Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-34641

FURIEX PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 27-1197863 | |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

3900 Paramount Parkway, Suite 150

Morrisville, North Carolina 27560

(Address of principal executive offices, including zip code)

(919) 456-7800

(Registrant’s telephone number, including area code):

Securities registered pursuant to Section 12(b) of the Act:

| (Title of each class) |

(Name of each exchange on which registered) | |

| Common Stock, par value $0.001 per share | Nasdaq Global Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities

Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the

Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its Corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

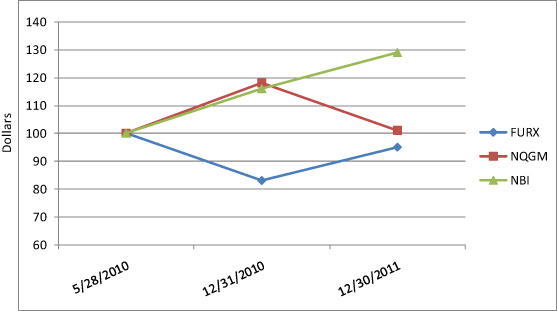

The aggregate market value of the common stock held by non-affiliates of the registrant was approximately $151.0 million as of June 30, 2011, based on the closing price of the Common Stock on that date on the Nasdaq Global Market. Shares of common stock held by each executive officer and director and by each person who owns 10% or more of the outstanding common stock have been excluded in that such person might be deemed to be an affiliate. This determination of affiliate status might not be conclusive for other purposes.

As of February 29, 2012, there were 9,949,422 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The Company’s definitive Proxy Statement for its 2012 Annual Meeting of Stockholders (certain parts, as indicated in Part III).

Table of Contents

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are subject to risks and uncertainties, including those set forth under “Item 1A. Risk Factors” and “Cautionary Statement” included in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in this report, that could cause actual results to differ materially from historical results or anticipated results. Unless otherwise indicated or required by the context, the terms “we,” “our,” “us” and the “Company” refer to Furiex Pharmaceuticals, Inc. and all of its subsidiaries.

2

Table of Contents

| Item 1. | Business |

Our Business

About Furiex Pharmaceuticals

We are a drug development collaboration company that uses innovative clinical development strategies to increase the value of partnered pharmaceutical assets and accelerate their development timelines. We collaborate with pharmaceutical and biotechnology companies to increase the value of their drug candidates by applying our novel approach to drug development, which we believe expedites research and development decision-making and can shorten drug development timelines. We share the risk with our collaborators by running and financing drug development programs up to agreed clinical milestones, and in exchange, we share the potential rewards, receiving milestone and royalty payments for successful drug candidates. This business model is designed to help feed product pipelines and deliver therapies to improve lives.

Our company continues the compound partnering business started by Pharmaceutical Product Development, Inc., or PPD, in 1998. We became an independent publicly traded company on June 14, 2010, when PPD spun-off its compound partnering business through a tax-free, pro-rata dividend distribution of all of the shares of the Company to PPD shareholders. PPD does not have any ownership or other form of equity interest in the Company following the spin-off. The Company’s operations are headquartered in Morrisville, North Carolina. Our website address is www.furiex.com. Information on our website is not incorporated herein by reference. We make available free of charge through our website press releases, Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports as soon as reasonably practicable after electronically filed with or furnished to the Securities and Exchange Commission.

Business Description

Our goal is to in-license from or form strategic alliances with pharmaceutical and biotechnology businesses to develop and commercialize therapeutics in which the risks and rewards are shared. We seek to collaborate with pharmaceutical and biotechnology companies to increase the value of early stage drug candidates by applying our novel approach to drug development that we believe expedites research and development decision-making and can shorten drug development timelines. Furiex’s team is staffed with the same key PPD team members who demonstrated proven success in the drug development collaboration business while at PPD, as well as highly-qualified additional members. Our strategy is to invest in drug candidates that have a relatively straightforward path to regulatory approval and a large addressable market. Every drug candidate we review is subjected to our rigorous due diligence process by our team of experts who possess experience in all aspects of the drug development process.

Once we in-license or form an alliance, we use our drug development experience and financial resources to advance the drug candidate through clinical development. We apply a novel approach that shortens drug development timelines that we believe transforms research and development into revenues more rapidly than the typical development cycle for such collaborations. Specifically, we set the development strategy based on a product candidate’s best market position, design and manage non-clinical and clinical studies, manage the drug manufacturing programs and evaluate the efficacy and safety data necessary to obtain regulatory approvals for the drug candidate. We use service providers to execute the tasks needed to develop and commercialize our product candidates.

Most of our collaborations involve late development and commercialization agreements with large pharmaceutical companies. Typically, if our collaborators are unable or unwilling to execute on late stage development and commercialization, then we have the option to seek new collaborators.

In exchange for our drug development efforts and sharing the risk with our collaborator, we are entitled to receive milestone payments and royalties based on the continued development and commercialization success of the drug candidate.

3

Table of Contents

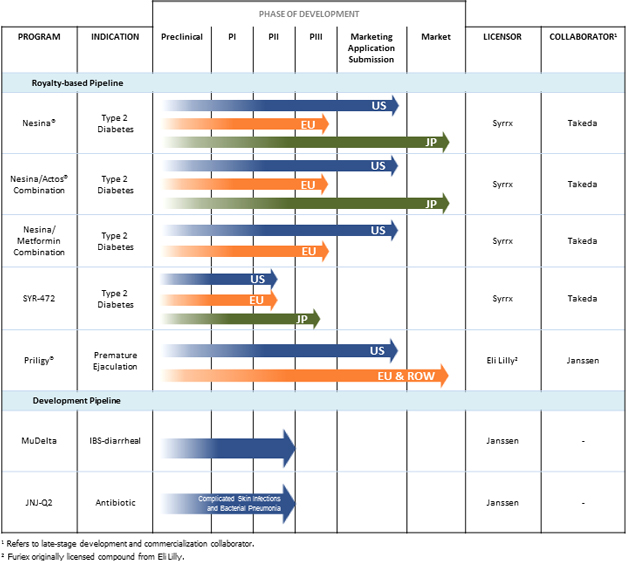

Currently, we have rights to several compounds in various stages of development and commercialization, including:

| • | Rights to royalties and regulatory and sales-based milestone payments from Takeda Pharmaceuticals Company Limited, for alogliptin and SYR-472. Takeda received regulatory and pricing approval in Japan during the second quarter of 2010 for alogliptin for the treatment of Type-2 diabetes. Takeda markets alogliptin in Japan under the name Nesina®. In February 2011, additional indications for Nesina were approved in Japan including use in combination with two common classes of diabetes drugs, sulfonylureas and biguanides. In the third quarter of 2011, Takeda launched two dosages of Liovel®, a fixed dose combination tablet of Nesina (alogliptin) and Actos® (pioglitazone HCL), in Japan. In July 2011, Takeda announced resubmission of the U.S. NDAs for alogliptin and alogliptin in fixed-dose combination with pioglitazone. In September 2011, Takeda announced that SYR-472 entered Phase III clinical trials in Japan for treatment of Type-2 diabetes. |

| • | Rights to royalties and regulatory and sales-based milestones from the collaboration with Alza Corporation, an affiliate of Janssen Pharmaceutica, N.V., for Priligy®, the first approved treatment in the world for premature ejaculation. Priligy is currently marketed in 15 countries in Europe, Asia-Pacific and Latin America. |

| • | A compound licensed from Janssen, (an affiliate of Johnson & Johnson), in November 2009 that is a mu opioid receptor agonist and delta opioid receptor antagonist, which we call MuDelta, for the treatment of diarrhea-predominant irritable bowel syndrome. We completed a Phase II Proof-of-Concept clinical trial during 2011 which demonstrated that MuDelta has a favorable efficacy and safety profile. In November 2011, we acquired full exclusive license rights to develop and commercialize MuDelta under our existing development and license agreement with Janssen. |

| • | A fluoroquinolone antibiotic licensed from Janssen in November 2009, which we call JNJ-Q2, for the treatment of acute bacterial skin and skin structure infections, such as abscesses that occur deep in the skin layers, and respiratory infections. In 2010, we completed a Phase II clinical trial using the oral formulation for acute bacterial skin infections reporting positive results. In late 2011, we halted a community-acquired bacterial pneumonia study, ongoing since late 2010, due to challenges in recruiting the study based on the current U.S. Food and Drug Administration, or FDA, guidance and recent information that the FDA’s guidance may change. In April 2011, we acquired full exclusive license rights to develop and commercialize JNJ-Q2 under our existing development and license agreement with Janssen. |

4

Table of Contents

The following chart summarizes the status of our pipeline of compounds:

Our Solution

The drug development industry is under increasing economic pressure to develop new products more quickly and efficiently. To address this industry issue, we have developed what we believe is a novel approach to drug development. Our approach to drug development involves applying proven solutions from our extensive global drug development experience to reduce development timelines and expedite the decision-making cycle, planning for success and bridging steps in development by conducting earlier elements of a program while simultaneously planning for later phases of development.

In order to obtain regulatory approval from the FDA to market a drug, certain data about the safety and efficacy of the drug is required. To obtain such data, drug developers frequently choose to run studies sequentially. For example, they might run one study, wait to see the results, and then they run the next study. Developers prefer this approach primarily to limit upfront expenditures since the success of any given study is not known and the decision might be made not to move forward due to negative data. This sequential approach slows down the development process.

We approach drug development by minimizing the time it takes to bring products to the market. Our novel approach manages drug development with parallel processing and efficient decision-making. We use our drug development experience to predict possible outcomes of a study and take risks based on those predictions. By assuming success at each critical decision point in advance, as opposed to waiting for

5

Table of Contents

results, development time is reduced. In addition, we seek to mitigate risks by contingency planning for potential problems. As a result, we can accelerate the development process by bridging steps across the developmental program as well as between studies, as was evidenced with alogliptin where it took just 39 months from the filing of the Investigational New Drug application, or IND, to the filing of the New Drug Application, or NDA. Additionally, we focus our efforts on only those essential studies necessary for regulatory approval. This helps to shorten developmental timelines.

Two key elements to our approach are our due diligence process and our planning for the success of each compound. Before we enter into a collaboration for a compound, we subject it to an intense due diligence review covering every step in the development process, from preclinical and clinical studies through marketing approval. We generally look for and enter into collaborations with respect to compounds that have the following characteristics:

| • | address medical conditions with a significant unmet need; |

| • | a reasonable development time; |

| • | reasonable predictability of non-clinical models; |

| • | clinical evidence no later than Phase Ib; |

| • | a solid patent estate; |

| • | acceptable estimated cost of goods; and |

| • | attractive economic terms with the compound’s innovator and ultimate commercial collaborator. |

If a compound passes our rigorous diligence review hurdles, we then plan the entire development timeline upfront, using a set of assumptions. Part of the upfront planning involves initiating long-term studies, such as carcinogenicity studies, earlier than usual. We also use real-time data analysis tools to monitor the clinical study data of a drug candidate. By initiating long-term studies earlier and reviewing data in real time, we can significantly reduce the time needed after the conclusion of clinical studies to complete the necessary documentation for regulatory filing.

We believe this approach works well because the core development team is empowered to make decisions, real-time technology tools facilitate rapid data review, development programs are designed to optimize market position and timelines are driven by science and “must have” studies. The resulting ability to reduce development timelines in turn allows us to capitalize more quickly on our investment. We believe our success evolves from our development efficiency.

According to the Tufts University Center for the Study of Drug Development Outlook 2009, since 2002 the average time from the filing of an IND to the filing of an NDA is over eight years. By contrast, we advanced alogliptin as a treatment for Type-2 diabetes (for the monotherapy program) from IND to NDA in only 39 months.

Our Business Strategy

Our strategy is to in-license and develop novel early stage drug candidates that address medical conditions with a significant unmet need. We invest in innovative early stage drug candidates whose targets have scientific or clinical validation, and in disease areas that have a relatively straightforward path to regulatory approval. We leverage our extensive drug development expertise to implement efficient and high quality development programs that accelerate time to market. We progress drug candidates to key value inflection points and form strategic collaborations with commercial pharmaceutical companies in exchange for milestones and royalties. Each potential drug candidate we consider is subjected to a rigorous review process by our due diligence team, which has expertise in all aspects of drug development, as well as in intellectual property and commercial assessment. This approach has enabled us to build what we believe is a strong, diversified portfolio of drug candidates and commercialized products that offer value to patients, our investors and collaborators. We plan to continue to grow our business by in-licensing or acquiring promising compounds and establishing new development and commercialization partnerships.

6

Table of Contents

Our Portfolio

We have two Phase III-ready products in clinical development, with exclusive license rights to both products: MuDelta and JNJ-Q2. In addition we have one compound in Phase III development with a collaborator, SYR-472, and two compounds that are commercialized by collaborators, for which we are eligible to receive regulatory milestone payments plus worldwide sales royalty and milestone payments. These compounds, Nesina and Priligy, are currently marketed outside of the United States, and we have no further development obligations for any of these three compounds.

Compounds in Clinical Development

MuDelta for diarrhea-predominant irritable bowel syndrome

Diarrhea-predominant irritable bowel syndrome, or IBS-d, affects approximately 28 million patients in the United States and the five major European Union countries, and is characterized by chronic abdominal pain and frequent diarrhea. Studies have demonstrated that IBS-d is associated with work absenteeism, high medical costs and low quality of life. We believe the market for prescription treatments for IBS-d is underserved due to the limited number of available treatments and the adverse side effects associated with those treatments.

MuDelta is a novel, orally active, Phase III-ready investigational agent with combined mu opioid receptor agonist and delta opioid receptor antagonist activity. The compound’s dual opioid activity is designed to treat diarrhea and pain symptoms of IBS-d, without causing the constipating side effects that occur with mu opioid agonists. MuDelta acts locally in the gut and has very low oral bioavailability, thus limiting the potential for systemic side effects, such as sedation. In January 2011, the FDA granted Fast Track designation to the MuDelta IBS-d program. Fast Track is a process for facilitating the development and expediting the review of drugs to treat serious diseases and fill unmet medical needs, with the goal of bringing important new drugs to patients earlier. Approximately 700 subjects have been treated with MuDelta to date.

In 2011, we progressed the development of MuDelta from both a developmental and regulatory perspective. We completed a large multicenter randomized-double-blind Phase II Proof-of-Concept trial in patients with IBS-d, which demonstrated that MuDelta has a favorable efficacy and safety profile. We also presented top-line data for the study at the American College of Gastroenterology 2011 meeting. Key findings from the Phase II Proof- of-Concept study results are summarized below:

The study reached statistical significance for the primary endpoint of improvement in stool consistency and abdominal pain at week four of treatment, which was developed prior to the release of the FDA’s IBS guidance in 2010, as well as secondary endpoints of adequate relief of IBS-d symptoms at weeks 4, 8, and 12. Importantly, the favorable efficacy results were obtained in a post hoc responder analysis, using the composite endpoint of improvement in pain and diarrheal symptoms, based on the FDA 2010 guidance. Using this endpoint (where a responder is defined as a patient with a Bristol Stool Score of < 4 and daily pain ratings improved by > 30% compared to baseline for at least 50% of days of the 12-week treatment period), MuDelta showed statistically and clinically meaningful differences compared with placebo at both the 100 mg BID and 200 mg BID doses.

The FDA agreed at our End of Phase II Meeting, that the aforementioned endpoint is an acceptable primary endpoint for Phase III pivotal studies; we believe this provides a clear regulatory path for progressing the program. We believe that our favorable Phase II study results with this endpoint bodes well for the Phase III program.

In November 2011, we acquired full exclusive license rights to develop and commercialize MuDelta under our existing development and license agreement with Janssen Pharmaceutica, N.V., or Janssen. We acquired these rights as a result of Janssen’s recent decision not to exercise its option under the agreement to continue development of MuDelta. Based on our 2009 agreement, we will continue developing and commercializing the compound and Janssen may receive up to $50.0 million in regulatory milestone payments and, if approved for marketing, up to $75.0 million in sales-based milestone payments and sales-based royalties increasing from the mid- to upper-single digit percentages as sales volume increases. Royalties are to be paid for a period of ten years after the first commercial sale or, if later, the expiration of the last valid patent claim or the expiration of patent exclusivity.

We are actively exploring various partnering and funding options to advance development of MuDelta. In January 2012, we received favorable written feedback from the FDA on the manufacturing program, which enables us to keep program timelines on track. We are conducting Phase III manufacturing as well as other study start-up activities, with the goal of commencing Phase III dosing in the third quarter of 2012. We are also in the process of obtaining Scientific Advice from the European regulatory authorities about a European development strategy for MuDelta.

7

Table of Contents

JNJ-Q2

Community-acquired bacterial pneumonia, or CABP, and acute bacterial skin and skin structure infections, or ABSSSI, are important public-health concerns due to increasing drug resistance of established antibiotics to causative pathogens. Due to the emerging resistance to established antibiotics, there is a large unmet need for antibiotics such as JNJ-Q2, that cover a broad range of pathogens, including resistant Staphylococcus (“Staph”) and Streptococcus (“Strep”), and that have the potential for both intravenous and oral use. Bacterial infections are a major cause of morbidity and mortality. More than 14 million ambulatory physician visits each year are related to skin and soft-tissue infections, and approximately 94,000 Americans developed serious MRSA (methicillin resistant Staphylococcus “Staph” aureus) infections in 2005, according to a recent study published in the Journal of the American Medical Association. Global microbiological surveillance suggests that approximately 40% of Staph infections in the U.S., Latin America and Asia Pacific are MRSA. According to Global Data, the global MRSA market was valued at $900 million in 2010 and is projected to exceed $1.0 billion by 2017. The pneumonia therapeutics market was valued at $2.0 billion in 2010 with $1.8 billion value forecast for 2018 due to expected patent expirations.

JNJ-Q2 is a novel broad-spectrum fluoroquinolone antibiotic that also has broad coverage against two important drug resistant pathogens: MRSA and drug-resistant Streptococcus pneumoniae. In addition, it is highly active against other common and difficult to treat bacteria, including those that are gram-negative, gram-positive, atypical and anaerobic, and it has a low propensity for drug resistance. JNJ-Q2 is also active against resistant pathogens that might be used in bioterrorism and also, in drug-resistant gonorrhea. This broad bactericidal spectrum gives JNJ-Q2 an advantage over many other antibiotics, which do not reliably treat polymicrobial infections (i.e., wound infections containing multiple bacterial species) or such a wide variety of respiratory pathogens. We are developing JNJ-Q2 for both IV and oral use, which differentiates it from many other MRSA treatments, which are available for IV use only. The product has been in development for both skin infections and pneumonia, with the lead indication being ABSSSI.

In November 2010, we reported positive results for our randomized, double-blind, multicenter Phase II clinical trial comparing the efficacy, safety and tolerability of JNJ-Q2 with linezolid (Zyvox®) in a study of 161 patients with ABSSSI receiving oral treatment twice a day with either JNJ-Q2 or linezolid for 7 to14 days. JNJ-Q2 had positive results for both clinical cure and early response endpoints involving cessation of skin lesion spread or reduction in lesion size and absence of fever within 48 to 72 hours after starting treatment, consistent with the latest FDA draft guidance, with a slightly higher response rate for JNJ-Q2 at 62.7% than for linezolid at 57.7%. These results were published in the December 2011 issue of Antimicrobial Agents and Chemotherapy (Volume 55: pages 5790-5797) and are also available on line http://aac.asm.org/content/55/12/5790.full.

In April 2011, we acquired full exclusive license rights to develop and commercialize JNJ-Q2 under our existing development and license agreement with Janssen. We acquired rights to JNJ-Q2 as a result of Janssen’s decision not to exercise its option under the agreement which gave Janssen the opportunity to continue development of JNJ-Q2. This decision was related to Janssen’s April 2011 announcement that it will be directing its research and development investments toward antivirals and vaccines and would not be investing in new antibacterial therapies. Based on our existing agreement, Janssen may receive up to $50.0 million in regulatory milestone payments, and if approved for marketing, up to $75.0 million in sales-based milestone payments and sales-based royalties increasing from the mid- to upper-single digit percentages as sales volume increases. Royalties would be paid for a period of ten years after the first commercial sale or, if later, the expiration of the last valid patent claim or the expiration of patent exclusivity.

In June and July of 2011, we had productive End of Phase II meetings with both the FDA and with several EU regulatory authorities, providing what we believe is a clear regulatory path to support global Phase III development in ABSSSI. Also, a total of 13 peer-reviewed scientific papers and abstracts on JNJ-Q2 were published in 2011.

8

Table of Contents

In the fourth quarter of 2011, we terminated our study of community-acquired bacterial pneumonia prior to full recruitment. This decision was made for business reasons related to challenges in recruiting the study based on the current FDA guidance and recent information that the FDA’s guidance might change. The study was a double-blind randomized trial where patients with severe community-acquired pneumonia received intravenous treatment with JNJ-Q2 (twice daily) versus moxifloxacin (once daily), and were switched from IV to oral therapy as their conditions improved. Although we enrolled only 32 patients, the data from this small study gives us valuable qualitative information about the drug’s efficacy and tolerability in this very ill patient population. The results were encouraging, with a clinical cure rate (primary endpoint) of 87.5% for patients receiving JNJ-Q2 versus 81.3% of patients receiving moxifloxacin. The study was too small, however, to verify statistical significance (i.e., non-inferiority testing). For the secondary endpoint of clinical stability at day 4 (determined by patients’ vital signs and respiratory status) 50.0% of patients receiving JNJ-Q2 met the endpoint compared with 43.8% of patients receiving moxifloxacin. Both the IV and oral formulations of JNJ-Q2 had favorable tolerability and safety profiles, with no nausea or vomiting reported.

We believe that these Phase II clinical trial data for CABP, taken together with the excellent lung penetration data from our Phase I study, support Phase III-readiness for a CABP indication. We believe these data add value to the asset, in that the Phase III-readiness of JNJ-Q2 for two indications may provide a competitive advantage over other antibiotics in the development pipeline.

We indicated in the fourth quarter of 2011 that we were invited to submit a government contract proposal for research funding of JNJ-Q2 to the Biomedical Advanced Research and Development Authority, or BARDA. Although we had a productive pre-proposal meeting with BARDA, we have elected not to proceed with a contract proposal at present, because of limitations in government funding to support Phase III development.

We are continuing to seek to out-license JNJ-Q2. We plan to maintain the Phase III-readiness of the program, which should require minimal expenditures during 2012. We believe this drug has the potential to be valuable broad spectrum therapy for serious skin and lung infections.

PPD-10558 (Statin compound)

In December 2006, we entered into an exclusive license agreement with Ranbaxy Laboratories, Ltd., or Ranbaxy, for rights to PPD-10558 as a potential treatment for dyslipidemia, a condition characterized by high cholesterol. In December 2011, we announced top-line results from the Phase II trial of the investigational drug PPD-10558 in patients with a history of statin-associated myalgia, or SAM. PPD-10558 did not meet its primary efficacy endpoint in this study.

Based on these results, we have made a decision to discontinue further spending on the PPD-10558 program and plan to terminate our license agreement with Ranbaxy in accordance with the terms of the agreement. As part of the agreement, we will owe Ranbaxy a $1.0 million development milestone payment upon completion of the Phase II final study report, which we anticipate will occur in the second quarter of 2012.

9

Table of Contents

Marketed Products

Nesina (alogliptin) for Type II diabetes

Globally, as of 2010, it is estimated that there are 285 million people with diabetes. Type-2 diabetes comprises about 85%-95% of the total cases of diabetes. Worldwide sales of anti-diabetic treatments in 2010 were $34.4 billion.

Nesina, which is marketed by Takeda Pharmaceuticals Company Limited, or Takeda, is the trade name for alogliptin, a member of a relatively new class of drugs for the oral treatment of Type-2 diabetes. Nesina is a highly selective dipeptidyl peptidase-4, or DPP-4, inhibitor that slows the inactivation of hormones known as incretins, which play a major role in regulating blood sugar levels and might improve pancreatic function. Pivotal trials demonstrated that Nesina was well-tolerated when given as a single daily dose and it significantly improved glycemic control in Type-2 diabetes patients without raising the incidence of hypoglycemia. Additionally, Nesina has been shown to enhance glycemic control when used in combination with other commonly prescribed diabetes drugs.

We continue to see increasing sales of Nesina in Japan, with royalty revenues growing more than 64% over each of the last two quarters. Nesina was approved in Japan as monotherapy for Type-2 diabetes in 2010. In February 2011, additional indications for Nesina were approved in Japan for use in combination with sulfonylureas and use in combination with biguanides. In the third quarter of 2011, Takeda launched two dosages of Liovel, a fixed dose combination tablet of Nesina (alogliptin) and Actos (pioglitazone HCL), in Japan.

In July 2011, Takeda announced resubmission of the U.S. NDAs for alogliptin and alogliptin in fixed-dose combination with pioglitazone and a Prescription Drug User Fee Act, or PDUFA, action date of January 25, 2012 was assigned by the FDA. On November 18, 2011, Takeda announced that the PDUFA action date was delayed until April 25, 2012. If U.S. approval is granted, we would be eligible to receive a $25.0 million milestone payment as well as royalties and sales-based milestones. Also, Takeda announced that it had submitted an NDA in the U.S. for a fixed-dose combination of alogliptin and metformin, and that this application has a PDUFA action date in December 2012.

SYR-472 is part of the DPP-4 inhibitor portfolio that Takeda purchased from PPD and Syrrx in 2005. SYR-472 has the same mechanism of action as alogliptin. However, in contrast to alogliptin, which is a once-daily oral therapy, SYR-472 is a once-weekly oral formulation, which offers potential for greater convenience for diabetes patients. On September 8, 2011, Takeda announced that SYR-472 entered Phase III clinical trials in Japan for treatment of Type-2 diabetes. If SYR-472 is approved, then we would be eligible to receive royalty payments at the same rates as for Nesina. Under our agreement with Takeda, we would be entitled to receive milestone payments for SYR-472 or Nesina, whichever compound achieves the milestone(s) first.

Under our agreement with Takeda, we will be entitled to receive up to $45.0 million in future regulatory milestone payments ($25.0 million for U.S. approval, $10.0 million on regulatory filing for marketing authorization in the EU and $10.0 million for EU marketing authorization), and up to $33.0 million in sales-based milestone payments. In addition, we are entitled to receive payments on worldwide sales of Nesina based on royalty rates of 7% to 12% in the U.S., 4% to 8% in Europe and Japan and 3% to 7% in regions other than the U.S., Europe or Japan. These royalty payments are subject to a reduction of up to 0.5% for a portion of payments by Takeda to a licensor for intellectual property related to Nesina. Royalties are to be paid for the later of ten years following the first commercial sale or two years following the expiration of the last to expire patent. Takeda must pay us royalties for Liovel sales based on the proportion of Nesina’s average sales price compared to that of pioglitazone plus Nesina. We have no further financial obligation under this agreement.

10

Table of Contents

Priligy (dapoxetine) for premature ejaculation

Priligy is the trade name for dapoxetine, a drug in tablet form specifically indicated for the “on-demand” treatment of premature ejaculation, or PE. It is the first oral medication to be approved for this condition. The reported percentage of men affected with PE at some point during their lives ranges from 4% to 30%, depending on the methodology and criteria used. Priligy is a unique, short-acting, selective serotonin reuptake inhibitor, or SSRI, designed to be taken only when needed, one to three hours before sexual intercourse, rather than every day. Priligy has been studied in five randomized, placebo-controlled Phase III clinical trials involving more than 6,000 men with PE and is marketed in 15 countries in Europe, Asia-Pacific and Latin America. Additional clinical studies are being conducted on Priligy in the U.S. and abroad. We are enthusiastic about the potential for Priligy ex-U.S.; however, we cannot assure that the drug will be approved in the United States.

We are actively evaluating and pursuing the possibility of restructuring the existing agreement with Alza Corporation, or Alza, for Priligy, with the possibility of involving another collaborative partner. Any transaction might require that the Company negotiate additional out-licenses or collaborations, and could require additional external sources of financing.

We acquired Priligy from Eli Lilly and Company, or Lilly, and out-licensed it to Alza, and it is currently being marketed by Alza’s affiliate Janssen. Under our license agreement with Alza, we have the right to receive up to $15.0 million in additional regulatory milestone payments, up to $50.0 million in sales-based milestone payments, and sales-based royalties ranging from 10% to 20% for sales of patented products without generic competition and ranging from 10% to 17.5% for non-patented products without generic competition, in both cases the percentages rise as sales volumes increase, and a royalty of 7.5% for patented and non-patented products with generic competition regardless of sales volume based on the level of Priligy sales worldwide. We are obligated to pay Lilly a royalty of 5% on annual sales in excess of $800.0 million.

Priligy has been marketed in seven European countries since 2009: Germany, Spain, Italy, Portugal, Finland, Sweden and Austria. In January 2012, the European Commission endorsed the positive opinion adopted by the Committee for Human Medicinal Products for Priligy (dapoxetine) 30 mg and 60 mg doses. Pending national approvals, the marketing authorization for the Priligy doses can be granted in the 20 European Union Member States where the drug has not yet been approved (including the United Kingdom and France), as well as in Norway and Iceland.

11

Table of Contents

Our Drug Development Capabilities

The drug development capabilities of our executive officer team embodies over 50 years of research and development experience. This experience includes a deep understanding of the biological causes of human diseases and the factors that impact all aspects of successful drug development such as manufacturing, formulation, the cause of drug side effects, drug interactions and drug pharmacokinetics. We believe that our drug development capability and proven success rate will continue to provide a pipeline of unique compounds. Depending upon the availability of our development resources, our preclinical candidates might be added to our own internal clinical pipeline, or out-licensed to other companies for clinical development and commercialization.

Our Patents and Other Proprietary Rights

Patents and other proprietary rights are important to our business. It is our policy to seek patent protection for our assets, and also to rely upon trade secrets, know-how and licensing opportunities to develop and maintain our competitive position.

We own or have exclusively licensed 15 issued U.S. patents and have approximately 290 U.S. and non-U.S. pending patent applications. We have a policy to seek worldwide patent protection for our products and have foreign patent rights corresponding to most of our U.S. patents.

We license the rights to the following material patents related to our product candidates:

| • | MuDelta. Licensed from Janssen. The license continues as long as we meet our obligations to Janssen and we have marketing rights to the compound. As of December 31, 2011, 23 U.S. and foreign patents have been issued to Janssen in this patent family. Additional U.S. and foreign patent applications are still pending. |

| • | JNJ-Q2. Licensed from Janssen. The license continues as long as we meet our obligations to Janssen and we have marketing rights to the compound. As of December 31, 2011, 56 U.S. and foreign patents have been issued to Janssen in this patent family. Additional U.S. and foreign patent applications are still pending. |

Pursuant to the terms of the Uruguay Round Agreements Act, patents issued from applications filed on or after June 8, 1995, have a term of 20 years from the date of filing, no matter how long it takes for the patent to

12

Table of Contents

issue. Because patent applications in the pharmaceutical industry often take a long time to issue, this method of patent term calculation can result in a shorter period of patent protection afforded to us compared to the prior method of term calculation, which was 17 years from the date of issue. Our issued U.S. patents expire between 2023 and 2029, excluding any potential patent term extension available under U.S. federal law. We actively seek full patent term adjustment following allowance of a patent. We also actively seek patent term extensions following marketing approval. Under the Drug Price Competition and Patent Term Restoration Act of 1984 and the Generic Animal Drug and Patent Term Restoration Act of 1988, a patent that claims a product, use or method of manufacture covering drugs may be extended for up to five years to compensate the patent holder for a portion of the time required for FDA review.

While we file and prosecute patent applications to protect our inventions, our pending patent applications might not result in the issuance of patents or our issued patents might not provide competitive advantages. Also, our patent protection might not prevent others from developing competitive products using related or other technology.

In addition to seeking the protection of patents and licenses, we also rely upon trade secrets, know-how and continuing technological innovation, which we seek to protect, in part, by confidentiality agreements with employees, consultants, suppliers and licensees.

The scope, enforceability and effective term of issued patents can be highly uncertain and often involve complex legal and factual questions. No consistent policy has emerged regarding the breadth of claims in pharmaceutical patents, so that even issued patents might later be modified or revoked by the relevant patent authorities or courts. Moreover, the issuance of a patent in one country does not assure the issuance of a patent with similar claim scope in another country, and claim interpretation and infringement laws vary among countries, so we are unable to predict the extent of patent protection in any country. The patents we obtain and the unpatented proprietary technology we hold might not afford us significant commercial protection. Additional information regarding risks associated with our patents and other proprietary rights that affect our business is contained under the headings “We must protect our patents and other intellectual property rights to succeed” and “We might need to obtain patent licenses from others in order to manufacture or sell our potential products and we might not be able to obtain these licenses on terms acceptable to us or at all” under the heading “Risk Factors”.

Manufacturing and Supply

We currently rely on our collaborators and contract manufacturers to produce drug substances and drug products required for our clinical trials under current good manufacturing practices, with oversight by our internal managers. We plan to continue to rely upon contract manufacturers and collaboration partners to manufacture commercial quantities of our drug candidates if and when approved for marketing by the applicable regulatory agency. We generally rely on one manufacturer for the active pharmaceutical ingredient and another manufacturer for the formulated drug product for each of our drug candidate programs. At the early stage of clinical studies, we do not believe that we are substantially dependent on any supplier, or that additional manufacturers would be beneficial due the possibility of changes in the method of manufacturing of the drug candidate. As a drug candidate moves to later stages of development and the drug formulation method is established, we then seek additional manufacturers for the drug.

Sales and Marketing

We currently have no marketing, sales or distribution capabilities. We plan to rely on third party collaborators to market our products, like Alza for Priligy and Takeda for Nesina and related products, and therefore we are subject to the strategic marketing decisions of such third parties. We generally plan to out-license our commercial rights

13

Table of Contents

in a territory to a third party with marketing, sales and distribution capabilities in exchange for one or more of the following: up-front payments; research funding; development funding; milestone payments; and royalties on drug sales. In some instances, however, we might choose to develop our own staff for marketing, sales or distribution.

Government Regulation

The manufacturing, testing, labeling, approval and storage of our products are subject to rigorous regulation by numerous governmental authorities in the United States and other countries at the federal, state and local level, including the FDA. The process of obtaining approval for a new pharmaceutical product or for additional therapeutic indications within this regulatory framework requires expenditure of substantial resources and usually takes several years. Companies in the pharmaceutical and biotechnology industries, including us, have suffered significant setbacks in various stages of clinical trials, even in advanced clinical trials after promising results had been obtained in earlier trials.

The process for obtaining FDA approval of drug candidates customarily begins with the filing of an IND with the FDA for the use of a drug candidate to treat a particular indication. If the IND is accepted by the FDA, we would then start human clinical trials to determine, among other things, the proper dose, safety and efficacy of the drug candidate in the stated indication. The clinical trial process is customarily divided into three phases—Phase I, Phase II and Phase III. Each successive phase is generally larger and more time-consuming and expensive than the preceding phase. Throughout each phase we are subject to extensive regulation and oversight by the FDA. Even after a drug is approved and being marketed for commercial use, the FDA may require that we conduct additional trials, including Phase IV trials, to further study safety or efficacy.

As part of the regulatory approval process, we must demonstrate to the FDA the ability to manufacture a pharmaceutical product before we receive marketing approval. We and our manufacturing collaborators must conform to rigorous standards regarding manufacturing and quality control procedures in order to receive FDA approval. The validation of these procedures is a costly endeavor. Pharmaceutical manufacturers are subject to inspections by the FDA and local authorities as well as inspections by authorities of other countries. To supply pharmaceutical products for use in the United States, foreign manufacturers must comply with these FDA-approved guidelines. These foreign manufacturers are also subject to periodic inspection by the FDA or by corresponding regulatory agencies in these countries under reciprocal agreements with the FDA. Moreover, state, local and other authorities may also regulate pharmaceutical product manufacturing facilities. Before we are able to manufacture commercial products, we or our contract manufacturer, as the case may be, must meet FDA guidelines.

Both before and after marketing approval is obtained, a pharmaceutical product, its manufacturer and the holder of the Biologics License Application, or BLA, or NDA for the pharmaceutical product are subject to comprehensive regulatory oversight. The FDA may deny approval to a BLA or NDA if applicable regulatory criteria are not satisfied. Moreover, even if regulatory approval is granted, such approval may be subject to limitations on the indicated uses for which we may market the pharmaceutical product. Further, marketing approvals may be withdrawn if compliance with regulatory standards is not maintained or if problems with the pharmaceutical product occur following approval. In addition, under a BLA or NDA, the manufacturer of the product continues to be subject to facility inspections and the applicant must assume responsibility for compliance with applicable pharmaceutical product and establishment standards. Violations of regulatory requirements at any stage may result in various adverse consequences, which may include, among other adverse actions, withdrawal of the previously approved pharmaceutical product or marketing approvals or the imposition of criminal penalties against the manufacturer or BLA or NDA holder.

For the development of pharmaceutical products outside the United States, we and our collaborators are subject to foreign regulatory requirements and the ability to market a drug is contingent upon receiving marketing authorizations from the appropriate regulatory authorities. The requirements governing the conduct of

14

Table of Contents

clinical trials and marketing authorization vary widely from country to country. In countries other than European Union countries, foreign marketing authorizations are applied for at a national level. Within the European Union, procedures are available to companies wishing to market a product in more than one European Union member state. Clinical trial applications must be filed with the relevant regulatory authority in each country in which we would want to conduct a clinical trial. Assuming approval and the success of any clinical trial, we would then need to seek marketing approval for the drug. The process for obtaining marketing approval of drug candidates in the European Union begins with the filing with the European Medicines Agency, or EMA, of a Marketing Authorization Application, or MAA, for the use of a drug candidate to treat a particular indication. Similar processes and outcomes of such human clinical trials that are required by the FDA are also required by the EMA including testing for dose, safety and efficacy in three phases. Similar to the FDA, we are subject to extensive regulation and oversight by the European regulators throughout each phase. Even after a drug is approved and being marketed for commercial use, the EMA may require that we conduct additional trials, including Phase IV trials, to further study safety or efficacy. As a result, the EMA regulatory approval process includes all of the risks associated with FDA approval set forth above.

If and when necessary, we will choose the appropriate route of European or other international regulatory filing to accomplish the most rapid regulatory approvals. Requirements relating to manufacturing, conduct of clinical trials and product licensing vary widely in different countries, and the chosen regulatory strategy might not secure regulatory approvals or approvals of our chosen product indications. In addition, if a particular product to be used outside of the United States is manufactured in the United States, FDA requirements and U.S. export provisions will apply.

Outside of the United States, many countries require us to obtain pricing approval in addition to regulatory approval prior to launching the product in the approving country. We or our licensees may encounter difficulties or unanticipated costs or price controls in our respective efforts to secure necessary governmental approvals. Failure to obtain pricing approval in a timely manner or approval of pricing which would support an adequate return on investment or generate a sufficient margin to justify the economic risk might delay or prohibit the commercial launch of the product in those countries.

The marketing and sale of approved pharmaceutical product is subject to strict regulation. Promotional materials and activities must comply with the approving agency’s regulations and other guidelines. Physicians may prescribe pharmaceutical or biologic products for uses that are not described in a product’s labeling or differ from those approved by the approving agency. While such “off-label” uses are common and regulatory agencies do not regulate physicians’ choice of treatments, many approving agencies restrict a company’s communications on the subject of “off-label” use. Companies cannot promote approved pharmaceutical or biologic products for off-label uses. If any advertising or promotional activities we undertake fail to comply with applicable regulations or guidelines regarding “off-label” use, we may be subject to warnings or enforcement action.

Competition

The pharmaceutical industry is highly competitive. Many of our competitors are worldwide conglomerates with substantially greater resources than we have to develop and commercialize their drugs and drug candidates. Potential competitors have developed and are developing compounds for treating the same indications as our product candidates. In addition, a number of academic and commercial organizations are actively pursuing similar technologies, and several companies have developed or may develop technologies that might compete with our compounds.

Priligy, indicated for premature ejaculation, competes with Cromadyn, a generic paroxetine sold by More Pharmaceuticals in Mexico. Additional competition includes “off label” treatment with chronically dosed SSRIs (e.g. paroxetine, fluoxetine). We are aware of three other compounds in development for premature ejaculation: (1) PD502 (Phase III) novel formulation of lidocaine and prilocaine being developed by Shionogi that is administered topically (2) Zertane (Phase III) a re-purposed formulation of tramadol (a centrally acting oral opioid mu receptor agonist with serotonin and norepinephrine reuptake inhibitory activities), being developed ex-U.S. by Ampio Pharma, and (3) GSK-557296 (Phase II) an oxytocin receptor antagonist, being developed by GlaxoSmithKline.

15

Table of Contents

Nesina competes in the Type-2 diabetes space with three DPP4 inhibitors currently on the market, Bristol-Myers Squibb/AstraZeneca’s Onglyza® (saxagliptin), Boehringer Ingelheim/Lilly’s Tradjenta™ (linagliptin) and Merck’s Januvia® (sitagliptin). Merck also markets Janumet®, a fixed-dose combination of sitagliptin and metformin, Boehringer Ingelheim/Lilly, Jentadueto™, a combination of linagliptin and metformin, and Bristol-Myers Squibb/AstraZeneca, Kombiglyze®, a combination of saxagliptin and extended release metformin. Novartis markets the DPP4 inhibitor Galvus® (vildagliptin) and Eucreas® (vildagliptin/metformin) in Europe. Other marketed oral anti-diabetic competitors include generic metformin, generic sulfonylureas, and thiazolidinediones, including GlaxoSmithKline’s Avandia® (rosiglitazone) and Takeda’s Actos (pioglitazone). Generic competitors to Avandia and Actos are expected to enter the market in 2012.

The diabetes pipeline is crowded, with, to our knowledge, approximately 90 compounds in Phase I development, approximately 80 in Phase II development, and approximately 25 in Phase III development or preregistration. In addition to DPP4 inhibitors, competitors are also developing GLP-1 agonists, SGLT-2 antagonists, PPAR agonists, and compounds with other mechanisms for treatment of diabetes. Other companies with DPP4 inhibitors in clinical development of which we are aware include Amgen/Servier, Arisaph Pharmaceuticals, Dong-A Pharmaceuticals (South Korea), Dainippon Sumitomo Pharma, Phenomix, Glenmark Pharmaceuticals, Kyorin Pharmaceuticals, LG Life Sciences (South Korea), Mitsubishi Tanabe Pharma, and Sanwa Kagaku Kenkyusho (Japan).

If approved, JNJ-Q2 will compete with other fluoroquinolones currently on the market, including Johnson and Johnson’s Levaquin® (levofloxacin), Bayer/Merck’s Avelox® (moxifloxacin), Bayer/Merck’s Cipro® (ciprofloxacin), and Cornerstone Therapeutics’s Factive® (gemifloxacin). Generic versions of ciprofloxacin and levofloxacin are currently available, and generic versions of moxifloxacin will likely become available when the patents covering these products expire in 2014. If JNJ-Q2 is found to be effective against MRSA infections, it would compete with Pfizer’s Zyrox® (linezolid), Cubist’s Cubicin (daptomycin), Wyeth’s Tygacil (tigecycline), Theravance’s Vibativ® (telavancin), Forest’s Teflro ™ (ceftaroline), and the generic drug vancomycin.

Companies developing compounds to treat MRSA infections in clinical trials include Baselia, Nabriva, Trius, Paratek/Novartis, Cempra, Durata, Affinium, e-Therapeutics, FAB Pharma, Medicines Company, Novexel (now AstraZeneca), Phico Therapeutics, PolyMedix, Rib-X Pharmaceuticals, TaiGen, Theravance, and Wockhardt (India). The Rib-X and Wockhardt compounds are both fluoroquinolones. In addition, MerLion Pharmaceuticals is developing a fluoroquinolone in Phase II. Merck and Nabi Biopharmaceuticals are both developing vaccines against staphylococcus aureus.

If approved, MuDelta will compete with Lotronex® (alosetron), marketed by Prometheus Laboratories. Generic opiates and/or antispasmodic agents are also used for diarrhea predominant IBS: loperamide (Imodium®, an over the counter anti-diarrheal), diphenoxylate/atropine (an opiate/anticholinergic agent), and dicyclomine. The pipeline for diarrhea-predominant IBS includes: asimadoline, which is being developed by Tioga Pharmaceuticals and is in Phase III, rifaximin, an antibiotic approved product for hepatic encephalopathy that is the subject of a supplemental NDA, by Salix Pharmaceuticals; AST-120, currently in Phase II development by Ocera; ibodutant (NK 2 antagonist), currently in Phase II development by Menarini Group; ramosetron (a 5HT3 antagonist), currently in Phase II development by Astellas Pharma; dextofisopam, currently in Phase II development by Pharmos Corporation; and LX1031 (a serotonin synthesis inhibitor), currently in Phase II development by Lexicon Pharmaceuticals.

Competitors might succeed in more rapidly developing and marketing technologies and products that are more effective than our products or that would render our products or technology obsolete or noncompetitive. Our collaborators might also independently develop products that are competitive with products that we have licensed to them. Any product that we or our collaborators succeed in developing and for which regulatory approval is obtained must then compete for market acceptance and market share. The relative speed with which we and our collaborators can develop products, complete clinical testing and approval processes, and supply commercial quantities of the products to the market compared to competitive companies will affect market success. In addition, the amount of marketing and sales resources, and the effectiveness of the marketing used with respect to a product will affect its success. In addition, some clinical research organizations, or CRO, service providers and private equity funds are developing risk sharing models to finance the pharmaceutical industry’s pipeline. NovaQuest, a subsidiary of Quintiles Transnational, is active in this business. As these types of business models evolve, there will be increasing competition for compounds and funds that will affect our ability to add to our portfolio.

16

Table of Contents

Other competitive factors affecting our business generally include:

| • | product efficacy and safety; |

| • | timing and scope of regulatory approval; |

| • | product availability, marketing and sales capabilities; |

| • | reimbursement coverage; |

| • | the amount of clinical benefit of our product candidates relative to their cost; |

| • | method of and frequency of administration of any of our product candidates which may be commercialized; |

| • | patent protection of our product candidates; |

| • | the capabilities of our collaborators; and |

| • | the ability to hire qualified personnel. |

Employees

We have 24 full-time employees, a majority of whom are engaged in research and development activities. Our success depends in large part on our ability to attract and retain skilled and experienced employees. None of our employees are covered by a collective bargaining agreement. We consider our relations with our employees to be good.

| Item 1A. | Risk Factors |

Our business operations face a number of risks. These risks should be read and considered with other information provided in this report.

Risks Relating to Furiex’s Business

We anticipate that we will incur additional losses. We might never achieve or sustain profitability. If additional capital is not available, we might have to curtail or cease operations.

Our business has experienced significant net losses. We had net losses of $8.9 million, $54.7 million and $49.0 million in 2009, 2010 and 2011, respectively. The results for 2009 and 2010 included aggregate milestone payments of $5.0 million and $7.5 million, respectively. We did not receive any milestone payments during 2011. We will continue to incur additional net losses, as we continue our research and development activities and incur significant preclinical and clinical development costs, until revenues from all sources reach a level sufficient to support our ongoing operations. Because we or our collaborators or licensees might not successfully develop additional products, obtain required regulatory approvals, manufacture products at an acceptable cost or with appropriate quality, or successfully market products with desired margins, our expenses might continue to exceed any revenues we receive. Our commitment of resources to the continued development of our products might require significant additional funds for development. Our operating expenses also might increase if we:

| • | move our earlier stage potential products into later stage clinical development, which is generally a more expensive stage of development; |

| • | encounter problems during clinical development that require a change in scope and/or timelines resulting in higher costs; |

| • | pursue clinical development of our potential products in new indications; |

| • | increase the number of patents we are prosecuting or otherwise expend additional resources on patent prosecution or defense; |

| • | invest in or acquire additional technologies, product candidates or businesses, although we have no current agreements to do so; or |

| • | impair any of our investments in our product candidates. |

17

Table of Contents

In the absence of substantial licensing, milestone and other revenues from third-party collaborators, royalties on sales of products licensed under our intellectual property rights, future revenues from our products in development or other sources of revenues, we will continue to incur operating losses and might require additional capital to fully execute our business strategy. The likelihood of reaching, and time required to reach, sustained profitability are highly uncertain.

Although we expect that we will have sufficient cash to fund our operations and working capital requirements for at least the next 12 months based on current operating plans, we might need to raise additional capital in the future to:

| • | fund our research and development programs; |

| • | acquire complementary businesses or technologies; |

| • | respond to competitive pressures; or |

| • | commercialize our product candidates. |

Our future capital needs depend on many factors, including:

| • | the scope, duration and expenditures associated with our research and development programs; |

| • | continued scientific progress in these programs; |

| • | the outcome of potential licensing transactions, if any; |

| • | competing technological developments; |

| • | our proprietary patent position, if any, in our product candidates; |

| • | the regulatory approval process for our product candidates; and |

| • | the cost of attracting and retaining employees. |

We might seek to raise necessary funds through public or private equity offerings, debt financings or additional collaborations and licensing arrangements. We might not be able to obtain additional financing on terms favorable to us, if at all. General market conditions might make it difficult for us to seek financing from the capital markets. We might have to relinquish rights to our technologies or product candidates, or grant licenses on terms that are not favorable to us, in order to raise additional funds through collaborations or licensing arrangements. If adequate funds are not available, we might have to delay, reduce or eliminate one or more of our research or development programs and reduce overhead expenses, or restructure or cease operations. These actions might reduce the market price of our common stock.

18

Table of Contents

Our near-term revenue is largely dependent on the success of Nesina and Priligy as well as our other drug candidates, and we cannot be certain that our collaborators will be able to obtain regulatory approval for or commercialize any of these drug candidates.

We currently are relying on Nesina and Priligy to generate revenue. While Priligy is approved for marketing outside of the U.S., it has not been approved in the U.S. and the FDA issued a not approvable letter to our collaborative partner at the time, Janssen, in October 2005. We are investigating regulatory strategies for a potential refiling with the FDA. While Nesina is approved for marketing in Japan, Takeda, our collaborative partner, continues to seek approval in the U.S. and Europe. Takeda is performing a cardiovascular safety trial for alogliptin and has refiled its NDA with the FDA. A decision by the FDA is expected in the second quarter of 2012. The data from this cardiovascular safety trial might also impact the approval of Nesina by the EMA. We have also invested a significant amount of time and financial resources in the development of JNJ-Q2. FDA guidance for developing drugs to treat community-acquired bacterial pneumonia includes challenging requirements for the drug developer. Our future success might depend on our collaborator’s ability to successfully complete the Phase III trial for this pneumonia indication using JNJ-Q2 in view of the FDA guidelines. We have also invested a significant amount of time and financial resources in the development of MuDelta. Our future success might depend on our or our collaborator’s ability to successfully complete Phase III clinical trials for MuDelta. We anticipate that our success will depend largely on the receipt of regulatory approval and successful commercialization of these drug candidates. The future success of these drug candidates will depend on several factors, including the following:

| • | our ability to provide acceptable evidence of their safety and efficacy; |

| • | receipt of marketing approval from the FDA and any similar foreign regulatory authorities; |

| • | obtaining and maintaining commercial manufacturing arrangements with third-party manufacturers or establishing commercial-scale manufacturing capabilities; |

| • | collaborating with pharmaceutical companies or contract sales organizations to further develop, market and sell any approved drug; |

| • | acceptance of any approved drug in the medical community and by patients and third-party payors; and |

| • | successful review of the alogliptin NDA by the FDA leading to a marketing authorization. |

Many of these factors are beyond our control. Accordingly, we cannot assure you that we will be able to continue generating revenues through the sale of Priligy or Nesina or generate any revenue from the sale of other product candidates.

Our ability to continue to develop and commercialize our late stage product candidates depends on our ability to find new collaborators.

Our ability to succeed in our drug development business by advancing our late stage product candidates through Phase III clinical trials will depend on our ability to successfully find collaborators able to fund and execute late-stage development and commercialization of our product candidates. We generally conduct our drug development business in two stages. During the first stage, we in-license a product candidate from a collaborator and develop that candidate through Phase II clinical trials. If the product candidate successfully completes Phase II testing, we enter a second stage during which we seek a collaborator, which might be the same collaborator as in the first stage, for the continued late stage development and ultimate commercialization of the product candidate. Janssen, our original collaborator for JNJ-Q2 and MuDelta, has elected not to continue development of these two product candidates. If we cannot find a collaborator for final development and commercialization, we might not be able to complete the development and commercialization on our own due to the significant costs associated with these activities. As a result, we may not be able to recoup all or any part of our investment in the product candidate.

19

Table of Contents

Our milestone and royalty payments from collaborators and the successful development and marketing of our product candidates depends on our collaborators continuing to develop and commercialize the product candidates. If our collaborators are not successful or choose not to develop these compounds, we might not receive future payment.

The drug development industry is under increasing economic pressure. The third parties with which we collaborate might not perform their obligations as expected or they might breach or terminate their agreements with us or otherwise fail to conduct their collaborative activities successfully or in a timely manner. Further, parties collaborating with us who elect to develop a drug candidate might not devote sufficient resources to the development, manufacture, regulatory strategy and approvals, marketing or sale of these product candidates. If the parties to our collaborative agreements do not fulfill their obligations, elect not to develop a candidate or fail to devote sufficient resources to it, our business could be materially and adversely affected. In these circumstances, our ability to further develop potential products could be severely limited. While we generally seek non-compete terms in our agreements with our collaborators for the products we are developing, the enforcement of a non-compete can be expensive and difficult to monitor and enforce and might be subject to being invalidated by a court or judge.

We have agreements under which we rely on collaborators to manufacture our product candidates and essential components for those product candidates, design and conduct clinical trials, compile and analyze the data received from these trials, obtain regulatory approvals and, if approved, market these products. As a result, we may have limited or no control over the manufacturing, development and marketing of these potential products. In addition, the performance of our collaborators might not be sufficient or appropriate for regulatory review and approval for our product candidates. Further, we often rely on one manufacturer or other collaborator for such services, the loss of which could significantly delay the development of any of our product candidates. Our milestone and royalty payments rely on the performance of our collaborators and would be impacted by any delay or termination by our collaborators.

Our collaborators can terminate our collaborative agreements under certain conditions. A collaborator may terminate its agreement with us or separately pursue alternative products, therapeutic approaches or technologies as a means of developing treatments for the diseases targeted by us, or our collaborative effort. Even if a collaborator continues to contribute to the arrangement, it might nevertheless decide not to actively pursue the development or commercialization of any resulting products. In these circumstances, our ability to further develop potential products could be severely limited. While we generally seek non-compete terms in our agreements with our collaborators for the products we are developing, the enforcement of a non-compete can be expensive and difficult to monitor and enforce and might be subject to being invalidated by a court or judge.

Continued funding and participation by collaborators will depend on the continued timely achievement of our research and development objectives, the retention of key personnel performing work under those agreements and on each collaborator’s own financial, competitive, marketing and strategic capabilities and priorities. These considerations include:

| • | the commitment of each collaborator’s management to the continued development of the licensed products or technology; |

| • | the relationships among the individuals responsible for the implementation and maintenance of the development efforts; and |

| • | the relative advantages of alternative products or technology being marketed or developed by each collaborator or by others, including their relative patent and proprietary technology positions, and their ability to manufacture potential products successfully. |

The willingness of our existing collaborators to continue development of our potential products and our ability to enter into new relationships depends upon, among other things, our patent position with respect to such products. If we are unable to successfully obtain and maintain patents, we might be unable to collect royalties on existing licensed products or enter into additional agreements.

20

Table of Contents

In addition, our collaborators might independently develop products that are competitive with products that we have licensed to them. This could reduce our revenues or the likelihood of achieving revenues under our agreements with these collaborators.

If we are unable to enter into agreements with third parties to market and sell our drug candidates or are unable to establish our own sales and marketing capabilities, we might be unable to generate product revenue.

We do not currently have the resources to sell, market or distribute any pharmaceutical products. In order to market any of our products that receive regulatory approval, we must make arrangements with third parties to perform these services, or build our sales, marketing, managerial and other non-technical capabilities. If we are unable to do so, we might not be able to generate product revenue and might not become profitable.

We might obtain future financing through the issuance of debt or equity or other forms of financing, which might have an adverse effect on our shareholders or otherwise adversely affect our business.

If we raise funds through the issuance of debt or equity or other forms of financing, any debt securities or preferred stock issued will have rights, preferences and privileges senior to those of holders of our common stock in the event of liquidation. In such event, there is a possibility that once all senior claims are settled, there might be no assets remaining to pay out to the holders of our common stock. In addition, if we raise funds through the issuance of additional equity, whether through private placements or public offerings, such an issuance would dilute the ownership of our then current shareholders.

The terms of debt securities might also impose restrictions on our operations, which might include limiting our ability to incur additional indebtedness, to pay dividends on or repurchase our capital stock, or to make certain acquisitions or investments. In addition, we might be subject to covenants requiring us to satisfy certain financial tests and ratios, and our ability to satisfy such covenants may be affected by events outside of our control.

Our operating expenses and results and any revenue likely will fluctuate in future periods.

Our revenues and expenses are unpredictable and likely will fluctuate from quarter to quarter due to, among other things, the timing and the unpredictable nature of clinical trials and related expenses, including payments owed by us and to us under collaborative agreements for reimbursement of expenses, future milestone revenues under collaborative agreements, sales of Priligy and Nesina and any future sales of other products. In addition, the recognition of clinical trial and other expenses that we otherwise would recognize over a period of time under applicable accounting principles might be accelerated or expanded in certain circumstances. In such a case, it might cause our expenses during that period to be higher than they otherwise would have been had the circumstances not occurred. For example, if we terminate a clinical trial for which we paid non-refundable upfront fees to a clinical research organization and in which we did not accrue all of the patient costs, the recognition of the expense associated with those fees that we were recognizing as we accrued patient costs would be accelerated and recognized in the period in which the termination occurred.

We are dependent on the performance of service providers.

We rely on service providers, such as contract manufacturers, clinical research organizations, medical institutions and clinical investigators, including physician sponsors, to conduct nearly all of our clinical trials, including recruiting and enrolling patients in the trials. In connection with the spin-off, we entered into a Master Development Services Agreement with PPD pursuant to which PPD provides us clinical development services at discounted rates on a preferred provider basis. If PPD or any of these other parties do not successfully carry out their contractual duties or meet expected deadlines, we might be delayed or may not obtain regulatory approval for or be able to commercialize our product candidates. If any of the third parties upon whom we rely to conduct our clinical trials do not comply with applicable laws, successfully carry out their obligations or meet expected deadlines, our clinical trials might be extended, delayed or terminated.

21

Table of Contents

If the quality or accuracy of the clinical data obtained by third party contractors is compromised due to their failure to adhere to applicable laws or our clinical protocols, or for other reasons, we might not obtain regulatory approval for or successfully commercialize any of our product candidates. If our relationship with any of these organizations or individuals terminates, replacing any of these third parties could delay our clinical trials and could jeopardize our ability to obtain regulatory approvals and commercialize our product candidates on a timely basis, if at all.

Risks Relating to Our Operations

We might not successfully operate the compound partnering business as an independent entity.