Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PNC FINANCIAL SERVICES GROUP, INC. | d311213d8k.htm |

Exhibit 99.1

From the Chairman March 7, 2012

To Our Shareholders,

As I think back to the beginning of 2011, it was predicted that banks would be facing an operating environment dominated by low interest rates, slow economic growth and new and challenging regulations. As it turned out, 2011 was all that it was advertised to be... and then some.

PNC Stands Out Last year we said we would grow the number of customers we serve, manage risk and expenses, and continue to build our already strong capital position. And we succeeded in these turbulent times. By focusing on these strategies, we had a good year in 2011, with net income of $3.1 billion or $5.64 per diluted common share. We believe that our distinctive corporate culture, with its focus on teamwork and executing for all our constituents, drove our success.

Banking in a New Environment As I look at the business world today, there’s no doubt that we are experiencing unprecedented change. Less than a decade ago Twitter didn’t exist. Neither did Facebook or Skype. Blockbuster was the number one entertainment company in the United States, and Apple was rumored to be on the verge of bankruptcy.

In the banking industry, we are experiencing sweeping changes in customer preferences and almost daily advances in technology. We are operating at a time of historically low interest rates, important new regulations and a challenging political environment.

| While some banks regard the current environment as a time for contraction, we see it as an opportunity. And we believe we are better positioned today than we have ever been in the 160-year history of the company. | At PNC, we have always taken the long view. While some banks regard the current environment as a time for contraction, we see it as an opportunity. And we believe we are better positioned today than we have ever been in the 160-year history of the company. |

Our capital and liquidity positions are strong. We have a highly competitive set of products and services to meet our customers’ needs. Our existing markets are profitable and we are entering new ones that provide the potential for significant growth. And we have outstanding employees who are led by a management team that is committed to delivering for our customers, shareholders and communities.

PNC’s performance over time is reflected in our share price. For the last five-year period, we have ranked first in cumulative total shareholder return among our peer banks.* Although our share price declined 5 percent in 2011, the S&P 500 Banks index declined by 12 percent.

While these are good results on a relative basis, no one ever made money on a relative basis. At PNC we manage our business with the goal of creating opportunities for increased shareholder value over the long term.

|

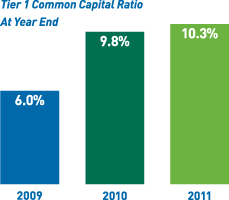

Meeting Our Highest Capital Priorities In the current regulatory environment, great attention is being paid to capital adequacy and for good reason. Banks need sufficient capital to weather changes in the global economy.

Today, most U.S. banks have stronger capital and liquidity than at the height of the 2008 downturn. In fact U.S. bank capital ratios are at their highest levels in six decades. |

| * | PNC’s 2011 peer group consists of BB&T Corporation, Bank of America Corporation, Capital One Financial Corporation, Comerica Incorporated, Fifth Third Bancorp, JPMorgan Chase & Co., KeyCorp, M&T Bank Corporation, The PNC Financial Services Group, Inc., Regions Financial Corporation, SunTrust Banks, Inc., U.S. Bancorp, and Wells Fargo & Company. |

On a relative basis, PNC remains among the best capitalized banks in our peer group. At year end, our Tier 1 common capital ratio was 10.3 percent, more than double what it was at the end of 2008. That capital strength and earnings supported our decision to increase the common stock dividend in the second quarter of 2011, a decision we were pleased to deliver to our shareholders.

| Our future capital plans will depend on various factors, including the final Basel III capital rules and the Federal Reserve’s ongoing requirements for capital planning by large banks. While Basel III capital requirements are still a long way from being fully phased in and a number of items are yet to be resolved, we believe that we are very well positioned.

For 2012, we continue to focus on three capital priorities. First, we will build capital to support our clients, increase customer relationships and invest in our businesses. Second, we must maintain appropriate capital in light of global economic uncertainty. Finally, we expect to return excess capital to shareholders as appropriate, subject to regulatory approval. |

|

An important measure of any stock is its tangible book value per share, and PNC’s more than doubled from 2007 to the end of 2011. This metric dramatically outperformed the average of our peers during the same period.**

| ** | We believe that tangible book value per share, a non-GAAP measure, is useful as a tool to help to better evaluate growth of the company’s business apart from the amount, on a per share basis, of intangible assets other than servicing rights included in book value. Our book value per share was $61.52 at year-end 2011, a 41% increase over $43.60 at year-end 2007. Subtracting approximately $9.0 billion ($10.1 billion of goodwill and other intangible assets less $1.1 billion of servicing rights) or $17.14 per share for year-end 2011, and subtracting approximately $8.9 billion ($9.6 billion of goodwill and other intangible assets less $0.7 billion of servicing rights) or $26.02 per share for year-end 2007, results in a tangible book value per share of approximately $44.38 for year-end 2011, a 152% increase over approximately $17.58 at year-end 2007. |

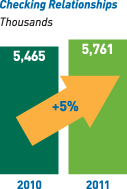

Serving More Customers We had an exceptional year for customer growth in 2011. In our Retail Bank, checking relationships increased by almost 300,000, including some 40,000 from acquisitions. That represents 5 percent growth, which substantially surpassed the 1 percent population increase in our footprint, demonstrating that PNC is winning market share.

|

We believe some of this growth was driven by disruption in the marketplace. Checking accounts, while traditionally profitable, have come under intense pressure as an extended period of low interest rates and regulatory changes eroded their value.

Some of our competitors responded by adding incremental fees to existing products, and many banks eliminated free checking. PNC took a different path.

We chose to offer our customers more in return for their business. In March of 2011, we introduced a new suite of checking products designed to provide more choices for customers, moving them away from free checking and into stronger, deeper, more profitable relationships with the bank based on cross-selling other products, such as home equity and mortgage loans. We also decided to continue to offer free checking. |

At the beginning of 2011, approximately 70 percent of PNC’s new checking customers had free checking accounts. By the fourth quarter of 2011, we had flipped the ratio of free checking to relationship checking accounts, with nearly 60 percent of new customers now choosing relationship accounts.

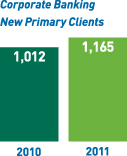

In our Corporate & Institutional Bank, new primary client acquisitions in Corporate Banking were 1,165, an increase of 15 percent over the new primary clients we added in 2010. This marks the second consecutive year we added more than 1,000 new primary clients.

|

In addition to adding new customers, C&IB had a record year on several other fronts: the number of agent-led deals and new transactions in business credit as well as cross-selling its products. Looking ahead to our opportunities in this area, if we could cross-sell our new C&IB clients to the same degree as our existing customers, it would add approximately $200 million of incremental revenue. |

We ranked second in the number of middle market business loans arranged in 2011. As we grow, we see opportunities to lead syndications for larger corporate clients at higher dollar amounts.

New client acquisition in our Asset Management Group continued to grow to record levels in 2011, fueled in part by significant increases in referrals from retail branches and corporate bankers. Overall sales were up nearly 40 percent for 2011 compared to 2010, with referral activity representing one-third of the total sales results.

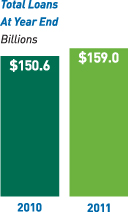

Increasing Lending Our customer growth helped to drive increased lending in 2011. Loan growth accelerated toward the end of the year, with $4.5 billion of the $8.4 billion annual increase occurring in the fourth quarter. Overall, we grew loans by 6 percent during 2011, with gains in commercial loans, indirect auto and education lending.

| Tepid growth in the gross domestic product along with low interest rates had a dampening effect on the banking industry in 2011, and we expect those factors to persist. In this challenging environment, our balance sheet provides us with options to enhance our net interest income through continued loan growth and repricing our deposit business.

We have significant opportunities to reduce funding costs through the repricing of certificates of deposit and maturing debt as well as the potential to redeem relatively high-cost trust preferred securities. In the fourth quarter of 2011 alone, we saw $6 billion of certificates of deposit mature, and we called $750 million of trust preferred securities. We expect to see additional opportunities to reduce funding costs in 2012. |

|

Growing and Strengthening the Franchise During 2011 we leveraged our financial performance and resulting capital strength to invest in our businesses. We also announced several strategic acquisitions. These included purchases in greater Tampa, Florida, of 19 branches from BankAtlantic, and 27 branches in the Atlanta area from Flagstar. The acquisition of RBC Bank (USA), the U.S. retail banking operation of the Royal Bank of Canada, closed and converted on March 2 of this year and is expected to be accretive to our 2012 earnings, excluding integration costs.

The RBC transaction added more than 400 Southeastern U.S. branches to PNC’s powerful retail franchise. With RBC Bank (USA), PNC has approximately 2,900 branches in 17 states and the District of Columbia. Since the beginning of 2008, this represents an increase of almost 1,800 branches and nine new states.

At PNC, acquisition was only one part of our growth story in 2011. Throughout the year, we continued to add more customers and deepen our relationships with them across our existing footprint, and all of our legacy markets exceeded their sales plans.

To support this growth, we developed innovative products and services focused on the needs of tomorrow’s banking and investing clients. We applied an understanding of customer trends – the roughly flat growth of branch and call center activity, the ongoing decline in check writing, the expansion of online and mobile payments, and the increased use of multiple distribution channels – to give customers a top-flight banking experience.

One example, the PNC Virtual Wallet® payments platform, has grown rapidly since its introduction more than three years ago. At times in 2011, we added 14,000 new users every

week. More than 750,000 customers now use Virtual Wallet and it represents 50 percent of our new checking relationships.

We followed our Virtual Wallet success with the introduction of bolt-on products to serve distinct customer segments, including students and those who prefer banking on their smart phone device. And in 2011, we introduced PNC Wealth InsightSM, a platform that gives investors a snapshot of their net worth at any time. We already have nearly 10,000 customers using it.

Managing Risk As 2012 begins, the U.S. economy is showing signs of improvement, and we are optimistic about the ongoing recovery, albeit at a deliberate pace. At the same time, we are mindful of the impact that sustained high rates of unemployment and slow GDP growth could have on our business. As a result, credit risk remains a priority for us.

| … we believe adherence to the risk management principles we have established will continue to serve us well. |

Our nonperforming assets declined and our provision for credit losses and net charge-offs significantly improved in 2011. Overall, we remain committed to a moderate risk profile. |

We take a similar approach in managing our balance sheet. I am fond of saying that every company will eventually meet its balance sheet. We have met ours, and we like it. Our balance sheet remained highly liquid and core funded with an 85 percent loan-to-deposit ratio at the end of the year.

Looking ahead, we are focused on managing our balance sheet effectively, adding clients that meet our standards for risk-adjusted returns and making enhancements to risk management capabilities and technologies.

While challenges remain, we believe adherence to the risk management principles we have established will continue to serve us well.

Assembling a Strong Team It takes teamwork to achieve results, and in 2011, our employees were more engaged than ever. We won a “Gallup Great Workplace Award” and were the only U.S. bank to be recognized for this achievement.

Our effort to engage the workforce includes improving diversity at PNC. In 2011, we launched a number of Employee Business Resource Groups – Latino, African-American, Women, and Gay, Lesbian, Bisexual and Transgender among them. For the benefit of both employees and customers, we dramatically increased the amount of outreach we do in Spanish.

PNC has continued to hire employees throughout the economic downturn, and we seek top talent at all levels across our franchise. As we begin our recruiting process in the Southeast, we have received more than 10,000 external applications to join our firm in that region.

We also enhanced our management team. We named Joe Guyaux, a 40-year PNC veteran who most recently led Retail Banking, as our chief risk officer. In today’s risk environment, we could find

no better leader than Joe given his tremendous banking knowledge and his history of excellence in every role he has had at the firm. Neil Hall, who has overseen our retail distribution system since 2005, will now manage Retail Banking. And last year we recruited Mike Lyons to lead our Corporate & Institutional Bank.

Maintaining Our Reputation Public outreach has helped sustain our reputation as a strong and reliable bank in spite of the difficult environment. In fact earlier this month, we were ranked second on Fortune’s list of most-admired companies in the category of superregional banks. Awareness of our brand has been enhanced since the beginning of the Achievement advertising campaign in 2010, rising from 57 percent to 74 percent today.

A good reputation could not be more important in this environment, and while our reputation is solid, the industry as a whole is under intense scrutiny. Trust has plummeted from about 70 percent of the public saying they had confidence in financial services companies in 2008 to about 25 percent in 2011.

PNC is working to restore confidence in America’s financial institutions. We have joined with others to form the Partnership for a Secure Financial Future. The Partnership is committed to raising awareness of the vital role the financial services industry plays in growing the nation’s economy, creating new jobs and supporting small businesses.

Similarly, PNC has committed to renewed efforts at the state and local level that have enhanced coordination between PNC and community leaders working on topics such as economic development and mortgage servicing practices.

| Giving Back to the Community PNC has continued to deliver for its communities. Overall, we contributed nearly $69 million to strengthen and enrich the lives of those in the places where we had a significant presence in 2011. |

|

Importantly, we met our original $100 million goal for Grow Up Great by mid-2011, two years earlier than expected. In just eight years, we have helped more than a million children under age five prepare for school and life. We followed that success by expanding Grow Up Great in 2011. Today, this is a $350 million initiative that will also kick off in the Southeast as PNC builds its presence there.

| PNC knows something about building. We have more environmentally friendly buildings LEED- certified by the U.S. Green Building Council than any company on Earth. Our most remarkable building is yet to come. In May, we announced that PNC would undertake the construction of a new headquarters. We expect The Tower at PNC Plaza, at the same intersection where PNC is currently located, to be the most energy efficient office building in the world when it opens in 2015.

PNC earned another “Outstanding” Community Reinvestment Act rating from our regulators in 2011. And we believe we are an outstanding company, working hard for shareholders, customers, employees and communities. |

|

New Challenges and New Opportunities This year will bring new challenges and a continuation of some past ones. The Federal Open Market Committee has signaled low interest rates into 2014. An already difficult political climate will feature a highly contentious presidential election. The economic outlook is for a modest recovery, but that depends on events over which we have little or no control. From the European debt crisis to American consumers’ worries about jobs and housing, the dangers are many. In this environment, all banks will be challenged.

| Five years from now, we want to look back at this moment and say: We saw the opportunity and we made the most of it. |

Despite these circumstances, we believe we are better off than virtually all of our competitors on a relative basis. The longer these conditions exist, the greater our opportunities for market share growth at the expense of smaller banks that are either unwilling or unable to deploy the necessary resources to overcome increased |

regulatory expenses, reduced fees and low rates. This environment also affects global banks, which are facing higher capital requirements along with regulations that will limit some business activities.

For large regional banks like PNC, regulatory changes represent a considerable work set, but we believe it is manageable. We must move forward to seize this moment, execute on our priorities and continue to build our business. Five years from now, we want to look back at this moment and say: We saw the opportunity and we made the most of it.

There is no magic formula to make the industry’s challenges disappear. At PNC, we believe our effective leadership team, focus on more and deeper customer relationships, strong risk and expense management, and a solid reputation for acting in our customers’ best interests remain the best strategy.

In difficult times, it is important to take the long view, and that is something we have always done at PNC. This year marks our 160th as PNC traces its roots to 1852, when the Pittsburgh Trust Company opened near Fifth Avenue and Wood Street, the same corner where our headquarters stands today. More than a century and a half later, PNC remains committed to helping businesses and consumers achieve their goals.

We are proud of our company’s performance in 2011 and are confident that our best days lie ahead as we continue to build a great company. As it has for the last 160 years, you can expect PNC to deliver for our customers, shareholders, employees and communities.

| Sincerely,

James E. Rohr

Chairman and Chief Executive Officer |

For more information regarding certain factors that could cause future results to differ, possibly materially, from historical performance or from those anticipated in forward-looking statements, see the Cautionary Statement in Item 7 of our 2011 Annual Report on Form 10-K, which accompanies this letter. |