke Realty Corporation

CAPITAL STRATEGY

30

Liquidity Position

($ in millions)

Manageable debt maturities

and beyond |

RELIABLE. ANSWERS.

2011

Duke

Realty

Corporation

2012 Range of Estimates

Metrics

2011

Actual

Pessimistic

Optimistic

Key Assumptions

Core FFO per share

$1.15

$0.94

$1.06

- Blackstone/repositioning dilution $.10 - $.12

- Lower service operations income

- Partially offset by improvement in occupancy of core portfolio

AFFO Payout Ratio

87%

96%

80%

- Annual dividend maintained at $0.68 per share

Average Occupancy - In-Service

89.7%

89.5%

92.5%

- Positive momentum anticipated given industrial and medical office perform

- Lower expirations than 2011 (7% vs. 10%)

- Upside to guidance driven by lease-up of portfolio

Same Property NOI Growth

3.2%

(1.5%)

2.5%

- Occupancy increase lower than 2011

- Rental rate pressure remains

Building Acquisitions

$747

$300

$500

- Remain selective regarding property type and location in alignment with

long-term strategy

- Focus on industrial and medical office

Building Dispositions

$1,634

$200

$300

- Continue to prune remaining non-core office portfolio

Land Sale Proceeds

$12

$20

$30

- Selling 10% to 20% of identified non-strategic parcels

- Demand still sluggish

Construction and Development Starts

$489

$300

$500

- Comprised of medical office and industrial starts

- Development of $200 to $300 million

- Third party of $100 to $200 million

Construction Volume

$727

$400

$600

- Wind down of BRAC project partially offset by development volume

Service Operations Income

$46

$20

$25

- Reduced fees from BRAC project

General & Administrative expense

$40

$43

$38

- In line with 2011

- 2012 Range -

$ in millions

Leasing Actions Combined with Modest Rental Rate Increases Drive

Upside

31 |

Strong balance sheet …

executing according to strategy

* Timing of Blackstone transaction; Including adjustments to EBITDA for

Blackstone transaction results in recast Debt to EBITDA of 7.03x

32

2011

Duke

Realty

Corporation

2011 PERFORMANCE

$1.6 billion of capital raised through asset

dispositions

Retired $333 million of unsecured bonds

Redeemed $109 million of preferred equity

Fixed charge ratio of 1.82x and

debt to EBITDA of 6.02x*

2012 GOALS

Opportunistically access capital markets

Continue improving coverage ratios

Maintain minimal balance on line of credit

CAPITAL STRATEGY |

2011

Duke

Realty

Corporation

MIDWEST OVERVIEW

Performance Update

33 |

2011

Duke

Realty

Corporation

34

Midwest

New Lease -

Industrial

Plainfield 8 –

Indianapolis

250,000 SF

Tenant: Gilchrist & Soames

Term: 11 years

Renewal -

Industrial

Mosteller Dist Ctr. II -

Cincinnati

206,000 SF

Tenant: Kellogg’s

Term: 2 years

Strong distribution base: Over 30% of U.S.

population within one day’s drive

74 Fortune 500 headquarters

High growth and return opportunities, particularly in

Chicago, Columbus, and Indianapolis

Duke Realty’s roots and a position of strength

Original

location

–

since

1972

Low basis product

Dominant market position

46% of our total investment

Acquisition -

Industrial

Eight Bldg Portfolio -

Chicago

1,500,000 SF

100% Leased

Remaining Term: 4 years

MIDWEST OVERVIEW

Disposition-Office

Three Bldg Portfolio-

Cleveland

273,000 SF

22 Year Old Portfolio

MARKET OVERVIEW & KEY POINTS

Committed to Midwest because we perform…

Midwest remains a key component to our strategy

RECENT TRANSACTIONS |

2011

Duke

Realty

Corporation

35

Midwest Overview

Location

Product

Type

Industrial

Office

Average Age

12.1 years

16.2 years

Average Building Size

240,000 SF

124,000 SF

Total Square Footage

55.4 million

12.4 million

Current Occupancy

94.5%

83.9%

Indianapolis

96.2%

91.9%

Chicago

98.50%

87.8%

Cincinnati

91.7%

82.4%

St. Louis

87.6%

78.8%

Columbus

96.8%

88.0%

Minneapolis

86.0%

100%

MIDWEST OVERVIEW |

2011

Duke

Realty

Corporation

36

Midwest Focus

DOMINANT POSITION

BULK INDUSTRIAL

REDUCE OFFICE

CONCENTRATION

MIDWEST OVERVIEW

Enhancing dominant industrial position in Midwest |

2011

Duke

Realty

Corporation

EAST & SOUTHEAST OVERVIEW

Performance Update

37 |

2011 Duke Realty Corporation

38

East & Southeast Overview

Strong presence: entered Southeast in 1999 (Weeks

merger) and East in 2006 (acquisition of Winkler

portfolio)

15 Fortune 500 headquarters

East and Southeast cities among top growth markets

in country…

strong in-migration

Diversified economies; Government, healthcare,

finance and education

Eastern cities maintained highest employment rate

through downturn

Atlanta and Northeast corridor strong in bulk industrial

38% of our total investment

MARKET OVERVIEW & KEY POINTS

EAST & SOUTHEAST OVERVIEW

Renewal–

Industrial

Atlantic Business Ctr

South Florida

Point Blank Body Armor

104,000 SF

Term: 3 Years

New Leases -

Office

Liberty Ctr I Washington DC

Fortune 50 Defense

Contractor

80,000 SF

Term: 7 Years

Renewal -

Office

Crabtree Overlook

Raleigh

75,000 SF

Tenant: Alcatel-Lucent

Term: 5 Years

RECENT TRANSACTIONS |

East

& Southeast Overview Location

Product

Type

Industrial

Office

9.5 years

10.1 years

161,000 SF

110,000 SF

28.6 million

9.7 million

86.9%

86.2%

77.2%

81.5%

83.0%

85.2%

96.6%

88.2%

91.7%

87.5%

92.2%

84.0%

91.8%

NA

EAST & SOUTHEAST OVERVIEW

Office

39%

Industrial

48%

Medical

Office

5%

Retail

8%

Atlanta

19%

D.C./

Baltimore

13%

Central

Florida

7%

Raleigh

24%

South

Florida

28%

Savannah

9%

39

2011

Duke

Realty

Corporation

Average Age

Average Building Size

Total Square Footage

Current Occupancy

Atlanta

South Florida

Raleigh

Washington D.C./Baltimore

Central Florida

Savannah |

2011

Duke

Realty

Corporation

40

East & Southeast Focus

BULK INDUSTRIAL/PORTS

LEASE UP AND RENT GROWTH

ACQUISITIONS & DEVELOPMENT

EAST & SOUTHEAST OVERVIEW

Maximize assets and market position |

2011

Duke

Realty

Corporation

41

SOUTHWEST OVERVIEW

Performance Update |

2011

Duke

Realty

Corporation

42

Southwest

Acquisition -

Industrial

Lakeside Ranch / Pioneer

Dallas

1,400,000 SF

100% Leased

Remaining Term: 5 Years

Acquisition-

Industrial

1283 Sherborn Street

Southern California

290,000 SF

100% Leased

Remaining Term: 9 Years

MARKET OVERVIEW & KEY POINTS

Renewal/Expansion-

Industrial

Freeport X

Container Store

Dallas

955,000 SF

Duke Realty one of top 3 owner/developers in

Dallas/Ft.Worth

Duke Realty presence since 1999 (Weeks merger) 52 Fortune 500 headquarters

Demographic drivers: modern transportation and

infrastructure, population and job growth

Strong industrial demand expected post-recovery

Port, inland port and logistics key for bulk distribution

markets

16% of our total investment

Expand industrial presence by pursuing select

acquisition opportunities in Houston, Phoenix and

Southern California

SOUTHWEST OVERVIEW

RECENT TRANSACTIONS |

2011 Duke Realty Corporation

SOUTHWEST OVERVIEW

43

Southwest Overview

Industrial

Office

Average Age

8.3 years

7.3 years

Average Building Size

272,000 SF

106,700 SF

Total Square Footage

23.4 million

1.6 million

Current Occupancy

91.8%

95.2%

Dallas

89.6%

100%

Nashville

95.9%

93.4%

Houston

95.3%

100%

Phoenix

94.4%

N/A

Southern California

100%

N/A |

2011

Duke

Realty

Corporation

44

Southwest Focus

DALLAS LEASE-UP

HOUSTON INDUSTRIAL PORT

DALLAS INLAND PORT

SOUTHERN CALIFORNIA

EXPANSION

SOUTHWEST OVERVIEW

Grow |

2011

Duke

Realty

Corporation

45

MEDICAL OFFICE STRATEGY &

Performance Update |

2011

Duke

Realty

Corporation

Medical Office Portfolio at December 31, 2011

46

In-Service

Under

Development

Total

Properties

38

5

43

Investment $

$625 M

$106 M

$731 M

Square Feet

3.38 M

568 K

3.95 M

Occupancy

90%

83%

89%

Local

26%

Regional

48%

National

26%

Specialty

Hospital

4%

MOB On-

Campus

89%

MOB

Off-Campus

7%

Portfolio investment by product type

Portfolio investment by

hospital system

MEDICAL OFFICE STRATEGY |

PIEDMONT ATLANTIC

Atlanta*

Birmingham

Charlotte

Nashville*

Raleigh*

NORTHEAST

Baltimore*

Boston

Philadelphia

Richmond

Washington, D.C.*

GREAT LAKES

Chicago*

Columbus*

Indianapolis*

Louisville

Minneapolis*

St. Louis*

FLORIDA

Jacksonville

Miami

Orlando*

Tampa*

GULF COAST

ARIZONA SUN

CORRIDOR

NORTHERN

CALIFORNIA

SOUTHERN

CALIFORNIA

CASCADIA

Megaregions by 2050:

major cities that produce more than $100 billion in goods and

services. Mega-regions will drive need for healthcare,

transportation infrastructure and jobs through 2050

Duke Realty Markets: Demographic Focus

*

Duke Realty market

Map Source: ATLANTA REGIONAL COMMISSION MEGAREGIONS REPORT

47

TEXAS TRIANGLE

Austin*

Dallas

*

Houston*

San Antonio

Populations in contiguous regions with

MEDICAL OFFICE STRATEGY

2011

Duke

Realty

Corporation |

2011

Duke

Realty

Corporation

48

Healthcare Data Points

The nation’s largest industry

•

Represents more than 17% of GDP, predicted to exceed 23% by

2020

•

Americans spend more than 5% of pre-tax income on

healthcare. Lower income brackets pay 15% or more ($7,800

per capita health expenditures in 2008/2009)

Reform

•

Increased number of people insured expected to increase by 30

to

50

million

–

increased

demand

for

care

•

Number

of

physicians

will

increase

–

more

space

demand

•

Hospitals expect margin pressure and need to increase market

share –

Hospitals seeking capital partners for “non-core

assets”

•

May

reduce

reimbursements

–

real

estate

efficiency

a

priority –

larger deals and floor plates

Healthcare systems growing and physician employment changing

MEDICAL OFFICE STRATEGY |

2011

Duke

Realty

Corporation

49

Healthcare Systems

Consolidation of hospitals into systems

continues

Hospitals need capital and must grow

market share

Healthcare systems are drivers for more

strategically located outpatient facilities

Employment of Physicians

More physicians are being employed by

hospitals

Hospitals and physicians are forming

multi-specialty practices to prepare for

improved quality and reduced

reimbursement

Hospitals are driving more medical office

space needs for physicians

Fewer Independent Community Hospitals

More Physician’s Aligning with Hospitals

Demand Drivers

#

Hospitals

5,000

MEDICAL OFFICE STRATEGY

Source: Robert Kocher, MD and Nikhil R. Sahni, B.S., “Hospitals’ Race to Employ Physicians

– The Logic behind a Money-Losing Proposition. ”The New England Journal of

Medicine.;364:1790-1793. 12 May 2011. Physician Compensation and Production Survey, Medical Group Mgt Assoc, 2003-2009.

|

2011

Duke

Realty

Corporation

50

Development Focus

ACTION PLAN

National brand awareness

Be “Experts”

–

Speak at national conferences (ASHE, BOMA)

–

Third party references

National system relationships

–

Ascension

–

Tenet

–

HCA

–

Adventist

Regional system relationships

–

Baylor Health

–

Rex Healthcare

–

Carolina Healthcare Systems

–

Advocate

System

Focus

MEDICAL OFFICE STRATEGY |

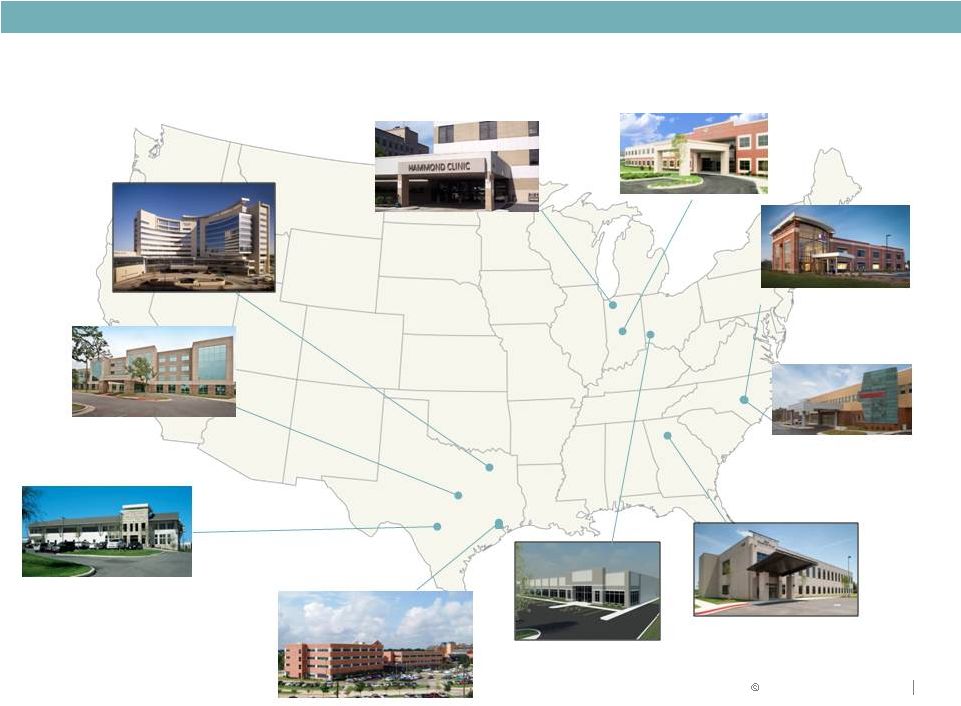

Healthcare Projects Delivered/Acquired in 2011

Western Ridge MOB II

Cincinnati, OH

29,500 SF, 80% leased

New Hampton Place

Snellville, GA

40,000 SF, 66% leased

Rex Holly Springs MOB

Raleigh, NC

30,000 SF, 100% leased

Christus St. Catherine

Houston, TX

169,000 SF, 96% leased

Baylor Cancer Center

Dallas, TX

460,000 SF, 95% leased

WakeMed Brier Creek

Healthplex

Raleigh, NC

48,000 SF, 79% leased

Cedar Park MOB

Austin, TX

83,000 SF, 95% leased

Christus Santa Rosa

San Antonio, TX

111,000 SF, 100% leased

Max Simon MOB

Indianapolis, IN

85,000 SF, 100% leased

Franciscan Alliance

Chicago area (Hammond, IN)

195,000 SF, 100% leased

MEDICAL OFFICE STRATEGY

51

2011 Duke Realty Corporation |

Healthcare Projects Under Development at December 31, 2011

Baylor McKinney MOB I

McKinney, TX

114,000 SF, 66% preleased

WakeMed Raleigh

Medical Park

Raleigh, NC

86,000 SF, 58% preleased

Marquette General Hospital MOB

Escanaba, MI

43,000 SF, 100% preleased

North Fulton MOB

Atlanta, GA

52,000 SF, 52% preleased

Wishard Faculty Office

Building

Indianapolis, IN

275,000 SF, 100% preleased

MEDICAL OFFICE STRATEGY

2011

Duke

Realty

Corporation

52 |

Existing healthcare assets $775 Million by

1/31/2012

New developments

$200 Million in 2012 and

2013

Acquire

$200-$250 Million in 2012 and 2013

Goal: Grow Medical Office to $1.25 Billion by 2013

MEDICAL OFFICE STRATEGY

Our Plan

Our Focus

Growth regions (Southeast, South)

Health system relationships

On-campus assets

Class A product (50,000 –

400,000 + square feet)

National industry expert

53

2011

Duke

Realty

Corporation |

2011 Duke Realty Corporation

54

WHY DUKE REALTY?

Quality portfolio improving with asset strategy

Solid balance sheet improving with capital strategy

Unmatched ability to execute on daily operations

Development capabilities in place with existing land bank

Talent and leadership depth to execute

Delivering on what we say we will do

MEDICAL OFFICE STRATEGY |

Vision Road Map –

Future Duke Realty

Low leverage industrial and office REIT in high growth markets

and product segments

MEDICAL OFFICE STRATEGY

What We Will Be

Action Plan

•

Low leveraged

•

Move from 54% to 45% leverage

Non-Strategic property and land sales

•

Product focused

•

Become bulk industrial focused

Industrial: Increase from 35% to > 60%

Office: Decrease from 55% to < 25%

Medical: Grow from 5% to 15%+

•

Concentrated in high growth

markets

•

Align investment and resources to high

growth markets; dispose/exit non

-strategic

areas

Differentiated asset strategy within

tighter geographic focus

55

2011

Duke

Realty

Corporation |

2011 Duke Realty Corporation

APPENDIX

56 |

2011

Duke

Realty

Corporation

EXECUTIVE TEAM

57 |

2011

Duke

Realty

Corporation

58

DENNIS D. OKLAK

Chairman and Chief Executive Officer

Denny serves as head of Duke Realty’s Executive Committee, overseeing the

company’s strategic direction and its Investment Committee, with

responsibility for approving major capital transactions. Prior to becoming

Chief Executive Officer in April 2004, Denny served as President and Chief Operating

Officer, a position in which he was responsible for all real estate

operations. In the 25 years he has been with Duke Realty, Denny has served

in various roles throughout the company including Executive Vice President

and Chief Administrative Officer and Vice President and Treasurer.

Denny

spent

nine

years

with

Deloitte

&

Touche,

a

global

auditing

and

consulting

firm

before

joining

Duke

Realty.

CHRISTIE B. KELLY

Executive Vice President and Chief Financial Officer

Christie oversees all accounting and financial reporting functions of Duke Realty,

including property, operations,

taxation,

treasury,

financial

analysis,

and

investor

relations.

She

joined

Duke

Realty

in

2009,

bringing

with

her

25

years’

experience

in

financial

management,

mergers and acquisitions, information technology and investment banking. Most

recently, she was a Senior

Vice

President,

Global

Real

Estate,

with

Lehman

Brothers,

where

she

led

real

estate

equity

syndication in the United States and Canada. She spent most of her career at

General Electric, holding a variety of domestic and global leadership roles

for GE Real Estate, GE Capital, GE Corporate Audit, and GE Medical Systems.

EXECUTIVE |

JAMES B. CONNOR

Senior Regional Executive Vice President, Midwest

Jim manages and leads business units in Minneapolis, St. Louis, Chicago,

Indianapolis, Cincinnati, Columbus and Cleveland, and is a member of the

company’s Executive, Investment and Overhead Committees.

Previously, Jim served as Senior Vice President of Duke Realty’s Chicago

operations, where he was responsible for that market’s office and

industrial portfolios. He led and directed the leasing, acquisition and

development activity, building Duke Realty’s Chicago portfolio to more than 12.8 million square feet

and was awarded the 2000 Build-to-Suit of the Year and 2002 Redevelopment

of the Year by the National Association of Industrial and Office

Professionals (NAIOP). In 2008, he was recognized by the Society of

Industrial and Office Realtors for the Largest Investment Transaction in the Country.

Jim joined Duke Realty 13 years ago after holding numerous executive and brokerage

positions with Cushman & Wakefield, most recently serving as Senior

Managing Director for the Midwest area. CHARLES E. PODELL

Senior Vice President, Indiana Operations

Charlie is responsible for all development, marketing, and leasing activities for

the company’s Indiana operations, comprising more than 29 million

square feet of industrial and office properties. Charlie joined Duke Realty

in 1989 as an Industrial Leasing Representative, later becoming Director of

Leasing. In 1997, he was named Assistant Vice President, taking responsibility for

the leasing and development of three industrial parks. In 2001, Charlie was

promoted to Vice President of Leasing for Duke Realty’s Indiana

Industrial Team. In 2006, Charlie was chosen to oversee the Duke Realty portion

of the Browning/Duke Realty Joint venture. This JV is made up of

more than 1,500 acres and 20 million

square feet of new development. In 2009, he was named Senior Vice President of all

of Duke’s Indiana operations.

MIDWEST

59

2011

Duke

Realty

Corporation |

2011

Duke

Realty

Corporation

60

JON C. BURGER

Senior Vice President, Cincinnati

Jon is responsible for the development, construction, leasing, and management of

Duke Realty’s office and industrial portfolio in Cincinnati.

Previously, Jon served as Vice President, Cleveland Operations. Prior to

joining Duke Realty, he was a Managing Director at Armstrong Development. He also spent 13

years as a Principal with Trammel Crow Company.

STEVEN W. SCHNUR

Senior Vice President, Chicago

Steve is responsible for the Chicago market’s expanding office and industrial

portfolios. In addition to leading

the

Asset

Management

and

Leasing

Operations,

he

works

to

identify

new

land

positions,

acquisition and development opportunities, and prospects for built-to-suit

development. Prior to his position with Duke Realty, Steve was Director of

Real Estate for Opus North Corporation, where he was responsible for the

development and leasing-related activities for industrial, office and

residential projects.

MIDWEST |

2011

Duke

Realty

Corporation

61

JAMES T. CLARK

Senior Vice President, Columbus

Jim is responsible for all development, leasing and asset management activities

for the Columbus, Ohio market.

Previously as Vice President for the Columbus Office division, he oversaw leasing,

development and acquisitions for Tuttle Crossing and Easton. Jim has been

with the company since 1996 and has served in several different capacities

including leasing, development and operations of the Columbus Office

portfolio. Prior to Duke Realty, Jim worked in Columbus for The Galbreath

Company. Jim has helped develop four planned office parks and was involved

in significant built-to-suit projects including Discover Card,

Nationwide Insurance, Lane Bryant and Alliance Data Systems. In addition, he

oversaw large industrial projects for Kellogg’s, Restoration Hardware and

Kraft. THOMAS (TOBY) R. MARTIN

Senior Vice President, St. Louis

Toby is responsible for overseeing the leasing, management, and expansion of Duke

Realty’s more than 7 million-square foot St. Louis industrial and

office portfolio. Before joining Duke Realty in 2008, Toby worked in the

commercial real estate industry for more than 15 years. He joined Colliers

Turley Martin Tucker in 1991, holding several management positions, including

Senior Vice President and Management Committee member. In 2003, he founded TM

Properties III, L.P., a real estate investment company focusing on

industrial and retail properties in the central corridor of the United

States. He operates this company, as well as TM Properties, LLC, a company founded by

his father, under the name of Martin Equity Management.

During his brokerage career, Toby represented landlords and tenants in hundreds of

transactions involving millions of square feet of space.

MIDWEST |

2011

Duke

Realty

Corporation

62

PAT MASCIA

Senior Vice President, Minneapolis/St. Paul

Pat is the business unit head responsible for the profitability and operation of

Duke Realty’s Twin Cities’ office.

Pat joined Duke Realty in 2004. He began his real estate career practicing real

estate, real estate finance and municipal law with Briggs and Morgan, P.A.

in Saint Paul for six years. He then joined Opus Corporation

as

Associate

General

Counsel,

a

position

he

held

for

approximately

two

years.

Pat

was

later

named Vice President of Dispositions, Finance, and Investments at Opus Properties,

L.L.C. and held this position for approximately five years before joining

Duke Realty. MIDWEST |

2011

Duke

Realty

Corporation

63

JEFF TURNER

Regional Executive Vice President, South and West Regions

Jeff has responsibility for the company’s South and West Regions, including

overseeing all development, leasing, asset management, and real estate

operations. Duke Realty’s South and West Regions include the cities of

Dallas, Houston, Nashville, Phoenix and Seattle, where Duke Realty has

nearly 23 million square feet of office and industrial properties. Jeff is also a

member of the company’s Management and Investment and Executive

Committees. Previously, Jeff served as Senior Vice President of Duke

Realty’s Dallas operations, where his team grew the Dallas portfolio

from 1.3 million square feet to more than 15 million square feet, primarily

through speculative and built-to-suit development and a large joint

venture with JP Morgan Investments. Prior to joining Duke Realty 13 years

ago Jeff was Vice President for Paragon Group, where he was involved in

industrial leasing and development for 13 years and was a National Top Producer.

JEFF THORNTON

Senior Vice President, Dallas

Jeff

is

responsible

for

leasing,

land

and

building

acquisitions,

built-to-suit

and

multi-tenant

development

projects, and overseeing the day-to-day activities of the Dallas

office. Jeff joined Duke Realty in 2001 and served as Vice President of

Industrial Leasing. He was responsible for the development and marketing of

Duke Realty’s industrial projects in the Dallas/Fort Worth area, which

totaled more than 13 million square feet. Prior to joining Duke Realty, Jeff

was Leasing Manager at Insignia/ESG where he leased and sold both office

and industrial properties for institutional owners including Aetna Life Insurance Company,

Weingarten

Realty,

J.P.

Morgan,

John

Hancock,

and

The

Blackstone

Group.

SOUTHWEST |

2011

Duke

Realty

Corporation

64

JEFF PALMQUIST

Senior Vice President, Nashville

Jeff is responsible for leading and directing the leasing, property management and

marketing of the existing 4.8-million square foot Nashville portfolio,

as well as all new development and land and building acquisitions and

dispositions. Jeff joined Duke Realty in 1995 as a Senior Leasing

Representative in its Columbus office and was promoted to Vice President,

Industrial Leasing in 1999. During his tenure in Columbus, Jeff was

instrumental in Duke Realty’s completion of more than 7.5 million square feet

of industrial development and acquisitions In 2006, Jeff relocated to

Nashville to assume day-to-day responsibilities for the office. KEVIN

ROGUS Senior Vice President, Phoenix

Kevin

is

responsible

for

identifying

opportunities

and

executing

Duke

Realty’s

projects

in

Phoenix

and

expansion into new markets in the western United States.

Kevin joined Duke Realty in 1985, holding various positions during his first 14

years, including Project Engineer, Preconstruction Manager, Construction

Manager, and Vice President of Construction for Cincinnati

operations. From 1999 to 2003, he was Senior Vice President of Duke

Realty’s Construction group, with responsibility for the overall

performance of all design and construction activities in Cincinnati, Ohio;

Nashville, Tennessee; Raleigh, North Carolina; and Orlando, Florida. From

2003–2006, Kevin was Senior Vice President of Duke Realty’s

Cincinnati, Ohio operations, where he oversaw the development, construction,

leasing, and management of a 17.5 million-square foot office and industrial portfolio.

SOUTHWEST |

2011

Duke

Realty

Corporation

65

DAVID HUDSON

Senior Vice President, Houston

David

is

responsible

for

new

development,

leasing,

acquisitions,

and

other

day-to-day

activities

of

Duke

Realty’s Houston office. Since joining the company in February 2006,

David has overseen the development of more than 900,000 square feet of

office and industrial properties in the Houston market and continues to

search for opportunities to expand Duke Realty’s presence in Texas.

Prior to Duke Realty, David worked for Trammell Crow Company, where he was

responsible for the marketing and leasing of approximately 9 million square

feet of office and warehouse space. Additionally, David supervised and

trained marketing representatives in dealing with investors and owners of

industrial properties, including several large institutional and private investors. He also has

been actively involved in both built-to-suit and speculative

transactions. SOUTHWEST |

2011

Duke

Realty

Corporation

66

J. SAMUEL O’BRIANT

Regional Executive Vice President, Southeast & East

Sam has overall responsibility for the company’s new investment activities

and portfolio operations in its Southeast and East regions, overseeing

business units in Atlanta, Savannah, Central and South Florida,

Raleigh,

Washington,

DC,

Baltimore

and

northern

New

Jersey.

Duke

Realty’s

southeast

and

east

property portfolios total more than 38 million square feet of office and

industrial space and more than 1,400

acres

of

land

for

future

development.

In

addition,

he

is

a

member

of

the

company’s

Executive,

Investment and Operating Committees.

Previously,

Sam

served

as

Regional

Senior

Vice

President

for

the

Southeast

Region

and,

before

that,

managed the company's Atlanta and Savannah industrial business units. Before

joining Duke Realty in 2004, Sam held positions with MetLife Real Estate

Investments, iStar Financial, and First Industrial Realty Trust, most

recently serving as Vice President of Acquisitions and Development at First

Industrial.

J. CHRISTOPHER BROWN

Senior Vice President, Atlanta

Chris is responsible for all development, marketing and leasing activities for the

company’s Georgia office and industrial properties, comprising nearly

20 million square feet in metro Atlanta and Savannah. Chris

joined

Duke

Realty

in

1996

as

a

Financial

Analyst.

Between

1999

and

2004,

Chris

served

in a

variety of roles in acquisitions/dispositions, ultimately being promoted to Vice

President in 2002. In 2004, Chris

transferred

to

Leasing

as

a

Leasing

Representative

for

the

Atlanta

Industrial

Group.

In

2006,

he

was promoted to Vice President of Leasing for the Atlanta Industrial Group. In

2007, Chris was promoted to

Senior

Vice

President,

Atlanta

Industrial

Group

and,

in

2009,

took

the

leading

role

in

Duke

Realty’s

Savannah portfolio and its Atlanta suburban office portfolio.

Before joining Duke Realty, Chris was a Senior Real Estate Consultant for four

years and a Tax Accountant for one year with Arthur Andersen, LLP.

SOUTHEAST & EAST |

2011

Duke

Realty

Corporation

67

DOUG IRMSCHER

Senior Vice President, Central Florida

Doug

is

responsible

for

the

overall

profitability

and

operations

of

the

company’s

expanding

office

and

industrial portfolios in Orlando and Tampa. In addition, he is responsible for

identifying new land positions, building acquisitions, new development and

build-to-suit opportunities. Since relocating to Orlando in 2001,

Doug has developed than 3 million square feet of office and industrial projects.

Prior to relocating to Orlando, Doug was responsible for more than 4 million

square feet of suburban office space in the Cincinnati, Ohio office. He

joined the company in 1994 and has served in several different capacities

on the leasing/development side of the business. JEFF SHEEHAN

Senior Vice President, Raleigh

Jeff is responsible for the overall operations of Duke Realty’s Raleigh

office, as well as the pursuit of opportunities throughout the state. Duke

Realty’s portfolio in the Triangle region is composed of 5.4 million

square feet of office and industrial space. Jeff

joined

Duke

Realty’s

Executive

Leadership

Program

in

2000.,

starting

out

as

a

Financial

Analyst.

He

then

transferred

to

Sales/Leasing

as

a

Leasing

Representative

in

2002.

In

2005,

Jeff

was

promoted

to

Senior Leasing Representative, where he was responsible for the sales and leasing

of office properties in the Triangle area. He was promoted to Vice

President of Leasing in the Raleigh office in 2006, and moved into his

current role in January 2007. SOUTHEAST & EAST

|

2011

Duke

Realty

Corporation

68

ED MITCHELL

Senior Vice President, South Florida

Ed is responsible for the development, marketing, leasing, and management of the

South Florida office, retail and industrial portfolio, which currently

consists of more than 1,700,000 square feet. Duke Realty also has 155 acres

of land in South Florida that will support the development of approximately 800,000

square feet of office space and 1.1 million square feet of industrial

properties. Prior to joining Duke Realty in 2007, he was First Vice

President with CB Richard Ellis for three years and Managing Director for

four years; Director of Leasing and Development with Premier Commercial

Realty for five years; and Leasing Representative and Construction Manager with

Trammell Crow Company for five years.

PETER SCHOLZ

Senior Vice President, Washington D.C.

Peter oversees the marketing, leasing, property management, acquisition, and

development functions of a nearly 4.0 million-square foot industrial

and office portfolio in the Washington, D.C. market. Peter joined Duke

Realty in 2006 as part of The Mark Winkler Company acquisition that led to Duke

Realty’s entry into the Washington, D.C. market. As a principal with and

Senior Vice President of that company, Peter was responsible for directing

its leasing and transaction group, serving as the liaison with

third-party asset management clients, coordinating build-to-suit activities, and evaluating acquisition

and disposition opportunities.

Peter has more than 25 years of experience in real estate management, leasing,

development, and finance, and has held positions within the Marriott

Corporation and was a principal with Landstar Development Corporation prior

to joining The Mark Winkler Company. SOUTHEAST & EAST

|

2011

Duke

Realty

Corporation

69

JAMES D. BREMNER

President, Healthcare

Jim leads the company’s efforts in the development, ownership, leasing and

management of healthcare facilities. He has 30 years of real estate

experience and 15 years of dedicated healthcare experience (4 years with

Duke Realty). Duke Realty entered the healthcare market in 2007 with the

acquisition of Bremner Healthcare, a company Jim founded in 1986. Prior to

that, Jim was a partner and President of Revel Companies, which leased and

managed more than 5,000 apartment units and 4 million square feet of office space.

In addition to sitting on Duke Realty’s Executive and Investment Committees,

Jim brings a “hands-on” approach to the many phases of the

development process, including capital analysis, ownership modeling and

physician relationships. DONALD R. DUNBAR

Executive Vice President, Healthcare

Don is responsible for the planning, funding and execution of healthcare

development projects in the Midwest and East Coast regions. His expertise

in strategic planning, physician ownership modeling, and leasing services

offers a distinct skill set for successful healthcare development. Don

guides each project to a successful start, working with hospital personnel, the healthcare leasing

team, project managers, and general contractors.

Don joined the healthcare group in 1989, and has been actively involved in

developing and managing real estate since 1985.

HEALTHCARE |

2011

Duke

Realty

Corporation

70

DEENI TAYLOR

Executive Vice President, Healthcare

Deeni works with physicians and hospitals to understand their goals and objectives

regarding their real estate. With his 25-year hospital career,

Deeni’s wealth of knowledge and experience are valuable in each

development project. Deeni came to the Healthcare group after serving as

Chief Strategy Officer for St. Vincent Health, an Ascension Health system

of 16 hospitals serving 45 counties in central Indiana. Before joining St.

Vincent Health, Taylor was president of UNITY Health Management Services in

Birmingham, Alabama. He

also

worked

for

St.

Vincent’s

Hospital

in

Birmingham,

Alabama,

as

Vice

President

of

Planning

and

Marketing.

HEALTHCARE

KEITH KONKOLI

Senior Vice President, Healthcare –

Midwest

Keith oversees new business development, project development, asset management,

and leasing for all healthcare projects in the Midwest Region. Keith

ensures effective use of the company’s delivery system and ensures

that funds generated from operations are maximized to grow our client base through

professional development, acquisitions and third-party fees.

Keith joined Duke Realty as a Senior Property Manager in the Columbus office in

1997. In 2000, he moved to Atlanta and was promoted to Vice President,

Property Management. In 2004, he was named Regional Asset Manager for the

Indianapolis Asset Management group and, in 2005, was promoted to Senior

Vice President, Real Estate Operations. |

MARK

A. DENIEN Senior Vice President and Chief Accounting Officer

Mark has been Senior Vice President of Accounting for Duke Realty since 2006. He

joined the company six years ago as Senior Vice President of

Administration. Prior to joining Duke Realty, he was with KMPG, LLP for 16

years and left the firm as a partner. RON HUBBARD

Assistant Vice President, Investor Relations

FINANCE

Ron

comes

to

Duke

Realty

with

17

years

of

experience

in

investor

relations,

corporate

finance and

financial analysis from a real estate investment management firm, a

publicly-traded healthcare REIT and

a

big

6

CPA

firm.

Prior

to

joining

Duke

Realty,

Ron

spent

3

years

with

Nationwide

Health

Properties, a firm with investments in medical office, nursing homes and senior

housing, as Vice President of Investor Relations & Capital Markets,

where he was responsible for investor relations, corporate finance and

project finance. Ron also spent 11 years with Pacific Life’s Real

Estate Division as Managing Director of REIT Finance where he was the

credit analyst and portfolio manager for $1.5 billion

of

REIT

unsecured

notes,

preferred

equity

securities

and

leveraged

loans.

Ron

holds

a

Masters

Degree in Business with a

dual major in Real Estate and Finance from the University of Wisconsin, and

an undergraduate degree in Accounting from the same institution.

71

2011

Duke

Realty

Corporation |

NICK

ANTHONY Senior Vice President, Capital Transactions and JV Management

As Senior Vice President, Capital Transactions and JV Management, Nick is

responsible for the overall management

of

Duke

Realty’s

joint

venture

business,

as

well

as

acquisition

and

disposition

activity.

Previously, as Vice President of Portfolio Management, Nick was responsible for

the overall management of the Dugan Joint Venture, a $1 billion industrial

portfolio between J.P. Morgan and Duke Realty. He began his career with

Duke Realty in 1989 as a Staff Accountant. FINANCE

72

2011

Duke

Realty

Corporation |

Forward-Looking Statement

This slide presentation contains statements that constitute “forward-looking

statements” within the

meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934 as

amended by the Private Securities Litigation Reform Act of 1995. These

forward-looking statements include, among others, our statements regarding

(1) strategic initiatives with respect to our assets, operations and capital and (2) the

assumptions underlying our expectations. Prospective investors are cautioned

that any such forward- looking statements are not guarantees of future

performance and involve risks and uncertainties, and that actual results may

differ materially from those contemplated by such forward-looking statements. A

number of important factors could cause actual results to differ

materially from those contemplated by

forward-looking statements in this slide presentation. Many of these

factors are beyond our ability to control or predict. Factors that could

cause actual results to differ materially from those contemplated in this

slide presentation include the factors set forth in our filings with the Securities and Exchange

Commission, including our annual report on Form10-K, quarterly reports on Form

10-Q and current reports on Form 8-K. We believe these

forward-looking statements are reasonable, however, undue reliance should

not be placed on any forward-looking statements, which are based on current expectations. We

do

not assume any obligation to update any forward-looking statements as a result of

new information or future developments or otherwise.

Certain of the financial measures appearing in this slide presentation are or may be

considered to be non- GAAP financial measures. Management believes that

these non-GAAP financial measures provide additional appropriate measures

of our operating results. While we believe these non-GAAP financial

measures are useful in evaluating our company, the information should be considered

supplemental in nature and not a substitute for the information prepared in

accordance with GAAP. We have provided for

your reference supplemental financial disclosure for these measures, including the

most directly comparable GAAP measure and an associated reconciliation in our

most recent quarter supplemental report, which is available on our website at

www.dukerealty.com. Our most recent quarter supplemental report also

includes the information necessary to recalculate certain operational ratios and ratios of

financial position. The calculation of these non-GAAP measures may differ

from the methodology used by other REITs, and therefore, may not be

comparable. 73

2011

Duke

Realty

Corporation

RELIABLE. ANSWERS. |