Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K RE EARNINGS RELEASE - AutoWeb, Inc. | form8k_03012012.htm |

| EX-99.1 - EX 99.1 - PRESS RELEASE RE EARNINGS RELEASE - AutoWeb, Inc. | ex99_1.htm |

Exhibit 99.2

AUTOBYTEL INC

Moderator: Roger Pondel

March 1, 2012

5:00 p.m. ET

|

Operator:

|

Good day, ladies and gentlemen, and thank you for standing by, and welcome to the Autobytel announces 2011 fourth quarter and full-year financial results. At this time, all participants are in a listen-only mode. Later, we'll conduct a question and answer session, and instructions will follow at that time. Should you require assistance during the call, you may press star then zero on your touch-tone telephone for a live operator. As a reminder, today’s call may be recorded.

|

And now it’s my pleasure to turn the call over to Roger Pondel, investor relations for Autobytel. Sir, the floor is yours.

|

Roger Pondel:

|

Thanks, Huie, and hello, everyone. Welcome to Autobytel’s 2011 fourth quarter and year-end conference call. I’m joined today by Jeffrey Coats, President and Chief Executive Officer, and Curt DeWalt, Senior Vice President and Chief Financial Officer.

|

Before we begin, I would like to remind you that during today’s call, including the Q&A session, any projections and forward-looking statements made regarding future events or Autobytel's future financial performance are covered by the safe harbor statements contained in today’s press release, the slides accompanying this presentation and the company’s public filings with the SEC. Actual events and results may differ materially from those forward-looking statements.

Specifically, please refer to the company’s form 10-K for the year ended 2011, which was filed just before the start of today’s call, as well as other filings made by Autobytel with the SEC. These filings identify factors that could cause results to differ materially from those forward-looking statements.

AUTOBYTEL INC.

Moderator: Roger Pondel

03-01-12/5:00 p.m. ET

Confirmation # 51255427

Page 2

Slides are included with today’s presentation to help illustrate some of the points being made and discussed during the call. You can access the slides by clicking on the link in today’ press release, or by going to Autobytel’s Website at autobytel.com, and when there, go to Investor Relations and then click on Events and Presentations.

Also, please note that during this call, we will be discussing adjusted operating expenses, EBITDA, cash flow, which are non-GAAP financial measures as defined by SEC Regulation G. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measures are included in the slides being used on this call, and that are posted on Autobytel’s website.

And now, I will turn the call over to Jeff.

|

Jeff Coats:

|

Thank you, Roger. Good afternoon, everyone.

|

2011 was a milestone year for Autobytel. We were profitable for the last three quarters of the year and posted our first full-year profit since 2004.

Our turnaround is the result of a variety of factors. First, steps we’ve taken to enhance the quality of our purchase requests, namely the rate at which sales closed, are resonating with our dealer and manufacturer customers, as well as generating revenue and gross margin gains. Second, we significantly enhanced the online experience of Autobytel.com for consumers, which is improving our engagement with them and beginning to drive greater and deeper traffic to our site. Continuing to attract additional traffic to Autobytel.com should produce incrementally higher close rates for our purchase requests, boosting quality while also further helping improve margins. Third,

industry trends have been steadily improving, as we saw again today with the release of February’s SAAR of 15.1 million. And last but not least, over a several-year effort, we have brought more discipline to our P&L by focusing on business fundamentals, optimizing operating efficiencies and keeping a tight line on costs.

AUTOBYTEL INC.

Moderator: Roger Pondel

03-01-12/5:00 p.m. ET

Confirmation # 51255427

Page 3

We have come a long way and have reached an important inflection point. Autobytel is now well-positioned to benefit from our ability to help dealers and manufacturers sell more cars and trucks through our high quality purchase requests.

When Curt completes his financial review, I will return to speak about some of our key initiatives. Curt?

|

Curt DeWalt:

|

Thanks, Jeff.

|

Starting with a brief recap of the full year, which you can see on slide 4 of the fourth quarter package posted on our investor relations website, total revenues rose 24% to $63.8 million for 2011, from $51.5 million for 2010. Purchase request revenues increased 25% from the prior year, and advertising revenues of $3.9 million were approximately the same as 2010.

Gross profit rose 33% to $26 million for 2011, from $19.5 million for the prior year. Gross margin improved 40.7% for 2011, up from 37.8% for 2010.

EBITDA increased 145% to $3.2 million from a negative $7.0 million in 2010.

Net income for 2011 was $416,000, or $0.01 per diluted share, versus a net loss of $8.6 million [Correction Note: Inadvertently reported as $6.8 million during the call.], or $.019 per share for 2010.

Cash flow provided by operations improved substantially for the full year at $2.2 million for 2011, compared with cash flow used in operations of $4.3 million for 2010.

All of my following discussion will now focus on the fourth quarter.

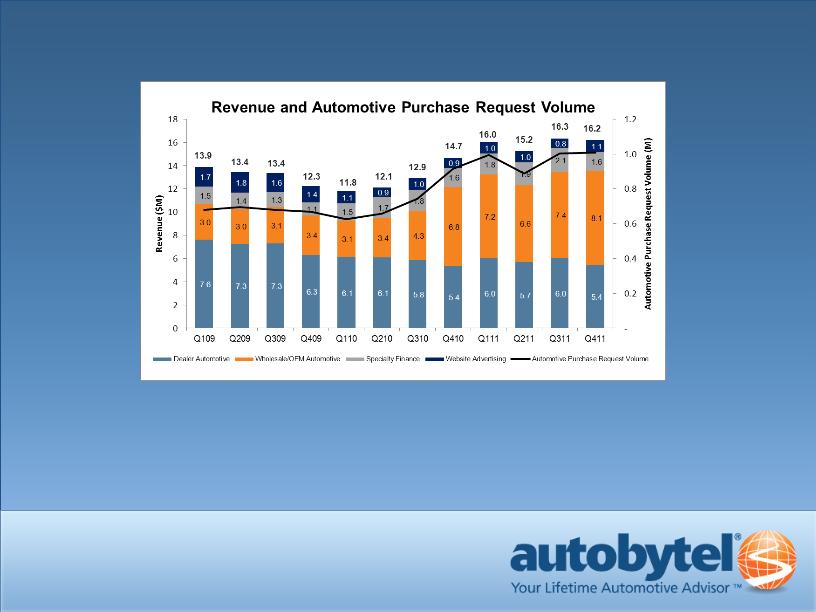

As you’ll see on slide 5, total revenues for 2011 fourth quarter grew 11% to $16.2 million, from $14.7 million in the prior year, reflecting an increase in wholesale purchase requests. For those of you that are new to the Autobytel

AUTOBYTEL INC.

Moderator: Roger Pondel

03-01-12/5:00 p.m. ET

Confirmation # 51255427

Page 4

story, wholesale refers primarily to purchase requests sold to manufacturers or OEMs, and retail refers to purchase requests sold directly to dealers. On a sequential basis revenues were generally flat as a result of normal seasonality.

Moving to slide 6 you can see the quarterly revenue by source for 2011 fourth quarter. Total automotive purchase request revenue increased by nearly 11% over the prior year, which included a 19% increase in OEM and other wholesale channels, compared with the prior year’s fourth quarter.

Finance request revenue declined 2% compared with the prior year, as a result of our decision to eliminate lower quality traffic.

Advertising revenue improved 26% over last year’s fourth quarter, as we redesigned Autobytel.com and the consumer proposition to be “Your Lifetime Automotive Advisor” which is attracting incremental advisors, advertisers and revenue. This positive momentum combined with improved consumer purchase intent will allow us to realize new content monetization opportunities.

The volume of purchase requests delivered rose year-over-year compared with the fourth quarter of the prior year. We delivered approximately 1 million automotive purchase requests in 2011 fourth quarter versus 917,000 in the prior year’s fourth quarter. 74% of the automotive purchase requests we delivered were in the wholesale channel and 26% were in the retail channel. We delivered approximately 91,000 finance requests in the current quarter versus 98,000 in the prior year’s fourth quarter.

As seen on slide 7, gross profit increased 20% to $6.9 million for the 2011 fourth quarter, up from $5.8 million for the fourth quarter of 2010, and $6.6 million for the 2011 third quarter. Gross margin improved to 42.5% versus 39.3% for the prior year’s fourth quarter, and 40.3% in the third quarter of 2011. The year-over-year and sequential improvements were driven, in part, by a greater number of internally-generated purchase requests.

AUTOBYTEL INC.

Moderator: Roger Pondel

03-01-12/5:00 p.m. ET

Confirmation # 51255427

Page 5

Moving to slide 8, you’ll see our cost structure on an adjusted basis. Total operating expenses for the 2011 fourth quarter were reduced by 28% to $6.5 million from $9.0 million in the prior year’s fourth quarter.

As you’ll see on slide 9, non-cash stock-based compensation for 2011 fourth quarter was $254,000 versus $298,000 for the fourth quarter of last year. Amortization and depreciation was $508,000 for the most recent fourth quarter compared with $499,000 in the prior year’s fourth quarter.

This brings EBITDA to $1.0 million for the fourth quarter of 2011, versus an EBITDA loss of $2.6 million for the fourth quarter of 2010. In the third quarter of 2011 EBITDA also totaled $1.0 million.

We generated net income of $341,000 or $0.01 per diluted share for the 2011 fourth quarter compared with a net loss of $3.3 million, or $0.07 per share, in the prior year’s fourth quarter.

Cash flow provided by operations was $2.1 million in the 2011 fourth quarter, compared with cash used in operations of $586,000 for the 2010 fourth quarter.

At the end of December our cash and cash equivalents balance had grown to $11.2 million, up from $9.2 million at the end of September and $8.8 million at the end of 2010. We are carrying a $5 million dollar convertible note from the acquisition of Cyber Ventures which pays simple interest at a rate of 6% per year.

As I’m sure you know, we received a letter from NASDAQ last September notifying us that we were not in compliance with the $1 minimum bid closing price. We have until March 13th to regain compliance; however, given the trading in our stock that has not resulted in regaining the compliance, we will not be able to regain compliance in time prior to the expiration of the initial grace period. We have, however, already been evaluating our options for regaining compliance, including a reverse stock split of our common stock.

AUTOBYTEL INC.

Moderator: Roger Pondel

03-01-12/5:00 p.m. ET

Confirmation # 51255427

Page 6

As a reminder, on February 13th we announced that our Board of Directors had approved a stock repurchase program that authorizes the repurchase of up to $1.5 million of our common stock. We may repurchase common stock from time to time on the open market or in private transactions, and we will fund the repurchases through the use of available cash. We currently anticipate that we will initiate repurchases in the open market the week of March 5th, but the timing and the extent of the purchases will depend upon market conditions, legal constraints and corporate considerations at the company’s sole discretion.

Now I’ll turn the call back to Jeff.

|

Jeff Coats:

|

Thanks, Curt.

|

The auto industry is healthier now than it’s been for some time, and we have reason to believe the positive momentum will continue. As you’ll see on slides 10 and 11, 2011 U.S. light vehicle sales were up approximately 10% to 12.7 million units from 2010, and that growth continued into January and February 2012, with sales up 11% and 16%, respectively, from the same months last year.

On the same slide, you’ll see that January SAAR grew meaningfully to 14.1 million units while February SAAR grew to 15.1 million units, from 13.6 million in both December and November of last year. According to data from J.D. Power, this is the first time in nearly 4 years that SAAR has surpassed the 14 million mark. In fact, last week J.D. Power lifted their 2012 forecast to 14 million units, which you can see on slide 11. Other full-year 2012 forecasts currently range from about 13.5 million to 14 million units.

Also, if attendance and temperament at the recent auto shows in Detroit and Chicago are any indication, consumers appear to be more ready to enter the market than they have been in a long time. We believe this is likely to be spurred by pent-up demand, replacement of aging vehicles, expected new vehicle introductions and an expanding credit market. In fact, Automotive

AUTOBYTEL INC.

Moderator: Roger Pondel

03-01-12/5:00 p.m. ET

Confirmation # 51255427

Page 7

News recently reported that lenders are charging U.S. car buyers the lowest rates in at least 4 years, which is supporting demand for new vehicles.

Our core business of delivering high quality purchase requests to dealers and OEMs continues to perform well. As Curt mentioned, automotive purchase request revenue for the fourth quarter of 2011 was up 11% from the prior year’s fourth quarter. The improvement stems from our ability to directly generate purchase requests that convert to vehicle sales for our customers. Currently, 70% of all of our purchase requests are generated from Autobytel-owned sites – a level that will likely remain stable in the months ahead. Internal purchase request generation is important for many reasons, including reducing our expenses and driving higher margins.

Equally important, internally-generated purchase requests are typically of higher quality than those purchased from most third parties. Quality is measured in our industry by purchase request conversion into sales, so we are taking a proactive approach to helping our dealer and OEM customers better understand the value we are delivering. We are now working with R.L. Polk, a trusted automotive data and marketing solutions company, to provide transparency in purchase request quality. With this actionable data, our customers will be able to more effectively calculate and understand their return on investment with Autobytel.

We know from experience that the conversion rates of Autobytel internally generated purchase requests significantly outperform by as much as 150% what we believe represents an industry average closing rate of between 6% and 8%. This is the number one reason OEMs and dealers buy our purchase requests – because they convert at a significantly higher rate.

As a result of quality improvements to date, we are already being allocated increased budget from OEM and large dealer group customers, driving a significant increase in purchase requests and corresponding close rates sold into our wholesale channel. We expect this trend to continue as the result of ongoing quality enhancement, coupled with our new approach to dealer customer acquisition and retention, which concentrates on higher revenue

AUTOBYTEL INC.

Moderator: Roger Pondel

03-01-12/5:00 p.m. ET

Confirmation # 51255427

Page 8

accounts in dealerships where we can supply an increasing percentage of purchase requests through internally generated channels.

Autobytel is now healthy and vibrant, and we are confident that we are continuing to significantly upgrade the quality of the purchase requests we deliver to our customers, and by leveraging the growing auto market, we will continue to drive improved operating performance.

Our ongoing commitment to producing highly credible authoritative content on Autobytel.com continues to drive consumer traffic and engagement. Specifically in January, Autobytel announced its choices for our 2012 Car and Truck of the Year Awards. The awards, our first in several years, have been met with outstanding response from both the automotive manufacturers and the press, while also generating terrific conversations among auto bloggers and across social networks. Importantly, the awards announcement and related content generated 105% increase in traffic and 176% increase in page views.

In addition to the awards, our editors had some fun to mark this year’s Valentines Day by naming the “hottest” cars for 2012 across different price points. The Valentines Day editorial increased traffic and page views by 46% and 137%, respectively. This approach to tying annual events to consumer interest will, with increasing frequency, continue throughout the year with several entertaining and thought-provoking takes for consumers to enjoy.

We believe these examples of highly visible branded content, along with a wide array of editorial offerings such as exclusive Autobytel vehicle video reviews, our customizable MyGarage ownership section, and the addition of mobile capabilities in the second quarter of this year, position us well for continued growth as we deliver our consumer promise as “Your Lifetime Automotive Advisor” across multiple channels, platforms and devices. Slide 12 provides an example of some of the content we are currently offering.

We have also teamed with AutoNation to offer one of our newest features, “Sell Your Car”, which gives consumer a hassle-free way to sell their cars,

AUTOBYTEL INC.

Moderator: Roger Pondel

03-01-12/5:00 p.m. ET

Confirmation # 51255427

Page 9

and AutoNation dealers an easier way to source used cars, which is especially important in the current tight market for previously owned vehicles. Autobytel is one of only 3 AutoNation partners offering this program.

I am gratified by our progress and our ability to emerge from what was one of the most challenging periods in the history of auto sales. We have meaningfully enhanced Autobytel’s current business and future prospects. With the industry continuing its positive trajectory, Autobytel.com driving increased consumer traffic, as well as additional and ongoing improvements to purchase request quality, we are looking ahead with a sense of optimism about Autobytel’s future performance.

Our outlook for 2012 is bullish as we continue along the path we followed in 2011. Based on our business plan, we believe that purchase request volumes should grow in line with anticipated SAAR growth. Thus, we expect strong top-line growth with positive cash flow and net income. Before opening the call to questions, I would like to address an issue that we have learned may be confusing for some of our investors. I’ve mentioned in the past that our industry is consolidating and that Autobytel expects to be among the consolidators. This may have signaled an unintended message that we would soon be in fundraising mode to support a transaction. For

clarity and as an update, while we are always open to strategic opportunities, at the present time we have no plans to engage in fund raising. However, we fully intend to work diligently to grow our business and enhance our shareholder value.

With that, operator, we’re now ready to take questions.

|

Operator:

|

Thank you, sir. Ladies and gentlemen on the phone lines, to queue up for a question at this time, please press star then one on your touch tone phone. If your question has been answered or you wish to remove yourself from the queue, you may press the pound key. Again, to queue up for a question at this time, please press star then one on your touch tone phone. One moment for questioners to queue.

|

AUTOBYTEL INC.

Moderator: Roger Pondel

03-01-12/5:00 p.m. ET

Confirmation # 51255427

Page 10

All right, our first questioner in queue comes from Steve Dyer with Craig-Hallum. Your line is open. Your questions, please.

|

Steve Dyer:

|

Thanks. Good afternoon, Jeff and Curt.

|

|

Jeff Coats:

|

Hi, Steve.

|

|

Curt DeWalt:

|

Hi, Steve.

|

|

Steve Dyer:

|

Nice quarter. Jeff, you had mentioned it sort of in passing, you know, how strong a start we are off to this year. I guess the next logical question is any help or direction you could give us on sort of how you see kind of the first quarter shaking out, you know, maybe even directionally, would be helpful.

|

|

Jeff Coats:

|

We’ve entered the year pretty strongly, so we expect to have a good first quarter with growth. Probably really shouldn’t go much beyond that.

|

|

Steve Dyer:

|

OK, fair enough. Advertising kind of perked up for the first time in a while. Can it move higher, maybe any information about uniques or anything like that that you could share, that would - you know, how that makes you feel about kind of the advertising line going forward?

|

|

Jeff Coats:

|

We feel pretty good about advertising. You know, the relaunch of autobytel.com last summer kind of reset the bar with all of our manufacturer advertising customers. We had a good up-front sell-through as we entered the year, and even were able to achieve some CPM increases. So there is growth. There is a growth opportunity for us in advertising revenue during 2012. Absolutely.

|

We, as you know, have not thus far begun reporting on certain kinds of metrics, including uniques. That may change during the course of the year, but not at the present time.

|

Steve Dyer:

|

OK. As you sort of look across your customer base, is there any OEM, or numerous OEMs, that you feel like you’re maybe more levered to than others

|

AUTOBYTEL INC.

Moderator: Roger Pondel

03-01-12/5:00 p.m. ET

Confirmation # 51255427

Page 11

as I think this will be a year where there’s a lot of share shift and so forth. Who would you say, and I know you’re probably pretty diversified, but who have you sort of tied your wagon to?

|

Jeff Coats:

|

You know, we really do business with all of the major manufacturers, you know, domestic and international. We do have a bit more of a concentration with some than with others, but we’re pretty well balanced, I think, with pretty much all the major manufacturers.

|

|

Steve Dyer:

|

I guess asked another way, you know, the falloff in the Japan 6 last year due to the natural disasters hurt you guys quite a bit. Would you expect a similar kind of a bounce back as they get restocked and start selling through?

|

|

Jeff Coats:

|

We should see a benefit as that is happening, and actually just today in some of the automotive news stories, there were some comments being made about inventory levels with major Japanese firms already being back in substantially better shape than they were even in the fourth quarter, so I don’t think we’ll have those same kind of problems rolling into this year that we saw because of the natural disasters in the Far East last year.

|

|

Steve Dyer:

|

Okay, thanks a lot.

|

|

Jeff Coats:

|

Thank you.

|

|

Operator:

|

Thank you, sir. Next questioner in queue is Sameet Sinha with B. Riley. Please go ahead, your line is open.

|

|

Sameet Sinha:

|

Yes, thank you. So, can you talk about data sales and did you have any during the quarter, how do you expect that business to kind of ramp throughout the year, and what’s the potential, if you can guess, at what peak sales could be for that particular revenue line? A couple of other ones. You spoke about eliminating the lower quality traffic for financing needs, if you could elaborate on that. Also, you mentioned some consolidation amongst dealers, I would appreciate insight on that as well. That’s it. Thank you.

|

AUTOBYTEL INC.

Moderator: Roger Pondel

03-01-12/5:00 p.m. ET

Confirmation # 51255427

Page 12

|

Jeff Coats:

|

Sameet, I’m not sure I caught your first question completely, but let me answer or try to answer the others, and then maybe we can go back to that.

|

We did see - as sub-prime financing has begun coming back pretty strongly in general in the markets. Last year, in the second half of last year, we began seeing some quality problems in the - coming from some of our suppliers and traffic partners - that we weren’t happy with. As you know, we are completely focused on either generating or acquiring for our customers a top quality product. So we began pulling back as we noticed problems with some of those suppliers. It did affect our revenue in that business in the second half of the year.

We think that’s mostly straightened out at this point, so we don’t expect to see a big impact from that in 2012. And now I’ve forgotten your third question, so can you hit me up again on that?

|

Sameet Sinha:

|

Yes, basically I was asking about anything in your presentation or your press release, where you mentioned that there was some consolidation amongst dealers, was that consolidation amongst dealer groups, or was it - I know your kind of internal effort to focus efforts on larger dealer groups versus smaller ones.

|

|

Jeff Coats:

|

It’s really an effort to focus the way we internally go to market with our retail dealer customers. We’re trying to focus on areas and markets, in large part, where we can create a larger relationship with a dealer or, you know, a dealer group, and deliver more purchase requests into those customers. So it’s a way to basically try to better balance our expenses of going to that market as compared to the revenue that we’re generating.

|

It does impact, to some extent, looking at doing business with some of the larger groups, but you know, we’re still - we still have a widely-diverse customer base. We’re just trying to focus on doing business with people that really want to do business with us and that value our product.

AUTOBYTEL INC.

Moderator: Roger Pondel

03-01-12/5:00 p.m. ET

Confirmation # 51255427

Page 13

|

Sameet Sinha:

|

Sure. And my fourth question actually, which you missed was you had - you have been talking to Daytran contacts where it promotes selling visitor data into their data pool. That was my question. Have you started sales into those companies? If yes, how do you expect that revenue stream to ramp throughout the year, and if they have given you an assessment of what the peak revenue potential is for this particular revenue line?

|

|

Jeff Coats:

|

We are still working with Daytran. They actually merged with another company during 2011. The efforts have been refocused as we move into 2012. There are some customer conversations going on. I am not exactly sure of what the sales cycle will look like on that, but I think it’s safe to say that with sales - I mean, you know - February SAAR skyrocketed to 15.1 million, I don’t think anybody was expecting anything close to that. General Motors and Ford - or no, General Motors and Nissan came out this morning and made comments that based upon their sales they thought SAAR could hit 14.9. So I think we’ll see more activity as more of the manufacturers begin pushing their vehicles as we enter the prime selling

season, you know, March, April, moving into the summer months is really the prime selling season, so it’s interesting to see car sales jump up so high in a couple of the seasonally weakest months.

|

|

Sameet Sinha:

|

And you know, the article that you referenced about SAAR data and a month of inventory on the dealer lots, also mentioned that the level of incentives have declined. I’m wondering, how should we think about these two and how do they impact your business, either to the magnitude or direction? If you could elaborate I would appreciate it.

|

|

Jeff Coats:

|

You’re right, some of those articles did refer to the fact that incentives were down, but I think that’s in part because General Motors, in the first quarter of 2011, was pushing some pretty heavy incentives, particularly in January and February, that they ended up pulling back from as we moved into the second quarter. So I think some of those year-over-year comparisons are a little skewed from that standpoint.

|

AUTOBYTEL INC.

Moderator: Roger Pondel

03-01-12/5:00 p.m. ET

Confirmation # 51255427

Page 14

It’s my understanding that as some of the dealers of Toyota, Honda and the like that did have some inventory issues last year, those sales programs are ramping up as we move into this year. None of that, really, has a negative impact on us. When the manufacturers are advertising, it generally draws people online, and as they come online, they either come to us or we find them through some of our other activities.

So overall, manufacturer advertising, manufacturer incentives generally are a good thing for us.

|

Sameet Sinha:

|

Great, thank you very much.

|

|

Jeff Coats:

|

Thank you.

|

|

Operator:

|

Thank you, sir. Our next questioner in queue is George Santana with Ascendiant. Please go ahead. Your line is now open.

|

|

George Santana:

|

Thank you, and guys, congratulations on just a great quarter. I mean, you kind of told us what to expect, the improvement quarter-to-quarter, and you guys have just executed in a fairly non-flashy but consistent way. This is - this is great. A few questions for you.

|

The gross margin of 42½% or so – my model goes back to the beginning of 2007, and that margin, I think, is the highest since the March 2007 quarter. Is that right?

|

Jeff Coats:

|

That - I don’t have all the information in front of me, but going off memory, George, that is correct.

|

|

George Santana:

|

Is this sustainable? Is it a question of the advertising revenues coming back and giving you a higher margin? What should we look for going forward?

|

|

Jeff Coats:

|

You know, George, our revenues are always a mix issue. We did have some spot advertising buys in the fourth quarter that helped boost our margins in the

|

AUTOBYTEL INC.

Moderator: Roger Pondel

03-01-12/5:00 p.m. ET

Confirmation # 51255427

Page 15

fourth quarter. It really is affected by a mix of the wholesale and retail revenue as well. I don’t think that margin level is out of reach for us as we move through the course of the year, but I wouldn’t expect to see us post a 42% gross margin in the first quarter. Generally, it’s a result of a lot of different factors, and I do think over time as we continue to bring data revenue into our mix, as well as continue to boost our advertising revenue, it’s going to go ahead and push us up into the low 40s overall.

|

George Santana:

|

OK. You know, unfortunately, when you look back at the two, three, four, five years, the seasonality by quarter of gross margin can’t really draw a beat on what to expect and what to forecast. So, it really isn’t subject to seasonality much at all, right?

|

|

Jeff Coats:

|

It’s not so much seasonality. It really is the revenue mix.

|

|

George Santana:

|

OK.

|

|

Jeff Coats:

|

And, it’s even harder to keep a good handle on today because our business has been evolving into a stronger wholesale growth profile than on the retail side, and our wholesale margins are not thus far on a par with our retail margins. And so it’s really a mix. You know, during the course of a given quarter manufacturers may periodically increase what they want to take from us, given other things they have going on, and so it tends to move things around a bit, so it’s just one of those issues that we currently deal with on a regular basis. It’s however - we do maintain a pretty stable gross margin, however, it’s just a mix issue.

|

|

George Santana:

|

OK, but if we look for - what was the level you said, kind of towards the low 40s?

|

|

Jeff Coats:

|

The low 40s, yes.

|

|

George Santana:

|

The low 40s on a kind of annual basis, then, is fair. Did I hear you correctly? OK.

|

AUTOBYTEL INC.

Moderator: Roger Pondel

03-01-12/5:00 p.m. ET

Confirmation # 51255427

Page 16

|

Jeff Coats:

|

Yes.

|

|

George Santana:

|

OK, and something - something that you mentioned in the prepared remarks kind of towards the end, that you have enrolled R.L. Polk to do a study on your company’s purchase requests, did I hear that correctly?

|

|

Jeff Coats:

|

What we have done is signed a contract with them, and we have them reconcile all of the purchase requests that we generate and sell to our dealers and manufacturers, against their registration data on a 30, 60, 90 look-back basis, so we can actually see, you know, did the consumers that generated those purchase requests with us end up buying a car, you know, within those periods of time? So, historically in our business, close rate data has not been something that lead generators or aggregators could really calculate. It was provided to us by our customers. So in addition to the R.L. Polk information we also get feedback from our OEM customers that do give us regular close rate feedback. We get a lot of close rate feedback from our large dealer group

customers, and we also have several regular retail dealers or dealer groups that provide us with periodic close rate information.

|

So what we’re really looking at doing is reconciling all of this for the leads that we are generating. It’s very interesting information. It’s very timely information, and we have been gratified to see that our efforts to buckle down and work on generating ever-improving quality of purchase requests are paying dividends. Because, as I mentioned, our close rates are closing as much as 150% higher than the average industry close rates of 6 to 8%. So that’s what dealers and manufacturers care about – how many cars they sell from the purchase requests we sell them.

|

George Santana:

|

That’s the number one thing I heard back in my due diligence of auto dealers is, that’s, you know, the leads stink, and we can’t follow up, or they’re great. So my question to you is, has anyone ever done this kind of study? Has this data been out there before, independently verified by a third party?

|

|

Jeff Coats:

|

I don’t - not to my knowledge. Certainly not on a program basis that we’re currently doing it. Their people have always had some level or other of close

|

AUTOBYTEL INC.

Moderator: Roger Pondel

03-01-12/5:00 p.m. ET

Confirmation # 51255427

Page 17

rate feedback, but again, it’s from customers. And if you think about the difference between our wholesale business and our retail business, you know, we have a handful - you know, two or three dozen - wholesale customers who focus on the close rates and provide them to us. So they see the quality at which our purchase requests are closing because we generally always are closing above their program average, and generally pull up their program average.

On the retail side, it’s more candidly of an opportunity for us to have this good close rate data, because our folks in the field will now be armed with close rate information based upon the purchase requests we’ve sold to different dealers or dealer groups, who can go and sit down and have those kind of conversations with them. You know, what kind of transparency are you getting from your other lead providers in the marketplace. You know, we really want to introduce that whole topic to our marketplace because transparency of the quality of the purchase requests or leads that the customers are buying is something that everyone in this business ought to be focused on.

|

George Santana:

|

Sure, sure. When would that study conclude?

|

|

Jeff Coats:

|

It’s not a study, George, it’s an ongoing relationship.

|

|

George Santana:

|

Oh, I see. OK.

|

|

Jeff Coats:

|

As we generate leads, the purchase requests for what we’re doing, they go into these filters, and we generally get reports back as to what’s going on.

|

|

George Santana:

|

Do you think that’ll be -

|

|

Jeff Coats:

|

It’s an ongoing – it’s an ongoing, daily, weekly, monthly business arrangement that we have with Polk that will continue for the foreseeable future.

|

|

George Santana:

|

That’s great. And that transparency surely will be welcome. I’ll refrain from asking you for the data, going forward.

|

AUTOBYTEL INC.

Moderator: Roger Pondel

03-01-12/5:00 p.m. ET

Confirmation # 51255427

Page 18

|

Jeff Coats:

|

Well, it is our intention at some point to start disclosing that data publicly.

|

|

George Santana:

|

That’s great. That’s great.

|

|

Jeff Coats:

|

We just need to get a little bit of it under our belts first, but that’s the goal, to begin reporting on it publicly.

|

|

George Santana:

|

That’s fantastic. Kind of the last question, can you give us at least any indication of expense levels and capex for 2012?

|

|

Jeff Coats:

|

I don’t think our capex levels will really be anything materially different than they were in 2011. You know, our operating expenses will, of course, grow as our revenues grow, to some extent, because of the variable expenses in our P&L, sales commissions, various other things that are related to growth. We don’t expect to see a large increase in expenses that aren’t driving growth at the top line.

|

|

George Santana:

|

OK, thanks guys, and congrats again.

|

|

Jeff Coats:

|

Thank you, sure.

|

|

Operator:

|

Thank you, sir. Our next questioner in queue is Jared Shaw with ROTH Capital. Your line is open. Please go ahead.

|

|

Jared Schramm:

|

Congrats on the quarter.

|

|

Jeff Coats:

|

Thank you, Jared.

|

|

Curt DeWalt:

|

Thanks Jared.

|

|

Jared Schramm:

|

I think most of my questions have already been answered, just two quick ones here additionally. When do you see the decline in revenue from finance requests leveling out?

|

|

Jeff Coats:

|

We think it’s pretty much already leveled out as we rolled into 2012.

|

AUTOBYTEL INC.

Moderator: Roger Pondel

03-01-12/5:00 p.m. ET

Confirmation # 51255427

Page 19

|

Jared Schramm:

|

OK, and looking over - you touched briefly on consolidation as far as the dealership level was concerned - what stage is that transition in currently from what you’re seeing in the market?

|

|

Jeff Coats:

|

It’s still pretty early.

|

|

Jared Schramm:

|

OK. And how long would you anticipate that takes to resolve?

|

|

Jeff Coats:

|

It’s a multi-month process. Probably not until some time in 2013.

|

|

Jared Schramm:

|

OK, and lastly, last quarter’s call we touched on the Thai floods potentially having an impact on some of the wholesale revenue. Could you describe if you saw any impact of that in Q4 if there was any at all?

|

|

Jeff Coats:

|

We didn’t really see any meaningful impact in the fourth quarter from that.

|

|

Jared Schramm:

|

OK, great, that’s it for me, thank you.

|

|

Jeff Coats:

|

Thanks, Jared.

|

|

Operator:

|

Thank you, sir. Next questioner in queue is Robert Setrakian with The Helios Group. Please go ahead. Your line is open.

|

|

Robert Setrakian:

|

Hi, guys, great quarter, great year. You delivered on everything that you have said. Congratulations. A couple of questions, a couple of technical ones first. I know that you have a very large tax NOL. However, on book taxes reported income for the fourth quarter, book taxes are 24%, and book taxes for the year are 45% plus. Is there a possibility that those book taxes could be lowered somehow? I mean, I know it doesn’t affect business, it doesn’t affect cash flow, but just for EPS reporting purposes, have you guys looked into that?

|

|

Curt DeWalt:

|

Yes, the single biggest thing in there, Robert, is a result of the acquisition we did, it’s something we talked about in prior quarters. It’s a technical thing called the naked credit on the goodwill, and so we are required to provide, for book purposes, a tax provision. There’s no cash out. We’re not paying

|

AUTOBYTEL INC.

Moderator: Roger Pondel

03-01-12/5:00 p.m. ET

Confirmation # 51255427

Page 20

anything, but from a - from a technical accounting standpoint, we do need to provide against this - the goodwill, this naked credit. The fact that we have all of our deferred tax assets and liabilities under a full valuation allowance is the reason we find ourselves in this position. Otherwise, it would - we’d have more than enough to sweep it up, but it’s a bit involved. I can certainly go into it in more detail with you, but that’s the crux of what’s driving that, is the acquisition, goodwill, naked credit.

|

Robert Setrakian:

|

OK, and does that mean that we practically pay no federal or state taxes, cash?

|

|

Curt DeWalt:

|

That is - that is correct. On a cash basis, we pay very little. What little we do pay, a number of the states are getting smart. They’re moving away from income taxes and are going to gross receipts and things of that nature. But there are some states where we do actually have to pay taxes, but the majority - the vast majority, and certainly at a federal level, we are not paying taxes.

|

|

Robert Setrakian:

|

OK. Second question relates to the NASDAQ compliance and the reverse stock split. Is there any possibility that we may appeal to NASDAQ? Are you guys considering that?

|

|

Jeff Coats:

|

Appeal to them in what regard?

|

|

Robert Setrakian:

|

To give us additional time to get in compliance?

|

|

Jeff Coats:

|

Yes, actually, we would expect to receive an additional 180 days to regain compliance. That is one of the options that we have available to us with NASDAQ.

|

|

Robert Setrakian:

|

OK, good.

|

|

Jeff Coats:

|

And I would expect that to happen.

|

|

Robert Setrakian:

|

OK, good. Excellent. And finally, I noticed that the cash on the balance sheet as of December 31st was actually higher than what most of the analysts expected, and I expected, by about a million dollars. And I saw that working

|

AUTOBYTEL INC.

Moderator: Roger Pondel

03-01-12/5:00 p.m. ET

Confirmation # 51255427

Page 21

capital was managed excellently also. Was there anything that was spent less in the quarter than anticipated to account for that higher than expected cash?

|

Curt DeWalt:

|

No, Robert, there's nothing unusual. It’s really just an ongoing ebbing and flowing of timing of payments, as well as receipts of folks paying us the receivables.

|

|

Robert Setrakian:

|

I mean, that’s what I noticed from the receivables and the payables also, but I just wanted to make sure that it wasn’t something that was just deferred in the first quarter or something like that. So actually, cash came out better than we thought. That’s excellent. That’s it for me. That’s it for me for right now, thanks.

|

|

Jeff Coats:

|

Thanks, Robert.

|

|

Curt DeWalt:

|

Thanks, Robert.

|

|

Operator:

|

Thank you, sir. Our next questioner in queue is Brian Horey, with Aurelian. Please go ahead. Your line is open.

|

|

Brian Horey:

|

Hi, Jeff. Thanks for taking my question.

|

|

Jeff Coats:

|

Hi, how are you?

|

|

Brian Horey:

|

I’m well, thanks. In terms of opex, I heard your prior answer about some parts growing in line with revenue, but if we assume that you guys grow in line with, let’s say, the SAAR number for this year, how much leverage do you think you can generate on that line from kind of a basis point standpoint?

|

|

Jeff Coats:

|

Brian, we do have some leverage in our opex. So you know, we can grow revenue without meaningfully increasing our opex. However, at the same time, we’re in a very interesting period of time, having relaunched autobytel.com, and you know, beginning to drive traffic back to it, which of course becomes a virtuous circle, as traffic comes to the site, it increases our page views, which increases our advertising revenue, and then positions us

|

AUTOBYTEL INC.

Moderator: Roger Pondel

03-01-12/5:00 p.m. ET

Confirmation # 51255427

Page 22

nicely again for the up-fronts, toward the end of this year, for our 2013 advertising year.

So you know, we’re looking at creative ways that we can help accelerate the growth in our top line without meaningfully increasing our operating expenses for the wrong reasons. So it’s a balance. We worked hard to get our opex down. We think we’re in a pretty good range based on what we’re doing right now and based upon the business that we currently have configured.

|

Brian Horey:

|

OK. So, just looking at your top line versus, you know, the SAAR number, I’m tempted to infer that you guys have picked up share. Is that your sense?

|

|

Jeff Coats:

|

It is our sense.

|

|

Brian Horey:

|

OK. And can you quantify that in any degree?

|

|

Jeff Coats:

|

No, I really would rather not do that.

|

|

Brian Horey:

|

OK, fair enough. And just the other question I had was, you know, you talked a lot about consolidation of your business on these calls over time. Has there been any other consolidation - you know, obviously you guys, you know, did that last year, but has there been any other consolidation activity recently that’s been disclosed?

|

|

Jeff Coats:

|

You know, the bigger ones - there were quite a few in late 2010. Auto Trader bought Kelly Blue Book.

|

|

Brian Horey:

|

Right.

|

|

Jeff Coats:

|

And a couple of other companies, you know, there were a couple of smaller ones during the course of ‘11. Otherwise - I am familiar with a couple of others, but they have not been publicly disclosed, and I don’t think it’s for me to disclose them.

|

AUTOBYTEL INC.

Moderator: Roger Pondel

03-01-12/5:00 p.m. ET

Confirmation # 51255427

Page 23

|

Brian Horey:

|

OK. But you’re still, I guess, bullish on there being more activity to come on that regard?

|

|

Jeff Coats:

|

Yes, there are still opportunities in the market. Absolutely.

|

|

Brian Horey:

|

OK, thanks very much.

|

|

Jeff Coats:

|

Thank you.

|

|

Operator:

|

Thank you, sir. And it looks like that concludes our time for questions and answers. I’d like to turn the program back over to Mr. Jeff Coats.

|

|

Jeff Coats:

|

I just want to say in closing, everyone, you know, we do feel bullish about 2012. I think today’s SAAR number was pretty eye-opening, coming off of a pretty good-looking month anyhow. We look forward to speaking with you all as we move forward during the course of the year, so thank you. Good bye.

|

|

Operator:

|

Thank you, sir. Ladies and gentlemen, this does conclude today’s program. Thank you for your participation, and have a wonderful day. Attendees, you may log off at this time.

|

|

|

END

|

4Q 2011 Results

March 1, 2012

Copyright (c) 2012 Autobytel Inc.

Safe Harbor Statement

and Non-GAAP Disclosures

and Non-GAAP Disclosures

The statements made in the accompanying conference call or contained in this presentation that are not historical facts are forward-looking statements under

the federal securities laws. These forward-looking statements, including, but not limited to future growth opportunities being created by our sharp focus on

business fundamentals, combined with a recovering automotive market, are not guarantees of future performance and involve assumptions and risks and

uncertainties that are difficult to predict. Actual outcomes and results may differ materially from what is expressed in, or implied by, these forward-looking

statements. Autobytel undertakes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or

otherwise. Among the important factors that could cause actual results to differ materially from those expressed in, or implied by, the forward-looking

statements are changes in general economic conditions; the financial condition of automobile manufacturers and dealers; disruptions in automobile

production resulting from natural disasters in Japan and Thailand; changes in fuel prices; the economic impact of terrorist attacks, political revolutions or

military actions; failure of our internet security measures; dealer attrition; pressure on dealer fees; increased or unexpected competition; the failure of new

products and services to meet expectations; failure to retain key employees or attract and integrate new employees; actual costs and expenses exceeding

charges taken by Autobytel; changes in laws and regulations; costs of legal matters, including, defending lawsuits and undertaking investigations and related

matters; and other matters disclosed in Autobytel’s filings with the Securities and Exchange Commission. Investors are strongly encouraged to review the

company’s Annual Report on Form 10-K for the year ended December 31, 2011, and other filings with the Securities and Exchange Commission for a

discussion of risks and uncertainties that could affect the business, operating results, or financial condition of Autobytel and the market price of the company’s

stock. In addition, current year financial information could be subject to change as a result of subsequent events or the finalization of the company’s financial

statement close which culminates with the filing of the company’s Annual Report on Form 10-K for the current year.

the federal securities laws. These forward-looking statements, including, but not limited to future growth opportunities being created by our sharp focus on

business fundamentals, combined with a recovering automotive market, are not guarantees of future performance and involve assumptions and risks and

uncertainties that are difficult to predict. Actual outcomes and results may differ materially from what is expressed in, or implied by, these forward-looking

statements. Autobytel undertakes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or

otherwise. Among the important factors that could cause actual results to differ materially from those expressed in, or implied by, the forward-looking

statements are changes in general economic conditions; the financial condition of automobile manufacturers and dealers; disruptions in automobile

production resulting from natural disasters in Japan and Thailand; changes in fuel prices; the economic impact of terrorist attacks, political revolutions or

military actions; failure of our internet security measures; dealer attrition; pressure on dealer fees; increased or unexpected competition; the failure of new

products and services to meet expectations; failure to retain key employees or attract and integrate new employees; actual costs and expenses exceeding

charges taken by Autobytel; changes in laws and regulations; costs of legal matters, including, defending lawsuits and undertaking investigations and related

matters; and other matters disclosed in Autobytel’s filings with the Securities and Exchange Commission. Investors are strongly encouraged to review the

company’s Annual Report on Form 10-K for the year ended December 31, 2011, and other filings with the Securities and Exchange Commission for a

discussion of risks and uncertainties that could affect the business, operating results, or financial condition of Autobytel and the market price of the company’s

stock. In addition, current year financial information could be subject to change as a result of subsequent events or the finalization of the company’s financial

statement close which culminates with the filing of the company’s Annual Report on Form 10-K for the current year.

This presentation includes a discussion of "EBITDA," “Adjusted Operating Expenses,” and “Cash Flow,” which are non-GAAP financial measures. The

company defines EBITDA as net income before (i) interest income (expense); (ii) income tax provision (benefit); and (iii) depreciation and amortization. The

company defines Adjusted Operating Expenses as GAAP operating expenses adjusted for unusual, infrequent or non-recurring items. The company defines

non-GAAP Cash Flow as EBITDA plus non-cash stock compensation related to the company's grant of stock options and other equity instruments. The

company believes these non-GAAP financial measures provide important supplemental information to management and investors. These non-GAAP financial

measures reflect an additional way of viewing aspects of the company's operations that, when viewed with the GAAP results and the accompanying

reconciliations to corresponding GAAP financial measures, provide a more complete understanding of factors and trends affecting the company's business

and results of operations. These non-GAAP financial measures are used in addition to and in conjunction with results presented in accordance with GAAP

and should not be relied upon to the exclusion of GAAP financial measures. Management strongly encourages investors to review the company's

consolidated financial statements in their entirety and to not rely on any single financial measure. Because non-GAAP financial measures are not

standardized, it may not be possible to compare these financial measures with other companies' non-GAAP financial measures having the same or similar

names. In addition, the company expects to continue to incur expenses similar to the non-GAAP adjustments described above, and exclusion of these items

from the company's non-GAAP measures should not be construed as an inference that these costs are unusual, infrequent or non-recurring.

company defines EBITDA as net income before (i) interest income (expense); (ii) income tax provision (benefit); and (iii) depreciation and amortization. The

company defines Adjusted Operating Expenses as GAAP operating expenses adjusted for unusual, infrequent or non-recurring items. The company defines

non-GAAP Cash Flow as EBITDA plus non-cash stock compensation related to the company's grant of stock options and other equity instruments. The

company believes these non-GAAP financial measures provide important supplemental information to management and investors. These non-GAAP financial

measures reflect an additional way of viewing aspects of the company's operations that, when viewed with the GAAP results and the accompanying

reconciliations to corresponding GAAP financial measures, provide a more complete understanding of factors and trends affecting the company's business

and results of operations. These non-GAAP financial measures are used in addition to and in conjunction with results presented in accordance with GAAP

and should not be relied upon to the exclusion of GAAP financial measures. Management strongly encourages investors to review the company's

consolidated financial statements in their entirety and to not rely on any single financial measure. Because non-GAAP financial measures are not

standardized, it may not be possible to compare these financial measures with other companies' non-GAAP financial measures having the same or similar

names. In addition, the company expects to continue to incur expenses similar to the non-GAAP adjustments described above, and exclusion of these items

from the company's non-GAAP measures should not be construed as an inference that these costs are unusual, infrequent or non-recurring.

Copyright (c) 2012 Autobytel Inc.

2

Overview

Copyright (c) 2012 Autobytel Inc.

3

§ 2011 revenue grew $12.3M or 24%

§ 2011 gross margin expanded 290bp to 40.7%

§ 2011 operating expenses reduced by $3.2M or 11%

§ Net income positive for the first time since 2004

§ Strong balance sheet

§ OEM and wholesale markets expanding

§ On track to deliver top and bottom line growth in 2012

2011 Full Year Results

Copyright (c) 2012 Autobytel Inc.

4

+ $12.3M

+ 24%

+ 290bps

+ $10.2M

+ 145%

+ $9.0M

+ 105%

2011 4Q Results

Copyright (c) 2012 Autobytel Inc.

5

+ $1.6M

+ 11%

+ 320bps

+ $3.7M

+ 139%

+ $3.6M

+ 110%

Comments

§ OEM and other wholesale purchase request revenue up 19% Y-O-Y and up 9% sequentially as a result of

increased OEM demand offset by seasonality

increased OEM demand offset by seasonality

§ Dealer revenue up 2% Y-O-Y, but down nearly 10% sequentially due to seasonality and supplier consolidation

§ Specialty finance purchase request revenue down 2% Y-O-Y due to the elimination of lower quality traffic

sources and 22% sequentially as a result of typical seasonality

sources and 22% sequentially as a result of typical seasonality

Revenue Results

Copyright (c) 2012 Autobytel Inc.

6

Financial Overview

Net Income, EBITDA, and Cash Flow POSITIVE in 2011

1 See slide 8 for Adjusted Operating Expenses reconciliation

2 EBITDA is equal to Net Income plus Interest, Taxes, and Depreciation and Amortization; See slide 9 for reconciliation

3 Cash Flow is equal to EBITDA plus Non-Cash Stock Compensation; See slide 9 for reconciliation

4 Cash decreased in Q3 2010 primarily as a result of the acquisition of Cyber Ventures / Autotropolis ($9M) and a strategic investment

in Driverside ($1M)

Copyright (c) 2012 Autobytel Inc.

7

2011 Operating Expenses

Copyright (c) 2012 Autobytel Inc.

8

4Q 2011

Full Year 2011

Adjusted Operating Expenses

1 Includes all patent and other litigation settlements

2 Severance includes associated accelerated stock compensation of $(0.1) and $(0.1) for Q210 and Q410, respectively

3 Acquisition costs consist of professional fees associated with the acquisition of Cyber Ventures and Autotropolis during 2010

4 Acquisition amortization relates to acquired intangible assets from Cyber Ventures and Autotropolis during 2010

5 Above financials are impacted by rounding to the nearest $0.1M

EBITDA and Cash Flow

1 EBITDA is equal to Net Income plus Interest, Taxes, and Depreciation and Amortization

2 Cash Flow is equal to EBITDA plus Non-Cash Stock Compensation

3 Above financials are impacted by rounding to the nearest $0.1M

POSITIVE FINANCIAL RESULTS for 2011

Copyright (c) 2012 Autobytel Inc.

9

Historical Auto Industry Sales

Copyright (c) 2012 Autobytel Inc.

10

Comments

§Recovery for SAAR US Light Vehicle sales began in Q3, as SAAR improved from a Q2 low of 11.4M to 12.2M in

July, continuing growth to 14.1M through January 2012

July, continuing growth to 14.1M through January 2012

§Vehicle Sales were up 10% in the 4th quarter of 2011 vs. prior year as well as 10% for the full year 2011 vs. prior

year

year

§January 2012 US Light Vehicle sales growth is on track with 2011 at 12% over prior year, half of which is

attributable to strong fleet growth, while February SAAR, just reported by Automotive News, is 15.1M

attributable to strong fleet growth, while February SAAR, just reported by Automotive News, is 15.1M

Source: J.D. Power and Associates with estimates from Automotive News

E

Auto Industry Sales Forecast

Copyright (c) 2012 Autobytel Inc.

11

Comments

§In January, IHS held their US Light Vehicle Sales Forecast of 13.5M for 2012, yet updated 2013 to 14.7M and

2014 at 15.6M

2014 at 15.6M

§In February, J.D. Power increased its 2012 US Light Vehicle Sales Forecast to 14.0M as leasing appears to have

rebounded, credit availability is improving, and the European impact seems to be less than expected

rebounded, credit availability is improving, and the European impact seems to be less than expected

Source: J.D. Power and Associates

Total Sales

Fleet Sales

Retail Sales

US Light Vehicle History and Forecast by Retail, Fleet and Total Sales

Autobytel.com

Copyright (c) 2012 Autobytel Inc.

§ Unique consumer proposition

“Your Lifetime Automotive

Advisor”™

“Your Lifetime Automotive

Advisor”™

§ Distinctive consumer content,

engagement and social

dialogue

engagement and social

dialogue

• What Car is Right for Me?

• MyGarage®

• Used Car Finder

• What’s Hot Now

• Sell Your Car

• Intuitive Navigation to Make and Model

Pages

Pages

• Detail page features Overviews, Expert

Reviews, Pricing and Specs along with

Consumer Ratings

Reviews, Pricing and Specs along with

Consumer Ratings

• Car Comparison Tools

• Incentives & Rebates Information

• Car and Truck of the Year Awards

12