Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Enventis Corp | form8-k.htm |

Exhibit 99.1

Fourth Quarter 2011

Earnings Conference Call

March 7, 2012

NASDAQ: HTCO

“Safe Harbor” Statement

Information set forth in this presentation contains financial estimates

and other forward-looking statements that are subject to risks and

uncertainties; therefore, actual results might differ materially from such

statements, whether as a result of new information, future events or

otherwise. You are cautioned not to place undue reliance on these

forward-looking statements. A discussion of factors that may effect

future results is contained in HickoryTech’s filings with the Securities

and Exchange Commission. HickoryTech disclaims any obligation to

update and revise statements contained in this presentation based on

new information or otherwise. This presentation also contains certain

non-GAAP financial measures. Reconciliations of these non-GAAP

measures to the most directly comparable GAAP measures are

available in our presentation.

2

Q4 and Fiscal 2011 Highlights

Fourth Quarter 2011 compared to Fourth Quarter 2010

• Revenue totaled $39.6 M, -5%

– Fiber and data revenue +7%

– Equipment sales down 28%, equipment support services

revenue +15%

revenue +15%

• Operating income totaled $3.6 M

• Net income totaled $1.4 M, EPS was $0.11

Fiscal 2011 compared to Fiscal 2010

• Revenue totaled $163.5 M, +1% (+4%*)

• Net income totaled $9.2 M, -24% (+11%*)

• Operating Income was $19.7 M, -6% (+5%*)

• Fiber and Data revenue of $45.9 M, + 2% (+14%*)

* (Normalized, excludes non-recurring 2010 fiber construction project

revenue and 2010 -11 tax reserve releases.)

revenue and 2010 -11 tax reserve releases.)

3

Consolidated Revenue

Q4 ’11 compared to Q4 ’10

• Equipment revenue -22%

• Fiber and data revenue +7%

(+13% when excluding the Q4-2010

fiber construction project revenue)

(+13% when excluding the Q4-2010

fiber construction project revenue)

• Broadband revenue +2%

2011 compared to 2010

• Revenue +1% (+4% excluding

2010 fiber construction project)

2010 fiber construction project)

($ in millions)

4

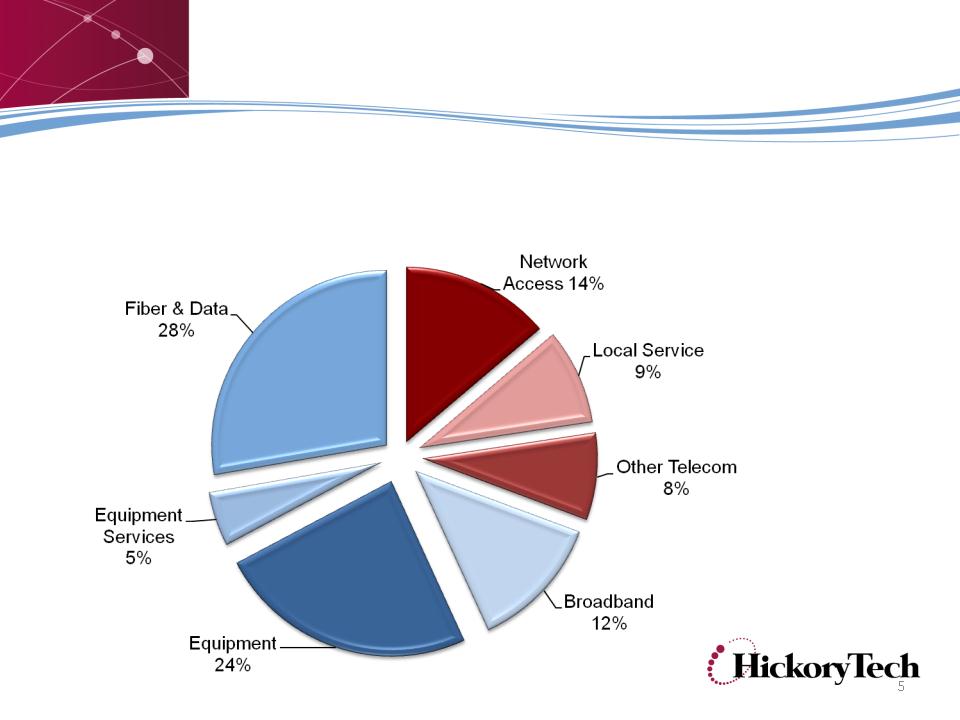

69% of 2011 revenue is from Business & Broadband Services;

less reliance on regulated telecom revenue

less reliance on regulated telecom revenue

Revenue Diversification

• 2011 EPS declined 7% compared t0

2010 when excluding the 2010 tax

reserve release*

2010 when excluding the 2010 tax

reserve release*

• 2011 EBITDA increased 6%

compared to 2010 when excluding

the 2010 fiber project.*

compared to 2010 when excluding

the 2010 fiber project.*

($ in millions)

EBITDA (as defined by our credit agreement)

6

*Excludes tax reserve releases

*Excludes the fiber construction project

Business Sector

2011 compared to 2010

• Revenue up 2%

• Excluding the fiber construction project in 2010

revenue was up 14% from organic growth

revenue was up 14% from organic growth

2011 compared to 2010

• Equipment sales stable, up 1%

• Equipment support services up 12%

($ in millions)

7

Excludes fiber construction project

Equipment Revenue

Fiber and Data Revenue

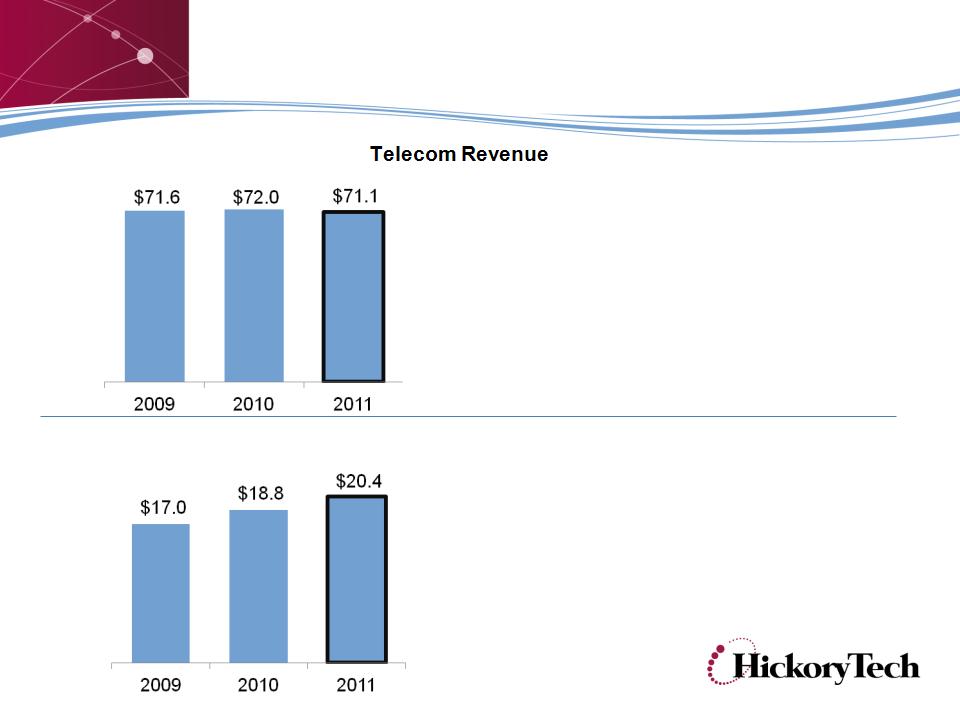

Telecom Sector

2011 compared to 2010

•Stable Telecom revenue

•Broadband revenue up 8%

•Network Access revenue down 3% and

Local Service revenue down 6%

Local Service revenue down 6%

2011 compared to 2010

•Business Ethernet and data sales strong

•Broadband residential markets maturing

Broadband Revenue (within Telecom Sector)

($ in millions)

before intersegment

eliminations

eliminations

8

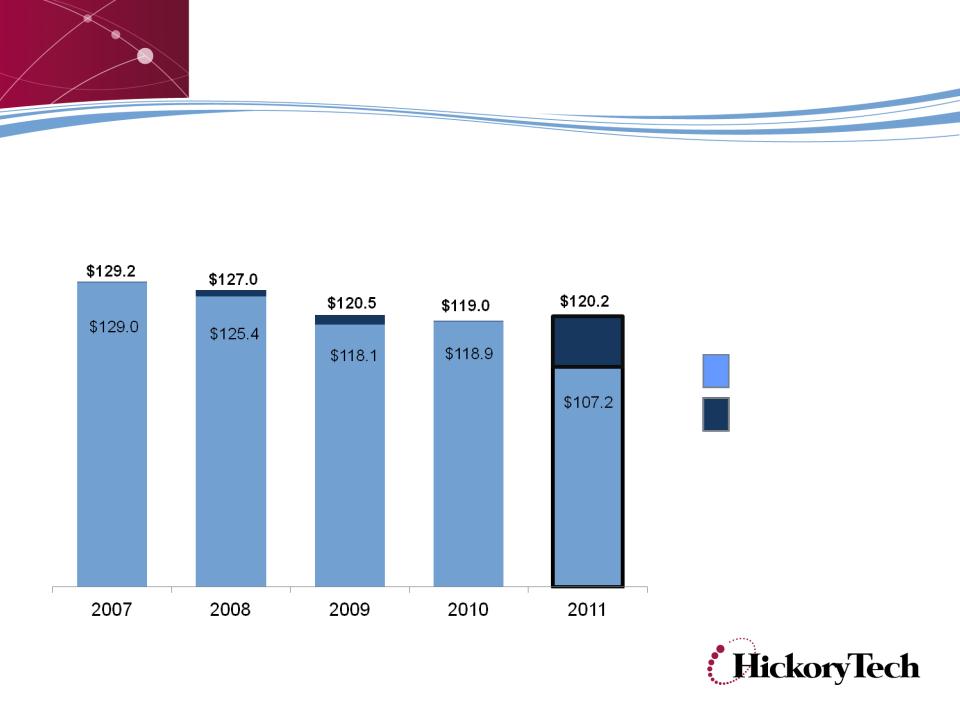

Debt Balance

($ in millions)

Net debt was $107.2 million at 12/31/11, a $11.7 million improvement from 12/31/10

9

Net Debt Balance

Total Debt Balance

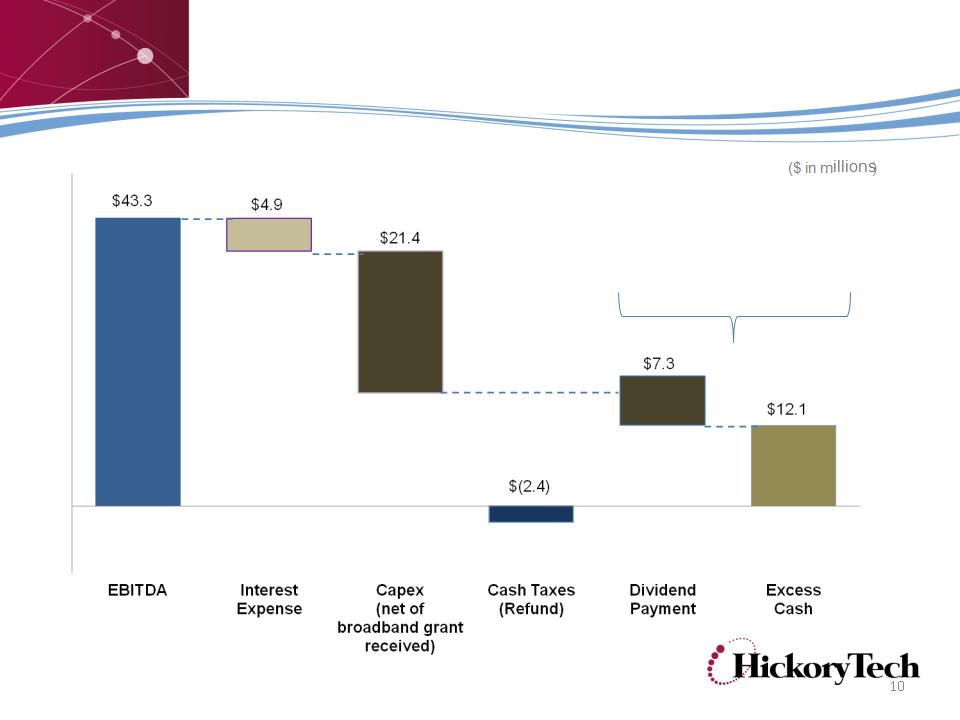

2011 Free Cash Flow

Free Cash Flow = $19.4 M

Dividend Payout is

38%

38%

IdeaOne Acquisition Close

|

Close Date

|

March 1, 2012 - IdeaOne will be included in the

Fiber & Data Segment for 10 mos. of 2012 |

|

Transaction price

|

$28 million, cash transaction with routine

adjustments for capital expenditures and working capital adjustments |

|

Financing structure

|

$22 M of new term debt under existing credit

facility plus $6 M cash |

|

Approximate transaction

multiples |

2.3x 2011 IdeaOne Revenue

5.8x 2011 IdeaOne EBITDA |

|

Integration status

|

In progress, to be completed by Q3-2012

|

|

Fiber network

|

225 fiber route miles, 650 lit buildings,

|

|

Employees

|

40 based in Fargo, No. Dakota

|

11

Greater Minnesota Broadband

Collaborative Project

•Phase 1 extends fiber network from

St. Paul to Duluth, Minn. / Superior, Wisc.

Majority of project was completed in 2011

St. Paul to Duluth, Minn. / Superior, Wisc.

Majority of project was completed in 2011

•Phase 2 will extend fiber from Brainerd, Minn.

to Fargo, N.D.

Construction to begin in 2012

to Fargo, N.D.

Construction to begin in 2012

•Project will be completed by Aug. 2013

12

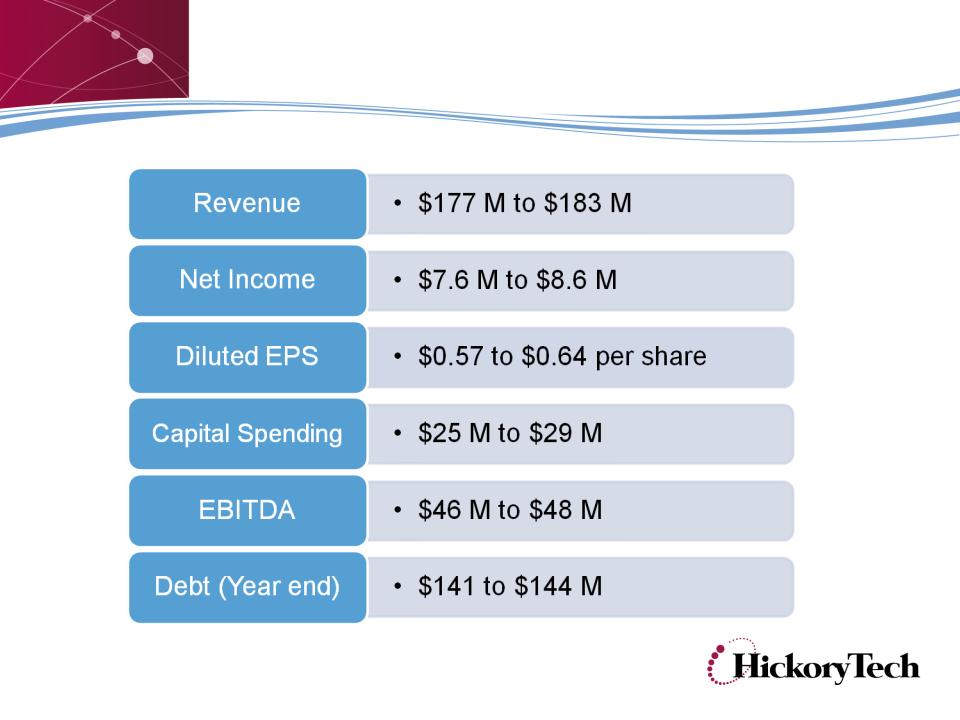

2012 Fiscal Outlook

13

Outlook provided in Q4 earnings release on March 6, 2012.

Strategic Initiatives

• Focus on growing business services:

Ø Fiber network expansion

Ø Accelerated SMB market plan

Ø Target last-mile fiber builds

Ø Construction of broadband stimulus project

• Grow broadband services (Digital TV, DSL, data services)

• Increase capital spending on key strategic initiatives

• Manage free cash flow, manage costs and reduce debt in long

term

term

14

Key Strategic Initiatives

15

Strategic Growth through organic and external growth

HickoryTech Strengths

Diverse revenue streams / markets, emerging

growth through business revenue stream and fiber

network expansion

growth through business revenue stream and fiber

network expansion

More than 60 years of dividend return, yield 5-6%

Increased dividend in 2011 and 2010

Experienced company with 114-year track record

of financial stability

of financial stability

Strong cash flow, strong balance sheet,

high level of recurring revenue

high level of recurring revenue

Focused on doubling the value of HickoryTech by

growing EBITDA, strategic services, managing debt

growing EBITDA, strategic services, managing debt

16

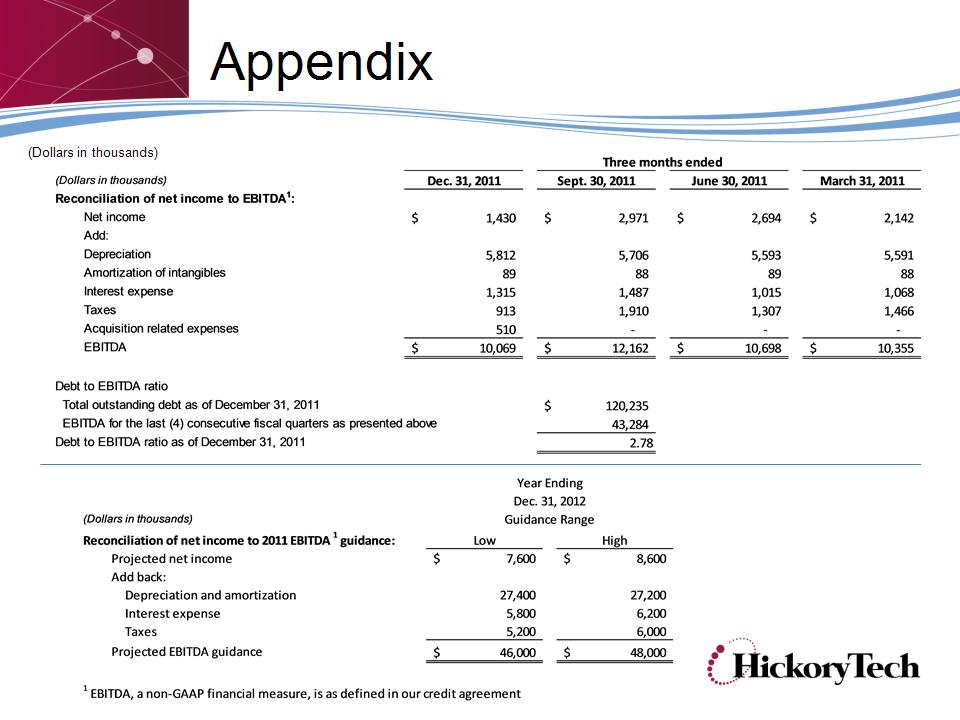

Reconciliation of Non-GAAP Measures

17

|

1 EBITDA, a non-GAAP financial measure, is as defined in our credit agreement

|

18

Reconciliation of Non-GAAP Measures

Appendix

19

Reconciliation of Non-GAAP Measures

(Dollars in thousands)