Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Chesapeake Lodging Trust | d311629d8k.htm |

Investor

Presentation March 2012

Exhibit 99.1 |

Disclaimer

1

We make forward-looking statements in this presentation that are subject to risks and

uncertainties. These forward-looking statements include information about possible or assumed future results

of our business, financial condition, liquidity, results of operations, plans and objectives.

When we use the words “believe,” “expect,” “anticipate,” “estimate,” “plan,” “continue,” “intend,” “should,”

“may” or similar expressions, we intend to identify forward-looking statements.

Statements regarding the following subjects, among others, may be forward-looking by their nature: our business

and investment strategy, including our ability to identify suitable properties to acquire; our

forecasted operating results; completion of any pending transactions; projected capital expenditures; our

ability to obtain adequate debt or equity financing to complete acquisitions and to maintain

future financing arrangements; market trends in our industry, interest rates, real estate values, the debt

securities markets or the general economy; our expected leverage levels; our expectations

regarding future distributions to shareholders; and our expectations for economic trends and recoveries,

and the impact of those on the lodging industry generally and the market segments in which we

operate, in particular. The forward-looking statements are based on our

beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. You should not place

undue reliance on these forward-looking statements. These beliefs, assumptions and

expectations can change as a result of many possible events or factors, not all of which are known to us. If a

change occurs, our business, financial condition, liquidity and results of operations may vary

materially from those expressed in our forward-looking statements. Additionally, the following factors

could cause actual results to vary from our forward-looking statements:

changes in our business or investment strategy;

availability to us, and the terms of, capital for use in our future growth;

our ability to reach agreement with prospective sellers and acquire additional hotels on

favorable terms or at all; the extent to which the general U.S. or international

economy recovers, and the resultant effect on our industry and the market segments in which we operate;

the degree and nature of our competition;

availability of and our ability to retain qualified personnel;

our ability to maintain our qualification as a REIT;

general volatility of the capital markets and the market price of our common shares;

actions and initiatives of the U.S. government, changes to U.S. government policies and

the execution and impact of these actions, initiatives and policies; changes in

interest rates; and the other factors discussed in our Form 10-K filed with

the Securities and Exchange Commission on February 24, 2012, including those set forth under the sections titled “Risk factors” and

“Management’s discussion and analysis of financial condition and results of

operations.” Any forward-looking statement speaks only as of the date

on which it is made. Except as required by law, we are not obligated to, and do not intend to, publicly update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise.

This presentation contains statistics and other data that has been obtained or compiled

from information made available by third-party service providers. |

2

What Makes Us Different

Focused and disciplined acquisition strategy has built a portfolio with a significant

discount to replacement cost and strong current yields

Newly built or “like new”

hotels (renovated by previous owner) will drive upside

performance without meaningful execution risk

Additional growth from value-add, ROI projects in key hotels

Intense asset management with predominantly independent management

companies will continue to drive RevPAR gains and margin expansion

Well-located, urban portfolio will significantly outperform industry with EBITDA

concentration in the strongest U.S. markets with very limited new supply on the

horizon

Significant free cash flow from combination of strong balance sheet with modest

leverage and high-yielding assets translates into a meaningful and reliable dividend

|

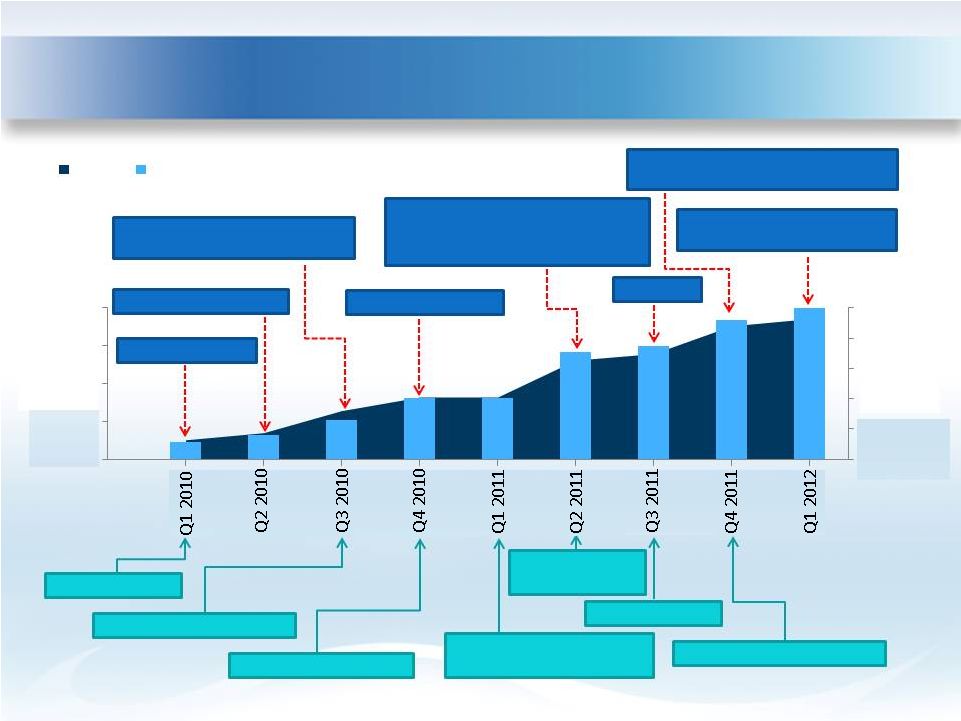

What We’ve

Done 3

$0

$200

$400

$600

$800

$1,000

0

1,000

2,000

3,000

4,000

Rooms

Invested Capital (Millions)

Hyatt Regency Boston

Hilton Checkers Los Angeles

Le Meridien

San Francisco

W

Chicago

-

City

Center

Homewood Suites Seattle Convention Center

Hotel Indigo San Diego Gaslamp Quarter

Courtyard Washington Capitol Hill/Navy Yard

Hotel

Adagio

Denver Marriott City Center

Holiday

Inn

New

York

City

Midtown

-

31

Street

st

IPO $169.4MM Net

Equity Raise $140.4MM Net

Secured Credit Facility $115.0MM

Amended Credit Facility

$150.0MM

Equity Raise $229.8MM Net

Amended Credit Facility $200.0MM

CMBS Loan $37.5MM

CMBS Loan $95.0MM

Term Loan $130.0MM

Boston Marriott Newton

Courtyard Anaheim at Disneyland Resort

Hyatt Place New York Midtown

South (Under Contract) |

Portfolio

Overview – Segmentation

4

Geographic

Boston

25%

San Francisco

14%

Denver

17%

Los Angeles

9%

NYC

8%

San Diego

6%

DC

6%

Seattle

5%

Chicago

10%

Marriott

38%

Starwood

20%

Hyatt

18%

Hilton

10%

IHG

9%

Independent

5%

Brand

Marriott

16%

Evolution

14%

Hyatt

13%

TPG

12%

Crestline

11%

HEI

10%

Starwood

10%

RHG

8%

IHG

6%

Management

Group

27%

Transient

69%

Contract

4%

Customer

Note: Geographic, brand and management segmentation based on room count and includes

CLT’s prospective acquisition of the Hyatt Place New York Midtown South. Customer

segmentation is based on room nights sold for the year ended December 31, 2011 for the 11 hotels as if owned for the

full

year

(excludes

Holiday

Inn

New

York

City

Midtown

–

31 Street

and

Hyatt

Place

New

York

Midtown

South).

st |

Portfolio

Overview – Top 15 Markets

5

Los Angeles

Seattle

San Francisco

San Diego

Denver

Chicago

DC

New York

Boston

Anaheim

Philadelphia

Orlando

Miami

New Orleans

CLT Top 15 Market

Other Top 15 Market

Note: Oahu Island, HI not shown. |

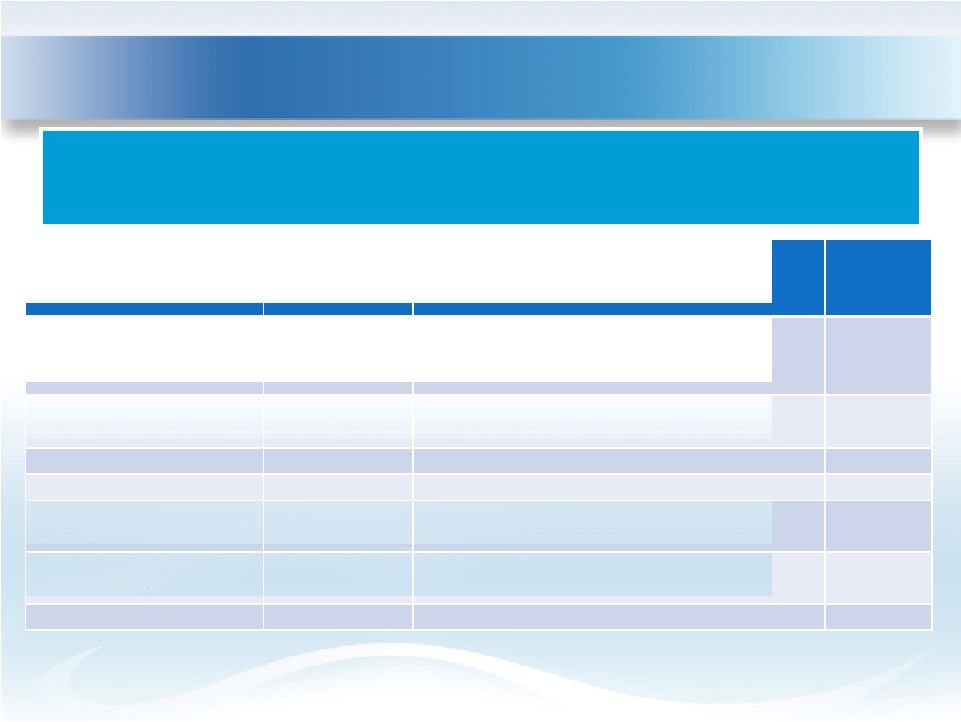

Portfolio

Overview – Summary

6

______________________________

(1)

2011 Pro Forma

EBITDA

Yield

includes

operating

results

for

the

year

ended

December

31,

2011

as

if

owned

for

the

full

period.

For

the

Holiday

Inn

New

York City

Midtown –

31

Street and Hyatt Place New York Midtown South, 2011 Pro Forma EBITDA Yield is based on

projected first year EBITDA. (2)

Estimated replacement cost of the portfolio is $355,000 -

$375,000 per key.

st

Price

Price Per Key

2011 Pro Forma

Hotel

Location

Interest

Rooms

(Millions)

(Thousands)

EBITDA Yield

(1)

Hyatt Regency Boston

Boston, MA

Fee Simple

502

$112.0

$223.0

11.0%

Hilton Checkers Los Angeles

Los Angeles, CA

Fee Simple

188

46.0

245.0

8.5%

Boston Marriott Newton

Newton, MA

Fee Simple

430

77.3

180.0

10.0%

Courtyard Anaheim at Disneyland Resort

Anaheim, CA

Fee Simple

153

25.0

163.0

9.2%

Le Meridien San Francisco

San Francisco, CA

Fee Simple

360

143.0

397.0

7.2%

Homewood Suites Seattle Convention Center

Seattle, WA

Fee Simple

195

53.0

272.0

7.7%

W Chicago -

City Center

Chicago, IL

Fee Simple

368

128.8

350.0

7.2%

Hotel Indigo San Diego Gaslamp Quarter

San Diego, CA

Fee Simple

210

55.5

264.0

5.6%

Courtyard Washington Capitol Hill / Navy Yard

Washington, DC

Fee Simple

204

68.0

333.0

7.4%

Hotel Adagio

San Francisco, CA

Fee Simple

171

42.3

247.0

6.9%

Denver Marriott City Center

Denver, CO

Fee Simple/Ground Lease

613

119.0

194.0

8.8%

Holiday

Inn

New

York

City

Midtown-31

Street

st

New York, NY

Fee Simple

122

52.2

428.0

8.2%

Hyatt Place New York Midtown South

New York, NY

Fee Simple

185

76.2

412.0

8.8%

Portfolio

(2)

3,701

$998.2

$269.7

8.3% |

Portfolio

Overview – Markets

Geographically diversified among the top producing markets in the country with over

50% of EBITDA concentrated in the top 5 markets

Urban locations minimize supply risk and offer numerous demand generators

Gateway markets provide balanced customer mix of domestic and international

travelers, corporate business and convention and group business

Strategically located properties in the strongest performing and

most desirable downtown

areas in the top U.S. markets

7

Le Meridien San Francisco

Note: Market

segmentation

based

on

pro

forma

EBITDA

for

the

year

ended

December

31,

2011,

which

includes

actual

operating

results

for

11

hotels

as

if

owned

for

the

full

year

and

projected

first

year

EBITDA

for

the

Holiday

Inn

New

York

City

Midtown

–

31

st

Street

and

Hyatt

Place

New York Midtown South.

Boston

24%

San Francisco

16%

NYC

13%

Denver

13%

Chicago

11%

Los Angeles

8%

DC

6%

Seattle

5%

San Diego

4% |

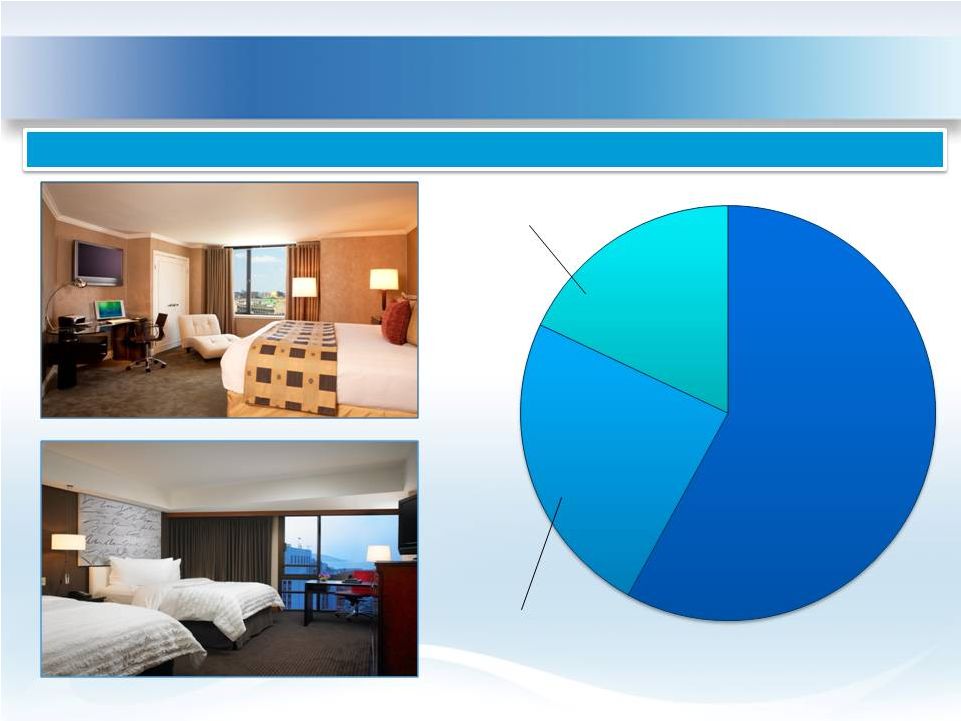

Portfolio

Overview – Asset Quality

CLT’s assets are new construction or have

already been renovated to “like new”

product

Superior quality, well-maintained assets

mitigate downside risk

Substantial prior owner capital investment

positions assets for growth and eliminates

execution risk

24% of the portfolio is ground up

construction completed within the last six

years

8

W Chicago -

City Center

Hotel Indigo San Diego Gaslamp Quarter |

Portfolio

Overview – Asset Quality

9

Hyatt Regency Boston

Le Meridien San Francisco

W Chicago -

City Center

Boston Marriott Newton

Denver Marriott City Center

Le Meridien San Francisco

Homewood Suites Seattle

Hilton Checkers Los Angeles

Courtyard Anaheim at Disneyland Resort

Hotel Indigo San Diego Gaslamp Quarter

Courtyard Washington Capitol Hill/Navy Yard

Holiday

Inn

New

York

City

Midtown-31

Street

Hyatt Place New York Midtown South

Note:

Based on room count.

58%

24%

18%

Prior Owner

Renovation

New Construction

Under

Renovation

Hotel Adagio (Full Repositioning)

Hyatt Regency Boston (Lobby & Bar)

st

82% of CLT’s portfolio is new or recently renovated “like new”

prior to acquisition |

Portfolio Overview

– Prior Owner Invested Capital

CLT’s portfolio benefits from recent capital investment and renovations completed by

previous owners, providing attractive upside with minimal near-term capital needs

and operational disruption

10

Hotel

Prior Owner

Invested Capital

(Millions)

Scope

Completion

W Chicago - City Center

$30.8

Guestrooms and 4-pipe HVAC system, lobby,

restaurant, lounge, meeting space and public

spaces

2010

Boston Marriott Newton

22.0

Guestrooms and 4-pipe HVAC system, lobby,

restaurant, lounge, meeting space and exterior

2010

Denver Marriott City Center

13.7

Guestrooms, meeting space and public space

2010

Le Meridien San Francisco

9.9

Guestrooms, lobby and lounge

2009

Homewood Suites Seattle

Convention Center

9.2

Conversion to Homewood Suites brand,

guestrooms and public space

2008

Hilton Checkers Los Angeles

4.0

Guestrooms, meeting space, public space,

restaurant and lounge

2009

Total

$89.6

$41,600/Key of Prior Owner Invested Capital |

Portfolio

Overview – Internal Growth Drivers

11

Several projects have been identified throughout the portfolio to drive incremental

growth and continued outperformance of the industry

______________________________

(1)

$8.5 million is expected to be funded through existing furniture, fixtures and equipment

(FF&E) or property improvement (PIP) reserves held by our hotel operators and

lenders. Hotel

Projects

Capital (Millions)

(1)

Est. Completion

Hotel Adagio

Renovation and repositioning

1,000 SF of additional meeting space

$6.9

Q3 2012

W Chicago -

City Center

21

st

and 22

nd

floor renovations

35 additional guestrooms

7.8

Q4 2012

Hyatt Regency Boston

Lobby, lobby lounge, presidential suite and meeting

space

renovation

4 additional guestrooms

3.8

Q1 2012

Le Meridien San Francisco

Lobby repositioning including expanded bar operation

3.6

Q3 2012

Denver Marriott City Center

Restaurant, lobby lounge and meeting space renovation

5,000 SF of additional meeting space

3.0

Q3 2012

Hilton Checkers Los Angeles

Presidential suite renovation, relocation of fitness center

and creation of the hotel's premiere penthouse suite

3 additional guestrooms

0.9

Q3 2012

Hotel Indigo Gaslamp Quarter

Creation of rooftop bar

0.5

Q2 2012

Holiday Inn New York City

Midtown-31

st

Street

Creation of rooftop bar

0.4

Q2 2012

Total

$26.9 |

Hotel Adagio

Repositioning 12

Full repositioning of the Hotel Adagio including redesigned guestrooms, lobby, lounge,

restaurant and meeting space with a Q3 2012 expected completion date

Strong value creation from developing additional meeting space and shrinking the $40

per night rate gap with the market leader |

W Chicago

– City Center Rooms Expansion

13

Conversion of the

vacant 21 and 22

floors to 35 new

guestrooms at an

estimated $220,000

per key cost with a

Q4 2012 expected

completion date

New guestrooms

will be significantly

larger than the

existing standard

rooms, commanding

rate premiums and

delivering an IRR of

approximately 20%

st

nd |

Value-Add

Capital Projects 14

Hotel Indigo San Diego Gaslamp

Quarter –

Rooftop bar

Holiday Inn New York City Midtown-31

st

Street –

Rooftop bar |

Hyatt

Regency Boston – Lobby, lobby lounge,

presidential suite and meeting space

renovation and four new guestrooms

Value-Add Capital Projects

15

Le Meridien San Francisco –

Lobby and lobby lounge

expansion and repositioning |

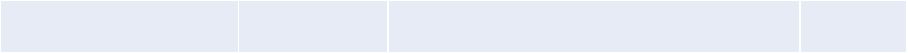

Portfolio

Overview – Peer Comparison

16

78.1%

77.6%

77.6%

76.4%

75.2%

74.3%

72.6%

72.1%

72.0%

2011 Occupancy

$228

$203

$193

$180

$179

$175

$167

$164

$129

2011 ADR

Source:

Based

on

most

recent

company

press

releases

and

SEC

filings;

CLT

Portfolio

is

pro

forma

actual

for

11

hotels

as

if

owned

for

the

full

year

(excludes

Holiday

Inn

New

York

City

Midtown-31

st

Street

and

Hyatt

Place

New

York

Midtown

South);

and

CLT

Full

Service

is

pro

forma

actual

for

the

eight

full

service

hotels

as

if

owned

for

the

full

year

(excludes

Holiday

Inn

New

York

City

Midtown-31

st

Street). |

Portfolio

Overview – Peer Comparison

17

$166

$159

$148

$139

$136

$130

$124

$123

$93

2011 RevPAR

12.7%

10.6%

10.3%

9.1%

7.2%

6.3%

6.2%

6.1%

5.2%

2011 RevPAR Change

Source:

Based

on

most

recent

company

press

releases

and

SEC

filings;

CLT

Portfolio

is

pro

forma

actual

for

11

hotels

as

if

owned

for

the

full

year

(excludes

Holiday

Inn

New

York

City

Midtown-31

st

Street

and

Hyatt

Place

New

York

Midtown

South);

and

CLT

Full

Service

is

pro

forma

actual

for

the

eight

full

service

hotels

as

if

owned

for

the

full

year

(excludes

Holiday

Inn

New

York

City

Midtown-31

st

Street). |

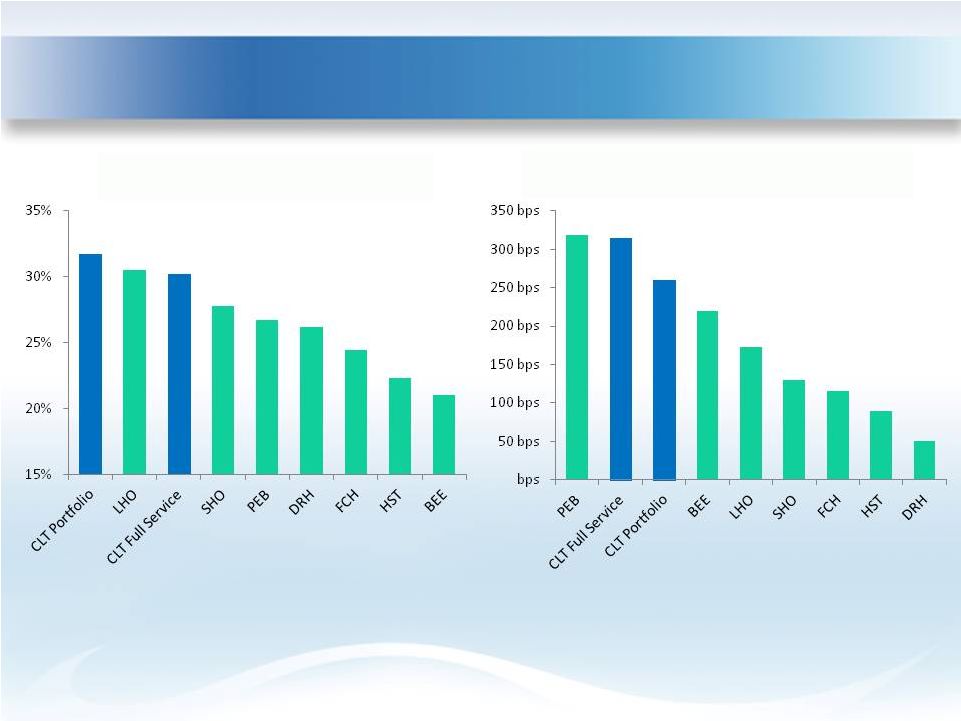

Portfolio

Overview – Peer Comparison

18

Source:

Based

on

most

recent

company

press

releases

and

SEC

filings;

CLT

Portfolio

is

pro

forma

actual

for

11

hotels

as

if

owned

for

the

full

year

(excludes

Holiday

Inn

New

York

City

Midtown-31

st

Street

and

Hyatt

Place

New

York

Midtown

South);

and

CLT

Full

Service

is

pro

forma

actual

for

the

eight

full

service

hotels

as

if

owned

for

the

full

year

(excludes

Holiday

Inn

New

York

City

Midtown-31

st

Street).

31.7%

30.5%

30.2%

27.8%

26.7%

26.2%

24.4%

22.3%

21.0%

2011 Hotel EBITDA Margin

318

315

260

220

173

130

116

90

51

2011 Hotel EBITDA Margin Change |

Portfolio

Overview – Peer Comparison

19

Source:

Based

on

most

recent

company

press

releases

and

SEC

filings;

CLT

Portfolio

is

pro

forma

actual

for

11

hotels

as

if

owned

for

the

full

year

(excludes

Holiday

Inn

New

York

City

Midtown-31

st

Street

and

Hyatt

Place

New

York

Midtown

South);

and

CLT

Full

Service

is

pro

forma

actual

for

the

eight

full

service

hotels

as

if

owned

for

the

full

year

(excludes

Holiday

Inn

New

York

City

Midtown-31

st

Street).

2011 Hotel EBITDA/Room

(Thousands) |

Acquisition

Strategy 20

Market

Asset

Brand

Return

Urban, Central Business District/Downtown locations in the top 15 MSAs

with high barriers-to-entry and superb positioning proximate to the

market’s strongest demand generators

Current focus markets are Miami, Chicago and Los Angeles where CLT has

limited or no exposure

Upper-upscale, full-service hotels that are either new construction or have

been renovated to “like new”

condition

Under positioned or branded assets with material upside through capital

investment will be cautiously targeted

On a limited basis, premium select-service hotels in Central Business

District/Downtown or unique locations

Longstanding and deep partnerships with the world’s most recognized and

respected brands including: Hyatt Hotels, Marriott International, Starwood

Hotels & Resorts Worldwide, Hilton Worldwide and InterContinental Hotels

Group

Investment focus on generating immediate returns for shareholders with

strong in-place cash-on-cash yields, below replacement cost pricing,

conservative cash flow growth expectations producing 5-year, unleveraged

IRRs in the 10%-11% range utilizing responsible exit cap rates and significant

remaining upside |

Long-Term

Debt 21

Clean balance sheet with no legacy issues

Prudent use of leverage that fits with

lodging industry’s cyclical and volatile

nature and debt structure is designed to

provide capacity and flexibility

Appropriate use of debt based on the

following considerations:

Balance mix of short-term vs. long-term to

stagger maturities

Proper mix of fixed vs. variable rate debt

given current interest rate environment

Expectations/timing regarding stabilization

of hotel cash flows

Lowest average cost of borrowing

compared to publicly traded lodging REIT

peers

Denver Marriott City Center |

Long-Term

Debt 22

(1)

Leverage and Fixed Charge Coverage are calculated as defined under our revolving credit

facility. As of 12/31/2011

(1)

Leverage

43%

Fixed Charge Coverage

3.1x

Weighted Avg. Rate

4.5%

$0.0

$0.0

$275.0

$0.0

$131.7

$0.0

$0

$100

$200

$300

2012

2013

2014

2015

2016

2017

Debt Maturities

(Millions)

Floating

Rate Debt

36%

Fixed

Rate Debt

64%

Debt Structure

Weighted Avg. Rate

5.0%

Weighted Avg. Rate

3.6% |

Long-Term

Debt – Peer Comparison

23

Low leveraged company with the lowest cost of borrowing among peers

Note:

Weighted average cost of borrowing includes cost of debt and preferred equity.

Source:

Most recent company SEC filings and R.W. Baird. Trailing 12 month fixed charge coverage as of

December 31, 2011. Trailing 12 Month Fixed Charge

Coverage

Weighted Average Cost of

Borrowing |

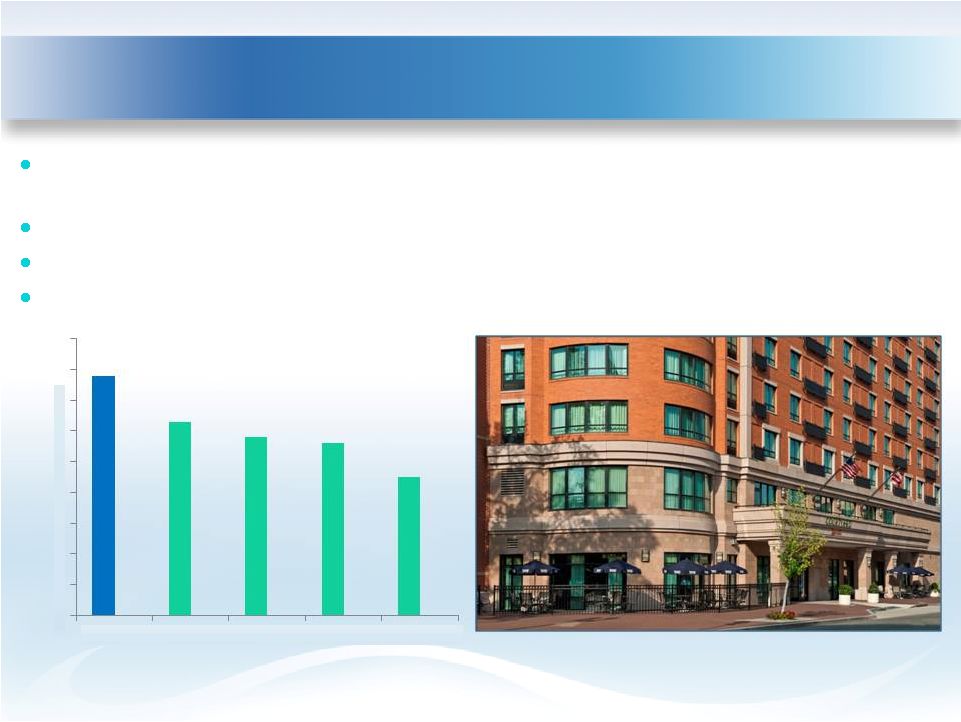

Dividend

– Overview

24

Acquisition of hotels with strong going-in yields has allowed CLT to distribute

significant free cash flows to shareholders and pay a recurring and consistent

dividend Increased dividend by 10% to $0.22 per share in Q1 2012 (5% annualized

yield) One of the highest dividend yields amongst lodging REITs

Well covered dividend and targeted 70% -

75% payout of cash available for distribution

Source:

Based

on

most

recent

company

press

releases

and

SEC

filings;

CLT

is

based

on

2011

Pro

Forma

AFFO

(see

Exhibit

1

to

this

presentation

for

reconciliation of this non-GAAP financial measure). AFFO Yield is calculated as AFFO as a

percentage of market capitalization as of March 1, 2012. Courtyard Washington Capitol

Hill / Navy Yard 7.8%

6.3%

5.8%

5.6%

4.5%

0%

1%

2%

3%

4%

5%

6%

7%

8%

9%

CLT

DRH

HST

LHO

PEB

2011 AFFO Yield |

st

2012 Outlook

25

___________________________________

(1)

2011 Pro Forma includes actual operating results for 11 of the 12 hotels owned as of December

31, 2011 as if owned for the full year and includes projected first year

results

for

the

Holiday

Inn

New

York

City

Midtown

-

31

Street.

(2)

See Exhibit 1 to this presentation for reconciliation of non-GAAP financial

measures. (Millions, except per share)

2011

2011

2012

Actual

Pro Forma

(1)

Guidance

Pro Forma RevPAR Change

9.1%

6.5% - 8.5%

Total Revenue

$172.2

$233.3

$251.9 - $256.9

Adjusted Hotel EBITDA

(2)

$56.0

$74.7

$82.3 - $85.6

Adjusted Hotel EBITDA Margin

(2)

32.5%

32.0%

32.7% - 33.3%

AFFO

(2)

$32.7

$44.5

$49.6 - $52.5

AFFO/Share

$1.11

$1.40

$1.55 - $1.64 |

Favorable

Valuation 26

____________________________

(1)

Enterprise value based on pro forma debt and market capitalization as of March 1, 2012.

Based on current multiples of primary peers, CLT’s 2012 guidance implies approximate

trading value of $21.00 to $23.00 per share

CLT’s approximate 9% 2012 EBITDA yield on hotel investments represents a significant

discount to current transaction cap rates

CLT’s current valuation

(1)

indicates the portfolio is trading at approximately $280,000

per key, or only a 4% premium over its cost basis of $270,000 per key

CLT’s current valuation

(1)

indicates the portfolio is trading at a 21% to 25% discount to

estimated replacement cost of $355,000 to $375,000 per key

CLT currently trading at favorable valuation relative to peers amidst strong expected

performance and attractive acquisitions to date |

27

What Makes Us Different

Well-located, urban portfolio will significantly outperform industry with EBITDA

concentration in the strongest U.S. markets with very limited new supply on the

horizon

Newly built or “like new”

hotels (renovated by previous owner) will drive upside

performance without meaningful execution risk

Additional growth from value-add, ROI projects in key hotels

Intense asset management with predominantly independent management

companies will continue to drive RevPAR gains and margin expansion

Focused and disciplined acquisition strategy has built a portfolio with a significant

discount to replacement cost and strong current yields

Significant free cash flow from combination of strong balance sheet with modest

leverage and high-yielding assets translates into a meaningful and reliable dividend

|

28

|

29

Exhibit 1 –

Non-GAAP Financial Measure Reconciliation

___________________________________

(1)

2011 Pro Forma includes actual operating results for 11 of the 12 hotels owned as of December

31, 2011 as if owned for the full year and includes projected first year

results

for

the

Holiday

Inn

New

York

City

Midtown

-

31

Street.

(2)

Includes non-cash amortization of ground lease asset, deferred franchise costs, and

unfavorable contract liability. (3)

Includes non-cash amortization of ground lease asset, deferred franchise costs,

unfavorable contract liability, and air rights contract. Note: Amounts

in

millions,

except

per

share

amounts,

and

may

not

sum

due

to

rounding.

Margins

and

per

share

amounts

are

calculated

on

amounts

before

rounding.

2011 Pro

2012 Guidance

2011 Actual

Forma

(1)

Low

High

ADJUSTED

HOTEL

EBITDA

AND

ADJUSTED

HOTEL

EBITDA

MARGIN:

Total revenue

$ 172.2

$

233.2

$ 251.9

$

256.9 Less:

Total hotel operating expenses

116.1

158.5

169.3

171.0

Hotel EBITDA

56.1

74.7

82.6

85.9

Less:

Non-cash

amortization

(2)

(0.1)

-

(0.3)

(0.3)

Adjusted Hotel EBITDA

$

56.0

$

74.7

$

82.3

$

85.6 Adjusted Hotel EBITDA Margin

32.5%

32.0%

32.7%

33.3%

AFFO:

Net income available to common shareholders

$

8.8

$

11.2

$

19.2

$

22.1 Add:

Depreciation and amortization

18.4

27.7

27.7

27.7

FFO available to common shareholders

27.2

38.9

46.9

49.7

Add:

Hotel acquisition costs

5.1

5.1

2.5

2.5

Non-cash

amortization

(3)

0.5

0.5

0.2

0.2

AFFO available to common shareholders

$

32.7

$

44.5

$

49.6

$

52.5 AFFO per diluted common share

$

1.11

$

1.40

$

1.55

$

1.64 Weighted-average number of diluted common shares outstanding

29.4

31.8

31.9

31.9

st |