Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - STRATEGIC HOTELS & RESORTS, INC | d311361d8k.htm |

1

Investor Presentation

March 2012

Exhibit 99.1 |

2

I.

BEE’s Unique Value Proposition

II.

Company Overview

III.

Industry Update

IV.

Operating Trends

V.

Financial Overview

Agenda |

3

The only pure play high-end lodging REIT

High-end outperforms the industry in a recovery

Industry leading asset management expertise

Assets are in pristine condition

Embedded organic growth through revenue growth and ROI opportunities

Replacement cost, excluding land, approximately $700,000 per key

Historically

low

supply

growth

environment,

particularly

in

BEE

markets

Balance sheet positioned for growth

BEE’s Unique Value Proposition

The best investment proposition in the lodging space |

4

BEE’s Unique Value Proposition

Proven Investment Track

Record

Industry Leading Asset

Management

High-end, Unique &

Irreplaceable Hotel & Resort

Portfolio |

5

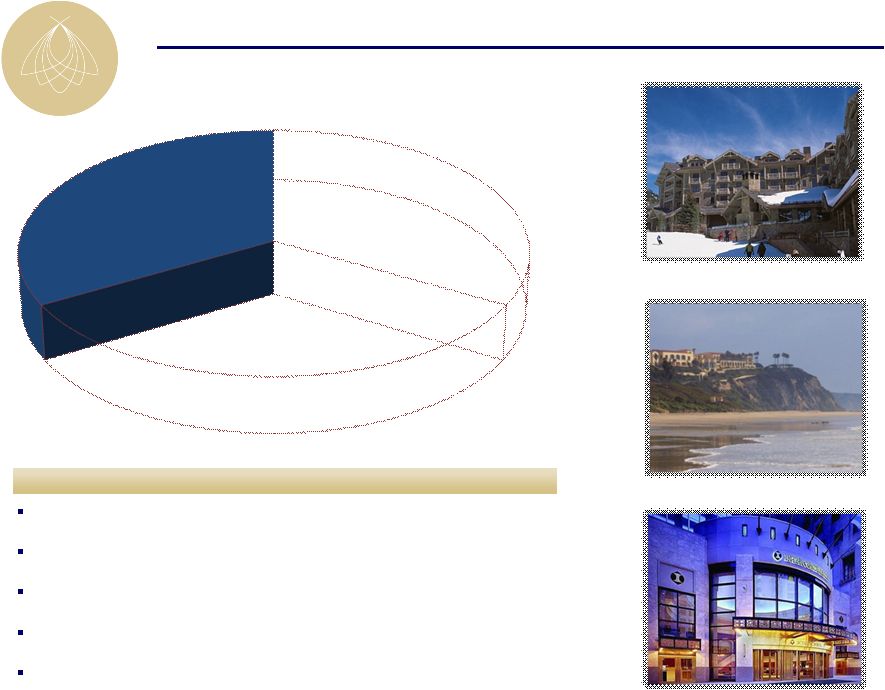

BEE’s Unique Value Proposition

Four Seasons Jackson Hole

Ritz-Carlton Laguna Niguel

InterContinental Chicago

Best portfolio in public markets

Locations in high barrier to entry markets

City-center and resort destinations

World-class amenities

No new supply in BEE’s markets

Highlights

High-end, Unique &

Irreplaceable Hotel & Resort

Portfolio |

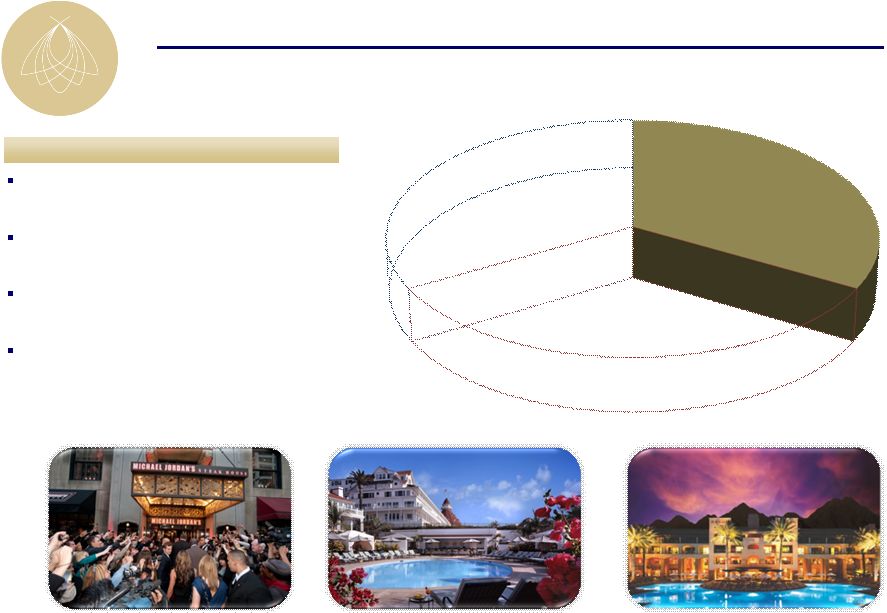

6

BEE’s Unique Value Proposition

Execution of complex and accretive

restructurings

Assessment and development of ROI

projects

Recent success in acquiring hotels through

off-market transactions

Maximized proceeds through well-timed

asset sales

Highlights

Michael Jordan’s Steak House

Grand Opening

Hotel del Coronado

Fairmont Scottsdale Princess

Proven Investment Track

Record |

7

BEE’s Unique Value Proposition

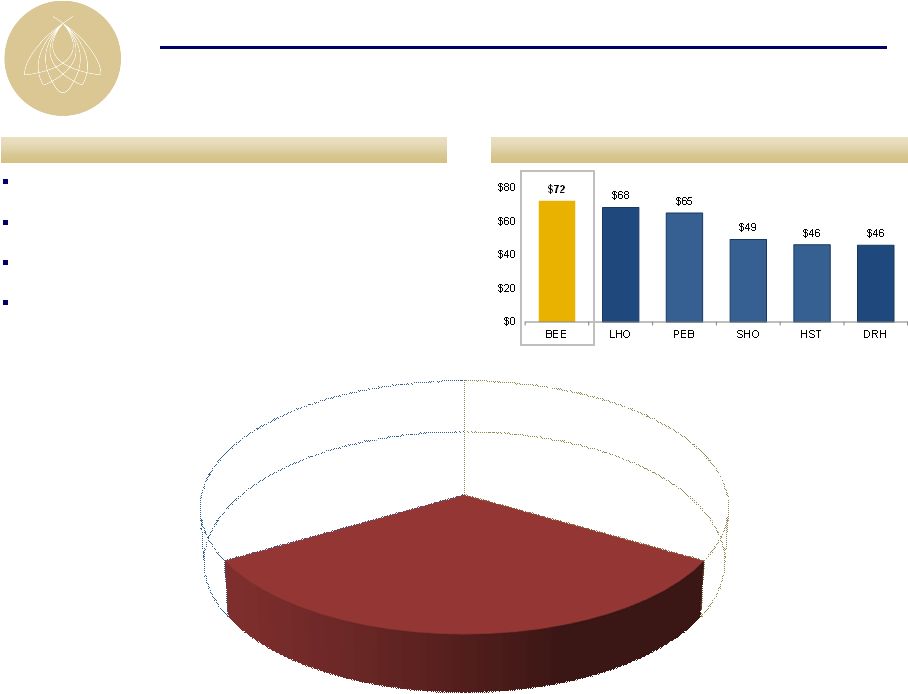

EBITDA Per Available Room

Sustained market share penetration and revenue growth

Implemented cost cutting initiatives in advance of downturn

Maintained fixed cost reductions in recovery

Rigorous oversight of brand managers

Highlights

Industry Leading Asset

Management |

8

I.

BEE’s Unique Value Proposition

II.

Company Overview

Agenda |

9

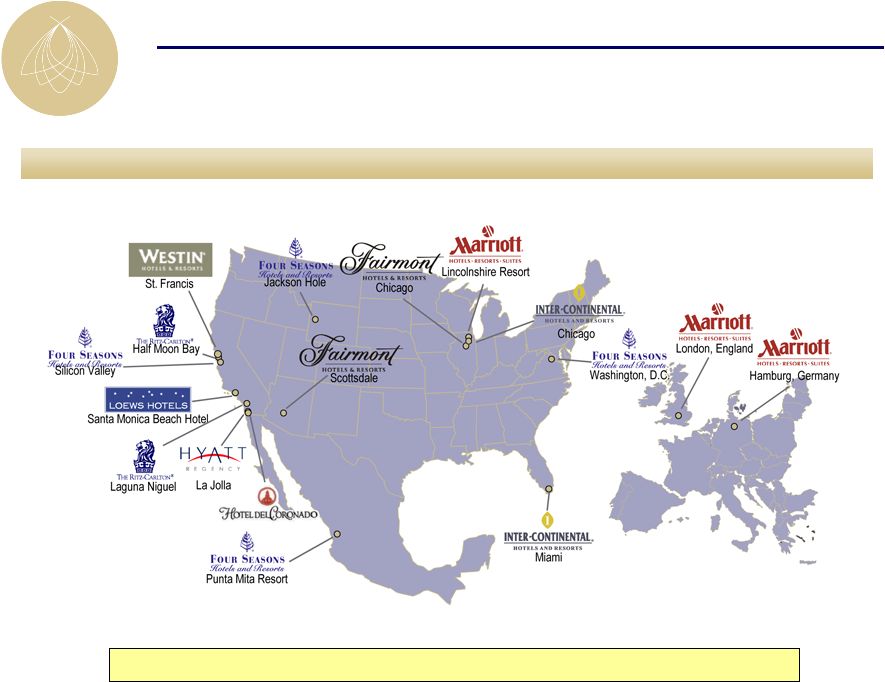

17 hotels and resorts with 7,762 rooms

Top-Tier Market Exposure

Assets located in primary gateway cities and high barrier to entry markets

|

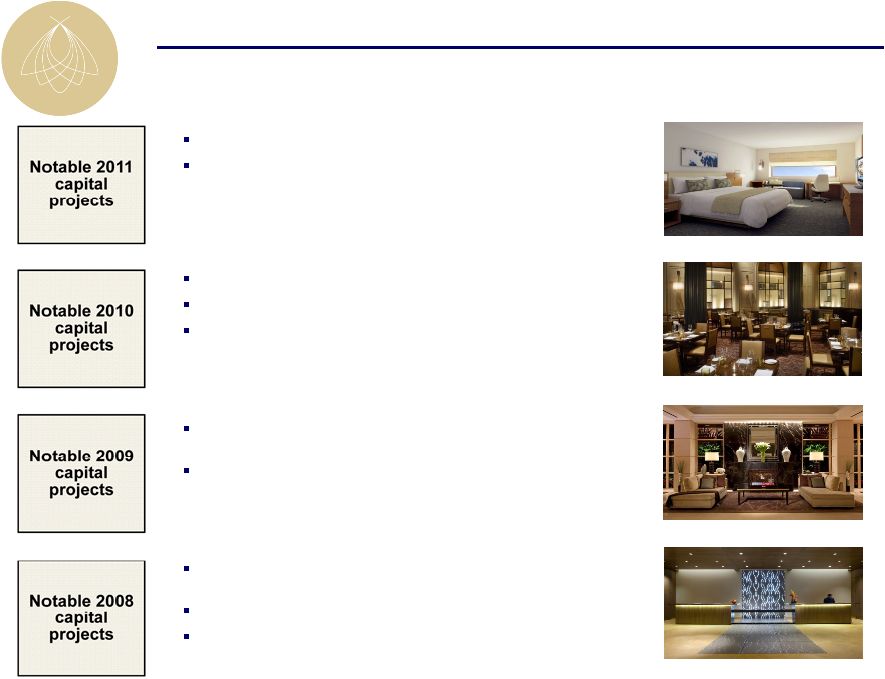

10

InterContinental Miami –

Guestroom renovation

InterContinental Chicago –

Michael Jordan’s Steak House

Four Seasons Washington, D.C –

Retail outlet renovation

Marriott Lincolnshire –

Lobby renovation

Westin St. Francis –

Michael Mina Steakhouse conversion

Four Seasons Washington, D.C. –

Lobby renovation, 11-room

expansion, new restaurant, 63-room and suite renovation

Westin St. Francis –

Clock Bar

Fairmont Chicago –

ENO wine tasting room, lobby renovation,

guestroom renovation, new spa and fitness center

Four Seasons Punta Mita –

New lobby bar

Ritz-Carlton Half Moon Bay –

ENO wine tasting room,

restaurant and lounge renovation, suite renovation

Portfolio Well-Positioned To Enhance Cash Flow Growth

Fairmont Chicago Lobby

Four Seasons Washington, D.C.

Lobby

Westin St. Francis Michael Mina

Bourbon Steak

InterContinental Miami Guestroom |

11

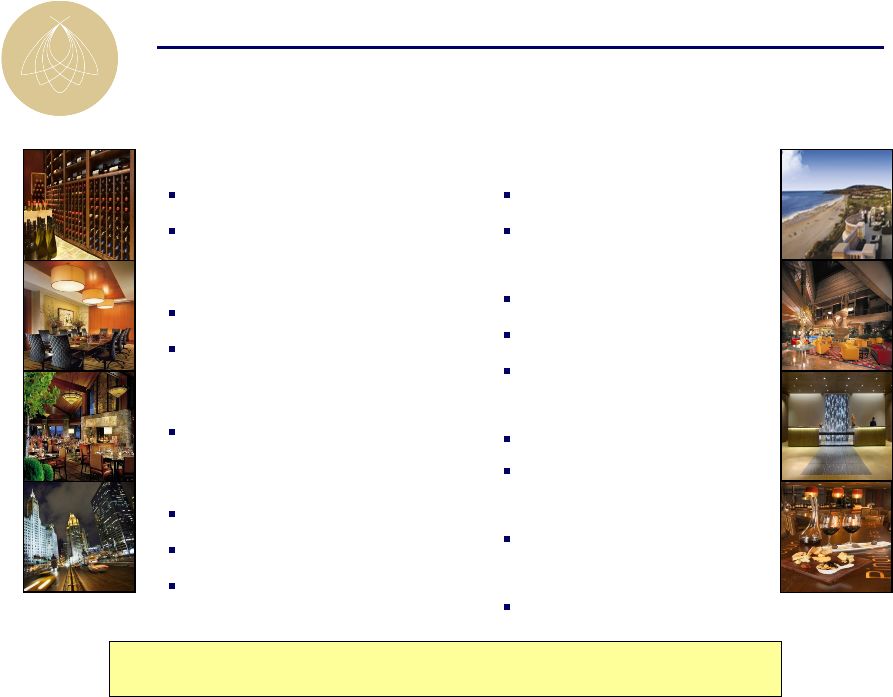

Four Seasons Washington, D.C.

ENO Wine Room

Retail space optimization

Four Seasons Silicon Valley

Quattro patio renovation

Meeting room renovation

Four Seasons Jackson Hole

Restaurant re-concept

InterContinental Chicago

North tower guestroom renovation

Meeting space expansion

Michigan Ave. frontage optimization

Potential Capital Projects in the Pipeline

Significant

ROI

capital

investment

opportunities

within

existing

portfolio;

rigorous

analysis

and

approval

process

for

each

project

Ritz-Carlton Laguna Niguel

35-room fire pit addition

Pool deck upgrades

InterContinental Miami

Public space revitalization

Meeting space expansion

Pool deck refurbishment

Fairmont Chicago

Meeting space renovation

Restaurant re-concept

Westin St. Francis

ENO wine room

Loews Santa Monica

Exterior / interior upgrade |

12

I.

BEE’s Unique Value Proposition

II.

Company Overview

III.

Industry Update

Agenda |

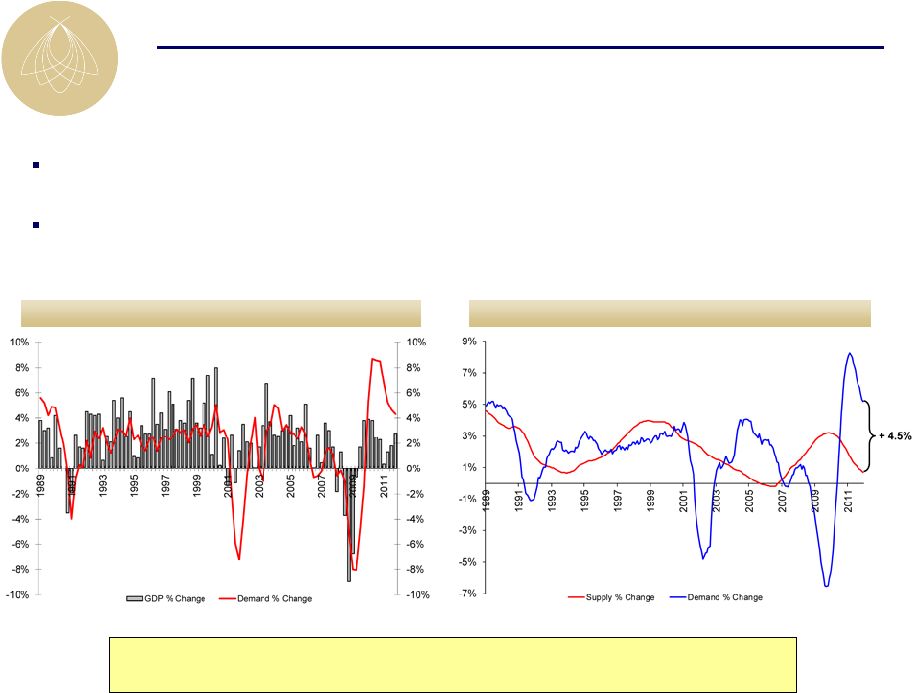

13

Total U.S. supply and demand change (TTM)

Lodging demand historically correlates with GDP (~80%) but potential exists for

near-term disconnect, particularly at the high-end

Supply growth remains historically low and development pipeline indicates muted

supply going forward Lodging Outlook

Demand growth exceeds supply growth by 450 bps which should result in

significant ADR growth as recovery continues; lower correlation to GDP

Source: Smith Travel Research

GDP and lodging demand change (TTM) |

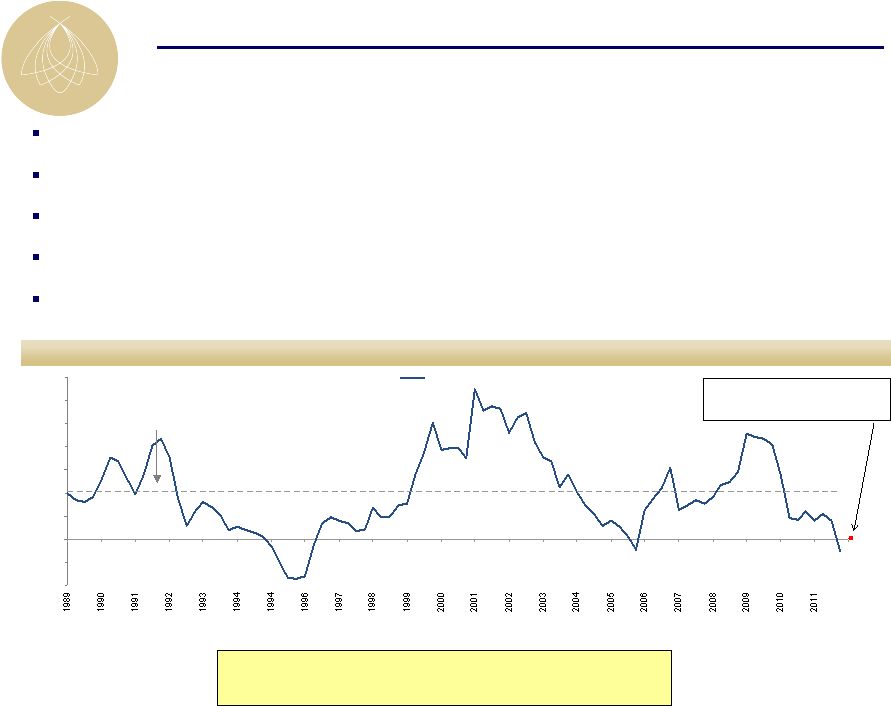

14

Source: Smith Travel Research

Note: Data represents trends within the United States

Luxury supply growth was lower leading into this downturn than past downturns

Projects in planning or under construction have decreased significantly

No new competitive luxury or upper-upscale supply projected in BEE

markets 1-2 years estimated time to permit; 3 years estimated time to

build a luxury hotel Economic proposition of hotel construction doubtful with

replacement cost estimated at over $700,000 per key

Quarterly luxury supply YoY % change

(4%)

(2%)

0%

2%

4%

6%

8%

10%

12%

14%

YoY % supply growth

1988 –

Q2 2011

Average: 4.1%

Favorable Supply Outlook

Zero supply growth environment and no new

supply growth likely until after 2015

Supply Growth in

BEE Markets = 0.0% |

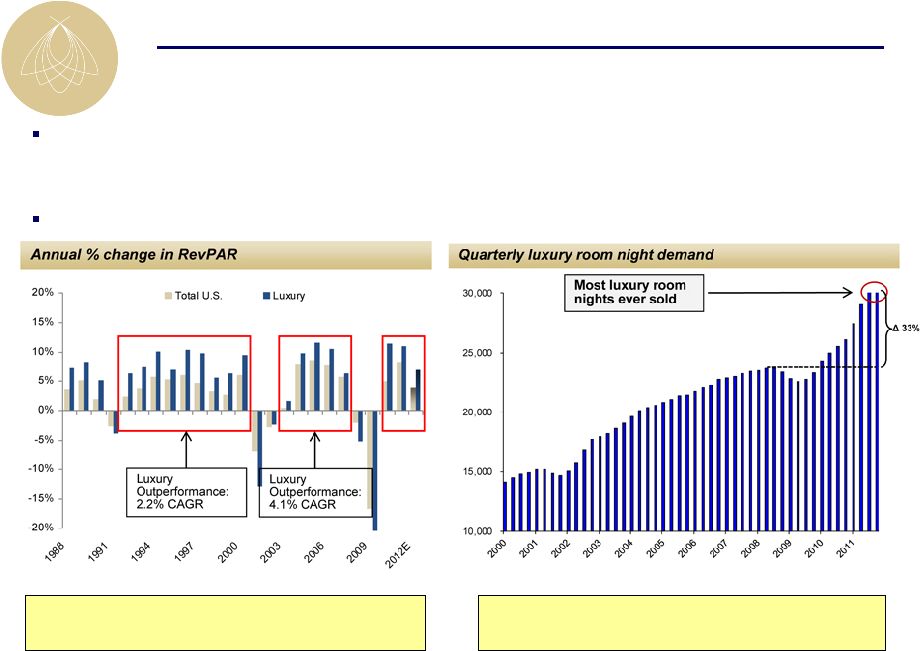

15

Source: Smith Travel Research and PWC

Luxury

hotels

have

experienced

prolonged

RevPAR

growth

following

past

industry

downturns

–

1992

–

2000:

9

consecutive

years

of

annual

luxury

RevPAR

growth

totaling

109%

or

8.5%

annually

–

2002

–

2007:

5

consecutive

years

of

annual

luxury

RevPAR

growth

totaling

48%

or

8.2%

annually

Overall luxury room nights sold is at an all-time high; 33% higher than

2007 Luxury Hotels Outperform in a Recovery

Luxury room night demand currently at all-

time high

Luxury outperformed Total U.S. 2.0% -

4.0% in previous two downturns

Source: Smith Travel Research |

16

EBITDA Per Available Room

Non –

Rooms Revenue Per Available Room

RevPAR

ADR

Note: All metrics represent full-year 2011 results

BEE portfolio reflects Total United States portfolio as of 12/31/2011.

Source: Public filings

BEE Positioning Compared to Peers

BEE delivers industry leading results |

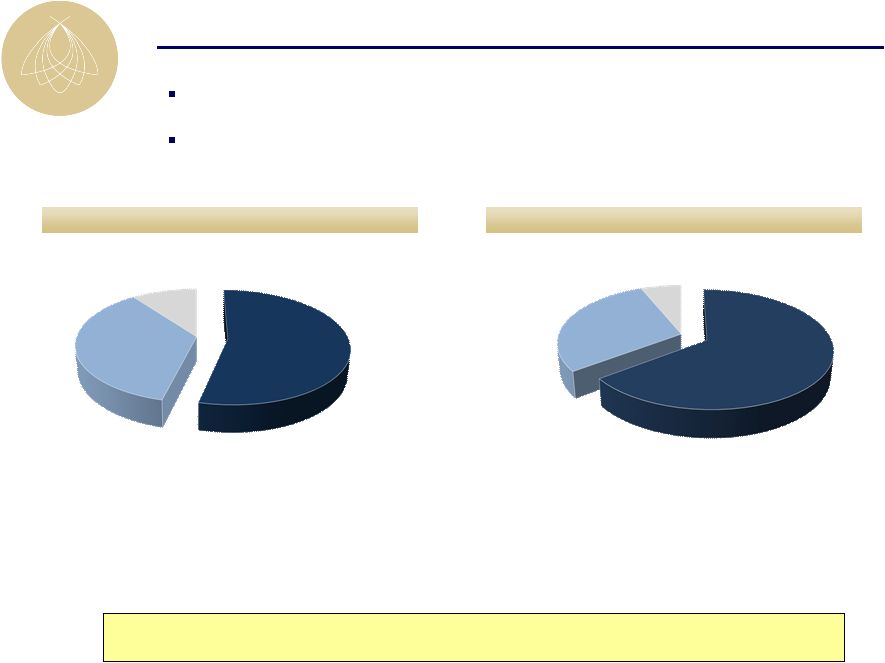

17

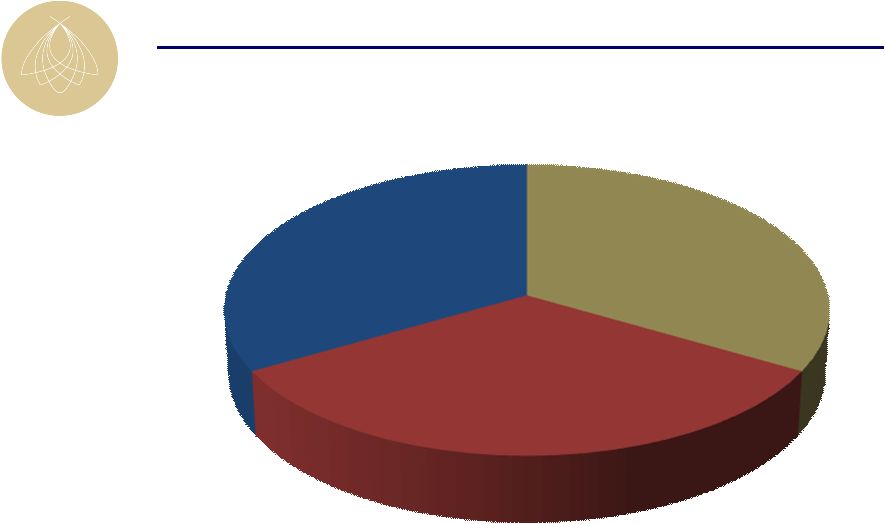

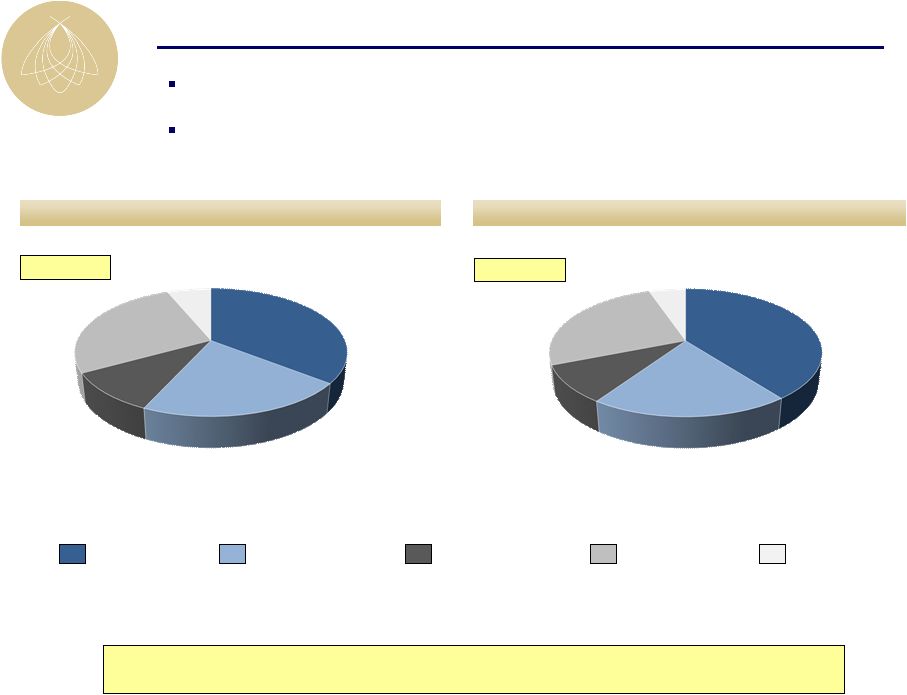

54%

36%

10%

65%

29%

6%

BEE Revenue Mix Compared to Peers

BEE revenue driven more heavily by non-rooms revenue relative to peers,

maximizing yield per square foot from our hotels

Rooms

Food & Beverage

Other

BEE Total Revenue Mix

Peers Total Revenue Mix

BEE Total RevPAR is key top-line performance metric

BEE focus on maximizing yield per square foot

Rooms

Food & Beverage

Other

Note: All metrics represent the full-year 2011. BEE portfolio reflects

the North America Same Store portfolio. Peers include: DRH, HST, LHO, PEB,

SHO Source: Public filings |

18

36%

21%

10%

27%

6%

40%

20%

9%

26%

5%

BEE Revenue Mix

BEE

total

revenue

driven

heavily

by

group

business

and

ancillary

group

spend;

still

significant

capacity

to

grow

group

business

43% Group

40% Group

57% Transient

60% Transient

Note: Statistics represent the full year 2011. Portfolio reflects the North

America Same Store portfolio. BEE Occupied Room Nights Mix

BEE Room Revenue Mix

Targeted mix of business ~50%/50% group/transient

Group business typically yields higher non-rooms revenue than transient

business Transient - Other

Transient - Negotiated

Group - Association

Group - Corporate

Group - Other |

19

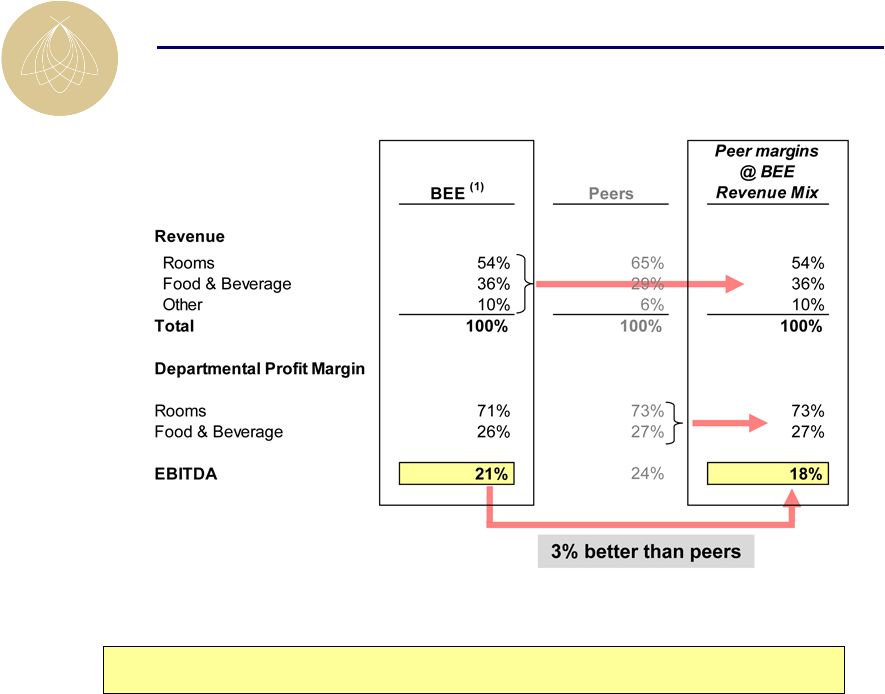

Industry Leading Operating Margins

BEE’s

margins

significantly

outperform

when

adjusted

for

same

revenue

mix

(1) Portfolio includes all North American hotels owned for the full year

2011 Peers include: DRH, HST, LHO, PEB, & SHO

Source: Public filings |

20

I.

BEE’s Unique Value Proposition

II.

Company Overview

III.

Industry Update

IV.

Operating Trends

Agenda |

21

0

200,000

400,000

600,000

800,000

1,000,000

1,200,000

2007

2008

2009

2010

2011

2012*

Definite through January

Production in the year

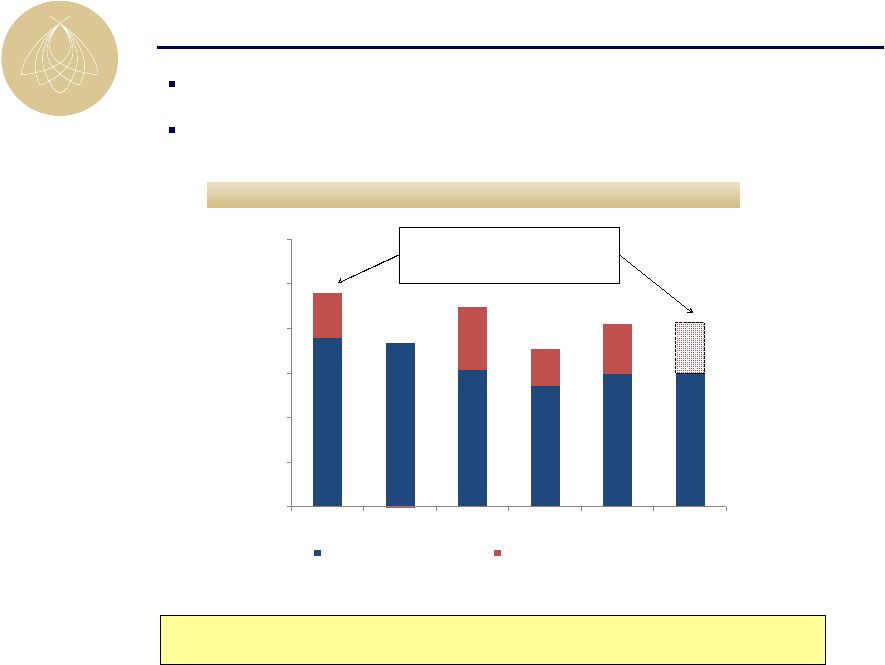

Group Booking Outlook

Year-Over-Year Group Pace

*2012 production in the year assumes the same production as in 2011

Group pace remains the most reliable forward looking indicator

Booking window has shortened forcing more reliance on room nights booked ITYFTY

(“in-the-year-for-the-year”)

Group room nights on the books for 2012 are up 1% compared to same

time last year; ADR up 3% compared to 2011 rate

Assuming similar production

as 2011, group room nights

would be down 14% to peak |

22

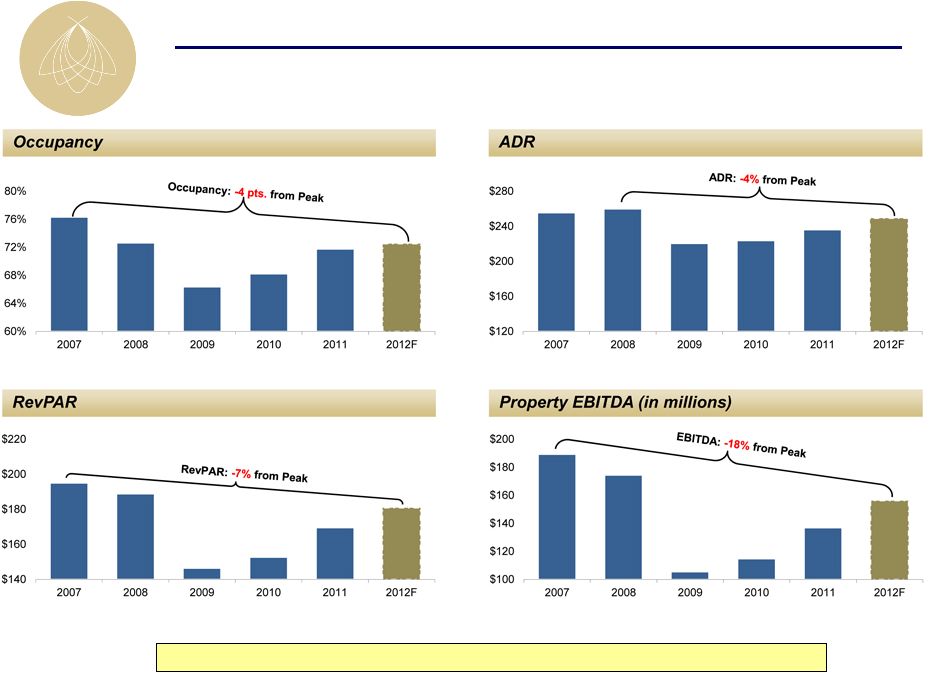

Embedded Portfolio Growth

Operating performance improving; still below peak

Note:

Same

store

North

America

portfolio,

excludes:

Hotel

del

Coronado,

Fairmont

Scottsdale

Princess,

Four

Seasons

Jackson

Hole,

Four

Seasons

Silicon

Valley

2012

forecast

assumes

midpoint

of

guidance

range |

23

I.

BEE’s Unique Value Proposition

II.

Company Overview

III.

Industry Update

IV.

Operating Trends

V.

Financial Overview

Agenda |

24

(EBITDA in millions)

(a) Excludes

Fairmont

Scottsdale

Princess,

Four

Seasons

Jackson

Hole,

Four

Seasons

Silicon

Valley,

and

Hotel

del

Coronado

(b) 2010 results exclude $4.9mm of real estate tax refunds and no adjustment

for cancellation fees (c) 2011 Comparable FFO excludes a $10.7mm

one-time gain relating to the successful preferred equity tender 2011

Results 2010 Actual

2011 Actual

Operations

(Same Store N.A. Portfolio)

(a)

ADR

$223

5.8%

$236

RevPAR

$153

11.0%

$170

Total RevPAR

$287

9.6%

$314

EBITDA Margins

(b)

18.7%

240 bps

21.1%

Corporate Results

Comparable EBITDA

$132.0

17.2%

$154.8

Comparable FFO / share

(c)

$0.05

180.0%

$0.14 |

25

2012 Guidance

(EBITDA in millions)

(a)

Portfolio excludes Fairmont Scottsdale Princess, Four Seasons Jackson Hole, Four

Seasons Silicon Valley, and Hotel del Coronado 2011 Actual

2012 Guidance

Operations

(Same Store N.A. Portfolio)

(a)

RevPAR

$170

6%-8%

$180-$183

Total RevPAR

$314

5%-7%

$330-$336

EBITDA Margins

21.1%

100 - 175bps

22.1%-22.9%

Corporate Results

Comparable EBITDA

$155

7%-16%

$165-$180

Comparable FFO / share

$0.14

55%-115%

$0.22-$0.30 |

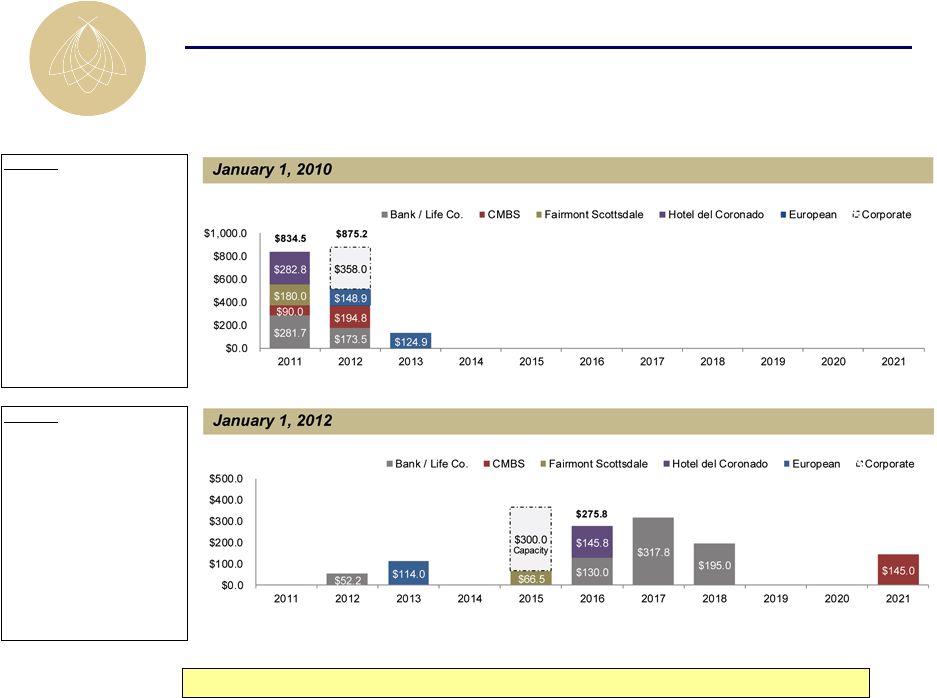

26

($ in millions)

Note: Assumes full extension periods for all loans.

BEE’s balance sheet is structured for growth

Strong Recapitalized Balance Sheet

Key Stats

Net Debt/EBITDA

14.3x

Net Debt+Pref /EBITDA

17.4x

Net Debt/TEV

76.9%

Avg. Maturity (yrs)

3.4

Unencumbered assets

0

Corporate liquidity (MM)

$105.0

Mix of Debt

Bank Debt

17.8%

Life Insurance Co.

25.6%

CMBS

56.6%

Key Stats

Net Debt/EBITDA

7.4x

Net Debt+Pref /EBITDA

9.3x

Net Debt/TEV

46.8%

Avg. Maturity (yrs)

5.2

Unencumbered assets

2

Corporate liquidity (MM)

$260.0

Mix of Debt

Bank Debt

38.0%

Life Insurance Co.

31.5%

CMBS

30.5% |

27

BEE’s Unique Value Proposition

The best investment proposition in the lodging space

The only pure play high-end lodging REIT

High-end outperforms the industry in a recovery

Industry leading asset management expertise

Assets are in pristine condition

Embedded organic growth from revenue growth and ROI opportunities

Replacement cost, excluding land, approximately $700,000 per key

Historically

low

supply

growth

environment,

particularly

in

BEE

markets

Balance sheet positioned for growth |

28

Except for historical information, the matters discussed in this

press release are forward-looking statements subject to

certain risks and uncertainties. Actual results could differ materially from the

Company's projections and forward-looking statements are not guarantees

of future performance. These forward looking statements are identified by

looking their use

of terms and phrases such as “anticipate,”

“believe,”

“could,”

“estimate,”

“expect,”

“intend,”

“may,”

“plan,”

“predict,”

“project,”

“should,”

“will,”

“continue”

and other similar terms and phrases, including references to assumptions and

forecasts of future results.

Factors that may contribute to these differences include, but are not limited to

the following: ability to obtain, refinance or restructure debt or comply

with covenants contained in our debt facilities; volatility in equity or

debt markets; availability of capital; rising interest rates and

operating costs; rising insurance premiums; cash available for

capital expenditures; competition; demand for hotel rooms in our

current and proposed market areas; economic conditions

generally and in the real estate market specifically, including deterioration of

economic conditions and the extent of its effect on business and leisure

travel and the lodging industry; ability to dispose of existing properties in a manner

consistent with our disposition strategy; delays in construction

and development; the failure of closing conditions to be

satisfied; risks related to natural disasters; the effect of threats of terrorism

and increased security precautions on travel patterns and hotel bookings;

the outbreak of hostilities and international political instability; legislative or regulatory

changes, including changes to laws governing the taxation of REITs; and changes in

generally accepted accounting principles, policies and guidelines

applicable to REITs. Certain of these risks and uncertainties are described in greater

detail in our filings with the Securities and Exchange Commission. Although we

believe our current expectations to be based upon reasonable assumptions,

we can give no assurance that our expectations will be attained or that

actual results will not differ materially. We undertake no obligation to

update any forward-looking statement to conform the statement to

actual results or changes in our expectations.

Disclaimer |

29

Non-GAAP to GAAP Reconciliations

Reconciliation of Net Debt + Preferred Equity / EBITDA

($ in 000s)

YE 2009

(a)

YE 2011

(b)

Preferred equity capitalization

$370,236

$289,102

Consolidated debt

1,658,745

1,050,385

Pro rata share of unconsolidated debt

282,825

212,275

Pro rata share of consolidated debt

(107,065)

(45,548)

Cash and cash equivalents

(116,310)

(72,013)

Net Debt + Preferreds

$2,088,431

$1,434,201

Comparable EBITDA

$119,953

$154,790

Net Debt + Preferreds / EBITDA

17.4x

9.3x

(a) All figures taken from year-end 2009 financial statements.

(b) All figures taken from year-end 2011 financial statements.

Reconciliation of Net Debt / EBITDA

($ in 000s)

YE 2009

(a)

YE 2011

(b)

Consolidated debt

$1,658,745

$1,050,385

Pro rata share of unconsolidated debt

282,825

212,275

Pro rata share of consolidated debt

(107,065)

(45,548)

Cash and cash equivalents

(116,310)

(72,013)

Net Debt

$1,718,195

$1,145,099

Comparable EBITDA

$119,953

$154,790

Net Debt / EBITDA

14.3x

7.4x

(a) All figures taken from year-end 2009 financial statements.

(b) All figures taken from year-end 2011 financial statements.

Reconciliation of Net Debt / TEV

($ in 000s)

YE 2009

(a)

YE 2011

(b)

Consolidated Debt

$1,658,745

$1,050,385

Pro rata share of unconsolidated debt

282,825

212,275

Pro rata share of consolidated debt

(107,065)

(45,548)

Cash and cash equivalents

(116,310)

(72,013)

Net Debt

$1,718,195

$1,145,099

Market Capitalization

$144,966

$1,014,092

Total Debt

1,834,505

1,217,112

Preferred Equity

370,236

289,102

Cash and cash equivalents

(116,310)

(72,013)

Total Enterprise Value

$2,233,397

$2,448,293

Net Debt / Enterprise Value

76.9%

46.8%

(a) All figures taken from year-end 2009 financial statements.

(b) All figures taken from year-end 2011 financial statements.

|

30

Non-GAAP to GAAP Reconciliations

2011

2010

2011

2010

Net loss attributable to SHR common shareholders

(15,917)

$

(134,835)

$

(23,688)

$

(261,937)

$

Depreciation and amortization - continuing operations

25,840

32,406

112,062

130,601

Depreciation and amortization - discontinued operations

-

567

-

5,980

Interest expense - continuing operations

19,299

17,797

86,447

86,285

Interest expense - discontinued operations

-

1,990

-

9,706

Income taxes - continuing operations

691

1,112

970

1,408

Income taxes - discontinued operations

-

(260)

379

476

Noncontrolling interests

(99)

(808)

(29)

(1,687)

Adjustments from consolidated affiliates

(1,302)

(2,013)

(6,733)

(7,609)

Adjustments from unconsolidated affiliates

6,928

3,673

23,221

15,563

Preferred shareholder dividends

(4,682)

7,722

18,482

30,886

EBITDA

30,758

(72,649)

211,111

9,672

Realized portion of deferred gain on

sale-leaseback - continuing operations (66)

(53)

(217)

(207)

Realized portion of deferred gain on

sale-leaseback - discontinued operations -

(1,144)

(1,214)

(4,465)

Gain on sale of assets - continuing operations

-

-

(2,640)

-

Gain on sale of assets

- discontinued operations (357)

(28,476)

(101,287)

(29,713)

Impairment losses and other charges

-

141,858

-

141,858

Loss on early extinguishment of debt - continuing operations

-

-

1,237

925

Loss on early extinguishment of

debt - discontinued operations -

95

-

95

Loss on early

termination of derivative financial instruments -

-

29,242

18,263

Gain on extinguishment of debt of unconsolidated

affiliate -

(11,025)

-

(11,025)

Foreign currency exchange loss - continuing operations (a)

79

16

2

1,410

Foreign currency exchange loss (gain) -

discontinued operations (a) -

98

(51)

(7,392)

Adjustment for Value Creation Plan

9,529

5,743

18,607

12,614

Comparable EBITDA

39,943

$

34,463

$

154,790

$

132,035

$

(a)

Foreign currency exchange gains or losses applicable to

third-party and inter-company debt and certain balance sheet items held by

foreign subsidiaries.

December 31,

December 31,

Reconciliation of Net Loss Attributable to SHR Common Shareholders to

EBITDA and Comparable EBITDA (in thousands)

Three Months Ended

Years Ended |

31

Non-GAAP to GAAP Reconciliations

2011

2010

2011

2010

Net loss attributable to SHR common shareholders

(15,917)

$

(134,835)

$

(23,688)

$

(261,937)

$

Depreciation and amortization - continuing operations

25,840

32,406

112,062

130,601

Depreciation and amortization - discontinued

operations -

567

-

5,980

Corporate depreciation

(273)

(303)

(1,141)

(1,217)

Gain on sale of assets - continuing

operations -

-

(2,640)

-

Gain on sale of

assets - discontinued operations (357)

(28,476)

(101,287)

(29,713)

Realized portion of deferred gain on sale-leaseback

- continuing operations (66)

(53)

(217)

(207)

Realized portion of

deferred gain on sale-leaseback - discontinued operations

-

(1,144)

(1,214)

(4,465)

Deferred tax expense on realized portion of

deferred gain on sale-leasebacks -

357

379

1,393

Noncontrolling interests

adjustments (135)

(222)

(575)

(1,159)

Adjustments from consolidated affiliates

(664)

(1,335)

(4,486)

(5,979)

Adjustments from unconsolidated

affiliates 3,740

1,874

11,763

7,973

FFO

12,168

(131,164)

(11,044)

(158,730)

Redeemable noncontrolling interests

36

(586)

546

(528)

FFO - Fully

Diluted 12,204

(131,750)

(10,498)

(159,258)

Impairment losses and other charges

-

141,858

-

141,858

Non-cash mark to market of interest rate swaps -

continuing operations (1,696)

(535)

(2,183)

9,014

Non-cash mark to market of

interest rate swaps - discontinued operations -

(204)

-

25

Loss on early extinguishment of debt - continuing operations

-

-

1,237

925

Loss on early

extinguishment of debt - discontinued operations -

95

-

95

Loss on early termination of derivative financial instruments

-

-

29,242

18,263

Gain on extinguishment of debt of

unconsolidated affiliate -

(11,025)

-

(11,025)

Foreign currency exchange loss - continuing

operations (a) 79

16

2

1,410

Foreign currency exchange loss

(gain), net of tax - discontinued operations (a) -

95

(51)

(7,421)

Adjustment for Value Creation Plan

9,529

5,743

18,607

12,614

Comparable FFO

20,116

$

4,293

$

36,356

$

6,500

$

Comparable FFO per diluted share

0.11

$

0.03

$

0.20

$

0.05

$

Weighted average diluted

shares 188,340

151,663

179,319

122,933

(a)

Foreign currency exchange gains or losses applicable to

third-party and inter-company debt and certain balance sheet items held by foreign

subsidiaries.

Reconciliation of Net Loss Attributable to SHR Common Shareholders to

(in thousands, except per share data)

December 31,

December 31,

Three Months Ended

Years Ended

Funds From Operations (FFO), FFO - Fully Diluted and Comparable

FFO |

32

Non-GAAP to GAAP Reconciliations

Operational Guidance

Low Range

High Range

North American same store Total RevPAR growth (a)

5.0%

7.0%

North American same store RevPAR growth (a)

6.0%

8.0%

(a) Includes North American hotels which are consolidated in our

financial results, but excludes the Four Seasons Jackson Hole and Four

Seasons Silicon Valley hotels, which were acquired in 2011.

Comparable EBITDA Guidance

Low Range

High Range

Net loss attributable to common shareholders

(86.7)

$

(71.8)

$

Depreciation and amortization

111.2

111.2

Interest expense

86.0

86.0

Income taxes

1.0

1.0

Noncontrolling

interests (0.3)

(0.2)

Adjustments from consolidated

affiliates (4.2)

(4.2)

Adjustments from unconsolidated

affiliates 28.8

28.8

Preferred shareholder

dividends 24.2

24.2

Realized portion of deferred gain

on sale-leasebacks (0.2)

(0.2)

Adjustment for Value Creation

Plan 5.2

5.2

Comparable

EBITDA 165.0

$

180.0

$

Comparable FFO Guidance

Low Range

High Range

Net loss attributable to common shareholders

(86.7)

$

(71.8)

$

Depreciation and amortization

109.9

109.9

Realized portion of deferred gain on

sale-leasebacks (0.2)

(0.2)

Noncontrolling interests

(0.3)

(0.2)

Adjustments from consolidated

affiliates (1.2)

(1.2)

Adjustments from unconsolidated

affiliates 15.6

15.6

Adjustment for Value Creation

Plan 5.2

5.2

Comparable

FFO 42.3

$

57.3

$

Comparable FFO per diluted share

0.22

$

0.30

$

December 31, 2012

Year Ended

December 31, 2012

Year Ended

2012 Guidance

(in millions, except per share data)

Year Ended

December 31, 2012 |

•* * * * * * * * * * * * *

*

*

*

*

*

*

*

*

*

*

•* * * * * * * * * * * *

* * * * * * * * * * * * * |