Attached files

| file | filename |

|---|---|

| 8-K - 8-K - REGIONS FINANCIAL CORP | d308746d8k.htm |

2012 CITI FINANCIAL

SERVICES CONFERENCE

March 7, 2012

Grayson Hall

Chief Executive Officer

Exhibit 99.1 |

2

INVESTMENT THESIS

Improved Credit Profile

•

Aggressive risk management initiatives

•

Significant reduction in higher risk loan portfolios

•

Continued improvement in credit quality metrics

Strong Funding Profile

and Capital Position

•

Continued growth in low cost core deposit base

•

Loan to deposit ratio well below historical and peer levels

•

Best in class liquidity position and attractive funding profile

•

Capital levels are solid and in line with Basel III regulatory requirements

Attractive

Market Presence

•

Leading Southeastern depository franchise with favorable demographics

•

Leading brand favorability

•

Top share in core markets

Comprehensive

Product Offering

•

Balanced business mix

•

Momentum in C&I and consumer offerings

•

Focused on core banking business post sale of Morgan Keegan

•

Sustainable and improving core profitability

•

Opportunity for outperformance

•

Significant credit leverage remaining

Profitability |

3

AGGRESSIVE RISK MANAGEMENT INITIATIVES

•

New

General

Counsel,

Chief

Risk

Officer

and

Chief

Credit

Officer

in

place

•

Strengthened Board of Directors by addition of 4 new members in the last 2

years •

Substantial reduction in highest risk credit exposures

•

Continued focus on risk / portfolio diversification

•

Capital planning and loss modeling capabilities substantially enhanced

•

Capital levels are solid and in excess of Basel III requirements

•

Sale of Morgan Keegan further reduces risk profile

3 |

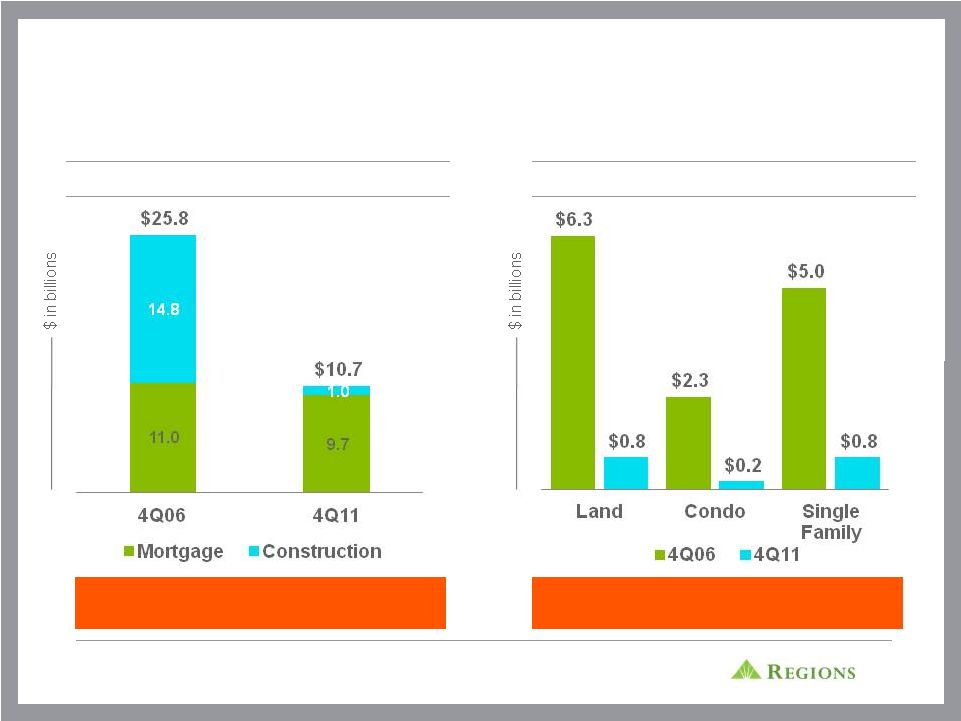

4

SIGNIFICANT REDUCTION IN HIGH RISK LOAN

PORTFOLIOS

Total Investor Real Estate

Higher Risk Investor Real Estate Portfolio

Reduced Investor Real Estate

$15.1 B or 59% over 5 years

Reduced High Risk Portfolios

$11.8 B or 87% over 5 years |

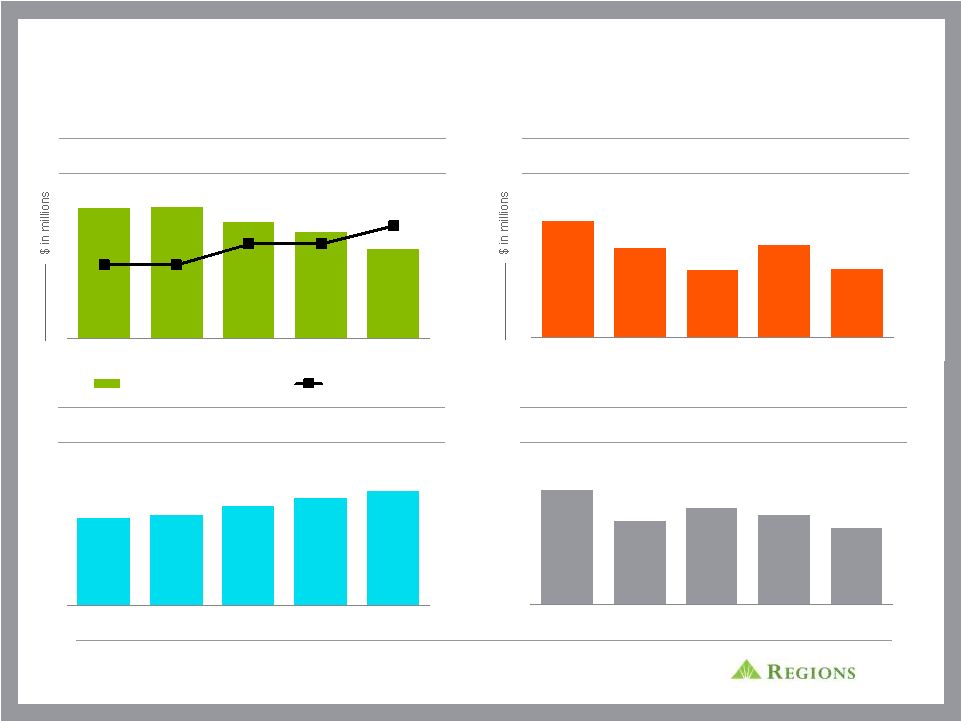

5

CONTINUED IMPROVEMENT IN CREDIT QUALITY METRICS

Total NPAs (including HFS)

NPLs Gross Migration

NPL Balances Paying Current and as Agreed

NCO’s / Avg Loans

24% Decline in Total NPAs*

41% Decline*

11 bps Increase*

106 bps Decline*

* Year-over-year change

$3,918

$3,933

$3,602

$3,391

$2,996

81%

81%

87%

87%

92%

60%

65%

70%

75%

80%

85%

90%

95%

4Q10

1Q11

2Q11

3Q11

4Q11

NPAs (including HFS)

ALLL / NPAs

$948

$730

$555

$755

$561

4Q10

1Q11

2Q11

3Q11

4Q11

37%

38%

42%

45%

48%

4Q10

1Q11

2Q11

3Q11

4Q11

3.22%

2.37%

2.71%

2.52%

2.16%

4Q10

1Q11

2Q11

3Q11

4Q11 |

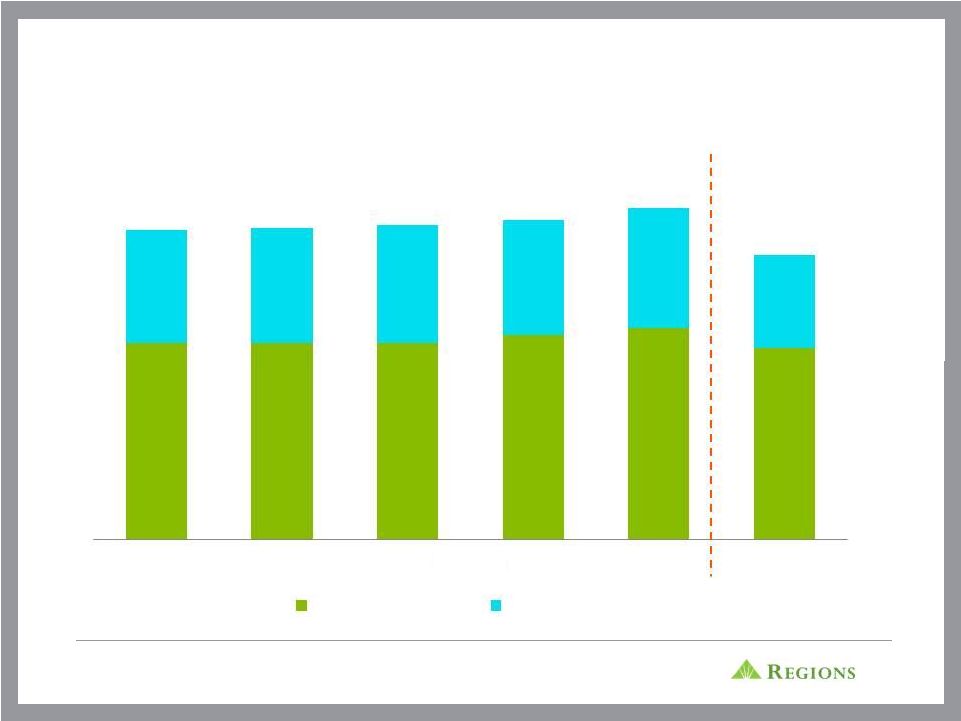

6

STRONG FUNDING PROFILE AND LIQUIDITY POSITION

Deposit Profile*

Core Deposits as a % of Total Funding

Liquidity Coverage Ratio **

Cost of Deposits

1.35%

0.49%

Low Cost Deposits*

$67.1B

$76.2B

% Low Cost Deposits*

68%

80%

Loans* / Deposits*

Source: SNL Financial -

Peers include BAC, BBT, CMA, FITB, KEY, MTB, PNC, STI, USB, WFC

•

** Liquidity Coverage Ratio as of 4Q11 Data provided by Barclay’s Capital

based on the their models using publicly available 24%

30%

16%

20%

4%

5%

24%

25%

32%

20%

2009

2011

Interest Free

Time

Money Market

Savings

Interest Bearing

89%

85%

Regions

Peer Median

101%

107%

92%

88%

81%

110%

111%

92%

95%

90%

2007

2008

2009

2010

2011

Regions

Peer Median

108%

72%

Regions

Peer Median

information and dual deposit run-off assumptions

Based

on

full

year

ending

balances |

7

STRONG CAPITAL LEVELS

(1)

(2)

1

Non-GAAP

–

see

appendix

page

23

for

reconciliation

2

Non-GAAP

-

Subject

to

change

as

interpretation

of

Basel

III

rules

is

ongoing

and

dependent

on

guidance

from

Basel

and

regulators; see appendix page 24 for reconciliation

7.9%

7.9%

7.9%

8.2%

8.5%

7.7%

12.4%

12.5%

12.6%

12.8%

13.3%

11.4%

4Q10

1Q11

2Q11

3Q11

4Q11

4Q11 Basel III

Tier 1 Common

Tier 1 Capital |

8

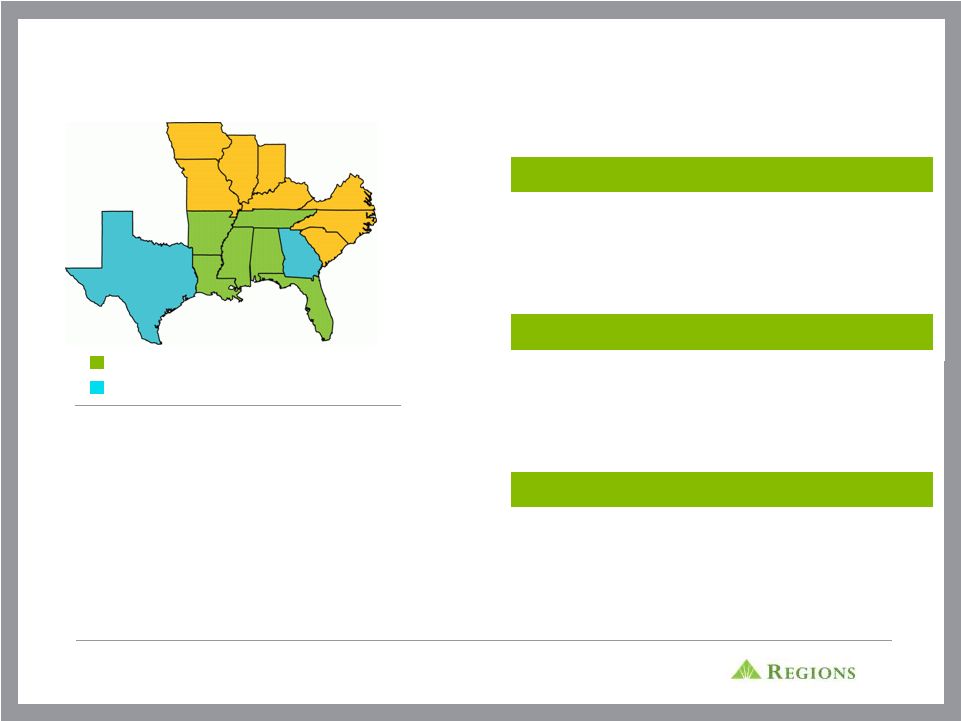

FRANCHISE OVERVIEW

•

Associates: 23,707*

•

Assets: $127B

•

Loans: $78B

•

Deposits: $96B

•

Branches: 1,726

•

Insurance Offices: 30

•

ATMs: 2,083

•

Market Cap: $7.4B**

* Excludes Morgan Keegan associates

**As of March 2, 2012

Ranked 5th or Better in Market Share

Targeted Growth Areas

Business Services

›

Small and mid-sized C&I lending

›

Commercial Real Estate

›

Equipment Finance

Consumer Services

›

Mortgage

›

Home Equity

›

Credit Card

›

Direct Lending

›

Indirect Auto

Wealth Management

›

Private Banking

›

Insurance

›

Trust Services |

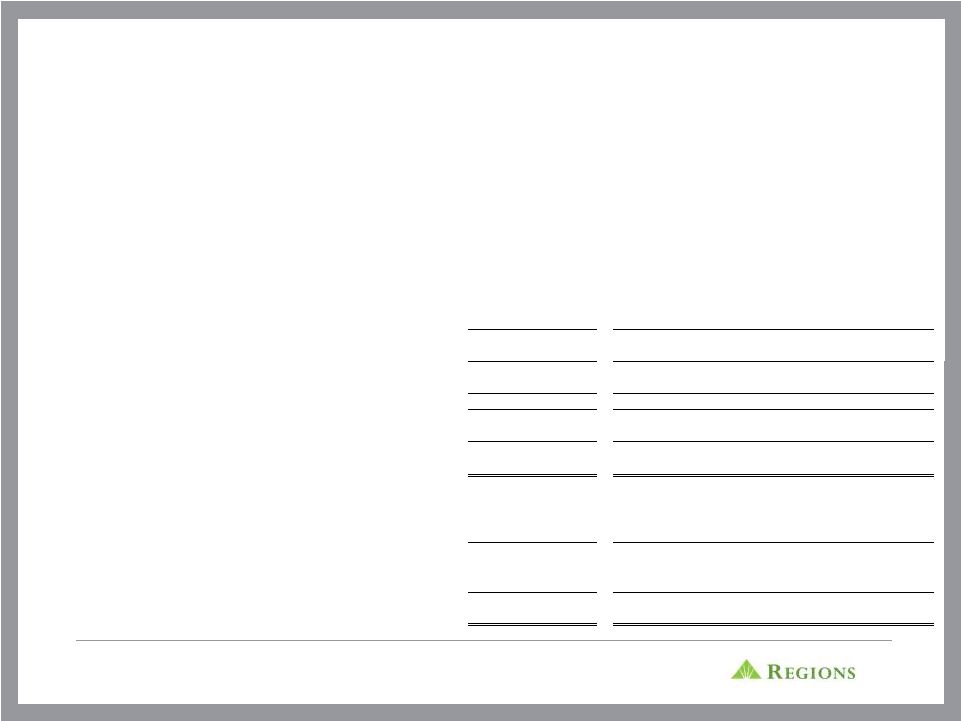

9

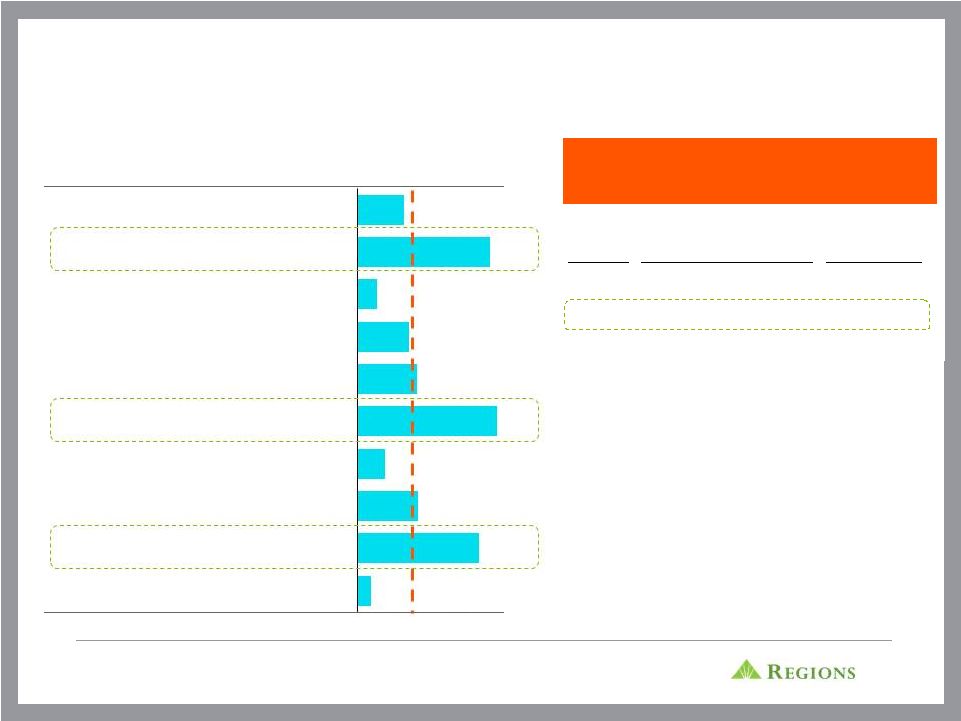

Top 10 MSAs

Deposits

Market

Share

Market

Rank

’10-’15

Population

Growth

Birmingham, AL

$11.0

37.6%

1

Nashville, TN

$6.6

17.3%

1

Miami, FL

$4.8

3.1%

7

Tampa, FL

$4.4

8.7%

4

Memphis, TN

$3.8

16.8%

2

Atlanta, GA

$3.4

3.0%

6

St. Louis, MO

$3.0

4.7%

4

Jackson, MS

$2.8

25.5%

2

New Orleans, LA

$2.4

8.3%

4

Mobile, AL

$2.3

38.2%

1

($ in billions)

National Average: 3.9%

REGIONS’

FOOTPRINT IS CHARACTERIZED BY EITHER HIGH

MARKET SHARE, HIGH GROWTH MARKETS OR BOTH

Source: SNL Financial

Note: Core Markets include AL, FL, LA, MS, AR, TN

Weighted Average Deposit Market

Share in Regions’

Core Markets

Rank

Name

Market

Share

1

Bank of America

11.5%

2

Regions

9.8%

3

Wells Fargo

9.4%

4

SunTrust

6.9%

5

JPMorgan Chase

3.3%

6

BB&T

2.5%

7

Capital One

2.3%

8

First Horizon

2.0%

9

Hancock

1.9%

10

PNC

1.4%

1.0%

8.8%

4.4%

2.0%

10.1

%

4.3%

3.7%

1.4%

9.6%

3.4% |

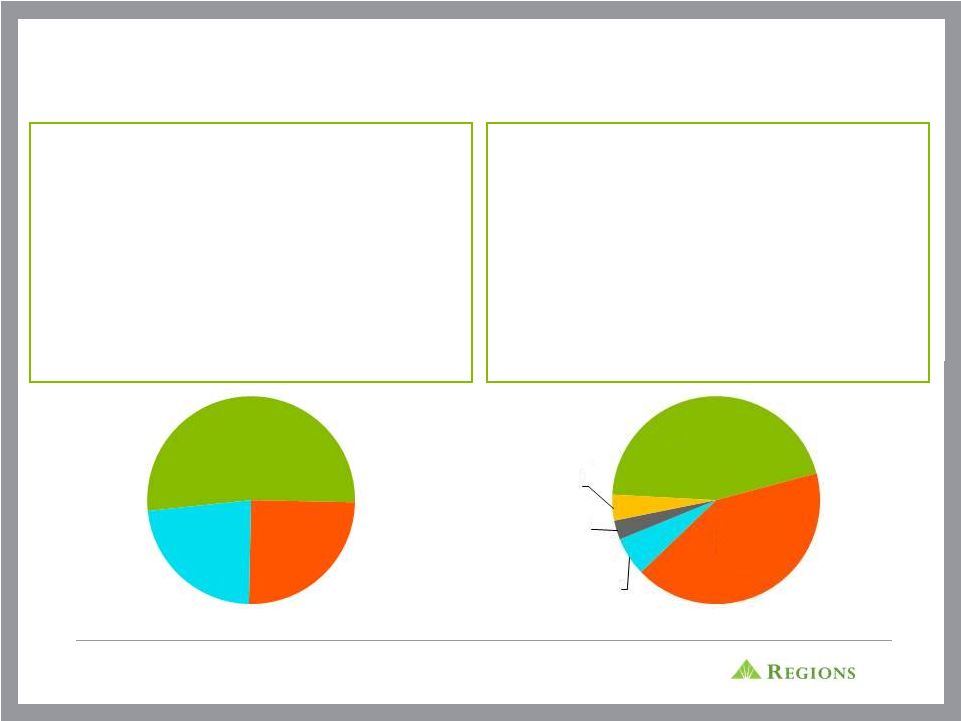

10

RENEWED FOCUS ON C&I AND CONSUMER LENDING

BUSINESS SERVICES

•

60% of Total Loan Portfolio

•

Focused on middle market and small business

•

Represents over 80% of Business Services Revenue

•

Broad based middle-market commercial loan growth across

footprint and industries

•

Driven by specialized industries, including healthcare,

franchise restaurant, energy, as well as technology and

defense

4Q11 Business Services Loans: $47B

4Q11 Consumer Services Loans: $31B

* Includes commercial real estate owner occupied loans

C&I

52%

CRE*

25%

IRE

23%

1st Mort

45%

Home

Equity

42%

Indirect

6%

Credit

Card

3%

Other

4%

CONSUMER SERVICES

•

40% of Total Loan Portfolio

•

Consumer loan growth will be fueled by new businesses as

well as growth in existing businesses

•

Mortgage loan production grew 18% QoQ

•

Non-real estate consumer portfolio has increased 45% since

2010

•

$1B Regions-branded credit card portfolio repurchased in 2011

•

Indirect auto lending grew 16% YoY |

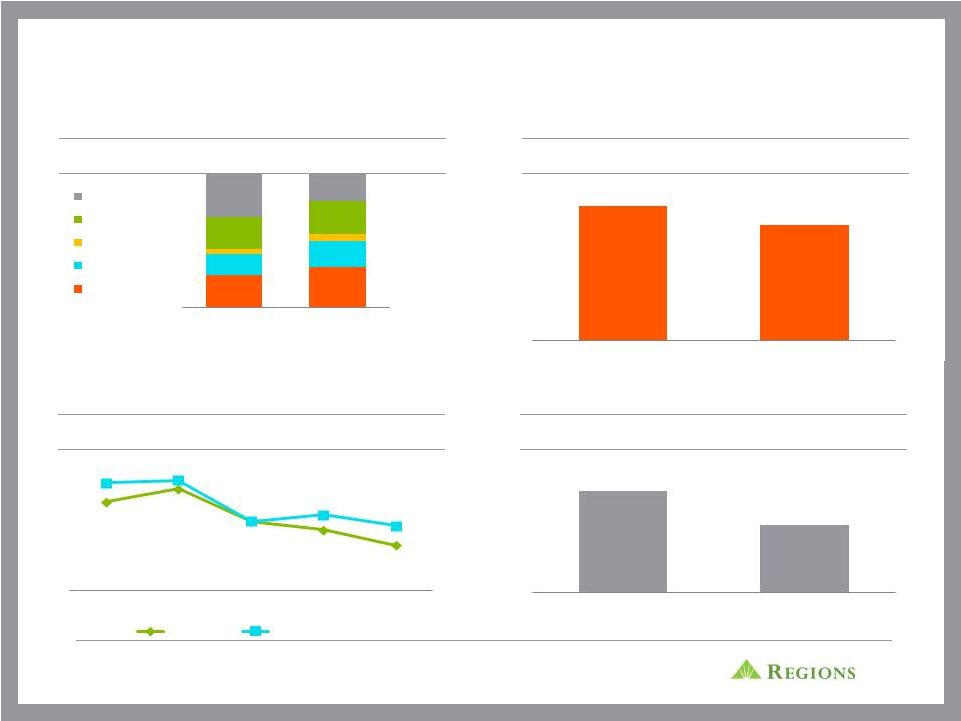

11

$430

$424

$496

$516

$468

1.8%

1.8%

2.1%

2.2%

2.0%

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

3.5%

4Q10

1Q11

2Q11

3Q11

4Q11

PPI

PPI / RWA

2011 FINANCIAL HIGHLIGHTS

Adjusted Pre-tax Pre-provision Income from Continuing

Operations

(2)

Loan

Loss

Provision

$682

$482

$398

$355

$295

(1)

Non-GAAP -

Excludes goodwill impairment charge of $253M in 4Q11 and excludes regulatory

charge of $75M in 2Q10 offset by $16M

related

tax

benefit

in

2Q11

–

See GAAP to non-GAAP reconciliation on slide 21

(2)

Non-GAAP, see GAAP to Non-GAAP reconciliation on slide 22

(3)

Source: SNL Financial; Company Reports Peer banks include BAC, BBT, CMA,

FITB, KEY, MTB, PNC, STI, USB, WFC Regions experienced the highest

full year 2011 vs. 2010 PPI growth

versus all peers

(2)

(2)

(2)

2011 Financial Results

Net Loss

($429)MM

EPS

($0.34)

Income from continuing

operations

(1)

$211MM

EPS from continuing

operations

(1)

$0.17 |

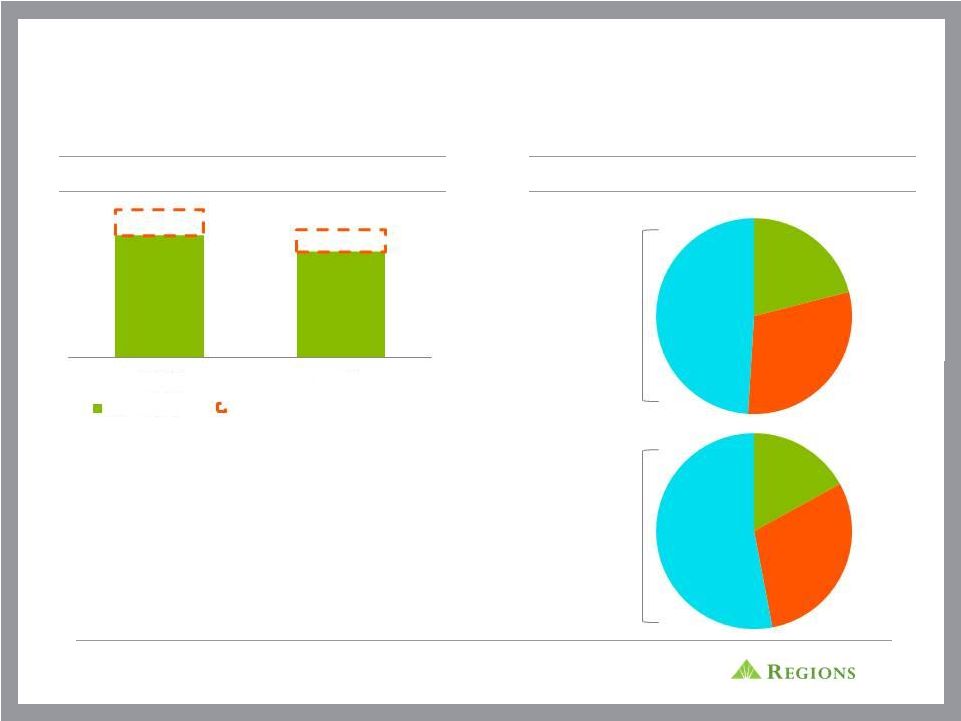

12

MIX AND COST OF DEPOSITS PROVIDES FURTHER

OPPORTUNITY TO LOWER DEPOSIT COSTS AND IMPROVE

MARGIN

Deposit Cost Opportunity Gap

•

Regions has additional room to reduce deposit

costs, most significantly through profitably re-pricing

maturing CDs

•

$11.7B of higher cost CDs maturing in 2012 at

1.46%

•

1H12

-

$7B

at

1.02%

and

2H12

-

$4.7B

at

2.09%

•

Funding costs declined 31 basis points from 4Q10

Deposit Mix Compared to Peers*

Regions

Peer

Average

* Average basis for 4Q11

Source: SNL Financial: Peer banks include BAC, BBT, CMA, FITB, KEY, MTB, PNC, STI,

USB, WFC 38 bps

33 bps

8 bps

7 bps

3Q11

4Q11

Peer Median

Regions Opportunity Gap

Time

21%

NIB

30%

Other

49%

Time

17%

NIB

30%

Other

53% |

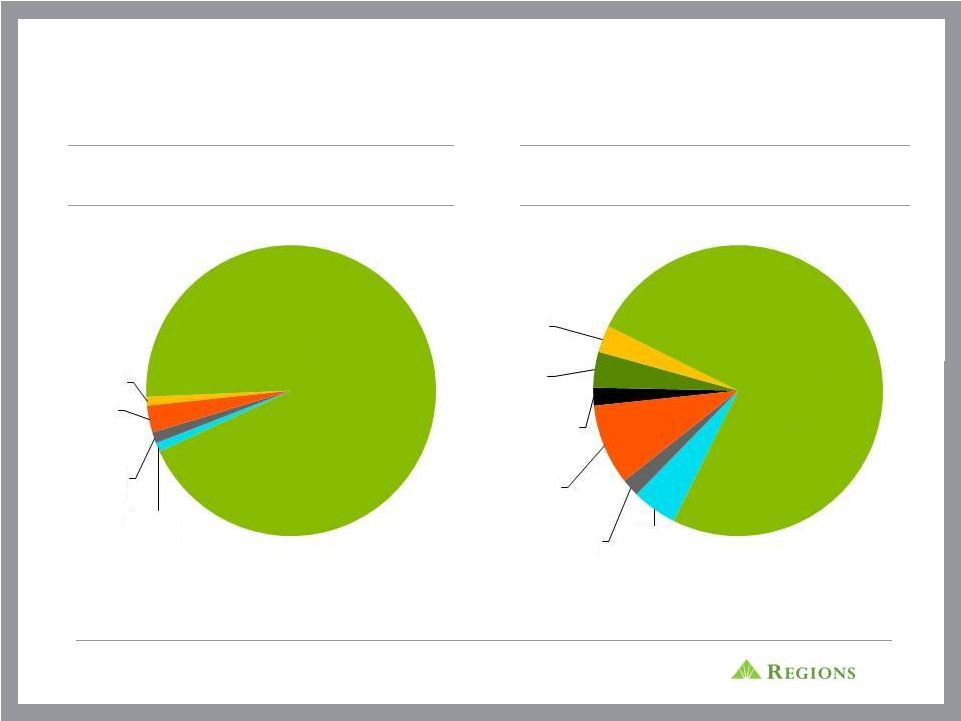

13

CONSERVATIVE INVESTMENT PORTFOLIO VS. PEERS

Regions Securities Portfolio Components*

Peer Average Securities Portfolio

Components *

*As of 12/31/2011

Source: FFIEC Call Report Data: Peer banks include BAC, BBT, CMA, FITB, KEY, MTB,

PNC, STI, USB, WFC Agency

Debt

1%

Agency

MBS

94%

Agency

CMBS

1%

Private

CMBS

1%

Other

3%

Treasuries

2%

Munis

4%

Agency

Debt

3%

Agency

MBS

75%

Private

MBS

5%

Private

CMBS

2%

Other

9% |

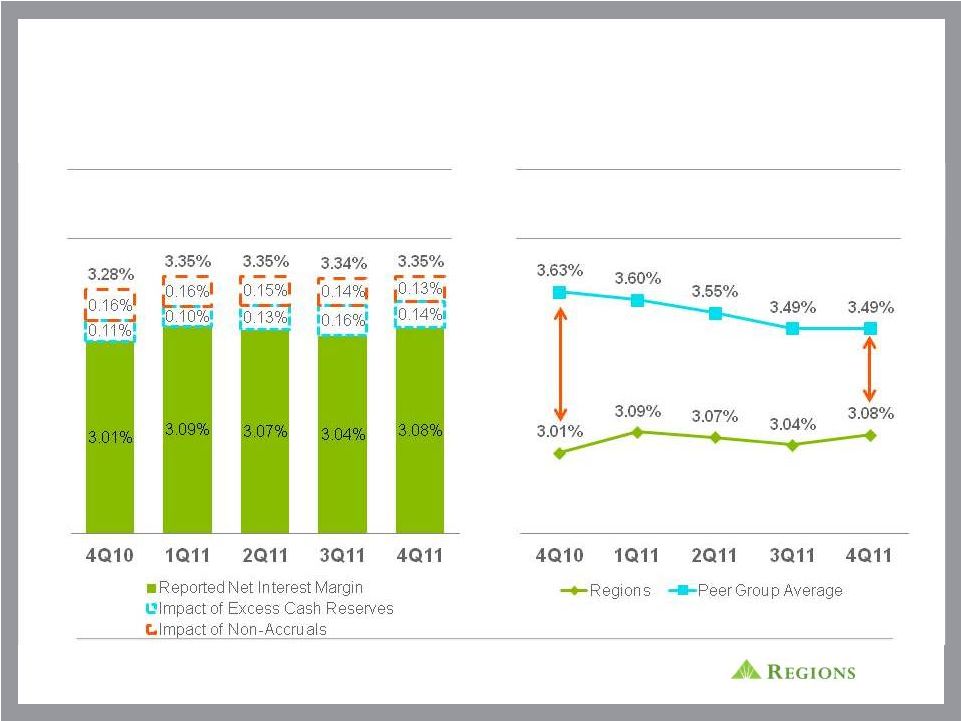

14

FUNDING MIX AND DEPLOYMENT OF CASH

RESERVES EXPECTED TO RESULT IN ADDITIONAL

IMPROVEMENT TO NIM*

Impact of Excess Cash Reserves & Non-

Accruals on NIM*

Regions has closed a portion of its gap vs.

peers in the last 5 quarters

69bps

41bps

* From continuing operations

Source: SNL Financial: Peer banks include BAC, BBT, CMA, FITB, KEY, MTB, PNC, STI,

USB, WFC |

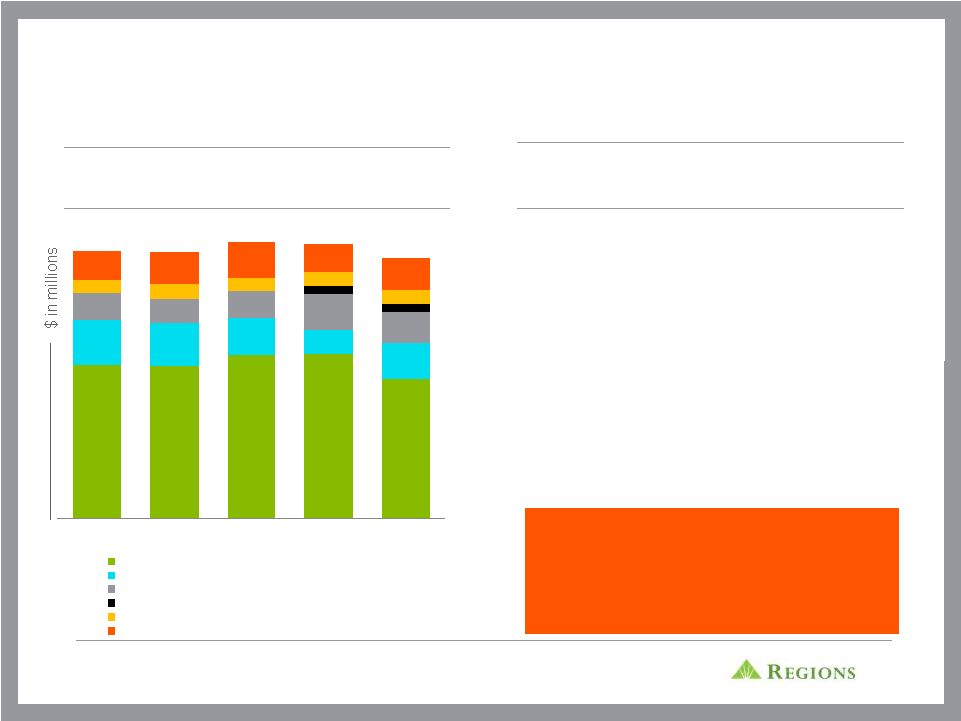

15

ABILITY TO ADAPT OUR BUSINESS MODEL HELPS

MITIGATE NEW LEGISLATION

•

Ongoing restructuring of our

accounts from free to fee-eligible

•

Increased hurdle to obtain free

checking

•

Cross-sell new revenue initiatives

•

Now Banking Suite of products

(expedited bill pay, check cashing,

reloadable prepaid debit card and

money transfer services)

Factors Offsetting Debit Interchange

Legislation

Total 2011 service charges were

relatively stable despite the negative

impact of Regulation E and debit

interchange legislation

Fee Income by Quarter *

* From continuing operations

290

287

308

310

263

83

81

70

44

68

51

45

50

68

57

15

16

25

28

25

27

26

53

60

66

52

60

$502

$501

$519

$516

$490

4Q10

1Q11

2Q11

3Q11

4Q11

Service charges

Capital Markets, Investment Income & Trust

Mortgage Income

Credit Card Income

Insurance Income

Other |

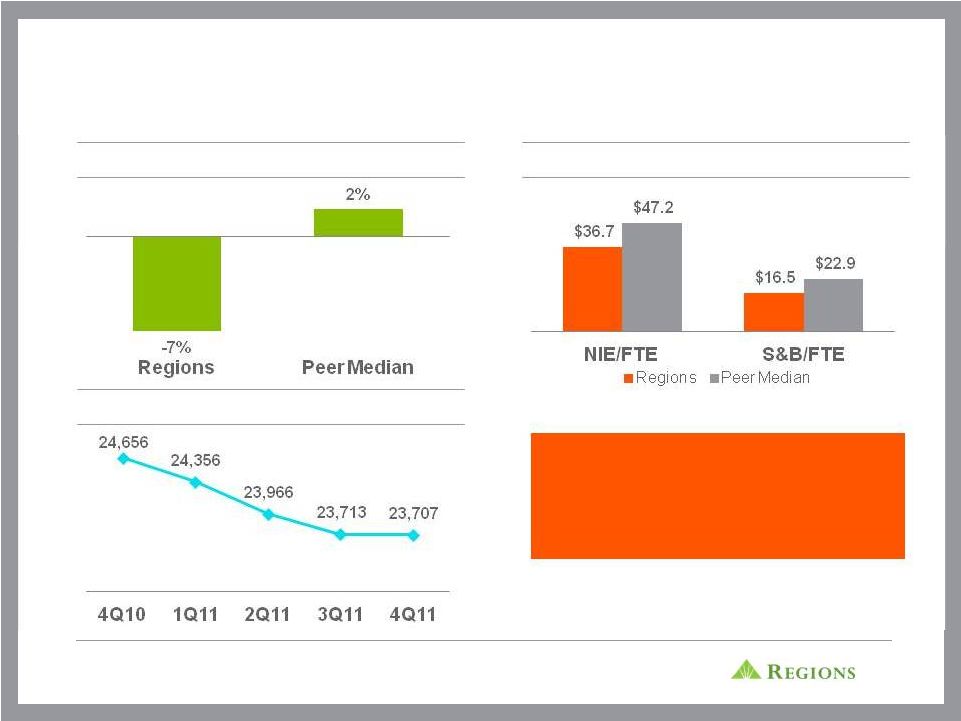

16

EXPENSE CONTROL CONTINUES TO BE A FOCUS

Expenses Per FTE

(1)

Non-GAAP from continuing operations excluding goodwill impairment; see GAAP to

Non-GAAP reconciliation on slide 22 (2)

Excludes Morgan Keegan Associates

Source: SNL Financial; Peers include BAC, BBT, CMA, FITB, KEY, MTB, PNC, STI, USB,

WFC Regions has the lowest expenses per

FTE of all peers

(1)

(1)

Non-Interest

Expense

(1)

–

4Q11

vs.

4Q10

Headcount

–

Bank

Associates

(2) |

17

OPPORTUNITY FOR OUTPERFORMANCE

REVENUE

EXPENSES

CREDIT

•

Tangible opportunity to close peer margin gap

•

Continued momentum in C&I and Consumer lending

•

Real estate expertise intact

•

Durbin mitigation efforts underway

•

Ongoing expense initiatives

•

Branch rationalization

•

Removed Morgan Keegan overhead / cost structure

•

Anticipating reduced credit related / OREO expenses

•

Solid reserve position

•

Reduced provisions with continued credit improvement

•

$11.7B of deposit repricing

•

Lower liquidity costs

•

Level of

non-accruals

|

18

INVESTMENT THESIS

Improved Credit Profile

•

Aggressive risk management initiatives

•

Significant reduction in higher risk loan portfolios

•

Continued improvement in credit quality metrics

Strong Funding Profile

and Capital Position

•

Continued growth in low cost core deposit base

•

Loan to deposit ratio well below historical and peer levels

•

Best in class liquidity position and attractive funding profile

•

Capital levels are solid and in line with Basel III regulatory requirements

Attractive

Market Presence

•

Leading Southeastern depository franchise with favorable demographics

•

Leading brand favorability

•

Top share in core markets

Comprehensive

Product Offering

•

Balanced business mix

•

Momentum in C&I and consumer offerings

•

Focused on core banking business post sale of Morgan Keegan

•

Sustainable and improving core profitability

•

Opportunity for outperformance

•

Significant credit leverage remaining

Profitability

|

19

APPENDIX |

20

FORWARD-LOOKING STATEMENTS

This

presentation

may

include

forward-looking

statements

which

reflect

Regions’

current

views

with

respect

to

future

events

and

financial

performance.

The

Private

Securities

Litigation

Reform

Act

of

1995

(“the

Act”)

provides

a

“safe

harbor”

for

forward-looking

statements

which

are

identified

as

such

and

are

accompanied

by

the

identification

of

important

factors

that

could

cause

actual

results

to

differ

materially

from

the

forward-

looking

statements.

For

these

statements,

we,

together

with

our

subsidiaries,

claim

the

protection

afforded

by

the

safe

harbor

in

the

Act.

Forward-looking

statements

are

not

based

on

historical

information,

but

rather

are

related

to

future

operations,

strategies,

financial

results

or

other

developments.

Forward-looking

statements

are

based

on

management’s

expectations

as

well

as

certain

assumptions

and

estimates

made

by,

and

information

available

to,

management

at

the

time

the

statements

are

made.

Those

statements

are

based

on

general

assumptions

and

are

subject

to

various

risks,

uncertainties

and

other

factors

that

may

cause

actual

results to differ materially from the views, beliefs and projections expressed in

such statements. These risks, uncertainties and other factors include, but are not limited to, those described below:

›

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the

“Dodd-Frank Act”)became law on July 21, 2010, and a number of legislative, regulatory and tax proposals remain pending. Additionally, the

U.S.

Treasury

and

federal

banking

regulators

continue

to

implement,

but

are

also

beginning

to

wind

down,

a

number

of

programs

to

address

capital

and

liquidity

in

the

banking

system.

Proposed

rules,

including

those that are part of the Basel III process, could require banking institutions to

increase levels of capital. All of the foregoing may have significant effects on Regions and the financial services industry, the

exact nature of which cannot be determined at this time.

›

Regions'

ability

to

mitigate

the

impact

of

the

Dodd-Frank

Act

on

debit

interchange

fees

through

revenue

enhancements

and

other

revenue

measures,

which

will

depend

on

various

factors,

including

the

acceptance by our customers of modified fee structures for Regions' products and

services. ›

The impact of compensation and other restrictions imposed under the Troubled Asset

Relief Program (“TARP”) until Regions repays the outstanding preferred stock and warrant issued under the TARP, including

restrictions

on

Regions’

ability

to

attract

and

retain

talented

executives

and

associates.

›

Possible additional loan losses, impairment of goodwill and other intangibles, and

adjustment of valuation allowances on deferred tax assets and the impact on earnings and capital.

›

Possible changes in interest rates may increase funding costs and reduce earning

asset yields, thus reducing margins. Increases in benchmark interest rates would also increase debt service requirements for

customers whose terms include a variable interest rate, which may negatively impact

the ability of borrowers to pay as contractually obligated. ›

Possible changes in general economic and business conditions in the United States in

general and in the communities Regions serves in particular, including any prolonging or worsening of the current

unfavorable economic conditions including unemployment levels.

›

Possible changes in the creditworthiness of customers and the possible impairment of

the collectability of loans. ›

Possible

changes

in

trade,

monetary

and

fiscal

policies,

laws

and

regulations

and

other

activities

of

governments,

agencies,

and

similar

organizations,

may

have

an

adverse

effect

on

business.

›

The current stresses in the financial and real estate markets, including possible

continued deterioration in property values. ›

Regions' ability to manage fluctuations in the value of assets and liabilities and

off-balance sheet exposure so as to maintain sufficient capital and liquidity to support Regions' business.

›

Regions' ability to expand into new markets and to maintain profit margins in the

face of competitive pressures. ›

Regions' ability to develop competitive new products and services in a timely manner

and the acceptance of such products and services by Regions' customers and potential customers.

›

Regions' ability to keep pace with technological changes.

›

Regions' ability to effectively manage credit risk, interest rate risk, market risk,

operational risk, legal risk, liquidity risk, and regulatory and compliance risk.

›

Regions’

ability to ensure adequate capitalization which is impacted by inherent

uncertainties in forecasting credit losses. ›

The cost and other effects of material contingencies, including litigation

contingencies, and any adverse judicial, administrative or arbitral rulings or proceedings.

›

The effects of increased competition from both banks and non-banks.

›

The effects of geopolitical instability and risks such as terrorist attacks.

›

Possible changes in consumer and business spending and saving habits could affect

Regions' ability to increase assets and to attract deposits. ›

The effects of weather and natural disasters such as floods, droughts, wind,

tornados and hurricanes, and the effects of man-made disasters.

›

Possible downgrades in ratings issued by rating agencies.

›

Potential

dilution

of

holders

of

shares

of

Regions’

common

stock

resulting

from

the

U.S.

Treasury’s

investment

in

TARP.

›

Possible

changes

in

the

speed

of

loan

prepayments

by

Regions’

customers

and

loan

origination

or

sales

volumes.

›

Possible acceleration of prepayments on mortgage-backed securities due to low

interest rates and the related acceleration of premium amortization on those securities.

›

The effects of problems encountered by larger or similar financial institutions that

adversely affect Regions or the banking industry generally. ›

Regions’

ability to receive dividends from its subsidiaries.

›

The

effects

of

the

failure

of

any

component

of

Regions’

business

infrastructure

which

is

provided

by

a

third

party.

›

Changes in accounting policies or procedures as may be required by the Financial

Accounting Standards Board or other regulatory agencies. ›

With regard to the sale of Morgan Keegan:

the possibility that regulatory and other approvals and conditions to the

transaction are not received on a timely basis or at all; the possibility that modifications to the terms of the transaction may be

required in order to obtain or satisfy such approvals or conditions; changes in the

anticipated timing for closing the transaction; business disruption during the pendency of or following the transaction;

diversion

of

management

time

on

transaction-related

issues;

reputational

risks

and

the

reaction

of

customers

and

counterparties

to

the

transaction

›

The

effects

of

any

damage

to

Regions’

reputation

resulting

from

developments

related

to

any

of

the

items

identified

above.

›

The

foregoing

list

of

factors

is

not

exhaustive.

For

discussion

of

these

and

other

factors

that

may

cause

actual

results

to

differ

from

expectations,

look

under

the

captions

“Forward-Looking

Statements”

and

“Risk

Factors”

in Regions’

Annual Report on Form 10-K for the year ended December 31, 2011.

›

The words "believe," "expect," "anticipate,"

"project," and similar expressions often signify forward-looking statements. You should not place undue reliance on any forward-looking statements, which speak only

as

of

the

date

made.

We

assume

no

obligation

to

update

or

revise

any

forward-looking

statements

that

are

made

from

time

to

time. |

21

NON-GAAP RECONCILIATION: NET INCOME / (LOSS) AND

EARNINGS PER SHARE

1

There are no preferred shares allocable to discontinued operations.

2

In the second quarter of 2010, Regions recorded a $200 million charge to account for

a probable, reasonably estimable loss related to a pending settlement of regulatory matters. At that time,

Regions assumed that the entire charge would be non-deductible for income tax

purposes. $75 million of the regulatory charge relates to continuing operations. The settlement was finalized

during the second quarter of 2011. At the time of settlement, Regions had better

information related to tax implications. Approximately $125 million of the settlement charge will be deductible

for

federal income tax purposes. Accordingly, during the second quarter of 2011, Regions

adjusted federal income taxes to account for the impact of the deduction. The adjustment reduced Regions'

provision for income taxes by approximately $44 million for the second quarter of

2011, of which approximately $17 million relates to continuing operations.

2011

2010

4Q11

3Q11

2Q11

1Q11

4Q10

Net income (loss) (GAAP)

(215)

$

(539)

$

(548)

$

155

$

109

$

69

$

89

$

Preferred dividends and accretion (GAAP)

(214)

(224)

(54)

(54)

(54)

(52)

(53)

Net income (loss) available to common shareholders (GAAP)

(429)

$

(763)

$

(602)

$

101

$

55

$

17

$

36

$

Income (loss) from discontinued operations, net of tax (GAAP)

(1)

(404)

(71)

(467)

14

30

19

22

Income (loss) from continuing operations available to common shareholders

(GAAP) (25)

$

(692)

$

(135)

$

87

$

25

$

(2)

$

14

$

Goodwill impairment from continuing operations (non-deductible)

253

-

253

-

-

-

-

Regulatory charge and related tax benefit from continuing operations

(2)

(17)

75

-

-

(17)

-

-

Income (loss) from continuing operations available to common shareholders,

excluding goodwill impairment and regulatory charge and related tax benefit

(non-GAAP) 211

$

(617)

$

118

$

87

$

8

$

(2)

$

14

$

GAAP to non-GAAP EPS Reconciliation

Earnings (loss) per share as reported (GAAP)

($0.34)

($0.62)

($0.48)

$0.08

$0.04

$0.01

$0.03

Earnings (loss) per share from discontinued operations (GAAP)

($0.32)

($0.06)

($0.37)

$0.01

$0.02

$0.01

$0.02

Earnings (loss) per share from continuing operations (GAAP)

($0.02)

($0.56)

($0.11)

$0.07

$0.02

($0.00)

$0.01

Goodwill impairment and related regulatory charge net of tax benefit from

continuing operations

($0.19)

($0.06)

($0.20)

$0.00

$0.01

$0.00

$0.00

Adjusted earnings per share from continuing operations, excluding goodwill

impairment and regulatory charge (non-GAAP)

$0.17

($0.50)

$0.09

$0.07

$0.01

($0.00)

$0.01

Year Ended December 31

As of and for Quarter Ended

The tables below and on the next slide present computations of earnings (loss) and certain other

financial measures, excluding goodwill impairment and regulatory charge and related tax benefit

(non-GAAP). The goodwill impairment charge and the regulatory charge and related tax benefit are included in financial results presented in accordance with generally accepted

accounting principles (GAAP). A table also presents computations of full year and quarterly

pre-tax pre-provision income (non-GAAP). Non-interest expense (GAAP) is presented excluding

certain adjustments to arrive at adjusted non-interest expense (non-GAAP). Regions believes

that the exclusion of the goodwill impairment and the regulatory charge and related tax benefit

in expressing earnings (loss) and certain other financial measures, including "earnings (loss) per

common share, excluding goodwill impairment and regulatory charge and related tax benefit“

provides a meaningful base for period-to-period comparisons, which management believes will assist investors in analyzing the operating results of the Company and predicting

future performance. These non-GAAP financial measures are also used by management to assess

the performance of Regions' business because management does not consider the goodwill

impairment and regulatory charge and related tax benefit to be relevant to ongoing operating results. Management and the Board of Directors utilize these non-GAAP financial

measures for the following purposes: preparation of Regions' operating budgets; monthly financial

performance reporting; monthly close-out "flash" reporting of consolidated results

(management only); and presentations to investors of company performance. Management uses these

measures to monitor performance and believes these measures provide meaningful information to

investors. |

22

NON-GAAP RECONCILIATION: PRE-TAX PRE-PROVISION

INCOME AND RISK WEIGHTED ASSETS

The Pre-Tax Pre-Provision Income from Continuing Operations table presents

computations of pre-tax pre-provision income from continuing operations excluding certain

adjustments

(non-GAAP).

Regions

believes

that

the

exclusion

of

these

adjustments

provides

a

meaningful

base

for

period-to-period

comparisons,which

management

believes

will

assist

investors

in

analyzing

the

operating

results

of

the

Company

and

predicting

future

performance.

These

non-GAAP

financial

measures

are

also

used

by

management to

assess

the

performance

of

Regions'

business.

It

is

possible

that

the activities related to the adjustments may recur; however, management does not

consider the activities related to the adjustments to be indications of

ongoing operations. Regions believes that presentation of these non-GAAP financial measures will permit investors to assess the

performance of the Company on the same basis as that applied by management.

Non-GAAP financial measures have inherent limitations, are not required to be uniformly

applied and are not audited. Although these non-GAAP financial measures are

frequently used by stakeholders in the evaluation of a company, they have limitations as

analytical

tools,

and

should

not

be

considered

in

isolation,

or

as

a

substitute

for

analyses

of

results

as

reported

under

GAAP.

In

particular,

a

measure

of

income

that

excludes

certain adjustments does not represent the amount that effectively accrues directly

to stockholders. (1)

After

tax

amounts

for

leveraged

lease

terminations

gains

are

$2.8

million

for

12/31/11,

$5.4

million

for

9/30/11

and

$3.2

million

for

12/31/10.

($ amounts in millions)

12/31/11

9/30/11

6/30/11

3/31/11

12/31/10

(135)

$

87

$

25

$

(2)

$

14

$

54

54

54

52

53

18

17

(34)

(29)

44

(63)

158

45

21

111

295

355

398

482

682

232

513

443

503

793

253

-

-

-

-

485

513

443

503

793

Other Adjustments:

Securities (gains) losses, net

(7)

1

(24)

(82)

(333)

Loss (gain) on sale of mortgage loans

-

-

-

3

(26)

Leveraged lease termination (gains) losses, net

(1)

(10)

2

-

-

(59)

Loss on early extinguishment of debt

-

-

-

-

55

Securities impairment, net

2

-

-

-

-

Branch consolidation and equipment costs

(2)

-

77

-

-

Total other adjustments

(17)

3

53

(79)

(363)

468

$

516

$

496

$

424

$

430

$

Risk-weighted assets (regulatory)

91,449

92,786

93,865

93,929

94,966

Adjusted Pre-tax Pre-provision Income / RWA (non-GAAP)

2.0%

2.2%

2.1%

1.8%

1.8%

Continuing Operations

Non-interest expense (GAAP)

1,124

$

850

$

956

$

932

$

990

$

Adjustments:

Regulatory charge

-

$

-

$

-

-

-

Loss on early extinguishment of debt

-

-

-

-

(55)

Securities impairment, net

(2)

-

-

-

-

Branch consolidation and property and equipment charges

2

-

(77)

-

-

Goodwill impairment

(253)

-

-

-

-

Adjusted non-interest expense (non-GAAP)

871

$

850

$

879

$

932

$

935

$

Pre-tax pre-provision income from continuing operations, excluding goodwill

impairment (non-GAAP)

Adjusted Pre-tax Pre-provision Income from continuing operations

(non-GAAP) Preferred dividends (GAAP)

Income tax expense (benefit) (GAAP)

Income (loss) from continuing operations before income taxes (GAAP)

Provision for loan losses (GAAP)

Pre-tax pre-provision income from continuing operations

(non-GAAP) Goodwill impairment

Quarter Ended

Income (loss) from continuing operations available to common shareholders

(GAAP) |

23

NON-GAAP RECONCILIATION: TIER 1 COMMON

The following table provides a reconciliation of stockholder’s equity to

"Tier 1 common equity" (non-GAAP). Traditionally, the Federal Reserve and

other banking regulatory bodies have assessed a bank's capital adequacy based on

Tier 1 capital, the calculation of which is codified in federal banking

regulations. In connection with the Company's Comprehensive Capital

Assessment and Review ("CCAR"), these regulators are supplementing their

assessment of the capital adequacy of a bank based on a variation of Tier 1

capital, known as Tier 1 common equity. While not codified, analysts and

banking

regulators

have

assessed

Regions'

capital

adequacy

using

the

Tier

1

common

equity

measure.

Because

and

Tier

1

common

equity

is

not

formally defined by GAAP or codified in the federal banking regulations, this

measure is considered to be non-GAAP and other entities may calculate it

differently than Regions' disclosed calculations. Since analysts and banking

regulators may assess Regions' capital adequacy using TIer 1 common equity,

we believe that it is useful to provide investors the ability to assess Regions' capital adequacy on these same bases.

Tier 1 common equity is often expressed as a percentage of risk-weighted

assets. Under the risk-based capital framework, a company's balance sheet

assets and credit equivalent amounts of off-balance sheet items are assigned to

one of four broad risk categories. The aggregated dollar amount in

each category is then multiplied by the risk-weighted category. The

resulting weighted values from each of the four categories are added together and

this sum is the risk-weighted assets total that, as adjusted, comprises the

denominator of certain risk-based capital ratios. Tier 1 capital is then divided

by this denominator (risk-weighted assets) to determine the Tier 1 capital

ratio. Adjustments are made to Tier 1 capital to arrive at Tier 1 common

equity. Tier 1 common equity is also divided by the risk-weighted assets

to determine the Tier 1 common equity ratio. The amounts disclosed as risk-

weighted assets are calculated consistent with banking regulatory

requirements. ($ amounts in millions)

12/31/11

9/30/11

6/30/11

3/31/11

12/31/10

TIER 1 COMMON RISK-BASED RATIO CONSOLIDATED

-

Stockholders' equity (GAAP)

16,499

$

17,263

$

16,888

$

16,619

$

16,734

$

Accumulated other comprehensive (income) loss

69

(92)

177

387

260

Non-qualifying goodwill and intangibles

(4,900)

(5,649)

(5,668)

(5,686)

(5,706)

Disallowed deferred tax assets

(432)

(506)

(498)

(463)

(424)

Disallowed servicing assets

(35)

(35)

(35)

(28)

(27)

Qualifying non-controlling interests

92

92

92

92

92

Qualifying trust preferred securities

846

846

846

846

846

Tier 1 capital (regulatory)

12,139

$

11,919

$

11,802

$

11,767

$

11,775

$

Qualifying non-controlling interests

(92)

(92)

(92)

(92)

(92)

Qualifying trust preferred securities

(846)

(846)

(846)

(846)

(846)

Preferred stock

(3,419)

(3,409)

(3,399)

(3,389)

(3,380)

Tier 1 common equity (non-GAAP)

7,782

$

7,572

$

7,465

$

7,440

$

7,457

$

Risk-weighted assets (regulatory)

91,449

92,786

93,865

93,929

94,966

Tier 1 common risk-based ratio (non-GAAP)

8.5%

8.2%

7.9%

7.9%

7.9%

As of and for Quarter Ended |

24

NON-GAAP RECONCILIATION: BASEL III

(1)

Under

Basel

III,

regulatory

capital

must

be

reduced

by

purchased

credit

card

relationship

intangible

assets.

These

assets

are

partially allowed in Basel I capital.

(2)

Regions continues to develop systems and internal controls to precisely calculate

risk-weighted assets as required by Basel III. The amount included

above is a reasonable approximation, based on our understanding of the requirements.

The

following

table

provides

calculations

of

Tier

1

capital

and

Tier

1

common,

based

on

Regions’

current

understanding

of

Basel

III

requirements. Regions currently calculates its risk-based capital ratios

under guidelines adopted by the Federal Reserve based on the 1988 Capital

Accord (“Basel I”) of the Basel Committee on Banking Supervision (the “Basel Committee”). In December 2010, the Basel

Committee

released

its

final

framework

for

Basel

III,

which

will

strengthen

international

capital

and

liquidity

regulation.

When

implemented

by

U.S.

bank

regulatory

agencies

and

fully

phased-in,

Basel

III

will

change

capital

requirements

and

place

greater

emphasis

on

common

equity. Implementation of Basel III will begin on January 1, 2013, and will

be phased in over a multi-year period. The U.S. bank regulatory

agencies have not yet finalized regulations governing the implementation of Basel

III. Accordingly, the calculations provided below are estimates, based

on Regions’ current understanding of the framework, including the

Company’s reading of the requirements, and informal feedback

received

through

the

regulatory

process.

Regions’

understanding

of

the

framework

is

evolving

and

will

likely

change

as

the

regulations

are

finalized.

Because

the

Basel

III

implementation

regulations

are

not

formally

defined

by

GAAP

and

have

not

yet

been

finalized and codified, these measures are considered to be non-GAAP financial

measures, and other entities may calculate them differently

from

Regions’

disclosed

calculations.

Since

analysts

and

banking

regulators

may

assess

Regions’

capital

adequacy

using

the

Basel

III

framework,

we

believe

that

it

is

useful

to

provide

investors

the

ability

to

assess

Regions’

capital

adequacy

on

the

same

basis.

($ amounts in millions)

12/31/11

Stockholders'

equity

(GAAP)

16,499

$

Non-qualifying goodwill and intangibles

(1)

(5,065)

Adjustments, including other comprehensive income related to cash flow hedges,

disallowed deferred tax assets, threshold deductions and other

adjustments (854)

10,580

$

Qualifying non-controlling interests

4

Basel III Tier 1 Capital (non-GAAP)

10,584

$

Basel III Tier 1 Capital (non-GAAP)

10,584

$

Preferred Stock

(3,419)

Qualifying non-controlling interests

(4)

Basel III Tier 1 Common (non-GAAP)

7,161

$

Basel I risk-weighted assets

91,449

Basel

III

risk-weighted

assets

(2)

92,935

Minimum

Basel III Tier 1 Capital Ratio

11.4%

8.5%

Basel III Tier 1 Common Ratio

7.7%

7.0% |

|