Attached files

Morgan Stanley Utilities Conference

NEW YORK, NY • MARCH 8, 2012

1

Safe Harbor Statement/Regulation G Information

Some of the statements contained in today’s presentation with respect to Pepco Holdings, Pepco, Delmarva Power and Atlantic City Electric, and each of their respective

subsidiaries, are forward-looking statements within the meaning of the U.S. federal securities laws and are subject to the safe harbor created thereby and by the Private

Securities Litigation Reform Act of 1995. These statements include declarations regarding each reporting company’s intents, beliefs and current expectations. You can

generally identify forward-looking statements by terminology such as “may,” “might,” “will,” “should,” “could,” “expects,” “intends,” “assumes,” “seeks to,” “plans,” “anticipates,”

“believes,” “projects,” “estimates,” “predicts,” “potential,” “future,” “goal,” “objective,” or “continue”, the negative or other variations of such terms, or comparable terminology, or

by discussions of strategy that involve risks and uncertainties. Forward-looking statements involve estimates, assumptions, known and unknown risks, uncertainties and other

factors that may cause one or more reporting company’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels

of activity, performance or achievements expressed or implied by such forward-looking statements. Therefore, forward-looking statements are not guarantees or assurances of

future performance, and actual results could differ materially from those indicated by the forward-looking statements. These forward-looking statements are qualified in their

entirety by, and should be read together with, the risk factors included in the “Risk Factors” section of each reporting company’s annual report on Form 10-K for the year ended

December 31, 2011 (as amended) and other SEC filings, and investors should refer to this risk factor section. The forward-looking statements contained herein are also

qualified in their entirety by reference to, and should be read together with, the following important factors, which are difficult to predict, contain uncertainties, are beyond each

reporting company’s control and may cause actual results to differ materially from those contained in forward-looking statements: changes in governmental policies and

regulatory actions affecting the energy industry, including allowed rates of return, industry and rate structure, acquisition and disposal of assets and facilities, operation and

construction of transmission and distribution facilities, and the recovery of purchased power expenses; the outcome of pending and future rate cases, including the possible

disallowance of costs and expenses; the expenditures necessary to comply with regulatory requirements, including regulatory orders, and to implement reliability enhancement,

emergency response and customer service improvement programs; possible fines, penalties or other sanctions assessed by regulatory authorities against Pepco Holdings’

regulated utilities; weather conditions affecting usage and emergency restoration costs; population growth rates and changes in demographic patterns; changes in customer

energy demand due to conservation measures and the use of more energy-efficient products; general economic conditions, including the impact of an economic downturn or

recession on energy usage; changes in and compliance with environmental and safety laws and policies; changes in tax rates or policies or in rates of inflation; changes in

accounting standards or practices; changes in project costs; unanticipated changes in operating expenses and capital expenditures; the ability to obtain funding in the capital

markets on favorable terms; rules and regulations imposed by, and decisions of, Federal and/or state regulatory commissions, PJM, the North American Electric Reliability

Corporation and other applicable electric reliability organizations; legal and administrative proceedings (whether civil or criminal) and settlements that influence each reporting

company’s business and profitability; pace of entry into new markets; volatility in customer demand for electricity and natural gas; interest rate fluctuations and the impact of

credit and capital market conditions on the ability of a reporting company to obtain funding on favorable terms; and effects of geopolitical events, including the threat of

domestic terrorism or cyber attacks. Any forward-looking statements speak only as to the date of this presentation and each reporting company undertakes no obligation to

update any forward-looking statements to reflect events or circumstances after the date on which such statements are made or to reflect the occurrence of unanticipated

events. New factors emerge from time to time, and it is not possible for a reporting company to predict all such factors, nor can any reporting company assess the impact of any

such factor on such reporting company’s business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any

forward-looking statement. The foregoing factors should not be construed as exhaustive.

subsidiaries, are forward-looking statements within the meaning of the U.S. federal securities laws and are subject to the safe harbor created thereby and by the Private

Securities Litigation Reform Act of 1995. These statements include declarations regarding each reporting company’s intents, beliefs and current expectations. You can

generally identify forward-looking statements by terminology such as “may,” “might,” “will,” “should,” “could,” “expects,” “intends,” “assumes,” “seeks to,” “plans,” “anticipates,”

“believes,” “projects,” “estimates,” “predicts,” “potential,” “future,” “goal,” “objective,” or “continue”, the negative or other variations of such terms, or comparable terminology, or

by discussions of strategy that involve risks and uncertainties. Forward-looking statements involve estimates, assumptions, known and unknown risks, uncertainties and other

factors that may cause one or more reporting company’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels

of activity, performance or achievements expressed or implied by such forward-looking statements. Therefore, forward-looking statements are not guarantees or assurances of

future performance, and actual results could differ materially from those indicated by the forward-looking statements. These forward-looking statements are qualified in their

entirety by, and should be read together with, the risk factors included in the “Risk Factors” section of each reporting company’s annual report on Form 10-K for the year ended

December 31, 2011 (as amended) and other SEC filings, and investors should refer to this risk factor section. The forward-looking statements contained herein are also

qualified in their entirety by reference to, and should be read together with, the following important factors, which are difficult to predict, contain uncertainties, are beyond each

reporting company’s control and may cause actual results to differ materially from those contained in forward-looking statements: changes in governmental policies and

regulatory actions affecting the energy industry, including allowed rates of return, industry and rate structure, acquisition and disposal of assets and facilities, operation and

construction of transmission and distribution facilities, and the recovery of purchased power expenses; the outcome of pending and future rate cases, including the possible

disallowance of costs and expenses; the expenditures necessary to comply with regulatory requirements, including regulatory orders, and to implement reliability enhancement,

emergency response and customer service improvement programs; possible fines, penalties or other sanctions assessed by regulatory authorities against Pepco Holdings’

regulated utilities; weather conditions affecting usage and emergency restoration costs; population growth rates and changes in demographic patterns; changes in customer

energy demand due to conservation measures and the use of more energy-efficient products; general economic conditions, including the impact of an economic downturn or

recession on energy usage; changes in and compliance with environmental and safety laws and policies; changes in tax rates or policies or in rates of inflation; changes in

accounting standards or practices; changes in project costs; unanticipated changes in operating expenses and capital expenditures; the ability to obtain funding in the capital

markets on favorable terms; rules and regulations imposed by, and decisions of, Federal and/or state regulatory commissions, PJM, the North American Electric Reliability

Corporation and other applicable electric reliability organizations; legal and administrative proceedings (whether civil or criminal) and settlements that influence each reporting

company’s business and profitability; pace of entry into new markets; volatility in customer demand for electricity and natural gas; interest rate fluctuations and the impact of

credit and capital market conditions on the ability of a reporting company to obtain funding on favorable terms; and effects of geopolitical events, including the threat of

domestic terrorism or cyber attacks. Any forward-looking statements speak only as to the date of this presentation and each reporting company undertakes no obligation to

update any forward-looking statements to reflect events or circumstances after the date on which such statements are made or to reflect the occurrence of unanticipated

events. New factors emerge from time to time, and it is not possible for a reporting company to predict all such factors, nor can any reporting company assess the impact of any

such factor on such reporting company’s business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any

forward-looking statement. The foregoing factors should not be construed as exhaustive.

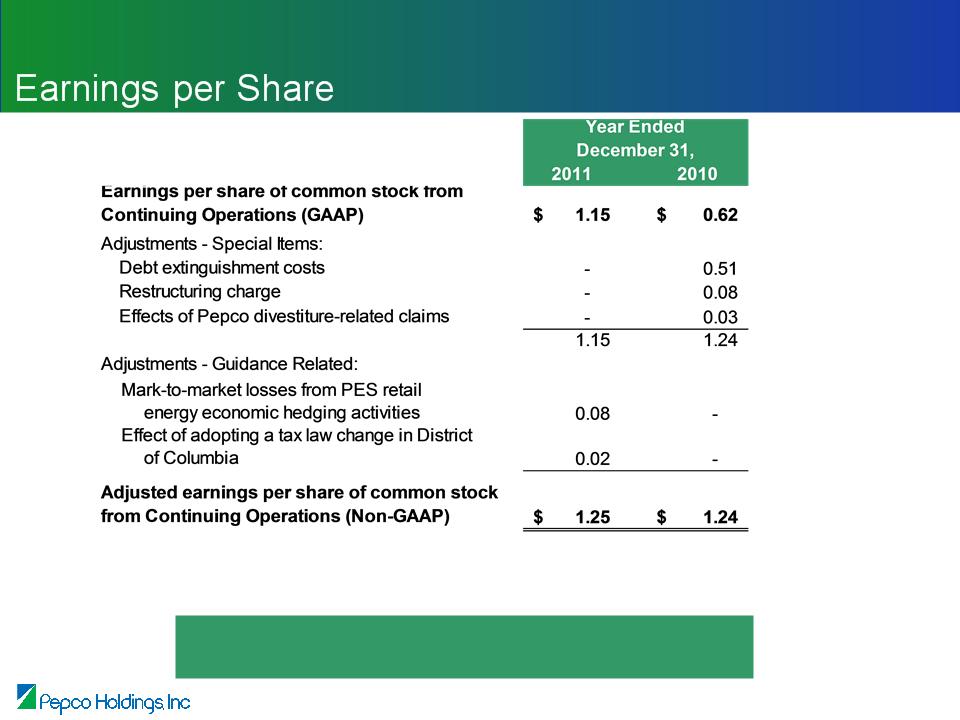

PHI discloses net income from continuing operations and related per share data (both as historical information and earnings guidance) excluding certain items (non-GAAP

financial information) because management believes that these items are not representative of PHI’s ongoing business operations. Management uses this information, and

believes that such information is useful to investors, in evaluating PHI’s period-over-period performance. The inclusion of this disclosure is intended to complement, and should

not be considered as an alternative to, PHI’s reported net income from continuing operations and related per share data in accordance with accounting principles generally

accepted in the United States (GAAP).

financial information) because management believes that these items are not representative of PHI’s ongoing business operations. Management uses this information, and

believes that such information is useful to investors, in evaluating PHI’s period-over-period performance. The inclusion of this disclosure is intended to complement, and should

not be considered as an alternative to, PHI’s reported net income from continuing operations and related per share data in accordance with accounting principles generally

accepted in the United States (GAAP).

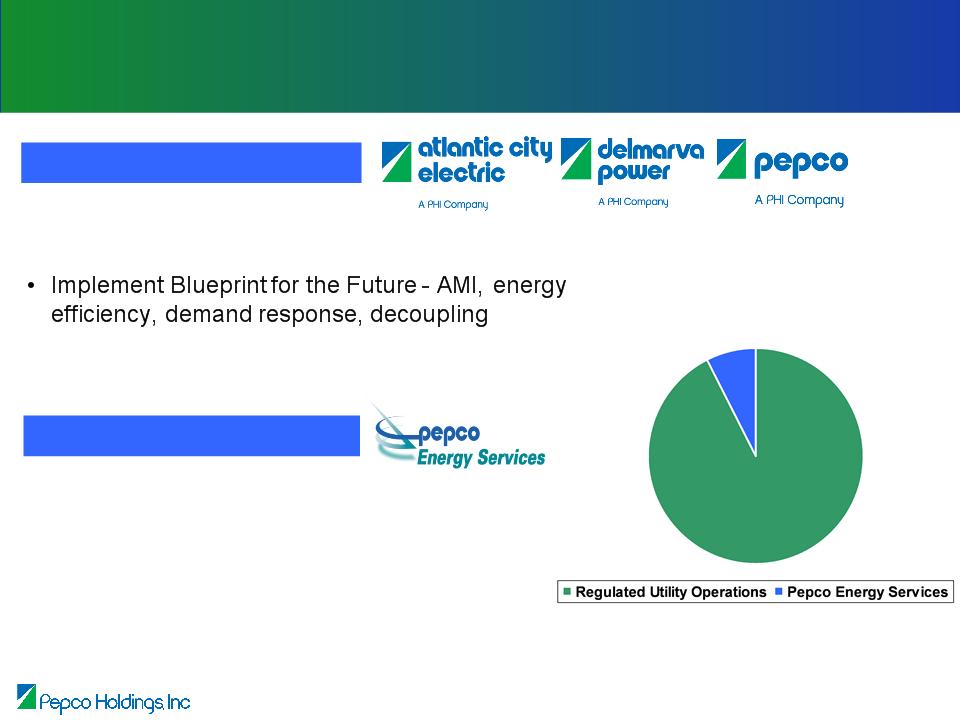

PHI’s Strategic Focus

• Invest in T&D infrastructure

• Focused on reliability and operational excellence

• Achieve reasonable regulatory outcomes

Power Delivery

Pepco Energy Services

• Build profitable market share and increase

earnings contribution from energy services

earnings contribution from energy services

Note: See Safe Harbor Statement at the beginning of today’s presentation.

2

Operating Income Business Mix

Forecasted 2012 - 2016

5 - 10 %

90 - 95%

Power Delivery - Growth Opportunity

Note: See Safe Harbor Statement at the beginning of today’s presentation.

(1) Assumes Mid-Atlantic Power Pathway (MAPP) in-service date of 2020.

(2) Net of anticipated reimbursement of $53 million pursuant to awards from the U.S. DOE under the ARRA.

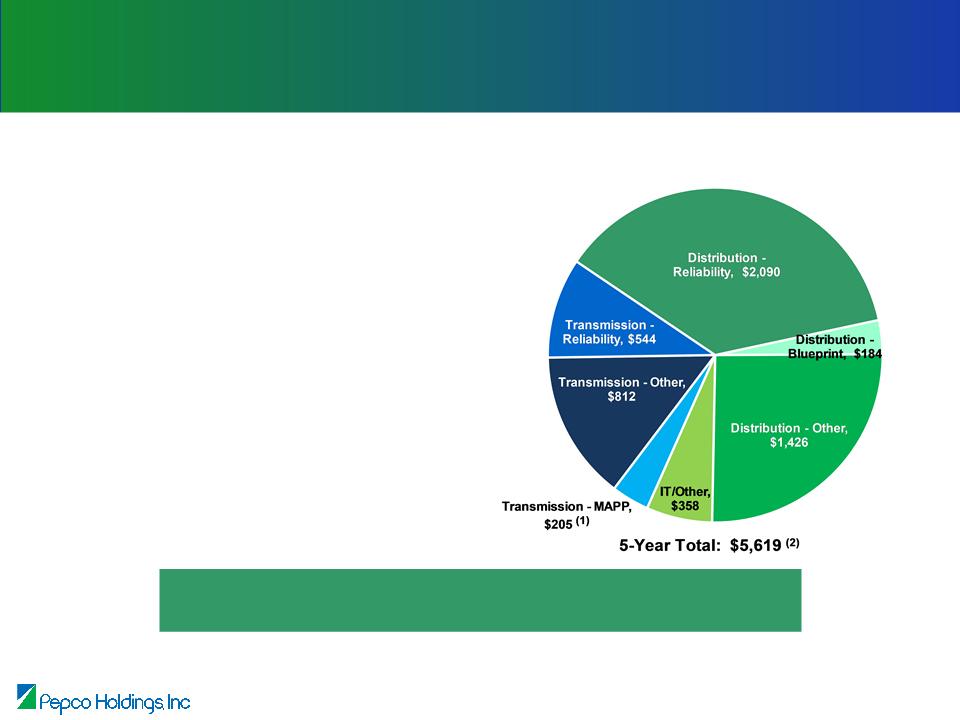

Capital Expenditures - 2012 - 2016 Forecast

(Millions of Dollars)

• 2010 year-end rate base of $5.1 billion

– Distribution - $3.9 billion (77%)

– Transmission - $1.2 billion (23%)

• Five-year capital expenditure forecast

of $5.6 billion

of $5.6 billion

– Distribution - $4.1 billion (73%)

– Transmission - $1.5 billion (27%)

Robust five-year capital expenditure forecast provides

opportunity for long-term earnings growth

opportunity for long-term earnings growth

3

Reliability Enhancement Plan -

Improving System Reliability is a Top Priority

• Our progress in Pepco’s service territory since 2010*:

– Tree Trimming - Trimmed along nearly 3,500 miles of power lines

to remove limbs that threatened our equipment

to remove limbs that threatened our equipment

– Cable Replacement - Replaced or upgraded more than 340 miles

of underground cable

of underground cable

– Selective Undergrounding - Identified overhead lines for potential

undergrounding

undergrounding

– Distribution Automation - Added 125 automated switches that will

reroute power more effectively during outages

reroute power more effectively during outages

– Customer Communications - Added call center staff and more

than doubled phone lines

than doubled phone lines

– Technology-Based Improvements - Implemented technology on

mobile devices to view online outage maps and enable customers to

report outages

mobile devices to view online outage maps and enable customers to

report outages

• System reliability has improved over the past year

– Improved reliability statistics in 2011 for Pepco customers serviced

by upgraded power lines:

by upgraded power lines:

• 39% reduction in the average number of power outages

• 56% reduction in the average outage duration

– Benefits of reliability initiatives demonstrated during Hurricane Irene

* Reliability Enhancement Plan introduced fall of 2010. Data as of 12/31/11

4

5

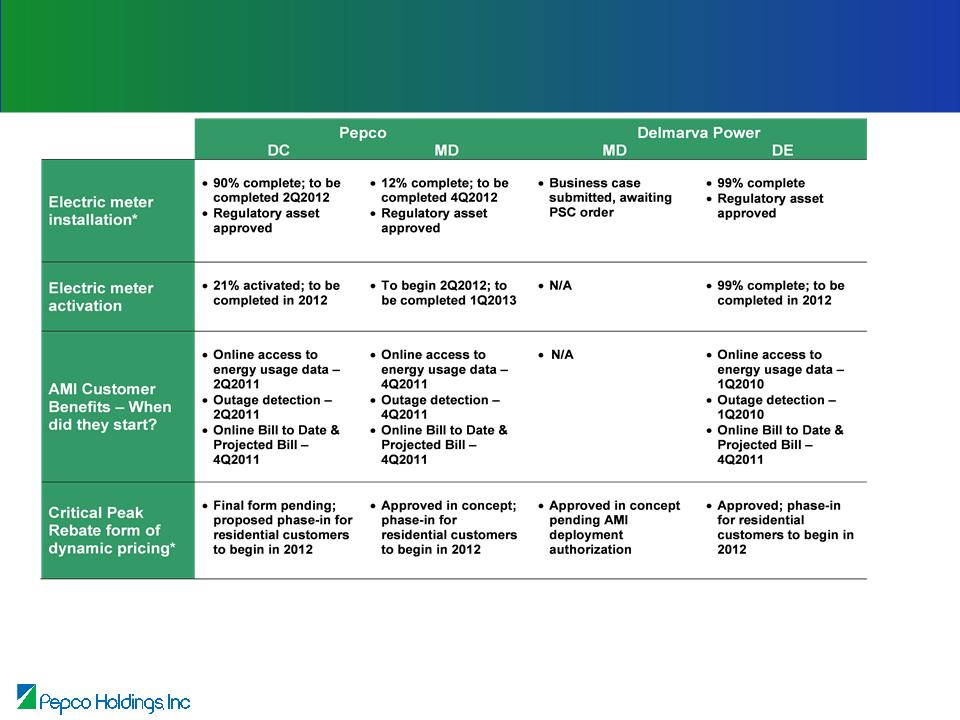

Advanced Metering Infrastructure -

Status by Jurisdiction

Status by Jurisdiction

Note: See Safe Harbor Statement at the beginning of today’s presentation.

* Deferred in New Jersey

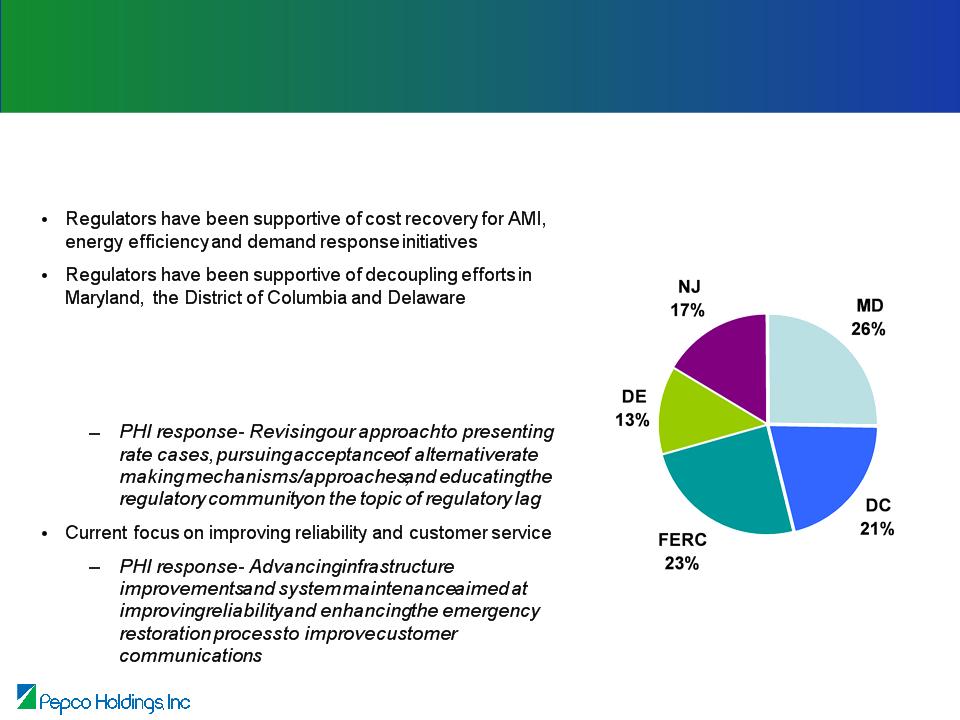

Diverse Regulatory Environment

Strengths

• Recent distribution rate case decisions have generally

reflected adherence to key ratemaking precedents

reflected adherence to key ratemaking precedents

• Formula rates in place at FERC

Challenges

• Regulatory lag in distribution business

Regulatory Diversity

Rate Base*

* Based on year-end 2010 rate base.

6

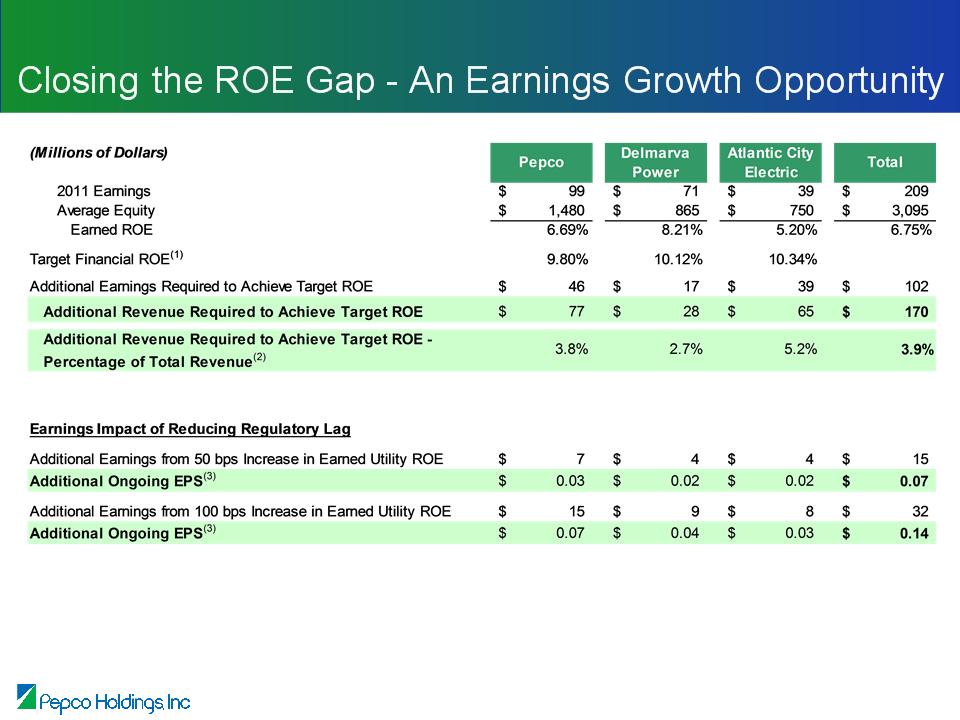

(1) Target Financial ROE reflects estimated weighted average authorized return on equity based on the estimated

2011 rate base. Target Financial ROEs are reduced by 25 basis points to allow for the historical differences

between “financial” and “regulatory” cost of service.

2011 rate base. Target Financial ROEs are reduced by 25 basis points to allow for the historical differences

between “financial” and “regulatory” cost of service.

(2) Excludes “Other Electric and Gas” revenue

(3) Based on 2011 weighted average common shares outstanding

7

Note: See Safe Harbor Statement at the beginning of today’s presentation.

• Filed distribution base rate cases in each of our electric jurisdictions in 2011 requesting

an annual increase in revenue of $247 million in total:

an annual increase in revenue of $247 million in total:

• Filed in each of our electric jurisdictions in 2011 proposals for adopting two

mechanisms to reduce regulatory lag:

mechanisms to reduce regulatory lag:

– Reliability Investment Recovery Mechanism* - provides full and timely recovery of future capital

investments related to distribution system reliability

investments related to distribution system reliability

– Fully forecasted test years

Distribution Rate Cases - The Current Cycle

|

Jurisdiction/Company

|

Requested Revenue

Requirement Increase (millions) |

Requested

Return on Equity |

Initial File

Date |

Expected

Timing of Decision |

|

DC - Pepco

|

$42.5

|

10.75%

|

7/8/11

|

Q2-2012

|

|

NJ - ACE

|

$79.5

|

10.75%

|

8/5/11

|

TBD

|

|

DE - DPL

|

$31.8

|

10.75%

|

12/2/11

|

Q3-2012

|

|

MD - DPL

|

$25.2

|

10.75%

|

12/9/11

|

Q3-2012

|

|

MD - Pepco

|

$68.4

|

10.75%

|

12/16/11

|

Q3-2012

|

* Referred to as the Infrastructure Investment Program in NJ

Note: See Safe Harbor Statement at the beginning of today’s presentation.

8

9

Distribution Rate Cases - Pending

Pepco - District of Columbia

Pepco - District of Columbia

Note: See Safe Harbor Statement at the beginning of today’s presentation.

Regulatory lag mitigation measures proposed:

• Reliability Investment Recovery Mechanism (RIM)

• Fully forecasted test years

(1) Current filed position as of October 29, 2011

(2) Intervenors revenue requirements are as follows: Washington Metropolitan Area Transit Authority (WMATA)

$33.9M based on 9.9% ROE; Apartment and Office Building Association (AOBA) $25.3M based on 9.2% ROE;

Office of People’s Counsel (OPC) $8.8M based on 9.0% ROE.

$33.9M based on 9.9% ROE; Apartment and Office Building Association (AOBA) $25.3M based on 9.2% ROE;

Office of People’s Counsel (OPC) $8.8M based on 9.0% ROE.

Drivers of requested increase:

•Rate base growth/reliability investments

•Increase in operating expenses

•Investment in Advanced Metering Infrastructure (AMI)

•Customer service enhancements

•Increase in authorized ROE

•Under-earning currently authorized returns

Distribution Rate Cases - Pending

Atlantic City Electric - New Jersey

Atlantic City Electric - New Jersey

Drivers of requested increase:

• Rate base growth/reliability investments

• Increase in operating expenses

• Recovery of Hurricane Irene restoration expenses

• Increase in authorized ROE

• Under-earning currently authorized returns

* Current filed position as of February 23, 2012.

Regulatory lag mitigation measure proposed in a separate

filing made October 18, 2011:

filing made October 18, 2011:

• Request the continuance and expansion of the recently

completed Infrastructure Investment Program (IIP)

completed Infrastructure Investment Program (IIP)

• Allows recovery of non-revenue generating infrastructure

investment through a special rate outside of a base rate

filing

investment through a special rate outside of a base rate

filing

• Under the IIP, Atlantic City Electric proposes to recover

reliability-related capital expenditures of $63 million, $94

million and $81 million, in 2012, 2013 and 2014,

respectively

reliability-related capital expenditures of $63 million, $94

million and $81 million, in 2012, 2013 and 2014,

respectively

Note: See Safe Harbor Statement at the beginning of today’s presentation.

10

11

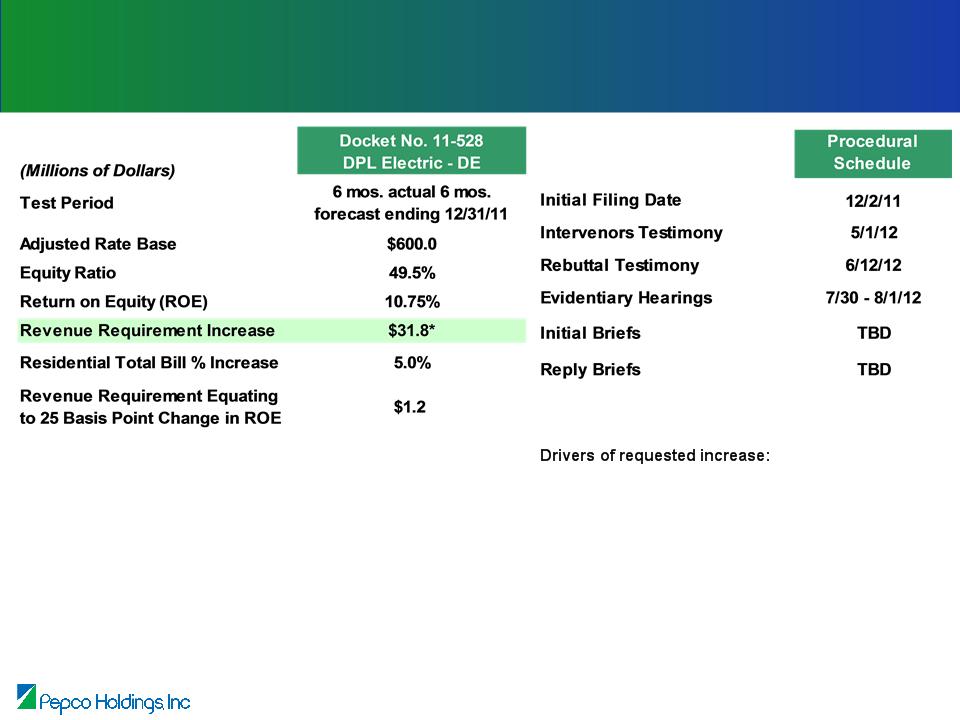

Distribution Rate Cases - Pending

Delmarva Power - Delaware Electric

Delmarva Power - Delaware Electric

Note: See Safe Harbor Statement at the beginning of today’s presentation.

• Rate base growth/reliability investments

• Increase in operating expenses

• Recovery of Hurricane Irene restoration expenses

• Customer service enhancements

• Increase in authorized ROE

• Under-earning currently authorized returns

Two regulatory lag mitigation measures proposed in filing:

•Reliability Investment Recovery Mechanism (RIM)

•Fully forecasted test periods

* As permitted by Delaware law, Delmarva Power implemented an interim rate increase of $2.5 million on

January 31, 2012, subject to refund.

January 31, 2012, subject to refund.

12

Distribution Rate Cases - Pending

Delmarva Power - Maryland

Delmarva Power - Maryland

Note: See Safe Harbor Statement at the beginning of today’s presentation.

• Rate base growth/reliability investments

• Increase in operating expenses

• Recovery of Hurricane Irene restoration expenses

• Customer service enhancements

• Increase in authorized ROE

• Under-earning currently authorized returns

Regulatory lag mitigation measures proposed in filing:

•Reliability Investment Recovery Mechanism (RIM)

•Fully forecasted test years

13

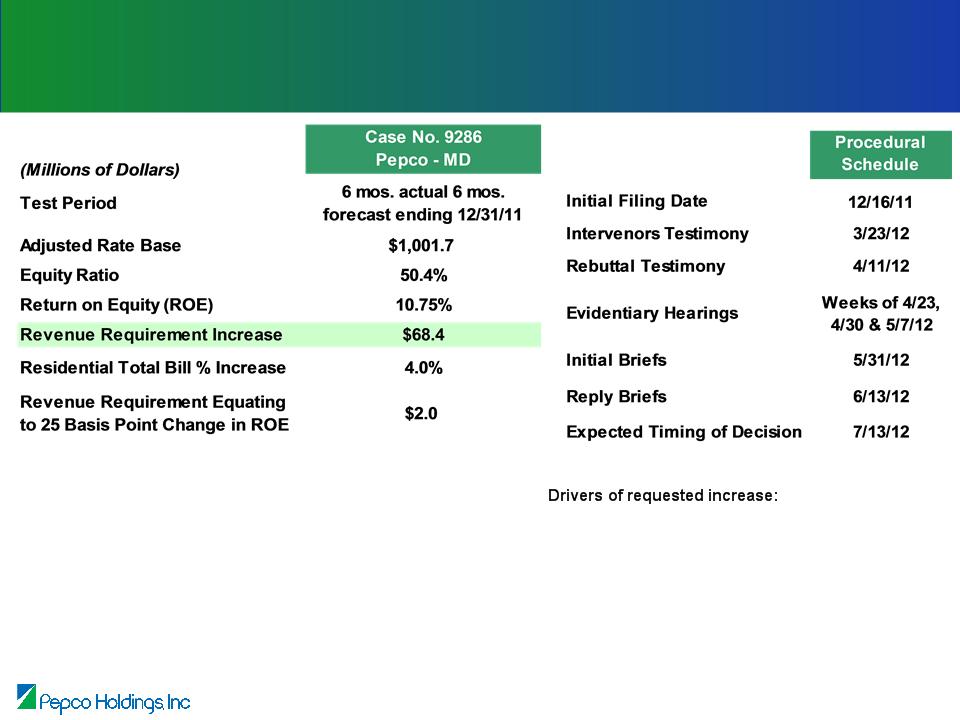

Distribution Rate Cases - Pending

Pepco - Maryland

Pepco - Maryland

Note: See Safe Harbor Statement at the beginning of today’s presentation.

• Rate base growth/reliability investments

• Increase in operating expenses

• Recovery of Hurricane Irene restoration expenses

• Customer service enhancements

• Increase in authorized ROE

• Under-earning currently authorized returns

Regulatory lag mitigation measures proposed in filing:

•Reliability Investment Recovery Mechanism (RIM)

•Fully forecasted test years

Pepco Energy Services

• Provider of retail energy services to large

government and institutional customers

government and institutional customers

• Energy Efficiency - leading developer of energy

efficiency projects; $1 billion of energy efficiency

projects completed since 1995

efficiency projects; $1 billion of energy efficiency

projects completed since 1995

• Combined Heat and Power (CHP)/Thermal -

develop, operate, and maintain CHP and thermal

energy plants

develop, operate, and maintain CHP and thermal

energy plants

• Renewable Energy - own and operate 12 MW of

renewable energy facilities

renewable energy facilities

• W.A. Chester - primarily underground high

voltage transmission construction for utilities

voltage transmission construction for utilities

• Energy Supply

– PES will substantially wind down the retail energy supply business by early 2013

– PES also owns two peaking power plants that are scheduled to retire in 2012

Note: See Safe Harbor Statement at the beginning of today’s presentation.

14

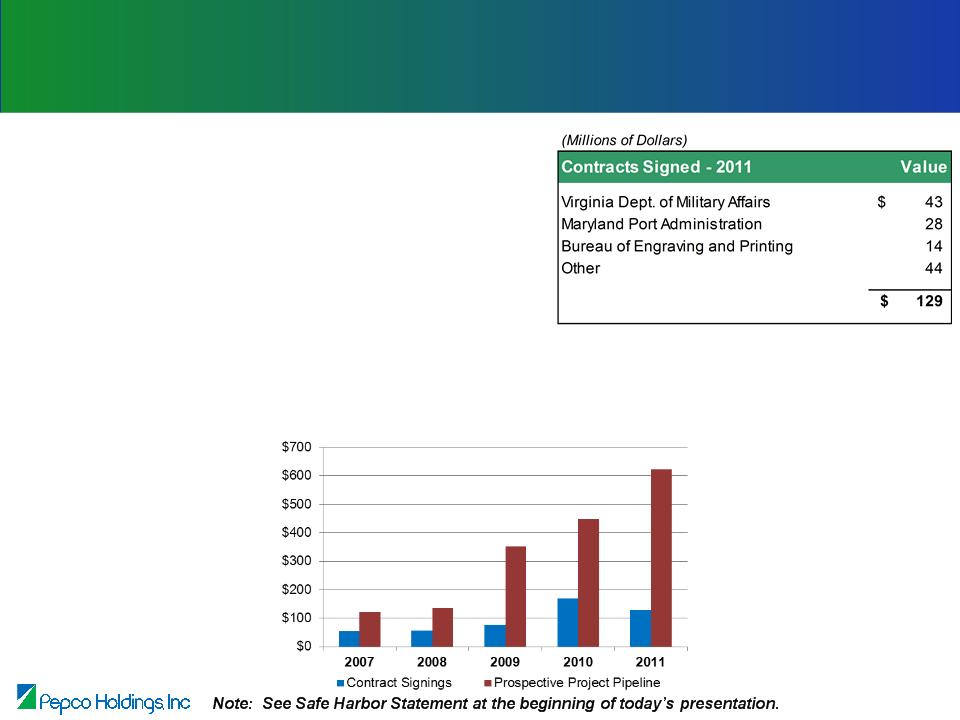

Pepco Energy Services -

Business Development and Marketing Update

Business Development and Marketing Update

• PES has signed $47 million of new energy efficiency

contacts in the fourth quarter of 2011 ($129 million in

2011)

contacts in the fourth quarter of 2011 ($129 million in

2011)

• Project development pipeline has grown to $622

million, up 38% since January 1, 2011

million, up 38% since January 1, 2011

• PES continues to grow its business development staff

• Economic environment slowed contract signings with

state and local governments in 2011

state and local governments in 2011

15

Contracts Signed and

Prospective Project Pipeline

(Millions of Dollars)

16

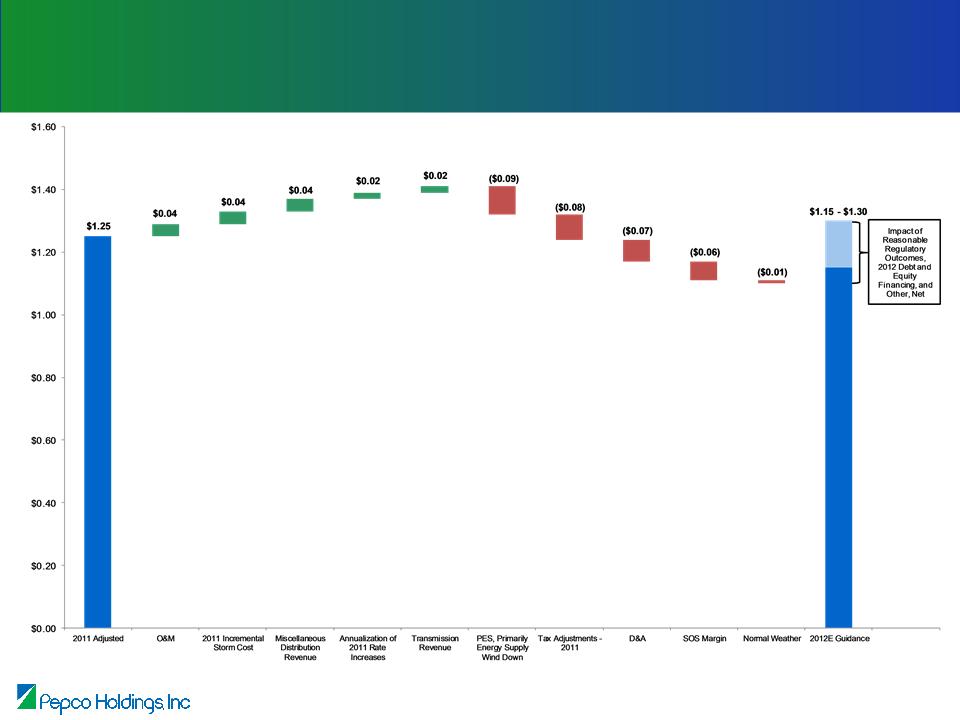

2012 Earnings Guidance

Earnings Per Share

$1.15 - $1.30

$1.25

The guidance range excludes:

• The results of discontinued operations and the impact of any special, unusual or extraordinary items

• The after tax net mark-to-market effects of economic hedging activities associated with the retail energy

supply business at Pepco Energy Services

supply business at Pepco Energy Services

The guidance range assumes/includes:

• Normal weather conditions

* See Appendix for reconciliation of GAAP earnings to adjusted earnings.

Note: See Regulation G Information at the beginning of today’s presentation.

17

2012 Earnings Guidance (continued)

Earnings Per Share - 2011 Adjusted vs. 2012 Guidance

Note: See Regulation G Information at the beginning of today’s presentation.

*

* See Appendix for reconciliation of GAAP earnings to adjusted earnings.

Stable Dividend, Attractive Yield

• Indicated annual dividend of $1.08 per share supported by regulated utility

earnings

earnings

• Current dividend yield is 19% higher than the average dividend yield for

companies in the S&P 500 Electric Utilities

companies in the S&P 500 Electric Utilities

Attractive Dividend Yield

18

Note: See Safe Harbor Statement at the beginning of today’s presentation.

• Stable Earnings Base - Derived primarily from regulated utility business

• Long-term Earnings Growth - Driven by T&D utility infrastructure

investments and reasonable regulatory outcomes

investments and reasonable regulatory outcomes

• Financial Strength - Strong balance sheet, ample liquidity, solid

investment grade credit ratings

investment grade credit ratings

• Stable Dividend - Attractive current yield

• Experienced Team - Delivering on commitments

Investment Highlights

PHI - Well Positioned to Deliver Value

Note: See Safe Harbor Statement at the beginning of today’s presentation.

19

Appendix

21

2011 Earnings Per Share Guidance Range

$1.15 - $1.25

Note: See Regulation G Information at the beginning of today’s presentation.

22

Earnings Per Share Variance -

Twelve Months Ended December 31

Twelve Months Ended December 31

(1) The 2010 weighted average number of basic and diluted shares outstanding was 224 million.

(2) See prior slide for reconciliation of GAAP earnings to adjusted earnings.

(3) The effect of weather compared to the 20-year average weather is estimated to have increased earnings by $0.01 per share.

(4) The 2011 weighted average number of basic and diluted shares outstanding was 226 million.

Note: See Regulation G Information at the beginning of today’s presentation.

23

Capital Expenditures Forecast

Note: See Safe Harbor Statement at the beginning of today’s presentation.

(1) Reflects the remaining anticipated reimbursement pursuant to awards from the U.S. DOE under the ARRA.

(2) Installation of AMI in New Jersey is contingent on regulatory approval ($9 million in 2015, $92 million in 2016).

(3) Assumes MAPP in-service date of 2020.

24

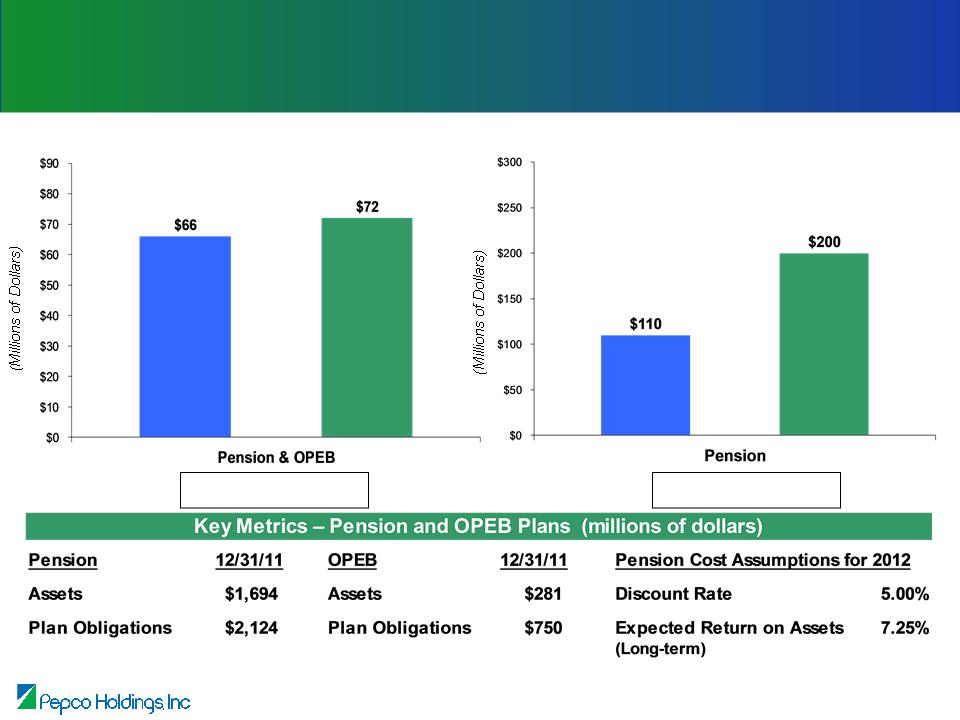

Pension and OPEB Impacts

Net Pension & OPEB Pre-Tax Expense (O&M)

Pension Cash Contributions

■ 2011A ■ 2012E

Note: See Safe Harbor Statement at the beginning of today’s presentation.

■ 2011A ■ 2012A

25

Reliability Standards - Maryland

• Following working group process and rule making hearings, Commission approved draft

rules establishing requirements for:

rules establishing requirements for:

– Service interruption duration and frequency standards

– Service restoration

– Poorest performing feeder and device activation standards

– Downed wire response

– Customer communications

– Vegetation management

– Equipment inspection

– Major Outage Event Plan

• First measurement period begins as soon as the regulations are adopted (expected to be

no later than July 1, 2012)

no later than July 1, 2012)

Maryland (PSC - RM43) - Rule making proceeding applying to all electric utilities in the state to

establish comprehensive reliability and service standards

establish comprehensive reliability and service standards

26

Reliability Standards - District of Columbia

• New rules require improvement in reliability performance (outage frequency and duration) on

an annual basis beginning in 2013 and continuing through 2020

an annual basis beginning in 2013 and continuing through 2020

• Revision to rules adopted by Commission in February 2012 to address certain issues raised

by Pepco in an application for reconsideration:

by Pepco in an application for reconsideration:

– Method to calculate reliability was revised to a manner reflecting District of Columbia-only data

– After June 2015, Pepco may petition the Commission to re-evaluate reliability standards for 2016-

2020 to address feasibility and cost issues

2020 to address feasibility and cost issues

District of Columbia - New reliability standards adopted in July 2011, further technical revisions

adopted February 2012

adopted February 2012

27

• Equity investment as of December 31, 2011 of $1.3 billion

• Annual tax benefits of $51 million

• Annual net earnings of $21 million

• Current Status:

– IRS audit settlement approved in November 2010 for the 2001/2002 periods; disallowed

net losses on the cross-border energy leases

net losses on the cross-border energy leases

– Paid $74 million of taxes, $1 million of penalties and $28 million of interest associated

with the 2001/2002 audit in 2011

with the 2001/2002 audit in 2011

– Filed a claim for refund of tax payment, interest and penalties with the IRS in July 2011

– Since the claim for refund was not approved by the IRS within the statutory six-month

period, complaints were filed in the U.S. Court of Federal Claims against the IRS in

January 2012 to resolve the issue and recover the tax payment, interest and penalties

period, complaints were filed in the U.S. Court of Federal Claims against the IRS in

January 2012 to resolve the issue and recover the tax payment, interest and penalties

– Absent a settlement, litigation will likely take several years to resolve

Cross-Border Energy Lease Status

Note: See Safe Harbor Statement at the beginning of today’s presentation.